- Y Diweddaraf sydd Ar Gael (Diwygiedig)

- Pwynt Penodol mewn Amser (26/06/2013)

- Gwreiddiol (Fel y’i mabwysiadwyd gan yr UE)

Regulation (EU) No 575/2013 of the European Parliament and of the CouncilDangos y teitl llawn

Regulation (EU) No 575/2013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and investment firms and amending Regulation (EU) No 648/2012 (Text with EEA relevance)

You are here:

- Dangos Graddfa Ddaearyddol(e.e. Lloegr, Cymru, Yr Alban aca Gogledd Iwerddon)

- Dangos Llinell Amser Newidiadau

Rhagor o Adnoddau

PDF o Fersiynau Diwygiedig

- ddiwygiedig 28/06/20235.43 MB

- ddiwygiedig 28/12/20205.48 MB

- ddiwygiedig 27/06/20205.43 MB

- ddiwygiedig 25/12/20194.80 MB

- ddiwygiedig 27/06/20194.80 MB

- ddiwygiedig 26/04/20194.04 MB

- ddiwygiedig 01/01/20193.86 MB

- ddiwygiedig 01/01/20183.84 MB

- ddiwygiedig 19/07/20163.26 MB

- ddiwygiedig 18/01/20153.82 MB

- ddiwygiedig 28/06/20133.79 MB

When the UK left the EU, legislation.gov.uk published EU legislation that had been published by the EU up to IP completion day (31 December 2020 11.00 p.m.). On legislation.gov.uk, these items of legislation are kept up-to-date with any amendments made by the UK since then.

Mae hon yn eitem o ddeddfwriaeth sy’n deillio o’r UE

Mae unrhyw newidiadau sydd wedi cael eu gwneud yn barod gan y tîm yn ymddangos yn y cynnwys a chyfeirir atynt gydag anodiadau.Ar ôl y diwrnod ymadael bydd tair fersiwn o’r ddeddfwriaeth yma i’w gwirio at ddibenion gwahanol. Y fersiwn legislation.gov.uk yw’r fersiwn sy’n weithredol yn y Deyrnas Unedig. Y Fersiwn UE sydd ar EUR-lex ar hyn o bryd yw’r fersiwn sy’n weithredol yn yr UE h.y. efallai y bydd arnoch angen y fersiwn hon os byddwch yn gweithredu busnes yn yr UE. EUR-Lex Y fersiwn yn yr archif ar y we yw’r fersiwn swyddogol o’r ddeddfwriaeth fel yr oedd ar y diwrnod ymadael cyn cael ei chyhoeddi ar legislation.gov.uk ac unrhyw newidiadau ac effeithiau a weithredwyd yn y Deyrnas Unedig wedyn. Mae’r archif ar y we hefyd yn cynnwys cyfraith achos a ffurfiau mewn ieithoedd eraill o EUR-Lex. The EU Exit Web Archive legislation_originated_from_EU_p3

Changes over time for: Section 4

Version Superseded: 28/06/2013

Status:

Point in time view as at 26/06/2013.

Changes to legislation:

Regulation (EU) No 575/2013 of the European Parliament and of the Council,

Section 4

is up to date with all changes known to be in force on or before 09 August 2024. There are changes that may be brought into force at a future date. Changes that have been made appear in the content and are referenced with annotations.![]()

Changes to Legislation

Changes and effects yet to be applied by the editorial team are only applicable when viewing the latest version or prospective version of legislation. They are therefore not accessible when viewing legislation as at a specific point in time. To view the ‘Changes to Legislation’ information for this provision return to the latest version view using the options provided in the ‘What Version’ box above.

Section 4 U.K. PD, LGD and maturity

Sub-Section 1 U.K. Exposures to corporates, institutions and central governments and central banks

Article 160U.K.Probability of default (PD)

1.The PD of an exposure to a corporate or an institution shall be at least 0,03 %.

2.For purchased corporate receivables in respect of which an institution is not able to estimate PDs or institution's PD estimates do not meet the requirements set out in Section 6, the PDs for these exposures shall be determined according to the following methods:

(a)for senior claims on purchased corporate receivables PD shall be the institutions estimate of EL divided by LGD for these receivables;

(b)for subordinated claims on purchased corporate receivables PD shall be the institution's estimate of EL;

(c)an institution that has received the permission of the competent authority to use own LGD estimates for corporate exposures pursuant to Article 143 and that can decompose its EL estimates for purchased corporate receivables into PDs and LGDs in a manner that the competent authority considers to be reliable, may use the PD estimate that results from this decomposition.

3.The PD of obligors in default shall be 100 %.

4.Institutions may take into account unfunded credit protection in the PD in accordance with the provisions of Chapter 4. For dilution risk, in addition to the protection providers referred to in Article 201(1)(g) the seller of the purchased receivables is eligible if the following conditions are met:

(a)the corporate entity has a credit assessment by an ECAI which has been determined by EBA to be associated with credit quality step 3 or above under the rules for the risk weighting of exposures to corporates under Chapter 2;

(b)the corporate entity, in the case of institutions calculating risk-weighted exposure amounts and expected loss amounts under the IRB Approach, does not have a credit assessment by a recognised ECAI and is internally rated as having a PD equivalent to that associated with the credit assessments of ECAIs determined by EBA to be associated with credit quality step 3 or above under the rules for the risk weighting of exposures to corporates under Chapter 2.

5.Institutions using own LGD estimates may recognise unfunded credit protection by adjusting PDs subject to Article 161(3).

6.For dilution risk of purchased corporate receivables, PD shall be set equal to the EL estimate of the institution for dilution risk. An institution that has received permission from the competent authority pursuant to Article 143 to use own LGD estimates for corporate exposures that can decompose its EL estimates for dilution risk of purchased corporate receivables into PDs and LGDs in a manner that the competent authority considers to be reliable, may use the PD estimate that results from this decomposition. Institutions may recognise unfunded credit protection in the PD in accordance with the provisions of Chapter 4. For dilution risk, in addition to the protection providers referred to in Article 201(1)(g), the seller of the purchased receivables is eligible provided that the conditions set out in paragraph 4 are met.

7.By way of derogation from Article 201(1)(g), the corporate entities that meet the conditions set out in paragraph 4 are eligible.

An institution that has received the permission of the competent authority pursuant to Article 143 to use own LGD estimates for dilution risk of purchased corporate receivables, may recognise unfunded credit protection by adjusting PDs subject to Article 161(3).

Article 161U.K.Loss Given Default (LGD)

1.Institutions shall use the following LGD values:

(a)senior exposures without eligible collateral: 45 %;

(b)subordinated exposures without eligible collateral: 75 %;

(c)institutions may recognise funded and unfunded credit protection in the LGD in accordance with Chapter 4;

(d)covered bonds eligible for the treatment set out in Article 129(4) or (5) may be assigned an LGD value of 11,25 %;

(e)for senior purchased corporate receivables exposures where an institution is not able to estimate PDs or the institution's PD estimates do not meet the requirements set out in Section 6: 45 %;

(f)for subordinated purchased corporate receivables exposures where an institution is not able to estimate PDs or the institution's PD estimates do not meet the requirements set out in Section 6: 100 %;

(g)For dilution risk of purchased corporate receivables: 75 %.

2.For dilution and default risk if an institution has received permission from the competent authority to use own LGD estimates for corporate exposures pursuant to Article 143 and it can decompose its EL estimates for purchased corporate receivables into PDs and LGDs in a manner the competent authority considers to be reliable, the LGD estimate for purchased corporate receivables may be used.

3.If an institution has received the permission of the competent authority to use own LGD estimates for exposures to corporates, institutions, central governments and central banks pursuant to Article 143, unfunded credit protection may be recognised by adjusting PD or LGD subject to requirements as specified in Section 6 and permission of the competent authorities. An institution shall not assign guaranteed exposures an adjusted PD or LGD such that the adjusted risk weight would be lower than that of a comparable, direct exposure to the guarantor.

4.For the purposes of the undertakings referred to in Article 153(3), the LGD of a comparable direct exposure to the protection provider shall either be the LGD associated with an unhedged facility to the guarantor or the unhedged facility of the obligor, depending upon whether in the event both the guarantor and obligor default during the life of the hedged transaction, available evidence and the structure of the guarantee indicate that the amount recovered would depend on the financial condition of the guarantor or obligor, respectively.

Article 162U.K.Maturity

1.Institutions that have not received permission to use own LGDs and own conversion factors for exposures to corporates, institutions or central governments and central banks shall assign to exposures arising from repurchase transactions or securities or commodities lending or borrowing transactions a maturity value (M) of 0,5 years and to all other exposures an M of 2,5 years.

Alternatively, as part of the permission referred to in Article 143, the competent authorities shall decide on whether the institution shall use maturity (M) for each exposure as set out under paragraph 2.

2.Institutions that have received the permission of the competent authority to use own LGDs and own conversion factors for exposures to corporates, institutions or central governments and central banks pursuant to Article 143 shall calculate M for each of these exposures as set out in points (a) to (e) of this paragraph and subject to paragraphs 3 to 5 of this Article. M shall be no greater than five years except in the cases specified in Article 384(1) where M as specified there shall be used:

(a)for an instrument subject to a cash flow schedule, M shall be calculated according to the following formula:

where CFt denotes the cash flows (principal, interest payments and fees) contractually payable by the obligor in period t;

(b)for derivatives subject to a master netting agreement, M shall be the weighted average remaining maturity of the exposure, where M shall be at least 1 year, and the notional amount of each exposure shall be used for weighting the maturity;

(c)for exposures arising from fully or nearly-fully collateralised derivative instruments listed in Annex II and fully or nearly-fully collateralised margin lending transactions which are subject to a master netting agreement, M shall be the weighted average remaining maturity of the transactions where M shall be at least 10 days;

(d)for repurchase transactions or securities or commodities lending or borrowing transactions which are subject to a master netting agreement, M shall be the weighted average remaining maturity of the transactions where M shall be at least five days. The notional amount of each transaction shall be used for weighting the maturity;

(e)an institution that has received the permission of the competent authority pursuant to Article 143 to use own PD estimates for purchased corporate receivables, for drawn amounts M shall equal the purchased receivables exposure weighted average maturity, where M shall be at least 90 days. This same value of M shall also be used for undrawn amounts under a committed purchase facility provided the facility contains effective covenants, early amortisation triggers, or other features that protect the purchasing institution against a significant deterioration in the quality of the future receivables it is required to purchase over the facility's term. Absent such effective protections, M for undrawn amounts shall be calculated as the sum of the longest-dated potential receivable under the purchase agreement and the remaining maturity of the purchase facility, where M shall be at least 90 days;

(f)for any other instrument than those mentioned in this paragraph or when an institution is not in a position to calculate M as set out in (a), M shall be the maximum remaining time (in years) that the obligor is permitted to take to fully discharge its contractual obligations, where M shall be at least 1 year;

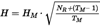

(g)for institutions using the Internal Model Method set out in Section 6 of Chapter 6 to calculate the exposure values, M shall be calculated for exposures to which they apply this method and for which the maturity of the longest-dated contract contained in the netting set is greater than one year according to the following formula:

where:

(h)an institution that uses an internal model to calculate a one-sided credit valuation adjustment (CVA) may use, subject to the permission of the competent authorities, the effective credit duration estimated by the internal model as M.

Subject to paragraph 2, for netting sets in which all contracts have an original maturity of less than one year the formula in point (a) shall apply;

(i)for institutions using the Internal Model Method set out in Section 6 of Chapter 6, to calculate the exposure values and having an internal model permission for specific risk associated with traded debt positions in accordance with Part Three, Title IV, Chapter 5, M shall be set to 1 in the formula laid out in Article 153(1), provided that an institution can demonstrate to the competent authorities that its internal model for Specific risk associated with traded debt positions applied in Article 383 contains effects of rating migrations;

(j)for the purposes of Article 153(3), M shall be the effective maturity of the credit protection but at least 1 year.

3.Where the documentation requires daily re-margining and daily revaluation and includes provisions that allow for the prompt liquidation or set off of collateral in the event of default or failure to remargin, M shall be at least one-day for:

(a)fully or nearly-fully collateralised derivative instruments listed in Annex II;

(b)fully or nearly-fully collateralised margin lending transactions;

(c)repurchase transactions, securities or commodities lending or borrowing transactions.

In addition, for qualifying short-term exposures which are not part of the institution's ongoing financing of the obligor, M shall be at least one-day. Qualifying short term exposures shall include the following:

(a)exposures to institutions arising from settlement of foreign exchange obligations;

(b)self-liquidating short-term trade financing transactions connected to the exchange of goods or services with a residual maturity of up to one year as referred to in point (80) of Article 4(1);

(c)exposures arising from settlement of securities purchases and sales within the usual delivery period or two business days;

(d)exposures arising from cash settlements by wire transfer and settlements of electronic payment transactions and prepaid cost, including overdrafts arising from failed transactions that do not exceed a short, fixed agreed number of business days.

4.For exposures to corporates situated in the Union and having consolidated sales and consolidated assets of less than EUR 500 million, institutions may choose to consistently set M as set out in paragraph 1 instead of applying paragraph 2. Institutions may replace EUR 500 million total assets with EUR 1 000 million total assets for corporates which primarily own and let non-speculative residential property.

5.Maturity mismatches shall be treated as specified in Chapter 4.

Sub-Section 2 U.K. Retail exposures

Article 163U.K.Probability of default (PD)

1.PD of an exposure shall be at least 0,03 %.

2.The PD of obligors or, where an obligation approach is used, of exposures in default shall be 100 %.

3.For dilution risk of purchased receivables PD shall be set equal to EL estimates for dilution risk. If an institution can decompose its EL estimates for dilution risk of purchased receivables into PDs and LGDs in a manner the competent authorities consider to be reliable, the PD estimate may be used.

4.Unfunded credit protection may be taken into account by adjusting PDs subject to Article 164(2). For dilution risk, in addition to the protection providers referred to in Article 201(1)(g), the seller of the purchased receivables is eligible if the conditions set out in Article 160(4) are met.

Article 164U.K.Loss Given Default (LGD)

1.Institutions shall provide own estimates of LGDs subject to requirements as specified in Section 6 and permission of the competent authorities granted in accordance with Article 143. For dilution risk of purchased receivables, an LGD value of 75 % shall be used. If an institution can decompose its EL estimates for dilution risk of purchased receivables into PDs and LGDs in a reliable manner, the institution may use its own LGD estimate.

2.Unfunded credit protection may be recognised as eligible by adjusting PD or LGD estimates subject to requirements as specified in Article 183(1), (2) and (3) and permission of the competent authorities either in support of an individual exposure or a pool of exposures. An institution shall not assign guaranteed exposures an adjusted PD or LGD such that the adjusted risk weight would be lower than that of a comparable, direct exposure to the guarantor.

3.For the purposes of Article 154(2), the LGD of a comparable direct exposure to the protection provider referred to in Article 153(3) shall either be the LGD associated with an unhedged facility to the guarantor or the unhedged facility of the obligor, depending upon whether, in the event both the guarantor and obligor default during the life of the hedged transaction, available evidence and the structure of the guarantee indicate that the amount recovered would depend on the financial condition of the guarantor or obligor, respectively.

4.The exposure weighted average LGD for all retail exposures secured by residential property and not benefiting from guarantees from central governments shall not be lower than 10 %.

The exposure weighted average LGD for all retail exposures secured by commercial immovable property and not benefiting from guarantees from central governments shall not be lower than 15 %.

5.Based on the data collected under Article 101 and taking into account forward-looking property market developments and any other relevant indicators, the competent authorities shall periodically, and at least annually, assess whether the minimum LGD values in paragraph 4 of this Article are appropriate for exposures secured by residential or commercial immovable property located in their territory. Competent authorities may, where appropriate on the basis of financial stability considerations, set higher minimum values of exposure weighted average LGD for exposures secured by property in their territory.

Competent authorities shall notify EBA of any changes to the minimum LGD values that they make in accordance with the first subparagraph and EBA shall publish these LGD values.

6.EBA shall develop draft regulatory technical standards to specify the conditions that competent authorities shall take into account when determining higher minimum LGD values.

EBA shall submit those draft regulatory technical standards to the Commission by 31 December 2014.

Power is delegated to the Commission to adopt the regulatory technical standards referred to in the first subparagraph in accordance with Articles 10 to 14 of Regulation (EU) No 1093/2010.

7.The institutions of one Member State shall apply the higher minimum LGD values that have been determined by the competent authorities of another Member State to exposures secured by property located in that Member State.

Sub-Section 3 U.K. Equity exposures subject to PD/LGD method

Article 165U.K.Equity exposures subject to the PD/LGD method

1.PDs shall be determined according to the methods for corporate exposures.

The following minimum PDs shall apply:

(a)0,09 % for exchange traded equity exposures where the investment is part of a long-term customer relationship;

(b)0,09 % for non-exchange traded equity exposures where the returns on the investment are based on regular and periodic cash flows not derived from capital gains;

(c)0,40 % for exchange traded equity exposures including other short positions as set out in Article 155(2);

(d)1,25 % for all other equity exposures including other short positions as set out in Article 155(2).

2.Private equity exposures in sufficiently diversified portfolios may be assigned an LGD of 65 %. All other such exposures shall be assigned an LGD of 90 %.

3.M assigned to all exposures shall be five years.

Options/Help

Print Options

PrintThe Whole Regulation

PrintThe Whole Part

PrintThe Whole Title

PrintThe Whole Chapter

PrintThis Section only

You have chosen to open The Whole Regulation

The Whole Regulation you have selected contains over 200 provisions and might take some time to download. You may also experience some issues with your browser, such as an alert box that a script is taking a long time to run.

Would you like to continue?

You have chosen to open The Whole Regulation as a PDF

The Whole Regulation you have selected contains over 200 provisions and might take some time to download.

Would you like to continue?

You have chosen to open The Whole Regulation without Annexes

The Whole Regulation without Annexes you have selected contains over 200 provisions and might take some time to download. You may also experience some issues with your browser, such as an alert box that a script is taking a long time to run.

Would you like to continue?

You have chosen to open The Whole Regulation without Annexes as a PDF

The Whole Regulation without Annexes you have selected contains over 200 provisions and might take some time to download.

Would you like to continue?

You have chosen to open the Whole Regulation

The Whole Regulation you have selected contains over 200 provisions and might take some time to download. You may also experience some issues with your browser, such as an alert box that a script is taking a long time to run.

Would you like to continue?

You have chosen to open the Whole Regulation without Annexes

The Whole Regulation without Annexes you have selected contains over 200 provisions and might take some time to download. You may also experience some issues with your browser, such as an alert box that a script is taking a long time to run.

Would you like to continue?

Mae deddfwriaeth ar gael mewn fersiynau gwahanol:

Y Diweddaraf sydd Ar Gael (diwygiedig):Y fersiwn ddiweddaraf sydd ar gael o’r ddeddfwriaeth yn cynnwys newidiadau a wnaed gan ddeddfwriaeth ddilynol ac wedi eu gweithredu gan ein tîm golygyddol. Gellir gweld y newidiadau nad ydym wedi eu gweithredu i’r testun eto yn yr ardal ‘Newidiadau i Ddeddfwriaeth’.

Gwreiddiol (Fel y’i mabwysiadwyd gan yr UE): Mae'r wreiddiol version of the legislation as it stood when it was first adopted in the EU. No changes have been applied to the text.

Pwynt Penodol mewn Amser: This becomes available after navigating to view revised legislation as it stood at a certain point in time via Advanced Features > Show Timeline of Changes or via a point in time advanced search.

Gweler y wybodaeth ychwanegol ochr yn ochr â’r cynnwys

Rhychwant ddaearyddol: Indicates the geographical area that this provision applies to. For further information see ‘Frequently Asked Questions’.

Dangos Llinell Amser Newidiadau: See how this legislation has or could change over time. Turning this feature on will show extra navigation options to go to these specific points in time. Return to the latest available version by using the controls above in the What Version box.

Rhagor o Adnoddau

Gallwch wneud defnydd o ddogfennau atodol hanfodol a gwybodaeth ar gyfer yr eitem ddeddfwriaeth o’r tab hwn. Yn ddibynnol ar yr eitem ddeddfwriaeth sydd i’w gweld, gallai hyn gynnwys:

- y PDF print gwreiddiol y fel adopted version that was used for the EU Official Journal

- rhestr o newidiadau a wnaed gan a/neu yn effeithio ar yr eitem hon o ddeddfwriaeth

- pob fformat o’r holl ddogfennau cysylltiedig

- slipiau cywiro

- dolenni i ddeddfwriaeth gysylltiedig ac adnoddau gwybodaeth eraill

Llinell Amser Newidiadau

Mae’r llinell amser yma yn dangos y fersiynau gwahanol a gymerwyd o EUR-Lex yn ogystal ag unrhyw fersiynau dilynol a grëwyd ar ôl y diwrnod ymadael o ganlyniad i newidiadau a wnaed gan ddeddfwriaeth y Deyrnas Unedig.

Cymerir dyddiadau fersiynau’r UE o ddyddiadau’r dogfennau ar EUR-Lex ac efallai na fyddant yn cyfateb â’r adeg pan ddaeth y newidiadau i rym ar gyfer y ddogfen.

Ar gyfer unrhyw fersiynau a grëwyd ar ôl y diwrnod ymadael o ganlyniad i newidiadau a wnaed gan ddeddfwriaeth y Deyrnas Unedig, bydd y dyddiad yn cyd-fynd â’r dyddiad cynharaf y daeth y newid (e.e. ychwanegiad, diddymiad neu gyfnewidiad) a weithredwyd i rym. Am ragor o wybodaeth gweler ein canllaw i ddeddfwriaeth ddiwygiedig ar Ddeall Deddfwriaeth.

Rhagor o Adnoddau

Defnyddiwch y ddewislen hon i agor dogfennau hanfodol sy’n cyd-fynd â’r ddeddfwriaeth a gwybodaeth am yr eitem hon o ddeddfwriaeth. Gan ddibynnu ar yr eitem o ddeddfwriaeth sy’n cael ei gweld gall hyn gynnwys:

- y PDF print gwreiddiol y fel adopted fersiwn a ddefnyddiwyd am y copi print

- slipiau cywiro

liciwch ‘Gweld Mwy’ neu ddewis ‘Rhagor o Adnoddau’ am wybodaeth ychwanegol gan gynnwys

- rhestr o newidiadau a wnaed gan a/neu yn effeithio ar yr eitem hon o ddeddfwriaeth

- manylion rhoi grym a newid cyffredinol

- pob fformat o’r holl ddogfennau cysylltiedig

- dolenni i ddeddfwriaeth gysylltiedig ac adnoddau gwybodaeth eraill