- Y Diweddaraf sydd Ar Gael (Diwygiedig)

- Pwynt Penodol mewn Amser (08/07/2019)

- Gwreiddiol (Fel y’i mabwysiadwyd gan yr UE)

Commission Delegated Regulation (EU) 2015/35Dangos y teitl llawn

Commission Delegated Regulation (EU) 2015/35 of 10 October 2014 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance)

You are here:

- Rheoliadau yn deillio o’r UE

- 2015 No. 35

- Whole Regulation without Annexes

- Dangos Graddfa Ddaearyddol(e.e. Lloegr, Cymru, Yr Alban aca Gogledd Iwerddon)

- Dangos Llinell Amser Newidiadau

Rhagor o Adnoddau

PDF o Fersiynau Diwygiedig

- ddiwygiedig 30/07/202048.27 MB

- ddiwygiedig 01/01/202048.00 MB

- ddiwygiedig 08/07/201944.91 MB

- ddiwygiedig 01/01/201946.16 MB

- ddiwygiedig 15/09/201740.90 MB

- ddiwygiedig 09/04/201746.19 MB

- ddiwygiedig 02/04/201646.19 MB

- ddiwygiedig 17/01/201539.54 MB

When the UK left the EU, legislation.gov.uk published EU legislation that had been published by the EU up to IP completion day (31 December 2020 11.00 p.m.). On legislation.gov.uk, these items of legislation are kept up-to-date with any amendments made by the UK since then.

Mae hon yn eitem o ddeddfwriaeth sy’n deillio o’r UE

Mae unrhyw newidiadau sydd wedi cael eu gwneud yn barod gan y tîm yn ymddangos yn y cynnwys a chyfeirir atynt gydag anodiadau.Ar ôl y diwrnod ymadael bydd tair fersiwn o’r ddeddfwriaeth yma i’w gwirio at ddibenion gwahanol. Y fersiwn legislation.gov.uk yw’r fersiwn sy’n weithredol yn y Deyrnas Unedig. Y Fersiwn UE sydd ar EUR-lex ar hyn o bryd yw’r fersiwn sy’n weithredol yn yr UE h.y. efallai y bydd arnoch angen y fersiwn hon os byddwch yn gweithredu busnes yn yr UE. EUR-Lex Y fersiwn yn yr archif ar y we yw’r fersiwn swyddogol o’r ddeddfwriaeth fel yr oedd ar y diwrnod ymadael cyn cael ei chyhoeddi ar legislation.gov.uk ac unrhyw newidiadau ac effeithiau a weithredwyd yn y Deyrnas Unedig wedyn. Mae’r archif ar y we hefyd yn cynnwys cyfraith achos a ffurfiau mewn ieithoedd eraill o EUR-Lex. The EU Exit Web Archive legislation_originated_from_EU_p3

Changes over time for: Commission Delegated Regulation (EU) 2015/35 (without Annexes)

Version Superseded: 01/01/2020

Alternative versions:

Status:

Point in time view as at 08/07/2019.

Changes to legislation:

Commission Delegated Regulation (EU) 2015/35 is up to date with all changes known to be in force on or before 26 November 2024. There are changes that may be brought into force at a future date. Changes that have been made appear in the content and are referenced with annotations.![]()

Changes to Legislation

Changes and effects yet to be applied by the editorial team are only applicable when viewing the latest version or prospective version of legislation. They are therefore not accessible when viewing legislation as at a specific point in time. To view the ‘Changes to Legislation’ information for this provision return to the latest version view using the options provided in the ‘What Version’ box above.

TITLE IU.K. [X1VALUATION AND RISK-BASED CAPITAL REQUIREMENTS (PILLAR I), ENHANCED GOVERNANCE (PILLAR II) AND INCREASED TRANSPARENCY (PILLAR III)]

CHAPTER IU.K. GENERAL PROVISIONS

SECTION 1 U.K. Definitions and general principles

Article 1U.K.Definitions

For the purposes of this Regulation, the following definitions shall apply:

alternative valuation methods' means valuation methods that are consistent with Article 75 of Directive 2009/138/EC, other than those which solely use the quoted market prices for the same or similar assets or liabilities;

‘scenario analysis’ means the analysis of the impact of a combination of adverse events;

‘health insurance obligation’ means an insurance obligation that covers one or both of the following:

the provision of medical treatment or care including preventive or curative medical treatment or care due to illness, accident, disability or infirmity, or financial compensation for such treatment or care,

financial compensation arising from illness, accident, disability or infirmity;

‘medical expense insurance obligation’ means an insurance obligation that covers the provision or financial compensation referred to in point (3)(i);

‘income protection insurance obligation’ means an insurance obligation that covers the financial compensation referred to in point (3)(ii) other than the financial compensation referred to in point (3)(i);

‘workers compensation insurance obligation’ means an insurance obligation that covers the provision or financial compensation referred to in points (3)(i) and (ii) and which arises only from to accidents at work, industrial injury and occupational disease;

‘health reinsurance obligation’ means a reinsurance obligation which arises from accepted reinsurance covering health insurance obligations;

‘medical expense reinsurance obligation’ means a reinsurance obligation which arises from accepted reinsurance covering medical expense insurance obligations;

‘income protection reinsurance obligation’ means a reinsurance obligation which arises from accepted reinsurance covering income protection insurance obligations;

‘workers' compensation reinsurance obligation’ means a reinsurance obligation which arises from accepted reinsurance covering workers' compensation insurance obligations;

‘written premiums’ means the premiums due to an insurance or reinsurance undertaking during a specified time period regardless of whether such premiums relate in whole or in part to insurance or reinsurance cover provided in a different time period;

‘earned premiums’ means the premiums relating to the risk covered by the insurance or reinsurance undertaking during a specified time period;

‘surrender’ means all possible ways to fully or partly terminate a policy, including the following:

voluntary termination of the policy with or without the payment of a surrender value;

change of insurance or reinsurance undertaking by the policy holder;

termination of the policy resulting from the policy holder's refusal to pay the premium;

‘discontinuance’ of an insurance policy means surrender, lapse without value, making a contract paid-up, automatic non-forfeiture provisions or exercising other discontinuity options or not exercising continuity options;

‘discontinuity options’ mean all legal or contractual policyholder rights which allow that policyholder to fully or partly terminate, surrender, decrease, restrict or suspend insurance cover or permit the insurance policy to lapse;

‘continuity options’ mean all legal or contractual policyholder rights which allow that policyholder to fully or partly establish, renew, increase, extend or resume insurance or reinsurance cover;

‘coverage of an internal model’ means the risks that are reflected in the probability distribution forecast underlying the internal model;

‘scope of an internal model’ means the risks that the internal model is approved to cover; the scope of an internal model may include both risks which are and which are not reflected in the standard formula for the Solvency Capital Requirement;

‘[F1securitisation’ means a transaction or scheme as defined in Article 2(1) of Regulation (EU) 2017/2402 (1) ;

‘ STS securitisation ’ means a securitisation designated ‘ simple, transparent and standardised ’ or ‘ STS ’ in accordance with the requirements set out in Article 18 of Regulation (EU) 2017/2402;]

[F2‘ securitisation position ’ means a securitisation position within the meaning of Article 2(19) of Regulation (EU) 2017/2402;]

‘[F1senior securitisation position’ means a senior securitisation position within the meaning of Article 242(6) of Regulation (EU) No 575/2013 (2) ;]

[F2‘ re-securitisation position ’ means an exposure to a re-securitisation within the meaning of Article 2(4) of Regulation (EU) 2017/2402;

‘ originator ’ means an originator within the meaning of Article 2(3) of Regulation (EU) 2017/2402;

‘ sponsor ’ means a sponsor within the meaning of Article 2(5) of Regulation (EU) 2017/2402;

‘ tranche ’ means tranche within the meaning of Article 2(6) of Regulation (EU) 2017/2402;]

‘central bank’ means central bank within the meaning ofArticle 4(1)(46) of Regulation (EU) No 575/2013.

‘basis risk’ means the risk resulting from the situation in which the exposure covered by the risk-mitigation technique does not correspond to the risk exposure of the insurance or reinsurance undertaking;

‘collateral arrangements’ means arrangements under which collateral providers do one of the following:

transfer full ownership of the collateral to the collateral taker for the purposes of securing or otherwise covering the performance of a relevant obligation;

provide collateral by way of security in favour of, or to, a collateral taker, and the legal ownership of the collateral remains with the collateral provider or a custodian when the security right is established;

in relation to a set of items, ‘all possible combinations of two’ such items means all ordered pairs of items from that set;

‘pooling arrangement’ means an arrangement whereby several insurance or reinsurance undertakings agree to share identified insurance risks in defined proportions. The parties insured by the members of the pooling arrangement are not themselves members of the pooling arrangement.

‘pool exposure of type A’ means the risk ceded by an insurance or reinsurance undertaking to a pooling arrangement where the insurance or reinsurance undertaking is not a party to that pooling arrangement.

‘pool exposure of type B’ means the risk ceded by an insurance or reinsurance undertaking to another member of a pooling arrangement, where the insurance or reinsurance undertaking is a party to that pooling arrangement;

‘pool exposure of type C’ means the risk ceded by an insurance or reinsurance undertaking which is a party to a pooling arrangement to another insurance or reinsurance undertaking which is not a member of that pooling arrangement.

‘deep market’ means a market where transactions involving a large quantity of financial instruments can take place without significantly affecting the price of the instruments.

‘liquid market’ means a market where financial instruments can readily be converted through an act of buying or selling without causing a significant movement in the price.

‘transparent market’ means a market where current trade and price information is readily available to the public, in particular to the insurance or reinsurance undertakings.

‘future discretionary bonuses’ and ‘future discretionary benefits’ mean future benefits other than index-linked or unit-linked benefits of insurance or reinsurance contracts which have one of the following characteristics:

they are legally or contractually based on one or more of the following results:

the performance of a specified group of contracts or a specified type of contract or a single contract;

the realised or unrealised investment return on a specified pool of assets held by the insurance or reinsurance undertaking;

the profit or loss of the insurance or reinsurance undertaking or fund corresponding to the contract;

they are based on a declaration of the insurance or reinsurance undertaking and the timing or the amount of the benefits is at its full or partial discretion;

‘basic risk-free interest rate term structure’ means a risk-free interest rate term structure which is derived in the same way as the relevant risk-free interest rate term structure to be used to calculate the best estimate referred to in Article 77(2) of Directive 2009/138/EC but without application of a matching adjustment or a volatility adjustment or a transitional adjustment to the relevant risk-free rate structure in accordance with Article 308c of that Directive;

‘matching adjustment portfolio’ means a portfolio of insurance or reinsurance obligations to which the matching adjustment is applied and the assigned portfolio of assets as referred to in Article 77b(1)(a) of Directive 2009/138/EC.

‘SLT Health obligations’ means health insurance obligations that are assigned to the lines of business for life insurance obligations in accordance with Article 55(1).

‘NSLT Health obligations’ means health insurance obligations that are assigned to the lines of business for non-life insurance obligations in accordance with Article 55(1).

‘Collective investment undertaking’ means an undertaking for collective investment in transferable securities (UCITS) as defined in Article 1(2) of Directive 2009/65/EC of the European Parliament and of the Council(3) or an alternative investment fund (AIF) as defined in Article 4(1)(a) of Directive 2011/61/EU of the European Parliament and of the Council(4);

in relation to an insurance or reinsurance undertaking, ‘major business unit’ means a defined segment of the insurance and reinsurance undertaking that operates independently from other parts of the undertaking and has dedicated governance resources and procedures within the undertaking and which contains risks that are material in relation to the entire business of the undertaking;

in relation to an insurance or reinsurance group, ‘major business unit’ means a defined segment of the group that operates independently from other parts of the group and has dedicated governance resources and procedures within the group and which contains risks that are material in relation to the entire business of the group; any legal entity belonging to the group is a major business unit or consists of several major business units;

‘administrative, management or supervisory body’ shall mean, where a two-tier board system comprising of a management body and a supervisory body is provided for under national law, the management body or the supervisory body or both of those bodies as specified in the relevant national legislation or, where nobody is specified in the relevant national legislation, the management body;

‘aggregate maximum risk exposure’ means the sum of the maximum payments, including expenses that the special purpose vehicles may incur, excluding expenses that meet all of the following criteria:

the special purpose vehicle has the right to require the insurance or reinsurance undertaking which has transferred risks to the special purpose vehicle to pay the expense;

the special purpose vehicle is not required to pay the expense unless and until an amount equal to the expense has been received from the insurance or reinsurance undertaking which has transferred the risks to the special purpose vehicle;

the insurance or reinsurance undertaking which has transferred risks to the special purpose vehicle does not include the expense as an amount recoverable from the special purpose vehicle in accordance with Article 41 of this Regulation.

‘existing insurance or reinsurance contract’ means an insurance or reinsurance contract for which insurance or reinsurance obligations have been recognised;

‘the expected profit included in future premiums’ means the expected present value of future cash flows which result from the inclusion in technical provisions of premiums relating to existing insurance and reinsurance contracts that are expected to be received in the future, but that may not be received for any reason, other than because the insured event has occurred, regardless of the legal or contractual rights of the policyholder to discontinue the policy.

‘mortgage insurance’ means credit insurance that provides cover to lenders in case their mortgage loans default.

‘subsidiary undertaking’ means any subsidiary undertaking within the meaning of Article 22(1) and (2) of Directive 2013/34/EU, including subsidiaries thereof;

‘related undertaking’ either a subsidiary undertaking or other undertaking in which a participation is held, or an undertaking linked with another undertaking by a relationship as set out in Article 22(7) of Directive 2013/34/EU;

‘regulated undertaking’ means ‘regulated entity’ within the meaning of Article 2(4) of Directive 2002/87/EC of the European Parliament and of the Council(5);

‘non-regulated undertaking’ means any undertaking other than those listed in Article 2(4) of Directive 2002/87/EC;

‘non-regulated undertaking carrying out financial activities’ means a non-regulated undertaking which carries one or more of the activities referred to in Annex I of Directive 2013/36/EU of the European Parliament and of the Council(6) where those activities constitute a significant part of its overall activity;

‘ancillary services undertaking’ means a non-regulated undertaking the principal activity of which consists of owning or managing property, managing data-processing services, health and care services or any other similar activity which is ancillary to the principal activity of one or more insurance or reinsurance undertakings.

‘UCITS management company’ means a management company within the meaning of Article 2(1)(b) of Directive 2009/65/EC or an investment company authorised pursuant to Article 27 of that Directive provided that it has not designated a management company pursuant to that Directive;

‘alternative investment fund manager’ means an alternative investment funds manager within the meaning of Article 4(1)(b) of Directive 2011/61/EU;

[F3‘ infrastructure assets ’ means physical assets, structures or facilities, systems and networks that provide or support essential public services;

‘ infrastructure entity ’ means an entity or corporate group which, during the most recent financial year of that entity or group for which figures are available or in a financing proposal, derives the substantial majority of its revenues from owning, financing, developing or operating infrastructure assets;]

‘institutions for occupational retirement provision’ means institutions within the meaning of Article 6(a) of Directive 2003/41/EC of the European Parliament and of the Council(7);

‘domestic insurance undertaking’ means an undertaking authorised and supervised by third-country supervisory authorities which would require authorisation as an insurance undertaking in accordance with Article 14 of Directive 2009/138/EC if its head office were situated in the Union;

‘domestic reinsurance undertaking’ means an undertaking authorised and supervised by third-country supervisory authorities which would require authorisation as a reinsurance undertaking in accordance with Article 14 of Directive 2009/138/EC if its head offices were situated in the Union[F4;]

‘[F5CCP’ means a CCP as defined in point (1) of Article 2 of Regulation (EU) No 648/2012 of the European Parliament and of the Council (8) ;

‘ bankruptcy remote ’ , in relation to client assets, means that effective arrangements exist which ensure that those assets will not be available to the creditors of a CCP or of a clearing member in the event of the insolvency of that CCP or clearing member respectively, or that the assets will not be available to the clearing member to cover losses it incurred following the default of a client or clients other than those that provided those assets;

‘ client ’ means a client as defined in point (15) of Article 2 of Regulation (EU) No 648/2012 or an undertaking that has established indirect clearing arrangements with a clearing member in accordance with Article 4(3) of that Regulation;

‘ clearing member ’ means a clearing member as defined in point (14) of Article 2 of Regulation (EU) No 648/2012;

‘ CCP-related transaction ’ means a contract or a transaction listed in paragraph 1 of Article 301 of Regulation (EU) No 575/2013 between a client and a clearing member that is directly related to a contract or a transaction listed in that paragraph between that clearing member and a CCP.]

Textual Amendments

F1 Inserted by Commission Delegated Regulation (EU) 2018/1221 of 1 June 2018 amending Delegated Regulation (EU) 2015/35 as regards the calculation of regulatory capital requirements for securitisations and simple, transparent and standardised securitisations held by insurance and reinsurance undertakings (Text with EEA relevance).

F2 Substituted by Commission Delegated Regulation (EU) 2018/1221 of 1 June 2018 amending Delegated Regulation (EU) 2015/35 as regards the calculation of regulatory capital requirements for securitisations and simple, transparent and standardised securitisations held by insurance and reinsurance undertakings (Text with EEA relevance).

F3 Substituted by Commission Delegated Regulation (EU) 2017/1542 of 8 June 2017 amending Delegated Regulation (EU) 2015/35 concerning the calculation of regulatory capital requirements for certain categories of assets held by insurance and reinsurance undertakings (infrastructure corporates) (Text with EEA relevance).

F4 Substituted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

F5 Inserted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

Article 2U.K.Expert judgement

1.Where insurance and reinsurance undertakings make assumptions about rules relating to the valuation of assets and liabilities, technical provisions, own funds, solvency capital requirements, minimum capital requirements and investment rules, these assumptions shall be based on the expertise of persons with relevant knowledge, experience and understanding of the risks inherent in the insurance or reinsurance business.

2.Insurance and reinsurance undertakings shall, taking due account of the principle of proportionality, ensure that internal users of the relevant assumptions are informed about their relevant content, their degree of reliability and their limitations. For that purpose, service providers to whom functions or activities have been outsourced shall be considered to be internal users.

SECTION 2 U.K. External credit assessments

Article 3U.K.Association of credit assessments to credit quality steps

The scale of credit quality steps referred to in Article 109a(1) of Directive 2009/138/EC shall include credit quality steps 0 to 6.

Article 4U.K.General requirements on the use of credit assessments

1.Insurance or reinsurance undertakings may use an external credit assessment for the calculation of the Solvency Capital Requirement in accordance with the standard formula only where it has been issued by an External Credit Assessment Institution (ECAI) or endorsed by an ECAI in accordance with Regulation (EC) No 1060/2009 of the European Parliament and of the Council(9).

2.Insurance or reinsurance undertakings shall nominate one or more ECAI to be used for the calculation of the Solvency Capital Requirement according to the standard formula.

3.The use of credit assessments shall be consistent and such assessments shall not be used selectively

4.When using credit assessments, insurance and reinsurance undertakings shall comply with all of the following requirements:

(a)where an insurance or reinsurance undertaking decides to use the credit assessments produced by a nominated ECAI for a certain class of items, it shall use those credit assessments consistently for all items belonging to that class;

(b)where an insurance or reinsurance undertaking decides to use the credit assessments produced by a nominated ECAI, it shall use them in a continuous and consistent way over time;

(c)an insurance or reinsurance undertaking shall only use nominated ECAI credit assessments that take into account all amounts of principal and interest owed to it;

(d)where only one credit assessment is available from a nominated ECAI for a rated item, that credit assessment shall be used to determine the capital requirements for that item;

(e)where two credit assessments are available from nominated ECAIs and they correspond to different parameters for a rated item, the assessment generating the higher capital requirement shall be used;

(f)where more than two credit assessments are available from nominated ECAIs for a rated item, the two assessments generating the two lowest capital requirements shall be used. If the two lowest capital requirements are different, the assessment generating the higher capital requirement of those two credit assessments shall be used. If the two lowest capital requirements are the same, the assessment generating that capital requirement shall be used;

(g)where available, insurance and reinsurance undertakings shall use both solicited and unsolicited credit assessments.

5.Where an item is part of the larger or more complex exposures of the insurance or reinsurance undertaking, the undertaking shall produce its own internal credit assessment of the item and allocate it to one of the seven steps in a credit quality assessment scale. Where the own internal credit assessment generates a lower capital requirement than the one generated by the credit assessments available from nominated ECAIs, then the own internal credit assessment shall not be taken into account for the purposes of this Regulation.

[F26. For the purposes of paragraph 5, the larger or more complex exposures of an undertaking shall include securitisation positions as referred to in Article 178(8) and (9) and re-securitisation positions.]

Textual Amendments

F2 Substituted by Commission Delegated Regulation (EU) 2018/1221 of 1 June 2018 amending Delegated Regulation (EU) 2015/35 as regards the calculation of regulatory capital requirements for securitisations and simple, transparent and standardised securitisations held by insurance and reinsurance undertakings (Text with EEA relevance).

Article 5U.K.Issuers and issue credit assessment

1.Where a credit assessment exists for a specific issuing program or facility to which the item constituting the exposure belongs, that credit assessment shall be used.

2.Where no directly applicable credit assessment exists for a certain item, but a credit assessment exists for a specific issuing program or facility to which the item constituting the exposure does not belong or a general credit assessment exists for the issuer, that credit assessment shall be used in either of the following cases:

(a)it produces the same or higher capital requirement than would otherwise be the case and the exposure in question ranks pari passu or junior in all respects to the specific issuing program or facility or to senior unsecured exposures of that issuer, as relevant;

(b)it produces the same or lower capital requirement than would otherwise be the case and the exposure in question ranks pari passu or senior in all respects to the specific issuing program or facility or to senior unsecured exposures of that issuer, as relevant.

In all other cases, insurance or reinsurance undertakings shall consider that there is no credit assessment by a nominated ECAI available for the exposure.

3.Credit assessments for issuers within a corporate group shall not be used as the credit assessment for another issuer within the same corporate group.

Article 6U.K.Double credit rating for securitisation positions

By way of derogation from Article 4(4)(d), where only one credit assessment is available from a nominated ECAI for a securitisation position, that credit assessment shall not be used. The capital requirements for that item shall be derived as if no credit assessment by a nominated ECAI is available.

CHAPTER IIU.K. VALUATION OF ASSETS AND LIABILITIES

Article 7U.K.Valuation assumptions

Insurance and reinsurance undertakings shall value assets and liabilities based on the assumption that the undertaking will pursue its business as a going concern.

Article 8U.K.Scope

Articles 9 to 16 shall apply to the recognition and valuation of assets and liabilities, other than technical provisions.

Article 9U.K.Valuation methodology — general principles

1.Insurance and reinsurance undertakings shall recognise assets and liabilities in conformity with the international accounting standards adopted by the Commission in accordance with Regulation (EC) No 1606/2002.

2.Insurance and reinsurance undertakings shall value assets and liabilities in accordance with international accounting standards adopted by the Commission pursuant to Regulation (EC) No 1606/2002 provided that those standards include valuation methods that are consistent with the valuation approach set out in Article 75 of Directive 2009/138/EC. Where those standards allow for the use of more than one valuation method, insurance and reinsurance undertakings shall only use valuation methods that are consistent with Article 75 of Directive 2009/138/EC.

3.Where the valuation methods included in international accounting standards adopted by the Commission in accordance with Regulation (EC) No 1606/2002 are not consistent either temporarily or permanently with the valuation approach set out in Article 75 of Directive 2009/138/EC, insurance and reinsurance undertakings shall use other valuation methods that are deemed to be consistent with Article 75 of Directive 2009/138/EC.

4.By way of derogation from paragraphs 1 and 2, and in particular by respecting the principle of proportionality laid down in paragraphs 3 and 4 of Article 29 of Directive 2009/138/EC, insurance and reinsurance undertakings may recognise and value an asset or a liability based on the valuation method it uses for preparing its annual or consolidated financial statements provided that:

(a)the valuation method is consistent with Article 75 of Directive 2009/138/EC;

(b)the valuation method is proportionate with respect to the nature, scale and complexity of the risks inherent in the business of the undertaking;

(c)the undertaking does not value that asset or liability using international accounting standards adopted by the Commission in accordance with Regulation (EC) No 1606/2002 in its financial statements;

(d)valuing assets and liabilities using international accounting standards would impose costs on the undertaking that would be disproportionate with respect to the total administrative expenses.

5.Insurance and reinsurance undertakings shall value individual assets separately.

6.Insurance and reinsurance undertakings shall value individual liabilities separately.

Article 10U.K.Valuation methodology — valuation hierarchy

1.Insurance and reinsurance undertakings shall, when valuing assets and liabilities in accordance with Article 9 (1), (2) and (3), follow the valuation hierarchy set out in paragraphs 2 to 7, taking into account the characteristics of the asset or liability where market participants would take those characteristics into account when pricing the asset or liability at the valuation date, including the condition and location of the asset or liability and restrictions, if any, on the sale or use of the asset.

2.As the default valuation method insurance and reinsurance undertakings shall value assets and liabilities using quoted market prices in active markets for the same assets or liabilities.

3.Where the use of quoted market prices in active markets for the same assets or liabilities is not possible, insurance and reinsurance undertakings shall value assets and liabilities using quoted market prices in active markets for similar assets and liabilities with adjustments to reflect differences. Those adjustments shall reflect factors specific to the asset or liability including all of the following:

(a)the condition or location of the asset or liability;

(b)the extent to which inputs relate to items that are comparable to the asset or liability; and

(c)the volume or level of activity in the markets within which the inputs are observed.

4.Insurance and reinsurance undertakings' use of quoted market prices shall be based on the criteria for active markets, as defined in international accounting standards adopted by the Commission in accordance with Regulation (EC) No 1606/2002.

5.Where the criteria referred to in paragraph 4 are not satisfied, insurance and reinsurance undertakings shall, unless otherwise provided in this Chapter, use alternative valuation methods.

6.When using alternative valuation methods, insurance and reinsurance undertakings shall rely as little as possible on undertaking-specific inputs and make maximum use of relevant market inputs including the following:

(a)quoted prices for identical or similar assets or liabilities in markets that are not active;

(b)inputs other than quoted prices that are observable for the asset or liability, including interest rates and yield curves observable at commonly quoted intervals, implied volatilities and credit spreads;

(c)market-corroborated inputs, which may not be directly observable, but are based on or supported by observable market data.

All those markets inputs shall be adjusted for the factors referred to in paragraph 3.

To the extent that relevant observable inputs are not available including in circumstances where there is little, if any, market activity for the asset or liability at the valuation date, undertakings shall use unobservable inputs reflecting the assumptions that market participants would use when pricing the asset or liability, including assumptions about risk. Where unobservable inputs are used, undertakings shall adjust undertaking-specific data if reasonable available information indicates that other market participants would use different data or there is something particular to the undertaking that is not available to other market participants.

When assessing the assumptions about risk referred to in this paragraph undertakings shall take into account the risk inherent in the specific valuation technique used to measure fair value and the risk inherent in the inputs of that valuation technique.

7.Undertakings shall use valuation techniques that are consistent with one or more of the following approaches when using alternative valuation methods:

(a)market approach, which uses prices and other relevant information generated by market transactions involving identical or similar assets, liabilities or group of assets and liabilities. Valuation techniques consistent with the market approach include matrix pricing.

(b)income approach, which converts future amounts, such as cash flows or income or expenses, to a single current amount. The fair value shall reflect current market expectations about those future amounts. Valuation techniques consistent with the income approach include present value techniques, option pricing models and the multi-period excess earnings method;

(c)cost approach or current replacement cost approach reflects the amount that would be required currently to replace the service capacity of an asset. From the perspective of a market participant seller, the price that would be received for the asset is based on the cost to a market participant buyer to acquire or construct a substitute asset of comparable quality adjusted for obsolescence.

Article 11U.K.Recognition of contingent liabilities

1.Insurance and reinsurance undertakings shall recognise contingent liabilities, as defined in accordance with Article 9 of this Regulation, that are material, as liabilities.

2.Contingent liabilities shall be material where information about the current or potential size or nature of those liabilities could influence the decision-making or judgement of the intended user of that information, including the supervisory authorities.

Article 12U.K.Valuation methods for goodwill and intangible assets

Insurance and reinsurance undertakings shall value the following assets at zero:

goodwill;

intangible assets other than goodwill, unless the intangible asset can be sold separately and the insurance and reinsurance undertaking can demonstrate that there is a value for the same or similar assets that has been derived in accordance with Article 10(2), in which case the asset shall be valued in accordance with Article 10.

Article 13U.K.Valuation methods for related undertakings

1.For the purposes of valuing the assets of individual insurance and reinsurance undertakings, insurance and reinsurance undertakings shall value holdings in related undertakings, within the meaning of Article 212(1)(b) of Directive 2009/138/EC in accordance with the following hierarchy of methods:

(a)using the default valuation method set out in Article 10(2) of this Regulation;

(b)using the adjusted equity method referred to in paragraph 3 where valuation in accordance with point (a) is not possible;

(c)using either the valuation method set out in Article 10(3) of this Regulation or alternative valuation methods in accordance with Article 10(5) of this Regulation provided that all of the following conditions are fulfilled:

neither valuation in accordance with point (a) nor point (b) is possible;

the undertaking is not a subsidiary undertaking, as defined in Article 212(2) of Directive 2009/138/EC.

2.By way of derogation from paragraph 1, for the purposes of valuing the assets of individual insurance and reinsurance undertakings, insurance and reinsurance undertakings shall value holdings in the following undertakings at zero:

[F6(a) undertakings that are excluded from the scope of the group supervision under Article 214(2) of Directive 2009/138/EC;]

(b)undertakings that are deducted from the own funds eligible for the group solvency in accordance with Article 229 of Directive 2009/138/EC.

3.The adjusted equity method referred to in point (b) of paragraph 1 shall require the participating undertaking to value its holdings in related undertakings based on the share of the excess of assets over liabilities of the related undertaking held by the participating undertaking.

4.When calculating the excess of assets over liabilities for related undertakings, the participating undertaking shall value the undertaking's individual assets and liabilities in accordance with Articles 75 of Directive 2009/138/EC and, where the related undertaking is an insurance or reinsurance undertaking or a special purpose vehicle referred to in Article 211 of that Directive, technical provisions in accordance Articles 76 to 85 of that Directive.

5.When calculating the excess of assets over liabilities for related undertakings other than insurance or reinsurance undertakings, the participating undertaking may consider the equity method as prescribed in international accounting standards adopted by the Commission in accordance with Regulation (EC) No 1606/2002 to be consistent with Articles 75 of Directive 2009/138/EC, where valuation of individual assets and liabilities in accordance with paragraph 4 is not practicable. In such cases, the participating undertaking shall deduct from the value of the related undertaking the value of goodwill and other intangible assets that would be valued at zero in accordance with Article 12(2) of this Regulation.

[F66. Where the criteria referred to in Article 9(4) of this Regulation are satisfied, and where the use of the valuation methods referred to in points (a) and (b) of paragraph 1 is not possible, holdings in related undertakings may be valued based on the valuation method the insurance or reinsurance undertakings uses for preparing its annual or consolidated financial statements. In such cases, the participating undertaking shall deduct from the value of the related undertaking the value of goodwill and other intangible assets that would be valued at zero in accordance with Article 12(2) of this Regulation.]

Textual Amendments

F6 Substituted by Commission Delegated Regulation (EU) 2016/467 of 30 September 2015 amending Commission Delegated Regulation (EU) 2015/35 concerning the calculation of regulatory capital requirements for several categories of assets held by insurance and reinsurance undertakings (Text with EEA relevance).

Article 14U.K.Valuation methods for specific liabilities

1.Insurance and reinsurance undertakings shall value financial liabilities, as referred to in international accounting standards adopted by the Commission in accordance with Regulation (EC) No 1606/2002, in accordance with Article 9 of this Regulation upon initial recognition. There shall be no subsequent adjustment to take account of the change in own credit standing of the insurance or reinsurance undertaking after initial recognition.

2.Insurance and reinsurance undertakings shall value contingent liabilities that have been recognised in accordance with Article 11. The value of contingent liabilities shall be equal to the expected present value of future cash flows required to settle the contingent liability over the lifetime of that contingent liability, using the basic risk-free interest rate term structure.

Article 15U.K.Deferred taxes

1.Insurance and reinsurance undertakings shall recognise and value deferred taxes in relation to all assets and liabilities, including technical provisions, that are recognised for solvency or tax purposes in accordance with Article 9.

2.Notwithstanding paragraph 1, insurance and reinsurance undertakings shall value deferred taxes, other than deferred tax assets arising from the carryforward of unused tax credits and the carryforward of unused tax losses, on the basis of the difference between the values ascribed to assets and liabilities recognised and valued in accordance with Article 75 of Directive 2009/138/EC and in the case of technical provisions in accordance with Articles 76 to 85 of that Directive and the values ascribed to assets and liabilities as recognised and valued for tax purposes.

3.Insurance and reinsurance undertaking shall only ascribe a positive value to deferred tax assets where it is probable that future taxable profit will be available against which the deferred tax asset can be utilised, taking into account any legal or regulatory requirements on the time limits relating to the carryforward of unused tax losses or the carryforward of unused tax credits.

Article 16U.K.Exclusion of valuation methods

1.Insurance and reinsurance undertakings shall not value financial assets or financial liabilities at cost or amortized cost.

2.Insurance and reinsurance undertakings shall not apply valuation models that value at the lower of the carrying amount and fair value less costs to sell.

3.Insurance and reinsurance undertakings shall not value property, investment property, plant and equipment with cost models where the asset value is determined as cost less depreciation and impairment.

4.Insurance and reinsurance undertakings which are lessees in a financial lease or lessors shall comply with all of the following when valuing assets and liabilities in a lease arrangement:

(a)lease assets shall be valued at fair value;

(b)for the purposes of determining the present value of the minimum lease payments market consistent inputs shall be used and no subsequent adjustments to take account of the own credit standing of the undertaking shall be made;

(c)valuation at depreciated cost shall not be applied.

5.Insurance and reinsurance undertakings shall adjust the net realisable value for inventories by the estimated cost of completion and the estimated costs necessary to make the sale where those costs are material. Those costs shall be considered to be material where their non-inclusion could influence the decision-making or the judgement of the users of the balance sheet, including the supervisory authorities. Valuation at cost shall not be applied.

6.Insurance and reinsurance undertakings shall not value non-monetary grants at a nominal amount.

7.When valuing biological assets, insurance and reinsurance undertakings shall adjust the value by adding the estimated costs to sell if the estimated costs to sell are material.

CHAPTER IIIU.K. RULES RELATING TO TECHNICAL PROVISIONS

SECTION 1 U.K. General provisions

Article 17U.K.Recognition and derecognition of insurance and reinsurance obligations

For the calculation of the best estimate and the risk margin of technical provisions, insurance and reinsurance undertakings shall recognise an insurance or reinsurance obligation at the date the undertaking becomes a party to the contract that gives rise to the obligation or the date the insurance or reinsurance cover begins, whichever date occurs earlier. Insurance and reinsurance undertakings shall only recognise the obligations within the boundary of the contract.

Insurance and reinsurance undertakings shall derecognise an insurance or reinsurance obligation only when it is extinguished, discharged, cancelled or expires.

Article 18U.K.Boundary of an insurance or reinsurance contract

1.The boundaries of an insurance or reinsurance contract shall be defined in accordance with paragraphs 2 to 7.

2.All obligations relating to the contract, including obligations relating to unilateral rights of the insurance or reinsurance undertaking to renew or extend the scope of the contract and obligations that relate to paid premiums, shall belong to the contract unless otherwise stated in paragraphs 3 to 6.

3.Obligations which relate to insurance or reinsurance cover provided by the undertaking after any of the following dates do not belong to the contract, unless the undertaking can compel the policyholder to pay the premium for those obligations:

(a)the future date where the insurance or reinsurance undertaking has a unilateral right to terminate the contract;

(b)the future date where the insurance or reinsurance undertaking has a unilateral right to reject premiums payable under the contract;

(c)the future date where the insurance or reinsurance undertaking has a unilateral right to amend the premiums or the benefits payable under the contract in such a way that the premiums fully reflect the risks.

Point (c) shall be deemed to apply where an insurance or reinsurance undertaking has a unilateral right to amend at a future date the premiums or benefits of a portfolio of insurance or reinsurance obligations in such a way that the premiums of the portfolio fully reflect the risks covered by the portfolio.

However, in the case of life insurance obligations where an individual risk assessment of the obligations relating to the insured person of the contract is carried out at the inception of the contract and that assessment cannot be repeated before amending the premiums or benefits, insurance and reinsurance undertakings shall assess at the level of the contract whether the premiums fully reflect the risk for the purposes of point (c).

Insurance and reinsurance undertakings shall not take into account restrictions of the unilateral right as referred to in points (a), (b) and (c) of this paragraph and limitations of the extent to which premiums or benefits can be amended that have no discernible effect on the economics of the contract.

4.Where the insurance or reinsurance undertaking has a unilateral right as referred to in paragraph 3 that only relates to a part of the contract, the same principles as defined in paragraph 3 shall apply to that part of the contract.

5.[F4Obligations that do not relate to premiums which have already been paid do not belong to an insurance or reinsurance contract if all of the following requirements are met:

(a) the contract does not provide compensation for a specified uncertain event that adversely affects the insured person;

(b) the contract does not include a financial guarantee of benefits;

(c) the undertaking cannot compel the policyholder to pay the future premium for those obligations.]

For the purpose of points (a) and (b), insurance and reinsurance undertakings shall not take into account coverage of events and guarantees that have no discernible effect on the economics of the contract.

[F46. Where an insurance or reinsurance contract can be unbundled into two parts and where one of those parts meets the requirements set out in points (a), (b) and (c) of paragraph 5, any obligations that do not relate to the premiums of that part and which have already been paid do not belong to the contract.]

7.Insurance and reinsurance undertakings shall, for the purposes of paragraph 3, only consider that premiums fully reflect the risks covered by a portfolio of insurance or reinsurance obligations, where there is no circumstance under which the amount of the benefits and expenses payable under the portfolio exceeds the amount of the premiums payable under the portfolio.

Textual Amendments

F4 Substituted by Commission Delegated Regulation (EU) 2019/981 of 8 March 2019 amending Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (Text with EEA relevance).

SECTION 2 U.K. Data quality

Article 19U.K.Data used in the calculation of technical provisions

1.Data used in the calculation of the technical provisions shall only be considered to be complete for the purpose of Article 82 of Directive 2009/138/EC where all of the following conditions are met:

(a)the data include sufficient historical information to assess the characteristics of the underlying risks and to identify trends in the risks;

(b)the data are available for each of the relevant homogeneous risk groups used in the calculation of the technical provisions and no relevant data is excluded from being used in the calculation of the technical provisions without justification.

2.Data used in the calculation of the technical provisions shall only be considered to be accurate for the purpose of Article 82 of Directive 2009/138/EC where all of the following conditions are met:

(a)the data are free from material errors;

(b)data from different time periods used for the same estimation are consistent;

(c)the data are recorded in a timely manner and consistently over time.

3.Data used in the calculation of the technical provisions shall only be considered to be appropriate for the purpose of Article 82 of Directive 2009/138/EC where all of the following conditions are met:

(a)the data are consistent with the purposes for which they will be used;

(b)the amount and nature of the data ensure that the estimations made in the calculation of the technical provisions on the basis of the data do not include a material estimation error;

(c)the data are consistent with the assumptions underlying the actuarial and statistical techniques that are applied to them in the calculation of the technical provisions;

(d)the data appropriately reflect the risks to which the insurance or reinsurance undertaking is exposed with regard to its insurance and reinsurance obligations;

(e)the data were collected, processed and applied in a transparent and structured manner, based on a documented process that comprises all of the following:

the definition of criteria for the quality of data and an assessment of the quality of data, including specific qualitative and quantitative standards for different data sets;

the use of and setting of assumptions made in the collection, processing and application of data;

the process for carrying out data updates, including the frequency of updates and the circumstances that trigger additional updates;

(f)Insurance or reinsurance undertakings shall ensure that their data are used consistently over time in the calculation of the technical provisions.

For the purposes of point (b), an estimation error in the calculation of the technical provisions shall be considered to be material where it could influence the decision-making or the judgement of the users of the calculation result, including the supervisory authorities.

4.Insurance and reinsurance undertakings may use data from an external source provided that, in addition to fulfilling the requirements set out in paragraphs 1 to 4, all of the following requirements are met:

(a)insurance or reinsurance undertakings are able to demonstrate that the use of that data is more suitable than the use of data which are exclusively available from an internal source;

(b)insurance or reinsurance undertakings know the origin of that data and the assumptions or methodologies used to process that data;

(c)insurance or reinsurance undertakings identify any trends in that data and the variation, over time or across data, of the assumptions or methodologies in the use of that data;

(d)insurance or reinsurance undertakings are able to demonstrate that the assumptions and methodologies referred to in points (b) and (c) reflect the characteristics of the insurance or reinsurance undertaking's portfolio of insurance and reinsurance obligations.

Article 20U.K.Limitations of data

Where data does not comply with Article 19, insurance and reinsurance undertakings shall document appropriately the limitations of the data including a description of whether and how such limitations will be remedied and of the functions within the system of governance of the insurance or reinsurance undertaking responsible for that process. The data, before adjustments to remedy limitations are made to it, shall be recorded and stored appropriately.

Article 21U.K.Appropriate use of approximations to calculate the best estimate

Where insurance and reinsurance undertakings have insufficient data of appropriate quality to apply a reliable actuarial method, they may use appropriate approximations to calculate the best estimate provided that all of the following requirements are met:

the insufficiency of data is not due to inadequate internal processes and procedures of collecting, storing or validating data used for the valuation of technical provisions;

the insufficiency of data cannot be remedied by the use of external data;

it would not be practicable for the undertaking to adjust the data to remedy the insufficiency.

SECTION 3 U.K. Methodologies to calculate technical provisions

Subsection 1 U.K. Assumptions underlying the calculation of technical provisions

Article 22U.K.General provisions

1.Assumptions shall only be considered to be realistic for the purposes of Article 77(2) of Directive 2009/138/EC where they meet all of the following conditions:

(a)insurance and reinsurance undertakings are able to explain and justify each of the assumptions used, taking into account the significance of the assumption, the uncertainty involved in the assumption as well as relevant alternative assumptions;

(b)the circumstances under which the assumptions would be considered false can be clearly identified;

(c)unless otherwise provided in this Chapter, the assumptions are based on the characteristics of the portfolio of insurance and reinsurance obligations, where possible regardless of the insurance or reinsurance undertaking holding the portfolio;

(d)insurance and reinsurance undertakings use the assumptions consistently over time and within homogeneous risk groups and lines of business, without arbitrary changes;

(e)the assumptions adequately reflect any uncertainty underlying the cash flows.

For the purpose of point (c), insurance and reinsurance undertakings shall only use information specific to the undertaking, including information on claims management and expenses, where that information better reflects the characteristics of the portfolio of insurance or reinsurance obligations than information that is not limited to the specific undertaking or where the calculation of technical provisions in a prudent, reliable and objective manner without using that information is not possible.

2.Assumptions shall only be used for the purpose of Article 77(3) of Directive 2009/138/EC where they comply with paragraph 1 of this Article.

3.Insurance and reinsurance undertakings shall set assumptions on future financial market parameters or scenarios that are appropriate and consistent with Article 75 of Directive 2009/138/EC. Where insurance and reinsurance undertakings use a model to produce projections of future financial market parameters, it shall comply with all of the following requirements:

(a)it generates asset prices that are consistent with asset prices observed in financial markets;

(b)it assumes no arbitrage opportunity;

(c)the calibration of the parameters and scenarios is consistent with the relevant risk-free interest rate term structure used to calculate the best estimate as referred to in Article 77(2) of Directive 2009/138/EC.

Article 23U.K.Future management actions

1.Assumptions on future management actions shall only be considered to be realistic for the purposes of Article 77(2) of Directive 2009/138/EC where they meet all of the following conditions:

(a)the assumptions on future management actions are determined in an objective manner;

(b)assumed future management actions are consistent with the insurance or reinsurance undertaking's current business practice and business strategy, including the use of risk-mitigation techniques; where there is sufficient evidence that the undertaking will change its practices or strategy, the assumed future management actions are consistent with the changed practices or strategy;

(c)assumed future management actions are consistent with each other;

(d)assumed future management actions are not contrary to any obligations towards policy holders and beneficiaries or to legal requirements applicable to the undertaking;

(e)assumed future management actions take account of any public indications by the insurance or reinsurance undertaking as to the actions that it would expect to take or not take.

2.Assumptions about future management actions shall be realistic and include all of the following:

a comparison of assumed future management actions with management actions taken previously by the insurance or reinsurance undertaking;

a comparison of future management actions taken into account in the current and in the past calculations of the best estimate;

an assessment of the impact of changes in the assumptions on future management actions on the value of the technical provisions.

Insurance and reinsurance undertakings shall be able to explain any relevant deviations in relation to points (i) and (ii) upon request of the supervisory authorities and, where changes in an assumption on future management actions have a significant impact on the technical provisions, the reasons for that sensitivity and how the sensitivity is taken into account in the decision-making process of the insurance or reinsurance undertaking.

3.For the purpose of paragraph 1, insurance and reinsurance undertakings shall establish a comprehensive future management actions plan, approved by the administrative, management or supervisory body of the insurance and reinsurance undertaking, which provides for all of the following:

(a)the identification of future management actions that are relevant to the valuation of the technical provisions;

(b)the identification of the specific circumstances in which the insurance or reinsurance undertaking would reasonably expect to carry out each respective future management action referred to in point (a);

(c)the identification of the specific circumstances in which the insurance or reinsurance undertaking may not be able to carry out each respective future management action referred to in point (a), and a description of how those circumstances are considered in the calculation of technical provisions;

(d)the order in which future management actions referred to in point (a) would be carried out and the governance requirements applicable to those future management actions;

(e)a description of any on-going work required to ensure that the insurance or reinsurance undertaking is in a position to carry out each respective future management action referred to in point (a);

(f)a description of how the future management actions referred to in point (a) have been reflected in the calculation of the best estimate;

(g)a description of the applicable internal reporting procedures that cover the future management actions referred to in point (a) included in the calculation of the best estimate;

4.Assumptions about future management actions shall take account of the time needed to implement the management actions and any expenses caused by them.

5.The system for ensuring the transmission of information shall only be considered to be effective for the purpose of Article 41(1) of Directive 2009/138/EC where the reporting procedures referred to in point (g) of paragraph 3 of this Article include at least an annual communication to the administrative, supervisory or management body.

Article 24U.K.Future discretionary benefits

Where future discretionary benefits depend on the assets held by the insurance or reinsurance undertaking, undertakings shall base the calculation of the best estimate on the assets currently held by the undertakings and shall assume future changes of their asset allocation in accordance with Article 23. The assumptions on the future returns of the assets shall be consistent with the relevant risk-free interest rate term structure, including where applicable a matching adjustment, a volatility adjustment, or a transitional measure on the risk-free rate, and the valuation of the assets in accordance with Article 75 of Directive 2009/138/EC.

Article 25U.K.Separate calculation of the future discretionary benefits

When calculating technical provisions, insurance and reinsurance undertakings shall determine separately the value of future discretionary benefits.

Article 26U.K.Policyholder behaviour

When determining the likelihood that policy holders will exercise contractual options, including lapses and surrenders, insurance and reinsurance undertakings shall conduct an analysis of past policyholder behaviour and a prospective assessment of expected policyholder behaviour. That analysis shall take into account all of the following:

how beneficial the exercise of the options was and will be to the policy holders under circumstances at the time of exercising the option;

the influence of past and future economic conditions;

the impact of past and future management actions;

any other circumstances that are likely to influence decisions by policyholders on whether to exercise the option.

The likelihood shall only be considered to be independent of the elements referred to in points (a) to (d) where there is empirical evidence to support such an assumption.

Subsection 2 U.K. Information underlying the calculation of best estimates

Article 27U.K.Credibility of information

Information shall only be considered to be credible for the purposes of Article 77(2) of Directive 2009/138/EC where insurance and reinsurance undertakings provide evidence of the credibility of the information taking into account the consistency and objectivity of that information, the reliability of the source of the information and the transparency of the way in which the information is generated and processed.

Subsection 3 U.K. Cash flow projections for the calculation of the best estimate

Article 28U.K.Cash flows

The cash flow projection used in the calculation of the best estimate shall include all of the following cash flows, to the extent that these cash flows relate to existing insurance and reinsurance contracts:

benefit payments to policy holders and beneficiaries;

payments that the insurance or reinsurance undertaking will incur in providing contractual benefits that are paid in kind;

payments of expenses as referred to in point (1) of Article 78 of Directive 2009/138/EC;

premium payments and any additional cash flows that result from those premiums;

payments between the insurance or reinsurance undertaking and intermediaries related to insurance or reinsurance obligations;

payments between the insurance or reinsurance undertaking and investment firms in relation to contracts with index-linked and unit-linked benefits;

payments for salvage and subrogation to the extent that they do not qualify as separate assets or liabilities in accordance with international accounting standards, as endorsed by the Commission in accordance with Regulation (EC) No 1606/2002;

taxation payments which are, or are expected to be, charged to policy holders or are required to settle the insurance or reinsurance obligations.

Article 29U.K.Expected future developments in the external environment

The calculation of the best estimate shall take into account expected future developments that will have a material impact on the cash in- and out-flows required to settle the insurance and reinsurance obligations over the lifetime thereof. For that purpose future developments shall include demographic, legal, medical, technological, social, environmental and economic developments including inflation as referred to in point (2) of Article 78 of Directive 2009/138/EC.

Article 30U.K.Uncertainty of cash flows

The cash flow projection used in the calculation of the best estimate shall, explicitly or implicitly, take account of all uncertainties in the cash flows, including all of the following characteristics:

uncertainty in the timing, frequency and severity of insured events;

uncertainty in claim amounts, including uncertainty in claims inflation, and in the period needed to settle and pay claims;

uncertainty in the amount of expenses referred to in point (1) of Article 78 of Directive 2009/138/EC;

uncertainty in expected future developments referred to in Article 29 to the extent that it is practicable;

uncertainty in policyholder behaviour;

dependency between two or more causes of uncertainty;

dependency of cash flows on circumstances prior to the date of the cash flow.

Article 31U.K.Expenses

1.A cash flow projection used to calculate best estimates shall take into account all of the following expenses, which relate to recognised insurance and reinsurance obligations of insurance and reinsurance undertakings and which are referred to in point (1) of Article 78 of Directive 2009/138/EC:

(a)administrative expenses;

(b)investment management expenses;

(c)claims management expenses;

(d)acquisition expenses.

The expenses referred to in points (a) to (d) shall take into account overhead expenses incurred in servicing insurance and reinsurance obligations.

2.Overhead expenses shall be allocated in a realistic and objective manner and on a consistent basis over time to the parts of the best estimate to which they relate.

3.Expenses in respect of reinsurance contracts and special purpose vehicles shall be taken into account in the gross calculation of the best estimate.

4.Expenses shall be projected on the assumption that the undertaking will write new business in the future.

Article 32U.K.Contractual options and financial guarantees

When calculating the best estimate, insurance and reinsurance undertakings shall take into account all of the following:

all financial guarantees and contractual options included in their insurance and reinsurance policies;

all factors which may affect the likelihood that policy holders will exercise contractual options or realise the value of financial guarantees.

Article 33U.K.Currency of the obligation

The best estimate shall be calculated separately for cash flows in different currencies.

Article 34U.K.Calculation methods

1.The best estimate shall be calculated in a transparent manner and in such a way as to ensure that the calculation method and the results that derive from it are capable of review by a qualified expert.

2.The choice of actuarial and statistical methods for the calculation of the best estimate shall be based on their appropriateness to reflect the risks which affect the underlying cash flows and the nature of the insurance and reinsurance obligations. The actuarial and statistical methods shall be consistent with and make use of all relevant data available for the calculation of the best estimate.

3.Where a calculation method is based on grouped policy data, insurance and reinsurance undertakings shall ensure that the grouping of policies creates homogeneous risk groups that appropriately reflect the risks of the individual policies included in those groups.

4.Insurance and reinsurance undertakings shall analyse the extent to which the present value of cash flows depend both on the expected outcome of future events and developments and on how the actual outcome in certain scenarios could deviate from the expected outcome.

5.Where the present value of cash flows depends on future events and developments as referred to in paragraph 4, insurance and reinsurance undertakings shall use a method to calculate the best estimate for cash flows which reflects such dependencies.

Article 35U.K.Homogeneous risk groups of life insurance obligations

The cash flow projections used in the calculation of best estimates for life insurance obligations shall be made separately for each policy. Where the separate calculation for each policy would be an undue burden on the insurance or reinsurance undertaking, it may carry out the projection by grouping policies, provided that the grouping complies with all of the following requirements:

there are no significant differences in the nature and complexity of the risks underlying the policies that belong to the same group;

the grouping of policies does not misrepresent the risk underlying the policies and does not misstate their expenses;

the grouping of policies is likely to give approximately the same results for the best estimate calculation as a calculation on a per policy basis, in particular in relation to financial guarantees and contractual options included in the policies.

Article 36U.K.Non-life insurance obligations

1.The best estimate for non-life insurance obligations shall be calculated separately for the premium provision and for the provision for claims outstanding.

2.The premium provision shall relate to future claim events covered by insurance and reinsurance obligations falling within the contract boundary referred to in Article 18. Cash flow projections for the calculation of the premium provision shall include benefits, expenses and premiums relating to these events.

3.The provision for claims outstanding shall relate to claim events that have already occurred, regardless of whether the claims arising from those events have been reported or not.

4.Cash flow projections for the calculation of the provision for claims outstanding shall include benefits, expenses and premiums relating to the events referred to in paragraph 3.

Subsection 4 U.K. Risk margin

Article 37U.K.Calculation of the risk margin

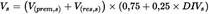

1.The risk margin for the whole portfolio of insurance and reinsurance obligations shall be calculated using the following formula:

where:

CoC denotes the Cost-of-Capital rate;

the sum covers all integers including zero;

SCR(t) denotes the Solvency Capital Requirement referred to in Article 38(2) after t years;

r(t + 1) denotes the basic risk-free interest rate for the maturity of t + 1 years.

The basic risk-free interest rate r(t + 1) shall be chosen in accordance with the currency used for the financial statements of the insurance and reinsurance undertaking.

2.Where insurance and reinsurance undertakings calculate their Solvency Capital Requirement using an approved internal model and determine that the model is appropriate to calculate the Solvency Capital Requirement referred to in Article 38(2) for each point in time over the lifetime of the insurance and reinsurance obligations, the insurance and reinsurance undertakings shall use the internal model to calculate the amounts SCR(t) referred to in paragraph 1.

3.Insurance and reinsurance undertakings shall allocate the risk margin for the whole portfolio of insurance and reinsurance obligations to the lines of business referred to in Article 80 of Directive 2009/138/EC. The allocation shall adequately reflect the contributions of the lines of business to the Solvency Capital Requirement referred to in Article 38(2) over the lifetime of the whole portfolio of insurance and reinsurance obligations.

Article 38U.K.Reference undertaking

1.The calculation of the risk margin shall be based on all of the following assumptions:

(a)the whole portfolio of insurance and reinsurance obligations of the insurance or reinsurance undertaking that calculates the risk margin (the original undertaking) is taken over by another insurance or reinsurance undertaking (the reference undertaking);

(b)notwithstanding point (a), where the original undertaking simultaneously pursues both life and non-life insurance activities according to Article 73(5) of Directive 2009/138/EC, the portfolio of insurance obligations relating to life insurance activities and life reinsurance obligations and the portfolio of insurance obligations relating to non-life insurance activities and non-life reinsurance obligations are taken over separately by two different reference undertakings;

(c)the transfer of insurance and reinsurance obligations includes any reinsurance contracts and arrangements with special purpose vehicles relating to these obligations;

(d)the reference undertaking does not have any insurance or reinsurance obligations or own funds before the transfer takes place;

(e)after the transfer, the reference undertaking does not assume any new insurance or reinsurance obligations;

(f)after the transfer, the reference undertaking raises eligible own funds equal to the Solvency Capital Requirement necessary to support the insurance and reinsurance obligations over the lifetime thereof;

(g)after the transfer, the reference undertaking has assets which amount to the sum of its Solvency Capital Requirement and of the technical provisions net of the amounts recoverable from reinsurance contracts and special purpose vehicles;

(h)the assets are selected in such a way that they minimise the Solvency Capital Requirement for market risk that the reference undertaking is exposed to;

(i)the Solvency Capital Requirement of the reference undertaking captures all of the following risks:

underwriting risk with respect to the transferred business,

where it is material, the market risk referred to in point (h), other than interest rate risk,

credit risk with respect to reinsurance contracts, arrangements with special purpose vehicles, intermediaries, policyholders and any other material exposures which are closely related to the insurance and reinsurance obligations,

operational risk;

(j)the loss-absorbing capacity of technical provisions, referred to in Article 108 of Directive 2009/138/EC, in the reference undertaking corresponds for each risk to the loss-absorbing capacity of technical provisions in the original undertaking;

(k)there is no loss-absorbing capacity of deferred taxes as referred to in Article 108 of Directive 2009/138/EC for the reference undertaking;

(l)the reference undertaking will, subject to points (e) and (f), adopt future management actions that are consistent with the assumed future management actions, as referred to in Article 23, of the original undertaking.

2.Over the lifetime of the insurance and reinsurance obligations, the Solvency Capital Requirement necessary to support the insurance and reinsurance obligations referred to in the first subparagraph of Article 77(5) of Directive 2009/138/EC shall be assumed to be equal to the Solvency Capital Requirement of the reference undertaking under the assumptions set out in paragraph 1.

3.For the purposes of point (i) of paragraph 1, a risk shall be considered to be material where its impact on the calculation of the risk margin could influence the decision-making or the judgment of the users of that information, including supervisory authorities.

Article 39U.K.Cost-of-Capital rate

The Cost-of-Capital rate referred to in Article 77(5) of Directive 2009/138/EC shall be assumed to be equal to 6 %.

Subsection 5 U.K. Calculation of technical provisions as a whole

Article 40U.K.Circumstances in which technical provisions shall be calculated as a whole and the method to be used

1.For the purposes of the second subparagraph of Article 77(4) of Directive 2009/138/EC, reliability shall be assessed pursuant to paragraphs 2 and 3 of this Article and technical provisions shall be valued pursuant to paragraph 4 of this Article.

2.The replication of cash flows shall be considered to be reliable where those cash flows are replicated in amount and timing in relation to the underlying risks of those cash flows and in all possible scenarios. The following cash flows associated with insurance or reinsurance obligations cannot be reliably replicated:

(a)cash flows associated with insurance or reinsurance obligations that depend on the likelihood that policy holders will exercise contractual options, including lapses and surrenders;

(b)cash flows associated with insurance or reinsurance obligations that depend on the level, trend, or volatility of mortality, disability, sickness and morbidity rates;

(c)all expenses that will be incurred in servicing insurance and reinsurance obligations.

3.Financial instruments shall be considered to be financial instruments for which a reliable market value is observable where those financial instruments are traded on an active, deep, liquid and transparent market. Active markets shall also comply with Article 10(4).