- Latest available (Revised)

- Point in Time (01/01/2014)

- Original (As adopted by EU)

Commission Regulation (EEC) No 2454/93 (repealed)Show full title

Commission Regulation (EEC) No 2454/93 of 2 July 1993 laying down provisions for the implementation of Council Regulation (EEC) No 2913/92 establishing the Community Customs Code (repealed)

You are here:

- Regulations originating from the EU

- 1993 No. 2454

- attachment 112

- Show Geographical Extent(e.g. England, Wales, Scotland and Northern Ireland)

- Show Timeline of Changes

More Resources

Revised version PDFs

- Revised 01/05/20160.44 MB

- Revised 08/12/201522.65 MB

- Revised 01/05/201522.74 MB

- Revised 05/12/201422.61 MB

- Revised 04/09/201422.55 MB

- Revised 01/03/201422.49 MB

- Revised 01/01/201422.51 MB

- Revised 31/01/201321.65 MB

- Revised 01/01/201320.37 MB

- Revised 01/01/201220.57 MB

- Revised 01/01/201120.39 MB

- Revised 01/07/201032.64 MB

- Revised 01/07/200932.61 MB

- Revised 01/01/200931.74 MB

- Revised 01/01/200828.48 MB

- Revised 04/03/200727.99 MB

- Revised 01/07/200612.18 MB

- Revised 01/06/200625.74 MB

- Revised 01/01/200612.18 MB

- Revised 01/05/20048.85 MB

- Revised 01/09/20037.37 MB

- Revised 01/04/200213.13 MB

- Revised 01/07/20017.49 MB

- Revised 01/07/20009.11 MB

- Revised 05/08/19999.47 MB

- Revised 01/01/19998.94 MB

When the UK left the EU, legislation.gov.uk published EU legislation that had been published by the EU up to IP completion day (31 December 2020 11.00 p.m.). On legislation.gov.uk, these items of legislation are kept up-to-date with any amendments made by the UK since then.

This item of legislation originated from the EU

Legislation.gov.uk publishes the UK version. EUR-Lex publishes the EU version. The EU Exit Web Archive holds a snapshot of EUR-Lex’s version from IP completion day (31 December 2020 11.00 p.m.).

Changes over time for:

Version Superseded: 01/05/2016

Alternative versions:

- 02/07/1993- Amendment

- 01/01/2006- Amendment

- 01/06/2006- Amendment

- 01/07/2006- Amendment

- 04/03/2007- Amendment

- 01/01/2008- Amendment

- 01/01/2009- Amendment

- 01/07/2009- Amendment

- 01/07/2010- Amendment

- 01/01/2011- Amendment

- 01/01/2012- Amendment

- 01/01/2013- Amendment

- 31/01/2013- Amendment

- 01/01/2014- Amendment

- 01/01/2014

Point in time - 01/03/2014- Amendment

- 04/09/2014- Amendment

- 05/12/2014- Amendment

- 01/05/2015- Amendment

- 08/12/2015- Amendment

- 01/05/2016- Amendment

- Exit day: start of implementation period31/01/2020 11pm- Amendment

- End of implementation period31/12/2020- Amendment

Status:

Point in time view as at 01/01/2014.

Changes to legislation:

There are currently no known outstanding effects for the Commission Regulation (EEC) No 2454/93 (repealed).![]()

Changes to Legislation

Revised legislation carried on this site may not be fully up to date. At the current time any known changes or effects made by subsequent legislation have been applied to the text of the legislation you are viewing by the editorial team. Please see ‘Frequently Asked Questions’ for details regarding the timescales for which new effects are identified and recorded on this site.

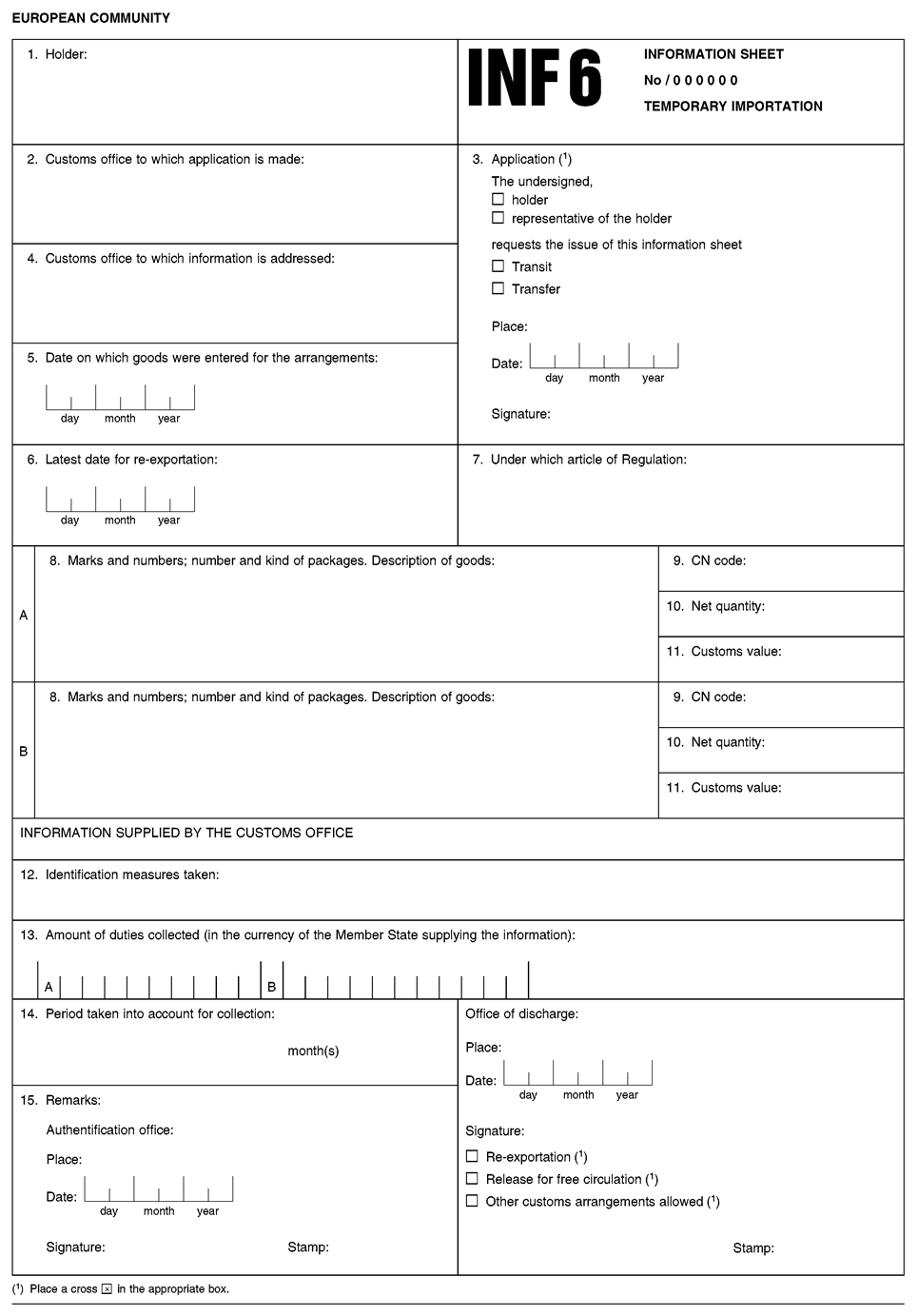

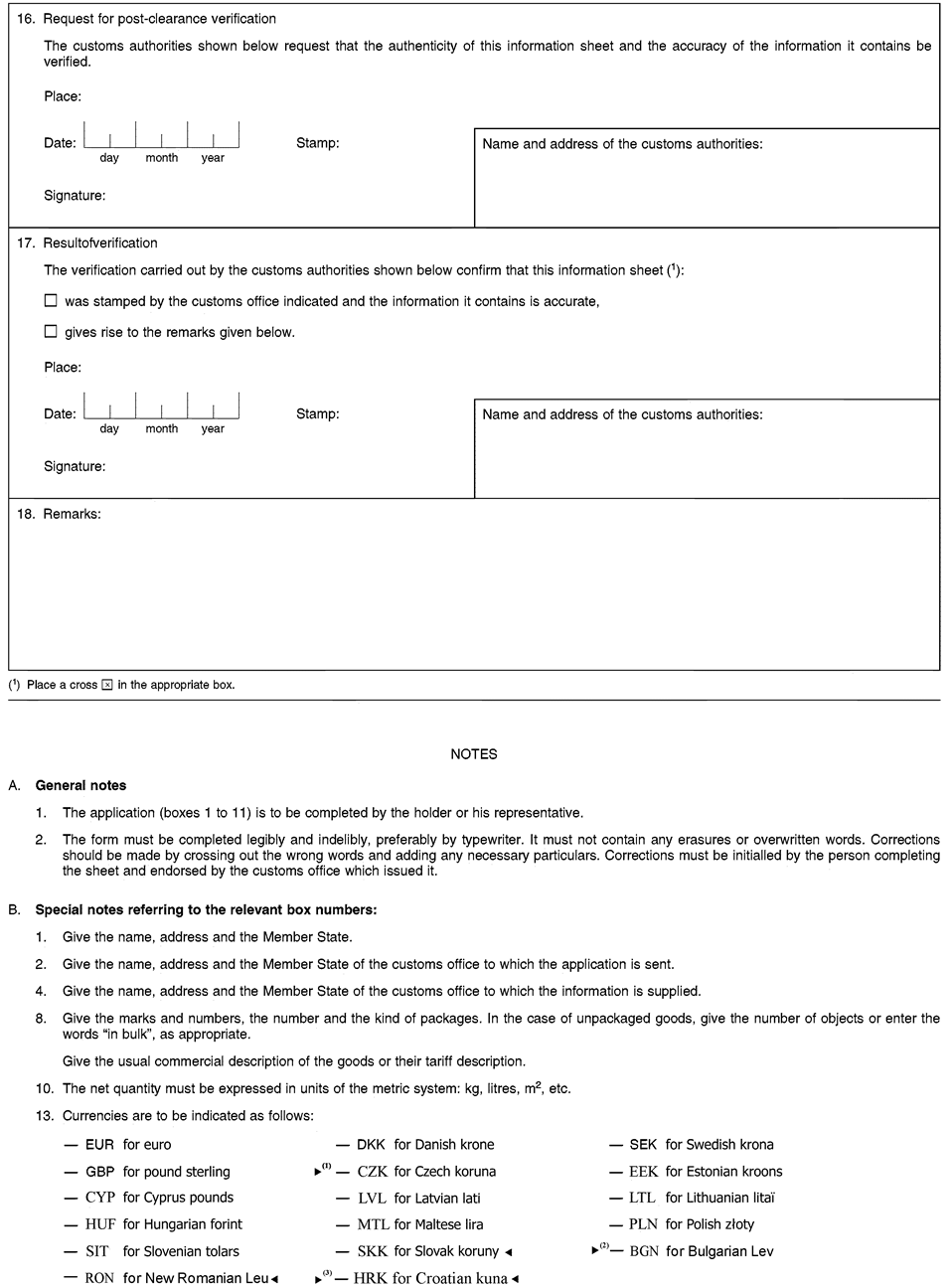

Appendix

1. GENERAL NOTES U.K.

1.1. The information sheets shall comply with the model set out in this Annex and be printed on white paper without mechanical pulp, dressed for writing purposes and weighing between 40 and 65 g/m 2 . U.K.

1.2. The form shall measure 210 mm × 297 mm. U.K.

1.3. The customs administrations shall be responsible for having the form printed. Each form shall bear the initials of the issuing Member State in accordance with the ISO norm Alpha 2, followed by an individual serial number. U.K.

1.4. The form shall be printed and the boxes shall be completed in an official language of the Community. The customs office requested to provide the information or make use of it may ask for the information contained in the form presented to it to be translated into the official language, or one of the official languages, of the customs administration. U.K.

2. USE OF THE INFORMATION SHEETS U.K.

2.1. Common provisions U.K.

Where the customs office issuing the information sheet considers that additional information to that appearing on the information sheet is required, it shall enter such particulars. Where not enough space remains, an additional sheet shall be annexed. It shall be mentioned on the original.

The customs office which endorsed the information sheet may be asked to carry out post-clearance verification of the authenticity of the sheet and the accuracy of the particulars which its contains.

In the case of successive consignments, the requisite number of information sheets may be made out for the quantity of goods or products entered for the arrangements. The initial information sheet may also be replaced with further information sheets or, where only one information sheet is used, the customs office to which the sheet is endorsed may note on the original the quantities of goods or products. Where not enough space remains, an additional sheet shall be annexed which shall be mentioned on the original.

The customs authorities may permit the use of recapitulative information sheets for triangular traffic trade flows involving a large number of operations which cover the total quantity of imports/exports over a given period.

In exceptional circumstances, the information sheet may be issued a posteriori but not beyond the expiry of the period required for keeping documents.

In the event of theft, loss or destruction of the information sheet, the operator may ask the customs office which endorsed it for a duplicate to be issued.

The original and copies of the information sheet so issued shall bear one of the following indications:

2.2. Specific provisions U.K.

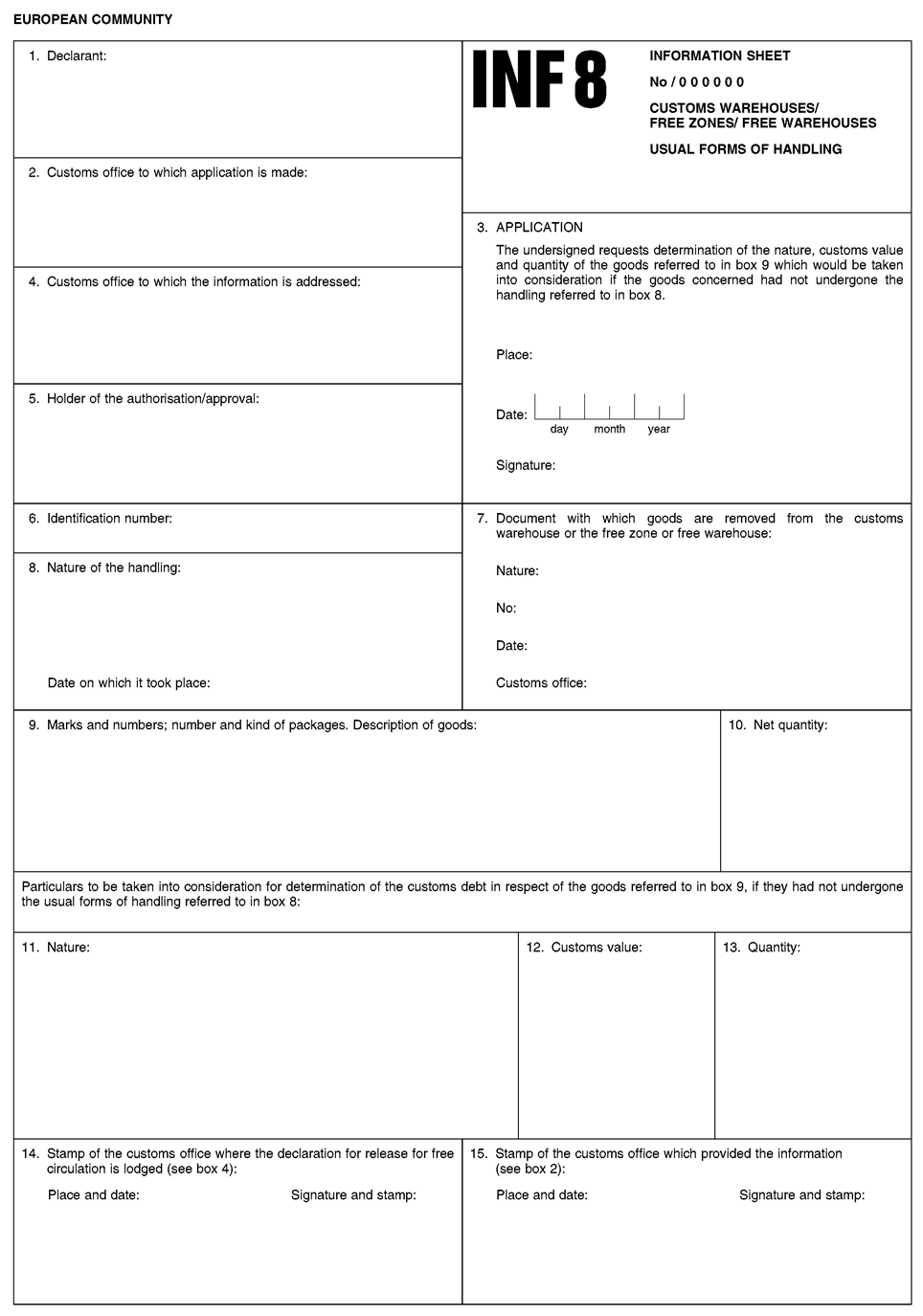

2.2.1. Information sheet INF 8 (customs warehousing) U.K.

The information sheet INF 8 (hereafter: INF 8) may be used when the goods are declared for new customs approved treatment or use, in order to determine the elements for assessment of the customs debt applicable before usual forms of handling took place.

The INF 8 shall be made out in an original and a copy.

The supervising office shall provide the information referred to in boxes 11, 12 and 13, endorse box 15 and return the original of the INF 8 to the declarant.

2.2.2. Information sheet INF 1 (inward processing) U.K.

The information sheet INF 1 (hereafter INF 1) may be used for providing information on:

duty amounts and compensatory interest,

applying commercial policy measures,

the amount of the security.

The INF 1 shall be made out in an original and two copies.

The original and one copy of the INF 1 shall be sent to the supervising office and a copy shall be kept by the customs office which endorsed the INF 1.

The supervising office shall supply the information requested in boxes 8, 9 and 11 of the INF 1, endorse it, retain the copy and return the original.

Where the release for free circulation of compensating products or goods in the unaltered state at a customs office other than the office of entry is requested, this customs office endorsing the INF 1 shall ask the supervising office to indicate:

in box 9(a), the amount of import duties due in accordance with Article 121(1) or 128(4) of the Code,

in box 9(b), the amount of compensatory interest in accordance with Article 519,

the quantity, CN code and origin of the import goods used in the manufacture of the compensating products released for free circulation.

Where the compensating products obtained under inward-processing (drawback system) are consigned to another customs-approved treatment or use allowing import duties to be repaid or remitted, and are subject to a new application for authorisation for the inward-processing arrangements, the customs authorities issuing this authorisation may use the INF 1 to determine the amount of import duties to be levied or the amount of the customs debt liable to be incurred.

Where the declaration for release for free circulation relates to compensating products obtained from import goods or goods in the unaltered state which had been subject to specific commercial policy measures at the moment of entry for the procedure (suspension system) and such measures continue to be applicable, the customs office accepting the declaration and endorsing the INF 1 shall ask the supervising office to indicate particulars necessary for the application of commercial policy measures.

Where release for free circulation is requested in the case of an INF 1 being made out for fixing the amount of security, the same INF 1 may be used, provided it contains:

in box 9(a) the amount of import duties payable on the import goods pursuant to Article 121(1) or 128(4) of the Code, and

in box 11, the date when the import goods concerned were first entered for the procedure or the date when the import duties have been repaid or remitted in accordance with Article 128(1) of the Code.

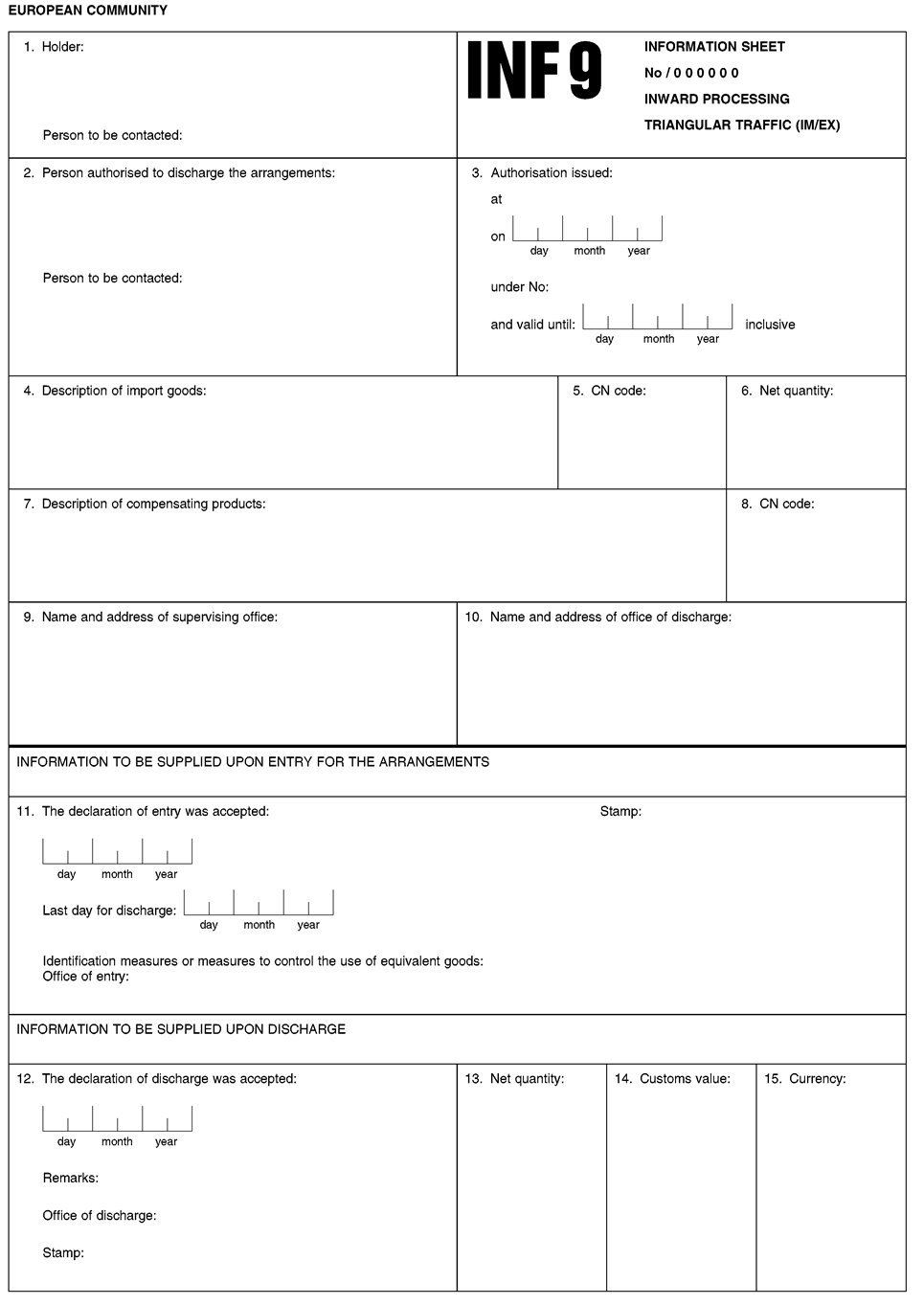

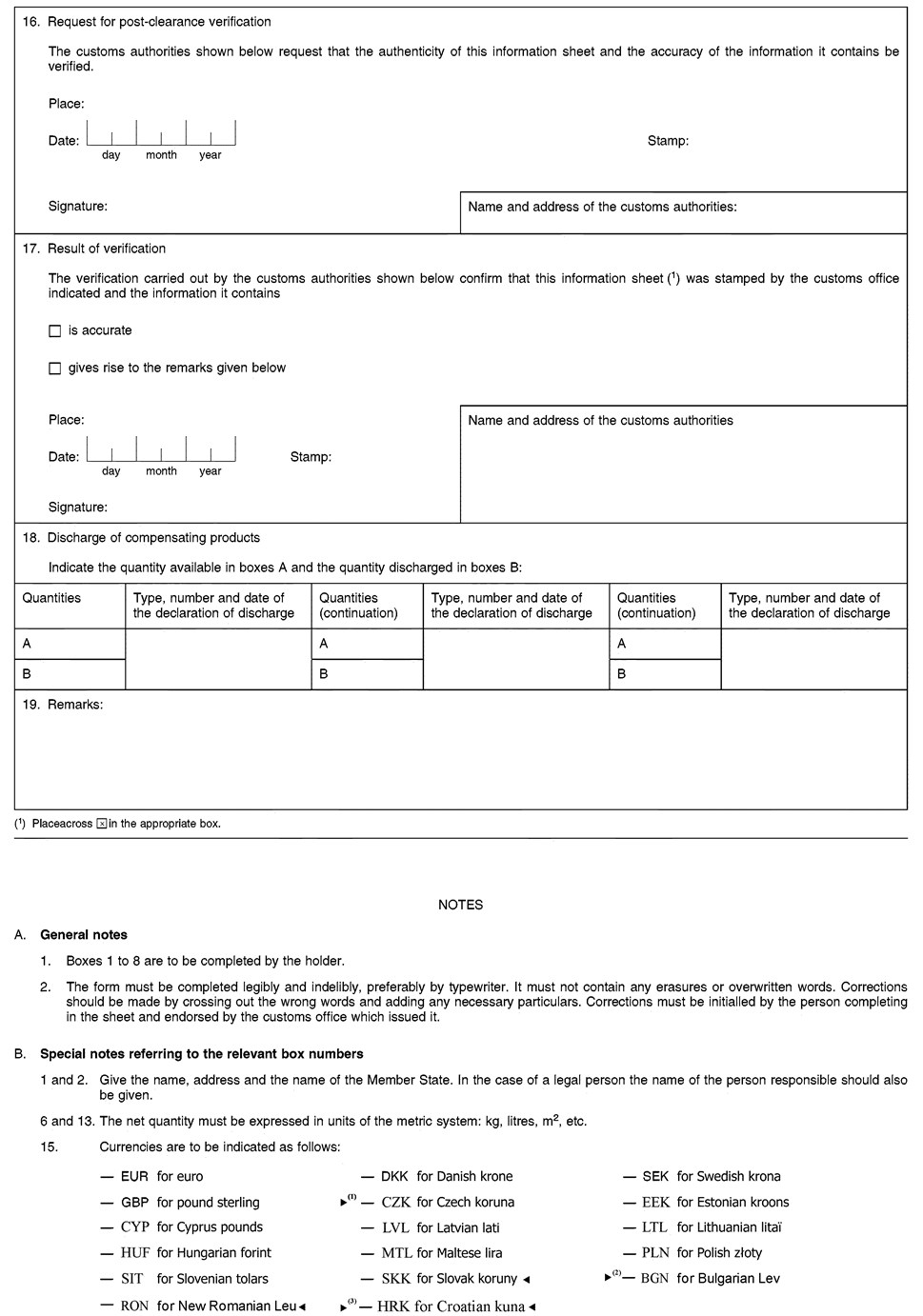

2.2.3. Information sheet INF 9 (inward processing) U.K.

The information sheet INF 9 (hereafter INF 9) may be used where compensating products are assigned another permitted customs approved treatment or use under triangular traffic (IM/EX).

The INF 9 shall be made out in an original and three copies for the quantities of import goods entered for the arrangements.

The office of entry shall endorse box 11 of the INF 9 and indicate which means of identification or measures to control the use of equivalent goods are used (such as the use of samples, illustrations or technical descriptions, or the carrying out of analysis).

The office of entry sends copy 3 to the supervising office and return the original and the other copies to the declarant.

The declaration discharging the arrangements shall be accompanied by the original and copies 1 and 2 of the INF 9.

The office of discharge shall indicate the quantity of compensating products and the date of acceptance. It shall send copy 2 to the supervising office, return the original to the declarant and retain copy 1.

2.2.4. Information sheet INF 5 (inward processing) U.K.

The information sheet INF 5 (hereafter INF 5) may be used when compensating products obtained from equivalent goods are exported under triangular traffic with prior exportation (EX/IM).

The INF 5 shall be made out in an original and three copies in respect of the quantity of import goods corresponding to the quantity of compensating products exported.

The customs office accepting the export declaration shall endorse box 9 of the INF 5 and return the original and the three copies to the declarant.

The customs office of exit shall complete box 10, send copy 3 to the supervising office and return the original and the other copies to the declarant.

Where durum wheat falling within CN code 1001 10 00 is processed into pasta falling within CN codes 1902 11 00 and 1902 19 , the name of the importer authorised to enter the import goods for the arrangements, to be given in box 2 of the INF 5, may be filled in after the INF 5 has been presented to the customs office where the export declaration is lodged. The information shall be given on the original and copies 1 and 2 of the INF 5 before the declaration entering the import goods for the arrangements is lodged.

The declaration of entry for the arrangements must be accompanied by the original and copies 1 and 2 of the INF 5.

The customs office where the declaration of entry is presented shall note on the original and copies 1 and 2 of the INF 5 the quantity of import goods entered for the arrangements and the date of acceptance of the declaration. It shall send copy 2 to the supervising office, returning the original to the declarant and retaining copy 1.

2.2.5. Information sheet INF 7 (inward processing) U.K.

The information sheet INF 7 (hereafter INF 7) may be used where the compensating products or the goods in the unaltered state under the drawback system are assigned one of the customs approved treatments or uses permitting repayment or remission, in accordance with Article 128(1) of the Code, without a repayment claim being lodged.

Where the holder has given the consent to transfer the right to claim repayment to another person in accordance with Article 90 of the Code, this information shall appear on the INF 7.

The INF 7 shall be made out in an original and two copies.

The customs office accepting the declaration of discharge shall endorse the INF 7, return the original and one copy to the holder and retain the other copy.

When the repayment claim is lodged, it shall be accompanied by the duly endorsed original of the INF 7.

2.2.6. Information sheet INF 6 (temporary importation) U.K.

The information sheet INF 6 (hereafter INF 6) may be used to communicate elements for assessment of the customs debt or of amounts of duties already levied where import goods are moved within the customs territory of the Community.

The INF 6 shall comprise all the information needed to show the customs authorities:

the date on which the import goods were entered for the temporary importation arrangements,

the elements for assessment of the customs debt ascertained on that date,

the amount of any import duties already levied under partial relief arrangements and the period taken into account for that purpose.

The INF 6 shall be made out of an original and two copies.

The INF 6 shall be endorsed either when the goods are placed under the external transit procedure, at the beginning of the transfer operation or at an earlier moment.

One copy shall be retained by the customs office which endorsed it. The original and the other copy shall be returned to the person concerned giving this copy to the office of discharge. After endorsement this copy shall be returned by the person concerned to the customs office which initially endorsed it.

2.2.7. Information sheet INF 2 (outward processing) U.K.

The information sheet INF 2 (hereafter INF 2) may be used, where compensating or replacement products are imported under triangular traffic.

The INF 2 shall be made out in an original and one copy for the quantity of goods entered for the procedure.

The request for the issue of the INF 2 shall constitute the consent of the holder to transfer the right of the total or partial relief from the import duties to another person importing the compensating or replacement products under triangular traffic.

The office of entry shall endorse the original and the copy of the INF 2. It shall retain the copy and return the original to the declarant.

It shall indicate in box 16 the means used to identify the temporary export goods.

Where samples are taken or illustrations or technical descriptions are used, this office shall authenticate such samples, illustrations or technical descriptions by affixing its customs seal either on the goods, where their nature permits it, or on the packaging, in such a way that it cannot be tampered with.

A label bearing the stamp of the office and reference particulars of the export declaration shall be attached to the samples, illustrations or technical descriptions in a manner which prevents substitution.

The samples, illustrations or technical descriptions, authenticated and sealed, shall be returned to the exporter, who shall present them with the seals intact when the compensating or replacement products are re-imported.

Where an analysis is required and the results will not be known until after the office of entry has endorsed the INF 2, the document containing the results of the analysis shall be given to the exporter in a sealed tamper-proof envelope.

The office of exit shall certify on the original that the goods have left the customs territory of the Community and shall return it to the person presenting it.

The importer of the compensating or replacement products shall present the original of the INF 2 and, where appropriate, the means of identification to the office of discharge.]

Textual Amendments

F2 Substituted by Act concerning the conditions of accession of the Czech Republic, the Republic of Estonia, the Republic of Cyprus, the Republic of Latvia, the Republic of Lithuania, the Republic of Hungary, the Republic of Malta, the Republic of Poland, the Republic of Slovenia and the Slovak Republic and the adjustments to the Treaties on which the European Union is founded.

F3 Inserted by Act concerning the conditions of accession of the Czech Republic, the Republic of Estonia, the Republic of Cyprus, the Republic of Latvia, the Republic of Lithuania, the Republic of Hungary, the Republic of Malta, the Republic of Poland, the Republic of Slovenia and the Slovak Republic and the adjustments to the Treaties on which the European Union is founded.

F4 Substituted by Commission Regulation (EC) No 1792/2006 of 23 October 2006 adapting certain regulations and decisions in the fields of free movement of goods, freedom of movement of persons, competition policy, agriculture (veterinary and phytosanitary legislation), fisheries, transport policy, taxation, statistics, social policy and employment, environment, customs union, and external relations by reason of the accession of Bulgaria and Romania.

F5 Inserted by Commission Regulation (EC) No 1792/2006 of 23 October 2006 adapting certain regulations and decisions in the fields of free movement of goods, freedom of movement of persons, competition policy, agriculture (veterinary and phytosanitary legislation), fisheries, transport policy, taxation, statistics, social policy and employment, environment, customs union, and external relations by reason of the accession of Bulgaria and Romania.

F6 Substituted by Commission Regulation (EU) No 519/2013 of 21 February 2013 adapting certain regulations and decisions in the fields of free movement of goods, freedom of movement for persons, right of establishment and freedom to provide services, company law, competition policy, agriculture, food safety, veterinary and phytosanitary policy, fisheries, transport policy, energy, taxation, statistics, social policy and employment, environment, customs union, external relations, and foreign, security and defence policy, by reason of the accession of Croatia.

F7 Inserted by Commission Regulation (EU) No 519/2013 of 21 February 2013 adapting certain regulations and decisions in the fields of free movement of goods, freedom of movement for persons, right of establishment and freedom to provide services, company law, competition policy, agriculture, food safety, veterinary and phytosanitary policy, fisheries, transport policy, energy, taxation, statistics, social policy and employment, environment, customs union, external relations, and foreign, security and defence policy, by reason of the accession of Croatia.

Textual Amendments

F1 Substituted by Commission Regulation (EC) No 993/2001 of 4 May 2001 amending Regulation (EEC) No 2454/93 laying down provisions for the implementation of Council Regulation (EEC) No 2913/92 establishing the Community Customs Code (Text with EEA relevance).

F2 Substituted by Act concerning the conditions of accession of the Czech Republic, the Republic of Estonia, the Republic of Cyprus, the Republic of Latvia, the Republic of Lithuania, the Republic of Hungary, the Republic of Malta, the Republic of Poland, the Republic of Slovenia and the Slovak Republic and the adjustments to the Treaties on which the European Union is founded.

F3 Inserted by Act concerning the conditions of accession of the Czech Republic, the Republic of Estonia, the Republic of Cyprus, the Republic of Latvia, the Republic of Lithuania, the Republic of Hungary, the Republic of Malta, the Republic of Poland, the Republic of Slovenia and the Slovak Republic and the adjustments to the Treaties on which the European Union is founded.

F4 Substituted by Commission Regulation (EC) No 1792/2006 of 23 October 2006 adapting certain regulations and decisions in the fields of free movement of goods, freedom of movement of persons, competition policy, agriculture (veterinary and phytosanitary legislation), fisheries, transport policy, taxation, statistics, social policy and employment, environment, customs union, and external relations by reason of the accession of Bulgaria and Romania.

F5 Inserted by Commission Regulation (EC) No 1792/2006 of 23 October 2006 adapting certain regulations and decisions in the fields of free movement of goods, freedom of movement of persons, competition policy, agriculture (veterinary and phytosanitary legislation), fisheries, transport policy, taxation, statistics, social policy and employment, environment, customs union, and external relations by reason of the accession of Bulgaria and Romania.

F6 Substituted by Commission Regulation (EU) No 519/2013 of 21 February 2013 adapting certain regulations and decisions in the fields of free movement of goods, freedom of movement for persons, right of establishment and freedom to provide services, company law, competition policy, agriculture, food safety, veterinary and phytosanitary policy, fisheries, transport policy, energy, taxation, statistics, social policy and employment, environment, customs union, external relations, and foreign, security and defence policy, by reason of the accession of Croatia.

F7 Inserted by Commission Regulation (EU) No 519/2013 of 21 February 2013 adapting certain regulations and decisions in the fields of free movement of goods, freedom of movement for persons, right of establishment and freedom to provide services, company law, competition policy, agriculture, food safety, veterinary and phytosanitary policy, fisheries, transport policy, energy, taxation, statistics, social policy and employment, environment, customs union, external relations, and foreign, security and defence policy, by reason of the accession of Croatia.

Options/Help

Print Options

PrintThe Whole Regulation

PrintThis Attachment only

You have chosen to open The Whole Regulation

The Whole Regulation you have selected contains over 200 provisions and might take some time to download. You may also experience some issues with your browser, such as an alert box that a script is taking a long time to run.

Would you like to continue?

You have chosen to open The Whole Regulation as a PDF

The Whole Regulation you have selected contains over 200 provisions and might take some time to download.

Would you like to continue?

You have chosen to open the Whole Regulation

The Whole Regulation you have selected contains over 200 provisions and might take some time to download. You may also experience some issues with your browser, such as an alert box that a script is taking a long time to run.

Would you like to continue?

Legislation is available in different versions:

Latest Available (revised):The latest available updated version of the legislation incorporating changes made by subsequent legislation and applied by our editorial team. Changes we have not yet applied to the text, can be found in the ‘Changes to Legislation’ area.

Original (As adopted by EU): The original version of the legislation as it stood when it was first adopted in the EU. No changes have been applied to the text.

Point in Time: This becomes available after navigating to view revised legislation as it stood at a certain point in time via Advanced Features > Show Timeline of Changes or via a point in time advanced search.

See additional information alongside the content

Geographical Extent: Indicates the geographical area that this provision applies to. For further information see ‘Frequently Asked Questions’.

Show Timeline of Changes: See how this legislation has or could change over time. Turning this feature on will show extra navigation options to go to these specific points in time. Return to the latest available version by using the controls above in the What Version box.

More Resources

Access essential accompanying documents and information for this legislation item from this tab. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as adopted version that was used for the EU Official Journal

- lists of changes made by and/or affecting this legislation item

- all formats of all associated documents

- correction slips

- links to related legislation and further information resources

Timeline of Changes

This timeline shows the different versions taken from EUR-Lex before exit day and during the implementation period as well as any subsequent versions created after the implementation period as a result of changes made by UK legislation.

The dates for the EU versions are taken from the document dates on EUR-Lex and may not always coincide with when the changes came into force for the document.

For any versions created after the implementation period as a result of changes made by UK legislation the date will coincide with the earliest date on which the change (e.g an insertion, a repeal or a substitution) that was applied came into force. For further information see our guide to revised legislation on Understanding Legislation.

More Resources

Use this menu to access essential accompanying documents and information for this legislation item. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as adopted version that was used for the print copy

- correction slips

Click 'View More' or select 'More Resources' tab for additional information including:

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- links to related legislation and further information resources