- Latest available (Revised)

- Original (As made)

The Social Security (Graduated Retirement Benefit) Regulations 2005

You are here:

- UK Statutory Instruments

- 2005 No. 454

- SCHEDULE 1

- Show Geographical Extent(e.g. England, Wales, Scotland and Northern Ireland)

- Show Timeline of Changes

Changes over time for: SCHEDULE 1

Alternative versions:

- 06/04/2005- Amendment

- 05/12/2005- Amendment

- 06/04/2006- Amendment

- 07/04/2008- Amendment

- 06/04/2009- Amendment

- 12/04/2010- Amendment

- 11/04/2011- Amendment

- 09/04/2012- Amendment

- 08/04/2013- Amendment

- 11/03/2014- Amendment

- 07/04/2014- Amendment

- 03/03/2015- Amendment

- 06/04/2015- Amendment

- 06/04/2016- Amendment

- 06/04/2017- Amendment

- 10/04/2017- Amendment

- 09/04/2018- Amendment

- 08/04/2019- Amendment

- 06/04/2020- Amendment

- 12/04/2021- Amendment

- 11/04/2022- Amendment

- 10/04/2023- Amendment

- 08/04/2024- Amendment

Changes to legislation:

There are currently no known outstanding effects for the The Social Security (Graduated Retirement Benefit) Regulations 2005, SCHEDULE 1.![]()

Changes to Legislation

Revised legislation carried on this site may not be fully up to date. At the current time any known changes or effects made by subsequent legislation have been applied to the text of the legislation you are viewing by the editorial team. Please see ‘Frequently Asked Questions’ for details regarding the timescales for which new effects are identified and recorded on this site.

Regulation 4

SCHEDULE 1E+W+SFURTHER PROVISIONS REPLACING SECTION 36(4) OF THE NATIONAL INSURANCE ACT 1965: INCREASES OF GRADUATED RETIREMENT BENEFIT AND LUMP SUMS

Modifications etc. (not altering text)

C1Sch. 1 modified (7.4.2008) by The Social Security Benefits Up-rating Order 2008 (S.I. 2008/632), arts. 1(2)(d), 12(3)

C2Sch. 1 modified (with effect in accordance with art. 1(3)(a), 6 of the amending S.I.) by The Social Security Benefits Up-rating Order 2009 (S.I. 2009/497), arts. 1(2)(d), 12(3)

C3Sch. 1 sums confirmed (12.4.2010) by The Social Security Benefits Up-rating Order 2010 (S.I. 2010/793), arts. 1(2)(d), 12(3)

C4Sch. 1 sums amended (with effect in accordance with arts. 1(3), 6 of the amending S.I.) by The Social Security Benefits Up-rating Order 2011 (S.I. 2011/821), arts. 1(2)(c), 12(3)

C5Sch. 1 sums amended (with effect in accordance with arts. 1(3), 6 of the amending S.I.) by The Social Security Benefits Up-rating Order 2012 (S.I. 2012/780), arts. 1(2)(c), 12(3)

C6Sch. 1 sums amended (with effect in accordance with art. 1(3), 6 of the amending S.I.) by The Social Security Benefits Up-rating Order 2013 (S.I. 2013/574), arts. 1(2)(c), 11(3)

C7Sch. 1 sums amended (with effect in accordance with arts. 1(3), 6 of the amending S.I.) by The Social Security Benefits Up-rating Order 2013 (S.I. 2013/574), arts. 1(2)(c), 11(3)

C8Sch. 1 sums amended (11.3.2014 for specified purposes and with effect in accordance with arts. 1(2)(c)(l), (3), (4), 6) by The Social Security Benefits Up-rating Order 2014 (S.I. 2014/516), art. 1(2)(c)(l)(3)8(3)

C9Sch. 1 sums amended (3.3.2015 for specified purposes and with effect in accordance with arts. 1(2)(c)(3)(4), 6) by The Social Security Benefits Up-rating Order 2015 (S.I. 2015/457), art. 1(2)(c)(3)8(3)

C10Sch. 1 sums amended (with effect in accordance with arts. 1(3) (4) 7 of the amending S.I.) by The Social Security Benefits Up-rating Order 2017 (S.I. 2017/260), arts. 1(2)(c), 12(3)

C11Sch. 1 sums amended (with effect in accordance with arts. 1(3)(4), 7 of the amending S.I.) by The Social Security Benefits Up-rating Order 2018 (S.I. 2018/281), arts. 1(2)(c), 12(3)

C12Sch. 1 sums amended (with effect in accordance with art. 1(4)(5) 7 of the amending S.I.) by The Social Security Benefits Up-rating Order 2019 (S.I. 2019/480), arts. 1(3)(c), 12(3)

C13Sch. 1 sums amended (with effect in accordance with arts. 1(4)(5), 7 of the amending S.I.) by The Social Security Benefits Up-rating Order 2020 (S.I. 2020/234), arts. 1(3)(c), 12(3)

C14Sch. 1 sums amended (with effect in accordance with arts. 1(4)(5), 7 of the amending S.I.) by The Social Security Benefits Up-rating Order 2021 (S.I. 2021/162), arts. 1(3)(c), 12(3)

C15Sch. 1 sums amended (with effect in accordance with arts. 1(4)(5), 7 of the amending S.I.) by The Social Security Benefits Up Rating Order 2022 (S.I. 2022/292), arts. 1(3)(c), 12(3)

C16Sch. 1: sums amended (coming into force in accordance with arts. 1(4)(5), 7 of the amending S.I.) by The Social Security Benefits Up-rating Order 2024 (S.I. 2024/242), arts. 1(3)(c), 11(3)

PART 1E+W+SINCREASE AND LUMP SUM WHERE ENTITLEMENT TO RETIREMENT PENSION IS DEFERRED

ScopeE+W+S

1. This Part applies only in respect of a person who is deferring entitlement to graduated retirement benefit by virtue of section 36(4A)(a) of the 1965 Act M1.

Marginal Citations

Increase or lump sum where pensioner's entitlement is deferredE+W+S

2.—(1) Where a person's entitlement to a Category A or Category B retirement pension is deferred and that person electsF1...—

(a)that paragraph 1 of Schedule 5 (increase of pension) is to apply in relation to the period of deferment, paragraph 3 of this Schedule shall also apply in relation to that period;

(b)that paragraph 3A of Schedule 5 (lump sum) is to apply in relation to the period of deferment, paragraph 5 of this Schedule shall also apply in relation to that period.

(2) The reference to an election in sub-paragraph (1) includes an election a person is treated as having made under paragraph A1(2) of Schedule 5.

Textual Amendments

F1Words in Sch. 1 para. 2(1) omitted (6.4.2006) by virtue of Social Security (Deferral of Retirement Pensions, Shared Additional Pension and Graduated Retirement Benefit) (Miscellaneous Provisions) Regulations 2005 (S.I. 2005/2677), regs. 1(1), 7(2)(a)

Increase where pensioner's entitlement is deferredE+W+S

3.—(1) This paragraph applies where—

(a)entitlement to a Category A or Category B retirement pension is deferred and the period of deferment is less than 12 months; or

(b)paragraph 2(1)(a) applies.

(2) The rate of the person's graduated retirement benefit shall be increased by an amount equal to the aggregate of the increments to which he is entitled under paragraph 4 but only if that amount is enough to increase the rate of the benefit by at least 1 per cent.

Calculation of incrementE+W+S

4.—(1) A person is entitled to an increment under this paragraph for each complete incremental period in his period of deferment.

(2) The amount of the increment for an incremental period shall be ⅕th per cent. of the weekly rate of the graduated retirement benefit to which the person would have been entitled for the period if his entitlement to a Category A or Category B retirement pension had not been deferred.

(3) For the purposes of sub-paragraph (2), the weekly rate of graduated retirement benefit shall be taken to include any increase in the weekly rate of that benefit and the amount of the increment in respect of such an increase shall be ⅕th per cent. of its weekly rate for each incremental period in the period of deferment beginning on the day the increase occurred.

(4) Amounts under sub-paragraphs (2) and (3) shall be rounded to the nearest penny, taking any ½p as nearest to the next whole penny.

(5) Where an amount under sub-paragraph (2) or (3) would, apart from this sub-paragraph, be a sum less than ½p, the amount shall be taken to be zero, notwithstanding any provision of the Benefits Act, the Administration Act or the Pension Schemes Act 1993 M2.

(6) In this paragraph, “incremental period” means any period of six days which are treated by the Social Security (Widow's Benefit and Retirement Pensions) Regulations 1979 M3 as days of increment for the purposes of paragraph 2 of Schedule 5 in relation to the person and pension in question.

(7) Where one or more orders have come into force under section 150 of the Administration Act during the period of deferment, the rate for any incremental period shall be determined as if the order or orders had come into force before the beginning of the period of deferment.

Marginal Citations

M3S.I.1979/642; the relevant amending instruments are S.I.1989/1642, 1991/2742, 1992/1695, 1996/1345 and 1999/2422.

Lump sum where pensioner's entitlement is deferredE+W+S

5.—(1) This paragraph applies where paragraph 2(1)(b) applies.

(2) The person is entitled to an amount calculated in accordance with paragraph 6 (a “lump sum”).

Calculation of lump sumE+W+S

6.—(1) The lump sum is the accrued amount for the last accrual period beginning during the period of deferment.

(2) In this paragraph—

“accrued amount” means the amount calculated in accordance with sub-paragraph (3);

“accrual period” means any period of seven days beginning with the day of the week on which Category A or Category B retirement pension would have been payable to a person in accordance with regulation 22(3) of, and paragraph 5 of Schedule 6 to, the Social Security (Claims and Payments) Regulations 1987 M4 [F2or in accordance with regulation 22C(3) or (4) of those Regulations], if his entitlement to a retirement pension had not been deferred, where that day falls within the period of deferment.

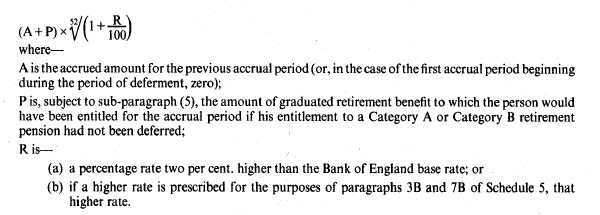

(3) The accrued amount for an accrual period for a person is—

(4) For the purposes of sub-paragraph (3), any change in the Bank of England base rate is to be treated as taking effect—

(a)at the beginning of the accrual period immediately following the accrual period during which the change took effect; or

(b)if regulations under paragraph 3B(4) of Schedule 5 so provide, at such other time as may be prescribed in those Regulations.

(5) Regulation 3 of the Social Security (Deferral of Retirement Pensions) Regulations 2005 M5 shall have effect for the purposes of this paragraph in like manner to graduated retirement benefit as it does to retirement pension in the calculation of the lump sum under paragraph 3B of Schedule 5.

Textual Amendments

F2Words in Sch. 1 para. 6(2) inserted (6.4.2017) by The Occupational Pension Schemes and Social Security (Schemes that were Contracted-out and Graduated Retirement Benefit) (Miscellaneous Amendments) Regulations 2017 (S.I. 2017/354), regs. 1(2), 3

Marginal Citations

M4S.I.1987/1968; the relevant amending instruments are S.I.2000/1483 and 2002/2441.

Increase or lump sum where pensioner's deceased spouse [F3or civil partner] has deferred entitlementE+W+S

7.—(1) This paragraph applies where—

(a)a [F4widow, widower or surviving civil partner] (“W”) is entitled to a Category A or Category B retirement pension;

(b)W was married to [F5or in a civil partnership with] the other party to the marriage [F6or civil partnership] (“S”) when S died;

(c)S's entitlement to a Category A or Category B retirement pension was deferred when S died; and

(d)S's entitlement had been deferred throughout the period of 12 months ending with the day before S's death.

(2) Where W elects—

(a)that paragraph 4 of Schedule 5 (increase of pension) is to apply in relation to the period of deferment, paragraph 8 of this Schedule shall also apply in relation to that period;

(b)that paragraph 7A of Schedule 5 (lump sum) is to apply in relation to the period of deferment, paragraph 9 of this Schedule shall also apply in relation to that period.

(3) The reference to an election in sub-paragraph (2) includes an election W is treated as having made under paragraph 3C(3) of Schedule 5.

Textual Amendments

F3Words in Sch. 1 para. 7 inserted (5.12.2005) by Social Security (Retirement Pensions and Graduated Retirement Benefit) (Widowers and Civil Partnership) Regulations 2005 (S.I. 2005/3078), regs. 1(1)(c), 3(2)(a)

F4Words in Sch. 1 para. 7(1)(a) substituted (5.12.2005) by Social Security (Retirement Pensions and Graduated Retirement Benefit) (Widowers and Civil Partnership) Regulations 2005 (S.I. 2005/3078), regs. 1(1)(c), 3(2)(b)

F5Words in Sch. 1 para. 7(1)(b) inserted (5.12.2005) by Social Security (Retirement Pensions and Graduated Retirement Benefit) (Widowers and Civil Partnership) Regulations 2005 (S.I. 2005/3078), regs. 1(1)(c), 3(2)(c)(i)

F6Words in Sch. 1 para. 7(1)(b) inserted (5.12.2005) by Social Security (Retirement Pensions and Graduated Retirement Benefit) (Widowers and Civil Partnership) Regulations 2005 (S.I. 2005/3078), regs. 1(1)(c), 3(2)(c)(ii)

Increase where pensioner's deceased spouse [F7or civil partner] has deferred entitlementE+W+S

8.—(1) This paragraph applies where a [F8widow, widower or surviving civil partner] is entitled to a Category A or Category B retirement pension, was married to [F9or in a civil partnership with] the other party to the marriage [F10or civil partnership] when S died and one of the following conditions is met—

(a)S was entitled to graduated retirement benefit with an increase under this Schedule;

(b)paragraph 7(2)(a) applies; or

(c)paragraph 7 would apply to W but for the fact that the condition in sub-paragraph (1)(d) of that paragraph is not met.

(2) The increase in the weekly rate of W's graduated retirement benefit shall, in a case to which sub-paragraph (1) applies, be determined in accordance with section 37 of the 1965 Act M6 as continued in force by virtue of regulations made under Schedule 3 to the Social Security (Consequential Provisions) Act 1975 M7 or under Schedule 3 to the Social Security (Consequential Provisions) Act 1992 M8.

Textual Amendments

F7Words in Sch. 1 para. 8 inserted (5.12.2005) by Social Security (Retirement Pensions and Graduated Retirement Benefit) (Widowers and Civil Partnership) Regulations 2005 (S.I. 2005/3078), regs. 1(1)(c), 3(3)(a)

F8Words in Sch. 1 para. 8(1) substituted (5.12.2005) by Social Security (Retirement Pensions and Graduated Retirement Benefit) (Widowers and Civil Partnership) Regulations 2005 (S.I. 2005/3078), regs. 1(1)(c), 3(3)(b)(i)

F9Words in Sch. 1 para. 8(1) inserted (5.12.2005) by Social Security (Retirement Pensions and Graduated Retirement Benefit) (Widowers and Civil Partnership) Regulations 2005 (S.I. 2005/3078), regs. 1(1)(c), 3(3)(b)(ii)

F10Words in Sch. 1 para. 8(1) inserted (5.12.2005) by Social Security (Retirement Pensions and Graduated Retirement Benefit) (Widowers and Civil Partnership) Regulations 2005 (S.I. 2005/3078), regs. 1(1)(c), 3(3)(b)(iii)

Marginal Citations

Entitlement to lump sum where pensioner's deceased spouse [F11or civil partner] has deferred entitlementE+W+S

9.—(1) This paragraph applies where paragraph 7(2)(b) applies.

(2) W is entitled to an amount calculated in accordance with paragraph 10 (a “widowed person's [F12or surviving civil partner's] lump sum“).

Textual Amendments

F11Words in Sch. 1 para. 9 inserted (5.12.2005) by Social Security (Retirement Pensions and Graduated Retirement Benefit) (Widowers and Civil Partnership) Regulations 2005 (S.I. 2005/3078), regs. 1(1)(c), 3(4)(a)

F12Words in Sch. 1 para. 9(2) inserted (5.12.2005) by Social Security (Retirement Pensions and Graduated Retirement Benefit) (Widowers and Civil Partnership) Regulations 2005 (S.I. 2005/3078), regs. 1(1)(c), 3(4)(b)

Calculation of widowed person's [F13or surviving civil partner's] lump sumE+W+S

10.—(1) The widowed person's [F14or surviving civil partner's] lump sum is the accrued amount for the last accrual period beginning during the period which—

(a)began at the beginning of S's period of deferment; and

(b)ended on the day before S's death.

(2) In this paragraph—

“S” means the other party to the marriage [F15or civil partnership];

“accrued amount” means the amount calculated in accordance with sub-paragraph (3);

M9“accrual period” means any period of seven days beginning with the day of the week on which Category A or Category B retirement pension would have been payable to S in accordance with regulation 22(3) of, and paragraph 5 of Schedule 6 to, the Social Security (Claims and Payments) Regulations 1987 [F16or in accordance with regulation 22C(3) or (4) of those Regulations], if his entitlement to a retirement pension had not been deferred, where that day falls within S's period of deferment.

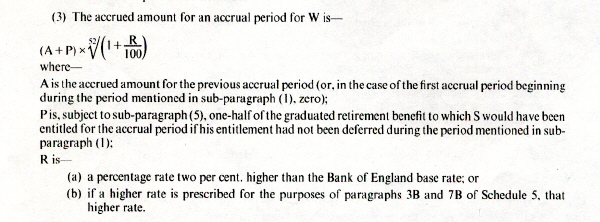

(3) The accrued amount for an accrual period for W is—

(4) For the purposes of sub-paragraph (3), any change in the Bank of England base rate is to be treated as taking effect—

(a)at the beginning of the accrual period immediately following the accrual period during which the change took effect; or

(b)if regulations under paragraph 7B(4) of Schedule 5 so provide, at such other time as may be prescribed.

(5) Regulation 3 of the Social Security (Deferral of Retirement Pensions) Regulations 2005 M10 shall have effect for the purposes of this paragraph in like manner to graduated retirement benefit as it does to retirement pension in the calculation of the lump sum under paragraph 7B of Schedule 5.

(6) In any case where—

(a)there is a period between the death of S and the date on which W becomes entitled to a Category A or Category B retirement pension; and

(b)one or more orders have come into force under section 150 of the Administration Act during that period,

the amount of the lump sum shall be increased in accordance with that order or those orders.

Textual Amendments

F13Words in Sch. 1 para. 10 inserted (5.12.2005) by Social Security (Retirement Pensions and Graduated Retirement Benefit) (Widowers and Civil Partnership) Regulations 2005 (S.I. 2005/3078), regs. 1(1)(c), 3(5)(a)

F14Words in Sch. 1 para. 10(1) inserted (5.12.2005) by Social Security (Retirement Pensions and Graduated Retirement Benefit) (Widowers and Civil Partnership) Regulations 2005 (S.I. 2005/3078), regs. 1(1)(c), 3(5)(b)

F15Words in Sch. 1 para. 10(2) inserted (5.12.2005) by Social Security (Retirement Pensions and Graduated Retirement Benefit) (Widowers and Civil Partnership) Regulations 2005 (S.I. 2005/3078), regs. 1(1)(c), 3(5)(c)

F16Words in Sch. 1 para. 10(2) inserted (6.4.2017) by The Occupational Pension Schemes and Social Security (Schemes that were Contracted-out and Graduated Retirement Benefit) (Miscellaneous Amendments) Regulations 2017 (S.I. 2017/354), regs. 1(2), 3

Modifications etc. (not altering text)

C17Sch. 1 para. 10(6) modified by S.I. 2015/173, reg. 19 (as inserted (6.4.2016 coming into force in accordance with reg. 1(4)) by The State Pension and Occupational Pension Schemes (Miscellaneous Amendments) Regulations 2016 (S.I. 2016/199), regs. 1(4), 4 (with reg. 1(5)))

Marginal Citations

M9S.I.1987/1968; the relevant amending instruments are S.I.2000/1483 and 2002/2441.

PART 2E+W+SINCREASE OR LUMP SUM WHERE PERSON IS TREATED AS RECEIVING RETIREMENT PENSION AT A NOMINAL WEEKLY RATE

ScopeE+W+S

11. This Part applies only in respect of a person who is deferring entitlement to graduated retirement benefit by virtue of section 36(4A)(b) of the 1965 Act M11.

Marginal Citations

Choice between increase and lump sumE+W+S

12.—(1) Where the period of deferment is at least 12 months, a person shall, on becoming entitled to graduated retirement benefit, elect that—

(a)paragraph 13; or

(b)paragraph 15,

is to apply in respect of that period.

[F17(2) The election referred to in sub-paragraph (1) shall be made—

(a)on the date on which he claims graduated retirement benefit; or

(b)within the period after claiming graduated retirement benefit prescribed in paragraph 20B,

and in the manner prescribed in paragraph 20C.]

(3) If no election under sub-paragraph (1) is made within the period referred to in sub-paragraph (2)(b), the person is to be treated as having made an election under sub-paragraph (1)(b).

(4) A person who has made an election under sub-paragraph (1) (including one that the person is treated by sub-paragraph (3) as having made) may change the election in the circumstances[F18, manner and within the period prescribed, in paragraph 20D] .

Textual Amendments

F17Sch. 1 para. 12(2) substituted (6.4.2006) by Social Security (Deferral of Retirement Pensions, Shared Additional Pension and Graduated Retirement Benefit) (Miscellaneous Provisions) Regulations 2005 (S.I. 2005/2677), regs. 1(1), 7(2)(b)(i)

F18Words in Sch. 1 para. 12(4) substituted (6.4.2006) by Social Security (Deferral of Retirement Pensions, Shared Additional Pension and Graduated Retirement Benefit) (Miscellaneous Provisions) Regulations 2005 (S.I. 2005/2677), regs. 1(1), 7(2)(b)(ii)

IncreaseE+W+S

13.—(1) This paragraph applies where—

(a)the period of deferment is less than 12 months; or

(b)the person has made an election under paragraph 12(1)(a) in respect of the period of deferment.

(2) The rate of the person's graduated retirement benefit shall be increased by an amount equal to the aggregate of the increments to which he is entitled under paragraph 14 but only if that amount is enough to increase the rate of the benefit by at least one per cent.

Calculation of incrementE+W+S

14.—(1) A person is entitled to an increment under this paragraph for each complete incremental period in the period of deferment.

(2) The amount of the increment for an incremental period shall be ⅕th per cent. of the weekly rate of the graduated retirement benefit to which the person would have been entitled for the period if his entitlement to graduated retirement benefit had not been deferred.

(3) For the purposes of sub-paragraph (2), the weekly rate of graduated retirement benefit shall be taken to include any increase in the weekly rate of that benefit and the amount of the increment in respect of such an increase shall be ⅕th per cent. of its weekly rate for each incremental period in the period of deferment beginning on the day the increase occurred.

(4) Amounts under sub-paragraphs (2) and (3) shall be rounded to the nearest penny, taking any ½p as nearest to the next whole penny.

(5) Where an amount under sub-paragraph (2) or (3) would, apart from this sub-paragraph, be a sum less than ½p, the amount shall be taken to be zero, notwithstanding any provision of the Benefits Act, the Administration Act or the Pension Schemes Act 1993 M12.

(6) Where one or more orders have come into force under section 150 of the Administration Act during the period of deferment, the rate for any incremental period shall be determined as if the order or orders had come into force before the beginning of the period of deferment.

Marginal Citations

Lump sumE+W+S

15.—(1) This paragraph applies where paragraph 12(1)(b) applies.

(2) The person is entitled to an amount calculated in accordance with paragraph 16 (a “lump sum”).

Calculation of lump sumE+W+S

16.—(1) The lump sum is the accrued amount for the last accrual period beginning during the period of deferment.

(2) In this paragraph—

“accrued amount” means the amount calculated in accordance with sub-paragraph (3);

“accrual period” means any period of seven days beginning with the day of the week on which Category A or Category B retirement pension would have been payable to a person in accordance with regulation 22(3) of, and paragraph 5 of Schedule 6 to, the Social Security (Claims and Payments) Regulations 1987 M13 [F19or in accordance with regulation 22C(3) or (4) of those Regulations], if he had been entitled to it, where that day falls within the period of deferment.

(3) The accrued amount for an accrual period for a person is—

(4) For the purposes of sub-paragraph (3), any change in the Bank of England base rate is to be treated as taking effect—

(a)at the beginning of the accrual period immediately following the accrual period during which the change took effect; or

(b)if regulations under paragraph 3B(4) of Schedule 5 so provide, at such other time as may be prescribed in those Regulations.

(5) Regulation 3 of the Social Security (Deferral of Retirement Pensions) Regulations 2005 M14 shall have effect for the purposes of this paragraph in like manner to graduated retirement benefit as it does to retirement pension in the calculation of the lump sum under paragraph 3B of Schedule 5.

Textual Amendments

F19Words in Sch. 1 para. 16(2) inserted (6.4.2017) by The Occupational Pension Schemes and Social Security (Schemes that were Contracted-out and Graduated Retirement Benefit) (Miscellaneous Amendments) Regulations 2017 (S.I. 2017/354), regs. 1(2), 3

Marginal Citations

M13S.I.1987/1968; the relevant amending instruments are S.I.2000/1483 and 2002/2441.

Choice between increase and lump sum where person's deceased spouse [F20or civil partner] has deferred entitlement to graduated retirement benefitE+W+S

17.—(1) This paragraph applies where—

(a)a [F21widow, widower or surviving civil partner] (“W”) is entitled to a Category A or Category B retirement pension;

(b)W was married to [F22or in a civil partnership with] the other party to the marriage [F23or civil partnership] (“S”) when S died;

(c)S's entitlement to graduated retirement benefit was deferred when S died; and

(d)S's entitlement had been deferred throughout the period of 12 months ending with the day before S's death.

(2) W shall elect either that—

(a)paragraph 18; or

(b)paragraph 19,

is to apply in respect of S's period of deferment.

[F24(3) The election referred to in sub-paragraph (2) shall be made within the period prescribed in paragraph 20B and in the manner prescribed in paragraph 20C.]

(4) If no election under sub-paragraph (2) is made within the period referred to in sub-paragraph [F25(3)], the person is to be treated as having made an election under sub-paragraph (2)(b).

[F26(5) A person who has made an election under sub-paragraph (2) (including one that the person is treated by sub-paragraph (4) as having made) may change the election in the circumstances, manner and within the period prescribed in paragraph 20D.]

Textual Amendments

F20Words in Sch. 1 para. 17 inserted (5.12.2005) by Social Security (Retirement Pensions and Graduated Retirement Benefit) (Widowers and Civil Partnership) Regulations 2005 (S.I. 2005/3078), regs. 1(1)(c), 3(6)(a)

F21Words in Sch. 1 para. 17(1)(a) substituted (5.12.2005) by Social Security (Retirement Pensions and Graduated Retirement Benefit) (Widowers and Civil Partnership) Regulations 2005 (S.I. 2005/3078), regs. 1(1)(c), 3(6)(b)

F22Words in Sch. 1 para. 17(1)(b) substituted (5.12.2005) by Social Security (Retirement Pensions and Graduated Retirement Benefit) (Widowers and Civil Partnership) Regulations 2005 (S.I. 2005/3078), regs. 1(1)(c), 3(6)(c)(i)

F23Words in Sch. 1 para. 17(1)(b) inserted (5.12.2005) by Social Security (Retirement Pensions and Graduated Retirement Benefit) (Widowers and Civil Partnership) Regulations 2005 (S.I. 2005/3078), regs. 1(1)(c), 3(6)(c)(ii)

F24Sch. 1 para. 17(3) substituted (6.4.2006) by Social Security (Deferral of Retirement Pensions, Shared Additional Pension and Graduated Retirement Benefit) (Miscellaneous Provisions) Regulations 2005 (S.I. 2005/2677), regs. 1(1), 7(2)(c)(i)

F25Word in Sch. 1 para. 17(4) substituted (6.4.2006) by Social Security (Deferral of Retirement Pensions, Shared Additional Pension and Graduated Retirement Benefit) (Miscellaneous Provisions) Regulations 2005 (S.I. 2005/2677), regs. 1(1), 7(2)(c)(ii)

F26Sch. 1 para. 17(5) substituted (6.4.2006) by Social Security (Deferral of Retirement Pensions, Shared Additional Pension and Graduated Retirement Benefit) (Miscellaneous Provisions) Regulations 2005 (S.I. 2005/2677), regs. 1(1), 7(2)(c)(iii)

Increase where person's deceased spouse [F27or civil partner] has deferred entitlement to graduated retirement benefitE+W+S

18.—(1) This paragraph applies where a [F28widow, widower or surviving civil partner] is entitled to graduated retirement benefit, was married to [F29or in a civil partnership with] the other party to the marriage [F30or civil partnership] when S died and one of the following conditions is met—

(a)S was entitled to graduated retirement benefit with an increase under this Schedule;

(b)W is a widow or widower to whom paragraph 17 applies and has made an election under paragraph 17(2)(a); or

(c)paragraph 17 would apply to W but for the fact that the condition in sub-paragraph (1)(d) of that paragraph is not met.

(2) The increase in the weekly rate of W's graduated retirement benefit shall, in a case to which sub-paragraph (1) applies, be determined in accordance with section 37 of the 1965 Act as continued in force by virtue of regulations made under Schedule 3 to the Social Security (Consequential Provisions) Act 1975 M15 or under Schedule 3 to the Social Security (Consequential Provisions) Act 1992 M16.

Textual Amendments

F27Words in Sch. 1 para. 18 inserted (5.12.2005) by Social Security (Retirement Pensions and Graduated Retirement Benefit) (Widowers and Civil Partnership) Regulations 2005 (S.I. 2005/3078), regs. 1(1)(c), 3(7)(a)

F28Words in Sch. 1 para. 18(1) substituted (5.12.2005) by Social Security (Retirement Pensions and Graduated Retirement Benefit) (Widowers and Civil Partnership) Regulations 2005 (S.I. 2005/3078), regs. 1(1)(c), 3(7)(b)(i)

F29Words in Sch. 1 para. 18(1) inserted (5.12.2005) by Social Security (Retirement Pensions and Graduated Retirement Benefit) (Widowers and Civil Partnership) Regulations 2005 (S.I. 2005/3078), regs. 1(1)(c), 3(7)(b)(ii)

F30Words in Sch. 1 para. 18(1) inserted (5.12.2005) by Social Security (Retirement Pensions and Graduated Retirement Benefit) (Widowers and Civil Partnership) Regulations 2005 (S.I. 2005/3078), regs. 1(1)(c), 3(7)(b)(iii)

Marginal Citations

Entitlement to lump sum where person's deceased spouse [F31or civil partner] has deferred entitlement to graduated retirement benefitE+W+S

19.—(1) This paragraph applies where paragraph 17(2)(b) applies.

(2) W is entitled to an amount calculated in accordance with paragraph 20 (a “widowed person's [F32or surviving civil partner's] lump sum“).

Textual Amendments

F31Words in Sch. 1 para. 19 inserted (5.12.2005) by Social Security (Retirement Pensions and Graduated Retirement Benefit) (Widowers and Civil Partnership) Regulations 2005 (S.I. 2005/3078), regs. 1(1)(c), 3(8)(a)

F32Words in Sch. 1 para. 19(2) inserted (5.12.2005) by Social Security (Retirement Pensions and Graduated Retirement Benefit) (Widowers and Civil Partnership) Regulations 2005 (S.I. 2005/3078), regs. 1(1)(c), 3(8)(b)

Calculation of widowed person's [F33or surviving civil partner's] lump sumE+W+S

20.—(1) The widowed person's [F34or surviving civil partner's] lump sum is the accrued amount for last accrual period beginning during the period which—

(a)began at the beginning of S's period of deferment; and

(b)ended on the day before S's death.

(2) In this paragraph—

“S” means the other party to the marriage [F35or civil partnership];

“accrued amount” means the amount calculated in accordance with sub-paragraph (3);

“accrual period” means any period of seven days beginning with the day of the week on which Category A or Category B retirement pension would have been payable to S in accordance with regulation 22(3) of, and paragraph 5 of Schedule 6 to, the Social Security (Claims and Payments) Regulations 1987 [F36or in accordance with regulation 22C(3) or (4) of those Regulations], if he had been entitled to it, where that day falls within S's period of deferment.

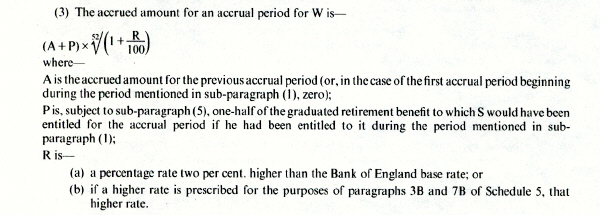

(3) The accrued amount for an accrual period for W is—

(4) For the purposes of sub-paragraph (3), any change in the Bank of England base rate is to be treated as taking effect—

(a)at the beginning of the accrual period immediately following the accrual period during which the change took effect; or

(b)if regulations under paragraph 7B(4) of Schedule 5 so provide, at such other time as may be prescribed.

(5) Regulation 3 of the Social Security (Deferral of Retirement Pensions) Regulations 2005 M17 shall have effect for the purposes of this paragraph in like manner to graduated retirement benefit as it does to retirement pension in the calculation of the lump sum under paragraph 7B of Schedule 5.

(6) In any case where—

(a)there is a period between the death of S and the date on which W becomes entitled to graduated retirement benefit; and

(b)one or more orders have come into force under section 150 of the Administration Act during that period,

the amount of the lump sum shall be increased in accordance with that order or those orders.

Textual Amendments

F33Words in Sch. 1 para. 20 inserted (5.12.2005) by Social Security (Retirement Pensions and Graduated Retirement Benefit) (Widowers and Civil Partnership) Regulations 2005 (S.I. 2005/3078), regs. 1(1)(c), 3(9)(a)

F34Words in Sch. 1 para. 20(1) inserted (5.12.2005) by Social Security (Retirement Pensions and Graduated Retirement Benefit) (Widowers and Civil Partnership) Regulations 2005 (S.I. 2005/3078), regs. 1(1)(c), 3(9)(a)

F35Words in Sch. 1 para. 20(2) inserted (5.12.2005) by Social Security (Retirement Pensions and Graduated Retirement Benefit) (Widowers and Civil Partnership) Regulations 2005 (S.I. 2005/3078), regs. 1(1)(c), 3(9)(b)

F36Words in Sch. 1 para. 20(2) inserted (6.4.2017) by The Occupational Pension Schemes and Social Security (Schemes that were Contracted-out and Graduated Retirement Benefit) (Miscellaneous Amendments) Regulations 2017 (S.I. 2017/354), regs. 1(2), 3

Modifications etc. (not altering text)

C18Sch. 1 para. 20(6) modified by S.I. 2015/173, reg. 19 (as inserted (6.4.2016 coming into force in accordance with reg. 1(4)) by The State Pension and Occupational Pension Schemes (Miscellaneous Amendments) Regulations 2016 (S.I. 2016/199), regs. 1(4), 4 (with reg. 1(5)))

Marginal Citations

[F37PART 2AE+W+SELECTIONS UNDER PART 2

Textual Amendments

Scope and interpretationE+W+S

20A.—(1) This Part applies in respect of elections which a person makes or is treated as having made under Part 2.

(2) In this Part, “elector” means the person who may make an election under paragraph 12(1) or 17(2).

Timing of electionE+W+S

20B.—(1) The period for making an election under paragraph 12(1) is, subject to sub-paragraph (4), three months starting on the date shown on the notice issued by the Secretary of State following the claim for graduated retirement benefit, confirming that the elector is required to make that election.

(2) The period for making an election under paragraph 17(2) is, subject to sub-paragraph (4), three months starting on the date shown on the notice issued by the Secretary of State following W's claim for a Category A or Category B retirement pension or, if later, the date of S's death, confirming that the elector is required to make that election.

(3) Where more than one notice has been issued by the Secretary of State in accordance with sub-paragraph (1) or (2), the periods prescribed in those sub-paragraphs shall only commence from the date shown on the latest such notice.

(4) The periods specified in sub-paragraphs (1) and (2) may be extended by the Secretary of State if he considers it reasonable to do so in any particular case.

(5) Nothing in this paragraph shall prevent the making of an election on or after claiming graduated retirement benefit or, as the case may be, Category A or Category B retirement pension, but before the issue of the notice referred to in sub-paragraph (1) or (2).

Manner of making electionE+W+S

20C. An election under paragraph 12(1) or 17(2) may be made—

(a)in writing to an office specified by the Secretary of State for accepting such elections; or

(b)except where the Secretary of State directs in any particular case that the election must be made in accordance with sub-paragraph (a), by telephone call to the telephone number specified by the Secretary of State.

Change of electionE+W+S

20D.—(1) Subject to sub-paragraphs (2) and (6), this paragraph applies in the case of an election which—

(a)has been made under paragraph 12(1) or 17(2); or

(b)has been treated as made under paragraph 12(3) or 17(4).

(2) This paragraph does not apply in the case of an election which is—

(a)made, or treated as made, by an elector who has subsequently died; or

(b)treated as having been made by virtue of [F38regulation 30(5E) or (5G)] of the Social Security (Claims and Payments) Regulations 1987.

(3) An election specified in sub-paragraph (1) may be changed by way of application made no later than the last day of the period specified in sub-paragraph (4).

(4) The period specified for the purposes of sub-paragraph (3) is, subject to sub-paragraph (5), three months after the date shown on the written notification issued by the Secretary of State to the elector, confirming the election which the elector has made or is treated as having made.

(5) The period specified in sub-paragraph (4) may be extended by the Secretary of State if he considers it reasonable to do so in any particular case.

(6) An election specified in sub-paragraph (1) may not be changed where—

(a)there has been a previous change of election under this paragraph in respect of the same period of deferment;

(b)the application is to change the election to one under paragraph 12(1)(a) or 17(2)(a) and any amount paid to him by way of, or on account of, a lump sum pursuant to paragraph 15 or 19, has not been repaid in full to the Secretary of State within the period specified in sub-paragraph (4) or, as the case may be, (5); or

(c)the application is to change the election to one under paragraph 12(1)(b) or 17(2)(b) and the amount actually paid by way of an increase of graduated retirement benefit, or actually paid on account of such an increase, would exceed the amount to which the elector would be entitled by way of a lump sum.

(7) For the purposes of sub-paragraph (6)(b), repayment in full of the amount paid by way of, or on account of, a lump sum shall only be treated as having occurred if repaid to the Secretary of State in the currency in which that amount was originally paid.

(8) Where the application is to change the election to one under paragraph 12(1)(b) or 17(2)(b) and sub-paragraph (6)(c) does not apply, any amount paid by way of an increase of graduated retirement benefit, or on account of such an increase, in respect of the period of deferment for which the election was originally made, shall be treated as having been paid on account of the lump sum to which the elector is entitled under paragraph 15 or 19.

(9) An application under sub-paragraph (3) to change an election may be made—

(a)in writing to an office specified by the Secretary of State for accepting such applications; or

(b)except where the Secretary of State directs in any particular case that the application must be made in accordance with paragraph (a), by telephone call to the telephone number specified by the Secretary of State.]

Textual Amendments

F38Words in Sch. 1 para. 20D(2)(b) substituted (6.4.2006) by Social Security (Deferral of Retirement Pensions etc.) Regulations 2006 (S.I. 2006/516), regs. 1, 5

[F39Transitional provision relating to widower’s entitlement to increase of graduated retirement benefit or lump sumE+W+S

20ZA. In the case of a widower who attains pensionable age before 6th April 2010, paragraphs 17 to 19 shall not apply unless he was over pensionable age when his wife died.

Textual Amendments

F39Sch. 1 paras. 20ZA-20ZB inserted (5.12.2005 in so far as not already in force) by Social Security (Retirement Pensions and Graduated Retirement Benefit) (Widowers and Civil Partnership) Regulations 2005 (S.I. 2005/3078), reg. 1(1)(a)(c), 3(10)

Transitional provision relating to civil partner’s entitlement to increase of graduated retirement benefit or lump sumE+W+S

20ZB. In the case of a civil partner who attains pensionable age before 6th April 2010, paragraphs 17 to 19 shall not apply unless he or she was over pensionable age when his or her civil partner died.]

Textual Amendments

F39Sch. 1 paras. 20ZA-20ZB inserted (5.12.2005 in so far as not already in force) by Social Security (Retirement Pensions and Graduated Retirement Benefit) (Widowers and Civil Partnership) Regulations 2005 (S.I. 2005/3078), reg. 1(1)(a)(c), 3(10)

PART 3E+W+SSUPPLEMENTARY

SupplementaryE+W+S

21. Any lump sum calculated under paragraph 6, 10, 16 or 20 must be rounded to the nearest penny, taking any ½p as nearest to the next whole penny above.

Options/Help

Print Options

PrintThe Whole Instrument

PrintThis Schedule only

Legislation is available in different versions:

Latest Available (revised):The latest available updated version of the legislation incorporating changes made by subsequent legislation and applied by our editorial team. Changes we have not yet applied to the text, can be found in the ‘Changes to Legislation’ area.

Original (As Enacted or Made): The original version of the legislation as it stood when it was enacted or made. No changes have been applied to the text.

See additional information alongside the content

Geographical Extent: Indicates the geographical area that this provision applies to. For further information see ‘Frequently Asked Questions’.

Show Timeline of Changes: See how this legislation has or could change over time. Turning this feature on will show extra navigation options to go to these specific points in time. Return to the latest available version by using the controls above in the What Version box.

Explanatory Memorandum

Explanatory Memorandum sets out a brief statement of the purpose of a Statutory Instrument and provides information about its policy objective and policy implications. They aim to make the Statutory Instrument accessible to readers who are not legally qualified and accompany any Statutory Instrument or Draft Statutory Instrument laid before Parliament from June 2004 onwards.

More Resources

Access essential accompanying documents and information for this legislation item from this tab. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as enacted version that was used for the print copy

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- correction slips

- links to related legislation and further information resources

Timeline of Changes

This timeline shows the different points in time where a change occurred. The dates will coincide with the earliest date on which the change (e.g an insertion, a repeal or a substitution) that was applied came into force. The first date in the timeline will usually be the earliest date when the provision came into force. In some cases the first date is 01/02/1991 (or for Northern Ireland legislation 01/01/2006). This date is our basedate. No versions before this date are available. For further information see the Editorial Practice Guide and Glossary under Help.

More Resources

Use this menu to access essential accompanying documents and information for this legislation item. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as made version that was used for the print copy

- correction slips

Click 'View More' or select 'More Resources' tab for additional information including:

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- links to related legislation and further information resources