- Latest available (Revised)

- Point in Time (31/12/2020)

- Original (As adopted by EU)

Directive 2013/36/EU of the European Parliament and of the CouncilShow full title

Directive 2013/36/EU of the European Parliament and of the Council of 26 June 2013 on access to the activity of credit institutions and the prudential supervision of credit institutions and investment firms, amending Directive 2002/87/EC and repealing Directives 2006/48/EC and 2006/49/EC (Text with EEA relevance)

You are here:

- Show Geographical Extent(e.g. England, Wales, Scotland and Northern Ireland)

- Show Timeline of Changes

More Resources

Revised version PDFs

- Revised 29/12/20201.54 MB

- Revised 09/07/20181.37 MB

- Revised 13/01/20181.06 MB

- Revised 01/01/20151.06 MB

- Revised 20/03/20141.05 MB

- Revised 17/07/20131.06 MB

When the UK left the EU, legislation.gov.uk published EU legislation that had been published by the EU up to IP completion day (31 December 2020 11.00 p.m.). On legislation.gov.uk, these items of legislation are kept up-to-date with any amendments made by the UK since then.

This item of legislation originated from the EU

Legislation.gov.uk publishes the UK version. EUR-Lex publishes the EU version. The EU Exit Web Archive holds a snapshot of EUR-Lex’s version from IP completion day (31 December 2020 11.00 p.m.).

Status:

EU Directives are published on this site to aid cross referencing from UK legislation. Since IP completion day (31 December 2020 11.00 p.m.) no amendments have been applied to this version.

CHAPTER 4 U.K. Capital Buffers

Section I U.K. Buffers

Article 128U.K.Definitions

For the purpose of this Chapter, the following definitions shall apply:

'capital conservation buffer' means the own funds that an institution is required to maintain in accordance with Article 129;

'institution-specific countercyclical capital buffer' means the own funds that an institution is required to maintain in accordance with Article 130;

'G-SII buffer' means the own funds that are required to be maintained in accordance with Article 131(4);

'O-SII buffer' means the own funds that may be required to be maintained in accordance with Article 131(5);

'systemic risk buffer' means the own funds that an institution is or may be required to maintain in accordance with Article 133;

'combined buffer requirement' means the total Common Equity Tier 1 capital required to meet the requirement for the capital conservation buffer extended by the following, as applicable:

an institution-specific countercyclical capital buffer;

a G-SII buffer;

an O-SII buffer;

a systemic risk buffer;

'countercyclical buffer rate' means the rate that institutions must apply in order to calculate their institution-specific countercyclical capital buffer, and that is set in accordance with Article 136, Article 137 or by a relevant third-country authority, as the case may be;

'domestically authorised institution' means an institution that has been authorised in the Member State for which a particular designated authority is responsible for setting the countercyclical buffer rate;

'buffer guide' means a benchmark buffer rate calculated in accordance with Article 135(1).

[F1Institutions shall not use Common Equity Tier 1 capital that is maintained to meet the combined buffer requirement referred to in point (6) of the first paragraph of this Article, to meet any of the requirements set out in points (a), (b) and (c) of Article 92(1) of Regulation (EU) No 575/2013, the additional own funds requirements imposed pursuant to Article 104a of this Directive to address risks other than the risk of excessive leverage, and the guidance communicated in accordance with Article 104b(3) of this Directive to address risks other than the risk of excessive leverage.

Institutions shall not use Common Equity Tier 1 capital that is maintained to meet one of the elements of its combined buffer requirement to meet the other applicable elements of its combined buffer requirement.

Institutions shall not use Common Equity Tier 1 capital that is maintained to meet the combined buffer requirement referred to in point (6) of the first paragraph of this Article to meet the risk-based components of the requirements set out in Articles 92a and 92b of Regulation (EU) No 575/2013 and in Articles 45c and 45d of Directive 2014/59/EU.]

This Chapter shall not apply to investment firms that are not authorised to provide the investment services listed in points 3 and 6 of Section A of Annex I to Directive 2004/39/EC.

Textual Amendments

F1 Inserted by Directive (EU) 2019/878 of the European Parliament and of the Council of 20 May 2019 amending Directive 2013/36/EU as regards exempted entities, financial holding companies, mixed financial holding companies, remuneration, supervisory measures and powers and capital conservation measures (Text with EEA relevance).

[F2Article 129 U.K. Requirement to maintain a capital conservation buffer

1. In addition to the Common Equity Tier 1 capital that is maintained to meet any of the own funds requirements set out in points (a), (b) and (c) of Article 92(1) of Regulation (EU) No 575/2013, Member States shall require institutions to maintain a capital conservation buffer of Common Equity Tier 1 capital equal to 2,5 % of their total risk exposure amount calculated in accordance with Article 92(3) of that Regulation on an individual and on a consolidated basis, as applicable in accordance with Title II of Part One of that Regulation.

2. By way of derogation from paragraph 1, a Member State may exempt small and medium-sized investment firms from complying with the requirements set out in paragraph 1 if such an exemption does not threaten the stability of the financial system of that Member State.

Decisions on the application of the exemption referred to in the first subparagraph shall be fully reasoned, shall include an explanation as to why the exemption does not threaten the stability of the financial system of the Member State and shall contain the exact definition of the small and medium-sized investment firms which are to be exempted.

Member States which decide to apply the exemption referred to in the first subparagraph shall notify the ESRB thereof. The ESRB shall forward such notifications to the Commission, to EBA and to the competent and designated authorities of the Member States concerned without delay.

3. For the purposes of paragraph 2, Member States shall designate an authority to be responsible for the application of this Article. That authority shall be the competent authority or the designated authority.

4. For the purposes of paragraph 2, investment firms shall be categorised as small or medium-sized in accordance with Commission Recommendation 2003/361/EC (1) .

5. Where an institution fails to fully meet the requirement set out in paragraph 1 of this Article, it shall be subject to the restrictions on distributions set out in Article 141(2) and (3).

Textual Amendments

F2 Substituted by Directive (EU) 2019/878 of the European Parliament and of the Council of 20 May 2019 amending Directive 2013/36/EU as regards exempted entities, financial holding companies, mixed financial holding companies, remuneration, supervisory measures and powers and capital conservation measures (Text with EEA relevance).

Article 130 U.K. Requirement to maintain an institution-specific countercyclical capital buffer

1. Member States shall require institutions to maintain an institution-specific countercyclical capital buffer equivalent to their total risk exposure amount calculated in accordance with Article 92(3) of Regulation (EU) No 575/2013 multiplied by the weighted average of the countercyclical buffer rates calculated in accordance with Article 140 of this Directive on an individual and on a consolidated basis, as applicable in accordance with Title II of Part One of that Regulation. That buffer shall consist of Common Equity Tier 1 capital.

2. By way of derogation from paragraph 1, a Member State may exempt small and medium-sized investment firms from complying with the requirements set out in paragraph 1 if such an exemption does not threaten the stability of the financial system of that Member State.

Decisions on the application of the exemption referred to in the first subparagraph shall be fully reasoned, shall include an explanation as to why the exemption does not threaten the stability of the financial system of the Member State and shall contain the exact definition of small and medium-sized investment firms which are to be exempted.

Member States which decide to apply the exemption referred to in the first subparagraph shall notify the ESRB thereof. The ESRB shall forward such notifications to the Commission, to EBA and to the competent and designated authorities of the Member States concerned without delay.

3. For the purposes of paragraph 2, Member States shall designate an authority to be responsible for the application of this Article. That authority shall be the competent authority or the designated authority.

4. For the purposes of paragraph 2, investment firms shall be categorised as small and medium-sized in accordance with Recommendation 2003/361/EC.

5. Where an institution fails to fully meet the requirement set out in paragraph 1 of this Article, it shall be subject to the restrictions on distributions set out in Article 141(2) and (3).]

Textual Amendments

F2 Substituted by Directive (EU) 2019/878 of the European Parliament and of the Council of 20 May 2019 amending Directive 2013/36/EU as regards exempted entities, financial holding companies, mixed financial holding companies, remuneration, supervisory measures and powers and capital conservation measures (Text with EEA relevance).

Article 131U.K.Global and other systemically important institutions

[F21. Member States shall designate an authority to be responsible for identifying, on a consolidated basis, G-SIIs, and, on an individual, sub-consolidated or consolidated basis, as applicable, other systemically important institutions (O-SIIs), which have been authorised within their jurisdiction. That authority shall be the competent authority or the designated authority. Member States may designate more than one authority.

G-SIIs shall be any of the following:

(a) a group headed by an EU parent institution, an EU parent financial holding company, or an EU parent mixed financial holding company; or

(b) an institution that is not a subsidiary of an EU parent institution, of an EU parent financial holding company or of an EU parent mixed financial holding company.

O-SIIs may either be an institution or a group headed by an EU parent institution, an EU parent financial holding company, an EU parent mixed financial holding company, a parent institution in a Member State, a parent financial holding company in a Member State or a parent mixed financial holding company in a Member State.]

2.The identification methodology for G-SIIs shall be based on the following categories:

(a)size of the group;

(b)interconnectedness of the group with the financial system;

(c)substitutability of the services or of the financial infrastructure provided by the group;

(d)complexity of the group;

(e)cross-border activity of the group, including cross border activity between Member States and between a Member State and a third country.

Each category shall receive an equal weighting and shall consist of quantifiable indicators.

The methodology shall produce an overall score for each entity as referred to in paragraph 1 assessed, which allows G-SIIs to be identified and allocated into a sub-category as described in paragraph 9.

[F12a. An additional identification methodology for G-SIIs shall be based on the following categories:

(a) the categories referred to in points (a) to (d) of paragraph 2 of this Article;

(b) cross-border activity of the group, excluding the group's activities across participating Member States as referred to in Article 4 of Regulation (EU) No 806/2014 of the European Parliament and of the Council (2) .

Each category shall receive an equal weighting and shall consist of quantifiable indicators. For the categories referred to in point (a) of the first subparagraph of this paragraph, the indicators shall be the same as the corresponding indicators determined pursuant to paragraph 2.

The additional identification methodology shall produce an additional overall score for each entity as referred to in paragraph 1 assessed, on the basis of which competent or designated authorities may take one of the measures referred to in point (c) of paragraph 10.]

3.O-SIIs shall be identified in accordance with paragraph 1. Systemic importance shall be assessed on the basis of at least any of the following criteria:

(a)size;

(b)importance for the economy of the Union or of the relevant Member State;

(c)significance of cross-border activities;

(d)interconnectedness of the institution or group with the financial system.

[F2EBA, after consulting the ESRB, shall issue guidelines, in accordance with Article 16 of Regulation (EU) No 1093/2010, by 1 January 2015 on the criteria to determine the conditions of application of this paragraph in relation to the assessment of O-SIIs. Those guidelines shall take into account international frameworks for domestic systemically important institutions and Union and national specificities.

After having consulted the ESRB, EBA shall report to the Commission by 31 December 2020 on the appropriate methodology for the design and calibration of O-SII buffer rates.]

4.Each G-SII shall, on a consolidated basis, maintain a G-SII buffer which shall correspond to the sub-category to which the G-SII is allocated. That buffer shall consist of and shall be supplementary to Common Equity Tier 1 capital.

[F25. The competent authority or the designated authority may require each O-SII, on a consolidated, sub-consolidated or individual basis, as applicable, to maintain an O-SII buffer of up to 3 % of the total risk exposure amount calculated in accordance with Article 92(3) of Regulation (EU) No 575/2013, taking into account the criteria for the identification of the O-SII. That buffer shall consist of Common Equity Tier 1 capital.]

[F15a. Subject to the Commission authorisation referred to in the third subparagraph of this paragraph, the competent authority or the designated authority may require each O-SII, on a consolidated, sub-consolidated or individual basis, as applicable, to maintain an O-SII buffer higher than 3 % of the total risk exposure amount calculated in accordance with Article 92(3) of Regulation (EU) No 575/2013. That buffer shall consist of Common Equity Tier 1 capital.

Within six weeks of receipt of the notification referred to in paragraph 7 of this Article, the ESRB shall provide the Commission with an opinion as to whether the O-SII buffer is deemed appropriate. EBA may also provide the Commission with its opinion on the buffer in accordance with Article 34(1) of Regulation (EU) No 1093/2010.

Within three months of the ESRB forwarding the notification referred to in paragraph 7 to the Commission, the Commission, taking into account the assessment of the ESRB and EBA, if relevant, and if it is satisfied that the O-SII buffer does not entail disproportionate adverse effects on the whole or parts of the financial system of other Member States or of the Union as a whole forming or creating an obstacle to the proper functioning of the internal market, shall adopt an act authorising the competent authority or the designated authority to adopt the proposed measure.]

6.When requiring an O-SII buffer to be maintained the competent authority or the designated authority shall comply with the following:

(a)the O-SII buffer must not entail disproportionate adverse effects on the whole or parts of the financial system of other Member States or of the Union as a whole forming or creating an obstacle to the functioning of the internal market;

(b)the O-SII buffer must be reviewed by the competent authority or the designated authority at least annually.

[F27. Before setting or resetting an O-SII buffer, the competent authority or the designated authority shall notify the ESRB one month before the publication of the decision referred to in paragraph 5 and shall notify the ESRB three months before the publication of the decision of the competent authority or the designated authority referred to in paragraph 5a. The ESRB shall forward such notifications to the Commission, to EBA and to the competent and designated authorities of the Member States concerned without delay. Such notifications shall set out in detail:]

(a)the justification for why the O-SII buffer is considered likely to be effective and proportionate to mitigate the risk;

(b)an assessment of the likely positive or negative impact of the O-SII buffer on the internal market, based on information which is available to the Member State;

(c)the O-SII buffer rate that the Member State wishes to set.

[F28. Without prejudice to Article 133 and paragraph 5 of this Article, where an O-SII is a subsidiary of either a G-SII or an O-SII which is either an institution or a group headed by an EU parent institution, and subject to an O-SII buffer on a consolidated basis, the buffer that applies on an individual or sub-consolidated basis for the O-SII shall not exceed the lower of:

(a) the sum of the higher of the G-SII or the O-SII buffer rate applicable to the group on a consolidated basis and 1 % of the total risk exposure amount calculated in accordance with Article 92(3) of Regulation (EU) No 575/2013; and

(b) 3 % of the total risk exposure amount calculated in accordance with Article 92(3) of Regulation (EU) No 575/2013, or the rate the Commission has authorised to be applied to the group on a consolidated basis in accordance with paragraph 5a of this Article.]

[F29. There shall be at least five sub-categories of G-SIIs. The lowest boundary and the boundaries between each subcategory shall be determined by the scores in accordance with the identification methodology referred to in paragraph 2 of this Article. The cut-off scores between adjacent sub-categories shall be defined clearly and shall adhere to the principle that there is a constant linear increase of systemic significance, between each sub-category resulting in a linear increase in the requirement of additional Common Equity Tier 1 capital, with the exception of sub-category five and any added higher sub-category. For the purposes of this paragraph, systemic significance is the expected impact exerted by the G-SII's distress on the global financial market. The lowest sub-category shall be assigned a G-SII buffer of 1 % of the total risk exposure amount calculated in accordance with Article 92(3) of Regulation (EU) No 575/2013 and the buffer assigned to each sub-category shall increase in gradients of at least 0,5 % of the total risk exposure amount calculated in accordance with Article 92(3) of that Regulation.

10. Without prejudice to paragraphs 1 and 9 and using the sub-categories and cut-off scores referred to in paragraph 9, the competent authority or the designated authority may, in the exercise of sound supervisory judgment:

(a) re-allocate a G-SII from a lower sub-category to a higher sub-category;

(b) allocate an entity as referred to in paragraph 1 that has an overall score as referred to in paragraph 2 that is lower than the cut-off score of the lowest sub-category to that sub-category or to a higher sub-category, thereby designating it as a G-SII;

(c) taking into account the Single Resolution Mechanism, on the basis of the additional overall score referred to in paragraph 2a re-allocate a G-SII from a higher sub-category to a lower sub-category.]

F311.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

[F212. The competent authority or the designated authority shall notify to the ESRB the names of the G-SIIs and O-SIIs and the respective sub-category to which each G-SII is allocated. The notification shall contain full reasons why supervisory judgment has been exercised or not in accordance with points (a), (b) and (c) of paragraph 10. The ESRB shall forward such notifications to the Commission and to EBA without delay, and shall publicly disclose their names. The competent authorities or designated authorities shall publicly disclose the sub-category to which each G-SII is allocated.

The competent authority or the designated authority shall review annually the identification of G-SIIs and O-SIIs and the G-SII allocation into the respective sub-categories and report the result to the systemically important institution concerned, to the ESRB which shall forward the results to the Commission and to EBA without delay. The competent authority or the designated authority shall publicly disclose the updated list of identified systemically important institutions and the sub-category into which each identified G-SII is allocated.]

F313.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

[F214. Where a group, on a consolidated basis, is subject to a G-SII buffer and to an O-SII buffer the higher buffer shall apply.

15. Where an institution is subject to a systemic risk buffer, set in accordance with Article 133, that buffer shall be cumulative with the O-SII buffer or the G-SII buffer that is applied in accordance with this Article.

Where the sum of the systemic risk buffer rate as calculated for the purposes of paragraph 10, 11 or 12 of Article 133 and the O-SII buffer rate or the G-SII buffer rate to which the same institution is subject to would be higher than 5 %, the procedure set out in paragraph 5a of this Article shall apply.]

F316.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F317.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

[F218. EBA shall develop draft regulatory technical standards to specify, for the purposes of this Article, the methodologies in accordance with which the competent authority or the designated authority shall identify an institution or a group headed by an EU parent institution, an EU parent financial holding company or by an EU parent mixed financial holding company as a G-SII and to specify the methodology for the definition of the sub-categories and the allocation of G-SIIs in the sub-categories based on their systemic significance, taking into account any internationally agreed standards.

EBA shall submit those draft regulatory technical standards to the Commission by 30 June 2014 .

Power is delegated to the Commission to adopt the regulatory technical standards referred to in this paragraph in accordance with Articles 10 to14 of Regulation (EU) No 1093/2010.]

Textual Amendments

F1 Inserted by Directive (EU) 2019/878 of the European Parliament and of the Council of 20 May 2019 amending Directive 2013/36/EU as regards exempted entities, financial holding companies, mixed financial holding companies, remuneration, supervisory measures and powers and capital conservation measures (Text with EEA relevance).

F2 Substituted by Directive (EU) 2019/878 of the European Parliament and of the Council of 20 May 2019 amending Directive 2013/36/EU as regards exempted entities, financial holding companies, mixed financial holding companies, remuneration, supervisory measures and powers and capital conservation measures (Text with EEA relevance).

F3 Deleted by Directive (EU) 2019/878 of the European Parliament and of the Council of 20 May 2019 amending Directive 2013/36/EU as regards exempted entities, financial holding companies, mixed financial holding companies, remuneration, supervisory measures and powers and capital conservation measures (Text with EEA relevance).

F3Article 132U.K. [F3Reporting]

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F3 Deleted by Directive (EU) 2019/878 of the European Parliament and of the Council of 20 May 2019 amending Directive 2013/36/EU as regards exempted entities, financial holding companies, mixed financial holding companies, remuneration, supervisory measures and powers and capital conservation measures (Text with EEA relevance).

[F2Article 133 U.K. Requirement to maintain a systemic risk buffer

1. Each Member State may introduce a systemic risk buffer of Common Equity Tier 1 capital for the financial sector or one or more subsets of that sector on all or a subset of exposures as referred to in paragraph 5 of this Article, in order to prevent and mitigate macroprudential or systemic risks not covered by Regulation (EU) No 575/2013 and by Articles 130 and 131 of this Directive, in the meaning of a risk of disruption in the financial system with the potential to have serious negative consequences to the financial system and the real economy in a specific Member State.

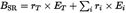

2. Institutions shall calculate the systemic risk buffer as follows:

where:

=

the systemic risk buffer;

=

the buffer rate applicable to the total risk exposure amount of an institution;

=

the total risk exposure amount of an institution calculated in accordance with Article 92(3) of Regulation (EU) No 575/2013;

=

the index denoting the subset of exposures as referred to in paragraph 5;

=

the buffer rate applicable to the risk exposure amount of the subset of exposures i; and

=

the risk exposure amount of an institution for the subset of exposures i calculated in accordance with Article 92(3) of Regulation (EU) No 575/2013.

3. For the purposes of paragraph 1, Member States shall designate an authority to be responsible for setting the systemic risk buffer and for identifying the exposures and subsets of institutions to which it applies. That authority shall be either the competent authority or the designated authority.

4. For the purposes of paragraph 1 of this Article, the relevant competent or designated authority, as applicable, may require institutions to maintain a systemic risk buffer of Common Equity Tier 1 capital calculated in accordance with paragraph 2 of this Article, on an individual, consolidated, or sub-consolidated basis, as applicable in accordance with Title II of Part One of Regulation (EU) No 575/2013.

5. A systemic risk buffer may apply to:

(a) all exposures located in the Member State that sets that buffer;

(b) the following sectoral exposures located in the Member State that sets that buffer:

all retail exposures to natural persons which are secured by residential property;

all exposures to legal persons which are secured by mortgages on commercial immovable property;

all exposures to legal persons excluding those specified in point (ii);

all exposures to natural persons excluding those specified in point (i);

(c) all exposures located in other Member States, subject to paragraphs 12 and 15;

(d) sectoral exposures, as identified in point (b) of this paragraph, located in other Member States only to enable recognition of a buffer rate set by another Member State in accordance with Article 134;

(e) exposures located in third countries;

(f) subsets of any of the exposure categories identified in point (b).

6. EBA shall, after consulting the ESRB, issue guidelines, in accordance with Article 16 of Regulation (EU) No 1093/2010, by 30 June 2020 on the appropriate subsets of exposures to which the competent authority or the designated authority may apply a systemic risk buffer in accordance with point (f) of paragraph 5 of this Article.

7. A systemic risk buffer shall apply to all exposures, or a subset of exposures as referred to in paragraph 5 of this Article, of all institutions, or one or more subsets of those institutions, for which the authorities of the Member State concerned are competent in accordance with this Directive and shall be set in steps of adjustment of 0,5 percentage points or multiples thereof. Different requirements may be introduced for different subsets of institutions and of exposures. The systemic risk buffer shall not address risks that are covered by Articles 130 and 131.

8. When requiring a systemic risk buffer to be maintained the competent authority or the designated authority shall comply with the following:

(a) the systemic risk buffer does not entail disproportionate adverse effects on the whole or parts of the financial system of other Member States or of the Union as a whole forming or creating an obstacle to the proper functioning of the internal market;

(b) the systemic risk buffer is to be reviewed by the competent authority or the designated authority at least every second year;

(c) the systemic risk buffer is not to be used to address risks that are covered by Articles 130 and 131.

9. The competent authority or the designated authority, as applicable, shall notify the ESRB before the publication of the decision referred to in paragraph 13. The ESRB shall forward such notifications to the Commission, to EBA and to the competent and designated authorities of the Member States concerned without delay.

Where the institution to which one or more systemic risk buffer rates apply is a subsidiary the parent of which is established in another Member State, the competent authority or the designated authority shall also notify the authorities of that Member State.

Where a systemic risk buffer rate applies to exposures located in third countries, the competent authority or the designated authority, as applicable, shall also notify the ESRB. The ESRB shall forward such notifications without delay to the supervisory authorities of those third countries.

Such notifications shall set out in detail:

(a) the macroprudential or systemic risks in the Member State;

(b) the reasons why the dimension of the macroprudential or systemic risks threatens the stability of the financial system at national level justifying the systemic risk buffer rate;

(c) the justification for why the systemic risk buffer is considered likely to be effective and proportionate to mitigate the risk;

(d) an assessment of the likely positive or negative impact of the systemic risk buffer on the internal market, based on information which is available to the Member State;

(e) the systemic risk buffer rate or rates that the competent authority or the designated authority, as applicable, intends to impose and the exposures to which such rates shall apply and the institutions which shall be subject to such rates;

(f) where the systemic risk buffer rate applies to all exposures, a justification of why the authority considers that the systemic risk buffer is not duplicating the functioning of the O-SII buffer provided for in Article 131.

Where the decision to set the systemic risk buffer rate results in a decrease or no change from the previously set buffer rate, the competent authority or the designated authority, as applicable, shall only comply with this paragraph.

10. Where the setting or resetting of a systemic risk buffer rate or rates on any set or subset of exposures referred to in paragraph 5 subject to one or more systemic risk buffers does not result in a combined systemic risk buffer rate higher than 3 % for any of those exposures, the competent authority or the designated authority, as applicable, shall notify the ESRB in accordance with paragraph 9 one month before the publication of the decision referred to in paragraph 13.

For the purposes of this paragraph, the recognition of a systemic risk buffer rate set by another Member State in accordance with Article 134 shall not count towards the 3 % threshold.

11. Where the setting or resetting of a systemic risk buffer rate or rates on any set or subset of exposures referred to in paragraph 5 subject to one or more systemic risk buffers results in a combined systemic risk buffer rate at a level higher than 3 % and up to 5 % for any of those exposures, the competent authority or the designated authority of the Member State that sets that buffer shall request in the notification submitted in accordance with paragraph 9 the Commission's opinion. The Commission shall provide its opinion within one month of receipt of the notification.

Where the opinion of the Commission is negative, the competent authority or the designated authority, as applicable, of the Member State that sets that systemic risk buffer shall comply with that opinion or give reasons for not doing so.

Where an institution to which one or more systemic risk buffer rates apply is a subsidiary the parent of which is established in another Member State, the competent authority or the designated authority shall request in the notification submitted in accordance with paragraph 9 a recommendation by the Commission and the ESRB.

The Commission and the ESRB shall each provide its recommendation within six weeks of receipt of the notification.

Where the authorities of the subsidiary and of the parent disagree on the systemic risk buffer rate or rates applicable to that institution and in the case of a negative recommendation of both the Commission and the ESRB, the competent authority or the designated authority, as applicable, may refer the matter to EBA and request its assistance in accordance with Article 19 of Regulation (EU) No 1093/2010. The decision to set the systemic risk buffer rate or rates for those exposures shall be suspended until EBA has taken a decision.

12. Where the setting or resetting of a systemic risk buffer rate or rates on any set or subset of exposures referred to in paragraph 5 subject to one or more systemic risk buffers results in a combined systemic risk buffer rate higher than 5 % for any of those exposures, the competent authority or the designated authority, as applicable, shall seek the authorisation of the Commission before implementing a systemic risk buffer.

Within six weeks of receipt of the notification referred to in paragraph 9 of this Article, the ESRB shall provide the Commission with an opinion as to whether the systemic risk buffer is deemed appropriate. EBA may also provide the Commission with its opinion on that systemic risk buffer in accordance with Article 34(1) of Regulation (EU) No 1093/2010.

Within three months of receipt of the notification referred to in paragraph 9, the Commission, taking into account the assessment of the ESRB and EBA, where relevant, and where it is satisfied that the systemic risk buffer rate or rates do not entail disproportionate adverse effects on the whole or parts of the financial system of other Member States or of the Union as a whole forming or creating an obstacle to the proper functioning of the internal market, shall adopt an act authorising the competent authority or the designated authority, as applicable, to adopt the proposed measure.

13. Each competent authority, or the designated authority, as applicable, shall announce the setting or resetting of one or more systemic risk buffer rates by publication on an appropriate website. That publication shall include at least the following information:

(a) the systemic risk buffer rate or rates;

(b) the institutions to which the systemic risk buffer applies;

(c) the exposures to which the systemic risk buffer rate or rates apply;

(d) a justification for setting or resetting the systemic risk buffer rate or rates;

(e) the date from which the institutions shall apply the setting or resetting of the systemic risk buffer; and

(f) the names of the countries where exposures located in those countries are recognised in the systemic risk buffer.

Where the publication of the information referred to in point (d) of the first subparagraph could jeopardise the stability of the financial system, that information shall not be included in the publication.

14. Where an institution fails to fully meet the requirement set out in paragraph 1 of this Article, it shall be subject to the restrictions on distributions set out in Article 141(2) and (3).

Where the application of the restrictions on distributions leads to an unsatisfactory improvement of the Common Equity Tier 1 capital of the institution in light of the relevant systemic risk, the competent authorities may take additional measures in accordance with Article 64.

15. Where the competent authority or the designated authority, as applicable, decides to set the systemic risk buffer on the basis of exposures located in other Member States, the buffer shall be set equally on all exposures located within the Union, unless the buffer is set to recognise the systemic risk buffer rate set by another Member State in accordance with Article 134.

Textual Amendments

F2 Substituted by Directive (EU) 2019/878 of the European Parliament and of the Council of 20 May 2019 amending Directive 2013/36/EU as regards exempted entities, financial holding companies, mixed financial holding companies, remuneration, supervisory measures and powers and capital conservation measures (Text with EEA relevance).

Article 134 U.K. Recognition of a systemic risk buffer rate

1. Other Member States may recognise a systemic risk buffer rate set in accordance with Article 133 and may apply that rate to domestically authorised institutions for exposures located in the Member State that sets that rate.

2. Where Member States recognise a systemic risk buffer rate for domestically authorised institutions in accordance with paragraph 1, they shall notify the ESRB. The ESRB shall forward such notifications to the Commission, to EBA and to the Member State that sets that rate without delay.

3. When deciding whether to recognise a systemic risk buffer rate in accordance with paragraph 1, a Member State shall take into consideration the information presented by the Member State that sets that rate in accordance with Article 133(9) and (13).

4. Where Member States recognise a systemic risk buffer rate for domestically authorised institutions, that systemic risk buffer may be cumulative with the systemic risk buffer applied in accordance with Article 133, provided that the buffers address different risks. Where the buffers address the same risks, only the higher buffer shall apply.

5. A Member State that sets a systemic risk buffer rate in accordance with Article 133 of this Directive may ask the ESRB to issue a recommendation as referred to in Article 16 of Regulation (EU) No 1092/2010 to one or more Member States which may recognise the systemic risk buffer rate.]

Textual Amendments

F2 Substituted by Directive (EU) 2019/878 of the European Parliament and of the Council of 20 May 2019 amending Directive 2013/36/EU as regards exempted entities, financial holding companies, mixed financial holding companies, remuneration, supervisory measures and powers and capital conservation measures (Text with EEA relevance).

Section II U.K. Setting and calculating countercyclical capital buffers

Article 135U.K.ESRB guidance on setting countercyclical buffer rates

1.The ESRB may give, by way of recommendations in accordance with Article 16 of Regulation (EU) No 1092/2010, guidance to authorities designated by Member States under Article 136(1) on setting countercyclical buffer rates, including the following:

(a)principles to guide designated authorities when exercising their judgment as to the appropriate countercyclical buffer rate, ensure that authorities adopt a sound approach to relevant macro-economic cycles and promote sound and consistent decision-making across Member States;

(b)general guidance on:

the measurement and calculation of the deviation from long term trends of ratios of credit to gross domestic product (GDP);

the calculation of buffer guides required by Article 136(2);

(c)guidance on variables that indicate the build-up of system-wide risk associated with periods of excessive credit growth in a financial system, in particular the relevant credit-to-GDP ratio and its deviation from the long-term trend, and on other relevant factors, including the treatment of economic developments within individual sectors of the economy, that should inform the decisions of designated authorities on the appropriate countercyclical buffer rate under Article 136;

(d)guidance on variables, including qualitative criteria, that indicate that the buffer should be maintained, reduced or fully released.

2.Where it issues a recommendation under paragraph 1, the ESRB shall duly take into account the differences between Member States and in particular the specificities of Member States with small and open economies.

3.Where it has issued a recommendation under paragraph 1, the ESRB shall keep it under review and update it, where necessary, in the light of experience of setting buffers under this Directive or of developments in internationally agreed practices.

Article 136U.K.Setting countercyclical buffer rates

1.Each Member State shall designate a public authority or body (a 'designated authority') that is responsible for setting the countercyclical buffer rate for that Member State.

2.Each designated authority shall calculate for every quarter a buffer guide as a reference to guide its exercise of judgment in setting the countercyclical buffer rate in accordance with paragraph 3. The buffer guide shall reflect, in a meaningful way, the credit cycle and the risks due to excess credit growth in the Member State and shall duly take into account specificities of the national economy. It shall be based on the deviation of the ratio of credit-to-GDP from its long-term trend, taking into account, inter alia:

(a)an indicator of growth of levels of credit within that jurisdiction and, in particular, an indicator reflective of the changes in the ratio of credit granted in that Member State to GDP;

(b)any current guidance maintained by the ESRB in accordance with Article 135(1)(b).

[F23. Each designated authority shall assess the intensity of cyclical systemic risk and the appropriateness of the countercyclical buffer rate for its Member State on a quarterly basis and set or adjust the countercyclical buffer rate, if necessary. In so doing, each designated authority shall take into account:]

(a)the buffer guide calculated in accordance with paragraph 2;

(b)any current guidance maintained by the ESRB in accordance with Article 135(1)(a), (c) and (d) and any recommendations issued by the ESRB on the setting of a buffer rate;

(c)other variables that the designated authority considers relevant for addressing cyclical systemic risk.

4.The countercyclical buffer rate, expressed as a percentage of the total risk exposure amount calculated in accordance with Article 92(3) of Regulation (EU) No 575/2013 of institutions that have credit exposures in that Member State, shall be between 0 % and 2,5 %, calibrated in steps of 0,25 percentage points or multiples of 0,25 percentage points. Where justified on the basis of the considerations set out in paragraph 3, a designated authority may set a countercyclical buffer rate in excess of 2,5 % of the total risk exposure amount calculated in accordance with Article 92(3) of Regulation (EU) No 575/2013 for the purpose set out in Article 140(2) of this Directive.

5.Where a designated authority sets the countercyclical buffer rate above zero for the first time, or where, thereafter, a designated authority increases the prevailing countercyclical buffer rate setting, it shall also decide the date from which the institutions must apply that increased buffer for the purposes of calculating their institution-specific countercyclical capital buffer. That date shall be no later than 12 months after the date when the increased buffer setting is announced in accordance with paragraph 7. If the date is less than 12 months after the increased buffer setting is announced, that shorter deadline for application shall be justified on the basis of exceptional circumstances.

6.If a designated authority reduces the existing countercyclical buffer rate, whether or not it is reduced to zero, it shall also decide an indicative period during which no increase in the buffer is expected. However, that indicative period shall not bind the designated authority.

[F27. Each designated authority shall publish quarterly at least the following information on its website:

(a) the applicable countercyclical buffer rate;

(b) the relevant credit-to-GDP-ratio and its deviation from the long-term trend;

(c) the buffer guide calculated in accordance with paragraph 2;

(d) a justification for that buffer rate;

(e) where the buffer rate is increased, the date from which institutions shall apply that increased buffer rate for the purpose of calculating their institution-specific countercyclical capital buffer;

(f) where the date referred to in point (e) is less than 12 months after the date of the publication under this paragraph, a reference to the exceptional circumstances that justify that shorter deadline for application;

(g) where the buffer rate is decreased, the indicative period during which no increase in the buffer rate is expected, together with a justification for that period.

Designated authorities shall take all reasonable steps to coordinate the timing of that publication.

Designated authorities shall notify each change of the countercyclical buffer rate and the required information specified in points (a) to (g) of the first subparagraph to the ESRB. The ESRB shall publish on its website all such notified buffer rates and related information.]

Textual Amendments

F2 Substituted by Directive (EU) 2019/878 of the European Parliament and of the Council of 20 May 2019 amending Directive 2013/36/EU as regards exempted entities, financial holding companies, mixed financial holding companies, remuneration, supervisory measures and powers and capital conservation measures (Text with EEA relevance).

Article 137U.K.Recognition of countercyclical buffer rates in excess of 2,5 %

1.Where a designated authority, in accordance with Article 136(4), or a relevant third-country authority has set a countercyclical buffer rate in excess of 2,5 % of the total risk exposure amount calculated in accordance with Article 92(3) of Regulation (EU) No 575/2013, the other designated authorities may recognise that buffer rate for the purposes of the calculation by domestically authorised institutions of their institution-specific countercyclical capital buffers.

2.Where a designated authority in accordance with paragraph 1 of this Article recognises a buffer rate in excess of 2,5 % of the total risk exposure amount calculated in accordance with Article 92(3) of Regulation (EU) No 575/2013, it shall announce that recognition by publication on its website. The announcement shall include at least the following information:

(a)the applicable countercyclical buffer rate;

(b)the Member State or third countries to which it applies;

(c)where the buffer rate is increased, the date from which the institutions authorised in the Member State of the designated authority must apply that increased buffer rate for the purposes of calculating their institution-specific countercyclical capital buffer;

(d)where the date referred to in point (c) is less than 12 months after the date of the announcement under this paragraph, a reference to the exceptional circumstances that justify that shorter deadline for application.

Article 138U.K.ESRB recommendation on third country countercyclical buffer rates

The ESRB may, in accordance with Article 16 of Regulation (EU) No 1092/2010, issue a recommendation to designated authorities on the appropriate countercyclical buffer rate for exposures to that third country where:

a countercyclical buffer rate has not been set and published by the relevant third-country authority for a third country ('relevant third-country authority') to which one or more Union institutions have credit exposures;

the ESRB considers that a countercyclical buffer rate which has been set and published by the relevant third-country authority for a third country is not sufficient to protect Union institutions appropriately from the risks of excessive credit growth in that country, or a designated authority notifies the ESRB that it considers that buffer rate to be insufficient for that purpose.

Article 139U.K.Decision by designated authorities on third country countercyclical buffer rates

1.This Article applies irrespective of whether the ESRB has issued a recommendation to designated authorities as referred to in Article 138.

2.In the circumstances referred to in point (a) of Article 138, designated authorities may set the countercyclical buffer rate that domestically authorised institutions must apply for the purposes of the calculation of their institution-specific countercyclical capital buffer.

3.Where a countercyclical buffer rate has been set and published by the relevant third-country authority for a third country, a designated authority may set a different buffer rate for that third country for the purposes of the calculation by domestically authorised institutions of their institution-specific countercyclical capital buffer if they reasonably consider that the buffer rate set by the relevant third-country authority is not sufficient to protect those institutions appropriately from the risks of excessive credit growth in that country.

When exercising the power under the first subparagraph, a designated authority shall not set a countercyclical buffer rate below the level set by the relevant third-country authority unless that buffer rate exceeds 2,5 %, expressed as a percentage of the total risk exposure amount calculated in accordance with Article 92(3) of Regulation (EU) No 575/2013 of institutions that have credit exposures in that third country.

In order to achieve coherence for the buffer settings for third countries the ESRB may give recommendations for such settings.

4.Where a designated authority sets a countercyclical buffer rate for a third country pursuant to paragraph 2 or 3 which increases the existing applicable countercyclical buffer rate, the designated authority shall decide the date from which domestically authorised institutions must apply that buffer rate for the purposes of calculating their institution-specific countercyclical capital buffer. That date shall be no later than 12 months from the date when the buffer rate is announced in accordance with paragraph 5. If that date is less than 12 months after the setting is announced, that shorter deadline for application shall be justified on the basis of exceptional circumstances.

5.Designated authorities shall publish any setting of a countercyclical buffer rate for a third country pursuant to paragraph 2 or 3 on their websites, and shall include the following information:

(a)the countercyclical buffer rate and the third country to which it applies;

(b)a justification for that buffer rate;

(c)where the buffer rate is set above zero for the first time or is increased, the date from which the institutions must apply that increased buffer rate for the purposes of calculating their institution-specific countercyclical capital buffer;

(d)where the date referred to in point (c) is less than 12 months after the date of the publication of the setting under this paragraph, a reference to the exceptional circumstances that justify that shorter deadline for application.

Article 140U.K.Calculation of institution-specific countercyclical capital buffer rates

1.The institution-specific countercyclical capital buffer rate shall consist of the weighted average of the countercyclical buffer rates that apply in the jurisdictions where the relevant credit exposures of the institution are located or are applied for the purposes of this Article by virtue of Article 139(2) or (3).

Member States shall require institutions, in order to calculate the weighted average referred to in the first subparagraph, to apply to each applicable countercyclical buffer rate its total own funds requirements for credit risk, determined in accordance with Part Three, Titles II and IV of Regulation (EU) No 575/2013, that relates to the relevant credit exposures in the territory in question, divided by its total own funds requirements for credit risk that relates to all of its relevant credit exposures.

2.If, in accordance with Article 136(4), a designated authority sets a countercyclical buffer rate in excess of 2,5 % of total risk exposure amount calculated in accordance with Article 92(3) of Regulation (EU) No 575/2013, Member States shall ensure that the following buffer rates apply to relevant credit exposures located in the Member State of that designated authority ('Member State A') for the purposes of the calculation required under paragraph 1 including, where relevant, for the purposes of the calculation of the element of consolidated capital that relates to the institution in question:

(a)domestically authorised institutions shall apply that buffer rate in excess of 2,5 % of total risk exposure amount;

(b)institutions that are authorised in another Member State shall apply a countercyclical buffer rate of 2,5 % of total risk exposure amount if the designated authority in the Member State in which they have been authorised has not recognised the buffer rate in excess of 2,5 % in accordance with Article 137(1);

(c)institutions that are authorised in another Member State shall apply the countercyclical buffer rate set by the designated authority of Member State A if the designated authority in the Member State in which they have been authorised has recognised the buffer rate in accordance with Article 137.

3.If the countercyclical buffer rate set by the relevant third-country authority for a third country exceeds 2,5 % of total risk exposure amount calculated in accordance with Article 92(3) of Regulation (EU) No 575/2013, Member States shall ensure that the following buffer rates apply to relevant credit exposures located in that third country for the purposes of the calculation required under paragraph 1 including, where relevant, for the purposes of the calculation of the element of consolidated capital that relates to the institution in question:

(a)institutions shall apply a countercyclical buffer rate of 2,5 % of total risk exposure amount if the designated authority in the Member State in which they have been authorised has not recognised the buffer rate in excess of 2,5 % in accordance with Article 137(1);

(b)institutions shall apply the countercyclical buffer rate set by the relevant third-country authority if the designated authority in the Member State in which they have been authorised has recognised the buffer rate in accordance with Article 137.

4.Relevant credit exposures shall include all those exposure classes, other than those referred to in points (a) to (f) of Article 112 of Regulation (EU) No 575/2013, that are subject to:

(a)the own funds requirements for credit risk under Part Three, Title II of that Regulation;

(b)where the exposure is held in the trading book, own funds requirements for specific risk under Part Three, Title IV, Chapter 2 of that Regulation or incremental default and migration risk under Part Three, Title IV, Chapter 5 of that Regulation;

(c)where the exposure is a securitisation, the own funds requirements under Part Three, Title II, Chapter 5 of that Regulation.

5.Institutions shall identify the geographical location of a relevant credit exposure in accordance with regulatory technical standards adopted in accordance with paragraph 7.

6.For the purposes of the calculation required under paragraph 1:

(a)a countercyclical buffer rate for a Member State shall apply from the date specified in the information published in accordance with Article 136(7)(e) or Article 137(2)(c) if the effect of that decision is to increase the buffer rate;

(b)subject to point (c), a countercyclical buffer rate for a third country shall apply 12 months after the date on which a change in the buffer rate was announced by the relevant third-country authority, irrespective of whether that authority requires institutions incorporated in that third country to apply the change within a shorter period, if the effect of that decision is to increase the buffer rate;

(c)where the designated authority of the home Member State of the institution sets the countercyclical buffer rate for a third country pursuant to Article 139(2) or (3), or recognises the countercyclical buffer rate for a third country pursuant to Article 137, that buffer rate shall apply from the date specified in the information published in accordance with Article 139(5)(c) or Article 137(2)(c), if the effect of that decision is to increase the buffer rate;

(d)a countercyclical buffer rate shall apply immediately if the effect of that decision is to reduce the buffer rate.

For the purposes of point (b), a change in the countercyclical buffer rate for a third country shall be considered to be announced on the date that it is published by the relevant third-country authority in accordance with the applicable national rules.

7.EBA shall develop draft regulatory technical standards to specify the method for the identification of the geographical location of the relevant credit exposures referred to in paragraph 5.

EBA shall submit those draft regulatory standards to the Commission by 1 January 2014.

Power is delegated to the Commission to adopt the regulatory technical standards referred to in the first subparagraph in accordance with Articles 10 to 14 of Regulation (EU) No 1093/2010.

Section III U.K. Capital conservation measures

Article 141U.K.Restrictions on distributions

[F21. An institution that meets the combined buffer requirement shall not make a distribution in connection with Common Equity Tier 1 capital to an extent that would decrease its Common Equity Tier 1 capital to a level where the combined buffer requirement is no longer met.

2. An institution that fails to meet the combined buffer requirement shall calculate the maximum distributable amount (MDA) in accordance with paragraph 4 and shall notify the competent authority thereof.

Where the first subparagraph applies, the institution shall not undertake any of the following actions before it has calculated the MDA:

(a) make a distribution in connection with Common Equity Tier 1 capital;

[X1(b) create an obligation to pay variable remuneration or discretionary pension benefits or pay variable remuneration if the obligation to pay was created at a time when the institution failed to meet the combined buffer requirement; or]

(c) make payments on Additional Tier 1 instruments.

3. Where an institution fails to meet or exceed its combined buffer requirement, it shall not distribute more than the MDA calculated in accordance with paragraph 4 through any action referred to in points (a), (b) and (c) of the second subparagraph of paragraph 2.

4. Institutions shall calculate the MDA by multiplying the sum calculated in accordance with paragraph 5 by the factor determined in accordance with paragraph 6. The MDA shall be reduced by any amount resulting from any of the actions referred to in point (a), (b) or (c) of the second subparagraph of paragraph 2.

5. The sum to be multiplied in accordance with paragraph 4 shall consist of:

(a) any interim profits not included in Common Equity Tier 1 capital pursuant to Article 26(2) of Regulation (EU) No 575/2013, net of any distribution of profits or any payment resulting from the actions referred to in point (a), (b) or (c) of the second subparagraph of paragraph 2 of this Article;

plus

(b) any year-end profits not included in Common Equity Tier 1 capital pursuant to Article 26(2) of Regulation (EU) No 575/2013 net of any distribution of profits or any payment resulting from the actions referred to in point (a), (b) or (c) of the second subparagraph of paragraph 2 of this Article;

minus

(c) amounts which would be payable by tax if the items specified in points (a) and (b) of this paragraph were to be retained.

6. The factor shall be determined as follows:

(a) where the Common Equity Tier 1 capital maintained by the institution which is not used to meet any of the own funds requirements set out in points (a), (b) and (c) of Article 92(1) of Regulation (EU) No 575/2013 and the additional own funds requirement addressing risks other than the risk of excessive leverage set out in point (a) of Article 104(1) of this Directive, expressed as a percentage of the total risk exposure amount calculated in accordance with Article 92(3) of that Regulation, is within the first (that is, the lowest) quartile of the combined buffer requirement, the factor shall be 0;

(b) where the Common Equity Tier 1 capital maintained by the institution which is not used to meet any of the own funds requirements set out in points (a), (b) and (c) of Article 92(1) of Regulation (EU) No 575/2013 and the additional own funds requirement addressing risks other than the risk of excessive leverage set out in point (a) of Article 104(1) of this Directive, expressed as a percentage of the total risk exposure amount calculated in accordance with Article 92(3) of that Regulation, is within the second quartile of the combined buffer requirement, the factor shall be 0,2;

(c) where the Common Equity Tier 1 capital maintained by the institution which is not used to meet the own funds requirements set out in points (a), (b) and (c) of Article 92(1) of Regulation (EU) No 575/2013 and the additional own funds requirement addressing risks other than the risk of excessive leverage set out in point (a) of Article 104(1) of this Directive, expressed as a percentage of the total risk exposure amount calculated in accordance with Article 92(3) of that Regulation, is within the third quartile of the combined buffer requirement, the factor shall be 0,4;

[X1(d) where the Common Equity Tier 1 capital maintained by the institution which is not used to meet the own funds requirements set out in points (a), (b) and (c) of Article 92(1) of Regulation (EU) No 575/2013 and the additional own funds requirement addressing risks other than the risk of excessive leverage set out in point (a) of Article 104(1) of this Directive, expressed as a percentage of the total risk exposure amount calculated in accordance with Article 92(3) of that Regulation, is within the fourth (that is, the highest) quartile of the combined buffer requirement, the factor shall be 0,6.]

The lower and upper bounds of each quartile of the combined buffer requirement shall be calculated as follows:

where:

=

the ordinal number of the quartile concerned.]

7.The restrictions imposed by this Article shall only apply to payments that result in a reduction of Common Equity Tier 1 capital or in a reduction of profits, and where a suspension of payment or failure to pay does not constitute an event of default or a condition for the commencement of proceedings under the insolvency regime applicable to the institution.

8.Where an institution fails to meet the combined buffer requirement and intends to distribute any of its distributable profits or undertake an action referred to in points (a), (b) and (c) of the second subparagraph of paragraph 2, it shall notify the competent authority and provide the following information:

(a)the amount of capital maintained by the institution, subdivided as follows:

Common Equity Tier 1 capital,

Additional Tier 1 capital,

Tier 2 capital;

(b)the amount of its interim and year-end profits;

(c)the MDA calculated in accordance with paragraph 4;

(d)the amount of distributable profits it intends to allocate between the following:

dividend payments,

share buybacks,

payments on Additional Tier 1 instruments,

the payment of variable remuneration or discretionary pension benefits, whether by creation of a new obligation to pay, or payment pursuant to an obligation to pay created at a time when the institution failed to meet its combined buffer requirements.

9.Institutions shall maintain arrangements to ensure that the amount of distributable profits and the MDA are calculated accurately, and shall be able to demonstrate that accuracy to the competent authority on request.

10.For the purposes of paragraphs 1 and 2, a distribution in connection with Common Equity Tier 1 capital shall include the following:

(a)a payment of cash dividends;

(b)a distribution of fully or partly paid bonus shares or other capital instruments referred to in Article 26(1)(a) of Regulation (EU) No 575/2013;

(c)a redemption or purchase by an institution of its own shares or other capital instruments referred to in Article 26(1)(a) of that Regulation;

(d)a repayment of amounts paid up in connection with capital instruments referred to in Article 26(1)(a) of that Regulation;

(e)a distribution of items referred to in points (b) to (e) of Article 26(1) of that Regulation.

Editorial Information

X1 Substituted by Corrigendum to Directive (EU) 2019/878 of the European Parliament and of the Council of 20 May 2019 amending Directive 2013/36/EU as regards exempted entities, financial holding companies, mixed financial holding companies, remuneration, supervisory measures and powers and capital conservation measures (Official Journal of the European Union L 150 of 7 June 2019).

Textual Amendments

F2 Substituted by Directive (EU) 2019/878 of the European Parliament and of the Council of 20 May 2019 amending Directive 2013/36/EU as regards exempted entities, financial holding companies, mixed financial holding companies, remuneration, supervisory measures and powers and capital conservation measures (Text with EEA relevance).

[F1Article 141a U.K. Failure to meet the combined buffer requirement

An institution shall be considered as failing to meet the combined buffer requirement for the purposes of Article 141 where it does not have own funds in an amount and of the quality needed to meet at the same time the combined buffer requirement and each of the following requirements in:

point (a) of Article 92(1) of Regulation (EU) No 575/2013 and the additional own funds requirement addressing risks other than the risk of excessive leverage under point (a) of Article 104(1) of this Directive;

point (b) of Article 92(1) of Regulation (EU) No 575/2013 and the additional own funds requirement addressing risks other than the risk of excessive leverage under point (a) of Article 104(1) of this Directive;

point (c) of Article 92(1) of Regulation (EU) No 575/2013 and the additional own funds requirement addressing risks other than the risk of excessive leverage under point (a) of Article 104(1) of this Directive.]

Textual Amendments

F1 Inserted by Directive (EU) 2019/878 of the European Parliament and of the Council of 20 May 2019 amending Directive 2013/36/EU as regards exempted entities, financial holding companies, mixed financial holding companies, remuneration, supervisory measures and powers and capital conservation measures (Text with EEA relevance).

Article 142U.K.Capital Conservation Plan

1.Where an institution fails to meet its combined buffer requirement, it shall prepare a capital conservation plan and submit it to the competent authority no later than five working days after it identified that it was failing to meet that requirement, unless the competent authority authorises a longer delay up to 10 days.

[X2Competent authorities shall grant such authorisations only on the basis of the individual situation of an institution] and taking into account the scale and complexity of the institution's activities.

2.The capital conservation plan shall include the following:

(a)estimates of income and expenditure and a forecast balance sheet;

(b)measures to increase the capital ratios of the institution;

(c)a plan and timeframe for the increase of own funds with the objective of meeting fully the combined buffer requirement;

(d)any other information that the competent authority considers to be necessary to carry out the assessment required by paragraph 3.

3.The competent authority shall assess the capital conservation plan, and shall approve the plan only if it considers that the plan, if implemented, would be reasonably likely to conserve or raise sufficient capital to enable the institution to meet its combined buffer requirements within a period which the competent authority considers appropriate.

4.If the competent authority does not approve the capital conservation plan in accordance with paragraph 3, it shall impose one or both of the following:

(a)require the institution to increase own funds to specified levels within specified periods;

(b)exercise its powers under Article 102 to impose more stringent restrictions on distributions than those required by Article 141.

Editorial Information

X2 Substituted by Corrigendum to Directive 2013/36/EU of the European Parliament and of the Council of 26 June 2013 on access to the activity of credit institutions and the prudential supervision of credit institutions and investment firms, amending Directive 2002/87/EC and repealing Directives 2006/48/EC and 2006/49/EC (Official Journal of the European Union L 176 of 27 June 2013).

[F2Commission Recommendation 2003/361/EC of 6 May 2003 concerning the definition of micro, small and medium-sized enterprises ( OJ L 124, 20.5.2003, p. 36 ).]

[F1Regulation (EU) No 806/2014 of the European Parliament and of the Council of 15 July 2014 establishing uniform rules and a uniform procedure for the resolution of credit institutions and certain investment firms in the framework of a Single Resolution Mechanism and a Single Resolution Fund and amending Regulation (EU) No 1093/2010 ( OJ L 225, 30.7.2014, p. 1 ).]

Textual Amendments

F1 Inserted by Directive (EU) 2019/878 of the European Parliament and of the Council of 20 May 2019 amending Directive 2013/36/EU as regards exempted entities, financial holding companies, mixed financial holding companies, remuneration, supervisory measures and powers and capital conservation measures (Text with EEA relevance).

F2 Substituted by Directive (EU) 2019/878 of the European Parliament and of the Council of 20 May 2019 amending Directive 2013/36/EU as regards exempted entities, financial holding companies, mixed financial holding companies, remuneration, supervisory measures and powers and capital conservation measures (Text with EEA relevance).

Options/Help

Print Options

PrintThe Whole Directive

PrintThe Whole Title

PrintThis Chapter only

Legislation is available in different versions:

Latest Available (revised):The latest available updated version of the legislation incorporating changes made by subsequent legislation and applied by our editorial team. Changes we have not yet applied to the text, can be found in the ‘Changes to Legislation’ area.

Original (As adopted by EU): The original version of the legislation as it stood when it was first adopted in the EU. No changes have been applied to the text.

Point in Time: This becomes available after navigating to view revised legislation as it stood at a certain point in time via Advanced Features > Show Timeline of Changes or via a point in time advanced search.

See additional information alongside the content

Geographical Extent: Indicates the geographical area that this provision applies to. For further information see ‘Frequently Asked Questions’.

Show Timeline of Changes: See how this legislation has or could change over time. Turning this feature on will show extra navigation options to go to these specific points in time. Return to the latest available version by using the controls above in the What Version box.

More Resources

Access essential accompanying documents and information for this legislation item from this tab. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as adopted version that was used for the EU Official Journal

- lists of changes made by and/or affecting this legislation item

- all formats of all associated documents

- correction slips

- links to related legislation and further information resources

Timeline of Changes

This timeline shows the different versions taken from EUR-Lex before exit day and during the implementation period as well as any subsequent versions created after the implementation period as a result of changes made by UK legislation.

The dates for the EU versions are taken from the document dates on EUR-Lex and may not always coincide with when the changes came into force for the document.

For any versions created after the implementation period as a result of changes made by UK legislation the date will coincide with the earliest date on which the change (e.g an insertion, a repeal or a substitution) that was applied came into force. For further information see our guide to revised legislation on Understanding Legislation.

More Resources

Use this menu to access essential accompanying documents and information for this legislation item. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as adopted version that was used for the print copy

- correction slips

Click 'View More' or select 'More Resources' tab for additional information including:

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- links to related legislation and further information resources