- Latest available (Revised)

- Point in Time (10/10/2014)

- Original (As adopted by EU)

Commission Delegated Regulation (EU) 2015/35Show full title

Commission Delegated Regulation (EU) 2015/35 of 10 October 2014 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance)

You are here:

- Show Geographical Extent(e.g. England, Wales, Scotland and Northern Ireland)

- Show Timeline of Changes

More Resources

Revised version PDFs

- Revised 30/07/202048.27 MB

- Revised 01/01/202048.00 MB

- Revised 08/07/201944.91 MB

- Revised 01/01/201946.16 MB

- Revised 15/09/201740.90 MB

- Revised 09/04/201746.19 MB

- Revised 02/04/201646.19 MB

- Revised 17/01/201539.54 MB

When the UK left the EU, legislation.gov.uk published EU legislation that had been published by the EU up to IP completion day (31 December 2020 11.00 p.m.). On legislation.gov.uk, these items of legislation are kept up-to-date with any amendments made by the UK since then.

This item of legislation originated from the EU

Legislation.gov.uk publishes the UK version. EUR-Lex publishes the EU version. The EU Exit Web Archive holds a snapshot of EUR-Lex’s version from IP completion day (31 December 2020 11.00 p.m.).

Changes over time for: Subsection 3

Version Superseded: 02/04/2016

Status:

Point in time view as at 10/10/2014.

Changes to legislation:

Commission Delegated Regulation (EU) 2015/35,

Subsection 3

is up to date with all changes known to be in force on or before 21 February 2025. There are changes that may be brought into force at a future date. Changes that have been made appear in the content and are referenced with annotations.![]()

Changes to Legislation

Changes and effects yet to be applied by the editorial team are only applicable when viewing the latest version or prospective version of legislation. They are therefore not accessible when viewing legislation as at a specific point in time. To view the ‘Changes to Legislation’ information for this provision return to the latest version view using the options provided in the ‘What Version’ box above.

Subsection 3 U.K. Equity risk sub-module

Article 168U.K.General provisions

1.The equity risk sub-module referred to in point (b) of the second subparagraph of Article 105(5) of Directive 2009/138/EC shall include a risk sub-module for type 1 equities and a risk sub-module for type 2 equities.

2.Type 1 equities shall comprise equities listed in regulated markets in the countries which are members of the European Economic Area (EEA) or the Organisation for Economic Cooperation and Development (OECD).

3.Type 2 equities shall comprise equities listed in stock exchanges in countries which are not members of the EEA or the OECD, equities which are not listed, commodities and other alternative investments. They shall also comprise all assets other than those covered in the interest rate risk sub-module, the property risk sub-module or the spread risk sub-module, including the assets and indirect exposures referred to in Article 84(1) and (2) where a look-through approach is not possible and the insurance or reinsurance undertaking does not make use of the provisions in Article 84(3).

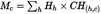

4.The capital requirement for equity risk shall be equal to the following:

where:

SCRtype 1 equities denotes the capital requirement for type 1 equities;

SCRtype 2 equities denotes the capital requirement for type 2 equities.

5.The impact of the instantaneous decreases set out in Articles 169 and 170 on the value of participations as referred to in Article 92(2) of Directive 2009/138/EC in financial and credit institutions shall be considered only on the value of the participations that are not deducted from own funds pursuant to Article 68 of this Regulation.

6.The following equities shall in any case be considered as type 1:

(a)equities held within collective investment undertakings which are qualifying social entrepreneurship funds as referred to in Article 3(b) of Regulation (EU) No 346/2013 of the European Parliament and of the Council(1) where the look-through approach set out in Article 84 of this Regulation is possible for all exposures within the collective investment undertaking, or units or shares of those funds where the look through approach is not possible for all exposures within the collective investment undertaking;

(b)equities held within collective investment undertakings which are qualifying venture capital funds as referred to in Article 3(b) of Regulation (EU) No 345/2013 where the look-through approach set out in Article 84 of this Regulation is possible for all exposures within the collective investment undertaking, or units or shares of those funds where the look through approach is not possible for all exposures within the collective investment undertaking;

(c)as regards closed-ended and unleveraged alternative investment funds which are established in the Union or, if they are not established in the Union, which are marketed in the Union in accordance with Articles 35 or 40 of Directive 2011/61/EU:

equities held within such funds where the look-through approach set out in Article 84 of this Regulation is possible for all exposures within the alternative investment fund;

units or shares of such funds where the look-through approach is not possible for all exposures within the alternative investment fund.

Article 169U.K.Standard equity risk sub-module

1.The capital requirement for type 1 equities referred to in Article 168 of this Regulation shall be equal to the loss in the basic own funds that would result from the following instantaneous decreases:

(a)an instantaneous decrease equal to 22 % in the value of type 1 equity investments in related undertakings within the meaning of Article 212(1)(b) and 212(2) of Directive 2009/138/EC where these investments are of a strategic nature;

(b)an instantaneous decrease equal to the sum of 39 % and the symmetric adjustment as referred to in Article 172 of this Regulation, in the value of type 1 equities other than those referred to in point (a).

2.The capital requirement for type 2 equities referred to in Article 168 of this Regulation shall be equal to the loss in the basic own funds that would result from the following instantaneous decreases:

(a)an instantaneous decrease equal to 22 % in the value of type 2 equity investments in related undertakings with the meaning of Article 212(1)(b) and 212(2) of Directive 2009/138/EC where these investments are of a strategic nature;

(b)an instantaneous decrease equal to the sum of 49 % and the symmetric adjustment as referred to in Article 172, in the value of type 2 equities, other than those referred to in point (a).

Article 170U.K.Duration-based equity risk sub-module

1.Where an insurance or reinsurance undertaking has received supervisory approval to apply the provisions set out in Article 304 of Directive 2009/138/EC, the capital requirement for type 1 equities shall be equal to the loss in the basic own funds that would result from the following instantaneous decreases:

(a)an instantaneous decrease equal to 22 % in the value of the type 1 equities corresponding to the business referred to in point (i) of Article 304(1)(b) of Directive 2009/138/EC;

(b)an instantaneous decrease equal to 22 % in the value of type 1 equity investments in related undertakings within the meaning of Article 212(1)(b) and 212(2) of Directive 2009/138/EC where these investments are of a strategic nature;

(c)an instantaneous decrease equal to the sum of 39 % and the symmetric adjustment as referred to in Article 172 of this Regulation, in the value of type 1 equities, other than those referred to in points (a) or (b).

2.Where an insurance or reinsurance undertaking has received supervisory approval to apply the provisions set out in Article 304 of Directive 2009/138/EC, the capital requirement for type 2 equities shall be equal to the loss in the basic own funds that would result from an instantaneous decrease:

(a)equal to 22 % in the value of the type 2 equities corresponding to the business referred to in point (i) of Article 304(1)(b) of Directive 2009/138/EC;

(b)equal to 22 % in the value of type 2 equity investments in related undertakings within the meaning of Article 212(1)(b) and (2) of Directive 2009/138/EC, where these investments are of a strategic nature;

(c)equal to the sum of 49 % and the symmetric adjustment as referred to in Article 172 of this Regulation, in the value of type 2 equities, other than those referred to in points (a) or (b).

Article 171U.K.Strategic equity investments

For the purposes of Article 169(1)(a) and (2)(a) and of Article 170(1)(b) and (2)(b), equity investments of a strategic nature shall mean equity investments for which the participating insurance or reinsurance undertaking demonstrates the following:

that the value of the equity investment is likely to be materially less volatile for the following 12 months than the value of other equities over the same period as a result of both the nature of the investment and the influence exercised by the participating undertaking in the related undertaking;

that the nature of the investment is strategic, taking into account all relevant factors, including:

the existence of a clear decisive strategy to continue holding the participation for long period;

the consistency of the strategy referred to in point (a) with the main policies guiding or limiting the actions of the undertaking;

the participating undertaking's ability to continue holding the participation in the related undertaking;

the existence of a durable link;

where the insurance or reinsurance participating company is part of a group, the consistency of such strategy with the main policies guiding or limiting the actions of the group.

Article 172U.K.Symmetric adjustment of the equity capital charge

1.The equity index referred to in Article 106(2) of Directive 2009/138/EC shall comply with all of the following requirements:

(a)the equity index measures the market price of a diversified portfolio of equities which is representative of the nature of equities typically held by insurance and reinsurance undertakings;

(b)the level of the equity index is publicly available;

(c)the frequency of published levels of the equity index is sufficient to enable the current level of the index and its average value over the last 36 months to be determined.

2.Subject to paragraph 4, the symmetric adjustment shall be equal to the following:

where:

CI denotes the current level of the equity index;

AI denotes the weighted average of the daily levels of the equity index over the last 36 months.

3.For the purposes of calculating the weighted average of the daily levels of the equity index, the weights for all daily levels shall be equal. The days during the last 36 months in respect of which the index was not determined shall not be included in the average.

4.The symmetric adjustment shall not be lower than – 10 % or higher than 10 %.

Article 173U.K.Criteria for the use of transitional measure for standard equity risk

The transitional measure for standard equity risk set out in Article 308b(12) of Directive 2009/138/EC shall only be applied to type 1 equities that were purchased on or before 1 January 2016 and which are not subject to the duration-based equity risk pursuant to Article 304 of that Directive.

Regulation (EU) No 346/2013 of the European Parliament and of the Council of 17 April 2013 on European social entrepreneurship funds (OJ L 115, 25.4.2013, p. 18).

Options/Help

Print Options

PrintThe Whole Regulation

PrintThe Whole Title

PrintThe Whole Chapter

PrintThe Whole Section

PrintThis Sub-section only

You have chosen to open The Whole Regulation

The Whole Regulation you have selected contains over 200 provisions and might take some time to download. You may also experience some issues with your browser, such as an alert box that a script is taking a long time to run.

Would you like to continue?

You have chosen to open The Whole Regulation as a PDF

The Whole Regulation you have selected contains over 200 provisions and might take some time to download.

Would you like to continue?

You have chosen to open The Whole Regulation without Annexes

The Whole Regulation without Annexes you have selected contains over 200 provisions and might take some time to download. You may also experience some issues with your browser, such as an alert box that a script is taking a long time to run.

Would you like to continue?

You have chosen to open The Whole Regulation without Annexes as a PDF

The Whole Regulation without Annexes you have selected contains over 200 provisions and might take some time to download.

Would you like to continue?

You have chosen to open the Whole Regulation

The Whole Regulation you have selected contains over 200 provisions and might take some time to download. You may also experience some issues with your browser, such as an alert box that a script is taking a long time to run.

Would you like to continue?

You have chosen to open the Whole Regulation without Annexes

The Whole Regulation without Annexes you have selected contains over 200 provisions and might take some time to download. You may also experience some issues with your browser, such as an alert box that a script is taking a long time to run.

Would you like to continue?

You have chosen to open Schedules only

The Schedules you have selected contains over 200 provisions and might take some time to download. You may also experience some issues with your browser, such as an alert box that a script is taking a long time to run.

Would you like to continue?

Legislation is available in different versions:

Latest Available (revised):The latest available updated version of the legislation incorporating changes made by subsequent legislation and applied by our editorial team. Changes we have not yet applied to the text, can be found in the ‘Changes to Legislation’ area.

Original (As adopted by EU): The original version of the legislation as it stood when it was first adopted in the EU. No changes have been applied to the text.

Point in Time: This becomes available after navigating to view revised legislation as it stood at a certain point in time via Advanced Features > Show Timeline of Changes or via a point in time advanced search.

See additional information alongside the content

Geographical Extent: Indicates the geographical area that this provision applies to. For further information see ‘Frequently Asked Questions’.

Show Timeline of Changes: See how this legislation has or could change over time. Turning this feature on will show extra navigation options to go to these specific points in time. Return to the latest available version by using the controls above in the What Version box.

More Resources

Access essential accompanying documents and information for this legislation item from this tab. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as adopted version that was used for the EU Official Journal

- lists of changes made by and/or affecting this legislation item

- all formats of all associated documents

- correction slips

- links to related legislation and further information resources

Timeline of Changes

This timeline shows the different versions taken from EUR-Lex before exit day and during the implementation period as well as any subsequent versions created after the implementation period as a result of changes made by UK legislation.

The dates for the EU versions are taken from the document dates on EUR-Lex and may not always coincide with when the changes came into force for the document.

For any versions created after the implementation period as a result of changes made by UK legislation the date will coincide with the earliest date on which the change (e.g an insertion, a repeal or a substitution) that was applied came into force. For further information see our guide to revised legislation on Understanding Legislation.

More Resources

Use this menu to access essential accompanying documents and information for this legislation item. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as adopted version that was used for the print copy

- correction slips

Click 'View More' or select 'More Resources' tab for additional information including:

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- links to related legislation and further information resources