SCHEDULE 5Stamp duty land tax: amount of tax chargeable: rent

Introduction

1

This Schedule provides for calculating the tax chargeable—

(a)

in respect of a chargeable transaction for which the chargeable consideration consists of or includes rent, or

(b)

where such a transaction is to be taken into account as a linked transaction.

F1Amounts payable in respect of periods before grant of lease

1A

For the purposes of this Part “rent” does not include any chargeable consideration for the grant of a lease that is payable in respect of a period before the grant of the lease.

Calculation of tax chargeable in respect of rent

2

(1)

Tax is chargeable under this Schedule in respect of so much of the chargeable consideration as consists of rent.

F2(2)

The tax chargeable is the total of the amounts produced by taking the relevant percentage of so much of the relevant rental value as falls within each rate band.

(3)

The relevant percentages and rate bands are determined by reference to whether the relevant land—

(a)

consists entirely of residential property (in which case Table A below applies), or

(b)

consists of or includes land that is not residential property (in which case Table B below applies).

Rate bands | Percentage |

|---|---|

£0 to £60,000 | 0% |

Over £60,000 | 1% |

Rate bands | Percentage |

|---|---|

£0 to £150,000 | 0% |

Over £150,000 | 1% |

(4)

For the purposes of sub-paragraphs (2) and (3)—

(a)

the relevant rental value is the net present value of the rent payable over the term of the lease, and

(b)

the relevant land is the land that is the subject of the lease.

(5)

If the lease in question is one of a number of linked transactions for which the chargeable consideration consists of or includes rent, the above provisions are modified.

(6)

In that case the tax chargeable is determined as follows.

First, calculate the amount of the tax that would be chargeable if the linked transactions were a single transaction, so that—

- (a)

the relevant rental value is the total of the net present values of the rent payable over the terms of all the leases, and

- (b)

the relevant land is all land that is the subject of any of those leases.

- (a)

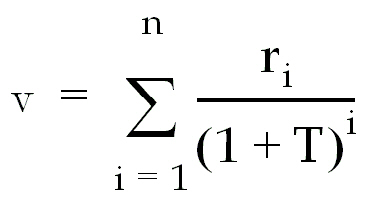

Then, multiply that amount by the fraction:

where—

NPV is the net present value of the rent payable over the term of the lease in question, and

TNPV is the total of the net present values of the rent payable over the terms of the all the leases.

Net present value of rent payable over term of lease

3

Rent payable

F44

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Effect of provision for rent review

F45

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Term of lease

F46

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Treatment of lease for indefinite term

F47

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Temporal discount rate

8

(1)

For the purposes of this Schedule the “temporal discount rate” is 3.5% or such other rate as may be specified by regulations made by the Treasury.

(2)

Regulations under this paragraph may make any such provision as is mentioned in subsection (3)(b) to (f) of section 178 of the Finance Act 1989 (c. 26) (power of Treasury to set rates of interest).

(3)

Subsection (5) of that section (power of Inland Revenue to specify rate by order in certain circumstances) applies in relation to regulations under this paragraph as it applies in relation to regulations under that section.

Tax chargeable in respect of consideration other than rent

9

(1)

Where in the case of a transaction to which this Schedule applies there is chargeable consideration other than rent, the provisions of this Part apply in relation to that consideration as in relation to other chargeable consideration.

(2)

If the F5relevant rental figure exceeds £600 a year, the 0% band in the Tables in subsection (2) of section 55 does not apply and any case that would have fallen within that band is treated as falling within the 1% band.

F6(2A)

For the purposes of sub-paragraph (2) the relevant rental figure is—

(a)

the annual rent in relation to the transaction in question, or

(b)

if that transaction is one of a number of linked transactions for which the chargeable consideration consists of or includes rent, the total of the annual rents in relation to all those transactions.

(3)

F7In sub-paragraph (2A) the “annual rent” means the average annual rent over the term of the lease or, if—

(a)

different amounts of rent are payable for different parts of the term, and

(b)

those amounts (or any of them) are ascertainable at the effective date of the transaction,

the average annual rent over the period for which the highest ascertainable rent is payable.

(4)

Tax chargeable under this Schedule is in addition to any tax chargeable under section 55 in respect of consideration other than rent.

(5)

Where a transaction to which this Schedule applies falls to be taken into account for the purposes of that section as a linked transaction, no account shall be taken of rent in determining the relevant consideration.

Increase of rent treated as grant of new lease

F810

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Interpretation

F911

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .