- Y Diweddaraf sydd Ar Gael (Diwygiedig)

- Pwynt Penodol mewn Amser (31/12/2020)

- Gwreiddiol (Fel y’i mabwysiadwyd gan yr UE)

Commission Delegated Regulation (EU) 2015/35Dangos y teitl llawn

Commission Delegated Regulation (EU) 2015/35 of 10 October 2014 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance)

You are here:

- Dangos Graddfa Ddaearyddol(e.e. Lloegr, Cymru, Yr Alban aca Gogledd Iwerddon)

- Dangos Llinell Amser Newidiadau

Rhagor o Adnoddau

PDF o Fersiynau Diwygiedig

- ddiwygiedig 30/07/202048.27 MB

- ddiwygiedig 01/01/202048.00 MB

- ddiwygiedig 08/07/201944.91 MB

- ddiwygiedig 01/01/201946.16 MB

- ddiwygiedig 15/09/201740.90 MB

- ddiwygiedig 09/04/201746.19 MB

- ddiwygiedig 02/04/201646.19 MB

- ddiwygiedig 17/01/201539.54 MB

Pan adawodd y DU yr UE, cyhoeddodd legislation.gov.uk ddeddfwriaeth yr UE a gyhoeddwyd gan yr UE hyd at ddiwrnod cwblhau’r cyfnod gweithredu (31 Rhagfyr 2020 11.00 p.m.). Ar legislation.gov.uk, mae'r eitemau hyn o ddeddfwriaeth yn cael eu diweddaru'n gyson ag unrhyw ddiwygiadau a wnaed gan y DU ers hynny.

Mae'r eitem hon o ddeddfwriaeth yn tarddu o'r UE

Mae legislation.gov.uk yn cyhoeddi fersiwn y DU. Mae EUR-Lex yn cyhoeddi fersiwn yr UE. Mae Archif Gwe Ymadael â’r UE yn rhoi cipolwg ar fersiwn EUR-Lex o ddiwrnod cwblhau’r cyfnod gweithredu (31 Rhagfyr 2020 11.00 p.m.).

Changes over time for: CHAPTER V

Version Superseded: 01/01/2024

Alternative versions:

- 10/10/2014- Amendment

- 02/04/2016- Amendment

- 15/09/2017- Amendment

- 01/01/2019- Amendment

- 08/07/2019- Amendment

- 01/01/2020- Amendment

- Exit day: start of implementation period31/01/2020 11pm- Amendment

- End of implementation period31/12/2020- Amendment

- 31/12/2020

Point in time - 01/01/2024- Amendment

- 30/06/2024- Amendment

- 31/12/2024- Amendment

Status:

Point in time view as at 31/12/2020.

Changes to legislation:

Commission Delegated Regulation (EU) 2015/35, CHAPTER V is up to date with all changes known to be in force on or before 20 February 2025. There are changes that may be brought into force at a future date. Changes that have been made appear in the content and are referenced with annotations.![]()

Changes to Legislation

Changes and effects yet to be applied by the editorial team are only applicable when viewing the latest version or prospective version of legislation. They are therefore not accessible when viewing legislation as at a specific point in time. To view the ‘Changes to Legislation’ information for this provision return to the latest version view using the options provided in the ‘What Version’ box above.

CHAPTER VU.K. SOLVENCY CAPITAL REQUIREMENT STANDARD FORMULA

SECTION 1 U.K. General provisions

Subsection 1 U.K. Scenario based calculations

Article 83U.K.

1.Where the calculation of a module or sub-module of the Basic Solvency Capital Requirement is based on the impact of a scenario on the basic own funds of insurance and reinsurance undertakings, all of the following assumptions shall be made in that calculation:

(a)the scenario does not change the amount of the risk margin included in technical provisions;

(b)the scenario does not change the value of deferred tax assets and liabilities;

(c)the scenario does not change the value of future discretionary benefits included in technical provisions;

(d)no management actions are taken by the undertaking during the scenario.

2.The calculation of technical provisions arising as a result of determining the impact of a scenario on the basic own funds of insurance and reinsurance undertakings as referred to in paragraph 1 shall not change the value of future discretionary benefits, and shall take account of all of the following:

(a)without prejudice to point (d) of paragraph 1, future management actions following the scenario, provided they comply with Article 23;

(b)any material adverse impact of the scenario or the management actions referred to in point (a) on the likelihood that policy holders will exercise contractual options.

3.Insurance and reinsurance undertakings may use simplified methods to calculate the technical provisions arising as a result of determining the impact of a scenario as referred to in paragraph 1, provided that the simplified method does not lead to a misstatement of the Solvency Capital Requirement that could influence the decision-making or the judgement of the user of the information relating to the Solvency Capital Requirement, unless the simplified calculation leads to a Solvency Capital Requirement which exceeds the Solvency Capital Requirement that results from the calculation according to the standard formula.

4.The calculation of assets and liabilities arising as a result of determining the impact of a scenario as referred to in paragraph 1 shall take account of the impact of the scenario on the value of any relevant risk mitigation instruments held by the undertaking which comply with Articles 209 to 215.

5.Where the scenario would result in an increase in the basic own funds of insurance and reinsurance undertakings, the calculation of the module or sub-module shall be based on the assumption that the scenario has no impact on the basic own funds.

Subsection 2 U.K. Look-through approach

Article 84U.K.

1.The Solvency Capital Requirement shall be calculated on the basis of each of the underlying assets of collective investment undertakings and other investments packaged as funds (look-through approach).

2.The look-through approach referred to in paragraph 1 shall also apply to the following:

(a)indirect exposures to market risk other than collective investment undertakings and investments packaged as funds;

(b)indirect exposures to underwriting risk;

(c)indirect exposures to counterparty risk.

[F13. Where Article 88 is complied with and the look-through approach cannot be applied to collective investment undertakings or investments packaged as funds, the Solvency Capital Requirement may be calculated on the basis of the target underlying asset allocation or, if the target underlying asset allocation is not available to the undertaking, on the basis of the last reported asset allocation, of the collective investment undertaking or fund, provided that, in either case, the underlying assets are managed in accordance with that target allocation or last reported asset allocation, as applicable, and that exposures and risks are not expected to vary materially over a short period of time.

For the purposes of that calculation, data groupings may be used provided they enable all relevant sub-modules and scenarios of the standard formula to be calculated in a prudent manner, and that they do not apply to more than 20 % of the total value of the insurance or reinsurance undertaking's assets.]

[F23a. For the purposes of determining the percentage of assets where data groupings are used as referred to in paragraph 3, insurance or reinsurance undertakings shall not take into account underlying assets of the collective investment undertaking, or the investments packaged as funds, backing unit-linked or index-linked obligations for which the market risk is borne by the policyholders.]

[F14. [F3Paragraph 2 shall not apply to investments in related undertakings, other than investments in respect of which all of the following conditions are met:]

(a) the main purpose of the related undertaking is to hold and manage assets on behalf of the participating undertaking;

(b) the related undertaking supports the operations of the participating undertaking related to investment activities, following a specific and documented investment mandate;

(c) the related undertaking does not carry on any significant business other than investing for the benefit of the participating undertaking.

F4 ...]

Textual Amendments

F1 Substituted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

F2 Inserted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

F3 Substituted by Commission Delegated Regulation (EU) 2020/442 of 17 December 2019 correcting Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

F4 Words in Art. 84(4) omitted (31.12.2020) by virtue of The Risk Transformation and Solvency 2 (Amendment) (EU Exit) Regulations 2019 (S.I. 2019/1233), regs. 1(4), 6(4); 2020 c. 1, Sch. 5 para. 1(1)

Textual Amendments

F1 Substituted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

F2 Inserted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

F3 Substituted by Commission Delegated Regulation (EU) 2020/442 of 17 December 2019 correcting Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

F4 Words in Art. 84(4) omitted (31.12.2020) by virtue of The Risk Transformation and Solvency 2 (Amendment) (EU Exit) Regulations 2019 (S.I. 2019/1233), regs. 1(4), 6(4); 2020 c. 1, Sch. 5 para. 1(1)

Subsection 3 U.K. Regional governments and local authorities

Article 85U.K.

The conditions for a categorisation of regional governments and local authorities shall be that there is no difference in risk between exposures to these and exposures to the central government, because of the specific revenue-raising power of the former, and specific institutional arrangements exist, the effect of which is to reduce the risk of default.

Subsection 4 U.K. Material basis risk

Article 86U.K.

Notwithstanding Article 210(2), where insurance or reinsurance undertakings transfer underwriting risk using reinsurance contracts or special purpose vehicles that are subject to material basis risk from a currency mismatch between underwriting risk and the risk-mitigation technique, insurance or reinsurance undertakings may take into account the risk-mitigation technique in the calculation of the Solvency Capital Requirement according to the standard formula, provided that the risk-mitigation technique complies with Article 209, Article 210(1), (3) and (4) and Article 211, and the calculation is carried out as follows:

the basis risk stemming from a currency mismatch between underwriting risk and the risk-mitigation technique shall be taken into account in the relevant underwriting risk module, sub-module or scenario of the standard formula at the most granular level by adding 25 % of the difference between the following to the capital requirement calculated in accordance with the relevant module, sub-module or scenario:

the hypothetical capital requirement for the relevant underwriting risk module, sub-module or scenario that would result from a simultaneous occurrence of the scenario set out in Article 188;

the capital requirement for the relevant underwriting risk module, sub-module or scenario.

where the risk-mitigation technique covers more than one module, sub-module or scenario, the calculation referred to in point (a) shall be carried out for each of those modules, sub-modules and scenarios. The capital requirement resulting from those calculations shall not exceed 25 % of the capacity of the non-proportional reinsurance contract or special purpose vehicle.

Subsection 5 U.K. Calculation of the basic solvency capital requirement

Article 87U.K.

The Basic Solvency Capital Requirement shall include a risk module for intangible asset risk. and shall be equal to the following:

where:

the summation, Corri,j , SCRi and SCRj are specified as set out in point (1) of Annex IV to Directive 2009/138/EC;

SCRintangibles denotes the capital requirement for intangible asset risk referred to in Article 203.

Subsection 6 U.K. Proportionality and simplifications

Article 88U.K.Proportionality

1.[F1For the purposes of Article 109 of Directive 2009/138/EC, insurance and reinsurance undertakings shall determine whether the simplified calculation is proportionate to the nature, scale and complexity of the risks by carrying out an assessment which shall include all of the following:]

(a)an assessment of the nature, scale and complexity of the risks of the undertaking falling within the relevant module or sub-module;

(b)an evaluation in qualitative or quantitative terms, as appropriate, of the error introduced in the results of the simplified calculation due to any deviation between the following:

the assumptions underlying the simplified calculation in relation to the risk;

the results of the assessment referred to in point (a).

[F12. A simplified calculation shall not be considered to be proportionate to the nature, scale and complexity of the risks where the error referred to in point (b) of paragraph 1 leads to a misstatement of the Solvency Capital Requirement that could influence the decision-making or the judgement of the user of the information relating to the Solvency Capital Requirement, unless the simplified calculation leads to a Solvency Capital Requirement which exceeds the Solvency Capital Requirement that results from the standard calculation.]

Textual Amendments

F1 Substituted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

Article 89U.K.General provisions for simplifications for captives

Captive insurance undertakings and captive reinsurance undertakings as defined in points (2) and (5) of Article 13 of Directive 2009/138/EC may use the simplified calculations set out in Articles 90, 103, 105 and 106 of this Regulation where Article 88 of this Regulation is complied with and all of the following requirements are met:

in relation to the insurance obligations of the captive insurance undertaking or captive reinsurance undertaking, all insured persons and beneficiaries are legal entities of the group of which the captive insurance or captive reinsurance undertaking is part;

in relation to the reinsurance obligations of the captive insurance or captive reinsurance undertaking, all insured persons and beneficiaries of the insurance contracts underlying the reinsurance obligations are legal entities of the group of which the captive insurance or captive reinsurance undertaking is part;

the insurance obligations and the insurance contracts underlying the reinsurance obligations of the captive insurance or captive reinsurance undertaking do not relate to any compulsory third party liability insurance.

Article 90U.K.Simplified calculation for captive insurance and reinsurance undertakings of the capital requirement for non-life premium and reserve risk

1.Where Articles 88 and 89 are complied with, captive insurance and captive reinsurance undertakings may calculate the capital requirement for non-life premium and reserve risk as follows:

where the s covers all segments set out in Annex II.

2.For the purposes of paragraph 1, the capital requirement for non-life premium and reserve risk of a particular segment s set out in Annex II shall be equal to the following:

where:

V(prem,s) denotes the volume measure for premium risk of segment s calculated in accordance with paragraph 3 of Article 116;

V(res,s) denotes the volume measure for reserve risk of a segment calculated in accordance with paragraph 6 of Article 116.

[F2Article 90a U.K. Simplified calculation for discontinuance of insurance policies in the non-life lapse risk sub-module

For the purposes of point (a) of Article 118(1), where Article 88 is complied with, insurance and reinsurance undertakings may determine the insurance policies for which discontinuance would result in an increase of technical provisions without the risk margin on the basis of groups of policies, provided that the grouping complies with the requirements laid down in points (a), (b) and (c) of Article 35.

Textual Amendments

F2 Inserted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

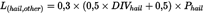

Article 90b U.K. Simplified calculation of the sum insured for natural catastrophe risks

1. Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the sum insured for windstorm risk referred to in point (b) of paragraph 6, and in paragraph 7, of Article 121 on the basis of groups of risk zones. Each of the risk zones within a group shall be situated within one and the same particular region set out in Annex V. Where the sum insured for windstorm risk referred to in point (b) of Article 121(6) is calculated on the basis of a group of risk zones, the risk weight for windstorm risk referred to in point (a) of Article 121(6) shall be the risk weight for windstorm risk in the risk zone within that group with the highest risk weight for windstorm risk set out in Annex X.

2. Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the sum insured for earthquake risk referred to in point (b) of paragraph 3, and in paragraph 4, of Article 122 on the basis of groups of risk zones. Each of the risk zones within a group shall be situated within one and the same particular region set out in Annex VI. Where the sum insured for earthquake risk referred to in point (b) of Article 122(3) is calculated on the basis of a group of risk zones, the risk weight for earthquake risk referred to in point (a) of Article 122(3) shall be the risk weight for earthquake risk in the risk zone within that group with the highest risk weight for earthquake risk as set out in Annex X.

3. Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the sum insured for flood risk referred to in point (b) of paragraph 6, and in paragraph 7, of Article 123 on the basis of groups of risk zones. Each of the risk zones within a group shall be situated within one and the same particular region set out in Annex VII. Where the sum insured for flood risk referred to in point (b) of Article 123(6) is calculated on the basis of a group of risk zones, the risk weight for flood risk referred to in point (a) of Article 123(6) shall be the risk weight for flood risk in the risk zone within that group with the highest risk weight for flood risk as set out in Annex X.

4. Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the sum insured for hail risk referred to in point (b) of paragraph 6, and in paragraph 7, of Article 124 on the basis of groups of risk zones. Each of the risk zones within a group shall be situated within one and the same particular region set out in Annex VIII. Where the sum insured for hail risk referred to in point (b) of Article 124(6) is calculated on the basis of a group of risk zones, the risk weight for hail risk referred to in point (a) of Article 124(6) shall be the risk weight for hail risk in the risk zone within that group with the highest risk weight for hail risk as set out in Annex X.

5. Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the weighted sum insured for subsidence risk referred to in Article 125(2) on the basis of groups of risk zones. Where the weighted sum insured referred to in Article 125(2) is calculated on the basis of a group of risk zones, the risk weight for subsidence risk referred to in point (a) of Article 125(2) shall be the risk weight for subsidence risk in the risk zone within that group with the highest risk weight for subsidence risk as set out in Annex X.

Textual Amendments

F2 Inserted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

Article 90c U.K. Simplified calculation of the capital requirement for fire risk

1. Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the capital requirement for fire risk referred to in Article 132(1) as follows:

SCR fire = max( SCR firei ; SCR firec ; SCR firer )

where:

SCR firei denotes the largest industrial fire risk concentration;

SCR firec denotes the largest commercial fire risk concentration;

SCR firer denotes the largest residential fire risk concentration.

2. The largest industrial fire risk concentration of an insurance or reinsurance undertaking shall be equal to the following:

SCR firei = max( E 1, i ; E 2, i ; E 3, i ; E 4, i ; E 5, i )

where E k,i denotes the total exposure within the perimeter of the k-th largest industrial fire risk exposure.

3. The largest commercial fire risk concentration of an insurance or reinsurance undertaking shall be equal to the following:

SCR firec = max( E 1, c ; E 2, c ; E 3, c ; E 4, c ; E 5, c )

where E k,c denotes the total exposure within the perimeter of the k-th largest commercial fire risk exposure.

4. The largest residential fire risk concentration of an insurance or reinsurance undertaking shall be equal to the following:

SCR firer = max( E 1, r ; E 2, r ; E 3, r ; E 4, r ; E 5, r ; θ )

where:

E k,r denotes the total exposure within the perimeter of the k-th largest residential fire risk exposure;

θ denotes the market share based residential fire risk exposure.

5. For the purpose of paragraphs 2, 3 and 4, the total exposure within the perimeter of the k-th largest industrial, commercial or residential fire risk exposure of an insurance or reinsurance undertaking is the sum insured by the insurance or reinsurance undertaking with respect to a set of buildings that meets all of the following conditions:

(a) in relation to each building, the insurance or reinsurance undertaking has obligations in lines of business 7 and 19 set out in Annex I which cover damage due to fire or explosion, including as a result of terrorist attacks;

(b) each building is partly or fully located within a radius of 200 meters around the industrial, commercial or residential building with the k-th largest sum insured after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles.

For the purposes of determining the sum insured with respect to a building, insurance and reinsurance undertakings shall take into account all reinsurance contracts and special purpose vehicles that would pay out in case of insurance claims related to that building. Reinsurance contracts and special purpose vehicles that are subject to conditions not related to that building shall not be taken into account.

6. The market share based residential fire risk exposure shall be equal to the following:

θ = SI av · 500 · max(0,05; max c ( marketShare c ))

where:

SI av is the average sum insured by the insurance or reinsurance undertaking with respect to residential property;

c denotes all countries where the insurance or reinsurance undertaking has obligations in lines of business 7 and 19 set out in Annex I covering residential property;

marketShare c is the market share of the insurance or reinsurance undertaking in country c related to obligations in those lines of business covering residential property.]

Textual Amendments

F2 Inserted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

Article 91U.K.Simplified calculation of the capital requirement for life mortality risk

Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the capital requirement for life mortality risk as follows:

[F1

where, with respect to insurance and reinsurance policies with a positive capital at risk:

[F1CAR k denotes the total capital at risk in year k , meaning the sum over all contracts of the higher of zero and the difference, in relation to each contract, between the following amounts:

the sum of:

the amount that the insurance or reinsurance undertaking would pay in year k in the event of the death of the persons insured under the contract after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles;

the expected present value of amounts not covered in the previous indent that the insurance or reinsurance undertaking would pay after year k in the event of the immediate death of the persons insured under the contract after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles;

the best estimate of the corresponding obligations in year k after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles;]

[F1q denotes the expected average mortality rate over all the insured persons and over all future years weighted by the sum insured;]

n denotes the modified duration in years of payments payable on death included in the best estimate;

ik denotes the annualized spot rate for maturity k of the relevant risk-free term structure as referred to in Article 43.

Textual Amendments

F1 Substituted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

Article 92U.K.Simplified calculation of the capital requirement for life longevity risk

Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the capital requirement for life longevity risk calculated as follows:

where, with respect to the policies referred to in Article 138(2):

q denotes the expected average mortality rate of the insured persons during the following 12 months weighted by the sum insured;

n denotes the modified duration in years of the payments to beneficiaries included in the best estimate;

BElong denotes the best estimate of the obligations subject to longevity risk.

Article 93U.K.Simplified calculation of the capital requirement for life disability-morbidity risk

Where 88 is complied with, insurance and reinsurance undertakings may calculate the capital requirement for life disability-morbidity risk as follows:

| SCRdisability-morbidity = | 0,35 · CAR 1 · d 1 + 0,25 · 1,1 (n – 3)/2 · (n – 1) · CAR 2 · d 2 + 0,2 · 1,1 (n –1)/2 · t · n · BEdis |

where with respect to insurance and reinsurance policies with a positive capital at risk:

CAR1 denotes the total capital at risk, meaning the sum over all contracts of the higher of zero and the difference between the following amounts:

the sum of:

the amount that the insurance or reinsurance undertaking would currently pay in the event of the death or disability of the persons insured under the contract after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles;

the expected present value of amounts not covered in the previous indent that the insurance or reinsurance undertaking would pay in the future in the event of the immediate death or disability of the persons insured under the contract after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles;

the best estimate of the corresponding obligations after deduction of the amounts recoverable form reinsurance contracts and special purpose vehicles;

CAR2 denotes the total capital at risk as defined in point (a) after 12 months;

d1 denotes the expected average disability-morbidity rate during the following 12 months weighted by the sum insured;

d2 denotes the expected average disability-morbidity rate in the 12 months after the following 12 months weighted by the sum insured;

n denotes the modified duration of the payments on disability-morbidity included in the best estimate;

t denotes the expected termination rates during the following 12 months;

BEdis denotes the best estimate of obligations subject to disability-morbidity risk.

Article 94U.K.Simplified calculation of the capital requirement for life-expense risk

Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the capital requirement for life-expense risk as follows:

where:

EI denotes the amount of expenses incurred in servicing life insurance or reinsurance obligations other than health insurance and reinsurance obligations during the last year;

n denotes the modified duration in years of the cash flows included in the best estimate of those obligations;

i denotes the weighted average inflation rate included in the calculation of the best estimate of those obligations, where the weights are based on the present value of expenses included in the calculation of the best estimate for servicing existing life obligations.

Article 95U.K.Simplified calculation of the capital requirement for permanent changes in lapse rates

1.Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the capital requirement for the risk of a permanent increase in lapse rates as follows:

where:

lup denotes the higher of the average lapse rate of the policies with positive surrender strains and 67 %;

nup denotes the average period in years over which the policies with a positive surrender strains run off;

Sup denotes the sum of positive surrender strains.

2.Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the capital requirement for the risk of a permanent decrease in lapse rates as follows:

where:

ldown denotes the higher of the average lapse rate of the policies with negative surrender strains and 40 %;

ndown denotes the average period in years over which the policies with a negative surrender strains runs off;

Sdown denotes the sum of negative surrender strains.

3.The surrender strain of an insurance policy referred to in paragraphs 1 and 2 is the difference between the following:

(a)the amount currently payable by the insurance undertaking on discontinuance by the policy holder, net of any amounts recoverable from policy holders or intermediaries;

(b)the amount of technical provisions without the risk margin.

[F2Article 95a U.K. Simplified calculation of the capital requirement for risks in the life lapse risk sub-module

Where Article 88 is complied with, insurance and reinsurance undertakings may calculate each of the following capital requirements on the basis of groups of policies, provided that the grouping complies with the requirements laid down in points (a), (b) and (c) of Article 35:

the capital requirement for the risk of a permanent increase in lapse rates referred to in Article 142(2);

the capital requirement for the risk of a permanent decrease in lapse rates referred to in Article 142(3);

the capital requirement for mass lapse risk referred to in Article 142(6).]

Textual Amendments

F2 Inserted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

Article 96U.K.Simplified calculation of the capital requirement for life-catastrophe risk

Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the capital requirement for life-catastrophe risk calculated as follows:

where:

the sum includes all policies with a positive capital at risk;

CARi denotes the capital at risk of the policy i, meaning the higher of zero and the difference between the following amounts:

the sum of:

the amount that the insurance or reinsurance undertaking would currently pay in the event of the death of the persons insured under the contract after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles;

the expected present value of amounts not covered in the previous indent that the insurance or reinsurance undertaking would pay in the future in the event of the immediate death of the persons insured under the contract after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles;

the best estimate of the corresponding obligations after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles.

[F2Article 96a U.K. Simplified calculation for discontinuance of insurance policies in the NSLT health lapse risk sub-module

For the purposes of point (a) of Article 150(1), where Article 88 is complied with, insurance and reinsurance undertakings may determine the insurance policies for which discontinuance would result in an increase of technical provisions without the risk margin on the basis of groups of policies, provided that the grouping complies with the requirements laid down in points (a), (b) and (c) of Article 35.]

Textual Amendments

F2 Inserted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

Article 97U.K.Simplified calculation of the capital requirement for health mortality risk

Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the capital requirement for health mortality risk as follows:

[F1

where with respect to insurance and reinsurance policies with a positive capital at risk:

[F1CAR k denotes the total capital at risk in year k , meaning the sum over all contracts of the higher of zero and the difference, in relation to each contract, between the following amounts:

the sum of:

the amount that the insurance or reinsurance undertaking would pay in year k in the event of the death of the persons insured under the contract after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles;

the expected present value of amounts not covered in the previous indent that the insurance or reinsurance undertaking would pay after year k in the event of the immediate death of the persons insured under the contract after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles;

the best estimate of the corresponding obligations in year k after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles;]

[F1q denotes the expected average mortality rate over all insured persons and over all future years weighted by the sum insured;]

n denotes the modified duration in years of payments payable on death included in the best estimate;

ik denotes the annualized spot rate for maturity k of the relevant risk-free term structure as referred to in Article 43.

Textual Amendments

F1 Substituted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

Article 98U.K.Simplified calculation of the capital requirement for health longevity risk

Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the capital requirement for health longevity risk as follows:

where, with respect to the policies referred to in Article 138(2):

q denotes the expected average mortality rate of the insured persons during the following 12 months weighted by the sum insured;

n denotes the modified duration in years of the payments to beneficiaries included in the best estimate;

BElong denotes the best estimate of the obligations subject to longevity risk.

Article 99U.K.Simplified calculation of the capital requirement for medical expense disability-morbidity risk

Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the capital requirement for medical expense disability-morbidity risk as follows:

where:

MP denotes the amount of medical payments during the last year on medical expense insurance or reinsurance obligations during the last year;

n denotes the modified duration in years of the cash flows included in the best estimate of those obligations;

i denotes the average rate of inflation on medical payments included in the calculation of the best estimate of those obligations, where the weights are based on the present value of medical payments included in the calculation of the best estimate of those obligations.

Article 100U.K.Simplified calculation of the capital requirement for income protection disability-morbidity risk

Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the capital requirement for income protection disability-morbidity risk as follows:

| SCRincome-protection-disability-morbidity = | 0,35 · CAR 1 · d 1 + 0,25 · 1,1 (n – 3)/2 · (n – 1) · CAR 2 · d 2 + 0,2 · 1,1 (n –1)/2 · t · n · BEdis |

where with respect to insurance and reinsurance policies with a positive capital at risk:

CAR 1 denotes the total capital at risk, meaning the sum over all contracts of the higher of zero and the difference between the following amounts:

the sum of:

the amount that the insurance or reinsurance undertaking would currently pay in the event of the death or disability of the persons insured under the contract after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles;

the expected present value of amounts not covered in the previous indent that the undertaking would pay in the future in the event of the immediate death or disability of the persons insured under the contract after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles;

the best estimate of the corresponding obligations after deduction of the amounts recoverable form reinsurance contracts and special purpose vehicles;

CAR 2 denotes the total capital at risk as defined in point (a) after 12 months;

d 1 denotes the expected average disability-morbidity rate during the following 12 months weighted by the sum insured;

d 2 denotes the expected average disability-morbidity rate in the 12 months after the following 12 months weighted by the sum insured;

n denotes the modified duration of the payments on disability-morbidity included in the best estimate;

t denotes the expected termination rates during the following 12 months;

BEdis denotes the best estimate of obligations subject to disability-morbidity risk.

Article 101U.K.Simplified calculation of the capital requirement for health expense risk

Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the capital requirement for health expense risk as follows:

where:

EI denotes the amount of expenses incurred in servicing health insurance and reinsurance obligations during the last year;

n denotes the modified duration in years of the cash flows included in the best estimate of those obligations;

i denotes the weighted average inflation rate included in the calculation of the best estimate of these obligations, weighted by the present value of expenses included in the calculation of the best estimate for servicing existing health obligations.

Article 102U.K.Simplified calculation of the capital requirement for SLT health lapse risk

1.Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the capital requirement for the risk of a permanent increase in lapse rates referred to in Article 159(1)(a) as follows:

where:

lup denotes the higher of the average lapse rate of the policies with positive surrender strains and 83 %;

nup denotes the average period in years over which the policies with a positive surrender strains run off;

Sup denotes the sum of positive surrender strains.

2.Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the capital requirement for the risk of a permanent decrease in lapse rates referred to in 159(1)(b) as follows:

where:

ldown denotes the average lapse rate of the policies with negative surrender strains;

ndown denotes the average period in years over which the policies with a negative surrender strains runs off;

Sdown denotes the sum of negative surrender strains.

3.The surrender strain of an insurance policy referred to in paragraphs (1) and (2) is the difference between the following:

(a)the amount currently payable by the insurance undertaking on discontinuance by the policy holder, net of any amounts recoverable from policy holders or intermediaries;

(b)the amount of technical provisions without the risk margin.

[F2Article 102a U.K. Simplified calculation of the capital requirement for risks in the SLT health lapse risk sub-module

Where Article 88 is complied with, insurance and reinsurance undertakings may calculate each of the following capital requirements on the basis of groups of policies, provided that the grouping complies with the requirements laid down in points (a), (b) and (c) of Article 35:

the capital requirement for the risk of a permanent increase in SLT health lapse rates referred to in Article 159(2);

the capital requirement for the risk of a permanent decrease in SLT health lapse rates referred to in Article 159(3);

the capital requirement for SLT health mass lapse risk referred to in Article 159(6).]

Textual Amendments

F2 Inserted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

Article 103U.K.Simplified calculation of the capital requirement for interest rate risk for captive insurance or reinsurance undertakings

1.Where Articles 88 and 89 are complied with, captive insurance or captive reinsurance undertakings may calculate the capital requirement for interest rate risk referred to in Article 165 as follows:

(a)the sum, for each currency, of the capital requirements for the risk of an increase in the term structure of interest rates as set out in paragraph 2 of this Article;

(b)the sum, for each currency, of the capital requirements for the risk of a decrease in the term structure of interest rates as set out in paragraph 3 of this Article.

2.For the purposes of point (a) of paragraph 1 of this Article, the capital requirement for the risk of an increase in the term structure of interest rates for a given currency shall be equal to the following:

where:

the first sum covers all maturity intervals i set out in paragraph 4 of this Article;

MVALi denotes the value in accordance with Article 75 of Directive 2009/138/EC of assets less liabilities other than technical provisions for maturity interval i;

duri denotes the simplified duration of maturity interval i;

ratei denotes the relevant risk-free rate for the simplified duration of maturity interval i;

stress(i,up) denotes the relative upward stress of interest rate for simplified duration of maturity interval i;

the second sum covers all lines of business set out in Annex I of this Regulation;

BElob denotes the best estimate for line of business lob;

durlob denotes the modified duration of the best estimate in line of business lob;

ratelob denotes the relevant risk-free rate for modified duration in line of business lob;

stress(lob,up) denotes the relative upward stress of interest rate for the modified duration durlob .

3.For the purposes of point (b) of paragraph 1 of this Article, the capital requirement for the risk of a decrease in the term structure of interest rates for a given currency shall be equal to the following:

where:

the first sum covers all maturity intervals i set out in paragraph 4;

MVALi denotes the value in accordance with Article 75 of Directive 2009/138/EC of assets less liabilities other than technical provisions for maturity interval i;

duri denotes the simplified duration of maturity interval i;

ratei denotes the relevant risk-free rate for the simplified duration of maturity interval i;

stress(i,down) denotes the relative downward stress of interest rate for simplified duration of maturity interval i;

the second sum covers all lines of business set out in Annex I of this Regulation;

BElob denotes the best estimate for line of business lob;

durlob denotes the modified duration of the best estimate in line of business lob;

ratelob denotes the relevant risk-free rate for modified duration in line of business lob;

stress(lob, down) denote the relative downward stress of interest rate for modified duration durlob .

4.The maturity intervals i and the simplified duration duri referred to in points (a) and (c)of paragraph 2 and in point (a) and (c) of paragraph 3 shall be as follows:

(a)up to the maturity of one year, the simplified duration shall be 0.5 years;

(b)between maturities of 1 and 3 years, the simplified duration shall be 2 years;

(c)between maturities of 3 and 5 years, the simplified duration shall be 4 years;

(d)between maturities of 5 and 10 years, the simplified duration shall be 7 years;

(e)from the maturity of 10 years onwards, the simplified duration shall be 12 years.

Article 104U.K.Simplified calculation for spread risk on bonds and loans

1.Where Article 88 is complied with, insurance or reinsurance undertakings may calculate the capital requirement for spread risk referred to in Article 176 of this Regulation as follows:

where:

SCRbonds denotes the capital requirement for spread risk on bonds and loans;

MVbonds denotes the value in accordance with [F5rules 2.1 and 2.2 of the Valuation part of the PRA Rulebook] of the assets subject to capital requirements for spread risk on bonds and loans;

%MVi bonds denotes the proportion of the portfolio of the assets subject to a capital requirement for spread risk on bonds and loans with credit quality step i, where a credit assessment by a nominated ECAI is available for those assets;

%MVbonds norating denotes the proportion of the portfolio of the assets subject to a capital requirement for spread risk on bonds and loans for which no credit assessment by a nominated ECAI is available;

duri and durnorating denote the modified duration denominated in years of the assets subject to a capital requirement for spread risk on bonds and loans where no credit assessment by a nominated ECAI is available;

stressi denotes a function of the credit quality step i and of the modified duration denominated in years of the assets subject to a capital requirement for spread risk on bonds and loans with credit quality step i, set out in paragraph 2;

ΔLiabul denotes the increase in the technical provisions less risk margin for policies where the policyholders bear the investment risk with embedded options and guarantees that would result from an instantaneous decrease in the value of the assets subject to the capital requirement for spread risk on bonds of:

2.stressi referred to in point (f) of paragraph 1, for each credit quality step i, shall be equal to:

| Credit quality step i | 0 | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|---|

| bi | 0,9 % | 1,1 % | 1,4 % | 2,5 % | 4,5 % | 7,5 % | 7,5 % |

3.durnorating referred to in point (e) of paragraph 1 and duri referred to in paragraph 2 shall not be lower than 1 year.

Textual Amendments

F5 Words in Art. 104(1)(b) substituted (31.12.2020) by The Solvency 2 and Insurance (Amendment, etc.) (EU Exit) Regulations 2019 (S.I. 2019/407), regs. 1(2), 11(14) (as amended by S.I. 2020/1385, regs. 1(2), 54(2) and with savings in S.I. 2019/680, reg. 11)

Article 105U.K.Simplified calculation for captive insurance or reinsurance undertakings of the capital requirement for spread risk on bonds and loans

Where Articles 88 and 89 are complied with, captive insurance or captive reinsurance undertakings may base the calculation of the capital requirement for spread risk to in Article 176 on the assumption that all assets are assigned to credit quality step 3.

[F2Article 105a U.K. Simplified calculation for the risk factor in the spread risk sub-module and the market risk concentration sub-module

Where Article 88 is complied with, insurance and reinsurance undertakings may assign a bond other than those to be included in the calculations under paragraphs (2) to (16) of Article 180 a risk factor stress i equivalent to credit quality step 3 for the purposes of Articles 176(3) and assign the bond to credit quality step 3 for the purpose of calculating the weighted average credit quality step in accordance with 182(4), provided that all of the following conditions are met:

credit assessments from a nominated ECAI are available for at least 80 % of the total value of the bonds other than those to be included in the calculations under paragraphs (2) to (16) of Article 180;

a credit assessment by a nominated ECAI is not available for the bond in question;

the bond in question provides a fixed redemption payment on or before the date of maturity, in addition to regular fixed or floating rate interest payments;

the bond in question is not a structured note or collateralised security as referred to in Annex VI to Commission Implementing Regulation (EU) 2015/2450 (1) ;

the bond in question does not cover liabilities that provide profit participation arrangements, nor does it cover unit-linked or index-linked liabilities, nor liabilities where a matching adjustment is applied.]

Textual Amendments

F2 Inserted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

Article 106U.K.Simplified calculation of the capital requirement for market risk concentration for captive insurance or reinsurance undertakings

Where Articles 88 and 89 are complied with, captive insurance or captive reinsurance undertakings may use all of the following assumptions for the calculation of the capital requirement for concentration risk:

intra-group asset pooling arrangements of captive insurance or reinsurance undertakings may be exempted from the calculation base referred to in Article 184(2) to the extent that there exist legally enforceable contractual terms which ensure that the liabilities of the captive insurance or reinsurance undertaking will be offset by the intra-group exposures it holds against other entities of the group.

the relative excess exposure threshold referred to in Article 184(1)(c) shall be equal to 15 % for the following single name exposures:

exposures to credit institutions that do not belong to the same group and that have been assigned to the credit quality step 2;

exposures to entities of the group that manages the cash of the captive insurance or reinsurance undertaking that have been assigned to the credit quality step 2.

Article 107U.K.Simplified calculation of the risk mitigating effect for reinsurance arrangements or securitisation

1.[F1Where both Article 88 is complied with and the best estimate of amounts recoverable from a reinsurance arrangement or securitisation and the corresponding debtors is not negative, insurance and reinsurance undertakings may calculate the risk-mitigating effect on underwriting risk of that reinsurance arrangement or securitisation referred to in Article 196 as follows:]

where

RMre,all denotes the risk mitigating effect on underwriting risk of the reinsurance arrangements and securitisations for all counterparties calculated in accordance with paragraph 2;

Recoverablesi denotes the best estimate of amounts recoverable from the reinsurance arrangement or securitisation and the corresponding debtors for counterparty i and Recoverablesall denotes the best estimate of amounts recoverable from the reinsurance arrangements and securitisations and the corresponding debtors for all counterparties.

2.The risk mitigating effect on underwriting risk of the reinsurance arrangements and securitisations for all counterparties referred to in paragraph 1 is the difference between the following capital requirements:

(a)the hypothetical capital requirement for underwriting risk of the insurance or reinsurance undertaking if none of the reinsurance arrangements and securitisations exist;

(b)the capital requirements for underwriting risk of the insurance or reinsurance undertaking.

Textual Amendments

F1 Substituted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

Article 108U.K.Simplified calculation of the risk mitigating effect for proportional reinsurance arrangements

[F1Where both Article 88 is complied with and the best estimate of amounts recoverable from a proportional reinsurance arrangement and the corresponding debtors for a counterparty i is not negative, insurance and reinsurance undertakings may calculate the risk-mitigating effect on underwriting risk j of the proportional reinsurance arrangement for counterparty i referred to Article 196 as follows:]

where

BE denotes the best estimate of obligations gross of the amounts recoverable,

Recoverablesi denotes the best estimate of amounts recoverable from the proportional reinsurance arrangement and the corresponding debtors for counterparty i,

Recoverablesall denotes the best estimate of amounts recoverable from the proportional reinsurance arrangements and the corresponding debtors for all counterparties

SCRj denotes the capital requirements for underwriting risk j of the insurance or reinsurance undertaking.

Textual Amendments

F1 Substituted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

Article 109U.K.Simplified calculations for pooling arrangements

Where Article 88 is complied with, insurance or reinsurance undertakings may use the following simplified calculations for the purposes of Articles 193, 194 and 195:

The best estimate referred to in Article 194(1)(d) may be calculated as follows:

where BEU denotes the best estimate of the liability ceded to the pooling arrangement by the undertaking to the pooling arrangement, net of any amounts reinsured with counterparties external to the pooling arrangement.

The best estimate referred to in Article 195(c) may be calculated as follows:

where BECEP denotes the best estimate of the liability ceded to the external counterparty by the pool, in relation to risk ceded to the pool by the undertaking.

The risk mitigating effect referred to in Article 195(d) may be calculated as follows:

where:

BECE denotes the best estimate of the liability ceded to the external counterparty by the pooling arrangement as a whole;

ΔRMCEP denotes the contribution of all external counterparties to the risk mitigating effect of the pooling arrangement on the underwriting risk of the undertaking;

The counterparty pool members and the counterparties external to the pool may be grouped according to the credit assessment by a nominated ECAI, provided there are separate groupings for pooling exposures of type A, type B and type C.

[F1Article 110 U.K. Simplified calculation — grouping of single name exposures

Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the loss-given-default set out in Article 192, including the risk-mitigating effect on underwriting and market risks and the risk-adjusted value of collateral, for a group of single name exposures. In that case, the group of single name exposures shall be assigned the highest probability of default assigned to single name exposures included in the group in accordance with Article 199.]

Textual Amendments

F1 Substituted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

Article 111U.K.Simplified calculation of the risk mitigating effect

Where Article 88 is complied with, insurance or reinsurance undertakings may calculate the risk-mitigating effect on underwriting and market risk of a reinsurance arrangement, securitisation or derivative referred to in Article 196 as the difference between the following capital requirements:

[F1the sum of the hypothetical capital requirement for the sub-modules of the underwriting and market risk modules of the insurance or reinsurance undertaking affected by the risk-mitigating technique, calculated in accordance with this Section and Sections 2 to 5 of this Chapter but as if the reinsurance arrangement, securitisation or derivative did not exist;]

the sum of the capital requirements for the sub-modules of the underwriting and market risk modules of the insurance or reinsurance undertaking affected by the risk-mitigating technique.

Textual Amendments

F1 Substituted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

[F2Article 111a U.K. Simplified calculation of the risk-mitigating effect on underwriting risk

For the purposes of Article 196, where Article 88 is complied with and the reinsurance arrangement, securitisation or derivative covers obligations from only one of the segments (segment s ) set out in Annex II or, as applicable, Annex XIV, insurance and reinsurance undertakings may calculate the risk-mitigating effect of that reinsurance arrangement, securitisation or derivative on their underwriting risk as follows:

where:

SCR CAT hyp denotes the hypothetical capital requirement for the non-life catastrophe underwriting risk module referred to in Article 119(2), or, as applicable, the hypothetical capital requirement for the health catastrophe risk sub-module referred to in Article 160, that would apply if the reinsurance arrangement, securitisation or derivative did not exist;

SCR CAT without denotes the capital requirement for the non-life catastrophe underwriting risk module referred to in Article 119(2) or, as applicable, the capital requirement for the health catastrophe risk sub-module referred to in Article 160;

σ s denotes the standard deviation for non-life premium risk of segment s determined in accordance with Article 117(3) or, as applicable, the standard deviation for the NSLT health premium risk of segment s determined in accordance with Article 148(3);

P s hyp denotes the hypothetical volume measure for premium risk of segment s determined in accordance with Article 116(3) or (4), or, as applicable, Article 147(3) or (4), that would apply if the reinsurance arrangement, securitisation or derivative did not exist;

P s without denotes the volume measure for premium risk of segment s determined in accordance with Article 116(3) or (4) or, as applicable, Article 147(3) or (4);

Recoverables denotes the best estimate of amounts recoverable from the reinsurance arrangement, securitisation or derivative and the corresponding debtors.]

Textual Amendments

F2 Inserted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

Article 112U.K.Simplified calculation of the risk adjusted value of collateral to take into account the economic effect of the collateral

1.Where Article 88 of this Regulation is complied with, and where the counterparty requirement and the third party requirement referred to in Article 197(1) are both met, insurance or reinsurance undertakings may, for the purposes of Article 197, calculate the risk-adjusted value of a collateral provided by way of security as referred to in Article 1(26)(b), as 85 % of the value of the assets held as collateral, valued in accordance with Article 75 of Directive 2009/138/EC.

2.Where Articles 88 and 214 of this Regulation are complied with, and where the counterparty requirement referred to in Article 197(1) is met and the third party requirement referred to in Article 197(1) is not met, insurance or reinsurance undertakings may, for the purposes of Article 197, calculate the risk-adjusted value of a collateral provided by way of security as referred to in Article 1(26)(b), as 75 % of the value of the assets held as collateral, valued in accordance with Article 75 of Directive 2009/138/EC.

[F2Article 112a U.K. Simplified calculation of the loss-given-default for reinsurance

Where Article 88 is complied with, insurance or reinsurance undertakings may calculate the loss-given-default on a reinsurance arrangement or insurance securitisation referred to in the first subparagraph of Article 192(2) as follows:

LGD = max[90 % · ( Recoverables + 50 % · RM re ) – F · Collateral ; 0]

where:

Recoverables denotes the best estimate of amounts recoverable from the reinsurance arrangement or insurance securitisation and the corresponding debtors;

RM re denotes the risk mitigating effect on underwriting risk of the reinsurance arrangement or securitisation;

Collateral denotes the risk-adjusted value of collateral in relation to the reinsurance arrangement or securitisation;

F denotes a factor to take into account the economic effect of the collateral arrangement in relation to the reinsurance arrangement or securitisation in case of any credit event related to the counterparty.

Textual Amendments

F2 Inserted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

Article 112b U.K. Simplified calculation of the capital requirement for counterparty default risk on type 1 exposures

Where Article 88 is complied with and the standard deviation of the loss distribution of type 1 exposures, as determined in accordance with Article 200(4), is lower than or equal to 20 % of the total losses-given default on all type 1 exposures, insurance and reinsurance undertakings may calculate the capital requirement for counterparty default risk referred to in Article 200(1) as follows:

SCR def ,1 = 5 · σ

where σ denotes the standard deviation of the loss distribution of type 1 exposures as determined in accordance with Article 200(4).]

Textual Amendments

F2 Inserted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

Subsection 7 U.K. Scope of the underwriting risk modules

Article 113U.K.

For the calculation of the capital requirements for non-life underwriting risk, life underwriting risk and health underwriting risk, insurance and reinsurance undertakings shall apply:

the non-life underwriting risk module to non-life insurance and reinsurance obligations other than health insurance and reinsurance obligations;

the life underwriting risk module to life insurance and reinsurance obligations other than health insurance and reinsurance obligations;

the health underwriting risk module to health insurance and reinsurance obligations.

SECTION 2 U.K. Non-life underwriting risk module

Article 114U.K.Non-life underwriting risk module

1.The non-life underwriting risk module shall consist of all of the following sub-modules:

(a)the non-life premium and reserve risk sub-module referred to in point (a) of the third subparagraph of Article 105(2) of Directive 2009/138/EC;

(b)the non-life catastrophe risk sub-module referred to in point (b) of the third subparagraph of Article 105(2) of Directive 2009/138/EC;

(c)the non-life lapse risk sub-module.

2.The capital requirement for non-life underwriting risk shall be equal to the following:

where:

the sum covers all possible combinations (i,j) of the sub-modules set out in paragraph 1;

CorrNL(i,j) denotes the correlation parameter for non-life underwriting risk for sub-modules i and j;

SCRi and SCRj denote the capital requirements for risk sub-module i and j respectively.

3.The correlation parameter CorrNL(i,j) referred to in paragraph 2 denotes the item set out in row i and in column j of the following correlation matrix:

| j i | Non-life premium and reserve | Non-life catastrophe | Non-life lapse |

|---|---|---|---|

| Non-life premium and reserve | 1 | 0,25 | 0 |

| Non-life catastrophe | 0,25 | 1 | 0 |

| Non-life lapse | 0 | 0 | 1 |

Modifications etc. (not altering text)

C1 Art. 114(3): power to amend and revoke conferred (31.12.2020) by The Solvency 2 and Insurance (Amendment, etc.) (EU Exit) Regulations 2019 (S.I. 2019/407), regs. 1(2), 4, Sch. 3 (as amended by S.I. 2020/1301, regs. 1, 3, Sch. para. 27(a) and S.I. 2020/1385, regs. 1(2), 54(2))

Article 115U.K.Non-life premium and reserve risk sub-module

The capital requirement for non-life premium and reserve risk shall be equal to the following:

where:

σnl denotes the standard deviation for non-life premium and reserve risk determined in accordance with Article 117;

Vnl denotes the volume measure for non-life premium and reserve risk determined in accordance with Article 116.

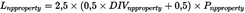

Article 116U.K.Volume measure for non-life premium and reserve risk

1.The volume measure for non-life premium and reserve risk shall be equal to the sum of the volume measures for premium and reserve risk of the segments set out in Annex II.

2.For all segments set out in Annex II, the volume measure of a particular segment s shall be equal to the following:

where:

V(prem,s) denotes the volume measure for premium risk of segment s;

V(res,s) denotes the volume measure for reserve risk of segment s;

DIVs denotes the factor for geographical diversification of segment s.

3.For all segments set out in Annex II, the volume measure for premium risk of a particular segment s shall be equal to the following:

where:

Ps denotes an estimate of the premiums to be earned by the insurance or reinsurance undertaking in the segment s during the following 12 months;

P(last,s) denotes the premiums earned by the insurance or reinsurance undertaking in the segment s during the last 12 months;

FP(existing,s) denotes the expected present value of premiums to be earned by the insurance or reinsurance undertaking in the segment s after the following 12 months for existing contracts;

[F1FP (future,s) denotes the following amount with respect to contracts where the initial recognition date falls in the following 12 months:

for all such contracts whose initial term is one year or less, the expected present value of premiums to be earned by the insurance or reinsurance undertaking in the segment s , but excluding the premiums to be earned during the 12 months after the initial recognition date;

for all such contracts whose initial term is more than one year, the amount equal to 30 % of the expected present value of premiums to be earned by the insurance or reinsurance undertaking in the segment s after the following 12 months.]

4.For all segments set out in Annex II, insurance and reinsurance undertakings may, as an alternative to the calculation set out in paragraph 3 of this Article, choose to calculate the volume measure for premium risk of a particular segment s in accordance with the following formula:

provided that the all of following conditions are met:

the administrative, management or supervisory body of the insurance or reinsurance undertaking has decided that its earned premiums in the segment s during the following 12 months will not exceed Ps ;

the insurance or reinsurance undertaking has established effective control mechanisms to ensure that the limits on earned premiums referred to in point (a) will be met;

the insurance or reinsurance undertaking has informed its supervisory authority about the decision referred to in point (a) and the reasons for it.

For the purposes of this calculation, the terms Ps , FP(existing,s) and FP(future,s) shall be denoted in accordance with points (a), (c) and (d) of paragraph 3.

5.For the purposes of the calculations set out in paragraphs 3 and 4, premiums shall be net, after deduction of premiums for reinsurance contracts. The following premiums for reinsurance contracts shall not be deducted:

(a)premiums in relation to non-insurance events or settled insurance claims that are not accounted for in the cash-flows referred to in Article 41(3);

(b)premiums for reinsurance contracts that do not comply with Articles 209, 210, 211 and 213.

6.For all segments set out in Annex II, the volume measure for reserve risk of a particular segment shall be equal to the best estimate of the provisions for claims outstanding for the segment, after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, provided that the reinsurance contracts or special purpose vehicles comply with Articles 209, 210, 211 and 213. The volume measure shall not be a negative amount.

7.For all segments set out in Annex II, the default factor for geographical diversification of a particular segment shall be either 1 or calculated in accordance with Annex III.

Textual Amendments

F1 Substituted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

Article 117U.K.Standard deviation for non-life premium and reserve risk

1.The standard deviation for non-life premium and reserve risk shall be equal to the following:

where:

Vnl denotes the volume measure for non-life premium and reserve risk;

the sum covers all possible combinations (s,t) of the segments set out in Annex II;

CorrS(s,t) denotes the correlation parameter for non-life premium and reserve risk for segment s and segment t set out in Annex IV;

σs and σt denote standard deviations for non-life premium and reserve risk of segments s and t respectively;

Vs and Vt denote volume measures for premium and reserve risk of segments s and t, referred to in Article 116, respectively.

2.For all segments set out in Annex II, the standard deviation for non-life premium and reserve risk of a particular segment s shall be equal to the following:

where:

σ(prem,s) denotes the standard deviation for non-life premium risk of segment s determined in accordance with paragraph 3;

σ(res,s) denotes the standard deviation for non-life reserve risk of segment s as set out in Annex II;

V(prem,s) denotes the volume measure for premium risk of segment s referred to in Article 116;

V(res,s) denotes the volume measure for reserve risk of segment s referred to in Article 116.

3.For all segments set out in Annex II, the standard deviation for non-life premium risk of a particular segment shall be equal to the product of the standard deviation for non-life gross premium risk of the segment set out in Annex II and the adjustment factor for non-proportional reinsurance. For segments 1, 4 and 5 set out in Annex II the adjustment factor for non-proportional reinsurance shall be equal to 80 %. For all other segments set out in Annex the adjustment factor for non-proportional reinsurance shall be equal to 100 %.

Article 118U.K.Non-life lapse risk sub-module

1.The capital requirement for the non-life lapse risk sub-module referred to in 114(1)(c) shall be equal to the loss in basic own funds of the insurance or reinsurance undertaking resulting from a combination of the following instantaneous events:

(a)the discontinuance of 40 % of the insurance policies for which discontinuance would result in an increase of technical provisions without the risk margin;

(b)where reinsurance contracts cover insurance or reinsurance contracts that will be written in the future, the decrease of 40 % of the number of those future insurance or reinsurance contracts used in the calculation of technical provisions.

2.The events referred to in paragraph 1 shall apply uniformly to all insurance and reinsurance contracts concerned. In relation to reinsurance contracts the event referred to in point (a) of paragraph 1 shall apply to the underlying insurance contracts.

3.For the purposes of determining the loss in basic own funds of the insurance or reinsurance undertaking under the event referred to in point (a) of paragraph 1, the undertaking shall base the calculation on the type of discontinuance which most negatively affects the basic own funds of the undertaking on a per policy basis.

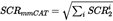

Article 119U.K.Non-life catastrophe risk sub-module

1.The non-life catastrophe risk sub-module shall consist of all of the following sub-modules:

(a)the natural catastrophe risk sub-module;

(b)the sub-module for catastrophe risk of non-proportional property reinsurance;

(c)the man-made catastrophe risk sub-module;

(d)the sub-module for other non-life catastrophe risk.

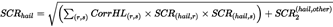

2.The capital requirement for the non-life catastrophe underwriting risk module shall be equal to the following:

where:

SCRnatCAT denotes the capital requirement for natural catastrophe risk;

SCRnpproperty denotes the capital requirement for the catastrophe risk of non-proportional property reinsurance;

SCRmmCAT denotes the capital requirement for man-made catastrophe risk;

SCRCATother denotes the capital requirement for other non-life catastrophe risk.

Article 120U.K.Natural catastrophe risk sub-module

1.The natural catastrophe risk sub-module shall consist of all of the following sub-modules:

(a)the windstorm risk sub-module;

(b)the earthquake risk sub-module;

(c)the flood risk sub-module;

(d)the hail risk sub-module;

(e)the subsidence risk sub-module.

2.The capital requirement for natural catastrophe risk shall be equal to the following:

where:

the sum includes all possible combinations of the sub-modules i set out in paragraph 1;

SCRi denotes the capital requirement for sub-module i.

Article 121U.K.Windstorm risk sub-module

1.The capital requirement for windstorm risk shall be equal to the following:

where:

the sum includes all possible combinations (r,s) of the regions set out in Annex V;

CorrWS(r,s) denotes the correlation coefficient for windstorm risk for region r and region s as set out in Annex V;