SCHEDULES

C6SCHEDULE 36Pension schemes etc: transitional provisions and savings

C3Part 3Pre-commencement benefit rights

Sch. 36 Pt. 3 modified (6.4.2006) by The Pension Protection Fund (Tax) Regulations 2006 (S.I. 2006/575), regs. 1, 31(1)

Entitlement to lump sums exceeding 25% of uncrystallised rights

C4C3C131

1

If the pension condition is met in relation to an individual and a registered pension scheme which is a protected pension scheme, the provisions of Schedule 29 relating to pension commencement lump sums apply in relation to the individual and the pension scheme with the modifications specified in paragraph 34 (but subject to sub-paragraph (2)).

2

Those provisions do not apply with those modifications if the lump sum condition and registration condition in paragraph 24 are met.

C2C10C7C9C83

The pension condition is that the individual becomes entitled to all the pensions payable to the individual under arrangements under the pension scheme (to which the individual did not have an actual entitlement on or before 5th April 2006) on the same date.

4

A registered pension scheme is a protected pension scheme if condition A or condition B is met.

5

Condition A is met if—

a

the pension scheme was within any of paragraphs (a) to (e) of paragraph 1(1), and

b

on 5th April 2006 the lump sum percentage of the individual’s uncrystallised rights under the pension scheme exceeded 25%.

6

The lump sum percentage of an individual’s uncrystallised pension rights under a pension scheme on 5th April 2006 is—

where—

VULSR is the value of the individual’s uncrystallised lump sum rights under the pension scheme on 5th April 2006, calculated in accordance with paragraph 32, and

VUR is the value of the individual’s uncrystallised rights under the pension scheme on 5th April 2006, calculated in accordance with paragraph 33.

7

Condition B is met if the individual is a member of the pension scheme F1(“a transferee pension scheme”) as a result of—

a

a block transfer from the pension scheme (“the original pension scheme”) in relation to which condition A is met to the transferee pension scheme, or

b

a block transfer to the transferee pension scheme from a pension scheme that was a transferee pension scheme in relation to the original pension scheme by virtue of the previous application of paragraph (a) or the previous application (on one or more occasions) of this paragraph.

8

“Block transfer” has the same meaning as in paragraph 22(6), but treating the references there to the member as references to the individual.

9

Where a pension scheme is a protected pension scheme because condition B is met, Schedule 29 as modified by paragraph 34 applies as if the protected pension scheme were the same pension scheme as the original pension scheme.

32

1

Subject to sub-paragraph (2), the value of the individual’s uncrystallised lump sum rights under the pension scheme on 5th April 2006 is the aggregate of the value of the individual’s uncrystallised lump sum rights under each arrangement in respect of the individual under the pension scheme, calculated in accordance with paragraph 25(5), on that date.

2

If the pension scheme is a relevant pension scheme, the value of the individual’s uncrystallised lump sum rights on 5th April 2006 under an arrangement—

a

which relates to a particular employment, and

b

in relation to which the excess lump sum condition is met (see sub-paragraph (5) or (6)),

is the amount arrived at in accordance with sub-paragraph (7) or (8).

3

A pension scheme is a relevant pension scheme if it falls within paragraph 1(1)(a) to (d).

4

Whether an arrangement relating to the individual relates to a particular employment is to be determined in accordance with paragraph 9(6).

5

If no other arrangement relating to the individual under a relevant pension scheme relates to the employment to which the arrangement relates, the excess lump sum condition is met in relation to the arrangement if—

a

the value of the individual’s uncrystallised lump sum rights under the arrangement calculated in accordance with paragraph 25(5), exceeds

b

the amount arrived at in relation to the arrangement in accordance with paragraph 26.

6

If one or more other arrangements relating to the individual under a relevant pension scheme or relevant pension schemes relates or relate to the employment to which the arrangement relates, the excess lump sum condition is met in relation to the arrangement if—

a

the aggregate of the values of the individual’s uncrystallised lump sum rights under the arrangement and the other arrangement or arrangements, calculated in accordance with paragraph 25(5), exceeds

b

the amount arrived at in relation to those arrangements in accordance with paragraph 26;

and the amount by which the aggregate of those values exceeds that amount is the “lump sum excess”.

7

Where the excess lump sum condition is met by virtue of sub-paragraph (5), the value of the individual’s uncrystallised lump sum rights under the arrangement is the amount arrived at in accordance with paragraph 26.

8

Where the excess lump sum condition is met by virtue of sub-paragraph (6), the value of the individual’s uncrystallised lump sum rights under the arrangement is the value of those rights calculated in accordance with paragraph 25(5), less the appropriate proportion of the lump sum excess.

9

The appropriate proportion of the lump sum excess is—

where—

V is the value of the individual’s uncrystallised lump sum rights under the arrangement, calculated in accordance with paragraph 25(5), and

AV is the aggregate of the values of the individual’s uncrystallised lump sum rights under the arrangement and the other arrangement or arrangements, calculated in accordance with paragraph 25(5).

33

1

Subject to sub-paragraph (2), the value of the individual’s uncrystallised rights under the pension scheme on 5th April 2006 is the aggregate of the value of the individual’s uncrystallised rights under each arrangement in respect of the individual under the pension scheme, calculated in accordance with paragraph 8(5).

2

If the pension scheme is a relevant pension scheme, the value of the individual’s uncrystallised rights on 5th April 2006 under an arrangement—

a

which relates to a particular employment, and

b

in relation to which the excess rights condition is met (see sub-paragraph (5) or (6)),

is the amount arrived at in accordance with sub-paragraph (7) or (8).

3

A pension scheme is a relevant pension scheme if it falls within paragraph 1(1)(a) to (d).

4

Whether an arrangement relating to the individual relates to a particular employment is to be determined in accordance with paragraph 9(6).

5

If no other arrangement relating to the individual under a relevant pension scheme relates to the employment to which the arrangement relates, the excess rights condition is met in relation to the arrangement if—

a

the value of the individual’s uncrystallised rights under the arrangement calculated in accordance with paragraph 8(5), exceeds

b

the amount arrived at in relation to the arrangement in accordance with paragraph 9(3).

6

If one or more other arrangements relating to the individual under a relevant pension scheme or relevant pension schemes relates or relate to the employment to which the arrangement relates, the excess rights condition is met in relation to the arrangement if—

a

the aggregate of the values of the individual’s uncrystallised rights under the arrangement and the other arrangement or arrangements, calculated in accordance with paragraph 8(5), exceeds

b

the amount arrived at in relation to those arrangements in accordance with paragraph 9(3);

and the amount by which the aggregate of those values exceeds that amount is the “rights excess”.

7

Where the excess rights condition is met by virtue of sub-paragraph (5), the value of the individual’s uncrystallised rights under the arrangement is the amount arrived at in accordance with paragraph 9(3).

8

Where the excess rights condition is met by virtue of sub-paragraph (6), the value of the individual’s uncrystallised rights under the arrangement is the value of those rights calculated in accordance with paragraph 8(5), less the appropriate proportion of the rights excess.

9

The appropriate proportion of the rights excess is—

where—

V is the value of the individual’s uncrystallised rights under the arrangement, calculated in accordance with paragraph 8(5), and

AV is the aggregate of the values of the individual’s uncrystallised rights under the arrangement and the other arrangement or arrangements, calculated in accordance with paragraph 8(5).

C3C534

1

Schedule 29 applies with the following modifications.

C12C13C112

Paragraph 2 applies as if the reference in sub-paragraph (2) to the arrangement under which the member becomes entitled to the relevant pension were to the pension scheme and for sub-paragraphs (5) to (8) there were substituted—

5

If paragraph 2(2) does not apply F6..., the permitted maximum is—

F76

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

In this paragraph—

VULSR is the value of the individual’s uncrystallised lump sum rights under the pension scheme on 5th April 2006, calculated in accordance with paragraph 32 of Schedule 36,

CSLA is the current standard lifetime allowance,

FSLA is £1,500,000 (the standard lifetime allowance for the tax year 2006-07), and

ALSA is the F8greater of the additional lump sum amount and nil.

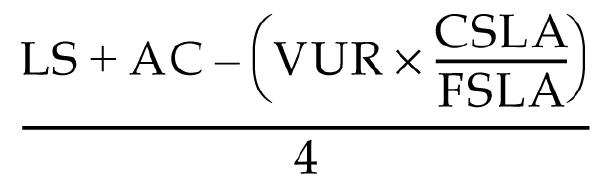

7A

The additional lump sum amount is—

where—

LS is the lump sum paid (but this is subject to F4sub-paragraphs (7AA) and (7B)),

AC is the amount crystallised on the individual becoming entitled to the pension in connection with which the lump sum is paid (see section 216) (but this is subject to sub-paragraph (7B)), and

VUR is the value of the individual’s uncrystallised rights under the pension scheme on 5th April 2006, calculated in accordance with paragraph 33 of Schedule 36.

F27AA

Where the pension in connection with which the lump sum is paid is a scheme pension under a money purchase arrangement, AC is the scheme pension purchase price, as it would be defined by paragraph 3 if the words “but subject to sub-paragraph (8)” in sub-paragraph (7A) and sub-paragraph (8) were omitted.

7B

Any part of F5what would otherwise be LS or AC which represents rights attributable to a disqualifying pension credit is to be disregarded.

F77C

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

Omit paragraph 3 (applicable amount for pension commencement lump sums) F3(but without prejudice to its operation for the purposes of paragraph 2(7AA) of Schedule 29 as inserted by sub-paragraph (2)).

Sch. 36 modified by The Taxation of Pension Schemes (Transitional Provisions) Order 2006 (S.I. 2006/572), art. 23D (as inserted (1.6.2009) by S.I. 2009/1172, arts. 1, 3)