- Latest available (Revised)

- Point in Time (01/02/1991)

- Original (As enacted)

Hydrocarbon Oil Duties Act 1979

You are here:

- UK Public General Acts

- 1979 c. 5

- Schedules only

- Show Geographical Extent(e.g. England, Wales, Scotland and Northern Ireland)

- Show Timeline of Changes

More Resources

Status:

Point in time view as at 01/02/1991.

Changes to legislation:

Hydrocarbon Oil Duties Act 1979 is up to date with all changes known to be in force on or before 12 November 2024. There are changes that may be brought into force at a future date. Changes that have been made appear in the content and are referenced with annotations.![]()

Changes to Legislation

Changes and effects yet to be applied by the editorial team are only applicable when viewing the latest version or prospective version of legislation. They are therefore not accessible when viewing legislation as at a specific point in time. To view the ‘Changes to Legislation’ information for this provision return to the latest version view using the options provided in the ‘What Version’ box above.

SCHEDULES

Section 27(1).

SCHEDULE 1U.K. VEHICLES WHICH ARE NOT ROAD VEHICLES WITHIN THE MEANING OF THIS ACT

Vehicles excluded from definition of “road vehicle”U.K.

1Any vehicle while it is not used on a public road and no vehicle excise licence is in force in respect of it.

[F1TractorsU.K.

Textual Amendments

F1Sch. 1 substituted (1.7.1995) by 1995 c. 4, s. 8(2)(3)

2The following—

(a)any vehicle exempted from vehicle excise duty by section 4(1)(h) of the M1Vehicles (Excise) Act 1971 (road construction vehicles) [F2section 4(1)(i) of that Act (gritting vehicles)] section 7(1) of that Act (vehicles used only for passing to and from land in the same occupation) [F3or section 7(3) of that Act (snow ploughs etc.)];

[F4(b)a special machine within the meaning of Schedule 3 to that Act;]

(c)a road roller.

Textual Amendments

F2Words substituted by Finance Act 1982 (c. 39, SIF 40:1), s. 3(2)

F3Words added by Finance Act 1982 (c. 39, SIF 40:1), s. 3(2)

F4Sch. 1 para. 2(b) substituted by Finance Act 1989 (c. 26, SIF 40:1), s. 8(2)

Marginal Citations

InterpretationU.K.

3In paragraph 1 above “public road” means a road which is repairable at the public expense.

Agricultural enginesU.K.

4In this Schedule “vehicle excise licence”, “vehicle excise duty” and “duty” means a licence and duty under the Vehicles (Excise) Act 1971; but a vehicle in respect of which there is current a certificate or document in the form of a licence issued in pursuance of regulations under section 23 of that Act shall be treated as a vehicle for which a road licence is in force.

Vehicles used between different parts of landU.K.

5In the application of this Schedule to Northern Ireland, for any reference to the Vehicles (Excise) Act 1971 there shall be substituted a reference to the M2Vehicles (Excise) Act (Northern Ireland) 1972.

Marginal Citations

Valid from 01/07/1995

Mowing machinesU.K.

6U.K.A mowing machine is an excepted vehicle.

Valid from 01/07/1995

Snow clearing vehiclesU.K.

7U.K.A vehicle is an excepted vehicle when it is—

(a)being used, or

(b)going to or from the place where it is to be or has been used,

for the purpose of clearing snow from public roads by means of a snow plough or similar device (whether or not forming part of the vehicle).

Valid from 01/07/1995

GrittersU.K.

8U.K.A vehicle is an excepted vehicle if it is constructed or adapted, and used, solely for the conveyance of machinery for spreading material on roads to deal with frost, ice or snow (with or without articles or material used for the purposes of the machinery).

Valid from 01/07/1995

Mobile cranesU.K.

9(1)A mobile crane is an excepted vehicle.U.K.

(2)In sub-paragraph (1) above “mobile crane” means a vehicle which is designed and constructed as a mobile crane and which—

(a)is used on public roads only as a crane in connection with work carried on at a site in the immediate vicinity or for the purpose of proceeding to and from a place where it is to be or has been used as a crane, and

(b)when so proceeding does not carry any load except such as is necessary for its propulsion or equipment.

Valid from 01/07/1995

Digging machinesU.K.

10(1)A digging machine is an excepted vehicle.U.K.

(2)In sub-paragraph (1) above “digging machine” means a vehicle which is designed, constructed and used for the purpose of trench digging, or any kind of excavating or shovelling work, and which—

(a)is used on public roads only for that purpose or for the purpose of proceeding to and from the place where it is to be or has been used for that purpose, and

(b)when so proceeding does not carry any load except such as is necessary for its propulsion or equipment.

Valid from 01/07/1995

Works trucksU.K.

11(1)A works truck is an excepted vehicle.U.K.

(2)In sub-paragraph (1) above “works truck” means a goods vehicle which is designed for use in private premises and is used on public roads only—

(a)for carrying goods between private premises and a vehicle on a road within one kilometre of those premises,

(b)in passing from one part of private premises to another,

(c)in passing between private premises and other private premises in a case where the premises are within one kilometre of each other, or

(d)in connection with road works at the site of the works or within one kilometre of the site of the works.

(3)In sub-paragraph (2) above “goods vehicle” means a vehicle constructed or adapted for use and used for the conveyance of goods or burden of any description, whether in the course of trade or not.

Valid from 01/07/1995

Road construction vehiclesU.K.

12(1)A vehicle is an excepted vehicle if it is—U.K.

(a)a road construction vehicle, and

(b)used or kept solely for the conveyance of built-in road construction machinery (with or without articles or material used for the purposes of the machinery).

(2)In sub-paragraph (1) above “road construction vehicle” means a vehicle—

(a)which is constructed or adapted for use for the conveyance of built-in road construction machinery, and

(b)which is not constructed or adapted for the conveyance of any other load except articles and material used for the purposes of such machinery.

(3)In sub-paragraphs (1) and (2) above “built-in road construction machinery”, in relation to a vehicle, means road construction machinery built in as part of, or permanently attached to, the vehicle.

(4)In sub-paragraph (3) above “road construction machinery” means a machine or device suitable for use for the construction or repair of roads and used for no purpose other than the construction or repair of roads.

Valid from 01/07/1995

Road rollersU.K.

13U.K.A road roller is an excepted vehicle.

Valid from 01/07/1995

InterpretationU.K.

14U.K.In this Schedule “public road” means a road which is repairable at the public expense.]

Section 17(7).

SCHEDULE 2U.K. MEANING OF “HORTICULTURAL PRODUCE” FOR PURPOSES OF RELIEF UNDER SECTION 17

In section 17 of this Act “horticultural produce” means—

(a)fruit;

(b)vegetables of a kind grown for human consumption, including fungi, but not including maincrop potatoes or peas grown for seed, for harvesting dry or for vining;

(c)flowers, pot plants and decorative foliage;

(d)herbs;

(e)seeds other than pea seeds, and bulbs and other material, being seeds, bulbs or material for sowing or planting for the production of—

(i)fruit,

(ii)vegetables falling within paragraph (b) above,

(iii)flowers, plants or foliage falling within paragraph (c) above, or

(iv)herbs,

or for reproduction of the seeds, bulbs or other material planted; or

(f)trees and shrubs, other than trees grown for the purpose of afforestation;

but does not include hops.

Valid from 15/11/1996

[F5SCHEDULE 2AU.K. Mixing of rebated oil]

Textual Amendments

Part IU.K. Light oil

[ Converting unleaded petrol into leaded petrol]U.K.

1(1)A mixture which is leaded petrol is produced in contravention of this paragraph if such a mixture is produced by—

(a)adding lead to unleaded petrol in respect of which a rebate has been allowed under subsection (1) of section 13A of this Act at the rate given by subsection (1A)(a) of that section;

(b)adding lead to unleaded petrol in respect of which a rebate has been allowed under subsection (1) of that section at the rate given by subsection (1A)(b) of that section; or

(c)adding lead to a mixture of unleaded petrol of a description mentioned in paragraph (a) above and unleaded petrol of a description mentioned in paragraph (b) above.

(2)In sub-paragraph (1) above the reference to adding lead to unleaded petrol includes a reference to adding leaded petrol to unleaded petrol.

(3)This paragraph is subject to any direction given under paragraph 3 below.

Adding octane enhancers to low octane unleaded petrolU.K.

2(1)A mixture which is super-unleaded petrol is produced in contravention of this paragraph if such a mixture is produced by adding an octane enhancer to unleaded petrol in respect of which a rebate has been allowed under subsection (1) of section 13A of this Act at the rate given by subsection (1A)(b) of that section.

(2)For the purposes of sub-paragraph (1) above “super-unleaded petrol” means unleaded petrol—

(a)whose research octane number is not less than 96; and

(b)whose motor octane number is not less than 86.

(3)Subsection (1C) of section 13A applies for the purposes of this paragraph as it applies for the purposes of that section.

(4)This paragraph is subject to any direction given under paragraph 3 below.

Valid from 01/10/2000

[F6Mixing different kinds of unleaded petrol]U.K.

Textual Amendments

F6Sch. 2A para. 2A and cross-heading inserted (1.10.2000) by 2000 c. 17, ss. 5(6), 6, Sch. 1 para. 3(1); S.I. 2000/2674, art. 2

F72A(1)A mixture which is unleaded petrol is produced in contravention of this paragraph if the mixture is produced by mixing unleaded petrol of any two or more of the following descriptions—

(a)petrol on which duty has been paid at the rate specified in section 6(1A)(a),

(b)petrol in respect of which a rebate has been allowed under section 13A(1A)(b),

(c)petrol in respect of which a rebate has been allowed under section 13A(1A)(a),

where the mixture produced is petrol of a description subject to a higher effective rate of duty than one or more of the ingredients of the mixture.

(2)The comparison required by sub-paragraph (1) shall be made by reference to the effective rates of duty in force at the time the mixture is produced.

(3)This paragraph is subject to any direction given under paragraph 3.

Textual Amendments

F7Sch. 2A para. 2A inserted (1.10.2000) by 2000 c. 17, ss. 5(6), 6, Sch. 1 para. 3(1); S.I. 2000/2674, art. 2

Power to create exceptionsU.K.

3The Commissioners may give a direction that, in such description of circumstances as may be specified in the direction, a mixture is not produced in contravention of paragraph 1 above or (as the case may be) paragraph 2 above.

Part IIU.K.Heavy oil

Mixing partially rebated heavy oil with unrebated heavy oilU.K.

4A mixture of heavy oils is produced in contravention of this paragraph if such a mixture is produced by mixing—

(a)gas oil in respect of which a rebate has been allowed under section 11(1)(b) of this Act; and

(b)heavy oil in respect of which, on its delivery for home use, a declaration was made that it was intended for use as fuel for a road vehicle.

Mixing fully rebated heavy oil with unrebated heavy oilU.K.

5U.K.A mixture of heavy oils is produced in contravention of this paragraph if such a mixture is produced by mixing—

(a)heavy oil which is neither fuel oil nor gas oil and in respect of which a rebate has been allowed under section 11(1)(c) of this Act; and

(b)heavy oil in respect of which, on its delivery for home use, a declaration was made that it was intended for use as fuel for a road vehicle.

Mixing fully rebated heavy oil with partially rebated heavy oilU.K.

6A mixture of heavy oils is produced in contravention of this paragraph if such a mixture is produced by mixing—

(a)heavy oil which is neither fuel oil nor gas oil and in respect of which a rebate has been allowed under section 11(1)(c) of this Act; and

(b)gas oil in respect of which a rebate has been allowed under section 11(1)(b) of this Act.

Valid from 15/08/1997

[F8 Mixing different types of partially rebated gas oilU.K.

Textual Amendments

F8Sch. 2A para. 6A inserted (15.8.1997) by 1997 c. 16, s. 7(9)(c); S.I. 1997/1960, art. 2

F96AU.K.A mixture of heavy oils is produced in contravention of this paragraph if such a mixture is produced by mixing—

(a)ultra low sulphur diesel in respect of which a rebate has been allowed under section 11(1)(ba) of this Act; and

(b)gas oil in respect of which a rebate has been allowed under section 11(1)(b) of this Act.]

Textual Amendments

F9Sch. 2A para. 6A inserted (15.8.1997) by 1997 c. 16, s. 7(9)(c); S.I. 1997/1960, art. 2

Complex mixtures of heavy oilsU.K.

7A mixture of heavy oils is produced in contravention of this paragraph if such a mixture is produced in contravention of more than one paragraph of paragraphs 4 to 6 above.

Valid from 17/03/1998

[F10Part IIAU.K. Unrebated heavy oil

Textual Amendments

F10Sch. 2A Pt. IIA para. 7A inserted (retrospective to 6pm on 17.3.1998) by 1998 c. 36, s. 9(4)(6)

F117AU.K.A mixture of heavy oils is produced in contravention of this paragraph if such a mixture is produced by mixing—

(a)ultra low sulphur diesel in respect of which, on its delivery for home use, a declaration was made that it was intended for use as fuel for a road vehicle; and

(b)heavy oil of any other description in respect of which, on its delivery for home use, such a declaration was made.]

Textual Amendments

F11Sch. 2A Pt. IIA para. 7A inserted (retrospectove to 6pm on 17.3.1998) by 1998 c. 36, s. 9(4)

Valid from 24/07/2002

[F12Part 2B Biodiesel

Textual Amendments

F12Sch. 2A, Part 2B, para. 7B inserted (24.7.2002 with application as mentioned in s. 5(8)(b) of the amending Act) by 2002 c. 23, s. 5, Sch. 2 para. 5(3)

Mixing biodiesel with rebated heavy oilU.K.

F137B(1)A mixture is produced in contravention of this paragraph if it is produced by mixing—

(a)biodiesel or a substance containing biodiesel, and

(b)rebated heavy oil.

(2)In sub-paragraph (1)(b) above “rebated heavy oil” means heavy oil in respect of which a rebate has been allowed under section 11 of this Act.]

Textual Amendments

F12Sch. 2A, Part 2B, para. 7B inserted (24.7.2002 with application as mentioned in s. 5(8)(b) of the amending Act) by 2002 c. 23, s. 5, Sch. 2 para. 5(3)

F13Sch. 2A Part 2B, para. 7B inserted (24.7.2002 with application as mentioned in s. 5(8)(b) of the amending Act) by 2002 c. 23, s. 5, Sch. 2 para. 5(3)

Part IIIU.K. Rates of duty, etc.

Rate for mixtures of light oilU.K.

8(1)Subject to paragraph 10 below, duty under section 20AAA(1) of this Act shall be charged at the following rates.

(2)In the case of a mixture produced in contravention of paragraph 1 above, the rate is the rate for light oil in force at the time that the mixture is produced.

(3)In the case of a mixture produced in contravention of paragraph 2 above, the rate is the rate produced by deducting from the rate for light oil in force at the time the mixture is produced the rate of rebate which at that time is in force under section 13A(1A)(a) of this Act.

(4)In this paragraph “the rate for light oil” means the rate given in the case of light oil by section 6(1) of this Act.

Rate for mixtures of heavy oilU.K.

9(1)Subject to paragraph 10 below, duty charged under subsection (2) of section 20AAA of this Act shall be charged at the rate for heavy oil in force at the time when the mixture is supplied as mentioned in that subsection.

(2)In this paragraph “the rate for heavy oil” means the rate given in the case of heavy oil by section 6(1) of this Act.

Credit for duty paid on ingredients of mixtureU.K.

10Where duty is charged under section 20AAA of this Act in respect of any mixture, the amount of duty produced by applying paragraph 8 or 9 above shall be reduced by the amount of any duty under section 6 of this Act which the Commissioners are satisfied has been paid in respect of any ingredient of the mixture.

InterpretationU.K.

11In this Schedule—

“fuel oil” and “gas oil” have the same meanings as in section 11 of this Act;

“leaded petrol” and “unleaded petrol” shall be construed in accordance with section 13A of this Act.

Section 21(1).

SCHEDULE 3U.K. SUBJECTS FOR REGULATIONS UNDER SECTION 21

Part IU.K. hydrocarbon oil

1U.K.Prohibiting the production of hydrocarbon oil or any description of hydrocarbon oil except by a person holding a licence.

2U.K.[F14Specifying the circumstances in which any such licence may be surrendered or revoked]

Textual Amendments

F14Words substituted by Finance Act 1986 (c. 41, SIF 40:1), s. 8(6), Sch. 5 para. 4

3U.K.Regulating the production, storage and warehousing of hydrocarbon oil or any description of hydrocarbon oil and the removal of any such oil to or from premises used for the production of any such oil.

4U.K.Prohibiting the refining of hydrocarbon oil elsewhere than in a refinery.

5U.K.Prohibiting the incorporation of gas in hydrocarbon oil elsewhere than in a refinery.

6U.K.Regulating the use and storage of hydrocarbon oil in a refinery.

7U.K.Regulating or prohibiting the removal to a refinery of hydrocarbon oil in respect of which any rebate has been allowed.

8U.K.Regulating the removal of imported hydrocarbon oil to a refinery without payment of the excise duty on such oil.

9U.K.Making provision for securing payment of the excise duty on any imported hydrocarbon oil received into a refinery.

10U.K.Relieving from the excise duty chargeable on hydrocarbon oil produced in the United Kingdom any such oil intended for exportation or shipment as stores.

[F1510A F16U.K.Amending the definition of “aviation gasoline” in subsection (4) of section 6 of this Act.]

Textual Amendments

F15Sch. 3 Pt. I para. 10A substituted by Finance Act 1990 (c. 29, SIF 40:1), s. 3(5)(6)

F16Sch. 3 Pt. I paras. 10A-10C inserted by Finance Act 1982 (c. 39), s. 4(5)

10B F17U.K.Conferring power to require information relating to the supply or use of aviation gasoline to be given by producers, dealers and users.

Textual Amendments

F17Sch. 3 Pt. I paras. 10A-C inserted by Finance Act 1992 (c. 39), s. 4(5)

10C F18U.K.Requiring producers and users of and dealers in aviation gasoline to keep and produce records relating to aviation gasoline.

Textual Amendments

F18Sch. 3 Pt. I paras. 10A-C inserted by Finance Act 1992 (c. 39), s. 4(5)

11U.K.Generally for securing and collecting the excise duty chargeable on hydrocarbon oil . . . F19.

Textual Amendments

F19Words repealed by Finance Act 1985 (c. 54, SIF 40:1), s. 7, Sch. 4 para. 4, Sch. 27 Pt. I Note 2

Modifications etc. (not altering text)

C1Sch. 3 para. 11 modified (26.7.2002) by S.I. 2002/1928, reg. 3(1)(d)

Part IIU.K. petrol substitutes

12Prohibiting the production of petrol substitutes, and dealing in petrol substitutes on which the excise duty has not been paid, except by persons holding a licence.

13[F20Specifying the circumstances in which any such licence may be surrendered or revoked].

Textual Amendments

F20Words substituted by Finance Act 1986 (c. 41, SIF 40:1), s. 8(6), Sch. 5 para. 4

14Regulating the production, dealing in, storage and warehousing of petrol substitutes and their removal to and from premises used therefor.

15Relieving from the excise duty petrol substitutes intended for exportation or shipment as stores.

16Generally for securing and collecting the excise duty.

In this Part of this Schedule “the excise duty” means the excise duty on petrol substitutes.

Part IIIU.K. road fuel gas

17U.K.Prohibiting the production of gas, and dealing in gas on which the excise duty has not been paid, except by persons holding a licence.

18U.K.[F21Specifying the circumstances in which any such licence may be surrendered or revoked].

Textual Amendments

F21Words substituted by Finance Act 1986 (c. 41, SIF 40:1), s. 8(6), Sch. 5 para. 4

19U.K.Regulating the production, dealing in, storage and warehousing of gas and the removal of gas to and from premises used therefor.

20U.K.Requiring containers for gas to be marked in the manner prescribed by the regulations.

21U.K.Conferring power to require information relating to the supply or use of gas and containers for gas to be given by producers of and dealers in gas, and by the person owning or possessing or for the time being in charge of any road vehicle which is constructed or adapted to use gas as fuel.

22U.K.Requiring a person owning or possessing a road vehicle which is constructed or adapted to use gas as fuel to keep such accounts and records in such manner as may be prescribed by the regulations, and to preserve such books and documents relating to the supply of gas to or by him, or the use of gas by him, for such period as may be so prescribed.

23U.K.Requiring the production of books or documents relating to the supply or use of gas or the use of any road vehicle.

24U.K.Authorising the entry and inspection of premises (other than private dwelling-houses) and the examination of road vehicles, and authorising, or requiring the giving of facilities for, the inspection of gas found on any premises entered or on or in any road vehicle.

25U.K.Generally for securing and collecting the excise duty.

In this Part of this Schedule “the excise duty” means the excise duty chargeable under section 8 of this Act on gas, and “gas” means road fuel gas.

Section 24(1).

SCHEDULE 4U.K. SUBJECTS FOR REGULATIONS UNDER SECTION 24

As to grant of relief . . . F22U.K.

Textual Amendments

F22Words repealed by Finance Act 1981 (c. 35, SIF 40:1), s. 139(6), Sch. 19 Pt. III Note 4 (by Note 4 it is provided that the repeal has effect in relation to oil used on or after 1.1.1982)

1U.K.Regulating the approval of persons for purposes of section 9(1) or (4) or 14(1) of this Act, whether individually or by reference to a class, and whether in relation to particular descriptions of oil or generally; enabling approval to be granted subject to conditions and providing for the conditions to be varied, or the approval revoked, for reasonable cause.

2U.K.Enabling permission under section 9(1) of this Act to be granted subject to conditions as to the giving of security and otherwise.

[F233Requiring claims or applications for repayment under section 9(4), 17, 18(1), 19 or 19A of this Act to be made at such times and in respect of such periods as are prescribed; providing that no such claim or application shall lie where the amount to be paid is less than the prescribed minimum; and preventing, where a claim or application can be made under section 9(4) or 19, the payment of drawback.]

Textual Amendments

F23Sch. 4 Pt. II para. 3 substituted by Finance Act 1981 (c.35, SIF 40:1), s. 6(1)(3)

As to mixing of oilU.K.

4U.K.Imposing restrictions on the mixing with other oil of any rebated oil or oil delivered without payment of duty.

As to marking of oilU.K.

5U.K.Requiring as a condition of allowing rebate on, or delivery without payment of duty of, any oil (subject to any exceptions provided by or under the regulations) that there shall have been added to that oil, at such times, in such manner and in such proportions as may be prescribed, one or more prescribed markers, with or without a prescribed colouring substance (not being a prescribed marker), and that a declaration to that effect is furnished.

Modifications etc. (not altering text)

C2Sch. 4 para 5 modified by S.I. 2004/2065, reg. 3(1A)(b) (as inserted (1.4.2008) by The Hydrocarbon Oil, Biofuels and Other Fuel Substitutes (Determination of Composition of a Substance and Miscellaneous Amendments) Regulations 2008 (S.I. 2008/753), regs. 1(2), 8(2)(a))

C3Sch. 4 para 5 modified by S.I. 2004/2065, reg. 3(2A)(c) (as inserted (1.4.2008) by The Hydrocarbon Oil, Biofuels and Other Fuel Substitutes (Determination of Composition of a Substance and Miscellaneous Amendments) Regulations 2008 (S.I. 2008/753), regs. 1(2), 8(2)(d))

6U.K.Prescribing the substances which are to be used as markers.

7U.K.Providing that the presence of a marker shall be disregarded if the proportion in which it is present is less than that prescribed for the purposes of this paragraph.

8U.K.Prohibiting the addition to any oil of any prescribed marker or prescribed colouring substance except in such circumstances as may be prescribed.

Modifications etc. (not altering text)

C4Sch. 4 paras. 8-10 modified by S.I. 2004/2065, reg. 3(1A)(b) (as inserted (1.4.2008) by The Hydrocarbon Oil, Biofuels and Other Fuel Substitutes (Determination of Composition of a Substance and Miscellaneous Amendments) Regulations 2008 (S.I. 2008/753), regs. 1(2), 8(2)(a))

C5Sch. 4 paras. 8-10 modified by S.I. 2004/2065, reg. 3(2A)(c) (as inserted (1.4.2008) by The Hydrocarbon Oil, Biofuels and Other Fuel Substitutes (Determination of Composition of a Substance and Miscellaneous Amendments) Regulations 2008 (S.I. 2008/753), regs. 1(2), 8(2)(d))

9U.K.Prohibiting the removal from any oil of any prescribed marker or prescribed colouring substance.

Modifications etc. (not altering text)

C6Sch. 4 paras. 8-10 modified by S.I. 2004/2065, reg. 3(1A)(b) (as inserted (1.4.2008) by The Hydrocarbon Oil, Biofuels and Other Fuel Substitutes (Determination of Composition of a Substance and Miscellaneous Amendments) Regulations 2008 (S.I. 2008/753), regs. 1(2), 8(2)(a))

C7Sch. 4 paras. 8-10 modified by S.I. 2004/2065, reg. 3(2A)(c) (as inserted (1.4.2008) by The Hydrocarbon Oil, Biofuels and Other Fuel Substitutes (Determination of Composition of a Substance and Miscellaneous Amendments) Regulations 2008 (S.I. 2008/753), regs. 1(2), 8(2)(d))

10U.K.Prohibiting the addition to oil of any substance, not being a prescribed marker, which is calculated to impede the identification of a prescribed marker.

Modifications etc. (not altering text)

C8Sch. 4 paras. 8-10 modified by S.I. 2004/2065, reg. 3(1A)(b) (as inserted (1.4.2008) by The Hydrocarbon Oil, Biofuels and Other Fuel Substitutes (Determination of Composition of a Substance and Miscellaneous Amendments) Regulations 2008 (S.I. 2008/753), regs. 1(2), 8(2)(a))

C9Sch. 4 paras. 8-10 modified by S.I. 2004/2065, reg. 3(2A)(c) (as inserted (1.4.2008) by The Hydrocarbon Oil, Biofuels and Other Fuel Substitutes (Determination of Composition of a Substance and Miscellaneous Amendments) Regulations 2008 (S.I. 2008/753), regs. 1(2), 8(2)(d))

11U.K.Regulating the storage or movement of prescribed markers.

12U.K.Requiring any person who adds a prescribed marker to any oil to keep in such manner and to preserve for such period as may be prescribed such accounts and records in connection with his use of that marker as may be prescribed, and requiring the production of the accounts and records.

Modifications etc. (not altering text)

C10Sch. 4 paras. 12-16 modified by S.I. 2004/2065, reg. 3(1A)(b) (as inserted (1.4.2008) by The Hydrocarbon Oil, Biofuels and Other Fuel Substitutes (Determination of Composition of a Substance and Miscellaneous Amendments) Regulations 2008 (S.I. 2008/753), regs. 1(2), 8(2)(a))

C11Sch. 4 paras. 12-17 modified by S.I. 2004/2065, reg. 3(2A)(c) (as inserted (1.4.2008) by The Hydrocarbon Oil, Biofuels and Other Fuel Substitutes (Determination of Composition of a Substance and Miscellaneous Amendments) Regulations 2008 (S.I. 2008/753), regs. 1(2), 8(2)(d))

13U.K.Requiring, in such circumstances or subject to such exceptions as may be prescribed, that any drum, storage tank, delivery pump or other container or outlet which contains any oil in which a prescribed marker is present shall be marked in the prescribed manner to indicate that the oil is not to be used as road fuel or for any other prohibited purpose.

Modifications etc. (not altering text)

C12Sch. 4 paras. 12-16 modified by S.I. 2004/2065, reg. 3(1A)(b) (as inserted (1.4.2008) by The Hydrocarbon Oil, Biofuels and Other Fuel Substitutes (Determination of Composition of a Substance and Miscellaneous Amendments) Regulations 2008 (S.I. 2008/753), regs. 1(2), 8(2)(a))

C13Sch. 4 paras. 12-17 modified by S.I. 2004/2065, reg. 3(2A)(c) (as inserted (1.4.2008) by The Hydrocarbon Oil, Biofuels and Other Fuel Substitutes (Determination of Composition of a Substance and Miscellaneous Amendments) Regulations 2008 (S.I. 2008/753), regs. 1(2), 8(2)(d))

14U.K.Requiring any person who supplies oil in which a prescribed marker is present to deliver to the recipient a document containing a statement in the prescribed form to the effect that the oil is not to be used as road fuel or for any other prohibited purpose.

Modifications etc. (not altering text)

C14Sch. 4 paras. 12-16 modified by S.I. 2004/2065, reg. 3(1A)(b) (as inserted (1.4.2008) by The Hydrocarbon Oil, Biofuels and Other Fuel Substitutes (Determination of Composition of a Substance and Miscellaneous Amendments) Regulations 2008 (S.I. 2008/753), regs. 1(2), 8(2)(a))

C15Sch. 4 paras. 12-17 modified by S.I. 2004/2065, reg. 3(2A)(c) (as inserted (1.4.2008) by The Hydrocarbon Oil, Biofuels and Other Fuel Substitutes (Determination of Composition of a Substance and Miscellaneous Amendments) Regulations 2008 (S.I. 2008/753), regs. 1(2), 8(2)(d))

15U.K.Prohibiting the sale of any oil the colour of which would prevent any prescribed colouring substance from being readily visible if present in the oil.

Modifications etc. (not altering text)

C16Sch. 4 paras. 12-16 modified by S.I. 2004/2065, reg. 3(1A)(b) (as inserted (1.4.2008) by The Hydrocarbon Oil, Biofuels and Other Fuel Substitutes (Determination of Composition of a Substance and Miscellaneous Amendments) Regulations 2008 (S.I. 2008/753), regs. 1(2), 8(2)(a))

C17Sch. 4 paras. 12-17 modified by S.I. 2004/2065, reg. 3(2A)(c) (as inserted (1.4.2008) by The Hydrocarbon Oil, Biofuels and Other Fuel Substitutes (Determination of Composition of a Substance and Miscellaneous Amendments) Regulations 2008 (S.I. 2008/753), regs. 1(2), 8(2)(d))

16U.K.Prohibiting the importation of oil in which any prescribed marker, or any other substance which is calculated to impede the identification of a prescribed marker, is present.

Modifications etc. (not altering text)

C18Sch. 4 paras. 12-16 modified by S.I. 2004/2065, reg. 3(1A)(b) (as inserted (1.4.2008) by The Hydrocarbon Oil, Biofuels and Other Fuel Substitutes (Determination of Composition of a Substance and Miscellaneous Amendments) Regulations 2008 (S.I. 2008/753), regs. 1(2), 8(2)(a))

C19Sch. 4 paras. 12-17 modified by S.I. 2004/2065, reg. 3(2A)(c) (as inserted (1.4.2008) by The Hydrocarbon Oil, Biofuels and Other Fuel Substitutes (Determination of Composition of a Substance and Miscellaneous Amendments) Regulations 2008 (S.I. 2008/753), regs. 1(2), 8(2)(d))

As to control of storage, supply etc. of oil, entry of premises etc.U.K.

17U.K.Regulating the storage or movement of oil.

18U.K.Restricting the supplying of oil in respect of which rebate has been allowed and not repaid or on which excise duty has not been paid.

[F2418AU.K.Prohibiting the use of aviation gasoline otherwise than as a fuel for aircraft.]

Textual Amendments

F24Sch. 4 paras. 18A, 18B inserted by Finance Act 1982 (c. 39, SIF 40:1), s. 4(6)

F2518BU.K.Prohibiting the taking of aviation gasoline into fuel tanks for engines other than aircraft engines.

Textual Amendments

F25Sch. 4 paras. 18A,18B inserted by Finance Act 1982 (c. 39, SIF 40:1), s. 4(6)

19U.K.Requiring a person owning or possessing a road vehicle which is constructed or adapted to use heavy oil as fuel to keep such accounts and records in such manner as may be prescribed, and to preserve such books and documents relating to the supply of heavy oil to or by him, or the use of heavy oil by him, for such period as may be prescribed.

20U.K.Requiring the production of books or documents relating to the supply or use of oil or the use of any vehicle.

21U.K.Authorising the entry and inspection of premises (other than private dwelling-houses) and the examination of vehicles, and authorising, or requiring the giving of facilities for, the inspection of oil found on any premises entered or on or in any vehicle and the taking of samples of any oil inspected.

InterpretationU.K.

22U.K.In this Schedule—

“oil” means hydrocarbon oil;

“prescribed” means prescribed by regulations made under section 24 of this Act;

and section 12(3)(a) of this Act shall apply for the purposes of paragraph 19 above as it applies for the purposes of that section.

Section 24(5).

SCHEDULE 5U.K. SAMPLING

1U.K.The person taking a sample—

(a)if he takes it from a motor vehicle, shall if practicable do so in the presence of a person appearing to him to be the owner or person for the time being in charge of the vehicle;

(b)if he takes the sample on any premises but not from a motor vehicle, shall if practicable take it in the presence of a person appearing to him to be the occupier of the premises or for the time being in charge of the part of the premises from which it is taken.

2(1)The result of an analysis of a sample shall not be admissible—U.K.

(a)in criminal proceedings under the Customs and Excise Acts 1979; or

(b)on behalf of the Commissioners in any civil proceedings under those Acts,

unless the analysis was made by an authorised analyst and the requirements of paragraph 1 above (where applicable) and of the following provisions of this paragraph have been complied with.

(2)The person taking a sample must at the time have divided it into three parts (including the part to be analysed), marked and sealed or fastened up each part, and—

(a)delivered one part to the person in whose presence the sample was taken in accordance with paragraph 1 above, if he requires it; and

(b)retained one part for future comparison.

(3)Where it was not practicable to comply with the relevant requirements of paragraph 1 above, the person taking the sample must have served notice on the owner or person in charge of the vehicle or, as the case may be, the occupier of the premises informing him that the sample has been taken and that one part of it is available for delivery to him, if he requires it, at such time and place as may be specified in the notice.

3(1)Subject to sub-paragraph (2) below, in any such proceedings as are mentioned in paragraph 2(1) above a certificate purporting to be signed by an authorised analyst and certifying the presence of any substance in any such sample of oil as may be specified in the certificate shall be evidence, and in Scotland sufficient evidence, of the facts stated in it.U.K.

(2)Without prejudice to the admissibility of the evidence of the analyst (which shall be sufficient in Scotland as well as in England), such a certificate shall not be admissible as evidence—

(a)unless a copy of it has, not less than 7 days before the hearing, been served by the prosecutor or, in the case of civil proceedings, the Commissioners on all other parties to the proceedings; or

(b)if any of those other parties, not less than 3 days before the hearing or within such further time as the court may in special circumstances allow, serves notice on the prosecutor or, as the case may be, the Commissioners requiring the attendance at the hearing of the person by whom the analysis was made.

4(1)Any notice required or authorised to be given under this Schedule shall be in writing.U.K.

(2)Any such notice shall be deemed, unless the contrary is shown, to have been received by a person if it is shown to have been left for him at his last-known residence or place of business in the United Kingdom.

(3)Any such notice may be given by post, and the letter containing the notice may be sent to the last-known residence or place of business in the United Kingdom of the person to whom it is directed.

(4)Any such notice given to the secretary or clerk of a company or body of persons (incorporated or unincorporated) on behalf of the company or body shall be deemed to have been given to the company or body; and for the purpose of the foregoing provisions of this paragraph any such company or body of persons having an office in the United Kingdom shall be treated as resident at that office or, if it has more then one, at the registered or principal office.

(5)Where any such notice is to be given to any person as the occupier of any land, and it is not practicable after reasonable inquiry to ascertain—

(a)what is the name of any person being the occupier of the land; or

(b)whether or not there is a person being the occupier of the land,

the notice may be addressed to the person concerned by any sufficient description of the capacity in which it is given to him.

(6)In any case to which sub-paragraph (5) above applies, and in any other case where it is not practicable after reasonable inquiry to ascertain an address in the United Kingdom for the service of a notice to be given to a person as being the occupier of any land, the notice shall be deemed to have been received by the person concerned on being left for him on the land, either in the hands of a responsible person or conspicuously affixed to some building or object on the land.

(7)Sub-paragraphs (2) to (6) above shall not affect the validity of any notice duly given otherwise than in accordance with those sub-paragraphs.

5In this Schedule “authorised analyst” means—

(a)the Government Chemist or a person acting under his direction;

(b)the Government Chemist for Northern Ireland or a person acting under his direction;

(c)any chemist authorised by the Treasury to make analyses for the purposes of this Schedule; or

(d)any other person appointed as a public analyst or deputy public analyst under—

[F26section 27 of the Food Safety Act 1990], or

[F27Article 36 of the Food (Northern Ireland) Order 1989].

Textual Amendments

F26Words substituted (E.W.S.) by virtue of Food Safety Act 1990 (c. 16, SIF 53:1, 2), s. 59(1), Sch. 3 para. 22

F27Words substituted by S.I. 1989/846 (N.I. 6), art. 76(1), Sch. 3 para. 15

6U.K.References in this Schedule to the taking of a sample or to a sample shall be construed respectively as references to the taking of a sample in pursuance of regulations under section [F2820AA or] 24 of this Act and to a sample so taken.

Textual Amendments

F28Words inserted by Finance Act 1989 (c. 26, SIF 40:1), s. 2(2)

7U.K.This Schedule shall have effect in its application to a vehicle of which a person other than the owner is, or is for the time being, entitled to possession as if for references to the owner there were substituted references to the person entitled to possession.

Section 28(1).

SCHEDULE 6U.K. CONSEQUENTIAL AMENDMENTS

Finance Act 1965 and Finance Act (Northern Ireland) Act 1965U.K.

1U.K.In section 92(2) of the M3Finance Act 1965 and section 14(2) of the M4Finance Act (Northern Ireland) Act 1966 (grants towards duty on bus fuel) for the words “hydrocarbon oil” there shall be substituted the words “ heavy oil ”.

Modifications etc. (not altering text)

C20The text of s. 28(1)(2)(5), Sch. 6 paras. 1, 2 and 6, and Sch. 7 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

Marginal Citations

Transport Act 1968U.K.

2In section 69 of the M5Transport Act 1968 (revocation etc. of operators’ licences), in subsection (4)(e), after the words “section 200 of the Customs and Excise Act 1952” there shall be inserted the words “section 11 of the Hydrocarbon Oil (Customs & Excise) Act 1971 or section 13 of the Hydrocarbon Oil Duties Act 1979”.

Modifications etc. (not altering text)

C21The text of s. 28(1)(2)(5), Sch. 6 paras. 1, 2 and 6, and Sch. 7 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

Marginal Citations

3, 4, 5.U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F29

Textual Amendments

F29Sch. 6 paras. 3, 4, 5 and 7 repealed by Value Added Tax Act 1983 (c. 55, SIF 40:2), s. 50(2), Sch. 11

Excise Duties (Gas as Road Fuel) Order 1972U.K.

6U.K.In Article 3 of the M6Excise Duties (Gas as Road Fuel) Order 1972 for the words “hydrocarbon oil” there shall be substituted the words “ light oil ”.

Modifications etc. (not altering text)

C22The text of s. 28(1)(2)(5), Sch. 6 paras. 1, 2 and 6, and Sch. 7 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

Marginal Citations

7U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F30

Textual Amendments

F30Sch. 6 paras. 3, 4, 5 and 7 repealed by Value Added Tax Act 1983 (c. 55, SIF 40:2), s. 50(2), Sch. 11

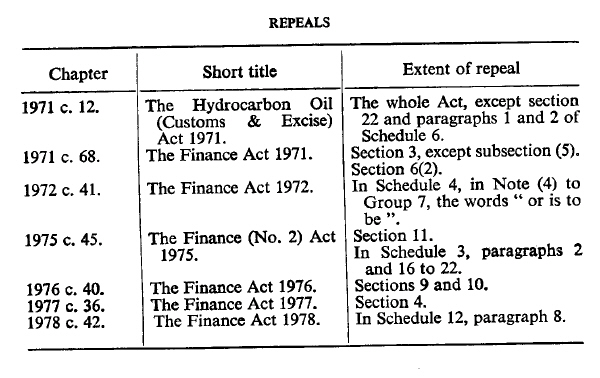

Section 28(2)

SCHEDULE 7U.K. REPEALS

Modifications etc. (not altering text)

C23The text of s. 28(1)(2)(5), Sch. 6 paras. 1, 2 and 6, and Sch. 7 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

Options/Help

Print Options

PrintThe Whole Act

PrintThe Schedules only

Legislation is available in different versions:

Latest Available (revised):The latest available updated version of the legislation incorporating changes made by subsequent legislation and applied by our editorial team. Changes we have not yet applied to the text, can be found in the ‘Changes to Legislation’ area.

Original (As Enacted or Made): The original version of the legislation as it stood when it was enacted or made. No changes have been applied to the text.

Point in Time: This becomes available after navigating to view revised legislation as it stood at a certain point in time via Advanced Features > Show Timeline of Changes or via a point in time advanced search.

See additional information alongside the content

Geographical Extent: Indicates the geographical area that this provision applies to. For further information see ‘Frequently Asked Questions’.

Show Timeline of Changes: See how this legislation has or could change over time. Turning this feature on will show extra navigation options to go to these specific points in time. Return to the latest available version by using the controls above in the What Version box.

More Resources

Access essential accompanying documents and information for this legislation item from this tab. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as enacted version that was used for the print copy

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- correction slips

- links to related legislation and further information resources

Timeline of Changes

This timeline shows the different points in time where a change occurred. The dates will coincide with the earliest date on which the change (e.g an insertion, a repeal or a substitution) that was applied came into force. The first date in the timeline will usually be the earliest date when the provision came into force. In some cases the first date is 01/02/1991 (or for Northern Ireland legislation 01/01/2006). This date is our basedate. No versions before this date are available. For further information see the Editorial Practice Guide and Glossary under Help.

More Resources

Use this menu to access essential accompanying documents and information for this legislation item. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as enacted version that was used for the print copy

- correction slips

Click 'View More' or select 'More Resources' tab for additional information including:

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- links to related legislation and further information resources