Leasehold Reform Act 1967

An Act to enable tenants of houses held on long leases at low rents to acquire the freehold or an extended lease; to apply the Rent Acts to premises held on long leases at a rackrent, and to bring the operation of the Landlord and Tenant Act 1954 into conformity with the Rent Acts as so amended; to make other changes in the law in relation to premises held on long leases, including amendments of the Places of Worship (Enfranchisement) Act 1920; and for purposes connected therewith.

Part I Enfranchisement and Extension of Long Leaseholds

Right to enfranchisement or extension

1 Tenants entitled to enfranchisement or extension.

(1)

This Part of this Act shall have effect to confer on a tenant of a leasehold house, occupying the house as his residence, a right to acquire on fair terms the freehold or an extended lease of the house and premises where—

F1(a)

his tenancy is a long tenancy at a low rent and,—

(i)

if the tenancy was entered into before 1st April 1990 F2, or on or after 1st April 1990 in pursuance of a contract made before that date, and the house and premises had a rateable value at the date of commencement of the tenancy or else at any time before 1st April 1990, subject to subsections (5) and (6) below, the rateable value of the house and premises on the appropriate day was not more than £200 or, if it is in Greater London, than £400; and

(ii)

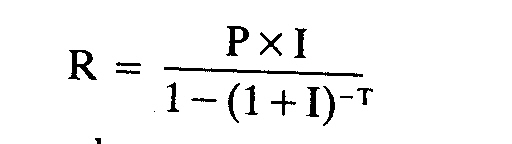

if the tenancy F2does not fall within sub-paragraph (i) above, on the date the contract for the grant of the tenancy was made or, if there was no such contract, on the date the tenancy was entered into R did not exceed £25,000 under the formula—

where—

P is the premium payable as a condition of the grant of the tenancy (and includes a payment of money’s worth) or, where no premium is so payable, zero,

I is 0.06, and

T is the term, expressed in years, granted by the tenancy (disregarding any right to terminate the tenancy before the end of the term or to extend the tenancy); and

(b)

at the relevant time (that is to say, at the time when he gives notice in accordance with this Act of his desire to have the freehold or to have an extended lease, as the case may be) he has been tenant of the house under a long tenancy at a low rent, and occupying it as his residence, for the last F3three years or for periods amounting to F3three years in the last ten years;

and to confer the like right in the other cases for which provision is made in this Part of this Act.

F4(1A)

The references in subsection (1)(a) and (b) to a long tenancy at a low rent do not include a tenancy excluded from the operation of this Part by section 33A of and Schedule 4A to this Act.

(2)

In this Part of this Act references, in relation to any tenancy, to the tenant occupying a house as his residence shall be construed as applying where, but only where, the tenant is, in right of the tenancy, occupying it as his only or main residence (whether or not he uses it also for other purposes); but—

(a)

references to a person occupying a house shall apply where he occupies it in part only; and

(b)

in determining in what right the tenant occupies, there shall be disregarded any mortgage term and any interest arising in favour of any person by his attorning tenant to a mortgagee or chargee.

(3)

This Part of this Act shall not confer on the tenant of a house any right by reference to his occupation of it as his residence (but shall apply as if he were not so occupying it) at any time when—

(a)

it is let to and occupied by him with other land or premises to which it is ancillary; or

F5(b)

it is comprised in—

(i)

an agricultural holding within the meaning of the Agricultural Holdings Act 1986 held under a tenancy in relation to which that Act applies, or

(ii)

the holding held under a farm business tenancy within the meaning of the Agricultural Tenancies Act 1995

F6or, in the case of any right to which subsection (3A) below applies, at any time when the tenant’s immediate landlord is a charitable housing trust and the house forms part of the housing accommodation provided by the trust in the pursuit of its charitable purposes.

F7(3A)

For the purposes of subsection (3) above this subsection applies as follows—

(a)

where the tenancy was created after the commencement of Chapter III of Part I of the Leasehold Reform, Housing and Urban Development Act 1993, this subsection applies to any right to acquire the freehold of the house and premises; but

(b)

where the tenancy was created before that commencement, this subsection applies only to any such right exercisable by virtue of any one or more of the provisions of sections 1A F8, 1AA and 1B below;

and in that subsection “charitable housing trust” means a housing trust within the meaning of the Housing Act 1985 which is a charity within the meaning of the Charities Act 1993.

(4)

In subsection (1)(a) above, “the appropriate day”, in relation to any house and premises, means the 23rd March 1965 or such later day as by virtue of F9section 25(3) of the M1Rent Act 1977 would be the appropriate day for purposes of that Act in relation to a dwelling house consisting of that house.

F10(4A)

Schedule 8 to the M2Housing Act 1974 shall have effect to enable a tenant to have the rateable value of the house and premises reduced for purposes of this section in consequence of tenant’s improvements.

F11(5)

If, in relation to any house and premises, the appropriate day for the purposes of subsection (1)(a) above falls on or after 1st April 1973 that subsection shall have effect in relation to the house and premises,—

(a)

in a case where the tenancy was created on or before 18th February 1966, as if for the sums of £200 and £400 specified in that subsection there were substituted respectively the sums of £750 and £1,500; and

(b)

in a case where the tenancy was created after 18th February 1966, as if for those sums of £200 and £400 there were substituted respectively the sums of £500 and £1,000.

(6)

If, in relation to any house and premises,—

(a)

the appropriate day for the purposes of subsection (1)(a) above falls before 1st April 1973, and

(b)

the rateable value of the house and premises on the appropriate day was more than £200 or, if it was then in Greater London, £400, and

(c)

the tenancy was created on or before 18th February 1966,

subsection (1)(a) above shall have effect in relation to the house and premises as if for the reference to the appropriate day there were substituted a reference to 1st April 1973 and as if for the sums of £200 and £400 specified in that subsection there were substituted respectively the sums of £750 and £1,500.

F12(7)

The Secretary of State may by order replace the amount referred to in subsection (1)(a)(ii) above and the number in the definition of “I” in that subsection by such amount or number as is specified in the order; and such an order shall be made by statutory instrument which shall be subject to annulment in pursuance of a resolution of either House of Parliament.

F131A Right to enfranchisement only in case of houses whose value or rent exceeds limit under s.1 or 4.

(1)

Where subsection (1) of section 1 above would apply in the case of the tenant of a house but for the fact that the applicable financial limit specified in subsection (1)(a)(i) or (ii) or (as the case may be) subsection (5) or (6) of that section is exceeded, this Part of this Act shall have effect to confer on the tenant the same right to acquire the freehold of the house and premises as would be conferred by subsection (1) of that section if that limit were not exceeded.

(2)

Where a tenancy of any property is not a tenancy at a low rent in accordance with section 4(1) below but is a tenancy falling within section 4A(1) below, the tenancy shall nevertheless be treated as a tenancy at a low rent for the purposes of this Part of this Act so far as it has effect for conferring on any person a right to acquire the freehold of a house and premises.

F141AA Additional right to enfranchisement only in case of houses whose rent exceeds applicable limit under section 4.

(1)

Where—

(a)

section 1(1) above would apply in the case of the tenant of a house but for the fact that the tenancy is not a tenancy at a low rent, and

(b)

the tenancy falls within subsection (2) below and is not an excluded tenancy,

this Part of this Act shall have effect to confer on the tenant the same right to acquire the freehold of the house and premises as would be conferred by section 1(1) above if it were a tenancy at a low rent.

(2)

A tenancy falls within this subsection if—

(a)

it is granted for a term of years certain exceeding thirty-five years, whether or not it is (or may become) terminable before the end of that term by notice given by or to the tenant or by re-entry, forfeiture or otherwise,

(b)

it is for a term fixed by law under a grant with a covenant or obligation for perpetual renewal, unless it is a tenancy by sub-demise from one which is not a tenancy which falls within this subsection,

(c)

it is a tenancy taking effect under section 149(6) of the M3Law of Property Act 1925 (leases terminable after a death or marriage), or

(d)

it is a tenancy which—

(i)

is or has been granted for a term of years certain not exceeding thirty-five years, but with a covenant or obligation for renewal without payment of a premium (but not for perpetual renewal), and

(ii)

is or has been once or more renewed so as to bring to more than thirty-five years the total of the terms granted (including any interval between the end of a tenancy and the grant of a renewal).

(3)

A tenancy is an excluded tenancy for the purposes of subsection (1) above if—

(a)

the house which the tenant occupies under the tenancy is in an area designated for the purposes of this provision as a rural area by order made by the Secretary of State,

(b)

the freehold of that house is owned together with adjoining land which is not occupied for residential purposes and has been owned together with such land since the coming into force of section 106 of the Housing Act 1996, and

(c)

the tenancy was granted on or before the day on which that section came into force.

(4)

Where this Part of this Act applies as if there were a single tenancy of property comprised in two or more separate tenancies, then, if each of the separate tenancies falls within subsection (2) above, this section shall apply as if the single tenancy did so.

(5)

The power to make an order under subsection (3) above shall be exercisable by statutory instrument which shall be subject to annulment in pursuance of a resolution of either House of Parliament.

1BF15Right to enfranchisement only in case of certain tenancies terminable after death or marriage.

Where a tenancy granted so as to become terminable by notice after a death or marriage—

(a)

is (apart from this section) a long tenancy in accordance with section 3(1) below, but

(b)

was granted before 18th April 1980 or in pursuance of a contract entered into before that date,

then (notwithstanding section 3(1)) the tenancy shall be a long tenancy for the purposes of this Part of this Act only so far as this Part has effect for conferring on any person a right to acquire the freehold of a house and premises.

2 Meaning of “house” and “houses and premises”, and adjustment of boundary.

(1)

For purposes of this Part of this Act, “house” includes any building designed or adapted for living in and reasonably so called, notwithstanding that the building is not structurally detached, or was or is not solely designed or adapted for living in, or is divided horizontally into flats or maisonettes; and—

(a)

where a building is divided horizontally, the flats or other units into which it is so divided are not separate “houses”, though the building as a whole may be; and

(b)

where a building is divided vertically the building as a whole is not a “house” though any of the units into which it is divided may be.

(2)

References in this Part of this Act to a house do not apply to a house which is not structurally detached and of which a material part lies above or below a part of the structure not comprised in the house.

(3)

Subject to the following provisions of this section, where in relation to a house let to and occupied by a tenant reference is made in this Part of this Act to the house and premises, the reference to premises is to be taken as referring to any garage, outhouse, garden, yard and appurtenances which at the relevant time are let to him with the house and are occupied with and used for the purposes of the house or any part of it by him or by another occupant.

(4)

In relation to the exercise by a tenant of any right conferred by this Part of this Act there shall be treated as included in the house and premises any other premises let with the house and premises but not at the relevant time occupied and used as mentioned in subsection (3) above (whether in consequence of an assignment of the term therein or a subletting or otherwise), if—

(a)

the landlord at the relevant time has an interest in the other premises and, not later than two months after the relevant time, gives to the tenant written notice objecting to the further severance of them from the house and premises; and

(b)

either the tenant agrees to their inclusion with the house and premises or the court is satisfied that it would be unreasonable to require the landlord to retain them without the house and premises.

(5)

In relation to the exercise by a tenant of any right conferred by this Part of this Act there shall be treated as not included in the house and premises any part of them which lies above or below other premises (not consisting only of underlying mines or minerals), if—

(a)

the landlord at the relevant time has an interest in the other premises and, not later than two months after the relevant time, gives to the tenant written notice objecting to the further severance from them of that part of the house and premises; and

(b)

either the tenant agrees to the exclusion of that part of the house and premises or the court is satisfied that any hardship or inconvenience likely to result to the tenant from the exclusion, when account is taken of anything that can be done to mitigate its effects and of any undertaking of the landlord to take steps to mitigate them, is outweighed by the difficulties involved in the further severance from the other premises and any hardship or inconvenience likely to result from that severance to persons interested in those premises.

(6)

The rights conferred on a tenant by this Part of this Act in relation to any house and premises shall not extend to underlying minerals comprised in the tenancy if the landlord requires that the minerals be excepted, and if proper provision is made for the support of the house and premises as they have been enjoyed during the tenancy and in accordance with its terms.

(7)

Where by virtue of subsection (4) above a tenant of a house acquiring the freehold or an extended lease is required to include premises of which the tenancy is not vested in him, this Part of this Act shall apply for the purpose as if in the case of those premises a tenancy on identical terms were vested in him and the holder of the actual tenancy were a sub-tenant; and where by virtue of subsection (5) or (6) above a tenant of a house acquiring the freehold or an extended lease is required to exclude property of which the tenancy is vested in him, then unless the landlord and the tenant otherwise agree or the court for the protection of either of them from hardship or inconvenience otherwise orders, the grant to the tenant shall operate as a surrender of the tenancy in that property and the provision to be made by the grant shall be determined as if the surrender had taken place before the relevant time.

3 Meaning of “long tenancy”.

(1)

In this Part of this Act “long tenancy” means, subject to the provisions of this section, a tenancy granted for a term of years certain exceeding twenty-one years, whether or not the tenancy is (or may become) terminable before the end of that term by notice given by or to the tenant or by re-entry, forfeiture or otherwise, and includes F16both a tenancy taking effect under section 149(6) of the Law of Property Act 1925 (leases terminable after a death or marriage) and a tenancy for a term fixed by law under a grant with a covenant or obligation for perpetual renewal unless it is a tenancy by sub-demise from one which is not a long tenancy:

Provided that a tenancy granted so as to become terminable by notice after a death or marriage is not to be treated as a long tenancy F17if—

(a)

the notice is capable of being given at any time after the death or marriage of the tenant;

(b)

the length of the notice is not more than three months; and

(c)

the terms of the tenancy preclude both—

(i)

its assignment otherwise than by virtue of section 92 of the Housing Act 1985 (assignments by way of exchange), and

(ii)

the sub-letting of the whole of the premises comprised in it.

(2)

Where the tenant of any property under a long tenancy at a low rent F18(other than a lease excluded from the operation of this Part by section 33A of and Schedule 4A to this Act) , on the coming to an end of that tenancy, becomes or has become tenant of the property or part of it under another tenancy (whether by express grant or by implication of law), then the later tenancy shall be deemed for the purposes of this Part of this Act, including any further application of this subsection, to be a long tenancy irrespective of its terms.

(3)

Where the tenant of any property under a long tenancy, on the coming to an end of that tenancy, becomes or has become tenant of the property or part of it under another long tenancy, then in relation to the property or that part of it this Part of this Act F19, except section 1AA, shall apply as if there had been a single tenancy granted for a term beginning at the same time as the term under the earlier tenancy and expiring at the same time as the term under the later tenancy.

(4)

Where a tenancy is or has been granted for a term of years certain not exceeding twenty-one years, but with a covenant or obligation for renewal without payment of a premium (but not for perpetual renewal), and the tenancy is or has been once or more renewed so as to bring to more than twenty-one years the total of the terms granted (including any interval between the end of a tenancy and the grant of a renewal), then this Part of this Act shall apply as it would apply if the term originally granted had been one exceeding twenty-one years.

(5)

References in this Part of this Act to a long tenancy include any period during which the tenancy is or was continued under Part I or II of the M4Landlord and Tenant Act 1954 F20under Schedule 10 to the Local Government and Housing Act 1989 or under the M5Leasehold Property (Temporary Provisions) Act 1951.

(6)

Where at any time there are separate tenancies, with the same landlord and the same tenant, of two or more parts of a house, or of a house or part of it and land or other premises occupied therewith, then in relation to the property comprised in such of those tenancies as are long tenancies this Part of this Act shall apply as it would if at that time there were a single tenancy of that property and the tenancy were a long tenancy, and for that purpose references in this Part of this Act to the commencement of the term or to the term date shall, if the separate tenancies commenced at different dates or have different term dates, have effect as references to the commencement or term date, as the case may be, of the tenancy comprising the house (or the earliest commencement or earliest term date of the tenancies comprising it):

Provided that this subsection shall have effect subject to the operation of subsections (2) to (5) above in relation to any of the separate tenancies.

4 Meaning of “low rent”.

(1)

For purposes of this Part of this Act a tenancy of any property is a tenancy at a low rent at any time when rent is not payable under the tenancy in respect of the property at a yearly rate

F21(i)

if the tenancy was entered into before 1st April 1990 F22, or on or after 1st April 1990 in pursuance of a contract made before that date, and the property had a rateable value other than nil at the date of the commencement of the tenancy or else at any time before 1st April 1990, equal to or more than two-thirds of the rateable value of the property on the appropriate day or, if later, the first day of the term

F23(ii)

if the tenancy F24does not fall within paragraph (i) above, more than £1,000 if the property is in Greater London and £250 if the property is elsewhere:

Provided that a tenancy granted between the end of August 1939 and the beginning of April 1963 otherwise than by way of building lease (whether or not it is, by virtue of section 3(3) above, to be treated for other purposes as forming a single tenancy with a previous tenancy) shall not be regarded as a tenancy at a low rent if at the commencement of the tenancy the rent payable under the tenancy exceeded two-thirds of the letting value of the property (on the same terms).

For the purposes of this subsection—

- (a)

“appropriate day” means the 23rd March 1965 or such later day as by virtue of F25section 25(3) of the M6Rent Act 1977 would be the appropriate day for purposes of that Act in relation to a dwelling-house consisting of the house in question F26if the reference in paragraph (a) of that provision to a rateable value were to a rateable value other than nil; and

- (b)

“rent” means rent reserved as such, and there shall be disregarded any part of the rent expressed to be payable in consideration of services to be provided, or of repairs, maintenance or insurance to be effected by the landlord, or to be payable in respect of the cost thereof to the landlord or a superior landlord; and

- (c)

there shall be disregarded any term of the tenancy providing for suspension or reduction of rent in the event of damage to property demised, or for any penal addition to the rent in the event of a contravention of or non-compliance with the terms of the tenancy or an agreement collateral thereto; and

- (d)

“building lease” means a lease granted in pursuance or in consideration of an agreement for the erection or the substantial re-building or reconstruction of the whole or part of the house in question or a building comprising it.

(2)

Where on a claim by the tenant of a house to exercise any right conferred by this Part of this Act a question arises under section 1(1) above whether his tenancy of the house is or was at any time a tenancy at a low rent, the question shall be determined by reference to the rent and rateable value of the house and premises as a whole, and in relation to a time before the relevant time shall be so determined whether or not the property then occupied with the house or any part of it was the same in all respects as that comprised in the house and premises for purposes of the claim; but, in a case where the tenancy derives (in accordance with section 3(6) above) from more than one separate tenancy, the proviso to subsection (1) above shall have effect if, but only if, it applies to one of the separate tenancies which comprises the house or part of it.

(3)

Where on a claim by the tenant of a house to exercise any right conferred by this Part of this Act a question arises under section 3(2) above whether a tenancy is or was a long tenancy by reason of a previous tenancy having been a long tenancy at a low rent, the question whether the previous tenancy was one at a low rent shall be determined in accordance with subsection (2) above as if it were a question arising under section 1(1), and shall be so determined by reference to the rent and rateable value of the house and premises or the part included in the previous tenancy, exclusive of any other land or premises so included:

Provided that where an apportionment of rent or rateable value is required because the previous tenancy did not include the whole of the house and premises or included other property, the apportionment shall be made as at the end of the previous tenancy except in so far as, in the case of rent, an apportionment falls to be made at an earlier date under subsection (6) below.

(4)

For purposes of subsection (2) or (3) above a house and premises shall be taken as not including any premises which are to be or may be included under section 2(4) above in giving effect to the tenant’s claim, and as including any part which is to be or may be excluded under section 2(5) or (6).

(5)

Where on a claim by the tenant of a house to exercise any right conferred by this Part of this Act a question arises whether a tenancy granted as mentioned in the proviso to subsection (1) above is or was at any time a tenancy at a low rent, it shall be presumed until the contrary is shown that the letting value referred to in that proviso was such that the proviso does not apply.

(6)

Any entire rent payable at any time in respect of both a house and premises or part thereof and of property not included in the house and premises shall for purposes of this section be apportioned as may be just according to the circumstances existing at the date of the severance giving rise to the apportionment, and references in this section to the rent of a house and premises or of part thereof shall be construed accordingly.

F27(7)

Section 1(7) above applies to any amount referred to in subsection (1)(ii) above as it applies to the amount referred to in subsection (1)(a)(ii) of that section.

F284A Alternative rent limits for purposes of section 1A(2).

(1)

For the purposes of section 1A(2) above a tenancy of any property falls within this subsection if either no rent was payable under it in respect of the property during the initial year or the aggregate amount of rent so payable during that year did not exceed the following amount, namely—

(a)

where the tenancy was entered into before 1st April 1963, two-thirds of the letting value of the property (on the same terms) on the date of the commencement of the tenancy;

(b)

where—

(i)

the tenancy was entered into either on or after 1st April 1963 but before 1st April 1990, or on or after 1st April 1990 in pursuance of a contract made before that date, and

F29(ii)

the property had a rateable value other than nil at the date of commencement of the tenancy or else at any time before 1st April 1990,

two-thirds of the rateable value of the property on the relevant date; or

(c)

in any other case, £1,000 if the property is in Greater London or £250 if elsewhere.

(2)

For the purposes of subsection (1) above—

(a)

“the initial year”, in relation to any tenancy, means the period of one year beginning with the date of the commencement of the tenancy;

F30(b)

“the relevant date” means the date of the commencement of the tenancy or, if the property did not have a rateable value, or had a rateable value of nil, on that date, the date on which it first had a rateable value other than nil;

(c)

paragraphs (b) and (c) of section 4(1) above shall apply as they apply for the purposes of section 4(1);

and it is hereby declared that in subsection (1) above the reference to the letting value of any property is to be construed in like manner as the reference in similar terms which appears in the proviso to section 4(1) above.

(3)

Section 1(7) above applies to any amount referred to in subsection (1)(c) above as it applies to the amount referred to in subsection (1)(a)(ii) of that section.

5 General provisions as to claims to enfranchisement or extension.

(1)

Where under this Part of this Act a tenant of a house has the right to acquire the freehold or an extended lease and gives notice of his desire to have it, the rights and obligations of the landlord and the tenant arising from the notice shall inure for the benefit of and be enforceable against them, their executors, administrators and assigns to the like extent (but no further) as rights and obligations arising under a contract for a sale or lease freely entered into between the landlord and tenant; and accordingly, in relation to matters arising out of any such notice, references in this Part of this Act to the tenant and the landlord shall, in so far as the context permits, include their respective executors, administrators and assigns.

(2)

Notwithstanding anything in subsection (1) above, the rights and obligations there referred to of a tenant shall be assignable with, but not capable of subsisting apart from, the tenancy of the entire house and premises; and if the tenancy is assigned without the benefit of the notice, or if the tenancy of one part of the house and premises is assigned to or vests in any person without the tenancy of another part, the notice shall accordingly cease to have effect, and the tenant shall be liable to make such compensation as may be just to the landlord in respect of the interference (if any) by the notice with the exercise by the landlord of his power to dispose of or deal with the house and premises or any neighbouring property.

(3)

In the event of any default by the landlord or the tenant in carrying out the obligations arising from any such notice, the other of them shall have the like rights and remedies as in the case of a contract freely entered into.

(4)

The provisions of Schedule 1 to this Act shall have effect in relation to the operation of this Part of this Act where a person gives notice of his desire to have the freehold or an extended lease of a house and premises, and either he does so in respect of a sub-tenancy or there is a tenancy reversionary on his tenancy; but any such notice given in respect of a tenancy granted by sub-demise out of a superior tenancy other than a long tenancy at a low rent shall be of no effect if the grant was made in breach of the terms of the superior tenancy and there has been no waiver of the breach by the superior landlord.

(5)

No lease shall be registrable under F31the M7Land Charges Act 1972 or be deemed to be an estate contract within the meaning of that Act by reason of the rights conferred on the tenant by this Part of this Act to acquire the freehold or an extended lease of property thereby demised, nor shall any right of a tenant arising from a notice under this Act of his desire to have the freehold or to have an extended lease be an overriding interest within the meaning of the M8Land Registration Act 1925; but any such notice shall be registrable under F32the M9Land Charges Act 1972 or may be the subject of a notice or caution under the Land Registration Act 1925, as if it were an estate contract.

(6)

A notice of a person’s desire to have the freehold or an extended lease of a house and premises under this Part of this Act—

(a)

shall be of no effect if at the relevant time any person or body of persons who has or have been, or could be, authorised to acquire the whole or part of the house and premises compulsorily for any purpose has or have, with a view to its acquisition for that purpose, served notice to treat on the landlord or on the tenant, or entered into a contract for the purchase of the interest of either of them, and the notice to treat or contract remains in force; and

(b)

shall cease to have effect if before the completion of the conveyance in pursuance of the tenant’s notice any such person or body of persons serves notice to treat as aforesaid;

but where a tenant’s notice ceases to have effect by reason of a notice to treat served on him or on the landlord, then on the occasion of the compulsory acquisition in question the compensation payable in respect of any interest in the house and premises (whether or not the one to which that notice to treat relates) shall be determined on the basis of the value of the interest subject to and with the benefit of the rights and obligations arising from the tenant’s notice and affecting that interest.

(7)

Where any such notice given by a tenant entitled to acquire the freehold or an extended lease has effect, then (without prejudice to the general law as to the frustration of contracts) the landlord and all other persons shall be discharged from the further performance, so far as relates to the disposal in any manner of the landlord’s interest in the house and premises or any part thereof, of any contract previously entered into and not providing for the eventuality of such a notice (including any such contract made in pursuance of the order of any court):

Provided that, in the case of a notice of the tenant’s desire to have an extended lease, this subsection shall not apply to discharge a person from performance of a contract unless the contract was entered into on the basis, common to both parties, that vacant possession of the house and premises or part thereof would or might be obtainable on the termination of the existing tenancy.

(8)

A tenant’s notice of his desire to have an extended lease under this Part of this Act shall cease to have effect if afterwards (being entitled to do so) he gives notice of his desire to have the freehold.

6 Rights of trustees.

(1)

Where a tenant of a house is occupying it as his residence, his occupation of it at any earlier time shall for purposes of this Part of this Act be treated as having been an occupation in right of the tenancy if at that time—

(a)

the tenancy was settled land for purposes of the M10Settled Land Act 1925, and he was sole tenant for life within the meaning of that Act; or

(b)

the tenancy was vested in trustees and he, as a person beneficially interested (whether directly or derivatively) under the trusts, was entitled or permitted to occupy the house by reason of that interest.

References in this section to trustees include persons holding on F33a trust arising under section 34 or section 36 of the M11Law of Property Act 1925 in cases of joint ownership or ownership in common.

(2)

Where a tenancy of a house is settled land for purposes of the Settled Land Act 1925, a sole tenant for life within the meaning of that Act shall have the same rights under this Part of this Act in respect of his occupation of the house as if the tenancy of it belonged to him absolutely, but without prejudice to his position under the settlement as a trustee for all parties entitled under the settlement; and—

(a)

the powers under that Act of a tenant for life shall include power to accept an extended lease under this Part of this Act; and

(b)

an extended lease granted under this Part of this Act to a tenant for life or statutory owner shall be treated as a subsidiary vesting deed in accordance with section 53(2) of that Act.

(3)

Where a tenancy of a house is vested in trustees (other than a sole tenant for life within the meaning of the Settled Land Act 1925), and a person beneficially interested (whether directly or derivatively) under the trusts is entitled or permitted by reason of his interest to occupy the house, then the trustees shall have the like rights under this Part of this Act in respect of his occupation as he would have if he were the tenant occupying in right of the tenancy.

(4)

Without prejudice to any powers exercisable under the Settled Land Act 1925 by tenants for life or statutory owners within the meaning of that Act, where a tenancy of a house is vested in trustees, then unless the instrument regulating the trusts (being made after the passing of this Act) contains an explicit direction to the contrary, the powers of the trustees under that instrument shall include power, with the like consent or on the like direction (if any) as may be required for the exercise of their powers (or ordinary powers) of investment, to acquire and retain the freehold or an extended lease under this Part of this Act.

(5)

The purposes authorised for the application of capital money by section 73 of the M12Settled Land Act 1925, F34. . . and the purposes authorised by section 71 of the Settled Land Act 1925 F34. . . as purposes for which moneys may be raised by mortgage, shall include the payment of any expenses incurred by a tenant for life or statutory owners F34. . ., as the case may be, in or in connection with proceedings taken by him or them by virtue of subsection (2) or (3) above.

F356A Rights of personal representatives

(1)

Where a tenant of a house dies and, immediately before his death, he had under this Part of this Act—

(a)

the right to acquire the freehold, or

(b)

the right to an extended lease,

the right is exercisable by his personal representatives while the tenancy is vested in them (but subject to subsection (2) below); and, accordingly, in such a case references in this Part of this Act to the tenant shall, in so far as the context permits, be to the personal representatives.

(2)

The personal representatives of a tenant may not give notice of their desire to have the freehold or an extended lease by virtue of subsection (1) above later than two years after the grant of probate or letters of administration.

7 Rights of members of family succeeding to tenancy on death.

(1)

Where the tenant of a house dies while occupying it as his residence, and on his death a member of his family resident in the house becomes tenant of it under the same tenancy, then for the purposes of any claim by that member of the family to acquire the freehold or an extended lease under this Part of this Act he shall be treated as having been the tenant, and occupying the house as his residence, during any period when—

(a)

he was resident in the house, and it was his only or main place of residence; and

(b)

the deceased person was, as the tenant under that tenancy, occupying the house as his residence (or would for the purposes of a claim made by him at the time of his death have been treated as having been so occupying it).

(2)

For purposes of this section—

(a)

a member of a tenant’s family on whom the tenancy devolves on the tenant’s death by virtue of a testamentary disposition or the law of intestate succession shall, on the tenancy vesting in him, be treated as having become tenant on the death; and

(b)

a member of a tenant’s family who, on the tenant’s death, acquires the tenancy by the appropriation of it in or towards satisfaction of any legacy, share in residue, debt or other share in or claim against the tenant’s estate, or by the purchase of it on a sale made by the tenant’s personal representatives in the administration of the estate, shall be treated as a person on whom the tenancy devolved by direct bequest; and

(c)

a person’s interest in a tenancy as personal representative of a deceased tenant shall be disregarded, but references in paragraphs (a) and (b) above to a tenancy vesting in, or being acquired by, a member of a tenant’s family shall apply also where, after the death of a member of the family, the tenancy vests in or is acquired by the personal representatives of that member.

(3)

Where a tenancy of a house is settled land for purposes of the Settled Land Act 1925, and on the death of a tenant for life within the meaning of that Act a member of his family resident with him becomes entitled to the tenancy in accordance with the settlement or by any appropriation by or purchase from the personal representatives in respect of the settled land, this section shall apply as if the tenancy had belonged to the tenant for life absolutely and the trusts of the settlement taking effect after his death had been trusts of his will.

(4)

Where in a case not falling within subsection (3) above a tenancy of a house is held on trust and—

(a)

a person beneficially interested (whether directly or derivatively) under the trust is entitled or permitted by reason of his interest to occupy the house; and

(b)

on his death a member of his family resident with him becomes tenant of the house in accordance with the terms of the trust or by any appropriation by or purchase from the trustees;

then this section shall apply as if the deceased person while so occupying the house had been tenant of it occupying in right of the tenancy, and as if after his death the trustees had held and dealt with the tenancy as his executors (the remaining trusts being trusts of his will).

(5)

Subsections (3) and (4) above shall apply, with any necessary adaptations, where a person becomes entitled to a tenancy on the termination of a settlement or trust as they would apply if he had become entitled in accordance with the settlement or trust.

(6)

The reference in section 6(3) above to the rights which a beneficiary under a trust would have if he were the tenant occupying in right of the tenancy includes any rights which he would have by virtue of this section.

(7)

For purposes of this section a person is a member of another’s family if that person is—

(a)

the other’s wife or husband; or

(b)

a son or daughter or a son-in-law or daughter-in-law of the other, or of the other’s wife or husband; or

(c)

the father or mother of the other, or of the other’s wife or husband.

In paragraph (b) above any reference to a person’s son or daughter includes a reference to any stepson or stepdaughter, any illegitimate son or daughter, . . . F36 of that person, and “son-in-law” and “daughter-in-law” shall be construed accordingly.

(8)

In Schedule 2 to the M13Intestates’ Estates Act 1952 (which gives a surviving spouse a right to require the deceased’s interest in the matrimonial home to be appropriated to the survivor’s interest in the deceased’s estate, but by paragraph 1(2) excludes tenancies terminating, or terminable by the landlord, within two years of the death), paragraph 1(2) shall not apply to a tenancy if—

(a)

the surviving wife or husband would in consequence of an appropriation in accordance with that paragraph become entitled by virtue of this section to acquire the freehold or an extended lease under this Part of this Act, either immediately on the appropriation or before the tenancy can determine or be determined as mentioned in paragraph 1(2); or

(b)

the deceased husband or wife, being entitled to acquire the freehold or an extended lease under this Part of this Act, had given notice of his or her desire to have it and the benefit of that notice is appropriated with the tenancy.

(9)

This section shall have effect in relation to deaths occurring before this Act was passed as it has effect in relation to deaths occurring after.

Enfranchisement

8 Obligation to enfranchise.

(1)

Where a tenant of a house has under this Part of this Act a right to acquire the freehold, and gives to the landlord written notice of his desire to have the freehold, then except as provided by this Part of this Act the landlord shall be bound to make to the tenant, and the tenant to accept, (at the price and on the conditions so provided) a grant of the house and premises for an estate in fee simple absolute, subject to the tenancy and to tenant’s incumbrances, but otherwise free of incumbrances.

(2)

For purposes of this Part of this Act “incumbrances” includes rentcharges and, subject to subsection (3) below, personal liabilities attaching in respect of the ownership of land or an interest in land though not charged on that land or interest; and “tenant’s incumbrances” includes any interest directly or indirectly derived out of the tenancy, and any incumbrance on the tenancy or any such interest (whether or not the same matter is an incumbrance also on any interest reversionary on the tenancy).

(3)

Burdens originating in tenure, and burdens in respect of the upkeep or regulation for the benefit of any locality of any land, building, structure, works, ways or watercourse shall not be treated as incumbrances for purposes of this Part of this Act, but any conveyance executed to give effect to this section shall be made subject thereto except as otherwise provided by section 11 below.

(4)

A conveyance executed to give effect to this section—

(a)

shall have effect under section 2(1) of the M14Law of Property Act 1925 to overreach any incumbrance capable of being overreached under that section as if, where the interest conveyed is settled land, the conveyance were made under the powers of the M15Settled Land Act 1925 and as if the requirements of section 2(1) as to payment of the capital money allowed any part of the purchase price paid or applied in accordance with sections 11 to 13 below to be so paid or applied;

(b)

shall not be made subject to any incumbrance capable of being overreached by the conveyance, but shall be made subject (where they are not capable of being overreached) to rentcharges F37redeemable under sections 8 to 10 of the M16Rentcharges Act 1977 and those falling within paragraphs (c) and (d) of section 2(3) of that Act (estate rentcharges and rentcharges imposed under certain enactments), except as otherwise provided by section 11 below.

(5)

Notwithstanding that on a grant to a tenant of a house and premises under this section no payment or a nominal payment only is required from the tenant for the price of the house and premises, the tenant shall nevertheless be deemed for all purposes to be a purchaser for a valuable consideration in money or money’s worth.

9 Purchase price and costs of enfranchisement, and tenant’s right to withdraw.

(1)

Subject to subsection (2) below, the price payable for a house and premises on a conveyance under section 8 above shall be the amount which at the relevant time the house and premises, if sold in the open market by a willing seller, F38(with the tenant and members of his family who reside in the house not buying or seeking to buy) might be expected to realise on the following assumptions:—

(a)

on the assumption that the vendor was selling for an estate in fee simple, subject to the tenancy but on the assumption that this Part of this Act conferred no right to acquire the freehold, and if the tenancy has not been extended under this Part of this Act, on the assumption that (subject to the landlord’s rights under section 17 below) it was to be so extended;

(b)

on the assumption that (subject to paragraph (a) above) the vendor was selling subject, in respect of rentcharges . . . F39 to which section 11(2) below applies, to the same annual charge as the conveyance to the tenant is to be subject to, but the purchaser would otherwise be effectively exonerated until the termination of the tenancy from any liability or charge in respect of tenant’s incumbrances; and

(c)

on the assumption that (subject to paragraphs (a) and (b) above) the vendor was selling with and subject to the rights and burdens with and subject to which the conveyance to the tenant is to be made, and in particular with and subject to such permanent or extended rights and burdens as are to be created in order to give effect to section 10 below.

F40The reference in this subsection to members of the tenant’s family shall be construed in accordance with section 7(7) of this Act.

F41(1A)

F42Notwithstanding the foregoing subsection, the price payable for a house and premises,—

(i)

the rateable value of which was above £1,000 in Greater London and £500 elsewhere on 31st March 1990, or,

(ii)

which had no rateable value on that date and R exceeded £16,333 under the formula in section 1(1)(a) above (and section 1(7) above shall apply to that amount as it applies to the amount referred to in subsection (1)(a)(ii) of that section)

shall be the amount which at the relevant time the house and premises, if sold in the open market by a willing seller, might be expected to realise on the following assumptions:—

(a)

on the assumption that the vendor was selling for an estate in fee simple, subject to the tenancy, but on the assumption that this Part of this Act conferred no right to acquire the freehold; F43or an extended lease and, where the tenancy has been extended under this Part of this Act, that the tenancy will terminate on the original term date.

(b)

on the assumption that at the end of the tenancy the tenant has the right to remain in possession of the house and premises

F44(i)

if the tenancy is such a tenancy as is mentioned in subsection (2) or subsection (3) of section 186 of the Local Government and Housing Act M171989, or is a tenancy which is a long tenancy at a low rent for the purposes of Part I of the Landlord and Tenant Act M181954 in respect of which the landlord is not able to serve a notice under section 4 of that Act specifying a date of termination earlier than 15th January 1999, under the provisions of Schedule 10 to the Local Government and Housing Act 1989; and

(ii)

in any other case under the provisions of Part I of the M19Landlord and Tenant Act 1954;

(c)

on the assumption that the tenant has no liability to carry out any repairs, maintenance or redecorations under the terms of the tenancy or Part I of the Landlord and Tenant Act 1954;

(d)

on the assumption that the price be diminished by the extent to which the value of the house and premises has been increased by any improvement carried out by the tenant or his predecessors in title at their own expense;

(e)

on the assumption that (subject to paragraph (a) above) the vendor was selling subject, in respect of rentcharges . . . F45 to which section 11(2) below applies, to the same annual charge as the conveyance to the tenant is to be subject to, but the purchaser would otherwise be effectively exonerated until the termination of the tenancy from any liability or charge in respect of tenant’s incumbrances; and

(f)

on the assumption that (subject to paragraphs (a) and (b) above) the vendor was selling with and subject to the rights and burdens with and subject to which the conveyance to the tenant is to be made, and in particular with and subject to such permanent or extended rights and burdens as are to be created in order to give effect to section 10 below.

(1B)

For the purpose of determining whether the rateable value of the house and premises is above £1,000 in Greater London, or £500 elsewhere, the rateable value shall be adjusted to take into account any tenant’s improvements in accordance with Schedule 8 to the M20Housing Act 1974.

F46(1C)

Notwithstanding subsection (1) above, the price payable for a house and premises where the right to acquire the freehold arises by virtue of any one or more of the provisions of sections 1A F47, 1AA and 1B above shall be determined in accordance with subsection (1A) above; but in any such case—

(a)

if in determining the price so payable there falls to be taken into account any marriage value arising by virtue of the coalescence of the freehold and leasehold interests, the share of the marriage value to which the tenant is to be regarded as being entitled shall not exceed one-half of it; and

(b)

section 9A below has effect for determining whether any additional amount is payable by way of compensation under that section;

and in a case where the provision (or one of the provisions) by virtue of which the right to acquire the freehold arises is section 1A(1) above, subsection (1A) above shall apply with the omission of the assumption set out in paragraph (b) of that subsection.

(2)

The price payable for the house and premises shall be subject to such deduction (if any) in respect of any defect in the title to be conveyed to the tenant as on a sale in the open market might be expected to be allowed between a willing seller and a willing buyer.

(3)

On ascertaining the amount payable, or likely to be payable, as the price for a house and premises in accordance with this section (but not more than one month after the amount payable has been determined by agreement or otherwise), the tenant may give written notice to the landlord that he is unable or unwilling to acquire the house and premises at the price he must pay; and thereupon—

(a)

the notice under section 8 above of his desire to have the freehold shall cease to have effect, and he shall be liable to make such compensation as may be just to the landlord in respect of the interference (if any) by the notice with the exercise by the landlord of his power to dispose of or deal with the house and premises or any neighbouring property; and

(b)

any further notice given under that section with respect to the house or any part of it (with or without other property) shall be void if given within the following F48three years.

(4)

Where a person gives notice of his desire to have the freehold of a house and premises under this Part of this Act, then unless the notice lapses under any provision of this Act excluding his liability, there shall be borne by him (so far as they are incurred in pursuance of the notice) the reasonable costs of or incidental to any of the following matters:—

(a)

any investigation by the landlord of that person’s right to acquire the freehold;

(b)

any conveyance or assurance of the house and premises or any part thereof or of any outstanding estate or interest therein;

(c)

deducing, evidencing and verifying the title to the house and premises or any estate or interest therein;

(d)

making out and furnishing such abstracts and copies as the person giving the notice may require;

(e)

any valuation of the house and premises;

but so that this subsection shall not apply to any costs if on a sale made voluntarily a stipulation that they were to be borne by the purchaser would be void.

(5)

The landlord’s lien (as vendor) on the house and premises for the price payable shall extend—

(a)

to any sums payable by way of rent or recoverable as rent in respect of the house and premises up to the date of the conveyance; and

(b)

to any sums for which the tenant is liable under subsection (4) above; and

(c)

to any other sums due and payable by him to the landlord under or in respect of the tenancy or any agreement collateral thereto.

9AF49Compensation payable in cases where right to enfranchisement arises by virtue of section 1A or 1B.

(1)

If, in a case where the right to acquire the freehold of a house and premises arises by virtue of any one or more of the provisions of sections 1A F50, 1AA and 1B above, the landlord will suffer any loss or damage to which this section applies, there shall be payable to him such amount as is reasonable to compensate him for that loss or damage.

(2)

This section applies to—

(a)

any diminution in value of any interest of the landlord in other property resulting from the acquisition of his interest in the house and premises; and

(b)

any other loss or damage which results therefrom to the extent that it is referable to his ownership of any interest in other property.

(3)

Without prejudice to the generality of paragraph (b) of subsection (2) above, the kinds of loss falling within that paragraph include loss of development value in relation to the house and premises to the extent that it is referable as mentioned in that paragraph.

(4)

In subsection (3) above “development value”, in relation to the house and premises, means any increase in the value of the landlord’s interest in the house and premises which is attributable to the possibility of demolishing, reconstructing, or carrying out substantial works of construction on, the whole or a substantial part of the house and premises.

(5)

In relation to any case falling within subsection (1) above—

(a)

any reference (however expressed)—

(i)

in section 8 or 9(3) or (5) above, or

(ii)

in any of the following provisions of this Act,

to the price payable under section 9 above shall be construed as including a reference to any amount payable to the landlord under this section; and

(b)

for the purpose of determining any such separate price as is mentioned in paragraph 7(1)(b) of Schedule 1 to this Act, this section shall accordingly apply (with any necessary modifications) to each of the superior interests in question.

10 Rights to be conveyed to tenant on enfranchisement.

(1)

Except for the purpose of preserving or recognising any existing interest of the landlord in tenant’s incumbrances or any existing right or interest of any other person, a conveyance executed to give effect to section 8 above shall not be framed so as to exclude or restrict the general words implied in conveyances under section 62 of the M21Law of Property Act 1925, or the all-estate clause implied under section 63, unless the tenant consents to the exclusion or restriction; but the landlord shall not be bound to convey to the tenant any better title than that which he has or could require to be vested in him, F51. . ..

F52(1A)

The landlord shall not be required to enter into any covenant for title beyond those implied under Part I of the Law of Property (Miscellaneous Provisions) Act 1994 in a case where a disposition is expressed to be made with limited title guarantee; and in the absence of agreement to the contrary he shall be entitled to be indemnified by the tenant in respect of any costs incurred by him in complying with the covenant implied by virtue of section 2(1)(b) of that Act (covenant for further assurance).

(2)

As regards rights of any of the following descriptions, that is to say,—

(a)

rights of support for any building or part of a building;

(b)

rights to the access of light and air to any building or part of a building;

(c)

rights to the passage of water or of gas or other piped fuel, or to the drainage or disposal of water, sewage, smoke or fumes, or to the use or maintenance of pipes or other installations for such passage, drainage or disposal;

(d)

rights to the use or maintenance of cables or other installations for the supply of electricity, for the telephone or for the receipt directly or by landline of visual or other wireless transmissions;

a conveyance executed to give effect to section 8 above shall by virtue of this subsection (but without prejudice to any larger operation it may have apart from this subsection) have effect—

(i)

to grant with the house and premises all such easements and rights over other property, so far as the landlord is capable of granting them, as are necessary to secure to the tenant as nearly as may be the same rights as at the relevant time were available to him under or by virtue of the tenancy or any agreement collateral thereto, or under or by virtue of any grant, reservation or agreement made on the severance of the house and premises or any part thereof from other property then comprised in the same tenancy; and

(ii)

to make the house and premises subject to all such easements and rights for the benefit of other property as are capable of existing in law and are necessary to secure to the person interested in the other property as nearly as may be the same rights as at the relevant time were available against the tenant under or by virtue of the tenancy or any agreement collateral thereto, or under or by virtue of any grant, reservation or agreement made as is mentioned in paragraph (i) above.

(3)

As regards right of way, a conveyance executed to give effect to section 8 above shall include—

(a)

such provisions (if any) as the tenant may require for the purpose of securing to him rights of way over property not conveyed, so far as the landlord is capable of granting them, being rights of way which are necessary for the reasonable enjoyment of the house and premises as they have been enjoyed during the tenancy and in accordance with its provisions; and

(b)

such provisions (if any) as the landlord may require for the purpose of making the property conveyed subject to rights of way necessary for the reasonable enjoyment of other property, being property in which at the relevant time the landlord has an interest, or to rights of way granted or agreed to be granted before the relevant time by the landlord or by the person then entitled to the reversion on the tenancy.

(4)

As regards restrictive covenants (that is to say, any covenant or agreement restrictive of the user of any land or premises), a conveyance executed to give effect to section 8 above shall include—

(a)

such provisions (if any) as the landlord may require to secure that the tenant is bound by, or to indemnify the landlord against breaches of, restrictive covenants which affect the house and premises otherwise than by virtue of the tenancy or any agreement collateral thereto and are enforceable for the benefit of other property; and

(b)

such provisions (if any) as the landlord or the tenant may require to secure the continuance (with suitable adaptations) of restrictions arising by virtue of the tenancy or any agreement collateral thereto, being either—

(i)

restrictions affecting the house and premises which are capable of benefiting other property and (if enforceable only by the landlord) are such as materially to enhance the value of the other property; or

(ii)

restrictions affecting other property which are such as materially to enhance the value of the house and premises;

(c)

such further provisions (if any) as the landlord may require to restrict the use of the house and premises in any way which will not interfere with the reasonable enjoyment of the house and premises as they have been enjoyed during the tenancy but will materially enhance the value of other property in which the landlord has an interest.

(5)

Neither the landlord nor the tenant shall be entitled under subsection (3) or (4) above to require the inclusion in a conveyance of any provision which is unreasonable in all the circumstances, in view—

(a)

of the date at which the tenancy commenced, and changes since that date which affect the suitability at the relevant time of the provisions of the tenancy; and

(b)

where the tenancy is or was one of a number of tenancies of neighbouring houses, of the interests of those affected in respect of other houses.

(6)

The landlord may be required to give to the tenant an acknowledgment within the meaning of section 64 of the M22Law of Property Act 1925 as regards any documents of which the landlord retains possession, but not an undertaking for the safe custody of any such documents; and where the landlord is required to enter into any covenant under subsection (4) above, the person entering into the covenant as landlord shall be entitled to limit his personal liability to breaches of the covenant for which he is responsible.

11 Exoneration from, or redemption of, rentcharges etc.

(1)

Where a house and premises are to be conveyed to a tenant in pursuance of section 8 above, section 8(4)(b) shall not preclude the landlord from releasing, or procuring the release of, the house and premises from any rentcharge . . . F53; and the conveyance may, with the tenant’s agreement (which shall not be unreasonably withheld), provide in accordance with section 190(1) of the M23Law of Property Act 1925 that a rentcharge shall be charged exclusively on other land affected by it in exoneration of the house and premises, or be apportioned between other land affected by it and the house and premises.

(2)

Where, but for this subsection, a conveyance of a house and premises to a tenant might in accordance with section 8 above be made subject, in respect of rents to which this subsection applies, to an annual charge exceeding the annual rent payable under the tenancy at the relevant time, then the landlord shall be bound on or before the execution of the conveyance to secure that the house and premises are discharged from the whole or part of any rents in question to the extent necessary to secure that the annual charge shall not exceed the annual rent so payable; and for this purpose the annual rent shall be calculated in accordance with section 4(1)(b) and (c) and (6) above.

(3)

For purposes of subsection (2) above the house and premises shall be treated as discharged from a rent to the extent to which—

(a)

the rent is charged on or apportioned to other land so as to confer on the tenant in respect of the house and premises the remedies against the other land provided for by section 190(2) of the Law of Property Act 1925; or

(b)

the landlord is otherwise entitled to be exonerated from or indemnified against liability for the rent in respect of the house and premises and the tenant will (in so far as the landlord’s right is not a right against the tenant himself or his land) become entitled on the conveyance to the like exoneration or indemnity.

(4)

Where for the purpose of complying with subsection (2) above the house and premises are to be discharged from a rent by redemption of it (with or without prior apportionment), and for any reason mentioned in section F5413(2) below difficulty arises in paying the redemption price, the tenant may, and if so required by the landlord shall, before execution of the conveyance pay into court on account of the price for the house and premises an amount not exceeding the appropriate amount to secure redemption of the rent; and if the amount so paid by the tenant is less than that appropriate amount, the landlord shall pay into court the balance.

(5)

Where payment is made into court in accordance with subsection (4) above, the house and premises shall on execution of the conveyance be discharged from the rent, and any claim to the redemption money shall lie against the fund in court and not otherwise.

(6)

For purposes of subsection (4) above “the appropriate amount to secure redemption” of a rent is (subject to subsection (7) below) the amount of redemption money agreed to be paid or in default of agreement, the amount F55specified as the redemption price in instructions for redemption under section 9(4) of the M24Rentcharges Act 1977.

(7)

Where a rent affects other property as well as the house and premises, and the other property is not exonerated or indemnified by means of a charge on the house and premises, then—

(a)

“the appropriate amount to secure redemption” of the rent for purposes of subsection (4) above shall, if no amount has been agreed or F56specified as mentioned in subsection (6), be such sum as, on an application under section F564 of the Rentcharges Act 1977 for the apportionment of the rent, may, pending the apportionment, be approved by the apportioning authority as suitable provision (with a reasonable margin) for the redemption money of the part likely to be apportioned to the house and premises; and

(b)

the apportionment, when made, shall be deemed to have had effect from the date of the payment into court, and if in respect of any property affected by the rent there has been any overpayment or underpayment, the amount shall be made good by abatement of or addition to the next payment after the apportionment and (if necessary) later payments.

(8)

Subsection (2) above applies to rentcharges F57redeemable under sections 8 to 10 of the Rentcharges Act 1977 which during the continuance of the tenancy are, or but for the termination of the tenancy before their commencement would have been, recoverable from the landlord without his having a right to be indemnified by the tenant.

12 Discharge of mortgages etc. on landlord’s estate.

(1)

Subject to the provisions of this section, a conveyance executed to give effect to section 8 above shall, as regards any charge on the landlord’s estate (however created or arising) to secure the payment of money or the performance of any other obligation by the landlord or any other person, not being a charge subject to which the conveyance is required to be made or which would be overreached apart from this section, be effective by virtue of this section to discharge the house and premises from the charge, and from the operation of any order made by a court for the enforcement of the charge, and to extinguish any term of years created for the purposes of the charge, and shall do so without the persons entitled to or interested in the charge or in any such order or term of years becoming parties to or executing the conveyance.

(2)

Where in accordance with subsection (1) above the conveyance to a tenant will be effective to discharge the house and premises from a charge to secure the payment of money, then except as otherwise provided by this section it shall be the duty of the tenant to apply the price payable for the house and premises, in the first instance, in or towards the redemption of any such charge (and, if there are more than one, then according to their priorities); and if any amount payable in accordance with this subsection to the person entitled to the benefit of a charge is not so paid nor paid into court in accordance with section 13 below, then for the amount in question the house and premises shall remain subject to the charge, and to that extent subsection (1) above shall not apply.

(3)

For the purpose of determining the amount payable in respect of any charge under subsection (2) above a person entitled to the benefit of a charge to which that subsection applies shall not be permitted to exercise any right to consolidate that charge with a separate charge on other property; and if the landlord or the tenant is himself entitled to the benefit of a charge to which that subsection applies, it shall rank for payment as it would if another person were entitled to it, and the tenant shall be entitled to retain the appropriate amount in respect of any such charge of his.

(4)

For the purpose of discharging the house and premises from a charge to which subsection (2) above applies, a person may be required to accept three months or any longer notice of the intention to pay the whole or part of the principal secured by the charge, together with interest to the date of payment, notwithstanding that the terms of the security make other provision or no provision as to the time and manner of payment; but he shall be entitled, if he so requires, to receive such additional payment as is reasonable in the circumstances in respect of the costs of re-investment or other incidental costs and expenses and in respect of any reduction in the rate of interest obtainable on reinvestment.

(5)

Subsection (2) above shall not apply to any debenture holders’ charge, that is to say, any charge, whether a floating charge or not, in favour of the holders of a series of debentures issued by a company or other body of persons, or in favour of trustees for such debenture holders; and any such charge shall be disregarded in determining priorities for purposes of subsection (2):

Provided that this subsection shall not have effect in relation to a charge in favour of trustees for debenture holders which at the date of the conveyance to the tenant is (as regards the house and premises) a specific and not a floating charge.

(6)

Where the house and premises are discharged by this section from a charge (without the obligations secured by the charge being satisfied by the receipt of the whole or part of the price), the discharge of the house and premises shall not prejudice any right or remedy for the enforcement of those obligations against other property comprised in the same or any other security, nor prejudice any personal liability as principal or otherwise of the landlord or any other person.

(7)

Subsections (1) and (2) above shall not be taken to prevent a person from joining in the conveyance for the purpose of discharging the house and premises from any charge without payment or for a less payment than that to which he would otherwise be entitled; and, if he does so, the persons to whom the price ought to be paid shall be determined accordingly.

(8)

A charge on the landlord’s estate to secure the payment of money or the performance of any other obligation shall not be treated for the purposes of this Part of this Act as a tenant’s incumbrance by reason only of the grant of the tenancy being subsequent to the creation of the charge and not authorised as against the persons interested in the charge; and this section shall apply as if the persons so interested at the time of the grant had duly concurred in the grant for the purpose (but only for the purpose) of validating it despite the charge on the grantor’s estate:

Provided that, where the tenancy is granted after the commencement of this Part of this Act (whether or not it is, by virtue of section 3(3) above, to be treated for other purposes as forming a single tenancy with a previous tenancy) and the tenancy has not by the time of the conveyance of the house and premises to the tenant become binding on the persons interested in the charge, the conveyance shall not by virtue of this section discharge the house and premises from the charge except so far as it is satisfied by the application or payment into court of the price payable for the house and premises.

(9)

Nothing in this section shall apply in relation to any charge falling within section 11 above, and for purposes of subsection (2) above the price payable for the house and premises shall be treated as reduced by any amount to be paid out of it before execution of the conveyance for the redemption of a rent in accordance with section 11(4).

13 Payment into court in respect of mortgages etc.

(1)

Where under section 12(1) above a house and premises are, on a conveyance to the tenant, to be discharged of any charge falling within that subsection, and in accordance with section 12(2) a person is or may be entitled in respect of the charge to receive the whole or part of the price payable for the house and premises, then if—

(a)

for any reason difficulty arises in ascertaining how much is payable in respect of the charge; or

(b)

for any reason mentioned in subsection (2) below difficulty arises in making a payment in respect of the charge;

the tenant may pay into court on account of the price for the house and premises the amount, if known, of the payment to be made in respect of the charge or, if that amount is not known, the whole of the price or such less amount as the tenant thinks right in order to provide for that payment.

(2)

Payment may be made into court in accordance with subsection (1)(b) above where the difficulty arises for any of the following reasons:—

(a)

because a person who is or may be entitled to receive payment cannot be found or ascertained;

(b)

because any such person refuses or fails to make out a title, or to accept payment and give a proper discharge, or to take any steps reasonably required of him to enable the sum payable to be ascertained and paid; or

(c)

because a tender of the sum payable cannot, by reason of complications in the title to it or the want of two or more trustees or for other reasons, be effected, or not without incurring or involving unreasonable cost or delay.

(3)

Without prejudice to subsection (1)(a) above, the price payable for a house and premises on a conveyance under section 8 above shall be paid by the tenant into court if before execution of the conveyance written notice is given to him—

(a)

that the landlord or a person entitled to the benefit of a charge on the house and premises so requires for the purpose of protecting the rights of persons so entitled, or for reasons related to any application made or to be made under section 36 below, or to the bankruptcy or winding up of the landlord; or

(b)

that steps have been taken to enforce any charge on the landlord’s interest in the house and premises by the bringing of proceedings in any court, or by the appointment of a receiver, or otherwise;

and where payment is to be made into court by reason only of a notice under this subsection, and the notice is given with reference to proceedings in a court specified in the notice other than the county court, payment shall be made into the court so specified.

(4)

For the purpose of computing the amount payable into court under this section, the price payable for the house and premises shall be treated as reduced by any amount to be paid out of it before execution of the conveyance for the redemption of a rent in accordance with section 11(4) above.

Extension

14 Obligation to grant extended lease.

(1)

Where a tenant of a house has under this Part of this Act a right to an extended lease, and gives to the landlord written notice of his desire to have it, then except as provided by this Part of this Act the landlord shall be bound to grant to the tenant, and the tenant to accept, in substitution for the existing tenancy a new tenancy of the house and premises for a term expiring fifty years after the term date of the existing tenancy.

(2)

Where a person gives notice of his desire to have an extended lease of a house and premises under this Part of this Act, then unless the notice lapses under any provision of this Act excluding his liability, there shall be borne by him (so far as they are incurred in pursuance of the notice) the reasonable costs of or incidental to any of the following matters:—

(a)

any investigation by the landlord of that person’s right to an extended lease;

(b)

any lease granting the new tenancy;

(c)