- Latest available (Revised)

- Point in Time (01/04/2004)

- Original (As enacted)

Leasehold Reform Act 1967

You are here:

- Show Geographical Extent(e.g. England, Wales, Scotland and Northern Ireland)

- Show Timeline of Changes

More Resources

Changes over time for: Section 1

Version Superseded: 05/12/2005

Status:

Point in time view as at 01/04/2004. This version of this provision has been superseded.![]()

Status

You are viewing this legislation item as it stood at a particular point in time. A later version of this or provision, including subsequent changes and effects, supersedes this version.

Note the term provision is used to describe a definable element in a piece of legislation that has legislative effect – such as a Part, Chapter or section.

Changes to legislation:

Leasehold Reform Act 1967, Section 1 is up to date with all changes known to be in force on or before 17 November 2024. There are changes that may be brought into force at a future date. Changes that have been made appear in the content and are referenced with annotations.![]()

Changes to Legislation

Changes and effects yet to be applied by the editorial team are only applicable when viewing the latest version or prospective version of legislation. They are therefore not accessible when viewing legislation as at a specific point in time. To view the ‘Changes to Legislation’ information for this provision return to the latest version view using the options provided in the ‘What Version’ box above.

1 Tenants entitled to enfranchisement or extension.E+W

(1)This Part of this Act shall have effect to confer on a tenant of a leasehold house F1. . . a right to acquire on fair terms the freehold or an extended lease of the house and premises where—

[F2(a)his tenancy is a long tenancy at a low rent and,—

(i)if the tenancy was entered into before 1st April 1990 [F3, or on or after 1st April 1990 in pursuance of a contract made before that date, and the house and premises had a rateable value at the date of commencement of the tenancy or else at any time before 1st April 1990,] subject to subsections (5) and (6) below, the rateable value of the house and premises on the appropriate day was not more than £200 or, if it is in Greater London, than £400; and

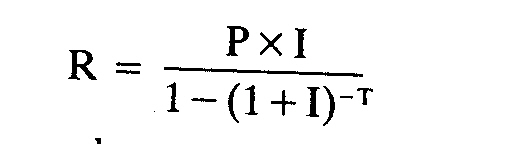

(ii)if the tenancy [F3does not fall within sub-paragraph (i) above,] on the date the contract for the grant of the tenancy was made or, if there was no such contract, on the date the tenancy was entered into R did not exceed £25,000 under the formula—

where—

P is the premium payable as a condition of the grant of the tenancy (and includes a payment of money’s worth) or, where no premium is so payable, zero,

I is 0.06, and

T is the term, expressed in years, granted by the tenancy (disregarding any right to terminate the tenancy before the end of the term or to extend the tenancy); and]

(b)at the relevant time (that is to say, at the time when he gives notice in accordance with this Act of his desire to have the freehold or to have an extended lease, as the case may be) he has been tenant of the house under a long tenancy at a low rent F1. . . for the last [F4two years] ;

and to confer the like right in the other cases for which provision is made in this Part of this Act.

[F5(1ZA)Where a house is for the time being let under two or more tenancies, a tenant under any of those tenancies which is superior to that held by any tenant on whom this Part of this Act confers a right does not have any right under this Part of this Act.

(1ZB)Where a flat forming part of a house is let to a person who is a qualifying tenant of the flat for the purposes of Chapter 1 or 2 of Part 1 of the Leasehold Reform, Housing and Urban Development Act 1993 (c. 28), a tenant of the house does not have any right under this Part of this Act unless, at the relevant time, he has been occupying the house, or any part of it, as his only or main residence (whether or not he has been using it for other purposes)—

(a)for the last two years; or

(b)for periods amounting to two years in the last ten years.]

[F6(1ZC)The references in subsection (1)(a) and (b) to a long tenancy do not include a tenancy to which Part 2 of the Landlord and Tenant Act 1954 (business tenancies) applies unless—

(a)it is granted for a term of years certain exceeding thirty-five years, whether or not it is (or may become) terminable before the end of that term by notice given by or to the tenant or by re-entry, forfeiture or otherwise,

(b)it is for a term fixed by law under a grant with a covenant or obligation for perpetual renewal, unless it is a tenancy by sub-demise from one which is not a tenancy which falls within any of the paragraphs in this subsection,

(c)it is a tenancy taking effect under section 149(6) of the Law of Property Act 1925 (c. 20) (leases terminable after a death or marriage), or

(d)it is a tenancy which—

(i)is or has been granted for a term of years certain not exceeding thirty-five years, but with a covenant or obligation for renewal without payment of a premium (but not for perpetual renewal), and

(ii)is or has been once or more renewed so as to bring to more than thirty-five years the total of the terms granted (including any interval between the end of a tenancy and the grant of a renewal).

(1ZD)Where this Part of this Act applies as if there were a single tenancy of property comprised in two or more separate tenancies, then, if each of the separate tenancies falls within any of the paragraphs of subsection (1ZC) above, that subsection shall apply as if the single tenancy did so.]

[F7(1A)The references in subsection (1)(a) and (b) to a long tenancy at a low rent do not include a tenancy excluded from the operation of this Part by section 33A of and Schedule 4A to this Act.]

[F8(1B)This Part of this Act shall not have effect to confer any right on the tenant of a house under a tenancy to which Part 2 of the Landlord and Tenant Act 1954 (c. 56) (business tenancies) applies unless, at the relevant time, the tenant has been occupying the house, or any part of it, as his only or main residence (whether or not he has been using it for other purposes)—

(a)for the last two years; or

(b)for periods amounting to two years in the last ten years.]

(2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(3)This Part of this Act shall not confer on the tenant of a house any right by reference to his [F9being a tenant of it] at any time when—

(a)it is let to F10. . . him with other land or premises to which it is ancillary; or

[F11(b)it is comprised in—

(i)an agricultural holding within the meaning of the Agricultural Holdings Act 1986 held under a tenancy in relation to which that Act applies, or

(ii)the holding held under a farm business tenancy within the meaning of the Agricultural Tenancies Act 1995]

[F12or, in the case of any right to which subsection (3A) below applies, at any time when the tenant’s immediate landlord is a charitable housing trust and the house forms part of the housing accommodation provided by the trust in the pursuit of its charitable purposes.]

[F13(3A)For the purposes of subsection (3) above this subsection applies as follows—

(a)where the tenancy was created after the commencement of Chapter III of Part I of the Leasehold Reform, Housing and Urban Development Act 1993, this subsection applies to any right to acquire the freehold of the house and premises; but

(b)where the tenancy was created before that commencement, this subsection applies only to any such right exercisable by virtue of any one or more of the provisions of sections 1A [F14, 1AA]] and 1B below;

and in that subsection “charitable housing trust” means a housing trust within the meaning of the Housing Act 1985 which is a charity within the meaning of the Charities Act 1993.

(4)In subsection (1)(a) above, “the appropriate day”, in relation to any house and premises, means the 23rd March 1965 or such later day as by virtue of [F15section 25(3) of the M1Rent Act 1977] would be the appropriate day for purposes of that Act in relation to a dwelling house consisting of that house.

[F16(4A)Schedule 8 to the M2Housing Act 1974 shall have effect to enable a tenant to have the rateable value of the house and premises reduced for purposes of this section in consequence of tenant’s improvements.]

[F17(5)If, in relation to any house and premises, the appropriate day for the purposes of subsection (1)(a) above falls on or after 1st April 1973 that subsection shall have effect in relation to the house and premises,—

(a)in a case where the tenancy was created on or before 18th February 1966, as if for the sums of £200 and £400 specified in that subsection there were substituted respectively the sums of £750 and £1,500; and

(b)in a case where the tenancy was created after 18th February 1966, as if for those sums of £200 and £400 there were substituted respectively the sums of £500 and £1,000.

(6)If, in relation to any house and premises,—

(a)the appropriate day for the purposes of subsection (1)(a) above falls before 1st April 1973, and

(b)the rateable value of the house and premises on the appropriate day was more than £200 or, if it was then in Greater London, £400, and

(c)the tenancy was created on or before 18th February 1966,

subsection (1)(a) above shall have effect in relation to the house and premises as if for the reference to the appropriate day there were substituted a reference to 1st April 1973 and as if for the sums of £200 and £400 specified in that subsection there were substituted respectively the sums of £750 and £1,500.]

[F18(7)The Secretary of State may by order replace the amount referred to in subsection (1)(a)(ii) above and the number in the definition of “I” in that subsection by such amount or number as is specified in the order; and such an order shall be made by statutory instrument which shall be subject to annulment in pursuance of a resolution of either House of Parliament.]

Textual Amendments

F1Words in s. 1(1) repealed (26.7.2002 for E. and 1.1.2003 for W.) by 2002 c. 15, ss. 138(1), 180, Sch. 14; S.I. 2002/1912, art. 2(b)(ii), Sch. 1 Pt. 3 (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.); S.I. 2002/3012, art. 2(b), Sch. 1 Pt. 3 (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.)

F2S. 1(1)(a) substituted by S.I. 1990/434, reg. 2, Sch. para. 5 (as amended by S.I. 1990/701, reg. 2)

F3Words in s. 1(1)(a)(i)(ii) substituted (1.10.1996) by 1996 c. 52, s. 114; S.I. 1996/2212, arts. 1(2), 2(2), Sch.

F4Words in s. 1(1)(b) substituted (26.7.2002 for E. and 1.1.2003 for W.) by 2002 c. 15, s. 139(1); S.I. 2002/1912, art. 2(b)(i) (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.); S.I. 2002/3012, art. 2(b)(i) (subject to transitional provions and savings in Sch. 2 of the commencing S.I.)

F5S. 1(1ZA)(1ZB) inserted (26.7.2002 for E. and 1.1.2003 for W.) by 2002 c. 15, s. 138(2); S.I. 2002/1912, art. 2(b)(i) (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.); S.I. 2002/3012, art. 2(b)(i) (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.)

F6S. 1(1ZC)(1ZD) inserted (26.7.2002 for E. and 1.1.2003 for W.) by 2002 c. 15, s. 140; S.I. 2002/1912, art. 2(b)(i) (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.); S.I. 2002/3012, art. 2(b)(i) (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.)

F7S. 1(1A) inserted by Housing and Planning Act 1986 (c. 63, SIF 75:1), s. 18, Sch. 4 para. 3

F8S. 1(1B) inserted (26.7.2002 for E. and 1.1.2003 for W.) by 2002 c. 15, s. 139(2); S.I. 2002/1912, art. 2(b)(i) (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.); S.I. 2002/3012, art. 2(b)(i) (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.)

F9Words in s. 1(3) substituted (26.7.2002 for E. and 1.1.2003 for W.) by 2002 c. 15, s. 138(3); S.I. 2002/1912, art. 2(b)(i) (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.); S.I. 2002/3012, art. 2(b)(i) (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.)

F10Words in s. 1(3)(a) repealed (26.7.2002 for E. and 1.1.2003 for W.) by 2002 c. 15, s. 180, Sch. 14; S.I. 2002/1912, art. 2(b)(ii), Sch. 1 Pt. 3 (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.); S.I. 2002/3012, art. 2(b)(ii), Sch. 1 Pt. 3 (subject to transitional provisions and savings in Sch. 2 of the commencing S.I.)

F12Words in s. 1(3) added (1.11.1993) by 1993 c. 28, s. 67(2); S.I. 1993/2134, art 5(b) (subject to arts. 4, 5, Sch. 1 para. 1)

F13S. 1(3A) inserted (1.11.1993) by 1993 c. 28, s. 67(3); S.I. 1993/2134, art 5(b) (subject to arts. 4, 5, Sch. 1 para. 1)

F14Words in S. 1(3A)(b) inserted (1.4.1997) by 1996 c. 52, ss. 106, Sch. 9 para. 2(1)(2); S.I. 1997/618, art. 2(1) (with Sch.)

F15Words substituted by Rent Act 1977 (c. 42), s. 155(2), Sch. 23 para. 42

F16S. 1(4A) substituted by Housing Act 1980 (c. 51), Sch. 21 para. 2

F17S. 1(5)(6) added by Housing Act 1974 (c. 44), s. 118(1)(5)

F18S. 1(7) inserted by S.I. 1990/434, reg. 2, Sch. para. 6

Marginal Citations

Options/Help

Print Options

PrintThe Whole Act

PrintThe Whole Part

PrintThe Whole Cross Heading

PrintThis Section only

Legislation is available in different versions:

Latest Available (revised):The latest available updated version of the legislation incorporating changes made by subsequent legislation and applied by our editorial team. Changes we have not yet applied to the text, can be found in the ‘Changes to Legislation’ area.

Original (As Enacted or Made): The original version of the legislation as it stood when it was enacted or made. No changes have been applied to the text.

Point in Time: This becomes available after navigating to view revised legislation as it stood at a certain point in time via Advanced Features > Show Timeline of Changes or via a point in time advanced search.

See additional information alongside the content

Geographical Extent: Indicates the geographical area that this provision applies to. For further information see ‘Frequently Asked Questions’.

Show Timeline of Changes: See how this legislation has or could change over time. Turning this feature on will show extra navigation options to go to these specific points in time. Return to the latest available version by using the controls above in the What Version box.

More Resources

Access essential accompanying documents and information for this legislation item from this tab. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as enacted version that was used for the print copy

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- correction slips

- links to related legislation and further information resources

Timeline of Changes

This timeline shows the different points in time where a change occurred. The dates will coincide with the earliest date on which the change (e.g an insertion, a repeal or a substitution) that was applied came into force. The first date in the timeline will usually be the earliest date when the provision came into force. In some cases the first date is 01/02/1991 (or for Northern Ireland legislation 01/01/2006). This date is our basedate. No versions before this date are available. For further information see the Editorial Practice Guide and Glossary under Help.

More Resources

Use this menu to access essential accompanying documents and information for this legislation item. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as enacted version that was used for the print copy

- correction slips

Click 'View More' or select 'More Resources' tab for additional information including:

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- links to related legislation and further information resources