Act wholly in force at 1.4.1979 see s. 20(2)

S. 6 repealed by Isle of Man Act 1979 (c. 58), Sch. 2

S. 7 substituted by Finance Act 1984 (c. 43, SIF 40:1), s. 14(1)(3)

Words inserted by Isle of Man Act 1979 (c. 58), Sch. 1 para. 26

Words inserted by Isle of Man Act 1979 (c. 58), Sch. 1 para. 27

Words inserted by Isle of Man Act 1979 (c. 58), Sch. 1 para. 28

S. 11A inserted by Finance Act 1988 (c. 39, SIF 40:1), s. 5(1)

S. 13(1A) inserted by Finance Act 1984 (c. 43, SIF 40:1), s. 15(2)(8)

Words inserted (retrospectively) by Finance Act 1984 (c. 43, SIF 40:1), s. 15(3)(8)

Words in s. 13(3)(a) inserted (1.12.1992) by Finance (No. 2) Act 1992 (c. 48), s. 1(5)(8), Sch. 1 para. 8(1)(a); S.I. 1992/2979, art. 4, Sch. Pt.II (and S.I. 1992/3261, art. 3, Sch.)

Words inserted (retrospectively) by Finance Act 1984 (c. 43, SIF 40:1), s. 15(4)(8)

Words in s. 13(3)(b) inserted (1.12.1992) by Finance (No. 2) Act 1992 (c. 48), s. 1(5)(8), Sch. 1 para. 8(1)(b); S.I. 1992/2979, art. 4, Sch.Pt. II (and S.I. 1992/3261, art. 3, Sch.)

S. 13(3A)(3B)(3C) inserted (1.12.1992) by Finance (No. 2) Act 1992 (c. 48), s. 1(5)(8), Sch. 1 para. 8(2); S.I. 1992/2979, art. 4, Sch. Pt.II (and S.I. 1992/3261, art. 3, Sch.)

Definition inserted (retrospectively) by Finance Act 1984 (c. 43, SIF 40:1), s. 15(5)(8)

Definition of "conduct" in s. 13(4) inserted (1.12.1992) by Finance (No. 2) Act 1992 (c. 48), s. 1(5)(8), Sch. 1 para. 8(3); S.I. 1992/2979, art. 4, Sch. Pt.II (and S.I. 1992/3261, art. 3, Sch.)

Words in definition of "value added tax" in s. 13(4) inserted (1.12.1992) by Finance (No. 2) Act 1992 (c. 48), s. 14(2)(3), Sch. 3 Pt. III para.93; S.I. 1992/2979, art. 4, Sch. Pt.II (and S.I. 1992/3261, art. 3, Sch.)

Ss. 13A–13C inserted by Finance Act 1989 (c. 26, SIF 40:1), s. 28(1)(2)

S. 13B(1)(b)(v) substituted (17.6.2002) by International Development Act 2002 (c. 1), s. 19, Sch. 3 para. 7; S.I. 2002/1408, art. 2 (with savings in Sch. 5 para. 5)

S. 13C(5) inserted (9.12.1992) by Finance (No. 2) Act 1992 (c. 48), s. 3, Sch. 2 para.10; S.I. 1992/3104, art.2

Words substituted by S.I. 1984/703, (N.I. 3) Sch. 6 para. 8(a)

Words substituted by Magistrates' Courts Act 1980 (c. 43, SIF 82), s. 154, Sch. 7 para. 179

Words in s. 15(3)(b) substituted (1.4.1996) by 1995 c. 40, ss. 5, 7(2), Sch. 4 para. 19

S. 15(3)(c) added by S.I. 1984/703, (N.I. 3) Sch. 6 para. 8(b)

“7” inserted by Finance Act 1984 (c. 43, SIF 40:1), s. 14(2)(3)

“, 11A” inserted by Finance Act 1988 (c. 39, SIF 40:1), s. 5(2)(a)

Words substituted by Finance Act 1989 (c. 26, SIF 40:1), s. 28(3)

“, 11A” inserted by Finance Act 1988 (c. 39, SIF 40:1), s. 5(2)(a)

Words substituted by virtue of Finance Act 1989 (c. 26, SIF 40:1), s. 28(3)

Words substituted by Finance Act 1988 (c. 39, SIF 40:1), s. 5(2)(b)

Sch. 1 repealed by Isle of Man Act 1979 (c. 58), Sch. 2

Sch. 2 para. 1 repealed (5.11.1993) by 1993 c. 50, s. 1(1), Sch. 1 Pt. II.

Sch. 2 para. 2 repealed by Value Added Tax Act 1983 (c. 55, SIF 40:2), s. 50(2), Sch. 11

Act amended by Value Added Tax Act 1983 (c. 55, SIF 40:2), s. 24(1)(3) and Police and Criminal Evidence Act 1984 (c. 60, SIF 95), s. 114(1)

Act modified by S.I. 1990/2167, art. 5

Act applied (1.12.1992) by Value Added Tax Act 1983 (c. 55), s. 24(1) (as substituted (1.12.1992) by Finance (No. 2) Act 1992 (c. 48), s. 14(2)(3), Sch. 3 para.25; S.I. 1992/2979, art. 4, Sch. Pt.II (and S.I. 1992/3261, art. 3, Sch.))

Act other than ss. 8, 9(b), excluded (20.10.1995) by S.I. 1995/2518, reg. 118(d)

S. 10(2)(a) amended by S.I. 1985/1032, reg. 11(b)

S. 10(2)(a) modified by S.I. 1983/947, regs. 12, 13

S. 10(2)(a) amended (1.1.1993) by S.I. 1992/3152, regs. 11(b), 12

S. 11(1)(a) amended by S.I. 1985/1032, reg. 11(b)

S. 11(1)(a) modified by S.I. 1983/947, regs. 12, 13

S. 11(1)(a) amended (1.1.1993) by S.I. 1992/3152, regs. 11(b), 12

S. 15 amended by Finance Act 1985 (c. 54, SIF 40:1), s. 10(6)(e)

The text of s. 19(1)(2), Schs. 2 (except as indicated) and 3 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

The text of s. 19(1)(2), Schs. 2 (except as indicated) and 3 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

The text of s. 19(1)(2), Schs. 2 (except as indicated) and 3 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

1979 c.8 (40:1).

1979 c.8 (40:1).

1972 c.68 (29:5).

1979 c.8 (40:1).

1964 c.5 (68:1).

1964 c.81 (68:1).

1966 c.10 (26:1).

1968 c.18 (68:1).

1968 c.48 (68:1).

S. 1: for exercises of this power before 1.2.1991 see Index to Government Orders.

S. 1: ss. 1 and 4 power exercised (31.12.1991) by S.I.1991/2925

S. 4: for exercises of this power before 1.2.1991 see Index to Government Orders.

S. 4: ss. 1 and 4 power exercised (31.12.1991) by S.I.1991/2925.

S. 11A: S. 11A power exercised by S.I. 1991/2089

S. 13: power exercised by S.I. 1991/1286 and 1991/1287

S. 13: power exercised by S.I. 1991/1293

S. 13: for previous exercises of this power see Index to Government Orders

An Act to consolidate certain enactments relating to reliefs and exemptions from customs and excise duties, section 7 of the Finance Act 1968 and certain other related enactments.

The Secretary of State may, in accordance with subsections (2) to (6) below, by order provide for relieving goods from the whole or part of any customs duty chargeable on goods imported into the United Kingdom.

Goods of any description may be relieved from customs duty if and in so far as the relief appears to the Secretary of State to be necessary or expedient with a view to—

conforming with any Community obligations; or

otherwise affording relief provided for by or under the Community Treaties or any decisions of the representatives of the governments of the member States of the Coal and Steel Community meeting in Council.

Goods of any description may be relieved from customs duty if and in so far as the relief appears to the Secretary of State to be necessary or expedient with a view to conforming with an international agreement relating to matters other than commercial relations.

Exposed cinematograph film may be relieved from customs duty if certified as provided by the order to be of an educational character.

Relief given by virtue of subsection (4) above may be restricted with a view to securing reciprocity in countries or territories outside the United Kingdom.

Articles recorded with sound, other than exposed cinematograph film, may be relieved from customs duty (other than duty chargeable on similar articles not so recorded) if the articles are not produced in quantity for general sale as so recorded.

The Secretary of State may by regulations make such provision as regards reliefs from customs duty chargeable on goods imported into the United Kingdom as appears to him to be expedient having regard to the practices adopted or to be adopted in other member States, whether by law or administrative action and whether or not for conformity with Community obligations.

Regulations under this section may amend or repeal accordingly any of sections 1, 3, 4 and 15 of this Act.

Subject to the provisions of this section, the Secretary of State may direct that payment shall not be required of the whole or part of any customs duty which is chargeable on any goods imported or proposed to be imported into the United Kingdom if he is satisfied—

that the goods qualify for relief under this section; and

that in all the circumstances it is expedient for the relief to be given.

The following goods qualify for relief under this section, that is to say, articles intended and reasonably required—

for the purpose of subjecting the articles, or any material or component in the articles, to examination or tests with a view to promoting or improving the manufacture in the United Kingdom of goods similar to those articles or to that material or component, as the case may be; or

for the purpose of subjecting goods capable of use with those or similar articles (including goods which might be used as materials or components in such articles or in which such articles might be used as materials or components) to examination or tests with a view to promoting or improving the manufacture in the United Kingdom of those or similar goods.

Any direction of the Secretary of State under this section may be given subject to such conditions as he thinks fit.

Where a direction given by the Secretary of State under this section is subject to any conditions, and it is proposed to use or dispose of the goods in any manner for which the consent of the Secretary of State is required by the conditions, the Secretary of State may consent to the goods being so used or disposed of subject to payment of the duty which would have been payable but for the direction or such part of the duty as the Secretary of State thinks appropriate in the circumstances.

The Secretary of State shall not give a direction under this section except on a written application made by the importer, and a direction under this section shall have effect to such extent (if any) as the Commissioners may allow if the goods have been released from customs and excise control without the importer having given to the Commissioners notice of the direction or of his application or intention to apply for it.

Any notice to the Commissioners under subsection (5) above shall be in such form as they may require, and the Commissioners on receiving any such notice or at any time afterwards may impose any such conditions as they see fit for the protection of the revenue (including conditions requiring security for the observance of any conditions subject to which relief is granted).

A direction of the Secretary of State under this section shall have effect only if and so long as any conditions of the relief, including any conditions imposed by the Commissioners under subsection (6) above, are complied with; but where any customs duty is paid on the importation of any goods, and the Commissioners are satisfied that by virtue of a direction subsequently given and having effect under this section payment of the duty is not required, then the duty shall be repaid.

The Secretary of State may by order make provision for the administration of any relief under section 1 above or for the implementation or administration of any like relief provided for by any Community instrument.

An order under this section may in particular—

impose or authorise the imposition of conditions for securing that goods relieved from duty as being imported for a particular purpose are used for that purpose or such other conditions as appear expedient to secure the object or prevent abuse of the relief;

where the relief is limited to a quota of imported goods, provide for determining the allocation of the quota or for enabling it to be determined by the issue of certificates or licences or otherwise;

confer on a government department or any other authority or person functions in connection with the administration of the relief or the enforcement of any condition of relief;

authorise any government department having any such functions to make payments (whether for remuneration or for expenses) to persons advising the department or otherwise acting in the administration of the relief;

require the payment of fees by persons applying for the relief or applying for the registration of any person or premises in connection with the relief;

authorise articles for which relief is claimed to be sold or otherwise disposed of if the relief is not allowed and duty is not paid.

Any expenses incurred by a government department by virtue of any order under this section shall be defrayed out of money provided by Parliament, and any fees received by a government department by virtue of any such order shall be paid into the Consolidated Fund.

Subject to subsection (2) below, any goods which are the produce or growth of any of the Channel Islands or which have been manufactured in any of those islands from—

materials which are such produce or growth; or

materials not chargeable with any duty in the United Kingdom; or

materials so chargeable upon which that duty has been paid and not drawn back,

may be imported without payment of any customs duty chargeable thereon.

Subsection (1) above shall not apply in relation to any goods unless the master of the ship or commander of the aircraft in which the goods are imported produces to the proper officer at the place of importation a certificate from the Lieutenant-Governor or other proper authority of the island from which the goods are imported that a declaration in such form and containing such particulars as the Commissioners may direct has been made before a magistrate of that island by the person exporting the goods therefrom that the goods are goods to which this section applies.

Directions under subsection (2) above may make different provision for different circumstances and may be varied or revoked by subsequent directions thereunder.

The Commissioners may by order make provision for conferring reliefs from duty and value added tax in respect of goods imported into the United Kindom by or for any person who has become entitled to them as legatee.

Any such relief may take the form either of an exemption from payment of duty and tax or of a provision whereby the sum payable by way of duty or tax is less than it would otherwise be.

The Commissioners may by order make provision supplementing any Community relief, in such manner as they think necessary or expedient.

An order under this section—

may make any relief for which it provides or any Community relief subject to conditions, including conditions which are to be complied with after the importation of the goods to which the relief applies;

may, in relation to any relief conferred by order made under this section, contain such incidental and supplementary provisions as the Commissioners think necessary or expedient; and

may make different provision for different cases.

In this section—

“

“

“

“

The Commissioners may allow the delivery without payment of customs or excise duty on importation, subject to such conditions and restrictions as they see fit—

of trade samples of such goods as they see fit, whether imported as samples or drawn from the goods on their importation;

of labels or other articles supplied without charge for the purpose of being re-exported with goods manufactured or produced in, and to be exported from, the United Kingdom

The Commissioners may allow the delivery without payment of customs or excise duty on importation—

of any goods (other than spirits or wine) which are proved to the satisfaction of the Commissioners to have been manufactured or produced more than 100 years before the date of importation;

of articles which are shown to the satisfaction of the Commissioners to have been awarded abroad to any person for distinction in art, literature, science or sport, or for public service, or otherwise as a record of meritorious achievement or conduct, and to be imported by or on behalf of that person.

Without prejudice to any other enactment relating to excise, the following provisions of this section shall have effect in relation to goods manufactured or produced in the United Kingdom

If the goods are at the date of their re-importation excise goods, they may on re-importation be delivered for home use without payment of excise duty if it is shown to the satisfaction of the Commissioners—

that at the date of their exportation the goods were not excise goods or, if they were then excise goods, that the excise duty had been paid before their exportation; and

that no drawback in respect of the excise duty and no allowance has been paid on their exportation or that any such drawback or allowance so paid has been repaid to the Consolidated Fund; and

that the goods have not undergone any process outside the United Kingdom since their exportation.

If the goods both are at the date of their re-importation and were at the date of their exportation excise goods, but they were exported without the excise duty having been paid from a warehouse or from the place where they were manufactured or produced, then, where the following conditions are satisfied, that is to say—

it is shown to the satisfaction of the Commissioners that they have not undergone any process outside the United Kingdom since their exportation; and

any allowance paid on their exportation is repaid to the Consolidated Fund,

the goods may on their re-importation, subject to such conditions and restrictions as the Commissioners may impose, be entered and removed without payment of excise duty for re-warehousing or for return to the place where they were manufactured or produced, as the case may be.

Nothing in this section shall authorise the delivery for home use of any goods not otherwise eligible therefor.

In this section—

“

of a class or description chargeable at the time in question with a duty of excise; or

in the manufacture or preparation of which any goods of such a class or description have been used;

“

Without prejudice to any other enactment relating to excise but subject to subsection (2) below, goods manufactured or produced outside the United Kingdom

that no excise duty was chargeable thereon at their previous importation or that any excise duty so chargeable was then paid; and

that no drawback has been paid or excise duty refunded on their exportation or that any drawback so paid or excise duty so refunded has been repaid to the Consolidated Fund; and

that the goods have not undergone any process outside the United Kingdom since their exportation.

For the purposes of this section goods which on their previous importation were entered for transit or transhipment or were permitted to be delivered without payment of excise duty as being imported only temporarily with a view to subsequent re-exportation and which were re-exported accordingly shall on their re-importation be deemed not to have been previously imported.

The Commissioners may by order provide that, in such cases and subject to such exceptions as may be specified in the order, goods imported into the United Kingdom for the sole or main purpose—

of being examined, analysed or tested; or

of being used to test other goods,

shall be relieved from excise duty chargeable on importation; and any such relief may take the form either of an exemption from payment of duty or of a provision whereby the sum payable by way of duty is less than it otherwise would be.

An order under this section—

may make any relief for which it provides subject to conditions specified in or under the order, including conditions to be complied with after the importation of the goods to which the relief applies;

may contain such incidental and supplementary provisions as the Commissioners think necessary or expedient; and

may make different provision for different cases.

In this section, reference to excise duty include any additions to such duty by virtue of section 1 of the Excise Duties (Surcharges or Rebates) Act

The Treasury may by regulations provide that, subject to any prescribed conditions, goods of any description specified in the regulations which are supplied either—

to any ship of the Royal Navy in commission of a description so specified, for the use of persons serving in that ship, being persons borne on the books of that or some other ship of the Royal Navy or a naval establishment; or

to the Secretary of State, for the use of persons serving in ships of the Royal Navy or naval establishments,

shall for all or any purposes of any excise duty or drawback in respect of those goods be treated as exported, and a person supplying or intending to supply goods as mentioned in paragraph (a) or (b) above shall be treated accordingly as exporting or intending to export them.

Regulations made under this section with respect to goods of any description may regulate or provide for regulating the quantity allowed to any ship or establishment, the manner in which they are to be obtained and their use or distribution.

The regulations may—

contain such other incidental or supplementary provisions as appear to the Treasury to be necessary for the purposes of this section, including any adaptations of the customs and excise Acts; and

make different provision in relation to different cases, and in particular in relation to different classes or descriptions of goods or of ships or establishments.

In subsection (1) above “

Before making any regulations under this section, the Treasury shall consult with the Secretary of State and with the Commissioners.

The powers conferred by this section shall apply for the purposes of customs duty as they apply for the purposes of excise duty but shall not so apply after such day as the Commissioners may by order appoint.

The Commissioners may by order make provision for conferring on persons entering the United Kingdom reliefs from duty and value added tax; and any such relief may take the form either of an exemption from payment of duty and tax or of a provision whereby the sum payable by way of duty or tax is less than it would otherwise be.

The Commissioners may by order make provision supplementing any Community relief, in such manner as they think necessary or expedient.

Without prejudice to subsection (1) above, the Commissioners may by order make provision whereby, in such cases and to such extent as may be specified in the order, a sum calculated at a rate specified in the order is treated as the aggregate amount payable by way of duty and tax in respect of goods imported by a person entering the United Kingdom; but any order making such provision shall enable the person concerned to elect that duty and tax shall be charged on the goods in question at the rate which would be applicable apart from that provision.

An order under this section—

may make any relief for which it provides

may

may make different provision for different cases.

An order under this section may provide, in relation to any relief which under such an order is made subject to a condition, for there to be a presumption that, in such cases as may be described in the order by reference—

to the quantity of goods in question; or

to any other factor which the Commissioners consider appropriate,

the condition is to be treated, unless the Commissioners are satisfied to the contrary, as not being complied with.

An order under this section may provide, in relation to any requirement of such an order for the Commissioners to be notified of non-compliance with a condition to which any relief from payment of any duty of excise is made subject, for goods to be exempt from forfeiture under section 124 of the Customs and Excise Management Act 1979 (forfeiture for breach of certain conditions) in respect of non-compliance with that condition if—

the non-compliance is notified to the Commissioners in accordance with that requirement;

any duty which becomes payable on those goods by virtue of the non-compliance is paid; and

the circumstances are otherwise such as may be described in the order.

If any person fails to comply with any requirement of an order under this section to notify the Commissioners of any non-compliance with a condition to which any relief is made subject-

he shall be liable, on summary conviction, to a penalty of an amount not exceeding level 5 on the standard scale; and

the goods in respect of which the offence was committed shall be liable to forfeiture.

In this section—

“

“value added tax” or “

Nothing in any order under this section shall be construed as authorising any person to import any thing in contravention of any prohibition or restriction for the time being in force with respect thereto under or by virtue of any enactment.

The Commissioners may by order make provision for conferring in respect of any persons to whom this section applies reliefs, by way of remission or repayment, from payment by them or others of duties of customs or excise, value added tax or car tax.

An order under this section may make any relief for which it provides subject to such conditions binding the person in respect of whom the relief is conferred and, if different, the person liable apart from the relief for payment of the tax or duty (including conditions which are to be complied with after the time when, apart from the relief, the duty or tax would become payable) as may be imposed by or under the order.

An order under this section may include any of the provisions mentioned in subsection (4) below for cases where—

relief from payment of any duty of customs or excise, value added tax or car tax chargeable on any goods, or on the supply of any goods or services or the importation of any goods has been conferred (whether by virtue of an order under this section or otherwise) in respect of any person to whom this section applies, and

any condition required to be complied with in connection with the relief is not complied with.

The provisions referred to in subsection (3) above are—

provision for payment to the Commissioners of the tax or duty by—

the person liable, apart from the relief, for its payment, or

any person bound by the condition, or

any person who is or has been in possession of the goods or has received the benefit of the services,

or for two or more of those persons to be jointly and severally liable for such payment, and

in the case of goods, provision for forfeiture of the goods.

An order under this section—

may contain such incidental and supplementary provisions as the Commissioners think necessary or expedient, and

may make different provision for different cases.

In this section and section 13C of this Act—

“

“

For the purposes of this section and section 13C of this Act, where in respect of any person to whom this section applies relief is conferred (whether by virtue of an order under this section or otherwise) in relation to the use of goods by any persons or for any purposes, the relief is to be treated as conferred subject to a condition binding on him that the goods will be used only by those persons or for those purposes.

Nothing in any order under this section shall be construed as authorising a person to import any thing in contravention of any pro-hibition or restriction for the time being in force with respect to it under or by virtue of any enactment.

The persons to whom section 13A of this Act applies are—

any person who, for the purposes of any provision of the Visiting Forces Act

a member of a visiting force or of a civilian component of such a force or a dependent of such a member, or

a headquarters, a member of a headquarters or a dependant of such a member,

any person enjoying any privileges or immunities under or by virtue of—

the Diplomatic Privileges Act

the Commonwealth Secretariat Act

the Consular Relations

the International Organisations Act

the International Development Act 2002.

any person enjoying, under or by virtue of section 2 of the European Communities Act 1972, any privileges or immunities similar to those enjoyed under or by virtue of the enactments referred to in paragraph (b) above.

The Secretary of State may by order amend subsection (1) above to include any persons enjoying any privileges or immunities similar to those enjoyed under or by virtue of the enactments referred to in paragraph (b) of that subsection.

No order shall be made under this section unless a draft of the order has been laid before and approved by resolution of each House of Parliament.

Subsection (2) below applies where—

any relief from payment of any duty of customs or excise, value added tax or car tax chargeable on, or on the supply or importation of, any goods has been conferred (whether by virtue of an order under section 13A of this Act or otherwise) in respect of any person to whom that section applies subject to any condition as to the persons by whom or the purposes for which the goods may be used, and

if the tax or duty has subsequently become payable, it has not been paid.

If any person—

acquires the goods for his own use, where he is not permitted by the condition to use them, or for use for a purpose that is not permitted by the condition or uses them for such a purpose, or

acquires the goods for use, or causes or permits them to be used, by a person not permitted by the condition to use them or by a person for a purpose that is not permitted by the condition or disposes of them to a person not permitted by the condition to use them,

with intent to evade payment of any tax or duty that has become payable or that, by reason of the disposal, acquisition or use, becomes or will become payable, he is guilty of an offence.

For the purposes of this section—

in the case of a condition as to the persons by whom goods may be used, a person is not permitted by the condition to use them unless he is a person referred to in the condition as permitted to use them, and

in relation to a condition as to the purposes for which goods may be used, a purpose is not permitted by the condition unless it is a purpose referred to in the condition as a permitted purpose,

and in this section “dispose” includes “lend” and “let on hire”, and “acquire” shall be interpreted accordingly.

A person guilty of an offence under this section may be detained and shall be liable—

on summary conviction, to a penalty of the statutory maximum or of three times the value of the goods (whichever is the greater), or to imprisonment for a term not exceeding six months, or to both, or

on conviction on indictment, to a penalty of any amount, or to imprisonment for a term not exceeding seven years, or to both.

Where any person is guilty of an offence under this section, the goods in respect of which the offence was committed shall be liable to forfeiture.

Fish, whales or other natural produce of the sea, or goods produced or manufactured therefrom at sea, if brought direct to the United Kingdom, shall—

in the case of goods which, under any enactment or instrument having the force of law, are to be treated as originating in the United Kingdom, be deemed for the purposes of any charge to customs duty not to be imported; and

in the case of goods which, under any enactment or instrument having the force of law, are to be treated as originating in any other country or territory, be deemed to be consigned to the United Kingdom from that country.

Any goods brought into the United Kingdom which are shown to the satisfaction of the Commissioners to have been grown, produced or manufactured in any area for the time being designated under section 1(7) of the

The Secretary of State may by regulations prescribe cases in which, with a view to exempting any goods from any duty, or charging any goods with duty at a reduced or preferential rate, under any of the enactments relating to duties of customs the continental shelf of any country prescribed by the regulations, or of any country of a class of countries so prescribed, shall be treated for the purposes of such of those enactments or of any instruments made thereunder as may be so prescribed as if that shelf formed part of that country and any goods brought from that shelf were consigned from that country.

In subsection (3) above “

if that country is the United Kingdom, any area for the time being designated under section 1(7) of the

in any other case, the seabed and sub-soil of the submarine areas adjacent to the coast, but outside the seaward limits of the territorial waters, of that country over which the exercise by that country of sovereign rights in accordance with international law is recognised or authorised by Her Majesty’s Government in the United Kingdom.

If a person—

for the purpose of an application for relief from customs duty under section 1 or 3 above or under a Community instrument; or

for the purpose of an application for an authorisation under regulations made under section 2 above,

makes any statement or furnishes any document which is false in a material particular to any government department or to any authority or person on whom functions are conferred by or under section 1, 3 or 4 above or a Community instrument, then—

any decision allowing the relief or granting the authorisation applied for shall be of no effect; and

if the statement was made or the document was furnished knowingly or recklessly, that person shall be guilty of an offence under this section.

A person guilty of an offence under this section shall be liable—

on summary conviction, to a fine not exceeding the prescribed sum, or to imprisonment for a term not exceeding 3 months, or to both; or

on conviction on indictment, to a fine of any amount or to imprisonment for a term not exceeding 2 years, or to both.

In subsection (2)(a) above “

if the offence was committed in England

if the offence was committed in Scotland, the prescribed sum within the meaning of

if the offence was committed in Northern Ireland, the prescribed sum within the meaning of Article 4 of the Fines and Penalties (Northern Ireland) Order 1984 (£1,0 or other sum substituted by order under Article 17 of that Order).

References in Parts XI and XII of the

As soon as may be after the end of each financial year the Secretary of State shall lay before each House of Parliament a report on the exercise during that year of the powers conferred by sections 1, 3 and 4 above with respect to the allowance of exemptions and reliefs from customs duties (including the power to amend or revoke orders providing for any exemption or relief from customs duties).

Any power to make orders or regulations under this Act shall be exercisable by statutory instrument.

Any statutory instrument containing regulations under section 2 or 12 above shall be subject to annulment in pursuance of a resolution of either House of Parliament except where, in the case of regulations under section 2, a draft of the regulations has been approved by resolution of each House of Parliament.

Any statutory instrument containing an order under section 1, 4

Subject to subsection (5) below, where an order under section 1, 4

In reckoning the said period of 28 days no account shall be taken of any time during which Parliament is dissolved or prorogued or during which the House of Commons is adjourned for more than 4 days.

Subjection (4) above does not apply in the case of an instrument containing an order under section 1

For the purposes of this section restricting any relief includes removing or reducing any relief previously conferred.

This Act and the other Acts included in the Customs and Excise Acts 1979 shall be construed as one Act but where a provision of this Act refers to this Act that reference is not to be construed as including a reference to any of the others.

Any expression used in this Act or in any instrument made under this Act to which a meaning is given by any other Act included in the Customs and Excise Acts 1979 has, except where the context otherwise requires, the same meaning in this Act or in any such instrument as in that Act; and for ease of reference the Table below indicates the expressions used in this Act to which a meaning is given by any other such Act—

Customs and Excise Management Act 1979

“the Commissioners”

“the Customs and Excise Acts 1979”

“the customs and excise Acts”

“customs and excise airport”

“goods”

“hovercraft”

“importer”

“master”

“

“port”

“ship”

“transit and transhipment”

“warehouse”

Alcoholic Liquor Duties Act 1979

“spirits”

“wine”

This Act applies as if references to ships included references to hovercraft.

The enactments specified in Schedule 2 to this Act shall be amended in accordance with the provisions of that Schedule.

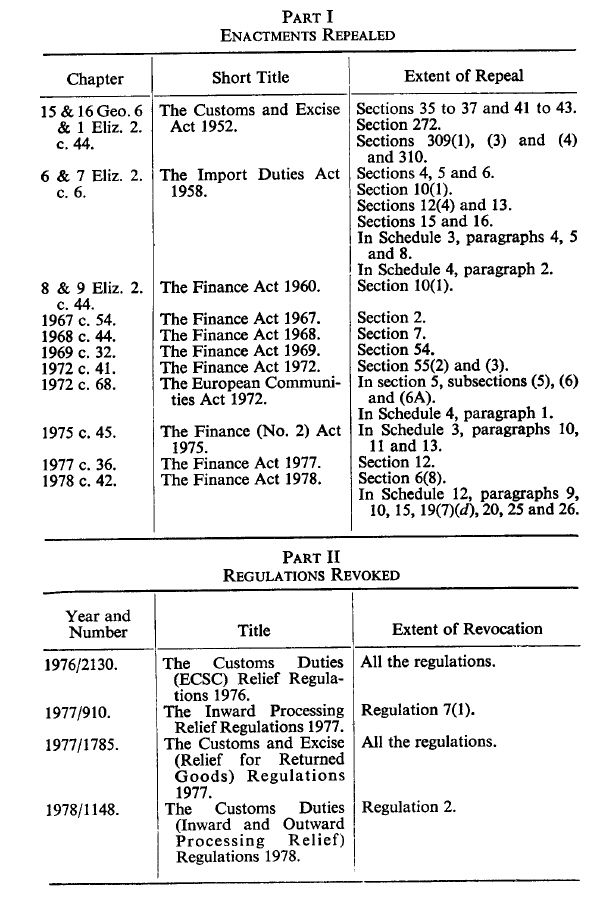

The enactments specified in Part I of Schedule 3 to this Act are hereby repealed to the extent specified in the third column of that Schedule and the regulations specified in Part II of that Schedule are hereby revoked to the extent so specified.

References to import duties in instruments in force at the commencement of this Act shall, on and after that commencement, be construed—

in the case of references in orders under section 5 or directions under section 6 of the

in the case of references in such orders or directions made by virtue of section 5(1A) of the said Act of 1958 or in regulations under section 5(6) of the

This Act may be cited as the Customs and Excise Duties (General Reliefs) Act 1979 and is included in the Acts which may be cited as the Customs and Excise Acts 1979.

This Act shall come into operation on 1st April 1979.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Section 19(1)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Schedule 2 to this Act shall also have effect in connection with the powers to make orders conferred by subsection (1) and (2) above.

sections 1, 3, 4, 5, 6 (including Schedule 1), 7, 8, 9, 12, 13, 15, 17 and 18 of the Customs and Excise Duties (General Reliefs) Act 1979 but so that— anty references in sections 1, 3 and 4 to the Secretary of State shall include the Ministers ; and the reference in section 15 to an application for an authorisation under regulations made under section 2 of that Act shall be read as a reference to an application for an authorisation under regulations made under section 2(2) of this Act ;

The power to make orders under section 5(1) or (2) of this Act shall be exercisable in accordance with the following provisions of this paragraph. The power to make such orders shall be exercisable by statutory instrument and includes power to amend or revoke any such order made in the exercise of that power. Any statutory instrument containing any such order shall be subject to annulment in pursuance of a resolution of the House of Commons except in a case falling within sub-paragraph (4) below. Subject to sub-paragraph (6) below, where an order imposes or increases any customs duty, or restricts any relief from customs duty under the said section 5, the statutory instrument containing the order shall be laid before the House of Commons after being made and, unless the order is approved by that House before the end of the period of 28 days beginning with the day on which it was made, it shall cease to have effect at the end of that period, but without prejudice to anything previously done under the order or to the making of a new order. In reckoning the said period of 28 days no account shall be taken of any time during which Parliament is dissolved or prorogued or during which the House of Commons is adjourned for more than 4 days. Where an order has the effect of altering the rate of duty on any goods in such a way that the new rate is not directly comparable with the old, it shall not be treated for the purposes of sub-paragraph (4) above as increasing the duty on those goods if it declares the opinion of the Treasury to be that, in the circumstances existing at the date of the order, the alteration is not calculated to raise the general level of duty on the goods. Sub-paragraph (4) above does not apply in the case of an instrument containing an order which states that it does not impose or increase any customs duty or resrict ant relief from customs duty otherwise than in pursuance of a Community obligation. As soon as may be after the end of each financial year the Secretary of State shall lay before each House of Parliament a report on the exercise during that year of the powers conferred by section 5(1) and (2) of this Act with respect to the imposition of customs duties and the allowance of exemptions and reliefs from duties so imposed (including the power to amend or revoke orders imposing customs duties or providing for any exemption or relief from duties so imposed).

Section 19(2).