PART TWOOWN FUNDS

Article 9Own funds composition

1

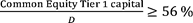

Investment firms shall have own funds consisting of the sum of their Common Equity Tier 1 capital, Additional Tier 1 capital and Tier 2 capital, and shall meet all the following conditions at all times:

a

b

c

where:

- (i)

Common Equity Tier 1 capital is defined in accordance with Chapter 2 of Title I of Part Two of Regulation (EU) No 575/2013, Additional Tier 1 capital is defined in accordance with Chapter 3 of Title I of Part Two of Regulation (EU) No 575/2013, and Tier 2 capital is defined in accordance with Chapter 4 of Title I of Part Two of Regulation (EU) No 575/2013; and

- (ii)

D is defined in Article 11.

2

By way of derogation from paragraph 1:

a

the deductions referred to in point (c) of Article 36(1) of Regulation (EU) No 575/2013 shall apply in full, without the application of Articles 39 and 48 of that Regulation;

b

the deductions referred to in point (e) of Article 36(1) of Regulation (EU) No 575/2013 shall apply in full, without the application of Article 41 of that Regulation;

c

the deductions referred to in point (h) of Article 36(1), point (c) of Article 56, and point (c) of Article 66 of Regulation (EU) No 575/2013, insofar as they relate to holdings of capital instruments which are not held in the trading book, shall apply in full, without the application of the mechanisms provided for in Articles 46, 60 and 70 of that Regulation;

d

the deductions referred to in point (i) of Article 36(1) of Regulation (EU) No 575/2013 shall apply in full, without the application of Article 48 of that Regulation;

e

the following provisions shall not apply to the determination of own funds of investment firms:

- (i)

Article 49 of Regulation (EU) No 575/2013;

- (ii)

the deductions referred to in point (h) of Article 36(1), point (c) of Article 56, point (c) of Article 66 of Regulation (EU) No 575/2013 and the related provisions in Articles 46, 60 and 70 of that Regulation, insofar as those deductions relate to holdings of capital instruments held in the trading book;

- (iii)

the trigger event referred to in point (a) of Article 54(1) of Regulation (EU) No 575/2013; the trigger event shall instead be specified by the investment firm in the terms of the Additional Tier 1 instrument referred to in paragraph 1;

- (iv)

the aggregate amount referred to in point (a) of Article 54(4) of Regulation (EU) No 575/2013; the amount to be written down or converted shall be the full principal amount of the Additional Tier 1 instrument referred to in paragraph 1.

3

Investment firms shall apply the relevant provisions set out in Chapter 6 of Title I of Part Two of Regulation (EU) No 575/2013 when determining the own funds requirements pursuant to this Regulation. In applying those provisions, the supervisory permission in accordance with Articles 77 and 78 of Regulation (EU) No 575/2013 shall be deemed to be granted if one of the conditions set out in point (a) of Article 78(1) or in Article 78(4) of that Regulation is fulfilled.

4

For the purpose of applying point (a) of paragraph 1, for investment firms which are not legal persons or joint‐stock companies or which meet the conditions for qualifying as small and non‐interconnected investment firms set out in Article 12(1) of this Regulation, competent authorities may, after consulting the EBA, permit further instruments or funds to qualify as own funds for those investment firms, provided that those instruments or funds also qualify for treatment under Article 22 of Council Directive 86/635/EEC24. On the basis of information received from each competent authority, EBA, together with ESMA, shall establish, maintain and publish a list of all the forms of instruments or funds in each Member State that qualify as such own funds. The list shall be published for the first time by 26 December 2020.

5

Holdings of own funds instruments of a financial sector entity within an investment firm group shall not be deducted for the purpose of calculating own funds of any investment firm in the group on an individual basis, provided that all of the following conditions are met:

a

there is no current or foreseen material, practical or legal impediment to the prompt transfer of capital or repayment of liabilities by the parent undertaking;

b

the risk evaluation, measurement and control procedures of the parent undertaking include the financial sector entity;

c

the derogation provided for in Article 8 is not used by the competent authorities.