- Latest available (Revised)

- Original (As enacted)

Finance Act 1968

You are here:

- UK Public General Acts

- 1968 c. 44

- Whole Act

- Previous

- Next

- Show Geographical Extent(e.g. England, Wales, Scotland and Northern Ireland)

- Show Timeline of Changes

More Resources

Changes to legislation:

There are currently no known outstanding effects for the Finance Act 1968.![]()

Changes to Legislation

Revised legislation carried on this site may not be fully up to date. At the current time any known changes or effects made by subsequent legislation have been applied to the text of the legislation you are viewing by the editorial team. Please see ‘Frequently Asked Questions’ for details regarding the timescales for which new effects are identified and recorded on this site.

Finance Act 1968

1968 CHAPTER 44

An Act to grant certain duties, to alter other duties, and to amend the law relating to the National Debt and the Public Revenue, and to make further provision in connection with Finance.

[26th July 1968]

Commencement Information

I1Act partly in force at Royal Assent, partly retrospective, see individual sections; all provisions so far as unrepealed wholly in force at 1.2.1991. Some provisions came in to force at specific times of the day.

I2For the extent of this Act as regards Northern Ireland, see s. 61(9)

Part IU.K.

1

(1)(2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F1

(3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F2

(4). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F1

Textual Amendments

F1S. 1(1)(2)(4) repealed by Finance Act 1969 (c. 32), s. 61(6), Sch. 21 Pt. I

F2S. 1(3) repealed by Alcoholic Liquor Duties Act 1979 (c. 4), s. 92(2), Sch. 4 Pt. I

2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F3U.K.

Textual Amendments

F3S. 2 repealed by Hydrocarbon Oil (Customs & Excise) Act 1971 (c. 12), s. 24(2), Sch. 7

3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F4U.K.

Textual Amendments

F4S. 3 repealed by Finance Act 1973 (c. 51), s. 59(7), Sch. 22 Pt. I

4

(1). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F5

(2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F6

(3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F7

(4). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F6

Textual Amendments

F5S. 4(1) repealed by Finance Act 1970 (c. 24), s. 36(8), Sch. 8 Pt. II

F6S. 4(2)(4) repealed by Betting and Gaming Duties Act 1972 (c. 25), s. 29(2), Sch. 7

F7S. 4(3) repealed by Finance Act 1969 (c. 32), s. 61(6), Sch. 21 Pt. I

5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F8U.K.

Textual Amendments

F8S. 5 repealed by Finance Act 1972 (c. 41), ss. 54(8), 134(7), Sch. 28 Pt. II

6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F9U.K.

Textual Amendments

F9S. 6 repealed by Customs and Excise Management Act 1979 (c. 2), s. 177(3), Sch. 6 Pt. I

7. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F10U.K.

Textual Amendments

F10S. 7 repealed by Customs and Excise Duties (General Reliefs) Act 1979 (c. 3), s. 19(2), Sch. 3 Pt. I

8, 9.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F11U.K.

Textual Amendments

F11Ss. 8, 9 repealed by Vehicles (Excise) Act 1971 (c. 10), s. 39(5), Sch. 8 Pt. I

10

(1). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F12

(2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F13

Textual Amendments

F12S. 10(1) repealed by Finance Act 1969 (c. 32), s. 61(6), Sch. 21 Pt. I

F13S. 10(2) repealed by Excise Duties (Surcharges or Rebates) Act 1979 (c. 8), s. 4(3), Sch. 2

Part IIU.K.

11—22.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F14U.K.

Textual Amendments

F14Ss. 11–22 repealed by Income and Corporation Taxes Act 1970 (c. 10), ss. 538(1), 539(1), Sch. 16

23

(1)(2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F15

(3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F16

(4)(5). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F15

Textual Amendments

F15S. 23(1)(2)(4)(5) repealed by Income and Corporation Taxes Act 1970 (c. 10), ss. 538(1), 539(1), Sch. 16

F16S. 23(3) repealed by Finance Act 1974 (c. 30), s. 57, Sch. 14 Pt. VII

24—30.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F17U.K.

Textual Amendments

F17Ss. 24–30 repealed by Income and Corporation Taxes Act 1970 (c. 10), ss. 538(1), 539(1), Sch. 16

Part IIIU.K.

31. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F18U.K.

Textual Amendments

F18S. 31 repealed by Finance Act 1971 (c. 68), ss. 57(5), 69(7), Sch. 14 Pt. VII

32. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F19U.K.

Textual Amendments

F19S. 32 repealed (with savings) by Capital Gains Tax Act 1979 (c. 14), ss. 157(1), 158, Sch. 6 para. 10(2)(b), Sch. 8

33. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F20U.K.

Textual Amendments

F20S. 33 repealed by Income and Corporation Taxes Act 1970 (c. 10), ss. 538(1), 539(1), Sch. 16

34. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F21U.K.

Textual Amendments

F21S. 34 repealed (with savings) by Capital Gains Tax Act 1979 (c. 14), ss. 157(1), 158, Sch. 6 para. 10(2)(b), Sch. 8

35—37.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F22U.K.

Textual Amendments

F22S. 35–37 repealed (with savings) by Finance Act 1975 (c. 7), ss. 50, 52(2)(3), 59, Sch. 13 Pt. I

38, 39.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F23U.K.

Textual Amendments

F23Ss. 38, 39 repealed by Finance Act 1969 (c. 32), s. 61(6), Sch. 21 Pt. V

Betterment levyU.K.

F2440. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F24S. 40 repealed (19.11.1998) by 1998 c. 43, s. 1(1), Sch. 1 Pt. IV Group 2

F25Part IVU.K. The Special Charge

Textual Amendments

F25Pt. IV repealed (21.7.2008) by Statute Law (Repeals) Act 2008 (c. 12), Sch. 1 Pt. 8

41 The special charge. U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

42 Investment income. U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

43 Due date, interest and administration. U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

44 Husband and wife. U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

45 Close companies. U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

46 Relief where income attributable to period of years was received in 1967–68. U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

47 Relief where capital is subject to estate duty or capital gains tax. U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

48 Relief in respect of error or mistake, U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

49 Double taxation relief. U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

50 Transactions designed to avoid liability. U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Part VU.K.

51

(1). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F26

(2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F27

(3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F26

(4). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F27

Textual Amendments

F26S. 51(1)(3) repealed by Finance Act 1969 (c. 32), s. 61(6), Sch. 21 Pt. VII

F27S. 51 (so far as unrepealed) repealed by Finance Act 1972 (c. 41), ss. 122(5), 134(7), Sch. 28 Pt. VIII

52. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F28U.K.

Textual Amendments

F28S. 52 repealed by Finance Act 1972 (c. 41), ss. 122(5), 134(7), Sch. 28 Pt. IX

Part VIU.K. Miscellaneous

53 Interest on overdue tax. U.K.

(1). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F29 in section 8(2) of the Finance (No. 2) Act 1947 (remission of interest for tax paid not later than three months from the date on which it becomes due and payable) for the words “three months" there shall be substituted the words “two months".

(2)Without prejudice to the general interpretative provisions of this Act, this section applies to the enactmemtns mentioned in subsection (1) above as extended by any other enactments, . . . F29

(3)This section has effect as respects tax becoming due and payable on or after 1st July 1968.

Textual Amendments

F29Words repealed by Income and Corporation Taxes Act 1970 (c. 10), ss. 538(1), 539(1), Sch. 16

Modifications etc. (not altering text)

C1The text of ss, 40–50, 53, 60, 61(2)(7) and Schs. 15 and 16 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and, except as otherwise indicated, does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

54 Premium savings bonds: increase of prize money.U.K.

(1)The terms of issue of premium savings bonds shall be altered by substituting for the prospectus relating to the issue of bonds of series B the provisions of Schedule 18 to this Act, being provisions which—

(a)increase the rate of interest at which the prize fund is calculated from 4½ per cent. to 45/8percent. (but subject F30... to a power of varying the rate of interest F31... )F32...

F33(b). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(2)Subsection (1) above shall come into force on 1st September 1968 and have effect as respects all bonds issued before that date, whether before or after the passing of this Act.

(3)If after the coming into force of subsection (1) above the Treasury issue premium savings bonds on the terms set out in the said Schedule to this Act, they may use any stock of forms of bonds which were prepared before the passing of this Act, notwithstanding that the forms refer to the prospectus superseded by subsection (1) above, and bonds issued in that form shall be valid and effectual as if they stated that the bond was issued under the terms in the said Schedule to this Act.

This subsection applies whether or not the bonds are issued after notice has been given, in pursuance of paragraph 15 in the said Schedule, of a variation of its terms.

(4)In this section “bonds of series B” means the second issue of premium savings bonds, and “” means both those issued under the M1National Loans Act 1939 and those issued under the M2National Loans Act 1968.

Textual Amendments

F30Words in s. 54(1)(a) repealed (30.9.2004) by Premium Savings Bonds (Amendment etc) Regulations 2004 (S.I. 2004/2353), regs. 1, 2(1)(a)(i)

F31Words in s. 54(1)(a) repealed (30.9.2004) by Premium Savings Bonds (Amendment etc) Regulations 2004 (S.I. 2004/2353), regs. 1, 2(1)(a)(ii)

F32Word in s. 54(1)(a) repealed (30.9.2004) by Premium Savings Bonds (Amendment etc) Regulations 2004 (S.I. 2004/2353), regs. 1, 2(1)(a)(iii)

F33S. 54(1)(b) repealed (30.9.2004) by Premium Savings Bonds (Amendment etc) Regulations 2004 (S.I. 2004/2353), regs. 1, 2(1)(b)

Modifications etc. (not altering text)

C2S. 54 power to repeal conferred (22.7.2004) by Finance Act 2004 (c. 12), s. 325

Marginal Citations

F3455. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F34S. 55 repealed (14.12.2001) by 2001 c. 24, ss. 16(1)(b)(2), 125, 127(2), Sch. 8 Pt. II (with s. 14(3))

56. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F35U.K.

Textual Amendments

F35S. 56 repealed by Finance Act 1973 (c. 51), s. 59(7), Sch. 22 Pt. V

57. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F36U.K.

Textual Amendments

F36S. 57 repealed by Finance Act 1970 (c. 24), s. 36(8), Sch. 8 Pt. V

58. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F37U.K.

Textual Amendments

F37S. 58 repealed by European Communities Act 1972 (c. 68), s. 4, Sch. 3 Pt. II

59. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F38U.K.

Textual Amendments

F38S. 59 repealed by Finance Act 1971 (c. 68), s. 69(7), Sch. 14 Pt. VII

60 Provisional collection of taxes. U.K.

In section 1(4) of the Provisional Collection of Taxes Act 1968 M3 (circumstances in which a resolution ceases to have statutory effect) paragraph (b) (under which a resolution continues in force if a Bill is amended by the house so as to implement the resolution within twenty-five sitting days from the passing of the resolution) shall have effect as if after the words “is amended by the House" there were added the words “in Committee or on Report, or by any Standing Committee of the House".

Modifications etc. (not altering text)

C3The text of ss, 40–50, 53, 60, 61(2)(7) and Schs. 15 and 16 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and, except as otherwise indicated, does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

Marginal Citations

61 Citation, interpretation, construction, extent and repeals.U.K.

(1)This Act may be cited as the Finance Act 1968.

(2)In this Act, except where the context otherwise requires, “the Board” means the Commissioners of Inland Revenue.

(3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F39

(4). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F40

(5). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F41

(6). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F42

F43(7). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(8)Any reference in this Act to any other enactment shall, except so far as the context otherwise requires, be construed as a reference to that enactment as amended or applied by or under any other enactment, including this Act.

(9)Except as otherwise expressly provided, such of the provisions of this Act as relate to matters in respect of which the Parliament of Northern Ireland has power to make laws shall not extend to Northern Ireland.

Textual Amendments

F39S. 61(3) repealed by Customs and Excise Management Act 1979 (c. 2), s. 177(3), Sch. 6 Pt. I

F40S. 61(4) repealed by Income and Corporation Taxes Act 1970 (c. 10), ss. 538(1), 539(1), Sch. 16

F41S. 61(5) repealed (with savings) by Capital Gains Tax Act 1979 (c. 14), ss. 157(1), 158, Sch. 6 para. 10(2)(b), Sch. 8

F42S. 61(6) repealed (with savings) by Finance Act 1975 (c. 7), ss. 50, 52(2)(3), 59, Sch. 13 Pt. I

F43S. 61(7) repealed (21.7.2008) by Statute Law (Repeals) Act 2008 (c. 12), Sch. 1 Pt. 8

Modifications etc. (not altering text)

C4The text of ss, 40–50, 53, 60, 61(2)(7) and Schs. 15 and 16 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and, except as otherwise indicated, does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

Schedules

Schedules 1—4.U.K. . . . F44

Textual Amendments

F44Schs. 1–4 repealed by Finance Act 1969 (c. 32), s. 61(6), Sch. 21 Pt. I

Schedule 5.U.K. . . . F45

Textual Amendments

F45Sch. 5 repealed by Betting and Gaming Duties Act 1972 (c. 25), s. 29(2), Sch. 7

Schedule 6.U.K. . . . F46

Textual Amendments

F46Sch. 6 repealed by Finance Act 1972 (c. 41), ss. 54(8), 134(7), Sch. 28 Pt. II

Schedule 7.U.K. . . . F47

Textual Amendments

F47Sch. 7 repealed by Vehicles (Excise) Act 1971 (c. 10), s. 39(5), Sch. 8 Pt. I

Schedules 8—10.U.K. . . . F48

Textual Amendments

Schedules 11, 12.U.K. . . . F49

Textual Amendments

F49Schs. 11, 12 repealed (with savings) by Capital Gains Tax Act 1979 (c. 14), ss. 157(1), 158, Sch. 6 para. s. 10(2)(b), Sch. 8

Schedule 13.U.K. . . . F50

Textual Amendments

Schedule 14.U.K. . . . F51

Textual Amendments

F51Sch. 14 repealed (with savings) by Finance Act 1975 (c. 7), ss. 50, 52(2)(3), 59, Sch. 13 Pt. I

Section 41.

F52Schedule 15.U.K. Special Charge: Trusts

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F52Sch. 15 repealed (21.7.2008) by Statute Law (Repeals) Act 2008 (c. 12), Sch. 1 Pt. 8

Section 45.

F53Schedule 16.U.K. Special Charge: Close Companies

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F53Sch. 16 repealed (21.7.2008) by Statute Law (Repeals) Act 2008 (c. 12), Sch. 1 Pt. 8

Schedule 17.U.K. . . . F54

Textual Amendments

F54Sch. 17 repealed by Finance Act 1972 (c. 41), ss. 122(5), 134(7), Sch. 28 Pt. IX

SCHEDULE 18U.K. Premium Savings Bonds: New Terms

1U.K.Premium Savings Bonds are a Government Security and are eligible for inclusion in draws for cash prizes. These prizes are free from United Kingdom Income Tax, Surtax and Capital Gains Tax.

2U.K.Premium Saving Bonds, (Series B) (hereinafter called Bonds) will be issued in units of £1 by the Treasury and will be subject to regulations made from time to time by the Treasury under section 12 of the M4National Debt Act 1958, or having effect by virtue of that Act. The principal of the Bonds and the prizes allotted will be a charge on the National Loans Fund with recourse to the Consolidated Fund.

F553U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F55Sch. 18 para. 3 repealed (30.9.2004) by Premium Savings Bonds (Amendment etc) Regulations 2004 (S.I. 2004/2353), regs. 1, 2(2)

4U.K.Bonds are not transferable either during the lifetime or on the death of the registered holder. No responsibility can be accepted in respect of their use as security for a loan.

5U.K.There will be a monthly prize fund which will be determined by calculating one month’s interest on each bond eligible for the draws in that month. The rate of interest will be 45/8% per annum or such other rate as may be prescribed under the provisions of paragraph 15 below.

F566U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F56Sch. 18 para. 6 repealed (30.9.2004) by Premium Savings Bonds (Amendment etc) Regulations 2004 (S.I. 2004/2353), regs. 1, 2(2)

7U.K.F57... After a Bond has qualified for its first draw it will be included in each succeeding draw, unless it has been repaid before the first day of the month in which the draw is held or (subject to the provisions of paragraph 15 below) the registered holder has died before the first day of a period of twelve consecutive calendar months preceding the month in which the draw is held.

Textual Amendments

F57Words in Sch. 18 para. 7 repealed (2.11.2010) by Premium Savings Bonds (Amendment etc) Regulations 2010 (S.I. 2010/2479), regs. 1, 14(a)

8U.K.Each £1 unit Bond will have one chance in each draw for which it is eligible. Each £1 unit Bond may win not more than one prize in each draw for which it is eligible and in draws producing more that one prize will be allotted the highest prize for which it is drawn.

9U.K.Notwithstanding the provisions of paragraph 7 above any Bond purchased in contravention of any regulation limiting the number of unit Bonds which may held by any person shall not be eligible for inclusion in any draw until the holding has been reduced to not more than the maximum number permitted by such regulation.

F5810U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F58Sch. 18 para. 10 repealed (30.9.2004) by Premium Savings Bonds (Amendment etc) Regulations 2004 (S.I. 2004/2353), regs. 1, 2(2)

11U.K.The serial numbers of Bonds which are allotted prizes will be published F59... F60...

Textual Amendments

F59Words in Sch. 18 para. 11 repealed (30.9.2004) by Premium Savings Bonds (Amendment etc) Regulations 2004 (S.I. 2004/2353), regs. 1, 2(3)

F60Words in Sch. 18 para. 11 repealed (2.11.2010) by Premium Savings Bonds (Amendment etc) Regulations 2010 (S.I. 2010/2479), regs. 1, 14(b)

12U.K.All matters relating to the method and conduct of the draw and allotment of prizes shall be at the sole discretion of the Postmaster General, whose decision as to which Bonds have drawn prizes shall be final.

13U.K.The purchase price of a Bond is repayable in full on application to the Bonds and Stock Office.

F6114U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F61Sch. 18 para. 14 repealed (30.9.2004) by Premium Savings Bonds (Amendment etc) Regulations 2004 (S.I. 2004/2353), regs. 1, 2(2)

15U.K.The Treasury reserve the right F62...:—

(a)to vary the rate of interest specified in paragraph 5 above for determining the amount of the prize fund;

F63(b). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(c)to vary the provisions of paragraph 7 above insofar as they relate to the eligibility of a Bond for inclusion in a draw after the death of the registered holder;

(d)to declare any Bonds purchased on or before a date specified F64... to be ineligible for further draws.

Textual Amendments

F62Words in Sch. 18 para. 15 repealed (30.9.2004) by Premium Savings Bonds (Amendment etc) Regulations 2004 (S.I. 2004/2353), regs. 1, 2(4)(a)

F63Sch. 18 para. 15(b) repealed (30.9.2004) by Premium Savings Bonds (Amendment etc) Regulations 2004 (S.I. 2004/2353), regs. 1, 2(4)(b)

F64Words in Sch. 18 para. 15(d) repealed (30.9.2004) by Premium Savings Bonds (Amendment etc) Regulations 2004 (S.I. 2004/2353), regs. 1, 2(4)(c)

F6516U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F65Sch. 18 para. 16 repealed (30.9.2004) by Premium Savings Bonds (Amendment etc) Regulations 2004 (S.I. 2004/2353), regs. 1, 2(2)

Schedule 19U.K. . . . F66

Textual Amendments

F66Sch. 19 repealed by Finance Act 1971 (c. 68), s. 69(7), Sch. 14 Pt. VII

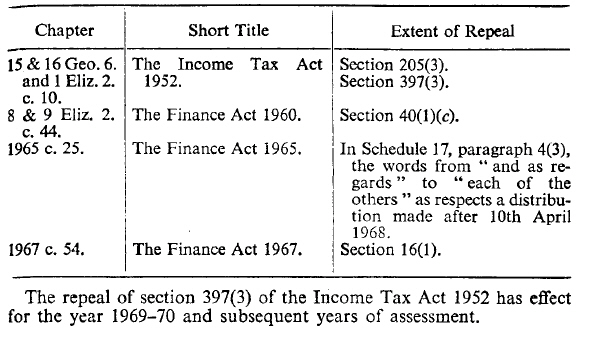

Section 61

schedule 20U.K. REPEALS

Modifications etc. (not altering text)

C5The text of Schedule 20 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and, does not reflect any amendments or repeals which may have been prior to 1.2.1991.

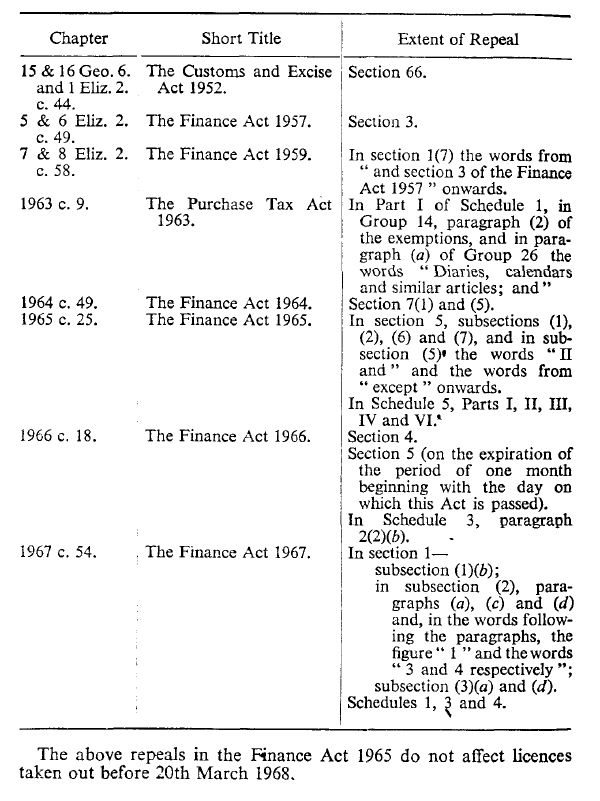

PART IU.K. CUSTOMS AND EXCISE REPEALS

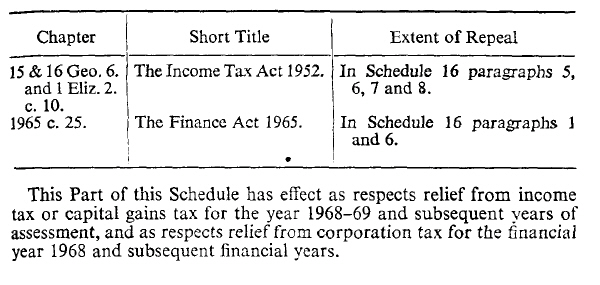

PART IIU.K. DOUBLE TAXATION RELIEF REPEALS

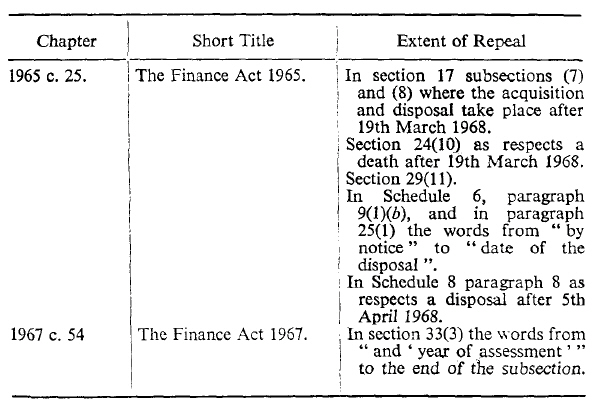

PART IIIU.K. CAPITAL GAINS REPEALS

PART IVU.K. ESTATE DUTY REPEALS

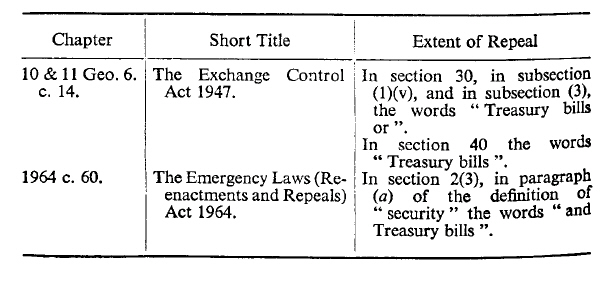

PART VU.K. EXCHANGE CONTROL REPEALS

PART VIU.K. MISCELLANEOUS REPEALS

Options/Help

Print Options

PrintThe Whole Act

Legislation is available in different versions:

Latest Available (revised):The latest available updated version of the legislation incorporating changes made by subsequent legislation and applied by our editorial team. Changes we have not yet applied to the text, can be found in the ‘Changes to Legislation’ area.

Original (As Enacted or Made): The original version of the legislation as it stood when it was enacted or made. No changes have been applied to the text.

See additional information alongside the content

Geographical Extent: Indicates the geographical area that this provision applies to. For further information see ‘Frequently Asked Questions’.

Show Timeline of Changes: See how this legislation has or could change over time. Turning this feature on will show extra navigation options to go to these specific points in time. Return to the latest available version by using the controls above in the What Version box.

More Resources

Access essential accompanying documents and information for this legislation item from this tab. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as enacted version that was used for the print copy

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- correction slips

- links to related legislation and further information resources

Timeline of Changes

This timeline shows the different points in time where a change occurred. The dates will coincide with the earliest date on which the change (e.g an insertion, a repeal or a substitution) that was applied came into force. The first date in the timeline will usually be the earliest date when the provision came into force. In some cases the first date is 01/02/1991 (or for Northern Ireland legislation 01/01/2006). This date is our basedate. No versions before this date are available. For further information see the Editorial Practice Guide and Glossary under Help.

More Resources

Use this menu to access essential accompanying documents and information for this legislation item. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as enacted version that was used for the print copy

- correction slips

Click 'View More' or select 'More Resources' tab for additional information including:

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- links to related legislation and further information resources