- Latest available (Revised)

- Point in Time (01/02/1991)

- Original (As enacted)

Aircraft and Shipbuilding Industries Act 1977 (repealed)

You are here:

- UK Public General Acts

- 1977 c. 3

- Schedules only

- Show Geographical Extent(e.g. England, Wales, Scotland and Northern Ireland)

- Show Timeline of Changes

More Resources

Changes over time for: Aircraft and Shipbuilding Industries Act 1977 (repealed) (Schedules only)

Version Superseded: 01/01/1996

Status:

Point in time view as at 01/02/1991.

Changes to legislation:

There are currently no known outstanding effects for the Aircraft and Shipbuilding Industries Act 1977 (repealed).![]()

Changes to Legislation

Revised legislation carried on this site may not be fully up to date. At the current time any known changes or effects made by subsequent legislation have been applied to the text of the legislation you are viewing by the editorial team. Please see ‘Frequently Asked Questions’ for details regarding the timescales for which new effects are identified and recorded on this site.

SCHEDULES

Section 19(1).

SCHEDULE 1U.K. Aircraft Industry

Part IU.K. Companies whose Securities are to Vest in British Aerospace

British Aircraft Corporation Limited

Hawker Siddeley Aviation Limited

Hawker Siddeley Dynamics Limited

Scottish Aviation Limited

Part IIU.K. Qualifying Conditions

1U.K.On 29th October 1974 each of the companies specified in Part I of this Schedule fulfilled the following conditions, namely,—

(a)the company was incorporated and had its principal place of business in Great Britain; and

(b)the company was engaged in manufacturing complete aircraft or guided weapons; and

(c)the aggregate of—

(i)the company’s turnover for the relevant financial year, as stated or otherwise shown in its accounts, and

(ii)the turnover of each of the company’s subsidiaries for the relevant financial year, as stated or otherwise shown in its accounts,

exceeded £7·5 million; and

(d)the company was not a wholly owned subsidiary of a company which fulfilled each of the preceding conditions.

2U.K.In paragraph 1 above—

“aircraft” does not include—

(a)hovercraft;

(b)lighter than air aircraft;

(c)rotary-wing aircraft;

(d)non-motorised and motorised gliders;

(e)aircraft designed to fly unmanned; and

(f)replicas of aircraft of historic interest; and

“relevant financial year”, in relation to a company, means that one of the company’s financial years, within the meaning of the M1Companies Act 1948, for which accounts were last laid before it in general meeting before 29th October 1974.

Marginal Citations

Section 19(2).

SCHEDULE 2U.K. Shipbuilding Industry

Part IU.K. Companies whose Securities are to Vest in British Shipbuilders

Shipbuilding companiesU.K.

Appledore Shipbuilders Limited

Austin & Pickersgill Ltd.

Brooke Marine Limited

Cammell Laird Shipbuilders Limited

Clelands Shipbuilding Company Ltd.

Ferguson Brothers (Port Glasgow) Limited

The Goole Shipbuilding & Repairing Co. Ltd.

Govan Shipbuilders Limited

Hall Russell & Company Ltd.

Lithgows Limited

Robb Caledon Shipbuilders Limited

Scott and Sons (Bowling) Limited

Scotts’ Shipbuilding Company Limited

Smith’s Dock Company Ltd.

Sunderland Shipbuilders Limited

Swan Hunter Shipbuilders Limited

Vickers Shipbuilding Group Limited

Vosper Thornycroft Limited

Yarrow (Shipbuilders) Limited

Companies manufacturing slow speed diesel marine enginesU.K.

Barclay, Curle & Company Limited

George Clark & NEM Limited

Hawthorn Leslie (Engineers) Ltd.

John G. Kincaid & Company Limited

Scotts’ Engineering Company Limited

Training companiesU.K.

The Scott Lithgow Training Centre Limited

Swan Hunter Training and Safety Company Limited

Yarrow (Training) Limited

Part IIU.K. Qualifying Conditions

1U.K.On 31st July 1974 each of the companies specified in Part I of this Schedule fulfilled the following conditions, namely,—

(a)the company was incorporated and had its principal place of business in Great Britain, and

(b)the company fulfilled the criteria in any one of paragraphs 2 to 4 below as a shipbuilding company, a manufacturer of slow speed diesel marine engines or a training company, and

(c)the company was not a wholly owned subsidiary of a company which fulfilled both of the preceding conditions.

2(1)For the purposes of paragraph 1 above a company is a shipbuilding company if—U.K.

(a)it was, on 31st July 1974, entitled, either alone or together with another company which was then a member of the same group of companies, to an interest in possession in a shipyard which on that date was being used for the construction of ships; and

(b)the aggregate of the total tonnage of the ships completed in that shipyard and in any associated shipyards during the period of three years ending on 31st July 1974 exceeded the specified minimum.

(2)The specified minimum tonnage referred to in sub-paragraph (1) above is—

(a)750 standard displacement tons in respect of warships, or

(b)15,000 gross tons in respect of other ships, or

(c)500 standard displacement tons in respect of warships and 10,000 gross tons in respect of other ships.

(3)For the purposes of paragraph (b) of sub-paragraph (1) above, a shipyard is associated with one in which a company falling within paragraph (a) of that sub-paragraph has an interest in possession on 31st July 1974 if, on that date, either that company or another company which was then a member of the same group of companies was entitled, either alone or together with another company which was then a member of the same group, to an interest in possession in it.

3U.K.For the purposes of paragraph 1 above, a company is a manufacturer of slow speed diesel marine engines if on 31st July 1974 it was engaged in the business of manufacturing diesel engines—

(a)designed for use for the main propulsion of ships; and

(b)designed to deliver continuously, at a crankshaft speed of less than 160 revolutions per minute, a power output greater than 4,000 horsepower, as measured under the operating conditions specified in the British Standard Specification published on 19th February 1958 under the number B.S.649:1958 (specification for the performance of reciprocating compression-ignition (diesel) engines, utilising liquid fuel only, for general purposes).

4U.K.For the purpose of paragraph 1 above, a company is a training company if on 31st July 1974—

(a)it was engaged in the business of training persons in any of the skills required for the repairing, refitting, conversion, maintenance and construction of ships; and

(b)it was a member of a group of companies of which another member was a company which fulfilled the conditions in paragraph 1 above but does not fall within this paragraph.

5(1)In this Part of this Schedule “ship” means a floating or submersible vessel with an integral hull and, except in the case of a warship, of over 100 gross tons, but does not include a hovercraft or a mobile offshore installation; and for the purposes of this Part of this Schedule—

(a)the gross tonnage of a ship shall be determined in the same manner as for registration under the M2Merchant Shipping Act 1894 (whether or not the ship is in fact so registered); and

(b)the standard displacement tonnage of a warship means that tonnage as determined in accordance with the Treaty for the Limitation of Naval Armament signed in London on 25th March 1936.

(2)In sub-paragraph (1) above “mobile offshore installation” has the same meaning as in Part III of the M3Industry Act 1972, namely, any installation which is intended for underwater exploitation of mineral resources or exploration with a view to such exploitation and can move by water from place to place without major dismantling or modification, whether or not it has its own motive power.

Section 20.

SCHEDULE 3U.K. Vesting of Assets of Undertakings in Acquired Companies

1U.K.In this Schedule—

“the principal section” means section 20 of this Act;

“the relevant undertaking” means, in relation to the acquired company, the undertaking carried on as mentioned in subsection (3) or, as the case may require, subsection (4) of the principal section.

2(1)Subject to sub-paragraph (2) below, any question whether any particular property, rights or liabilities vests or vest in the acquired company by virtue of the principal section shall be determined by agreement between the Secretary of State and the associated privately owned company in whom the property, rights or liabilities is or are vested immediately before the date of transfer of the acquired company or, in default of such agreement, by arbitration under this Act.U.K.

(2)In its application to any question relating to any rights or liabilities in respect of a person’s services sub-paragraph (1) above shall have effect as if the person concerned were required to be a party to the agreement referred to in that sub-paragraph.

3U.K.Where any rights or liabilities vested in the acquired company by virtue of the principal section are rights or liabilities under an agreement to which an associated privately owned company was a party immediately before the date of transfer, then, except in so far as the context otherwise requires, whether or not the agreement is in writing or of such a nature that rights and liabilities under it could be assigned by that privately owned company, the agreement shall have effect on and after that date as if—

(a)for any reference (however worded and whether express or implied) to the privately owned company there were substituted, with respect to anything falling to be done on or after that date, a reference to the acquired company, and

(b)any reference (however worded and whether express or implied) to a person holding a particular post in the privately owned company were, with respect to anything falling to be done on or after that date, a reference to such person as the acquired company may appoint or, in default of appointment, to the person holding the most nearly equivalent post in the acquired company.

4U.K.Without prejudice to the generality of paragraph 3 above, where any rights or liabilities vest in the acquired company by virtue of the principal section, the acquired company and any other person shall, as from the date of transfer, have the same rights, powers and remedies (and in particular the same rights and powers as to the taking or resisting of legal proceedings) for ascertaining, perfecting or enforcing any right or liability vested in the acquired company by virtue of the principal section as it or he would have had if that right or liability had at all times been a right or liability of the acquired company.

5U.K.Any legal proceedings pending on the date of transfer by or against the privately owned company concerned, in so far as they relate to any property, rights or liabilities vested in the acquired company by virtue of the principal section or to any agreement relating to any such property, rights or liabilities, shall be continued by or against the acquired company to the exclusion of the privately owned company.

6U.K.Without prejudice to the provisions of paragraph 3 above, the vesting of any property, rights or liabilities in the acquired company by virtue of the principal section shall be binding on all other persons, notwithstanding that any transfer of that property or of those rights or liabilities would, apart from this sub-paragraph, have required the consent or concurrence of any other person.

7U.K.Where any property, rights or liabilities which by virtue of the principal section fall to be vested in the acquired company cannot be properly so vested because transfers of that property or those rights or liabilities are governed otherwise than by the law of a part of the United Kingdom, the privately owned company concerned shall take all practicable steps for the purpose of securing that the ownership of the property is or, as the case may be, the rights or liabilities are, effectively transferred to the acquired company, but for the purposes of this Act, other than this paragraph, any such property, rights or liabilities shall continue to be treated as vested in the acquired company by virtue of that section and not by virtue of any steps taken in accordance with this paragraph.

8U.K.Section 12 of the M4Finance Act 1895 (which requires certain Acts to be stamped as conveyances on sale) (including that section as it applies to Northern Ireland) shall not apply to a vesting of property or rights in the acquired company by the principal section; and stamp duty shall not be payable either in Great Britain or in Northern Ireland on any instrument executed in pursuance of paragraph 7 above.

Marginal Citations

Section 29.

SCHEDULE 4U.K. Acquisition of Certain Assets

1U.K.Where a Schedule 4 notice is served by a Corporation and not withdrawn or revoked, then, on such date not earlier than the relevant vesting date as may be agreed by the Corporation and the person on whom the notice is served (in this Schedule referred to as “the transferor”) or, in default of agreement, as may be determined by arbitration under this Act, there shall vest by virtue of this Act in such body as may be specified in the notice, being either the Corporation or a company which comes into public ownership,—

(a)the property or rights to which the notice relates;

(b)in a case where the vesting of the property or rights involves the transfer of the operation of any works from the transferor to the body so specified, all such property and rights of the transferor as may be so agreed or determined to be property and rights held by the transferor wholly or mainly for the purposes of the business carried on by him at the works; and

(c)such other property and rights, being property or rights held by the transferor for the purposes of the business carried on by him, as may be so agreed or determined to be property or rights which cannot reasonably be severed from property or rights referred to in sub-paragraph (a) or sub-paragraph (b) above and ought to be held in the same ownership.

2U.K.All such agreements, whether in writing or not and whether or not of such a nature that the rights or liabilities thereunder could be assigned by the transferor, being agreements to which the transferor was a party and which are agreed by the Corporation concerned and the transferor or, in default of agreement, determined by arbitration under this Act,—

(a)to have been entered into for the purposes of, or in connection with, the use or exercise of any property or rights which vest in pursuance of the Schedule 4 notice, and

(b)to be agreements which ought to be transferred with that property or those rights,

shall have effect as from the date referred to in paragraph 1 above (in the following provisions of this Schedule referred to as “the acquisition date”)—

(i)as if the body specified in the Schedule 4 notice had been a party to the agreement, and

(ii)for any reference (however worded and whether express or implied) to the transferor that were substituted as respects anything falling to be done on or after that date, a reference to that body, and

(iii)with such other modifications as may be necessary to transfer rights, liabilities and obligations under the agreement, so far as unperformed, from the transferor to that body:

Provided that, if the arbitration tribunal are satisfied, on the application of the Corporation concerned that any such agreement could, if the transferor had been a company whose securities vested in the Corporation by virtue of section 19 of this Act have been disclaimed under Part II of this Act, they shall exclude that agreement from transfer under this paragraph.

3(1)Subject to sub-paragraph (2) below, there shall be paid to the transferor, by way of compensation for the property and rights vested or transferred in pursuance of the Schedule 4 notice, such amount as they might have been expected to realise if—U.K.

(a)they had been sold on the acquisition date in the open market by a willing seller to a willing buyer, and

(b)in calculating the price for which they were to be sold, any charges to which they were subject had been disregarded, and

(c)in so far as they comprised a business capable of being sold as a going concern, they had been so sold, and

(d)this Act had not been passed.

(2)In any case where the property and rights vested or transferred in pursuance of a Schedule 4 notice constitute the whole or any part of the undertaking of a company which by virtue of section 27(2)(a)(ii) or (iii) above does not come into public ownership, the compensation payable under this paragraph shall not exceed the amount of compensation which would have been due under section 35 of this Act in respect of the securities of that company if it had remained an acquired company.

(3)Any question as to the amount of compensation to be paid under this paragraph shall, in default of agreement between the Corporation concerned and the transferor, be determined by arbitration under this Act.

4(1)All property and rights which vest under this Schedule shall vest free of any mortgage or other like incumbrance, but, where any such property or right was, immediately before the acquisition date, subject to a mortgage or other like incumbrance (other than a floating charge which will attach to the compensation), so much of any compensation as is properly referable to that property or right shall be paid to the incumbrancer; and if the property or right was subject to two or more mortgages or other like incumbrances, the payment shall be made to the incumbrancer whose mortgage or other incumbrance has priority.U.K.

(2)Where a payment is made to an incumbrancer under this paragraph, the incumbrancer shall be liable to account therefor as if payment had accrued to him as proceeds of sale of the property or right in question arising under a power of sale exercised by him immediately before the acquisition date.

5U.K.The compensation payable under the preceding provisions of this Schedule shall be satisfied by the issue to the transferor or incumbrancer to whom it is payable of such amount of government stock (that is to say, stock the principal whereof and the interest whereon shall be charged on the National Loans Fund, with recourse to the Consolidated Fund) as, in the opinion of the Treasury, is of a value equal on the date of the issue to the amount of the compensation, regard being had (in estimating the value of the stock so issued) to the market values of other government securities on or about that date; and the Treasury shall be liable to pay interest on that amount, at such rates as they may determine, in respect of the period from the acquisition date until the date of payment.

6U.K.References in this Schedule to the vesting of rights shall, in the case of rights which have been granted out of or derived from greater rights held by the company specified in the Schedule 4 notice, so that the surrender thereof results in their merger in those greater rights, be construed as references to the surrender of the rights so granted or derived.

7U.K.Section 12 of the M5Finance Act 1895 (which requires certains Acts to be stamped as conveyances on sale) (including that section as it applies to Northern Ireland) shall not apply to the vesting by this Schedule of property or rights in a company which comes into public ownership; and stamp duty shall not be payable either in Great Britain or Northern Ireland on any instrument of transfer, surrender or grant of rights executed in pursuance of a Schedule 4 notice.

Marginal Citations

Section 35.

SCHEDULE 5U.K. Satisfaction of Compensation by Issue of Compensation Stock

1U.K.In this Schedule “the principal section” means section 35 above.

2U.K.This Schedule applies to securities which are vested in a Corporation by virtue of Part II of this Act and in respect of the vesting of which compensation stock falls to be issued under the principal section; and, in relation to any such securities, any reference in this Schedule to the date of transfer is a reference to the date of transfer of the company whose securities they are.

3(1)During the period beginning with the date of transfer and ending immediately before the conversion date, the persons who, immediately before the date of transfer, were the holders of securities to which this Schedule applies shall have the right to have the amount of compensation stock to which they are entitled in accordance with the principal section less any amount issued to them by virtue of the application of subsections (1), (2), (5) and (9) of that section to section 36(6) above.U.K.

(2)During the period specified in sub-paragraph (1) above, the right specified in that sub-paragraph shall be transferable in the like manner as the securities concerned were transferable, before the date of transfer, and the Corporation in which those securities vest shall make arrangements for recording the persons who are the holders thereof.

Modifications etc. (not altering text)

C1By British Aerospace Act 1980 (c. 26, SIF 64), s. 10(1) it is provided that para. 3(2) of Sch. 5 is repealed in relation to British Aerospace and that any reference in that provision (in whatever terms expressed) to either or both of the Corporations originally established by s. 1 of this Act shall be construed as a reference to the other corporation so established (that is to say British Shipbuilders)

4U.K.Every holder of any such right as is specified in paragraph 3(1) above shall, by virtue of this Act, become instead on the conversion date the holder of the amount of compensation stock to which he is entitled as mentioned in that paragraph.

5U.K.The interest on compensation stock issued in respect of securities to which this Schedule applies shall be treated as accruing as from the date of transfer.

6U.K.In any case where—

(a)by virtue of the preceding provisions of this Schedule, a person who immediately before the date of transfer was the holder of any securities to which this Schedule applies becomes instead the holder of compensation stock, or

(b)there is conferred on a person the right specified in paragraph 3(1) above,

he shall hold that stock or right in the same right and on the same trusts and subject to the same powers, privileges, charges, restraints and liabilities as those in, on or subject to which he held the securities by virtue of which he acquired the stock or right; and any provision of any deed, will, disposition or other instrument and any statutory provision as to what is to be done by the holder of the securities or the redemption moneys thereof shall, with any necessary modifications, have the like effect in relation to the compensation stock or the right as it would have had in relation to the securities if they had not vested in a Corporation by virtue of this Act.

7U.K.Nothing in this Schedule affects the making of any payment of interest or dividend, in accordance with section 25 of this Act, to the holders of securities to which this Schedule applies.

8U.K.The power conferred on the Treasury by section 74 of the M6Finance Act 1948 to direct, in connection with any statutory scheme for the carrying on of an industry under national ownership under which provision is made for the transfer of the undertaking of a body corporate, that as from the date of the transfer of the undertaking transfers of the securities of the body corporate shall be exempt from all stamp duties, shall extend to a direction, as respects the right specified in paragraph 3(1) above, that, as from the date of transfer, transfers of that right shall be so exempt.

Marginal Citations

9U.K.Each Corporation shall have, in relation to the right specified in paragraph 3(1) above, the like power as the company which issued the securities by virtue of which that right is conferred has, in relation to those securities, under the M7Forged Transfers Acts 1891 M8 and 1892.

Modifications etc. (not altering text)

C3By British Aerospace Act 1980 (c. 26, SIF 64), s. 10(1) it is provided that para. 9 of Sch. 5 is repealed in relation to British Aerospace and that any reference in that provision (in whatever terms expressed) to either or both of the Corporations originally established by s. 1 of this Act shall be construed as a reference to the other Corporation so established (that is to say, British Shipbuilders)

C4Sch. 5 para. 9 extended by British Aerospace Act 1980 (c. 26, SIF 64), s. 10(1), Sch. 2 para. 5(1)

Marginal Citations

Section 41.

SCHEDULE 6U.K. Provisions as to Office of Stockholders’ Representative, Meetings of Holders of Securities and Incidental Matters

Appointment and tenure of officeU.K.

1(1)Subject to sub-paragraphs (2) and (3) below, a stockholders’ representative shall be appointed for each company by the holders of securities, at a meeting of those holders called by the company, and shall be appointed not later than the end of the period of one month from the passing of this Act.U.K.

(2)In the case of a company the securities of which vest in a Corporation by virtue of section 26 of this Act, the stockholders’ representative shall be appointed not later than the end of the period of one month from the service on the company of the notice of acquisition under that section.

(3)If the holders of securities fail to appoint a stockholders’ representative within the required time, the Secretary of State shall appoint such a representative.

2U.K.Where the office of a stockholders’ representative is about to become vacant or has become vacant, otherwise than in consequence of the completion of his duties under this Act, a stockholders’ representative to fill the vacancy shall be appointed at a meeting of the holders of securities called—

(a)if the office is not yet vacant, by the stockholders’ representative,

(b)if the office is vacant and the meeting is called before the relevant vesting date, by the company, or

(c)in any other case, by the Secretary of State,

but if the appointment has not been made within the period of 2 months beginning on the date on which the vacancy occurred, the appointment may be made by the Secretary of State.

3U.K.Every stockholders’ representative shall, as soon as practicable after his appointment, give notice in writing thereof to the Secretary of State (unless he was appointed by the Secretary of State) and to the registrar of companies and shall, except in the case of a private company, insert an advertisement of his appointment in such one or more newspapers as in his opinion is or are best calculated to bring the appointment to the notice of the holders of securities; and the advertisement shall state the name of the company, the full name and description of the stockholders’ representative, the address to which communications for him are to be sent and any other matters which the stockholders’ representative thinks fit to include.

4(1)Subject to the following provisions of this paragraph—U.K.

(a)a stockholders’ representative may resign his office by giving not less than one month’s notice in writing to the Secretary of State and, if he was appointed by the holders of securities, to every such holder, and his office shall become vacant on the date specified in the notice;

(b)a stockholders’ representative may be removed from his office by a resolution passed at a meeting of the holders of securities, and his office shall become vacant on the passing of the resolution; and

(c)in the case of a stockholders’ representative appointed by the Secretary of State, who becomes, in the Secretary of State’s opinion, unfit to continue in his office or incapable of performing his duties, the Secretary of State may, by notice in writing to the holders of securities and to the stockholders’ representative, declare his office to be vacant; and his office shall become vacant on the date specified in the notice.

(2)A resolution for the removal of a stockholders’ representative shall not be moved unless 14 days’ notice of the intention to do so has been given to every holder of securities, and any such notice may be included in the notice calling the meeting and, if not so included, may be given in like manner as the notice calling the meeting.

(3)Where a stockholders’ representative resigns his office—

(a)he shall, before his resignation takes effect, call a meeting of the holders of securities for the appointment of his successor;

(b)if a new stockholders’ representative is appointed before the day preceding the taking effect of his resignation, he shall, before it takes effect, deliver all books kept by him in the performance of his duties to his successor, and in any other case he shall deliver them to the Secretary of State on the day before his resignation takes effect; and

(c)he shall furnish such information with respect to any matters which have arisen in connection with the performance of his duties as his successor may reasonably require.

(4)When a stockholders’ representative is removed from his office, he shall deliver to the Secretary of State, or as the Secretary of State may direct, all books kept by him in the performance of his duties and shall furnish to the Secretary of State such information relating to any matters which have arisen in connection with the performance of those duties as the Secretary of State may reasonably require.

5(1)Where a stockholders’ representative dies not less than 14 days before the date of transfer of a company, the company shall forthwith give notice thereof to the Secretary of State and to every holder of securities, and the books referred to in paragraph 4(4) above shall as soon as practicable be delivered by his legal personal representative or, so far as any of them are in the possession or control of any other person, by that other person, to the Secretary of State, or as the Secretary of State may direct.U.K.

(2)Where a stockholders’ representative dies less than 14 days before, or on or after the date of transfer of a company, the appropriate person specified in sub-paragraph (1) above shall forthwith give notice thereof to the Secretary of State, and shall as soon as practicable deliver any such books as aforesaid to the Secretary of State or as the Secretary of State may direct.

Meetings of holders of securitiesU.K.

6(1)A stockholders’ representative may at any time call a meeting of holders of securities, and shall call such a meeting within 21 days of the service on him of such a requisition as is mentioned in this paragraph.U.K.

(2)A stockholders’ representative may at any time call a meeting of such class or classes of holders of securities as are exclusively affected by any matter dealt with by him in the performance of his duties, so, however, that the business of any such meeting shall be confined to matters affecting exclusively the class or classes summoned to that meeting.

(3)A requisition to a stockholders’ representative to call a meeting of holders of securities may be made by holders of securities representing not less than—

(a)one-tenth of the aggregate nominal value of the securities of the company in respect of which compensation is payable under this Act; or

(b)one-fifth of the aggregate nominal value of any class of such securities;

and every requisition shall state the purpose of the meeting and shall be signed by the requisitionists and deposited with the stockholders’ representative, and may consist of several documents in like form each signed by one or more of the requisitionists.

(4)If, in a case falling within sub-paragraph (3) above, the stockholders’ representative does not within 21 days after the deposit of the requisition proceed duly to call the meeting, the requisitionists, or any of them representing not less than one-twentieth of the aggregate nominal value of the securities referred to in that sub-paragraph or, as the case may be, one-tenth of the aggregate nominal value of the class of securities referred to in that sub-paragraph, may themselves call the meeting.

(5)Any expenses reasonably incurred by the requisitionists in calling a meeting under sub-paragraph (4) above shall be repaid to them by the stockholders’ representative and shall, except to the extent of any excess over the expenses which would have been incurred by the stockholders’ representative if the meeting had been called by him, be deemed to be expenses incurred by him in the exercise of his functions.

7(1)A meeting of holders of securities shall be called by notice in writing served on every such holder not less than 14 and not more than 40 days before the date of the meeting.U.K.

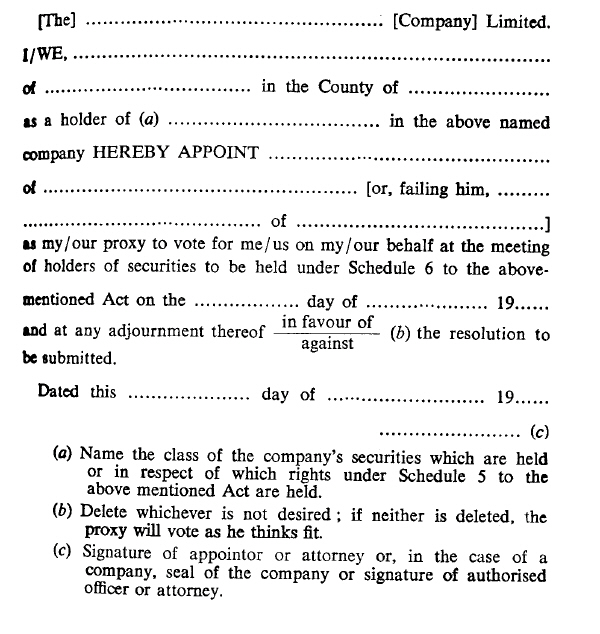

(2)A notice under sub-paragraph (1) above shall state that the meeting is to be held under this Schedule, shall state the purpose of the meeting and the place, date and time at which it is to be held, and shall draw attention to the provisions of this Schedule relating to proxies and specify the address at which proxies for the meeting are to be deposited; and, if the notice is served, a form of instrument for appointing a proxy, being the form set out in the Appendix to this Schedule, shall be served together with it.

(3)If a meeting is adjourned for more than two weeks this paragraph shall apply to the adjourned meeting as it applies to the original meeting, except that it shall not be necessary to give notice of an adjourned meeting.

(4)The accidental omission to give notice to, or the non-receipt of a notice by, any holder of securities shall not invalidate the proceedings at the meeting.

8(1)An instrument appointing a proxy shall be in the form set out in the Appendix to this Schedule or in a form as near thereto as circumstances admit, and shall be in writing under the hand of the appointor or of an attorney duly authorised by him in writing, or, if the appointor is a corporation, shall be either under seal or under the hand of an officer or attorney duly authorised by the corporation in writing.U.K.

(2)A proxy need not be a holder of securities.

(3)The appointment of a proxy shall not be valid unless the instrument of appointment, and the power of attorney or other authority (if any) under which it is signed or a notarially certified copy of that power or authority, is deposited at the address specified for the purpose in the notice convening the meeting, not less than 48 hours before the time for holding the meeting.

(4)An appointment of a proxy may be made for one or more meetings, and any appointment for a meeting shall be deemed to apply to any adjournment thereof.

Procedure at meetingsU.K.

9(1)The holders of securities present in person at any meeting shall choose one of their number to be chairman, and for that purpose the persons present in person at any meeting shall be a quorum.U.K.

(2)Subject as aforesaid, holders of securities present in person or by proxy representing not less than one-twentieth of the aggregate nominal value of the securities of the company in respect of which compensation is payable under this Act shall be a quorum.

(3)If within half an hour of the time appointed for any meeting a quorum is not present, the chairman shall adjourn the meeting to a place, date and time determined by him (which shall if practicable be the same place and the same day and time in the following week), and if at that adjourned meeting a quorum is not present at the appointed time or within 30 minutes thereafter, the holders of securities present in person or by proxy shall be a quorum.

(4)At any meeting voting shall be by holders of securities present in person or by proxy, and a resolution put to the vote of the meeting shall be decided on a show of hands unless a poll is (before or on the declaration of the result of the show of hands) demanded by persons present in person or by proxy representing not less than one-twentieth of the aggregate nominal value aforesaid.

(5)A poll, if so demanded, shall be taken in such manner as the chairman may direct, and on any such poll every holder voting shall be entitled to one vote for each pound by nominal value of the securities held by him.

(6)In the case of an equality of votes, whether on a show of hands or on a poll, the chairman of the meeting shall be entitled to a second or casting vote.

(7)An entry in any minutes or record kept with respect to any meeting by the stockholders’ representative, or, before the appointment of a stockholders’ representative or during a vacancy in that office, by a person authorised in that behalf by the chairman of the meeting, shall, if signed by the chairman of the meeting or by the chairman of a meeting at which the minutes or record were or was read, be evidence of the matter so recorded.

(8)The proceedings at any meeting of holders of securities shall not be invalidated by any defect discovered after the meeting in the qualifications to vote of any person who voted at the meeting.

10(1)In the case of a joint holding of securities, the vote of the senior joint holder who tenders a vote, whether in person or by proxy, shall be accepted to the exclusion of the votes of the other joint holders, and for this purpose seniority shall be determined by the order in which the names stand or stood in the relevant register or, if there is no register, in the relevant document of title.U.K.

(2)Any person who has been duly authorised to act on behalf of a holder of securities who is of unsound mind may vote on his behalf.

11U.K.Where any class of securities is secured by a trust deed and any trustee thereof is not a holder of securities, notice of any meeting of holders of securities held under this Schedule shall be served on him, and any such trustee may attend and speak at any such meeting, but shall not be entitled to vote.

12U.K.The provisions of paragraphs 7 to 11 above shall with the requisite modifications apply in relation to a meeting of a class or classes of holders of securities as they apply in relation to a meeting of holders of securities of all classes.

13U.K.Any body corporate which is a holder of securities may by resolution of its directors or other governing body authorise such person as it thinks fit to act as its representative at any meeting of holders of securities, and the person so authorised shall be entitled to exercise the same powers on behalf of the body which he represents as that body could exercise if it were an individual holder of securities.

Service of documentsU.K.

14U.K.In addition to the methods of serving documents under section 54 of this Act, any notice or statement required under this Schedule to be served on, or given or sent to, any holder of securities who is entered in a register kept by the company or any record kept by the Corporation concerned under Schedule 5 to this Act, may be so served, given or sent by sending it in a prepaid letter addressed to that holder at the address entered in the register or record and, in the case of a joint holding of securities, may be sent to the senior holder as determined for the purpose of paragraph 10 above.

(2)In the case of holders of bearer securities, any notice required under this Schedule to be given or served may be given by advertisement in such one or more newspapers as in the opinion of the person required to give or serve the notice is or are best calculated to bring the matter in question to the notice of those holders.

Modifications etc. (not altering text)

C5By British Aerospace Act 1980 (c. 26, SIF 64), s. 10(1) it is provided that para. 14 of Sch. 6 is repealed in relation to British Aerospace and that any reference in that provision (in whatever terms expressed) to either or both of the Corporations originally established by s. 1 of this Act shall be construed as a reference to the other Corporation so established (that is to say, British Shipbuilders)

SupplementaryU.K.

15(1)Every stockholders’ representative shall keep proper books in which shall appear—U.K.

(a)a record of every matter dealt with by him in the performance of his duties under this Act; and

(b)minutes of the proceedings of every meeting of holders of securities, which shall include a record of every resolution passed.

(2)All such books shall be open at any reasonable hour to inspection by any holder of securities or by any person authorised in writing in that behalf by any such holder.

16U.K.As soon as practicable after he has completed his duties under this Schedule, each stockholders’ representative shall—

(a)prepare a statement showing how he has carried out those duties,

(b)send copies of that statement to the Secretary of State, to the Corporation in which vest the securities to which his duties relate and to every holder of securities, and

(c)call a meeting of the holders of securities,

and the stockholders’ representative shall present the statement at the meeting and shall give any explanation of the statement that may reasonably be required by any holder of securities present at the meeting.

17(1)In this Schedule the expression “holder of securities”, in relation to a stockholders’ representative or the appointment of a stockholders’ representative, means any holder of securities of the company for which he is or is to be appointed or any holder of rights in respect of those securities under Schedule 5 to this Act, or any person to whom those securities or rights are transferred.U.K.

(2)Expressions to which meanings are assigned by any provision of this Act shall bear the same meanings in any notice, minute or other document, given, served, or made under this Schedule.

APPENDIXU.K.

Appointment of proxy for votingU.K.

Section 42.

SCHEDULE 7U.K. Procedure Etc. of Arbitration Tribunal

Part IU.K. Proceedings other than Scottish Proceedings

1U.K.The provisions of this Part of this Schedule shall have effect with respect to proceedings of the arbitration tribunal other than those which, by virtue of this Act, are to be treated as Scottish proceedings, and references in the following provisions of this Part of this Schedule to proceedings shall be construed accordingly.

2The provisions of the M9Arbitration Act 1950 or, in Northern Ireland, the M10Arbitration Act (Northern Ireland) 1937 with respect to—

(a)the administration of oaths and the taking of affirmations,

(b)the correction in awards of mistakes and errors,

(c)the summoning, attendance and examination of witnesses and the production of documents, and

(d)the costs of the reference and award,

shall, with any necessary modifications, apply in respect of proceedings before the arbitration tribunal but, except as provided by this paragraph, the provisions of that Act shall not apply to any such proceedings.

3U.K.The arbitration tribunal may, and if so ordered by the Court of Appeal shall, state in the form of a special case for determination by the Court of Appeal any question of law which may arise before them.

4U.K.An appeal shall lie to the Court of Appeal on any question of law or fact from any determination or order of the arbitration tribunal with respect to a claim by either Corporation—

(a)against the directors of a company to enforce a liability arising under section 23 of this Act, or

(b)for compensation for loss arising from any transaction referred to the tribunal under any of sections 28, 30 and 31 of this Act.

5(1)Subject to the provisions of this Schedule, the procedure in or in connection with any proceedings before the arbitration tribunal shall be such as may be determined by rules made by the Lord Chancellor by statutory instrument.U.K.

(2)A statutory instrument containing rules made under this paragraph shall be subject to annulment in pursuance of a resolution of either House of Parliament.

Part IIU.K. Scottish Proceedings

6U.K.The provisions of this Part of this Schedule shall have effect with respect to proceedings of the arbitration tribunal which, by virtue of this Act, are to be treated as Scottish proceedings, and references in the following provisions of this Part of this Schedule to proceedings shall be construed accordingly.

7U.K.The arbitration tribunal shall have the like powers for securing the attendance of witnesses and the production of documents and with regard to the examination of witnesses on oath and the awarding of expenses as if the arbitration tribunal were an arbiter under a submission.

8U.K.The arbitration tribunal may, and if so directed by the Court of Session shall, state a case for the opinion of that Court on any question of law arising in the proceedings.

9(1)An appeal shall lie to the Court of Session on any question of law or fact from any determination or order of the arbitration tribunal with respect to a claim by either Corporation—U.K.

(a)against the directors of a company to enforce a liability arising under section 23 of this Act, or

(b)for compensation for loss arising from any transaction referred to the tribunal under any of sections 28, 30 and 31 of this Act.

(2)An appeal shall lie, with the leave of the Court of Session or of the House of Lords, from any decision of the Court of Session under this paragraph, and such leave may be given on such terms as to costs or otherwise as the Court of Session or the House of Lords may determine.

10(1)Subject to the provisions of this Schedule, the procedure in or in connection with any proceedings before the arbitration tribunal shall be such as may be determined by rules made by the Lord Advocate by statutory instrument.U.K.

(2)A statutory instrument containing rules made under this paragraph shall be subject to annulment in pursuance of a resolution of either House of Parliament.

Modifications etc. (not altering text)

C7Sch. 7 para. 10: functions of the Lord Advocate transferred to the Secretary of State and all property, rights and liabilities to which the Lord Advocate is entitled or subject in connection with any such function transferred to the Secretary of State for Scotland (19.5.1999) by S.I. 1999/678, arts. 2(1), 3, Sch. (with art. 7)

Sch. 7 para. 10 transfer of functions (S) (1.7.1999) by S.I. 1999/1750, art. 2, Sch. 1

11U.K.Unless the arbitration tribunal consider that there are special reasons for not doing so, they shall sit in Scotland for the hearing and determination of any proceedings which, by virtue of this Act, are to be treated as Scottish proceedings.

Part IIIU.K. All Proceedings

12U.K.Every order of the arbitration tribunal—

(a)shall be enforceable in England and Wales and Northern Ireland as if it were an order of the High Court; and

(b)may be recorded for execution in the books of Council and Session and may be enforced accordingly.

13U.K.The arbitration tribunal may, at any stage in any proceedings before them, refer to a person or persons appointed by them for the purpose any question arising in the proceedings, other than a question which in their opinion is primarily one of law, for inquiry and report, and the report of any such person or persons may be adopted wholly or partly by the tribunal and, if so adopted, may be incorporated in an order of the tribunal.

Options/Help

Print Options

PrintThe Whole Act

PrintThe Schedules only

Legislation is available in different versions:

Latest Available (revised):The latest available updated version of the legislation incorporating changes made by subsequent legislation and applied by our editorial team. Changes we have not yet applied to the text, can be found in the ‘Changes to Legislation’ area.

Original (As Enacted or Made): The original version of the legislation as it stood when it was enacted or made. No changes have been applied to the text.

Point in Time: This becomes available after navigating to view revised legislation as it stood at a certain point in time via Advanced Features > Show Timeline of Changes or via a point in time advanced search.

See additional information alongside the content

Geographical Extent: Indicates the geographical area that this provision applies to. For further information see ‘Frequently Asked Questions’.

Show Timeline of Changes: See how this legislation has or could change over time. Turning this feature on will show extra navigation options to go to these specific points in time. Return to the latest available version by using the controls above in the What Version box.

More Resources

Access essential accompanying documents and information for this legislation item from this tab. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as enacted version that was used for the print copy

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- correction slips

- links to related legislation and further information resources

Timeline of Changes

This timeline shows the different points in time where a change occurred. The dates will coincide with the earliest date on which the change (e.g an insertion, a repeal or a substitution) that was applied came into force. The first date in the timeline will usually be the earliest date when the provision came into force. In some cases the first date is 01/02/1991 (or for Northern Ireland legislation 01/01/2006). This date is our basedate. No versions before this date are available. For further information see the Editorial Practice Guide and Glossary under Help.

More Resources

Use this menu to access essential accompanying documents and information for this legislation item. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as enacted version that was used for the print copy

- correction slips

Click 'View More' or select 'More Resources' tab for additional information including:

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- links to related legislation and further information resources