- Y Diweddaraf sydd Ar Gael (Diwygiedig)

- Pwynt Penodol mewn Amser (01/04/2004)

- Gwreiddiol (Fel y'i Deddfwyd)

Leasehold Reform Act 1967

You are here:

- Deddfau Cyhoeddus Cyffredinol y Deyrnas Unedig

- 1967 c. 88

- Part I

- Right to enfranchisement or...

- Dangos Graddfa Ddaearyddol(e.e. Lloegr, Cymru, Yr Alban aca Gogledd Iwerddon)

- Dangos Llinell Amser Newidiadau

Rhagor o Adnoddau

Status:

Point in time view as at 01/04/2004.

Changes to legislation:

Leasehold Reform Act 1967, Cross Heading: Right to enfranchisement or extension is up to date with all changes known to be in force on or before 17 November 2024. There are changes that may be brought into force at a future date. Changes that have been made appear in the content and are referenced with annotations.![]()

Changes to Legislation

Changes and effects yet to be applied by the editorial team are only applicable when viewing the latest version or prospective version of legislation. They are therefore not accessible when viewing legislation as at a specific point in time. To view the ‘Changes to Legislation’ information for this provision return to the latest version view using the options provided in the ‘What Version’ box above.

Right to enfranchisement or extensionE+W

1 Tenants entitled to enfranchisement or extension.E+W

(1)This Part of this Act shall have effect to confer on a tenant of a leasehold house F1. . . a right to acquire on fair terms the freehold or an extended lease of the house and premises where—

[F2(a)his tenancy is a long tenancy at a low rent and,—

(i)if the tenancy was entered into before 1st April 1990 [F3, or on or after 1st April 1990 in pursuance of a contract made before that date, and the house and premises had a rateable value at the date of commencement of the tenancy or else at any time before 1st April 1990,] subject to subsections (5) and (6) below, the rateable value of the house and premises on the appropriate day was not more than £200 or, if it is in Greater London, than £400; and

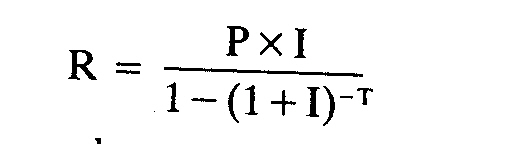

(ii)if the tenancy [F3does not fall within sub-paragraph (i) above,] on the date the contract for the grant of the tenancy was made or, if there was no such contract, on the date the tenancy was entered into R did not exceed £25,000 under the formula—

where—

P is the premium payable as a condition of the grant of the tenancy (and includes a payment of money’s worth) or, where no premium is so payable, zero,

I is 0.06, and

T is the term, expressed in years, granted by the tenancy (disregarding any right to terminate the tenancy before the end of the term or to extend the tenancy); and]

(b)at the relevant time (that is to say, at the time when he gives notice in accordance with this Act of his desire to have the freehold or to have an extended lease, as the case may be) he has been tenant of the house under a long tenancy at a low rent F1. . . for the last [F4two years] ;

and to confer the like right in the other cases for which provision is made in this Part of this Act.

[F5(1ZA)Where a house is for the time being let under two or more tenancies, a tenant under any of those tenancies which is superior to that held by any tenant on whom this Part of this Act confers a right does not have any right under this Part of this Act.

(1ZB)Where a flat forming part of a house is let to a person who is a qualifying tenant of the flat for the purposes of Chapter 1 or 2 of Part 1 of the Leasehold Reform, Housing and Urban Development Act 1993 (c. 28), a tenant of the house does not have any right under this Part of this Act unless, at the relevant time, he has been occupying the house, or any part of it, as his only or main residence (whether or not he has been using it for other purposes)—

(a)for the last two years; or

(b)for periods amounting to two years in the last ten years.]

[F6(1ZC)The references in subsection (1)(a) and (b) to a long tenancy do not include a tenancy to which Part 2 of the Landlord and Tenant Act 1954 (business tenancies) applies unless—

(a)it is granted for a term of years certain exceeding thirty-five years, whether or not it is (or may become) terminable before the end of that term by notice given by or to the tenant or by re-entry, forfeiture or otherwise,

(b)it is for a term fixed by law under a grant with a covenant or obligation for perpetual renewal, unless it is a tenancy by sub-demise from one which is not a tenancy which falls within any of the paragraphs in this subsection,

(c)it is a tenancy taking effect under section 149(6) of the Law of Property Act 1925 (c. 20) (leases terminable after a death or marriage), or

(d)it is a tenancy which—

(i)is or has been granted for a term of years certain not exceeding thirty-five years, but with a covenant or obligation for renewal without payment of a premium (but not for perpetual renewal), and

(ii)is or has been once or more renewed so as to bring to more than thirty-five years the total of the terms granted (including any interval between the end of a tenancy and the grant of a renewal).

(1ZD)Where this Part of this Act applies as if there were a single tenancy of property comprised in two or more separate tenancies, then, if each of the separate tenancies falls within any of the paragraphs of subsection (1ZC) above, that subsection shall apply as if the single tenancy did so.]

[F7(1A)The references in subsection (1)(a) and (b) to a long tenancy at a low rent do not include a tenancy excluded from the operation of this Part by section 33A of and Schedule 4A to this Act.]

[F8(1B)This Part of this Act shall not have effect to confer any right on the tenant of a house under a tenancy to which Part 2 of the Landlord and Tenant Act 1954 (c. 56) (business tenancies) applies unless, at the relevant time, the tenant has been occupying the house, or any part of it, as his only or main residence (whether or not he has been using it for other purposes)—

(a)for the last two years; or

(b)for periods amounting to two years in the last ten years.]

(2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(3)This Part of this Act shall not confer on the tenant of a house any right by reference to his [F9being a tenant of it] at any time when—

(a)it is let to F10. . . him with other land or premises to which it is ancillary; or

[F11(b)it is comprised in—

(i)an agricultural holding within the meaning of the Agricultural Holdings Act 1986 held under a tenancy in relation to which that Act applies, or

(ii)the holding held under a farm business tenancy within the meaning of the Agricultural Tenancies Act 1995]

[F12or, in the case of any right to which subsection (3A) below applies, at any time when the tenant’s immediate landlord is a charitable housing trust and the house forms part of the housing accommodation provided by the trust in the pursuit of its charitable purposes.]

[F13(3A)For the purposes of subsection (3) above this subsection applies as follows—

(a)where the tenancy was created after the commencement of Chapter III of Part I of the Leasehold Reform, Housing and Urban Development Act 1993, this subsection applies to any right to acquire the freehold of the house and premises; but

(b)where the tenancy was created before that commencement, this subsection applies only to any such right exercisable by virtue of any one or more of the provisions of sections 1A [F14, 1AA]] and 1B below;

and in that subsection “charitable housing trust” means a housing trust within the meaning of the Housing Act 1985 which is a charity within the meaning of the Charities Act 1993.

(4)In subsection (1)(a) above, “the appropriate day”, in relation to any house and premises, means the 23rd March 1965 or such later day as by virtue of [F15section 25(3) of the M1Rent Act 1977] would be the appropriate day for purposes of that Act in relation to a dwelling house consisting of that house.

[F16(4A)Schedule 8 to the M2Housing Act 1974 shall have effect to enable a tenant to have the rateable value of the house and premises reduced for purposes of this section in consequence of tenant’s improvements.]

[F17(5)If, in relation to any house and premises, the appropriate day for the purposes of subsection (1)(a) above falls on or after 1st April 1973 that subsection shall have effect in relation to the house and premises,—

(a)in a case where the tenancy was created on or before 18th February 1966, as if for the sums of £200 and £400 specified in that subsection there were substituted respectively the sums of £750 and £1,500; and

(b)in a case where the tenancy was created after 18th February 1966, as if for those sums of £200 and £400 there were substituted respectively the sums of £500 and £1,000.

(6)If, in relation to any house and premises,—

(a)the appropriate day for the purposes of subsection (1)(a) above falls before 1st April 1973, and

(b)the rateable value of the house and premises on the appropriate day was more than £200 or, if it was then in Greater London, £400, and

(c)the tenancy was created on or before 18th February 1966,

subsection (1)(a) above shall have effect in relation to the house and premises as if for the reference to the appropriate day there were substituted a reference to 1st April 1973 and as if for the sums of £200 and £400 specified in that subsection there were substituted respectively the sums of £750 and £1,500.]

[F18(7)The Secretary of State may by order replace the amount referred to in subsection (1)(a)(ii) above and the number in the definition of “I” in that subsection by such amount or number as is specified in the order; and such an order shall be made by statutory instrument which shall be subject to annulment in pursuance of a resolution of either House of Parliament.]

Textual Amendments

F1Words in s. 1(1) repealed (26.7.2002 for E. and 1.1.2003 for W.) by 2002 c. 15, ss. 138(1), 180, Sch. 14; S.I. 2002/1912, art. 2(b)(ii), Sch. 1 Pt. 3 (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.); S.I. 2002/3012, art. 2(b), Sch. 1 Pt. 3 (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.)

F2S. 1(1)(a) substituted by S.I. 1990/434, reg. 2, Sch. para. 5 (as amended by S.I. 1990/701, reg. 2)

F3Words in s. 1(1)(a)(i)(ii) substituted (1.10.1996) by 1996 c. 52, s. 114; S.I. 1996/2212, arts. 1(2), 2(2), Sch.

F4Words in s. 1(1)(b) substituted (26.7.2002 for E. and 1.1.2003 for W.) by 2002 c. 15, s. 139(1); S.I. 2002/1912, art. 2(b)(i) (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.); S.I. 2002/3012, art. 2(b)(i) (subject to transitional provions and savings in Sch. 2 of the commencing S.I.)

F5S. 1(1ZA)(1ZB) inserted (26.7.2002 for E. and 1.1.2003 for W.) by 2002 c. 15, s. 138(2); S.I. 2002/1912, art. 2(b)(i) (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.); S.I. 2002/3012, art. 2(b)(i) (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.)

F6S. 1(1ZC)(1ZD) inserted (26.7.2002 for E. and 1.1.2003 for W.) by 2002 c. 15, s. 140; S.I. 2002/1912, art. 2(b)(i) (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.); S.I. 2002/3012, art. 2(b)(i) (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.)

F7S. 1(1A) inserted by Housing and Planning Act 1986 (c. 63, SIF 75:1), s. 18, Sch. 4 para. 3

F8S. 1(1B) inserted (26.7.2002 for E. and 1.1.2003 for W.) by 2002 c. 15, s. 139(2); S.I. 2002/1912, art. 2(b)(i) (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.); S.I. 2002/3012, art. 2(b)(i) (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.)

F9Words in s. 1(3) substituted (26.7.2002 for E. and 1.1.2003 for W.) by 2002 c. 15, s. 138(3); S.I. 2002/1912, art. 2(b)(i) (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.); S.I. 2002/3012, art. 2(b)(i) (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.)

F10Words in s. 1(3)(a) repealed (26.7.2002 for E. and 1.1.2003 for W.) by 2002 c. 15, s. 180, Sch. 14; S.I. 2002/1912, art. 2(b)(ii), Sch. 1 Pt. 3 (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.); S.I. 2002/3012, art. 2(b)(ii), Sch. 1 Pt. 3 (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.)

F12Words in s. 1(3) added (1.11.1993) by 1993 c. 28, s. 67(2); S.I. 1993/2134, art 5(b) (subject to arts. 4, 5, Sch. 1 para. 1)

F13S. 1(3A) inserted (1.11.1993) by 1993 c. 28, s. 67(3); S.I. 1993/2134, art 5(b) (subject to arts. 4, 5, Sch. 1 para. 1)

F14Words in S. 1(3A)(b) inserted (1.4.1997) by 1996 c. 52, ss. 106, Sch. 9 para. 2(1)(2); S.I. 1997/618, art. 2(1) (with Sch.)

F15Words substituted by Rent Act 1977 (c. 42), s. 155(2), Sch. 23 para. 42

F16S. 1(4A) substituted by Housing Act 1980 (c. 51), Sch. 21 para. 2

F17S. 1(5)(6) added by Housing Act 1974 (c. 44), s. 118(1)(5)

F18S. 1(7) inserted by S.I. 1990/434, reg. 2, Sch. para. 6

Marginal Citations

[F191A Right to enfranchisement only in case of houses whose value or rent exceeds limit under s.1 or 4.E+W

(1)Where subsection (1) of section 1 above would apply in the case of the tenant of a house but for the fact that the applicable financial limit specified in subsection (1)(a)(i) or (ii) or (as the case may be) subsection (5) or (6) of that section is exceeded, this Part of this Act shall have effect to confer on the tenant the same right to acquire the freehold of the house and premises as would be conferred by subsection (1) of that section if that limit were not exceeded.

(2)Where a tenancy of any property is not a tenancy at a low rent in accordance with section 4(1) below but is a tenancy falling within section 4A(1) below, the tenancy shall nevertheless be treated as a tenancy at a low rent for the purposes of this Part of this Act so far as it has effect for conferring on any person a right to acquire the freehold of a house and premises.]

Textual Amendments

F19S. 1A inserted (1.11.1993) by 1993 c. 28, s. 63; S.I. 1993/2134, art. 5(a)

[F201AA Additional right to enfranchisement only in case of houses whose rent exceeds applicable limit under section 4.E+W

(1)Where—

(a)section 1(1) above would apply in the case of the tenant of a house but for the fact that the tenancy is not a tenancy at a low rent, and

(b)the tenancy F21. . . is not an excluded tenancy,

this Part of this Act shall have effect to confer on the tenant the same right to acquire the freehold of the house and premises as would be conferred by section 1(1) above if it were a tenancy at a low rent.

F22(2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(3)A tenancy is an excluded tenancy for the purposes of subsection (1) above if—

(a)the house which the tenant occupies under the tenancy is in an area designated for the purposes of this provision as a rural area by order made by the Secretary of State,

(b)the freehold of that house is owned together with adjoining land which is not occupied for residential purposes and has been owned together with such land since [F231st April 1997 (the date on which section 106 of the Housing Act 1996 came into force)], and

[F24(c)the tenancy either—

(i)was granted on or before that date, or

(ii)was granted after that date, but on or before the coming into force of section 141 of the Commonhold and Leasehold Reform Act 2002, for a term of years certain not exceeding thirty-five years.]

(4)Where this Part of this Act applies as if there were a single tenancy of property comprised in two or more separate tenancies, then, if each of the separate tenancies falls within subsection (2) above, this section shall apply as if the single tenancy did so.

(5)The power to make an order under subsection (3) above shall be exercisable by statutory instrument which shall be subject to annulment in pursuance of a resolution of either House of Parliament.]

Textual Amendments

F20S. 1AA inserted (1.4.1997) by 1996 c. 52, s. 106, Sch. 9 para. 1; S.I. 1997/618, art. 2(1) (with Sch.)

F21Words in s. 1AA(1)(b) repealed (26.7.2002 for E. and 1.1.2003 for W.) by 2002 c. 15, ss. 141(2)(a), 180, Sch. 14; S.I. 2002/1912, art. 2(b), Sch. 1 Pt. 3 (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.); S.I. 2002/3012, art. 2(b), Sch. 1 Pt. 3 (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.)

F22S. 1AA(2) repealed (26.7.2002 for E. and 1.1.2003 for W.) by 2002 c. 15, ss. 141(2)(b), 180, Sch. 14; S.I. 2002/1912, art. 2(b), Sch. 1 Pt. 3 (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.); S.I. 2002/3012, art. 2(b), Sch. 1 Pt. 3 (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.)

F23Words in s. 1AA(3)(b) substituted (26.7.2002 for E. and 1.1.2003 for W.) by 2002 c. 15, s. 141(3)(a); S.I. 2002/1912, art. 2(b)(i) (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.); S.I. 2002/3012, art. 2(b)(i) (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.)

F24S. 1AA(3)(c) substituted (26.7.2002 for E. and 1.1.2003 for W.) by 2002 c. 15, s. 141(3)(b); S.I. 2002/1912, art. 2(b)(i) (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.); S.I. 2002/3012, art. 2(b)(i) (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.)

[1BF25Right to enfranchisement only in case of certain tenancies terminable after death or marriage.E+W

Where a tenancy granted so as to become terminable by notice after a death or marriage—

(a)is (apart from this section) a long tenancy in accordance with section 3(1) below, but

(b)was granted before 18th April 1980 or in pursuance of a contract entered into before that date,

then (notwithstanding section 3(1)) the tenancy shall be a long tenancy for the purposes of this Part of this Act only so far as this Part has effect for conferring on any person a right to acquire the freehold of a house and premises.]

Textual Amendments

F25S. 1B inserted (1.11.1993) by 1993 c. 28, s. 64(1); S.I. 1993/2134, art 5(a)

2 Meaning of “house” and “houses and premises”, and adjustment of boundary.E+W

(1)For purposes of this Part of this Act, “house” includes any building designed or adapted for living in and reasonably so called, notwithstanding that the building is not structurally detached, or was or is not solely designed or adapted for living in, or is divided horizontally into flats or maisonettes; and—

(a)where a building is divided horizontally, the flats or other units into which it is so divided are not separate “houses”, though the building as a whole may be; and

(b)where a building is divided vertically the building as a whole is not a “house” though any of the units into which it is divided may be.

(2)References in this Part of this Act to a house do not apply to a house which is not structurally detached and of which a material part lies above or below a part of the structure not comprised in the house.

(3)Subject to the following provisions of this section, where in relation to a house let to F26. . . a tenant reference is made in this Part of this Act to the house and premises, the reference to premises is to be taken as referring to any garage, outhouse, garden, yard and appurtenances which at the relevant time are let to him with the house F26. . ..

(4)In relation to the exercise by a tenant of any right conferred by this Part of this Act there shall be treated as included in the house and premises any other premises let with the house and premises but not at the relevant time [F27subject to a tenancy vested in him](whether in consequence of an assignment of the term therein F26. . . or otherwise), if—

(a)the landlord at the relevant time has an interest in the other premises and, not later than two months after the relevant time, gives to the tenant written notice objecting to the further severance of them from the house and premises; and

(b)either the tenant agrees to their inclusion with the house and premises or the court is satisfied that it would be unreasonable to require the landlord to retain them without the house and premises.

(5)In relation to the exercise by a tenant of any right conferred by this Part of this Act there shall be treated as not included in the house and premises any part of them which lies above or below other premises (not consisting only of underlying mines or minerals), if—

(a)the landlord at the relevant time has an interest in the other premises and, not later than two months after the relevant time, gives to the tenant written notice objecting to the further severance from them of that part of the house and premises; and

(b)either the tenant agrees to the exclusion of that part of the house and premises or the court is satisfied that any hardship or inconvenience likely to result to the tenant from the exclusion, when account is taken of anything that can be done to mitigate its effects and of any undertaking of the landlord to take steps to mitigate them, is outweighed by the difficulties involved in the further severance from the other premises and any hardship or inconvenience likely to result from that severance to persons interested in those premises.

(6)The rights conferred on a tenant by this Part of this Act in relation to any house and premises shall not extend to underlying minerals comprised in the tenancy if the landlord requires that the minerals be excepted, and if proper provision is made for the support of the house and premises as they have been enjoyed during the tenancy and in accordance with its terms.

(7)Where by virtue of subsection (4) above a tenant of a house acquiring the freehold or an extended lease is required to include premises of which the tenancy is not vested in him, this Part of this Act shall apply for the purpose as if in the case of those premises a tenancy on identical terms were vested in him and the holder of the actual tenancy were a sub-tenant; and where by virtue of subsection (5) or (6) above a tenant of a house acquiring the freehold or an extended lease is required to exclude property of which the tenancy is vested in him, then unless the landlord and the tenant otherwise agree or the court for the protection of either of them from hardship or inconvenience otherwise orders, the grant to the tenant shall operate as a surrender of the tenancy in that property and the provision to be made by the grant shall be determined as if the surrender had taken place before the relevant time.

Textual Amendments

F26Words in s. 2(3)(4) repealed (26.7.2002 for E. and 1.1.2003 for W.) by 2002 c. 15, s. 180, Sch. 14; S.I. 2002/1912, art. 2(b)(ii), Sch. 1 Pt. 3 (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.); S.I. 2002/3012, art. 2(b)(ii), Sch. 1 Pt. 3 (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.)

F27Words in s. 2(4) substituted (26.7.2002 for E. and 1.1.2003 for W.) by 2002 c. 15, s. 138(4), S.I. 2002/1912, art. 2(b)(i) (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.); S.I. 2002/3012, art. 2(b)(i) (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.)

3 Meaning of “long tenancy”.E+W

(1)In this Part of this Act “long tenancy” means, subject to the provisions of this section, a tenancy granted for a term of years certain exceeding twenty-one years, whether or not the tenancy is (or may become) terminable before the end of that term by notice given by or to the tenant or by re-entry, forfeiture or otherwise, and includes [F28both a tenancy taking effect under section 149(6) of the Law of Property Act 1925 (leases terminable after a death or marriage) and] a tenancy for a term fixed by law under a grant with a covenant or obligation for perpetual renewal unless it is a tenancy by sub-demise from one which is not a long tenancy:

Provided that a tenancy granted so as to become terminable by notice after a death or marriage is not to be treated as a long tenancy [F29if—

(a)the notice is capable of being given at any time after the death or marriage of the tenant;

(b)the length of the notice is not more than three months; and

(c)the terms of the tenancy preclude both—

(i)its assignment otherwise than by virtue of section 92 of the Housing Act 1985 (assignments by way of exchange), and

(ii)the sub-letting of the whole of the premises comprised in it.]

(2)Where the tenant of any property under a long tenancy at a low rent [F30(other than a lease excluded from the operation of this Part by section 33A of and Schedule 4A to this Act)] , on the coming to an end of that tenancy, becomes or has become tenant of the property or part of it under another tenancy (whether by express grant or by implication of law), then the later tenancy shall be deemed for the purposes of this Part of this Act, including any further application of this subsection, to be a long tenancy irrespective of its terms.

(3)Where the tenant of any property under a long tenancy, on the coming to an end of that tenancy, becomes or has become tenant of the property or part of it under another long tenancy, then in relation to the property or that part of it this Part of this Act F31. . . shall apply as if there had been a single tenancy granted for a term beginning at the same time as the term under the earlier tenancy and expiring at the same time as the term under the later tenancy.

(4)Where a tenancy is or has been granted for a term of years certain not exceeding twenty-one years, but with a covenant or obligation for renewal without payment of a premium (but not for perpetual renewal), and the tenancy is or has been once or more renewed so as to bring to more than twenty-one years the total of the terms granted (including any interval between the end of a tenancy and the grant of a renewal), then this Part of this Act shall apply as it would apply if the term originally granted had been one exceeding twenty-one years.

(5)References in this Part of this Act to a long tenancy include any period during which the tenancy is or was continued under Part I or II of the M3Landlord and Tenant Act 1954 [F32under Schedule 10 to the Local Government and Housing Act 1989] or under the M4Leasehold Property (Temporary Provisions) Act 1951.

(6)Where at any time there are separate tenancies, with the same landlord and the same tenant, of two or more parts of a house, or of a house or part of it and land or other premises occupied therewith, then in relation to the property comprised in such of those tenancies as are long tenancies this Part of this Act shall apply as it would if at that time there were a single tenancy of that property and the tenancy were a long tenancy, and for that purpose references in this Part of this Act to the commencement of the term or to the term date shall, if the separate tenancies commenced at different dates or have different term dates, have effect as references to the commencement or term date, as the case may be, of the tenancy comprising the house (or the earliest commencement or earliest term date of the tenancies comprising it):

Provided that this subsection shall have effect subject to the operation of subsections (2) to (5) above in relation to any of the separate tenancies.

Textual Amendments

F28Words in s. 3(1) inserted (1.11.1993) by 1993 c. 28, s. 64(2)(a); S.I. 1993/2134, art. 5(a)

F29Word and 3(1)(a)-(c) substituted (1.11.1993) by 1993 c. 28, s. 64(2)(b); S.I. 1993/2134, art. 5(a)

F30Words inserted by Housing and Planning Act 1986 (c. 63, SIF 75:1), s. 18, Sch. 4 para. 4

F31Words in s. 3(3) repealed (26.7.2002 for E. and 1.1.2003 for W.) by 2002 c. 15, s. 180, Sch. 14; S.I. 2002/1912, art. 2(b)(ii), Sch. 1 Pt. 3 (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.); S.I. 2002/3012, art. 2(b)(ii), Sch. 1 Pt. 3 (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.)

F32Words inserted by Local Government and Housing Act 1989 (c. 42, SIF 75:1), s. 194(1), Sch. 11 para. 8

Marginal Citations

4 Meaning of “low rent”.E+W

(1)For purposes of this Part of this Act a tenancy of any property is a tenancy at a low rent at any time when rent is not payable under the tenancy in respect of the property at a yearly rate

[F33(i)if the tenancy was entered into before 1st April 1990 [F34, or on or after 1st April 1990 in pursuance of a contract made before that date, and the property had a rateable value other than nil at the date of the commencement of the tenancy or else at any time before 1st April 1990,]] equal to or more than two-thirds of the rateable value of the property on the appropriate day or, if later, the first day of the term

[F35(ii)if the tenancy [F36does not fall within paragraph (i) above,] more than £1,000 if the property is in Greater London and £250 if the property is elsewhere]:

Provided that a tenancy granted between the end of August 1939 and the beginning of April 1963 otherwise than by way of building lease (whether or not it is, by virtue of section 3(3) above, to be treated for other purposes as forming a single tenancy with a previous tenancy) shall not be regarded as a tenancy at a low rent if at the commencement of the tenancy the rent payable under the tenancy exceeded two-thirds of the letting value of the property (on the same terms).

For the purposes of this subsection—

“appropriate day” means the 23rd March 1965 or such later day as by virtue of [F37section 25(3) of the M5Rent Act 1977] would be the appropriate day for purposes of that Act in relation to a dwelling-house consisting of the house in question [F38if the reference in paragraph (a) of that provision to a rateable value were to a rateable value other than nil]; and

“rent” means rent reserved as such, and there shall be disregarded any part of the rent expressed to be payable in consideration of services to be provided, or of repairs, maintenance or insurance to be effected by the landlord, or to be payable in respect of the cost thereof to the landlord or a superior landlord; and

there shall be disregarded any term of the tenancy providing for suspension or reduction of rent in the event of damage to property demised, or for any penal addition to the rent in the event of a contravention of or non-compliance with the terms of the tenancy or an agreement collateral thereto; and

“building lease” means a lease granted in pursuance or in consideration of an agreement for the erection or the substantial re-building or reconstruction of the whole or part of the house in question or a building comprising it.

(2)Where on a claim by the tenant of a house to exercise any right conferred by this Part of this Act a question arises under section 1(1) above whether his tenancy of the house is or was at any time a tenancy at a low rent, the question shall be determined by reference to the rent and rateable value of the house and premises as a whole, and in relation to a time before the relevant time shall be so determined whether or not the property then occupied with the house or any part of it was the same in all respects as that comprised in the house and premises for purposes of the claim; but, in a case where the tenancy derives (in accordance with section 3(6) above) from more than one separate tenancy, the proviso to subsection (1) above shall have effect if, but only if, it applies to one of the separate tenancies which comprises the house or part of it.

(3)Where on a claim by the tenant of a house to exercise any right conferred by this Part of this Act a question arises under section 3(2) above whether a tenancy is or was a long tenancy by reason of a previous tenancy having been a long tenancy at a low rent, the question whether the previous tenancy was one at a low rent shall be determined in accordance with subsection (2) above as if it were a question arising under section 1(1), and shall be so determined by reference to the rent and rateable value of the house and premises or the part included in the previous tenancy, exclusive of any other land or premises so included:

Provided that where an apportionment of rent or rateable value is required because the previous tenancy did not include the whole of the house and premises or included other property, the apportionment shall be made as at the end of the previous tenancy except in so far as, in the case of rent, an apportionment falls to be made at an earlier date under subsection (6) below.

(4)For purposes of subsection (2) or (3) above a house and premises shall be taken as not including any premises which are to be or may be included under section 2(4) above in giving effect to the tenant’s claim, and as including any part which is to be or may be excluded under section 2(5) or (6).

(5)Where on a claim by the tenant of a house to exercise any right conferred by this Part of this Act a question arises whether a tenancy granted as mentioned in the proviso to subsection (1) above is or was at any time a tenancy at a low rent, it shall be presumed until the contrary is shown that the letting value referred to in that proviso was such that the proviso does not apply.

(6)Any entire rent payable at any time in respect of both a house and premises or part thereof and of property not included in the house and premises shall for purposes of this section be apportioned as may be just according to the circumstances existing at the date of the severance giving rise to the apportionment, and references in this section to the rent of a house and premises or of part thereof shall be construed accordingly.

[F39(7)Section 1(7) above applies to any amount referred to in subsection (1)(ii) above as it applies to the amount referred to in subsection (1)(a)(ii) of that section.]

Textual Amendments

F33Words inserted by S.I. 1990/434, reg. 2, Sch. para. 7(a)

F34Words in s. 4(1)(i) substituted (1.10.1996) by 1996 c. 52, s. 105(1)(a); S.I. 1996/2212, arts. 1(2), 2(2) (with Sch.)

F35S. 4(1)(ii) inserted by S.I. 1990/434, reg. 2, Sch. para. 7(b)

F36Words in s. 4(1)(ii) substituted (1.10.1996) by 1996 c. 52, s. 105(1)(b); S.I. 1996/2212, arts. 1(2), 2(2) (with Sch.)

F37Words substituted by Rent Act 1977 (c. 42), s. 155(2), Sch. 23 para. 42

F38S. 4(1)(a): words in definition of

“appropriate day”

inserted (1.10.1996) by 1996 c. 52, s. 105(1)(c); S.I. 1996/2212, arts. 1(2), 2(2) (with Sch.)

F39S. 4(7) inserted by S.I. 1990/434, reg. 2, Sch. para. 8

Modifications etc. (not altering text)

C1S. 4(1) (proviso) applied (1.11.1993) by 1993 c. 28, s. 8(3); S.I. 1993/2134, art. 5(a)

Marginal Citations

[F404A Alternative rent limits for purposes of section 1A(2).E+W

(1)For the purposes of section 1A(2) above a tenancy of any property falls within this subsection if either no rent was payable under it in respect of the property during the initial year or the aggregate amount of rent so payable during that year did not exceed the following amount, namely—

(a)where the tenancy was entered into before 1st April 1963, two-thirds of the letting value of the property (on the same terms) on the date of the commencement of the tenancy;

(b)where—

(i)the tenancy was entered into either on or after 1st April 1963 but before 1st April 1990, or on or after 1st April 1990 in pursuance of a contract made before that date, and

[F41(ii)the property had a rateable value other than nil at the date of commencement of the tenancy or else at any time before 1st April 1990,]

two-thirds of the rateable value of the property on the relevant date; or

(c)in any other case, £1,000 if the property is in Greater London or £250 if elsewhere.

(2)For the purposes of subsection (1) above—

(a)“the initial year”, in relation to any tenancy, means the period of one year beginning with the date of the commencement of the tenancy;

[F42(b)“the relevant date” means the date of the commencement of the tenancy or, if the property did not have a rateable value, or had a rateable value of nil, on that date, the date on which it first had a rateable value other than nil;]

(c)paragraphs (b) and (c) of section 4(1) above shall apply as they apply for the purposes of section 4(1);

and it is hereby declared that in subsection (1) above the reference to the letting value of any property is to be construed in like manner as the reference in similar terms which appears in the proviso to section 4(1) above.

(3)Section 1(7) above applies to any amount referred to in subsection (1)(c) above as it applies to the amount referred to in subsection (1)(a)(ii) of that section.]

Textual Amendments

F40S. 4A inserted (1.11.1993) by 1993 c. 28, s. 65; S.I. 1993/2134, art. 5(a)

F41S. 4A(1)(b)(ii) substituted (1.10.1996) by 1996 c. 52, s. 105(2)(a); S.I. 1996/2212, arts. 1(2), 2(2) (with Sch.)

F42S. 4A(2)(b) substituted (1.10.1996) by 1996 c. 52, s. 105(2)(b); S.I. 1996/2212, arts. 1(2), 2(2) (with Sch.)

5 General provisions as to claims to enfranchisement or extension.E+W

(1)Where under this Part of this Act a tenant of a house has the right to acquire the freehold or an extended lease and gives notice of his desire to have it, the rights and obligations of the landlord and the tenant arising from the notice shall inure for the benefit of and be enforceable against them, their executors, administrators and assigns to the like extent (but no further) as rights and obligations arising under a contract for a sale or lease freely entered into between the landlord and tenant; and accordingly, in relation to matters arising out of any such notice, references in this Part of this Act to the tenant and the landlord shall, in so far as the context permits, include their respective executors, administrators and assigns.

(2)Notwithstanding anything in subsection (1) above, the rights and obligations there referred to of a tenant shall be assignable with, but not capable of subsisting apart from, the tenancy of the entire house and premises; and if the tenancy is assigned without the benefit of the notice, or if the tenancy of one part of the house and premises is assigned to or vests in any person without the tenancy of another part, the notice shall accordingly cease to have effect, and the tenant shall be liable to make such compensation as may be just to the landlord in respect of the interference (if any) by the notice with the exercise by the landlord of his power to dispose of or deal with the house and premises or any neighbouring property.

(3)In the event of any default by the landlord or the tenant in carrying out the obligations arising from any such notice, the other of them shall have the like rights and remedies as in the case of a contract freely entered into.

(4)The provisions of Schedule 1 to this Act shall have effect in relation to the operation of this Part of this Act where a person gives notice of his desire to have the freehold or an extended lease of a house and premises, and either he does so in respect of a sub-tenancy or there is a tenancy reversionary on his tenancy; but any such notice given in respect of a tenancy granted by sub-demise out of a superior tenancy other than a long tenancy at a low rent shall be of no effect if the grant was made in breach of the terms of the superior tenancy and there has been no waiver of the breach by the superior landlord.

(5)No lease shall be registrable under [F43the M6Land Charges Act 1972] or be deemed to be an estate contract within the meaning of that Act by reason of the rights conferred on the tenant by this Part of this Act to acquire the freehold or an extended lease of property thereby demised, nor shall any right of a tenant arising from a notice under this Act of his desire to have the freehold or to have an extended lease be [F44regarded for the purposes of the Land Registration Act 2002 as an interest falling within any of the paragraphs of Schedule 1 or 3 to that Act] ; but any such notice shall be registrable under [F45the M7Land Charges Act 1972] or may be the subject of a notice [F46under the Land Registration Act 2002] , as if it were an estate contract.

(6)A notice of a person’s desire to have the freehold or an extended lease of a house and premises under this Part of this Act—

(a)shall be of no effect if at the relevant time any person or body of persons who has or have been, or could be, authorised to acquire the whole or part of the house and premises compulsorily for any purpose has or have, with a view to its acquisition for that purpose, served notice to treat on the landlord or on the tenant, or entered into a contract for the purchase of the interest of either of them, and the notice to treat or contract remains in force; and

(b)shall cease to have effect if before the completion of the conveyance in pursuance of the tenant’s notice any such person or body of persons serves notice to treat as aforesaid;

but where a tenant’s notice ceases to have effect by reason of a notice to treat served on him or on the landlord, then on the occasion of the compulsory acquisition in question the compensation payable in respect of any interest in the house and premises (whether or not the one to which that notice to treat relates) shall be determined on the basis of the value of the interest subject to and with the benefit of the rights and obligations arising from the tenant’s notice and affecting that interest.

(7)Where any such notice given by a tenant entitled to acquire the freehold or an extended lease has effect, then (without prejudice to the general law as to the frustration of contracts) the landlord and all other persons shall be discharged from the further performance, so far as relates to the disposal in any manner of the landlord’s interest in the house and premises or any part thereof, of any contract previously entered into and not providing for the eventuality of such a notice (including any such contract made in pursuance of the order of any court):

Provided that, in the case of a notice of the tenant’s desire to have an extended lease, this subsection shall not apply to discharge a person from performance of a contract unless the contract was entered into on the basis, common to both parties, that vacant possession of the house and premises or part thereof would or might be obtainable on the termination of the existing tenancy.

(8)A tenant’s notice of his desire to have an extended lease under this Part of this Act shall cease to have effect if afterwards (being entitled to do so) he gives notice of his desire to have the freehold.

Textual Amendments

F43Words substituted by virtue of Land Charges Act 1972 (c. 61), s. 18(6)

F44Words in s. 5(5) substituted (13.10.2003) by Land Registration Act 2002 (c. 9), s. 136(2), Sch. 11 para. 8(2)(a) (with s. 129); S.I. 2003/1725, art. 2(1)

F45Words substituted by virtue of Land Charges Act 1972 (c. 61), s. 18(6)

F46Words in s. 5(5) substituted (13.10.2003) by Land Registration Act 2002 (c. 9), s. 136(2), Sch. 11 para. 8(2)(b) (with s. 129); S.I. 2003/1725, art. 2(1)

Marginal Citations

6 Rights of trustees.E+W

(1)[F47A tenant of a house shall for purposes of this Part of this Act be treated as having been a tenant of it at any earlier time] if at that time—

(a)the tenancy was settled land for purposes of the M8Settled Land Act 1925, and he was sole tenant for life within the meaning of that Act; or

(b)the tenancy was vested in trustees and he, as a person beneficially interested (whether directly or derivatively) under the trusts, was entitled or permitted to occupy the house by reason of that interest.

References in this section to trustees include persons holding on [F48a trust arising under section 34 or section 36] of the M9Law of Property Act 1925 in cases of joint ownership or ownership in common.

(2)Where a tenancy of a house is settled land for purposes of the Settled Land Act 1925, a sole tenant for life within the meaning of that Act shall have the same rights under this Part of this Act F49. . . as if the tenancy of it belonged to him absolutely, but without prejudice to his position under the settlement as a trustee for all parties entitled under the settlement; and—

(a)the powers under that Act of a tenant for life shall include power to accept an extended lease under this Part of this Act; and

(b)an extended lease granted under this Part of this Act to a tenant for life or statutory owner shall be treated as a subsidiary vesting deed in accordance with section 53(2) of that Act.

(3)Where a tenancy of a house is vested in trustees (other than a sole tenant for life within the meaning of the Settled Land Act 1925), and a person beneficially interested (whether directly or derivatively) under the trusts is entitled or permitted by reason of his interest to occupy the house, then the trustees shall have the like rights under this Part of this Act in respect of his occupation as he would have if he were the tenant occupying in right of the tenancy.

(4)Without prejudice to any powers exercisable under the Settled Land Act 1925 by tenants for life or statutory owners within the meaning of that Act, where a tenancy of a house is vested in trustees, then unless the instrument regulating the trusts (being made after the passing of this Act) contains an explicit direction to the contrary, the powers of the trustees under that instrument shall include power, with the like consent or on the like direction (if any) as may be required for the exercise of their powers (or ordinary powers) of investment, to acquire and retain the freehold or an extended lease under this Part of this Act.

(5)The purposes authorised for the application of capital money by section 73 of the M10Settled Land Act 1925,. . . and the purposes authorised by section 71 of the Settled Land Act 1925. . . as purposes for which moneys may be raised by mortgage, shall include the payment of any expenses incurred by a tenant for life F49. . .in or in connection with proceedings taken by him F49. . . by virtue of subsection (2) or (3) above.

Textual Amendments

F47Words in s. 6(1) substituted (26.7.2002 E. and 1.1.2003 W.) by 2002 c. 15, s. 138(5); S.I. 2002/1912, art. 2(b)(i) (subject to transitional provision in Sch. 2 of the commencing S.I); S.I. 2002/3012, art. 2(b)(i) (subject to transitional provision in Sch. 2 of the commencing S.I)

F48Words in s. 6(1) substituted (1.1.1997) by 1996 c. 47, s. 25(1), Sch. 3 para. 10(a) (with ss. 24(2), 25(4)(5)); S.I. 1996/2974, art. 2

F49Words in s. 6(2)(5) repealed (26.7.2002 E. and 1.1.2003 W.) by 2002 c. 15, s. 180, Sch. 14; S.I. 2002/1912, art. 2(b)(ii), Sch. 1 Pt. 3 (subject to transitional provision in Sch. 2 of the commencing S.I); S.I. 2002/3012, art. 2(b)(ii), Sch. 1 Pt. 3 (subject to transitional provision in Sch. 2 of the commencing S.I)

Marginal Citations

[F506A Rights of personal representativesE+W

(1)Where a tenant of a house dies and, immediately before his death, he had under this Part of this Act—

(a)the right to acquire the freehold, or

(b)the right to an extended lease,

the right is exercisable by his personal representatives while the tenancy is vested in them (but subject to subsection (2) below); and, accordingly, in such a case references in this Part of this Act to the tenant shall, in so far as the context permits, be to the personal representatives.

(2)The personal representatives of a tenant may not give notice of their desire to have the freehold or an extended lease by virtue of subsection (1) above later than two years after the grant of probate or letters of administration.]

Textual Amendments

F50S. 6A inserted (26.7.2002 for E. and 1.1.2003 for W.) by 2002 c. 15, s. 142(1); S.I. 2002/1912, art. 2(a) (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.); S.I. 2002/3012, art. 2(a) (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.)

7 Rights of members of family succeeding to tenancy on death.E+W

(1)Where the tenant of a house dies F51. . . and on his death a member of his family resident in the house becomes tenant of it under the same tenancy, then for the purposes of any claim by that member of the family to acquire the freehold or an extended lease under this Part of this Act he shall be treated as having been the tenant F51. . . during any period when—

(a)he was resident in the house, and it was his only or main place of residence; F51and

F51(b). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(2)For purposes of this section—

(a)a member of a tenant’s family on whom the tenancy devolves on the tenant’s death by virtue of a testamentary disposition or the law of intestate succession shall, on the tenancy vesting in him, be treated as having become tenant on the death; and

(b)a member of a tenant’s family who, on the tenant’s death, acquires the tenancy by the appropriation of it in or towards satisfaction of any legacy, share in residue, debt or other share in or claim against the tenant’s estate, or by the purchase of it on a sale made by the tenant’s personal representatives in the administration of the estate, shall be treated as a person on whom the tenancy devolved by direct bequest; and

(c)a person’s interest in a tenancy as personal representative of a deceased tenant shall be disregarded, but references in paragraphs (a) and (b) above to a tenancy vesting in, or being acquired by, a member of a tenant’s family shall apply also where, after the death of a member of the family, the tenancy vests in or is acquired by the personal representatives of that member.

(3)Where a tenancy of a house is settled land for purposes of the Settled Land Act 1925, and on the death of a tenant for life within the meaning of that Act a member of his family resident [F52in the house] becomes entitled to the tenancy in accordance with the settlement or by any appropriation by or purchase from the personal representatives in respect of the settled land, this section shall apply as if the tenancy had belonged to the tenant for life absolutely and the trusts of the settlement taking effect after his death had been trusts of his will.

(4)Where in a case not falling within subsection (3) above a tenancy of a house is held on trust and—

(a)a person beneficially interested (whether directly or derivatively) under the trust is entitled or permitted by reason of his interest to occupy the house; and

(b)on his death a member of his family resident [F52in the house] becomes tenant of the house in accordance with the terms of the trust or by any appropriation by or purchase from the trustees;

then this section shall apply as if the deceased person F51. . . had been tenant of it F51. . . and as if after his death the trustees had held and dealt with the tenancy as his executors (the remaining trusts being trusts of his will).

(5)Subsections (3) and (4) above shall apply, with any necessary adaptations, where a person becomes entitled to a tenancy on the termination of a settlement or trust as they would apply if he had become entitled in accordance with the settlement or trust.

F53(6). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(7)For purposes of this section a person is a member of another’s family if that person is—

(a)the other’s wife or husband; or

(b)a son or daughter or a son-in-law or daughter-in-law of the other, or of the other’s wife or husband; or

(c)the father or mother of the other, or of the other’s wife or husband.

In paragraph (b) above any reference to a person’s son or daughter includes a reference to any stepson or stepdaughter, any illegitimate son or daughter, . . . F54 of that person, and “son-in-law” and “daughter-in-law” shall be construed accordingly.

(8)In Schedule 2 to the M11Intestates’ Estates Act 1952 (which gives a surviving spouse a right to require the deceased’s interest in the matrimonial home to be appropriated to the survivor’s interest in the deceased’s estate, but by paragraph 1(2) excludes tenancies terminating, or terminable by the landlord, within two years of the death), paragraph 1(2) shall not apply to a tenancy if—

(a)the surviving wife or husband would in consequence of an appropriation in accordance with that paragraph become entitled by virtue of this section to acquire the freehold or an extended lease under this Part of this Act, either immediately on the appropriation or before the tenancy can determine or be determined as mentioned in paragraph 1(2); or

(b)the deceased husband or wife, being entitled to acquire the freehold or an extended lease under this Part of this Act, had given notice of his or her desire to have it and the benefit of that notice is appropriated with the tenancy.

(9)This section shall have effect in relation to deaths occurring before this Act was passed as it has effect in relation to deaths occurring after.

Textual Amendments

F51Words in s. 7(1)(b)(4) repealed (26.7.2002 for E. and 1.1.2003 for W.) by 2002 c. 15, s. 180, Sch. 14; S.I. 2002/1912, art. 2(b)(ii), Sch. 1 Pt. 3 (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.); S.I. 2002/3012, art. 2(b)(ii), Sch. 1 Pt. 3 (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.)

F52Words in s. 7(3)(4)(b) substituted (26.7.2002 for E. and 1.1.2003 for W.) by 2002 c. 15, s. 138(6); S.I. 2002/1912, art. 2(b)(i) (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.); S.I. 2002/3012, art. 2(b)(i) (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.)

F53S. 7(6) repealed (26.7.2002 for E. and 1.1.2003 for W.) by 2002 c. 15, s. 180, Sch. 14; S.I. 2002/1912, art. 2(b)(ii), Sch. 1 Pt. 3 (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.); S.I. 2002/3012, art. 2(b)(ii), Sch. 1 Pt. 3 (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.)

F54Words repealed by Children Act 1975 (c. 72), Sch. 4 Pt. I

Marginal Citations

Options/Help

Print Options

PrintThe Whole Act

PrintThe Whole Part

PrintThis Cross Heading only

Mae deddfwriaeth ar gael mewn fersiynau gwahanol:

Y Diweddaraf sydd Ar Gael (diwygiedig):Y fersiwn ddiweddaraf sydd ar gael o’r ddeddfwriaeth yn cynnwys newidiadau a wnaed gan ddeddfwriaeth ddilynol ac wedi eu gweithredu gan ein tîm golygyddol. Gellir gweld y newidiadau nad ydym wedi eu gweithredu i’r testun eto yn yr ardal ‘Newidiadau i Ddeddfwriaeth’.

Gwreiddiol (Fel y’i Deddfwyd neu y’i Gwnaed): Mae'r wreiddiol fersiwn y ddeddfwriaeth fel ag yr oedd pan gafodd ei deddfu neu eu gwneud. Ni wnaed unrhyw newidiadau i’r testun.

Pwynt Penodol mewn Amser: This becomes available after navigating to view revised legislation as it stood at a certain point in time via Advanced Features > Show Timeline of Changes or via a point in time advanced search.

Gweler y wybodaeth ychwanegol ochr yn ochr â’r cynnwys

Rhychwant ddaearyddol: Indicates the geographical area that this provision applies to. For further information see ‘Frequently Asked Questions’.

Dangos Llinell Amser Newidiadau: See how this legislation has or could change over time. Turning this feature on will show extra navigation options to go to these specific points in time. Return to the latest available version by using the controls above in the What Version box.

Rhagor o Adnoddau

Gallwch wneud defnydd o ddogfennau atodol hanfodol a gwybodaeth ar gyfer yr eitem ddeddfwriaeth o’r tab hwn. Yn ddibynnol ar yr eitem ddeddfwriaeth sydd i’w gweld, gallai hyn gynnwys:

- y PDF print gwreiddiol y fel deddfwyd fersiwn a ddefnyddiwyd am y copi print

- rhestr o newidiadau a wnaed gan a/neu yn effeithio ar yr eitem hon o ddeddfwriaeth

- manylion rhoi grym a newid cyffredinol

- pob fformat o’r holl ddogfennau cysylltiedig

- slipiau cywiro

- dolenni i ddeddfwriaeth gysylltiedig ac adnoddau gwybodaeth eraill

Llinell Amser Newidiadau

This timeline shows the different points in time where a change occurred. The dates will coincide with the earliest date on which the change (e.g an insertion, a repeal or a substitution) that was applied came into force. The first date in the timeline will usually be the earliest date when the provision came into force. In some cases the first date is 01/02/1991 (or for Northern Ireland legislation 01/01/2006). This date is our basedate. No versions before this date are available. For further information see the Editorial Practice Guide and Glossary under Help.

Rhagor o Adnoddau

Defnyddiwch y ddewislen hon i agor dogfennau hanfodol sy’n cyd-fynd â’r ddeddfwriaeth a gwybodaeth am yr eitem hon o ddeddfwriaeth. Gan ddibynnu ar yr eitem o ddeddfwriaeth sy’n cael ei gweld gall hyn gynnwys:

- y PDF print gwreiddiol y fel deddfwyd fersiwn a ddefnyddiwyd am y copi print

- slipiau cywiro

liciwch ‘Gweld Mwy’ neu ddewis ‘Rhagor o Adnoddau’ am wybodaeth ychwanegol gan gynnwys

- rhestr o newidiadau a wnaed gan a/neu yn effeithio ar yr eitem hon o ddeddfwriaeth

- manylion rhoi grym a newid cyffredinol

- pob fformat o’r holl ddogfennau cysylltiedig

- dolenni i ddeddfwriaeth gysylltiedig ac adnoddau gwybodaeth eraill