- Y Diweddaraf sydd Ar Gael (Diwygiedig)

- Gwreiddiol (Fel y’i mabwysiadwyd gan yr UE)

Commission Delegated Regulation (EU) 2015/35Dangos y teitl llawn

Commission Delegated Regulation (EU) 2015/35 of 10 October 2014 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance)

You are here:

Rhagor o Adnoddau

PDF o Fersiynau Diwygiedig

- ddiwygiedig 30/07/202048.27 MB

- ddiwygiedig 01/01/202048.00 MB

- ddiwygiedig 08/07/201944.91 MB

- ddiwygiedig 01/01/201946.16 MB

- ddiwygiedig 15/09/201740.90 MB

- ddiwygiedig 09/04/201746.19 MB

- ddiwygiedig 02/04/201646.19 MB

- ddiwygiedig 17/01/201539.54 MB

When the UK left the EU, legislation.gov.uk published EU legislation that had been published by the EU up to IP completion day (31 December 2020 11.00 p.m.). On legislation.gov.uk, these items of legislation are kept up-to-date with any amendments made by the UK since then.

Mae hon yn eitem o ddeddfwriaeth sy’n deillio o’r UE

Mae unrhyw newidiadau sydd wedi cael eu gwneud yn barod gan y tîm yn ymddangos yn y cynnwys a chyfeirir atynt gydag anodiadau.Ar ôl y diwrnod ymadael bydd tair fersiwn o’r ddeddfwriaeth yma i’w gwirio at ddibenion gwahanol. Y fersiwn legislation.gov.uk yw’r fersiwn sy’n weithredol yn y Deyrnas Unedig. Y Fersiwn UE sydd ar EUR-lex ar hyn o bryd yw’r fersiwn sy’n weithredol yn yr UE h.y. efallai y bydd arnoch angen y fersiwn hon os byddwch yn gweithredu busnes yn yr UE. EUR-Lex Y fersiwn yn yr archif ar y we yw’r fersiwn swyddogol o’r ddeddfwriaeth fel yr oedd ar y diwrnod ymadael cyn cael ei chyhoeddi ar legislation.gov.uk ac unrhyw newidiadau ac effeithiau a weithredwyd yn y Deyrnas Unedig wedyn. Mae’r archif ar y we hefyd yn cynnwys cyfraith achos a ffurfiau mewn ieithoedd eraill o EUR-Lex. The EU Exit Web Archive legislation_originated_from_EU_p3

Status:

EU_status_warning_original_version

This legislation may since have been updated - see the latest available (revised) version

SECTION 1 General provisions

Subsection 1 Scenario based calculations

Article 83

1.Where the calculation of a module or sub-module of the Basic Solvency Capital Requirement is based on the impact of a scenario on the basic own funds of insurance and reinsurance undertakings, all of the following assumptions shall be made in that calculation:

(a)the scenario does not change the amount of the risk margin included in technical provisions;

(b)the scenario does not change the value of deferred tax assets and liabilities;

(c)the scenario does not change the value of future discretionary benefits included in technical provisions;

(d)no management actions are taken by the undertaking during the scenario.

2.The calculation of technical provisions arising as a result of determining the impact of a scenario on the basic own funds of insurance and reinsurance undertakings as referred to in paragraph 1 shall not change the value of future discretionary benefits, and shall take account of all of the following:

(a)without prejudice to point (d) of paragraph 1, future management actions following the scenario, provided they comply with Article 23;

(b)any material adverse impact of the scenario or the management actions referred to in point (a) on the likelihood that policy holders will exercise contractual options.

3.Insurance and reinsurance undertakings may use simplified methods to calculate the technical provisions arising as a result of determining the impact of a scenario as referred to in paragraph 1, provided that the simplified method does not lead to a misstatement of the Solvency Capital Requirement that could influence the decision-making or the judgement of the user of the information relating to the Solvency Capital Requirement, unless the simplified calculation leads to a Solvency Capital Requirement which exceeds the Solvency Capital Requirement that results from the calculation according to the standard formula.

4.The calculation of assets and liabilities arising as a result of determining the impact of a scenario as referred to in paragraph 1 shall take account of the impact of the scenario on the value of any relevant risk mitigation instruments held by the undertaking which comply with Articles 209 to 215.

5.Where the scenario would result in an increase in the basic own funds of insurance and reinsurance undertakings, the calculation of the module or sub-module shall be based on the assumption that the scenario has no impact on the basic own funds.

Subsection 2 Look-through approach

Article 84

1.The Solvency Capital Requirement shall be calculated on the basis of each of the underlying assets of collective investment undertakings and other investments packaged as funds (look-through approach).

2.The look-through approach referred to in paragraph 1 shall also apply to the following:

(a)indirect exposures to market risk other than collective investment undertakings and investments packaged as funds;

(b)indirect exposures to underwriting risk;

(c)indirect exposures to counterparty risk.

3.Where the look-through approach cannot be applied to collective investment undertakings or investments packaged as funds, the Solvency Capital Requirement may be calculated on the basis of the target underlying asset allocation of the collective investment undertaking or fund, provided such a target allocation is available to the undertaking at the level of granularity necessary for calculating all relevant sub-modules and scenarios of the standard formula, and the underlying assets are managed strictly according to this target allocation. For the purposes of that calculation, data groupings may be used, provided they are applied in a prudent manner, and that they do not apply to more than 20 % of the total value of the assets of the insurance or reinsurance undertaking.

4.Paragraph 2 shall not apply to investments in related undertakings within the meaning of Article 212(1)(b) and (2) of Directive 2009/138/EC.

Subsection 3 Regional governments and local authorities

Article 85

The conditions for a categorisation of regional governments and local authorities shall be that there is no difference in risk between exposures to these and exposures to the central government, because of the specific revenue-raising power of the former, and specific institutional arrangements exist, the effect of which is to reduce the risk of default.

Subsection 4 Material basis risk

Article 86

Notwithstanding Article 210(2), where insurance or reinsurance undertakings transfer underwriting risk using reinsurance contracts or special purpose vehicles that are subject to material basis risk from a currency mismatch between underwriting risk and the risk-mitigation technique, insurance or reinsurance undertakings may take into account the risk-mitigation technique in the calculation of the Solvency Capital Requirement according to the standard formula, provided that the risk-mitigation technique complies with Article 209, Article 210(1), (3) and (4) and Article 211, and the calculation is carried out as follows:

the basis risk stemming from a currency mismatch between underwriting risk and the risk-mitigation technique shall be taken into account in the relevant underwriting risk module, sub-module or scenario of the standard formula at the most granular level by adding 25 % of the difference between the following to the capital requirement calculated in accordance with the relevant module, sub-module or scenario:

the hypothetical capital requirement for the relevant underwriting risk module, sub-module or scenario that would result from a simultaneous occurrence of the scenario set out in Article 188;

the capital requirement for the relevant underwriting risk module, sub-module or scenario.

where the risk-mitigation technique covers more than one module, sub-module or scenario, the calculation referred to in point (a) shall be carried out for each of those modules, sub-modules and scenarios. The capital requirement resulting from those calculations shall not exceed 25 % of the capacity of the non-proportional reinsurance contract or special purpose vehicle.

Subsection 5 Calculation of the basic solvency capital requirement

Article 87

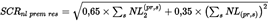

The Basic Solvency Capital Requirement shall include a risk module for intangible asset risk. and shall be equal to the following:

where:

the summation, Corri,j , SCRi and SCRj are specified as set out in point (1) of Annex IV to Directive 2009/138/EC;

SCRintangibles denotes the capital requirement for intangible asset risk referred to in Article 203.

Subsection 6 Proportionality and simplifications

Article 88Proportionality

1.For the purposes of Article 109, insurance and reinsurance undertakings shall determine whether the simplified calculation is proportionate to the nature, scale and complexity of the risks by carrying out an assessment which shall include all of the following:

(a)an assessment of the nature, scale and complexity of the risks of the undertaking falling within the relevant module or sub-module;

(b)an evaluation in qualitative or quantitative terms, as appropriate, of the error introduced in the results of the simplified calculation due to any deviation between the following:

the assumptions underlying the simplified calculation in relation to the risk;

the results of the assessment referred to in point (a).

2.A simplified calculation shall not be considered to be proportionate to the nature, scale and complexity of the risks where the error referred to in point (b) of paragraph 2 leads to a misstatement of the Solvency Capital Requirement that could influence the decision-making or the judgement of the user of the information relating to the Solvency Capital Requirement, unless the simplified calculation leads to a Solvency Capital Requirement which exceeds the Solvency Capital Requirement that results from the standard calculation.

Article 89General provisions for simplifications for captives

Captive insurance undertakings and captive reinsurance undertakings as defined in points (2) and (5) of Article 13 of Directive 2009/138/EC may use the simplified calculations set out in Articles 90, 103, 105 and 106 of this Regulation where Article 88 of this Regulation is complied with and all of the following requirements are met:

in relation to the insurance obligations of the captive insurance undertaking or captive reinsurance undertaking, all insured persons and beneficiaries are legal entities of the group of which the captive insurance or captive reinsurance undertaking is part;

in relation to the reinsurance obligations of the captive insurance or captive reinsurance undertaking, all insured persons and beneficiaries of the insurance contracts underlying the reinsurance obligations are legal entities of the group of which the captive insurance or captive reinsurance undertaking is part;

the insurance obligations and the insurance contracts underlying the reinsurance obligations of the captive insurance or captive reinsurance undertaking do not relate to any compulsory third party liability insurance.

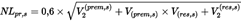

Article 90Simplified calculation for captive insurance and reinsurance undertakings of the capital requirement for non-life premium and reserve risk

1.Where Articles 88 and 89 are complied with, captive insurance and captive reinsurance undertakings may calculate the capital requirement for non-life premium and reserve risk as follows:

where the s covers all segments set out in Annex II.

2.For the purposes of paragraph 1, the capital requirement for non-life premium and reserve risk of a particular segment s set out in Annex II shall be equal to the following:

where:

V(prem,s) denotes the volume measure for premium risk of segment s calculated in accordance with paragraph 3 of Article 116;

V(res,s) denotes the volume measure for reserve risk of a segment calculated in accordance with paragraph 6 of Article 116.

Article 91Simplified calculation of the capital requirement for life mortality risk

Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the capital requirement for life mortality risk as follows:

where, with respect to insurance and reinsurance policies with a positive capital at risk:

CAR denotes the total capital at risk, meaning the sum over all contracts of the higher of zero and the difference between the following amounts:

the sum of:

the amount that the insurance or reinsurance undertaking would currently pay in the event of the death of the persons insured under the contract after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles;

the expected present value of amounts not covered in the previous indent that the undertaking would pay in the future in the event of the immediate death of the persons insured under the contract after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles;

the best estimate of the corresponding obligations after deduction of the amounts recoverable form reinsurance contracts and special purpose vehicles;

q denotes the expected average mortality rate of the insured persons during the following 12 months weighted by the sum insured;

n denotes the modified duration in years of payments payable on death included in the best estimate;

ik denotes the annualized spot rate for maturity k of the relevant risk-free term structure as referred to in Article 43.

Article 92Simplified calculation of the capital requirement for life longevity risk

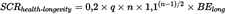

Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the capital requirement for life longevity risk calculated as follows:

where, with respect to the policies referred to in Article 138(2):

q denotes the expected average mortality rate of the insured persons during the following 12 months weighted by the sum insured;

n denotes the modified duration in years of the payments to beneficiaries included in the best estimate;

BElong denotes the best estimate of the obligations subject to longevity risk.

Article 93Simplified calculation of the capital requirement for life disability-morbidity risk

Where 88 is complied with, insurance and reinsurance undertakings may calculate the capital requirement for life disability-morbidity risk as follows:

| SCRdisability-morbidity = | 0,35 · CAR 1 · d 1 + 0,25 · 1,1 (n – 3)/2 · (n – 1) · CAR 2 · d 2 + 0,2 · 1,1 (n –1)/2 · t · n · BEdis |

where with respect to insurance and reinsurance policies with a positive capital at risk:

CAR1 denotes the total capital at risk, meaning the sum over all contracts of the higher of zero and the difference between the following amounts:

the sum of:

the amount that the insurance or reinsurance undertaking would currently pay in the event of the death or disability of the persons insured under the contract after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles;

the expected present value of amounts not covered in the previous indent that the insurance or reinsurance undertaking would pay in the future in the event of the immediate death or disability of the persons insured under the contract after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles;

the best estimate of the corresponding obligations after deduction of the amounts recoverable form reinsurance contracts and special purpose vehicles;

CAR2 denotes the total capital at risk as defined in point (a) after 12 months;

d1 denotes the expected average disability-morbidity rate during the following 12 months weighted by the sum insured;

d2 denotes the expected average disability-morbidity rate in the 12 months after the following 12 months weighted by the sum insured;

n denotes the modified duration of the payments on disability-morbidity included in the best estimate;

t denotes the expected termination rates during the following 12 months;

BEdis denotes the best estimate of obligations subject to disability-morbidity risk.

Article 94Simplified calculation of the capital requirement for life-expense risk

Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the capital requirement for life-expense risk as follows:

where:

EI denotes the amount of expenses incurred in servicing life insurance or reinsurance obligations other than health insurance and reinsurance obligations during the last year;

n denotes the modified duration in years of the cash flows included in the best estimate of those obligations;

i denotes the weighted average inflation rate included in the calculation of the best estimate of those obligations, where the weights are based on the present value of expenses included in the calculation of the best estimate for servicing existing life obligations.

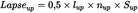

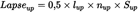

Article 95Simplified calculation of the capital requirement for permanent changes in lapse rates

1.Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the capital requirement for the risk of a permanent increase in lapse rates as follows:

where:

lup denotes the higher of the average lapse rate of the policies with positive surrender strains and 67 %;

nup denotes the average period in years over which the policies with a positive surrender strains run off;

Sup denotes the sum of positive surrender strains.

2.Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the capital requirement for the risk of a permanent decrease in lapse rates as follows:

where:

ldown denotes the higher of the average lapse rate of the policies with negative surrender strains and 40 %;

ndown denotes the average period in years over which the policies with a negative surrender strains runs off;

Sdown denotes the sum of negative surrender strains.

3.The surrender strain of an insurance policy referred to in paragraphs 1 and 2 is the difference between the following:

(a)the amount currently payable by the insurance undertaking on discontinuance by the policy holder, net of any amounts recoverable from policy holders or intermediaries;

(b)the amount of technical provisions without the risk margin.

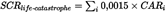

Article 96Simplified calculation of the capital requirement for life-catastrophe risk

Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the capital requirement for life-catastrophe risk calculated as follows:

where:

the sum includes all policies with a positive capital at risk;

CARi denotes the capital at risk of the policy i, meaning the higher of zero and the difference between the following amounts:

the sum of:

the amount that the insurance or reinsurance undertaking would currently pay in the event of the death of the persons insured under the contract after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles;

the expected present value of amounts not covered in the previous indent that the insurance or reinsurance undertaking would pay in the future in the event of the immediate death of the persons insured under the contract after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles;

the best estimate of the corresponding obligations after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles.

Article 97Simplified calculation of the capital requirement for health mortality risk

Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the capital requirement for health mortality risk as follows:

where with respect to insurance and reinsurance policies with a positive capital at risk:

CAR denotes the total capital at risk, meaning the sum, in relation to each contract, of the higher of zero and the difference between the following amounts:

the sum of:

the amount that the insurance or reinsurance undertaking would currently pay in the event of the death of the persons insured under the contract after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles;

the expected present value of amounts not covered in the previous indent that the insurance and reinsurance undertaking would pay in the future in the event of the immediate death of the persons insured under the contract after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles;

the best estimate of the corresponding obligations after deduction of the amounts recoverable form reinsurance contracts and special purpose vehicles;

q denotes the expected average mortality rate of the insured persons over the following 12 months weighted by the sum insured;

n denotes the modified duration in years of payments payable on death included in the best estimate;

ik denotes the annualized spot rate for maturity k of the relevant risk-free term structure as referred to in Article 43.

Article 98Simplified calculation of the capital requirement for health longevity risk

Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the capital requirement for health longevity risk as follows:

where, with respect to the policies referred to in Article 138(2):

q denotes the expected average mortality rate of the insured persons during the following 12 months weighted by the sum insured;

n denotes the modified duration in years of the payments to beneficiaries included in the best estimate;

BElong denotes the best estimate of the obligations subject to longevity risk.

Article 99Simplified calculation of the capital requirement for medical expense disability-morbidity risk

Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the capital requirement for medical expense disability-morbidity risk as follows:

where:

MP denotes the amount of medical payments during the last year on medical expense insurance or reinsurance obligations during the last year;

n denotes the modified duration in years of the cash flows included in the best estimate of those obligations;

i denotes the average rate of inflation on medical payments included in the calculation of the best estimate of those obligations, where the weights are based on the present value of medical payments included in the calculation of the best estimate of those obligations.

Article 100Simplified calculation of the capital requirement for income protection disability-morbidity risk

Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the capital requirement for income protection disability-morbidity risk as follows:

| SCRincome-protection-disability-morbidity = | 0,35 · CAR 1 · d 1 + 0,25 · 1,1 (n – 3)/2 · (n – 1) · CAR 2 · d 2 + 0,2 · 1,1 (n –1)/2 · t · n · BEdis |

where with respect to insurance and reinsurance policies with a positive capital at risk:

CAR 1 denotes the total capital at risk, meaning the sum over all contracts of the higher of zero and the difference between the following amounts:

the sum of:

the amount that the insurance or reinsurance undertaking would currently pay in the event of the death or disability of the persons insured under the contract after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles;

the expected present value of amounts not covered in the previous indent that the undertaking would pay in the future in the event of the immediate death or disability of the persons insured under the contract after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles;

the best estimate of the corresponding obligations after deduction of the amounts recoverable form reinsurance contracts and special purpose vehicles;

CAR 2 denotes the total capital at risk as defined in point (a) after 12 months;

d 1 denotes the expected average disability-morbidity rate during the following 12 months weighted by the sum insured;

d 2 denotes the expected average disability-morbidity rate in the 12 months after the following 12 months weighted by the sum insured;

n denotes the modified duration of the payments on disability-morbidity included in the best estimate;

t denotes the expected termination rates during the following 12 months;

BEdis denotes the best estimate of obligations subject to disability-morbidity risk.

Article 101Simplified calculation of the capital requirement for health expense risk

Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the capital requirement for health expense risk as follows:

where:

EI denotes the amount of expenses incurred in servicing health insurance and reinsurance obligations during the last year;

n denotes the modified duration in years of the cash flows included in the best estimate of those obligations;

i denotes the weighted average inflation rate included in the calculation of the best estimate of these obligations, weighted by the present value of expenses included in the calculation of the best estimate for servicing existing health obligations.

Article 102Simplified calculation of the capital requirement for SLT health lapse risk

1.Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the capital requirement for the risk of a permanent increase in lapse rates referred to in Article 159(1)(a) as follows:

where:

lup denotes the higher of the average lapse rate of the policies with positive surrender strains and 83 %;

nup denotes the average period in years over which the policies with a positive surrender strains run off;

Sup denotes the sum of positive surrender strains.

2.Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the capital requirement for the risk of a permanent decrease in lapse rates referred to in 159(1)(b) as follows:

where:

ldown denotes the average lapse rate of the policies with negative surrender strains;

ndown denotes the average period in years over which the policies with a negative surrender strains runs off;

Sdown denotes the sum of negative surrender strains.

3.The surrender strain of an insurance policy referred to in paragraphs (1) and (2) is the difference between the following:

(a)the amount currently payable by the insurance undertaking on discontinuance by the policy holder, net of any amounts recoverable from policy holders or intermediaries;

(b)the amount of technical provisions without the risk margin.

Article 103Simplified calculation of the capital requirement for interest rate risk for captive insurance or reinsurance undertakings

1.Where Articles 88 and 89 are complied with, captive insurance or captive reinsurance undertakings may calculate the capital requirement for interest rate risk referred to in Article 165 as follows:

(a)the sum, for each currency, of the capital requirements for the risk of an increase in the term structure of interest rates as set out in paragraph 2 of this Article;

(b)the sum, for each currency, of the capital requirements for the risk of a decrease in the term structure of interest rates as set out in paragraph 3 of this Article.

2.For the purposes of point (a) of paragraph 1 of this Article, the capital requirement for the risk of an increase in the term structure of interest rates for a given currency shall be equal to the following:

where:

the first sum covers all maturity intervals i set out in paragraph 4 of this Article;

MVALi denotes the value in accordance with Article 75 of Directive 2009/138/EC of assets less liabilities other than technical provisions for maturity interval i;

duri denotes the simplified duration of maturity interval i;

ratei denotes the relevant risk-free rate for the simplified duration of maturity interval i;

stress(i,up) denotes the relative upward stress of interest rate for simplified duration of maturity interval i;

the second sum covers all lines of business set out in Annex I of this Regulation;

BElob denotes the best estimate for line of business lob;

durlob denotes the modified duration of the best estimate in line of business lob;

ratelob denotes the relevant risk-free rate for modified duration in line of business lob;

stress(lob,up) denotes the relative upward stress of interest rate for the modified duration durlob .

3.For the purposes of point (b) of paragraph 1 of this Article, the capital requirement for the risk of a decrease in the term structure of interest rates for a given currency shall be equal to the following:

where:

the first sum covers all maturity intervals i set out in paragraph 4;

MVALi denotes the value in accordance with Article 75 of Directive 2009/138/EC of assets less liabilities other than technical provisions for maturity interval i;

duri denotes the simplified duration of maturity interval i;

ratei denotes the relevant risk-free rate for the simplified duration of maturity interval i;

stress(i,down) denotes the relative downward stress of interest rate for simplified duration of maturity interval i;

the second sum covers all lines of business set out in Annex I of this Regulation;

BElob denotes the best estimate for line of business lob;

durlob denotes the modified duration of the best estimate in line of business lob;

ratelob denotes the relevant risk-free rate for modified duration in line of business lob;

stress(lob, down) denote the relative downward stress of interest rate for modified duration durlob .

4.The maturity intervals i and the simplified duration duri referred to in points (a) and (c)of paragraph 2 and in point (a) and (c) of paragraph 3 shall be as follows:

(a)up to the maturity of one year, the simplified duration shall be 0.5 years;

(b)between maturities of 1 and 3 years, the simplified duration shall be 2 years;

(c)between maturities of 3 and 5 years, the simplified duration shall be 4 years;

(d)between maturities of 5 and 10 years, the simplified duration shall be 7 years;

(e)from the maturity of 10 years onwards, the simplified duration shall be 12 years.

Article 104Simplified calculation for spread risk on bonds and loans

1.Where Article 88 is complied with, insurance or reinsurance undertakings may calculate the capital requirement for spread risk referred to in Article 176 of this Regulation as follows:

where:

SCRbonds denotes the capital requirement for spread risk on bonds and loans;

MVbonds denotes the value in accordance with Article 75 of Directive 2009/138/EC of the assets subject to capital requirements for spread risk on bonds and loans;

%MVi bonds denotes the proportion of the portfolio of the assets subject to a capital requirement for spread risk on bonds and loans with credit quality step i, where a credit assessment by a nominated ECAI is available for those assets;

%MVbonds norating denotes the proportion of the portfolio of the assets subject to a capital requirement for spread risk on bonds and loans for which no credit assessment by a nominated ECAI is available;

duri and durnorating denote the modified duration denominated in years of the assets subject to a capital requirement for spread risk on bonds and loans where no credit assessment by a nominated ECAI is available;

stressi denotes a function of the credit quality step i and of the modified duration denominated in years of the assets subject to a capital requirement for spread risk on bonds and loans with credit quality step i, set out in paragraph 2;

ΔLiabul denotes the increase in the technical provisions less risk margin for policies where the policyholders bear the investment risk with embedded options and guarantees that would result from an instantaneous decrease in the value of the assets subject to the capital requirement for spread risk on bonds of:

2.stressi referred to in point (f) of paragraph 1, for each credit quality step i, shall be equal to:

| Credit quality step i | 0 | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|---|

| bi | 0,9 % | 1,1 % | 1,4 % | 2,5 % | 4,5 % | 7,5 % | 7,5 % |

3.durnorating referred to in point (e) of paragraph 1 and duri referred to in paragraph 2 shall not be lower than 1 year.

Article 105Simplified calculation for captive insurance or reinsurance undertakings of the capital requirement for spread risk on bonds and loans

Where Articles 88 and 89 are complied with, captive insurance or captive reinsurance undertakings may base the calculation of the capital requirement for spread risk to in Article 176 on the assumption that all assets are assigned to credit quality step 3.

Article 106Simplified calculation of the capital requirement for market risk concentration for captive insurance or reinsurance undertakings

Where Articles 88 and 89 are complied with, captive insurance or captive reinsurance undertakings may use all of the following assumptions for the calculation of the capital requirement for concentration risk:

intra-group asset pooling arrangements of captive insurance or reinsurance undertakings may be exempted from the calculation base referred to in Article 184(2) to the extent that there exist legally enforceable contractual terms which ensure that the liabilities of the captive insurance or reinsurance undertaking will be offset by the intra-group exposures it holds against other entities of the group.

the relative excess exposure threshold referred to in Article 184(1)(c) shall be equal to 15 % for the following single name exposures:

exposures to credit institutions that do not belong to the same group and that have been assigned to the credit quality step 2;

exposures to entities of the group that manages the cash of the captive insurance or reinsurance undertaking that have been assigned to the credit quality step 2.

Article 107Simplified calculation of the risk mitigating effect for reinsurance arrangements or securitisation

1.Where Article 88 is complied with, insurance or reinsurance undertakings may calculate the risk-mitigating effect on underwriting risk of a reinsurance arrangement or securitisation referred to in Article 196 as follows:

where

RMre,all denotes the risk mitigating effect on underwriting risk of the reinsurance arrangements and securitisations for all counterparties calculated in accordance with paragraph 2;

Recoverablesi denotes the best estimate of amounts recoverable from the reinsurance arrangement or securitisation and the corresponding debtors for counterparty i and Recoverablesall denotes the best estimate of amounts recoverable from the reinsurance arrangements and securitisations and the corresponding debtors for all counterparties.

2.The risk mitigating effect on underwriting risk of the reinsurance arrangements and securitisations for all counterparties referred to in paragraph 1 is the difference between the following capital requirements:

(a)the hypothetical capital requirement for underwriting risk of the insurance or reinsurance undertaking if none of the reinsurance arrangements and securitisations exist;

(b)the capital requirements for underwriting risk of the insurance or reinsurance undertaking.

Article 108Simplified calculation of the risk mitigating effect for proportional reinsurance arrangements

Where Article 88 is complied with, insurance or reinsurance undertakings may calculate the risk-mitigating effect on underwriting risk j of a proportional reinsurance arrangement for counterparty i referred to Article 196 as follows:

where

BE denotes the best estimate of obligations gross of the amounts recoverable,

Recoverablesi denotes the best estimate of amounts recoverable from the proportional reinsurance arrangement and the corresponding debtors for counterparty i,

Recoverablesall denotes the best estimate of amounts recoverable from the proportional reinsurance arrangements and the corresponding debtors for all counterparties

SCRj denotes the capital requirements for underwriting risk j of the insurance or reinsurance undertaking.

Article 109Simplified calculations for pooling arrangements

Where Article 88 is complied with, insurance or reinsurance undertakings may use the following simplified calculations for the purposes of Articles 193, 194 and 195:

The best estimate referred to in Article 194(1)(d) may be calculated as follows:

where BEU denotes the best estimate of the liability ceded to the pooling arrangement by the undertaking to the pooling arrangement, net of any amounts reinsured with counterparties external to the pooling arrangement.

The best estimate referred to in Article 195(c) may be calculated as follows:

where BECEP denotes the best estimate of the liability ceded to the external counterparty by the pool, in relation to risk ceded to the pool by the undertaking.

The risk mitigating effect referred to in Article 195(d) may be calculated as follows:

where:

BECE denotes the best estimate of the liability ceded to the external counterparty by the pooling arrangement as a whole;

ΔRMCEP denotes the contribution of all external counterparties to the risk mitigating effect of the pooling arrangement on the underwriting risk of the undertaking;

The counterparty pool members and the counterparties external to the pool may be grouped according to the credit assessment by a nominated ECAI, provided there are separate groupings for pooling exposures of type A, type B and type C.

Article 110Simplified calculation — grouping of single name exposures

Where Article 88 is complied with, insurance or reinsurance undertakings may calculate the loss-given-default set out in Article 192 for a group of single name exposures. In that case, the group of single name exposures shall be assigned the highest probability of default assigned to single name exposures included in the group in accordance with Article 199.

Article 111Simplified calculation of the risk mitigating effect

Where Article 88 is complied with, insurance or reinsurance undertakings may calculate the risk-mitigating effect on underwriting and market risk of a reinsurance arrangement, securitisation or derivative referred to in Article 196 as the difference between the following capital requirements:

the sum of the hypothetical capital requirement for the sub-modules of the underwriting and market risk modules of the insurance or reinsurance undertaking affected by the risk-mitigating technique, as if the reinsurance arrangement, securitisation or derivative did not exist;

the sum of the capital requirements for the sub-modules of the underwriting and market risk modules of the insurance or reinsurance undertaking affected by the risk-mitigating technique.

Article 112Simplified calculation of the risk adjusted value of collateral to take into account the economic effect of the collateral

1.Where Article 88 of this Regulation is complied with, and where the counterparty requirement and the third party requirement referred to in Article 197(1) are both met, insurance or reinsurance undertakings may, for the purposes of Article 197, calculate the risk-adjusted value of a collateral provided by way of security as referred to in Article 1(26)(b), as 85 % of the value of the assets held as collateral, valued in accordance with Article 75 of Directive 2009/138/EC.

2.Where Articles 88 and 214 of this Regulation are complied with, and where the counterparty requirement referred to in Article 197(1) is met and the third party requirement referred to in Article 197(1) is not met, insurance or reinsurance undertakings may, for the purposes of Article 197, calculate the risk-adjusted value of a collateral provided by way of security as referred to in Article 1(26)(b), as 75 % of the value of the assets held as collateral, valued in accordance with Article 75 of Directive 2009/138/EC.

Subsection 7 Scope of the underwriting risk modules

Article 113

For the calculation of the capital requirements for non-life underwriting risk, life underwriting risk and health underwriting risk, insurance and reinsurance undertakings shall apply:

the non-life underwriting risk module to non-life insurance and reinsurance obligations other than health insurance and reinsurance obligations;

the life underwriting risk module to life insurance and reinsurance obligations other than health insurance and reinsurance obligations;

the health underwriting risk module to health insurance and reinsurance obligations.

Options/Help

Print Options

PrintThe Whole Regulation

PrintThe Whole Title

PrintThe Whole Chapter

PrintThis Section only

You have chosen to open The Whole Regulation

The Whole Regulation you have selected contains over 200 provisions and might take some time to download. You may also experience some issues with your browser, such as an alert box that a script is taking a long time to run.

Would you like to continue?

You have chosen to open The Whole Regulation as a PDF

The Whole Regulation you have selected contains over 200 provisions and might take some time to download.

Would you like to continue?

You have chosen to open The Whole Regulation without Annexes

The Whole Regulation without Annexes you have selected contains over 200 provisions and might take some time to download. You may also experience some issues with your browser, such as an alert box that a script is taking a long time to run.

Would you like to continue?

You have chosen to open The Whole Regulation without Annexes as a PDF

The Whole Regulation without Annexes you have selected contains over 200 provisions and might take some time to download.

Would you like to continue?

You have chosen to open the Whole Regulation

The Whole Regulation you have selected contains over 200 provisions and might take some time to download. You may also experience some issues with your browser, such as an alert box that a script is taking a long time to run.

Would you like to continue?

You have chosen to open the Whole Regulation without Annexes

The Whole Regulation without Annexes you have selected contains over 200 provisions and might take some time to download. You may also experience some issues with your browser, such as an alert box that a script is taking a long time to run.

Would you like to continue?

You have chosen to open Schedules only

Y Rhestrau you have selected contains over 200 provisions and might take some time to download. You may also experience some issues with your browser, such as an alert box that a script is taking a long time to run.

Would you like to continue?

Mae deddfwriaeth ar gael mewn fersiynau gwahanol:

Y Diweddaraf sydd Ar Gael (diwygiedig):Y fersiwn ddiweddaraf sydd ar gael o’r ddeddfwriaeth yn cynnwys newidiadau a wnaed gan ddeddfwriaeth ddilynol ac wedi eu gweithredu gan ein tîm golygyddol. Gellir gweld y newidiadau nad ydym wedi eu gweithredu i’r testun eto yn yr ardal ‘Newidiadau i Ddeddfwriaeth’.

Gwreiddiol (Fel y’i mabwysiadwyd gan yr UE): Mae'r wreiddiol version of the legislation as it stood when it was first adopted in the EU. No changes have been applied to the text.

Rhagor o Adnoddau

Gallwch wneud defnydd o ddogfennau atodol hanfodol a gwybodaeth ar gyfer yr eitem ddeddfwriaeth o’r tab hwn. Yn ddibynnol ar yr eitem ddeddfwriaeth sydd i’w gweld, gallai hyn gynnwys:

- y PDF print gwreiddiol y fel adopted version that was used for the EU Official Journal

- rhestr o newidiadau a wnaed gan a/neu yn effeithio ar yr eitem hon o ddeddfwriaeth

- pob fformat o’r holl ddogfennau cysylltiedig

- slipiau cywiro

- dolenni i ddeddfwriaeth gysylltiedig ac adnoddau gwybodaeth eraill

Rhagor o Adnoddau

Defnyddiwch y ddewislen hon i agor dogfennau hanfodol sy’n cyd-fynd â’r ddeddfwriaeth a gwybodaeth am yr eitem hon o ddeddfwriaeth. Gan ddibynnu ar yr eitem o ddeddfwriaeth sy’n cael ei gweld gall hyn gynnwys:

- y PDF print gwreiddiol y fel adopted fersiwn a ddefnyddiwyd am y copi print

- slipiau cywiro

liciwch ‘Gweld Mwy’ neu ddewis ‘Rhagor o Adnoddau’ am wybodaeth ychwanegol gan gynnwys

- rhestr o newidiadau a wnaed gan a/neu yn effeithio ar yr eitem hon o ddeddfwriaeth

- manylion rhoi grym a newid cyffredinol

- pob fformat o’r holl ddogfennau cysylltiedig

- dolenni i ddeddfwriaeth gysylltiedig ac adnoddau gwybodaeth eraill