SECTION 2 U.K. Non-life underwriting risk module

Article 114U.K.Non-life underwriting risk module

1.The non-life underwriting risk module shall consist of all of the following sub-modules:

(a)the non-life premium and reserve risk sub-module referred to in point (a) of the third subparagraph of Article 105(2) of Directive 2009/138/EC;

(b)the non-life catastrophe risk sub-module referred to in point (b) of the third subparagraph of Article 105(2) of Directive 2009/138/EC;

(c)the non-life lapse risk sub-module.

2.The capital requirement for non-life underwriting risk shall be equal to the following:

where:

the sum covers all possible combinations (i,j) of the sub-modules set out in paragraph 1;

CorrNL(i,j) denotes the correlation parameter for non-life underwriting risk for sub-modules i and j;

SCRi and SCRj denote the capital requirements for risk sub-module i and j respectively.

3.The correlation parameter CorrNL(i,j) referred to in paragraph 2 denotes the item set out in row i and in column j of the following correlation matrix:

| j i | Non-life premium and reserve | Non-life catastrophe | Non-life lapse |

|---|---|---|---|

| Non-life premium and reserve | 1 | 0,25 | 0 |

| Non-life catastrophe | 0,25 | 1 | 0 |

| Non-life lapse | 0 | 0 | 1 |

Modifications etc. (not altering text)

C1 Art. 114(3): power to amend and revoke conferred (31.12.2020) by The Solvency 2 and Insurance (Amendment, etc.) (EU Exit) Regulations 2019 (S.I. 2019/407), regs. 1(2), 4, Sch. 3 (as amended by S.I. 2020/1301, regs. 1, 3, Sch. para. 27(a) and S.I. 2020/1385, regs. 1(2), 54(2))

Article 115U.K.Non-life premium and reserve risk sub-module

The capital requirement for non-life premium and reserve risk shall be equal to the following:

where:

σnl denotes the standard deviation for non-life premium and reserve risk determined in accordance with Article 117;

Vnl denotes the volume measure for non-life premium and reserve risk determined in accordance with Article 116.

Article 116U.K.Volume measure for non-life premium and reserve risk

1.The volume measure for non-life premium and reserve risk shall be equal to the sum of the volume measures for premium and reserve risk of the segments set out in Annex II.

2.For all segments set out in Annex II, the volume measure of a particular segment s shall be equal to the following:

where:

V(prem,s) denotes the volume measure for premium risk of segment s;

V(res,s) denotes the volume measure for reserve risk of segment s;

DIVs denotes the factor for geographical diversification of segment s.

3.For all segments set out in Annex II, the volume measure for premium risk of a particular segment s shall be equal to the following:

where:

Ps denotes an estimate of the premiums to be earned by the insurance or reinsurance undertaking in the segment s during the following 12 months;

P(last,s) denotes the premiums earned by the insurance or reinsurance undertaking in the segment s during the last 12 months;

FP(existing,s) denotes the expected present value of premiums to be earned by the insurance or reinsurance undertaking in the segment s after the following 12 months for existing contracts;

[F1FP (future,s) denotes the following amount with respect to contracts where the initial recognition date falls in the following 12 months:

for all such contracts whose initial term is one year or less, the expected present value of premiums to be earned by the insurance or reinsurance undertaking in the segment s , but excluding the premiums to be earned during the 12 months after the initial recognition date;

for all such contracts whose initial term is more than one year, the amount equal to 30 % of the expected present value of premiums to be earned by the insurance or reinsurance undertaking in the segment s after the following 12 months.]

4.For all segments set out in Annex II, insurance and reinsurance undertakings may, as an alternative to the calculation set out in paragraph 3 of this Article, choose to calculate the volume measure for premium risk of a particular segment s in accordance with the following formula:

provided that the all of following conditions are met:

the administrative, management or supervisory body of the insurance or reinsurance undertaking has decided that its earned premiums in the segment s during the following 12 months will not exceed Ps ;

the insurance or reinsurance undertaking has established effective control mechanisms to ensure that the limits on earned premiums referred to in point (a) will be met;

the insurance or reinsurance undertaking has informed its supervisory authority about the decision referred to in point (a) and the reasons for it.

For the purposes of this calculation, the terms Ps , FP(existing,s) and FP(future,s) shall be denoted in accordance with points (a), (c) and (d) of paragraph 3.

5.For the purposes of the calculations set out in paragraphs 3 and 4, premiums shall be net, after deduction of premiums for reinsurance contracts. The following premiums for reinsurance contracts shall not be deducted:

(a)premiums in relation to non-insurance events or settled insurance claims that are not accounted for in the cash-flows referred to in Article 41(3);

(b)premiums for reinsurance contracts that do not comply with Articles 209, 210, 211 and 213.

6.For all segments set out in Annex II, the volume measure for reserve risk of a particular segment shall be equal to the best estimate of the provisions for claims outstanding for the segment, after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, provided that the reinsurance contracts or special purpose vehicles comply with Articles 209, 210, 211 and 213. The volume measure shall not be a negative amount.

7.For all segments set out in Annex II, the default factor for geographical diversification of a particular segment shall be either 1 or calculated in accordance with Annex III.

Textual Amendments

F1 Substituted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

Article 117U.K.Standard deviation for non-life premium and reserve risk

1.The standard deviation for non-life premium and reserve risk shall be equal to the following:

where:

Vnl denotes the volume measure for non-life premium and reserve risk;

the sum covers all possible combinations (s,t) of the segments set out in Annex II;

CorrS(s,t) denotes the correlation parameter for non-life premium and reserve risk for segment s and segment t set out in Annex IV;

σs and σt denote standard deviations for non-life premium and reserve risk of segments s and t respectively;

Vs and Vt denote volume measures for premium and reserve risk of segments s and t, referred to in Article 116, respectively.

2.For all segments set out in Annex II, the standard deviation for non-life premium and reserve risk of a particular segment s shall be equal to the following:

where:

σ(prem,s) denotes the standard deviation for non-life premium risk of segment s determined in accordance with paragraph 3;

σ(res,s) denotes the standard deviation for non-life reserve risk of segment s as set out in Annex II;

V(prem,s) denotes the volume measure for premium risk of segment s referred to in Article 116;

V(res,s) denotes the volume measure for reserve risk of segment s referred to in Article 116.

3.For all segments set out in Annex II, the standard deviation for non-life premium risk of a particular segment shall be equal to the product of the standard deviation for non-life gross premium risk of the segment set out in Annex II and the adjustment factor for non-proportional reinsurance. For segments 1, 4 and 5 set out in Annex II the adjustment factor for non-proportional reinsurance shall be equal to 80 %. For all other segments set out in Annex the adjustment factor for non-proportional reinsurance shall be equal to 100 %.

Article 118U.K.Non-life lapse risk sub-module

1.The capital requirement for the non-life lapse risk sub-module referred to in 114(1)(c) shall be equal to the loss in basic own funds of the insurance or reinsurance undertaking resulting from a combination of the following instantaneous events:

(a)the discontinuance of 40 % of the insurance policies for which discontinuance would result in an increase of technical provisions without the risk margin;

(b)where reinsurance contracts cover insurance or reinsurance contracts that will be written in the future, the decrease of 40 % of the number of those future insurance or reinsurance contracts used in the calculation of technical provisions.

2.The events referred to in paragraph 1 shall apply uniformly to all insurance and reinsurance contracts concerned. In relation to reinsurance contracts the event referred to in point (a) of paragraph 1 shall apply to the underlying insurance contracts.

3.For the purposes of determining the loss in basic own funds of the insurance or reinsurance undertaking under the event referred to in point (a) of paragraph 1, the undertaking shall base the calculation on the type of discontinuance which most negatively affects the basic own funds of the undertaking on a per policy basis.

Article 119U.K.Non-life catastrophe risk sub-module

1.The non-life catastrophe risk sub-module shall consist of all of the following sub-modules:

(a)the natural catastrophe risk sub-module;

(b)the sub-module for catastrophe risk of non-proportional property reinsurance;

(c)the man-made catastrophe risk sub-module;

(d)the sub-module for other non-life catastrophe risk.

2.The capital requirement for the non-life catastrophe underwriting risk module shall be equal to the following:

where:

SCRnatCAT denotes the capital requirement for natural catastrophe risk;

SCRnpproperty denotes the capital requirement for the catastrophe risk of non-proportional property reinsurance;

SCRmmCAT denotes the capital requirement for man-made catastrophe risk;

SCRCATother denotes the capital requirement for other non-life catastrophe risk.

Article 120U.K.Natural catastrophe risk sub-module

1.The natural catastrophe risk sub-module shall consist of all of the following sub-modules:

(a)the windstorm risk sub-module;

(b)the earthquake risk sub-module;

(c)the flood risk sub-module;

(d)the hail risk sub-module;

(e)the subsidence risk sub-module.

2.The capital requirement for natural catastrophe risk shall be equal to the following:

where:

the sum includes all possible combinations of the sub-modules i set out in paragraph 1;

SCRi denotes the capital requirement for sub-module i.

Article 121U.K.Windstorm risk sub-module

1.The capital requirement for windstorm risk shall be equal to the following:

where:

the sum includes all possible combinations (r,s) of the regions set out in Annex V;

CorrWS(r,s) denotes the correlation coefficient for windstorm risk for region r and region s as set out in Annex V;

SCR(windstorm,r) and SCR(windstorm,s) denote the capital requirements for windstorm risk in region r and s respectively;

SCR(windstorm,other) denotes the capital requirement for windstorm risk in regions other than those set out in Annex XIII.

2.For all regions set out in Annex V the capital requirement for windstorm risk in a particular region r shall be the larger of the following two capital requirements:

(a)the capital requirement for windstorm risk in region r according to scenario A as set out in paragraph 3;

(b)the capital requirement for windstorm risk in region r according to scenario B as set out in paragraph 4.

3.For all regions set out in Annex V the capital requirement for windstorm risk in a particular region r according to scenario A shall be equal to the loss in basic own funds of insurance and reinsurance undertakings that would result from the following sequence of events:

(a)an instantaneous loss of an amount that, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, is equal to 80 % of the specified windstorm loss in region r;

(b)a loss of an amount that, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, is equal to 40 % of the specified windstorm loss in region r.

4.For all regions set out in Annex V the capital requirement for windstorm risk in a particular region r according to scenario B shall be equal to the loss in basic own funds of insurance and reinsurance undertakings that would result from the following sequence of events:

(a)an instantaneous loss of an amount that, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, is equal to 100 % of the specified windstorm loss in region r;

(b)a loss of an amount that, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, is equal to 20 % of the specified windstorm loss in region r.

5.For all regions set out in Annex V, the specified windstorm loss in a particular region r shall be equal to the following amount:

[F1

where:

[F2. . . . .]

the sum includes all possible combinations of risk zones (i,j) of region r set out in Annex IX;

Corr(windstorm,r,i,j) denotes the correlation coefficient for windstorm risk in risk zones i and j of region r set out in Annex XXII;

WSI(windstorm,r,i) and WSI(windstorm,r,j) denote the weighted sums insured for windstorm risk in risk zones i and j of region r set out in Annex IX.

6.For all regions set out in Annex V and all risk zones of those regions set out in Annex IX the weighted sum insured for windstorm risk in a particular windstorm zone i of a particular region r shall be equal to the following:

[F1WSI ( windstorm,r,i ) = Q ( windstorm,r ) · W ( windstorm,r,i ) · SI ( windstorm,r,i )]

where:

(a)W(windstorm,r,i) denotes the risk weight for windstorm risk in risk zone i of region r set out in Annex X;

(b)SI(windstorm,r,i) denotes the sum insured for windstorm risk in windstorm zone i of region r [F1;]

[F3(c) Q (windstorm,r) denotes the windstorm risk factor for region r as set out in Annex V.]

[F3Where the amount determined for a particular risk zone in accordance with the first subparagraph exceeds an amount (referred to in this subparagraph as ‘ the lower amount ’ ) equal to the sum of the potential losses without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, that the insurance or reinsurance undertaking could suffer for windstorm risk in that risk zone, taking into account the terms and conditions of its specific policies, including any contractual payment limits, the insurance or reinsurance undertaking may, as an alternative calculation, determine the weighted sum insured for windstorm risk in that risk zone as the lower amount.]

7.For all regions set out in Annex V and all risk zones of those regions set out in Annex IX, the sum insured for windstorm risk in a particular windstorm zone i of a particular region r shall be equal to the following:

where:

SI(property,r,i) denotes the sum insured by the insurance or reinsurance undertaking for lines of business 7 and 19 set out in Annex I in relation to contracts that cover windstorm risk and where the risk is situated in risk zone i of region r;

SI(onshore-property,r,i) denotes the sum insured by the insurance or reinsurance undertaking for lines of business 6 and 18 set out in Annex I in relation to contracts that cover onshore property damage by windstorm and where the risk is situated in risk zone i of region r.

8.The capital requirement for windstorm risk in regions other than those set out in Annex XIII shall be equal to the loss in basic own funds of insurance and reinsurance undertakings that would result from an instantaneous loss in relation to each insurance and reinsurance contract that covers any of the following insurance or reinsurance obligations:

(a)obligations of lines of business 7 or 19 set out in Annex I that cover windstorm risk and where the risk is not situated in one of the regions set out in Annex XIII;

(b)obligations of lines of business 6 or 18 set out in Annex I in relation to onshore property damage by windstorm and where the risk is not situated in one of the regions set out in Annex XIII.

9.The amount of the instantaneous loss, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, referred to in paragraph 8 shall be equal to the following amount:

where:

DIVwindstorm is calculated in accordance with Annex III, but based on the premiums in relation to the obligations referred to in paragraph 8 and restricted to the regions 5 to 18 set out in point (8) of Annex III;

Pwindstorm is an estimate of the premiums to be earned by insurance and reinsurance undertakings for each contract that covers the obligations referred to in paragraph 8 during the following 12 months: for this purpose premiums shall be gross, without deduction of premiums for reinsurance contracts.

Textual Amendments

F1 Substituted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

F2 Deleted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

F3 Inserted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

Article 122U.K.Earthquake risk sub-module

1.The capital requirement for earthquake risk shall be equal to the following:

where:

the sum includes all possible combinations (r,s) of the regions set out in Annex VI;

CorrEQ(r,s) denotes the correlation coefficient for earthquake risk for region r and region s as set out in Annex VI;

SCR(earthquake,r) and SCR(earthquake,s) denote the capital requirements for earthquake risk in region r and s respectively;

SCR(earthquake,other) denotes the capital requirement for earthquake risk in regions other than those set out in Annex XIII.

2.[F1For all regions set out in Annex VI, the capital requirement for earthquake risk in a particular region r shall be equal to the loss in basic own funds of insurance and reinsurance undertakings that would result from an instantaneous loss of an amount that, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, is equal to the following amount:]

[F1

where:

[F2. . . . .]

the sum includes all possible combinations of risk zones (i,j) of region r set out in Annex IX;

Corr(earthquake,r,i,j) denotes the correlation coefficient for earthquake risk in risk zones i and j of region r set out in Annex XXIII;

WSI(earthquake,r,i) and WSI(earthquake,r,j) denote the weighted sums insured for earthquake risk in risk zones i and j of region r set out in Annex IX.

3.For all regions set out in Annex VI and all risk zones of those regions set out in Annex IX, the weighted sum insured for earthquake risk in a particular earthquake zone i of a particular region r shall be equal to the following:

[F1WSI ( earthquake,r,i ) = Q ( earthquake,r ) · W ( earthquake,r,i ) · SI ( earthquake,r,i )]

where:

(a)W(earthquake,r,i) denotes the risk weight for earthquake risk in risk zone i of region r set out in Annex X;

(b)SI(earthquake,r,i) denotes the sum insured for earthquake risk in earthquake zone i of region r [F1;]

[F3(c) Q (earthquake,r) denotes the earthquake risk factor for region r as set out in Annex VI.]

[F3Where the amount determined for a particular risk zone in accordance with the first subparagraph exceeds an amount (referred to in this subparagraph as ‘ the lower amount ’ ) equal to the sum of the potential losses, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, that the insurance or reinsurance undertaking could suffer for earthquake risk in that risk zone, taking into account the terms and conditions of its specific policies, including any contractual payment limits, the insurance or reinsurance undertaking may, as an alternative calculation, determine the weighted sum insured for earthquake risk in that risk zone as the lower amount.]

4.For all regions set out in Annex VI and all risk zones of those regions set out in Annex IX, the sum insured for earthquake risk in a particular earthquake zone i of a particular region r shall be equal to the following:

where:

SI(property,r,i) denotes the sum insured of the insurance or reinsurance undertaking for lines of business 7 and 19 as set out in Annex I in relation to contracts that cover earthquake risk and where the risk is situated in risk zone i of region r;

SI(onshore-property,r,i) denotes the sum insured of the insurance or reinsurance undertaking for lines of business 6 and 18 as set out in Annex I in relation to contracts that cover onshore property damage by earthquake and where the risk is situated in risk zone i of region r.

5.The capital requirement for earthquake risk in regions other than those set out in Annex XIII shall be equal to the loss in basic own funds of insurance and reinsurance undertakings that would result from an instantaneous loss in relation to each insurance and reinsurance contract that covers one or both of the following insurance or reinsurance obligations:

(a)obligations of lines of business 7 or 19 as set out in Annex I that cover earthquake risk, where the risk is not situated in one of the regions set out in Annex XIII;

(b)obligations of lines of business 6 or 18 as set out in Annex I in relation to onshore property damage by earthquake, where the risk is not situated in one of the regions set out in Annex XIII.

6.The amount of the instantaneous loss, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, referred to in paragraph 5 shall be equal to the following amount:

where:

DIVearthquake is calculated in accordance with Annex III, but based on the premiums in relation to the obligations referred to in points (a) and (b) of paragraph 5 and restricted to the regions 5 to 18 set out in Annex III;

Pearthquake is an estimate of the premiums to be earned by insurance and reinsurance undertakings for each contract that covers the obligations referred to in points (a) and (b) of paragraph 5 during the following 12 months: for this purpose premiums shall be gross, without deduction of premiums for reinsurance contracts.

Textual Amendments

F1 Substituted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

F2 Deleted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

F3 Inserted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

Article 123U.K.Flood risk sub-module

1.The capital requirement for flood risk shall be equal to the following:

where:

the sum includes all possible combinations (r,s) of the regions set out in Annex VII;

CorrFL(r,s) denotes the correlation coefficient for flood risk for region r and region s as set out in Annex VII;

SCR(flood,r) and SCR(flood,s) denote the capital requirements for flood risk in region r and s respectively;

SCR(flood,other) denotes the capital requirement for flood risk in regions other than those set out in Annex XIII.

2.For all regions set out in Annex VII, the capital requirement for flood risk in a particular region r shall be the larger of the following capital requirements:

(a)the capital requirement for flood risk in region r according to scenario A as set out in paragraph 3;

(b)the capital requirement for flood risk in region r according to scenario B as set out in paragraph 4.

3.For all regions set out in Annex VII, the capital requirement for flood risk in a particular region r according to scenario A shall be equal to the loss in basic own funds of insurance and reinsurance undertakings that would result from the following sequence of events:

(a)an instantaneous loss of an amount that, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, is equal to 65 % of the specified flood loss in region r;

(b)a loss of an amount that, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, is equal to 45 % of the specified flood loss in region r.

4.For all regions set out in Annex VII, the capital requirement for flood risk in a particular region r according to scenario B shall be equal to the loss in basic own funds of insurance and reinsurance undertakings that would result from the following sequence of events:

(a)an instantaneous loss of an amount that, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, is equal to 100 % of the specified flood loss in region r;

(b)a loss of an amount that, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, is equal to 10 % of the specified flood loss in region r.

5.For all regions set out in Annex VII, the specified flood loss in a particular region r shall be equal to the following amount:

[F1

where:

[F2. . . . .]

the sum includes all possible combinations of risk zones (i,j) of region r set out in Annex IX;

Corr(flood,r,i,j) denotes the correlation coefficient for flood risk in flood zones i and j of region r set out in Annex XXIV;

WSI(flood,r,i) and WSI(flood,r,j) denote the weighted sums insured for flood risk in risk zones i and j of region r set out in Annex IX.

6.For all regions set out in Annex VII and all risk zones of those regions set out in Annex IX, the weighted sum insured for flood risk in a particular flood zone i of a particular region r shall be equal to the following:

[F1WSI ( flood,r,i ) = Q ( flood,r ) · W ( flood,r,i ) · SI ( flood,r,i )]

where:

(a)W(flood,r,i) denotes the risk weight for flood risk in risk zone i of region r set out in Annex X;

(b)SI(flood,r,i) denotes the sum insured for flood risk in flood zone i of region r [F1;]

[F3(c) Q (flood,r) denotes the flood risk factor for region r as set out in Annex VII.]

[F3Where the amount determined for a particular risk zone in accordance with the first subparagraph exceeds an amount (referred to in this subparagraph as ‘ the lower amount ’ ) equal to the sum of the potential losses, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, that the insurance or reinsurance undertaking could suffer for flood risk in that risk zone, taking into account the terms and conditions of its specific policies, including any contractual payment limits, the insurance or reinsurance undertaking may, as an alternative calculation, determine the weighted sum insured for flood risk in that risk zone as the lower amount.]

7.[F1For all regions set out in Annex VII and all risk zones of those regions set out in Annex IX, the sum insured for flood risk for a particular risk zone i of a particular region r shall be equal to the following:]

where:

SI(property,r,i) denotes the sum insured by the insurance or reinsurance undertaking for lines of business 7 and 19 as set out in Annex I in relation to contracts that cover flood risk, where the risk is situated in risk zone i of region r;

SI(onshore-property,r,i) denotes the sum insured by the insurance or reinsurance undertaking for lines of business 6 and 18 as set out in Annex I in relation to contracts that cover onshore property damage by flood and where the risk is situated in risk zone i of region r;

SI(motor,r,i) denotes the sum insured by the insurance or reinsurance undertaking for lines of business 5 and 17 as set out in Annex I in relation to contracts that cover flood risk, where the risk is situated in risk zone i of region r.

8.The capital requirement for flood risk in regions other than those set out in Annex XIII, shall be equal to the loss in basic own funds of insurance and reinsurance undertakings that would result from an instantaneous loss in relation to each insurance and reinsurance contract that covers any of the following insurance or reinsurance obligations:

(a)obligations of lines of business 7 or 19 as set out in Annex I that cover flood risk, where the risk is not situated in one of the regions set out in Annex XIII;

(b)obligations of lines of business 6 or 18 as set out in Annex I in relation to onshore property damage by flood, where the risk is not situated in one of the regions set out in Annex XIII;

(c)obligations of lines of business 5 or 17 as set out in Annex I that cover flood risk, where the risk is not situated in one of the regions set out in Annex XIII.

9.The amount of the instantaneous loss, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, referred to in paragraph 8 shall be equal to the following amount:

where:

DIVflood is calculated in accordance with Annex III, but based on the premiums in relation to the obligations referred to in points (a), (b) and (c) of paragraph 8 and restricted to the regions 5 to 18 set out in point (8) of Annex III;

Pflood is an estimate of the premiums to be earned by the insurance or reinsurance undertaking for each contract that covers the obligations referred to in points (a), (b) and (c) of paragraph 8 during the following 12 months: for this purpose, premiums shall be gross, without deduction of premiums for reinsurance contracts.

Textual Amendments

F1 Substituted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

F2 Deleted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

F3 Inserted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

Article 124U.K.Hail risk sub-module

1.The capital requirement for hail risk shall be equal to the following:

where:

the sum includes all possible combinations (r,s) of the regions set out in Annex VIII;

CorrHL(r,s) denotes the correlation coefficient for hail risk for region r and region s as set out in Annex VIII;

SCR(hail,r) and SCR(hail,s) denote the capital requirements for hail risk in regions r and s respectively;

SCR(hail,other) denotes the capital requirement for hail risk in regions other than those set out in Annex XIII.

2.For all regions set out in Annex VIII, the capital requirement for hail risk in a particular region r shall be the larger of the following capital requirements:

(a)the capital requirement for hail risk in region r according to scenario A;

(b)the capital requirement for hail risk in region r according to scenario B.

3.For all regions set out in Annex VIII, the capital requirement for hail risk in a particular region r according to scenario A shall be equal to the loss in basic own funds of insurance and reinsurance undertakings that would result from the following sequence of events:

(a)an instantaneous loss of an amount that, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, is equal to 70 % of the specified hail loss in region r;

(b)a loss of an amount that, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, is equal to 50 % of the specified hail loss in region r.

4.For all regions set out in Annex VIII, the capital requirement for hail risk in a particular region r according to scenario B shall be equal to the loss in basic own funds of insurance and reinsurance undertakings that would result from the following sequence of events:

(a)an instantaneous loss of an amount that, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, is equal to 100 % of the specified hail loss in region r;

(b)a loss of an amount that, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, is equal to 20 % of the specified hail loss in region r.

5.For all regions set out in Annex VIII, the specified hail loss in a particular region r shall be equal to the following amount:

[F1

where:

[F2. . . . .]

the sum includes all possible combinations of risk zones (i,j) of region r set out in Annex IX;

Corr(hail,r,i,j) denotes the correlation coefficient for hail risk in risk zones i and j of region r set out in Annex XXV;

WSI(hail,r,i) and WSI(hail,r,j) denote the weighted sums insured for hail risk in risk zones i and j of region r set out in Annex IX.

6.For all regions set out in Annex VIII and all risk zones of those regions set out in Annex IX, the weighted sum insured for hail risk in a particular hail zone i of a particular region r shall be equal to the following:

[F1WSI ( hail,r,i ) = Q ( hail,r ) · W ( hail,r,i ) · SI ( hail,r,i )]

where:

(a)W(hail,r,i) denotes the risk weight for hail risk in risk zone i of region r set out in Annex X;

(b)SI(hail,r,i) denotes the sum insured for hail risk in hail zone i of region r [F1;]

[F3(c) Q (hail,r) denotes the hail risk factor for region r as set out in Annex VIII.]

[F3Where the amount determined for a particular risk zone in accordance with the first subparagraph exceeds an amount (referred to in this subparagraph as ‘ the lower amount ’ ) equal to the sum of the potential losses, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, that the insurance or reinsurance undertaking could suffer for hail risk in that risk zone taking into account the terms and conditions of its specific policies, including any contractual payment limits, the insurance or reinsurance undertaking may, as an alternative calculation, determine the weighted sum insured for hail risk in that risk zone as the lower amount.]

7.For all regions set out in Annex VIII and all hail zones, the sum insured for hail risk in a particular hail zone i of a particular region r shall be equal to the following:

where:

SI(property,r,i) denotes the sum insured by the insurance or reinsurance undertaking for lines of business 7 and 19 as set out in Annex I in relation to contracts that cover hail risk, where the risk is situated in risk zone i of region r;

SI(onshore-property,r,i) denotes the sum insured by the insurance or reinsurance undertaking for lines of business 6 and 18 as set out in Annex I in relation to contracts that cover onshore property damage by hail, where the risk is situated in risk zone i of region r;

SI(motor,r,i) denotes the sum insured by the insurance or reinsurance undertaking for insurance or reinsurance obligations for lines of business 5 and 17 as set out in Annex I in relation to contracts that cover hail risk, where the risk is situated in risk zone i of region r.

8.The capital requirement for hail risk in regions other than those set out in Annex XIII, shall be equal to the loss in basic own funds of insurance and reinsurance undertakings that would result from an instantaneous loss in relation to each insurance and reinsurance contract that covers one or more of the following insurance or reinsurance obligations:

(a)obligations of lines of business 7 or 19 as set out in Annex I that cover hail risk, where the risk is not situated in one of the regions set out in Annex XIII;

(b)obligations of lines of business 6 or 18 as set out in Annex I in relation to onshore property damage by hail, where the risk is not situated in one of the regions set out in Annex XIII;

(c)obligations of lines of business 5 or 17 as set out in Annex I that cover hail risk, where the risk is not situated in one of the regions set out in Annex XIII.

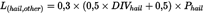

9.The amount of the instantaneous loss, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, referred to in paragraph 8 shall be equal to the following amount:

where:

DIVhail is calculated in accordance with Annex III, but based on the premiums in relation to the obligations referred to in points (a), (b) and (c) of paragraph 8 and restricted to the regions 5 to 18 set out in Annex III;

Phail is an estimate of the premiums to be earned by the insurance or reinsurance undertaking for each contract that covers the obligations referred to in points (a), (b) and (c) of paragraph 8 during the following 12 months: for this purpose premiums shall be gross, without deduction of premiums for reinsurance contracts.

Textual Amendments

F1 Substituted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

F2 Deleted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

F3 Inserted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

Article 125U.K.Subsidence risk sub-module

1.The capital requirement for subsidence risk shall be equal to the loss in basic own funds of insurance and reinsurance undertakings that would result from an instantaneous loss of an amount that, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, is equal to the following:

[F1

where:

the sum includes all possible combinations of risk zones (i,j) of France set out in Annex IX;

Corr(subsidence,i,j) denotes the correlation coefficient for subsidence risk in risk zones i and j set out in Annex XXVI;

WSI(subsidence,i) and WSI(subsidence,j) denote the weighted sums insured for subsidence risk in risk zones i and j of France set out in Annex IX.

2.For all subsidence zones the weighted sum insured for subsidence risk in a particular risk zone i of France set out in the Annex IX shall be equal to the following:

[F1WSI ( subsidence,i ) = 0,0005 · W ( subsidence,i ) · SI ( subsidence,i )]

where:

(a)W(subsidence,i) denotes the risk weight for subsidence risk in risk zone i set out in Annex X;

(b)SI(subsidence,i) denotes the sum insured of the insurance or reinsurance undertaking for lines of business 7 and 19 as set out in Annex I in relation to contracts that cover subsidence risk of residential buildings in subsidence zone i.

[F3Where the amount determined for a particular risk zone in accordance with the first subparagraph exceeds an amount (referred to in this subparagraph as ‘ the lower amount ’ ) equal to the sum of the potential losses, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, that the insurance or reinsurance undertaking could suffer for subsidence risk in that risk zone, taking into account the terms and conditions of its specific policies, including any contractual payment limits, the insurance or reinsurance undertaking may, as an alternative calculation, determine the weighted sum insured for subsidence risk in that risk zone as the lower amount.]

Textual Amendments

F1 Substituted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

F3 Inserted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

Article 126U.K.Interpretation of catastrophe scenarios

1.For the purposes of Article 121(3) and (4), Article 123(3) and (4) and Article 124(3) and (4), insurance and reinsurance undertakings shall base the calculation of the capital requirement on the following assumptions:

(a)the two consecutive events referred to in those Articles are independent;

(b)insurance and reinsurance undertakings do not enter into new insurance risk mitigation techniques between the two events.

2.Notwithstanding point (d) of Article 83(1), where current reinsurance contracts allow for reinstatements, insurance and reinsurance undertakings shall take into account future management actions in relation to the reinstatements between the first and the second event. The assumptions about future management actions shall be realistic, objective and verifiable.

Article 127U.K.Sub-module for catastrophe risk of non-proportional property reinsurance

1.The capital requirement for catastrophe risk of non-proportional property reinsurance shall be equal to the loss in basic own funds of insurance and reinsurance undertakings that would result from an instantaneous loss in relation to each reinsurance contract that covers reinsurance obligations of line of business 28 as set out in Annex I other than non-proportional reinsurance obligations relating to insurance obligations included in lines of business 9 and 21 set out in Annex I.

2.The amount of the instantaneous loss, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, referred to in paragraph 1 shall be equal to the following:

where:

DIVnpproperty is calculated in accordance with Annex III, but based on the premiums earned by the insurance and reinsurance undertaking in line of business 28 as set out in Annex I, other than non-proportional reinsurance obligations relating to insurance obligations included in lines of business 9 and 21 as set out in Annex I;

Pproperty is an estimate of the premiums to be earned by the insurance or reinsurance undertaking during the following 12 months for each contract that covers the reinsurance obligations of line of business 28 as set out in Annex I other than non-proportional reinsurance obligations relating to insurance obligations included in lines of business 9 and 21 as set out in Annex I: for this purpose premiums shall be gross, without deduction of premiums for reinsurance contracts.

Article 128U.K.Man-made catastrophe risk sub-module

1.The man-made catastrophe risk sub-module shall consist of all of the following sub-modules:

(a)the motor vehicle liability risk sub-module;

(b)the marine risk sub-module;

(c)the aviation risk sub-module;

(d)the fire risk sub-module;

(e)the liability risk sub-module;

(f)the credit and suretyship risk sub-module.

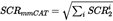

2.The capital requirement for the man-made catastrophe risk shall be equal to the following:

where:

the sum includes all sub-modules set out in paragraph 1;

SCRi denotes the capital requirements for sub-module i.

Article 129U.K.Motor vehicle liability risk sub-module

1.The capital requirement for motor vehicle liability risk shall be equal to the loss in basic own funds of insurance and reinsurance undertakings that would result from an instantaneous loss that, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, is equal to the following amount in euro:

where:

Na is the number of vehicles insured by the insurance or reinsurance undertaking in lines of business 4 and 16 as set out in Annex I with a deemed policy limit above EUR 24 000 000;

Nb is the number of vehicles insured by the insurance or reinsurance undertaking in lines of business 4 and 16 as set out in Annex I with a deemed policy limit below or equal to EUR 24 000 000.

The number of motor vehicles covered by the proportional reinsurance obligations of the insurance or reinsurance undertaking shall be weighted by the relative share of the undertaking's obligations in respect of the sum insured of the motor vehicles.

2.The deemed policy limit referred to in paragraph 1 shall be the overall limit of the motor vehicle liability insurance policy or, where no such overall limit is specified in the terms and conditions of the policy, the sum of the limits for damage to property and for personal injury. Where the policy limit is specified as a maximum per victim, the deemed policy limit shall be based on the assumption of ten victims.

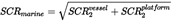

[F1Article 130 U.K. Marine risk sub-module

1. The capital requirement for marine risk shall be equal to the following:

where:

SCR vessel is the capital requirement for the risk of a vessel collision;

SCR platform is the capital requirement for the risk of a platform explosion.

2. The capital requirement for the risk of a vessel collision shall be equal to the loss in basic own funds of insurance and reinsurance undertakings that would result from an instantaneous loss of an amount equal to the following:

L vessel = max v ( SI ( hull,v ) + SI ( liab,v ) + SI ( pollution,v ) )

where:

the maximum relates to all sea, lake, river and canal vessels insured by the insurance or reinsurance undertaking in respect of vessel collision in lines of business 6, 18 and 27 set out in Annex I where the insured value of the vessel is at least EUR 250 000 ;

SI (hull,v) is the sum insured by the insurance or reinsurance undertaking, after deduction of the amounts that the insurance or reinsurance undertaking can recover from reinsurance contracts and special purpose vehicles, for marine hull insurance and reinsurance in relation to vessel v ;

SI (liab,v) is the sum insured by the insurance or reinsurance undertaking, after deduction of the amounts that the insurance or reinsurance undertaking can recover from reinsurance contracts and special purpose vehicles, for marine liability insurance and reinsurance in relation to vessel v ;

SI (pollution,v) is the sum insured by the insurance or reinsurance undertaking, after deduction of the amounts that the insurance or reinsurance undertaking can recover from reinsurance contracts and special purpose vehicles, for oil pollution insurance and reinsurance in relation to vessel v .

For the purposes of determining SI (hull,v) , SI (liab,v) and SI (pollution,v) , insurance and reinsurance undertakings shall only take into account reinsurance contracts and special purpose vehicles that would pay out in the event of insurance claims related to vessel v . Reinsurance contracts and special purpose vehicles where payout is dependent on insurance claims not related to vessel v shall not be taken into account.

Where the deduction of amounts recoverable would lead to a capital requirement for the risk of a vessel collision that captures insufficiently the risk of a vessel collision that the insurance or reinsurance undertaking is exposed to, the insurance or reinsurance undertaking shall calculate SI (hull,v) , SI (liab,v) or SI (pollution,v) without deduction of amounts recoverable.

3. The capital requirement for the risk of a platform explosion shall be equal to the loss in basic own funds of insurance and reinsurance undertakings that would result from an instantaneous loss of an amount equal to the following:

L platform = max p ( SI p )

where:

the maximum relates to all oil and gas offshore platforms insured by the insurance or reinsurance undertaking in respect of platform explosion in lines of business 6, 18 and 27 set out in Annex I;

SI p is the accumulated sum insured by the insurance or reinsurance undertaking, after deduction of the amounts that the insurance or reinsurance undertaking can recover from reinsurance contracts and special purpose vehicles, for the following insurance and reinsurance obligations in relation to platform p :

obligations to compensate for property damage;

obligations to compensate for the expenses for the removal of wreckage;

obligations to compensate for loss of production income;

obligations to compensate for the expenses for capping of the well or making the well secure;

liability insurance and reinsurance obligations.

For the purposes of determining SI p , insurance and reinsurance undertakings shall only take into account reinsurance contracts and special purpose vehicles that would pay out in the event of insurance claims related to platform p . Reinsurance contracts and special purpose vehicles where payout is dependent on insurance claims that are not related to platform p shall not be taken into account.

Where the deduction of amounts recoverable would lead to a capital requirement for the risk of a platform explosion that captures insufficiently the risk of a platform explosion that the insurance or reinsurance undertaking is exposed to, the insurance or reinsurance undertaking shall calculate SI p without the deduction of amounts recoverable.]

Textual Amendments

F1 Substituted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

Article 131U.K.Aviation risk sub-module

[F1The capital requirement for aviation risk shall be equal to the loss in basic own funds of insurance and reinsurance undertakings that would result from an instantaneous loss of an amount that is equal to the following:]

where:

the maximum relates to all aircrafts insured by the insurance or reinsurance undertaking in lines of business 6, 18 and 27 set out in Annex I;

[F1SI a is the sum insured by the insurance or reinsurance undertaking, after deduction of the amounts that the insurance or reinsurance undertaking can recover from reinsurance contracts and special purpose vehicles, for aviation hull insurance and reinsurance and aviation liability insurance and reinsurance in relation to aircraft a .

For the purposes of this Article, insurance and reinsurance undertakings shall only take into account reinsurance contracts and special purpose vehicles that would pay out in the event of insurance claims related to aircraft a . Reinsurance contracts and special purpose vehicles where payout is dependent on insurance claims that are not related to aircraft a shall not be taken into account.

Where the deduction of amounts recoverable would lead to a capital requirement for aviation risk that captures insufficiently the aviation risk that the insurance or reinsurance undertaking is exposed to, the insurance or reinsurance undertaking shall, calculate SI a without the deduction of amounts recoverable.]

Textual Amendments

F1 Substituted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

Article 132U.K.Fire risk sub-module

[F11. The capital requirement for fire risk shall be equal to the loss in basic own funds of insurance and reinsurance undertakings that would result from an instantaneous loss of an amount equal to the sum insured by the insurance or reinsurance undertaking with respect to the largest fire risk concentration.

2. The largest fire risk concentration of an insurance or reinsurance undertaking is the set of buildings with the largest sum insured, after deduction of the amounts that the insurance or reinsurance undertaking can recover from reinsurance contracts and special purpose vehicles, that meets all of the following conditions:

(a) the insurance or reinsurance undertaking has insurance or reinsurance obligations in lines of business 7 and 19 set out in Annex I, in relation to each building which cover damage due to fire or explosion, including as a result of terrorist attacks;

(b) all buildings are partly or fully located within a radius of 200 meters.

In determining the sum insured for a set of buildings, insurance and reinsurance undertakings shall only take into account reinsurance contracts and special purpose vehicles that would pay out in the event of insurance claims related to that set of buildings. Reinsurance contracts and special purpose vehicles where payout is dependent on insurance claims that are not related to that set of buildings shall not be taken into account.

Where the deduction of amounts recoverable would lead to a capital requirement for fire risk that captures insufficiently the fire risk that the insurance or reinsurance undertaking is exposed to, the insurance or reinsurance undertaking shall calculate the sum insured for a set of buildings without the deduction of amounts recoverable.]

3.For the purposes of paragraph 2, the set of buildings may be covered by one or several insurance or reinsurance contracts.

Textual Amendments

F1 Substituted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

Article 133U.K.Liability risk sub-module

1.The capital requirement for liability risk shall be equal to the following:

where:

the sum includes all possible combinations of liability risk groups (i,j) as set out in Annex XI;

Corr(liability,i,j) denotes the correlation coefficient for liability risk of liability risk groups i and j as set out in Annex XI;

SCR(liability,i) denotes the capital requirement for liability risk of liability risk group i.

2.For all liability risk groups set out in Annex XI the capital requirement for liability risk of a particular liability risk group i shall be equal to the loss in basic own funds of insurance and reinsurance undertakings that would result from an instantaneous loss of an amount that, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, is equal to the following:

where:

f(liability,i) denotes the risk factor for liability risk group i as set out in Annex XI;

P(liability,i) denotes the premiums earned by the insurance or reinsurance undertaking during the following 12 months in relation to insurance and reinsurance obligations in liability risk group i; for this purpose premiums shall be gross, without deduction of premiums for reinsurance contracts.

3.The calculation of the loss in basic own funds referred to in paragraph 2 shall be based on the following assumptions:

(a)the loss of liability risk group i is caused by ni claims and the losses caused by these claims are representative for the business of the insurance or reinsurance undertaking in liability risk group i and sum up to the loss of liability risk group i;

(b)the number of claims ni is equal to the lowest integer that exceeds the following amount:

where:

f(liability,i) and P(liability,i) are defined as in paragraph 2;

Lim(i,1) denotes the largest liability limit of indemnity provided by the insurance or reinsurance undertaking in liability risk group i;

(c)where the insurance or reinsurance undertaking provides unlimited cover in liability risk group i, the number of claims ni is equal to one.

Article 134U.K.Credit and suretyship risk sub-module

1.The capital requirement for credit and suretyship risk shall be equal to the following:

where:

SCRdefault is the capital requirement for the risk of a large credit default;

SCRrecession is the capital requirement for recession risk.

2.The capital requirement for the risk of a large credit default shall be equal to the loss in basic own funds of insurance and reinsurance undertakings that would result from an instantaneous default of the two largest exposures relating to obligations included in the lines of business 9 and 21of an insurance or reinsurance undertaking. The calculation of the capital requirement shall be based on the assumption that the loss-given-default, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, of each exposure is 10 % of the sum insured in relation to the exposure.

3.The two largest credit insurance exposures referred to in paragraph 2 shall be determined based on a comparison of the net loss-given-default of the credit insurance exposures, being the loss-given-default after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles.

4.The capital requirement for recession risk shall be equal to the loss in basic own funds of insurance and reinsurance undertakings that would result from an instantaneous loss of an amount that, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, is equal to 100 % of the premiums earned by the insurance or reinsurance undertaking during the following 12 months in lines of business 9 and 21.

Article 135U.K.Sub-module for other non-life catastrophe risk

The capital requirement for other non-life catastrophe risk shall be equal to the loss in basic own funds of insurance and reinsurance undertakings that would result from an instantaneous loss, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, that is equal to the following amount:

where:

P 1, P 2, P 3, P 4 and P 5 denote estimates of the gross premium, without deduction of the amounts recoverable from reinsurance contracts, expected to be earned by the insurance or reinsurance undertaking during the following 12 months in relation to the groups of insurance and reinsurance obligations 1 to 5 set out in Annex XII;

c 1, c 2, c 3, c 4 and c 5 denote the risk factors for the groups of insurance and reinsurance obligations 1 to 5 set out in Annex XII.