- Latest available (Revised)

- Point in Time (08/04/2019)

- Original (As made)

The Employment and Support Allowance Regulations 2008

You are here:

- UK Statutory Instruments

- 2008 No. 794

- SCHEDULE 6

- Show Geographical Extent(e.g. England, Wales, Scotland and Northern Ireland)

- Show Timeline of Changes

More Resources

- Original: King's Printer Version

- Revised Version 31/3/2030

- Revised Version 31/3/2019

- Revised Version 30/11/2018

- Revised Version 31/8/2018

- Revised Version 31/5/2018

- Revised Version 28/2/2018

- Revised Version 30/11/2017

- Revised Version 31/8/2017

- Revised Version 30/6/2017

- Revised Version 31/3/2017

- Revised Version 30/9/2016

- Revised Version 29/2/2016

- Revised Version 30/11/2015

- Revised Version 31/8/2015

- Revised Version 31/5/2015

- Revised Version 28/2/2015

- Revised Version 30/11/2014

- Correction Slip - 15/10/2010

Changes over time for: SCHEDULE 6

Version Superseded: 06/04/2020

Alternative versions:

- 27/10/2008- Amendment

- 05/01/2009- Amendment

- 06/04/2009- Amendment

- 02/10/2009- Amendment

- 26/10/2009- Amendment

- 06/04/2010- Amendment

- 12/04/2010- Amendment

- 28/06/2010- Amendment

- 01/10/2010- Amendment

- 05/03/2011- Amendment

- 11/04/2011- Amendment

- 31/10/2011- Amendment

- 09/04/2012- Amendment

- 01/05/2012- Amendment

- 02/04/2013- Amendment

- 08/04/2013- Amendment

- 29/04/2013- Amendment

- 29/10/2013- Amendment

- 07/04/2014- Amendment

- 28/04/2014- Amendment

- 26/11/2014- Amendment

- 31/12/2014- Amendment

- 06/04/2015- Amendment

- 01/04/2016- Amendment

- 11/04/2016- Amendment

- 03/04/2017- Amendment

- 10/04/2017- Amendment

- 19/06/2017- Amendment

- 23/10/2017- Amendment

- 06/04/2018- Amendment

- 09/04/2018- Amendment

- 08/04/2019- Amendment

- 08/04/2019

Point in time - 06/04/2020- Amendment

- 15/07/2020- Amendment

- 12/04/2021- Amendment

- 26/07/2021- Amendment

- 01/01/2022- Amendment

- 21/03/2022- Amendment

- 11/04/2022- Amendment

- 10/04/2023- Amendment

- 09/07/2023- Amendment

- 08/04/2024- Amendment

- 21/10/2024- Amendment

- 16/11/2024- Amendment

Status:

Point in time view as at 08/04/2019.

Changes to legislation:

There are currently no known outstanding effects for the The Employment and Support Allowance Regulations 2008, SCHEDULE 6.![]()

Changes to Legislation

Revised legislation carried on this site may not be fully up to date. At the current time any known changes or effects made by subsequent legislation have been applied to the text of the legislation you are viewing by the editorial team. Please see ‘Frequently Asked Questions’ for details regarding the timescales for which new effects are identified and recorded on this site.

Regulations 67(1)(c), [F168(1)(d)]

SCHEDULE 6E+W+SHOUSING COSTS

Textual Amendments

F1Word in Sch. 6 heading substituted (27.10.2008) by The Employment and Support Allowance (Miscellaneous Amendments) Regulations 2008 (S.I. 2008/2428), regs. 1(2), 16(a)

Housing costs

1.—(1) Subject to the following provisions of this Schedule, the housing costs applicable to a claimant are those costs—E+W+S

(a)which the claimant or, where the claimant has a partner, that partner is, in accordance with paragraph 4, liable to meet in respect of the dwelling occupied as the home which the claimant or that claimant's partner is treated as occupying; and

(b)which qualify [F2under paragraphs 16 to 18] [F2under paragraph 18].

(2) In this Schedule—

[F3“existing housing costs” means housing costs arising under an agreement entered into before 2nd October 1995, or under an agreement entered into after 1st October 1995 (“the new agreement”)—

which replaces an existing agreement, provided that the person liable to meet the housing costs—

remains the same in both agreements; or

where in either agreement more than one person is liable to meet the housing costs, the person is liable to meet the housing costs in both the existing agreement and the new agreement;

where the existing agreement was entered into before 2nd October 1995; and

which is for a loan of the same amount as, or less than the amount of, the loan under the agreement it replaces, and for this purpose any amount payable to arrange the new agreement and included in the loan must be disregarded];

“housing costs” means those costs to which sub-paragraph (1) refers;

[F3“new housing costs” means housing costs arising under an agreement entered into after 1st October 1995 other than an agreement referred to in the definition of “existing housing costs”;]

[F4“standard rate” means the rate for the time being determined in accordance with paragraph 13.]

(3) For the purposes of this Schedule a disabled person is a person—

[F5(a)(i)in respect of whom the main phase employment and support allowance is payable to the claimant or to a person living with the claimant; or

(ii)where they are the claimant or a person living with the claimant, in respect of whom there would be entitlement to an employment and support allowance [F6including a work-related activity component under section 2(3) of the Act (amount of contributory allowance: work-related activity component)], but for the application of section 1A of the Act (duration of contributory allowance);]

(b)who, had that person in fact been entitled to income support, would have satisfied the requirements of paragraph 12 of Schedule 2 to the Income Support Regulations (additional condition for the disability premium);

(c)aged 75 or over; F7...

(d)who is disabled or severely disabled for the purposes of section 9(6) of the Tax Credits Act (maximum rate)[F8; or]

[F8(e)who is entitled to an award of universal credit [F9and has limited capability for work or limited capability for work and work-related activity as construed in accordance with regulations 39 and 40 of the Universal Credit Regulations 2013.]]

[F10(3A) For the purposes of this Schedule a claimant is a “work or training beneficiary” on any day in a linking term where the claimant—

(a)had limited capability for work–

(i)for more than 13 weeks in the most recent past period of limited capability for work; or

(ii)for 13 weeks or less in the most recent past period of limited capability for work where the claimant became entitled to an award of an employment and support allowance by virtue of a conversion decision which took effect from the commencement of the most recent past period of limited capability for work;

(b)ceased to be entitled to an allowance or advantage at the end of that most recent past period of limited capability for work; and

(c)became engaged in work or training within one month of so ceasing to be entitled.

(3B) A claimant is not a work or training beneficiary if–

(a)the most recent past period of limited capability for work was ended by a determination that the claimant did not have limited capability for work; and

(b)that determination was on the basis of a limited capability for work assessment.

(3C) In sub-paragraphs (3A) and (3B)—

“allowance or advantage” means any allowance or advantage under the Act or the Contributions and Benefits Act for which entitlement is dependent on limited capability for work;

“conversion decision” has the meaning given in regulation 5(2)(a) of the Employment and Support Allowance (Transitional Provisions, Housing Benefit and Council Tax Benefit) (Existing Awards) (No. 2) Regulations 2010;

“linking term” means a period of 104 weeks from the first day immediately following the last day in a period of limited capability for work;

“most recent past period of limited capability for work” means the period of limited capability for work which most recently precedes the period in respect of which the current claim is made, including any period of which that previous period is treated as a continuation by virtue of regulation 145(1) (linking rules); and

“work” means work, other than work under regulation 45 (exempt work), for which payment is made or which is done in expectation of payment.]

(4) For the purposes of sub-paragraph (3), a person will not cease to be a disabled person on account of that person being disqualified for receiving benefit or treated as not having limited capability for work by virtue of the operation of section 18(1) to (3) of the Act.

Textual Amendments

F2Words in Sch. 6 para. 1(1)(b) substituted (with effect in accordance with regs.19 - 21 of the amending S.I.) by The Loans for Mortgage Interest Regulations 2017 (S.I. 2017/725), reg. 1(2)(a), Sch. 5 para. 1(c)(i)

F3Words in Sch. 6 para. 1(2) omitted (1.4.2016) by virtue of The Social Security (Housing Costs Amendments) Regulations 2015 (S.I. 2015/1647), regs. 1, 4(2)(a) (with reg. 8)

F4Words in Sch. 6 para. 1(2) omitted (with effect in accordance with regs.19 - 21 of the amending S.I.) by virtue of The Loans for Mortgage Interest Regulations 2017 (S.I. 2017/725), reg. 1(2)(a), Sch. 5 para. 1(c)(ii)

F5Sch. 6 para. 1(3)(a) substituted (1.5.2012) by The Employment and Support Allowance (Duration of Contributory Allowance) (Consequential Amendments) Regulations 2012 (S.I. 2012/913), regs. 1(2), 9(4)

F6Words in Sch. 6 para. 1(3)(a)(ii) omitted (3.4.2017) by virtue of The Employment and Support Allowance and Universal Credit (Miscellaneous Amendments and Transitional and Savings Provisions) Regulations 2017 (S.I. 2017/204), regs. 1, 2(5)(a) (with Sch. 2 paras. 1-7)

F7Word in Sch. 6 para. 1(3) omitted (29.4.2013) by virtue of The Universal Credit (Consequential, Supplementary, Incidental and Miscellaneous Provisions) Regulations 2013 (S.I. 2013/630), regs. 1(2), 37(7)(a)

F8Sch. 6 para. 1(3)(e) and word inserted (29.4.2013) by The Universal Credit (Consequential, Supplementary, Incidental and Miscellaneous Provisions) Regulations 2013 (S.I. 2013/630), regs. 1(2), 37(7)(a)

F9Words in Sch. 6 para. 1(3)(e) substituted (3.4.2017) by The Employment and Support Allowance and Universal Credit (Miscellaneous Amendments and Transitional and Savings Provisions) Regulations 2017 (S.I. 2017/204), reg. 1, Sch. 1 para. 15

F10Sch. 6 para. 1(3A)-(3C) inserted (1.5.2012) by The Employment and Support Allowance (Amendment of Linking Rules) Regulations 2012 (S.I. 2012/919), regs. 1(2), 5(8)

Modifications etc. (not altering text)

C1Sch. 6 para. 1(2) applied (with modifications) (5.1.2009) by The Social Security (Housing Costs Special Arrangements) (Amendment and Modification) Regulations 2008 (S.I. 2008/3195), regs. 1(3), 9(a) (with reg. 8)

Remunerative workE+W+S

2.—(1) Subject to [F11sub-paragraphs (2) to (8)], a [F12non-dependant (referred to in this paragraph as “person”)] is to be treated for the purposes of this Schedule as engaged in remunerative work if that person is engaged, or, where the person's hours of work fluctuate, is engaged on average, for not less than 16 hours a week, being work for which payment is made or which is done in expectation of payment.

(2) Subject to sub-paragraph (3), in determining the number of hours for which a person is engaged in work where that person's hours of work fluctuate, regard is to be had to the average of hours worked over—

(a)if there is a recognisable cycle of work, the period of one complete cycle (including, where the cycle involves periods in which the person does no work, those periods but disregarding any other absences);

(b)in any other case, the period of 5 weeks immediately prior to the date of claim, or such other length of time as may, in the particular case, enable the person's weekly average hours of work to be determined more accurately.

(3) Where no recognisable cycle has been established in respect of a person's work, regard is to be had to the number of hours or, where those hours will fluctuate, the average of the hours, which that person is expected to work in a week.

(4) A person is to be treated as engaged in remunerative work during any period for which that person is absent from work referred to in sub-paragraph (1) if the absence is either without good cause or by reason of a recognised, customary or other holiday.

(5) A person is not to be treated as engaged in remunerative work on any day on which the person is on maternity leave, paternity leave[F13, shared parental leave] or adoption leave or is absent from work because the person is ill.

(6) For the purposes of this paragraph, in determining the number of hours in which a person is engaged or treated as engaged in remunerative work, no account is to be taken of any hours in which the person is engaged in an employment or a scheme to which regulation 43(1) (circumstances under which partners of persons entitled to an income-related allowance are not to be treated as engaged in remunerative work) applies.

(7) For the purposes of sub-paragraphs (1) and (2), in determining the number of hours for which a person is engaged in work, that number is to include any time allowed to that person by that person's employer for a meal or for refreshment, but only where that person is, or expects to be, paid earnings in respect of that time.

[F14(8) A person is to be treated as not being engaged in remunerative work on any day in which that person falls within the circumstances prescribed in regulation 43(2) (circumstances in which partners of claimants entitled to an income-related allowance are not to be treated as engaged in remunerative work).

(9) Whether a claimant or the claimant’s partner is engaged in, or to be treated as being engaged in, remunerative work is to be determined in accordance with regulations 41 or 42 (meaning of “remunerative work” for the purposes of paragraph 6(1)(e) and (f) of Schedule 1 to the Act) as the case may be.]

Textual Amendments

F11Words in Sch. 6 para. 2(1) substituted (27.10.2008) by The Employment and Support Allowance (Miscellaneous Amendments) Regulations 2008 (S.I. 2008/2428), regs. 1(2), 16(b)(i)(aa)

F12Words in Sch. 6 para. 2(1) substituted (27.10.2008) by The Employment and Support Allowance (Miscellaneous Amendments) Regulations 2008 (S.I. 2008/2428), regs. 1(2), 16(b)(i)(bb)

F13Words in Sch. 6 para. 2(5) inserted (31.12.2014) by The Shared Parental Leave and Statutory Shared Parental Pay (Consequential Amendments to Subordinate Legislation) Order 2014 (S.I. 2014/3255), arts. 1(2), 20(8)

F14Sch. 6 para. 2(8) (9) substituted for Sch. 6 para. 2(8) (27.10.2008) by The Employment and Support Allowance (Miscellaneous Amendments) Regulations 2008 (S.I. 2008/2428), regs. 1(2), 16(b)(ii)

Previous entitlement to other income-related benefitsE+W+S

3.—(1) Where the claimant or the claimant's partner was in receipt of, or was treated as being in receipt of, an income-based jobseeker's allowance or income support not more than 12 weeks before one of them becomes entitled to an income-related allowance or, where the claimant or the claimant's partner is a person to whom paragraph 15(2) or (13) (linking rules) refers, not more than 26 weeks before becoming so entitled and—

(a)the applicable amount for that income-based jobseeker's allowance or income support included an amount in respect of housing costs [F15under paragraphs 14 to 16 of Schedule 2] [F15under paragraph 16 of Schedule 2] to the Jobseeker's Allowance Regulations or, as the case may be, [F15paragraphs 15 to 17 of Schedule 3] [F15paragraph 17 of Schedule 3] to the Income Support Regulations; and

(b)the circumstances affecting the calculation of those housing costs remain unchanged since the last calculation of those costs,

the applicable amount in respect of housing costs for an income-related allowance is to be the applicable amount in respect of those costs current when entitlement to an income-based jobseeker's allowance or income support was last determined.

(2) Where a claimant or the claimant's partner was in receipt of state pension credit not more than 12 weeks before one of them becomes entitled to [F16an income-related allowance] or, where the claimant or the claimant's partner is a person to whom paragraph 15(2) or (13) (linking rules) refers, not more than 26 weeks before becoming so entitled, and—

(a)the appropriate minimum guarantee included an amount in respect of housing costs [F17under paragraphs 11 to 13 of Schedule 2] [F17under paragraph 13 of Schedule 2] to the State Pension Credit Regulations 2002 F18; and

(b)the circumstances affecting the calculation of those housing costs remain unchanged since the last calculation of those costs,

the applicable amount in respect of housing costs for an income-related allowance is to be the applicable amount in respect of those costs current when entitlement to state pension credit was last determined.

(3) Where, in the period since housing costs were last calculated for an income-based jobseeker's allowance, income support or, as the case may be, state pension credit, there has been a change of circumstances, other than a reduction in the amount of an outstanding loan, which increases or reduces those costs, the amount to be met under this Schedule must, for the purposes of the claim for an income-related allowance, be recalculated so as to take account of that change.

Textual Amendments

F15Words in Sch. 6 para. 3(1)(a) substituted (with effect in accordance with regs.19 - 21 of the amending S.I.) by The Loans for Mortgage Interest Regulations 2017 (S.I. 2017/725), reg. 1(2)(a), Sch. 5 para. 1(c)(iii)(aa)

F16Words in Sch. 6 para. 3(2) substituted (27.10.2008) by The Employment and Support Allowance (Miscellaneous Amendments) Regulations 2008 (S.I. 2008/2428), regs. 1(2), 16(c)

F17Words in Sch. 6 para. 3(2)(a) substituted (with effect in accordance with regs.19 - 21 of the amending S.I.) by The Loans for Mortgage Interest Regulations 2017 (S.I. 2017/725), reg. 1(2)(a), Sch. 5 para. 1(c)(iii)(bb)

F18S.I. 2002/1792, the relevant amending instruments are S.I. 2002/3019, S.I. 2006/718 and S.I. 2006/2378.

Circumstances in which a person is liable to meet housing costsE+W+S

4. A person is liable to meet housing costs where—

(a)the liability falls upon that person or that person's partner but not where the liability is to a member of the same household as the person on whom the liability falls;

(b)because the person liable to meet the housing costs is not meeting them, the claimant has to meet those costs in order to continue to live in the dwelling occupied as the home and it is reasonable in all the circumstances to treat the claimant as liable to meet those costs;

(c)in practice the claimant shares the housing costs with other members of the household none of whom are close relatives either of the claimant or the claimant's partner, and—

(i)one or more of those members is liable to meet those costs; and

(ii)it is reasonable in the circumstances to treat the claimant as sharing responsibility.

Circumstances in which a person is to be treated as occupying a dwelling as the homeE+W+S

5.—(1) Subject to the following provisions of this paragraph, a person is to be treated as occupying as the home the dwelling normally occupied as the home by that person or, if that person is a member of a family, by that person and that person's family and that person is not to be treated as occupying any other dwelling as the home.

(2) In determining whether a dwelling is the dwelling normally occupied as the claimant's home for the purposes of sub-paragraph (1) regard must be had to any other dwelling occupied by the claimant or by the claimant and that claimant's family whether or not that other dwelling is in Great Britain.

(3) Subject to sub-paragraph (4), where a claimant who has no partner is a full-time student or is on a training course and is liable to make payments (including payments of mortgage interest or, in Scotland, payments under heritable securities or, in either case, analogous payments) in respect of either (but not both) the dwelling which that claimant occupies for the purpose of attending the course of study or the training course or, as the case may be, the dwelling which that claimant occupies when not attending that course, that claimant is to be treated as occupying as the home the dwelling in respect of which that claimant is liable to make payments.

(4) A full-time student is not to be treated as occupying a dwelling as that student's home for any week of absence from it, other than an absence occasioned by the need to enter hospital for treatment, outside the period of study, if the main purposes of that student's occupation during the period of study would be to facilitate attendance on that student's course.

(5) Where a claimant has been required to move into temporary accommodation by reason of essential repairs being carried out to the dwelling normally occupied as the home and that claimant is liable to make payments (including payments of mortgage interest or, in Scotland, payments under heritable securities or, in either case, analogous payments) in respect of either (but not both) the dwelling normally occupied or the temporary accommodation, that claimant must be treated as occupying as the home the dwelling in respect of which that claimant is liable to make those payments.

(6) Where a claimant is liable to make payments in respect of two (but not more than two) dwellings, that claimant must be treated as occupying both dwellings as the home only—

(a)where that claimant has left and remains absent from the former dwelling occupied as the home through fear of violence in that dwelling or of violence by a former member of the claimant's family and it is reasonable that housing costs should be met in respect of both that claimant's former dwelling and that claimant's present dwelling occupied as the home;

(b)in the case of a couple or a member of a polygamous marriage where a partner is a full-time student or is on a training course and it is unavoidable that that student, or they, should occupy two separate dwellings and reasonable that housing costs should be met in respect of both dwellings; or

(c)in the case where a claimant has moved into a new dwelling occupied as the home, except where sub-paragraph (5) applies, for a period not exceeding four benefit weeks from the first day of the benefit week in which the move occurs if that claimant's liability to make payments in respect of two dwellings is unavoidable.

(7) Where—

(a)a claimant has moved into a dwelling and was liable to make payments in respect of that dwelling before moving in;

(b)that claimant had claimed an income-related allowance before moving in and either that claim has not yet been determined or it has been determined but an amount has not been included under this Schedule and if the claim has been refused a further claim has been made within four weeks of the date on which the claimant moved into the new dwelling occupied as the home; and

(c)the delay in moving into the dwelling in respect of which there was liability to make payments before moving in was reasonable and—

(i)that delay was necessary in order to adapt the dwelling to meet the disablement needs of the claimant or any member of the claimant's family;

(ii)the move was delayed pending [F19local welfare provision or] the outcome of an application for a social fund payment under Part 8 of the Contributions and Benefits Act to meet a need arising out of the move or in connection with setting up the home in the dwelling, and—

(aa)a member of the claimant's family is aged five or under;

(bb)the claimant is a person in respect of whom the main phase employment and support allowance is payable;

(cc)the claimant's applicable amount includes a pensioner premium;

(dd)the claimant's applicable amount includes a severe disability premium; or

(ee)a child tax credit is paid for a member of the claimant's family who is disabled or severely disabled for the purposes of section 9(6) of the Tax Credits Act; or

(iii)the claimant became liable to make payments in respect of the dwelling while that claimant was a patient or was in residential accommodation,

that claimant is to be treated as occupying the dwelling as the home for any period not exceeding four weeks immediately prior to the date on which that claimant moved into the dwelling and in respect of which that claimant was liable to make payments.

(8) This sub-paragraph applies to a claimant who enters residential accommodation—

(a)for the purpose of ascertaining whether the accommodation suits that claimant's needs; and

(b)with the intention of returning to the dwelling which that claimant normally occupies as the home should, in the event, the residential accommodation prove not to suit that claimant's needs,

and while in the accommodation, the part of the dwelling which that claimant normally occupies as the home is not let or sub-let to another person.

(9) A claimant to whom sub-paragraph (8) applies is to be treated as occupying the dwelling that the claimant normally occupies as the home during any period (commencing on the day that claimant enters the accommodation) not exceeding 13 weeks in which the claimant is resident in the accommodation, but only in so far as the total absence from the dwelling does not exceed 52 weeks.

(10) A claimant, other than a claimant to whom sub-paragraph (11) applies, is to be treated as occupying a dwelling as the home throughout any period of absence not exceeding 13 weeks, if, and only if—

(a)that claimant intends to return to occupy the dwelling as the home;

(b)the part of the dwelling normally occupied by that claimant has not been let or sub-let to another person; and

(c)the period of absence is unlikely to exceed 13 weeks.

(11) This sub-paragraph applies to a claimant whose absence from the dwelling that that claimant normally occupies as the home is temporary and—

(a)that claimant intends to return to occupy the dwelling as the home;

(b)the part of the dwelling normally occupied by that claimant has not been let or sub-let; and

(c)that claimant is—

(i)detained in custody on remand pending trial or, as a condition of bail, required to reside—

(aa)in a dwelling other than the dwelling that claimant occupies as the home; or

(bb)in premises approved under section 13 of the Offender Management Act 2007 F20,

or, detained pending sentence upon conviction;

(ii)resident in a hospital or similar institution as a patient;

(iii)undergoing or, as the case may be, that claimant's partner or dependant child is undergoing, in the United Kingdom or elsewhere, medical treatment or medically approved convalescence, in accommodation other than residential accommodation;

(iv)following, in the United Kingdom or elsewhere, a training course;

(v)undertaking medically approved care of a person residing in the United Kingdom or elsewhere;

(vi)undertaking the care of a child whose parent or guardian is temporarily absent from the dwelling normally occupied by that parent or guardian for the purpose of receiving medically approved care or medical treatment;

(vii)a claimant who is, whether in the United Kingdom or elsewhere, receiving medically approved care provided in accommodation other than residential accommodation;

(viii)a full-time student to whom sub-paragraph (3) or (6)(b) does not apply;

(ix)a claimant other than a claimant to whom sub-paragraph (8) applies, who is receiving care provided in residential accommodation; or

(x)a claimant to whom sub-paragraph (6)(a) does not apply and who has left the dwelling that claimant occupies as the home through fear of violence in that dwelling, or by a person who was formerly a member of that claimant's family; and

(d)the period of that claimant's absence is unlikely to exceed a period of 52 weeks, or in exceptional circumstances, is unlikely substantially to exceed that period.

(12) A claimant to whom sub-paragraph (11) applies is to be treated as occupying the dwelling that claimant normally occupies as the home during any period of absence not exceeding 52 weeks beginning with the first day of that absence.

(13) In this paragraph—

“medically approved” means certified by a medical practitioner;

“patient” means a person who is undergoing medical or other treatment as an in-patient in a hospital or similar institution;

[F21“period of study” has the meaning given in regulation 131 (interpretation);]

“residential accommodation” means accommodation which is a care home, an Abbeyfield Home or an independent hospital;

“training course” means such a course of training or instruction provided wholly or partly by or on behalf of or in pursuance of arrangements made with, or approved by or on behalf of, [F22Skills Development Scotland,] Scottish Enterprise, Highlands and Islands Enterprise, a government department or the Secretary of State.

Textual Amendments

F19Words in Sch. 6 para. 5(7)(c) inserted (2.4.2013) by The Social Security (Miscellaneous Amendments) Regulations 2013 (S.I. 2013/443), regs. 1, 9(4)

F21Words in Sch. 6 para. 5(13) inserted (26.10.2009) by The Social Security (Miscellaneous Amendments) (No. 4) Regulations 2009 (S.I. 2009/2655), regs. 1(1), 11(17)(a)

F22Words in Sch. 6 para. 5(13) inserted (6.4.2009) by The Social Security (Miscellaneous Amendments) Regulations 2009 (S.I. 2009/583), regs. 1(2), 10(2)(c)

Housing costs not metE+W+S

6.—(1) No amount may be met under the provisions of this Schedule—

(a)in respect of housing benefit expenditure; or

(b)where the claimant is living in a care home, an Abbeyfield Home or an independent hospital except where the claimant is living in such a home or hospital during a temporary absence from the dwelling the claimant occupies as the home and in so far as they relate to temporary absences, the provisions of paragraph 5(8) to (12) apply to that claimant during that absence.

(2) [F23Subject to the following provisions of this paragraph, loans which, apart from this paragraph, qualify under paragraph 16 (loans on residential property) must not so qualify where the loan was incurred during the relevant period and was incurred—

(a)after 27th October 2008; or

[F24(b)after 2nd May 1994 and the housing costs applicable to that loan were not met by virtue of the former paragraph 5A of Schedule 3 to the Income Support Regulations, or paragraph 4(2)(a) of Schedule 3 to the Income Support Regulations, paragraph 4(2)(a) of Schedule 2 to the Jobseeker’s Allowance Regulations or paragraph 5(2)(a) of Schedule 2 to the State Pension Credit Regulations;]

(c)subject to sub-paragraph (3), in the 26 weeks preceding 27th October 2008 by a person—

(i)who was not at that time entitled to income support, income-based jobseeker's allowance or state pension credit; and

(ii)who becomes, or whose partner becomes entitled to an income-related allowance after 27th October 2008 and that entitlement is within 26 weeks of an earlier entitlement to income support, an income-based jobseeker's allowance or state pension credit of the claimant or the claimant's partner.]

(3) [F23Sub-paragraph (2)(c) will not apply in respect of a loan where the claimant has interest payments on that loan met without restrictions under an award of income support in respect of a period commencing before 27th October 2008.]

(4) [F23The “relevant period” for the purposes of this paragraph is any period during which the person to whom the loan was made—

(a)is entitled to an income-related allowance, an income-based jobseeker's allowance, income support or state pension credit; or

(b)has a partner and the partner is entitled to an income-related allowance, an income-based jobseeker's allowance, income support or state pension credit,

together with any linked period, that is to say a period falling between two periods separated by not more than 26 weeks in which one of the paragraphs (a) or (b) is satisfied.]

(5) [F23For the purposes of sub-paragraph (4), a person is to be treated as entitled to an income-related allowance during any period when that person or that person's partner was not so entitled because—

(a)that person or that person's partner was participating in an employment programme specified in regulation 75(1)(a)(ii) of the Jobseeker's Allowance Regulations or in the Intensive Activity Period specified in regulation 75(1)(a)(iv) of those Regulations; and

(b)in consequence of such participation that person or that person's partner was engaged in remunerative work or had an income [F25equal to or] in excess of the claimant's applicable amount as prescribed in Part 9.]

(6) [F23A person treated by virtue of paragraph 15 as being in receipt of an income-related allowance for the purposes of this Schedule is not to be treated as entitled to an income-related allowance for the purposes of sub-paragraph (4).]

(7) [F23For the purposes of sub-paragraph (4)—

(a)any week in the period of 26 weeks ending on 1st October 1995 on which there arose an entitlement to income support such as is mentioned in that sub-paragraph must be taken into account in determining when the relevant period commences; and

(b)two or more periods of entitlement and any intervening linked periods must together form a single relevant period.]

(8) [F23Where the loan to which sub-paragraph (2) refers has been applied—

(a)for paying off an earlier loan, and that earlier loan qualified under paragraph 16 during the relevant period; or

(b)to finance the purchase of a property where an earlier loan, which qualified under paragraph 16 or 17 during the relevant period in respect of another property, is paid off (in whole or in part) with monies received from the sale of that property,

then the amount of the loan to which sub-paragraph (2) applies is the amount (if any) by which the new loan exceeds the earlier loan.]

(9) [F23Notwithstanding the preceding provisions of this paragraph, housing costs must be met in any case where a claimant satisfies any of the conditions specified in sub-paragraphs (10) to (13), but—

(a)those costs must be subject to any additional limitations imposed by the sub-paragraph; and

(b)where the claimant satisfies the conditions in more than one of these sub-paragraphs, only one of them will apply in that claimant's case and the one that applies will be the one most favourable to the claimant.]

(10) [F23The conditions specified in this sub-paragraph are that—

(a)during the relevant period the claimant or a member of the claimant's family acquires an interest (“the relevant interest”) in a dwelling which that claimant then occupies or continues to occupy, as the home; and

(b)in the week preceding the week in which the relevant interest was acquired, housing benefit was payable to the claimant or a member of the claimant's family,

so however that the amount to be met by way of housing costs will initially not exceed the aggregate of—

(i)the housing benefit payable in the week mentioned at sub-paragraph (10)(b); and

(ii)any amount included in the applicable amount of the claimant or a member of the claimant's family in accordance with regulation 67(1)(c) or 68(1)(d) in that week,

and is to be increased subsequently only to the extent that it is necessary to take account of any increase, arising after the date of the acquisition, in the standard rate or in any housing costs which qualify under paragraph 18 (other housing costs).]

(11) [F23The condition specified in this sub-paragraph is that the loan was taken out, or an existing loan increased, to acquire alternative accommodation more suited to the special needs of a disabled person than the accommodation which was occupied before the acquisition by the claimant.]

(12) [F23The conditions specified in this sub-paragraph are that—

(a)the loan commitment increased in consequence of the disposal of the dwelling occupied as the home and the acquisition of an alternative such dwelling; and

(b)the change of dwelling was made solely by reason of the need to provide separate sleeping accommodation for [F26persons of different sexes aged 10 or over but aged under 20] who belong to the same family as the claimant.]

(13) [F23The conditions specified in this sub-paragraph are that—

(a)during the relevant period the claimant or a member of the claimant's family acquires an interest (“the relevant interest”) in a dwelling which that claimant then occupies as the home; and

(b)in the week preceding the week in which the relevant interest was acquired, the applicable amount of the claimant or a member of the claimant's family included an amount determined by reference to paragraph 18 and did not include any amount specified in paragraph 16 or paragraph 17,

so however that the amount to be met by way of housing costs will initially not exceed the amount so determined, and will be increased subsequently only to the extent that it is necessary to take account of any increase, arising after the date of acquisition, in the standard rate or in any housing costs which qualify under paragraph 18.]

(14) [F23The following provisions of this Schedule will have effect subject to the provisions of this paragraph.]

Textual Amendments

F23Sch. 6 para. 6(2)-(14) omitted (with effect in accordance with regs.19 - 21 of the amending S.I.) by virtue of The Loans for Mortgage Interest Regulations 2017 (S.I. 2017/725), reg. 1(2)(a), Sch. 5 para. 1(c)(iv)

F24Sch. 6 para. 6(2)(b) substituted (27.10.2008) by The Employment and Support Allowance (Miscellaneous Amendments) Regulations 2008 (S.I. 2008/2428), regs. 1(2), 16(d)(i)

F25Words in Sch. 6 para. 6(5)(b) inserted (for specified purposes and with effect in accordance with reg. 1(3) of the amending S.I.) by The Social Security (Miscellaneous Amendments) Regulations 2011 (S.I. 2011/674), reg. 16(11)(a)

F26Words in Sch. 6 para. 6(12)(b) substituted (27.10.2008) by The Employment and Support Allowance (Miscellaneous Amendments) Regulations 2008 (S.I. 2008/2428), regs. 1(2), 16(d)(ii)

Apportionment of housing costsE+W+S

7.—(1) Where the dwelling occupied as the home is a composite hereditament and—

(a)before 1st April 1990 for the purposes of section 48(5) of the General Rate Act 1967 F27 (reduction of rates on dwellings), it appeared to a rating authority or it was determined in pursuance of subsection (6) of section 48 of that Act that the hereditament, including the dwelling occupied as the home, was a mixed hereditament and that only a proportion of the rateable value of the hereditament was attributable to use for the purpose of a private dwelling; or

(b)in Scotland, before 1st April 1989 an assessor acting pursuant to section 45(1) of the Water (Scotland) Act 1980 F28 (provision as to valuation roll) has apportioned the net annual value of the premises including the dwelling occupied as the home between the part occupied as a dwelling and the remainder,

the amounts applicable under this Schedule are to be such proportion of the amounts applicable in respect of the hereditament or premises as a whole as is equal to the proportion of the rateable value of the hereditament attributable to the part of the hereditament used for the purposes of a private tenancy or, in Scotland, the proportion of the net annual value of the premises apportioned to the part occupied as a dwelling house.

(2) Subject to sub-paragraph (1) and the following provisions of this paragraph, where the dwelling occupied as the home is a composite hereditament, the amount applicable under this Schedule is to be the relevant fraction of the amount which would otherwise be applicable under this Schedule in respect of the dwelling occupied as the home.

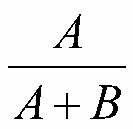

(3) For the purposes of sub-paragraph (2), the relevant fraction is to be obtained in accordance with the formula—

where—

A is the current market value of the claimant's interest in that part of the composite hereditament which is domestic property within the meaning of section 66 of the Act of 1988;

B is the current market value of the claimant's interest in that part of the composite hereditament which is not domestic property within that section.

(4) In this paragraph—

“composite hereditament” means—

as respects England and Wales, any hereditament which is shown as a composite hereditament in a local non-domestic rating list;

as respects Scotland, any lands and heritages entered in the valuation roll which are part residential subjects within the meaning of section 26(1) of the Act of 1987;

“local non-domestic rating list” means a list compiled and maintained under section 41(1) of the Act of 1988;

“the Act of 1987” means the Abolition of Domestic Rates Etc. (Scotland) Act 1987 F29;

“the Act of 1988” means the Local Government Finance Act 1988 F30.

(5) Where responsibility for expenditure which relates to housing costs met under this Schedule is shared, the amounts applicable are to be calculated by reference to the appropriate proportion of that expenditure for which the claimant is responsible.

Textual Amendments

F301988 c. 41. Section 41(1) was amended by the Local Government Finance Act 1992 (c. 14), Schedule 13, paragraph 59.

Modifications etc. (not altering text)

C2Sch. 6 para. 7(3) sum maintained (coming into force in accordance with art. 1(2)(m) of the amending S.I.) by The Social Security Benefits Up-rating Order 2017 (S.I. 2017/260), arts. 1(2)(m), 26(1)(5), Sch. 15

Existing housing costsE+W+S

8.—[F31(1) Subject to the provisions of this Schedule, the existing housing costs to be met in any particular case are—

(a)where the claimant has been entitled to an employment and support allowance for a continuous period of 26 weeks or more, the aggregate of—

(i)an amount determined in the manner set out in paragraph 11 by applying the standard rate to the eligible capital for the time being owing in connection with a loan which qualifies under paragraph 16 or 17; and

(ii)an amount equal to any payments which qualify under paragraph 18(1)(a) to (c);

(b)where the claimant has been entitled to an employment and support allowance for a continuous period of not less than 8 weeks but less than 26 weeks, an amount which is half the amount which would fall to be met by applying the provisions of sub-paragraph (a);

(c)in any other case, nil.

(2) For the purposes of sub-paragraph (1) and subject to sub-paragraph (3), the eligible capital for the time being owing is to be determined on the date the existing housing costs are first met and thereafter on each anniversary of that date.

(3) Where a claimant or that claimant's partner ceases to be in receipt of or treated as being in receipt of income support, income-based jobseeker's allowance or state pension credit and one of them becomes entitled to an income-related allowance in a case to which paragraph 3 applies, the eligible capital for the time being owing is to be recalculated on each anniversary of the date on which the housing costs were first met for whichever of the benefits concerned the claimant or the claimant's partner was first entitled.]

Textual Amendments

F31Sch. 6 para. 8 omitted (1.4.2016) by virtue of The Social Security (Housing Costs Amendments) Regulations 2015 (S.I. 2015/1647), regs. 1, 4(2)(b) (with reg. 8)

Modifications etc. (not altering text)

C3Sch. 6 para. 8 applied (with modifications) (5.1.2009) by The Social Security (Housing Costs Special Arrangements) (Amendment and Modification) Regulations 2008 (S.I. 2008/3195), regs. 1(3), 9(b) (with reg. 8)

C4Sch. 6 para. 8(1) applied (with modifications) (for specified purposes and with effect in accordance with reg. 1(2) of the amending S.I.) by The Social Security (Housing Costs Special Arrangements) (Amendment and Modification) Regulations 2008 (S.I. 2008/3195), regs. 1(2), 4(a) (with regs. 3, 7)

C5Sch. 6 para. 8(1)(b) sum maintained (coming into force in accordance with art. 1(2)(m) of the amending S.I.) by The Social Security Benefits Up-rating Order 2017 (S.I. 2017/260), arts. 1(2)(m), 26(1)(5), Sch. 15

C6Sch. 6 para. 8(1)(c) sum maintained (coming into force in accordance with art. 1(2)(m) of the amending S.I.) by The Social Security Benefits Up-rating Order 2017 (S.I. 2017/260), arts. 1(2)(m), 26(1)(5), Sch. 15

[F32New housing costs[F32Housing costs]]E+W+S

9.—(1) Subject to the provisions of this Schedule, the [F33new] housing costs to be met in any particular case are—

(a)where the claimant has been entitled to an employment and support allowance for a continuous period of 39 weeks or more, an amount—

(i)[F34determined in the manner set out in paragraph 11 by applying the standard rate to the eligible capital for the time being owing in connection with a loan which qualifies under paragraph 16 or 17; and]

(ii)equal to any payments which qualify under paragraph 18(1)(a) to (c);

(b)in any other case, nil.

(2) [F34For the purposes of sub-paragraph (1) and subject to sub-paragraph (3), the eligible capital for the time being owing is to be determined on the date the [F33new] housing costs are first met and thereafter on each anniversary of that date.]

(3) Where a claimant or that claimant's partner ceases to be in receipt of or treated as being in receipt of income support, income-based jobseeker's allowance or state pension credit and one of them becomes entitled to an income-related allowance in a case to which [F35paragraph 3] applies, the eligible capital for the time being owing is to be recalculated on each anniversary of the date on which the housing costs were first met for whichever of the benefits concerned the claimant or that claimant's partner was first entitled.

(4) [F36This sub-paragraph applies to a claimant who at the time the claim is made—

(a)is a person who is described in paragraph 4 or 5 of Schedule 1B of the Income Support Regulations (person caring for another person);

(b)is detained in custody pending trial or sentence upon conviction; or

(c)has been refused payments under a policy of insurance on the ground that—

(i)the claim under the policy is the outcome of a pre-existing medical condition which, under the terms of the policy, does not give rise to any payment by the insurer; or

(ii)that claimant was infected by the Human Immunodeficiency Virus;

(iii)and the policy was taken out to insure against the risk of being unable to maintain repayments on a loan which is secured by a mortgage or a charge over land, or (in Scotland) by a heritable security.]

(5) [F36This sub-paragraph applies subject to sub-paragraph (7) where a person claims an income-related allowance because of—

(a)the death of a partner; or

(b)being abandoned by that claimant's partner,

and where that claimant's family includes a child.]

(6) [F36In the case of a claimant to whom sub-paragraph (4) or (5) applies, any new housing costs are to be met as though they were existing housing costs and paragraph 8 (existing housing costs) applied to them.]

(7) [F36Sub-paragraph (5) must cease to apply to a claimant who subsequently becomes one of a couple.]

Textual Amendments

F32Sch. 6 para. 9 heading substituted (1.4.2016) by The Social Security (Housing Costs Amendments) Regulations 2015 (S.I. 2015/1647), regs. 1, 4(2)(c)(iii) (with reg. 8)

F33Word in Sch. 6 para. 9(1)(2) omitted (1.4.2016) by virtue of The Social Security (Housing Costs Amendments) Regulations 2015 (S.I. 2015/1647), regs. 1, 4(2)(c)(i) (with reg. 8)

F34Sch. 6 para. 9(1)(a)(i)(2) omitted (with effect in accordance with regs.19 - 21 of the amending S.I.) by virtue of The Loans for Mortgage Interest Regulations 2017 (S.I. 2017/725), reg. 1(2)(a), Sch. 5 para. 1(c)(v)

F35Words in Sch. 6 para. 9(3) substituted (27.10.2008) by The Employment and Support Allowance (Miscellaneous Amendments) Regulations 2008 (S.I. 2008/2428), regs. 1(2), 16(e)

F36Sch. 6 para. 9(4)-(7) omitted (1.4.2016) by virtue of The Social Security (Housing Costs Amendments) Regulations 2015 (S.I. 2015/1647), regs. 1, 4(2)(c)(ii) (with reg. 8)

Modifications etc. (not altering text)

C7Sch. 6 para. 9 applied (with modifications) (5.1.2009) by The Social Security (Housing Costs Special Arrangements) (Amendment and Modification) Regulations 2008 (S.I. 2008/3195), regs. 1(3), 9(c)(aa)(i) (with reg. 8)

C8Sch. 6 para. 9(1) applied (with modifications) (for specified purposes and with effect in accordance with reg. 1(2) of the amending S.I.) by The Social Security (Housing Costs Special Arrangements) (Amendment and Modification) Regulations 2008 (S.I. 2008/3195), regs. 1(2), 4(b) (with regs. 3, 7)

C9Sch. 6 para. 9(1) applied (with modifications) (5.1.2009) by The Social Security (Housing Costs Special Arrangements) (Amendment and Modification) Regulations 2008 (S.I. 2008/3195), regs. 1(3), 9(c)(ii) (with reg. 8)

C10Sch. 6 para. 9(1)(2) applied (with modifications) (5.1.2009) by The Social Security (Housing Costs Special Arrangements) (Amendment and Modification) Regulations 2008 (S.I. 2008/3195), regs. 1(3), 9(c)(bb)(i) (with reg. 8)

C11Sch. 6 para. 9(1)(b) sum maintained (coming into force in accordance with art. 1(2)(m) of the amending S.I.) by The Social Security Benefits Up-rating Order 2017 (S.I. 2017/260), arts. 1(2)(m), 26(1)(5), Sch. 15

C12Sch. 6 para. 9(4)-(7) applied (with modifications) (5.1.2009) by The Social Security (Housing Costs Special Arrangements) (Amendment and Modification) Regulations 2008 (S.I. 2008/3195), regs. 1(3), 9(c)(iii) (with reg. 8)

General exclusions from [F37paragraphs 8 and 9] [F37paragraph 9] E+W+S

10.—(1) [F38Paragraphs 8 and 9] [F38Paragraph 9] will not apply where—

(a)[F39the claimant or the claimant’s partner] has attained the qualifying age for state pension credit;

(b)the housing costs are payments—

(i)under a co-ownership agreement;

(ii)under or relating to a tenancy or licence of a Crown tenant; or

(iii)where the dwelling occupied as the home is a tent, in respect of the tent and the site on which it stands.

(2) In a case falling within sub-paragraph (1), the housing costs to be met are—

(a)where paragraph (a) of sub-paragraph (1) applies, an amount—

(i)[F40determined in the manner set out in paragraph 11 by applying the standard rate to the eligible capital for the time being owing in connection with a loan which qualifies under paragraph 16 or 17; and]

(ii)equal to the payments which qualify under paragraph 18;

(b)where paragraph (b) of sub-paragraph (1) applies, an amount equal to the payments which qualify under paragraph 18(1)(d) to (f).

Textual Amendments

F37Words in Sch. 6 para. 10 heading substituted (1.4.2016) by The Social Security (Housing Costs Amendments) Regulations 2015 (S.I. 2015/1647), regs. 1, 4(2)(d)(ii) (with reg. 8)

F38Words in Sch. 6 para. 10(1) substituted (1.4.2016) by The Social Security (Housing Costs Amendments) Regulations 2015 (S.I. 2015/1647), regs. 1, 4(2)(d)(i) (with reg. 8)

F39Words in Sch. 6 para. 10(1)(a) substituted (28.6.2010) by The Social Security (Miscellaneous Amendments) (No. 3) Regulations 2010 (S.I. 2010/840), regs. 1, 9(18)

F40Sch. 6 para. 10(2)(a)(i) omitted (with effect in accordance with regs.19 - 21 of the amending S.I.) by virtue of The Loans for Mortgage Interest Regulations 2017 (S.I. 2017/725), reg. 1(2)(a), Sch. 5 para. 1(c)(vi)

Modifications etc. (not altering text)

C13Sch. 6 para. 10 applied (with modifications) (5.1.2009) by The Social Security (Housing Costs Special Arrangements) (Amendment and Modification) Regulations 2008 (S.I. 2008/3195), regs. 1(3), 9(d)(i) (with reg. 8)

C14Sch. 6 para. 10(1) applied (with modifications) (5.1.2009) by The Social Security (Housing Costs Special Arrangements) (Amendment and Modification) Regulations 2008 (S.I. 2008/3195), regs. 1(3), 9(d)(ii) (with reg. 8)

The calculation for loansE+W+S

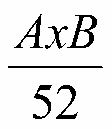

11. [F41The weekly amount of [F42existing housing costs or, as the case may be, new housing costs] [F42housing costs] to be met under this Schedule in respect of a loan which qualifies under paragraph 16 or 17 are to be calculated by applying the formula—

where—

A = the amount of the loan which qualifies under paragraph 16 or 17; and

B = the standard rate for the time being applicable in respect of that loan.]

Textual Amendments

F41Sch. 6 paras. 11-14 omitted (with effect in accordance with regs.19 - 21 of the amending S.I.) by virtue of The Loans for Mortgage Interest Regulations 2017 (S.I. 2017/725), reg. 1(2)(a), Sch. 5 para. 1(c)(vii)

F42Words in Sch. 6 para. 11 substituted (1.4.2016) by The Social Security (Housing Costs Amendments) Regulations 2015 (S.I. 2015/1647), regs. 1, 4(2)(e) (with reg. 8)

Modifications etc. (not altering text)

C15Sch. 6 para. 11 applied (with modifications) (5.1.2009) by The Social Security (Housing Costs Special Arrangements) (Amendment and Modification) Regulations 2008 (S.I. 2008/3195), regs. 1(3), 9(e) (with reg. 8)

C16Sch. 6 para. 11 sum maintained (coming into force in accordance with art. 1(2)(m) of the amending S.I.) by The Social Security Benefits Up-rating Order 2017 (S.I. 2017/260), arts. 1(2)(m), 26(1)(5), Sch. 15

General provisions applying to [F43new and existing] housing costsE+W+S

12.—[F41(1) [F44Where on or after 2nd October 1995 a person enters into a new agreement in respect of a dwelling and an agreement entered into before 2nd October 1995 (“the earlier agreement”) continues in force independently of the new agreement, then—

(a)the housing costs applicable to the new agreement are to be calculated by reference to the provisions of paragraph 9 (new housing costs);

(b)the housing costs applicable to the earlier agreement are to be calculated by reference to the provisions of paragraph 8 (existing housing costs);

and the resulting amounts are to be aggregated.]

(2) [F44Sub-paragraph (1) does not apply in the case of a claimant to whom paragraph 10 applies.]

(3) Where for the time being a loan exceeds, or in a case where more than one loan is to be taken into account, the aggregate of those loans exceeds the appropriate amount specified in sub-paragraph (4), then the amount of the loan or, as the case may be, the aggregate amount of those loans, will for the purposes of this Schedule, be the appropriate amount.

(4) Subject to the following provisions of this paragraph, the appropriate amount is £100,000.

(5) Where a claimant is treated under paragraph 5(6) (payments in respect of two dwellings) as occupying two dwellings as the home, then the restrictions imposed by sub-paragraph (3) are to be applied separately to the loans for each dwelling.

(6) In a case to which paragraph 7 (apportionment of housing costs) applies, the appropriate amount for the purposes of sub-paragraph (3) is to be the lower of—

(a)a sum determined by applying the formula—

where—

P = the relevant fraction for the purposes of paragraph 7; and

Q = the amount or, as the case may be, the aggregate amount for the time being of any loan or loans which qualify under this Schedule; or

(b)the sum for the time being specified in sub-paragraph (4).

(7) In a case to which paragraph 16(3) or 17(3) (loans which qualify in part only) applies, the appropriate amount for the purposes of sub-paragraph (3) is to be the lower of—

(a)a sum representing for the time being the part of the loan applied for the purposes specified in paragraph 16(1) or (as the case may be) paragraph 17(1); or

(b)the sum for the time being specified in sub-paragraph (4).

(8) In the case of any loan to which paragraph 17(2)(k) (loan taken out and used for the purpose of adapting a dwelling for the special needs of a disabled person) applies the whole of the loan, to the extent that it remains unpaid, is to be disregarded in determining whether the amount for the time being specified in sub-paragraph (4) is exceeded.

(9) Where in any case the amount for the time being specified for the purposes of sub-paragraph (4) is exceeded and there are two or more loans to be taken into account under either or both paragraphs 16 and 17, then the amount of eligible interest in respect of each of those loans to the extent that the loans remain outstanding is to be determined as if each loan had been reduced to a sum equal to the qualifying portion of that loan.

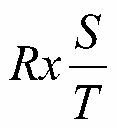

(10) For the purposes of sub-paragraph (9), the qualifying portion of a loan is to be determined by applying the following formula—

where—

R = the amount for the time being specified for the purposes of sub-paragraph (3);

S = the amount of the outstanding loan to be taken into account; and

T = the aggregate of all outstanding loans to be taken into account under paragraphs 16 and 17.

[F45(11) Sub-paragraph (12) applies to a person who, had the person been entitled to income support and not an employment and support allowance, would have been a person to whom any of the following transitional or savings provisions would have applied—

(a)regulation 4 of the Income Support (General) Amendment No. 3 Regulations 1993 (“the 1993 Regulations”);

(b)regulation 28 of the Income-related Benefits Schemes (Miscellaneous Amendments) Regulations 1995 (“the 1995 Regulations”).

(12) Where this sub-paragraph applies, the amount of housing costs applicable in the particular case shall be determined as if—

(a)in a case to which regulation 4(1) of the 1993 Regulations would have applied, sub-paragraphs 12(4) to (9) do not apply;

(b)in a case to which regulation 4(4) of the 1993 Regulations would have applied, the appropriate amount is £150,000; and

(c)in a case to which the 1995 Regulations would have applied, the appropriate amount is £125,000.]]

Textual Amendments

F41Sch. 6 paras. 11-14 omitted (with effect in accordance with regs.19 - 21 of the amending S.I.) by virtue of The Loans for Mortgage Interest Regulations 2017 (S.I. 2017/725), reg. 1(2)(a), Sch. 5 para. 1(c)(vii)

F43Words in Sch. 6 para. 12 heading omitted (1.4.2016) by virtue of The Social Security (Housing Costs Amendments) Regulations 2015 (S.I. 2015/1647), regs. 1, 4(2)(f)(ii) (with reg. 8)

F44Sch. 6 para. 12(1)(2) omitted (1.4.2016) by virtue of The Social Security (Housing Costs Amendments) Regulations 2015 (S.I. 2015/1647), regs. 1, 4(2)(f)(i) (with reg. 8)

F45Sch. 6 para. 12(11)(12) added (27.10.2008) by The Employment and Support Allowance (Miscellaneous Amendments) Regulations 2008 (S.I. 2008/2428), regs. 1(2), 16(f)

Modifications etc. (not altering text)

C17Sch. 6 para. 12 applied (with modifications) (5.1.2009) by The Social Security (Housing Costs Special Arrangements) (Amendment and Modification) Regulations 2008 (S.I. 2008/3195), regs. 1(3), 9(f)(i) (with reg. 8)

C18Sch. 6 para. 12(1)(2) applied (with modifications) (5.1.2009) by The Social Security (Housing Costs Special Arrangements) (Amendment and Modification) Regulations 2008 (S.I. 2008/3195), regs. 1(3), 9(f)(ii) (with reg. 8)

C19Sch. 6 para. 12(4) applied (with modifications) (for specified purposes and with effect in accordance with reg. 1(2) of the amending S.I.) by The Social Security (Housing Costs Special Arrangements) (Amendment and Modification) Regulations 2008 (S.I. 2008/3195), regs. 1(2), 4(c) (with regs. 3, 7)

C20Sch. 6 para. 12(4) sum maintained for certain purposes (coming into force in accordance with art. 1(3)(k) of the amending S.I.) by The Social Security Benefits Up-rating Order 2019 (S.I. 2019/480), art. 27(5)(a)

C21Sch. 6 para. 12(6)(a) sum maintained (coming into force in accordance with art. 1(2)(m) of the amending S.I.) by The Social Security Benefits Up-rating Order 2017 (S.I. 2017/260), arts. 1(2)(m), 26(1)(5), Sch. 15

C22Sch. 6 para. 12(10) sum maintained (coming into force in accordance with art. 1(2)(m) of the amending S.I.) by The Social Security Benefits Up-rating Order 2017 (S.I. 2017/260), arts. 1(2)(m), 26(1)(5), Sch. 15

C23Sch. 6 para. 12(12)(b) sum maintained for certain purposes (coming into force in accordance with art. 1(3)(k) of the amending S.I.) by The Social Security Benefits Up-rating Order 2019 (S.I. 2019/480), art. 27(5)(b)

C24Sch. 6 para. 12(12)(c) sum maintained for certain purposes (coming into force in accordance with art. 1(3)(k) of the amending S.I.) by The Social Security Benefits Up-rating Order 2019 (S.I. 2019/480), art. 27(5)(c)

The standard rateE+W+S

13.—[F41(1) The standard rate is the rate of interest applicable per annum to a loan which qualifies under this Schedule.

[F46(2) [F47The standard rate is to be the average mortgage rate published by the Bank of England in August 2010. It is to be varied each time that sub-paragraph (2B) applies such that the average mortgage rate published on the reference day then becomes the new standard rate in accordance with sub-paragraph (2D).]]

[F46(2A) The standard rate is to be varied each time that sub-paragraph (2B) applies.

(2B) This sub-paragraph applies when, on any reference day, the Bank of England publishes an average mortgage rate which differs by [F480.5 percentage points] or more from the standard rate that applies on that reference day (whether by virtue of sub-paragraph (2) or of a previous application of this sub-paragraph).

(2C) The average mortgage rate published on that reference day then becomes the new standard rate in accordance with sub-paragraph (2D).

(2D) Any variation in the standard rate by virtue of sub-paragraphs (2A) to (2C) comes into effect—

(a)for the purposes of sub-paragraph (2B) (in consequence of its first and any subsequent application), on the day after the reference day referred to in sub-paragraph (2C);

(b)for the purpose of calculating the weekly amount of housing costs to be met under this Schedule, on the day specified by the Secretary of State.

(2E) In this paragraph—

“average mortgage rate” means the effective interest rate (non-seasonally adjusted) of United Kingdom resident banks and building societies for loans to households secured on dwellings published by the Bank of England in respect of the most recent period for that rate specified at the time of publication;

“reference day” means any day falling after 1st October 2010.]

F49(3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .]

Textual Amendments

F41Sch. 6 paras. 11-14 omitted (with effect in accordance with regs.19 - 21 of the amending S.I.) by virtue of The Loans for Mortgage Interest Regulations 2017 (S.I. 2017/725), reg. 1(2)(a), Sch. 5 para. 1(c)(vii)

F46Sch. 6 para. 13(2)-(2E) substituted for Sch. 6 para. 13(2) (coming into force in accordance with reg. 1(2) of the amending S.I.) by The Social Security (Housing Costs) (Standard Interest Rate) Amendment Regulations 2010 (S.I. 2010/1811), regs. 1(2), 2(2)

F47Sch. 6 para. 13(2) words substituted (coming into force in accordance with art. 1(2)(n) of the amending S.I.) by The Social Security Benefits Up-rating Order 2012 (S.I. 2012/780), arts. 1(2)(n), 28(6), Sch. 20

F48Words in Sch. 6 para. 13(2B) substituted (28.4.2014) by The Social Security (Miscellaneous Amendments) Regulations 2014 (S.I. 2014/591), regs. 1, 10(3)

F49Sch. 6 para. 13(3) omitted (5.1.2009) by virtue of The Social Security (Housing Costs Special Arrangements) (Amendment and Modification) Regulations 2008 (S.I. 2008/3195), regs. 1(3), 2(1)(a)(2)(b)

Modifications etc. (not altering text)

C25Sch. 6 para. 13(2) sum maintained (coming into force in accordance with art. 1(2)(m) of the amending S.I.) by The Social Security Benefits Up-rating Order 2017 (S.I. 2017/260), arts. 1(2)(m), 26(1)(5), Sch. 15

Excessive Housing CostsE+W+S

14.—[F41(1) Housing costs which, apart from this paragraph, fall to be met under this Schedule are to be met only to the extent specified in sub-paragraph (3) where—

(a)the dwelling occupied as the home, excluding any part which is let, is larger than is required by the claimant, that claimant's partner (if the claimant has a partner), any person under the age of 20 and any other non-dependants having regard, in particular, to suitable alternative accommodation occupied by a household of the same size; or

(b)the immediate area in which the dwelling occupied as the home is located is more expensive than other areas in which suitable alternative accommodation exists; or

(c)the outgoings of the dwelling occupied as the home which are met under paragraphs 16 to 18 are higher than the outgoings of suitable alternative accommodation in the area.

(2) For the purposes of paragraphs (a) to (c) of sub-paragraph (1), no regard is to be had to the capital value of the dwelling occupied as the home.

(3) Subject to the following provisions of this paragraph, the amount of the loan which falls to be met is to be restricted and the excess over the amounts which the claimant would need to obtain suitable alternative accommodation will not be allowed.

(4) Where, having regard to the relevant factors, it is not reasonable to expect the claimant and the claimant's partner to seek alternative cheaper accommodation, no restriction is to be made under sub-paragraph (3).

(5) In sub-paragraph (4) “the relevant factors” are—

(a)the availability of suitable accommodation and the level of housing costs in the area; and

(b)the circumstances of the claimant and those who live with the claimant, including, in particular, the age and state of health of any of those persons, the employment prospects of the claimant and, where a change in accommodation is likely to result in a change of school, the effect on the education of any person below the age of 20 who lives with the claimant.

(6) Where sub-paragraph (4) does not apply and the claimant or the claimant's partner was able to meet the financial commitments for the dwelling occupied as the home when these were entered into, no restriction is to be made under this paragraph during the 26 weeks immediately following the date on which—

(a)the claimant became entitled to an income-related allowance where the claimant's housing costs fell within one of the cases in sub-paragraph (1) on that date; or

(b)a decision took effect which was made under section 10 of the Social Security Act 1998 on the ground that the claimant's housing costs fell within one of the cases in sub-paragraph (1),

nor during the next 26 weeks if and so long as the best endeavours of the claimant are used to obtain cheaper accommodation.

(7) For the purposes of calculating any period of 26 weeks referred to in sub-paragraph (6), and for those purposes only, a person is to be treated as entitled to an income-related allowance for any period of 12 weeks or less in respect of which that person was not in receipt of an income-related allowance and which fell immediately between periods in respect of which that person was in receipt of that allowance.

(8) Any period in respect of which—

(a)an income-related allowance was paid to a claimant; and

(b)it was subsequently determined that such a claimant was not entitled to an income-related allowance for that period,

will be treated for the purposes of sub-paragraph (7) as a period in respect of which that claimant was not in receipt of an income-related allowance.

(9) Paragraphs (c) to (f) of sub-paragraph (1) of paragraph 15 will apply to sub-paragraph (7) as they apply to [F50paragraphs 8 and 9] [F50paragraph 9] but with the modification that the words “Subject to sub-paragraph (2)” were omitted and references to “the claimant” were references to the person mentioned in sub-paragraph (7).

(10) References to an income-related allowance in sub-paragraphs (6) and (7) must be treated as including references to income support, income-based jobseeker's allowance and state pension credit in respect of any period which falls immediately before the appointed day.]

Textual Amendments

F41Sch. 6 paras. 11-14 omitted (with effect in accordance with regs.19 - 21 of the amending S.I.) by virtue of The Loans for Mortgage Interest Regulations 2017 (S.I. 2017/725), reg. 1(2)(a), Sch. 5 para. 1(c)(vii)

F50Words in Sch. 6 para. 14(9) substituted (1.4.2016) by The Social Security (Housing Costs Amendments) Regulations 2015 (S.I. 2015/1647), regs. 1, 4(2)(g) (with reg. 8)

Modifications etc. (not altering text)

C26Sch. 6 para. 14(9) applied (with modifications) (5.1.2009) by The Social Security (Housing Costs Special Arrangements) (Amendment and Modification) Regulations 2008 (S.I. 2008/3195), regs. 1(3), 9(g) (with reg. 8)

Linking ruleE+W+S

15.—(1) F51... for the purposes of this Schedule—

(a)a claimant is to be treated as being in receipt of an income-related allowance during the following periods—

(i)any period in respect of which it was subsequently determined that that claimant was entitled to an income-related allowance; and

(ii)any period of 12 weeks or less or, as the case may be, 52 weeks or less, in respect of which that claimant was not in receipt of an income-related allowance and which fell immediately between periods in respect of which—

(aa)that claimant was, or was treated as being, in receipt of an income-related allowance;

(bb)that claimant was treated as entitled to an income-related allowance for the purpose of sub-paragraph (9) or (10); or

(cc)(i) above applies;

(b)a claimant is to be treated as not being in receipt of an income-related allowance during any period other than a period to which (a)(ii) above applies in respect of which it is subsequently determined that that claimant was not so entitled;

(c)where—

(i)the claimant was a member of a couple or a polygamous marriage; and

(ii)the claimant's partner was, in respect of a past period, in receipt of an income-related allowance for that claimant's partner and the claimant; and

(iii)the claimant is no longer a member of that couple or polygamous marriage; and

(iv)the claimant made a claim for an income-related allowance within 12 weeks or, as the case may be, 52 weeks, of ceasing to be a member of that couple or polygamous marriage,

the claimant must be treated as having been in receipt of an income-related allowance for the same period as the claimant's former partner had been or had been treated, for the purposes of this Schedule, as having been;

(d)where the claimant's partner's applicable amount was determined in accordance with paragraph 1(1) (single claimant) or paragraph 1(2) [F52(lone parents etc.)] of Part 1 of Schedule 4 (prescribed amounts) in respect of a past period, provided that the claim was made within 12 weeks or, as the case may be, 52 weeks, of the claimant and that claimant's partner becoming one of a couple or polygamous marriage, the claimant is to be treated as having been in receipt of an income-related allowance for the same period as the claimant's partner had been or had been treated, for the purposes of this Schedule, as having been;

(e)where the claimant is a member of a couple or a polygamous marriage and the claimant's partner was, in respect of a past period, in receipt of an income-related allowance for that claimant's partner and the claimant, and the claimant has begun to receive an income-related allowance as a result of an election by the members of the couple or polygamous marriage, that claimant is to be treated as having been in receipt of an income-related allowance for the same period as that claimant's partner had been or had been treated, for the purposes of this Schedule, as having been;

(f)where the claimant—

(i)is a member of a couple or a polygamous marriage and the claimant's partner was, immediately before the participation by any member of that couple or polygamous marriage in an employment programme specified in regulation 75(1)(a)(ii) of the Jobseeker's Allowance Regulations, in the Intensive Activity Period specified in regulation 75(1)(a)(iv) of those Regulations, in receipt of an income-related allowance and the claimant's applicable amount included an amount for the couple or for the partners of the polygamous marriage; and

(ii)has, immediately after that participation in that programme, begun to receive an income-related allowance as a result of an election under regulation 4(3) of the Social Security (Claims and Payments) Regulations 1987 F53 by the members of the couple or polygamous marriage,

the claimant is to be treated as having been in receipt of an income-related allowance for the same period as that claimant's partner had been or had been treated, for the purposes of this Schedule, as having been;

(g)where—

(i)the claimant was a member of a family of a person (not being a former partner) entitled to an income-related allowance and at least one other member of that family was a child or young person;

(ii)the claimant becomes a member of another family which includes that child or young person; and

(iii)the claimant made a claim for an income-related allowance within 12 weeks or, as the case may be, 52 weeks, of the date on which the person entitled to an income-related allowance mentioned in paragraph (i) above ceased to be so entitled,

the claimant is to be treated as being in receipt of an income-related allowance for the same period as that person had been or had been treated, for the purposes of this Schedule, as having been.

F54(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(3) For the purposes of this Schedule, where a claimant has ceased to be entitled to an income-related allowance because that claimant or that claimant's partner is—

(a)participating in arrangements for training made under section 2 of the Employment and Training Act 1973 F55 or section 2 of the Enterprise and New Towns (Scotland) Act 1990 F56; or

(b)attending a course at an employment rehabilitation centre established under that section,

the claimant is to be treated as if that claimant had been in receipt of an income-related allowance for the period during which that claimant or that claimant's partner was participating in such arrangements or attending such a course.

(4) For the purposes of this Schedule, a claimant who has ceased to be entitled to an income-related allowance because—

(a)that claimant or that claimant's partner was participating in an employment programme specified in regulation 75(1)(a)(ii) of the Jobseeker's Allowance Regulations, in the Intensive Activity Period specified in regulation 75(1)(a)(iv) of those Regulations or in an employment zone scheme; and

(b)in consequence of such participation the claimant or the claimant's partner was engaged in remunerative work or had an income [F57equal to or] in excess of the claimant's applicable amount as prescribed in Part 9,

will be treated as if the claimant had been in receipt of an income-related allowance for the period during which that claimant or that claimant's partner was participating in that programme or activity.

(5) Where, for the purposes of sub-paragraphs (1), (3) and (4), a claimant is treated as being in receipt of an income-related allowance, for a certain period, that claimant will, subject to sub-paragraph (6), be treated as being entitled to an income-related allowance for the same period.

(6) [F58Where the appropriate amount of a loan exceeds the amount specified in paragraph 12(4), sub-paragraph (5) will not apply except—

(a)for the purposes of paragraph [F598(1) or] 9(1); or

(b)where a claimant has ceased to be in receipt of an income-related allowance for a period of 104 weeks or less because that claimant or that claimant's partner is a work or training beneficiary within the meaning of regulation 148 (work or training beneficiaries).]

(7) For the purposes of this Schedule, in determining whether a claimant is entitled to or to be treated as entitled to an income-related allowance, entitlement to a contribution-based jobseeker's allowance immediately before a period during which that claimant or that claimant's partner is participating in an employment programme specified in regulation 75(1)(a)(ii) of the Jobseeker's Allowance Regulations, in the Intensive Activity Period specified in regulation 75(1)(a)(iv) of those Regulations is to be treated as entitlement to an income-related allowance for the purposes of any requirement that a claimant is, or has been, entitled to an income-related allowance for any period of time.

(8) For the purposes of this Schedule, sub-paragraph (9) applies where a claimant is not entitled to an income-related allowance by reason only that the claimant has—

(a)capital exceeding £16,000; or

(b)income [F60equal to or] exceeding the applicable amount which applies in that claimant's case; or

[F61(bb)an amount of contributory allowance payable in respect of a claimant under section 2 that is equal to, or exceeds, the applicable amount in the claimant’s case; or]

(c)both capital exceeding £16,000 and income exceeding the applicable amount which applies in that claimant's case.

(9) A claimant to whom sub-paragraph (8) applies is to be treated as entitled to an income-related allowance throughout any period of not more than 39 weeks which comprises only days—

(a)on which that claimant is entitled to a contributory allowance, a contribution-based jobseeker's allowance, statutory sick pay or incapacity benefit; or

(b)on which that claimant is, although not entitled to any of the benefits mentioned in paragraph (a) above, entitled to be credited with earnings equal to the lower earnings limit for the time being in force in accordance with regulation 8A or 8B of the Social Security (Credits) Regulations 1975 F62.