- Y Diweddaraf sydd Ar Gael (Diwygiedig)

- Gwreiddiol (Fel y’i mabwysiadwyd gan yr UE)

Directive 2006/48/EC of the European Parliament and of the council (repealed)Dangos y teitl llawn

Directive 2006/48/EC of the European Parliament and of the council of 14 June 2006 relating to the taking up and pursuit of the business of credit institutions (recast) (Text with EEA relevance) (repealed)

You are here:

Rhagor o Adnoddau

PDF o Fersiynau Diwygiedig

- ddiwygiedig 01/01/20140.44 MB

- ddiwygiedig 01/07/20131.94 MB

- ddiwygiedig 09/12/20112.31 MB

- ddiwygiedig 04/01/20111.41 MB

- ddiwygiedig 30/03/20100.93 MB

- ddiwygiedig 07/12/20090.93 MB

- ddiwygiedig 30/10/20090.88 MB

- ddiwygiedig 17/08/20090.88 MB

- ddiwygiedig 21/03/20080.84 MB

- ddiwygiedig 25/12/20070.84 MB

- ddiwygiedig 21/09/20070.84 MB

- ddiwygiedig 17/04/20070.85 MB

Pan adawodd y DU yr UE, cyhoeddodd legislation.gov.uk ddeddfwriaeth yr UE a gyhoeddwyd gan yr UE hyd at ddiwrnod cwblhau’r cyfnod gweithredu (31 Rhagfyr 2020 11.00 p.m.). Ar legislation.gov.uk, mae'r eitemau hyn o ddeddfwriaeth yn cael eu diweddaru'n gyson ag unrhyw ddiwygiadau a wnaed gan y DU ers hynny.

Mae'r eitem hon o ddeddfwriaeth yn tarddu o'r UE

Mae legislation.gov.uk yn cyhoeddi fersiwn y DU. Mae EUR-Lex yn cyhoeddi fersiwn yr UE. Mae Archif Gwe Ymadael â’r UE yn rhoi cipolwg ar fersiwn EUR-Lex o ddiwrnod cwblhau’r cyfnod gweithredu (31 Rhagfyr 2020 11.00 p.m.).

Status:

Dyma’r fersiwn wreiddiol (fel y’i gwnaed yn wreiddiol).

PART 1Risk weighted exposure amounts and expected loss amounts

1.CALCULATION OF RISK WEIGHTED EXPOSURE AMOUNTS FOR CREDIT RISK

1.Unless noted otherwise, the input parameters PD, LGD, and maturity value (M) shall be determined as set out in Part 2 and the exposure value shall be determined as set out in Part 3.

2.The risk weighted exposure amount for each exposure shall be calculated in accordance with the following formulae.

1.1.Risk weighted exposure amounts for exposures to corporates, institutions and central governments and central banks.

3.Subject to points 5 to 9, the risk weighted exposure amounts for exposures to corporates, institutions and central governments and central banks shall be calculated according to the following formulae:

N(x) denotes the cumulative distribution function for a standard normal random variable (i.e. the probability that a normal random variable with mean zero and variance of one is less than or equal to x). G (Z) denotes the inverse cumulative distribution function for a standard normal random variable (i.e. the value x such that N(x) z)

For PD = 0, RW shall be 0.

For PD = 1:

for defaulted exposures where credit institutions apply the LGD values set out in Part 2, point 8, RW shall be 0; and

for defaulted exposures where credit institutions use own estimates of LGDs, RW shall be Max{0, 12.5 *(LGD-ELBE)};

where ELBE shall be the credit institution's best estimate of expected loss for the defaulted exposure according to point 80 of Part 4.

Risk—weighted exposure amount = RW * exposure value.

4.The risk weighted exposure amount for each exposure which meets the requirements set out in Annex VIII, Part 1, point 29 and Annex VIII, Part 2, point 22 may be adjusted according to the following formula:

Risk—weighted exposure amount = RW * exposure value * ((0,15 + 160*PDpp)]

where:

PDpp = PD of the protection provider.

RW shall be calculated using the relevant risk weight formula set out in point 3 for the exposure, the PD of the obligor and the LGD of a comparable direct exposure to the protection provider. The maturity factor (b) shall be calculated using the lower of the PD of the protection provider and the PD of the obligor.

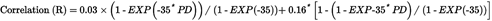

5.For exposures to companies where the total annual sales for the consolidated group of which the firm is a Part is less than EUR 50 million, credit institutions may use the following correlation formula for the calculation of risk weights for corporate exposures. In this formula S is expressed as total annual sales in millions of Euros with EUR 5 million <= S <= EUR 50 million. Reported sales of less than EUR 5 million shall be treated as if they were equivalent to EUR 5 million. For purchased receivables the total annual sales shall be the weighted average by individual exposures of the pool.

Credit institutions shall substitute total assets of the consolidated group for total annual sales when total annual sales are not a meaningful indicator of firm size and total assets are a more meaningful indicator than total annual sales.

6.For specialised lending exposures in respect of which a credit institution cannot demonstrate that its PD estimates meet the minimum requirements set out in Part 4 it shall assign risk weights to these exposures according to Table 1, as follows:

Table 1

| Remaining Maturity | Category 1 | Category 2 | Category 3 | Category 4 | Category 5 |

|---|---|---|---|---|---|

| Less than 2,5 years | 50 % | 70 % | 115 % | 250 % | 0 % |

| Equal or more than 2,5 years | 70 % | 90 % | 115 % | 250 % | 0 % |

The competent authorities may authorise a credit institution generally to assign preferential risk weights of 50 % to exposures in category 1, and a 70 % risk weight to exposures in category 2, provided the credit institution's underwriting characteristics and other risk characteristics are substantially strong for the relevant category.

In assigning risk weights to specialised lending exposures credit institutions shall take into account the following factors: financial strength, political and legal environment, transaction and/or asset characteristics, strength of the sponsor and developer, including any public private partnership income stream, and security package.

7.For their purchased corporate receivables credit institutions shall comply with the minimum requirements set out in points 105 to 109 of Part 4. For purchased corporate receivables that comply in addition with the conditions set out in point 14, and where it would be unduly burdensome for a credit institution to use the risk quantification standards for corporate exposures as set out in Part 4 for these receivables, the risk quantification standards for retail exposures as set out in Part 4 may be used.

8.For purchased corporate receivables, refundable purchase discounts, collateral or partial guarantees that provide first-loss protection for default losses, dilution losses, or both, may be treated as first-loss positions under the IRB securitisation framework.

9.Where an institution provides credit protection for a number of exposures under terms that the nth default among the exposures shall trigger payment and that this credit event shall terminate the contract, if the product has an external credit assessment from an eligible ECAI the risk weights set out in Articles 94 to 101 will be applied. If the product is not rated by an eligible ECAI, the risk weights of the exposures included in the basket will be aggregated, excluding n-1 exposures where the sum of the expected loss amount multiplied by 12,5 and the risk weighted exposure amount shall not exceed the nominal amount of the protection provided by the credit derivative multiplied by 12,5. The n-1 exposures to be excluded from the aggregation shall be determined on the basis that they shall include those exposures each of which produces a lower risk‐weighted exposure amount than the risk‐weighted exposure amount of any of the exposures included in the aggregation.

1.2.Risk weighted exposure amounts for retail exposures

10.Subject to points 12 and 13, the risk weighted exposure amounts for retail exposures shall be calculated according to the following formulae:

Risk weighted(RW)

N(x) denotes the cumulative distribution function for a standard normal random variable (i.e. the probability that a normal random variable with mean zero and variance of one is less than or equal to x). G (Z) denotes the inverse cumulative distribution function for a standard normal random variable (i.e. the value x such that N(x)= z).

For PD = 1 (defaulted exposure), RW shall be Max {0, 12.5 *(LGD-ELBE)},

where ELBE shall be the credit institution's best estimate of expected loss for the defaulted exposure according to point 80 of Part 4.

Risk—weighted exposure amount = RW * exposure value.

11.The risk weighted exposure amount for each exposure to small and medium sized entities as defined in Article 86(4) which meets the requirements set out in Annex VIII, Part 1, point 29 and Annex VIII, Part 2, point 22 may be calculated according to point 4.

12.For retail exposures secured by real estate collateral a correlation (R) of 0,15 shall replace the figure produced by the correlation formula in point 10.

13.For qualifying revolving retail exposures as defined in points (a) to (e), a correlation (R) of 0,04 shall replace the figure produced by the correlation formula in point 10.

Exposures shall qualify as qualifying revolving retail exposures if they meet the following conditions:

The exposures are to individuals;

The exposures are revolving, unsecured, and to the extent they are not drawn immediately and unconditionally, cancellable by the credit institution. (In this context revolving exposures are defined as those where customers' outstanding balances are permitted to fluctuate based on their decisions to borrow and repay, up to a limit established by the credit institution.). Undrawn commitments may be considered as unconditionally cancellable if the terms permit the credit institution to cancel them to the full extent allowable under consumer protection and related legislation;

The maximum exposure to a single individual in the sub-portfolio is EUR 100 000 or less;

The credit institution can demonstrate that the use of the correlation of this point is limited to portfolios that have exhibited low volatility of loss rates, relative to their average level of loss rates, especially within the low PD bands. Competent authorities shall review the relative volatility of loss rates across the qualifying revolving retail sub-portfolios, as well the aggregate qualifying revolving retail portfolio, and intend to share information on the typical characteristics of qualifying revolving retail loss rates across jurisdictions; and

The competent authority concurs that treatment as a qualifying revolving retail exposure is consistent with the underlying risk characteristics of the sub‐portfolio.

By way of derogation from point (b), competent authorities may waive the requirement that the exposure be unsecured in respect of collateralised credit facilities linked to a wage account. In this case amounts recovered from the collateral shall not be taken into account in the LGD estimate.

14.To be eligible for the retail treatment, purchased receivables shall comply with the minimum requirements set out in Part 4, points 105 to 109 and the following conditions:

The credit institution has purchased the receivables from unrelated, third party sellers, and its exposure to the obligor of the receivable does not include any exposures that are directly or indirectly originated by the credit institution itself;

The purchased receivables shall be generated on an arm's-length basis between the seller and the obligor. As such, inter-company accounts receivables and receivables subject to contra-accounts between firms that buy and sell to each other are ineligible;

The purchasing credit institution has a claim on all proceeds from the purchased receivables or a pro-rata interest in the proceeds; and

The portfolio of purchased receivables is sufficiently diversified.

15.For purchased receivables, refundable purchase discounts, collateral or partial guarantees that provide first-loss protection for default losses, dilution losses, or both, may be treated as first-loss positions under the IRB securitisation framework.

16.For hybrid pools of purchased retail receivables where purchasing credit institutions cannot separate exposures secured by real estate collateral and qualifying revolving retail exposures from other retail exposures, the retail risk weight function producing the highest capital requirements for those exposures shall apply.

1.3.Risk weighted exposure amounts for equity exposures

17.A credit institution may employ different approaches to different portfolios where the credit institution itself uses different approaches internally. Where a credit institution uses different approaches, the credit institution shall demonstrate to the competent authorities that the choice is made consistently and is not determined by regulatory arbitrage considerations.

18.Notwithstanding point 17, competent authorities may allow the attribution of risk weighted exposure amounts for equity exposures to ancillary services undertakings according to the treatment of other non credit-obligation assets.

1.3.1.Simple risk weight approach

19.The risk weighted exposure amount shall be calculated according to the following formula:

Risk weight (RW) = 190 % for private equity exposures in sufficiently diversified portfolios.

Risk weight (RW) = 290 % for exchange traded equity exposures.

Risk weight (RW) = 370 % for all other equity exposures.

Risk‐weighted exposure amount = RW * exposure value.

20.Short cash positions and derivative instruments held in the non-trading book are permitted to offset long positions in the same individual stocks provided that these instruments have been explicitly designated as hedges of specific equity exposures and that they provide a hedge for at least another year. Other short positions are to be treated as if they are long positions with the relevant risk weight assigned to the absolute value of each position. In the context of maturity mismatched positions, the method is that for corporate exposures as set out in point 16 of Annex VII, Part 2.

21.Credit institutions may recognise unfunded credit protection obtained on an equity exposure in accordance with the methods set out in Articles 90 to 93.

1.3.2.PD/LGD approach

22.The risk weighted exposure amounts shall be calculated according to the formulas in point 3. If credit institutions do not have sufficient information to use the definition of default set out in points 44 to 48 of Part 4, a scaling factor of 1,5 shall be assigned to the risk weights.

23.At the individual exposure level the sum of the expected loss amount multiplied by 12,5 and the risk weighted exposure amount shall not exceed the exposure value multiplied by 12,5.

24.Credit institutions may recognise unfunded credit protection obtained on an equity exposure in accordance with the methods set out in Articles 90 to 93. This shall be subject to an LGD of 90 % on the exposure to the provider of the hedge. For private equity exposures in sufficiently diversified portfolios an LGD of 65 % may be used. For these purposes M shall be 5 years.

1.3.3.Internal models approach

25.The risk weighted exposure amount shall be the potential loss on the credit institution's equity exposures as derived using internal value-at-risk models subject to the 99th percentile, one-tailed confidence interval of the difference between quarterly returns and an appropriate risk‐free rate computed over a long-term sample period, multiplied by 12,5. The risk weighted exposure amounts at the individual exposure level shall not be less than the sum of minimum risk weighted exposure amounts required under the PD/LGD Approach and the corresponding expected loss amounts multiplied by 12,5 and calculated on the basis of the PD values set out in Part 2, point 24(a) and the corresponding LGD values set out in Part 2, points 25 and 26.

26.Credit institutions may recognise unfunded credit protection obtained on an equity position.

1.4.Risk weighted exposure amounts for other non credit-obligation assets

27.The risk weighted exposure amounts shall be calculated according to the formula:

Risk‐weighted exposure amount = 100 % * exposure value,

except for when the exposure is a residual value in which case it should be provisioned for each year and will be calculated as follows:

1/t * 100 % * exposure value,

where t is the number of years of the lease contract term.

2.CALCULATION OF RISK WEIGHTED EXPOSURE AMOUNTS FOR DILUTION RISK OF PURCHASED RECEIVABLES

28.Risk weights for dilution risk of purchased corporate and retail receivables:

The risk weights shall be calculated according to the formula in point 3. The input parameters PD and LGD shall be determined as set out in Part 2, the exposure value shall be determined as set out in Part 3 and M shall be 1 year. If credit institutions can demonstrate to the competent authorities that dilution risk is immaterial, it need not be recognised.

3.CALCULATION OF EXPECTED LOSS AMOUNTS

29.Unless noted otherwise, the input parameters PD and LGD shall be determined as set out in Part 2 and the exposure value shall be determined as set out in Part 3.

30.The expected loss amounts for exposures to corporates, institutions, central governments and central banks and retail exposures shall be calculated according to the following formulae:

Expected loss (EL) = PD × LGD.

Expected loss amount = EL × exposure value.

For defaulted exposures (PD =1) where credit institutions use own estimates of LGDs, EL shall be ELBE, the credit institution's best estimate of expected loss for the defaulted exposure according to Part 4, point 80.

For exposures subject to the treatment set out in Part 1, point 4, EL shall be 0.

31.The EL values for specialised lending exposures where credit institutions use the methods set out in point 6 for assigning risk weights shall be assigned according to Table 2.

Table 2

| Remaining Maturity | Category 1 | Category 2 | Category 3 | Category 4 | Category 5 |

|---|---|---|---|---|---|

| Less than 2,5 years | 0 % | 0,4 % | 2,8 % | 8 % | 50 % |

| Equal to or more than 2,5 years | 0,4 % | 0,8 % | 2,8 % | 8 % | 50 % |

Where competent authorities have authorised a credit institution generally to assign preferential risk weights of 50 % to exposures in category 1, and 70 % to exposures in category 2, the EL value for exposures in category 1 shall be 0 %, and for exposures in category 2 shall be 0,4 %.

32.The expected loss amounts for equity exposures where the risk weighted exposure amounts are calculated according to the methods set out in points 19 to 21, shall be calculated according to the following formula:

Expected loss amount = EL × exposure value

The EL values shall be the following:

Expected loss (EL) = 0,8 % for private equity exposures in sufficiently diversified portfolios

Expected loss (EL) = 0,8 % for exchange traded equity exposures

Expected loss (EL) = 2,4 % for all other equity exposures.

33.The expected loss amounts for equity exposures where the risk weighted exposure amounts are calculated according to the methods set out in points 22 to 24 shall be calculated according to the following formulae:

Expected loss (EL) = PD × LGD and

Expected loss amount = EL × exposure value

34.The expected loss amounts for equity exposures where the risk weighted exposure amounts are calculated according to the methods set out in points 25 to 26 shall be 0 %.

35.The expected loss amounts for dilution risk of purchased receivables shall be calculated according to the following formula:

Expected loss (EL) = PD × LGD and

Expected loss amount = EL × exposure value

4.TREATMENT OF EXPECTED LOSS AMOUNTS

36.The expected loss amounts calculated in accordance with points 30, 31 and 35 shall be subtracted from the sum of value adjustments and provisions related to these exposures. Discounts on balance sheet exposures purchased when in default according to Part 3, point 1 shall be treated in the same manner as value adjustments. Expected loss amounts for securitised exposures and value adjustments and provisions related to these exposures shall not be included in this calculation.

Options/Cymorth

Print Options

PrintThe Whole Directive

PrintThe Whole Annex

PrintThis Part only

You have chosen to open the Whole Directive

The Whole Directive you have selected contains over 200 provisions and might take some time to download. You may also experience some issues with your browser, such as an alert box that a script is taking a long time to run.

Would you like to continue?

You have chosen to open Schedules only

Y Rhestrau you have selected contains over 200 provisions and might take some time to download. You may also experience some issues with your browser, such as an alert box that a script is taking a long time to run.

Would you like to continue?

Mae deddfwriaeth ar gael mewn fersiynau gwahanol:

Y Diweddaraf sydd Ar Gael (diwygiedig):Y fersiwn ddiweddaraf sydd ar gael o’r ddeddfwriaeth yn cynnwys newidiadau a wnaed gan ddeddfwriaeth ddilynol ac wedi eu gweithredu gan ein tîm golygyddol. Gellir gweld y newidiadau nad ydym wedi eu gweithredu i’r testun eto yn yr ardal ‘Newidiadau i Ddeddfwriaeth’.

Gwreiddiol (Fel y’i mabwysiadwyd gan yr UE): Mae'r wreiddiol version of the legislation as it stood when it was first adopted in the EU. No changes have been applied to the text.

Rhagor o Adnoddau

Gallwch wneud defnydd o ddogfennau atodol hanfodol a gwybodaeth ar gyfer yr eitem ddeddfwriaeth o’r tab hwn. Yn ddibynnol ar yr eitem ddeddfwriaeth sydd i’w gweld, gallai hyn gynnwys:

- y PDF print gwreiddiol y fel adopted version that was used for the EU Official Journal

- rhestr o newidiadau a wnaed gan a/neu yn effeithio ar yr eitem hon o ddeddfwriaeth

- pob fformat o’r holl ddogfennau cysylltiedig

- slipiau cywiro

- dolenni i ddeddfwriaeth gysylltiedig ac adnoddau gwybodaeth eraill

Rhagor o Adnoddau

Defnyddiwch y ddewislen hon i agor dogfennau hanfodol sy’n cyd-fynd â’r ddeddfwriaeth a gwybodaeth am yr eitem hon o ddeddfwriaeth. Gan ddibynnu ar yr eitem o ddeddfwriaeth sy’n cael ei gweld gall hyn gynnwys:

- y PDF print gwreiddiol y fel adopted fersiwn a ddefnyddiwyd am y copi print

- slipiau cywiro

liciwch ‘Gweld Mwy’ neu ddewis ‘Rhagor o Adnoddau’ am wybodaeth ychwanegol gan gynnwys

- rhestr o newidiadau a wnaed gan a/neu yn effeithio ar yr eitem hon o ddeddfwriaeth

- manylion rhoi grym a newid cyffredinol

- pob fformat o’r holl ddogfennau cysylltiedig

- dolenni i ddeddfwriaeth gysylltiedig ac adnoddau gwybodaeth eraill