- Y Diweddaraf sydd Ar Gael (Diwygiedig)

- Pwynt Penodol mewn Amser (10/10/2014)

- Gwreiddiol (Fel y’i mabwysiadwyd gan yr UE)

Commission Delegated Regulation (EU) 2015/35Dangos y teitl llawn

Commission Delegated Regulation (EU) 2015/35 of 10 October 2014 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance)

You are here:

- Dangos Graddfa Ddaearyddol(e.e. Lloegr, Cymru, Yr Alban aca Gogledd Iwerddon)

- Dangos Llinell Amser Newidiadau

Rhagor o Adnoddau

PDF o Fersiynau Diwygiedig

- ddiwygiedig 30/07/202048.27 MB

- ddiwygiedig 01/01/202048.00 MB

- ddiwygiedig 08/07/201944.91 MB

- ddiwygiedig 01/01/201946.16 MB

- ddiwygiedig 15/09/201740.90 MB

- ddiwygiedig 09/04/201746.19 MB

- ddiwygiedig 02/04/201646.19 MB

- ddiwygiedig 17/01/201539.54 MB

Pan adawodd y DU yr UE, cyhoeddodd legislation.gov.uk ddeddfwriaeth yr UE a gyhoeddwyd gan yr UE hyd at ddiwrnod cwblhau’r cyfnod gweithredu (31 Rhagfyr 2020 11.00 p.m.). Ar legislation.gov.uk, mae'r eitemau hyn o ddeddfwriaeth yn cael eu diweddaru'n gyson ag unrhyw ddiwygiadau a wnaed gan y DU ers hynny.

Mae'r eitem hon o ddeddfwriaeth yn tarddu o'r UE

Mae legislation.gov.uk yn cyhoeddi fersiwn y DU. Mae EUR-Lex yn cyhoeddi fersiwn yr UE. Mae Archif Gwe Ymadael â’r UE yn rhoi cipolwg ar fersiwn EUR-Lex o ddiwrnod cwblhau’r cyfnod gweithredu (31 Rhagfyr 2020 11.00 p.m.).

Changes over time for: SECTION 5

Version Superseded: 02/04/2016

Alternative versions:

- 10/10/2014- Amendment

- 10/10/2014

Point in time - 02/04/2016- Amendment

- 15/09/2017- Amendment

- 01/01/2019- Amendment

- 08/07/2019- Amendment

- Exit day: start of implementation period31/01/2020 11pm- Amendment

- End of implementation period31/12/2020- Amendment

- 01/01/2024- Amendment

- 30/06/2024- Amendment

- 31/12/2024- Amendment

Status:

Point in time view as at 10/10/2014.

Changes to legislation:

Commission Delegated Regulation (EU) 2015/35,

SECTION 5

is up to date with all changes known to be in force on or before 05 July 2025. There are changes that may be brought into force at a future date. Changes that have been made appear in the content and are referenced with annotations.![]()

Changes to Legislation

Changes and effects yet to be applied by the editorial team are only applicable when viewing the latest version or prospective version of legislation. They are therefore not accessible when viewing legislation as at a specific point in time. To view the ‘Changes to Legislation’ information for this provision return to the latest version view using the options provided in the ‘What Version’ box above.

SECTION 5 U.K. Market risk module

Subsection 1 U.K. Correlation coefficients

Article 164U.K.

1.The market risk module shall consist of all of the following sub-modules:

(a)the interest rate risk sub-module referred to in point (a) of subparagraph 2 of Article 105(5) of Directive 2009/138/EC;

(b)the equity risk sub-module referred to in point (b) of subparagraph 2 of Article 105(5) of Directive 2009/138/EC;

(c)the property risk sub-module referred to in point (c) of subparagraph 2 of Article 105(5) of Directive 2009/138/EC;

(d)the spread risk sub-module referred to in point (d) of subparagraph 2 of Article 105(5) of Directive 2009/138/EC;

(e)the currency risk sub-module referred to in point (e) of subparagraph 2 of Article 105(5) of Directive 2009/138/EC;

(f)the market risk concentrations sub-module referred to in point (f) of subparagraph 2 of Article 105(5) of Directive 2009/138/EC.

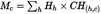

2.The capital requirement for market risk referred to in Article 105(5) of Directive 2009/138/EC shall be equal to the following:

where:

the sum covers all possible combinations i,j of sub-modules of the market risk module;

Corr(i,j) denotes the correlation parameter for market risk for sub-modules i and j;

SCRi and SCRj denote the capital requirements for sub-modules i and j respectively.

3.The correlation parameter Corr(i,j) referred to in paragraph 2 shall be equal to the item set out in row i and in column j of the following correlation matrix:

| j i | Interest rate | Equity | Property | Spread | Concentration | Currency |

|---|---|---|---|---|---|---|

| Interest rate | 1 | A | A | A | 0 | 0,25 |

| Equity | A | 1 | 0,75 | 0,75 | 0 | 0,25 |

| Property | A | 0,75 | 1 | 0,5 | 0 | 0,25 |

| Spread | A | 0,75 | 0,5 | 1 | 0 | 0,25 |

| Concentration | 0 | 0 | 0 | 0 | 1 | 0 |

| Currency | 0,25 | 0,25 | 0,25 | 0,25 | 0 | 1 |

The parameter A shall be equal to 0 where the capital requirement for interest rate risk set out in Article 165 is the capital requirement referred to in point (a) of that Article. In all other cases, the parameter A shall be equal to 0,5.

Subsection 2 U.K. Interest rate risk sub-module

Article 165U.K.General provisions

1.The capital requirement for interest rate risk referred to in point (a) of the second subparagraph Article 105(5) of Directive 2009/138/EC shall be equal to the larger of the following:

(a)the sum, over all currencies, of the capital requirements for the risk of an increase in the term structure of interest rates as set out in Article 166 of this Regulation;

(b)the sum, over all currencies, of the capital requirements for the risk of a decrease in the term structure of interest rates as set out in Article 167 of this Regulation.

2.Where the larger of the capital requirements referred to in points (a) and (b) of paragraph 1 and the larger of the corresponding capital requirements calculated in accordance with Article 206(2) are not based on the same scenario, the capital requirement for interest rate risk shall be the capital requirement referred to in points (a) or (b) of paragraph 1 for which the underlying scenario results in the largest corresponding capital requirement calculated in accordance with Article 206(2).

Article 166U.K.Increase in the term structure of interest rates

1.The capital requirement for the risk of an increase in the term structure of interest rates for a given currency shall be equal to the loss in the basic own funds that would result from an instantaneous increase in basic risk-free interest rates for that currency at different maturities in accordance with the following table:

For maturities not specified in the table above, the value of the increase shall be linearly interpolated. For maturities shorter than 1 year, the increase shall be 70 %. For maturities longer than 90 years, the increase shall be 20 %.

2.In any case, the increase of basic-risk-free interest rates at any maturity shall be at least one percentage point.

3.The impact of the increase in the term structure of basic risk-free interest rates on the value of participations as referred to in Article 92(2) of Directive 2009/138/EC in financial and credit institutions shall be considered only on the value of the participations that are not deducted from own funds pursuant to Article 68 of this Regulation. The part deducted from own funds shall be considered only to the extent that such impact increases the basic own funds.

Article 167U.K.Decrease in the term structure of interest rates

1.The capital requirement for the risk of a decrease in the term structure of interest rates for a given currency shall be equal to the loss in the basic own funds that would result from an instantaneous decrease in basic risk-free interest rates for that currency at different maturities in accordance with the following table:

For maturities not specified in the table above, the value of the decrease shall be linearly interpolated. For maturities shorter than 1 year, the decrease shall be 75 %. For maturities longer than 90 years, the decrease shall be 20 %.

2.Notwithstanding paragraph 1, for negative basic risk-free interest rates the decrease shall be nil.

3.The impact on the value of participations as referred to in Article 92(2) of Directive 2009/138/EC in financial and credit institutions of the decrease in the term structure of basic risk-free interest rates shall be considered only on the value of the participations that are not deducted from own funds pursuant to Article 68 of this Regulation. The part deducted from own funds shall be considered only to the extent that such impact increases the basic own funds.

Subsection 3 U.K. Equity risk sub-module

Article 168U.K.General provisions

1.The equity risk sub-module referred to in point (b) of the second subparagraph of Article 105(5) of Directive 2009/138/EC shall include a risk sub-module for type 1 equities and a risk sub-module for type 2 equities.

2.Type 1 equities shall comprise equities listed in regulated markets in the countries which are members of the European Economic Area (EEA) or the Organisation for Economic Cooperation and Development (OECD).

3.Type 2 equities shall comprise equities listed in stock exchanges in countries which are not members of the EEA or the OECD, equities which are not listed, commodities and other alternative investments. They shall also comprise all assets other than those covered in the interest rate risk sub-module, the property risk sub-module or the spread risk sub-module, including the assets and indirect exposures referred to in Article 84(1) and (2) where a look-through approach is not possible and the insurance or reinsurance undertaking does not make use of the provisions in Article 84(3).

4.The capital requirement for equity risk shall be equal to the following:

where:

SCRtype 1 equities denotes the capital requirement for type 1 equities;

SCRtype 2 equities denotes the capital requirement for type 2 equities.

5.The impact of the instantaneous decreases set out in Articles 169 and 170 on the value of participations as referred to in Article 92(2) of Directive 2009/138/EC in financial and credit institutions shall be considered only on the value of the participations that are not deducted from own funds pursuant to Article 68 of this Regulation.

6.The following equities shall in any case be considered as type 1:

(a)equities held within collective investment undertakings which are qualifying social entrepreneurship funds as referred to in Article 3(b) of Regulation (EU) No 346/2013 of the European Parliament and of the Council(1) where the look-through approach set out in Article 84 of this Regulation is possible for all exposures within the collective investment undertaking, or units or shares of those funds where the look through approach is not possible for all exposures within the collective investment undertaking;

(b)equities held within collective investment undertakings which are qualifying venture capital funds as referred to in Article 3(b) of Regulation (EU) No 345/2013 where the look-through approach set out in Article 84 of this Regulation is possible for all exposures within the collective investment undertaking, or units or shares of those funds where the look through approach is not possible for all exposures within the collective investment undertaking;

(c)as regards closed-ended and unleveraged alternative investment funds which are established in the Union or, if they are not established in the Union, which are marketed in the Union in accordance with Articles 35 or 40 of Directive 2011/61/EU:

equities held within such funds where the look-through approach set out in Article 84 of this Regulation is possible for all exposures within the alternative investment fund;

units or shares of such funds where the look-through approach is not possible for all exposures within the alternative investment fund.

Article 169U.K.Standard equity risk sub-module

1.The capital requirement for type 1 equities referred to in Article 168 of this Regulation shall be equal to the loss in the basic own funds that would result from the following instantaneous decreases:

(a)an instantaneous decrease equal to 22 % in the value of type 1 equity investments in related undertakings within the meaning of Article 212(1)(b) and 212(2) of Directive 2009/138/EC where these investments are of a strategic nature;

(b)an instantaneous decrease equal to the sum of 39 % and the symmetric adjustment as referred to in Article 172 of this Regulation, in the value of type 1 equities other than those referred to in point (a).

2.The capital requirement for type 2 equities referred to in Article 168 of this Regulation shall be equal to the loss in the basic own funds that would result from the following instantaneous decreases:

(a)an instantaneous decrease equal to 22 % in the value of type 2 equity investments in related undertakings with the meaning of Article 212(1)(b) and 212(2) of Directive 2009/138/EC where these investments are of a strategic nature;

(b)an instantaneous decrease equal to the sum of 49 % and the symmetric adjustment as referred to in Article 172, in the value of type 2 equities, other than those referred to in point (a).

Article 170U.K.Duration-based equity risk sub-module

1.Where an insurance or reinsurance undertaking has received supervisory approval to apply the provisions set out in Article 304 of Directive 2009/138/EC, the capital requirement for type 1 equities shall be equal to the loss in the basic own funds that would result from the following instantaneous decreases:

(a)an instantaneous decrease equal to 22 % in the value of the type 1 equities corresponding to the business referred to in point (i) of Article 304(1)(b) of Directive 2009/138/EC;

(b)an instantaneous decrease equal to 22 % in the value of type 1 equity investments in related undertakings within the meaning of Article 212(1)(b) and 212(2) of Directive 2009/138/EC where these investments are of a strategic nature;

(c)an instantaneous decrease equal to the sum of 39 % and the symmetric adjustment as referred to in Article 172 of this Regulation, in the value of type 1 equities, other than those referred to in points (a) or (b).

2.Where an insurance or reinsurance undertaking has received supervisory approval to apply the provisions set out in Article 304 of Directive 2009/138/EC, the capital requirement for type 2 equities shall be equal to the loss in the basic own funds that would result from an instantaneous decrease:

(a)equal to 22 % in the value of the type 2 equities corresponding to the business referred to in point (i) of Article 304(1)(b) of Directive 2009/138/EC;

(b)equal to 22 % in the value of type 2 equity investments in related undertakings within the meaning of Article 212(1)(b) and (2) of Directive 2009/138/EC, where these investments are of a strategic nature;

(c)equal to the sum of 49 % and the symmetric adjustment as referred to in Article 172 of this Regulation, in the value of type 2 equities, other than those referred to in points (a) or (b).

Article 171U.K.Strategic equity investments

For the purposes of Article 169(1)(a) and (2)(a) and of Article 170(1)(b) and (2)(b), equity investments of a strategic nature shall mean equity investments for which the participating insurance or reinsurance undertaking demonstrates the following:

that the value of the equity investment is likely to be materially less volatile for the following 12 months than the value of other equities over the same period as a result of both the nature of the investment and the influence exercised by the participating undertaking in the related undertaking;

that the nature of the investment is strategic, taking into account all relevant factors, including:

the existence of a clear decisive strategy to continue holding the participation for long period;

the consistency of the strategy referred to in point (a) with the main policies guiding or limiting the actions of the undertaking;

the participating undertaking's ability to continue holding the participation in the related undertaking;

the existence of a durable link;

where the insurance or reinsurance participating company is part of a group, the consistency of such strategy with the main policies guiding or limiting the actions of the group.

Article 172U.K.Symmetric adjustment of the equity capital charge

1.The equity index referred to in Article 106(2) of Directive 2009/138/EC shall comply with all of the following requirements:

(a)the equity index measures the market price of a diversified portfolio of equities which is representative of the nature of equities typically held by insurance and reinsurance undertakings;

(b)the level of the equity index is publicly available;

(c)the frequency of published levels of the equity index is sufficient to enable the current level of the index and its average value over the last 36 months to be determined.

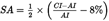

2.Subject to paragraph 4, the symmetric adjustment shall be equal to the following:

where:

CI denotes the current level of the equity index;

AI denotes the weighted average of the daily levels of the equity index over the last 36 months.

3.For the purposes of calculating the weighted average of the daily levels of the equity index, the weights for all daily levels shall be equal. The days during the last 36 months in respect of which the index was not determined shall not be included in the average.

4.The symmetric adjustment shall not be lower than – 10 % or higher than 10 %.

Article 173U.K.Criteria for the use of transitional measure for standard equity risk

The transitional measure for standard equity risk set out in Article 308b(12) of Directive 2009/138/EC shall only be applied to type 1 equities that were purchased on or before 1 January 2016 and which are not subject to the duration-based equity risk pursuant to Article 304 of that Directive.

Subsection 4 U.K. Property risk sub-module

Article 174U.K.

The capital requirement for property risk referred to in point (c) of the second subparagraph of Article 105(5) of Directive 2009/138/EC shall be equal to the loss in the basic own funds that would result from an instantaneous decrease of 25 % in the value of immovable property.

Subsection 5 U.K. Spread risk sub-module

Article 175U.K.Scope of the spread risk sub-module

The capital requirement for spread risk referred to in point (d) of the second subparagraph of Article 105(5) of Directive 2009/138/EC shall be equal to the following:

where

SCRbonds denotes the capital requirement for spread risk on bonds and loans;

SCRsecuritisation denotes the capital requirement for spread risk on securitisation positions;

SCRcd denotes the capital requirement for spread risk on credit derivatives.

Article 176U.K.Spread risk on bonds and loans

1.The capital requirement for spread risk on bonds and loans SCRbonds shall be equal to the loss in the basic own funds that would result from an instantaneous relative decrease of stressi in the value of each bond or loan i other than mortgage loans that meet the requirements in Article 191, including bank deposits other than cash at bank referred to in Article 189(2)(b).

2.The risk factor stressi shall depend on the modified duration of the bond or loan i denominated in years (duri ). duri shall never be lower than 1. For variable interest rate bonds or loans, duri shall be equivalent to the modified duration of a fixed interest rate bond or loan of the same maturity and with coupon payments equal to the forward interest rate.

3.Bonds or loans for which a credit assessment by a nominated ECAI is available shall be assigned a risk factor stressi depending on the credit quality step and the modified duration duri of the bond or loan i according to the following table.

4.Bonds and loans for which a credit assessment by a nominated ECAI is not available and for which debtors have not posted collateral that meets the criteria set out in Article 214 shall be assigned a risk factor stressi depending on the duration duri of the bond or loan i according to the following table:

5.Bonds and loans for which a credit assessment by a nominated ECAI is not available and for which debtors have posted collateral, where the collateral of those bonds and loans meet the criteria set out in Article 214, shall be assigned a risk factor stressi according to the following:

(a)where the risk-adjusted value of collateral is higher than or equal to the value of the bond or loan i, stressi shall be equal to half of the risk factor that would be determined in accordance with paragraph 4;

(b)where the risk-adjusted value of collateral is lower than the value of the bond or loan i, and where the risk factor determined in accordance with paragraph 4 would result in a value of the bond or loan i that is lower than the risk-adjusted value of the collateral, stressi shall be equal to the average of the following:

the risk factor determined in accordance with paragraph 4;

the difference between the value of the bond or loan i and the risk-adjusted value of the collateral, divided by the value of the bond or loan i;

(c)where the risk-adjusted value of collateral is lower than the value of the bond or loan i, and where the risk factor determined in accordance with paragraph 4 would result in a value of the bond or loan i that is higher than or equal to the risk-adjusted value of the collateral, stressi shall be determined in accordance with paragraph 4.

The risk-adjusted value of the collateral shall be calculated in accordance with Articles 112, 197, 198.

6.The impact of the instantaneous decrease in the value of participations, as referred to in Article 92(2) of Directive 2009/138/EC, in financial and credit institutions shall be considered only on the value of the participations that are not deducted from own funds pursuant to Article 68 of this Regulation.

Article 177U.K.Spread risk on securitisation positions: general provisions

1.The capital requirement SCRsecuritisation for spread risk on securitisation positions shall be the sum of a capital requirement for type 1 securitisation positions, a capital requirement for type 2 securitisation positions and a capital requirement for resecuritisation positions.

2.Type 1 securitisation positions shall include securitisation positions that meet all of the following criteria:

(a)the position has been assigned to credit quality step 3 or better;

(b)the securitisation is listed in a regulated market of a country which is a member of the EEA or the OECD, or is admitted to trading in an organised trading venue providing for an active and sizable market for outright sales which has the following features:

historical evidence of market breadth and depth as proven by low bid-ask spreads, high trading volume and a large number of market participants;

the presence of a robust market infrastructure;

(c)the position is in the most senior tranche or tranches of the securitisation and possess the highest level of seniority at all times during the ongoing life of the transaction; for these purposes, a tranche shall be deemed the most senior where after the delivery of an enforcement notice and where applicable an acceleration notice, the tranche is not subordinated to other tranches of the same securitisation transaction or scheme in respect of receiving principal and interest payments, without taking into account amounts due under interest rate or currency derivative contracts, fees or other similar payments;

(d)the underlying exposures have been acquired by the securitisation special purpose entity (SSPE) within the meaning of Article 4(1)(66) of Regulation (EU) No 575/2013 in a manner that is enforceable against any third party and are beyond the reach of the seller (originator, sponsor or original lender) and its creditors including in the event of the seller's insolvency;

(e)the transfer of the underlying exposures to the SSPE may not be subject to any severe clawback provisions in the jurisdiction where the seller (originator, sponsor or original lender) is incorporated; this includes but is not limited to provisions under which the sale of the underlying exposures can be invalidated by the liquidator of the seller (originator, sponsor or original lender) solely on the basis that it was concluded within a certain period before the declaration of the seller's insolvency or provisions where the SSPE can prevent such invalidation only if it can prove that it was not aware of the insolvency of the seller at the time of sale;

(f)the underlying exposures have their administration governed by a servicing agreement which includes servicing continuity provisions to ensure, at a minimum, that a default or insolvency of the servicer does not result in a termination of servicing;

(g)the documentation governing the securitisation includes continuity provisions to ensure, at a minimum, the replacement of derivative counterparties and of liquidity providers upon their default or insolvency, where applicable;

(h)the securitisation position is backed by a pool of homogeneous underlying exposures, which all belong to only one of the following categories, or by a pool of homogeneous underlying exposures which combines residential loans referred to in points (i) and (ii):

residential loans secured with a first-ranking mortgage granted to individuals for the acquisition of their main residence, provided that one of the two following conditions is met:

the loans in the pool meet on average the loan-to-value requirement laid down in point (i) of Article 129(1)(d) of Regulation (EU) No 575/2013;

the national law of the Member State where the loans were originated provides for a loan-to-income limit on the amount that an obligor may borrow in a residential loan, and that Member State has notified this law to the Commission and EIOPA. The loan-to-income limit shall be calculated on the gross annual income of the obligor, taking into account the tax obligations and other commitments of the obligor and the risk of changes in the interest rates over the term of the loan. For each residential loan in the pool, the percentage of the obligor's gross income that may be spent to service the loan, including interest, principal and fee payments, does not exceed 45 %.

fully guaranteed residential loans referred to in Article 129(1)(e) of Regulation (EU) No 575/2013, provided that the loans meet the collateralisation requirements laid down in that paragraph and meet on average the loan-to-value requirement laid down in point (i) of Article 129(1)(d) of Regulation (EU) No 575/2013;

commercial loans, leases and credit facilities to undertakings to finance capital expenditures or business operations other than the acquisition or development of commercial real estate, provided that at least 80 % of the borrowers in the pool in terms of portfolio balance are small and medium-sized enterprises at the time of issuance of the securitisation, and none of the borrowers is an institution as defined in Article 4(1)(3) of Regulation (EU) No 575/2013;

auto loans and leases for the financing of motor vehicles or trailers as defined in points (11) and (12) of Article 3 of Directive 2007/46/EC of the European Parliament and of the Council(2), agricultural or forestry tractors as referred to in Directive 2003/37/EC of the European Parliament and of the Council(3), motorcycles or motor tricycles as defined in points (b) and (c) of Article 1(2) of Directive 2002/24/EC of the European Parliament and of the Council(4) or tracked vehicles as referred to in point (c) of Article 2(2) of Directive 2007/46/EC. Such loans or leases may include ancillary insurance and service products or additional vehicle parts, and in the case of leases, the residual value of leased vehicles. All loans and leases in the pool shall be secured with a first-ranking charge or security over the vehicle or an appropriate guarantee in favour of the SSPE, such as a retention of title provision;

loans and credit facilities to individuals for personal, family or household consumption purposes.

(i)the position is not in a resecuritisation or a synthetic securitisation as referred to in Article 242(11) of Regulation (EU) No 575/2013;

(j)the underlying exposures do not include transferable financial instruments or derivatives, except financial instruments issued by the SSPE itself or other parties within the securitisation structure and derivatives used to hedge currency risk and interest rate risk;

(k)at the time of issuance of the securitisation or when incorporated in the pool of underlying exposures at any time after issuance, the underlying exposures do not include exposures to credit-impaired obligors (or where applicable, credit-impaired guarantors), where a credit-impaired obligor (or credit-impaired guarantor) is a borrower (or guarantor) who:

has declared bankruptcy, agreed with his creditors to a debt dismissal or reschedule or had a court grant his creditors a right of enforcement or material damages as a result of a missed payment within three years prior to the date of origination;

is on an official registry of persons with adverse credit history;

has a credit assessment by an ECAI or has a credit score indicating a significant risk that contractually agreed payments will not be made compared to the average obligor for this type of loans in the relevant jurisdiction.

(l)at the time of issuance of the securitisation or when incorporated in the pool of underlying exposures at any time after issuance, the underlying exposures do not include exposures in default within the meaning of Article 178(1) of Regulation (EU) No 575/2013;

(m)the repayment of the securitisation position is not structured to depend predominantly on the sale of assets securing the underlying exposures; however, this shall not prevent such exposures from being subsequently rolled-over or refinanced;

(n)where the securitisation has been set up without a revolving period or the revolving period has terminated and where an enforcement or an acceleration notice has been delivered, principal receipts from the underlying exposures are passed to the holders of the securitisation positions via sequential amortisation of the securitisation positions and no substantial amount of cash is trapped in the SSPE on each payment date;

(o)where the securitisation has been set up with a revolving period, the transaction documentation provides for appropriate early amortisation events, which shall include at a minimum all of the following:

a deterioration in the credit quality of the underlying exposures;

a failure to generate sufficient new underlying exposures of at least similar credit quality;

the occurrence of an insolvency-related event with regard to the originator or the servicer;

(p)at the time of issuance of the securitisation, the borrowers (or, where applicable, the guarantors) have made at least one payment, except where the securitisation is backed by credit facilities referred to in point (h)(v) of this paragraph;

(q)in the case of securitisations where the underlying exposures are residential loans referred to in point (h)(i) or (ii), the pool of loans does not include any loan that was marketed and underwritten on the premise that the loan applicant or, where applicable intermediaries, were made aware that the information provided might not be verified by the lender;

(r)in the case of securitisations where the underlying exposures are residential loans referred to in point (h)(i) or (ii), the assessment of the borrower's creditworthiness meets the requirements set out in paragraphs 1 to 4, 5(a), and 6 of Article 18 of Directive 2014/17/EU of the European Parliament and of the Council(5) or equivalent requirements in countries that are not members of the Union;

(s)in the case of securitisations where the underlying exposures are auto loans and leases and consumer loans and credit facilities referred to in point (h)(v) of this paragraph, the assessment of the borrower's creditworthiness meets the requirements set out in Article 8 of Directive 2008/48/EC of the European Parliament and of the Council(6) or equivalent requirements in countries that are not members of the Union;

(t)where the issuer, originator or sponsor of the securitisation is established in the Union, it complies with the requirements laid down in Part Five of Regulation (EU) No. 575/2013 and discloses information, in accordance with Article 8b of Regulation (EU) No 1060/2009, on the credit quality and performance of the underlying exposures, the structure of the transaction, the cash flows and any collateral supporting the exposures as well as any information that is necessary for investors to conduct comprehensive and well-informed stress tests; where the issuer, originator and sponsors are established outside the Union, comprehensive loan-level data in compliance with standards generally accepted by market participants is made available to existing and potential investors and regulators at issuance and on a regular basis.

3.Type 2 securitisation positions shall include all securitisation positions that do not qualify as type 1 securitisation positions.

4.Notwithstanding paragraph 2, securitisations that were issued before the entry into force of this Regulation shall qualify as type 1 if they meet only the requirements set out in points (a), (c), (d), (h), (i) and (j) of paragraph 2. Where the underlying exposures are residential loans referred to in point (h)(i) of paragraph 2, none of the two conditions on the loan-to-value or loan-to-income ratios set out in that point shall apply to those securitisations.

5.Notwithstanding paragraph 2, a securitisation position where the underlying exposures are residential loans referred to in point (h)(i) of paragraph 2 that do not meet the average loan-to-value requirement nor the loan-to-income requirement set out in that point, shall qualify as a type 1 securitisation position until 31 December 2025, provided that all of the following requirements are met:

(a)the securitisation was issued after the date of entry into force of this Regulation;

(b)the underlying exposures comprise residential loans that were granted to obligors before the application of the national law providing for a loan-to-income limit.

(c)the underlying exposures do not comprise residential loans that were granted to obligors after the date of entry into force of this Regulation and which do not comply with the loan-to-income requirement as referred to in point (h)(i) of paragraph 2.

Article 178U.K.Spread risk on securitisation positions: calculation of the capital requirement

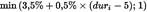

1.The capital requirement for spread risk on type 1 securitisation positions shall be equal to the loss in the basic own funds that would result from an instantaneous relative decrease of stressi in the value of each type 1 securitisation position i. The risk factor stressi shall be equal to the following:

where:

dur i denotes the modified duration of securitisation position i denominated in years;

b i shall be assigned depending on the credit quality step of securitisation position i according to the following table:

| Credit quality step | 0 | 1 | 2 | 3 |

|---|---|---|---|---|

| bi | 2,1 % | 3 % | 3 % | 3 % |

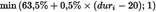

2.The capital requirement for spread risk on type 2 securitisation position shall be equal to the loss in the basic own funds that would result from an instantaneous relative decrease of stressi in the value of each type 2 securitisation position i. The risk factor stressi shall be equal to the following

where:

dur i denotes the modified duration of securitisation position i denominated in years;

b i shall be assigned depending on the credit quality step of securitisation position i according to the following table:

| Credit quality step | 0 | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|---|

| bi | 12,5 % | 13,4 % | 16,6 % | 19,7 % | 82 % | 100 % | 100 % |

3.The capital requirement for spread risk on resecuritisation positions shall be equal to the loss in the basic own funds that would result from an instantaneous relative decrease of stressi in the value of each resecuritisation position i. The risk factor stressi shall be equal to the following

where:

dur i denotes the modified duration of resecuritisation position i denominated in years;

b i shall be assigned depending on the credit quality step of resecuritisation position i according to the following table:

| Credit quality step | 0 | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|---|

| bi | 33 % | 40 % | 51 % | 91 % | 100 % | 100 % | 100 % |

4.The modified duration duri referred to in paragraphs 1 and 2 shall not be lower than 1 year.

5.Securitisation positions for which a credit assessment from a nominated ECAI is not available shall be assigned a risk factor stressi of 100 %.

Article 179U.K.Spread risk on credit derivatives

1.The capital requirement SCRcd for spread risk on credit derivatives other than those referred to in paragraph 4 shall be equal to the higher of the following capital requirements:

(a)the loss in the basic own funds that would result from an instantaneous increase in absolute terms of the credit spread of the instruments underlying the credit derivatives, as set out in paragraphs 2 and 3;

(b)the loss in the basic own funds that would result from an instantaneous relative decrease of the credit spread of the instruments underlying the credit derivatives by 75 %.

For the purposes of point (a), the instantaneous increase of the credit spread of the instruments underlying the credit derivatives for which a credit assessment by a nominated ECAI is available shall be calculated according to the following table.

| Credit quality step | 0 | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|---|

| Instantaneous increase in spread (in percentage points) | 1,3 | 1,5 | 2,6 | 4,5 | 8,4 | 16,20 | 16,20 |

2.For the purposes of point (a) of paragraph 1, the instantaneous increase of the credit spread of the instruments underlying the credit derivatives for which a credit assessment by a nominated ECAI is not available shall be 5 percentage points.

3.Credit derivatives which are part of the undertaking's risk mitigation policy shall not be subject to a capital requirement for spread risk, as long as the undertaking holds either the instruments underlying the credit derivative or another exposure with respect to which the basis risk between that exposure and the instruments underlying the credit derivative is not material in any circumstances.

4.Where the larger of the capital requirements referred to in points (a) and (b) of paragraph 1 and the larger of the corresponding capital requirements calculated in accordance with Article 206(2) are not based on the same scenario, the capital requirement for spread risk on credit derivatives shall be the capital requirement referred to in paragraph 1 for which the underlying scenario results in the largest corresponding capital requirement calculated in accordance with Article 206(2).

Article 180U.K.Specific exposures

1.Exposures in the form of bonds referred to Article 52(4) of Directive 2009/65/EC (covered bonds) which have been assigned to credit quality step 0 or 1 shall be assigned a risk factor stressi according to the following table.

2.Exposures in the form of bonds and loans to the following shall be assigned a risk factor stressi of 0 %:

(a)the European Central Bank;

(b)Member States' central government and central banks denominated and funded in the domestic currency of that central government and the central bank;

(c)multilateral development banks referred to in paragraph 2 of Article 117 of Regulation (EU) No 575/2013;

(d)international organisations referred to in Article 118 of Regulation (EU) No 575/2013;

Exposures in the form of bonds and loans that are fully, unconditionally and irrevocably guaranteed by one of the counterparties mentioned in points (a) to (d), where the guarantee meets the requirements set out in Article 215, shall also be assigned a risk factor stressi of 0 %.

3.Exposures in the form of bonds and loans to central governments and central banks other than those referred to in point (b) of paragraph 2, denominated and funded in the domestic currency of that central government and central bank, and for which a credit assessment by a nominated ECAI is available shall be assigned a risk factor stressi depending on the credit quality step and the duration of the exposure according to the following table:

4.Exposures in the form of bonds and loans to an insurance or reinsurance undertaking for which a credit assessment by a nominated ECAI is not available and where this undertaking meets its Minimum Capital Requirement, shall be assigned a risk factor stressi from the table in Article 176(3) depending on the undertaking's solvency ratio, using the following mapping between solvency ratios and credit quality steps:

| Solvency ratio | 196 % | 175 % | 122 % | 95 % | 75 % | 75 % |

| Credit quality step | 1 | 2 | 3 | 4 | 5 | 6 |

Where the solvency ratio falls in between the solvency ratios set out in the table above, the value of stressi shall be linearly interpolated from the closest values of stressi corresponding to the closest solvency ratios set out in the table above. Where the solvency ratio is lower than 75 %, stressi shall be equal to the factor corresponding to the credit quality steps 5 and 6. Where the solvency ratio is higher than 196 %, stressi shall be the same as the factor corresponding to the credit quality step 1.

For the purposes of this paragraph, ‘solvency ratio’ denotes the ratio of the eligible amount of own funds to cover the Solvency Capital Requirement and the Solvency Capital Requirement, using the latest available values.

5.Exposures in the form of bonds and loans to an insurance or reinsurance undertaking which does not meet its Minimum Capital Requirement shall be assigned a risk factor stressi according to the following table:

6.Paragraphs 4 and 5 of this Article shall only apply as of the first date of public disclosure, by the undertaking corresponding to the exposure, of the report on its solvency and financial condition referred to in Article 51 of Directive 2009/138/EC. Before that date, if a credit assessment by a nominated ECAI is available for the exposures, Article 176 of this Regulation shall apply, otherwise, the exposures shall be assigned the same risk factor as the ones that would result from the application of paragraph 4 of this Article to exposures to an insurance or reinsurance undertaking whose solvency ratio is 100 %.

7.Exposures in the form of bonds and loans to a third country insurance or reinsurance undertaking for which a credit assessment by a nominated ECAI is not available, situated in a country whose solvency regime is deemed equivalent to that laid down in Directive 2009/138/EC in accordance with Article 227 of Directive 2009/138/EC, and which complies with the solvency requirements of that third-country, shall be assigned the same risk factor as the ones that would result from the application of paragraph 4 of this Article to exposures to an insurance or reinsurance undertaking whose solvency ratio is 100 %.

8.Exposures in the form of bonds and loans to credit institutions and financial institutions within the meaning of points (1) and (26) of Article 4(1) of Regulation (EU) No 575/2013 which comply with the solvency requirements set out in Directive 2013/36/EU and Regulation (EU) No 575/2013, for which a credit assessment by a nominated ECAI is not available, shall be assigned the same risk factor as the ones that would result from the application of paragraph 4 of this Article to exposures to an insurance or reinsurance undertaking whose solvency ratio is 100 %.

9.The capital requirement for spread risk on credit derivatives where the underlying financial instrument is a bond or a loan to any exposure listed in paragraph 2 shall be nil.

10.Type 1 securitisation positions which are fully, unconditionally and irrevocably guaranteed by the European Investment Fund or the European Investment Bank, where the guarantee meets the requirements set out in Article 215, shall be assigned a risk factor stressi of 0 %.

Article 181U.K.Application of the spread risk scenarios to matching adjustment portfolios

Where insurance undertakings apply the matching adjustment referred to in Article 77b of Directive 2009/138/EC, they shall carry out the scenario based calculation for spread risk as follows:

the assets in the assigned portfolio shall be subject to the instantaneous decrease in value for spread risk set out in Articles 176, 178 and 180 of this Regulation;

the technical provisions shall be recalculated to take into account the impact on the amount of the matching adjustment of the instantaneous decrease in value of the assigned portfolio of assets. In particular, the fundamental spread shall increase, by an absolute amount that is calculated as the product of the following:

the absolute increase in spread that, multiplied by the modified duration of the relevant asset, would result in the relevant risk factor stressi , referred to in Articles 176, 178 and 180 of this Regulation;

a reduction factor, depending on the credit quality as set out in the following table:

| Credit quality step | 0 | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|---|

| Reduction factor | 45 % | 50 % | 60 % | 75 % | 100 % | 100 % | 100 % |

For assets in the assigned portfolio for which no credit assessment by a nominated ECAI is available, the reduction factor shall be equal to 100 %.

Subsection 6 U.K. Market risk concentrations sub-module

Article 182U.K.Single name exposure

1.The capital requirement for market risk concentration shall be calculated on the basis of single name exposures. For this purpose exposures to undertakings which belong to the same corporate group shall be treated as a single name exposure. Similarly, immovable properties which are located in the same building shall be considered as a single immovable property.

2.The exposure at default to a counterparty shall be the sum of the exposures to this counterparty.

3.The exposure at default to a single name exposure shall be the sum of the exposures at default to all counterparties that belong to the single name exposure.

4.The weighted average credit quality step on a single name exposure shall be equal to the rounded-up average of the credit quality steps of all exposures to all counterparties that belong to the single name exposure, weighted by the value of each exposure.

5.For the purposes of paragraph 4, exposures for which a credit assessment by a nominated ECAI is available, shall be assigned a credit quality step in accordance with Chapter 1 Section 2 of this Title. Exposures for which a credit assessment by a nominated ECAI is not available shall be assigned to credit quality step 5.

Article 183U.K.Calculation of the capital requirement for market risk concentration

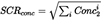

1.The capital requirement for market risk concentration shall be equal to the following:

where:

the sum covers all single name exposures i;

Conci denotes the capital requirement for market risk concentration on a single name exposure i.

2.For each single name exposure i, the capital requirement for market risk concentration Conci shall be equal to the loss in the basic own funds that would result from an instantaneous decrease in the value of the assets corresponding to the single name exposure i equal to the following:

where:

XSi is the excess exposure referred to in Article 184;

gi is the risk factor for market risk concentration referred to in Articles 186 and 187;

Article 184U.K.Excess exposure

1.The excess exposure on a single name exposure i shall be equal to the following:

where:

Ei denotes the exposure at default to single name exposure i that is included in the calculation base of the market risk concentrations sub-module;

Assets denotes the calculation base of the market risk concentrations sub-module;

CTi denotes the relative excess exposure threshold referred to in Article 185.

2.The calculation base of the market risk concentration sub-module Assets shall be equal to the value of all assets held by an insurance or reinsurance undertaking, excluding the following:

(a)assets held in respect of life insurance contracts where the investment risk is fully borne by the policy holders;

(b)exposures to a counterparty which belongs to the same group as the insurance or reinsurance undertaking, provided that all of the following conditions are met:

the counterparty is an insurance or reinsurance undertaking, an insurance holding company, a mixed financial holding company or an ancillary services undertaking;

the counterparty is fully consolidated in accordance with Article 335(1)(a);

the counterparty is subject to the same risk evaluation, measurement and control procedures as the insurance or reinsurance undertaking;

the counterparty is established in the Union;

there is no current or foreseen material practical or legal impediment to the prompt transfer of own funds or repayment of liabilities from the counterparty to the insurance or reinsurance undertaking;

(c)the value of the participations as referred to in Article 92(2) of Directive 2009/138/EC in financial and credit institutions that is deducted from own funds pursuant to Article 68 of this Regulation;

(d)exposures included in the scope of the counterparty default risk module;

(e)deferred tax assets;

(f)intangible assets.

3.The exposure at default on a single name exposure i shall be reduced by the amount of the exposure at default to counterparties belonging to that single name exposure and for which the risk factor for market risk concentration referred to in Articles 168 and 187 is 0 %.

Article 185U.K.Relative excess exposure thresholds

Each single name exposure i shall be assigned, in accordance with the following table, a relative excess exposure threshold depending on the weighted average credit quality step of the single name exposure i, calculated in accordance with Article 182(4).

| Weighted average credit quality step of single name exposure i | 0 | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|---|

| Relative excess exposure threshold CT i | 3 % | 3 % | 3 % | 1,5 % | 1,5 % | 1,5 % | 1,5 % |

Article 186U.K.Risk factor for market risk concentration

1.Each single name exposure i shall be assigned, in accordance with the following table, a risk factor gi for market risk concentration depending on the weighted average credit quality step of the single name exposure i, calculated in accordance with Article 182(4).

| Weighted average credit quality step of single name exposure i | 0 | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|---|

| Risk factor gi | 12 % | 12 % | 21 % | 27 % | 73 % | 73 % | 73 % |

2.Single name exposures to an insurance or reinsurance undertaking for which a credit assessment by a nominated ECAI is not available and where the undertaking meets its Minimum Capital Requirement, shall be assigned a risk factor gi for market risk concentration depending on the undertaking's solvency ratio in accordance with the following table:

| Solvency ratio | 95 % | 100 % | 122 % | 175 % | 196 % |

| Risk factor gi | 73 % | 64,5 % | 27 % | 21 % | 12 % |

Where the solvency ratio falls in between the solvency ratios set out in the table above, the value of gi shall be linearly interpolated from the closest values of gi corresponding to the closest solvency ratios set out in the table above. Where the solvency ratio is lower than 95 %, the risk factor gi shall be equal to 73 %. Where the solvency ratio is higher than 196 %, the risk factor gi shall be equal to 12 %.

For the purposes of this paragraph, ‘solvency ratio’ denotes the ratio of the eligible amount of own funds to cover the Solvency Capital Requirement and the Solvency Capital Requirement, using the latest available values.

3.Single name exposures to insurance or reinsurance undertakings which do not meet their Minimum Capital Requirement, shall be assigned a risk factor gi for market risk concentration equal to 73 %.

Paragraphs 2 and 3 of this Article shall only apply as of the first date of public disclosure, by the undertaking corresponding to the exposure, of the report on its solvency and financial condition referred to in Article 51 of Directive 2009/138/EC. Before that date, if a credit assessment by a nominated ECAI is available for the single name exposure, paragraph 1 shall apply, otherwise, the exposures shall be assigned a risk factor gi of 64,5 %.

4.Single name exposures to a third country insurance or reinsurance undertaking, for which a credit assessment by a nominated ECAI is not available, situated in a country whose solvency regime is deemed equivalent pursuant to Article 227 of Directive 2009/138/EC, and which complies with the solvency requirements of those that third-country, shall be assigned a risk factor gi of 64,5 %.

5.Single name exposures to credit institutions and financial institutions within the meaning of points (1) and (26) of Article 4(1) of Regulation (EU) No 575/2013 and which comply with the solvency requirements set out in of Directive 2013/36/EU and Regulation (EU) No 575/2013, for which a credit assessment by a nominated ECAI is not available, shall be assigned a risk factor gi of 64,5 %.

6.Single name exposures other than those identified in paragraphs 1 to 5 shall be assigned a risk factor gi for market risk concentration of 73 %.

Article 187U.K.Specific exposures

1.Exposures in the form of bonds as referred to Article 52(4) of Directive 2009/65/EC (covered bonds) shall be assigned a relative excess exposure threshold CTi of 15 %, provided that the corresponding exposures in the form of covered bonds have been assigned to credit quality step 0 or 1. Exposures in the form of covered bonds shall be considered as single name exposures, regardless of other exposures to the same counterparty as the issuer of the covered bonds, which constitute a distinct single name exposure.

2.Exposures to a single immovable property shall be assigned a relative excess exposure threshold CTi of 10 % and a risk factor gi for market risk concentration of 12 %.

3.Exposures to the following shall be assigned a risk factor gi for market risk concentration of 0 %:

(a)the European Central Bank;

(b)Member States' central government and central banks denominated and funded in the domestic currency of that central government and central bank;

(c)multilateral development banks referred to in Article 117(2) of Regulation (EU) No 575/2013;

(d)international organisations referred to in Article 118 of Regulation (EU) No 575/2013.

Exposures that are fully, unconditionally and irrevocably guaranteed by one of the counterparties mentioned in points (a) to (d), where the guarantee meets the requirements set out in Article 215, shall also be assigned a risk factor gi for market risk concentration of 0 %.

4.Exposures to central governments and central banks other than those referred to in point (b) of paragraph 3, denominated and funded in the domestic currency of that central government and central bank, shall be assigned a risk factor gi for market risk concentration depending on their weighted average credit quality steps, in accordance with the following table.

| Weighted average credit quality step of single name exposure i | 0 | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|---|

| Risk factor gi | 0 % | 0 % | 12 % | 21 % | 27 % | 73 % | 73 % |

5.Exposures in the form of bank deposits shall be assigned a risk factor gi for market risk concentration of 0 %, provided they meet all of the following requirements:

(a)the full value of the exposure is covered by a government guarantee scheme in the Union;

(b)the guarantee covers the insurance or reinsurance undertaking without any restriction;

(c)there is no double counting of such guarantee in the calculation of the Solvency Capital Requirement.

Subsection 7 U.K. Currency risk sub-module

Article 188U.K.

1.The capital requirement for currency risk referred to in point (e) of the second subparagraph of Article 105(5) of Directive 2009/138/EC shall be equal to the sum of the capital requirements for currency risk for each foreign currency. Investments in type 1 equities referred to in Article 168(2) and type 2 equities referred to in Article 168(3) which are listed in stock exchanges operating with different currencies shall be assumed to be sensitive to the currency of its main listing. Type 2 equities referred to in Article 168(3) which are not listed shall be assumed to be sensitive to the currency of the country in which the issuer has its main operations. Immovable property shall be assumed to be sensitive to the currency of the country in which it is located.

For the purposes of this Article, foreign currencies shall be currencies other than the currency used for the preparation of the insurance or reinsurance undertaking's financial statements (‘the local currency’).

2.For each foreign currency, the capital requirement for currency risk shall be equal to the larger of the following capital requirements:

(a)the capital requirement for the risk of an increase in value of the foreign currency against the local currency;

(b)the capital requirement for the risk of a decrease in value of the foreign currency against the local currency.

3.The capital requirement for the risk of an increase in value of a foreign currency against the local currency shall be equal to the loss in the basic own funds that would result from an instantaneous increase of 25 % in the value of the foreign currency against the local currency.

4.The capital requirement for the risk of a decrease in value of a foreign currency against the local currency shall be equal to the loss in the basic own funds that would result from an instantaneous decrease of 25 % in the value of the foreign currency against the local currency.

5.For currencies which are pegged to the euro, the 25 % factor referred to in paragraphs 3 and 4 of this Article may be adjusted in accordance with the implementing act adopted pursuant to point (d) of Article 109a(2) of Directive 2009/138/EC, provided that all of the following conditions are met:

(a)the pegging arrangement shall ensure that the relative changes in the exchange rate over a one-year period do not exceed the relative adjustments to the 25 % factor, in the event of extreme market events, that correspond to the confidence level set out in Article 101(3) of Directive 2009/138/EC;

(b)one of the following criteria is complied with:

participation of the currency in the European Exchange Rate Mechanism (ERM II);

existence of a decision from the Council which recognises pegging arrangements between this currency and the euro;

establishment of the pegging arrangement by the law of country establishing the country's currency.

For the purposes of point (a), the financial resources of the parties that guarantee the pegging shall be taken into account.

6.The impact of an increase or a decrease in the value of a foreign currency against the local currency on the value of participations as defined in Article 92(2) of Directive 2009/138/EC in financial and credit institutions, shall be considered only on the value of the participations that are not deducted from own funds pursuant to Article 68 of this Regulation. The part deducted from own funds shall be considered only to the extent such impact increases the basic own funds.

7.Where the larger of the capital requirements referred to in points (a) and (b) of paragraph 2 and the largest of the corresponding capital requirements calculated in accordance with Article 206(2) are not based on the same scenario, the capital requirement for currency risk on a given currency shall be the capital requirement referred to in points (a) or (b) of paragraph 2 for which the underlying scenario results in the largest corresponding capital requirement calculated in accordance with Article 206(2).

Regulation (EU) No 346/2013 of the European Parliament and of the Council of 17 April 2013 on European social entrepreneurship funds (OJ L 115, 25.4.2013, p. 18).

Directive 2007/46/EC of the European Parliament and of the Council of 5 September 2007 establishing a framework for the approval of motor vehicles and their trailers, and of systems, components and separate technical units intended for such vehicles (Framework Directive) (OJ L 263, 9.10.2007, p. 1).

Directive 2003/37/EC of the European Parliament and of the Council of 26 May 2003 on type-approval of agricultural or forestry tractors, their trailers and interchangeable towed machinery, together with their systems, components and separate technical units and repealing Directive 74/150/EEC (OJ L 171, 9.7.2003, p. 1–80).

Directive 2002/24/EC of the European Parliament and of the Council of 18 March 2002 relating to the Type-approval of two or three-wheel motor vehicles and repealing Council Directive 92/61/EEC (OJ L 124, 9.5.2002, p. 1–44).

Directive 2014/17/EU of the European Parliament and of the Council of 4 February 2014 on credit agreements for consumers relating to residential immovable property and amending Directives 2008/48/EC and 2013/36/EU and Regulation (EU) No 1093/2014, OJ L 60, 28.2.2014, p. 34.

Directive 2008/48/EC of the European Parliament and of the Council of 23 April 2008 on credit agreements for consumers and repealing Council Directive 87/102/EEC, OJ L 133, 22.5.2008, p. 66.

Options/Cymorth

Print Options

PrintThe Whole Regulation

PrintThe Whole Title

PrintThe Whole Chapter

PrintThis Section only

You have chosen to open The Whole Regulation

The Whole Regulation you have selected contains over 200 provisions and might take some time to download. You may also experience some issues with your browser, such as an alert box that a script is taking a long time to run.

Would you like to continue?

You have chosen to open The Whole Regulation as a PDF

The Whole Regulation you have selected contains over 200 provisions and might take some time to download.

Would you like to continue?

You have chosen to open The Whole Regulation without Annexes

The Whole Regulation without Annexes you have selected contains over 200 provisions and might take some time to download. You may also experience some issues with your browser, such as an alert box that a script is taking a long time to run.

Would you like to continue?

You have chosen to open The Whole Regulation without Annexes as a PDF

The Whole Regulation without Annexes you have selected contains over 200 provisions and might take some time to download.

Would you like to continue?

You have chosen to open the Whole Regulation

The Whole Regulation you have selected contains over 200 provisions and might take some time to download. You may also experience some issues with your browser, such as an alert box that a script is taking a long time to run.

Would you like to continue?

You have chosen to open the Whole Regulation without Annexes

The Whole Regulation without Annexes you have selected contains over 200 provisions and might take some time to download. You may also experience some issues with your browser, such as an alert box that a script is taking a long time to run.

Would you like to continue?

You have chosen to open Schedules only

Y Rhestrau you have selected contains over 200 provisions and might take some time to download. You may also experience some issues with your browser, such as an alert box that a script is taking a long time to run.

Would you like to continue?

Mae deddfwriaeth ar gael mewn fersiynau gwahanol:

Y Diweddaraf sydd Ar Gael (diwygiedig):Y fersiwn ddiweddaraf sydd ar gael o’r ddeddfwriaeth yn cynnwys newidiadau a wnaed gan ddeddfwriaeth ddilynol ac wedi eu gweithredu gan ein tîm golygyddol. Gellir gweld y newidiadau nad ydym wedi eu gweithredu i’r testun eto yn yr ardal ‘Newidiadau i Ddeddfwriaeth’.

Gwreiddiol (Fel y’i mabwysiadwyd gan yr UE): Mae'r wreiddiol version of the legislation as it stood when it was first adopted in the EU. No changes have been applied to the text.

Pwynt Penodol mewn Amser: This becomes available after navigating to view revised legislation as it stood at a certain point in time via Advanced Features > Show Timeline of Changes or via a point in time advanced search.

Gweler y wybodaeth ychwanegol ochr yn ochr â’r cynnwys

Rhychwant ddaearyddol: Indicates the geographical area that this provision applies to. For further information see ‘Frequently Asked Questions’.

Dangos Llinell Amser Newidiadau: See how this legislation has or could change over time. Turning this feature on will show extra navigation options to go to these specific points in time. Return to the latest available version by using the controls above in the What Version box.

Rhagor o Adnoddau

Gallwch wneud defnydd o ddogfennau atodol hanfodol a gwybodaeth ar gyfer yr eitem ddeddfwriaeth o’r tab hwn. Yn ddibynnol ar yr eitem ddeddfwriaeth sydd i’w gweld, gallai hyn gynnwys:

- y PDF print gwreiddiol y fel adopted version that was used for the EU Official Journal

- rhestr o newidiadau a wnaed gan a/neu yn effeithio ar yr eitem hon o ddeddfwriaeth

- pob fformat o’r holl ddogfennau cysylltiedig

- slipiau cywiro

- dolenni i ddeddfwriaeth gysylltiedig ac adnoddau gwybodaeth eraill

Llinell Amser Newidiadau

Mae’r llinell amser yma yn dangos y fersiynau gwahanol a gymerwyd o EUR-Lex yn ogystal ag unrhyw fersiynau dilynol a grëwyd ar ôl y diwrnod ymadael o ganlyniad i newidiadau a wnaed gan ddeddfwriaeth y Deyrnas Unedig.

Cymerir dyddiadau fersiynau’r UE o ddyddiadau’r dogfennau ar EUR-Lex ac efallai na fyddant yn cyfateb â’r adeg pan ddaeth y newidiadau i rym ar gyfer y ddogfen.

Ar gyfer unrhyw fersiynau a grëwyd ar ôl y diwrnod ymadael o ganlyniad i newidiadau a wnaed gan ddeddfwriaeth y Deyrnas Unedig, bydd y dyddiad yn cyd-fynd â’r dyddiad cynharaf y daeth y newid (e.e. ychwanegiad, diddymiad neu gyfnewidiad) a weithredwyd i rym. Am ragor o wybodaeth gweler ein canllaw i ddeddfwriaeth ddiwygiedig ar Ddeall Deddfwriaeth.

Rhagor o Adnoddau

Defnyddiwch y ddewislen hon i agor dogfennau hanfodol sy’n cyd-fynd â’r ddeddfwriaeth a gwybodaeth am yr eitem hon o ddeddfwriaeth. Gan ddibynnu ar yr eitem o ddeddfwriaeth sy’n cael ei gweld gall hyn gynnwys:

- y PDF print gwreiddiol y fel adopted fersiwn a ddefnyddiwyd am y copi print

- slipiau cywiro

liciwch ‘Gweld Mwy’ neu ddewis ‘Rhagor o Adnoddau’ am wybodaeth ychwanegol gan gynnwys

- rhestr o newidiadau a wnaed gan a/neu yn effeithio ar yr eitem hon o ddeddfwriaeth

- manylion rhoi grym a newid cyffredinol

- pob fformat o’r holl ddogfennau cysylltiedig

- dolenni i ddeddfwriaeth gysylltiedig ac adnoddau gwybodaeth eraill