- Latest available (Revised)

- Point in Time (01/05/2015)

- Original (As adopted by EU)

Commission Regulation (EEC) No 2454/93 (repealed)Show full title

Commission Regulation (EEC) No 2454/93 of 2 July 1993 laying down provisions for the implementation of Council Regulation (EEC) No 2913/92 establishing the Community Customs Code (repealed)

You are here:

- Regulations originating from the EU

- 1993 No. 2454

- attachment 5

- Show Geographical Extent(e.g. England, Wales, Scotland and Northern Ireland)

- Show Timeline of Changes

More Resources

Revised version PDFs

- Revised 01/05/20160.44 MB

- Revised 08/12/201522.65 MB

- Revised 01/05/201522.74 MB

- Revised 05/12/201422.61 MB

- Revised 04/09/201422.55 MB

- Revised 01/03/201422.49 MB

- Revised 01/01/201422.51 MB

- Revised 31/01/201321.65 MB

- Revised 01/01/201320.37 MB

- Revised 01/01/201220.57 MB

- Revised 01/01/201120.39 MB

- Revised 01/07/201032.64 MB

- Revised 01/07/200932.61 MB

- Revised 01/01/200931.74 MB

- Revised 01/01/200828.48 MB

- Revised 04/03/200727.99 MB

- Revised 01/07/200612.18 MB

- Revised 01/06/200625.74 MB

- Revised 01/01/200612.18 MB

- Revised 01/05/20048.85 MB

- Revised 01/09/20037.37 MB

- Revised 01/04/200213.13 MB

- Revised 01/07/20017.49 MB

- Revised 01/07/20009.11 MB

- Revised 05/08/19999.47 MB

- Revised 01/01/19998.94 MB

When the UK left the EU, legislation.gov.uk published EU legislation that had been published by the EU up to IP completion day (31 December 2020 11.00 p.m.). On legislation.gov.uk, these items of legislation are kept up-to-date with any amendments made by the UK since then.

This item of legislation originated from the EU

Legislation.gov.uk publishes the UK version. EUR-Lex publishes the EU version. The EU Exit Web Archive holds a snapshot of EUR-Lex’s version from IP completion day (31 December 2020 11.00 p.m.).

Changes over time for:

Version Superseded: 01/05/2016

Alternative versions:

- 02/07/1993- Amendment

- 01/01/2006- Amendment

- 01/06/2006- Amendment

- 01/07/2006- Amendment

- 04/03/2007- Amendment

- 01/01/2008- Amendment

- 01/01/2009- Amendment

- 01/07/2009- Amendment

- 01/07/2010- Amendment

- 01/01/2011- Amendment

- 01/01/2012- Amendment

- 01/01/2013- Amendment

- 31/01/2013- Amendment

- 01/01/2014- Amendment

- 01/03/2014- Amendment

- 04/09/2014- Amendment

- 05/12/2014- Amendment

- 01/05/2015

Point in time - 08/12/2015- Amendment

- 01/05/2016- Amendment

- Exit day: start of implementation period31/01/2020 11pm- Amendment

- End of implementation period31/12/2020- Amendment

Status:

Point in time view as at 01/05/2015.

Changes to legislation:

There are currently no known outstanding effects by UK legislation for Commission Regulation (EEC) No 2454/93 (repealed).![]()

Changes to Legislation

Revised legislation carried on this site may not be fully up to date. At the current time any known changes or effects made by subsequent legislation have been applied to the text of the legislation you are viewing by the editorial team. Please see ‘Frequently Asked Questions’ for details regarding the timescales for which new effects are identified and recorded on this site.

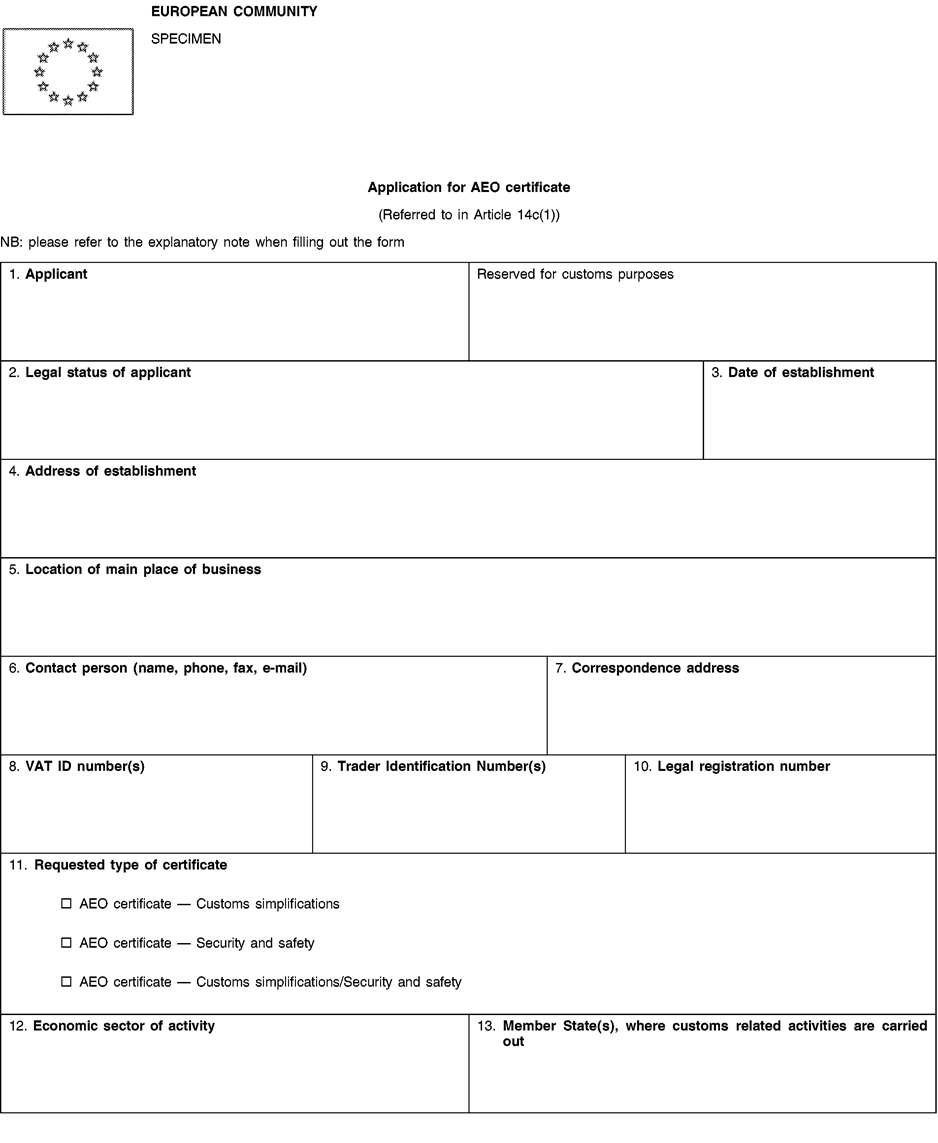

[F1ANNEX 1c

Explanatory notes: U.K.

:

Enter the full name of the applicant economic operator.

:

Enter the legal status as mentioned in the document of establishment.

:

Enter — with numbers — the day, month and year of establishment.

:

Enter the full address of the place where your entity was established, including the country.

:

Enter the full address of the place of your business where the main activities are carried out.

:

Indicate the full name, phone and fax numbers, and e-mail address of the contact person designated by you within your company to be contacted by the customs authorities when examining the application.

:

Fill in only in case it differs from your address of establishment.

:

Enter the required numbers.

The Trader Identification Number(s) is(are) the identification number(s) registered by the customs authority(ies).

The Legal registration number is the registration number given by the company registration office.

If these numbers are the same, enter only the VAT ID number.

If the applicant has no Trader Identification Number because e.g. in the applicant's Member State this number does not exist, leave the box blank.

:

Make a cross in the relevant box.

:

Describe your activity.

:

Enter the relevant ISO alpha-2 country code(s).

:

Indicate the names of customs offices regularly used for border crossing.

:

[F2In case of simplifications already granted, indicate the type of simplification, the relevant customs procedure and the authorisation number.The relevant customs procedure shall be entered in the form of the letters used as column headings (A to K) to identify customs procedures in the matrix in Annex 37, Title I, point B.

In the cases of Article 14k(2) and (3), indicate the status obtained:regulated agent or known consignor and the number of the certificate.

In case the applicant is the holder of one or more certificates mentioned in Article 14k(4), indicate the type and the number of the certificate(s).]

:

Enter the full addresses of the relevant offices. If the offices have the same address, fill in only Box 16.

:

:

the signatory should add his capacity. The signatory should always be the person who represents the applicant as a whole.

:

name of the applicant and the stamp of the applicant.

:

the applicant shall give the following general information:

Overview of the principal owners/shareholders, stating names and addresses and their proportional interests. Overview of the members of the board of directors. Are owners known by the customs authorities for previous non-compliant behaviour?

The person responsible in the applicant's administration for customs matters.

Description of the economic activities of the applicant.

Specification of the location details of the various sites of the applicant and brief description of the activities in each site. Specification of whether the applicant and each site acts within the supply chain in its own name and its own behalf, or acts in its own name and on behalf of another person, or acts in name of and on behalf of another person.

Specification of whether the goods are bought from and/or supplied to companies which are affiliated with the applicant.

Description of the internal structure of the organisation of the applicant. Please attach, if it exists, documentation on the functions/competencies for each department and/or function.

The number of the employees in total and for each division.

The names of the key office-holders (managing directors, divisional heads, accounting managers, head of customs division etc.). Description of the adopted routines in situations when the competent employee is not present, temporarily or permanently.

The names and the position within the organisation of the applicant who have specific customs expertise. Assessment of the level of knowledge of these persons in regards of the use of IT technology in customs and commercial processes and general commercial matters.

Agreement or disagreement with the publication of the information in the AEO certificate in the list of authorised economic operators referred to in Article 14x(4).]

Textual Amendments

F2 Substituted by Commission Implementing Regulation (EU) No 889/2014 of 14 August 2014 amending Regulation (EEC) No 2454/93, as regards recognition of the common security requirements under the regulated agent and known consignor programme and the Authorised Economic Operator programme (Text with EEA relevance).

Textual Amendments

F1 Inserted by Commission Regulation (EC) No 1875/2006 of 18 December 2006 amending Regulation (EEC) No 2454/93 laying down provisions for the implementation of Council Regulation (EEC) No 2913/92 establishing the Community Customs Code (Text with EEA relevance).

F2 Substituted by Commission Implementing Regulation (EU) No 889/2014 of 14 August 2014 amending Regulation (EEC) No 2454/93, as regards recognition of the common security requirements under the regulated agent and known consignor programme and the Authorised Economic Operator programme (Text with EEA relevance).

Options/Help

Print Options

PrintThe Whole Regulation

PrintThis Attachment only

You have chosen to open The Whole Regulation

The Whole Regulation you have selected contains over 200 provisions and might take some time to download. You may also experience some issues with your browser, such as an alert box that a script is taking a long time to run.

Would you like to continue?

You have chosen to open The Whole Regulation as a PDF

The Whole Regulation you have selected contains over 200 provisions and might take some time to download.

Would you like to continue?

You have chosen to open the Whole Regulation

The Whole Regulation you have selected contains over 200 provisions and might take some time to download. You may also experience some issues with your browser, such as an alert box that a script is taking a long time to run.

Would you like to continue?

Legislation is available in different versions:

Latest Available (revised):The latest available updated version of the legislation incorporating changes made by subsequent legislation and applied by our editorial team. Changes we have not yet applied to the text, can be found in the ‘Changes to Legislation’ area.

Original (As adopted by EU): The original version of the legislation as it stood when it was first adopted in the EU. No changes have been applied to the text.

Point in Time: This becomes available after navigating to view revised legislation as it stood at a certain point in time via Advanced Features > Show Timeline of Changes or via a point in time advanced search.

See additional information alongside the content

Geographical Extent: Indicates the geographical area that this provision applies to. For further information see ‘Frequently Asked Questions’.

Show Timeline of Changes: See how this legislation has or could change over time. Turning this feature on will show extra navigation options to go to these specific points in time. Return to the latest available version by using the controls above in the What Version box.

More Resources

Access essential accompanying documents and information for this legislation item from this tab. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as adopted version that was used for the EU Official Journal

- lists of changes made by and/or affecting this legislation item

- all formats of all associated documents

- correction slips

- links to related legislation and further information resources

Timeline of Changes

This timeline shows the different versions taken from EUR-Lex before exit day and during the implementation period as well as any subsequent versions created after the implementation period as a result of changes made by UK legislation.

The dates for the EU versions are taken from the document dates on EUR-Lex and may not always coincide with when the changes came into force for the document.

For any versions created after the implementation period as a result of changes made by UK legislation the date will coincide with the earliest date on which the change (e.g an insertion, a repeal or a substitution) that was applied came into force. For further information see our guide to revised legislation on Understanding Legislation.

More Resources

Use this menu to access essential accompanying documents and information for this legislation item. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as adopted version that was used for the print copy

- correction slips

Click 'View More' or select 'More Resources' tab for additional information including:

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- links to related legislation and further information resources