SCHEDULES

[SCHEDULE 1U.K. EXCEPTED VEHICLES

Unlicensed vehicles not used on public roadsU.K.

1(1)A vehicle is an excepted vehicle while—U.K.

(a)it is not used on a public road, and

(b)no licence under the Vehicle Excise and Registration Act 1994 is in force in respect of it.

(2)A vehicle in respect of which there is current a certificate or document in the form of a licence issued under regulations under section 22(2) of the Vehicle Excise and Registration Act 1994 shall be treated for the purposes of sub-paragraph (1) above as a vehicle in respect of which a licence under that Act is in force.

TractorsU.K.

2(1)A vehicle is an excepted vehicle if it is—U.K.

(a)an agricultural tractor, . . .

(b). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(2)In sub-paragraph (1) above “agricultural tractor” means a tractor used on public roads solely for purposes relating to agriculture, horticulture, forestry or activities falling within sub-paragraph (3) below.

(3)The activities falling within this sub-paragraph are—

(a)cutting verges bordering public roads;

(b)cutting hedges or trees bordering public roads or bordering verges which border public roads.

(4). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Light agricultural vehiclesU.K.

3(1)A vehicle is an excepted vehicle if it is a light agricultural vehicle.U.K.

(2)In sub-paragraph (1) above “light agricultural vehicle” means a vehicle which—

(a)has a revenue weight not exceeding 1,000 kilograms,

(b)is designed and constructed so as to seat only the driver,

(c)is designed and constructed primarily for use otherwise than on roads, and

(d)is used solely for purposes relating to agriculture, horticulture or forestry.

(3)In sub-paragraph (2)(a) above “revenue weight” has the meaning given by section 60A of the Vehicle Excise and Registration Act 1994.

Agricultural enginesU.K.

4U.K.An agricultural engine is an excepted vehicle.

Vehicles used between different parts of landU.K.

5U.K.A vehicle is an excepted vehicle if—

(a)it is used only for purposes relating to agriculture, horticulture or forestry,

(b)it is used on public roads only in passing between different areas of land occupied by the same person, and

(c)the distance it travels on public roads in passing between any two such areas does not exceed 1.5 kilometres.

Mowing machinesU.K.

6U.K.A mowing machine is an excepted vehicle.

Snow clearing vehiclesU.K.

7U.K.A vehicle is an excepted vehicle when it is—

(a)being used, or

(b)going to or from the place where it is to be or has been used,

for the purpose of clearing snow from public roads by means of a snow plough or similar device (whether or not forming part of the vehicle).

GrittersU.K.

8U.K.A vehicle is an excepted vehicle if it is constructed or adapted, and used, solely for the conveyance of machinery for spreading material on roads to deal with frost, ice or snow (with or without articles or material used for the purposes of the machinery).

Mobile cranesU.K.

9(1)A mobile crane is an excepted vehicle.U.K.

(2)In sub-paragraph (1) above “mobile crane” means a vehicle which is designed and constructed as a mobile crane and which—

(a)is used on public roads only as a crane in connection with work carried on at a site in the immediate vicinity or for the purpose of proceeding to and from a place where it is to be or has been used as a crane, and

(b)when so proceeding does not carry any load except such as is necessary for its propulsion or equipment.

Digging machinesU.K.

10(1)A digging machine is an excepted vehicle.U.K.

(2)In sub-paragraph (1) above “digging machine” means a vehicle which is designed, constructed and used for the purpose of trench digging, or any kind of excavating or shovelling work, and which—

(a)is used on public roads only for that purpose or for the purpose of proceeding to and from the place where it is to be or has been used for that purpose, and

(b)when so proceeding does not carry any load except such as is necessary for its propulsion or equipment.

Works trucksU.K.

11(1)A works truck is an excepted vehicle.U.K.

(2)In sub-paragraph (1) above “works truck” means a goods vehicle which is designed for use in private premises and is used on public roads only—

(a)for carrying goods between private premises and a vehicle on a road within one kilometre of those premises,

(b)in passing from one part of private premises to another,

(c)in passing between private premises and other private premises in a case where the premises are within one kilometre of each other, or

(d)in connection with road works at the site of the works or within one kilometre of the site of the works.

(3)In sub-paragraph (2) above “goods vehicle” means a vehicle constructed or adapted for use and used for the conveyance of goods or burden of any description, whether in the course of trade or not.

Road construction vehiclesU.K.

12(1)A vehicle is an excepted vehicle if it is—U.K.

(a)a road construction vehicle, and

(b)used or kept solely for the conveyance of built-in road construction machinery (with or without articles or material used for the purposes of the machinery).

(2)In sub-paragraph (1) above “road construction vehicle” means a vehicle—

(a)which is constructed or adapted for use for the conveyance of built-in road construction machinery, and

(b)which is not constructed or adapted for the conveyance of any other load except articles and material used for the purposes of such machinery.

(3)In sub-paragraphs (1) and (2) above “built-in road construction machinery”, in relation to a vehicle, means road construction machinery built in as part of, or permanently attached to, the vehicle.

(4)In sub-paragraph (3) above “road construction machinery” means a machine or device suitable for use for the construction or repair of roads and used for no purpose other than the construction or repair of roads.

Road rollersU.K.

13U.K.A road roller is an excepted vehicle.

InterpretationU.K.

14U.K.In this Schedule “public road” means a road which is repairable at the public expense.]

Section 17(7).

SCHEDULE 2U.K. MEANING OF “HORTICULTURAL PRODUCE” FOR PURPOSES OF RELIEF UNDER SECTION 17

In section 17 of this Act “horticultural produce” means—

(a)fruit;

(b)vegetables of a kind grown for human consumption, including fungi, but not including maincrop potatoes or peas grown for seed, for harvesting dry or for vining;

(c)flowers, pot plants and decorative foliage;

(d)herbs;

(e)seeds other than pea seeds, and bulbs and other material, being seeds, bulbs or material for sowing or planting for the production of—

(i)fruit,

(ii)vegetables falling within paragraph (b) above,

(iii)flowers, plants or foliage falling within paragraph (c) above, or

(iv)herbs,

or for reproduction of the seeds, bulbs or other material planted; or

(f)trees and shrubs, other than trees grown for the purpose of afforestation;

but does not include hops.

SCHEDULE 2AU.K. Mixing of rebated oil

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Section 21(1).

SCHEDULE 3U.K. SUBJECTS FOR REGULATIONS UNDER SECTION 21

Part IU.K. hydrocarbon oil

1U.K.Prohibiting the production of hydrocarbon oil or any description of hydrocarbon oil except by a person holding a licence.

2U.K.[Specifying the circumstances in which any such licence may be surrendered or revoked]

3U.K.Regulating the production, storage and warehousing of hydrocarbon oil or any description of hydrocarbon oil and the removal of any such oil to or from premises used for the production of any such oil.

Modifications etc. (not altering text)

4U.K.Prohibiting the refining of hydrocarbon oil elsewhere than in a refinery.

5U.K.Prohibiting the incorporation of gas in hydrocarbon oil elsewhere than in a refinery.

6U.K.Regulating the use and storage of hydrocarbon oil in a refinery.

Modifications etc. (not altering text)

7U.K.Regulating or prohibiting the removal to a refinery of hydrocarbon oil in respect of which any rebate has been allowed.

Modifications etc. (not altering text)

8U.K.Regulating the removal of imported hydrocarbon oil to a refinery without payment of the excise duty on such oil.

Modifications etc. (not altering text)

9U.K.Making provision for securing payment of the excise duty on any imported hydrocarbon oil received into a refinery.

Modifications etc. (not altering text)

10U.K.Relieving from the excise duty chargeable on hydrocarbon oil produced in the United Kingdom any such oil intended for exportation or shipment as stores.

Modifications etc. (not altering text)

[10A U.K.Amending the definition of “aviation gasoline” in subsection (4) of section 6 of this Act.]

Textual Amendments

Modifications etc. (not altering text)

10B U.K.Conferring power to require information relating to the supply or use of aviation gasoline to be given by producers, dealers and users.

Textual Amendments

Modifications etc. (not altering text)

10C U.K.Requiring producers and users of and dealers in aviation gasoline to keep and produce records relating to aviation gasoline.

Textual Amendments

Modifications etc. (not altering text)

11U.K.Generally for securing and collecting the excise duty chargeable on hydrocarbon oil . . . .

Textual Amendments

Modifications etc. (not altering text)

Part IIU.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Part IIIU.K. road fuel gas

17U.K.Prohibiting the production of gas, and dealing in gas on which the excise duty has not been paid, except by persons holding a licence.

18U.K.[Specifying the circumstances in which any such licence may be surrendered or revoked].

19U.K.Regulating the production, dealing in, storage and warehousing of gas and the removal of gas to and from premises used therefor.

20U.K.Requiring containers for gas to be marked in the manner prescribed by the regulations.

21U.K.Conferring power to require information relating to the supply or use of gas and containers for gas to be given by producers of and dealers in gas, and by the person owning or possessing or for the time being in charge of any road vehicle which is constructed or adapted to use gas as fuel.

22U.K.Requiring a person owning or possessing a road vehicle which is constructed or adapted to use gas as fuel to keep such accounts and records in such manner as may be prescribed by the regulations, and to preserve such books and documents relating to the supply of gas to or by him, or the use of gas by him, for such period as may be so prescribed.

23U.K.Requiring the production of books or documents relating to the supply or use of gas or the use of any road vehicle.

24U.K.Authorising the entry and inspection of premises (other than private dwelling-houses) and the examination of road vehicles, and authorising, or requiring the giving of facilities for, the inspection of gas found on any premises entered or on or in any road vehicle.

25U.K.Generally for securing and collecting the excise duty.

In this Part of this Schedule “the excise duty” means the excise duty chargeable under section 8 of this Act on gas, and “gas” means road fuel gas.

Section 24(1).

SCHEDULE 4U.K. SUBJECTS FOR REGULATIONS UNDER SECTION 24

As to grant of relief . . . U.K.

1U.K.Regulating the approval of persons for purposes of section 9(1) or (4) or 14(1) of this Act, whether individually or by reference to a class, and whether in relation to particular descriptions of oil or generally; enabling approval to be granted subject to conditions and providing for the conditions to be varied, or the approval revoked, for reasonable cause.

2U.K.Enabling permission under section 9(1) of this Act to be granted subject to conditions as to the giving of security and otherwise.

[3U.K.Requiring claims or applications for repayment under section 9(4), 17, [17A,]. . . 19 or 19A of this Act to be made at such times and in respect of such periods as are prescribed; providing that no such claim or application shall lie where the amount to be paid is less than the prescribed minimum; and preventing, where a claim or application can be made under section 9(4) or 19, the payment of drawback.]

As to mixing of oilU.K.

4U.K.Imposing restrictions on the mixing with other oil of any rebated oil or oil delivered without payment of duty.

As to marking of oilU.K.

5U.K.Requiring as a condition of allowing rebate on, or delivery without payment of duty of, any oil (subject to any exceptions provided by or under the regulations) that there shall have been added to that oil, at such times, in such manner and in such proportions as may be prescribed, one or more prescribed markers, with or without a prescribed colouring substance (not being a prescribed marker), and that a declaration to that effect is furnished.

Modifications etc. (not altering text)

6U.K.Prescribing the substances which are to be used as markers.

7U.K.Providing that the presence of a marker shall be disregarded if the proportion in which it is present is less than that prescribed for the purposes of this paragraph.

8U.K.Prohibiting the addition to any oil of any prescribed marker or prescribed colouring substance except in such circumstances as may be prescribed.

Modifications etc. (not altering text)

9U.K.Prohibiting the removal from any oil of any prescribed marker or prescribed colouring substance.

Modifications etc. (not altering text)

10U.K.Prohibiting the addition to oil of any substance, not being a prescribed marker, which is calculated to impede the identification of a prescribed marker.

Modifications etc. (not altering text)

11U.K.Regulating the storage or movement of prescribed markers.

12U.K.Requiring any person who adds a prescribed marker to any oil to keep in such manner and to preserve for such period as may be prescribed such accounts and records in connection with his use of that marker as may be prescribed, and requiring the production of the accounts and records.

Modifications etc. (not altering text)

13U.K.Requiring, in such circumstances or subject to such exceptions as may be prescribed, that any drum, storage tank, delivery pump or other container or outlet which contains any oil in which a prescribed marker is present shall be marked in the prescribed manner to indicate that the oil is not to be used as road fuel or for any other prohibited purpose.

Modifications etc. (not altering text)

14U.K.Requiring any person who supplies oil in which a prescribed marker is present to deliver to the recipient a document containing a statement in the prescribed form to the effect that the oil is not to be used as road fuel or for any other prohibited purpose.

Modifications etc. (not altering text)

15U.K.Prohibiting the sale of any oil the colour of which would prevent any prescribed colouring substance from being readily visible if present in the oil.

Modifications etc. (not altering text)

16U.K.Prohibiting the importation of oil in which any prescribed marker, or any other substance which is calculated to impede the identification of a prescribed marker, is present.

Modifications etc. (not altering text)

As to control of storage, supply etc. of oil, entry of premises etc.U.K.

17U.K.Regulating the storage or movement of oil.

Modifications etc. (not altering text)

18U.K.Restricting the supplying of oil in respect of which rebate has been allowed and not repaid or on which excise duty has not been paid.

[18AU.K.Prohibiting the use of aviation gasoline otherwise than as a fuel for aircraft.]

18BU.K.Prohibiting the taking of aviation gasoline into fuel tanks for engines other than aircraft engines.

19U.K.Requiring a person owning or possessing a road vehicle which is constructed or adapted to use heavy oil as fuel to keep such accounts and records in such manner as may be prescribed, and to preserve such books and documents relating to the supply of heavy oil to or by him, or the use of heavy oil by him, for such period as may be prescribed.

20U.K.Requiring the production of books or documents relating to the supply or use of oil or the use of any vehicle.

21U.K.Authorising the entry and inspection of premises (other than private dwelling-houses) and the examination of vehicles, and authorising, or requiring the giving of facilities for, the inspection of oil found on any premises entered or on or in any vehicle and the taking of samples of any oil inspected.

Modifications etc. (not altering text)

InterpretationU.K.

22U.K.In this Schedule—

and section 12(3)(a) of this Act shall apply for the purposes of paragraph 19 above as it applies for the purposes of that section.

Section 24(5).

SCHEDULE 5U.K. SAMPLING

1U.K.The person taking a sample—

(a)if he takes it from a motor vehicle, shall if practicable do so in the presence of a person appearing to him to be the owner or person for the time being in charge of the vehicle;

(b)if he takes the sample on any premises but not from a motor vehicle, shall if practicable take it in the presence of a person appearing to him to be the occupier of the premises or for the time being in charge of the part of the premises from which it is taken.

2(1)The result of an analysis of a sample shall not be admissible—U.K.

(a)in criminal proceedings under the Customs and Excise Acts 1979; or

(b)on behalf of the Commissioners in any civil proceedings under those Acts,

unless the analysis was made by an authorised analyst and the requirements of paragraph 1 above (where applicable) and of the following provisions of this paragraph have been complied with.

(2)The person taking a sample must at the time have divided it into three parts (including the part to be analysed), marked and sealed or fastened up each part, and—

(a)delivered one part to the person in whose presence the sample was taken in accordance with paragraph 1 above, if he requires it; and

(b)retained one part for future comparison.

(3)Where it was not practicable to comply with the relevant requirements of paragraph 1 above, the person taking the sample must have served notice on the owner or person in charge of the vehicle or, as the case may be, the occupier of the premises informing him that the sample has been taken and that one part of it is available for delivery to him, if he requires it, at such time and place as may be specified in the notice.

3(1)Subject to sub-paragraph (2) below, in any such proceedings as are mentioned in paragraph 2(1) above a certificate purporting to be signed by an authorised analyst and certifying the presence of any substance in any such sample of oil as may be specified in the certificate shall be evidence, and in Scotland sufficient evidence, of the facts stated in it.U.K.

(2)Without prejudice to the admissibility of the evidence of the analyst (which shall be sufficient in Scotland as well as in England), such a certificate shall not be admissible as evidence—

(a)unless a copy of it has, not less than 7 days before the hearing, been served by the prosecutor or, in the case of civil proceedings, the Commissioners on all other parties to the proceedings; or

(b)if any of those other parties, not less than 3 days before the hearing or within such further time as the court may in special circumstances allow, serves notice on the prosecutor or, as the case may be, the Commissioners requiring the attendance at the hearing of the person by whom the analysis was made.

4(1)Any notice required or authorised to be given under this Schedule shall be in writing.U.K.

(2)Any such notice shall be deemed, unless the contrary is shown, to have been received by a person if it is shown to have been left for him at his last-known residence or place of business in the United Kingdom.

(3)Any such notice may be given by post, and the letter containing the notice may be sent to the last-known residence or place of business in the United Kingdom of the person to whom it is directed.

(4)Any such notice given to the secretary or clerk of a company or body of persons (incorporated or unincorporated) on behalf of the company or body shall be deemed to have been given to the company or body; and for the purpose of the foregoing provisions of this paragraph any such company or body of persons having an office in the United Kingdom shall be treated as resident at that office or, if it has more then one, at the registered or principal office.

(5)Where any such notice is to be given to any person as the occupier of any land, and it is not practicable after reasonable inquiry to ascertain—

(a)what is the name of any person being the occupier of the land; or

(b)whether or not there is a person being the occupier of the land,

the notice may be addressed to the person concerned by any sufficient description of the capacity in which it is given to him.

(6)In any case to which sub-paragraph (5) above applies, and in any other case where it is not practicable after reasonable inquiry to ascertain an address in the United Kingdom for the service of a notice to be given to a person as being the occupier of any land, the notice shall be deemed to have been received by the person concerned on being left for him on the land, either in the hands of a responsible person or conspicuously affixed to some building or object on the land.

(7)Sub-paragraphs (2) to (6) above shall not affect the validity of any notice duly given otherwise than in accordance with those sub-paragraphs.

5U.K.In this Schedule “authorised analyst” means—

(a)the Government Chemist or a person acting under his direction;

(b)the Government Chemist for Northern Ireland or a person acting under his direction;

(c)any chemist authorised by the Treasury to make analyses for the purposes of this Schedule; or

(d)any other person appointed as a public analyst or deputy public analyst under—

[section 27 of the Food Safety Act 1990], or

[Article 27(1) of the Food Safety (Northern Ireland) Order 1991].

5N.I.In this Schedule “authorised analyst” means—

(a)the Government Chemist or a person acting under his direction;

(b)the Government Chemist for Northern Ireland or a person acting under his direction;

(c)any chemist authorised by the Treasury to make analyses for the purposes of this Schedule; or

(d)any other person appointed as a public analyst or deputy public analyst under—

[section 27 of the Food Safety Act 1990], or

[Article 27(1) of the Food Safety (Northern Ireland) Order 1991].

6U.K.References in this Schedule to the taking of a sample or to a sample shall be construed respectively as references to the taking of a sample in pursuance of regulations under section [20AA or] 24 of this Act and to a sample so taken.

7U.K.This Schedule shall have effect in its application to a vehicle of which a person other than the owner is, or is for the time being, entitled to possession as if for references to the owner there were substituted references to the person entitled to possession.

Section 28(1).

SCHEDULE 6U.K. CONSEQUENTIAL AMENDMENTS

Finance Act 1965 and Finance Act (Northern Ireland) Act 1965U.K.

1U.K.In section 92(2) of the Finance Act 1965 and section 14(2) of the Finance Act (Northern Ireland) Act 1966 (grants towards duty on bus fuel) for the words “hydrocarbon oil” there shall be substituted the words “ heavy oil ”.

Modifications etc. (not altering text)

Marginal Citations

Transport Act 1968U.K.

2U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3, 4, 5.U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Excise Duties (Gas as Road Fuel) Order 1972U.K.

6U.K.In Article 3 of the Excise Duties (Gas as Road Fuel) Order 1972 for the words “hydrocarbon oil” there shall be substituted the words “ light oil ”.

Modifications etc. (not altering text)

Marginal Citations

7U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Section 28(2)

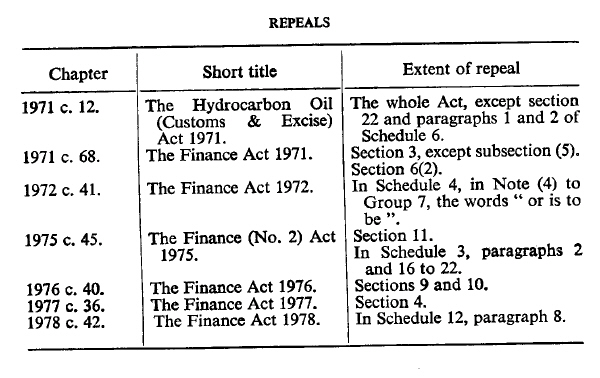

SCHEDULE 7U.K. REPEALS

Modifications etc. (not altering text)