- Latest available (Revised)

- Point in Time (26/06/2013)

- Original (As adopted by EU)

Regulation (EU) No 575/2013 of the European Parliament and of the CouncilShow full title

Regulation (EU) No 575/2013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and investment firms and amending Regulation (EU) No 648/2012 (Text with EEA relevance)

You are here:

- Show Geographical Extent(e.g. England, Wales, Scotland and Northern Ireland)

- Show Timeline of Changes

More Resources

Revised version PDFs

- Revised 28/06/20235.43 MB

- Revised 28/12/20205.48 MB

- Revised 27/06/20205.43 MB

- Revised 25/12/20194.80 MB

- Revised 27/06/20194.80 MB

- Revised 26/04/20194.04 MB

- Revised 01/01/20193.86 MB

- Revised 01/01/20183.84 MB

- Revised 19/07/20163.26 MB

- Revised 18/01/20153.82 MB

- Revised 28/06/20133.79 MB

When the UK left the EU, legislation.gov.uk published EU legislation that had been published by the EU up to IP completion day (31 December 2020 11.00 p.m.). On legislation.gov.uk, these items of legislation are kept up-to-date with any amendments made by the UK since then.

This item of legislation originated from the EU

Legislation.gov.uk publishes the UK version. EUR-Lex publishes the EU version. The EU Exit Web Archive holds a snapshot of EUR-Lex’s version from IP completion day (31 December 2020 11.00 p.m.).

Changes over time for: CHAPTER 5

Version Superseded: 28/06/2013

Alternative versions:

Status:

Point in time view as at 26/06/2013.

Changes to legislation:

There are outstanding changes by UK legislation not yet made to Regulation (EU) No 575/2013 of the European Parliament and of the Council. Any changes that have already been made to the legislation appear in the content and are referenced with annotations.![]()

Changes to Legislation

Changes and effects yet to be applied by the editorial team are only applicable when viewing the latest version or prospective version of legislation. They are therefore not accessible when viewing legislation as at a specific point in time. To view the ‘Changes to Legislation’ information for this provision return to the latest version view using the options provided in the ‘What Version’ box above.

CHAPTER 5 U.K. Securitisation

Section 1 U.K. Definitions

Article 242U.K.Definitions

For the purposes of this Chapter, the following definitions shall apply:

'excess spread' means finance charge collections and other fee income received in respect of the securitised exposures net of costs and expenses;

'clean-up call option' means a contractual option for the originator to repurchase or extinguish the securitisation positions before all of the underlying exposures have been repaid, when the amount of outstanding exposures falls below a specified level;

'liquidity facility' means the securitisation position arising from a contractual agreement to provide funding to ensure timeliness of cash flows to investors;

'KIRB' means 8 % of the risk-weighted exposure amounts that would be calculated under Chapter 3 in respect of the securitised exposures, had they not been securitised, plus the amount of expected losses associated with those exposures calculated under that Chapter;

'ratings based method' means the method of calculating risk-weighted exposure amounts for securitisation positions in accordance with Article 261;

'supervisory formula method' means the method of calculating risk-weighted exposure amounts for securitisation positions in accordance with Article 262;

'unrated position' means a securitisation position which does not have an eligible credit assessment by an ECAI as referred to in Section 4;

'rated position' means a securitisation position which has an eligible credit assessment by an ECAI as referred to in Section 4;

'asset-backed commercial paper (ABCP) programme' means a programme of securitisations the securities issued by which predominantly take the form of commercial paper with an original maturity of one year or less;

'traditional securitisation' means a securitisation involving the economic transfer of the exposures being securitised. This shall be accomplished by the transfer of ownership of the securitised exposures from the originator institution to an SSPE or through sub-participation by an SSPE. The securities issued do not represent payment obligations of the originator institution;

'synthetic securitisation' means a securitisation where the transfer of risk is achieved by the use of credit derivatives or guarantees, and the exposures being securitised remain exposures of the originator institution;

'revolving exposure' means an exposure whereby customers' outstanding balances are permitted to fluctuate based on their decisions to borrow and repay, up to an agreed limit;

'revolving securitisation' means a securitisation where the securitisation structure itself revolves by exposures being added to or removed from the pool of exposures irrespective of whether the exposures revolve or not;

'early amortisation provision' means a contractual clause in a securitisations of revolving exposures or a revolving securitisation which requires, on the occurrence of defined events, investors' positions to be redeemed before the originally stated maturity of the securities issued;

'first loss tranche' means the most subordinated tranche in a securitisation that is the first tranche to bear losses incurred on the securitised exposures and thereby provides protection to the second loss and, where relevant, higher ranking tranches.

Section 2 U.K. Recognition of significant risk transfer

Article 243U.K.Traditional securitisation

1.The originator institution of a traditional securitisation may exclude securitised exposures from the calculation of risk-weighted exposure amounts and expected loss amounts if either of the following conditions is fulfilled:

(a)significant credit risk associated with the securitised exposures is considered to have been transferred to third parties;

(b)the originator institution applies a 1 250 % risk weight to all securitisation positions it holds in this securitisation or deducts these securitisation positions from Common Equity Tier 1 items in accordance with Article 36(1)(k).

2.Significant credit risk shall be considered to have been transferred in the following cases:

(a)the risk-weighted exposure amounts of the mezzanine securitisation positions held by the originator institution in this securitisation do not exceed 50 % of the risk weighted exposure amounts of all mezzanine securitisation positions existing in this securitisation;

(b)where there are no mezzanine securitisation positions in a given securitisation and the originator can demonstrate that the exposure value of the securitisation positions that would be subject to deduction from Common Equity Tier 1 or a 1 250 % risk weight exceeds a reasoned estimate of the expected loss on the securitised exposures by a substantial margin, the originator institution does not hold more than 20 % of the exposure values of the securitisation positions that would be subject to deduction from Common Equity Tier 1 or a 1 250 % risk weight.

Where the possible reduction in risk weighted exposure amounts, which the originator institution would achieve by this securitisation is not justified by a commensurate transfer of credit risk to third parties, competent authorities may decide on a case-by-case basis that significant credit risk shall not be considered to have been transferred to third parties.

3.For the purposes of paragraph 2, mezzanine securitisation positions mean securitisation positions to which a risk weight lower than 1 250 % applies and that are more junior than the most senior position in this securitisation and more junior than any securitisation position in this securitisation to which either of the following is assigned in accordance with Section 4:

(a)in the case of a securitisation position subject to Section 3, Sub-section 3 a credit quality step 1;

(b)in the case of a securitisation position subject to points Section 3, Sub-section 4 a credit quality step 1 or 2.

4.As an alternative to paragraphs 2 and 3, competent authorities shall grant permission to originator institutions to consider significant credit risk as having been transferred where the originator institution is able to demonstrate, in every case of a securitisation, that the reduction of own funds requirements which the originator achieves by the securitisation is justified by a commensurate transfer of credit risk to third parties.

Permission shall be granted only where the institution meets all of the following conditions:

(a)the institution has appropriately risk-sensitive policies and methodologies in place to assess the transfer of risk;

(b)the institution has also recognised the transfer of credit risk to third parties in each case for purposes of the institution's internal risk management and its internal capital allocation.

5.In addition to the requirements set out in paragraphs 1 to 4, as applicable, all the following conditions shall be met:

(a)the securitisation documentation reflects the economic substance of the transaction;

(b)the securitised exposures are put beyond the reach of the originator institution and its creditors, including in bankruptcy and receivership. This shall be supported by the opinion of qualified legal counsel;

(c)the securities issued do not represent payment obligations of the originator institution;

(d)the originator institution does not maintain effective or indirect control over the transferred exposures. An originator shall be considered to have maintained effective control over the transferred exposures if it has the right to repurchase from the transferee the previously transferred exposures in order to realise their benefits or if it is obligated to re-assume transferred risk. The originator institution's retention of servicing rights or obligations in respect of the exposures shall not of itself constitute indirect control of the exposures;

(e)the securitisation documentation meets all the following conditions:

it does not contain clauses that other than in the case of early amortisation provisions, require positions in the securitisation to be improved by the originator institution including but not limited to altering the underlying credit exposures or increasing the yield payable to investors in response to a deterioration in the credit quality of the securitised exposures;

it does not contain clauses that increase the yield payable to holders of positions in the securitisation in response to a deterioration in the credit quality of the underlying pool;

it makes it clear, where applicable, that any purchase or repurchase of securitisation positions by the originator or sponsor beyond its contractual obligations is exceptional and may only be made at arms' lengths conditions;

(f)where there is a clean-up call option, that option shall also meet the following conditions:

it is exercisable at the discretion of the originator institution;

it may only be exercised when 10 % or less of the original value of the exposures securitised remains unamortised;

it is not structured to avoid allocating losses to credit enhancement positions or other positions held by investors and is not otherwise structured to provide credit enhancement.

6.The competent authorities shall keep EBA informed about the specific cases, referred to in paragraph 2, where the possible reduction in risk-weighted exposure amounts is not justified by a commensurate transfer of credit risk to third parties, and the use institutions make of paragraph 4. EBA shall monitor the range of practices in this area and shall, in accordance with Article 16 of Regulation (EU) No 1093/2010, issue guidelines. EBA shall review Member States' implementation of those guidelines and provide advice to the Commission by 31 December 2017 on whether a binding technical standard is required.

Article 244U.K.Synthetic securitisation

1.An originator institution of a synthetic securitisation may calculate risk-weighted exposure amounts, and, as relevant, expected loss amounts, for the securitised exposures in accordance with Article 249, if either of the following is met:

(a)significant credit risk is considered to have been transferred to third parties either through funded or unfunded credit protection;

(b)the originator institution applies a 1 250 % risk weight to all securitisation positions it holds in this securitisation or deducts these securitisation positions from Common Equity Tier 1 items in accordance with Article 36(1)(k).

2.Significant credit risk shall be considered to have been transferred if either of the following conditions is met:

(a)the risk-weighted exposure amounts of the mezzanine securitisation positions which are held by the originator institution in this securitisation do not exceed 50 % of the risk weighted exposure amounts of all mezzanine securitisation positions existing in this securitisation;

(b)where there are no mezzanine securitisation positions in a given securitisation and the originator can demonstrate that the exposure value of the securitisation positions that would be subject to deduction from Common Equity Tier 1 or a 1 250 % risk weight exceeds a reasoned estimate of the expected loss on the securitised exposures by a substantial margin, the originator institution does not hold more than 20 % of the exposure values of the securitisation positions that would be subject to deduction from Common Equity Tier 1 or a 1 250 % risk weight;

(c)where the possible reduction in risk weighted exposure amounts, which the originator institution would achieve by this securitisation, is not justified by a commensurate transfer of credit risk to third parties, competent authority may decide on a case- by-case basis that significant credit risk shall not be considered to have been transferred to third parties.

3.For the purposes of paragraph 2, mezzanine securitisation positions means securitisation positions to which a risk weight lower than 1 250 % applies and that are more junior than the most senior position in this securitisation and more junior than any securitisation positions in this securitisation to which either of the following is assigned in accordance with Section 4:

(a)in the case of a securitisation position subject to Section 3, Sub-section 3 a credit quality step 1;

(b)in the case of a securitisation position subject to Section 3, Sub-section 4 a credit quality step 1 or 2.

4.As an alternative to paragraphs 2 and 3, competent authorities shall grant permission to originator institutions to consider significant credit risk as having been transferred where the originator institution is able to demonstrate, in every case of a securitisation, that the reduction of own funds requirements which the originator achieves by the securitisation is justified by a commensurate transfer of credit risk to third parties.

Permission shall be granted only where the institution meets all of the following conditions:

(a)the institution has appropriately risk-sensitive policies and methodologies in place to assess the transfer of risk;

(b)the institution has also recognised the transfer of credit risk to third parties in each case for purposes of the institution's internal risk management and its internal capital allocation.

5.In addition to the requirements set out in paragraphs 1 to 4, as applicable, the transfer shall comply with the following conditions:

(a)the securitisation documentation reflects the economic substance of the transaction;

(b)the credit protection by which the credit risk is transferred complies with Article 247(2);

(c)the instruments used to transfer credit risk do not contain terms or conditions that:

impose significant materiality thresholds below which credit protection is deemed not to be triggered if a credit event occurs;

allow for the termination of the protection due to deterioration of the credit quality of the underlying exposures;

other than in the case of early amortisation provisions, require positions in the securitisation to be improved by the originator institution;

increase the institution's cost of credit protection or the yield payable to holders of positions in the securitisation in response to a deterioration in the credit quality of the underlying pool;

(d)an opinion is obtained from qualified legal counsel confirming the enforceability of the credit protection in all relevant jurisdictions;

(e)the securitisation documentation shall make clear, where applicable, that any purchase or repurchase of securitisation positions by the originator or sponsor beyond its contractual obligations may only be made at arms' lengths conditions;

(f)where there is a clean-up call option, that option meets all the following conditions:

it is exercisable at the discretion of the originator institution;

it may only be exercised when 10 % or less of the original value of the exposures securitised remains unamortised;

it is not structured to avoid allocating losses to credit enhancement positions or other positions held by investors and is not otherwise structured to provide credit enhancement.

6.The competent authorities shall keep EBA informed about the specific cases, referred to in paragraph 2, where the possible reduction in risk-weighted exposure amounts is not justified by a commensurate transfer of credit risk to third parties, and the use institutions make of paragraph 4. EBA shall monitor the range of practices in this area and shall, in accordance with Article 16 of Regulation (EU) No 1093/2010, issue guidelines. EBA shall review Member States' implementation of those guidelines and provide advice to the Commission by 31 December 2017 on whether a binding technical standard is required.

Section 3 U.K. Calculation of the risk weighted exposure amounts

Sub-Section 1 U.K. Principles

Article 245U.K.Calculation of risk-weighted exposure amounts

1.Where an originator institution has transferred significant credit risk associated with securitised exposures in accordance with Section 2, that institution may:

(a)in the case of a traditional securitisation, exclude from its calculation of risk-weighted exposure amounts, and, as relevant, expected loss amounts, the exposures which it has securitised;

(b)in the case of a synthetic securitisation, calculate risk-weighted exposure amounts, and, as relevant, expected loss amounts, in respect of the securitised exposures in accordance with Articles 249 and 250.

2.Where the originator institution has decided to apply paragraph 1, it shall calculate the risk-weighted exposure amounts prescribed in this Chapter for the positions that it may hold in the securitisation.

Where the originator institution has not transferred significant credit risk or has decided not to apply paragraph 1, it need not calculate risk-weighted exposure amounts for any positions it may have in the securitisation in question but shall continue including the securitised exposures in its calculation of risk-weighted exposure amounts as if they had not been securitised.

3.Where there is an exposure to different tranches in a securitisation, the exposure to each tranche shall be considered a separate securitisation position. The providers of credit protection to securitisation positions shall be considered to hold positions in the securitisation. Securitisation positions shall include exposures to a securitisation arising from interest rate or currency derivative contracts.

4.Unless a securitisation position is deducted from Common Equity Tier 1 items pursuant to Article 36(1)(k), the risk-weighted exposure amount shall be included in the institution's total of risk-weighted exposure amounts for the purposes of Article 92(3).

5.The risk-weighted exposure amount of a securitisation position shall be calculated by applying to the exposure value of the position, calculated as set out in Article 246, the relevant total risk weight.

6.The total risk weight shall be determined as the sum of the risk weight set out in this Chapter and any additional risk weight in accordance with Article 407.

Article 246U.K.Exposure value

1.The exposure value shall be calculated as follows:

(a)where an institution calculates risk-weighted exposure amounts under Sub-section 3, the exposure value of an on-balance sheet securitisation position shall be its accounting value remaining after specific credit risk adjustments treated in accordance with Article 110 have been applied;

(b)where an institution calculates risk-weighted exposure amounts under Sub-section 4, the exposure value of an on-balance sheet securitisation position shall be the accounting value measured without taking into account any credit risk adjustments treated in accordance with Article 110 made;

(c)where an institution calculates risk-weighted exposure amounts under Sub-section 3, the exposure value of an off-balance sheet securitisation position shall be its nominal value, less any specific credit risk adjustment of that securitisation position, multiplied by a conversion factor as prescribed in this Chapter. The conversion factor shall be 100 % unless otherwise specified;

(d)where an institution calculates risk-weighted exposure amounts under Sub-section 4, the exposure value of an off-balance sheet securitisation position shall be its nominal value multiplied by a conversion factor as prescribed in this Chapter. The conversion factor shall be 100 % unless otherwise specified;

(e)The exposure value for the counterparty credit risk of a derivative instrument listed in Annex II, shall be determined in accordance with Chapter 6.

2.Where an institution has two or more overlapping positions in a securitisation, it shall, to the extent that they overlap include in its calculation of risk-weighted exposure amounts only the position or portion of a position producing the higher risk-weighted exposure amounts. The institution may also recognise such overlap between specific risk own funds requirements for positions in the trading book and own funds requirements for securitisation positions in the non-trading book, provided that the institution is able to calculate and compare the own funds requirements for the relevant positions. For the purpose of this paragraph, overlapping occurs when the positions, wholly or partially, represent an exposure to the same risk such that, to the extent of the overlap, there is a single exposure.

3.Where Article 268(c) applies to positions in the ABCP, the institution may, use the risk-weight assigned to a liquidity facility in order to calculate the risk-weighted exposure amount for the ABCP provided that 100 % of the ABCP issued by the programme is covered by this or other liquidity facilities and all of those liquidity facilities rank pari passu with the ABCP so that they form overlapping positions.

The institution shall notify to the competent authorities the use it makes of that treatment.

Article 247U.K.Recognition of credit risk mitigation for securitisation positions

1.An institution may recognise funded or unfunded credit protection obtained in respect of a securitisation position in accordance with Chapter 4 and subject to the requirements laid down in this Chapter and in Chapter 4.

Eligible funded credit protection is limited to financial collateral which is eligible for the calculation of risk-weighted exposure amounts under Chapter 2 as laid down under Chapter 4 and recognition is subject to compliance with the relevant requirements as laid down under Chapter 4.

2.Eligible unfunded credit protection and unfunded credit protection providers are limited to those which are eligible under Chapter 4 and recognition is subject to compliance with the relevant requirements laid down under Chapter 4.

3.By way of derogation from paragraph 2, the eligible providers of unfunded credit protection listed in points (a) to (h) of Article 201(1) except for qualifying central counterparties shall have a credit assessment by a recognised ECAI which has been determined to be associated with credit quality step 3 or above under Article 136 and shall have been associated with credit quality step 2 or above at the time the credit protection was first recognised. Institutions that have a permission to apply the IRB Approach to a direct exposure to the protection provider may assess eligibility according to the first sentence based on the equivalence of the PD for the protection provider to the PD associated with the credit quality steps referred to in Article 136.

4.By way of derogation from paragraph 2, SSPEs are eligible protection providers where they own assets that qualify as eligible financial collateral and to which there are no rights or contingent rights preceding or ranking pari passu to the contingent rights of the institution receiving unfunded credit protection and all requirements for the recognition of financial collateral in Chapter 4 are fulfilled. In those cases, GA (the amount of the protection adjusted for any currency mismatch and maturity mismatch in accordance with the provisions of Chapter 4) shall be limited to the volatility adjusted market value of those assets and g (the risk weight of exposures to the protection provider as specified under the Standardised Approach) shall be determined as the weighted-average risk weight that would apply to those assets as financial collateral under the Standardised Approach.

Article 248U.K.Implicit support

1.A sponsor institution, or an originator institution which in respect of a securitisation has made use of Article 245(1) and (2) in the calculation of risk-weighted exposure amounts or has sold instruments from its trading book to the effect that it is no longer required to hold own funds for the risks of those instruments shall not, with a view to reducing potential or actual losses to investors, provide support to the securitisation beyond its contractual obligations. A transaction shall not be considered to provide support if it is executed at arm's length conditions and taken into account in the assessment of significant risk transfer. Any such transaction shall be, regardless of whether it provides support, notified to the competent authorities and subject to the institution's credit review and approval process. The institution shall, when assessing whether the transaction is not structured to provide support, adequately consider at least all the following:

(a)the price of the repurchase;

(b)the institution's capital and liquidity position before and after repurchase;

(c)the performance of the securitised exposures;

(d)the performance of the securitisation positions;

(e)the impact of support on the losses expected to be incurred by the originator relative to investors.

2.EBA shall, in accordance with Article 16 of Regulation (EU) No 1093/2010, issue guidelines on what constitutes arm's length conditions and when a transaction is not structured to provide support.

3.If an originator institution or a sponsor institution fails to comply with paragraph 1 in respect of a securitisation this institution shall at a minimum hold own funds against all of the securitised exposures as if they had not been securitised.

Sub-Section 2 U.K. Originator institutions' calculation of risk-weighted exposure amounts securitised in a synthetic securitisation

Article 249U.K.General treatment

In calculating risk-weighted exposure amounts for the securitised exposures, where the conditions in Article 244 are met, the originator institution of a synthetic securitisation shall, subject to Article 250, use the relevant calculation methodologies set out in this Section and not those set out in Chapter 2. For institutions calculating risk-weighted exposure amounts and expected loss amounts under Chapter 3, the expected loss amount in respect of such exposures shall be zero.

The requirements set out in the first subparagraph apply to the entire pool of exposures included in the securitisation. Subject to Article 250, the originator institution shall calculate risk-weighted exposure amounts in respect of all tranches in the securitisation in accordance with the provisions of this Section including those for which the institution recognises credit risk mitigation in accordance with Article 247, in which case the risk-weight to be applied to that position may be amended in accordance with Chapter 4, subject to the requirements laid down in this Chapter.

Article 250U.K.Treatment of maturity mismatches in synthetic securitisations

For the purposes of calculating risk-weighted exposure amounts in accordance with Article 249, any maturity mismatch between the credit protection which constitutes a tranche and by which the transfer of risk is achieved and the securitised exposures shall be taken into consideration as follows:

the maturity of the securitised exposures shall be taken to be the longest maturity of any of those exposures subject to a maximum of five years. The maturity of the credit protection shall be determined in accordance with Chapter 4;

an originator institution shall ignore any maturity mismatch in calculating risk-weighted exposure amounts for tranches appearing pursuant to this Section with a risk weighting of 1 250 %. For all other tranches, the maturity mismatch treatment set out in Chapter 4 shall be applied in accordance with the following formula:

where:

=

risk-weighted exposure amounts for the purposes of Article 92(3)(a);

=

risk-weighted exposure amounts for exposures if they had not been securitised, calculated on a pro-rata basis;

=

risk-weighted exposure amounts calculated under Article 249 if there was no maturity mismatch;

=

maturity of the underlying exposures expressed in years;

=

maturity of credit protection. expressed in years;

=

0,25.

Sub-Section 3 U.K. Calculation of risk-weighted exposure amounts under the Standardised Approach

Article 251U.K.Risk-weights

Subject to Article 252, the institution shall calculate the risk-weighted exposure amount of a rated securitisation or re-securitisation position by applying the relevant risk weight to the exposure value.

The relevant risk weight shall be the risk weight as laid down in Table 1, with which the credit assessment of the position is associated in accordance with Section 4.

Table 1

| Credit Quality Step | 1 | 2 | 3 | 4 (only for credit assessments other than short-term credit assessments) | all other credit quality steps |

|---|---|---|---|---|---|

| Securitisation positions | 20 % | 50 % | 100 % | 350 % | 1 250 % |

| Re-securitisation positions | 40 % | 100 % | 225 % | 650 % | 1 250 % |

Subject to Articles 252 to 255, the risk-weighted exposure amount of an unrated securitisation position shall be calculated by applying a risk weight of 1 250 %.

Article 252U.K.Originator and sponsor institutions

For an originator institution or sponsor institution, the risk-weighted exposure amounts calculated in respect of its securitisation positions in any one securitisation may be limited to the risk-weighted exposure amounts which would currently be calculated for the securitised exposures had they not been securitised subject to the presumed application of a 150 % risk weight to the following:

all items currently in default;

all items associated with particularly high risk in accordance with Article 128 amongst the securitised exposures.

Article 253U.K.Treatment of unrated positions

1.For the purpose of calculating the risk-weighted exposure amount of an unrated securitisation position an institution may apply the weighted-average risk weight that would be applied to the securitised exposures under Chapter 2 by an institution holding the exposures, multiplied by the concentration ratio referred to in paragraph 2. For this purpose, the institution shall know the composition of the pool of securitised exposures securitised at all times.

2.The concentration ratio shall be equal to the sum of the nominal amounts of all the tranches divided by the sum of the nominal amounts of the tranches junior to or pari passu with the tranche in which the position is held including that tranche itself. The resulting risk weight shall not be higher than 1 250 % or lower than any risk weight applicable to a rated more senior tranche. Where the institution is unable to determine the risk weights that would be applied to the securitised exposures under Chapter 2, it shall apply a risk weight of 1 250 % to the position.

Article 254U.K.Treatment of securitisation positions in a second loss tranche or better in an ABCP programme

Subject to the availability of a more favourable treatment for unrated liquidity facilities under Article 255 an institution may apply to securitisation positions meeting the following conditions a risk weight that is the greater of 100 % or the highest of the risk weights that would be applied to any of the securitised exposures under Chapter 2 by an institution holding the exposures:

the securitisation position shall be in a tranche which is economically in a second loss position or better in the securitisation and the first loss tranche shall provide meaningful credit enhancement to the second loss tranche;

the quality of the securitisation position shall be equivalent to credit quality step 3 under the Standardised Approach or better;

the securitisation position shall be held by an institution which does not hold a position in the first loss tranche.

Article 255U.K.Treatment of unrated liquidity facilities

1.Institutions may apply a conversion factor of 50 % to the nominal amount of an unrated liquidity facility in order to determine its exposure value when the following conditions are met:

(a)the liquidity facility documentation shall clearly identify and limit the circumstances under which the facility may be drawn;

(b)it shall not be possible for the facility to be drawn so as to provide credit support by covering losses already incurred at the time of draw and in particular not so as to provide liquidity in respect of exposures in default at the time of draw or so as to acquire assets at more than fair value;

(c)the facility shall not be used to provide permanent or regular funding for the securitisation;

(d)repayment of draws on the facility shall not be subordinated to the claims of investors other than to claims arising in respect of interest rate or currency derivative contracts, fees or other such payments, nor be subject to waiver or deferral;

(e)it shall not be possible for the facility to be drawn after all applicable credit enhancements from which the liquidity facility would benefit are exhausted;

(f)the facility shall include a provision that results in an automatic reduction in the amount that can be drawn by the amount of exposures that are in default, where 'default' has the meaning given to it under Chapter 3, or where the pool of securitised exposures consists of rated instruments, that terminates the facility if the average quality of the pool falls below investment grade.

The risk weight to be applied shall be the highest risk weight that would be applied to any of the securitised exposures under Chapter 2 by an institution holding the exposures.

2.To determine the exposure value of cash advance facilities, a conversion factor of 0 % may be applied to the nominal amount of a liquidity facility that is unconditionally cancellable provided that the conditions set out in paragraph 1 are satisfied and that repayment of draws on the facility are senior to any other claims on the cash flows arising from the securitised exposures.

Article 256U.K.Additional own funds requirements for securitisations of revolving exposures with early amortisation provisions

1.Where there is a securitisation of revolving exposures subject to an early amortisation provision, the originator institution shall calculate an additional risk-weighted exposure amount in respect of the risk that the levels of credit risk to which it is exposed may increase following the operation of the early amortisation provision, in accordance with this Article.

2.The institution shall calculate a risk-weighted exposure amount in respect of the sum of the exposure values of the originator's interest and the investors' interest.

For securitisation structures where the securitised exposures comprise revolving and non-revolving exposures, an originator institution shall apply the treatment set out in paragraphs 3 to 6 to that portion of the underlying pool containing revolving exposures.

The exposure value of the originator's interest shall be the exposure value of that notional part of a pool of drawn amounts sold into a securitisation, the proportion of which in relation to the amount of the total pool sold into the structure determines the proportion of the cash flows generated by principal and interest collections and other associated amounts which are not available to make payments to those having securitisation positions in the securitisation. The originator's interest shall not be subordinate to the investors' interest. The exposure value of the investors' interest shall be the exposure value of the remaining notional part of the pool of drawn amounts.

The risk-weighted exposure amount in respect of the exposure value of the originator's interest shall be calculated as that for a pro rata exposure to the securitised exposures as if they had not been securitised.

3.Originators of the following types of securitisation are exempt from the calculation of an additional risk-weighted exposure amount in paragraph 1:

(a)securitisations of revolving exposures whereby investors remain fully exposed to all future draws by borrowers so that the risk on the underlying facilities does not return to the originator institution even after an early amortisation event has occurred;

(b)securitisations where any early amortisation provision is solely triggered by events not related to the performance of the securitised assets or the originator institution, such as material changes in tax laws or regulations.

4.For an originator institution subject to the calculation of an additional risk-weighted exposure amount in accordance with paragraph 1 the total of the risk-weighted exposure amounts in respect of its positions in the investors' interest and the risk-weighted exposure amounts calculated under paragraph 1 shall be no greater than the greater of:

(a)the risk-weighted exposure amounts calculated in respect of its positions in the investors' interest;

(b)the risk-weighted exposure amounts that would be calculated in respect of the securitised exposures by an institution holding the exposures as if they had not been securitised in an amount equal to the investors' interest.

Deduction of net gains, if any, arising from the capitalisation of future income required under Article 32(1), shall be treated outside the maximum amount indicated in the preceding subparagraph.

5.The risk-weighted exposure amount to be calculated in accordance with paragraph 1 shall be determined by multiplying the exposure value of the investors' interest by the product of the appropriate conversion factor as indicated in paragraphs 6 to 9 and the weighted average risk weight that would apply to the securitised exposures if the exposures had not been securitised.

An early amortisation provision shall be considered to be controlled where all of the following conditions are met:

(a)the originator institution has an appropriate own funds/liquidity plan in place to ensure that it has sufficient own funds and liquidity available in the event of an early amortisation;

(b)throughout the duration of the transaction there is pro-rata sharing between the originator's interest and the investor's interest of payments of interest and principal, expenses, losses and recoveries based on the balance of receivables outstanding at one or more reference points during each month;

(c)the amortisation period is considered sufficient for 90 % of the total debt (originator's and investors' interest) outstanding at the beginning of the early amortisation period to have been repaid or recognised as in default;

(d)the speed of repayment is no more rapid than would be achieved by straight-line amortisation over the period set out in point (c).

6.In the case of securitisations subject to an early amortisation provision of retail exposures which are uncommitted and unconditionally cancellable without prior notice, where the early amortisation is triggered by the excess spread level falling to a specified level, institutions shall compare the three-month average excess spread level with the excess spread levels at which excess spread is required to be trapped.

Where the securitisation does not require excess spread to be trapped, the trapping point is deemed to be 4,5 percentage points greater than the excess spread level at which an early amortisation is triggered.

The conversion factor to be applied shall be determined by the level of the actual three month average excess spread in accordance with Table 2.

Table 2

| Securitisations subject to a controlled early amortisation provision | Securitisations subject to a non-controlled early amortisation provision | |

|---|---|---|

| Three months average excess spread | Conversion factor | Conversion factor |

| Above level A | 0 % | 0 % |

| Level A | 1 % | 5 % |

| Level B | 2 % | 15 % |

| Level C | 10 % | 50 % |

| Level D | 20 % | 100 % |

| Level E | 40 % | 100 % |

Where:

'Level A' refers to levels of excess spread less than 133,33 % of the trapping level of excess spread but not less than 100 % of that trapping level;

'Level B' refers to levels of excess spread less than 100 % of the trapping level of excess spread but not less than 75 % of that trapping level;

'Level C' refers to levels of excess spread less than 75 % of the trapping level of excess spread but not less than 50 % of that trapping level;

'Level D' refers to levels of excess spread less than 50 % of the trapping level of excess spread but not less than 25 % of that trapping level;

'Level E' refers to levels of excess spread less than 25 % of the trapping level of excess spread.

7.In the case of securitisations subject to an early amortization provision of retail exposures which are uncommitted and unconditionally cancellable without prior notice and where the early amortization is triggered by a quantitative value in respect of something other than the three months average excess spread, subject to permission by the competent authorities, institutions may apply a treatment which approximates closely to that prescribed in paragraph 6 for determining the conversion factor indicated. The competent authority shall grant permission, if the following conditions are met:

(a)that treatment is more appropriate because the institution can establish a quantitative measure equivalent, in relation to the quantitative value triggering early amortisation, to the trapping level of excess spread;

(b)that treatment leads to a measure of the risk that the credit risk to which the institution is exposed may increase following the operation of the early amortisation provision that is as prudent as that calculated in accordance with paragraph 6.

8.All other securitisations subject to a controlled early amortisation provision of revolving exposures shall be subject to a conversion factor of 90 %.

9.All other securitisations subject to a non-controlled early amortisation provision of revolving exposures shall be subject to a conversion factor of 100 %.

Article 257U.K.Credit risk mitigation for securitisation positions subject to the Standardised Approach

Where credit protection is obtained on a securitisation position, the calculation of risk-weighted exposure amounts may be amended in accordance with Chapter 4.

Article 258U.K.Reduction in risk-weighted exposure amounts

Where a securitisation position is assigned a 1 250 % risk weight, institutions may in accordance with Article 36(1)(k), as an alternative to including the position in their calculation of risk-weighted exposure amounts, deduct from Common Equity Tier 1 capital the exposure value of the position. For these purposes, the calculation of the exposure value may reflect eligible funded credit protection in a manner consistent with Article 257.

Where an originator institution makes use of this alternative, it may subtract 12.5 times the amount deducted in accordance with Article 36(1)(k) from the amount specified in Article 252 as the risk-weighted exposure amount which would currently be calculated for the securitised exposures had they not been securitised.

Sub-Section 4 U.K. Calculation of risk-weighted exposure amounts under the IRB Approach

Article 259U.K.Hierarchy of methods

1.Institutions shall use the methods in accordance with the following hierarchy:

(a)for a rated position or a position in respect of which an inferred rating may be used, the Ratings Based Method set out in Article 261 shall be used to calculate the risk-weighted exposure amount;

(b)for an unrated position the institution may use the Supervisory Formula Method set out in Article 262 where it can produce estimates of PD, and where applicable exposure value and LGD as inputs into the Supervisory Formula Method in accordance with the requirements for the estimation of those parameters under the Internal Ratings Based approach in accordance with Section 3. An institution other than the originator institution may only use the Supervisory Formula Method subject to the prior permission of the competent authorities, which shall only be granted where the institution fulfils the condition provided in the first sentence of this point;

(c)as an alternative to point (b) and only for unrated positions in ABCP programmes, the institution may use the Internal Assessment Approach as set out in paragraph 4 if the competent authorities have permitted it to do so;

(d)in all other cases, a risk weight of 1 250 % shall be assigned to securitisation positions which are unrated;

(e)notwithstanding point (d), and subject to the prior permission by the competent authorities, an institution may calculate the risk weight for an unrated position in an ABCP programme in accordance with Article 253 or 254, if the unrated position is not in commercial paper and falls within the scope of application of an Internal Assessment Approach for which permission is being sought. The aggregated exposure values treated by this exception shall not be material and in any case less than 10 % of the aggregate exposure values treated by the institution under the Internal Assessment Approach. The institution shall stop making use of this when the permission for the relevant Internal Assessment Approach has been refused.

2.For the purposes of using inferred ratings, an institution shall attribute to an unrated position an inferred credit assessment equivalent to the credit assessment of a rated reference position which is the most senior position which is in all respects subordinate to the unrated securitisation position in question and meets all of the following conditions:

(a)the reference positions shall be subordinate in all respects to the unrated securitisation position;

(b)the maturity of the reference positions shall be equal to or longer than that of the unrated position in question;

(c)on an ongoing basis, any inferred rating shall be updated to reflect any changes in the credit assessment of the reference positions.

3.The competent authorities shall grant institutions permission to use the 'Internal Assessment Approach' as set out in paragraph 4 where all of the following conditions are met:

(a)positions in the commercial paper issued from the ABCP programme shall be rated positions;

(b)the internal assessment of the credit quality of the position shall reflect the publicly available assessment methodology of one or more ECAIs, for the rating of securities backed by the exposures of the type securitised;

(c)the ECAIs, the methodology of which shall be reflected as required by point (b), shall include those ECAIs which have provided an external rating for the commercial paper issued from the ABCP programme. Quantitative elements, such as stress factors, used in assessing the position to a particular credit quality shall be at least as conservative as those used in the relevant assessment methodology of the ECAIs in question;

(d)in developing its internal assessment methodology the institution shall take into consideration relevant published ratings methodologies of the ECAIs that rate the commercial paper of the ABCP programme. This consideration shall be documented by the institution and updated regularly, as outlined in point (g);

(e)the institution's internal assessment methodology shall include rating grades. There shall be a correspondence between such rating grades and the credit assessments of ECAIs. This correspondence shall be explicitly documented;

(f)the internal assessment methodology shall be used in the institution's internal risk management processes, including its decision making, management information and internal capital allocation processes;

(g)internal or external auditors, an ECAI, or the institution's internal credit review or risk management function shall perform regular reviews of the internal assessment process and the quality of the internal assessments of the credit quality of the institution's exposures to an ABCP programme. If the institution's internal audit, credit review, or risk management functions perform the review, then these functions shall be independent of the ABCP programme business line, as well as the customer relationship;

(h)the institution shall track the performance of its internal ratings over time to evaluate the performance of its internal assessment methodology and shall make adjustments, as necessary, to that methodology when the performance of the exposures routinely diverges from that indicated by the internal ratings;

(i)the ABCP programme shall incorporate underwriting standards in the form of credit and investment guidelines. In deciding on an asset purchase, the ABCP programme administrator shall consider the type of asset being purchased, the type and monetary value of the exposures arising from the provision of liquidity facilities and credit enhancements, the loss distribution, and the legal and economic isolation of the transferred assets from the entity selling the assets. A credit analysis of the asset seller's risk profile shall be performed and shall include analysis of past and expected future financial performance, current market position, expected future competitiveness, leverage, cash flow, interest coverage and debt rating. In addition, a review of the seller's underwriting standards, servicing capabilities, and collection processes shall be performed;

(j)the ABCP programme's underwriting standards shall establish minimum asset eligibility criteria that, in particular:

exclude the purchase of assets that are significantly past due or defaulted;

limit excess concentration to individual obligor or geographic area;

limits the tenor of the assets to be purchased;

(k)the ABCP programme shall have collections policies and processes that take into account the operational capability and credit quality of the servicer. The ABCP programme shall mitigate risk relating to the performance of the seller and the servicer through various methods, such as triggers based on current credit quality that would preclude commingling of funds;

(l)the aggregated estimate of loss on an asset pool that the ABCP programme is considering purchasing shall take into account all sources of potential risk, such as credit and dilution risk. If the seller-provided credit enhancement is sized based only on credit-related losses, then a separate reserve shall be established for dilution risk, if dilution risk is material for the particular exposure pool. In addition, in sizing the required enhancement level, the program shall review several years of historical information, including losses, delinquencies, dilutions, and the turnover rate of the receivables;

(m)the ABCP programme shall incorporate structural features, such as wind-down triggers, into the purchase of exposures in order to mitigate potential credit deterioration of the underlying portfolio.

4.Under the Internal Assessment Approach, the unrated position shall be assigned by the institution to one of the rating grades laid down in point (e) of paragraph 3. The position shall be attributed a derived rating the same as the credit assessments corresponding to that rating grade as laid down in point (e) of paragraph 3. Where this derived rating is, at the inception of the securitisation, at the level of investment grade or better, it shall be considered the same as an eligible credit assessment by an ECAI for the purposes of calculating risk-weighted exposure amounts.

5.Institutions which have obtained permission to use the Internal Assessment Approach shall not revert to the use of other methods unless all of the following conditions are met:

(a)the institution has demonstrated to the satisfaction of the competent authority that the institution has good cause to do so;

(b)the institution has received the prior permission of the competent authority.

Article 260U.K.Maximum risk-weighted exposure amounts

An originator institution, a sponsor institution, or other institutions which can calculate KIRB may limit the risk-weighted exposure amounts calculated in respect of its positions in a securitisation to that which would produce a own funds requirement under Article 92(3) equal to the sum of 8 % of the risk-weighted exposure amounts which would be produced if the securitised assets had not been securitised and were on the balance sheet of the institution plus the expected loss amounts of those exposures.

Article 261U.K.Ratings Based Method

1.Under the Ratings Based Method, the institution shall calculate the risk-weighted exposure amount of a rated securitisation or re-securitisation position by applying the relevant risk weight to the exposure value and multiplying the result by 1,06.

The relevant risk weight shall be the risk weight as laid down in Table 4, with which the credit assessment of the position is associated in accordance with Section 4.

Table 4

| Credit Quality Step | Securitisation Positions | Re-securitisation Positions | ||||

|---|---|---|---|---|---|---|

| Credit assessments other than short term | Short term credit assessments | A | B | C | D | E |

| 1 | 1 | 7 % | 12 % | 20 % | 20 % | 30 % |

| 2 | 8 % | 15 % | 25 % | 25 % | 40 % | |

| 3 | 10 % | 18 % | 35 % | 35 % | 50 % | |

| 4 | 2 | 12 % | 20 % | 40 % | 65 % | |

| 5 | 20 % | 35 % | 60 % | 100 % | ||

| 6 | 35 % | 50 % | 100 % | 150 % | ||

| 7 | 3 | 60 % | 75 % | 150 % | 225 % | |

| 8 | 100 % | 200 % | 350 % | |||

| 9 | 250 % | 300 % | 500 % | |||

| 10 | 425 % | 500 % | 650 % | |||

| 11 | 650 % | 750 % | 850 % | |||

| all other and unrated | 1 250 % | |||||

The weightings in column C of Table 4 shall be applied where the securitisation position is not a re-securitisation position and where the effective number of exposures securitised is less than six.

For the remainder of the securitisation positions that are not re-securitisation positions, the weightings in column B shall be applied unless the position is in the most senior tranche of a securitisation, in which case the weightings in column A shall be applied.

For re-securitisation positions the weightings in column E shall be applied unless the re-securitisation position is in the most senior tranche of the re-securitisation and none of the underlying exposures are themselves re-securitisation exposures, in which case column D shall be applied.

When determining whether a tranche is the most senior, it is not required to take into consideration amounts due under interest rate or currency derivative contracts, fees due, or other similar payments.

In calculating the effective number of exposures securitised multiple exposures to one obligor shall be treated as one exposure. The effective number of exposures is calculated as:

where EADi represents the sum of the exposure values of all exposures to the ith obligor. If the portfolio share associated with the largest exposure, C1, is available, the institution may compute N as 1/C1.

2.Credit risk mitigation on securitisation positions may be recognised in accordance with Article 264(1) and (4), subject to the conditions in Article 247.

Article 262U.K.Supervisory Formula Method

1.Under the Supervisory Formula Method, the risk weight for a securitisation position shall be calculated as follows subject to a floor of 20 % for re-securitisation positions and 7 % for all other securitisation positions:

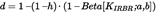

where:

where:

=

1 000;

=

20;

=

the cumulative beta distribution with parameters a and b evaluated at x;

=

the thickness of the tranche in which the position is held, measured as the ratio of (a) the nominal amount of the tranche to (b) the sum of the nominal amounts of the exposures that have been securitised. For derivative instruments listed in Annex II, the sum of the current replacement cost and the potential future credit exposure calculated in accordance with Chapter 6 shall be used in place of the nominal amount;

=

the ratio of (a) KIRB to (b) the sum of the exposure values of the exposures that have been securitised, and is expressed in decimal form;

=

the credit enhancement level, measured as the ratio of the nominal amount of all tranches subordinate to the tranche in which the position is held to the sum of the nominal amounts of the exposures that have been securitised. Capitalised future income shall not be included in the measured L. Amounts due by counterparties to derivative instruments listed in Annex II that represent tranches more junior than the tranche in question may be measured at their current replacement cost, without the potential future credit exposures, in calculating the enhancement level;

=

the effective number of exposures calculated in accordance with Article 261. In the case of re-securitisations, the institution shall look at the number of securitisation exposures in the pool and not the number of underlying exposures in the original pools from which the underlying securitisation exposures stem;

=

the exposure-weighted average loss-given-default, calculated as follows:

where:

=

the average LGD associated with all exposures to the ith obligor, where LGD is determined in accordance with Chapter 3. In the case of resecuritisation, an LGD of 100 % shall be applied to the securitised positions. When default and dilution risk for purchased receivables are treated in an aggregate manner within a securitisation, the LGDi input shall be constructed as a weighted average of the LGD for credit risk and the 75 % LGD for dilution risk. The weights shall be the stand-alone own funds charges for credit risk and dilution risk respectively.

2.Where the nominal amount of the largest securitised exposure, C1, is no more than 3 % of the sum of the nominal amount of the securitised exposures, then, for the purposes of the Supervisory Formula Method, the institution may set LGD= 50 % in the case of securitisations, which are not re-securitisations, and N equal to either of the following:

where:

=

the ratio of the sum of the nominal amounts of the largest 'm' exposures to the sum of the nominal amounts of the exposures securitised. The level of 'm' may be set by the institution.

For securitisations in which materially all securitised exposures are retail exposures, institutions may, subject to permission by the competent authority, use the Supervisory Formula Method using the simplifications h=0 and v=0, provided that the effective number of exposures is not low and that the exposures are not highly concentrated.

3.The competent authorities shall keep EBA informed about the use institutions make of paragraph 2. EBA shall monitor the range of practices in this area and shall, in accordance with Article 16 of Regulation (EU) No 1093/2010, issue guidelines.

4.Credit risk mitigation on securitisation positions may be recognised in accordance with Article 264(2) to (4), subject to the conditions in Article 247.

Article 263U.K.Liquidity Facilities

1.For the purposes of determining the exposure value of an unrated securitisation position in the form of cash advance facilities, a conversion factor of 0 % may be applied to the nominal amount of a liquidity facility that meets the conditions set out in Article 255(2).

2.When it is not possible for the institution to calculate the risk-weighted exposure amounts for the securitised exposures as if they had not been securitised, an institution may, on an exceptional basis and subject to the permission of the competent authorities, temporarily apply the method set out in paragraph 3 for the calculation of risk-weighted exposure amounts for an unrated securitisation position in the form of liquidity facility that meets the conditions in Article 255(1). Institutions shall notify the use they make of the first sentence to the competent authorities, together with its reasons and the intended time period of use.

The calculation of risk-weighted exposure amounts shall, in general, be deemed not to be possible if an inferred rating, the Internal Assessment Approach and the Supervisory Formula Approach are not at the institution's disposal.

3.The highest risk weight that would be applied under Chapter 2 to any of the securitised exposures, had they not been securitised, may be applied to the securitisation position represented by a liquidity facility that meets the conditions in Article 255(1). To determine the exposure value of the position a conversion factor of 100 % shall be applied.

Article 264U.K.Credit risk mitigation for securitisation positions subject to the IRB Approach

1.Where risk-weighted exposure amounts are calculated using the Ratings Based Method, the exposure value or the risk-weight for a securitisation position in respect of which credit protection has been obtained may be amended in accordance with the provisions of Chapter 4 as they apply for the calculation of risk-weighted exposure amounts under Chapter 2.

2.In the case of full credit protection, where risk-weighted exposure amounts are calculated using the Supervisory Formula Method, the following requirements shall apply:

(a)the institution shall determine the 'effective risk weight' of the position. It shall do this by dividing the risk-weighted exposure amount of the position by the exposure value of the position and multiplying the result by 100;

(b)in the case of funded credit protection, the risk-weighted exposure amount of the securitisation position shall be calculated by multiplying the funded protection-adjusted exposure amount of the position (E*), as calculated under Chapter 4 for the calculation of risk-weighted exposure amounts under Chapter 2 taking the amount of the securitisation position to be E, by the effective risk weight;

(c)in the case of unfunded credit protection, the risk-weighted exposure amount of the securitisation position shall be calculated by multiplying the amount of the protection adjusted for any currency mismatch and maturity mismatch (GA) in accordance with the provisions of Chapter 4 by the risk weight of the protection provider; and adding this to the amount arrived at by multiplying the amount of the securitisation position minus GA by the effective risk weight.

3.In the case of partial protection, where risk-weighted exposure amounts are calculated using the Supervisory Formula Method, the following requirements shall apply:

(a)if the credit risk mitigation covers the first loss or losses on a proportional basis on the securitisation position, the institution may apply paragraph 2;

(b)in other cases, the institution shall treat the securitisation position as two or more positions with the uncovered portion being considered the position with the lower credit quality. For the purposes of calculating the risk-weighted exposure amount for this position, the provisions in Article 262 shall apply subject to the adjustment of T to e* in the case of funded credit protection and to T-g in the case of unfunded credit protection, where e* denotes the ratio of E* to the total notional amount of the underlying pool, where E* is the adjusted exposure amount of the securitisation position calculated in accordance with the provisions of Chapter 4 as they apply for the calculation of risk-weighted exposure amounts under Chapter 2 taking the amount of the securitisation position to be E; and g is the ratio of the nominal amount of credit protection, adjusted for any currency or maturity mismatch in accordance with the provisions of Chapter 4, to the sum of the exposure amounts of the securitised exposures. In the case of unfunded credit protection the risk weight of the protection provider shall be applied to that portion of the position not falling within the adjusted value of T.

4.Where, in the case of unfunded credit protection, competent authorities have granted the institution permission to calculate risk-weighted exposure amounts for comparable direct exposures to the protection provider in accordance with Chapter 3, the risk weight g of exposures to the protection provider in accordance with Article 235 shall be determined as specified in Chapter 3.

Article 265U.K.Additional own funds requirements for securitisations of revolving exposures with early amortisation provisions

1.In addition to the risk-weighted exposure amounts calculated in respect of its securitisation positions, an originator institution shall calculate a risk-weighted exposure amount in accordance with the methodology set out in Article 256 when it sells revolving exposures into a securitisation that contains an early amortisation provision.

2.By way of derogation from Article 256, the exposure value of the originators interest shall be the sum of the following items:

(a)the exposure value of that notional part of a pool of drawn amounts sold into a securitisation, the proportion of which in relation to the amount of the total pool sold into the structure determines the proportion of the cash flows generated by principal and interest collections and other associated amounts which are not available to make payments to those having securitisation positions in the securitisation;

(b)the exposure value of that part of the pool of undrawn amounts of the credit lines, the drawn amounts of which have been sold into the securitisation, the proportion of which to the total amount of such undrawn amounts is the same as the proportion of the exposure value described in point (a) to the exposure value of the pool of drawn amounts sold into the securitisation.

The originator's interest shall not be subordinate to the investors' interest.

The exposure value of the Investors' interest shall be the exposure value of the notional part of the pool of drawn amounts not falling within point (a) plus the exposure value of that part of the pool of undrawn amounts of credit lines, the drawn amounts of which have been sold into the securitisation, not falling within point (b).

3.The risk-weighted exposure amount in respect of the exposure value of the originator's interest in accordance with point (a) of paragraph 2 shall be calculated as that for a pro-rata exposure to the securitised drawn amounts exposures as if they had not been securitised and a pro rata exposure to the undrawn amounts of the credit lines, the drawn amounts of which have been sold into the securitisation.

Article 266U.K.Reduction in risk-weighted exposure amounts

1.The risk-weighted exposure amount of a securitisation position to which a 1 250 % risk weight is assigned may be reduced by 12,5 times the amount of any specific credit risk adjustments treated in accordance with Article 110 made by the institution in respect of the securitised exposures. To the extent that specific credit adjustments are taken account of for this purpose they shall not be taken account of for the purposes of the calculation laid down in Article 159.

2.The risk-weighted exposure amount of a securitisation position may be reduced by 12,5 times the amount of any specific credit risk adjustments treated in accordance with Article 110 made by the institution in respect of the position.

3.As provided in Article 36(1)(k) in respect of a securitisation position in respect of which a 1 250 % risk weight applies, institutions may, as an alternative to including the position in their calculation of risk-weighted exposure amounts, deduct from own funds the exposure value of the position subject to the following:

(a)the exposure value of the position may be derived from the risk-weighted exposure amounts taking into account any reductions made in accordance with paragraphs 1 and 2;

(b)the calculation of the exposure value may reflect eligible funded protection in a manner consistent with the methodology prescribed in Articles 247 and 264;

(c)where the Supervisory Formula Method is used to calculate risk-weighted exposure amounts and L < KIRBR and [L+T] > KIRBR the position may be treated as two positions with L equal to KIRBR for the more senior of the positions.

4.Where an institution makes use of the option in paragraph 3 it may subtract 12,5 times the amount deducted in accordance with that paragraph from the amount specified in Article 260 as the amount to which the risk-weighted exposure amount in respect of its positions in a securitisation may be limited.

Section 4 U.K. External credit assessments

Article 267U.K.Use of Credit Assessments by ECAIs

Institutions may use credit assessments to determine the risk weight of a securitisation position only where the credit assessment has been issued or has been endorsed by an ECAI in accordance with Regulation (EC) No 1060/2009.

Article 268U.K.Requirements to be met by the credit assessments of ECAIs

For the purposes of calculating risk-weighted exposure amounts in accordance with Section 3, institutions shall only use a credit assessment of an ECAI if the following conditions are met:

there shall be no mismatch between the types of payments reflected in the credit assessment and the types of payment to which the institution is entitled under the contract giving rise to the securitisation position in question;

loss and cash-flow analysis as well as sensitivity of ratings to changes in the underlying ratings assumptions, including the performance of pool assets, shall be published by the ECAI as well as the credit assessments, procedures, methodologies, assumptions, and the key elements underpinning the assessments in accordance with Regulation (EC) No 1060/2009. Information that is made available only to a limited number of entities shall not be considered to have been published. The credit assessments shall be included in the ECAI's transition matrix;

the credit assessment shall not be based or partly based on unfunded support provided by the institution itself. In such case, the institution shall consider the relevant position for the purposes of calculating risk-weighted exposure amounts for this position in accordance with Section 3 as if it were not rated.

The ECAI shall be committed to publish explanations how the performance of pool assets affects this credit assessment.

Article 269U.K.Use of credit assessments

1.An institution may nominate one or more ECAIs the credit assessments of which shall be used in the calculation of its risk-weighted exposure amounts under this Chapter (a 'nominated ECAI').

2.An institution shall use credit assessments consistently and not selectively in respect of its securitisation positions, in accordance with the following principles:

(a)an institution may not use an ECAI's credit assessments for its positions in some tranches and another ECAI's credit assessments for its positions in other tranches within the same securitisation that may or may not be rated by the first ECAI;

(b)where a position has two credit assessments by nominated ECAIs, the institution shall use the less favourable credit assessment;

(c)where a position has more than two credit assessments by nominated ECAIs, the two most favourable credit assessments shall be used. If the two most favourable assessments are different, the less favourable of the two shall be used;

(d)an institution shall not actively solicit the withdrawal of less favourable ratings.

3.Where credit protection eligible under Chapter 4 is provided directly to the SSPE, and that protection is reflected in the credit assessment of a position by a nominated ECAI, the risk weight associated with that credit assessment may be used. Where the protection is not eligible under Chapter 4, the credit assessment shall not be recognised. Where the credit protection is not provided to the SSPE but directly to a securitisation position, the credit assessment shall not be recognised.

Article 270U.K.Mapping

EBA shall develop draft implementing technical standards to determine, for all ECAIs, which of the credit quality steps set out in this Chapter are associated with the relevant credit assessments of an ECAI. Those determinations shall be objective and consistent, and carried out in accordance with the following principles:

EBA shall differentiate between the relative degrees of risk expressed by each assessment;

EBA shall consider quantitative factors, such as default and/or loss rates and the historical performance of credit assessments of each ECAI across different asset classes;

EBA shall consider qualitative factors such as the range of transactions assessed by the ECAI, its methodology and the meaning of its credit assessments, in particular whether based on expected loss or first Euro loss, and to timely payment of interest or to ultimate payment of interest;

EBA shall seek to ensure that securitisation positions to which the same risk weight is applied on the basis of the credit assessments of ECAIs are subject to equivalent degrees of credit risk. EBA shall consider amending its determination as to the credit quality step with which a particular credit assessment shall be associated, as appropriate.

EBA shall submit those draft implementing technical standards to the Commission by 1 July 2014.

Power is conferred on the Commission to adopt the implementing technical standards referred to in the first subparagraph in accordance with Article 15 of Regulation (EU) No 1093/2010.

Options/Help

Print Options

PrintThe Whole Regulation

PrintThe Whole Part

PrintThe Whole Title

PrintThis Chapter only

You have chosen to open The Whole Regulation

The Whole Regulation you have selected contains over 200 provisions and might take some time to download. You may also experience some issues with your browser, such as an alert box that a script is taking a long time to run.

Would you like to continue?

You have chosen to open The Whole Regulation as a PDF

The Whole Regulation you have selected contains over 200 provisions and might take some time to download.

Would you like to continue?

You have chosen to open The Whole Regulation without Annexes

The Whole Regulation without Annexes you have selected contains over 200 provisions and might take some time to download. You may also experience some issues with your browser, such as an alert box that a script is taking a long time to run.

Would you like to continue?

You have chosen to open The Whole Regulation without Annexes as a PDF

The Whole Regulation without Annexes you have selected contains over 200 provisions and might take some time to download.

Would you like to continue?

You have chosen to open the Whole Regulation

The Whole Regulation you have selected contains over 200 provisions and might take some time to download. You may also experience some issues with your browser, such as an alert box that a script is taking a long time to run.

Would you like to continue?

You have chosen to open the Whole Regulation without Annexes

The Whole Regulation without Annexes you have selected contains over 200 provisions and might take some time to download. You may also experience some issues with your browser, such as an alert box that a script is taking a long time to run.

Would you like to continue?

Legislation is available in different versions:

Latest Available (revised):The latest available updated version of the legislation incorporating changes made by subsequent legislation and applied by our editorial team. Changes we have not yet applied to the text, can be found in the ‘Changes to Legislation’ area.

Original (As adopted by EU): The original version of the legislation as it stood when it was first adopted in the EU. No changes have been applied to the text.

Point in Time: This becomes available after navigating to view revised legislation as it stood at a certain point in time via Advanced Features > Show Timeline of Changes or via a point in time advanced search.

See additional information alongside the content

Geographical Extent: Indicates the geographical area that this provision applies to. For further information see ‘Frequently Asked Questions’.

Show Timeline of Changes: See how this legislation has or could change over time. Turning this feature on will show extra navigation options to go to these specific points in time. Return to the latest available version by using the controls above in the What Version box.

More Resources