SCHEDULES

Section 19

SCHEDULE 1U.K.VAT: face-value vouchers

1U.K.In Part 3 of the Value Added Tax Act 1994 (c. 23) (application of Act in particular cases) insert after section 51A—

“51BFace-value vouchers

Schedule 10A shall have effect with respect to face-value vouchers.”.

2U.K.After Schedule 10 to that Act insert—

“SCHEDULE 10AU.K.Face-value vouchers

Meaning of “face-value voucher” etcU.K.

1(1)In this Schedule “face-value voucher” means a token, stamp or voucher (whether in physical or electronic form) that represents a right to receive goods or services to the value of an amount stated on it or recorded in it.

(2)References in this Schedule to the “face value” of a voucher are to the amount referred to in sub-paragraph (1) above.

Nature of supplyU.K.

2The issue of a face-value voucher, or any subsequent supply of it, is a supply of services for the purposes of this Act.

Treatment of credit vouchersU.K.

3(1)This paragraph applies to a face-value voucher issued by a person who—

(a)is not a person from whom goods or services may be obtained by the use of the voucher, and

(b)undertakes to give complete or partial reimbursement to any such person from whom goods or services are so obtained.

Such a voucher is referred to in this Schedule as a “credit voucher”.

(2)The consideration for any supply of a credit voucher shall be disregarded for the purposes of this Act except to the extent (if any) that it exceeds the face value of the voucher.

(3)Sub-paragraph (2) above does not apply if any of the persons from whom goods or services are obtained by the use of the voucher fails to account for any of the VAT due on the supply of those goods or services to the person using the voucher to obtain them.

Treatment of retailer vouchersU.K.

4(1)This paragraph applies to a face-value voucher issued by a person who—

(a)is a person from whom goods or services may be obtained by the use of the voucher, and

(b)if there are other such persons, undertakes to give complete or partial reimbursement to those from whom goods or services are so obtained.

Such a voucher is referred to in this Schedule as a “retailer voucher”.

(2)The consideration for the issue of a retailer voucher shall be disregarded for the purposes of this Act except to the extent (if any) that it exceeds the face value of the voucher.

(3)Sub-paragraph (2) above does not apply if—

(a)the voucher is used to obtain goods or services from a person other than the issuer, and

(b)that person fails to account for any of the VAT due on the supply of those goods or services to the person using the voucher to obtain them.

(4)Any supply of a retailer voucher subsequent to the issue of it shall be treated in the same way as the supply of a voucher to which paragraph 6 below applies.

Treatment of postage stampsU.K.

5The consideration for the supply of a face-value voucher that is a postage stamp shall be disregarded for the purposes of this Act except to the extent (if any) that it exceeds the face value of the stamp.

Treatment of other kinds of face-value voucherU.K.

6(1)This paragraph applies to a face-value voucher that is not a credit voucher, a retailer voucher or a postage stamp.

(2)A supply of such a voucher is chargeable at the rate in force under section 2(1) (standard rate) except where sub-paragraph (3), (4) or (5) below applies.

(3)Where the voucher is one that can only be used to obtain goods or services in one particular non-standard rate category, the supply of the voucher falls in that category.

(4)Where the voucher is used to obtain goods or services all of which fall in one particular non-standard rate category, the supply of the voucher falls in that category.

(5)Where the voucher is used to obtain goods or services in a number of different rate categories—

(a)the supply of the voucher shall be treated as that many different supplies, each falling in the category in question, and

(b)the value of each of those supplies shall be determined on a just and reasonable basis.

Vouchers supplied free with other goods or servicesU.K.

7Where—

(a)a face-value voucher (other than a postage stamp) and other goods or services are supplied to the same person in a composite transaction, and

(b)the total consideration for the supplies is no different, or not significantly different, from what it would be if the voucher were not supplied,

the supply of the voucher shall be treated as being made for no consideration.

InterpretationU.K.

8(1)In this Schedule—

“credit voucher” has the meaning given by paragraph 3(1) above;

“face value” has the meaning given by paragraph 1(2) above;

“face value voucher” has the meaning given by paragraph 1(1) above;

“retailer voucher” has the meaning given by paragraph 4(1) above.

(2)For the purposes of this Schedule—

(a)the “rate categories” of supplies are—

(i)supplies chargeable at the rate in force under section 2(1) (standard rate),

(ii)supplies chargeable at the rate in force under section 29A (reduced rate),

(iii)zero-rated supplies, and

(iv)exempt supplies and other supplies that are not taxable supplies;

(b)the “non-standard rate categories” of supplies are those in sub-paragraphs (ii), (iii) and (iv) of paragraph (a) above;

(c)goods or services are in a particular rate category if a supply of those goods or services falls in that category.

(3)A reference in this Schedule to a voucher being used to obtain goods or services includes a reference to the case where it is used as part-payment for those goods or services.”.

3U.K.In Schedule 6 to the Value Added Tax Act 1994 (c. 23) (valuation: special cases), omit paragraph 5 (vouchers etc).

4U.K.The amendments made by this Schedule apply to supplies of tokens, stamps or vouchers issued on or after 9th April 2003.

Section 23

SCHEDULE 2U.K.Supply of electronic services in member States: VAT special accounting scheme

IntroductoryU.K.

1U.K.The Value Added Tax Act 1994 (c. 23) is amended as follows.

Insertion of new section 3AU.K.

2U.K.After section 3 insert—

“3ASupply of electronic services in member States: special accounting scheme

(1)Schedule 3B (scheme enabling persons who supply electronically supplied services in any member State, but who are not established in a member State, to account for and pay VAT in the United Kingdom on those supplies) has effect.

(2)The Treasury may by order amend Schedule 3B.

(3)The power of the Treasury by order to amend Schedule 3B includes power to make such incidental, supplemental, consequential and transitional provision in connection with any amendment of that Schedule as they think fit.”.

Persons registered under Schedule 1U.K.

3U.K.In Schedule 1 (registration in respect of taxable supplies) in paragraph 13 (cancellation of registration) at the end insert—

“(8)This paragraph is subject to paragraph 18 of Schedule 3B (cancellation of registration under this Schedule of persons seeking to be registered under that Schedule, etc).”.

The special accounting schemeU.K.

4U.K.After Schedule 3A insert—

Section 3A

“SCHEDULE 3BU.K.Supply of electronic services in member States: special accounting scheme

Part 1U.K.Registration

The registerU.K.

1Persons registered under this Schedule are to be registered in a single register kept by the Commissioners for the purposes of this Schedule.

Persons who may be registeredU.K.

2(1)A person may be registered under this Schedule if he satisfies the following conditions.

(2)Condition 1 is that the person makes or intends to make qualifying supplies in the course of a business carried on by him.

(3)Condition 2 is that the person has neither his business establishment nor a fixed establishment in the United Kingdom or in another member State in relation to any supply of goods or services.

(4)Condition 3 is that the person is not—

(a)registered under this Act,

(b)identified for the purposes of VAT in accordance with the law of another member State, or

(c)registered under an Act of Tynwald for the purposes of any tax imposed by or under an Act of Tynwald which corresponds to VAT.

(5)Condition 4 is that the person—

(a)is not required to be registered or identified as mentioned in condition 3, or

(b)is required to be so registered or identified, but solely by virtue of the fact that he makes or intends to make qualifying supplies.

(6)Condition 5 is that the person is not identified under any provision of the law of another member State which implements Article 26c.

(7)In this Schedule, “Article 26c” means Article 26c of the 1977 VAT Directive (which is inserted by Article 1(3) of the 2002 VAT Directive).

(8)References in this Schedule to a person’s being registered under this Act do not include a reference to that person’s being registered under this Schedule.

Qualifying suppliesU.K.

3In this Schedule, “qualifying supply” means a supply of electronically supplied services (within the meaning of paragraph 7C of Schedule 5) to a person who—

(a)belongs in the United Kingdom or another member State, and

(b)receives those services otherwise than for the purposes of a business carried on by him.

Registration requestU.K.

4(1)If a person—

(a)satisfies the Commissioners that the conditions in paragraph 2 above are satisfied in his case, and

(b)makes a request in accordance with this paragraph (a “registration request”),

the Commissioners must register him under this Schedule.

(2)Sub-paragraph (1) above is subject to paragraph 9 below.

(3)A registration request must contain the following particulars—

(a)the name of the person making the request;

(b)his postal address;

(c)his electronic addresses (including any websites);

(d)where he has been allocated a number by the tax authorities in the country in which he belongs, that number;

(e)the date on which he began, or intends to begin, making qualifying supplies.

(4)A registration request must include a statement that the person making the request is not—

(a)registered under this Act,

(b)identified for the purposes of VAT in accordance with the law of another member State, or

(c)registered under an Act of Tynwald for the purposes of any tax imposed by or under an Act of Tynwald which corresponds to VAT.

(5)A registration request must be made by such electronic means, and in such manner, as the Commissioners may direct or may by regulations prescribe.

Date on which registration takes effectU.K.

5(1)Where a person is registered under this Schedule, his registration takes effect—

(a)on the date on which his registration request is made, or

(b)on such earlier or later date as may be agreed between him and the Commissioners.

(2)For the purposes of sub-paragraph (1) above—

(a)no registration is to take effect before 1st July 2003, and

(b)registration requests made before that date are to be treated as if they were made on that date.

Registration numberU.K.

6On registering a person under this Schedule, the Commissioners must—

(a)allocate a registration number to him, and

(b)notify him electronically of the number.

Obligation to notify changesU.K.

7(1)A person who has made a registration request must notify the Commissioners if subsequently—

(a)there is a change in any of the particulars contained in his request in accordance with paragraph 4(3) above,

(b)he ceases to make, or to have the intention of making, qualifying supplies, or

(c)he ceases to satisfy the conditions in any of sub-paragraphs (3) to (6) of paragraph 2 above.

(2)A notification under this paragraph must be given within the period of 30 days beginning with the date of the change of particulars or of the cessation.

(3)A notification under this paragraph must be given by such electronic means, and in such manner, as the Commissioners may direct or may by regulations prescribe.

Cancellation of registrationU.K.

8(1)The Commissioners must cancel a person’s registration under this Schedule if—

(a)he notifies them that he has ceased to make, or to have the intention of making, qualifying supplies,

(b)they otherwise determine that he has ceased to make, or to have the intention of making, qualifying supplies,

(c)he notifies them that he has ceased to satisfy the conditions in any of sub-paragraphs (3) to (6) of paragraph 2 above,

(d)they otherwise determine that he has ceased to satisfy any of those conditions, or

(e)they determine that he has persistently failed to comply with his obligations under this Schedule.

(2)In a case falling within sub-paragraph (1)(a) or (c) above, cancellation of a person’s registration under this paragraph takes effect—

(a)on the date on which the notification is received, or

(b)on such earlier or later date as may be agreed between him and the Commissioners.

(3)In a case falling within sub-paragraph (1)(b), (d) or (e) above, cancellation of a person’s registration under this paragraph takes effect—

(a)on the date on which the determination is made, or

(b)on such earlier or later date as the Commissioners may in his particular case direct.

Registration after cancellation for persistent defaultU.K.

9(1)The Commissioners—

(a)are not required by paragraph 4(1) above to register a person under this Schedule if he is a persistent defaulter, but

(b)shall have the power to do so.

(2)In this paragraph, “persistent defaulter” means a person—

(a)whose previous registration under this Schedule has been cancelled under paragraph 8(1)(e) above (persistent failure to comply with obligations under this Schedule), or

(b)who has been excluded from the identification register under any provision of the law of another member State which implements Article 26c(B)(4)(d) of the 1977 VAT Directive (persistent failure to comply with rules concerning the special scheme).

Part 2U.K.Obligations following registration, etc

Liability for VATU.K.

10(1)A person is liable to pay VAT under and in accordance with this Schedule if—

(a)he makes a qualifying supply, and

(b)he is registered under this Schedule when he makes the supply.

(2)The amount of VAT which a person is liable to pay by virtue of this Schedule on any qualifying supply is to be determined in accordance with sub-paragraphs (3) and (4) below.

(3)If the qualifying supply is treated as made in the United Kingdom, the amount is the amount of VAT that would have been charged on the supply under this Act if the person had been registered under this Act when he made the supply.

(4)If the qualifying supply is treated as made in another member State, the amount is the amount of VAT that would have been charged on the supply in accordance with the law of that member State if the person had been identified for the purposes of VAT in that member State when he made the supply.

(5)Where a person is liable to pay VAT by virtue of this Schedule—

(a)any amount falling to be determined in accordance with sub-paragraph (3) above is to be regarded for the purposes of this Act as VAT charged in accordance with this Act, and

(b)any amount falling to be determined in accordance with sub-paragraph (4) above in relation to another member State is to be regarded for those purposes as VAT charged in accordance with the law of that member State.

Obligation to submit special accounting returnsU.K.

11(1)A person who is, or has been, registered under this Schedule must submit a return (a “special accounting return”) to the Controller for each reporting period.

(2)Each quarter for the whole or any part of which a person is registered under this Schedule is a “reporting period” in the case of that person.

(3)The special accounting return must state the person’s registration number.

(4)For each member State in which the person is treated as having made qualifying supplies for the reporting period, the special accounting return must specify—

(a)the total value of his qualifying supplies treated as made in that member State in that period, apart from the VAT which he is liable to pay by virtue of this Schedule in respect of those supplies,

(b)the rate of VAT applicable to those supplies by virtue of sub-paragraph (3) or (4) (as the case may be) of paragraph 10 above, and

(c)the total amount of VAT payable by him by virtue of this Schedule in respect of those supplies in that period.

(5)The special accounting return must state the total amount of VAT which the person is liable to pay by virtue of this Schedule in respect of all qualifying supplies treated as made by him in all member States in the reporting period.

(6)If a person is registered under this Schedule for part only of a reporting period, references in this paragraph to his qualifying supplies in that period are references to his qualifying supplies in that part of that period.

(7)In this Schedule, “the Controller” means the Controller, Customs and Excise Value Added Tax Central Unit.

Further obligations with respect to special accounting returnsU.K.

12(1)A special accounting return must set out in sterling the amounts referred to in paragraph 11 above.

(2)Any conversion from one currency into another for the purposes of sub-paragraph (1) above shall be made by using the exchange rates published by the European Central Bank—

(a)for the last day of the reporting period to which the special accounting return relates, or

(b)if no such rate is published for that day, for the next day for which such a rate is published.

(3)A special accounting return must be submitted to the Controller within the period of 20 days after the last day of the reporting period to which it relates.

(4)A special accounting return must be submitted by such electronic means, and in such manner, as the Commissioners may direct or may by regulations prescribe.

Payment of VATU.K.

13(1)A person who is required to submit a special accounting return must, at the same time as he submits the return, pay to the Controller in sterling the amount referred to in paragraph 11(5) above in respect of the reporting period to which the return relates.

(2)A payment under this paragraph must be made in such manner as the Commissioners may direct or may by regulations prescribe.

Obligations to keep and produce recordsU.K.

14(1)A person must keep records of the transactions which he enters into for the purposes of, or in connection with, qualifying supplies made by him at any time when he is registered under this Schedule.

(2)The records to be kept must be such as will enable the tax authorities for the member State in which a qualifying supply is treated as made to determine whether any special accounting return which is submitted in respect of that supply is correct.

(3)Any records required to be kept must be made available—

(a)to the tax authorities for the member State in which the qualifying supply to which the records relate was treated as made, if they so request, or

(b)to the Commissioners, if they so request.

(4)Records must be made available electronically under sub-paragraph (3) above.

(5)The records relating to a transaction must be maintained for a period of ten years beginning with the 1st January following the date on which the transaction was entered into.

Commissioners' power to request production of recordsU.K.

15(1)The Commissioners may request a person to make available to them electronically records of the transactions entered into by him for the purposes of, or in connection with, qualifying supplies to which this paragraph applies.

(2)This paragraph applies to qualifying supplies which—

(a)are treated as made in the United Kingdom, and

(b)are made by the person while he is identified under any provision of the law of another member State which implements Article 26c.

Part 3U.K.Understatements and overstatements of UK VAT

Understatement or overstatement of UK VAT in special scheme returnU.K.

16(1)If the Commissioners consider that a person who is or has been a participant in the special scheme has submitted a special scheme return which understates his liability to UK VAT, they may give him a notice—

(a)identifying the return in which they consider that the understatement was made,

(b)specifying the amount by which they consider that the person’s liability to UK VAT has been understated, and

(c)requesting him to pay that amount to the Controller within the period of 30 days beginning with the date on which the notice is given.

(2)If the Commissioners consider that a person who is or has been a participant in the special scheme has submitted a special scheme return which overstates his liability to UK VAT, they may give him a notice—

(a)identifying the return in which they consider that the overstatement was made, and

(b)specifying the amount by which they consider that the person’s liability to UK VAT has been overstated.

(3)Where the Commissioners give a person a notice under sub-paragraph (2) above, they are liable to pay him the amount specified in the notice.

(4)No notice under this paragraph may be given more than 3 years after the end of the period for which the special scheme return in question was made.

(5)In this Schedule, “participant in the special scheme” means a person who—

(a)is registered under this Schedule, or

(b)is identified under any provision of the law of another member State which implements Article 26c.

(6)In this paragraph—

“special scheme return” means—

(a)a special accounting return; or

(b)a value added tax return submitted to the tax authorities of another member State;

“UKVAT” means VAT which a person is liable to pay (whether in the United Kingdom or another member State) in respect of qualifying supplies treated as made in the United Kingdom at a time when he is or was a participant in the special scheme;

“value added tax return”, in relation to another member State, means any value added tax return required to be submitted under any provision of the law of that member State which implements Article 26c(B)(5) of the 1977 VAT Directive.

Part 4U.K.Application of provisions relating to VAT

Registration under this ActU.K.

17Notwithstanding any provision in this Act to the contrary, a participant in the special scheme is not required to be registered under this Act by virtue of making qualifying supplies.

De-registrationU.K.

18Where a person who is registered under Schedule 1 satisfies the Commissioners that he intends to apply for—

(a)registration under this Schedule, or

(b)identification under any provision of the law of another member State which implements Article 26c,

they may, if he so requests, cancel his registration under Schedule 1 with effect from the day on which the request is made or from such later date as may be agreed between him and the Commissioners.

VAT representativesU.K.

19Section 48(1) (VAT representatives) does not permit the Commissioners to direct a participant in the special scheme to appoint a VAT representative.

AppealsU.K.

20(1)An appeal shall lie to a tribunal with respect to any of the following—

(a)the registration or cancellation of the registration of any person under this Schedule;

(b)a decision of the Commissioners to give a notice under sub-paragraph (1) of paragraph 16 above;

(c)the amount specified in any such notice or in a notice under sub-paragraph (2) of that paragraph.

(2)Part 5 (appeals), and any orders or regulations under that Part, have effect in relation to an appeal under this paragraph as if it were an appeal under section 83 (but not under any particular paragraph of that section).

Payments on account of non-UK VAT to other member StatesU.K.

21(1)Neither—

(a)paragraph 1(2) of Schedule 11, nor

(b)section 10 of the Exchequer and Audit Departments Act 1866,

applies to money or securities for money collected or received for or on account of VAT if required to be paid to another member State by virtue of the VAT Co-operation Regulation.

(2)In sub-paragraph (1) above, “the VAT Co-operation Regulation” means the Council Regulation of 27 January 1992 on administrative co-operation in the field of indirect taxation (VAT) (218/92/EEC), as amended by the Council Regulation of 7 May 2002 (792/2002/EC) (which temporarily amends the VAT Co-operation Regulation as regards additional measures regarding electronic commerce).

Refund of UK VATU.K.

22(1)The provisions which give effect to the 1986 VAT Refund Directive in the United Kingdom have effect in relation to a participant in the special scheme, but with the following modifications.

(2)The provision which gives effect to Article 2(1) of the 1986 VAT Refund Directive (as at 9th April 2003, see regulation 186 of the Value Added Tax Regulations 1995) shall apply in relation to a participant in the special scheme, but only so as to entitle him to a refund of VAT charged on—

(a)goods imported by him into the United Kingdom, and

(b)supplies made to him in the United Kingdom,

in connection with the making by him of qualifying supplies while he is a participant in the special scheme.

(3)The following provisions shall be omitted.

(4)The first provision is that which gives effect to Article 1(1) of the 1986 VAT Refund Directive, so far as it requires a member State to prevent a person who is deemed to have supplied services in that member State during a period from being granted a refund of VAT for that period (as at 9th April 2003, see regulation 188(2)(b) of the Value Added Tax Regulations 1995).

(5)The second provision is that which gives effect to Article 2(2) of the 1986 VAT Refund Directive (which permits member States to make refunds conditional upon the granting by third States of comparable advantages regarding turnover taxes: as at 9th April 2003, see regulation 188(1) of the Value Added Tax Regulations 1995).

(6)The third provision is that which gives effect to Article 2(3) of the 1986 VAT Refund Directive (which permits member States to require the appointment of a tax representative: as at 9th April 2003, see regulation 187 of the Value Added Tax Regulations 1995).

(7)The fourth provision is that which gives effect to Article 4(2) of the 1986 VAT Refund Directive (which permits member States to provide for the exclusion of certain expenditure and to make refunds subject to additional conditions).

(8)In this paragraph “the 1986 VAT Refund Directive” means the Thirteenth Council Directive of 17th November 1986 on the harmonisation of the laws of the member States relating to turnover taxes – arrangements for the refund of value added tax to taxable persons not established in Community territory (86/560/EEC).

Part 5U.K.Supplementary

InterpretationU.K.

23(1)In this Schedule—

“the 1977 VAT Directive” means the Sixth Council Directive of 17 May 1977 on the harmonisation of the laws of the member States relating to turnover taxes – common system of value added tax: uniform basis of assessment (77/388/EEC);

“the 2002 VAT Directive” means the Council Directive of 7 May 2002 amending and amending temporarily the 1977 VAT Directive as regards the value added tax arrangements applicable to radio and television broadcasting services and certain electronically supplied services (2002/38/EC);

“Article 26c” has the meaning given by paragraph 2(7) above;

“the Controller” has the meaning given by paragraph 11(7) above;

“participant in the special scheme” has the meaning given by paragraph 16(5) above;

“qualifying supply” has the meaning given by paragraph 3 above;

“registration number” means the number allocated to a person on his registration under this Schedule in accordance with paragraph 6(a) above;

“registration request” is to be construed in accordance with paragraph 4(1)(b) above;

“reporting period” is to be construed in accordance with paragraph 11(2) above;

“special accounting return” is to be construed in accordance with paragraph 11(1) above.

(2)References in this Schedule to a qualifying supply being “treated as made” in a member State are references to its being treated as made—

(a)in the United Kingdom, by virtue of any provision which gives effect in the United Kingdom to Article 9(2)(f) of the 1977 VAT Directive (which is inserted by Article 1(1)(b) of the 2002 VAT Directive), or

(b)in another member State, by virtue of any provision of the law of that member State which gives effect to that Article.

(3)The provision which, as at 9th April 2003, is to give effect in the United Kingdom to Article 9(2)(f) of the 1977 VAT Directive (as mentioned in sub-paragraph (2)(a) above) is article 16A of the Value Added Tax (Place of Supply of Services) Order 1992 (which is prospectively inserted by article 3 of the Value Added Tax (Place of Supply of Services) (Amendment) Order 2003).”.

Section 49

SCHEDULE 3U.K.Stamp duty land tax: transactions exempt from charge

No chargeable considerationU.K.

1U.K.A land transaction is exempt from charge if there is no chargeable consideration for the transaction.

Grant of certain leases by registered social landlordsU.K.

2(1)The grant of a lease of a dwelling is exempt from charge if the lease—U.K.

(a)is granted by a registered social landlord to one or more individuals in accordance with arrangements to which this paragraph applies, and

(b)is for an indefinite term or is terminable by notice of a month or less.

(2)This paragraph applies to arrangements between a registered social landlord and a housing authority under which the landlord provides, for individuals nominated by the authority in pursuance of its statutory housing functions, temporary rented accommodation which the landlord itself has obtained on a short-term basis.

The reference above to accommodation obtained by the landlord “on a short-term basis” is to accommodation leased to the landlord for a term of five years or less.

(3)A “housing authority” means—

(a)in relation to England and Wales—

(i)a principal council within the meaning of the Local Government Act 1972 (c. 70), or

(ii)the Common Council of the City of London;

(b)in relation to Scotland, a council constituted under section 2 of the Local Government etc. (Scotland) Act 1994 (c. 39);

(c)in relation to Northern Ireland—

(i)the Department for Social Development in Northern Ireland, or

(ii)the Northern Ireland Housing Executive.

Transactions in connection with divorce etcU.K.

3U.K.A transaction between one party to a marriage and the other is exempt from charge if it is effected—

(a)in pursuance of an order of a court made on granting in respect of the parties a decree of divorce, nullity of marriage or judicial separation;

(b)in pursuance of an order of a court made in connection with the dissolution or annulment of the marriage, or the parties' judicial separation, at any time after the granting of such a decree;

(c)in pursuance of—

(i)an order of a court made at any time under section 22A, 23A or 24A of the Matrimonial Causes Act 1973 (c. 18), or

(ii)an incidental order of a court made under section 8(2) of the Family Law (Scotland) Act 1985 (c. 37) by virtue of section 14(1) of that Act;

(d)at any time in pursuance of an agreement of the parties made in contemplation or otherwise in connection with the dissolution or annulment of the marriage, their judicial separation or the making of a separation order in respect of them.

[F1Assents and appropriations by personal representativesU.K.

Textual Amendments

F1Sch. 3 para. 3A and cross-heading inserted (with effect in accordance with s. 300(2) of the amending Act) by Finance Act 2004 (c. 12), s. 300(1)

3A(1)The acquisition of property by a person in or towards satisfaction of his entitlement under or in relation to the will of a deceased person, or on the intestacy of a deceased person, is exempt from charge.U.K.

(2)Sub-paragraph (1) does not apply if the person acquiring the property gives any consideration for it, other than the assumption of secured debt.

(3)Where sub-paragraph (1) does not apply because of sub-paragraph (2), the chargeable consideration for the transaction is determined in accordance with paragraph 8A(1) of Schedule 4.

(4)In this paragraph—

“debt” means an obligation, whether certain or contingent, to pay a sum of money either immediately or at a future date, and

“secured debt” means debt that, immediately after the death of the deceased person, is secured on the property.]

[F2Transactions in connection with dissolution of civil partnership etcU.K.

Textual Amendments

F2Sch. 3 para. 3A inserted (5.12.2005) by The Tax and Civil Partnership Regulations 2005 (S.I. 2005/3229), regs. 1(1), 174

3A.U.K.A transaction between one party to a civil partnership and the other is exempt from charge if it is effected —

(a)in pursuance of an order of a court made on granting in respect of the parties an order or decree for the dissolution or annulment of the civil partnership or their judicial separation;

(b)in pursuance of an order of a court made in connection with the dissolution or annulment of the civil partnership, or the parties' judicial separation, at any time after the granting of such an order or decree for dissolution, annulment or judicial separation as mentioned in paragraph (a);

(c)in pursuance of —

(i)an order of a court made at any time under any provision of Schedule 5 to the Civil Partnership Act 2004 that corresponds to section 22A, 23A or 24A of the Matrimonial Causes Act 1973, or

(ii)an incidental order of a court made under any provision of the Civil Partnership Act 2004 that corresponds to section 8(2) of the Family Law (Scotland) Act 1985 by virtue of section 14(1) of that Act of 1985;

(d)at any time in pursuance of an agreement of the parties made in contemplation of or otherwise in connection with the dissolution or annulment of the civil partnership, their judicial separation or the making of a separation order in respect of them.]

Variation of testamentary dispositions etcU.K.

4(1)A transaction following a person’s death that varies a disposition (whether effected by will, under the law relating to intestacy or otherwise) of property of which the deceased was competent to dispose is exempt from charge if the following conditions are met.U.K.

(2)The conditions are—

(a)that the transaction is carried out within the period of two years after a person’s death, and

(b)that no consideration in money or money’s worth other than the making of a variation of another such disposition is given for it.

[F3(2A)Where the condition in sub-paragraph (2)(b) is not met, the chargeable consideration for the transaction is determined in accordance with paragraph 8A(2) of Schedule 4.]

(3)This paragraph applies whether or not the administration of the estate is complete or the property has been distributed in accordance with the original dispositions.

Textual Amendments

F3Sch. 3 para. 4(2A) inserted (with effect in accordance with s. 301(7) of the amending Act) by Finance Act 2004 (c. 12), s. 301(1)

Power to add further exemptionsU.K.

5(1)The Treasury may by regulations provide that any description of land transaction specified in the regulations is exempt from charge.U.K.

(2)The regulations may contain such supplementary, incidental and transitional provision as appears to the Treasury to be appropriate.

Section 50

SCHEDULE 4U.K.Stamp duty land tax: chargeable consideration

Money or money’s worthU.K.

1(1)The chargeable consideration for a transaction is, except as otherwise expressly provided, any consideration in money or money’s worth given for the subject-matter of the transaction, directly or indirectly, by the purchaser or a person connected with him.U.K.

(2)Section 839 of the Taxes Act 1988 (connected persons) applies for the purposes of sub-paragraph (1).

Value added taxU.K.

2U.K.The chargeable consideration for a transaction shall be taken to include any value added tax chargeable in respect of the transaction, other than value added tax chargeable by virtue of an [F4option to tax any land under Part 1 of Schedule 10] to the Value Added Tax Act 1994 (c. 23) made after the effective date of the transaction.

Textual Amendments

F4Words in Sch. 4 para. 2 substituted (with effect in accordance with art. 1(2) of the amending S.I.) by The Value Added Tax (Buildings and Land) Order 2008 (S.I. 2008/1146), art. 1(1), Sch. 1 para. 11 (with Sch. 2)

Postponed considerationU.K.

3U.K.The amount or value of the chargeable consideration for a transaction shall be determined without any discount for postponement of the right to receive it or any part of it.

Just and reasonable apportionmentU.K.

4(1)For the purposes of this Part consideration attributable—U.K.

(a)to two or more land transactions, or

(b)in part to a land transaction and in part to another matter, or

(c)in part to matters making it chargeable consideration and in part to other matters,

shall be apportioned on a just and reasonable basis.

(2)If the consideration is not so apportioned, this Part has effect as if it had been so apportioned.

(3)For the purposes of this paragraph any consideration given for what is in substance one bargain shall be treated as attributable to all the elements of the bargain, even though—

(a)separate consideration is, or purports to be, given for different elements of the bargain, or

(b)there are, or purport to be, separate transactions in respect of different elements of the bargain.

ExchangesU.K.

5(1)This paragraph applies to determine the chargeable consideration where one or more land transactions are entered into by a person as purchaser (alone or jointly) wholly or partly in consideration of one or more other land transactions being entered into by him (alone or jointly) as vendor.U.K.

(2)In this paragraph—

(a)“relevant transaction” means any of those transactions, and

(b)“relevant acquisition” means a relevant transaction entered into as purchaser and “relevant disposal” means a relevant transaction entered into as vendor.

(3)The following rules apply if the subject-matter of any of the relevant transactions is a major interest in land—

(a)where a single relevant acquisition is made, the chargeable consideration for the acquisition is—

(i)the market value of the subject-matter of the acquisition, and

(ii)if the acquisition is the grant of a lease at a rent, that rent;

(b)where two or more relevant acquisitions are made, the chargeable consideration for each relevant acquisition is—

(i)the market value of the subject-matter of that acquisition, and

(ii)if the acquisition is the grant of a lease at a rent, that rent.

(4)The following rules apply if the subject-matter of none of the relevant transactions is a major interest in land—

(a)where a single relevant acquisition is made in consideration of one or more relevant disposals, the chargeable consideration for the acquisition is the amount or value of any chargeable consideration other than the disposal or disposals that is given for the acquisition;

(b)where two or more relevant acquisitions are made in consideration of one or more relevant disposals, the chargeable consideration for each relevant acquisition is the appropriate proportion of the amount or value of any chargeable consideration other than the disposal or disposals that is given for the acquisitions.

(5)For the purposes of sub-paragraph (4)(b) the appropriate proportion is—

where—

MV is the market value of the subject-matter of the acquisition for which the chargeable consideration is being determined, and

TMV is the total market value of the subject-matter of all the relevant acquisitions.

(6)This paragraph has effect subject to—

[F7(7)This paragraph does not apply in a case to which paragraph 17 applies.]

Textual Amendments

F5Words in Sch. 4 para. 5(6) repealed (with effect in accordance with Sch. 39 para. 26 of the amending Act) by Finance Act 2004 (c. 12), Sch. 42 Pt. 4(2) (which amending provision re-enacts, subject to certain changes, a corresponding amendment made by the now revoked Stamp Duty and Stamp Duty Land Tax (Variation of the Finance Act 2003) (No. 2) Regulations 2003 (S.I. 2003/2816), see Sch. 39 para. 14)

F6Sch. 4 para. 5(6) entry omitted (7.4.2004) by virtue of The Stamp Duty Land Tax (Amendment of Part 4 of the Finance Act 2003) Regulations 2004 (S.I. 2004/1069), regs. 1, 4(2)(a)

F7Sch. 4 para. 5(7) added (7.4.2004) by The Stamp Duty Land Tax (Amendment of Part 4 of the Finance Act 2003) Regulations 2004 (S.I. 2004/1069), regs. 1, 4(2)(b)

Partition etc: disregard of existing interestU.K.

6U.K.In the case of a land transaction giving effect to a partition or division of a chargeable interest to which persons are jointly entitled, the share of the interest held by the purchaser immediately before the partition or division does not count as chargeable consideration.

Valuation of non-monetary considerationU.K.

7U.K.Except as otherwise expressly provided, the value of any chargeable consideration for a land transaction, other than—

(a)money (whether in sterling or another currency), or

(b)debt as defined for the purposes of paragraph 8 (debt as consideration),

shall be taken to be its market value at the effective date of the transaction.

Debt as considerationU.K.

8(1)Where the chargeable consideration for a land transaction consists in whole or in part of—U.K.

(a)the satisfaction or release of debt due to the purchaser or owed by the vendor, or

(b)the assumption of existing debt by the purchaser,

the amount of debt satisfied, released or assumed shall be taken to be the whole or, as the case may be, part of the chargeable consideration for the transaction.

[F8(1A)Where—

(a)debt is secured on the subject-matter of a land transaction immediately before and immediately after the transaction, and

(b)the rights or liabilities in relation to that debt of any party to the transaction are changed as a result of or in connection with the transaction,

then for the purposes of this paragraph there is an assumption of that debt by the purchaser, and that assumption of debt constitutes chargeable consideration for the transaction.

(1B)Where in a case in which sub-paragraph (1)(b) applies—

(a)the debt assumed is or includes debt secured on the property forming the subject-matter of the transaction, and

(b)immediately before the transaction there were two or more persons each holding an undivided share of that property, or there are two or more such persons immediately afterwards,

the amount of secured debt assumed shall be determined as if the amount of that debt owed by each of those persons at a given time were the proportion of it corresponding to his undivided share of the property at that time.

(1C)For the purposes of sub-paragraph (1B), in England and Wales and Northern Ireland each joint tenant of property is treated as holding an equal undivided share of it.]

(2)If the effect of [F9this paragraph] would be that the amount of the chargeable consideration for the transaction exceeded the market value of the subject-matter of the transaction, the amount of the chargeable consideration is treated as limited to that value.

(3)In this paragraph—

(a)“debt” means an obligation, whether certain or contingent, to pay a sum of money either immediately or at a future date,

(b)“existing debt”, in relation to a transaction, means debt created or arising before the effective date of, and otherwise than in connection with, the transaction, and

(c)references to the amount of a debt are to the principal amount payable or, as the case may be, the total of the principal amounts payable, together with the amount of any interest that has accrued due on or before the effective date of the transaction.

Textual Amendments

F8Sch. 4 para. 8(1A)-(1C) inserted (with effect in accordance with s. 301(6) of the amending Act) by Finance Act 2004 (c. 12), s. 301(3)

F9Words in Sch. 4 para. 8(2) substituted (with effect in accordance with s. 301(6) of the amending Act) by Finance Act 2004 (c. 12), s. 301(4)

Modifications etc. (not altering text)

C1Sch. 4 para. 8 excluded (6.4.2006) by The Pension Protection Fund (Tax) Regulations 2006 (S.I. 2006/575), regs. 1, 43(1)

[F10Cases where conditions for exemption not fully metU.K.

Textual Amendments

F10Sch. 4 para. 8A and cross-heading inserted (with effect in accordance with s. 301(7) of the amending Act) by Finance Act 2004 (c. 12), s. 301(5)

8A(1)Where a land transaction would be exempt from charge under paragraph 3A of Schedule 3 (assents and appropriations by personal representatives) but for sub-paragraph (2) of that paragraph (cases where person acquiring property gives consideration for it), the chargeable consideration for the transaction does not include the amount of any secured debt assumed.U.K.

“Secured debt” has the same meaning as in that paragraph.

(2)Where a land transaction would be exempt from charge under paragraph 4 of Schedule 3 (variation of testamentary dispositions etc) but for a failure to meet the condition in sub-paragraph (2)(b) of that paragraph (no consideration other than variation of another disposition), the chargeable consideration for the transaction does not include the making of any such variation as is mentioned in that sub-paragraph.]

Conversion of amounts in foreign currencyU.K.

9(1)References in this Part to the amount or value of the consideration for a transaction are to its amount or value in sterling.U.K.

(2)For the purposes of this Part the sterling equivalent of an amount expressed in another currency shall be ascertained by reference to the London closing exchange rate on the effective date of the transaction (unless the parties have used a different rate for the purposes of the transaction).

Carrying out of worksU.K.

10(1)Where the whole or part of the consideration for a land transaction consists of the carrying out of works of construction, improvement or repair of a building or other works to enhance the value of land, then—U.K.

(a)to the extent that the conditions specified in sub-paragraph (2) are met, the value of the works does not count as chargeable consideration, and

(b)to the extent that those conditions are not met, the value of the works shall be taken into account as chargeable consideration.

(2)The conditions referred to in sub-paragraph (1) are—

(a)that the works are carried out after the effective date of the transaction,

(b)that the works are carried out on land acquired or to be acquired under the transaction or on other land held by the purchaser or a person connected with him, and

(c)that it is not a condition of the transaction that the works are carried out by the vendor or a person connected with him.

[F11(2A)[F12Where by virtue of—

(a)subsection (8) of section 44 (contract and conveyance),

(b)paragraph 12A of Schedule 17A (agreement for lease), or

(c)paragraph 19(3) to (6) of Schedule 17A (missives of let etc in Scotland),

there are two notifiable transactions (the first being the contract or agreement and the second being the transaction effected on completion or, as the case may be, the grant or execution of the lease),] the condition in sub-paragraph (2)(a) is treated as met in relation to the second transaction if it is met in relation to the first.]

(3)In this paragraph—

(a)references to the acquisition of land are to the acquisition of a major interest in it;

(b)the value of the works shall be taken to be the amount that would have to be paid in the open market for the carrying out of the works in question.

(4)Section 839 of the Taxes Act 1988 (connected persons) has effect for the purposes of this paragraph.

[F13(5)This paragraph is subject to paragraph 17 (arrangements involving public or educational bodies).]

Textual Amendments

F11Sch. 4 para. 10(2A) inserted (with effect in accordance with Sch. 39 para. 13(3)-(6) of the amending Act) by Finance Act 2004 (c. 12), Sch. 39 para. 9(2)

F12Words in Sch. 4 para. 10(2A) substituted (with effect in accordance with s. 297(9) of the amending Act) by Finance Act 2004 (c. 12), s. 297(8)

F13Sch. 4 para. 10(5) added (19.12.2003) by The Stamp Duty Land Tax (Amendment of Schedule 4 to the Finance Act 2003) Regulations 2003 (S.I. 2003/3293), regs. 1, 2(3)

Provision of servicesU.K.

11[F14(1)]Where the whole or part of the consideration for a land transaction consists of the provision of services (other than the carrying out of works to which paragraph 10 applies), the value of that consideration shall be taken to be the amount that would have to be paid in the open market to obtain those services.U.K.

[F15(2)This paragraph is subject to paragraph 17 (arrangements involving public or educational bodies).]

Textual Amendments

F14Sch. 4 para. 11 renumbered as Sch. 4 para. 11(1) (19.12.2003) by The Stamp Duty Land Tax (Amendment of Schedule 4 to the Finance Act 2003) Regulations 2003 (S.I. 2003/3293), regs. 1, 2(4)

F15Sch. 4 para. 11(2) inserted (19.12.2003) by The Stamp Duty Land Tax (Amendment of Schedule 4 to the Finance Act 2003) Regulations 2003 (S.I. 2003/3293), regs. 1, 2(4)

Land transaction entered into by reason of employmentU.K.

12(1)Where a land transaction is entered into by reason of the purchaser’s employment, or that of a person connected with him, then—U.K.

(a)if the transaction gives rise to a charge to tax under Chapter 5 of Part 3 of the Income Tax (Earnings and Pensions) Act 2003 (c. 1) (taxable benefits: living accommodation) and—

(i)no rent is payable by the purchaser, or

(ii)the rent payable by the purchaser is less than the cash equivalent of the benefit calculated under section 105 or 106 of that Act,

there shall be taken to be payable by the purchaser as rent an amount equal to the cash equivalent chargeable under those sections;

(b)if the transaction would give rise to a charge under that Chapter but for section 99 of that Act (accommodation provided for performance of duties), the consideration for the transaction is the actual consideration (if any);

(c)if neither paragraph (a) nor paragraph (b) applies, the consideration for the transaction shall be taken to be not less than the market value of the subject-matter of the transaction as at the effective date of the transaction.

(2)Section 839 of the Taxes Act 1988 (connected persons) has effect for the purposes of this paragraph.

Obligations under leaseU.K.

F1613U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F16Sch. 4 paras. 13-15 repealed (with effect in accordance with Sch. 39 para. 26 of the amending Act) by Finance Act 2004 (c. 12), Sch. 42 Pt. 4(2) (which amending provision re-enacts, subject to certain changes, a corresponding amendment made by the now revoked Stamp Duty and Stamp Duty Land Tax (Variation of the Finance Act 2003) (No. 2) Regulations 2003 (S.I. 2003/2816), see Sch. 39 para. 14)

Surrender of existing lease in return for new leaseU.K.

F1614U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F16Sch. 4 paras. 13-15 repealed (with effect in accordance with Sch. 39 para. 26 of the amending Act) by Finance Act 2004 (c. 12), Sch. 42 Pt. 4(2) (which amending provision re-enacts, subject to certain changes, a corresponding amendment made by the now revoked Stamp Duty and Stamp Duty Land Tax (Variation of the Finance Act 2003) (No. 2) Regulations 2003 (S.I. 2003/2816), see Sch. 39 para. 14)

Reverse premiumU.K.

F1615U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F16Sch. 4 paras. 13-15 repealed (with effect in accordance with Sch. 39 para. 26 of the amending Act) by Finance Act 2004 (c. 12), Sch. 42 Pt. 4(2) (which amending provision re-enacts, subject to certain changes, a corresponding amendment made by the now revoked Stamp Duty and Stamp Duty Land Tax (Variation of the Finance Act 2003) (No. 2) Regulations 2003 (S.I. 2003/2816), see Sch. 39 para. 14)

Indemnity given by purchaserU.K.

16U.K.Where the purchaser agrees to indemnify the vendor in respect of liability to a third party arising from breach of an obligation owed by the vendor in relation to the land that is the subject of the transaction, neither the agreement nor any payment made in pursuance of it counts as chargeable consideration.

Purchaser bearing inheritance tax liabilityU.K.

[F1716AWhere—

(a)there is a land transaction that is—

(i)a transfer of value within section 3 of the Inheritance Tax Act 1984 (transfers of value), or

(ii)a disposition, effected by will or under the law of intestacy, of a chargeable interest comprised in the estate of a person immediately before his death,

and

(b)the purchaser is or becomes liable to pay, agrees to pay or does in fact pay any inheritance tax due in respect of the transfer or disposition,

his liability, agreement or payment does not count as chargeable consideration for the transaction.

Textual Amendments

F17Sch. 4 paras. 16A-16C inserted (with effect in accordance with reg. 1(2) of the amending S.I.) by The Stamp Duty Land Tax (Amendment to the Finance Act 2003) Regulations 2006 (S.I. 2006/875), regs. 1(1), 3

Purchaser bearing capital gains tax liabilityU.K.

16B(1)Where—

(a)there is a land transaction under which the chargeable interest in question—

(i)is acquired otherwise than by a bargain made at arm’s length, or

(ii)is treated by section 18 of the Taxation of Chargeable Gains Act 1992 (connected persons) as so acquired,

and

(b)the purchaser is or becomes liable to pay, or does in fact pay, any capital gains tax due in respect of the corresponding disposal of the chargeable interest,

his liability or payment does not count as chargeable consideration for the transaction.

(2)Sub-paragraph (1) does not apply if there is chargeable consideration for the transaction (disregarding the liability or payment referred to in sub-paragraph (1)(b)).

Textual Amendments

F17Sch. 4 paras. 16A-16C inserted (with effect in accordance with reg. 1(2) of the amending S.I.) by The Stamp Duty Land Tax (Amendment to the Finance Act 2003) Regulations 2006 (S.I. 2006/875), regs. 1(1), 3

Costs of enfranchisementU.K.

16CCosts borne by the purchaser under section 9(4) of the Leasehold Reform Act 1967 or section 33 of the Leasehold Reform, Housing and Urban Development Act 1993 (costs of enfranchisement) do not count as chargeable consideration.]

Textual Amendments

F17Sch. 4 paras. 16A-16C inserted (with effect in accordance with reg. 1(2) of the amending S.I.) by The Stamp Duty Land Tax (Amendment to the Finance Act 2003) Regulations 2006 (S.I. 2006/875), regs. 1(1), 3

[F18Arrangements involving public or educational bodiesU.K.

Textual Amendments

F18Sch. 4 para. 17 added (19.12.2003) by The Stamp Duty Land Tax (Amendment of Schedule 4 to the Finance Act 2003) Regulations 2003 (S.I. 2003/3293), regs. 1, 2(5)

17.(1)This paragraph applies in any case where arrangements are entered into under which—U.K.

[F19(a)there is a transfer, or the grant or assignment of a lease, of land by a qualifying body (“A”) to a non-qualifying body (“B”) (“the main transfer”),]

[F20(b)in consideration (whether in whole or in part) of the main transfer there is a grant by B to A of a lease or under-lease of the whole, or substantially the whole, of that land (“the leaseback”),]

(c)B undertakes to carry out works or provide services to A, and

(d)some or all of the consideration given by A to B for the carrying out of those works or the provision of those services is consideration in money,

[F21whether or not there is also a transfer, or the grant or assignment of a lease, of any other land by A to B (a “transfer of surplus land”).]

(2)The following are qualifying bodies—

(a)public bodies within section 66,

(b)institutions within the further education sector or the higher education sector within the meaning of 91 of the Further and Higher Education Act 1992,

(c)further education corporations within the meaning of section 17 of that Act,

(d)higher education corporations within the meaning section 90 of that Act,

(e)persons who undertake to establish and maintain, and carry on, or provide for the carrying on, of an Academy within the meaning of section 482 of the Education Act 1996, and

(f)in Scotland, institutions funded by the Scottish Further Education Funding Council or the Scottish Higher Education Funding Council.

[F22(3)The following shall not count as chargeable consideration for the main transfer or any transfer of surplus land—

(a)the lease-back;

(b)the carrying out of building works by B for A; or

(c)the provision of services by B to A.

(4)The chargeable consideration for the lease back does not include—

(a)the main transfer;

(b)any transfer of surplus land; or

(c)the consideration in money paid by A to B for the building works or other services referred to in sub-paragraph (3).]

[F23(4A)Sub-paragraphs (3) and (4) shall be disregarded for the purposes of determining whether the land transaction in question is notifiable.]

(5)This paragraph applies to Scotland as if—

(a)references to A transferring land to B were references to A transferring the interest of an owner of land to B, and

[F24(b)references in sub-paragraph (1) to assignment were references to assignation.]

Until the appointed day for the purposes of the Abolition of Feudal Tenure etc. (Scotland) Act 2000 (asp 5), the reference in paragraph (a) to the interest of the owner shall be read, in relation to feudal property, as a reference to the estate or interest of the proprietor of the dominium utile.

(6)In this paragraph “under-lease” includes a sub-lease.]

Textual Amendments

F19Sch. 4 para. 17(1)(a)(b) substituted (7.4.2004) by The Stamp Duty Land Tax (Amendment of Part 4 of the Finance Act 2003) Regulations 2004 (S.I. 2004/1069), regs. 1, 4(3)(a)(i)

F20Sch. 4 para. 17(1)(b) substituted (27.4.2004) by The Stamp Duty Land Tax (Amendment of Part 4 of the Finance Act 2003) (No. 2) Regulations 2004 (S.I. 2004/1206), regs. 1, 3

F21Words in Sch. 4 para. 17(1) substituted (7.4.2004) by The Stamp Duty Land Tax (Amendment of Part 4 of the Finance Act 2003) Regulations 2004 (S.I. 2004/1069), regs. 1, 4(3)(a)(ii)

F22Sch. 4 para. 17(3)(4) substituted (7.4.2004) by The Stamp Duty Land Tax (Amendment of Part 4 of the Finance Act 2003) Regulations 2004 (S.I. 2004/1069), regs. 1, 4(3)(b)

F23Sch. 4 para. 17(4A) inserted (with effect in accordance with Sch. 39 para. 13(3)-(6) of the amending Act) by Finance Act 2004 (c. 12), Sch. 39 para. 9(3)

F24Sch. 4 para. 17(5)(b) substituted (7.4.2004) by The Stamp Duty Land Tax (Amendment of Part 4 of the Finance Act 2003) Regulations 2004 (S.I. 2004/1069), regs. 1, 4(3)(c)

Section 56

SCHEDULE 5U.K.Stamp duty land tax: amount of tax chargeable: rent

IntroductionU.K.

1U.K.This Schedule provides for calculating the tax chargeable—

(a)in respect of a chargeable transaction for which the chargeable consideration consists of or includes rent, or

(b)where such a transaction is to be taken into account as a linked transaction.

[F25Amounts payable in respect of periods before grant of leaseU.K.

Textual Amendments

F25Sch. 5 para. 1A and cross-heading inserted (with effect in accordance with Sch. 39 para. 13(3)-(6) of the amending Act) by Finance Act 2004 (c. 12), Sch. 39 para. 10

1AU.K.For the purposes of this Part “rent” does not include any chargeable consideration for the grant of a lease that is payable in respect of a period before the grant of the lease.]

Calculation of tax chargeable in respect of rentU.K.

2(1)Tax is chargeable under this Schedule in respect of so much of the chargeable consideration as consists of rent.U.K.

[F26(2)The tax chargeable is the total of the amounts produced by taking the relevant percentage of so much of the relevant rental value as falls within each rate band.

(3)The relevant percentages and rate bands are determined by reference to whether the relevant land—

(a)consists entirely of residential property (in which case Table A below applies), or

(b)consists of or includes land that is not residential property (in which case Table B below applies).

TABLE B: NON-RESIDENTIAL OR MIXED

| Rate bands | Percentage |

|---|---|

| £0 to £150,000 | 0% |

| Over £150,000 | 1% |

(4)For the purposes of sub-paragraphs (2) and (3)—

(a)the relevant rental value is the net present value of the rent payable over the term of the lease, and

(b)the relevant land is the land that is the subject of the lease.

(5)If the lease in question is one of a number of linked transactions for which the chargeable consideration consists of or includes rent, the above provisions are modified.

(6)In that case the tax chargeable is determined as follows.

First, calculate the amount of the tax that would be chargeable if the linked transactions were a single transaction, so that—

(a)the relevant rental value is the total of the net present values of the rent payable over the terms of all the leases, and

(b)the relevant land is all land that is the subject of any of those leases.

Then, multiply that amount by the fraction:

where—

NPV is the net present value of the rent payable over the term of the lease in question, and

TNPV is the total of the net present values of the rent payable over the terms of the all the leases.]

Textual Amendments

F26Sch. 5 para. 2(2)-(6) substituted for Sch. 5 para. 2(2)-(5) (1.12.2003) by The Stamp Duty Land Tax (Amendment of Schedule 5 to the Finance Act 2003) Regulations 2003 (SI 2003/2914), reg. 2 Sch. para. 1

F27Sum in Sch. 5 para. 2(3) substituted (with effect in accordance with s. 162(4) of the amending Act) by Finance Act 2006 (c. 25), s. 162(2)

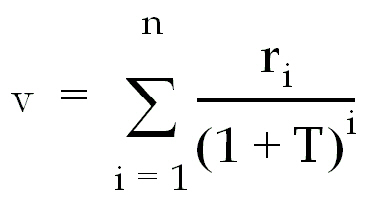

Net present value of rent payable over term of leaseU.K.

3U.K.The net present value (v) of the rent payable over the term of a lease is calculated by applying the formula:

where—

Textual Amendments

F28Words in Sch. 5 para. 3 repealed (with effect in accordance with Sch. 39 para. 26 of the amending Act) by Finance Act 2004 (c. 12), Sch. 42 Pt. 4(2) (which amending provision re-enacts, subject to certain changes, a corresponding amendment made by the now revoked Stamp Duty and Stamp Duty Land Tax (Variation of the Finance Act 2003) (No. 2) Regulations 2003 (S.I. 2003/2816), see Sch. 39 para. 14)

F29Words in Sch. 5 para. 3 substituted (with effect in accordance with s. 164(4) of the amending Act) by Finance Act 2006 (c. 25), s. 164(2)

Rent payableU.K.

F304U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F30Sch. 5 paras. 4-7 repealed (with effect in accordance with Sch. 39 para. 26 of the amending Act) by Finance Act 2004 (c. 12), Sch. 42 Pt. 4(2) (which amending provision re-enacts, subject to certain changes, a corresponding amendment made by the now revoked Stamp Duty and Stamp Duty Land Tax (Variation of the Finance Act 2003) (No. 2) Regulations 2003 (S.I. 2003/2816), see Sch. 39 para. 14)

Effect of provision for rent reviewU.K.

F305U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F30Sch. 5 paras. 4-7 repealed (with effect in accordance with Sch. 39 para. 26 of the amending Act) by Finance Act 2004 (c. 12), Sch. 42 Pt. 4(2) (which amending provision re-enacts, subject to certain changes, a corresponding amendment made by the now revoked Stamp Duty and Stamp Duty Land Tax (Variation of the Finance Act 2003) (No. 2) Regulations 2003 (S.I. 2003/2816), see Sch. 39 para. 14)

Term of leaseU.K.

F306U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F30Sch. 5 paras. 4-7 repealed (with effect in accordance with Sch. 39 para. 26 of the amending Act) by Finance Act 2004 (c. 12), Sch. 42 Pt. 4(2) (which amending provision re-enacts, subject to certain changes, a corresponding amendment made by the now revoked Stamp Duty and Stamp Duty Land Tax (Variation of the Finance Act 2003) (No. 2) Regulations 2003 (S.I. 2003/2816), see Sch. 39 para. 14)

Treatment of lease for indefinite termU.K.

F307U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F30Sch. 5 paras. 4-7 repealed (with effect in accordance with Sch. 39 para. 26 of the amending Act) by Finance Act 2004 (c. 12), Sch. 42 Pt. 4(2) (which amending provision re-enacts, subject to certain changes, a corresponding amendment made by the now revoked Stamp Duty and Stamp Duty Land Tax (Variation of the Finance Act 2003) (No. 2) Regulations 2003 (S.I. 2003/2816), see Sch. 39 para. 14)

Temporal discount rateU.K.

8(1)For the purposes of this Schedule the “temporal discount rate” is 3.5% or such other rate as may be specified by regulations made by the Treasury.U.K.

(2)Regulations under this paragraph may make any such provision as is mentioned in subsection (3)(b) to (f) of section 178 of the Finance Act 1989 (c. 26) (power of Treasury to set rates of interest).

(3)Subsection (5) of that section (power of Inland Revenue to specify rate by order in certain circumstances) applies in relation to regulations under this paragraph as it applies in relation to regulations under that section.

Tax chargeable in respect of consideration other than rent [F31: general] U.K.

Textual Amendments

F31Word in Sch. 5 para. 9 heading inserted (with effect in accordance with s. 95(13) of the amending Act) by Finance Act 2008 (c. 9), s. 95(2)

9(1)Where in the case of a transaction to which this Schedule applies there is chargeable consideration other than rent, the provisions of this Part apply in relation to that consideration as in relation to other chargeable consideration [F32(but see paragraph 9A)].U.K.

F33(2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F34(2A). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F35(3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(4)Tax chargeable under this Schedule is in addition to any tax chargeable under section 55 in respect of consideration other than rent.

(5)Where a transaction to which this Schedule applies falls to be taken into account for the purposes of that section as a linked transaction, no account shall be taken of rent in determining the relevant consideration.

Textual Amendments

F32Words in Sch. 5 para. 9(1) inserted (with effect in accordance with s. 95(13) of the amending Act) by Finance Act 2008 (c. 9), s. 95(2)(a)

F33Sch. 5 para. 9(2) omitted (with effect in accordance with s. 95(13) of the amending Act) by virtue of Finance Act 2008 (c. 9), s. 95(2)(b)

F34Sch. 5 para. 9(2A) omitted (with effect in accordance with s. 95(13) of the amending Act) by virtue of Finance Act 2008 (c. 9), s. 95(2)(b)

F35Sch. 5 para. 9(3) omitted (with effect in accordance with s. 95(13) of the amending Act) by virtue of Finance Act 2008 (c. 9), s. 95(2)(b)

[F36Tax chargeable in respect of consideration other than rent: 0% bandU.K.

Textual Amendments

F36Sch. 5 para. 9A and cross-heading inserted (with effect in accordance with s. 95(13) of the amending Act) by Finance Act 2008 (c. 9), s. 95(3)

9A(1)This paragraph applies in the case of a transaction to which this Schedule applies where there is chargeable consideration other than rent.U.K.

(2)If—

(a)the relevant land consists entirely of land that is non-residential property, and

(b)the relevant rent is at least £1,000,

the 0% band in Table B in section 55(2) does not apply in relation to the consideration other than rent and any case that would have fallen within that band is treated as falling within the 1% band.

(3)Sub-paragraphs (4) and (5) apply if—

(a)the relevant land is partly residential property and partly non-residential property, and

(b)the relevant rent attributable, on a just and reasonable apportionment, to the land that is non-residential property is at least £1,000.

(4)For the purpose of determining the amount of tax chargeable under section 55 in relation to the consideration other than rent, the transaction (or, where it is one of a number of linked transactions, that set of transactions) is treated as if it were two separate transactions (or sets of linked transactions), namely—

(a)one whose subject-matter consists of all of the interests in land that is residential property, and

(b)one whose subject-matter consists of all of the interests in land that is non-residential property.

(5)For that purpose, the chargeable consideration attributable to each of those separate transactions (or sets of linked transactions) is the chargeable consideration so attributable on a just and reasonable apportionment.

(6)In this paragraph “the relevant rent” means—

(a)the annual rent in relation to the transaction in question, or

(b)if that transaction is one of a number of linked transactions for which the chargeable consideration consists of or includes rent, the total of the annual rents in relation to all of those transactions.

(7)In sub-paragraph (6) the “annual rent” means the average annual rent over the term of the lease or, if—

(a)different amounts of rent are payable for different parts of the term, and

(b)those amounts (or any of them) are ascertainable at the effective date of the transaction,

the average annual rent over the period for which the highest ascertainable rent is payable.

(8)In this paragraph “relevant land” has the meaning given in section 55(3) and (4).]

Increase of rent treated as grant of new leaseU.K.

F3710U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F37Sch. 5 para. 10 repealed (with effect in accordance with Sch. 39 para. 26 of the amending Act) by Finance Act 2004 (c. 12), Sch. 42 Pt. 4(2) (which amending provision re-enacts, subject to certain changes, a corresponding amendment made by the now revoked Stamp Duty and Stamp Duty Land Tax (Variation of the Finance Act 2003) (No. 2) Regulations 2003 (S.I. 2003/2816), see Sch. 39 para. 14)

InterpretationU.K.

F3811U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F38Sch. 5 para. 11 repealed (with effect in accordance with Sch. 39 para. 26 of the amending Act) by Finance Act 2004 (c. 12), Sch. 42 Pt. 4(2) (which amending provision re-enacts, subject to certain changes, a corresponding amendment made by the now revoked Stamp Duty and Stamp Duty Land Tax (Variation of the Finance Act 2003) (No. 2) Regulations 2003 (S.I. 2003/2816), see Sch. 39 para. 14)

Section 57

SCHEDULE 6U.K.Stamp duty land tax: disadvantaged areas relief

Part 1U.K.Disadvantaged areas

Meaning of “disadvantaged area”U.K.

1(1)For the purposes of this Schedule a “disadvantaged area” means an area designated as a disadvantaged area by regulations made by the Treasury.U.K.

(2)The regulations may—

(a)designate specified areas as disadvantaged areas, or

(b)provide for areas of a description specified in the regulations to be designated as disadvantaged areas.

(3)If the regulations so provide, the designation of an area as a disadvantaged area shall have effect for such period as may be specified by or determined in accordance with the regulations.

(4)The regulations may—

(a)make different provision for different cases, and

(b)contain such incidental, supplementary, consequential or transitional provision as appears to the Treasury to be necessary or expedient.

Continuation of regulations made for purposes of stamp dutyU.K.

2U.K.Any regulations made by the Treasury—

(a)designating areas as disadvantaged areas for the purposes of section 92 of the Finance Act 2001 (c. 9) (stamp duty exemption for land in disadvantaged areas), and

(b)in force immediately before the implementation date,

have effect for the purposes of this Schedule as if made under paragraph 1 above and may be varied or revoked accordingly.

Part 2U.K.Land wholly situated in a disadvantaged area

IntroductionU.K.

3U.K.This Part of this Schedule applies to a land transaction if

[F39(a)] the subject matter of the transaction is a chargeable interest in relation to land that is wholly situated in a disadvantaged area[F40, and

(b)the land is wholly or partly residential property].

Textual Amendments

F39Word in Sch. 6 para. 3 inserted (with application in accordance with Sch. 9 para. 4(1) of the amending Act) by Finance Act 2005 (c. 7), Sch. 9 para. 1(2) (with Sch. 9 para. 4)

F40Sch. 6 para. 3(b) and word inserted (with application in accordance with Sch. 9 para. 4(1) of the amending Act) by Finance Act 2005 (c. 7), Sch. 9 para. 1(2) (with Sch. 9 para. 4)

Land all non-residentialU.K.

F414U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F41Sch. 6 para. 4 repealed (with application in accordance with Sch. 9 para. 4(1) of the amending Act) by Finance Act 2005 (c. 7), Sch. 9 para. 1(3), Sch. 11 Pt. 3(2) (with Sch. 9 para. 4)

Land all residentialU.K.

5(1)This paragraph applies where all the land is residential property.U.K.

(2)If—

(a)the consideration for the transaction does not include rent and the relevant consideration does not exceed £150,000, or

(b)the consideration for the transaction consists only of rent and the relevant rental value does not exceed £150,000,

the transaction is exempt from charge.

(3)If the consideration for the transaction includes rent and the relevant rental value does not exceed £150,000, the rent does not count as chargeable consideration.

(4)If the consideration for the transaction includes consideration other than rent, then—

(a)if—

F42(i). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(ii)the relevant consideration does not exceed £150,000,

the consideration other than rent does not count as chargeable consideration;

F43(b). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F42Sch. 6 para. 5(4)(a)(i) omitted (with effect in accordance with s. 95(13) of the amending Act) by virtue of Finance Act 2008 (c. 9), s. 95(4)(a)(5)(a)

F43Sch. 6 para. 5(4)(b) omitted (with effect in accordance with s. 95(13) of the amending Act) by virtue of Finance Act 2008 (c. 9), s. 95(4)(a)(5)(b)

Land partly non-residential and partly residentialU.K.

6(1)[F44This paragraph applies, where the land is partly non-residential property and partly residential property, in relation to the consideration attributable to land that is residential property.] U.K.

References in this paragraph to the consideration attributable to F45... land that is residential property (or to the rent or annual rent so attributable) are to the consideration (or rent or annual rent) so attributable on a just and reasonable apportionment.

F46(2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F46(3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(4)If—

(a)the consideration so attributable does not include rent and the relevant consideration does not exceed £150,000, or

(b)the consideration so attributable consists only of rent and the relevant rental value does not exceed £150,000,

none of the consideration so attributable counts as chargeable consideration.

(5)If the consideration so attributable includes rent and the relevant rental value does not exceed £150,000, the rent so attributable does not count as chargeable consideration.

(6)If the consideration so attributable includes consideration other than rent, then—

(a)if—

F47(i). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(ii)the relevant consideration does not exceed £150,000,

the consideration other than rent does not count as chargeable consideration;

F48(b). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F44Words in Sch. 6 para. 6(1) substituted (with application in accordance with Sch. 9 para. 4(1) of the amending Act) by Finance Act 2005 (c. 7), Sch. 9 para. 1(4)(a) (with Sch. 9 para. 4)

F45Words in Sch. 6 para. 6(1) repealed (with application in accordance with Sch. 9 para. 4(1) of the amending Act) by Finance Act 2005 (c. 7), Sch. 9 para. 1(4)(b), Sch. 11 Pt. 3(2) (with Sch. 9 para. 4)

F46Sch. 6 para. 6(2)(3) repealed (with application in accordance with Sch. 9 para. 4(1) of the amending Act) by Finance Act 2005 (c. 7), Sch. 9 para. 1(4)(c), Sch. 11 Pt. 3(2) (with Sch. 9 para. 4)

F47Sch. 6 para. 6(6)(a)(i) omitted (with effect in accordance with s. 95(13) of the amending Act) by virtue of Finance Act 2008 (c. 9), s. 95(4)(b)(5)(a)

F48Sch. 6 para. 6(6)(b) omitted (with effect in accordance with s. 95(13) of the amending Act) by virtue of Finance Act 2008 (c. 9), s. 95(4)(b)(5)(b)

Part 3U.K.Land partly situated in a disadvantaged area

IntroductionU.K.

7(1)This Part of this Schedule applies to a land transaction ifU.K.