Please note that the date you requested in the address for this web page is not an actual date upon which a change occurred to this item of legislation. You are being shown the legislation from , which is the first date before then upon which a change was made.

Commission Implementing Regulation (EU) No 1423/2013

of 20 December 2013

laying down implementing technical standards with regard to disclosure of own funds requirements for institutions according to Regulation (EU) No 575/2013 of the European Parliament and of the Council

(Text with EEA relevance)

THE EUROPEAN COMMISSION,

Having regard to the Treaty on the Functioning of the European Union,

Having regard to Regulation (EU) No 575/2013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and investment firms and amending Regulation (EU) No 648/2012(1), and in particular the third subparagraph of Article 437(2) and the third subparagraph of Article 492(5) thereof,

Whereas:

(1) Regulation (EU) No 575/2013 incorporates the internationally-agreed standards of the Basel Committee on Banking Supervision’s third International Regulatory Framework for banks(2) (hereinafter referred to as ‘Basel III’). Therefore, and also given that the objective of disclosure requirements is to help improve transparency in the area of regulatory capital, for comparison purposes, the rules set out for disclosure by institutions supervised under Directive 2013/36/EU of the European Parliament and of the Council(3) should be consistent with the international framework reflected in the ‘Composition of Capital disclosure requirements’(4) of the Basel Committee for Banking Supervision adapted to take into account the Union regulatory framework and its specificities.

(2) A set of disclosure templates should be provided in order to ensure the uniform application of Regulation (EU) No 575/2013. Such disclosure templates should include an own funds disclosure template, aiming at reflecting the detailed capital position of institutions; and a capital instruments’ features template, aiming at reflecting the level of detail required to be disclosed with regard to the features of an institution’s capital instruments.

(3) The scope of consolidation for accounting purposes and for regulatory purposes is different, and this results in differences between the information used in the calculation of own funds and the information used in the published financial statements, in particular for own funds items. In order to address the disparity between the data used for the calculation of own funds and the data used in institutions’ financial statements, it is necessary to also disclose how elements in the financial statements that are used to calculate own funds change when the regulatory scope of consolidation is applied. Therefore a balance sheet reconciliation methodology providing information on the reconciliation between balance sheet items used to calculate own funds and regulatory own funds should also be included in this Regulation. For that purpose, a regulatory scope balance sheet, covering only own funds items, should be used.

(4) The financial statements of some institutions subject to these disclosure requirements are extensive and complex. It is necessary to set out a uniform approach which follows clearly presented steps in order to assist institutions in establishing their balance sheet reconciliation.

(5) The provisions in this Regulation are closely linked, since they deal with disclosure of own funds items. To ensure coherence between those provisions, which should enter into force at the same time, and to facilitate a comprehensive view and compact access to them by persons subject to those obligations, it is desirable to include all the implementing technical standards required by Regulation (EU) No 575/2013 in relation to disclosure of own funds in a single Regulation.

(6) Regulation (EU) No 575/2013 contains a substantial number of transitional provisions with regard to own funds and own funds requirements. In order to provide a meaningful picture of the solvency situation of institutions, it is appropriate to introduce a different disclosure template for the transitional period reflecting the transitional provisions of the Regulation (EU) No 575/2013.

(7) Since the date of application of Regulation (EU) No 575/2013 is 1 January 2014 and since institutions will need to adapt their systems in order to comply with the requirements laid down in this Regulation, they should be given a sufficient amount of time to do so.

(8) This Regulation is based on the draft implementing technical standards submitted by the European Banking Authority to the European Commission.

(9) The European Banking Authority has conducted open public consultations on the draft implementing technical standards on which this Regulation is based, analysed the potential related costs and benefits and requested the opinion of the Banking Stakeholder Group established in accordance with Article 37 of Regulation (EU) No 1093/2010 of the European Parliament and of the Council(5),

HAS ADOPTED THIS REGULATION:

Article 1U.K.Subject matter

This Regulation specifies uniform templates for the purposes of disclosure pursuant to points (a), (b), (d) and (e) of paragraph 1 of Article 437 and pursuant to paragraph 3 of Article 492 of Regulation (EU) No 575/2013.

Article 2U.K.Full reconciliation of own funds items to audited financial statements

In order to meet the requirements for disclosure of a full reconciliation of own funds items to audited financial statements, as described in point (a) of Article 437(1) of Regulation (EU) No 575/2013, institutions shall apply the methodology referred to in Annex I and shall publish the balance sheet reconciliation information resulting from the application of this methodology

Article 3U.K.Description of the main features of Common Equity Tier 1, Additional Tier 1 and Tier 2 instruments issued by institutions

In order to meet the requirements for disclosure of the main features of Common Equity Tier 1, Additional Tier 1 and Tier 2 instruments issued by institutions, as referred to in point (b) of Article 437 (1) of Regulation (EU) No 575/2013, institutions shall complete and publish the capital instruments’ main features template provided in Annex II, according to the instructions provided in Annex III.

Article 4U.K.Disclosure of nature and amounts of specific items on own funds

In order to meet the requirements for disclosure of the specific items on own funds described in points (d) and (e) of Article 437 (1) of Regulation (EU) No 575/2013, institutions shall complete and publish the general own funds disclosure template provided in Annex IV, according to the instructions provided in Annex V.

Article 5U.K.Disclosure of nature and amounts of specific items on own funds during the transitional period

By way of derogation from Article 4 during the period from 31 March 2014 to 31 December 2017 in order to meet the requirements for disclosure of the additional items on own funds as provided for in Article 492(3) of Regulation (EU) No 575/2013, institutions shall complete and publish the transitional own funds disclosure template provided in Annex VI, according to the instructions provided in Annex VII, instead of the general own funds disclosure template provided in Annex IV, according to the instructions provided in Annex V.

Article 6U.K.Entry into force

This Regulation shall enter into force on the twentieth day following that of its publication in the Official Journal of the European Union.

It shall apply from 31 March 2014.

This Regulation shall be binding in its entirety and directly applicable in all Member States.

Done at Brussels, 20 December 2013.

For the Commission

The President

José Manuel Barroso

ANNEX IU.K. Balance Sheet Reconciliation Methodology

(1)Institutions shall apply the methodology described in this Annex in order to provide information on the reconciliation between balance sheet items used to calculate own funds and regulatory own funds. Own funds items in the audited financial statements shall include all items that are components of or are deducted from regulatory own funds, including equity, liabilities such as debt, or other balance sheet lines that affect regulatory own funds such as intangible assets, goodwill, deferred tax assets.U.K.

(2)Institutions shall use as a starting point the relevant balance sheet items used to calculate own funds as in their published financial statements. Financial statements shall be considered audited financial statements when reconciliation is carried out against the year-end financial statements.U.K.

(3)Where institutions meet the obligations laid down in Part Eight of Regulation (EU) No 575/2013 on a consolidated or sub-consolidated basis and where the scope of consolidation or the method for consolidation used in the balance sheet in the financial statements are different from the scope of consolidation and method for consolidation required pursuant to Chapter 2 of Title II of Part One of Regulation (EU) No 575/2013, institutions shall also disclose the regulatory scope balance sheet, meaning a balance sheet which is drawn up according to the rules on prudential consolidation pursuant to Chapter 2 of Title II of Part One of Regulation (EU) No 575/2013 and which is limited to own funds items. The regulatory scope balance sheet shall be at least as detailed as the balance sheet in the financial statements for own funds items, and its items shall be displayed side by side with a clear mapping with the own funds items of the balance sheet in the financial statements. Institutions shall provide qualitative and quantitative information on the differences in own funds items due to the scope and method for consolidation between the two balance sheets.U.K.

(4)Secondly, institutions shall expand the own funds items of the regulatory scope balance sheet such that all of the components required by the transitional disclosure template or in the own funds disclosure template appear separately. Institutions shall only expand elements of the balance sheet up to the level of granularity that is necessary for deriving the components required by the transitional disclosure template or the own funds disclosure template.U.K.

(5)Thirdly, institutions shall establish a mapping between the elements resulting from the expanding of the regulatory scope balance sheet as described in paragraph 4 with the elements included in the transitional disclosure template or in the own funds disclosure template.U.K.

(6)Where institutions comply with the obligations laid down in Part Eight of Regulation (EU) No 575/2013 on a consolidated or sub-consolidated basis but the scope of consolidation and the method for consolidation used for the balance sheet in the financial statements are identical to the scope of consolidation and the method for consolidation defined pursuant to Chapter 2 of Title II of Part One of Regulation (EU) No 575/2013, and institutions clearly state the absence of differences between the respective scopes and methods for consolidation, only paragraphs 4 and 5 of this Annex shall apply on the basis of the balance sheet in the financial statements.U.K.

(7)Where institutions meet the obligations laid down in Part Eight of Regulation (EU) No 575/2013 on an individual basis, paragraph 3 of this Annex shall not apply and paragraphs 4 and 5 of this Annex shall instead apply on the basis of the balance sheet in the financial statements.U.K.

(8)The balance sheet reconciliation information on own funds items resulting from the application of the methodology described in this Annex may be provided in an unaudited format.U.K.

ANNEX IIU.K. Capital instruments’ main features template

ANNEX IIIU.K. Instructions for completing the capital instruments main features template

(1)Institutions shall apply the instructions provided in this Annex in order to complete the capital main features template as presented in Annex II.U.K.

(2)Institutions shall complete this template for the following categories: Common Equity Tier 1 instruments, Additional Tier 1 instruments and Tier 2 instruments.U.K.

(3)The templates shall comprise columns with the features of the different instruments. In cases where capital instruments of a same category have identical features, institutions may complete only one column disclosing these identical features and identify the issuances to which the identical features refer.U.K.

ANNEX IVU.K. Own funds disclosure template

ANNEX VU.K. Instructions for completing the own funds disclosure template

For the purposes of the own funds disclosure template, regulatory adjustments comprise deductions from own funds and prudential filters.

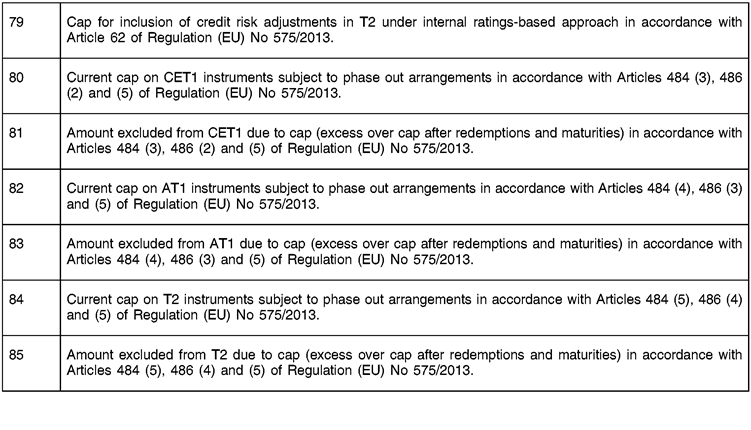

ANNEX VIU.K. Transitional own funds disclosure template

ANNEX VIIU.K. Instructions for completing the transitional own funds disclosure template

(1)Institutions shall disclose column (A) of the template called ‘Disclosure date’ the amount related to the item labelled in the corresponding row for which column (B) ‘CRR article reference’ mentions the applicable regulatory provisions (where ‘CRR’ refers to Regulation (EU) No 575/2013). The amounts disclosed in column (A) shall reflect the regulatory capital position of the institutions at the disclosure date during the transitional period and shall be net of the regulatory adjustments that have been phased-in up to the disclosure date.U.K.

(2)Institutions shall disclose in the visible cells of column (C) ‘Amounts to be subject to pre-CRR treatment or CRR prescribed residual amount’ the amount related to the item labelled in the corresponding row for which column (B) ‘CRR article reference’ mentions the applicable regulatory provisions (where ‘CRR’ refers to Regulation (EU) No 575/2013). The amounts disclosed shall reflect the residual amount of the regulatory adjustment i) that, under the national transposition measures, will continue to be applied to a part of the regulatory capital other than the part to which the adjustment shall be made once the transitional period is over, or ii) that is not otherwise deducted at the point of the disclosure date.U.K.

(3)By way of exception from paragraph 2, for rows 26a, 26b, 41a to 41c, 56a to 56c, 59a and all rows to these deriving from them, institutions shall disclose in column (A) the residual amount of the regulatory adjustments referred to in paragraph 3 respectively included in the calculation of the Common Equity Tier 1 capital, Additional Tier 1 capital, Tier 2 capital and Total capital.U.K.

(4)With regard to unrealised losses and gains measured at fair value referred to in Articles 467 and 468 of Regulation (EU) No 575/2013, institutions shall disclose the amount excluded from Common Equity Tier 1 capital pursuant to Article 467 and 468 in column (A) under the row 26a. Institutions shall include additional rows relating to this row in order to specify the nature of assets or liabilities, like equity or debt instruments, for which the unrealised losses or gains are excluded from Common Equity Tier 1 capital.U.K.

(5)With regard to deductions from Common Equity Tier 1 capital referred to in Article 469 of Regulation (EU) No 575/2013, institutions shall disclose the amounts to be deducted in column (A) and the residual amounts in column (C) under the rows related to the deductions items. The residual amounts to be deducted pursuant to Article 472 of Regulation (EU) No 575/2013 shall also be disclosed under row 41a (and below) for the amount to be deducted from Additional Tier 1 capital and under row 56a for the amount to be deducted from Tier 2 capital. Institutions shall include additional rows relating to rows 41a and 56a in order to specify the relevant items subject to this treatment.U.K.

(6)With regard to deductions from Additional Tier 1 capital referred to in Article 474 of Regulation (EU) No 575/2013, institutions shall disclose the amounts to be deducted in column (A) and the residual amounts in column (C) under the rows related to the deductions items. The residual amounts to be deducted pursuant to Article 475 of Regulation (EU) No 575/2013 shall also be disclosed under row 56b for the amount to be deducted from Tier 2 capital. Institutions shall include additional rows relating to row 56b in order to specify the relevant items subject to this treatment.U.K.

(7)With regard to deductions from Tier 2 capital referred to in Article 476 of Regulation (EU) No 575/2013, institutions shall disclose the amounts to be deducted in column (A) and the residual amounts in column (C) under the rows related to the deductions items. The residual amounts to be deducted pursuant to Article 477 of Regulation (EU) No 575/2013 shall also be disclosed under row 41c for the amount to be deducted from Additional Tier 1 capital. Institutions shall include additional rows relating to row 41c in order to specify the relevant items subject to this treatment.U.K.

(8)With regard to minority interests, institutions shall disclose in column (A) under row 5 the sum of minority interests that qualify as Common Equity Tier 1 capital pursuant to Part Two Title II of Regulation (EU) No 575/2013 and minority interests that would qualify as consolidated reserves as referred to in Articles 479 and 480 of Regulation (EU) No 575/2013. Institutions shall also disclose in column (C) under row 5 the minority interests that would qualify as consolidated reserves as referred to in Articles 479 and 480 of Regulation (EU) No 575/2013.U.K.

(9)With regard to filters and deductions referred to in Article 481 of Regulation (EU) No 575/2013, institutions shall disclose in column (A) the amount of the adjustments to be included in or deducted from Common Equity Tier 1 capital, Tier 1 capital and Tier 2 capital under rows 26b, 41c and 56c respectively. Institutions shall include additional rows relating to rows 26b, 41c and 56c in order to specify the relevant items subject to this treatment.U.K.

(10)Residual amounts relating to deductions from Common Equity Tier 1 capital, Additional Tier 1 capital and Tier 2 capital that are risk weighted pursuant to Articles 470, 472, 475 and 477 of Regulation (EU) No 575/2013 shall be disclosed in column (A) under row 59a. The disclosed amount shall be the risk weighted amount.U.K.

http://www.bis.org/publ/bcbs189.pdf

Directive 2013/36/EU of the European Parliament and of the Council of 26 June 2013 on access to the activity of credit institutions and the prudential supervision of credit institutions and investment firms, amending Directive 2002/87/EC and repealing Directives 2006/48/EC and 2006/49/EC (OJ L 176, 27.6.2013, p. 338).

http://www.bis.org/publ/bcbs221.pdf

Regulation (EU) No 1093/2010 of the European Parliament and of the Council of 24 November 2010 establishing a European Supervisory Authority (European Banking Authority), amending Decision No 716/2009/EC and repealing Commission Decision 2009/78/EC (OJ L 331, 15.12.2010, p. 12).