Schedules

Section 1(3).

SCHEDULE 1U.K. Wine: Rates of Duty

Modifications etc. (not altering text)

C1The text of Sch. 1 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and does not reflect any amendments or repeals which may have been made prior to 1.2.1991

| Description of wine | Rates of duty per hectolitre |

|---|---|

| £ | |

| Wine of a strength— | |

| not exceeding 15 per cent. ... | 106.80 |

| exceeding 15 but not exceeding 18 per cent. ... ... ... | 137.90 |

| exceeding 18 but not exceeding 22 per cent. ... ... ... | 162.30 |

| exceeding 22 per cent. ... | 162.30 plus |

| £14.47 for every 1 per cent. or part of 1 per cent. in excess of 22 per cent.; each of the above rates of duty being, in the case of sparkling wine, increased by £23.45 per hectolitre. |

SCHEDULE 2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F1U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F1Sch. 2 repealed by Finance Act 1984 (c. 43), s. 128(6), Sch. 23 Pt. I

Section 5(2).

SCHEDULE 3U.K. Provisions Substituted in Vehicles (Excise) Act 1971 (c. 10)

Modifications etc. (not altering text)

C2The text of Schs. 3 and 4 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and does not reflect any amendments or repeals which may have been made prior to 1.2.1991

IU.K. Provisions Substituted for Part II of Schedule 1

| Description of vehicle | Rate of duty |

|---|---|

| £ | |

| 1. Bicycles and tricycles of which the cylinder capacity of the engine does not exceed 150 cubic centimetres ... ... | 8.00 |

| 2. Bicycles of which the cylinder capacity of the engine exceeds 150 cubic centimetres but does not exceed 250 cubic centimetres; tricycles (other than those in the foregoing paragraph) and vehicles (other than mowing machines) with more than three wheels, being tricycles and vehicles neither constructed nor adapted for use nor used for the carriage of a driver or passenger ... ... ... ... | 16.00 |

| 3. Bicycles and tricycles not in the foregoing paragraphs ... | 32.00 |

IIU.K. Provisions Substituted for Part II of Schedule 2

| Description of vehicle | Rate of duty |

|---|---|

| £ | |

| Hackney carriages ... ... | 40.00 |

| with an additional 80p for each person above 20 (excluding the driver) for which the vehicle has seating capacity. |

IIIU.K. Provisions Substituted for Part II of Schedule 3

| Weight unladen of vehicle | Rate of duty | |||

|---|---|---|---|---|

| 1. Description of vehicle | 2. Exceeding | 3. Not exceeding | 4. Initial | 5. Additional for each ton or part of a ton in excess of the weight in column 2 |

| £ | £ | |||

| 1. Agricultural machines; digging machines; mobile cranes; works trucks; mowing machines; fishermen’s tractors. | 13.50 | |||

| 2. Haulage vehicles, being showmen’s vehicles. | 7¼ tons | 130.00 | ||

| 7¼ tons | 8 tons | 156.00 | ||

| 8 tons | 10 tons | 183.00 | ||

| 10 tons | 183.00 | 28.00 | ||

| 3. Haulage vehicles, not being showmen’s vehicles. | 2 tons | 155.00 | ||

| 2 tons | 4 tons | 278.00 | ||

| 4 tons | 6 tons | 402.00 | ||

| 6 tons | 7¼ tons | 525.00 | ||

| 7¼ tons | 8 tons | 642.00 | ||

| 8 tons | 10 tons | 642.00 | 109.00 | |

| 10 tons | 860.00 | 123.00 | ||

IVU.K. Provisions Substituted for Part II of Schedule 4Tables Showing Annual Rates of Duty on Goods Vehicles

Table AU.K. General Rates of Duty

| Weight unladen of vehicle | Rate of duty | |||

|---|---|---|---|---|

| 1. Description of vehicle | 2. Exceeding | 3. Not exceeding | 4. Initial | 5. Additional for each¼ ton or part of a¼ ton in excess of the weight in column 2 |

| £ | £ | |||

| 1. Farmers’ goods vehicles ... | 12 cwt. | 46 | ||

| 12 cwt. | 16 cwt. | 50 | ||

| 16 cwt. | 1 ton | 54 | ||

| 1 ton | 3 tons | 53 | 7 | |

| 3 tons | 4 tons | 106 | 5 | |

| 4 tons | 7 tons | 126 | 4 | |

| 7 tons | 9 tons | 176 | 2 | |

| 9 tons | 233 | 6 | ||

| 2. Showmen’s goods vehicles ... | 12 cwt. | 46 | ||

| 12 cwt. | 16 cwt. | 50 | ||

| 16 cwt. | 1 ton | 54 | ||

| 1 ton | 3 tons | 53 | 7 | |

| 3 tons | 4 tons | 106 | 5 | |

| 4 tons | 6 tons | 126 | 4 | |

| 6 tons | 9 tons | 156 | 7 | |

| 9 tons | 278 | 10 | ||

| 3. Tower wagons ... ... | 12 cwt. | 62 | ||

| 12 cwt. | 16 cwt. | 69 | ||

| 16 cwt. | 1 ton | 78 | ||

| 1 ton | 4 tons | 77 | 8 | |

| 4 tons | 6 tons | 171 | 9 | |

| 6 tons | 9 tons | 242 | 8 | |

| 9 tons | 394 | 15 | ||

| 4. Goods vehicles not included in any of the foregoing provisions of this Part of this Schedule. | 1 ton | 80 | ||

| 1 ton | 1¼ tons | 90 | ||

| 1¼ tons | 1½ tons | 100 | ||

| 1½ tons | 3 tons | 130 | 22 | |

| 3 tons | 4 tons | 264 | 23 | |

| 4 tons | 9 tons | 340 | 40 | |

| 9 tons | 10 tons | 1,351 | 48 | |

| 10 tons | 1,537 | 57 | ||

Table BU.K. Rates of Duty on Goods Vehicles Used for Drawing Trailers

VU.K. Provisions Substituted for Part II of Schedule 5

| Description of vehicle | Rate of duty |

|---|---|

| £ | |

| 1. Vehicles not exceeding seven horse-power, if registered under the Roads Act 1920 for the first time before 1st January 1947 ... ... ... ... | 57.00 |

| 2. Vehicles not included above ... ... ... ... ... | 80.00 |

Section 6(2).

Schedule 4U.K. Provisions Substituted in M1Vehicles (Excise) Act (Northern Ireland) 1972 (N.I. c. 10)

Modifications etc. (not altering text)

C3The text of Schs. 3 and 4 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and does not reflect any amendments or repeals which may have been made prior to 1.2.1991

Marginal Citations

IU.K. Provisions Substituted for Part II of Schedule 1

| Description of vehicle | Rate of duty |

|---|---|

| £ | |

| 1. Bicycles and tricycles of which the cylinder capacity of the engine does not exceed 150 cubic centimetres ... ... | 8.00 |

| 2. Bicycles of which the cylinder capacity of the engine exceeds 150 cubic centimetres but does not exceed 250 cubic centimetres; tricycles (other than those in the foregoing paragraph) and vehicles (other than mowing machines) with more than three wheels, being tricycles and vehicles neither constructed nor adapted for use nor used for the carriage of a driver or passenger ... ... ... ... | 16.00 |

| 3. Bicycles and tricycles not in the foregoing paragraphs ... | 32.00 |

IIU.K. Provisions Substituted for Part II of Schedule 2

| Description of vehicle | Rate of duty |

|---|---|

| £ | |

| Hackney carriages ... ... | 40.00 |

| with an additional 80p for each person above 20 (excluding the driver) for which the vehicle has seating capacity. |

IIIU.K. Provisions Substituted for Part II of Schedule 3

IVU.K. Provisions Substituted for Part II of Schedule 4Tables Showing Annual Rates of Duty on Goods Vehicles

Table AU.K. General Rates of Duty

VU.K. Provisions Substituted for Part II of Schedule 5

| Description of vehicle | Rate of duty |

|---|---|

| £ | |

| 1. Vehicles first registered under the Roads Act 1920 before 1st January 1947, or which, if its first registration for taxation purposes had been effected in Northern Ireland would have been so first registered as aforesaid under the Act as in force in Northern Ireland: | |

| (i) not exceeding 6 horse-power ... ... ... ... | 48.00 |

| (ii) exceeding 6 horse-power but not exceeding 9 horse-power—for each unit or part of a unit of horse-power | 8.00 |

| 2. Other vehicles ... ... ... ... ... ... ... | 80.00 |

Sections 5(4) and 6(4).

Schedule 5U.K. Annual Rates of Duty on Goods Vehicles

Modifications etc. (not altering text)

C4The text of Sch. 5 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and, except as specified, does not reflect any amendments or repeals which may have been made prior to 1.2.1991

Part AU.K. Provisions having effect as Schedule 4 to the M2Vehicles (Excise) Act 1971 and (as modified by Part B of this Schedule) as Schedule 4 to the M3Vehicles (Excise) Act (Northern Ireland) 1972

Part IU.K. General Provisions

Vehicles chargeable at the basic rate of dutyU.K.

1(1)Subject to paragraphs 5 and 6 below, the annual rate of duty applicable to a goods vehicle—

(a)which has a plated gross weight or a plated train weight which does not exceed 7.5 tonnes; or

(b)which has neither a plated gross weight nor a plated train weight but which has an unladen weight which exceeds 1,525 kilograms; or

(c)which is a tower wagon, having an unladen weight which exceeds 1,525 kilograms;

shall be £170.

(2)Any reference in the following provisions of this Schedule to the basic rate of duty is a reference to the annual rate of duty for the time being applicable to vehicles falling within sub-paragraph (1) above.

Vehicles exceeding 7.5 but not exceeding 12 tonnes plated weightU.K.

2Subject to paragraphs 1(1)(c) above and 6 below, the annual rate of duty applicable to a goods vehicle which has a plated gross weight or a plated train weight which exceeds 7.5 tonnes but does not exceed 12 tonnes shall be £360.

Rigid goods vehicles exceeding 12 tonnes plated gross weightU.K.

3(1)Subject to the provisions of this Schedule, the annual rate of duty applicable to a goods vehicle which is a rigid goods vehicle and has a plated gross weight which exceeds 12 tonnes shall be determined in accordance with Table A in Part II of this Schedule by reference to—

(a)the plated gross weight of the vehicle; and

(b)the number of axles on the vehicle.

(2)If a rigid goods vehicle to which sub-paragraph (1) above applies is used for drawing a trailer which—

(a)has a plated gross weight exceeding 4 tonnes; and

(b)when so drawn, is used for the conveyance of goods or burden;

the annual rate of duty applicable to it in accordance with that sub-paragraph shall be increased by the amount of the supplement which, in accordance with Table B in Part II of this Schedule, is appropriate to the gross plated weight of the trailer being drawn.

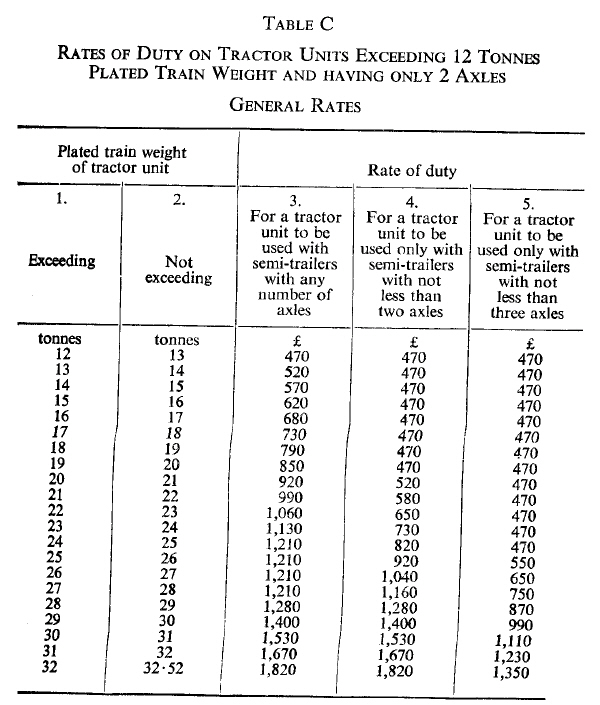

Tractor units exceeding 12 tonnes plated train weightU.K.

4(1)This paragraph applies to a tractor unit which has a plated train weight exceeding 12 tonnes.

(2)The annual rate of duty applicable to a tractor unit to which this paragraph applies and which has not more than two axles shall be determined, subject to the followingh provisions of this Schedule, in accordance with Table C in Part II of this Schedule by reference to—

(a)the plated train weight of the tractor unit; and

(b)the types of semi-trailers, distinguished according to the number of their axles, which are to be drawn by it.

(3)The annual rate of duty applicable to a tractor unit to which this paragraph applies and which has three or more axles shall be determined subject to the following provisions of this Schedule in accordance with Table D in Part II of this Schedule by reference to—

(a)the plated train weight of the tractor unit; and

(b)the types of semi-trailers, distinguished according to the number of their axles, which are to drawn by it.

Special types of vehiclesU.K.

5(1)This paragraph applies to a goods vehicle—

(a)which has an unladen weight exceeding 1,525 kilograms; and

(b)which does not comply with regulations under section 40 of the M4Road Traffic Act 1972 (construction and use regulations); and

(c)which is for the time being authorised for use on roads by virtue of an order under section 42 of that Act (authorisation of special vehicles).

(2)The annual rate of duty applicable to a goods vehicle to which this paragraph applies and which falls within a class specified by an order of the Secretary of State made for the purposes of this paragraph shall be determined, on the basis of the assumption in sub-paragraph (3) below, by the application of Table A, Table C or Table D in Part II of this Schedule, according to whether the vehicle is a rigid goods vehicle or a tractor unit and, in the latter case, according to the number of its axles.

(3)The assumptions referred to in sub-paragraph (2) above are—

(a)where Table A applies, that the vehicle has a plated gross weight which exceeds 30 tonnes but does not exceed 30.49 tonnes; and

(b)where Table C or Table D applies, that the vehicle has a plated train weight which exceeds 32 tonnes but does not exceed 32.52 tonnes.

(4)In the case of a goods vehicle to which this paragraph applies and which does not fall within such class as is referred to in sub-paragraph (2) above, the annual rate of duty shall be the basic rate of duty.

(5)The power to make an order under sub-paragraph (2) above shall be exercisable by statutory instrument ; but no such order shall be made unless a draft of it has been laid before Parliament and approved by a resolution of each House of Parliament.

Marginal Citations

Farmer’s goods vehicles and showmen’s goods vehiclesU.K.

6(1)If the unladen weight of—

(a)a farmer’s goods vehicle; or

(b)a showman’s goods vehicle;

does not exceed 1,525 kilograms, the annual rate of duty applicable to it shall be £60.

(2)If a farmer’s goods vehicle or a showman’s goods vehicle has a plated gross weight or a plated train weight, the annual rate of duty applicable to it shall be—

(a)£100, if that weight does not exceed 7.5 tonnes;

(b)£130, if that weight exceeds 7.5 tonnes but does not exceed 12 tonnes; and

(c)the appropriate Part II rate, if that weight exceeds 12 tonnes.

(3)In sub-paragraph (2) above the “appropriate Part II rate” means the rate determined in accordance with paragraph 3 or, as the case may be, 4 above but by reference—

(a)in the case of a farmer’s goods vehicle, to Table A(1), Table B(1), Table C(1) or, as the case may be, Table D(1) in Part II of this Schedule, in place of the corresponding Table referred to in that paragraph; and

(b)in the case of a showman’s goods vehicle, to Table A(2), Table B(2), Table C(2) or, as the case may be, Table D(2) in Part II of this Schedule, in place of the corresponding Table referred to in that paragraph.

(4)In the case of any other farmer’s goods vehicle or showman’s goods vehicle, the annual rate of duty applicable to it shall be £100.

Smaller goods vehiclesU.K.

7If a goods vehicle—

(a)has an unladen weight which does not exceed 1,525 kilograms; and

(b)does not fall within paragraph 6 above;

the annual rate of duty applicable to it shall be £80.

Vehicles treated as having reduced plated weightsU.K.

8(1)The Secretary of State may by regulations provide that, on an application made in accordance with the regulations, the goods vehicle to which the application relates shall be treated for the purposes of this Schedule as if its plated gross weight or plated train weight (the “operating weight”) specified in the application.

(2)Where, following an application duly made in accordance with the regulations, a licence is issued for the vehicle concerned at the rate of duty applicable to the operating weight, that weight shall be shown on the licence.

(3)The regulations may provide that the use of any vehicle in respect of which a lower rate of duty is chargeable by virtue of this paragraph shall be subject to prescribed conditions and to such further conditions as the Secretary of State may think fit to impose in any particular case.

(4)In any case where a vehicle in respect of which a lower rate of duty has been charged by virtue by virtue of this paragraph is used in contravention of a condition imposed by virtue of sub-paragraph (3) above, then—

(a)the higher rate of duty applicable to its plated gross weight or plated train weight shall become chargeable as from the date of the contravention; and

(b)section 19 of this Act shall apply as if—

(i)that higher rate had become chargeable under subsection (1) of that section by reason of the vehicle being used as mentioned in that subsection; and

(ii)subsections (5) to (9) were omitted.

Plated and unladen weightsU.K.

9(1)Any reference in this Schedule to the plated gross weight of a goods vehicle or trailer is a reference—

(a)to that plated weight, within the meaning of Part II of the Road Traffic Act 1972, which is the maximum gross weight which may not be exceeded in Great Britain for the vehicle or trailer in question; or

(b)in the case of any trailer which may lawfully be used in Great Britain without a plated gross weight, to the maximum laden weight at which the trailer may lawfully be used in Great Britain.

(2)Any reference in this Schedule to the plated train weight of a vehicle is a reference to that plated weight, within the meaning of the said Part II, which is the maximum gross weight which may not be exceeded in Great Britain for an articulated vehicle consisting of the vehicle in question and any semi-trailer which may be drawn by it.

(3)A mechanically propelled vehicle which—

(a)is constructed or adapted for use and used for the conveyance of a machine or contrivance and no other load except articles used in connection with the machine or contrivance; and

(b)is not a vehicle for which an annual rate of duty is specified in Schedule 3 to this Act; and

(c)has neither a plated gross weight nor a plated train weight,

shall, notwithstanding that the machine or contrivance is built in as part of the vehicle, be chargeable with duty at the rate which would be applicable if the machine or contrivance were burden.

Goods vehicles used partly for private purposesU.K.

10(1)Where a goods vehicle is partly used for private purposes, the annual rate of duty applicable to it shall, if apart from this paragraph it would be less, be the rate determined in accordance with Schedule 5 to this Act.

(2)A vehicle shall not be prevented from being a farmer’s goods vehicle for the purposes of this Schedule solely by reason of its being used partly for private purposes.

(3)In this paragraph “partly used for private purposes” means used partly otherwise than for the conveyance of goods or burden for hire or reward or for or in connection with a trade or business.

Exempted vehiclesU.K.

11Duty shall not be chargeable by virtue of this Schedule in respect of—

(a)a vehicle chargeable with duty by virtue of Schedule 1 to this Act;

(b)an agricultural machine which is a goods vehicle by reason of the fact that it is constructed or adapted for use, and used, for the conveyance of farming or forestry implements fitted to it for operation while so fitted;

(c)a mobile crane, works truck or fisherman’s tractor; or

(d)a vehicle which, though constructed or adapted for use for the conveyance of goods or burden, is not so used for hire or reward or for or in connection with a trade or business.

12(1)This paragraph and paragraph 13 below apply to agricultural machines which do not draw trailers.

(2)Subject to paragraph 13 below, a vehicle to which this paragraph applies shall not be chargeable with duty by virtue of this Schedule by reason of the fact that it is constructed or adapted for use and used for the conveyance of permitted goods or burden if they are carried in or on not more than one appliance and the conditions mentioned in sub-paragraph (3) below are satisfied.

(3)The conditions are that—

(a)the appliance is fitted either to the front or to the back of the vehicle;

(b)the appliance is removable;

(c)the area of the horizontal plane enclosed by verticle lines passing through the outside edges of the appliance is not, when the appliance is in the position in which it is carried when the vehicle is travelling and the appliance is loaded, greater than—

(i)0.65 of a square metre, if the appliance is carried at the front; or

(ii)1.394 square metres, if it is carried at the back.

(4)In sub-paragraph (2) above “permitted goods or burden” means goods or burden the haulage of which is permissable under paragraph 2(1) of Schedule 3 to this Act.

(5)Sub-paragraph (2) above does not apply—

(a)to the use of a vehicle on a public road more than 15 miles from a farm occupied by the person in whose name the vehicle is registered under this Act;

(b)to three-wheeled vehicles; or

(c)to any vehicle in respect of which the distance between the centre of the area of contact with the road surface of the relevant wheel and that of the nearest wheel on the other side of the vehicle is less than 1.22 metres.

(6)In sub-paragraph (5)(c) above “relevant wheel” means—

(a)in a case where only one appliance is being used for the carriage of goods or burden and that appliance is fitted to the back of the vehicle, a back wheel; and

(b)in any other case, any wheel on a side of the vehicle.

(7)For the purposes of this paragraph a vehicle which has two wheels at the front shall, if the distance between them (measured between the centres of their respective areas of contact with the road) is less than 46 centimetres, be treated as a three-wheeled vehicle.

13(1)This paragraph shall have effect in relation to any vehicle fitted with an appliance of any description prescribed for the purposes of all or any of the provisions of this paragraph by regulations under this paragraph.

(2)The limitation in paragraph 12(2) above to one appliance shall have effect as a limitation to two appliances of which at least one must be an appliance prescribed for the purposes of this sub-paragraph ; but if two appliances are used they must be fitted at opposite ends of the vehicle.

(3)Regulations under this paragraph may provide for all or any of the following matters where an appliance prescribed for the purposes of this paragraph is being used, that is to say, that paragraph 12(2) above shall not apply unless the prescribed appliance is fitted to the prescribed end of the vehicle, or unless the use of the prescribed or any appliance is limited to prescribed goods or burden or to use in prescribed circumstances.

(4)Regulations under this paragraph may provide that paragraph 12(3)(c) above shall not have effect in relation to appliances prescribed for the purposes of this sub-paragraph, but that in relation to those appliances paragraph 12(5)(a) above shall have effect with the substitution of such shorter distance as may be prescribed.

(5)In sub-paragraphs (2) to (4) above references to use are references to use for the carriage of goods or burden ; and regulations under this paragraph may make different provision in relation to different descriptions of prescribed appliances.

Tractor units used with semi-trailers having only one axle when duty paid by reference to use with semi-trailers having more than one axleU.K.

14(1)This paragraph applies in any case where—

(a)a vehicle licence has been taken out for a tractor unit having two axles which is to be used only with semi-trailers with not less than two axles or for a tractor unit having two axles which is to be used only with semi-trailers with not less than three axles; and

(b)the rate of duty paid on taking out the licence is equal to or exceeds the rate of duty applicable to a tractor unit having two axles—

(i)which has a plated train weight equal to the maximum laden weight at which a tractor unit having two axles may lawfully be used in Great Britain with a semi-trailer with a single axle; and

(ii)which is to be used with semi-trailers with any number of axles.

(2)If, in a case to which this paragraph applies, the tractor unit is used with a semi-trailer with a single axle and, when so used, the laden weight of the tractor unit and semi-trailer taken together does not exceed the maximum laden weight mentioned in sub-paragraph (1)(b)(i) above, the tractor unit shall, when so used, be taken to be licensed in accordance with the requirements of this Act.

InterpretationU.K.

15(1)In this Schedule, unless the context otherwise requires—

“agricultural machine” has the same meaning as in Schedule 3 to this Act;

“axle” includes—

(i)two or more stub axles which are fitted on opposite sides of the longitudinal axis of the vehicle so as to form—

(a)a pair in the case of two stub axles, and

(b)pairs in the case of more than two stub axles,

(ii)a single stub axle which is not one of a pair; and

(iii)a retractable axle;

“basic rate of duty” has the meaning given by paragraph 1(2);

“business” includes the performance by a local or public authority of its functions;

“farmer’s goods vehicle” means, subject to paragraph 10(2) above, a goods vehicle registered under this Act in the name of a person engaged in agriculture and used on public roads solely by him for the purpose of the conveyance of the produce of, or of articles required for the purposes of, the agricultural land which he occupies, and for no other purposes;

“fishermen’s tractor” has the same meaning as in Schedule 3 to this Act;

“goods vehicle” means a mechanically propelled vehicle (including a tricycle as defined in Schedule 1 to this Act and weighing more than 425 kilograms unladen) constructed or adapted for use and used for the conveyance of goods or burden of any description, whether in the course of trade or otherwise;

“mobile crane” has the same meaning as in Schedule 3 to this Act;

“rigid goods vehicle” means a goods vehicle which is not a tractor unit;

“showman’s goods vehicle” means a showman’s vehicle which is a goods vehicle and is permanently fitted with a living van or some other special type of body or superstructure, forming part of the equipment of the show of the person in whose name the vehicle is registered under this Act;

“showman’s vehicle” has the same meaning as in Schedule 3 to this Act;

“stub axle” means an axle on which only one wheel is mounted;

“tower wagon” means a goods vehicle—

(a)into which there is built, as part of the vehicle, any expanding or extensible contrivance designed for facilitating the erection, inspection, repair or maintenance of overhead structures or equipment; and

(b)which is neither constructed nor adapted for use nor used for the conveyance of any load, except such a contrivance and articles used in connection therewith;

“tractor unit” means a goods vehicle to which a semi-trailer may be so attached that part of the semi-trailer is super-imposed on part of the goods vehicle and that when the semi-trailer is uniformly loaded not less than 20 per cent. of the weight of its load is borne by the goods vehicle;

“trailer” shall be construed in accordance with sub-paragraph (2) below;

“unladen weight” has the same meaning as it has for the purposes of the M5Road Traffic Act 1972 by virtue of section 194 of that Act; and

“works truck” has the same meaning as in Schedule 3 to this Act.

(2)In this Schedule “trailer” does not include—

(a)an appliance constructed and used solely for the purpose of distributing on the road loose gritting material;

(b)a snow plough;

(c)a road construction vehicle as defined in section 4(2) of this Act;

(d)a farming implement not constructed or adapted for the conveyance of goods or burden of any description, when drawn by a farmer’s goods vehicle;

(e)a trailer used solely for the carriage of a container for holding gas for the propulsion of the vehicle by which it is drawn, or plant and materials for producing such gas.

Marginal Citations

Part BU.K. Modifications for Northern Ireland

16(1)The following are the modifications subject to which, by virtue of section 6(4) of this Act, the preceding provisions of this Schedule have effect as Schedule 4 to the M6Vehicles (Excise) Act (Northern Ireland) 1972.

(2)For any reference to a plated gross weight or a plated train weight there shall be substituted a reference to a relevant maximum weight or a maximum train weight.

(3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F2

(4)In paragraph 8(4)(b)(ii) for the words “subsections (5) to (9)” there shall be substituted the words “ subsections (5) to (8) ”.

(5)For paragraph 9(1) and (2) there shall be substituted—

“(1)Any reference in this Schedule to the relevant maximum weight of a goods vehicle or trailer is a reference—

(a)where the vehicle or trailer is required by regulations under Article 28 of the Road Traffic (Northern Ireland) Order 1981 to have a maximum gross weight in Great Britain for the vehicle or trailer marked on a plate attached to the vehicle or trailer, to the maximum gross weight in Great Britain marked on such a plate;

(b)where a vehicle or trailer on which the maximum gross weight in Great Britain is marked by the same means as would be reuired by regulations applied to the vehicle or trailer, to the maximum gross weight in Great Britain so marked on the vehicle or trailer;

(c)where a maximum gross weight is not marked on a vehicle or trailer as mentioned in sub-paragraph (a), to the notional maximum gross weight of the vehicle or trailer ascertained in accordance with the Goods Vehicles (Ascertainment of Maximum Gross Weights) Regulations (Northern Ireland) 1976 (or any regulations replacing those regulations, whether with or without amendments).

(2)Any reference in this Schedule to the relevant maximum train weight of a vehicle is a reference to the maximum gross weight which may not be exceeded in Great Britain for an articulated vehicle consisting of the vehicle in question and any semi-trailer which may be drawn by it.”

[F3(6)In paragraph 12(5)(a) for the words “a farm” there shall be substituted the words “ agricultural land ”.]

(7)In paragraph 15(1), in the definition of “unladen weight”, for the references to the M7Road Traffic Act 1972 and section 194 of that Act there shall be substituted, respectively, references to the Road Traffic (Northern Ireland) Order 1981 and Article 2(3) of that Order.

Textual Amendments

F3Sch. 5 para. 16(6) repealed by Finance Act 1989 (c. 26, SIF 107:2), s. 187(1), Sch. 17 Pt. II (in relation to licences taken out after 14.3.1989)

Marginal Citations

M61972 c. 10. (N.I.).

Section 8.

Schedule 6U.K. Betting and Gaming Duties

Modifications etc. (not altering text)

C5Part of the text of Sch. 6 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and, except as specified, does not reflect any amendments or repeals which may have been made prior to 1.2.1991

Part IU.K. General

1U.K.In this Schedule—

the “1981 Act” means the M8Betting and Gaming Duties Act 1981; and

the “1972 Act” means the M9Miscellaneous Transferred Excise Duties Act (Northern Ireland) 1972.

Part IIU.K.

2U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F4

Textual Amendments

Part IIIU.K. Gaming Licence Duty

3U.K.In section 14 of the 1981 Act (rate of duty) for the Table set out in subsection (1) there shall be substituted the following Table—

U.K.“ Table

| Part of gross gaming yield | Rate |

|---|---|

| The first £500,000 | 5 per cent. |

| The next £1,750,000 | 12½ per cent. |

| The remainder | 25 per cent.”. |

Part IVU.K. Bingo Duty

4U.K.In section 17 of the 1981 Act (bingo duty) in subsection (2)(a) (duty by reference to amount paid for bingo cards) after the words “the money taken” there shall be inserted the words “ (if any) ”.

5(1)Schedule 3 to the 1981 Act (exemptions from bingo duty) shall have effect subject to the following provisions of this paragraph.U.K.

(2)For paragraphs 2, 3 and 4 there shall be substituted the following paragraph—

“ Small-scale bingoU.K.

2(1)Bingo duty shall not be charged in respect of bingo promoted by any person and played on any day in a week (the “chargeable week”) at any premises, other than premises which are licensed under the Gaming Act 1968, if—

(a)where a person’s eligibility to particpate in that bingo depends upon his being a member of a particular society or his being a guest of such a member or of the society—

(i)the total value of the prizes won on any day in a relevant week at those premises in bingo played by members of that society or by guests of such members or of the society does not exceed £300; and

(ii)the total value of prizes won during any relevant week at those premises in bingo played by any such persons does not exceed £1,000; and

(b)in any other case—

(i)the total value of the prizes won on any day in a relevant week at those premises in bingo promoted by that person does not exceed £300; and

(ii)the total value of the prizes won during any relevant week at those premises in bingo promoted by that person does not exceed £1,000.

(2)In sub-paragraph (1) above—

“relevant week”, in relation to any chargeable week, means (subject to sub-paragraph (3) below that week or any of the preceding twelve weeks; and

“society” includes any club, institution, organisation or association of persons, by whatever name called, and any separate branch or section of such club, institution, organisation or association but a branch or section shall not be treated as a separate branch or section unless it occupies separate premises.

(3)For the purposes of this paragraph there shall be disregarded any bingo which—

(a)is played in any week beginning before 27th September 1982; or

(b)is exempt from duty by virtue of paragraph 5 or 6 below.”

(3)In paragraph 10 (registration of bingo promoters)—

(a)the following sub-paragraph shall be inserted after sub-paragraph (1)—

“(1A)Any person who is a bingo-promoter but is not registered as such and is not a person to whom sub-paragraph (1) above applies shall within five days of the date on which he became a bingo-promoter (disregarding any day which is a Saturday or Sunday or a Bank Holiday) notify the Commissioners of that fact and of the place where the bingo was and (if he intends to continue to promote the playing of bingo which will or may be chargeable with duty) is to be played and apply to be registered as a bingo-promoter.”; and

(b)in sub-paragraph (2) of that paragraph for the words “notifies his intention as aforesaid” there shall be su8bstituted the words “ gives notice to the Commissioners under sub-paragraph (1) or (1A) above ” and at the end of that sub-paragraph there shall be inserted the words—

“Conditions shall not be imposed under this sub-paragraph if the premises at which the bingo in question is or is to be played are not licensed under the Gaming Act 1968.”.

(4)In paragraph 12 (preservation of records by bingo-promoters)—

(a)in sub-paragraph (1) for the word “bingo-promoter” there shall be substituted the words “ promoter of bingo other than bingo which is exempt from duty by virtue of paragraph 1, 5 or 6 above ”;

(b)in sub-paragraph (3) for the words “A bingo-promoter” there shall be substituted the words “ Any such promoter of bingo ”; and

(c)in sub-paragraph (4) for the word “bingo-promoters” there shall be substituted the words “ such promoters of bingo as aforesaid ”.

(5)In paragraph 15 (computation of amount of payments for cards and of the value of prizes) in sub-paragraph (1)—

(a)for the words from “a bingo-promoter” to “any prize” there shall be substituted the words “ a promoter of bingo as to the amount taken by him or on his behalf on a particular occasion as payment by players for cards or as to the value of the prizes won in bingo promoted by him or by any other promoter on one or more occasions, ”;

(b)in sub-paragraph (a) for the words “the bingo-promoter” there shall be substituted the words “ the promoter ”; and

(c)in sub-paragraph (b) after the words “amount of duty” there shall be inserted the words “ (if any) ”.

(6)The following sub-paragraph shall be inserted in paragraph 15 after sub-paragraph (3)—

“(4)In any case where a promoter of bingo disputes the amount of duty chargeable to and recoverable from him by reference to bingo which is chargeable to duty by reason only that one or other (or both) of the conditions specified in sub-paragraph (1)(a) of paragraph 2 above is not satisfied with respect to that bingo, any information obtained in pursuance of this Schedule relating to bingo promoted by any other person may be disclosed to him and shall be admissible in evidence in any proceedings against him.”

Part VU.K. Gaming Machine Licence Duty

Great BritainU.K.

6—8.U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F5

Textual Amendments

9In subsection (5) of section 22 of the 1981 Act (lower rate, higher rate and peak rate machines)—

(a)in paragraph (a) for “2p” there shall be substituted the words “ 5p; and ”; and

(b)in paragraph (b) for sub-paragraphs (i) and (ii) there shall be substituted the words “ in any other case ”; and

(c)paragraph (c) shall be omitted.

10U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F6

Textual Amendments

F6Sch. 6 para. 10 repealed by Finance Act 1987 (c. 16, SIF 12:2), s. 72(7), Sch. 16 Part II Note 2

11In subsection (2) of section 23 (rate of duty for half-year licence) after the word “eleven-twentieths” there shall be inserted the words “ , and on a quarter-year licence six-twentieths, ”.

12U.K.In subsection (6) of section 24 of the 1981 Act (penalty for knowingly or recklessly contravening section 24) for sub-paragraph (a) there shall be substituted the following sub-paragraph—

“(a)on summary conviction to a penalty—

(i)of the prescribed sum, or

(ii)of an amount equal to three times the amount of duty payable on a whole-year gaming machine licence for those premises and that machine or, where more than one machine has been provided on those premises in contravention of this section, those machines (whether or not the duty has been paid),

whichever is the greater, or to imprisonment for a term not exceeding six months or to both such penalty and imprisonment;”.

13U.K.In subsection (4) of section 25 of the 1981 Act (gaming machines playable by more than one person)—

(a)after the words “a machine” in the second place where they occur, there shall be inserted the words “ other than a two-penny machine ”;

(b)in paragraph (a) for “2p” there shall be substituted “ 5p ”;

(c)in paragraph (b) for the words from the beginning to “5p” there shall be substituted the words “ in a case not falling within paragraph (a) above; ” and

(d)paragraph (c) shall be omitted.

14(1)In section 26 of the 1981 Act, in subsection (2) (interpretation) for the definition of “penny machine” there shall be substituted the following definition:—U.K.

““two-penny machine” means a gaming machine which can only be played by the insertion into the machine of a coin or coins of a denomination, or aggregate denomination, not exceeding 2p”.

(2)At the end of that section there shall be inserted the following subsection:—

“(4)Where the game playable by means of a gaming machine can be played more than once for the insertion of a coin or coins of a denomination, or aggregate denomination, exceeding any sum in pence mentioned in section 22(5) or subsection (2) above, the machine is to be treated for the purposes of those provisions as if it can only be played by the insertion into it of a coin of a denomination not exceeding that sum if, in effect, the amount payable to play the game once does not exceed that sum or, where the machine provides differing numbers of games in differing circumstances, cannot exceed that sum.”

15In paragraph 4 of Schedule 4 to 1981 Act (licences not required for March or October in certain cases) for the words from “during March or October” to the end there shall be substituted the words “which have local authority approval under the Gaming Acts—

(a)during March of any year if the provision of the machine on the premises during April of that year has been authorised by a half-year licence or a quarter-year licence.

(b)during October of any year if the provision of the machine on the premises during September of that year has been authorised by a half-year licence or a quarter-year licence.”.

16U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F7

Textual Amendments

17U.K.In paragraph 13 of Schedule 4 to the 1981 Act (regulations as to the marking of gaming machines) for the words from “the higher rate” to “penny machines” there shall be substituted the words “ or the higher rate or, as the case may be, as being two-penny machines ”.

U.K.

18—24.U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F8

Textual Amendments

F8Sch. 6 paras. 18–24 repealed by Finance Act 1985 (c. 54, SIF 12:2), s. 77, Sch. 27 Pt. III Note 1

Schedules 7—10. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F9U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

Schedules 11, 12. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F10U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F10Schs. 11, 12 repealed by Capital Allowances Act 1990 (c. 1, SIF 63:1), s. 164(4) and Sch. 2

Schedule 13U.K. The Indexation Allowance

Modifications etc. (not altering text)

C6See—Finance Act 1985 (c. 54), s. 68(3)(e) and Sch. 19 para. 23Income and Corporation Taxes 1988 (c. 1, SIF 63:1), Sch. 28 para. 4(3) re computation of offshore income gains

Part IU.K. General

Modifications etc. (not altering text)

Part disposalsU.K.

1For the purpose of determining the indexation allowance (if any) on the occasion of a part disposal of an asset, the apportionment under section 35 of the M10 Capital Gains Tax Act 1979 of the sums which make up the relevant allowable expenditure shall be effected before the application of section 87 of this Act and, accordingly, in relation to a part disposal—

(a)references in section 87 to an item of expenditure shall be construed as references to that part of that item which is so apportioned for the purposes of the computation under Chapter II of Part II of that Act of the [F11unindexed gain or loss] on the part disposal; and

(b)no indexation allowance shall be determined by reference to the part of each item of relevant allowable expenditure which is apportioned to the property which remains undisposed of.

Textual Amendments

F11Words substituted by Finance Act 1985 (c. 54), s. 68 and Sch. 19 Pt. I for disposals made on or after 6 April 1985, or 1 April 1985 for companies, or 28 February 1986 for securities within the meaning of Finance Act 1985 (c. 54) Part II Ch. IV other than gilt-edged securities (Capital Gains Tax Act 1979 (c. 14, SIF 63:2) Sch. 2) and qualifying corporate bonds (Finance Act 1984 (c. 43, SIF 40:1) s. 64), which are not affected

Marginal Citations

Disposals on a no-gain/no-loss basisU.K.

2(1)This paragraph applies to a disposal of an asset which falls within subsection (1)(a) of section 86 of this Act if, by virtue of any enactment other than [F12subsection (5)(b) of that section or] any provision of this Schedule, the disposal is treated as one on which neither a gain nor loss accrues to the person making the disposal.

(2)In relation to a disposal to which this paragraph applies—

“the transferor” means the person making the disposal of the asset concerned; and

“the transferee” means the person acquiring the asset on the disposal.

(3)On a disposal to which this paragraph applies [F12and which falls within subsection (1)(b) of section 86 of this Act], the amount of the consideration shall be calculated for the purposes of the M11Gains Tax Act 1979 on the assumption that—

(a)the disposal is one to which that section applies; and

(b)on the disposal [F13an unindexed gain] accrues to the transferor which is equal to the indexation allowance on the disposal;

and, accordingly, the disposal shall be one on which, after taking account of the indexation allowance, neither a gain nor a loss accrues.

(4)Except as provided by paragraph 3 below, for the purposes of the application of sections 86 and 87 of this Act there shall be disregarded so much of any enactment as provides that, on the subsequent disposal by the transferee of the asset acquired by him on a disposal to which this paragraph applies, the transferor’s acquisition of the asset is to be treated as the transferee’s acquisition of it.

Textual Amendments

F12Words repealed by Finance Act 1985 (c. 54), ss. 68, 98(6), Schs. 19 Pt. I and 27 Pt. VII for disposals made on or after 6 April 1985 or 1 April 1985 for companies, 2 July 1986 for gilt-edged securities (Capital Gains Tax Act 1979 (c. 14, SIF 63:2) Sch. 2) and qualifying corporate bonds (Finance Act 1984 (c. 43, SIF 40:1) s. 64), or 28 February 1986 for other securities within the meaning of Finance Act 1985 (c. 54) Part II Ch. IV

F13Words substituted by Finance Act 1985 (c. 54), s. 68 and Sch. 19 Pt. I for disposals made on or after 6 April 1985, or 1 April 1985 for companies, or 28 February 1986 for securities within the meaning of Finance Act 1985 (c. 54) Part II Ch. IV other than gilt-edged securities (Capital Gains Tax Act 1979 (c. 14, SIF 63:2) Sch. 2) and qualifying corporate bonds (Finance Act 1984 (c. 43, SIF 40:1) s. 64), which are not affected

Modifications etc. (not altering text)

C8See also Income and Corporation Taxes 1988 (c. 1, SIF 63:1), Sch. 28 para. 3(1) re computation of offshore income gains

Marginal Citations

[F14 Subsequent disposals following no-gain/no-loss disposals]U.K.

Textual Amendments

F14Sch. 13 para. 3 repealed by Finance Act 1985 (c. 54), ss. 68, 98(6), Schs. 19 Pt. I and 27 Pt. VII for disposals made on or after 6 April 1985 or 1 April 1985 for companies, 2 July 1986 for gilt-edged securities (Capital Gains Tax Act 1979 (c. 14, SIF 63:2) Sch. 2) and qualifying corporate bonds (Finance Act 1984 (c. 43, SIF 40:1) s. 64), or 28 February 1986 for other securities within the meaning of Finance Act 1985 (c. 54) Part II Ch. IV

3(1)The provisions of this paragraph apply in relation to a disposal by the transferee of the asset acquired by him on a disposal to which paragraph 2 above applies; and in this paragraph—

(a)“the initial disposal” means the disposal to which paragraph 2 above applies;

(b)“the subsequent disposal” means the disposal to which this paragraph applies; and

(c)“the transferor” and “the transferee” have the same meaning as in paragraph 2 above.

(2)If the subsequent disposal is one on which a loss accrues (and, accordingly, is one to which section 86 of this Act does not apply) then, for the purposes of the M12 Capital Gains Tax Act 1979, the amount of that loss shall be taken to be reduced by—

(a)an amount equal to the indexation allowance (if any) on the initial disposal; or

(b)such an amount as will secure that, on the subsequent disposal, neither a gain nor a loss accrues,

whichever is the less.

(3)The following provisions of this paragraph apply where the initial disposal is one to which paragraph 2 above applies by reason only of any of the following enactments applying to the initial disposal, namely—

(a)section 267 or section 273 of [F15the Taxes Act 1970]; or

(b)section 44 of the Capital Gains Tax Act 1979; or

(c)section 148 of this Act.

[F16(d)subsection (4) of section 7 of the Finance (No. 2) Act 1983.]

[F17(e)paragraph 2 of Schedule 2 to the Trustee Savings Banks Act 1985.]

(4)For the purpose of calculating the indexation allowance (if any) to which the transferee is entitled on the subsequent disposal in a case where the initial disposal falls within sub-paragraph (3) above and the transferor made that disposal outside the qualifying period,—

(a)subsection (1) of section 86 of this Act shall have effect with the omission of paragraph (b); and

(b)the indexed rise in any item of relevant allowable expenditure falling within section 32(1)(a) of the Capital Gains Tax Act 1979 shall be calculated as if, in the definition of RI in the formula in section 87(2) of this Act, the words “which is the twelfth month after that” were omitted, and as if section 87(3)(a) of this Act were also omitted.

(5)For the purpose of calculating the indexation allowance (if any) to which the transferee is entitled on the subsequent disposal in a case where the initial disposal falls within sub-paragraph (3) above and the transferor made that disposal within the qualifying period (so that he was not entitled to any indexation allowance) the transferor’s acquisition of the asset shall be treated as being the transferee’s acquisition of it.

(6)If, in a case where sub-paragraph (5) above applies, the subsequent disposal is itself a disposal to which paragraph 2 above applies, that sub-paragraph shall again apply so that the original transferor’s acquisition of the asset shall be treated as being the acquisition of it by the transferee under the subsequent disposal; and so on if there is a series of disposals to which paragraph 2 above applies, all occurring within twelve months of the first such disposal.

Textual Amendments

F15Words substituted by Income and Corporation Taxes Act 1988 (c. 1, SIF 63:1), Sch. 29 para. 32

F16Sch. 13 para. 3(3)(d) added by Finance (No. 2) Act 1983 (c. 49), s. 7(5) in relation to disposals on or after 6 April 1983 where the relevant date, as defined in s. 7(1) of that Act, falls after 1 January 1983

F17Sch. 13 para. 3(3)(e) added by Trustee Savings Banks Act 1985 (c. 58), s. 5 and Sch. 2 para. 2(3)

Marginal Citations

Receipts etc. which are not treated as disposals but affect relevant allowable expenditureU.K.

4(1)This paragraph applies where, in determining the relevant allowable expenditure in relation to a disposal to which section 86 of this Act applies, account is required to be taken, as mentioned in subsection (3) of that section, of any provision of any enactment which, by reference to a relevant event [F18occurring after the beginning of the qualifying period], reduces the whole or any part of an item of expenditure as mentioned in that subsection.

(2)For the purpose of determining, in a case where this paragraph applies, the indexation allowance (if any) to which the person making the disposal is entitled, not account shall in the first instance be taken of the provision referred to in sub-paragraph (1) above in calculating the indexed rise in the item of expenditure to which that provision applies but, from that indexed rise as so calculated, there shall be deducted a sum equal to the indexed rise (determined as for the purposes of the actual disposal) in a notional item of expenditure which—

(a)is equal to the amount of the reduction effected by the provision concerned; and

(b)was incurred on the date of the relevant event referred to in sub-paragraph (1) above.

(3)In this paragraph “relevant event” means any event which does not fall to be treated as a disposal for the purposes of the M13Capital Gains Tax Act 1979.

Textual Amendments

F18Words repealed by Finance Act 1985 (c. 54), ss. 68, 98(6), Schs. 19 Pt. I and 27 Pt. VII for disposals made on or after 6 April 1985 or 1 April 1985 for companies, 2 July 1986 for gilt-edged securities (Capital Gains Tax Act 1979 (c. 14, SIF 63:2) Sch. 2) and qualifying corporate bonds (Finance Act 1984 (c. 43, SIF 40:1) s. 64), or 28 February 1986 for other securities within the meaning of Finance Act 1985 (c. 54) Part II Ch. IV

Marginal Citations

Reorganisations, reconstructions etc.U.K.

5(1)This paragraph applies where,—

(a)by virtue of section 78 of the Capital Gains Tax Act 1979, on a reorganisation the original shares (taken as a single asset) and the new holding (taken as a single asset) fall to be treated as the same asset acquired as the original shares were acquired; and

(b)on the reorganisation, a person gives or becomes liable to give any consideration for his new holding or any part of it.

(2)Where this paragraph applies, so much of the consideration referred to in sub-paragraph (1)(b) above as, on a disposal to which section 86 of this Act applies of the new holding, will, by virtue of section 79(1) of the Capital Gains Tax Act 1979, be treated as having been given for the original shares, shall be treated for the purposes of section 87 of this Act as an item of relevant allowable expenditure incurred not at the time the original shares were acquired but at the time the person concerned gave or became liable to give the consideration (and, accordingly, subsection (5) of section 87 of this Act shall not apply in relation to that item of expenditure).

(3)In the preceding provisions of this paragraph the expressions “reorganisation”, “” and “the new holding” have the meanings assigned by section 77 of the Capital Gains Tax Act 1979 except that in a case where, by virtue of any other provision of Chapter II of Part IV of that Act (which extends to conversion of securities, company reconstructions and amalgamations etc.) sections 78 and 79 of that Act apply in circumstances other than a reorganisation (within the meaning of section 77 of that Act), those expressions shall be construed in like manner as they fall to be construed in sections 78 and 79 as so applied.

Calls on shares etc.U.K.

6(1)Sub-paragraph (2) below applies where,—

(a)on a disposal to which section 86 of this Act applies, the relevant allowable expenditure is or includes the amount or value of the consideration given for the issue of shares or securities in, or debentures of, a company; and

(b)the whole or some part of that consideration was given after the expiry of the [F19period of twelve months beginning on the date of the issue of the shares, securities or debentures].

(2)For the purpose of computing the indexation allowance (if any) on the disposal referred to in sub-paragraph (1)(a) above,—

(a)so much of the consideration as was given after the expiry of the [F19period referred to in sub-paragraph (1)(b) above] shall be regarded as an item of expenditure separate from any consideration given during that period; and

(b)subsection (5) of section 87 of this Act shall not apply to that separate item of expenditure which, accordingly, shall be regarded as incurred at the time the consideration in question was actually given.

Textual Amendments

F19Words substituted by Finance Act 1985 (c. 54), s. 68 and Sch. 19 Pt. I for disposals made on or after 6 April 1985, or 1 April 1985 for companies, or 28 February 1986 for securities within the meaning of Finance Act 1985 (c. 54) Part II Ch. IV other than gilt-edged securities (Capital Gains Tax Act 1979 (c. 14, SIF 63:2) Sch. 2) and qualifying corporate bonds (Finance Act 1984 (c. 43, SIF 40:1) s. 64), which are not affected

OptionsU.K.

7(1)This paragraph applies where, on a disposal to which section 86 of this Act applies, the relevant allowable expenditure includes both—

(a)the cost of acquiring an option binding the grantor to sell (in this paragraph referred to as “the option consideration”); and

(b)the cost of acquiring what was sold as a result of the exercise of the option (in this paragraph referred to as “the sale consideration”).

[F20(2)Where this paragraph applies, the qualifying period in relation to the disposal referred to in sub-paragraph (1) above shall not begin until the date of the sale resulting from the exercise of the option].

(3)For the purpose of computing the indexation allowance (if any) on the disposal referred to in sub-paragraph (1) above,—

(a)the option consideration and the sale consideration shall be regarded as separate items of expenditure; and

(b)subsection (5) of section 87 of this Act shall apply to neither of those items and, accordingly, they shall be regarded as incurred when the option was acquired and when the sale took place, respectively.

(4)The preceding provisions of this paragraph have effect notwithstanding section 137 of the M14 Capital Gains Tax Act 1979 (under which the grant of an option and the transaction entered into by the grantor in fulfilment of his obligations under the option are to be treated as a single transaction); but expressions used in this paragraph have the same meaning as in that section and subsection (6) of that section (division of consideration for option both to sell and to buy) applies for the purpose of determining the cost of acquiring an option binding the grantor to sell.

Textual Amendments

F20Sch. 13 para. 7(2) repealed by Finance Act 1985 (c. 54), ss. 68, 98(6), Schs. 19 Pt. I and 27 Pt. VII for disposals made on or after 6 April 1985 or 1 April 1985 for companies, 2 July 1986 for gilt-edged securities (Capital Gains Tax Act 1979 (c. 14, SIF 63:2) Sch. 2) and qualifying corporate bonds (Finance Act 1984 (c. 43, SIF 40:1) s. 64), or 28 February 1986 for other securities within the meaning of Finance Act 1985 (c. 54) Part II Ch. IV

Marginal Citations

Part IIU.K. Existing Share Pools

Modifications etc. (not altering text)

C9See Finance Act 1985 (c. 54), s. 68 and Sch. 19 Part II

8(1)The provisions of this Part of this Schedule have effect in relation to a number of securities of the same class which, immediately before the operative date, are held by one person in one capacity and, by virtue of section 65 of the M15 Capital Gains Act 1979 are to be regarded for the purposes of that Act as indistinguishable parts of a single asset (in that section and in this Part of this Schedule referred to as a holding).

(2)Subject to paragraph 9 below, on and after the operative date,—

(a)the holding shall continue to be regarded as a single asset for the purposes of the Capital Gains Tax Act 1979 (but one which cannot grow by the acquisition of additional securities of the same class); and

(b)the holding shall be treated for the purposes of section 86 of this Act as having been acquired twelve months before the operative date; and

(c)every sum which, on a disposal of the holding occurring after the operative date, would be an item of relevant allowable expenditure shall be regarded for the purposes of section 87 of this Act as having been incurred at such a time that the month which determines RI, in the formula in subsection (2) of that section, is March 1982.

(3)Nothing in sub-paragraph (2) above affects the operation of section 78 of the Capital Gains Tax Act 1979 (equation of original shares and new holding on a reorganisation etc.) in relation to the holding, but without prejudice to paragraph 5 above.

(4)In this Part of this Schedule “the operative date” means—

(a)where the holding is held by a company, 1st April 1982; and

(b)in any other case, 6th April 1982.

Modifications etc. (not altering text)

Marginal Citations

9(1)For the purposes of this paragraph there shall be ascertained—

(a)the amount which would be the relevant allowable expenditure on a disposal of the whole of the holding on the day in 1982 which immediately precedes the operative date; and

(b)the amount which would have been the relevant allowable expenditure on a disposal of the whole of the holding (as then constituted) on the same day in 1981;

and in this paragraph these amounts are referred to as the 1982 amount and the 1981 amount respectively.

(2)If the 1982 amount exceeds the 1981 amount, paragraph 8(2) above shall not apply to the holding and the following provisions of this paragraph shall have effect in relation to it.

(3)Where sub-paragraph (2) above applies, the identification rules set out in sub-paragraph (4) below shall be assumed to have applied in relation to every acquisition or disposal of securities which occurred after the day referred to in sub-paragraph (1)(b) above and before the operative date and which, apart from this paragraph, would have increased or reduced the size of the holding; and accordingly—

(a)only such of the securities (if any) which constituted the holding on that day as are not identified, by virtue of those rules, with securities disposed of before the operative date shall be regarded as constituting the holding on the operative date; and

(b)all securities acquired after that day and before the operative date, so far as they are not so identified with securities disposed of before the operative date, shall be regarded as separate assets.

(4)The identification rules referred to in sub-paragraph (3) above are—

(a)that securities disposed of on an earlier date shall be identified before securities disposed of on a later date, and the identification of the securities first disposed of shall accordingly determine the securities which could be comprised in the later disposal; and

(b)that securities disposed of shall be identified with securities acquired on a later date rather than with securities acquired on an earlier date; and

(c)that securities disposed of shall be identified with securities acquired at different times on any one day in as nearly as may be equal proportions;

and these rules shall have priority according to the order in which they are set out above.

(5)In this paragraph and paragraph 10 below—

(a)“the reduced holding” means the securities referred to in sub-paragraph (3)(a) above; and

(b)“relevant allowable expenditure” has, in relation to a disposal taking place at any time, the meaning assigned to it by subsection (2)(b) of section 86 of this Act in relation to a disposal to which that section applies.

(6)Sub-paragraph (2) of paragraph 8 above shall apply in relation to the reduced holding but, so far as paragraph (c) of that sub-paragraph is concerned, subject to paragraph 10(1) below.

10(1)For the purpose of computing the indexation allowance (if any) on a disposal of—

(a)the reduced holding, or

(b)any other securities which, by virtue of sub-paragraph (3)(b) of paragraph 9 above, constitute one or more separate assets,

the 1982 amount, as defined in that paragraph, shall be apportioned between the reduced holding and that asset or those assets in proportion to a number of securities comprised in each of them on the operative date.

(2)In relation to a disposal on or after the operative date, the amount apportioned to the reduced holding or to any asset by virtue of sub-paragraph (1) above shall be regarded for all purposes of capital gains tax as the relevant allowable expenditure attributable to the securities comprised in the reduced holding or, as the case may be, in the asset in question.

(3)For the purposes of section 87(5) of this Act any relevant allowable expenditure which is attributable to any securities by virtue of sub-paragraph (2) above shall be deemed to be expenditure falling within paragraph (a) of subsection (1) of section 32 of the M16Capital Gains Tax Act 1979.

Modifications etc. (not altering text)

Marginal Citations

11In paragraph 2(2) of Schedule 5 to the Capital Gains Tax Act 1979 (identification of quoted securities held on 6th April 1965 with—among other cases—shares or securities subsequently disposed of) and in paragraph 13(3) of that Schedule (corresponding provisions for unquoted securities etc.) for the words “earlier time” there shall be substituted the words “ later time ” and for the words “later time” there shall be substituted the words “ earlier time ”.

Schedules 14—17. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F21U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F21Schs. 14–17 repealed by Capital Transfer Tax Act 1984 (c. 51), ss. 274, 277, Schs. 7, 9

Section 134.

SCHEDULE 18U.K. Alternative Valuation of Ethane Used for Petrochemical Purposes

Modifications etc. (not altering text)

C12See Finance Act 1986 (c. 41), s. 109(5) and Sch. 21

The electionU.K.

1(1)An election shall be made—U.K.

(a)in so far as it is to apply to ethane which is relevantly appropriated, by the participator alone; and

(b)in so far as it is to apply to ethane which is disposed of, by the particpator and the person to whom it is disposed of.

(2)An election shall be made in such form as may be prescribed by the Board and shall—

(a)identify, by reference to volume, chemical composition and initial treatment, the ethane to which the election is to apply;

(b)specify the period, beginning on or after the date of the election and not exceeding fifteen years, which is covered by the election;

(c)specify the price formula which is to apply for determining the market values of ethane during that period;

(d)specify the petrochemical purposes for which ethane to which the election applies will be used; and

(e)specify the place to or at which any such ethane is to be delivered or appropriated.

(3)The reference in sub-paragraph (2)(a) above to initial treatment is a reference to such initial treatment (if any) as the ethane will have been subjected to before it is disposed of or relevantly appropriated.

Conditions for acceptance of an electionU.K.

2(1)Subject to sub-paragraphs (2) and (3) below, the Board shall accept an election if they are satisfied that, under a relevant contract (as defined in paragraph 3 below) for the sale at arm’s length of the ethane to which the election applies, the contract prices would not differ materially from the market values determined in accordance with the price formula specified in the election ; and if the Board are not so satisfied they shall reject the election.U.K.

(2)The Board shall reject an election if they are not satisfied that the price formula specified in the election is such that the market value of ethane disposed of or relevantly appropriated at any time during the period covered by the election will be readily ascertainable either by reference to the price formula alone or by reference to that formula and to information—

(a)which is, or is expected to be at that time, publicly available; and

(b)which is not related or dependent, in whole or to any substantial degree, to or on the activities of the person or persons making the election or any person connected or associated with him or them.

(3)The Board shall reject an election if, after receiving notice in writing from the Board, the person or, as the case may be, either of the persons by whom the elction was made—

(a)fails to furnish to the Board, before the appropriate date, any information which the Board may reasonably require for the purpose of determining whether the election should be accepted; or

(b)fails to make available for inspection, before the appropriate date, by an officer authorised by the Board any books, accounts or documents in his possession or power which contain any information relevant for that purpose.

(4)In sub-paragraph (3) above “the appropriate date” means such date as may be specified in the notice concerned, being a date not earlier than one month after the date on which the notice was given.

(5)Any notice under sub-paragraph (3) above shall be given within the period of three months beginning on the date of the election in question.

3(1)In paragraph 2 above “relevant contract” means a contract which is entered into,—

(a)if the price formula specified in the election is derived from an actual contract which is identified in the election and was entered into not more than two years before the date of the election, at the time at which that contract was entered into, and

(b)in any other case, at the time of the election in question,

and which incorporates the terms specified in sub-paragraph (2) below, but it is not necessarily a contract for the sale of ethane for petrochemical purposes.

(2)The terms referred to in sub-paragraph (1) above are—

(a)that the ethane is required to be delivered at the place in the United Kingdom at which the seller could reasonably be expected to deliver it or, if there is more than one such place, the one nearest to the place of extraction; and

(b)that the price formula may be varied only in the event of a substantial and lasting change in the economic circumstances surrounding or underlying the contract and that any such variation may not take place before the expiry of the period of five years beginning on the date of the first delivery of ethane during the period covered by the election.

Notice of acceptance or rejectionU.K.

4(1)Notice of the acceptance or rejection of an election shall be given to the party or, as the case may be, each of the parties to the election before the expiry of the period of three months beginning on—U.K.

(a)the date of the election, or

(b)if a notice has been given under paragraph 2(3) above relating to the election, the date or, as the case may be, the last date which is the appropriate date, as defined in paragraph 2(4) above, in relation to such a notice.

(2)If no such notice of acceptance or rejection is so given, the Board shall be deemed to have accepted the election and to have given notice of their acceptance on the last day of the period referred to in sub-paragraph (1) above.

(3)After notice of the acceptance of an election has been given under this paragraph, a change in the identity of the participator or, where appropriate, of the person to whom the ethane in question is disposed of shall not, of itself, affect the continuing operation of the election.

Market value ceasing to be readily ascertainableU.K.

5(1)In any case where—U.K.

(a)it appears to the Board that, at some time during the period covered by an election, the market value of ethane to which the election applies has ceased or is ceasing to be readily ascertainable as mentioned in paragraph 2(2) above, and

(b)the Board give notice of that fact to the party or, as the case may be, each of the parties to the election and in that notice specify a date for the purposes of this paragraph (which may be a date earlier than that on which the notice is given),

then, subject to sub-paragraph (2) below, on the date so specified the election shall cease to have effect.

(2)If—

(a)within the period of three months beginning on the date of a notice under sub-paragraph (1)(b) above, the party or parties to the elction by notice in writing given to the Board specify a new price formula, and

(b)the new price formula is accepted by the Board in accordance with paragraph 7 below,

the election shall continue to have effect and, subject to paragraph 9 below, for the purpose of determining the market value, on and after the date specified in the notice under sub-paragraph (1)(b) above, of ethane to which the election applies, section 134 of this Act shall have effect as if the new price formula were the formula specified in the election.

Price formula ceasing to give realistic market valuesU.K.

6(1)If, at any time after the expiry of the period of five years beginning on the date of the first delivery or relevant appropriation of ethane during the period covered by an election,—U.K.

(a)it appears to the party or parties to the election or, as the case may be, to the Board that, by reason of any substantial and lasting change in any economic circumstances which were relevant at the time referred to in paragraph 3(1) above, the market values determined in accordance with the price formula specified in the election are no longer realistic; and

(b)the party or parties to the election give notice of that fact to the Board, or the Board give notice of that fact to the party or, as the case may be, each of the parties to the election,

then, subject to the following provisions of this paragraph, sub-paragraph (2) below shall apply.

(2)Where this sub-paragraph applies, the election shall not have effect with respect to any chargeable period beginning after the date of the notice under sub-paragraph (1)(b) above.

(3)Before the expiry of the period of three months beginning on the date on which a notice under sub-paragraph (1)(b) above given by the party or parties to the election is received by the Board, the Board shall give notice of acceptance or rejection of that notice to the party or parties concerned; and

(a)if the Board give notice of rejection, sub-paragraph (2) above shall not apply; and

(b)if no notice of acceptance or rejection is in fact given as required by this sub-paragraph, the Board shall be deemed to have given notice of acceptance on the last day of the period of three months referred to above.

(4)If a notice under sub-paragraph (1)(b) above which has been given by the party or parties to the election contains a new price formula, the Board shall first consider the notice without regard to that formula and if, followingnupon that consideration, the Board give a notice of acceptance under sub-paragraph (3) above, they shall then proceed to consider the new price formula.

(5)In any case where—

(a)sub-paragraph (4) above applies and the new price formula contained in the notice under sub-paragraph (1)(b) above is accepted by the Board in accordance with paragraph 7 below, or

(b)within the period of three months beginning on the date of a notice given by the Board under sub-paragraph (1)(b) above, the party or parties to the election by notice in writing given to the Board specify a new price formula which is accepted by the Board in accordance with paragraph 7 below,

sub-paragraph (2) above shall not apply and for the purpose of determining, for any chargeable period beginning after the date of the notice under sub-paragraph (1)(b) above, the market value of ethane to which the election applies, section 134 of this Act shall have effect as if the new price formula were the formula specified in the election.

(6)If, by virtue of sub-paragraph (5) above or an appeal under paragraph 8 below, a new price formula has effect for determining the market value of ethane to which an election applies, sub-paragraph (1) above shall thereafter have effect in relation to the market value of any such ethane as if—

(a)the reference therein to the date of the first delivery or relevant appropriation of ethane during the period covered by the election, and

(b)the reference therein to the time referred to in paragraph 3(1) above,

were each a reference to the beginning of the first chargeable period for which the new price formula has effect.

Acceptance or rejection of new price formulaU.K.

7(1)Subject to sub-paragraph (3) below, the Board shall accept a new price formula specified in a notice under paragraph 5(2) above if they are satisfied that the new formula provides for readily ascertainable market values which correspond, so far as practicable, with those which were intended to be provided for under the original price formula ; and if the Board are not so satisfied they shall reject such a new price formula.U.K.

(2)Subject to sub-paragraph (3) below, sub-paragraphs (1) and (2) of paragraph 2 above and paragraph 3 above shall apply to determine whether the Board shall accept—

(a)a new price formula contained in a notice under paragraph 6(1)(b) above which has been accepted by the Board under paragraph 6(3) above, or

(b)if the Board have given notice under paragraph 6(1)(b) above, a new price formula specified in a notice under paragraph 6(5)(b) above,

as if the new price formula were specified in an election made at the time the notice under paragraph 6(1)(b) above was given.

(3)The Board shall reject such a new price formula as is referred to in sub-paragraph (1) or sub-paragraph (2) above if, after receiving notice in writing from the Board, the party or, as the case may be, either of the parties to the election—

(a)fails to furnish to the Board, before the appropriate date, any information which the Board may reasonably require for the purpose of determining whether the new formula should be accepted in accordance with sub-paragraph (1) or, as the case may be, sub-paragraph (2) above, or

(b)fails to make available for inspection, before the appropriate date, by an officer authorised by the Board nay books, accounts or documents in his possession or power which contain information relevant for that purpose.

(4)Sub-paragraph (4) of paragraph 2 above applies in relation to sub-paragraph (3) above as it applies in relation to sub-paragraph (3) of that paragraph.

(5)Notice of the acceptance or rejection of a new price formula—

(a)specified in a notice under paragraph 5(2) or paragraph 6(5)(b) above, or

(b)contained in a notice under paragraph 6(1)(b) above which has been accepted by the Board by a notice under paragraph 6(3) above,

shall be given to the party or, as the case may be, each of the parties to the election concerned before the expiry of the period of three months beginning on the relevant date (as defined in sub-paragraph (6) below), and if no notice of acceptance or rejection is in fact given as required by this sub-paragraph, the Board shall be deemed to have accepted the formula and to have given notice of their acceptance on the last day of that period.

(6)In sub-paragraph (5) above “the relevant date” means—

(a)if a notice has been given under sub-paragraph (3) above relating to the price formula in question, the date or, as the case may be, the last date which is the appropriate date, within the meaning of that sub-paragraph, in relation to such a notice; and

(b)if no such notice has been given, then—

(i)in relation to a new price formula falling within paragraph (a) of sub-paragraph (5) above, the date on which the notice referred to in that paragraph was received by the Board; and

(ii)in relation to a new price formula falling within paragraph (b) of that sub-paragraph, the date of the notice from the Board under paragraph 6(3) above.

8(1)Where the Board give notice to any person or persons—U.K.