Tobacco Products Duty Act 1979

1979 CHAPTER 7

An Act to consolidate the enactments relating to the excise duty on tobacco products.

[22nd February 1979]

Modifications etc. (not altering text)

C1Act amended by Value Added Tax Act 1983 (c. 55, SIF 40:2), s. 24(1)(3) and Police and Criminal Evidence Act 1984 (c. 60, SIF 95), s. 114(1)

C2Act modified by S.I. 1990/2167, art. 5

C3Act modified by Alcoholic Liquor Duties Act 1979 (c. 4), Sch. 2A para. 3(5) (as inserted (22.2.2006) by Finance Act 2004 (c. 12), Sch. 1; S.I. 2006/201, art. 2)

C4Act applied (with modifications) (17.12.2020 for specified purposes, 31.12.2020 in so far as not already in force) by Taxation (Post-transition Period) Act 2020 (c. 26), ss. 5, 11(1)(e) (with Sch. 2 para. 7(7)-(9)); S.I. 2020/1642, reg. 9

C5Act applied (31.12.2020) by 1994 c. 23, s. 16(1) (as substituted by Taxation (Cross-border Trade) Act 2018 (c. 22), s. 57(3), Sch. 8 para. 13 (with Sch. 8 para. 99) (with savings and transitional provisions in S.I. 2019/105 (as amended by S.I. 2020/1495, regs. 1(2), 21), S.I. 2020/1545, Pt. 4 and 2020 c. 26, Sch. 2 para. 7(7)-(9)); S.I. 2020/1642, reg. 4(b) (with reg. 7))

Commencement Information

I1Act wholly in force at 1.4.1979 see s. 12(2)

1 Tobacco products.U.K.

(1)In this Act “tobacco products” means any of the following products, namely,—

(a)cigarettes;

(b)cigars;

(c)hand-rolling tobacco;

(d)other smoking tobacco; F1...

(e)chewing tobacco, [F2and

(f)tobacco for heating,]

which are manufactured wholly or partly from tobacco or any substance used as a substitute for tobaccoF3....

[F4(1A)But a product is not a tobacco product for the purposes of this Act if—

(a)the product does not contain any tobacco, and

(b)the Commissioners are satisfied that—

(i)the product is of a description that is used for medical purposes, and

(ii)the product is intended to be used exclusively for such purposes.]

F5(2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F5(2A). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(3)The Treasury may by order made by statutory instrument provide that in this Act references to cigarettes, cigars, hand-rolling tobacco, other smoking tobacco[F6, chewing tobacco and tobacco for heating] shall or shall not include references to any product of a description specified in the order, being a product manufactured as mentioned in subsection (1) above F7... ; and any such order may amend or repeal subsection (2) [F8or (2A)] above.

(4)Subject to subsection (5) below, a statutory instrument by which there is made an order under subsection (3) above shall be laid before the House of Commons after being made; and unless the order is approved by that House before the expiration of 28 days beginning with the date on which it was made, it shall cease to have effect on the expiration of that period, but without prejudice to anything previously done under it or to the making of a new order.

In reckoning any such period no account shall be taken of any time during which Parliament is dissolved or prorogued or during which the House of Commons is adjourned for more than 4 days.

(5)Subsection (4) above shall not apply to any order containing a statement by the Treasury that the order does not extend the incidence of the duty or involve a greater charge to duty or a reduction of any relief; and a statutory instrument by which any such order is made shall be subject to annulment in pursuance of a resolution of the House of Commons.

F9(6). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F1Word in s. 1(1)(d) omitted (1.7.2019) by virtue of Finance Act 2019 (c. 1), s. 57(2)(a)(7); S.I. 2019/981, reg. 2

F2S. 1(1)(f) and word inserted (1.7.2019) by Finance Act 2019 (c. 1), s. 57(2)(b)(7); S.I. 2019/981, reg. 2

F3Words in s. 1(1) omitted (1.1.2014) by virtue of Finance Act 2013 (c. 29), s. 182(2)(6)

F4S. 1(1A) inserted (1.1.2014) by Finance Act 2013 (c. 29), s. 182(3)(6)

F5S. 1(2)(2A) repealed (1.8.2003) by Tobacco Products (Descriptions of Products) Order 2003 (S.I. 2003/1471), arts. 1, 3

F6Words in s. 1(3) substituted (12.2.2019) by Finance Act 2019 (c. 1), s. 57(3)

F7Words in s. 1(3) omitted (1.1.2014) by virtue of Finance Act 2013 (c. 29), s. 182(4)(6)

F8Words in s. 1(3) inserted (27.7.1993) by 1993 s. 14(5)

F9S. 1(6) omitted (1.1.2014) by virtue of Finance Act 2013 (c. 29), s. 182(5)(6)

2 Charge and remission or repayment of tobacco products duty.U.K.

(1)There shall be charged on tobacco products imported into or manufactured in the United Kingdom a duty of excise at the rates shown, . . . F10, in the Table in Schedule 1 to this Act.

(2)Subject to such conditions as they see fit to impose, the Commissioners shall remit or repay the duty charged by this section where it is shown to their satisfaction [F11that —

(a)the products in question have been—

(i)exported or shipped as stores, or

(ii)used solely for the purposes of research or experiment; and

(b)any fiscal marks carried by the products have been obliterated;]

and the Commissioners may by regulations provide for the remission or repayment of the duty in such other cases as may be specified in the regulations and subject to such conditions as they see fit to impose.

Textual Amendments

F10Words repealed by Finance Act 1981 (c. 35, SIF 40:1), s. 139(6), Sch. 19 Pt. III

F11Words and paras. (a) and (b) in s. 2(2) substituted (28.7.2000) by 2000 c. 17, s. 15(2)

Modifications etc. (not altering text)

C6S. 2 modified (17.12.2020 for specified purposes, 31.12.2020 in so far as not already in force) by Taxation (Post-transition Period) Act 2020 (c. 26), ss. 4(1)(2)(o), 11(1)(e) (with Sch. 2 para. 7(7)-(9)); S.I. 2020/1642, reg. 9

C7S. 2(2) excluded (20.10.1995) by S.I. 1995/2518, reg. 118(f)

3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F12U.K.

Textual Amendments

F12S. 3 repealed by Finance Act 1981 (c. 35, SIF 40:1), s. 139(6), Sch. 19 Pt. III

4 Calculation of duty in case of cigarettes more than [F138 cm.] long.U.K.

For the purposes of the references to a thousand cigarettes in paragraph 1 in the Table in Schedule 1 to this Act . . . F14 any cigarette more [F15than 8 cm.] long (excluding any filter or mouthpiece) shall be treated as if [F16the first 8 cm. of it, each 3 cm. portion of the remainder of it (if any) and the remaining portion of it (if any)] were a separate cigarette.

Textual Amendments

F13Words in s. 4 heading substituted (1.1.2011) by Finance (No. 3) Act 2010 (c. 33), s. 23(1)(2)

F14Words repealed by Finance Act 1981 (c. 35, SIF 40:1), s. 139(6), Sch. 19 Pt. III

F15Words in s. 4 substituted (1.1.2011) by Finance (No. 3) Act 2010 (c. 33), s. 23(1)(a)(2)

F16Words in s. 4 substituted (1.1.2011) by Finance (No. 3) Act 2010 (c. 33), s. 23(1)(b)(2)

5 Retail price of cigarettes.U.K.

(1)For the purposes of the duty chargeable at any time under section 2 above in respect of cigarettes of any description, the retail price of the cigarettes [F17shall be taken to be—

(a)the higher of—

(i)the recommended price for the sale by retail at that time in the United Kingdom of cigarettes of that description, and

(ii)any (or, if more than one, the highest) retail price shown at that time on the packaging of the cigarettes in question,

or

(b)if there is no such price recommended or shown, the highest price at which cigarettes of that description are normally sold by retail at that time in the United Kingdom.]

[F18(1A) In subsection (1) above “ recommended price ”—

(a)in relation to a case in which cigarettes of the applicable description are manufactured by a manufacturer in [F19the United Kingdom], means any price recommended by that manufacturer; and

(b)in relation to a case which does not fall within paragraph (a) above, means any price recommended by an importer of cigarettes of the applicable description.]

(2)The duty in respect of any number of cigarettes shall be charged by reference to the price which, in accordance with subsection (1) above, is applicable to cigarettes sold in packets of 20 or of such other number as the Commissioners may determine in relation to cigarettes of the description in question; and the whole of the price of a packet shall be regarded as referable to the cigarettes it contains notwithstanding that it also contains a coupon, token, card or other additional item.

(3)In any case in which duty is chargeable in accordance with [F20paragraph (b) of subsection (1)] above—

(a)the question as to what price is applicable under that paragraph shall, subject to subsection (4) below, be determined by the Commissioners; and

(b)the Commissioners may require security (by deposit of money or otherwise to their satisfaction) for the payment of duty to be given pending their determination.

(4)Any person who has paid duty in accordance with a determination of the Commissioners under subsection (3)(a) above and is dissatisfied with their determination may require the question of what price was applicable under [F21subsection (1)(b)] above to be referred to the arbitration of a referee appointed [F22in accordance with subsections (7) to (9).]

(5)If, on a reference to him under subsection (4) above, the referee determines that the price was lower than that determined by the Commissioners, they shall repay the duty overpaid together with interest on the overpaid duty from the date of the overpayment at such rate as the referee may determine.

(6)The procedure on any reference to a referee under subsection (4) above shall be such as may be determined by the referee; and the referee’s decision on any such reference shall be final and conclusive.

[F23(7)The Lord Chancellor is to appoint the referee.

(8)The appointment is to be made only with the concurrence of—

(a)the Lord Chief Justice of England and Wales, if the determination of the Commissioners was made in relation to England and Wales;

(b)the Lord President of the Court of Session, if the determination was made in relation to Scotland; or

(c)the Lord Chief Justice of Northern Ireland, if the determination was made in relation to Northern Ireland.

(9)None of the following may be appointed—

(a)an official of any government department;

(b)an office holder in, or a member of the staff of, the Scottish Administration.

(10)The Lord Chief Justice of England and Wales may nominate a judicial office holder (as defined in section 109(4) of the Constitutional Reform Act 2005) to exercise his functions under this section.

(11)The Lord President of the Court of Session may nominate a judge of the Court of Session who is a member of the First or Second Division of the Inner House of that Court to exercise his functions under this section.

(12)The Lord Chief Justice of Northern Ireland may nominate any of the following to exercise his functions under this section—

(a)the holder of one of the offices listed in Schedule 1 to the Justice (Northern Ireland) Act 2002;

(b)a Lord Justice of Appeal (as defined in section 88 of that Act).]

Textual Amendments

F17Words and paras. (a) and (b) in s. 5(1) substituted (28.7.2000) by 2000 c. 17, s. 13(2)

F18S. 5(1A) inserted (16.7.1992) by Finance (No.2) Act 1992 (c.48), s. 8 (b).

F19Words in s. 5(1A)(a) substituted (31.12.2020) by Taxation (Cross-border Trade) Act 2018 (c. 22), s. 57(3), Sch. 9 para. 7 (with savings and transitional provisions in 2020 c. 26, Sch. 2 para. 7(7)-(9)); S.I. 2020/1642, reg. 4(c)

F20Words in s. 5(3) substituted (28.7.2000) by 2000 c. 17, s. 13(3)

F21Words in s. 5(4) substituted (28.7.2000) by 2000 c. 17, s. 13(4)

F22Words in s. 5(4) inserted (3.4.2006) by Constitutional Reform Act 2005 (c. 4), s. 148(1), Sch. 4 para. 98(2); S.I. 2006/1014, art. 2(a), Sch. 1 para. 11(e)

F23S. 5(7)-(12) inserted (3.4.2006) by Constitutional Reform Act 2005 (c. 4), s. 148(1), Sch. 4 para. 98(3); S.I. 2006/1014, art. 2(a), Sch. 1 para. 11(e)

6 Alteration of rates of duty.U.K.

(1)The Treasury may by order made by statutory instrument increase or decrease any of the rates of duty for the time being in force under the Table in Schedule 1 to this Act by such percentage of the rate, not exceeding 10 per cent., as may be specified in the order, but any such order shall cease to be in force at the expiration of a period of one year from the date on which it takes effect unless continued in force by a further order made under this subsection.

(2)In relation to any order made under subsection (1) above to continue, vary or replace a previous order so made, the reference in that subsection to the rate for the time being in force is a reference to the rate that would be in force if no order under that subsection had been made.

(3)A statutory instrument under subsection (1) above by which there is made an order increasing the rate in force at the time of making the order shall be laid before the House of Commons after being made; and unless the order is approved by that House before the expiration of 28 days beginning with the date on which it was made, it shall cease to have effect on the expiration of that period, but without prejudice to anything previously done under it or to the making of a new order.

In reckoning any such period no account shall be taken of any time during which Parliament is dissolved or prorogued or during which the House of Commons is adjourned for more than 4 days.

(4)A statutory instrument made under subsection (1) above to which subsection (3) above does not apply shall be subject to annulment in pursuance of a resolution of the House of Commons.

(5)For the purposes of this section—

(a)the percentage and [F24each amount] per thousand cigarettes in paragraph 1 in the Table in Schedule 1 to this Act shall be treated as separate rates of duty; F25. . .

(b). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F25

Textual Amendments

F24Words in s. 6(5)(a) substituted (20.5.2017) by Finance Act 2017 (c. 10), s. 23(2)(4)

F25S. 6(5)(b) together with the word “and” immediately preceding it repealed by Finance Act 1981 (c. 35, SIF 40:1), s. 139(6), Sch. 19 Pt. III

[F266AAnti-forestalling notices in connection with anticipated alteration of rate of dutyU.K.

(1)If the Commissioners consider that an alteration to a rate of duty charged under section 2 on tobacco products may be made (whether under section 6 or otherwise), they may publish a notice under this section (an “anti-forestalling notice”).

(2)An anti-forestalling notice—

(a)must specify a period of up to 3 months (“the controlled period”),

(b)may impose such restrictions (“anti-forestalling restrictions”), as to the quantities of the tobacco products that may during the controlled period be removed for home use, as the Commissioners consider to be reasonable for the purpose of protecting the public revenue,

(c)may make provision for, and in connection with, the controlled period coming to an end early (including provision modifying an anti-forestalling restriction in such circumstances),

(d)may make provision for the removal of tobacco products for home use to be disregarded for the purposes of one or more anti-forestalling restrictions in certain circumstances, and

(e)may make different provision for different cases.

(3)The anti-forestalling restrictions that may be imposed include, in particular—

(a)restrictions as to the total quantity of the tobacco products, or of the tobacco products of a particular description, that may, during the controlled period, be removed for home use, and

(b)restrictions as to the quantity of the tobacco products, or the tobacco products of a particular description, that may be removed for home use during any month, or any period of two weeks, in the controlled period.

This is subject to subsections (4) and (5).

(4)An anti-forestalling notice may not restrict a person, during the controlled period, to removing for home use a total quantity of the tobacco products, or of the tobacco products of a particular description, that is less than 80% of—

where—

TPY is the total quantity of the tobacco products, or (as the case may be) of the tobacco products of a particular description, removed for home use by the person in the period of 12 months ending with the third month before the month in which the controlled period begins, and

DCP is the number of days in the controlled period.

(5)An anti-forestalling notice may not restrict a person, in any month of the controlled period, to removing for home use less than 30% of the total quantity of the tobacco products, or of the tobacco products of a particular description, that could, under the anti-forestalling restrictions imposed by the notice, be removed for home use during the whole controlled period.

(6)If, before the end of the controlled period, it appears to the Commissioners that the rate of duty—

(a)will not be altered during the controlled period, but

(b)may be altered within a month of the end of the controlled period,

the Commissioners may publish an extension notice.

(7)An extension notice may—

(a)extend the controlled period by up to one month, and

(b)in accordance with subsections (2) to (5), make such other modifications of the anti-forestalling notice as the Commissioners think appropriate in consequence of the extension.

(8)The Commissioners may vary or revoke an anti-forestalling notice—

(a)as it applies generally, or

(b)if the Commissioners consider that exceptional circumstances justify doing so, in relation to a particular person.

(9)This section does not affect the Commissioners' powers—

(a)under section 128 of the Customs and Excise Management Act 1979 (restriction of delivery of goods), or

(b)to make regulations under section 7 of this Act in relation to periods specified under that section of that Act.

Textual Amendments

F26Ss. 6A, 6B inserted (26.3.2015) by Finance Act 2015 (c. 11), s. 56

6BAnti-forestalling notices: sanctionsU.K.

(1)This section applies if a person fails to comply with an anti-forestalling notice published under section 6A by, on one or more occasions, removing tobacco products for home use during the controlled period in contravention of an anti-forestalling restriction.

(2)The failure to comply attracts a penalty under section 9 of the Finance Act 1994 (civil penalties) of an amount determined in accordance with subsection (3) (rather than that section).

(3)The person is liable to a penalty of—

(a)if the person has given an admission notice, 150% of the lost duty, and

(b)otherwise, 200% of the lost duty.

(4)An “admission notice” is a notice—

(a)in which the person admits that the person—

(i)has failed to comply with the anti-forestalling notice, and

(ii)is liable to a penalty determined in accordance with subsection (3), and

(b)that is in such form, and that provides such information, as the Commissioners may specify.

(5)An admission notice cannot be given if, at any time in the period of 3 years ending with the day before the controlled period, the person has given an admission notice in relation to a failure to comply with another anti-forestalling notice.

(6)An admission notice cannot be given—

(a)at a time when the person has reason to believe that Her Majesty's Revenue and Customs have discovered, or are about to discover, that the person has failed to comply with the anti-forestalling notice, or

(b)after the end of the controlled period.

(7)The “lost duty” is the amount (if any) by which the duty that would have been charged under section 2 on the excess tobacco products if they had, immediately after the end of the controlled period, been removed for home use exceeds the duty that was charged under that section on those tobacco products.

(8)The “excess tobacco products” are the tobacco products mentioned in subsection (1) that the person removed, for home use, in contravention of an anti-forestalling restriction.

(9)See section 6A for the meaning of “anti-forestalling notice”, “anti-forestalling restriction” and “controlled period”.]

Textual Amendments

F26Ss. 6A, 6B inserted (26.3.2015) by Finance Act 2015 (c. 11), s. 56

7 Regulations for management of duty.U.K.

(1)The Commissioners may with a view to managing the duty charged by section 2 above make regulations—

(a)prescribing the method of charging the duty and for securing and collecting the duty;

[F27(aa)for charging the duty, in such circumstances as may be specified in the regulations, by reference to the weight of the tobacco products at a time specified in the regulations or by the Commissioners (whether the time at which the products become chargeable or that at which the duty becomes payable or any other time);]

(b)for the registration of premises for the safe storage of tobacco products and for requiring the deposit of tobacco products in, and regulating their [F28storage and]treatment in and removal from, premises so registered;

[F29(ba)for the registration of premises for the manufacture of tobacco products, for restricting or prohibiting the manufacture of tobacco products otherwise than in premises so registered and for regulating their storage and treatment in, and removal from, such premises;]

(c)for the registration of premises where—

F30(i). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(ii)materials for the manufacture of tobacco products are grown, produced, stored or treated; or

(iii)refuse from the manufacture of tobacco products is stored or treated,

and for regulating the storage and treatment in, and removal from, premises so registered of such materials and refuse;

(d)for requiring the keeping and preservation of such records, [F31the notification of such information, and the making of such returns, as may be specified in the regulations or required by the Commissioners]; and

(e)for the inspection of goods, documents and premises.

[F32(1A)Regulations under subsection (1) above may, in particular, include provision—

(a)imposing, or providing for the imposition under the regulations of, conditions and restrictions relating to any of the matters mentioned in that subsection;

(b)enabling the Commissioners to dispense with compliance with any provision contained in the regulations in such circumstances and subject to such conditions (if any) as they may determine.]

(2)If any person fails to comply with any regulation made under subsection (1) above [F33his failure to comply shall attract a penalty under section 9 of the Finance Act 1994 (civil penalities), and any article in respect of which any person fails to comply with any such regulation, or which is found on premises in respect of which any person has failed to comply with any such regulation, shall be liable to forfeiture]

Textual Amendments

F27S. 7(1)(aa) inserted (28.7.2000) by 2000 c. 17, s. 15(4)

F28Words in s. 7(1)(b) inserted (28.7.2000) by 2000 c. 17, s. 15(5)

F29S. 7(1)(ba) inserted (28.7.2000) by 2000 c. 17, s. 15(6)

F30S. 7(1)(c)(i) repealed (28.7.2000) by 2000 c. 17, ss. 15(7), 156, Sch. 40 Pt. I(2)

F31Words in s. 7(1)(d) substituted (28.7.2000) by 2000 c. 17, s. 15(8)

F32S. 7(1A) inserted (28.7.2000) by 2000 c. 17, s. 15(9)

F33Words substituted (1.1.1995) by virtue of 1994 c. 9, s. 9, Sch. 4 para. 59 (with s. 19); S.I. 1994/2679, art. 3

Modifications etc. (not altering text)

C8S. 7(2) applied (1.12.2002) by The Channel Tunnel (Alcoholic Liquor and Tobacco Products) Order 2000 (S.I. 2000/426), art. 5A (as inserted by The Channel Tunnel (Alcoholic Liquor and Tobacco Products) (Amendment) Order 2002 (S.I. 2002/2693), art. 7)

C9S. 7(2) applied (24.11.2003) by Channel Tunnel (Alcoholic Liquor and Tobacco Products) Order 2003 (S.I. 2003/2758), arts. 1, 4(c)

[F347ADuty not to facilitate smugglingU.K.

(1)A manufacturer of cigarettes or hand-rolling tobacco shall so far as is reasonably practicable avoid—

(a)supplying cigarettes or hand-rolling tobacco to persons who are likely to smuggle them into the United Kingdom,

(b)supplying cigarettes or hand-rolling tobacco where the nature or circumstances of the supply makes it likely that they will be resupplied to persons who are likely to smuggle them into the United Kingdom, or

(c)otherwise facilitating the smuggling into the United Kingdom of cigarettes or hand-rolling tobacco.

(2)In particular, a manufacturer—

(a)in supplying cigarettes or hand-rolling tobacco to persons carrying on business in or in relation to a country other than the United Kingdom, shall consider whether the size or nature of the supply suggests that the products may be required for smuggling into the United Kingdom,

(b)shall maintain a written policy about steps to be taken for the purpose of complying with the duty under subsection (1), and

(c)shall provide a copy of the policy to the Commissioners on request.

(3)In this section a reference to smuggling products into the United Kingdom is a reference to importing them into the United Kingdom without payment of duty which is—

(a)chargeable under section 2, and

(b)payable by virtue of section 1(1) of the Finance (No. 2) Act 1992 (c. 48) (power to fix excise duty point).

(4)The Commissioners may notify a manufacturer in writing that they think the risk of smuggling into the United Kingdom is particularly great in relation to—

(a)products marketed under a specified brand name;

(b)products supplied to persons carrying on business in or in relation to a specified country or place.

(5)The Commissioners may by notice in writing require a manufacturer of cigarettes or hand-rolling tobacco to provide, within a specified period of time, specified information about—

(a)supply of products marketed under a brand name specified under subsection (4)(a);

(b)supply to persons carrying on business in or in relation to a country or place specified under subsection (4)(b);

(c)demand for cigarettes or hand-rolling tobacco in a country or place specified under subsection (4)(b).

(6)The Commissioners may issue guidance about the content of policies under subsection (2)(b).

(7)The Commissioners may make regulations—

(a)under which they are required to notify manufacturers of cigarettes or hand-rolling tobacco where products of a kind specified in the regulations are seized under section 139 of the Customs and Excise Management Act 1979 (c. 2) in circumstances specified in the regulations,

(b)specifying the procedure for notification,

(c)including provision about access to seized products for the purpose of determining who manufactured them, and

(d)requiring manufacturers to provide the Commissioners with information or documents, of a kind specified in the regulations or determined by the Commissioners, in relation to notified seizures.

Textual Amendments

F34Ss. 7A-7D inserted (1.10.2006) by Finance Act 2006 (c. 25), s. 2(1)(3); S.I. 2006/2367, art. 2

7BPenalty for facilitating smuggling: initial noticeU.K.

(1)Where the Commissioners think that a manufacturer has without reasonable excuse failed to comply with the duty under section 7A(1) they may give him written notice that they are considering requiring him to pay a penalty.

(2)In determining whether to give notice to a manufacturer under subsection (1) the Commissioners shall have regard to—

(a)the content of the manufacturer's policy under section 7A(2)(b),

(b)compliance with that policy,

(c)action taken pursuant to any notice under section 7A(4),

(d)compliance by the manufacturer with any notice under section 7A(5),

(e)the number, size and nature of seizures of which the manufacturer has been given notice by virtue of section 7A(7)(a),

(f)compliance by the manufacturer with any requirement by virtue of section 7A(7)(d),

(g)evidence about the level of demand for the manufacturer's products for consumption outside the United Kingdom, and

(h)any other matter that they think relevant.

(3)A notice must specify the matters to which the Commissioners have had regard in determining to give it.

(4)After the end of the period of six months beginning with the date on which a notice is given to a manufacturer, the Commissioners shall give him notice in writing either—

(a)that they require payment of a penalty, or

(b)that they do not require payment of a penalty.

(5)The Commissioners shall comply with subsection (4) during the period of 45 days beginning with the end of the period specified in that subsection; and for that purpose they shall consider—

(a)any representations made by the manufacturer during that period in such form and manner as the Commissioners may direct, and

(b)action taken by the manufacturer during that period.

Textual Amendments

F34Ss. 7A-7D inserted (1.10.2006) by Finance Act 2006 (c. 25), s. 2(1)(3); S.I. 2006/2367, art. 2

7CPenalty for facilitating evasion: penalty noticeU.K.

(1)A notice under section 7B(4)(a) (a “penalty notice”) must—

(a)specify the amount of the penalty which the manufacturer is required to pay, and

(b)state the grounds on which the Commissioners think that the manufacturer has failed to comply with the duty under section 7A(1).

(2)The amount specified under subsection (1)(a) must not exceed £5 million; and in determining the amount to specify the Commissioners shall have regard to—

(a)the nature or extent of the manufacturer's failure to comply with the duty under section 7A(1),

(b)action taken by the manufacturer to secure compliance with that duty,

(c)the content of the manufacturer's policy under section 7A(2)(b),

(d)compliance with that policy,

(e)action taken pursuant to any notice under section 7A(4),

(f)compliance by the manufacturer with any notice under section 7A(5),

(g)the number, size and nature of seizures of which the manufacturer has been given notice by virtue of section 7A(7)(a),

(h) the loss of revenue by way of duty under section 2, or VAT , in respect of the products seized, and

(i)any other matter that they think relevant.

[F35(3)Sections 13A to 16 of the Finance Act 1994 apply to a decision to issue a penalty notice as they apply to the decisions mentioned in section 13A(2)(a) to (h) of that Act.]

Textual Amendments

F34Ss. 7A-7D inserted (1.10.2006) by Finance Act 2006 (c. 25), s. 2(1)(3); S.I. 2006/2367, art. 2

F35S. 7C(3) substituted for s. 7C(3)-(5) (1.4.2009) by The Transfer of Tribunal Functions and Revenue and Customs Appeals Order 2009 (S.I. 2009/56), art. 1(2), Sch. 1 para. 93(2)

7DSections 7A to 7C: supplementalU.K.

(1)Payment of a penalty imposed under section 7B(4)(a) shall not be allowed as a deduction in computing income, profits or losses for purposes of income tax or corporation tax.

(2)A penalty may be enforced as a debt due to the Commissioners.

(3)In sections 7A to 7C and this section a reference to a manufacturer of cigarettes or hand-rolling tobacco includes a reference to a person who, in the opinion of the Commissioners—

(a)arranges to have cigarettes or hand-rolling tobacco manufactured, and

(b)is wholly or partly responsible for the initial supply of the products after manufacture.

(4)Where a manufacturer is a parent undertaking or a subsidiary undertaking (within the meaning of [F36section 1162 of the Companies Act 2006]) the Commissioners may—

(a)treat the parent and its subsidiaries as a single undertaking for the purpose of sections 7A to 7C and this section, and

(b)in particular, enforce a penalty imposed on the single undertaking as a debt owed by—

(i)the single undertaking,

(ii)the parent, or

(iii)any of the subsidiaries.

(5)A notice or guidance under section 7A(4) to (6)—

(a)may be issued to manufacturers generally or to one or more manufacturers or classes of manufacturer,

(b)may be expressed to apply to or in respect of manufacturers generally or only to or in respect of one or more specified manufacturers or classes of manufacturer,

(c)may make provision generally or only in relation to specified cases or circumstances,

(d)may make different provision in relation to different cases or circumstances, and

(e)may be varied, replaced or revoked.

(6)The Treasury may by order—

(a)amend the list in section 7B(2) or 7C(2) so as to—

(i)add an entry,

(ii)remove an entry, or

(iii)amend an entry;

(b)amend sections 7A to 7C and this section so as to alter the class of tobacco products in relation to which they apply.

(7)An order under subsection (6)—

(a)may include transitional, consequential or incidental provision,

(b)shall be made by statutory instrument,

(c)shall be laid before the House of Commons, and

(d)shall cease to have effect unless approved by resolution of the House of Commons within the period of 28 days beginning with the date on which it is laid (disregarding any period of dissolution or prorogation or of adjournment for more than four days).]

Textual Amendments

F34Ss. 7A-7D inserted (1.10.2006) by Finance Act 2006 (c. 25), s. 2(1)(3); S.I. 2006/2367, art. 2

F36Words in s. 7D(4) substituted (6.4.2008) by Companies Act 2006 (Consequential Amendments) (Taxes and National Insurance) Order 2008 (S.I. 2008/954), arts. 1(1), 5 (with art. 4)

8 Charge in cases of default.U.K.

(1)Where the records or returns kept or made by any person in pursuance of regulations under section 2 or 7 above show that any tobacco products or materials for their manufacture are or have been in his possession or under his control, the Commissioners may from time to time require him to account for those products or materials.

(2)Unless a person required under subsection (1) above to account for any products or materials proves—

(a)that duty has been paid or secured under section 7 above in respect of the products or, as the case may be, products manufactured from the materials; or

(b)that the products or materials are being or have been otherwise dealt with in accordance with regulations under section 2 or 7 above,

the Commissioners may [F37assess an amount as duty due from him] under section 2 above in respect of those products or, as the case may be, in respect of such products as in their opinion might reasonably be expected to be manufactured from those materials [F38, and they may notify him or his representative accordingly].

F39(3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F37Words in s. 8(2) substituted (1.10.1998) by 1998 c. 36, s. 20, Sch. 2 para. 5(a); S.I. 1998/2243, art. 2(1)

F38Words in s. 8(2) substituted (1.10.1998) by 1998 c. 36, s. 20, Sch. 2 para. 5(b); S.I. 1998/2243, art. 2(1)

[F408A Fiscal marks: introductory.U.K.

Fiscal marking applies to tobacco products that are—

(a)cigarettes, or

(b)hand-rolling tobacco.]

Textual Amendments

F40Ss. 8A-8J inserted (28.7.2000) by 2000 c. 17, s. 14

[F418B Power to alter range of products to which fiscal marking applies.U.K.

(1)The Commissioners may by order made by statutory instrument amend section 8A above for the purpose of causing fiscal marking—

(a)to apply to any description of tobacco products to which it does not apply, or

(b)to cease to apply to any description of tobacco products to which it does apply.

(2)Where fiscal marking applies to any description of tobacco products, the Commissioners may by regulations provide that fiscal marking does not apply to such products of that description as are of a description specified in the regulations.

(3)A statutory instrument containing (whether alone or with other provisions) an order under subsection (1)(a) above shall not be made unless a draft of the instrument has been laid before, and approved by a resolution of, each House of Parliament.

(4)A statutory instrument that—

(a)contains (whether alone or with other provisions) an order under subsection (1) above, and

(b)is not subject to any requirement that a draft of the instrument be laid before and approved by a resolution of each House of Parliament,

shall be subject to annulment in pursuance of a resolution of either House of Parliament.]

Textual Amendments

F41Ss. 8A-8J inserted (28.7.2000) by 2000 c. 17, s. 14

[F428C Fiscal mark regulations.U.K.

(1)The Commissioners may make provision by regulations—

(a)requiring the carrying of fiscal marks by tobacco products to which fiscal marking applies, and

(b)as to such matters relating to fiscal marks as appear to the Commissioners to be necessary or expedient.

(2) In this Act “ fiscal mark ” means a mark carried by tobacco products indicating all or any of the following—

(a)that excise duty has been paid on the products;

(b)the rate at which excise duty was paid on the products;

(c)the amount of excise duty paid on the products;

(d)when excise duty was paid on the products;

(e)that sale of the products—

(i)is only permissible on dates ascertainable from the mark;

(ii)is not permissible after (or on or after) a date so ascertainable;

(iii)is not permissible before (or before or on) a date so ascertainable.

(3)Regulations under this section may, in particular, make provision about—

(a)the contents of a fiscal mark;

(b)the appearance of a fiscal mark;

(c)in the case of tobacco products that have more than one layer of packaging, which of the layers is (or are) to carry a fiscal mark;

(d)the positioning of a fiscal mark on the packaging of any tobacco products;

(e)when tobacco products are required to carry a fiscal mark.

(4)Regulations under this section may make different provision for different cases.]

Textual Amendments

F42Ss. 8A-8J inserted (28.7.2000) by 2000 c. 17, s. 14

[F438D Fiscal marks: public notices.U.K.

(1)The Commissioners may by notices published by them regulate any of the matters mentioned in paragraphs (a) to (d) of section 8C(3) above.

(2)A notice under this section may provide for provision made by regulations under section 8C above to have effect subject to provisions of the notice.

(3)A notice under this section may make different provision for different cases.]

Textual Amendments

F43Ss. 8A-8J inserted (28.7.2000) by 2000 c. 17, s. 14

[F448E Failure to comply with fiscal mark regulations and public notices.U.K.

(1)This section applies if a person fails to comply with any requirement imposed by or under—

(a)regulations made under section 8C above, or

(b)a notice published under section 8D above.

(2)Any article in respect of which the person fails to comply with the requirement shall be liable to forfeiture.

(3)The person’s failure to comply shall attract a penalty under section 9 of the M1Finance Act 1994 (civil penalties).

(4)The Commissioners may by regulations make such provision as is mentioned in subsection (5) below about the calculation of the penalty in a case where the failure involves post-dating of any tobacco products.

For this purpose “ post-dating ” means that the products carry a fiscal mark (“ the later period mark ”) that—

(a)is not one they are required to carry by virtue of this Act, and

(b)is one they would be required to carry by virtue of this Act if the requirement to pay the duty charged on them under section 2 above took effect at a time later than that at which it in fact takes effect.

(5)The provision that may be made by regulations under subsection (4) above is for the penalty to be calculated by reference to the duty currently charged on the products.

For this purpose “the duty currently charged” on the products is the amount of the duty charged under section 2 above that would be payable on the products if the requirement to pay the duty took effect at the time of the failure.]

[F458F Sale of marked tobacco when not permitted: penalties.U.K.

(1)This section applies if provision made by or under—

(a)regulations made under section 8C above, or

(b)a notice published under section 8D above,

provides for any tobacco products to carry a period of sale mark.

(2)In this section—

“ a period of sale mark ” means a fiscal mark indicating any of the matters mentioned in subsection (2)(e) of section 8C above; and

“ prohibited time ”, in relation to tobacco products that carry a period of sale mark, means a time when, according to the mark, sale of the products is not permissible.

(3)If—

(a)a person sells by way of retail sale, or exposes for retail sale, any tobacco products that carry a period of sale mark, and

(b)he so sells or exposes the products at a prohibited time,

his so selling or exposing the products shall attract a penalty under section 9 of the M2Finance Act 1994 (civil penalties) and the products are liable to forfeiture.]

[F468G Offences: possession and sale etc. of unmarked tobacco.U.K.

(1)In this section “unmarked products” means tobacco products that are subject to fiscal marking but do not carry a compliant duty-paid fiscal mark.

(2) For the purposes of this section “ duty-paid fiscal mark ” means a fiscal mark carried by tobacco products indicating that excise duty has been paid on the products.

(3) For the purposes of this section a duty-paid fiscal mark carried by tobacco products of any description is “ compliant ” if it complies with all relevant requirements for any duty-paid fiscal mark that by virtue of this Act is required to be carried by such tobacco products of that description as are by virtue of this Act required to carry such a mark.

For this purpose “ relevant requirement ” means a requirement, imposed by virtue of this Act, as to any of the matters mentioned in paragraphs (a) to (d) of section 8C(3) above (contents, appearance and positioning etc. of fiscal marks).

(4)If a person—

(a)is in possession of, transports or displays, or

(b)sells, offers for sale or otherwise deals in,

unmarked products then, except in such cases as may be prescribed in regulations made by the Commissioners, that person commits an offence and the products are liable to forfeiture.

(5)It is a defence for a person charged with an offence under subsection (4) above to prove that the unmarked products were not required by virtue of this Act to carry a duty paid fiscal mark.

(6)A person guilty of an offence under subsection (4) above shall be liable on summary conviction to a fine not exceeding level 5 on the standard scale.]

Textual Amendments

F46Ss. 8A-8J inserted (28.7.2000) by 2000 c. 17, s. 14

[F478H Offences: use of premises for sale of unmarked tobacco.U.K.

(1)A manager of premises commits an offence if he suffers the premises to be used for the sale of unmarked products.

In this section “ unmarked products ” has the same meaning as in section 8G above.

(2)It is a defence for a person charged with an offence under subsection (1) above to prove that the unmarked products were not required by virtue of this Act to carry a duty-paid fiscal mark.

For this purpose “ duty-paid fiscal mark ” has the same meaning as in section 8G above.

(3)A person guilty of an offence under subsection (1) above shall be liable on summary conviction to a fine not exceeding level 5 on the standard scale.

(4)A court by or before which a person is convicted of an offence under subsection (1) above may make an order prohibiting the use of the premises in question for the sale of tobacco products during a period specified in the order.

(5)The period specified in an order under subsection (4) above shall not exceed six months; and the first day of the period shall be the day specified as such in the order.

(6)A manager of premises commits an offence if he suffers the premises to be used in breach of an order under subsection (4) above.

(7)A person guilty of an offence under subsection (6) above shall be liable on summary conviction to a fine not exceeding level 5 on the standard scale.

(8)For the purposes of this section a person is a manager of premises if he—

(a)is entitled to control their use,

(b)is entrusted with their management, or

(c)is in charge of them.]

Textual Amendments

F47Ss. 8A-8J inserted (28.7.2000) by 2000 c. 17, s. 14

[F488J Interfering with fiscal marks: penalties.U.K.

(1)This section applies where a person—

(a)alters or overprints any fiscal mark carried by any tobacco products in compliance with any provision made under this Act, or

(b)causes any such mark to be altered or overprinted.

(2)His altering or overprinting of the mark, or his causing it to be altered or overprinted, shall attract a penalty under section 9 of the M3Finance Act 1994 (civil penalties).

(3)The products that carried the mark shall be liable to forfeiture.

(4)The penalty under subsection (2) above shall be calculated by reference to the duty currently charged on the products.

For this purpose “the duty currently charged” on the products is the amount of the duty charged under section 2 above that would be payable on the products if the requirement to pay the duty took effect at the time of the conduct attracting the penalty.]

[F498KRaw tobacco: definitionsU.K.

(1)The following definitions apply for the purposes of sections 8L to 8U.

(2)“Raw tobacco” means the leaves or any other part of a plant of the genus Nicotiana but does not include—

(a)any part of a living plant, or

(b)a tobacco product.

(3)“Controlled activity” means any activity involving raw tobacco.

Textual Amendments

F49Ss. 8K-8U inserted (6.12.2016 except for the insertion of s. 8L(1), 1.4.2017 in so far as not already in force) by Finance Act 2016 (c. 24), s. 179(1)(5); S.I. 2016/1171, reg. 2(2)(3)

8LRaw tobacco: requirement for approvalU.K.

(1)A person may not carry on a controlled activity otherwise than in accordance with an approval given by the Commissioners under this section.

(2)The Commissioners may approve a person to carry on a controlled activity only if satisfied that—

(a)the person is a fit and proper person to carry on the activity, and

(b)the activity will not be carried on for the purpose of, or with a view to, the fraudulent evasion of the duty of excise charged on tobacco products under section 2(1).

(3)An approval may—

(a)specify the period of approval, and

(b)be subject to conditions or restrictions.

(4)The Commissioners may at any time for reasonable cause revoke or vary the terms of an approval.

Textual Amendments

F49Ss. 8K-8U inserted (6.12.2016 except for the insertion of s. 8L(1), 1.4.2017 in so far as not already in force) by Finance Act 2016 (c. 24), s. 179(1)(5); S.I. 2016/1171, reg. 2(2)(3)

Modifications etc. (not altering text)

C10S. 8L(1) excluded (1.1.2017) by The Raw Tobacco (Approval Scheme) Regulations 2016 (S.I. 2016/1172), regs. 1(2), 18

C11S. 8L(1) excluded (1.1.2017) by The Raw Tobacco (Approval Scheme) Regulations 2016 (S.I. 2016/1172), regs. 1(2), 20(1), (2)

C12S. 8L(1) excluded (1.1.2017) by The Raw Tobacco (Approval Scheme) Regulations 2016 (S.I. 2016/1172), regs. 1(2), 17

C13S. 8L(1) excluded (1.1.2017) by The Raw Tobacco (Approval Scheme) Regulations 2016 (S.I. 2016/1172), regs. 1(2), 19

8MRegulations about approval etc.U.K.

The Commissioners may, by or under regulations, make provision—

(a)regulating the approval of persons under section 8L,

(b)about the form, manner and content of an application for approval,

(c)specifying conditions or restrictions to which an approval is subject,

(d)regulating the variation or revocation of an approval, or of any condition or restriction to which an approval is subject, and

(e)about the surrender or transfer of an approval.

Textual Amendments

F49Ss. 8K-8U inserted (6.12.2016 except for the insertion of s. 8L(1), 1.4.2017 in so far as not already in force) by Finance Act 2016 (c. 24), s. 179(1)(5); S.I. 2016/1171, reg. 2(2)(3)

8NExemptions from requirement for approvalU.K.

(1)The Commissioners may by regulations provide that section 8L(1) does not apply in relation to a person (an “exempt person”) who—

(a)carries on any controlled activity, or a controlled activity of a specified description, and

(b)meets the conditions (if any) specified by or under the regulations.

(2)The regulations may require an exempt person to comply with specified requirements or restrictions relating to the carrying on of a controlled activity.

(3)The regulations may, in particular—

(a)specify the maximum quantity of raw tobacco that may be involved in a controlled activity carried on by an exempt person;

(b)require an exempt person to keep records relating to the activity.

Textual Amendments

F49Ss. 8K-8U inserted (6.12.2016 except for the insertion of s. 8L(1), 1.4.2017 in so far as not already in force) by Finance Act 2016 (c. 24), s. 179(1)(5); S.I. 2016/1171, reg. 2(2)(3)

8ORaw tobacco: penaltiesU.K.

(1)A person who contravenes section 8L(1) is liable to a penalty of an amount equal to the amount of duty that would be charged on the relevant quantity of smoking tobacco.

(2)A person who contravenes a requirement or restriction imposed by regulations under section 8N is liable to a penalty of—

(a)£250, or

(b)if less, an amount equal to the amount of duty that would be charged on the relevant quantity of smoking tobacco.

(3)The relevant quantity of smoking tobacco is equal to the quantity by weight of the raw tobacco in respect of which the controlled activity contravening section 8L(1) or (as the case may be) regulations under section 8N has been carried on.

(4)In this section a reference to “smoking tobacco” is a reference to tobacco products within section 1(1)(d) (“other smoking tobacco”).

Textual Amendments

F49Ss. 8K-8U inserted (6.12.2016 except for the insertion of s. 8L(1), 1.4.2017 in so far as not already in force) by Finance Act 2016 (c. 24), s. 179(1)(5); S.I. 2016/1171, reg. 2(2)(3)

8PPenalties under section 8O: special reductionU.K.

(1)If the Commissioners think it right because of special circumstances, they may reduce a penalty under section 8O.

(2)In subsection (1) “special circumstances” does not include ability to pay.

(3)In subsection (1) the reference to reducing a penalty includes a reference to—

(a)staying a penalty, and

(b)agreeing a compromise in relation to proceedings for a penalty.

Textual Amendments

F49Ss. 8K-8U inserted (6.12.2016 except for the insertion of s. 8L(1), 1.4.2017 in so far as not already in force) by Finance Act 2016 (c. 24), s. 179(1)(5); S.I. 2016/1171, reg. 2(2)(3)

8QPenalties under section 8O: assessment of penaltyU.K.

(1)Where a person becomes liable for a penalty under section 8O—

(a)the Commissioners may assess the penalty, and

(b)if they do so, they must notify the person liable.

(2)A notice under subsection (1)(b) must state the contravention in respect of which the penalty is assessed.

(3)A penalty payable under section 8O must be paid before the end of the period of 30 days beginning with the day on which the notification of the penalty is issued.

(4)An assessment is to be treated as an amount of duty due from the person liable for the penalty and may be recovered accordingly.

(5)An assessment may not be made later than one year after evidence of facts sufficient in the opinion of the Commissioners to indicate the contravention comes to their knowledge.

(6)Two or more contraventions may be treated by the Commissioners as a single contravention for the purposes of assessing a penalty payable under section 8O.

Textual Amendments

F49Ss. 8K-8U inserted (6.12.2016 except for the insertion of s. 8L(1), 1.4.2017 in so far as not already in force) by Finance Act 2016 (c. 24), s. 179(1)(5); S.I. 2016/1171, reg. 2(2)(3)

8RPenalties under section 8O: reasonable excuseU.K.

(1)A person is not liable to a penalty under section 8O in respect of a contravention if—

(a)the contravention is not deliberate, and

(b)the person satisfies the Commissioners that there is a reasonable excuse for the contravention.

(2)For the purposes of subsection (1)(b)—

(a)where the person relies on another person to do anything, that is not a reasonable excuse unless the first person took reasonable care to avoid the contravention;

(b)where the person had a reasonable excuse for the relevant act or failure but the excuse has ceased, the person is to be treated as having continued to have the excuse if the contravention is remedied without unreasonable delay after the excuse has ceased.

Textual Amendments

F49Ss. 8K-8U inserted (6.12.2016 except for the insertion of s. 8L(1), 1.4.2017 in so far as not already in force) by Finance Act 2016 (c. 24), s. 179(1)(5); S.I. 2016/1171, reg. 2(2)(3)

8SPenalties under section 8O: double jeopardyU.K.

A person is not liable to a penalty under section 8O in respect of a contravention in respect of which the person has been convicted of an offence.

Textual Amendments

F49Ss. 8K-8U inserted (6.12.2016 except for the insertion of s. 8L(1), 1.4.2017 in so far as not already in force) by Finance Act 2016 (c. 24), s. 179(1)(5); S.I. 2016/1171, reg. 2(2)(3)

8TForfeiture of raw tobaccoU.K.

Where a person carries on a controlled activity in relation to raw tobacco in contravention of section 8L(1) or a requirement or restriction imposed by regulations under section 8N, the raw tobacco is liable to forfeiture.

Textual Amendments

F49Ss. 8K-8U inserted (6.12.2016 except for the insertion of s. 8L(1), 1.4.2017 in so far as not already in force) by Finance Act 2016 (c. 24), s. 179(1)(5); S.I. 2016/1171, reg. 2(2)(3)

8URaw tobacco: application of Customs and Excise Management Act 1979U.K.

The Commissioners may by regulations provide that specified provisions of the Customs and Excise Management Act 1979 apply (with or without modification)—

(a)in relation to persons who carry on controlled activities as they apply in relation to revenue traders whose trade or business relates to tobacco products, and

(b)in relation to raw tobacco as they apply in relation to tobacco products.]

Textual Amendments

F49Ss. 8K-8U inserted (6.12.2016 except for the insertion of s. 8L(1), 1.4.2017 in so far as not already in force) by Finance Act 2016 (c. 24), s. 179(1)(5); S.I. 2016/1171, reg. 2(2)(3)

[F508VTobacco products manufacturing machinery: licensing schemeU.K.

(1)In this section “tobacco products manufacturing machinery” means machinery that is designed primarily for use for the purpose of (or for purposes including) manufacturing tobacco products.

(2)The Commissioners may by regulations—

(a)prohibit a person from purchasing, acquiring, owning or being in possession of, or carrying out other specified activities in respect of, an item of tobacco products manufacturing machinery, except in accordance with a licence granted under the regulations;

(b)provide that if a person contravenes the prohibition in relation to an item of tobacco products manufacturing machinery, the machinery is liable to forfeiture.

(3)The regulations may provide that the prohibition does not apply—

(a)in relation to persons, or items of tobacco products manufacturing machinery, of a specified description;

(b)in specified circumstances.

(4)Regulations under this section may include provision—

(a)imposing obligations on licensed persons;

(b)for a licensed person who fails to comply with a condition or restriction of a licence, or with an obligation imposed by the regulations, to be liable to a penalty of the amount for the time being specified in section 9(2)(b) of the Finance Act 1994;

(c)for exceptions from liability to a penalty under the regulations;

(d)for the assessment and recovery of a penalty, including provision for two or more contraventions to be treated as a single contravention for the purposes of assessment;

(e)for the Commissioners, if they think it right because of special circumstances, to remit, reduce (including reduce to nil) or stay a penalty, or agree a compromise in relation to proceedings for a penalty;

(f)about reviews by the Commissioners, or by an officer of Revenue and Customs, of decisions in connection with licensing and the imposition of penalties under the regulations and about appeals against those decisions (which may include provision for specified decisions of the Commissioners to be treated as if they were listed in section 13A(2) of, or Schedule 5 to, the Finance Act 1994);

(g)for the Customs and Excise Management Act 1979 to have effect in relation to licensed persons as it has effect in relation to revenue traders, subject to such modifications as may be specified in the regulations.

(5)The Commissioners may, by or under regulations under this section, make provision—

(a)regulating the grant of licences, including provision about the circumstances in which a licence may be granted and the requirements to be met by or in relation to the applicant (which may include a requirement that the applicant is a fit and proper person to hold a licence);

(b)about the form, manner and content of an application for or in respect of a licence;

(c)for licences to be subject to specified conditions or restrictions;

(d)regulating the variation or revocation of a licence, or of any condition or restriction to which a licence is subject;

(e)about the renewal, surrender or transfer of a licence;

(f)for communications by or with the Commissioners in connection with a licence to be made electronically;

(g)as to the arrangements for licensing bodies corporate which are members of the same group (as defined in the regulations);

(h)for members of a group to be jointly and severally liable for any penalties imposed under the regulations.]

Textual Amendments

F50S. 8V inserted (16.11.2017) by Finance (No. 2) Act 2017 (c. 32), s. 47(1)

9 Regulations.U.K.

[F51(1)]Any power to make regulations under this Act shall be exercisable by statutory instrument and [F52, subject to subsection (1A),] any statutory instrument by which the power is exercised shall be subject to annulment in pursuance of a resolution of either House of Parliament.

[F53(1A)A statutory instrument containing regulations under section 8M, 8N [F54, 8U or 8V] is subject to annulment in pursuance of a resolution of the House of Commons.]

[F55(2)Regulations under this Act—

(a)may enable the Commissioners to dispense with compliance with a provision of the regulations (whether absolutely or conditionally),

(b)may make provision generally or only in relation to specified cases or circumstances,

(c)may make different provision in relation to different cases or circumstances, and

(d)may include transitional, consequential or incidental provision.]

Textual Amendments

F51S. 9(1): s. 9 renumbered as s. 9(1) (1.10.2006) by Finance Act 2006 (c. 25), s. 2(2)(3); S.I. 2006/2367, art. 2

F52Words in s. 9(1) inserted (6.12.2016) by Finance Act 2016 (c. 24), s. 179(2)(a)(5); S.I. 2016/1171, reg. 2(2)

F53S. 9(1A) inserted (6.12.2016) by Finance Act 2016 (c. 24), s. 179(2)(b)(5); S.I. 2016/1171, reg. 2(2)

F54Words in s. 9(1A) substituted (16.11.2017) by Finance (No. 2) Act 2017 (c. 32), s. 47(2)

F55S. 9(2) added (1.10.2006) by Finance Act 2006 (c. 25), s. 2(2)(3); S.I. 2006/2367, art. 2

10 Interpretation.U.K.

(1)In this Act—

“hand-rolling tobacco” has the meaning given by section 1(2) above; and

“tobacco products” has the meaning given by section 1(1) above.

(2)This Act and the other Acts included in the Customs and Excise Acts 1979 shall be construed as one Act but where a provision of this Act refers to this Act that reference is not to be construed as including a reference to any of the others.

(3)Any expression used in this Act or in any instrument made under this Act to which a meaning is given by any other Act included in the Customs and Excise Acts 1979 has, except where the context otherwise requires, the same meaning in this Act or in any such instrument as in that Act; and for ease of reference the Table below indicates the expressions used in this Act to which a meaning is given by any other such Act—

Customs and Excise Management Act 1979

“the Commissioners”

“the Customs and Excise Acts 1979”

“goods”

“importer”

“shipped”

“stores”.

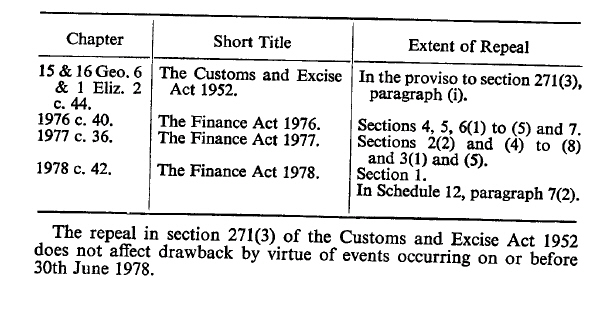

11 Repeals, savings and transitional and consequential provisions.U.K.

(1)The enactments specified in Schedule 2 to this Act are hereby repealed to the extent specified in the third column of that Schedule, but subject to the provision at the end of that Schedule.

(2)Any provision of this Act relating to anything done or required or authorised to be done under or by reference to that provision or any other provision of this Act shall have effect as if any reference to that provision, or that other provision, as the case may be, included a reference to the corresponding provision of the enactments repealed by this Act.

F56(3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(4)Nothing in this section shall be taken as prejudicing the operation of sections 15 to 17 of the M4Interpretation Act 1978 (which relate to the effect of repeals).

Textual Amendments

F56S. 11(3) repealed (29.4.1996) by 1996 c. 8, s. 205(1), Sch. 41 Pt. III

Marginal Citations

12 Citation and commencement.U.K.

(1)This Act may be cited as the Tobacco Products Duty Act 1979 and is included in the Acts which may be cited as the Customs and Excise Acts 1979.

(2)This Act shall come into operation on 1st April 1979

SCHEDULES

Section 2(1).

SCHEDULE 1U.K. Table of Rates of Tobacco Products Duty

Modifications etc. (not altering text)

C14Sch. 1 amended (16.11.2020) by The Tobacco Products Duty (Alteration of Rates) Order 2020 (S.I. 2020/1256), arts. 1, 2, Sch.

TABLE

| [F571 Cigarettes | An amount equal to the higher of— (a) 16.5% of the retail price plus £237.34 per thousand cigarettes, or (b) £305.23 per thousand cigarettes. |

| 2 Cigars | £296.04 per kilogram |

| 3 Hand-rolling tobacco | £253.33 per kilogram |

| 4 Other smoking tobacco and chewing tobacco | £130.16 per kilogram |

| 5 Tobacco for heating | £243.95 per kilogram] |

Textual Amendments

F57Sch. 1 Table substituted (retrospective to 11.3.2020 at 6 p.m.) by Finance Act 2020 (c. 14), s. 82(1)(2)

Section 11(1).

X1SCHEDULE 2U.K. REPEALS

Editorial Information

X1The text of Sch. 2 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and does not reflect any amendments or repeals which may have been made prior to 1.2.1991.