- Latest available (Revised)

- Point in Time (01/10/2009)

- Original (As enacted)

Aircraft and Shipbuilding Industries Act 1977 (repealed)

You are here:

- UK Public General Acts

- 1977 c. 3

- Schedules only

- Show Geographical Extent(e.g. England, Wales, Scotland and Northern Ireland)

- Show Timeline of Changes

More Resources

Changes over time for: Aircraft and Shipbuilding Industries Act 1977 (repealed) (Schedules only)

Version Superseded: 12/04/2010

Status:

Point in time view as at 01/10/2009.

Changes to legislation:

There are currently no known outstanding effects for the Aircraft and Shipbuilding Industries Act 1977 (repealed).![]()

Changes to Legislation

Revised legislation carried on this site may not be fully up to date. At the current time any known changes or effects made by subsequent legislation have been applied to the text of the legislation you are viewing by the editorial team. Please see ‘Frequently Asked Questions’ for details regarding the timescales for which new effects are identified and recorded on this site.

SCHEDULES

Section 19(1).

SCHEDULE 1U.K. Aircraft Industry

Part IU.K. Companies whose Securities are to Vest in British Aerospace

British Aircraft Corporation Limited

Hawker Siddeley Aviation Limited

Hawker Siddeley Dynamics Limited

Scottish Aviation Limited

Part IIU.K. Qualifying Conditions

1U.K.On 29th October 1974 each of the companies specified in Part I of this Schedule fulfilled the following conditions, namely,—

(a)the company was incorporated and had its principal place of business in Great Britain; and

(b)the company was engaged in manufacturing complete aircraft or guided weapons; and

(c)the aggregate of—

(i)the company’s turnover for the relevant financial year, as stated or otherwise shown in its accounts, and

(ii)the turnover of each of the company’s subsidiaries for the relevant financial year, as stated or otherwise shown in its accounts,

exceeded £7·5 million; and

(d)the company was not a wholly owned subsidiary of a company which fulfilled each of the preceding conditions.

2U.K.In paragraph 1 above—

“aircraft” does not include—

(a)hovercraft;

(b)lighter than air aircraft;

(c)rotary-wing aircraft;

(d)non-motorised and motorised gliders;

(e)aircraft designed to fly unmanned; and

(f)replicas of aircraft of historic interest; and

“relevant financial year”, in relation to a company, means that one of the company’s financial years, within the meaning of the M1Companies Act 1948, for which accounts were last laid before it in general meeting before 29th October 1974.

Marginal Citations

Section 19(2).

SCHEDULE 2U.K. Shipbuilding Industry

Part IU.K. Companies whose Securities are to Vest in British Shipbuilders

Shipbuilding companiesU.K.

Appledore Shipbuilders Limited

Austin & Pickersgill Ltd.

Brooke Marine Limited

Cammell Laird Shipbuilders Limited

Clelands Shipbuilding Company Ltd.

Ferguson Brothers (Port Glasgow) Limited

The Goole Shipbuilding & Repairing Co. Ltd.

Govan Shipbuilders Limited

Hall Russell & Company Ltd.

Lithgows Limited

Robb Caledon Shipbuilders Limited

Scott and Sons (Bowling) Limited

Scotts’ Shipbuilding Company Limited

Smith’s Dock Company Ltd.

Sunderland Shipbuilders Limited

Swan Hunter Shipbuilders Limited

Vickers Shipbuilding Group Limited

Vosper Thornycroft Limited

Yarrow (Shipbuilders) Limited

Companies manufacturing slow speed diesel marine enginesU.K.

Barclay, Curle & Company Limited

George Clark & NEM Limited

Hawthorn Leslie (Engineers) Ltd.

John G. Kincaid & Company Limited

Scotts’ Engineering Company Limited

Training companiesU.K.

The Scott Lithgow Training Centre Limited

Swan Hunter Training and Safety Company Limited

Yarrow (Training) Limited

Part IIU.K. Qualifying Conditions

1U.K.On 31st July 1974 each of the companies specified in Part I of this Schedule fulfilled the following conditions, namely,—

(a)the company was incorporated and had its principal place of business in Great Britain, and

(b)the company fulfilled the criteria in any one of paragraphs 2 to 4 below as a shipbuilding company, a manufacturer of slow speed diesel marine engines or a training company, and

(c)the company was not a wholly owned subsidiary of a company which fulfilled both of the preceding conditions.

2(1)For the purposes of paragraph 1 above a company is a shipbuilding company if—U.K.

(a)it was, on 31st July 1974, entitled, either alone or together with another company which was then a member of the same group of companies, to an interest in possession in a shipyard which on that date was being used for the construction of ships; and

(b)the aggregate of the total tonnage of the ships completed in that shipyard and in any associated shipyards during the period of three years ending on 31st July 1974 exceeded the specified minimum.

(2)The specified minimum tonnage referred to in sub-paragraph (1) above is—

(a)750 standard displacement tons in respect of warships, or

(b)15,000 gross tons in respect of other ships, or

(c)500 standard displacement tons in respect of warships and 10,000 gross tons in respect of other ships.

(3)For the purposes of paragraph (b) of sub-paragraph (1) above, a shipyard is associated with one in which a company falling within paragraph (a) of that sub-paragraph has an interest in possession on 31st July 1974 if, on that date, either that company or another company which was then a member of the same group of companies was entitled, either alone or together with another company which was then a member of the same group, to an interest in possession in it.

3U.K.For the purposes of paragraph 1 above, a company is a manufacturer of slow speed diesel marine engines if on 31st July 1974 it was engaged in the business of manufacturing diesel engines—

(a)designed for use for the main propulsion of ships; and

(b)designed to deliver continuously, at a crankshaft speed of less than 160 revolutions per minute, a power output greater than 4,000 horsepower, as measured under the operating conditions specified in the British Standard Specification published on 19th February 1958 under the number B.S.649:1958 (specification for the performance of reciprocating compression-ignition (diesel) engines, utilising liquid fuel only, for general purposes).

4U.K.For the purpose of paragraph 1 above, a company is a training company if on 31st July 1974—

(a)it was engaged in the business of training persons in any of the skills required for the repairing, refitting, conversion, maintenance and construction of ships; and

(b)it was a member of a group of companies of which another member was a company which fulfilled the conditions in paragraph 1 above but does not fall within this paragraph.

5(1)In this Part of this Schedule “ship” means a floating or submersible vessel with an integral hull and, except in the case of a warship, of over 100 gross tons, but does not include a hovercraft or a mobile offshore installation; and for the purposes of this Part of this Schedule—U.K.

(a)the gross tonnage of a ship shall be determined in the same manner as for registration under the [F1Merchant Shipping Act 1995] (whether or not the ship is in fact so registered); and

(b)the standard displacement tonnage of a warship means that tonnage as determined in accordance with the Treaty for the Limitation of Naval Armament signed in London on 25th March 1936.

(2)In sub-paragraph (1) above “mobile offshore installation” has the same meaning as in Part III of the M2Industry Act 1972, namely, any installation which is intended for underwater exploitation of mineral resources or exploration with a view to such exploitation and can move by water from place to place without major dismantling or modification, whether or not it has its own motive power.

Textual Amendments

F1Words in Sch. 2 para. 5(1)(a) substituted (1.1.1996) by 1995 c. 21, ss. 314(2), 316(2), Sch. 13 para. 50 (with s. 312(1)).

Marginal Citations

Section 20.

SCHEDULE 3U.K. Vesting of Assets of Undertakings in Acquired Companies

1U.K.In this Schedule—

“the principal section” means section 20 of this Act;

“the relevant undertaking” means, in relation to the acquired company, the undertaking carried on as mentioned in subsection (3) or, as the case may require, subsection (4) of the principal section.

2(1)Subject to sub-paragraph (2) below, any question whether any particular property, rights or liabilities vests or vest in the acquired company by virtue of the principal section shall be determined by agreement between the Secretary of State and the associated privately owned company in whom the property, rights or liabilities is or are vested immediately before the date of transfer of the acquired company or, in default of such agreement, by arbitration under this Act.U.K.

(2)In its application to any question relating to any rights or liabilities in respect of a person’s services sub-paragraph (1) above shall have effect as if the person concerned were required to be a party to the agreement referred to in that sub-paragraph.

3U.K.Where any rights or liabilities vested in the acquired company by virtue of the principal section are rights or liabilities under an agreement to which an associated privately owned company was a party immediately before the date of transfer, then, except in so far as the context otherwise requires, whether or not the agreement is in writing or of such a nature that rights and liabilities under it could be assigned by that privately owned company, the agreement shall have effect on and after that date as if—

(a)for any reference (however worded and whether express or implied) to the privately owned company there were substituted, with respect to anything falling to be done on or after that date, a reference to the acquired company, and

(b)any reference (however worded and whether express or implied) to a person holding a particular post in the privately owned company were, with respect to anything falling to be done on or after that date, a reference to such person as the acquired company may appoint or, in default of appointment, to the person holding the most nearly equivalent post in the acquired company.

4U.K.Without prejudice to the generality of paragraph 3 above, where any rights or liabilities vest in the acquired company by virtue of the principal section, the acquired company and any other person shall, as from the date of transfer, have the same rights, powers and remedies (and in particular the same rights and powers as to the taking or resisting of legal proceedings) for ascertaining, perfecting or enforcing any right or liability vested in the acquired company by virtue of the principal section as it or he would have had if that right or liability had at all times been a right or liability of the acquired company.

5U.K.Any legal proceedings pending on the date of transfer by or against the privately owned company concerned, in so far as they relate to any property, rights or liabilities vested in the acquired company by virtue of the principal section or to any agreement relating to any such property, rights or liabilities, shall be continued by or against the acquired company to the exclusion of the privately owned company.

6U.K.Without prejudice to the provisions of paragraph 3 above, the vesting of any property, rights or liabilities in the acquired company by virtue of the principal section shall be binding on all other persons, notwithstanding that any transfer of that property or of those rights or liabilities would, apart from this sub-paragraph, have required the consent or concurrence of any other person.

7U.K.Where any property, rights or liabilities which by virtue of the principal section fall to be vested in the acquired company cannot be properly so vested because transfers of that property or those rights or liabilities are governed otherwise than by the law of a part of the United Kingdom, the privately owned company concerned shall take all practicable steps for the purpose of securing that the ownership of the property is or, as the case may be, the rights or liabilities are, effectively transferred to the acquired company, but for the purposes of this Act, other than this paragraph, any such property, rights or liabilities shall continue to be treated as vested in the acquired company by virtue of that section and not by virtue of any steps taken in accordance with this paragraph.

8U.K.Section 12 of the M3Finance Act 1895 (which requires certain Acts to be stamped as conveyances on sale) (including that section as it applies to Northern Ireland) shall not apply to a vesting of property or rights in the acquired company by the principal section; and stamp duty shall not be payable either in Great Britain or in Northern Ireland on any instrument executed in pursuance of paragraph 7 above.

Marginal Citations

Section 29.

[F2SCHEDULE 4]U.K. Acquisition of Certain Assets

Textual Amendments

F2Schs. 4-6 repealed (22.7.2004) by Statute Law (Repeals) Act 2004 (c. 14), Sch. 1 Pt. 16 Group 1

F21U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F22U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F23U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F24U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F25U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F26U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F27U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Section 35.

[F2SCHEDULE 5]U.K. Satisfaction of Compensation by Issue of Compensation Stock

F21U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F22U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F23U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F24U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F25U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F26U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F27U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F28U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F29U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Modifications etc. (not altering text)

C1By British Aerospace Act 1980 (c. 26, SIF 64), s. 10(1) it is provided that para. 9 of Sch. 5 is repealed in relation to British Aerospace and that any reference in that provision (in whatever terms expressed) to either or both of the Corporations originally established by s. 1 of this Act shall be construed as a reference to the other Corporation so established (that is to say, British Shipbuilders)

C2Sch. 5 para. 9 extended by British Aerospace Act 1980 (c. 26, SIF 64), s. 10(1), Sch. 2 para. 5(1)

Section 41.

[F2SCHEDULE 6]U.K. Provisions as to Office of Stockholders’ Representative, Meetings of Holders of Securities and Incidental Matters

Appointment and tenure of officeU.K.

F21U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F22U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F23U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F24U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F25U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Meetings of holders of securitiesU.K.

F26U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F27U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F28U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Procedure at meetingsU.K.

F29U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F210U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F211U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F212U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F213U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Service of documentsU.K.

F214U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Modifications etc. (not altering text)

C3By British Aerospace Act 1980 (c. 26, SIF 64), s. 10(1) it is provided that para. 14 of Sch. 6 is repealed in relation to British Aerospace and that any reference in that provision (in whatever terms expressed) to either or both of the Corporations originally established by s. 1 of this Act shall be construed as a reference to the other Corporation so established (that is to say, British Shipbuilders)

C4Sch. 6 para. 14 extended by British Aerospace Act 1980 (c. 26, SIF 64), s. 10(1), Sch. 2 para. 5(2)

SupplementaryU.K.

F215U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F216U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F217U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

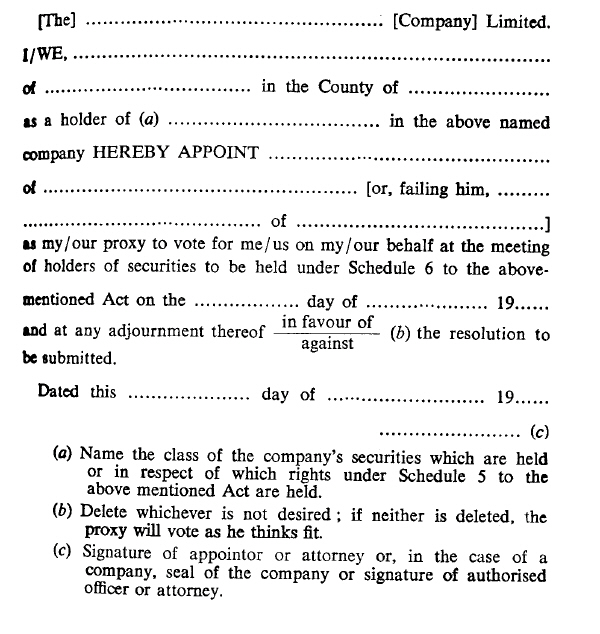

[F2APPENDIX]U.K.

Appointment of proxy for votingU.K.

Section 42.

SCHEDULE 7U.K. Procedure Etc. of Arbitration Tribunal

Part IU.K. Proceedings other than Scottish Proceedings

1U.K.The provisions of this Part of this Schedule shall have effect with respect to proceedings of the arbitration tribunal other than those which, by virtue of this Act, are to be treated as Scottish proceedings, and references in the following provisions of this Part of this Schedule to proceedings shall be construed accordingly.

2U.K.The provisions of [F3Part I of the Arbitration Act 1996] with respect to—

(a)the administration of oaths and the taking of affirmations,

(b)the correction in awards of mistakes and errors,

(c)the summoning, attendance and examination of witnesses and the production of documents, and

(d)the costs of the reference and award,

shall, with any necessary modifications, apply in respect of proceedings before the arbitration tribunal but, except as provided by this paragraph, the provisions of [F4that Part] shall not apply to any such proceedings.

Textual Amendments

F3Words in Sch. 7 para. 2 substituted (31.1.1997 subject to transitional provisions) by 1996 c. 23, s. 107(1), Sch. 3 para. 32(a); S.I. 1996/3146, arts. 3, 4, Sch. 2.

F4Words in Sch. 7 para. 2 substituted (31.1.1997 subject to transitional provisions) by 1996 c. 23, s. 107(1), Sch. 3 para. 32(b); S.I. 1996/3146, arts. 3, 4, Sch. 2.

3U.K.The arbitration tribunal may, and if so ordered by the Court of Appeal shall, state in the form of a special case for determination by the Court of Appeal any question of law which may arise before them.

4U.K.An appeal shall lie to the Court of Appeal on any question of law or fact from any determination or order of the arbitration tribunal with respect to a claim by either Corporation—

(a)against the directors of a company to enforce a liability arising under section 23 of this Act, or

(b)for compensation for loss arising from any transaction referred to the tribunal under any of sections 28, 30 and 31 of this Act.

5(1)Subject to the provisions of this Schedule, the procedure in or in connection with any proceedings before the arbitration tribunal shall be such as may be determined by rules made by the Lord Chancellor by statutory instrument.U.K.

(2)A statutory instrument containing rules made under this paragraph shall be subject to annulment in pursuance of a resolution of either House of Parliament.

Part IIU.K. Scottish Proceedings

6U.K.The provisions of this Part of this Schedule shall have effect with respect to proceedings of the arbitration tribunal which, by virtue of this Act, are to be treated as Scottish proceedings, and references in the following provisions of this Part of this Schedule to proceedings shall be construed accordingly.

7U.K.The arbitration tribunal shall have the like powers for securing the attendance of witnesses and the production of documents and with regard to the examination of witnesses on oath and the awarding of expenses as if the arbitration tribunal were an arbiter under a submission.

8U.K.The arbitration tribunal may, and if so directed by the Court of Session shall, state a case for the opinion of that Court on any question of law arising in the proceedings.

9(1)An appeal shall lie to the Court of Session on any question of law or fact from any determination or order of the arbitration tribunal with respect to a claim by either Corporation—U.K.

(a)against the directors of a company to enforce a liability arising under section 23 of this Act, or

(b)for compensation for loss arising from any transaction referred to the tribunal under any of sections 28, 30 and 31 of this Act.

(2)An appeal shall lie, with the leave of the Court of Session or of the [F5 Supreme Court], from any decision of the Court of Session under this paragraph, and such leave may be given on such terms as to costs or otherwise as the Court of Session or the[F5Supreme Court ] may determine.

Textual Amendments

F5Words in Sch. 7 para. 9(2) substituted (1.10.2009) by Constitutional Reform Act 2005 (c. 4), s. 148(1), Sch. 9 para. 29; S.I. 2009/1604, art. 2(d)

10(1)Subject to the provisions of this Schedule, the procedure in or in connection with any proceedings before the arbitration tribunal shall be such as may be determined by rules made by the Lord Advocate by statutory instrument.U.K.

(2)A statutory instrument containing rules made under this paragraph shall be subject to annulment in pursuance of a resolution of either House of Parliament.

Modifications etc. (not altering text)

C5Sch. 7 para. 10: functions of the Lord Advocate transferred to the Secretary of State and all property, rights and liabilities to which the Lord Advocate is entitled or subject in connection with any such function transferred to the Secretary of State for Scotland (19.5.1999) by S.I. 1999/678, arts. 2(1), 3, Sch. (with art. 7)

Sch. 7 para. 10 transfer of functions (S) (1.7.1999) by S.I. 1999/1750, art. 2, Sch. 1

11U.K.Unless the arbitration tribunal consider that there are special reasons for not doing so, they shall sit in Scotland for the hearing and determination of any proceedings which, by virtue of this Act, are to be treated as Scottish proceedings.

Part IIIU.K. All Proceedings

12U.K.Every order of the arbitration tribunal—

(a)shall be enforceable in England and Wales and Northern Ireland as if it were an order of the High Court; and

(b)may be recorded for execution in the books of Council and Session and may be enforced accordingly.

13U.K.The arbitration tribunal may, at any stage in any proceedings before them, refer to a person or persons appointed by them for the purpose any question arising in the proceedings, other than a question which in their opinion is primarily one of law, for inquiry and report, and the report of any such person or persons may be adopted wholly or partly by the tribunal and, if so adopted, may be incorporated in an order of the tribunal.

Options/Help

Print Options

PrintThe Whole Act

PrintThe Schedules only

Legislation is available in different versions:

Latest Available (revised):The latest available updated version of the legislation incorporating changes made by subsequent legislation and applied by our editorial team. Changes we have not yet applied to the text, can be found in the ‘Changes to Legislation’ area.

Original (As Enacted or Made): The original version of the legislation as it stood when it was enacted or made. No changes have been applied to the text.

Point in Time: This becomes available after navigating to view revised legislation as it stood at a certain point in time via Advanced Features > Show Timeline of Changes or via a point in time advanced search.

See additional information alongside the content

Geographical Extent: Indicates the geographical area that this provision applies to. For further information see ‘Frequently Asked Questions’.

Show Timeline of Changes: See how this legislation has or could change over time. Turning this feature on will show extra navigation options to go to these specific points in time. Return to the latest available version by using the controls above in the What Version box.

More Resources

Access essential accompanying documents and information for this legislation item from this tab. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as enacted version that was used for the print copy

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- correction slips

- links to related legislation and further information resources

Timeline of Changes

This timeline shows the different points in time where a change occurred. The dates will coincide with the earliest date on which the change (e.g an insertion, a repeal or a substitution) that was applied came into force. The first date in the timeline will usually be the earliest date when the provision came into force. In some cases the first date is 01/02/1991 (or for Northern Ireland legislation 01/01/2006). This date is our basedate. No versions before this date are available. For further information see the Editorial Practice Guide and Glossary under Help.

More Resources

Use this menu to access essential accompanying documents and information for this legislation item. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as enacted version that was used for the print copy

- correction slips

Click 'View More' or select 'More Resources' tab for additional information including:

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- links to related legislation and further information resources