- Y Diweddaraf sydd Ar Gael (Diwygiedig)

- Gwreiddiol (Fel y’i mabwysiadwyd gan yr UE)

Commission Regulation (EC) No 3665/93Dangos y teitl llawn

Commission Regulation (EC) No 3665/93 of 21 December 1993 amending Commission Regulation (EEC) No 2454/93 laying down provisions for the implementation of Council Regulation (EEC) No 2913/92 establishing the Community customs code

You are here:

- Rheoliadau yn deillio o’r UE

- 1993 No. 3665

- Whole Regulation

- Blaenorol

- Nesaf

- Dangos Graddfa Ddaearyddol(e.e. Lloegr, Cymru, Yr Alban aca Gogledd Iwerddon)

- Dangos Llinell Amser Newidiadau

Rhagor o Adnoddau

When the UK left the EU, legislation.gov.uk published EU legislation that had been published by the EU up to IP completion day (31 December 2020 11.00 p.m.). On legislation.gov.uk, these items of legislation are kept up-to-date with any amendments made by the UK since then.

Mae hon yn eitem o ddeddfwriaeth sy’n deillio o’r UE

Mae unrhyw newidiadau sydd wedi cael eu gwneud yn barod gan y tîm yn ymddangos yn y cynnwys a chyfeirir atynt gydag anodiadau.Ar ôl y diwrnod ymadael bydd tair fersiwn o’r ddeddfwriaeth yma i’w gwirio at ddibenion gwahanol. Y fersiwn legislation.gov.uk yw’r fersiwn sy’n weithredol yn y Deyrnas Unedig. Y Fersiwn UE sydd ar EUR-lex ar hyn o bryd yw’r fersiwn sy’n weithredol yn yr UE h.y. efallai y bydd arnoch angen y fersiwn hon os byddwch yn gweithredu busnes yn yr UE. EUR-Lex Y fersiwn yn yr archif ar y we yw’r fersiwn swyddogol o’r ddeddfwriaeth fel yr oedd ar y diwrnod ymadael cyn cael ei chyhoeddi ar legislation.gov.uk ac unrhyw newidiadau ac effeithiau a weithredwyd yn y Deyrnas Unedig wedyn. Mae’r archif ar y we hefyd yn cynnwys cyfraith achos a ffurfiau mewn ieithoedd eraill o EUR-Lex. The EU Exit Web Archive legislation_originated_from_EU_p3

Changes over time for: Commission Regulation (EC) No 3665/93

Changes to legislation:

This version of this Regulation was derived from EUR-Lex on IP completion day (31 December 2020 11:00 p.m.). It has not been amended by the UK since then. Find out more about legislation originating from the EU as published on legislation.gov.uk![]()

Changes to Legislation

Revised legislation carried on this site may not be fully up to date. Changes and effects are recorded by our editorial team in lists which can be found in the ‘Changes to Legislation’ area. Where those effects have yet to be applied to the text of the legislation by the editorial team they are also listed alongside the legislation in the affected provisions. Use the ‘more’ link to open the changes and effects relevant to the provision you are viewing.

Changes and effects yet to be applied to :

- Regulation implicit repeal by EUR 2016/481 Regulation

Commission Regulation (EC) No 3665/93

of 21 December 1993

amending Commission Regulation (EEC) No 2454/93 laying down provisions for the implementation of Council Regulation (EEC) No 2913/92 establishing the Community customs code

THE COMMISSION OF THE EUROPEAN COMMUNITIES,

Having regard to the Treaty establishing the European Community,

Having regard to Council Regulation (EEC) No 2913/92 of 12 October 1992 establishing the Community customs code(1), and in particular Article 249 thereof,

Whereas Commission Regulation (EEC) No 2454/93(2) lays down certain provisions for the implementation of Regulation (EEC) No 2913/92;

Whereas amendments have been concerning certain subheadings of CN codes 0408, 2208 and 2710 and the designation of certain certificate issuing authorities;

Whereas it is opportune to align the maximum amounts permitted in respect of consignments which give rise to the establishment of Forms APR or EUR 2 used in relations with the Republics of Bosnia-Herzegovina, Croatia and Slovenia and the territory of the former Yugoslav Republic of Macedonia, as well as the Occupied Territories;

Whereas the implementation of the Cooperation Agreement between the EC and the Republic of Slovenia requires the amendment of Articles 120 to 140 of Regulation (EEC) No 2454/93;

Whereas Articles 222, 223 and 224 of Regulation (EEC) No 2454/93 contain provisions on customs declarations using data-processing techniques; whereas it has become necessary to make those provisions more explicit; whereas it is appropriate to lay down that all other customs formalities may also be carried out using data-processing techniques; whereas these special rules must nevertheless be reserved for cases where only the formalities carried out by data-processing techniques have the desired legal effects;

Whereas goods placed inter alia in a free zone or free warehouse, in temporary storage or under suspensive arrangements may be declared in error for a customs procedure involving the obligation to pay import duties, instead of other goods; whereas it is appropriate to provide that the declaration for that procedure should be invalidated under certain conditions;

Whereas it is necessary to make the provisions for the implementation of Community measures entailing verification of the use and/or destination of goods consistent with evolving administrative methods; whereas in connection with the suppression of checks and formalities at internal frontiers it is appropriate to introduce further flexibility in administrative checks at offices of destination;

Whereas it is necessary for reasons connected with customs checks to align the provisions concerning the use of the consignment note CIM and the TR transfer note, by providing for the application of the customs stamp on sheet 1 of the TR transfer note;

Whereas it has become apparent that the Member States apply differing rules concerning the customs status of goods which have been abandoned to the Exchequer or seized or confiscated by the competent authorities; whereas, while these goods are not released for free circulation, a customs debt may still be incurred with regard to them; whereas it is therefore appropriate to lay down Community provisions to ensure that these goods do not enter into the Community's economic circuit without import duties being paid;

Whereas it is necessary to add to the list of boxes to be completed in the declaration in relation to the customs warehousing procedure in order to harmonize and facilitate customs checks on declarations used for the customs warehousing procedure;

Whereas it is appropriate to adapt the provisions relating to securities to take account of increased risks of fraud for certain categories of goods, in order to make those provisions more binding;

Whereas it is appropriate to insert into Regulation (EEC) No 2454/93 the provisions amending the Community rules in force before the date of application of that Regulation;

Whereas errors and omissions produced during the transposition of the rules in force into the implementing provisions of the code should be corrected;

Whereas the measures provided for by this Regulation are in accordance with the opinion of the Customs Code Committee.

HAS ADOPTED THIS REGULATION:

Article 1U.K.

Regulation (EEC) No 2454/93 is amended as follows:

The following Article 1a is inserted:

‘Article 1a

For the purposes of applying Articles 16 to 34 and 291 to 308, the countries of the Benelux Economic Union shall be considered as a single Member State.’

In Title I of Part I the following Chapter 3 is inserted:

‘CHAPTER 3U.K. Data-processing techniques

Article 4a

1.Under the conditions and in the manner which they shall determine, and with due regard to the principles laid down by customs rules, the customs authorities may provide that formalities shall be carried out by a data-processing technique.

For this purpose:

“a data-processing technique” means:

(a)the exchange of EDI standard messages with the customs authorities;

(b)the introduction of information required for completion of the formalities concerned into customs data-processing systems;

“EDI” (electronic data interchange) means, the transmission of data structured according to agreed message standards, between one computer system and another, by electronic means,

“standard message” means a predefined structure recognized for the electronic transmission of data.

2.The conditions laid down for carrying out formalities by a data-processing technique shall include inter alia measures for checking the source of data and for protecting data against the risk of unauthorized access, loss, alteration or destruction.

Article 4b

Where formalities are carried out by a data-processing technique, the customs authorities shall determine the rules for replacement of the handwritten signature by another technique which may be based on the use of codes.’

In the table in Article 16, order No 1 is replaced by Annex 1.

Article 26 is amended as follows:

the table is amended in accordance with Annex 2,

the second sentence of paragraph 3 is deleted.

the following paragraph 3a is inserted:

‘3a.Such a certificate shall be neither issued nor accepted for the tobaccos listed under order No 6 of the table below, when more than one type is presented in the same immediate packaging.’

Article 41 is amended as follows:

the following paragraph 1 is inserted:

‘1.Accessories, spare parts or tools delivered with any piece of equipment, machine, apparatus or vehicle which form part of its standard equipment shall be deemed to have the same origin as that piece of equipment, machine, apparatus or vehicle.’

the current text becomes paragraph 2.

In Article 115 (1), the amount of ‘ECU 2 820’ is replaced by ‘ECU 3 000.’

In Article 117 (1), the amounts of ‘ECU 200’ and ‘ECU 565’are replaced by ‘ECU 215’ and ‘ECU 600’ respectively.

The following paragraph is added to Article 120:

‘Insofar as the Republic of Slovenia is concerned, the provisions of the first paragraph, along with those of Articles 121 to 140, shall apply only to those products listed in Annex I of the Treaty establishing the European Coal and Steel Community’.

In Article 183 (4), ‘in paragraph 2’ is replaced by ‘in paragraphs 1 and 2’.

Article 188 is deleted.

In Article 199, the current text becomes paragraph 1 and the following paragraphs 2 and 3 are added:

‘2.Where the declarant uses data-processing systems to produce his customs declarations, the customs authorities may provide that the handwritten signature may be replaced by another identification technique which may be based on the use of codes. This facility shall be granted only if the technical and administrative conditions laid down by the customs authorities are complied with.

The customs authorities may also provide that declarations produced using customs data-processing systems may be directly authenticated by those systems, in place of the manual or mechanical application of the customs office stamp and the signature of the competent official.

3.Under the conditions and in the manner which they shall determine, the customs authorities may allow some of the particulars of the written declaration referred to in Annex 37 to be replaced by sending these particulars to the customs office designated for that purpose by electronic means, where appropriate in coded form.’

Article 205 (4) is deleted.

Chapter 2 of Title VII of Part I is replaced by the following:

‘CHAPTER 2U.K. Customs declarations made using a data-processing technique

Article 222

1.Where the customs declaration is made by a data-processing technique, the particulars of the written declaration referred to in Annex 37 shall be replaced by sending to the customs office designated for that purpose, with a view to their processing by computer, data in codified form or data made out in any other form specified by the customs authorities and corresponding to the particulars required for written declarations.

2.A customs declaration made by EDI shall be considered to have been lodged when the EDI message is received by the customs authorities.

Acceptance of a customs declaration made by EDI shall be communicated to the declarant by means of a response message containing at least the identification details of the message received and/or the registration number of the customs declaration and the date of acceptance.

3.Where the customs declaration is made by EDI, the customs authorities shall lay down the rules for implementing the provisions laid down in Article 247.

4.Where the customs declaration is made by EDI, the release of the goods shall be notified to the declarant, indicating at least the identification details of the declaration and the date of release.

5.Where the particulars of the customs declaration are introduced into customs data-processing systems, paragraphs 2, 3 and 4 shall apply mutatis mutandis.

Article 223

Where a paper copy of the customs declaration is required for the completion of other formalities, this shall, at the request of the declarant, be produced and authenticated, either by the customs office concerned, or in accordance with the second subparagraph of Article 199 (2).

Article 224

Under the conditions and in the manner which they shall determine, the customs authorities may authorize the documents required for the entry of goods for a customs procedure to be made out and transmitted by electronic means.’

The first and second indents of point (a) of Article 229 (1) are replaced by the following:

‘animals for the uses referred to in points 12 and 13 of Annex 93a and equipment satisfying the conditions laid down in point (b) of Article 685 (2).

packings listed in Article 679, imported filled, bearing the permanent, indelible markings of a person established outside the customs territory of the Community,’

The following point la is inserted in Article 251:

‘1a.Where it is established that the goods have been declared in error, instead of other goods, for a customs procedure entailing the obligation to pay import duties, the customs authorities shall invalidate the declaration if a request to that effect is made within three months of the date of acceptance of the declaration, provided that:

the goods originally declared:

(i)have not been used other than as authorized in their original status; and

(ii)have been restored to their original status;

and that

the goods which ought to have been declared for the customs procedure originally intended:

(i)could, when the original declaration was lodged, have been presented to the same customs office: and

(ii)have been declared for the same customs procedure as that originally intended.

The customs authorities may allow the time limit referred to above to be exceeded in duly substantiated exceptional cases;’

Article 252 is replaced by the following:

‘Article 252

Where the customs authorities sell Community goods in accordance with point (b) of Article 75 of the code, this shall be done in accordance with the procedures in force in the Member States.’

The heading of Chapter 1 of Title IX of Part I is replaced by: the following:

‘CHAPTER 1U.K. General provisions’

The following Article 253a is inserted:

‘ Article 253a

Where a simplified procedure is applied using data-processing systems to produce customs declarations or using a data-processing technique, the provisions referred to in Articles 199 (2) and (3), 222, 223 and 224 shall apply mutatis mutandis.’

In Article 269 paragraph 3 is replaced by the following:

‘3.The procedure referred to in paragraph 1 shall not apply to Type F warehouses nor to the entry for the procedure of the Community agricultural products referred to in Articles 529 to 534 in any type of warehouse.

4.The procedure referred to in the second indent of paragraph 1 shall apply to Type B warehouses except that it shall not be possible to use a commercial document. Where the administrative document does not contain all the particulars shown in Annex 37 Title I (B) (2) (f) (aa), these should be supplied on the accompanying application.’

Article 272 (2) is replaced by the following:

‘2.Article 269 (3) and Article 270 shall apply mutatis mutandis.’

Article 275 (1) is replaced by the following:

‘1.Declarations of entry for a customs procedure with economic impact other than outward processing or customs warehousing which the customs office of entry for the procedure may accept at the declarant's request without their containing some of the particulars referred to in Annex 37 or without their being accompanied by certain documents referred to in Article 220 must contain at least the particulars referred to in Boxes 14, 21, 31, 37, 40 and 54 of the single administrative document and, in Box 44, a reference to the authorization, or a reference to the application where the second subparagraph of Article 556 (1) applies.’

In Article 291 (4), paragraph 4 becomes the second subparagraph of paragraph 3.

Article 411 (1) is replaced by the following:

‘1.Where presentation of the Community transit declaration at the office of departure is waived in respect of goods which are to be dispatched under cover of a consignment note CIM, or a TR transfer note, in accordance with Articles 413 to 442, the customs authorities shall determine the measures necessary to ensure that sheets 1, 2 and 3 of the consignment note CIM, or sheets 1, 2, 3A and 3B of the TR transfer note bear the symbol “T1” or “T2”, as the case may be.’

In Article 434, paragraphs (2), (3) and (4) are replaced by the following:

‘2.The office of departure shall indicate clearly in the box reserved for customs on sheets 1, 2, 3A and 3B of the TR transfer note:

the symbol “T1”, where the goods are moving under the external Community transit procedure,

the symbol “T2”, “T2ES” or “T2PT” as the case may be, where the goods are moving under the internal Community transit procedure, in accordance with Article 165 of the code and with point (b) of Article 311.

The symbol “T2”, “T2ES” or “T2PT” shall be authenticated by application of the stamp of the office of departure.

3.Where a TR transfer note relates both to containers containing goods moving under the external Community transit procedure and containers containing goods moving under the internal Community transit procedure, in accordance with Article 165 of the code and with point (b) of Article 311, the office of departure shall enter in the box reserved for customs on sheets 1, 2, 3A and 3B of the TR transfer note separate references to the container(s), depending upon which type of goods they contain, and shall enter the symbol “T1” and the symbol “T2”, “T2ES” or “T2PT” respectively, alongside the reference to the corresponding container(s).

4.In cases covered by paragraph 3, where lists of large containers are used, separate lists shall be made out for each category of container and the reference thereto shall be indicated by entering in the box reserved for customs on sheets 1, 2, 3A and 3B of the TR transfer note, the serial number(s) of the list(s). The symbol “T1” or the symbol “T2”, “T2ES” or “T2PT”shall be entered alongside the serial number(s) of the list(s) according to the category of containers to which they relate.’

The following subparagraph is added to Article 482 (4):

‘However, the competent authority of the Member State of destination may decide that the goods shall be delivered directly to the consignee under further conditions specified by the competent office of destination which enable the office to carry out any necessary checks upon or after arrival of the goods.’

Article 524 (1) is replaced by the following:

‘1.Provided the proper conduct of operations is not thereby affected, the supervising office shall allow Community goods and non-Community goods to be stored in the same storage area.’

Article 529 is amended as follows:

the single paragraph becomes paragraph 1 and ‘Articles 522 and 524’ are replaced by ‘Article 522’,

the following paragraph 2 is added:

‘2.Without prejudice to the specific provisions adopted under the agriculture rules, prefinanced goods may be stored in the same storage area as other Community or non-Community goods pursuant to Article 524 (1) only if the identity and customs status of each item can be established at all times.’

In Article 534 (2) the following is deleted:

‘, including the export licence or advance-fixing certificate referred to in Commission Regulation (EEC) No 3719/88’.

Article 546 is replaced by the following:

‘Article 546

Articles 544 (2) and 545 (2) and (4) shall be without prejudice to the application of Articles 121, 122, 135 and 136 of the code concerning the application of charges to goods or products placed under the inward processing procedure or the procedure for processing under customs control.’

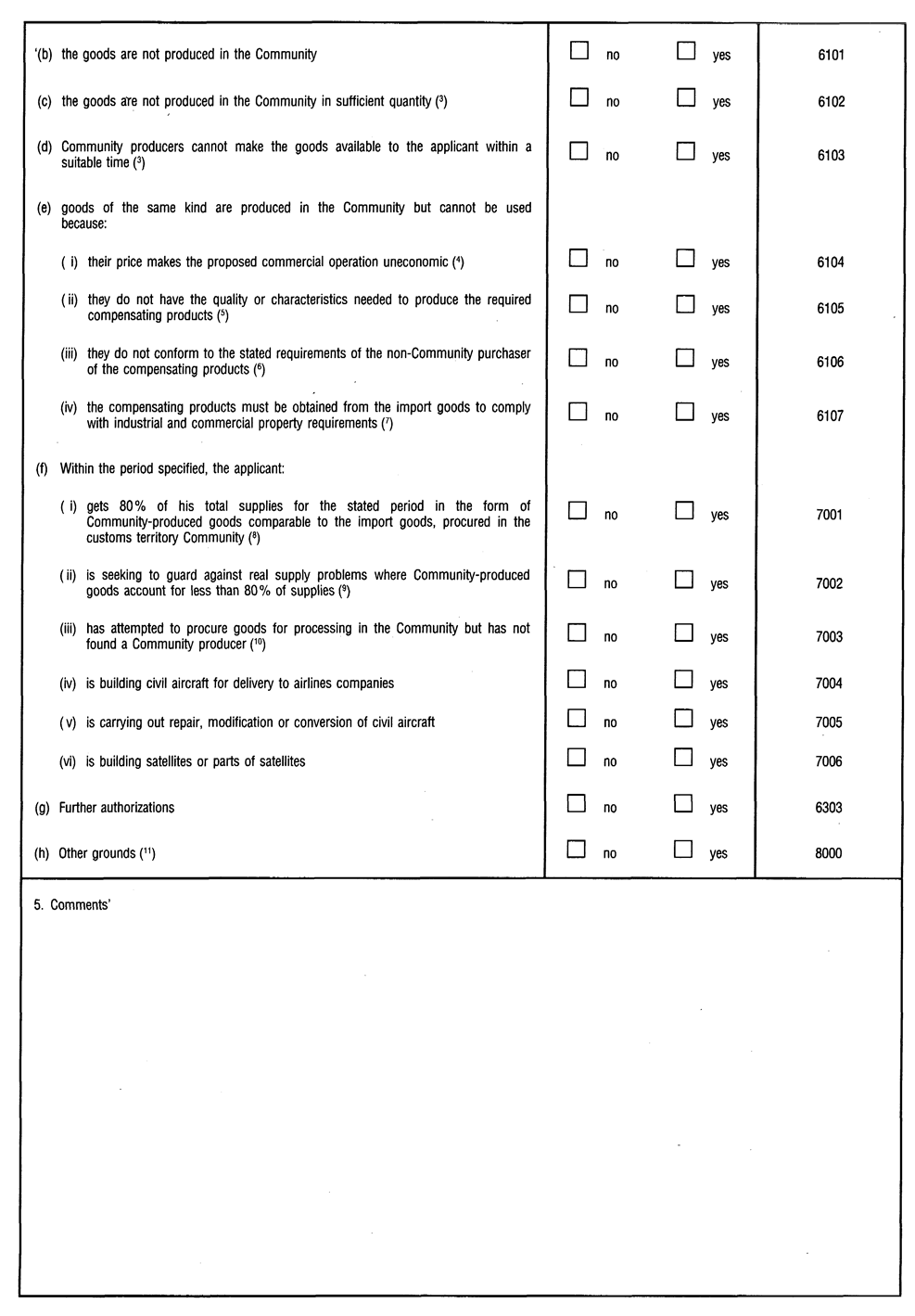

Article 552 (1) (f) is amended as follows:

Point (i) is replaced by the following:

‘(i)during the period in question, obtains 80 % of his total requirements for such goods incorporated in the compensating products in the customs territory of the Community in the form of comparable goods, as defined in point (b), produced in the Community.

To make use of this provision, the applicant must supply the customs authorities with supporting documents that enable those authorities to satisfy themselves that the intended procurement of Community goods may be reasonably carried out. Such supporting documents, to be annexed to the application, may take the form, for example, of copies of commercial or administrative documents which refer to procurement in an earlier reference period, or orders or intended procurement for the period under consideration.

Without prejudice to Article 87 (2) of the code, the customs authorities shall, where appropriate, check that the percentage is correct at the end of the period in question (code 7001);’

The following point (vi) is added:

‘(vi)is building satellites or parts of satellites (code 7006).’

In Article 553 (2) the first subparagraph is replaced by the following:

(This amendment does not concern the English version)

Article 564 (2) is replaced by the following:

‘2.Where monthly aggregation is authorized for the agricultural products referred to in Article 560 (2), the periods for re-exportation shall expire no later than the last day of the third month following that for which aggregation was authorized.’

Article 569 (1) is replaced by the following:

‘1.Without prejudice to paragraph 2 and Article 570 (1), where use is to be made of equivalent compensation, the equivalent goods must fall within the same eight-digit subheading of the combined nomenclature code, be of the same commercial quality and have the same technical characteristics as the import goods.’

Article 572 is replaced by the following:

‘Article 572

1.The use of the prior exportation system is not possible for authorizations to be issued on the basis of one or more of the economic conditions referred to by codes 6201, 6202, 6301, 6302, 6303, 7004, 7005 and 7006, and if the applicant is not able to prove that the benefit of using this system accrues solely to the holder of the authorization.

2.Where prior exportation is used under the suspension system, Articles 569, 570 and 571 (2) and (3) shall apply mutatis mutandis.

3.In the case of prior exportation, the change in customs status referred to in Article 115 (3) of the code shall take place:

in respect of the exported compensating products, at the time of acceptance of the export declaration and on condition that the import goods are entered for the procedure,

in respect of the import goods and equivalent goods, at the time of release of the import goods declared for the procedure.’

In Article 577 (2) the following point (e) is added:

the delivery, in the form of compensating products, of goods used for the construction of satellites and ground station equipment that are an integral part of those satellites, intended for launching sites established in the customs territory of the Community. With respect to this ground station equipment, the delivery shall not be definitively assimilated to export until the moment when this equipment is assigned another permitted customs-approved treatment or use, other than release for free circulation.’

Article 580 (1), (2) and (3) is replaced by the following:

‘1.The release for free circulation of goods in the unaltered state or main compensating products is possible where the person concerned declares that he is unable to assign those products or goods to a customs-approved treatment or use under which import duties would not be payable, subject to payment of compensatory interest in accordance with Article 589 (1).

2.The customs authorities may authorize release for free circulation on a general basis. Such an authorization is only possible if this does not contravene other Community provisions relating to release for free circulation.

3.When an authorization for release for free circulation on a general basis has been issued in accordance with paragraph 2, import goods may be put on the Community market in the form either of compensating products or of goods in the unaltered state without the formalities for release for free circulation being completed at the time of their being put on the market.

For the purposes of paragraph 4 only, goods put on the market in such a manner shall not be considered to have been assigned a customs-approved treatment or use.’

The following Article 585a is inserted:

‘Article 585a

1.The import duties to be charged under Article 121 (1) of the code on import goods eligible, at the time when the declaration of entry for the procedure was accepted, for favourable tariff treatment by reason of their end-use shall be calculated at the rate corresponding to such end-use without special authorization for the granting of such treatment being required, provided that the conditions attaching to the granting of favourable tariff treatment are satisfied.

2.Paragraph 1 shall apply only where the goods have been put to the end-use qualifying them for favourable tariff treatment before expiry of the time limit set for that purpose by the Community provisions governing the conditions under which such goods may be accorded the said treatment. The time limit shall run from the time of acceptance of the declaration of entry for the procedure. It may be extended by the customs authorities where the goods have not been put to the end-use in question as a result of unforeseeable circumstances, force majeure or the inherent technical exigencies of the processing operation.’

Article 587 (1) is replaced by the following:

‘1.Where the compensating products are released for free circulation and the customs debt is calculated on the basis of the items of charge appropriate to the import goods, in accordance with Article 122 of the code, boxes 15, 16, 34, 41 and 42 of the declaration shall refer to the import goods.’

The following indent is added to Article 589 (2):

‘where a customs debt is incurred as a result of an application for release for free circulation under Article 128 (4) of the code, as long as the import duties payable on the products in question have not yet actually been repaid or remitted.’

Article 591 (2) is replaced by the following:

‘2.The calculations shall be effected in accordance with the methods referred to in Articles 592, 593 and 594 or by any other method giving the same results on the basis of the examples set out in Annex 80.’

In Article 601 the following paragraphs 4, 5 and 6 are added:

‘4.Simplified procedures may be established for specific triangular trade flows at the request of firms with a sufficiently large number of anticipated export operations.

This procedure shall be requested, by the holder of the authorization, from the customs authorities of the Member State in which the authorization was issued.

This derogation shall provide for the aggregation of anticipated exports of compensating products over a given period, with a view to the issuing of an Information Sheet INF 5 covering the total quantity of the exports over the said period.

5.The request shall be accompanied by any supporting documents or evidence necessary for its appraisal. Such documents or evidence shall inter alia show the frequency of the exports, give an outline of the procedures envisaged and include particulars showing that it will be possible to verify whether the conditions for equivalent goods are satisfied.

6.When the customs authorities are in possession of all the necessary particulars they shall forward the request to the Commission, together with their opinion.

As soon as the Commission receives the request it shall communicate the particulars to the Member States.

The Commission shall decide, in accordance with the Committee procedure, whether and on what conditions an authorization may be issued, specifying inter alia the control measures to be used to ensure the proper conduct of operations under the equivalent compensation system.’

Article 616 is replaced by the following:

‘Article 616

1.When products or goods entered for the inward processing procedure (suspension system) are to be moved within the customs territory of the Community, the transportation of the products or goods concerned shall be effected either in accordance with the provisions concerning external transit or in accordance with the transfer procedures provided for in paragraph 3 and in Articles 617 to 623.

2.The external transit document or the document treated as the external transit document shall bear the indications referred to in Article 610.

3.If permission is given for the use of the transfer procedures, they shall be set out in the authorization. They shall replace the movement procedures of the external transit arrangements. In the case of a transfer of products or goods from the holder of one authorization to the holder of a second authorization, both of these authorizations shall stipulate the transfer procedures.

Permission for the use of the procedures in question may be given only if the holder of the authorization keeps or has kept for him the inward processing records referred to in Article 556 (3).’

In Article 621 (1) the following point (d) is added:

simplification of the formalities laid down in Article 619, provided that the system established guarantees communication of the information in the same way as that set out in Annex 83, as well as completion of the formalities using a commercial or administrative document.’

Article 624 is replaced by the following:

‘Article 624

The procedures laid down for release for free circulation under the drawback system shall apply to import goods, including import goods under the equivalent compensation system without prior exportation. In this last case, the goods are released for free circulation without application of import duties.’

Article 634 (2) is replaced by the following:

‘2.The calculation shall be effected in accordance with the methods referred to in Articles 635, 636 and 637 or by any other method giving the same results on the basis of the examples set out in Annex 80.’

Article 640 (2) is replaced by the following:

‘2.Where the simplified procedures relating to the formalities for release for free circulation under the drawback system and to export have been applied, the declarations referred to in points (f) and (j) of paragraph 1 or the documents shall be those referred to in Article 76 (2) of the code.’

Article 645 is replaced by the following:

‘Article 645

Where the compensating products obtained from inward processing operations under the drawback system are consigned to another customs office under the external Community transit procedure, which may constitute justification for a request for repayment, and are the subject of a new inward processing application, the duly empowered customs authorities responsible for issuing the new authorization shall use the Information Sheet INF 1 referred to in Article 611 to determine the amount of any import duties to be levied or the amount of the customs debt liable to be incurred.’

Article 646 (2) is replaced by the following:

‘2.The Information Sheet INF 7 referred to in paragraph 1 shall be used where the compensating products obtained from inward processing operations under the drawback system are transferred, without a repayment claim being lodged, to an office of discharge not mentioned in the authorization and are assigned there, either in the unaltered state or after further duly authorized processing, to one of the customs-approved treatments or uses permitting repayment or remission, in accordance with Article 128 (1) of the code. The customs office where the products or goods were assigned such treatment or use shall where necessary, at the request of the person concerned, issue the Information Sheet INF 7.’

Article 647 (1) is replaced by the following:

‘1.The Information Sheet INF 7 shall be presented by the person concerned at the same time as the customs declaration used to assign the customs-approved treatment or use applied for.’

In Article 648 (1) point (a) is replaced by the following:

in respect of each authorization where the value of the import goods per operator and per calendar year exceeds the limits set in Article 552 (1) (a) (v), the particulars indicated in Annex 85; such particulars need not be communicated where the inward processing application has been issued on the basis of one or more of the economic conditions referred to by the following codes: 6106, 6107, 6201, 6202, 6301, 6302, 6303, 7004, 7005 and 7006.

Such particulars must also be communicated where the economic conditions have been re-examined for an authorization of unlimited validity, or when changes are made to previously reported information concerning authorizations already issued.

However, in respect of the products referred to in Article 560 (2), the particulars must be supplied for every authorization granted, irrespective of the value of the products and irrespective of the code used to identify the economic conditions.’

Article 674 is replaced by the following:

‘Article 674

1.The temporary importation procedure with total relief from import duties shall be granted for:

(a)pedagogic material and scientific equipment;

(b)spare parts and accessories for such material or equipment;

(c)tools especially designed for the maintenance, checking, calibration or repair of such material or equipment.

2.“Pedagogic material” means any material intended for the sole purpose of teaching or vocational training, and in particular models, instruments, apparatus and machines.

The list of goods to be considered as pedagogic materials is set out in Annex 91. An illustrative list of other goods imported in connection with educational, scientific or cultural activities is given in Annex 91a.

3.“Scientific equipment” means equipment intended for the sole purpose of scientific research or teaching, and in particular models, instruments, apparatus and machines.

4.The temporary importation procedure referred to in paragraph 1 shall be granted provided that the pedagogic material or scientific equipment, spare parts, accessories or tools:

(a)are imported by approved establishments and are used under the supervision and responsibility of such establishments;

(b)are used for non-commercial purposes;

(c)are imported in reasonable numbers, having regard to the purpose of the importation;

(d)remain throughout their stay in the customs territory of the Community the property of a person established outside that territory.

5.The period during which such pedagogic material or scientific equipment may remain under the temporary importation procedure shall be 12 months.’

Article 675 is deleted.

Article 680 is amended as follows:

The sole paragraph becomes paragaph 1 and points (c) and (f) are replaced respectively by the following:

(c)special tools and instruments made available free of charge to a person established in the customs territory of the Community for use in the manufacture of goods which are to be exported in their entirety, on condition that such tools and instruments remain the property of a person established outside the customs territory of the Community;

(f)samples, i.e. articles which are representative of a particular category of goods already produced or which are examples of goods the production of which is contemplated, but not including identical articles brought in by the same individual, or sent to a single consignee, in such quantity that, taken as a whole, they no longer constitute samples under ordinary commercial usage.’

The following paragraph 2 is added:

‘2.To qualify for the temporary importation procedure referred to in paragraph 1:

(a)the goods referred to in points (a), (b), (c) and (f) of that paragraph must be owned by a person established outside the customs territory of the Community;

(b)the samples referred to in point (f) of that paragraph must be imported solely for the purpose of being shown or demonstrated in the customs territory of the Community for the soliciting of orders for similar goods to be imported into that territory. They may not be sold or put to normal use except for the purposes of demonstration, or used in any way while in the customs territory of the Community.’

In Article 684 paragraphs 2 and 3 are replaced by the following:

‘2.For these purposes:

(a)“traveller” means any person referred to in Article 236 (A) (1);

(b)“personal effects” means all articles, new or used, which a traveller may reasonably require for his or her personal use during the journey, taking into account all the circumstances of the journey, but excluding any goods imported for commercial purposes;

(c)“goods imported for sports purposes” means sports requisites and other articles for use by travellers in sports contests or demonstrations or for training taking place in the customs territory of the Community.

3.Personal effects shall be re-exported at the latest when the person who imported them leaves the customs territory of the Community.

The period during which goods imported for sports purposes may remain under the temporary importation procedure shall be 12 months.

4.The illustrative list of such goods is set out in Annex 92.’

The following Article 684a is inserted:

‘Article 684a

1.The temporary importation procedure with total relief from import duties shall be granted for tourist publicity material.

2.“Tourist publicity material” means goods the purpose of which is to encourage the public to visit foreign countries, in particular in order to attend cultural, religious, touristic, sporting or professional meetings or events held there.

3.An illustrative list of such goods is set out in Annex 93.’

Article 685 is replaced by the following:

‘Article 685

1.The temporary importation procedure with total relief from import duties shall be granted for the equipment and live animals of any species imported for the purposes listed in Annex 93a.

2.The temporary importation procedure referred to in paragraph 1 shall be granted on condition that:

(a)the animals are owned by a person established outside the customs territory of the Community;

(b)the equipment is owned by a person established in the frontier zone adjacent to that of the customs territory of the Community;

(c)draught animals and equipment are imported by a person established in the frontier zone adjacent to that of the customs territory of the Community for working land located inside the customs territory of the Community, involving the performance of agricultural or forestry work, including the clearing or transport of timber, or for pisciculture.

3.“Frontier zone” means, without prejudice to existing conventions in this respect, a zone which, as the crow flies, does not extend more than 15 kilometres from the frontier. The local administrative districts, part of whose territory lies within the zone, shall also be considered to be part of the frontier zone, notwithstanding any derogations on this matter.’

In Article 689 the following paragraph 3 is added:

‘3.Following expiry of the period for which goods entered for the procedure under this Article may remain under the procedure, the goods shall be assigned to a new customs-approved treatment or use or entered for the temporary importation procedure with partial relief from import duties.

If it becomes necessary to determine the duties to be levied under the partial relief procedure, the date to be taken into consideration shall be that on which the goods were entered for temporary importation under paragraph 1.’

Article 694 (1) is replaced by the following:

‘1.When issuing the authorization the designated customs authorities shall specify the period within the import goods must be assigned a customs-approved treatment or use, taking into account the periods provided for in Article 140 (2) of the code and Articles 674, 675, 679, 681, 682 and 684 and the time required to achieve the object of the temporary importation.’

Article 698 is replaced by the following:

‘Article 698

1.Travellers' personal effects and goods imported for sports purposes referred to in Article 684 shall be authorized for the temporary importation procedure without a written application or authorization.

In that case the act provided for in Article 233 shall be considered to be an application for temporary importation and the absence of intervention by the customs authorities to be an authorization.

2.At the express request of the customs authorities and where a high amount of import duties and other charges is involved, paragraph 1 shall be waived with regard to personal effects.’

Article 699 (3) is replaced by the following:

‘3.Where Article 697 applies, the ATA carnet shall be presented in order to enter goods for the temporary importation procedure at any duly empowered office of entry. The office of entry shall then act as the office of entry for the procedure.

However:

(a)where the duly empowered office of entry is unable to check the fulfilment of all conditions to which the use of the temporary importation procedure is subject, or

(b)where the office of entry is not empowered to act as the office of entry for the procedure,

the said office shall permit the goods to be carried to the office of destination able to carry out such checks under cover of the ATA carnet used as a transit document.’

Article 700 is replaced by the following:

‘1.For the purposes of Article 88 of the code, entry for the temporary importation procedure shall be subject to the provision of a security.

2.By way of derogation from paragraph 1, Annex 97 lists the cases in which no security shall be required for entry of goods for the temporary importation procedure.’

The followiong Article 700a is inserted:

‘Article 700a

1.For the purposes of Article 691 (2) (b) and 692 (2), the security shall be provided at the customs office which issued the authorization of entry for the procedure, in order to ensure payment of any customs debt and other charges which may be incurred in respect of the goods.

2.Where the authorization is issued pursuant to Article 692 using the simplified procedures provided for in Article 713, and the goods are to be used in more than one Member State, the holder of the procedure shall bring this information to the attention of the customs office.

3.The security shall be released by the customs office which issued the authorization, once the customs office which initially endorsed the information sheet referred to in Article 715 (3) receives the copy endorsed by the office of discharge under Article 716 (2), accompanied:

either by copy No 3 of the re-export declaration,

or

by a copy of the document entering the goods for another customs-approved treatment or use or, failing that, proof to the satisfaction of the customs authorities that the goods have been assigned another customs-approved treatment or use.’

The following Article 710a is inserted:

‘Article 710a

In the event of the release for free circulation of the goods in a Member State other than the one in which they were entered for the procedure, the Member State of release for free circulation shall collect the import duties which are referred to in Information Sheet INF 6, provided for in Article 715 (3), in accordance with the corresponding indications.’

In Article 712 the following paragraph 3 is aded:

‘3.By way of derogation from paragraph 1, goods entered for the temporary importation procedure under cover of an ATA carnet shall move within the customs territory of the Community without further customs formalities until completion of the formalities for discharge of the procedure. Article 452 shall apply mutatis mutandis.’

The following subsection is added to Section 2 of Chapter 5 in Part II, Title III;

‘Subsection 9U.K. Renewal of ATA carnets

Article 716a

1.Where it is foreseen that the temporary importation operation might exceed the period of validity of the ATA carnet because the holder is unable to re-export the goods, the issuing association may issue a replacement carnet. The holder shall return the original carnet to the issuing association.

2.The replacement carnet shall be submitted to the competent customs office for the place where the goods are located, which shall carry out the following formalities:

(a)it shall discharge the original carnet using the re-exportation voucher which it shall return without delay to the initial customs office of temporary importation;

(b)it shall receive the replacement carnet and retain the importation voucher, first entering on the said voucher the final date for re-exportation as shown on the original carnet plus any extension, and the number of the original carnet.

3.When the temporary importation procedure is discharged the office of re-exportation shall carry out the formalities laid down in Article 706 (3) using the re-exportation voucher of the replacement carnet, which it shall return without delay to the customs office which received the replacement carnet.

4.The issue of replacement carnets is the responsibility of the issuing association. If an ATA carnet expires and the holder is unable to re-export the goods, and the issuing association refuses to issue a replacement carnet, the customs authorities shall require completion of the customs formalities laid down in Articles 691 to 702.’

Point (b) of Article 719 (10) is replaced by the following:

a vehicle for private use which has been placed under the temporary importation procedure may be used occasionally by a natural person established in the customs territory of the Community where such person is acting on behalf of and on the instructions of the user of the procedure, who is himself in that territory.’

Point (b) of Article 747 (1) is replaced by the following:

the list of customs offices empowered to accept declarations for the procedure pursuant to Articles 695, 696, 697 and 699.’

The heading of Chapter 3 of Title II of Part IV is replaced by the following:

‘CHAPTER 3 U.K. Goods in special situations’

The following Article 867a is inserted:

‘Article 867a

1.Non-Community goods which have been abandoned to the Exchequer or seized or confiscated shall be considered to have been entered for the customs warehousing procedure.

2.The goods referred to in paragraph 1 may be sold by the customs authorities only on the condition that the buyer immediately carries out the formalities to assign them a customs-approved treatment or use.

Where the sale is at a price inclusive of import duties, the sale shall be considered as equivalent to release for free circulation, and the customs authorities themselves shall calculate the duties and enter them in the accounts.

In these cases, the sale shall be conducted according to the procedures in force in the Member States.

3.Where the administration decides to deal with the goods referred to in paragraph 1 otherwise than by sale, it shall immediately carry out the formalities to assign them one of the customs-approved treatments or uses laid down in Article 4 (15) (a), (b), (c) and (d) of the code.’

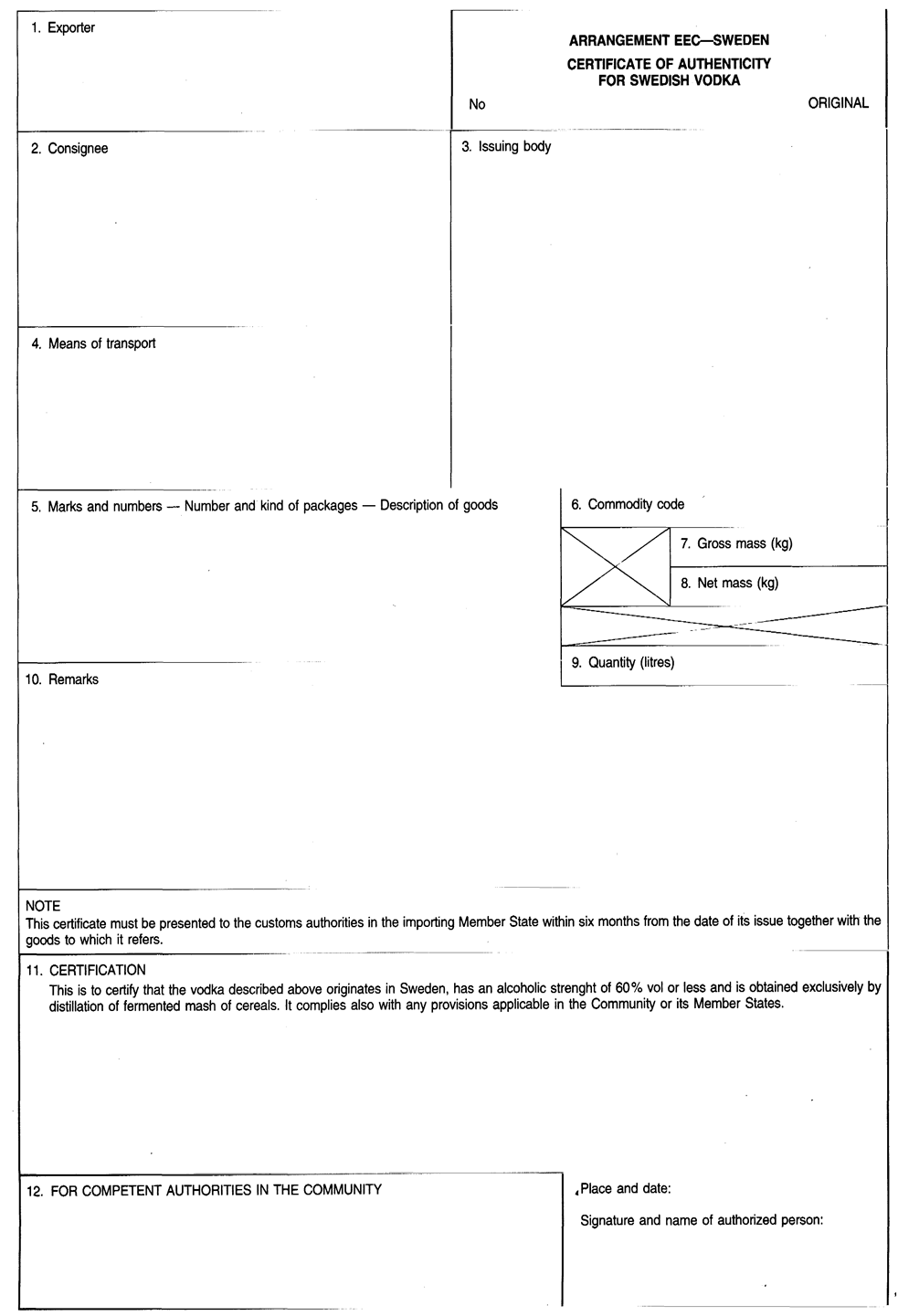

Annex 6a which is set out in Annex 3 hereto is inserted.

Annex 37 is amended in accordance with Annex 4 hereto.

Annex 38 is amended in accordance with Annex 5 hereto.

The first page of Annex 39 is replaced by Annex 6 hereto.

Annex 52 is replaced by Annex 7 hereto.

Annex 53 is replaced by Annex 8 hereto.

Annex 56 is replaced by Annex 9 hereto.

In Annex 67/B, the second page of the Annex to Inward Processing Application (economic grounds) is replaced by Annex 10 hereto.

Annex 77 is amended in accordance with Annex 11 hereto.

Annex 79 is amended in accordance with Annex 12 hereto.

Annexes 91a and 93a which are set out in Annexes 13 and 14 hereto respectively are inserted.

Article 2U.K.

The following Regulations shall be repealed:

Council Regulation (EEC) No 2955/85 of 22 October 1985 derogating in respect of the countries of the Association of South-East Asian Nations, of the countries of the Central American Common Market and the countries which have signed the Cartagena Agreement (Andean Group) from Regulation (EEC) No 3749/83 on the definition of the concept of originating products for the purposes of the application of tariff preferences granted by the European Economic Community in respect of certain products from developing countries(3),

Commission Regulation (EEC) No 1592/93 of 22 June 1993 determining the conditions for the entitlement of vodka falling within CN codes 2208 90 31 and 2208 90 53, imported into the Community, to the tariff concessions provided for in the arrangement between the European Economic Community and the Kingdom of Sweden on trade in spirituous beverages(4).

Article 3U.K.

This Regulation shall enter into force on 1 January 1994.

This Regulation shall be binding in its entirety and directly applicable in all Member States.

Done at Brussels, 21 December 1993.

For the Commission

Christiane Scrivener

Member of the Commission

ANNEX 1U.K.

| Order No | CN code | Description | Denaturant | |

|---|---|---|---|---|

| Name | Maximum quantity to be used in g per 100 kg of product to be denatured | |||

| (1) | (2) | (3) | (4) | (5) |

| 1 | 0408 | Birds' eggs, not in shell, and egg yolks, fresh, dried, cooked by steaming or by boiling in water, moulded, frozen or otherwise preserved, whether or not containing added sugar or other sweetening matter: – Egg yolks: | Spirit of turpentine Essence of lavender Oil of rosemary Birch oil | 500 100 150 100 |

| 0408 11 | – – Dried: | Fish meal of subheading 2301 20 00 of the Combined Nomenclature, having a characteristic odour and containing by weight in the dry matter at least:

| 5 000 | |

| 0408 11 20 | – – – Unfit for human consumption | |||

| 0408 19 | – – Other: | |||

| 0408 19 20 | – – – Unfit for human consumption | |||

| – Other: | ||||

| 0408 91 | – – Dried: | |||

| 0408 91 20 | – – – Unfit for human consumption | |||

| 0408 99 | – – Other: | |||

| 0408 99 20 | – – – Unfit for human consumption | |||

ANNEX 2U.K.

The table in Article 26 shall be amended as follows:

In order No 2, columns 6 and 7, the text ‘Österreichische Hartkäse Export GmbH — Innsbruck’ is replaced by the following:

‘Agrarmarkt Austria (AMA)’ — ‘Vienna’.

The text of order No 5 is replaced by order No 5 below.

In order No 6, columns 6 and 7:

The text ‘Carteira de commercio exterior do Banco do Brasil’‘Rio de Janeiro’, and the corresponding ‘Country of exportation’‘Brazil’, is replaced by the following:

Secretariat do comercio exterior, Rio de Janeiro

Federacao das industrias do Rio Grande do Sul, Porto Alegre

Federacao das industrias do Estado do Parana, Curitiba

Federacao das industrias do Estado de Santa Catarjna Florianopolis

and

The text ‘Office of Korean Monopoly Corporation’‘Sintanjin’, and the corresponding ‘Country of exportation’‘South Korea’, is replaced by the following: ‘Korea Tobacco and Ginseng Corporation’‘Taejon’.

| Order No | CN code | Description | Annex No | Issuing body | ||

|---|---|---|---|---|---|---|

| Exporting country | Name | Place where established | ||||

| (1) | (2) | (3) | (4) | (5) | (6) | (7) |

| 5 | 2208 90 | – Other: | ||||

| – – Vodka of an alcoholic strength by volume of 45,4 % vol or less and plum, pear or cherry spirit (excluding liqueurs), in containers holding: | 6 | Finland | ALKO Limited | Salmisaarenranta, 7 00100 Helsinki 10 Finland | ||

| – – – 2 litres or less: | ||||||

| 2208 90 31 | – – – – Vodka | 6a | Sweden | V&S Vin & Sprit AB | Formansvagen, 19 Årstadal | |

| – – Other spirits, liqueurs and other spirituous beverages, in containers holding: | 11743 Stockholm | |||||

| – – – 2 l or less: | ||||||

| – – – – Other: | ||||||

| – – – – – Spirits (excluding liqueurs): | ||||||

| – – – – – – Other: | ||||||

| 2208 90 58 | – – – – – – – Other | |||||

ANNEX 3U.K.

“ANNEX 6A

ANNEX 4U.K.

Annex 37 shall be amended as follows:

Title I (B) shall be amended as follows:

in the fourth indent of paragraph 1, the numbers 40 and 44 shall be added,

in paragraph 2 (f) (aa) and (bb) the following numbers shall be added: 8, 35, 40, and 44. In the second subparagraph of paragraph 2 (f) the following numbers shall be added: 8, 35 and 40.

Title II (A) shall be amended as follows:

in point 35, the first paragraph shall be replaced by the following:

‘Box mandatory for the Member States in respect of the Community transit procedure, where the re-export discharges the customs warehousing procedure, and when the form is used for evidence of the Community status of the goods, but for optional use for the Member States in other cases.’

in point 40 the following paragraph shall be added:

‘This box is mandatory where goods are re-exported following discharge of the customs warehousing procedure in a type B customs warehouse; enter the reference of the declaration of entry of the goods for the procedure.’

in point 44 the following paragraph shall be added:

‘Where the re-export declaration discharging the customs warehousing procedure is lodged with a customs office other than the supervising office, enter the full name and full address of the supervising office.’

Title II (C) shall be amended as follows:

in point 8 the second paragraph shall be replaced by the following:

‘In the case of entry for the customs warehousing procedure in a private warehouse (type C, D or E), enter the full name and address of the depositor where the latter is not the declarant.’

In point 35 the following paragraph shall be added:

‘Box mandatory in the case of the entry for the customs warehousing procedure’.

In point 40 the following paragraph shall be added:

‘This box is mandatory in the case of the entry for the customs warehousing procedure and where appropriate for the evidence of Community status.’

in point 44 the following paragraph shall be added:

‘Where a declaration entering goods for the customs warehousing procedure is lodged with a customs office other than the supervising office, enter the name and full address of the supervising office.’

ANNEX 5U.K.

Annex 38 shall be amended as follows:

The wording relating to box 1: declaration — first subdivision — COM is supplemented by the following:

‘declaration in respect of Community goods in the context of trade between parts of the customs territory of the Community to which the provisions of Directive 77/388/EEC are applicable and parts of that territory to which those provisions do not apply, or in the context of trade between parts of that territory where those provisions do not apply.’

ANNEX 6U.K.

“ANNEX 39LIST OF PETROLEUM PRODUCTS FOR WHICH THE CONDITIONS FOR ADMISSION WITH FAVOURABLE TARIFF BY REASON OF THEIR END-USE APPLY

| CN code | Description of goods |

|---|---|

| ex Chapter 27: Miscellaneous | Certain cases referred to in Additional Notes 4 (n) and (5) |

| 2707 | Oils and other products of the distillation of high temperature coal tar; similar products in which the weight of the aromatic constituents exceeds that of the non-aromatic constituents: |

| 2707 10 | – Benzole: |

| 2707 10 90 | – – For other purposes |

| 2707 20 | – Toluole: |

| 2707 20 90 | – – For other purposes |

| 2707 30 | – Xylole: |

| 2707 30 90 | – – For other purposes |

| 2707 50 | – Other aromatic hydrocarbon mixtures of which 65 % or more by volume (including losses) distils at 250 oC by the ASTM D 86 method: |

| – – For other purposes: | |

| 2707 50 91 | – – – Solvent naphtha |

| 2707 50 99 | – – – Other |

| – Other: | |

| 2707 99 | – – Other: |

| – – – Other: | |

| 2707 99 91 | – – – – For the manufacture of products of heading No 2803 |

| 2710 | Petroleum oils and oils obtained from bituminous minerals, other than crude; preparations not elsewhere specified or included, containing by weight 70 % or more of petroleum oils or of oils obtained from bituminous minerals, these oils being the basic constituents of the preparations: |

| – Light oils: | |

| 2710 00 11 | – – For undergoing a specific process |

| 2710 00 15 | – – For undergoing chemical transformation by a process other than those specified in respect of subheading 2710 00 11 |

| – Medium oils: | |

| 2710 00 41 | – – For undergoing a specific process |

| 2710 00 45 | – – For undergoing chemical transformation by a process other than those specified in respect of subheading 2710 00 41 |

| – Heavy oils: | |

| – – Gas oils: | |

| 2710 00 61 | – – – For undergoing a specific process |

| 2710 00 65 | – – – For undergoing chemical transformation by a process other than those specified in respect of subheading 2710 00 61 |

| – – Fuel oils: | |

| 2710 00 71 | – – – For undergoing a specific process |

| 2710 00 72 | – – – For undergoing chemical transformation by a process other than those specified in respect of subheading 2710 00 71 |

| – – Lubricating oils; other oils: | |

| 2710 00 81 | – – – For undergoing a specific process |

| 2710 00 83 | – – – For undergoing chemical transformation by a process other than those specified in respect of subheading 2710 00 81 |

| 2710 00 85 | – – – To be mixed in accordance with the terms of Additional Note 6 to this Chapter |

| 2711 | Petroleum gases and other gaseous hydrocarbons: |

| – Liquefied” |

ANNEX 7U.K.

“ANNEX 52LIST OF GOODS WHICH WHEN TRANSPORTED GIVE RISE TO AN INCREASE IN THE FLAT-RATE GUARANTEE

| HS code | Description | Quantity corresponding to the standard amount of ECU 7 000 |

|---|---|---|

| 1 | 2 | 3 |

| ex 0102 | Live bovine animals, other than purebred breeding animals | 4 000 kg |

| ex 0103 | Live pigs, other than pure-bred breeding animals | 5 000 kg |

| ex 0104 | Live sheep or goats, other than pure-bred breeding animals | 6 000 kg |

| 0201 | Meat of bovine animals, fresh or chilled | 2 000 kg |

| 0202 | Meat of bovine animals, frozen | 3 000 kg |

| 0203 | Meat of pigs, fresh, chilled or frozen | 4 000 kg |

| 0204 | Meat of sheep or goats, fresh, chilled or frozen | 3 000 kg |

| ex 0210 | Meat of bovine animals, salted, in brine, dried or smoked | 3 000 kg |

| 0402 | Milk and cream, concentrated or containing added sugar or other sweetening matter | 5 000 kg |

| 0405 | Butter and other fats and oils derived from milk | 3 000 kg |

| 0406 | Cheeese and curd | 3 500 kg |

| ex 0901 | Coffee, not roasted, whether or not decaffeinated | 3 000 kg |

| ex 0901 | Coffee, roasted, whether or not decaffeinated | 2 000 kg |

| 1001 | Cereals (wheat) and (meslin) | 900 kg |

| 1002 | Rye | 1 000 kg |

| 1003 | Barley | 1 000 kg |

| 1004 | Oats | 850 kg |

| ex 1601 | Sausages and similar products of meat, meat offal or blood, of domestic swine | 4 000 kg |

| ex 1602 | Other prepared or preserved meat, meat offal or blood, of domestic swine | 4 000 kg |

| ex 1602 | Other prepared or preserved meat, meat offal or blood of bovine animals | 3 000 kg |

| ex 2101 | Extracts, essence and concentrates, of coffee | 1 000 kg |

| ex 2106 | Food preparations not elsewhere specified or included, containing 18 % or more by weight of milkfats | 3 000 kg |

| 2204 | Wine of fresh grapes, including fortified wines, grape must other than that of heading No 2009 | 15 hl |

| 2205 | Vermouth and other wine of fresh grapes flavoured with plants or aromatic substances | 15 hl |

| ex 2207 | Undenatured ethyl alcohol of an alcoholic strength by volume of 80 % vol or higher | 3 hl |

| ex 2208 | Undenatured ethyl alcohol of an alcoholic strength by volume of less than 80 % vol | 3 hl |

| ex 2208 | Spirits, liqueurs and other spirituous beverages | 5 hl |

| ex 2402 | Cigarettes | 70 000 items |

| ex 2402 | Cigarillos | 60 000 items |

| ex 2402 | Cigars | 25 000 items |

| ex 2403 | Smoking tobacco | 100 kg |

| ex 2710 | Light and medium petroleum oils and gas oils | 200 hl” |

ANNEX 8U.K.

“ANNEX 53LIST OF GOODS WHICH MAY GIVE RISE TO AN INCREASE IN THE AMOUNT OF THE COMPREHENSIVE GUARANTEE

| ex 0102 | Live bovine animals, other than pure-bred breeding animals |

| ex 0103 | Live swine, other than pure-bred breeding animals |

| ex 0104 | Live sheep or goats, other than pure-bred breeding animals |

| 0201 | Meat of bovine animals, fresh or chilled |

| 0202 | Meat of bovine animals, frozen |

| 0203 | Meat of swine, fresh, chilled or frozen |

| 0204 | Meat of sheep or goats, fresh, chilled or frozen |

| 0402 | Milk and cream, concentrated or containing added sugar or other sweetening matter |

| 0405 | Butter and other fats and oils derived from milk |

| 0406 | Cheese and curd |

| 1001 | Wheat and meslin |

| 1002 | Rye |

| 1003 | Barley |

| 1004 | Oats |

| ex 2207 | Undenatured ethyl alcohol of an alcoholic strength by volume of 80 % vol or higher |

| ex 2208 | Undenatured ethyl alcohol of an alcoholic strength by volume of less than 80 % vol |

| ex 2208 | Spirits, liqueurs and other sprirituous beverages |

| ex 2402 | Cigarettes |

| ex 2402 | Cigarillos |

| ex 2402 | Cigars |

| ex 2403 | Smoking tobacco” |

ANNEX 9U.K.

“ANNEX 56LIST OF GOODS PRESENTING INCREASED RISKS TO WHICH THE GUARANTEE WAIVER DOES NOT APPLY

| ex 0102 | Live bovine animals, other than pure-bred breeding animals |

| ex 0103 | Live swine, other than pure-bred breeding animals |

| ex 0104 | Live sheep or goats, other than pure-bred breeding animals |

| 0201 | Meat of bovine animals, fresh or chilled |

| 0202 | Meat of bovine animals, frozen |

| 0203 | Meat of swine, fresh, chilled or frozen |

| 0204 | Meat of sheep or goats, fresh, chilled or frozen |

| 0402 | Milk and cream, concentrated or containing added sugar or other sweetening matter |

| 0405 | Butter and other fats and oils derived from milk |

| 0406 | Cheese and curd |

| ex 0901 | Coffee, not roasted, whether or not decaffeinated |

| ex 0901 | Coffee, roasted, whether or not decaffeinated |

| 1001 | Wheat and meslin |

| 1002 | Rye |

| 1003 | Barley |

| 1004 | Oats |

| ex 2101 | Extracts, essences and concentrates, of coffee |

| 2203 | Beer made from malt |

| 2204 | Wine of fresh grapes, incluiding fortified wines, grape must other than that of heading No 2009 |

| 2205 | Vermouth and other wine of fresh grapes flavoured with plants or aromatic substances |

| 2206 | Other fermented beverages (for example, cider, perry, mead); mixtures of fermented beverages and mixtures of fermented beverages and non-alcoholic beverages |

| ex 2207 | Undenatured ethyl alcohol of an alcoholic strength by volume of 80 % vol or higher |

| ex 2208 | Undenatured ethyl alcohol of an alcoholic strength by volume of less than 80 % vol |

| ex 2208 | Spirits, liqueurs and other spirituous beverages |

| ex 2402 | Cigarettes |

| ex 2402 | Cigarillos |

| ex 2402 | Cigars |

| ex 2403 | Smoking tobacco |

| ex 2710 | Light and medium petroleum oils and gas oils |

| ex 2711 | Petroleum gases and other gaseous hydrocarbons” |

ANNEX 10U.K.

ANNEX 11U.K.

In Annex 77 numerical order 128 is replaced by the following:

ANNEX 12U.K.

In Annex 79, the following order number shall be inserted:

| Order No | CN code and description of the compensating products | Processing operations from which they result | |

|---|---|---|---|

| (1) | (2) | (3) | |

| 45(a) | ex 1522 00 39 | stearin | Refining fats and oils of Chapter 15 |

ANNEX 13U.K.

“ANNEX 91aOTHER GOODS IMPORTED IN CONNECTION WITH EDUCATIONAL, SCIENTIFIC OR CULTURAL ACTIVITIESILLUSTRATIVE LIST

Goods such as:

Costumes and scenery items sent on loan free of charge to dramatic societies or theatres.

Music scores sent on loan free of charge to music theatres or orchestras.”

ANNEX 14U.K.

“ANNEX 93AANIMALSILLUSTRATIVE LIST

Dressage

Training

Breeding

Shoeing or weighing

Veterinary treatment

Testing (for example, with a view to purchase)

Participation in shows, exhibitions, contests, competitions or demonstrations

Entertainment (circus animals, etc.)

Touring (including pet animals of travellers)

Exercise of function (police dogs or horses; detector dogs, dogs for the blind, etc.)

Rescue operations

Transhumance or grazing

Performance of work or transport

Medical purposes (delivery of snake poison, etc.)”

Options/Help

Print Options

PrintThe Whole Regulation

Mae deddfwriaeth ar gael mewn fersiynau gwahanol:

Y Diweddaraf sydd Ar Gael (diwygiedig):Y fersiwn ddiweddaraf sydd ar gael o’r ddeddfwriaeth yn cynnwys newidiadau a wnaed gan ddeddfwriaeth ddilynol ac wedi eu gweithredu gan ein tîm golygyddol. Gellir gweld y newidiadau nad ydym wedi eu gweithredu i’r testun eto yn yr ardal ‘Newidiadau i Ddeddfwriaeth’.

Gwreiddiol (Fel y’i mabwysiadwyd gan yr UE): Mae'r wreiddiol version of the legislation as it stood when it was first adopted in the EU. No changes have been applied to the text.

Gweler y wybodaeth ychwanegol ochr yn ochr â’r cynnwys

Rhychwant ddaearyddol: Indicates the geographical area that this provision applies to. For further information see ‘Frequently Asked Questions’.

Dangos Llinell Amser Newidiadau: See how this legislation has or could change over time. Turning this feature on will show extra navigation options to go to these specific points in time. Return to the latest available version by using the controls above in the What Version box.

Rhagor o Adnoddau

Gallwch wneud defnydd o ddogfennau atodol hanfodol a gwybodaeth ar gyfer yr eitem ddeddfwriaeth o’r tab hwn. Yn ddibynnol ar yr eitem ddeddfwriaeth sydd i’w gweld, gallai hyn gynnwys:

- y PDF print gwreiddiol y fel adopted version that was used for the EU Official Journal

- rhestr o newidiadau a wnaed gan a/neu yn effeithio ar yr eitem hon o ddeddfwriaeth

- pob fformat o’r holl ddogfennau cysylltiedig

- slipiau cywiro

- dolenni i ddeddfwriaeth gysylltiedig ac adnoddau gwybodaeth eraill

Llinell Amser Newidiadau

Mae’r llinell amser yma yn dangos y fersiynau gwahanol a gymerwyd o EUR-Lex yn ogystal ag unrhyw fersiynau dilynol a grëwyd ar ôl y diwrnod ymadael o ganlyniad i newidiadau a wnaed gan ddeddfwriaeth y Deyrnas Unedig.

Cymerir dyddiadau fersiynau’r UE o ddyddiadau’r dogfennau ar EUR-Lex ac efallai na fyddant yn cyfateb â’r adeg pan ddaeth y newidiadau i rym ar gyfer y ddogfen.

Ar gyfer unrhyw fersiynau a grëwyd ar ôl y diwrnod ymadael o ganlyniad i newidiadau a wnaed gan ddeddfwriaeth y Deyrnas Unedig, bydd y dyddiad yn cyd-fynd â’r dyddiad cynharaf y daeth y newid (e.e. ychwanegiad, diddymiad neu gyfnewidiad) a weithredwyd i rym. Am ragor o wybodaeth gweler ein canllaw i ddeddfwriaeth ddiwygiedig ar Ddeall Deddfwriaeth.

Rhagor o Adnoddau

Defnyddiwch y ddewislen hon i agor dogfennau hanfodol sy’n cyd-fynd â’r ddeddfwriaeth a gwybodaeth am yr eitem hon o ddeddfwriaeth. Gan ddibynnu ar yr eitem o ddeddfwriaeth sy’n cael ei gweld gall hyn gynnwys:

- y PDF print gwreiddiol y fel adopted fersiwn a ddefnyddiwyd am y copi print

- slipiau cywiro

liciwch ‘Gweld Mwy’ neu ddewis ‘Rhagor o Adnoddau’ am wybodaeth ychwanegol gan gynnwys

- rhestr o newidiadau a wnaed gan a/neu yn effeithio ar yr eitem hon o ddeddfwriaeth

- manylion rhoi grym a newid cyffredinol

- pob fformat o’r holl ddogfennau cysylltiedig

- dolenni i ddeddfwriaeth gysylltiedig ac adnoddau gwybodaeth eraill

The data on this page is available in the alternative data formats listed: