Calculation of lump sumE+W+S

6.—(1) The lump sum is the accrued amount for the last accrual period beginning during the period of deferment.

(2) In this paragraph—

“accrued amount” means the amount calculated in accordance with sub-paragraph (3);

“accrual period” means any period of seven days beginning with the day of the week on which Category A or Category B retirement pension would have been payable to a person in accordance with regulation 22(3) of, and paragraph 5 of Schedule 6 to, the Social Security (Claims and Payments) Regulations 1987 M1 [F1or in accordance with regulation 22C(3) or (4) of those Regulations], if his entitlement to a retirement pension had not been deferred, where that day falls within the period of deferment.

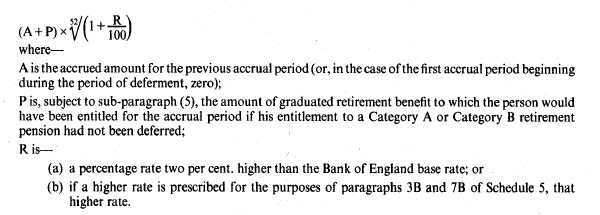

(3) The accrued amount for an accrual period for a person is—

(4) For the purposes of sub-paragraph (3), any change in the Bank of England base rate is to be treated as taking effect—

(a)at the beginning of the accrual period immediately following the accrual period during which the change took effect; or

(b)if regulations under paragraph 3B(4) of Schedule 5 so provide, at such other time as may be prescribed in those Regulations.

(5) Regulation 3 of the Social Security (Deferral of Retirement Pensions) Regulations 2005 M2 shall have effect for the purposes of this paragraph in like manner to graduated retirement benefit as it does to retirement pension in the calculation of the lump sum under paragraph 3B of Schedule 5.

Textual Amendments

F1Words in Sch. 1 para. 6(2) inserted (6.4.2017) by The Occupational Pension Schemes and Social Security (Schemes that were Contracted-out and Graduated Retirement Benefit) (Miscellaneous Amendments) Regulations 2017 (S.I. 2017/354), regs. 1(2), 3

Marginal Citations

M1S.I.1987/1968; the relevant amending instruments are S.I.2000/1483 and 2002/2441.