Finance Act 1990

1990 CHAPTER 29

An Act to grant certain duties, to alter other duties, and to amend the law relating to the National Debt and the Public Revenue, and to make further provision in connection with Finance.

[26th July 1990]

X1X2Most Gracious Sovereign,WE, Your Majesty’s most dutiful and loyal subjects, the Commons of the United Kingdom in Parliament assembled, towards raising the necessary supplies to defray Your Majesty’s public expenses, and making an addition to the public revenue, have freely and voluntarily resolved to give and grant unto Your Majesty the several duties hereinafter mentioned; and do therefore most humbly beseech Your Majesty that it may be enacted, and be it enacted by the Queen’s most Excellent Majesty, by and with the advice and consent of the Lords Spiritual and Temporal, and Commons, in this present Parliament assembled, and by the authority of the same, as follows:—

Editorial Information

X1Ss. 4, 132, Sch. 19 Pt. I from Gp 12:2 (Betting, Gaming and Lotteries), ss. 1-3, 7-9, 132, 133, Schs. 1, 3, 19 Pt. I from Gp 40:1 (Customs and Excise), ss. 10-16, 131(2), 132, 133, Sch. 19 Pt III from Gp 40:2 (Customs and Excise), ss. 132, 133 from Gp 44:2 (Energy), ss. 115-120, 133 from Gp 58 (Harbours, Docks and Piers), ss. 17-30, 39(9), 41-62, 65-71, 73-82, 86-106, 114, 121, 122, 125-127, 131-133, Schs. 4-17, 18 paras. 2, 5, Sch 19 Pts IV, V from Gp 63:1 (Income, Corporation and Capital Gains Taxes), ss 28(3), 31-40, 48, 54, 56, 63, 64, 70(5)-(9), 72, 81(3)(6)(8), 83-85, 89, 127(2)-(4), 131(3), 133, Sch 9 paras 2, 7, Sch. 10 paras 28, 29, Sch. 14 paras 17-19, Sch 18 para 3 from Gp 63:2 (Income, Corporation and Capital Gains Taxes), ss 124-126, 127(3)(4), 133, Sch 18 para 4 from Gp 65 (Inheritance Tax), ss 128-130, 132, 133, Sch 19 Pt VIII from Gp 99:5 (Public Finance and Economic Controls), ss. 5, 6, 132, 133, Schs 2, 19 Pt II from Gp 107:2 (Road Traffic), ss. 107-114, 127(3)(4), 132, 133, Sch 18 para 1, Sch 19 Pts VI, VII from Gp 114 (Stamp Duty)

X2General amendments to Tax Acts, Income Tax Acts, and/or Corporation Tax Acts made by legislation after 1.2.1991 are noted against Income and Corporation Taxes Act 1988 (c. 1, SIF 63:1) but not against each Act

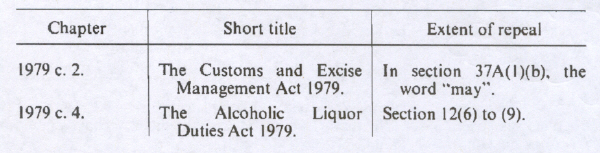

Part IU.K. Customs and Excise and Value Added Tax

chapter IU.K. Customs and Excise

Rates of dutyU.K.

1 Spirits, beer, wine, made-wine and cider.U.K.

(1)In section 5 of the M1Alcoholic Liquor Duties Act 1979 (spirits) for “£15.77” there shall be substituted “ £17.35 ”.

(2)In section 36 of that Act (beer) for “£0.90” there shall be substituted “ £0.97 ”.

(3)For the Table of rates of duty in Schedule 1 to that Act (wine and made-wine) there shall be substituted the Table in Schedule 1 to this Act.

(4)In section 62(1) of that Act (cider) for “£17.33” there shall be substituted “ £18.66 ”.

(5)This section shall be deemed to have come into force at 6 o’clock in the evening of 20th March 1990.

2 Tobacco products.U.K.

(1)For the Table in Schedule 1 to the M2Tobacco Products Duty Act 1979 there shall be substituted—

“ TABLE

| 1. Cigarettes | An amount equal to 21 per cent. of the retail price plus £34.91 per thousand cigarettes. |

| 2. Cigars | £53.67 per kilogram. |

| 3. Hand-rolling tobacco | £56.63 per kilogram. |

| 4. Other smoking tobacco and chewing tobacco | £24.95 per kilogram.” |

(2)This section shall be deemed to have come into force on 23rd March 1990.

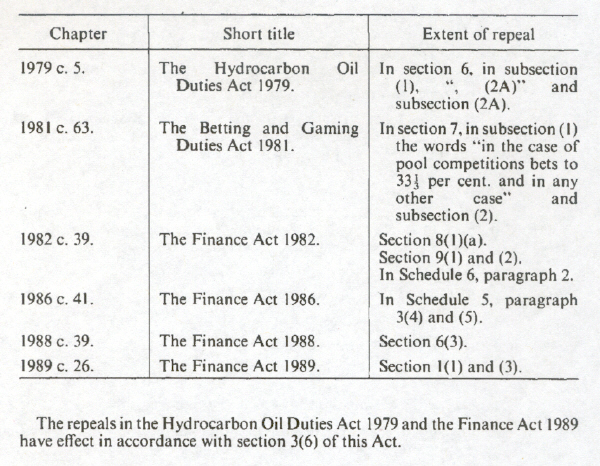

3 Hydrocarbon oil.U.K.

(1)In section 6 of the M3Hydrocarbon Oil Duties Act 1979—

(a)in subsection (1), for “£0.2044” (duty on light oil) and “£0.1729” (duty on heavy oil) there shall be substituted “ £0.2248 ” and “ £0.1902 ” respectively; and

(b)subsection (2A) (special rate of duty on petrol below 4 star) shall cease to have effect.

(2)In section 11(1) of that Act, for “£0.0077” (rebate on fuel oil) and “£0.0110” (rebate on gas oil) there shall be substituted “ £0.0083 ” and “ £0.0118 ” respectively.

(3)In section 13A(1) of that Act (rebate on unleaded petrol), for “£0.0272” there shall be substituted “ £0.0299 ”.

(4)In section 14(1) of that Act (rebate on light oil for use as furnace fuel), for “£0.0077” there shall be substituted “ £0.0083 ”.

(5)In Part I of Schedule 3 to that Act, for paragraph 10A there shall be substituted—

“10AAmending the definition of “aviation gasoline” in subsection (4) of section 6 of this Act.”

(6)Subsections (1) to (4) above shall be deemed to have come into force at 6 o’clock in the evening of 20th March 1990.

4 Pool betting duty.U.K.

(1)In section 7(1) of the M4Betting and Gaming Duties Act 1981 (which specifies 42½ per cent. as the rate of pool betting duty), for the words “42½ per cent.” there shall be substituted the words “ 40 per cent. ”.

(2)This section shall apply in relation to bets made at any time by reference to an event taking place on or after 6th April 1990.

Marginal Citations

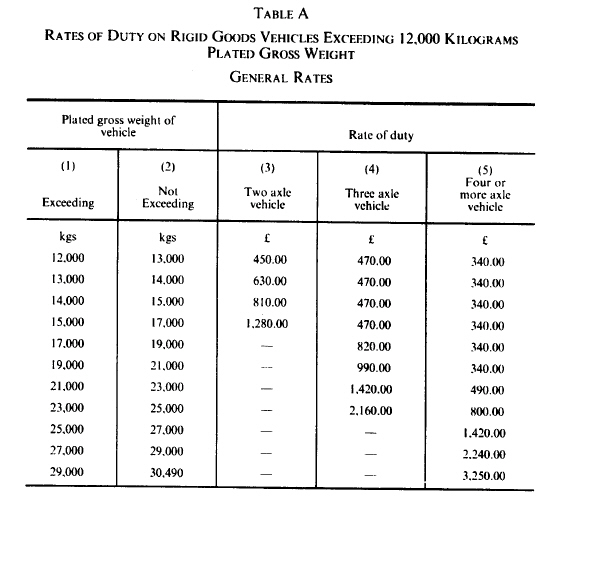

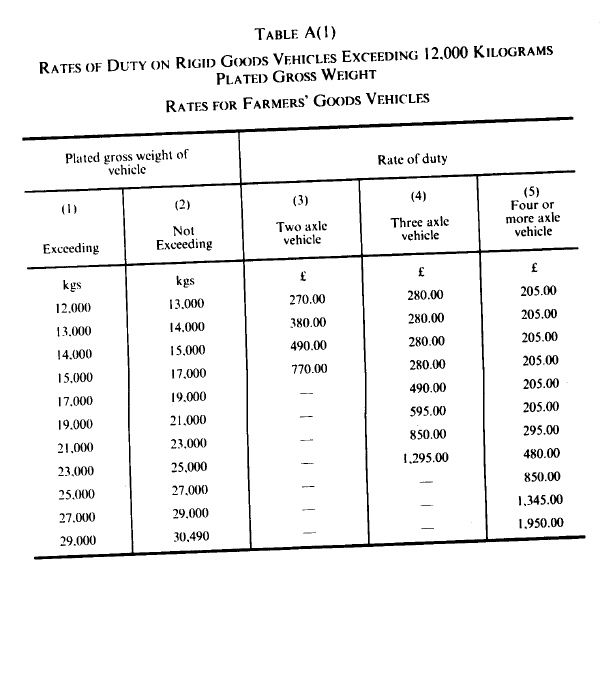

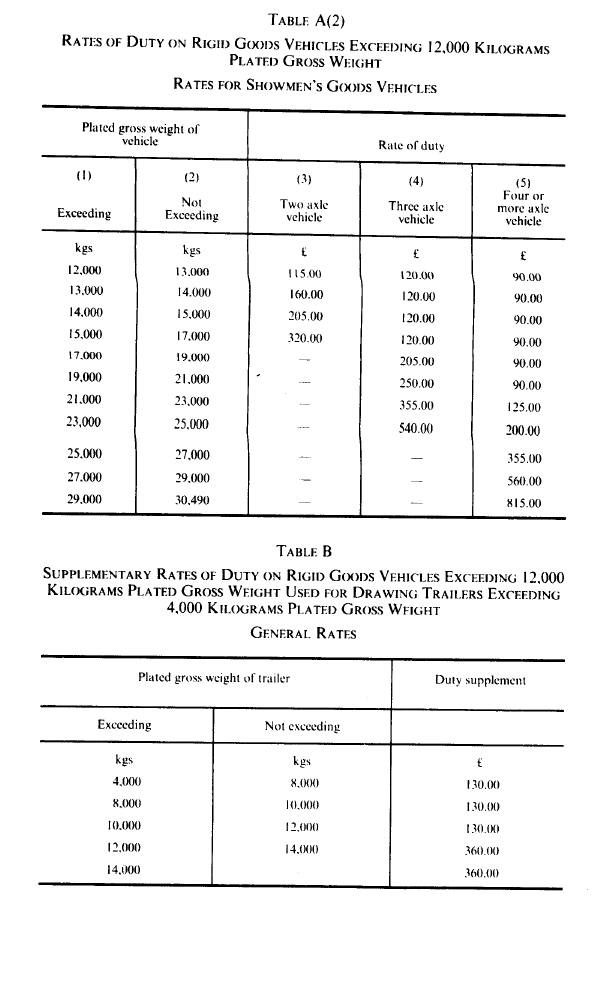

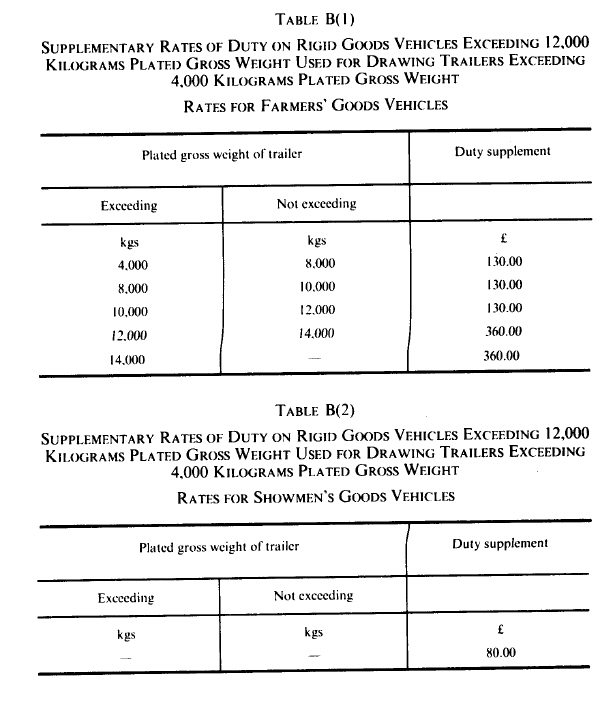

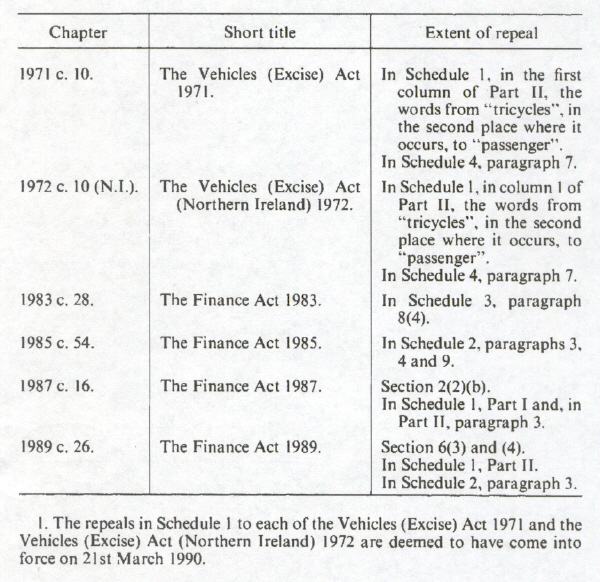

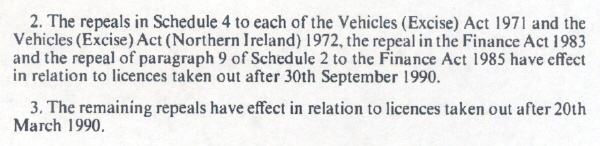

5 Vehicles excise duty.U.K.

F1(1). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F1(2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F1(3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F2(4). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F3(5). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F2(6). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F4(7). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F1(8). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F1(9). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F1S. 5(1)-(3)(8)(9) repealed (1.9.1994) by 1994 c. 22, ss. 65, 66(1), Sch. 5 Pt. I (with s. 57(4), Sch. 4 para. 6)

F2S. 5(4)(6) repealed(1.10.1991) by Finance Act 1991 (c. 31, SIF 107:2), ss. 10, 123, Sch. 19 Pt. IV; S.I. 1991/2021, art. 2.

F3S. 5(5) repealed (8.11.1993) by S.I. 1993/2452, art. 3, Sch. 2.

Other provisionsU.K.

F56. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F5S. 6 repealed (1.9.1994) by 1994 c. 22, ss. 65, 66(1), Sch. 5 Pt. I (with s. 57(4), Sch. 4 para. 6)

7 Entry of goods on importation.U.K.

Schedule 3 to this Act (which amends the provisions of the M5Customs and Excise Management Act 1979 about initial and supplementary entries and postponed entry) shall have effect in relation to goods imported on or after the day on which this Act is passed.

8 Spirits methylated abroad.U.K.

(1)In section 4(1) of the M6Alcoholic Liquor Duties Act 1979, for the definition of “methylated spirits” there shall be substituted—

““methylated spirits” means—

(a)spirits mixed in the United Kingdom with some other substance in accordance with regulations made under section 77 below; or

(b)spirits mixed outside the United Kingdom with some other substance if the spirits and other substance, and the proportions in which they are mixed, are such as are prescribed by those regulations for the production of methylated spirits in the United Kingdom;”.

(2)This section shall come into force on 1st January 1991.

9 Lodgings for officers in charge of distillery.U.K.

In section 12 of the Alcoholic Liquor Duties Act 1979 (licence to manufacture spirits) subsections (6) to (9) (requirement that distiller provide lodgings for officers in charge of distillery) shall cease to have effect.

chapter IIU.K. Value Added Tax

F610. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F6Ss. 10-16 repealed (1.9.1994) by 1994 c. 23, ss. 100(2), 101(1), Sch. 15

F711. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F7Ss. 10-16 repealed (1.9.1994) by 1994 c. 23, ss. 100(2), 101(1), Sch. 15

F812. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F8Ss. 10-16 repealed (1.9.1994) by 1994 c. 23, ss. 100(2), 101(1), Sch. 15

F913. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F9Ss. 10-16 repealed (1.9.1994) by 1994 c. 23, ss. 100(2), 101(1), Sch. 15

F1014. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F10Ss. 10-16 repealed (1.9.1994) by 1994 c. 23, ss. 100(2), 101(1), Sch. 15

F1115. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F11Ss. 10-16 repealed (1.9.1994) by 1994 c. 23, ss. 100(2), 101(1), Sch. 15

F1216. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F12Ss. 10-16 repealed (1.9.1994) by 1994 c. 23, ss. 100(2), 101(1), Sch. 15

Part IIU.K. Income Tax, Corporation Tax and Capital Gains Tax

Chapter IU.K. General

Income tax rates and allowancesU.K.

17 Rates and main allowances.U.K.

(1)Income tax shall be charged for the year 1990-91, and—

(a)the basic rate shall be 25 per cent.;

(b)the basic rate limit shall be £20,700;

(c)the higher rate shall be 40 per cent.; and

(d)section 1(4) of the Taxes Act 1988 (indexation of basic rate limit) shall not apply.

F13(2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(3)In section 828 of that Act (orders and regulations), in subsection (4), for “257(11)” there shall be substituted “ 257C ”.

(4)Subsections (2) and (3) above shall have effect for the year 1990-91 and subsequent years of assessment.

Textual Amendments

F13S. 17(2) repealed (27.07.1993 with effect for the year 1994-95 and subsequent years of assessment) by 1993 c. 34, ss. 107, 213, Sch. 23, Pt. III(10).

18 Relief for blind persons.U.K.

In section 265(1) of the Taxes Act 1988, for “£540” there shall be substituted “ £1,080 ”.

Corporation tax ratesU.K.

19 Charge and rate of corporation tax for 1990.U.K.

Corporation tax shall be charged for the financial year 1990 at the rate of 35 per cent.

Modifications etc. (not altering text)

C1S. 19 excluded by Finance Act 1991 (c. 31, SIF 63:1), s. 23(1).

20 Small companies.U.K.

(1)For the financial year 1990—

(a)the small companies’ rate shall be 25 per cent., and

(b)the fraction mentioned in section 13(2) of the Taxes Act 1988 (marginal relief for small companies) shall be one-fortieth.

(2)In section 13(3) of that Act (limits of marginal relief), in paragraphs (a) and (b)—

(a)for “£150,000” there shall be substituted “ £200,000 ”, and

(b)for “£750,000” there shall be substituted “ £1,000,000 ”.

(3)Subsection (2) above shall have effect for the financial year 1990 and subsequent financial years; and where by virtue of that subsection section 13 of the Taxes Act 1988 has effect with different relevant maximum amounts in relation to different parts of a company’s accounting period, then for the purposes of that section those parts shall be treated as if they were separate accounting periods and the profits and basic profits of the company for that period shall be apportioned between those parts.

Modifications etc. (not altering text)

C2S. 20 excluded by Finance Act 1991 (c. 31, SIF 63:1), s. 23(2).

Benefits in kindU.K.

21 Care for children.U.K.

(1)The following section shall be inserted after section 155 of the Taxes Act 1988—

“155A Care for children.

(1)Where a benefit consists in the provision for the employee of care for a child, section 154 does not apply to the benefit to the extent that it is provided in qualifying circumstances.

(2)For the purposes of subsection (1) above the benefit is provided in qualifying circumstances if—

(a)the child falls within subsection (3) below,

(b)the care is provided on premises which are not domestic premises,

(c)the condition set out in subsection (4) below or the condition set out in subsection (5) below (or each of them) is fulfilled, and

(d)in a case where the registration requirement applies, it is met.

(3)The child falls within this subsection if—

(a)he is a child for whom the employee has parental responsibility,

(b)he is resident with the employee, or

(c)he is a child of the employee and maintained at his expense.

(4)The condition is that the care is provided on premises which are made available by the employer alone.

(5)The condition is that—

(a)the care is provided under arrangements made by persons who include the employer,

(b)the care is provided on premises which are made available by one or more of those persons, and

(c)under the arrangements the employer is wholly or partly responsible for financing and managing the provision of the care.

(6)The registration requirement applies where—

(a)the premises on which the care is provided are required to be registered under section 1 of the Nurseries and Child-Minders Regulation Act 1948 or section 11 of the Children and Young Persons Act (Northern Ireland) 1968, or

(b)any person providing the care is required to be registered under section 71 of the Children Act 1989 with respect to the premises on which it is provided;

and the requirement is met if the premises are so registered or (as the case may be) the person is so registered.

(7)In subsection (3)(c) above the reference to a child of the employee includes a reference to a stepchild of his.

(8)In this section—

“care” means any form of care or supervised activity, whether or not provided on a regular basis, but excluding supervised activity provided primarily for educational purposes;

“child” means a person under the age of eighteen;

“domestic premises” means any premises wholly or mainly used as a private dwelling;

“parental responsibility” has the meaning given in section 3(1) of the Children Act 1989.”

(2)In section 154(2) of the Taxes Act 1988 for the words “section 155” there shall be substituted the words “ sections 155 and 155A ”.

(3)This section applies for the year 1990-91 and subsequent years of assessment.

22 Car benefits.U.K.

(1)In Schedule 6 to the Taxes Act 1988 (taxation of directors and others in respect of cars) for Part I (tables of flat rate cash equivalents) there shall be substituted—

“Part IU.K. Tables of Flat Rate Cash Equivalents

Table A

Cars with an original market value up to £19,250 and having a cylinder capacity

| Cylinder capacity of car in cubic centimetres | Age of car at end of relevant year of assessment | |

|---|---|---|

| Under 4 years | 4 years or more | |

| 1400 or less | £1,700 | £1,150 |

| More than 1400 but not more than 2000 | £2,200 | £1,500 |

| More than 2000 | £3,550 | £2,350 |

Table B

Cars with an original market value up to £19,250 and not having a cylinder capacity

| Original market value of car | Age of car at end of relevant year of assessment | |

|---|---|---|

| Under 4 years | 4 years or more | |

| Less than £6,000 | £1,700 | £1,150 |

| £6,000 or more but less than £8,500 | £2,200 | £1,500 |

| £8,500 or more but not more than £19,250 | £3,550 | £2,350 |

Table C

Cars with an original market value of more than £19,250

(2) This section shall have effect for the year 1990-91 and subsequent years of assessment.” | ||

| Original market value of car | Age of car at end of relevant year of assessment | |

|---|---|---|

| Under 4 years | 4 years or more | |

| More than £19,250 but not more than £29,000 | £4,600 | £3,100 |

| More than £29,000 | £7,400 | £4,900 |

Mileage allowancesU.K.

F1423. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F14S. 23 repealed (11.5.2001 with effect for the year 2002-03 and subsequent years of assessment) by 2001 c. 9, s. 110, Sch. 33 Pt. 2(1)

CharitiesU.K.

F1524. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F15S. 24 repealed (27.07.1993 with effect for the year 1993-94 and subsequent years of assessment) by 1993 c. 34, s. 213, Sch. 23 Pt. III.

25 Donations to charity by individuals.U.K.

(1)For the purposes of this section, a gift to a charity by an individual (“the donor”) is a qualifying donation if—

(a)it is made on or after 1st October 1990,

(b)it satisfies the requirements of subsection (2) below, and

(c)the donor gives [F16an appropriate declaration] in relation to it to the charity.

(2)A gift satisfies the requirements of this subsection if—

(a)it takes the form of a payment of a sum of money;

(b)it is not subject to a condition as to repayment;

F17(c). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(d)it does not constitute a sum falling within section 202(2) of the Taxes Act 1988 (payroll deduction scheme);

(e)neither the donor nor any person connected with him receives a benefit in consequence of making it or, where the donor or a person connected with him does receive a benefit in consequence of making it, the relevant value in relation to the gift does not exceed [F18the limit imposed by subsection (5A) below] and the amount to be taken into account for the purposes of this paragraph in relation to the gift does not exceed £250;

(f)it is not conditional on or associated with, or part of an arrangement involving, the acquisition of property by the charity, otherwise than by way of gift, from the donor or a person connected with him;

F17(g). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F19(h). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

[F20(i)either—

(i)at the time the gift is made, the donor is resident in the United Kingdom or performs duties which by virtue of section 132(4)(a) of the Taxes Act 1988 (Crown employees serving overseas) are treated as being performed in the United Kingdom; or

(ii)the grossed up amount of the gift would, if in fact made, be payable out of profits or gains brought into charge to income tax or capital gains tax.]

[F21(3)The reference in subsection (1)(c) above to an appropriate declaration is a reference to a declaration which—

(a)is given in such manner as may be prescribed by regulations made by the Board; and

(b)contains such information and such statements as may be so prescribed.

(3A)Regulations made for the purposes of subsection (3) above may—

(a)provide for declarations to have effect, to cease to have effect or to be deemed never to have had effect in such circumstances and for such purposes as may be prescribed by the regulations;

(b)require charities to keep records with respect to declarations given to them by donors; and

(c)make different provision for declarations made in a different manner.]

(4)For the purposes of subsections (2)(e) above and (5) below, the relevant value in relation to a gift is—

(a)where there is one benefit received in consequence of making it which is received by the donor or a person connected with him, the value of that benefit;

(b)where there is more than one benefit received in consequence of making it which is received by the donor or a person connected with him, the aggregate value of all the benefits received in consequence of making it which are received by the donor or a person connected with him.

(5)The amount to be taken into account for the purposes of subsection (2)(e) above in relation to a gift to a charity is an amount equal to the aggregate of—

(a)the relevant value in relation to the gift, and

(b)the relevant value in relation to each gift already made to the charity by the donor in the relevant year of assessment which is a qualifying donation for the purposes of this section.

[F22(5A)The limit imposed by this subsection is—

(a)where the amount of the gift does not exceed £100, 25 per cent of the amount of the gift;

(b)where the amount of the gift exceeds £100 but does not exceed £1,000, £25;

(c)where the amount of the gift exceeds £1,000, 2.5 per cent of the amount of the gift.

(5B)Where a benefit received in consequence of making a gift—

(a)consists of the right to receive benefits at intervals over a period of less than twelve months;

(b)relates to a period of less than twelve months; or

(c)is one of a series of benefits received at intervals in consequence of making a series of gifts at intervals of less than twelve months,

the value of the benefit shall be adjusted for the purposes of subsection (4) above and the amount of the gift shall be adjusted for the purposes of subsection (5A) above.

(5C)Where a benefit, other than a benefit which is one of a series of benefits received at intervals, is received in consequence of making a gift which is one of a series of gifts made at intervals of less than twelve months, the amount of the gift shall be adjusted for the purposes of subsection (5A) above.

(5D)Where the value of a benefit, or the amount of a gift, falls to be adjusted under subsection (5B) or (5C) above, the value or amount shall be multiplied by 365 and the result shall be divided by—

(a)in a case falling within subsection (5B)(a) or (b) above, the number of days in the period of less than twelve months;

(b)in a case falling within subsection (5B)(c) or (5C) above, the average number of days in the intervals of less than twelve months;

and the reference in subsection (5B) above to subsection (4) above is a reference to that subsection as it applies for the purposes of subsection (2)(e) above.

(5E)In determining whether a gift to a charity falling within subsection (5F) below is a qualifying donation, there shall be disregarded the benefit of any right of admission received in consequence of the making of the gift—

(a)to view property the preservation of which is the sole or main purpose of the charity; or

(b)to observe wildlife the conservation of which is the sole or main purpose of the charity;

but this subsection shall not apply unless the opportunity to make gifts which attract such a right is available to members of the public.

(5F)A charity falls within this subsection if its sole or main purpose is the preservation of property, or the conservation of wildlife, for the public benefit.

(5G)In subsection (5E) above “right of admission” refers to admission of the person making the gift (or any member of his family who may be admitted because of the gift) either free of the charges normally payable for admission by members of the public, or on payment of a reduced charge.]

[F23(6)Where any gift made by the donor in a year of assessment is a qualifying donation, then, for that year—

(a)the Income Tax Acts and the M7Taxation of Chargeable Gains Act 1992 shall have effect, in their application to him, as if—

(i)the gift had been made after deduction of income tax at the basic rate; and

(ii)the basic rate limit were increased by an amount equal to the grossed up amount of the gift;

(b)the provisions mentioned in subsection (7) below shall have effect, in their application to him, as if any reference to income tax which he is entitled to charge against any person included a reference to the tax treated as deducted from the gift; and

(c)to the extent, if any, necessary to ensure that he is charged to an amount of income tax and capital gains tax equal to the tax treated as deducted from the gift, he shall not be entitled to relief under Chapter I of Part VII of the Taxes Act 1988;

but paragraph (a)(ii) above shall not apply for the purposes of any computation under section 550(2)(a) or (b) of that Act (relief where gain charged at a higher rate).

(7)The provisions referred to in subsection (6)(b) above are—

(a)section 289A(5)(e) of the Taxes Act 1988 (relief under enterprise investment scheme);

(b)section 796(3) of that Act (credit for foreign tax); and

(c)paragraph 1(6)(f) of Schedule 15B to that Act (venture capital trusts).

(8)Where the tax treated as deducted from a gift by virtue of subsection (6) above exceeds the amount of income tax and capital gains tax with which the donor is charged for the year of assessment, the donor shall be assessable and chargeable with income tax at the basic rate on so much of the gift as is necessary to recover an amount of tax equal to the excess.

(9)In determining for the purposes of subsection (8) above the total amount of income tax and capital gains tax with which the donor is charged for the year of assessment, there shall be disregarded—

(a)any tax charged at the basic rate by virtue of—

(i)section 348 of the Taxes Act 1988 (read with section 3 of that Act); or

(ii)section 349 of that Act (read with section 350 of that Act);

(b)any tax treated as having been paid under—

(i)section 233(1)(a) of that Act (taxation of certain recipients of distributions);

(ii)section 249(4)(a) of that Act (stock dividends treated as income); or

(iii)section 547(5)(a) of that Act (method of charging life policy gain to tax);

(c)any relief to which section 256(2) of that Act applies (relief by way of income tax reduction);

(d)any relief under—

(i)section 347B of that Act (relief for maintenance payments);

(ii)section 788 of that Act (relief by agreement with other countries); or

(iii)section 790(1) of that Act (unilateral relief);

(e)any set off of tax deducted, or treated as deducted, from income other than—

(i)tax treated as deducted from income by virtue of section 421(1)(a) of that Act (taxation of borrower when loan released etc); or

(ii)tax treated as deducted from a relevant amount within the meaning of section 699A of that Act (untaxed sums comprised in the income of an estate) except to the extent that the relevant amount is or would be paid in respect of a distribution chargeable under Schedule F; and

(f)any set off of tax credits.

(9A)For the purposes of sections 257(5) and 257A(5) of the Taxes Act 1988 (age related allowances), the donor’s total income shall be treated as reduced by the aggregate amount of gifts from which tax is treated as deducted by virtue of subsection (6) above.]

(10)The receipt by a charity of a gift which is a qualifying donation shall be treated for the purposes of the Tax Acts, in their application to the charity, as the receipt, under deduction of income tax at the basic rate for the relevant year of assessment, of an annual payment of an amount equal to the grossed up amount of the gift.

(11)Section 839 of the Taxes Act 1988 applies for the purposes of subsections (2) and (4) above.

(12)For the purposes of this section—

(a)“charity” has the same meaning as in section 506 of the Taxes Act 1988 and includes each of the bodies mentioned in section 507 of that Act;

F24(b). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(c)“relevant year of assessment”, in relation to a gift, means the year of assessment in which the gift is made;

(d)references, in relation to a gift, to the grossed up amount are to the amount which after deducting income tax at the basic rate for the relevant year of assessment leaves the amount of the gift; F24. . .

F24(e). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F16Words in s. 25(1)(c) substituted (28.7.2000 with effect as mentioned in s. 39(10) of the amending Act) by 2000 c. 17, s. 39(2)

F17S. 25(2)(c)(g) repealed (28.7.2000 with effect as mentioned in s. 39(10) of the amending Act) by 2000 c. 17, ss. 39(3)(a), 156, Sch. 40 Pt. II(1) note 4

F18Words in s. 25(2)(e) substituted (28.7.2000 with effect as mentioned in s. 39(10) of the amending Act) by 2000 c. 17, s. 39(3)(b)

F19S. 25(2)(h) repealed(for gifts made on or after 19.03.1991) by Finance Act 1991 (c. 31, SIF 63:1), ss. 71(5)(6), 123, Sch. 19 Pt. V Note 12.

F20S. 25(2)(i) substituted (28.7.2000 with effect as mentioned in s. 39(10) of the amending Act) by 2000 c. 17, s. 39(3)(c)

F21S. 25(3)(3A) substituted for s. 25(3) (28.7.2000 with effect as mentioned in s. 39(10) of the amending Act) by 2000 c. 17, s. 39(4)

F22S. 25(5A)-(5G) inserted (28.7.2000 with effect as mentioned in s. 39(10) of the amending Act) by 2000 c. 17, s. 39(5)

F23S. 25(6)-(9A) substituted for s. 25(6)-(9) (28.7.2000 with effect as mentioned in s. 39(10) of the amending Act) by 2000 c. 17, s. 39(6)

F24S. 25(12)(b)(e) and the word “and” immediately preceding paragraph (e) repealed (28.7.2000 with effect as mentioned in s. 39(10) of the amending Act) by 2000 c. 17, ss. 39(7), 156, Sch. 40 Pt. II(1) note 4

Modifications etc. (not altering text)

C3S. 25 modified (31.7.1998) by 1998 c. 36, s. 48(1)(4)

S. 25 applied (31.7.1998) by 1998 c. 36, s. 48(1)(10)

C4S. 25 modified (with effect as mentioned in s. 98(6) of the modifying Act) by Finance Act 2002 (c. 23), s. 98(1)-(5);

S. 25 modified (with effect as mentioned in s. 58(4) of the modifying Act) by Finance Act 2002 (c. 23), s. 58(1), Sch. 18 Pt. 3 para. 9(1)

C5S. 25(2)(e) applied (31.7.1998) by 1998 c. 36, s. 48(4)(d)

C6S. 25(3) (as substituted by 2000 c. 17, s. 39(4)): power to make regulations extended (28.7.2000 with effect as mentioned in s. 39(10) of the amending Act) by 2000 c. 17, s. 39(10)

Marginal Citations

26 Company donations to charity.U.K.

(1)Section 339 of the Taxes Act 1988 (charges on income: donations to charity) shall be amended as follows.

(2)In subsection (1) after the word “payment” there shall be inserted the words “ of a sum of money ”.

(3)In subsection (2) the words “and is not a close company” shall be omitted.

(4)The following subsections shall be inserted after subsection (3)—

“(3A)A payment made by a close company is not a qualifying donation if it is of a sum which leaves less than £600 after deducting income tax under subsection (3) above.

(3B)A payment made by a close company is not a qualifying donation if—

(a)it is made subject to a condition as to repayment, or

(b)the company or a connected person receives a benefit in consequence of making it and either the relevant value in relation to the payment exceeds two and a half per cent. of the amount given after deducting tax under section 339(3) or the amount to be taken into account for the purposes of this paragraph in relation to the payment exceeds £250.

(3C)For the purposes of subsections (3B) above and (3D) below, the relevant value in relation to a payment to a charity is—

(a)where there is one benefit received in consequence of making it which is received by the company or a connected person, the value of that benefit;

(b)where there is more than one benefit received in consequence of making it which is received by the company or a connected person, the aggregate value of all the benefits received in consequence of making it which are received by the company or a connected person.

(3D)The amount to be taken into account for the purposes of subsection (3B)(b) above in relation to a payment to a charity is an amount equal to the aggregate of—

(a)the relevant value in relation to the payment, and

(b)the relevant value in relation to each payment already made to the charity by the company in the accounting period in which the payment is made which is a qualifying donation within the meaning of this section.

(3E)A payment made by a close company is not a qualifying donation if it is conditional on, or associated with, or part of an arrangement involving, the acquisition of property by the charity, otherwise than by way of gift, from the company or a connected person.

(3F)A payment made by a company is not a qualifying donation unless the company gives to the charity to which the payment is made a certificate in such form as the Board may prescribe and containing—

(a)in the case of any company, a statement to the effect that the payment is one out of which the company has deducted tax under subsection (3) above, and

(b)in the case of a close company, a statement to the effect that the payment satisfies the requirements of subsections (3A) to (3E) above.

(3G)A payment made by a company is not a qualifying donation if the company is itself a charity.”

(5)The following subsection shall be inserted after subsection (7)—

“(7A)In subsections (3B) to (3E) above references to a connected person are to a person connected with—

(a)the company, or

(b)a person connected with the company;

and section 839 applies for the purposes of this subsection.”

(6)This section applies in relation to payments made on or after 1st October 1990.

27 Maximum qualifying company donations.U.K.

F25(1). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(2)In section 339 of that Act (charges on income: donations to charity) subsection (5) shall be omitted and in subsection (9) for “(5)” there shall be substituted “ (4) ”.

F25(3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(4)This section applies in relation to accounting periods ending on or after 1st October 1990.

Textual Amendments

F25S. 27(1)(3) repealed(for accounting periods beginning on or after 19.03.1991) by Finance Act 1991 (c. 31, SIF 63:1), s. 123, Sch. 19 Pt.V Note 5.

SavingsU.K.

28 Tax-exempt special savings accounts.U.K.

(1)After section 326 of the Taxes Act 1988 there shall be inserted—

“326A Tax-exempt special savings accounts.

(1)Subject to the provisions of section 326B, any interest or bonus payable on a deposit account in respect of a period when it is a tax-exempt special savings account shall not be regarded as income for any income tax purpose.

(2)An account is a “tax-exempt special savings account” for the purposes of this section if the conditions set out in subsections (3) to (9) below and any further conditions prescribed by regulations made by the Board are satisfied when the account is opened; and subject to section 326B it shall continue to be such an account until the end of the period of five years beginning with the day on which it is opened, or until the death of the account-holder if that happens earlier.

(3)The account must be opened on or after 1st January 1991 by an individual aged 18 or more.

(4)The account must be with a building society or an institution authorised under the Banking Act 1987.

(5)The account must be identified as a tax-exempt special savings account and the account-holder must not simultaneously hold any other such account (with the same or any other society or institution).

(6)The account must not be a joint account.

(7)The account must not be held on behalf of a person other than the account-holder.

(8)The account must not be connected with any other account held by the account-holder or any other person; and for this purpose an account is connected with another if—

(a)either was opened with reference to the other, or with a view to enabling the other to be opened on particular terms, or with a view to facilitating the opening of the other on particular terms, and

(b)the terms on which either was opened would have been significantly less favourable to the holder if the other had not been opened.

(9)There must not be in force a notice given by the Board to the society or institution prohibiting it from operating new tax-exempt special savings accounts.

326B Loss of exemption for special savings accounts.

(1)A tax-exempt special savings account shall cease to be such an account if at any time after it is opened any of the conditions set out in subsections (4) to (8) of section 326A, or any further condition prescribed by regulations made by the Board, is not satisfied, or if any of the events mentioned in subsection (2) below occurs.

(2)The events referred to in subsection (1) above are—

(a)the deposit of more than £3,000 in the account during the period of 12 months beginning with the day on which it is opened, more than £1,800 in any of the succeeding periods of 12 months, or more than £9,000 in total;

(b)a withdrawal from the account which causes the balance to fall below an amount equal to the aggregate of—

(i)all the sums deposited in the account before the time of the withdrawal, and

(ii)an amount equal to income tax at the basic rate on any interest or bonus paid on the account before that time (and for this purpose the basic rate in relation to any interest or bonus is the rate that was the basic rate when the interest or bonus was paid);

(c)the assignment of any rights of the account-holder in respect of the account, or the use of such rights as security for a loan.

(3)If at any time an account ceases to be a tax-exempt special savings account by virtue of subsection (1) above, the Income Tax Acts shall have effect as if immediately after that time the society or institution had credited to the account an amount of interest equal to the aggregate of any interest and bonus payable in respect of the period during which the account was a tax-exempt special savings account.

326C Tax-exempt special savings accounts: supplementary.

(1)The Board may make regulations—

(a)prescribing conditions additional to those set out in section 326A which must be satisfied if an account is to be or remain a tax-exempt special savings account;

(b)making provision for the giving by the Board to building societies and other institutions of notices prohibiting them from operating new tax-exempt special savings accounts, including provision about appeals against the giving of notices;

(c)requiring building societies and other institutions operating or proposing to operate tax-exempt special savings accounts to give information or send documents to the Board or to make documents available for inspection;

(d)making provision as to the transfer of tax-exempt special savings accounts from one building society or institution to another;

(e)generally for supplementing the provisions of sections 326A and 326B.

(2)The reference in section 326A to a deposit account shall be taken to include a reference to a share account with a building society, and accordingly that section, section 326B and subsection (1) above shall apply to such an account with the necessary modifications.”

(2)In the Table in section 98 of the M8Taxes Management Act 1970 (penalties for failure to comply with notices etc), in each column, before “regulations under section 333” there shall be inserted— “ regulations under section 326C; ”.

F26(3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F26S. 28(3) repealed (6.3.1992 with effect as mentioned in s. 289(1)(2) of the repealing Act) by Taxation of Chargeable Gains Act 1992 (c. 12), s. 290, Sch.12 (with ss. 60, 101, 201(3), Sch. 11 paras. 22, 26(2), 27).

Marginal Citations

29 Extension of SAYE.U.K.

In section 326 of the Taxes Act 1988 (income tax relief for SAYE)—

(a)in subsection (1), after paragraph (b) there shall be inserted the words “or

(c)in respect of money paid to an institution authorised under the Banking Act 1987,”;

(b)in that subsection, for the words “be disregarded” onwards there shall be substituted the words “ not be regarded as income for any income tax purpose. ”;

(c)in subsection (2), after the words “building society” there shall be inserted the words “ or an institution authorised under the Banking Act 1987 ”; and

(d)after subsection (3) there shall be inserted—

“(4)In this section “certified contractual savings scheme” means, in relation to an institution authorised under the Banking Act 1987, a scheme—

(a)providing for periodical contributions by individuals for a specified period, and

(b)certified by the Treasury as corresponding to a scheme certified under subsection (2) above, and as qualifying for exemption under this section.”

30 Building societies.U.K.

Schedule 5 to this Act (which contains provisions relating to building societies, deposit-takers and investors) shall have effect.

Employee share ownership trustsU.K.

F2731. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F2832. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F2933. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F29Ss. 31-40 repealed (6.3.1992 with effect as mentioned in s. 289(1)(2) of the repealing Act) by Taxation of Chargeable Gains Act 1992 (c. 12), s. 290 Sch.12 (with ss. 60, 101, 201(3), Sch. 11 paras. 22, 26(2), 27).

F3034. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F3135. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F3236. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F32Ss. 31-40 repealed (6.3.1992 with effect as mentioned in s. 289(1)(2) of the repealing Act) by Taxation of Chargeable Gains Act 1992 (c. 12), s. 290, Sch.12 (with ss. 60, 101, 201(3), Sch. 11 paras. 20,22, 26(2), 27).

F3337. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F3438. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F3539. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F3640. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

Insurance companies and friendly societiesU.K.

41 Apportionment of income etc.U.K.

Schedule 6 to this Act (which makes provision about the apportionment of income etc. and related provision) shall have effect.

42 Overseas life assurance business.U.K.

Schedule 7 to this Act (which makes provision about the taxation of overseas life assurance business) shall have effect.

43 Deduction for policy holders’ tax.U.K.

(1)In section 82(1)(a) of the M9Finance Act 1989 (computation of profits on Case I basis), for the words “, in respect of the period, are allocated to or expended on behalf of policy holders or annuitants” there shall be substituted the words “ are allocated to, and any amounts of tax or foreign tax which are expended on behalf of, policy holders or annuitants in respect of the period ”.

(2)In section 436(3) of the Taxes Act 1988 (modified application of section 82 in relation to computations of profits of general annuity business or pension business), the words “and of the words “tax or” in section 82(1)(a)” shall be added at the end of paragraph (a).

(3)The Finance Act 1989 shall be deemed always to have had effect with the amendment made by subsection (1) above, and the amendment made by subsection (2) above shall have the same effect as, by virtue of section 84(5)(b) of that Act, it would have had if it had been made by Schedule 8 to that Act.

Marginal Citations

44 Reinsurance commissions.U.K.

(1)In section 85(2) of the Finance Act 1989 (receipts excluded from charge under Case VI of Schedule D), after paragraph (c) there shall be inserted—

“(ca)any reinsurance commission; or”.

(2)In section 86 of the Finance Act 1989 (spreading of relief for expenses), at the end of subsection (1) there shall be added the words “ and less any reinsurance commissions falling within section 76(1)(ca) of that Act ”.

(3)In section 76(1) of the Taxes Act 1988 (treatment of expenses of management), after paragraph (c) there shall be inserted—

“(ca)there shall also be deducted from the amount treated as the expenses of management for any accounting period any reinsurance commission earned in the period which is referable to basic life assurance business; and”.

(4)Sections 85 and 86 of the M10Finance Act 1989 shall be deemed always to have had effect with the amendments made by subsections (1) and (2) above, and section 76 of the Taxes Act 1988 shall have effect as if the amendment made by subsection (3) above had been included among those made by section 87 of the Finance Act 1989.

(5)Nothing in subsection (2) above applies to commissions in respect of the reinsurance of liabilities assumed by the recipient company in respect of insurances made before 14th March 1989, but without prejudice to the application of that subsection to any reinsurance commission attributable to a variation on or after that date in a policy issued in respect of such an insurance; and for this purpose the exercise of any rights conferred by a policy shall be regarded as a variation of it.

Marginal Citations

45 Policy holders’ share of profits etc.U.K.

(1)In section 88 of the Finance Act 1989 (corporation tax: policy holders’ fraction of profits), in subsection (1) for the words “the policy holders’ fraction of its relevant profits for any accounting period shall” there shall be substituted the words—

“(a)the policy holders’ share of the relevant profits for any accounting period, or

(b)where the business is mutual business, the whole of those profits

shall ”.

(2)In subsection (4) of that section, for the word “fraction” there shall be substituted the word “ share ”, and after the words “that period” there shall be inserted the words “ , or where the business is mutual business the whole of those profits, ”.

(3)For section 89 of that Act (which defines the shareholders’ and policy holders’ fractions) there shall be substituted—

“89 Policy holders’ share of profits.

(1)The references in section 88 above to the policy holders’ share of the relevant profits for an accounting period of a company carrying on life assurance business are references to the amount arrived at by deducting from those profits the Case I profits of the company for the period in respect of the business, reduced in accordance with subsection (2) below.

(2)For the purposes of subsection (1) above, the Case I profits for a period shall be reduced by—

(a)the amount, so far as unrelieved, of any franked investment income arising in the period as respects which the company has made an election under section 438(6) of the Taxes Act 1988, and

(b)the shareholders’ share of any other unrelieved franked investment income arising in the period from investments held in connection with the business.

(3)For the purposes of this section “the shareholders’ share” in relation to any income is so much of the income as is represented by the fraction

where—

A is an amount equal to the Case I profits of the company for the period in question in respect of its life assurance business, and

B is an amount equal to the excess of the company’s relevant non-premium income and relevant gains over its relevant expenses and relevant interest for the period.

(4)Where there is no such excess as is mentioned in subsection (3) above, or where the Case I profits are greater than any excess, the whole of the income shall be the shareholders’ share; and (subject to that) where there are no Case I profits, none of the income shall be the shareholders’ share.

(5)In subsection (3) above the references to the relevant non-premium income, relevant gains, relevant expenses and relevant interest of a company for an accounting period are references respectively to the following items as brought into account for the period, so far as referable to the company’s life assurance business,—

(a)the company’s investment income from the assets of its long-term business fund together with its other income, apart from premiums;

(b)any increase in the value (whether realised or not) of those assets;

(c)expenses payable by the company;

(d)interest payable by the company;

and if for any period there is a reduction in the value referred to in paragraph (b) above (as brought into account for the period), that reduction shall be taken into account as an expense of the period.

(6)Except in so far as regulations made by the Treasury otherwise provide, in this section “brought into account” means brought into account in the revenue account prepared for the purposes of the Insurance Companies Act 1982; and where the company’s period of account does not coincide with the accounting period, any reference to an amount brought into account for the accounting period is a reference to the corresponding amount brought into account for the period of account in which the accounting period is comprised, proportionately reduced to reflect the length of the accounting period as compared with the length of the period of account.

(7)In this section “Case I profits” means profits computed in accordance with the provisions of the Taxes Act 1988 applicable to Case I of Schedule D.

(8)For the purposes of this section franked investment income is “unrelieved” if—

(a)it has not been excluded from charge to tax by virtue of any provision,

(b)no tax credit comprised in it has been paid, and

(c)no relief has been allowed against it by deduction or set-off.”

(4)In subsection (3) of section 434 of the Taxes Act 1988 (franked investment income etc.)—

(a)for the words “policy holders’ fraction” in both places where they occur there shall be substituted the words “ policy holders’ share ”;

(b)in paragraph (a), after the word “income” there shall be inserted the words “ from investments held in connection with the company’s life assurance business ”;

(c)in paragraph (b), for the words “only to the shareholders’ fraction of that income” there shall be substituted the words “ to that income excluding the amount within paragraph (a) above ”.

(5)In subsection (3A) of that section, for the word “fraction” there shall be substituted the word “ share ”.

F37(6). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(7)After subsection (6) of that section there shall be inserted—

“(6A)For the purposes of this section—

(a)“the policy holders’ share” of any franked investment income is so much of that income as is not the shareholders’ share within the meaning of section 89 of the Finance Act 1989, and

(b)“the policy holders’ share of the relevant profits” has the same meaning as in section 88 of that Act.”

F38(8). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F39(9). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(10)The M11Finance Act 1989 shall be deemed always to have had effect with the amendments made by subsections (1) to (3) above, and the amendments made by subsections (4) to (9) above shall have the same effect as, by virtue of section 84(5)(b) of that Act, they would have had if they had been made by Schedule 8 to that Act.

(11)Paragraphs 1 and 3(3) of Schedule 8 to the Finance Act 1989 shall be deemed never to have had effect.

Textual Amendments

F37S. 45(6) repealed (31.7.1998 with effect in accordance with Schedule 3 to the amending Act) by 1998 c. 36, s. 165, Sch. 27 Pt.(2) Note

F38S. 45(8) repealed (1.5.1995 with effect as mentioned in Sch. 8 paras. 55-57 of the amending Act) by 1995 c. 4, s. 162, Sch. 29 Pt. VIII

F39S. 45(9) repealed (31.7.1997 with effect in accordance with the provisions of Sch. 3 to the amending Act, other than para. 11) by 1997 c. 58, s. 52, Sch. 8 Pt. II (6) Note (with s. 3(3))

Marginal Citations

F4046. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F40S. 46 repealed (6.3.1992 with effect as mentioned in s. 289(1)(2) of the repealing Act) by Taxation of Chargeable Gains Act 1992 (c. 12), s. 290, Sch.12 (with ss. 60, 101, 201(3), Sch. 11 paras. 22, 26(2), 27) (and expressed to be modified (31.7.1992) by S.I. 1992/1655, arts. 1, 19(1)); and expressed to be excluded (27.7.1993) by 1993 c. 34, s. 91(1).

F4147. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

48 Transfers of long term business.U.K.

Schedule 9 to this Act (which makes provision about the tax consequences of certain transfers of long term business by insurance companies) shall have effect.

49 Friendly societies: increased tax exemption.U.K.

(1)In subsection (2) of section 460 of the Taxes Act 1988 (exemption from tax for profits of friendly society arising from life or endowment business), in paragraph (c)—

(a)in sub-paragraph (i), for “£100” there shall be substituted “ £150 ”; and

(b)after that sub-paragraph there shall be inserted—

“(ia)where the profits relate to contracts made after 31st August 1987 but before 1st September 1990, of the assurance of gross sums under contracts under which the total premiums payable in any period of 12 months exceed £100;”.

(2)In subsection (3) of that section, for the words “of subsection (2)(c)(i)” there shall be substituted the words “ of subsection (2)(c)(i) or (ia) ”.

(3)In subsection (3) of section 464 of that Act (maximum benefits payable to members of friendly societies), for the words from “Kingdom)” to the end there shall be substituted the words “Kingdom)—

(a)contracts under which the total premiums payable in any period of 12 months exceed £150; or

(b)contracts made before 1st September 1990 under which the total premiums payable in any period of 12 months exceed £100,

unless all those contracts were made before 1st September 1987. ”

(4)In subsection (4) of that section, for the word “limit” there shall be substituted the word “ limits ”.

(5)In paragraph 3(8)(b)(ii) of Schedule 15 to that Act (amount of premiums to be disregarded in determining whether a policy meets conditions for it to be a qualifying policy), after the word “premiums” there shall be inserted the words “ or, where those premiums are payable otherwise than annually, an amount equal to 10 per cent. of those premiums if that is greater ”.

50 Friendly societies: application of enactments.U.K.

(1)Section 463 of the Taxes Act 1988 (application to life or endowment business of friendly societies of Corporation Tax Acts as they apply to mutual life assurance business) shall be renumbered as subsection (1) of that section.

(2)After that provision as so renumbered there shall be added—

“(2)The provisions of the Corporation Tax Acts which apply on the transfer of the whole or part of the long term business of an insurance company to another company shall apply in the same way—

(a)on the transfer of the whole or part of the business of a friendly society to another friendly society (and on the amalgamation of friendly societies), and

(b)on the transfer of the whole or part of the business of a friendly society to a company which is not a friendly society (and on the conversion of a friendly society into such a company),

so however that the Treasury may by regulations provide that those provisions as so applied shall have effect subject to such modifications and exceptions as may be prescribed by the regulations.

(3)The Treasury may by regulations provide that the provisions of the Corporation Tax Acts which apply on the transfer of the whole or part of the long term business of an insurance company to another company shall have effect where the transferee is a friendly society subject to such modifications and exceptions as may be prescribed by the regulations.

(4)Regulations under this section may make different provision for different cases and may include provision having retrospective effect.”

Unit and investment trusts etc.U.K.

F4251. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

52 Unit trusts: repeals.U.K.

(1)The Taxes Act 1988 shall have effect subject to the following provisions of this section.

(2)In section 468 (authorised unit trusts) subsection (5) shall not apply as regards a distribution period beginning after 31st December 1990.

(3)Where a particular distribution period is by virtue of subsection (2) above the last distribution period as regards which section 468(5) applies in the case of a trust, the trustees’ liability to income tax in respect of any source of income chargeable under Case III of Schedule D shall be assessed as if they had ceased to possess the source of income on the last day of that distribution period.

(4)But where section 67 of the Taxes Act 1988 applies by virtue of subsection (3) above, it shall apply with the omission from subsection (1)(b) of the words from “and shall” to “this provision”.

(5)Section 468B (certified unit trusts: corporation tax) shall not apply as regards an accounting period ending after 31st December 1990.

(6)Section 468C (certified unit trusts: distributions) shall not apply as regards a distribution period ending after 31st December 1990.

(7)Section 468D (funds of funds: distributions) shall not apply as regards a distribution period ending after 31st December 1990.

(8)In this section “distribution period” has the same meaning as in section 468 of the Taxes Act 1988.

53 Unit trust managers: exemption from bond-washing provisions.U.K.

F43(1). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(2)Section 472 of the Taxes Act 1970 (corresponding provision of the old law) shall be deemed always to have had effect with the insertion after subsection (5) of the subsection set out in subsection (1) above.

Textual Amendments

F43S. 53(1) repealed (31.7.1997 with effect in accordance with s. 26 of the amending Act) by 1997 c. 58, ss. 26, 52, Sch. 8 Pt. II(8) note (with s. 3(3))

F4454. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

55 Investment trusts.U.K.

(1)In section 842 of the Taxes Act 1988 (investment trusts) the following subsections shall be inserted after subsection (2)—

“(2A)Subsection (1)(e) above shall not apply as regards an accounting period if—

(a)the company is required to retain income in respect of the period by virtue of a restriction imposed by law, and

(b)the amount of income the company is so required to retain in respect of the period exceeds an amount equal to 15 per cent. of the income the company derives from shares and securities.

(2B)Subsection (2A) above shall not apply where—

(a)the amount of income the company retains in respect of the accounting period exceeds the amount of income it is required by virtue of a restriction imposed by law to retain in respect of the period, and

(b)the amount of the excess or, where the company distributes income in respect of the period, that amount together with the amount of income which the company so distributes is at least £10,000 or, where the period is less than 12 months, a proportionately reduced amount.

(2C)Paragraph (e) of subsection (1) above shall not apply as regards an accounting period if the amount which the company would be required to distribute in order to fall within that paragraph is less than £10,000 or, where the period is less than 12 months, a proportionately reduced amount.”

(2)This section applies in relation to accounting periods ending on or after the day on which this Act is passed.

SecuritiesU.K.

F4556. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

[F4657 Deep gain securities.U.K.

(1)In Schedule 11 to the M12Finance Act 1989 (deep gain securities) paragraph 1 (meaning of deep gain security) shall be amended as follows.

(2)The following sub-paragraph shall be inserted after sub-paragraph (3)—

“(3A)In the case of a security issued on or after 9th June 1989, for the purposes of sub-paragraph (2) above “redemption” does not include any redemption which may be made before maturity only if—

(a)the person who issued the security fails to comply with the duties imposed on him by the terms of issue,

(b)the person who issued the security becomes unable to pay his debts, or

(c)the security was issued by a company and a person gains control of the company in pursuance of the acceptance of an offer made by that person to acquire shares in the company.”

(3)The amendment made by this section shall be deemed always to have had effect.]

Textual Amendments

F46S. 57 repealed (retrospectively and to be taken always to have had effect) by Finance (No. 2) Act 1992 (c. 48), ss. 33, 82, Sch. 7 para. 7 Sch. 18 Pt.VII (made 16.7.1992).

Marginal Citations

F4758. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F4859. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

Oil industryU.K.

F4960. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F5061. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F50S. 61 repealed (for losses incurred in accounting periods ending on or after 01.04.1991) by Finance Act 1991 (c. 31, SIF 63:1), s. 123, Sch. 19 Pt.V Note 4(c).

62 CT treatment of PRT repayment.U.K.

(1)In section 500 of the Taxes Act 1988 (deduction of PRT in computing income for corporation tax purposes), in subsection (4) (reduction or extinguishment of deduction where PRT repaid)—

(a)at the beginning there shall be inserted the words “ Subject to the following provisions of this section ”; and

(b)for the words “accounting period” there shall be substituted “ calendar year ”.

(2)For subsection (5) of that section there shall be substituted the following subsections—

“(5)If, in a case where paragraph 17 of Schedule 2 to the 1975 Act applies, an amount of petroleum revenue tax in respect of which a deduction has been made under subsection (1) above is repaid by virtue of an assessment under that Schedule or an amendment of such an assessment, then, so far as concerns so much of that repayment as constitutes the appropriate repayment,—

(a)subsection (4) above shall not apply; and

(b)the following provisions of this section shall apply in relation to the company which is entitled to the repayment.

(6)In subsection (5) above and the following provisions of this section—

(a)“the appropriate repayment” has the meaning assigned by sub-paragraph (2) of paragraph 17 of Schedule 2 to the 1975 Act;

(b)in relation to the appropriate repayment, a “carried back loss” means an allowable loss which falls within sub-paragraph (1)(a) of that paragraph and which (alone or together with one or more other carried back losses) gives rise to the appropriate repayment;

(c)in relation to a carried back loss, “the operative chargeable period” means the chargeable period in which the loss accrued; and

(d)in relation to the company which is entitled to the appropriate repayment, “the relevant accounting period” means the accounting period in or at the end of which ends the operative chargeable period or, if the company’s ring fence trade is permanently discontinued before the end of the operative chargeable period, the last accounting period of that trade.

(7)In computing for corporation tax the amount of the company’s income arising in the relevant accounting period from oil extraction activities or oil rights there shall be added an amount equal to the appropriate repayment; but this subsection has effect subject to subsection (8) below in any case where—

(a)two or more carried back losses give rise to the appropriate repayment; and

(b)the operative chargeable period in relation to each of the carried back losses is not the same; and

(c)if subsection (6)(d) above were applied separately in relation to each of the carried back losses there would be more than one relevant accounting period.

(8)Where paragraphs (a) to (c) of subsection (7) above apply, the appropriate repayment shall be treated as apportioned between each of the relevant accounting periods referred to in paragraph (c) of that subsection in such manner as to secure that the amount added by virtue of that subsection in relation to each of those relevant accounting periods is what it would have been if—

(a)relief for each of the carried back losses for which there is a different operative chargeable period had been given by a separate assessment or amendment of an assessment under Schedule 2 to the 1975 Act; and

(b)relief for a carried back loss accruing in an earlier chargeable period had been so given before relief for a carried back loss accruing in a later chargeable period.

(9)Any additional assessment to corporation tax required in order to give effect to the addition of an amount by virtue of subsection (7) above may be made at any time not later than six years after the end of the calendar year in which is made the repayment of petroleum revenue tax comprising the appropriate repayment.

(10)In this section “allowable loss” and “chargeable period” have the same meaning as in Part I of the 1975 Act and “calendar year” means a period of twelve months beginning on 1st January.”

(3)At the end of section 502(1) of the Taxes Act 1988 (defined expressions for Chapter V of Part XII) there shall be added “and

“ring fence trade” means activities which—

(a)fall within any of paragraphs (a) to (c) of subsection (1) of section 492; and

(b)constitute a separate trade (whether by virtue of that subsection or otherwise)”.

F5163. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F5264. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

InternationalU.K.

F5365. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F5466. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

67 Dual resident companies: controlled foreign companies.U.K.

F55(1). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F55(2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(3)In Schedule 25 to that Act—

(a)paragraphs 2(1)(c) and 4(1)(c) shall be omitted,

(b)after paragraph 2(1) there shall be inserted—

“(1A)A payment of dividend to a company shall not fall within sub-paragraph (1)(d) above unless it is taken into account in computing the company’s income for corporation tax.”, and

(c)after paragraph 4(1) there shall be inserted—

“(1A)A payment to a company shall not be a subsequent dividend within the meaning of sub-paragraph (1)(b) above unless it is taken into account in computing the company’s income for corporation tax.”

(4)Subsections (1) and (2) above shall apply on and after 20th March 1990 and subsection (3) above shall apply to dividends paid on or after that date.

Textual Amendments

F55S. 67(1)(2) repealed (3.5.1994 with effect in accordance with section 251 of the amending Act) by 1994 c. 9, ss. 251, 258, Sch. 26 Pt. VIII(1) Note

68 Movements of capital between residents of member States.U.K.

(1)In section 765 of the Taxes Act 1988 (certain transactions unlawful unless carried out with Treasury consent), in subsection (1), after the words “Subject to the provisions of this section” there shall be inserted the words “ and section 765A ”.

(2)After that section there shall be inserted—

“765A Movements of capital between residents of member States.

(1)765(1) shall not apply to a transaction which is a movement of capital to which Article 1 of the Directive of the Council of the European Communities dated 24th June 1988 No. 88/361/EEC applies.

(2)Where if that Article did not apply to it a transaction would be unlawful under section 765(1), the body corporate in question (that is to say, the body corporate resident in the United Kingdom) shall—

(a)give to the Board within six months of the carrying out of the transaction such information relating to the transaction, or to persons connected with the transaction, as regulations made by the Board may require, and

(b)where notice is given to the body corporate by the Board, give to the Board within such period as is prescribed by regulations made by the Board (or such longer period as the Board may in the case allow) such further particulars relating to the transaction, to related transactions, or to persons connected with the transaction or related transactions, as the Board may require.”

(3)In section 98 of the M13Taxes Management Act 1970 (penalties for failure to furnish information and for false information)—

(a)in subsection (1), after the words “Subject to” there shall be inserted the words “ the provisions of this section and ”;

(b)after subsection (4) there shall be inserted—

“(5)In the case of a failure to comply with section 765A(2)(a) or (b) of the principal Act, subsection (1) above shall have effect as if for “£300” there were substituted “ £3,000 ” and as if for “£60” there were substituted “ £600 ”.”;

(c)in the first column of the Table, after “section 755” there shall be inserted “ section 765A(2)(b); ”; and

(d)in the second column of the Table, after “section 639” there shall be inserted “ section 765A(2)(a); ”.

(4)This section shall apply to transactions carried out on or after 1st July 1990.

69 European Economic Interest Groupings.U.K.

Schedule 11 to this Act (which makes provision about the taxation of income and gains in the case of European Economic Interest Groupings) shall have effect.

F5670. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F56S. 70 repealed (6.3.1992 with effect as mentioned in s. 289 (1)(2) of the repealing Act) by Taxation of Chargeable Gains Act 1992 (c. 12), s, 290, Sch. 12 (with ss. 60, 101(1), 201(3), Sch. 11 paras. 22, 26(2), 27).

MiscellaneousU.K.

71 Relief for interest.U.K.

For the year 1990-91 the qualifying maximum defined in section 367(5) of the Taxes Act 1988 (limit on relief for interest on certain loans) shall be £30,000.

F5772. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F57S. repealed (6.3.1992 with effect as mentioned in s. 289 (1)(2) of the repealing Act) by Taxation of Chargeable Gains Act 1992 (c. 12), s. 290, Sch.12 (with ss. 60, 101(1), 201(3), Sch. 11 paras. 22, 26(2), 27).

F5873. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F58S. 73 repealed (3.5.1994 with effect in relation to shares issued on or after 1st January 1994) by 1994 c. 9, s. 258, Sch. 26 Pt. V(17) Note

F5974. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F6075. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F60S. 75 repealed (3.5.1994) by 1994 c. 9, s. 258, Sch. 26 Pt. V(21)

76 Training and enterprise councils and local enterprise companies.U.K.

After section 79 of the Taxes Act 1988 there shall be inserted—

“79A Contributions to training and enterprise councils and local enterprise companies.

(1)Notwithstanding anything in section 74, but subject to the provisions of this section, where a person carrying on a trade, profession or vocation makes any contribution (whether in cash or in kind) to a training and enterprise council or a local enterprise company, any expenditure incurred by him in making the contribution may be deducted as an expense in computing the profits or gains of the trade, profession or vocation for the purposes of tax if it would not otherwise be so deductible.

(2)Where any such contribution is made by an investment company any expenditure allowable as a deduction under subsection (1) above shall for the purposes of section 75 be treated as expenses of management.

(3)Subsection (1) above does not apply in relation to a contribution made by any person if either he or any person connected with him receives or is entitled to receive a benefit of any kind whatsoever for or in connection with the making of that contribution, whether from the council or company concerned or from any other person.

(4)In any case where—

(a)relief has been given under subsection (1) above in respect of a contribution, and

(b)any benefit received in any chargeable period by the contributor or any person connected with him is in any way attributable to that contribution,

the contributor shall in respect of that chargeable period be charged to tax under Case I or Case II of Schedule D, or if he is not chargeable to tax under either of those Cases for that period under Case VI of Schedule D, on an amount equal to the value of that benefit.

(5)In this section—

(a)“training and enterprise council” means a body with which the Secretary of State has made an agreement (not being one which has terminated) under which it is agreed that the body shall carry out the functions of a training and enterprise council, and

(b)“local enterprise company” means a company with which an agreement (not being one which has terminated) under which it is agreed that the company shall carry out the functions of a local enterprise company has been made by the Scottish Development Agency, the Highlands and Islands Development Board, Scottish Enterprise or Highlands and Islands Enterprise.

(6)Section 839 applies for the purposes of subsections (3) and (4) above.

(7)This section applies to contributions made on or after 1st April 1990 and before 1st April 1995.”

77 Expenses of entertainers.U.K.

The following section shall be inserted after section 201 of the Taxes Act 1988—

“201A Expenses of entertainers.

(1)Where emoluments of an employment to which this section applies fall to be charged to tax for a year of assessment for which this section applies, there may be deducted from the emoluments of the employment to be charged to tax for the year—

(a)fees falling within subsection (2) below, and

(b)any additional amount paid by the employee in respect of value added tax charged by reference to those fees.

(2)Fees fall within this subsection if—

(a)they are paid by the employee to another person,

(b)they are paid under a contract made between the employee and the other person, who agrees under the contract to act as an agent of the employee in connection with the employment,

(c)at each time any of the fees are paid the other person carries on an employment agency with a view to profit and holds a current licence for the agency,

(d)they are calculated as a percentage of the emoluments of the employment or as a percentage of part of those emoluments, and

(e)they are defrayed out of the emoluments of the employment falling to be charged to tax for the year concerned.

(3)For the purposes of subsection (2) above—

(a)“employment agency” means an employment agency within the meaning given by section 13(2) of the Employment Agencies Act 1973, and

(b)a person holds a current licence for an employment agency if he holds a current licence under that Act authorising him to carry on the agency.

(4)The amount which may be deducted by virtue of this section shall not exceed 175 per cent. of the emoluments of the employment falling to be charged to tax for the year concerned.

(5)This section applies to employment as an actor, singer, musician, dancer or theatrical artist.

(6)This section applies for the year 1990–91 and subsequent years of assessment.”

78 Waste disposal.U.K.

The following sections shall be inserted after section 91 of the Taxes Act 1988—

“91A Waste disposal: restoration payments.

(1)This section applies where on or after 6th April 1989 a person makes a site restoration payment in the course of carrying on a trade.

(2)Subject to subsection (3) below, for the purposes of income tax or corporation tax the payment shall be allowed as a deduction in computing the profits or gains of the trade for the period of account in which the payment is made.

(3)Subsection (2) above shall not apply to so much of the payment as—

(a)represents expenditure which has been allowed as a deduction in computing the profits or gains of the trade for any period of account preceding the period of account in which the payment is made, or

(b)represents capital expenditure in respect of which an allowance has been, or may be, made under the enactments relating to capital allowances.

(4)For the purposes of this section a site restoration payment is a payment made—

(a)in connection with the restoration of a site or part of a site, and

(b)in order to comply with any condition of a relevant licence, or any condition imposed on the grant of planning permission to use the site for the carrying out of waste disposal activities, or any term of a relevant agreement.

(5)For the purposes of this section waste disposal activities are the collection, treatment, conversion and final depositing of waste materials, or any of those activities.

(6)For the purposes of this section a relevant licence is—

(a)a disposal licence under Part I of the Control of Pollution Act 1974 or Part II of the Pollution Control and Local Government (Northern Ireland) Order 1978, or

(b)a waste management licence under Part II of the Environmental Protection Act 1990 or any corresponding provision for the time being in force in Northern Ireland.

(7)For the purposes of this section a relevant agreement is an agreement made under section 52 of the Town and Country Planning Act 1971, section 50 of the Town and Country Planning (Scotland) Act 1972 or section 106 of the Town and Country Planning Act 1990 (all of which relate to agreements regulating the development or use of land) or under any provision corresponding to section 106 of the Town and Country Planning Act 1990 and for the time being in force in Northern Ireland.

(8)For the purposes of this section a period of account is a period for which an account is made up.

91B Waste disposal: preparation expenditure.

(1)This section applies where a person—

(a)incurs, in the course of carrying on a trade, site preparation expenditure in relation to a waste disposal site (the site in question),

(b)holds, at the time the person first deposits waste materials on the site in question, a relevant licence which is then in force,