SCHEDULES

Sections 50(5), 68(4) and 170(4).

SCHEDULE 1U.K. Controlled Drugs: Variation of Punishments for Certain Offences under this Act

1U.K.Section 50(4), 68(3) and 170(3) of this Act shall have effect in a case where the goods in respect of which the offence referred to in that subsection was committed were a Class A drug or a Class B drug as if for the words from shall be liable onwards there were substituted the following words, that is to say—

“shall be liable—

(a)on summary conviction, to a penalty of the prescribed sum or of three times the value of the goods, whichever is the greater, or to imprisonment for a term not exceeding 6 months, or to both;

[(b)on conviction on indictment—

(i)where the goods were a Class A drug, to a penalty of any amount, or to imprisonment for life, or to both; and

(ii)where they were a Class B drug, to a penalty of any amount, or to imprisonment for a term not exceeding 14 years, or to both.”].

2U.K.Section 50(4), 68(3) and 170(3) of this Act shall have effect in a case where the goods in respect of which the offence referred to in that subsection was committed were a Class C drug as if for the words from shall be liable onwards there were substituted the following words, that is to say—

“shall be liable—

(a)on summary conviction , to a penalty of three times the value of the goods or £500, whichever is the greater, or to imprisonment for a term not exceeding 3 months, or to both;

(b)

(c)on conviction on indictment, to a penalty of any amount, or to imprisonment for a term not exceeding [14 years ] , or to both.”.

3U.K.In this Schedule Class A drug, Class B drug and Class C drug have the same meanings as in the Misuse of Drugs Act 1971.

Section 126(3).

SCHEDULE 2U.K. Composite Goods:Supplementary Provisions as to Excise Duties and Drawbacks

DutiesU.K.

1(1)Where under subsection (1) of the principal section imported goods of any class or desciption are chargeable with a duty of excise in respect of any article contained in the goods as a part or ingredient of them and it appears to the Treasury on the recommendation of the Commissioners that to charge the duty according to the quantity of the article used in the manufacture or preparation of the goods (as provided by the principal section) is inconvenient and of no material advantage to the revenue or to importers of goods of that class or description, then the Treasury may by order give a direction in relation to goods of that class or description under and in accordance with this paragraph.U.K.

(2)An order under this paragraph may direct that in the case of goods of the class or description to which it applies the duty chargeable shall be calculated in such of the following ways as may be provided by the order, that is to say—

(a)at a rate specified in the order by reference to the weight, quantity or value of the goods; or

(b)by reference to a quantity so specified of the article, and (where material) on the basis that the article is of such value, type or quality as may be so specified.

(3)If it appears to the Treasury on the recommendation of the Commissioners that, in the case of goods of any class or description, the net amounts payable in the absence of any direction under this paragraph are insignificant, the order may direct that any such goods shall be treated for the purpose of the duty as not containing the article in respect of which the duty is chargeable.

(4)If it appears to the Treasury on the recommendation of the Commissioners that goods of any class or description are substantially of the same nature and use as if they consisted wholly of the article in respect of which the duty is chargeable, the order may direct that any such goods shall be treated for the purpose of the duty as consisting wholly of that article.

(5)In making an order under this paragraph the Treasury shall have regard to the quantity and (where material) the type or quality of the article in question appearing to them, on the advice of the Commissioners, to be ordinarily used in the manufacture or preparation of goods of the class or description to which the order applies which are imported into the United Kingdom.

2U.K.Where a direction given by virtue of paragraph 1 above is in force as regards goods of any class or description and any article contained in them, and goods of that class or description are imported into the United Kingdom containing a quantity of that article such as, in the opinion of the Commissioners, to suggest that advantage is being taken of the direction for the purpose of evading duty on the article, the Commissioners may, notwithstanding the direction, require that on those goods the duty in question shall be calculated as if they consisted wholly of that article or (if the Commissioners see fit) shall be calculated according to the quantity of the article actually contained in the goods.

3U.K.Nothing in paragraphs 1 and 2 above shall affect the powers of the Treasury under subsection (2) of the principal section; and any goods as regards which a direction under that subsection is for the time being in force shall be deemed to be excepted from any order under paragraph 1 above.

DrawbacksU.K.

4U.K.Where a direction is given by virtue of paragraph 1 above as regards imported goods of any class or description, the Treasury may by order provide that for the purpose of allowing any drawback of excise duties there shall, in such cases and subject to such conditions (if any) as may be specified in the order, be treated as paid on imported goods of that class or description the same duties as would be chargeable apart from the direction.

5(1)Where, in the case of imported goods of any class or description which contain as a part or ingredient any article chargeable with a duty of excise, drawback of the duty may be allowed in respect of the article according to the quantity contained in the goods or the quantity used in their preparation or manufacture, and it appears to the Treasury on the recommendation of the Commissioners that to allow the drawback according to that quantity is inconvenient and of no material advantage to the revenue or to the persons entitled to the drawback, then the Treasury may by order give the like directions as to the manner in which the drawback is to be calculated, or in which the goods are to be treated for the purposes of the drawback, as by virtue of paragraph 1 above they may give in relation to charging duty.U.K.

(2)For the purposes of this paragraph, the reference in paragraph 1(5) above to goods imported into the United Kingdom shall be taken as a reference to goods in the case of which the drawback may be allowed.

SupplementaryU.K.

6U.K.Where any order under paragraph 1 or 5 above directs that, for the purpose of any duty or of any drawback, goods are to be treated as not containing or as consisting wholly of a particular article, the goods shall be so treated also for the purpose of determining whether any other duty is chargeable or any other drawback may be allowed, as the case may be; but any duty or drawback which is charged or allowed shall, notwithstanding the direction, be calculated by reference to the actual quantity and value of the goods and, except for the duty or drawback to which the direction relates, by reference to their actual composition.

7U.K.Where a resolution passed by the House of Commons has statutory effect under the Provisional Collection of Taxes Act 1968 in relation to any duty of excise charged on imported goods, and any provision about the duty contained in an order under paragraph 1 above is expressed to be made in view of the resolution, then that provision may be varied or revoked retrospectively by an order made not later than one month after the resolution ceases to have statutory effect, and that order may include provision for repayment of any duty overpaid or for other matters arising from its having retrospective effect; but no such order shall have retrospective effect for the purpose of increasing the duty chargeable on any goods.

8U.K.The power to make orders under this Schedule shall be exercisable by statutory instrument subject to annulment in pursuance of a resolution of the House of Commons.

InterpretationU.K.

9U.K.In this Schedule the principal section means section 126 of this Act.

Sections 139, 143 and 145.

SCHEDULE 3U.K. Provisions Relating to Forfeiture

Modifications etc. (not altering text)

Notice of seizureU.K.

1(1)The Commissioners shall, except as provided in sub-paragraph (2) below, give notice of the seizure of any thing as liable to forfeiture and of the grounds therefor to any person who to their knowledge was at the time of the seizure the owner or one of the owners thereof.U.K.

(2)Notice need not be given under this paragraph if the seizure was made in the presence of—

(a)the person whose offence or suspected offence occasioned the seizure; or

(b)the owner or any of the owners of the thing seized or any servant or agent of his; or

(c)in the case of any thing seized in any ship or aircraft, the master or commander.

Modifications etc. (not altering text)

2U.K.Notice under paragraph 1 above shall be given in writing and shall be deemed to have been duly served on the person concerned—

(a)if delivered to him personally; or

(b)if addressed to him and left or forwarded by post to him at his usual or last known place of abode or business or, in the case of a body corporate, at their registered or principal office; or

(c)where he has no address within the United Kingdom [or the Isle of Man], or his address is unknown, by publication of notice of the seizure in the London, Edinburgh or Belfast Gazette.

Notice of claimU.K.

3U.K.Any person claiming that any thing seized as liable to forfeiture is not so liable shall, within one month of the date of the notice of seizure or, where no such notice has been served on him, within one month of the date of the seizure, give notice of his claim in writing to the Commissioners at any office of customs and excise.

4(1)Any notice under paragraph 3 above shall specify the name and address of the claimant and, in the case of a claimant who is outside the United Kingdom [and the Isle of Man], shall specify the name and address of a solicitor in the United Kingdom who is authorised to accept service of process and to act on behalf of the claimant.U.K.

(2)Service of process upon a solicitor so specified shall be deemed to be proper service upon the claimant.

Textual Amendments

Modifications etc. (not altering text)

CondemnationU.K.

5U.K.If on the expiration of the relevant period under paragraph 3 above for the giving of notice of claim in respect of any thing no such notice has been given to the Commissioners, or if, in the case of any such notice given, any requirement of paragraph 4 above is not complied with, the thing in question shall be deemed to have been duly condemned as forfeited.

6U.K.Where notice of claim in respect of any thing is duly given in accordance with paragraphs 3 and 4 above, the Commissioners shall take proceedings for the condemnation of that thing by the court, and if the court finds that the thing was at the time of seizure liable to forfeiture the court shall condemn it as forfeited.

7U.K.Where any thing is in accordance with either of paragraphs 5 or 6 above condemned or deemed to have been condemned as forfeited, then, without prejudice to any delivery up or sale of the thing by the Commissioners under paragraph 16 below, the forfeiture shall have effect as from the date when the liability to forfeiture arose.

Proceedings for condemnation by courtU.K.

8U.K.Proceedings for condemnation shall be civil proceedings and may be instituted—

(a)in England or Wales either in the High Court or in a magistrates’ court;

(b)in Scotland either in the Court of Session or in the sheriff court;

(c)in Northern Ireland either in the High Court or in a court of summary jurisdiction.

9U.K.Proceedings for the condemnation of any thing instituted in a magistrates’ court in England or Wales, in the sheriff court in Scotland or in a court of summary jurisdiction in Northern Ireland may be so instituted—

(a)in any such court having jurisdiction in the place where any offence in connection with that thing was committed or where any proceedings for such an offence are instituted; or

(b)in any such court having jurisdiction in the place where the claimant resides or, if the claimant has specified a solicitor under paragraph 4 above, in the place where that solicitor has his office; or

(c)in any such court having jurisdiction in the place where that thing was found, detained or seized or to which it is first brought after being found, detained or seized.

Modifications etc. (not altering text)

10(1)In any proceedings for condemnation instituted in England, Wales or Northern Ireland, the claimant or his solicitor shall make oath that the thing seized was, or was to the best of his knowledge and belief, the property of the claimant at the time of the seizure.U.K.

(2)In any such proceedings instituted in the High Court, the claimant shall give such security for the costs of the proceedings as may be determined by the Court.

(3)If any requirement of this paragraph is not complied with, the court shall give judgment for the Commissioners.

11(1)In the case of any proceedings for condemnation instituted in a magistrates’ court in England or Wales, without prejudice to any right to require the statement of a case for the opinion of the High Court, either party may appeal against the decision of that court to the Crown Court.U.K.

(2)In the case of any proceedings for condemnation instituted in a court of summary jurisdiction in Northern Ireland, without prejudice to any right to require the statement of a case for the opinion of the High Court, either party may appeal against the decision of that court to the county court.

12U.K.Where an appeal, including an appeal by way of case stated, has been made against the decision of the court in any proceedings for the condemnation of any thing, that thing shall, pending the final determination of the matter, be left with the Commissioners or at any convenient office of customs and excise.

Provisions as to proofU.K.

13U.K.In any proceedings arising out of the seizure of any thing, the fact, form and manner of the seizure shall be taken to have been as set forth in the process without any further evidence thereof, unless the contrary is proved.

14U.K.In any proceedings, the condemnation by a court of any thing as forfeited may be proved by the production either of the order or certificate of condemnation or of a certified copy thereof purporting to be signed by an officer of the court by which the order or certificate was made or granted.

Special provisions as to certain claimantsU.K.

15U.K.For the purposes of any claim to, or proceedings for the condemnation of, any thing, where that thing is at the time of seizure the property of a body corporate, of two or more partners or of any number of persons exceeding five, the oath required by paragraph 10 above to be taken and any other thing required by this Schedule or by any rules of the court to be done by, or by any person authorised by, the claimant or owner may be taken or done by, or by any other person authorised by, the following persons respectively, that is to say—

(a)where the owner is a body corporate, the secretary or some duly authorised officer of that body;

(b)where the owners are in partnership, any one of those owners;

(c)where the owners are any number of persons exceeding five not being in partnership, any two of those persons on behalf of themselves and their co-owners.

Power to deal with seizures before condemnation, etc.U.K.

16U.K.Where any thing has been seized as liable to forfeiture the Commissioners may at any time if they see fit and notwithstanding that the thing has not yet been condemned, or is not yet deemed to have been condemned, as forfeited—

(a)deliver it up to any claimant upon his paying to the Commissioners such sum as they think proper, being a sum not exceeding that which in their opinion represents the value of the thing, including any duty or tax chargeable thereon which has not been paid;

(b)if the thing seized is a living creature or is in the opinion of the Commissioners of a perishable nature, sell or destroy it.

17(1)If, where any thing is delivered up, sold or destroyed under paragraph 16 above, it is held in proceedings taken under this Schedule that the thing was not liable to forfeiture at the time of its seizure, the Commissioners shall, subject to any deduction allowed under sub-paragraph (2) below, on demand by the claimant tender to him—U.K.

(a)an amount equal to any sum paid by him under sub-paragraph (a) of that paragraph; or

(b)where they have sold the thing, an amount equal to the proceeds of sale; or

(c)where they have destroyed the thing, an amount equal to the market value of the thing at the time of its seizure.

(2)Where the amount to be tendered under sub-paragraph (1)(a), (b) or (c) above includes any sum on account of any duty or tax chargeable on the thing which had not been paid before its seizure the Commissioners may deduct so much of that amount as represents that duty or tax.

(3)If the claimant accepts any amount tendered to him under sub-paragraph (1) above, he shall not be entitled to maintain any action on account of the seizure, detention, sale or destruction of the thing.

(4)For the purposes of sub-paragraph (1)(c) above, the market value of any thing at the time of its seizure shall be taken to be such amount as the Commissioners and the claimant may agree or, in default of agreement, as may be determined by a referee appointed by the Lord Chancellor (not being an official of any government department [or an office-holder in, or a member of the staff of, the Scottish Administration]), whose decision shall be final and conclusive; and the procedure on any reference to a referee shall be such as may be determined by the referee.

Section 177(1).

SCHEDULE 4U.K. Consequential Amendments

Modifications etc. (not altering text)

Construction of references in Acts passed before 1st April 1909 and in instruments made thereunderU.K.

1U.K.Save where the context otherwise requires, any reference in, or in any instrument made under, any enactment relating to customs or excise passed before 1st April 1909 to any of the persons mentioned in column 1 of the following Table shall be construed as a reference to the persons respectively specified in relation thereto in column 2.

TABLE

| Original reference | To be construed as reference to— |

|---|

| Commissioners of Customs | |

| Commissioners of Inland Revenue | Commissioners of Customs and Excise. |

| Commissioners of Excise | |

| Solicitor for the Customs | Solicitor for the Customs and Excise. |

| Solicitor of Inland Revenue | |

| Secretary for the Customs | Secretary to the Commissioners of Customs and Excise. |

| Secretary of the Commissioners of Inland Revenue | |

| Accountant and Comptroller General of Customs | Accountant and Comptroller General of the Customs and Excise. |

| Accountant and Comptroller General of Inland Revenue | |

| Collector of Customs | |

| Collector of Inland Revenue | Collector of Customs and Excise. |

| Collector of Excise | |

| Officer of Customs | |

| Officer of Inland Revenue | Officer of Customs and Excise. |

| Officer of Excise | |

2U.K.

Diplomatic Privileges Act 1964U.K.

3U.K.In section 2 of the Diplomatic Privileges Act 1964, after subsection (5) there shall be inserted the following subsection—

“(5A)The reference in Article 36 to customs duties shall be construed as including a reference to excise duties chargeable on goods imported into the United Kingdom.”

Provisional Collection of Taxes Act 1964U.K.

4U.K.In section 3 of the Provisional Collection of Taxes Act 1968, after subsection (2) there shall be inserted the following subsection—

“(2A)Subsection (2) above shall apply for the purposes of a duty of excise imposed as mentioned in subsection (1) above to the extent that the duty is charged on goods imported into the United Kingdom, as it applies for the purposes of a duty of customs so imposed.”

5U.K.In section 3(3) of the Provisional Collection of Taxes Act 1968, after the words duty of excise there shall be inserted the words

“then—

(a)where it is a duty of excise charged otherwise than on goods; or

(b)where it is a duty of excise charged on goods, to the extent that it is charged on goods produced or manufactured in the United Kingdom;”

Consular Relations Act 1968U.K.

6U.K.In section 1 of the Consular Relations Act 1968, after subsection (8) there shall be inserted the following subsection—

“(8A)The references in Articles 50 and 62 to customs duties shall be construed as including references to excise duties chargeable on goods imported into the United Kingdom.”

7U.K.In section 5 of the Consular Relations Act 1968, after subsection (1) there shall be inserted the following subsection—

“(1A)In subsection (1)(b) of this section the expression the law relating to customs, to the extent that it refers to the law relating to duties on goods, refers to the law relating to duties (whether of customs or excise) for the time being chargeable on goods imported into the United Kingdom.”

Misuse of Drugs Act 1971U.K.

8U.K.In section 12(1)(b) of the Misuse of Drugs Act 1971, after the words “the Customs and Excise Act 1952” there shall be inserted the words “ or under section 50, 68 or 170 of the Customs and Excise Management Act 1979 ”.

9–11U.K.

Table of textual amendmentsU.K.

12U.K.In the enactments specified in the following Table, for so much of the provision in column 1 as is specified in column 2 there shall be substituted the words in column 3.

| TABLE |

|---|

| Part I Enactments of the Parliament of the United Kingdom |

|---|

| Section or Schedule | Words or provision replaced | Replacement |

|---|

| | |

| Naval Prize Act 1864 c. 25 |

| Section 47. | duties of Customs. | duties chargeable on imported goods (whether of customs or excise). |

| the Customs (twice). | customs or excise. |

| Sections 48 and 48A. | relating to the Customs. | relating to customs or excise. |

| Section 49. | duties of Customs. | duties (whether of customs or excise) chargeable on imported goods. |

| Explosives Act 1875 c. 17 |

| Section 40(9)(e). | the Customs (twice). | customs or excise. |

| Section 43. | the Customs (twice). | customs or excise. |

| Customs and Inland Revenue Act 1879 c. 21 |

| Section 5 (as originally enacted). | From the beginning to following. | The importation of the following goods is prohibited, that is to say. |

| Stamp Duties Management Act 1891 c. 38 |

| Section 23. | duty of excise. | duty of excise other than a duty of excise chargeable on goods imported into the United Kingdom. |

| . . . | . . . | . . . |

| Foreign Prison-Made Goods Act 1897 c. 63 |

| Section 1 (as originally enacted). | From the beginning to following. | The importation of the following goods is prohibited. |

| Revenue Act 1898 c. 46 |

| Section 1 (as originally enacted). | From the beginning to following. | The importation of the following articles is prohibited. |

| Finance Act 1901 c. 7 |

| Section 10. | customs import duty (in three places). | customs duty. |

| Seal Fisheries (North Pacific) Act 1912 c. 10 |

| Section 4 (as originally enacted). | From shall onwards. | are hereby prohibited to be imported. |

| | |

| | |

| Diseases of Fish Act 1937 c. 33 |

| Section 1(2). | the Customs Acts. | the enactments for the time being in force relating to customs or excise. |

| Trade Marks Act 1938 c. 22 |

| Section 64A(5). | section 11 of the Customs and Excise Act 1952. | section 17 of the Customs and Excise Management Act 1979. |

| customs. | duties (whether of customs or excise) charged on imported goods |

| Import, Export and Customs Powers (Defence) Act 1939 c. 69 |

| Sections 1(4) and 3(1). | enactments relating to customs. | enactments for the time being in force relating to customs or excise. |

| Section 1(5) (as originally enacted). | section eleven of the Customs and Inland Revenue Act 1879. | section 145 of the Customs and Excise Management Act 1979. |

| Section 9(2). | Customs Consolidation Act 1876, and the enactments amending that Act. | Customs and Excise Management Act 1979. |

| | |

| . . . | . | . |

| Merchant Shipping (Safety Convention) Act 1949 c. 43 |

| Section 24(5). | the Customs Consolidation Act 1876. | section 35 of the Customs and Excise Management Act 1979. |

| | |

| | |

| . . . |

| . . . | . . . | . . . |

| . . . | . . . | . . . |

| | |

| | |

| Food and Drugs (Scotland) Act 1956 c. 30 |

| Section 58(1) (in the definition of importation). | the Customs and Excise Act 1952. | the Customs and Excise Management Act 1979. |

| | |

| | |

| Isle of Man Act 1958 c. 11 |

| Section 2(4). | duties of customs (in four places). | duties of customs or excise. |

| Dog Licences Act 1959 c. 55 |

| Section 15(1). | From section three hundred and thirteen to dog licences). | section 176(2) of the Customs and Excise Management Act 1979 (which makes provision for the application of certain provisions of that Act to game licences and duties thereon and is applied by section 16(5) below). |

| Section 16(5). | From the beginning to the said section three hundred and thirteen. | Subsections (1) to (3) of section 176 of the Customs and Excise Management Act 1979 (which make provision for the application of certain provisions of that Act to game licences and duties thereon), and any order made by the Treasury under that section,. |

| From duties transferred under section six to the said Act of 1908. | duties on licences to kill and to deal in game and to local authorities and their officers with respect to those duties and licences, and the reference in the said subsection (3) to the Order in Council made under section 6 of the Finance Act 1908. |

| Finance Act 1961 c. 36 |

| Section 37(3). | the Customs and Excise Act 1952. | the Customs and Excise Management Act 1979. |

| | |

| Licensing Act 1964 c. 26 |

| Section 87(1). | section 16 of the Customs and Excise Act 1952. | section 22 of the Customs and Excise Management Act 1979. |

| . . . | . . . | . . . |

| Diplomatic Privileges Act 1964 c. 81 |

| Section 7(1)(b). | customs duties. | duties (whether of customs or excise) chargeable on imported goods. |

| | |

| Finance Act 1966 c. 18 |

| Section 2(13)(b). | section 11 of the Act of 1952. | section 17 of the Customs and Excise Management Act 1979. |

| Section 53(2). | From Customs and Excise Act 1952 to that Act. | Customs and Excise Management Act 1979. |

| Schedule 1, paragraph 4. | Act of 1952. | Customs and Excise Management Act 1979. |

| that Act. | the Customs and Excise Acts 1979. |

| section 270. | section 135. |

| section 271(1). | section 136(1) and (2). |

| section 301(2). | section 167(4). |

| Plant Health Act 1967 c. 8 |

| Section 2(2). | the Customs and Excise Act 1952. | the Customs and Excise Management Act 1979. |

| Finance Act 1967 c. 54 |

| Section 7(8)(b). | sections 281 and 287 of the Act of 1952. | sections 145 and 151 of the Customs and Excise Management Act 1979. |

| the excise Acts (twice). | the customs and excise Acts. |

| Section 45(3)(a). | From Customs and Excise Act 1952 to that Act. | Customs and Excise Management Act 1979. |

| Wireless Telegraphy Act 1967 c. 72 |

| Section 7(5). | the Customs and Excise Act 1952. | the Customs and Excise Management Act 1979. |

| Section 7(6). | 1952. | 1979. |

| Provisional Collection of Taxes Act 1968 c. 2 |

| Section 3(3). | the excise Acts. | the revenue trade provisions of the customs and excise Acts. |

| Section 3(5). | the Customs and Excise Act 1952. | the Customs and Excise Management Act 1979. |

| Section 4. | duty of customs or excise. | duty of excise. |

| Consular Relations Act 1968 c. 18 |

| Section 8(1). | From customs duty to which are. | duty (whether of customs or excise) paid on imported hydrocarbon oil (within the meaning of the Hydrocarbon Oil Duties Act 1979) or value added tax paid on the importation of such oil which is. |

| Section 8(1)(b). | they. | it. |

| customs duty. | duty. |

| Firearms Act 1968 c. 27 |

| Section 45(2)(b). | enactments relating to customs. | enactments for the time being in force relating to customs or excise. |

| Trade Descriptions Act 1968 c. 29 |

| Section 32(b). | Customs and Excise Act 1952. | Customs and Excise Management Act 1979. |

| International Organisations Act 1968 c. 48 |

| Section 9. | customs duty. | duty. |

| Schedule 1, paragraphs 3(1), 4, 9, 10, 16 and 17. | customs duties. | duties (whether of customs or excise). |

| Schedule 1, paragraphs 6 and 12. | From customs duty to which are. | duty (whether of customs or excise) paid on imported hydrocarbon oil (within the meaning of the Hydrocarbon Oil Duties Act 1979) or value added tax paid on the importation of such oil which is. |

| | |

| Medicines Act 1968 c. 67 |

| Section 116(1). | section 44 of the Customs and Excise Act 1952. | section 49 of the Customs and Excise Management Act 1979. |

| Section 116(2). | section 56 of the Customs and Excise Act 1952. | section 68 of the Customs and Excise Management Act 1979. |

| Customs Duties (Dumping and Subsidies) Act 1969 c. 16 |

| . . .. | . . .. | . . .. |

| . . .. | . . .. |

| . . .. | . . .. |

| . . . | . . .. . . . . .. | . . .. |

| . . . . . .. | . . .. | . . .. |

| Finance Act 1969 c. 32 |

| Section 61(3)(a). | the Customs and Excise Act 1952. | the Customs and Excise Acts 1979. |

| . . . |

| . . . | . . . | . . . |

| Vehicles (Excise) Act 1971 c. 10 |

| . . .. | . . .. | . . ... |

| . . . | . . .. | . . .. |

| . . .. | . . .. |

| . . . | . . .. | . . .. |

| Misuse of Drugs Act 1971 c. 38 |

| Section 22(a)(ii). | the Customs and Excise Act 1952, that is to say sections 45(1), 56(2) and 304. | the Customs and Excise Management Act 1979, that is to say, sections 50(1) to (4), 68(2) and (3) and 170. |

| | |

| Diplomatic and Other Privileges Act 1971 c. 64 |

| Section 1(1). | From customs duty to 1971). | duty (whether of customs or excise) paid on imported hydrocarbon oil (within the meaning of the Hydrocarbon Oil Duties Act 1979) or value added tax paid on the importation of such oil. |

| Section 1(1)(b). | customs duty. | duty. |

| | |

| | |

| European Communities Act 1972 c. 68 |

| Section 6(5). | Paragraph (a). | (a) the Customs and Excise Management Act 1979 (as for the time being amended by any later Act) and any other statutory provisions for the time being in force relating generally to customs or excise duties on imported goods; and. |

| From section 267 to customs duties. | section 133 (except sub-section (3) and the reference to that subsection in sub-section (2)) and section 159 of the Customs and Excise Management Act 1979 shall apply as they apply in relation to a drawback of excise duties. |

| Section 6(6). | section 259 of the Customs and Excise Act 1952. | section 126 of the Customs and Excise Management Act 1979. |

| . . .. | . . .. | . . .. |

| Health and Safety at Work etc. Act 1974 c. 37 |

| Schedule 3, paragraph 2(2). | the Customs and Excise Act 1952. | the Customs and Excise Acts 1979. |

| Merchant Shipping Act 1974 c. 43 |

| Section 2(9) (in the definition of importer). | customs purposes. | customs or excise purposes. |

| Schedule 4, paragraph 1(3). | Section 53 of the Customs and Excise Act 1952. | Section 65 of the Customs and Excise Management Act 1979. |

| Schedule 4, paragraph 2(1)(c). | customs Acts which relate to duties of customs. | enactments for the time being in force relating to duties (whether of customs or excise) chargeable on goods imported into the United Kingdom. |

| Salmon and Freshwater Fisheries Act 1975 c. 51 |

| Schedule 4, paragraph 6. | Schedule 7 to the Customs and Excise Act 1952. | Schedule 3 to the Customs and Excise Management Act 1979. |

| Paragraph (a). | (a) paragraphs 1(2) and 5 shall be omitted;. |

| Licensing (Scotland) Act 1976 c. 66 |

| Section 63(2). | section 16 of the Customs and Excise Act 1952. | section 22 of the Customs and Excise Management Act 1979. |

| Endangered Species (Import and Export) Act 1976 c. 72 |

| Section 1(8). | the Customs and Excise Act 1952. | the Customs and Excise Management Act 1979. |

| Section 4(8). | section 45 or 304 of the Customs and Excise Act 1952. | section 50 or 170 of the Customs and Excise Management Act 1979. |

| Section 5(4) (in the definition of airport). | From customs airport to 1952. | customs and excise airport as mentioned in section 21(7) of the Customs and Excise Management Act 1979. |

| Section 5(4) (in the definition of port). | section 13(1). | section 19(1). |

| Finance Act 1977 c. 36 |

| Section 10(5). | made by the Commissioners. | made by statutory instrument by the Commissioners which shall be subject to annulment in pursuance of a resolution of either House of Parliament. |

| Section 59(3)(a). | the Customs and Excise Act 1952. | such of the Customs and Excise Acts 1979 as the provision in question requires. |

| Finance Act 1978 c. 42 |

| Section 80(3)(a). | the Customs and Excise Act 1952. | the Customs and Excise Management Act 1979. |

| Part IIEnactments of the Parliament of Northern Ireland |

| | |

| Diseases of Animals Act (Northern Ireland) 1958 c. 13 |

| Section 52(2) (in the definition of the Customs Acts). | the Customs and Excise Act 1952. | the Customs and Excise Management Act 1979. |

| | |

| | |

| Plant Health Act (Northern Ireland) 1967 c. 28 |

| Section 2(2). | the Customs and Excise Act 1952. | the Customs and Excise Management Act 1979. |

| Miscellaneous Transferred Excise Duties Act (Northern Ireland) 1972 c. 11 |

| Section 73. | the Customs and Excise Act 1952. | the Customs and Excise Management Act 1979. |

Section 177(2).

SCHEDULE 5U.K. Transitory Consequential Amendments of Enactments Relating to Purchase Tax

Modifications etc. (not altering text)

Purchase Tax Act 1963U.K.

1U.K.In section 1(3)(a) of the Purchase Tax Act 1963 (in this Schedule referred to as “the 1963 Act”) for the words “section 11 of the Customs and Excise Act 1952” there shall be substituted the words “ section 17 of the Customs and Excise Management Act 1979 ”.

2(1)In section 25 of the 1963 Act the amendments specified in this paragraph shall be made.U.K.

(2)In subsection (1)—

(a)for the words “the Customs and Excise Act 1952” there shall be substituted the words “ the Customs and Excise Management Act 1979 ” ; and

(b)after the word “customs”, in each place where it occurs, there shall be inserted the words “ or excise ”.

(3)In subsection (2)—

(a)the words “of the Customs and Excise Act 1952” shall be omitted ;

(b)in paragraph (a), for the words “section 34(4), 35 and 36” there shall be substituted the words “ section 43(5) of the Customs and Excise Management Act 1979, and sections 10 and 11 of the Customs and Excise Duties (General Reliefs) Act 1979 ” ;

(c)in paragraph (b), for the words “section 37” there shall be substituted the words “ section 5 of the Customs and Excise Duties (General Reliefs) Act 1979 ” ;

(d)in paragraph (c), for the words “section 259” there shall be substituted the words “ section 5 of the Customs and Excise Excise Management Act 1979 ” ; and

(e)in paragraph (d), for the words “section 272” there shall be substituted the words “ section 12 of the Customs and Excise Duties (General Reliefs) Act 1979 ”.

(4)In subsection (3)—

(a)for the words “section 258 of the Customs and Excise Act 1952” there shall be substituted the words “ section 125 of the Customs and Excise Management Act 1979 ” ; and

(b)for the words “section 260” there shall be substituted the words “ section 127 ”.

(5)In subsection (4), for the words “Section 46 of the Custom and Excise Act 1952” there shall be substituted the words “ Section 51 of the Customs and Excise Management Act 1979 ”.

3(1)In section 34 of the 1963 Act the amendments specified in this paragraph shall be made.U.K.

(2)In subsection (1) for the words “the Customs and Excise Act 1952” and “the said Act of 1952” there shall be substituted the words “ the Customs and Excise Management Act 1979 ”.

(3)In subsection (2)—

(a)for the words “Sections 290(2) and 301(2) of the Customs and Excise Act 1952” there shall be substituted the words “ Sections 154(2) and 167(4) of the Customs and Excise Management Act 1979 ”; and

(b)after the words “duty of excise” there shall be inserted the words “ for the time being chargeable on goods produced or manufactured in the United Kingdom ”.

(4)For subsection (3) there shall be substituted the following subsection—

“(3)Section 156 of the Customs and Excise Management Act 1979 shall apply to this Act as it applies to the outlying provisions of the customs and excise Acts within the meaning of that section ; and the reference in subsection (2) of that section to Part XI of that Act includes a reference to that Part as applied in relation to penalties under this Act by subsection (1) of this section.”

4U.K.In Schedule 2 to the 1963 Act, in paragraph 2 (b) for the words “duties of customs” there shall be substituted the words “ duties (whether of customs or excise) ”.

Finance Act 1964U.K.

5U.K.In section 10(2)(b) of the Finance Act 1964—

(a)for the words “subsection (1) above” there shall be substituted the words “ section 1(4) of the Customs and Excise Management Act 1979 ” ; and

(b)for the words “section 307 of the Act of 1952” there shall be substituted the words “ section 1(1) of that Act ”.

Finance Act 1967U.K.

6U.K.In section 9(1) of the Finance Act 1967 for the words “the Act of 1952” there shall be substituted the words “ the Customs and Excise Management Act 1979 ”.

Section 177(3).

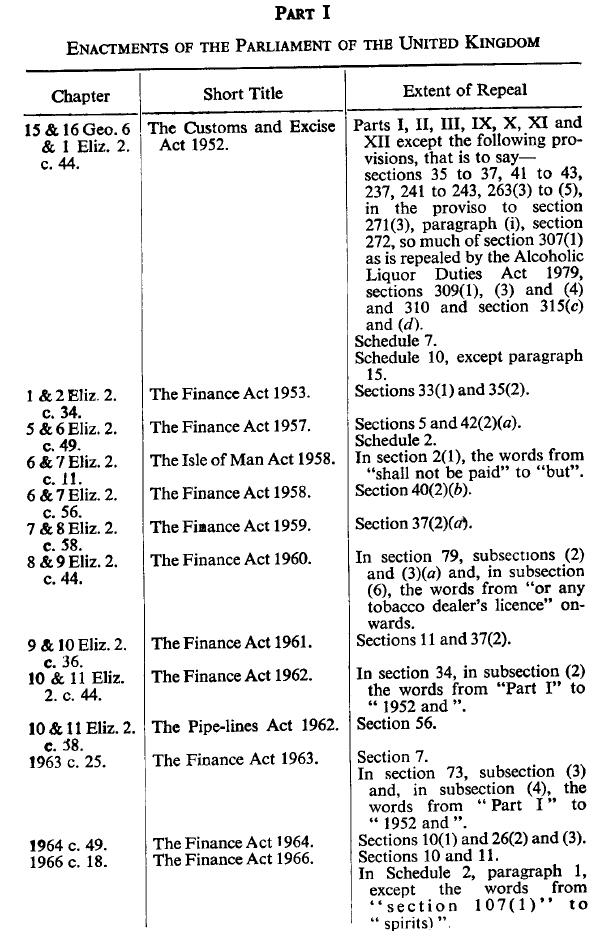

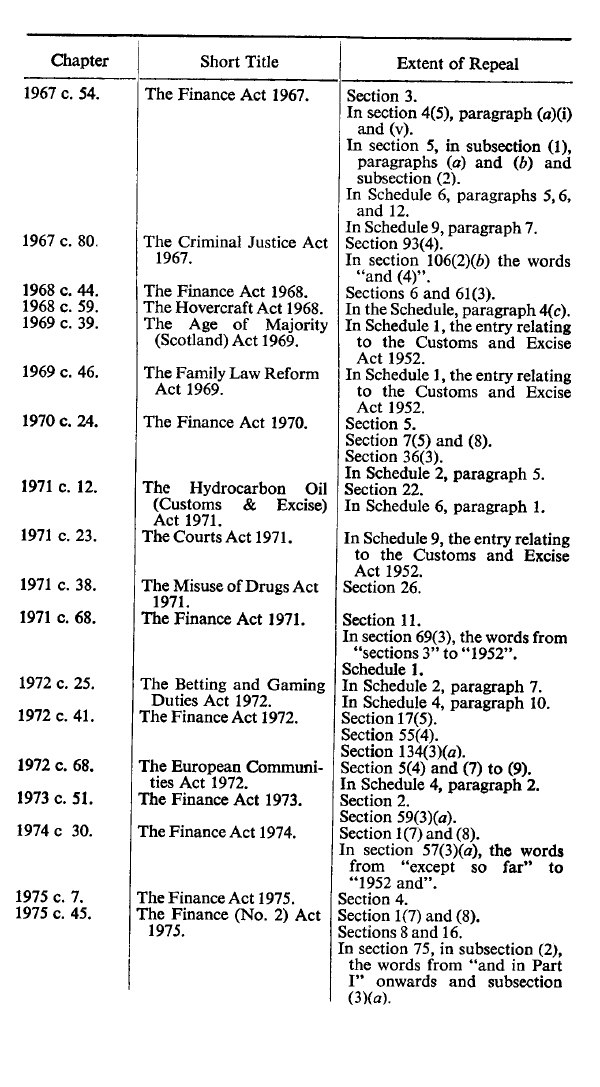

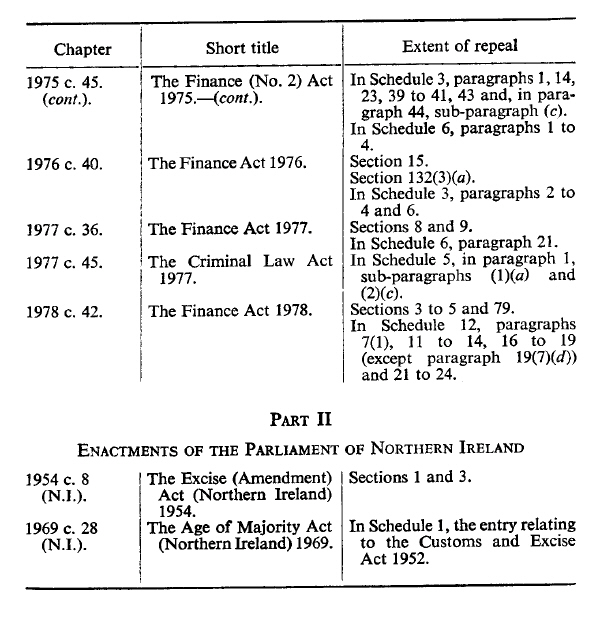

SCHEDULE 6U.K. REPEALS

Modifications etc. (not altering text)

Section 177(4).

SCHEDULE 7U.K. Saving and Transitional Provisions

1U.K.Notwithstanding the repeal by this Act of section 258 of the Customs and Excise Act 1952, of paragraph 5 of Schedule 2 to the Finance Act 1970, and of paragraph 2(8) of Schedule 4 to the European Communities Act 1972, that section (together with Schedule 6) as it had effect immediately before the entry date within the meaning of the said Act of 1972, shall continue to have effect for cases in which the value of goods falls to be determined as at a time before that date.

[2U.K.Notwithstanding the repeal by this Act of subsections (2) and (5) of section 283 of the Customs and Excise Act 1952, those subsections shall continue to have effect in relation to offences under Part I of, and paragraph 22 of Schedule 7 to, the Finance Act 1972; and, accordingly, in section 38(8) of, and paragraph 22(5) of Schedule 7 to, that Act (as amended by Schedule 4 to this Act) the reference in that section and in that paragraph to sections 145 to 155 of this Act shall be construed as including a reference to the said section 283(2) and (5).]

Textual Amendments

Marginal Citations

3U.K.Notwithstanding the repeal by this Act of section 308(3) of the Customs and Excise Act 1952, section 277 of the Customs Consolidation Act 1876 does not apply in relation to any Act passed after 1st January 1953.

4U.K.

5U.K.The repeal by this Act of section 5(4) of the European Communities Act 1972 (which, so far as it relates to enactments contained in this Act, is re-enacted by section 1(7) of this Act) shall not affect the application of any law not contained in this Act which relates to customs duties.

6U.K.The repeal by this Act of any enactment already repealed by section 75(5) of the Finance (No. 2) Act 1975 and specified in Part I of Schedule 14 to that Act shall not affect the operation of the saving in paragraph 2 in that Part in relation to that enactment.

7U.K.The repeal by this Act of section 8(4) of the Finance (No. 2) Act 1975 and the repeal by any of the Customs and Excise Acts 1979 of any provision of Part I of Schedule 3 to that Act shall not affect the right to any drawback or other relief under any enactment amended by that provision in respect of customs duty charged before the end of 1975.

8U.K.Any such reference as is specified in paragraph 1 of Schedule 3 to the Finance (No. 2) Act 1975 (customs duty, excise duty and associated references), being a reference in—

(a)any instrument of a legislative character made under the customs and excise Acts which was in force at the end of 1975; or

(b)any local and personal or private Act which was then in force,

shall continue to be construed as provided by that paragraph notwithstanding the repeal of that paragraph by this Act.

9U.K.Any such reference as is specified in sub-paragraph (2), (6) or (8) of paragraph 19 of Schedule 12 to the Finance Act 1978 (customs Acts, excise Acts, excise trade, excise trader, customs airport and customs station), being a reference in—

(a)any instrument in force immediately before the commencement of this Act; or

(b)any local and personal or private Act then in force,

shall continue to be construed as provided by the said sub-paragraph (2), (6) or (8), as the case may be, notwithstanding the repeal of that sub-paragraph by this Act.

10(1)Any provision of this Act relating to anything done or required or authorised to be done under or in pursuance of the Customs and Excise Acts 1979 shall have effect as if any reference to those Acts included a reference to the Customs and Excise Act 1952.U.K.

(2)Any provision of this Act relating to anything done or required or authorised to be done under, in pursuance of or by reference to that provision or any other provision of this Act shall have effect as if any reference to that provision, or that other provision, as the case may be, included a reference to the corresponding provision of the enactments repealed by this Act.

11U.K.Any functions which, immediately before the commencement of this Act, fall to be performed on behalf of any other person by the Commissioners or by officers or by any person appointed by the Commissioners shall continue to be so performed by them unless and until other arrangements are made, notwithstanding that those functions are not expressly mentioned in this Act.

12(1)The repeal by this Act of subsection (4) of section 316 of the Customs and Excise Act 1952 shall not affect any such right or privilege as is referred to in that subsection.U.K.

(2)Where by any enactment, grant or other instrument, any right or privilege not relating to customs or excise has at any time been granted by reference to the then existing limits of any port or approved wharf appointed or approved for the purposes of customs and excise, then, subject to any provision contained in that instrument, nothing in any order made or other thing done under section 19 or 20 of this Act shall affect that right or privilege.