- Y Diweddaraf sydd Ar Gael (Diwygiedig)

- Gwreiddiol (a wnaed Fel)

The Bankruptcy (Scotland) Regulations 2016

You are here:

- Offerynnau Statudol yr Alban

- 2016 No. 397

- Whole Instrument

- Blaenorol

- Nesaf

- Dangos Graddfa Ddaearyddol(e.e. Lloegr, Cymru, Yr Alban aca Gogledd Iwerddon)

- Dangos Llinell Amser Newidiadau

Rhagor o Adnoddau

Changes over time for: The Bankruptcy (Scotland) Regulations 2016

Changes to legislation:

There are currently no known outstanding effects for the The Bankruptcy (Scotland) Regulations 2016.![]()

Changes to Legislation

Revised legislation carried on this site may not be fully up to date. At the current time any known changes or effects made by subsequent legislation have been applied to the text of the legislation you are viewing by the editorial team. Please see ‘Frequently Asked Questions’ for details regarding the timescales for which new effects are identified and recorded on this site.

Scottish Statutory Instruments

2016 No. 397

Insolvency

Bankruptcy

Debt

The Bankruptcy (Scotland) Regulations 2016

Made

24th November 2016

Coming into force

30th November 2016

The Scottish Ministers make the following Regulations in exercise of the powers conferred by sections 2(2)(a)(ii) and (f), 3(1), 4(1)(d) and (2)(b), 6(8), 8(3)(a), 9(4)(b), 19(1), 46(2)(a) and (6), 48(1)(a), 51(14), 54(4), 87(8), 89, 94(7), 113(5), 116(2), 117(1), 119(6)(a), 126(5), 129(10)(a), 137(2), 138(2), 140(2) 141(2)(a) and (c), 142(2) and (5), 200(1)(c) and (8), 221, 224(1), 225(2), 228(1), 234(3)(b) and paragraph 2(5)(a) of schedule 1 of the Bankruptcy (Scotland) Act 2016 M1 (“the Act”), section 7(2)(bd) of the Debt Arrangement and Attachment (Scotland) Act 2002 M2 (“the 2002 Act”) and all other powers enabling them to do so.

In accordance with section 225(4)(a) of the Act and section 62(4) of the 2002 Act M3, a draft of this instrument has been laid before and approved by resolution of the Scottish Parliament.

Marginal Citations

M12016 asp 21 (“the Act”). Section 8(3)(a) is applied for the purposes of section 6, by section 6(9), of the Act. Section 228(1) of the Act contains definitions of “prescribed” and “statement of assets and liabilities” relevant to the exercise of the statutory powers under which these Regulations are made.

M22002 asp 17, as amended by the Bankruptcy and Diligence etc. (Scotland) Act 2007 (asp 3), sections 173, 209(1), 211 and 212 and schedule 4, paragraph 10, schedule 5, paragraph 30 and schedule 6, Part 1. Section 7(2)(bd) was inserted by the Bankruptcy and Debt Advice (Scotland) Act 2014 (asp 11) (“the 2014 Act”), section 3(2).

M3Section 62(4) was amended by the 2014 Act, schedule 3, paragraph 38(b) and has been modified by paragraph 5(2) of schedule 3 to the Interpretation and Legislative Reform (Scotland) Act 2010 (asp 10) (“the 2010 Act”). The powers to make these Regulations are exercised together by virtue of section 33(2) and (3) of the 2010 Act.

Citation and commencementS

1. These Regulations may be cited as the Bankruptcy (Scotland) Regulations 2016 and come into force on 30th November 2016.

InterpretationS

2.—(1) In these Regulations—

“the Act” means the Bankruptcy (Scotland) Act 2016;

“AiB” means the Accountant in Bankruptcy (with the meaning given by section 199 of the Act);

“Common Financial Statement” means the style and format for income and expenditure categories under that title (and, where relevant, related spread sheets, budget sheets, trigger figures, guidance materials and notes) published by the Money Advice Trust M4;

“common financial tool” has the meaning given by section 89(1) of the Act (see regulations 15 to 17);

“debtor's contribution” has the meaning given by section 89(1) of the Act; and

“the Keeper” means the Keeper of the Registers of Scotland.

(2) Any reference in these Regulations, except regulation 20, to anything done in writing or produced in written form includes a reference to an electronic communication, as defined in section 15(1) of the Electronic Communications Act 2000 M5, which has been recorded and is consequently capable of being reproduced.

Marginal Citations

M4The Money Advice Trust is a company registered in England and Wales with registered number 4741583, registered charity in England and Wales registration number 1099506. Available at www.cfs.moneyadvicetrust.org.

M52000 c.7. Section 15(1) was amended by the Communications Act 2003 (c.21), section 406 and schedule 17, paragraph 158.

FormsS

3.—(1) The forms set out in schedule 1 are the forms referred to in regulations 8, 12, 19, 20, 23, 24, 27 and 29, failing which they are prescribed for the purposes of the provisions of the Act referred to in the form.

(2) Any signature required as shown on a form set out in schedule 1 must be provided F1... by—

(a)a manuscript signature; F1...

(b)except in Forms 19 to 21, an image of a manuscript signature sent electronically [F2; or

(c)in any case, an electronic signature.]

[F3(3) In paragraph (2), “electronic signature” (except where it relates to Form 9) is to be construed in accordance with section 7(2) of the Electronic Communications Act 2000 (electronic signatures and related certificates), but includes a version of an electronic signature which is reproduced on a paper document.]

Textual Amendments

F1Words in reg. 3(2) omitted (29.3.2021) by virtue of The Bankruptcy (Miscellaneous Amendments) (Scotland) Regulations 2021 (S.S.I. 2021/148), regs. 1, 6(2) (with reg. 3(c))

F2Reg. 3(2)(c) and word inserted (29.3.2021) by The Bankruptcy (Miscellaneous Amendments) (Scotland) Regulations 2021 (S.S.I. 2021/148), regs. 1, 6(3) (with reg. 3(c))

PART 1SMoney advisers

Approved categories of money advisersS

4. Subject to regulation 5, the following classes of persons are prescribed for the purposes of section 4(2)(b) of the Act as money advisers—

(a)persons who—

(i)are qualified to act as insolvency practitioners in accordance with sections 390 of the Insolvency Act 1986 M6 who are fully authorised, or partially authorised so to act in relation to individuals, within the meaning of 390A of that Act M7; or

(ii)work for such an insolvency practitioner, who have been given authority by that insolvency practitioner to act on his or her behalf in providing money advice under the Act; and

(b)persons who—

(i)work as money advisers for organisations which have been awarded accreditation at Type 2 level or above against the Scottish National Standards for Information and Advice Provision; or

(ii)are approved for the purposes of the Debt Arrangement Scheme M8; or

(iii)work as money advisers for a citizens advice bureau which is a full member of the Scottish Association of Citizens Advice Bureaux – Citizens Advice Scotland; or

(iv)work as money advisers for a local authority.

Marginal Citations

M61986 c.45. Section 390 was amended by the Adults with Incapacity (Scotland) Act 2000 (asp 4), schedule 5, paragraph 18; the Insolvency Act 2000 (c.39), schedule 4, paragraph 16(2); the Enterprise Act 2002 (c.22), schedule 21, paragraph 4; S.S.I. 2005/465, schedule 1, paragraph 18(3); the Mental Capacity Act 2005 (c.9), schedule 6, paragraph 31(3), schedule 7; the Tribunals, Courts and Enforcement Act 2007 (c.15), schedule 20, paragraph 6; S.I. 2009/1941, schedule 1, paragraph 78(4); the Deregulation Act 2015 (c.20) (“the 2015 Act”), section 17(2) and the Small Business, Enterprise and Employment Act 2015 (c.26), section 115.

M7Section 390A was inserted by the 2015 Act, section 17(3).

M8Under Part 1 of the Debt Arrangement and Attachment (Scotland) Act 2002 (asp 17).

Persons who may not be approved money advisersS

5.—(1) The following persons may not be a money adviser—

(a)a sheriff officer or messenger-at-arms, or an employee of such a person;

(b)a person or body providing financial services, or financial advice other than money advice, in the course of a business or otherwise for profit, or an employee of such a person, unless the person is a—

(i)solicitor;

(ii)chartered or certified accountant;

(iii)a credit union registered under the Co-operative and Community Benefit Societies Act 2014 M9 or the Industrial and Provident Societies Act 1965 M10 by virtue of section 1 of the Credit Unions Act 1979 M11;

(c)a person providing debt collection services, or an employee of such a person;

(d)a person convicted of an offence involving theft, fraud or other dishonesty;

(e)a person subject to a bankruptcy restrictions order (including an interim order) under section 155 or 160 of the Act M12 or subject to a bankruptcy restrictions order, or bound by a bankruptcy restrictions undertaking, under schedule 4A of the Insolvency Act 1986 M13;

(f)a person in respect of whom a court has made a disqualification order under section 1, or who has had a disqualification undertaking accepted under section 1A, of the Company Directors Disqualification Act 1986 M14;

(g)persons without a licence from the Money Advice Trust M15 to use the Common Financial Statement; or

(h)persons whose approval is revoked or suspended under paragraph (2).

(2) AiB may revoke or suspend the approval of a money adviser who fails without good cause—

(a)to apply the common financial tool in accordance with Part 3; or

(b)to comply with regulation 7.

(3) AiB must provide written notice of the revocation or suspension to the money adviser (together with reasons for the decision to revoke or suspend).

(4) AiB must provide written notice of the revocation or suspension to any debtor where it is known to AiB that the money adviser is acting as money adviser to that debtor.

Marginal Citations

M101965 c.12. Section 1 is relevantly amended and repealed subject to savings and transitional provisions by the Co-operative and Community Benefit Societies Act 2014 (c.14).

M111979 c.34. Section 1 was amended by S.I. 1996/1189, 2001/2617 and 2538 and 2002/1501 and the Co-operative and Community Benefit Societies Act 2014 (c.14), schedule 4, subject to savings and transitional provisions specified in section 151 and schedule 5 of that Act.

M12Bankruptcy restrictions undertakings for Scotland were repealed by section 52 of the 2014 Act, subject to transitional arrangements (see article 4(4) of S.S.I. 2014/261, amended by S.S.I. 2015/54).

M131986 c.45. Schedule 4A was inserted by the Enterprise Act 2002 (c.40), schedule 20, paragraph 1.

M141986 c.46, amended by the Insolvency Act 2000 (c.39), sections 5 and 6 and schedule 4, paragraph 2; the Enterprise Act 2002 (c.40), section 204(3) and the Small Business, Enterprise and Employment Act 2015 (c.26), schedule 7, paragraph 2.

M15The Money Advice Trust is a company registered in England and Wales with registered number 4741583, registered charity in England and Wales registration number 1099506.

Other matters on which a debtor must obtain adviceS

6. The following are prescribed for the purposes of section 4(1)(d) of the Act as matters on which the debtor must obtain advice from a money adviser—

(a)the income and expenditure of the debtor in accordance with the common financial tool;

(b)the evidence required to confirm the debts of the debtor in making the debtor application;

(c)the debt advice and information package M16;

(d)the options of a voluntary repayment plan, debt payment programme under the Debt Arrangement Scheme or a trust deed;

(e)the consequences of sequestration and that an award of sequestration, if granted, is recorded in a public register and may result in one or more of—

(i)the debtor being refused credit, or being offered credit at a higher rate, whether before or after the date of the debtor being discharged;

(ii)the debtor not being able to remain in his or her current place of residence;

(iii)the debtor being required to relinquish property which the debtor owns;

(iv)the debtor requiring to make contributions from income for the benefit of creditors;

(v)damage to the debtor's business interests and employment prospects;

(vi)the debtor still being liable for some debts;

(vii)the debtor's past financial transactions being investigated; and

(viii)other restrictions or requirements imposed on the debtor as a result of the debtor's own circumstances and actions.

Marginal Citations

M16Referred to in section 3(2) of the Act and section 10(5) of the Debt Arrangement and Attachment (Scotland) Act 2002 (asp 17).

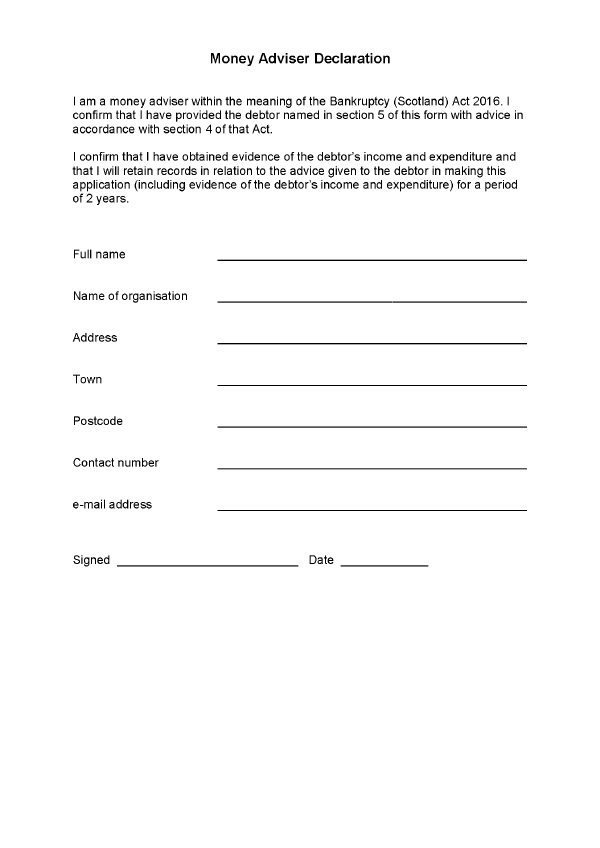

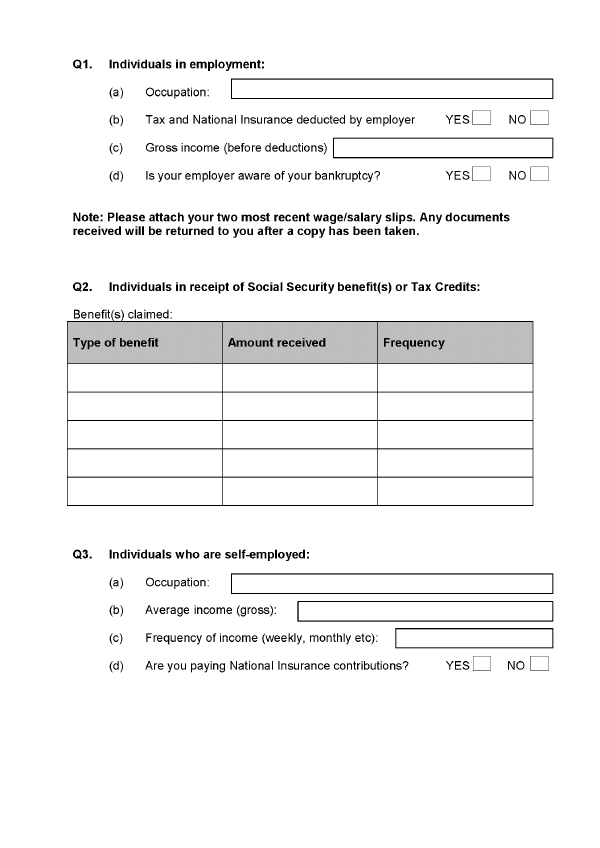

Money advice on debtor applications: procedure on evidence and informationS

7.—(1) In advising under section 4 of the Act on a debtor application, a money adviser must obtain evidence of the debtor's income and expenditure.

(2) A money adviser must retain records in relation to the advice given to the debtor (including the evidence obtained under paragraph (1)) in making a debtor application, for 2 years from the date on which the advice was given.

(3) A money adviser must provide as required by AiB, information about a debtor's application (including evidence obtained under paragraph (1) or the debtor's consent to the application).

Certificate for sequestration: form and mannerS

8.—(1) A certificate for sequestration granted in accordance with section 9 of the Act must be in Form 2.

(2) The certificate must be signed and dated to the effect provided in that form—

(a)by the money adviser; and

(b)by the debtor.

(3) The certificate must be printed on the headed notepaper—

(a)where the money adviser belongs to an organisation, of the organisation to which the money adviser belongs, or

(b)in other cases, of the money adviser.

Certificate for sequestration: feeS

9. No fee is chargeable for granting a certificate for sequestration.

Certificate for sequestration: prescribed periodS

10. The time period prescribed for a granted certificate for sequestration for the purposes of section 2(2)(f) or (8)(e)(ii) of the Act is 30 days.

PART 2SSequestration process

Debt advice and information packageS

11.—(1) Subject to paragraph (2), the time prescribed for the purposes of section 3(1) of the Act is not less than 14 days before the presentation of the petition and not more than 12 weeks before the presentation of the petition.

(2) Paragraph (1) (and so the requirement to provide the debtor with a debt advice and information package in that section) does not apply where it is averred that the address of the debtor is not known M17.

Marginal Citations

M17This regulation re-enacts, with modifications, regulation 7 of the Bankruptcy (Scotland) Regulations 2014 (S.S.I. 2014/225) (“the 2014 Regulations”) as amended by S.S.I. 2015/80.

Debtor applicationsS

12.—(1) A debtor application to AiB—

(a)in the case of an application by a living debtor, or by the executor (or a person entitled to be appointed executor) on the estate of a deceased debtor, must be in Form 1;

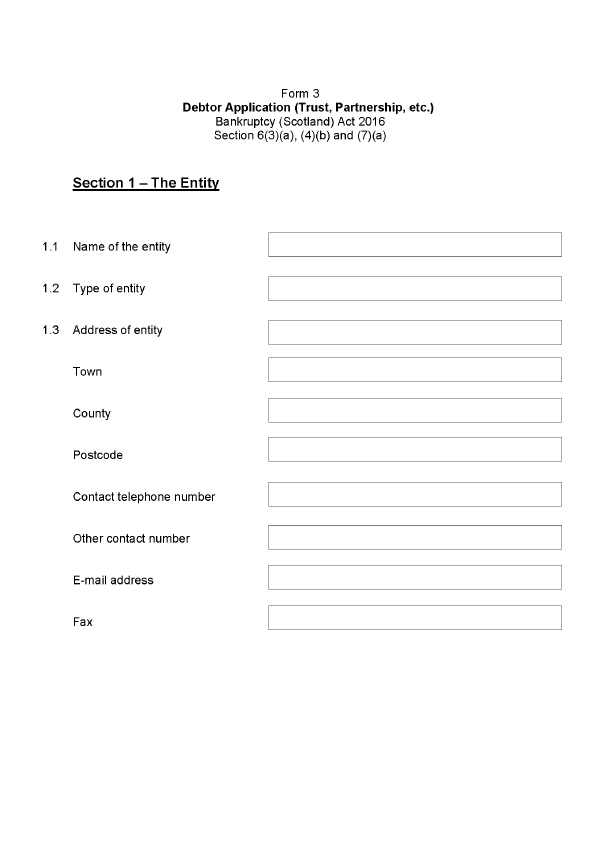

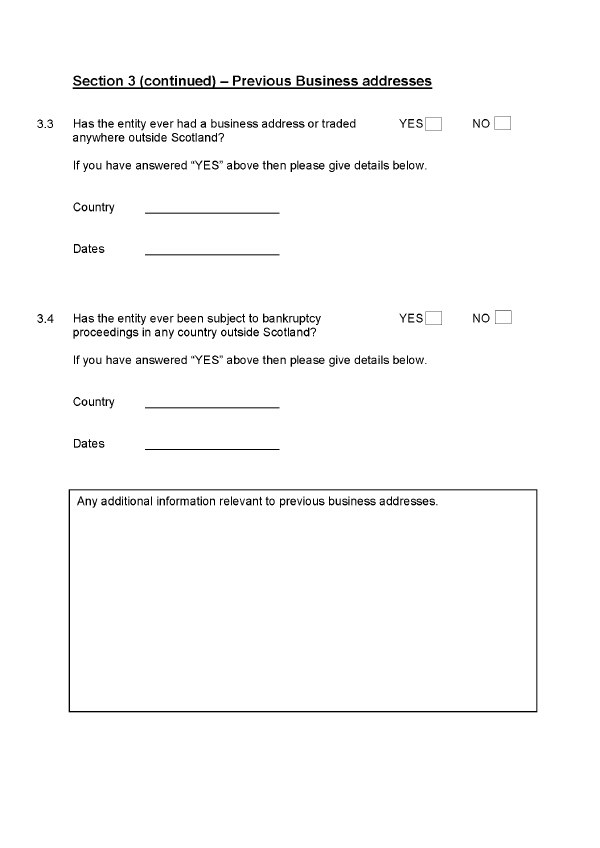

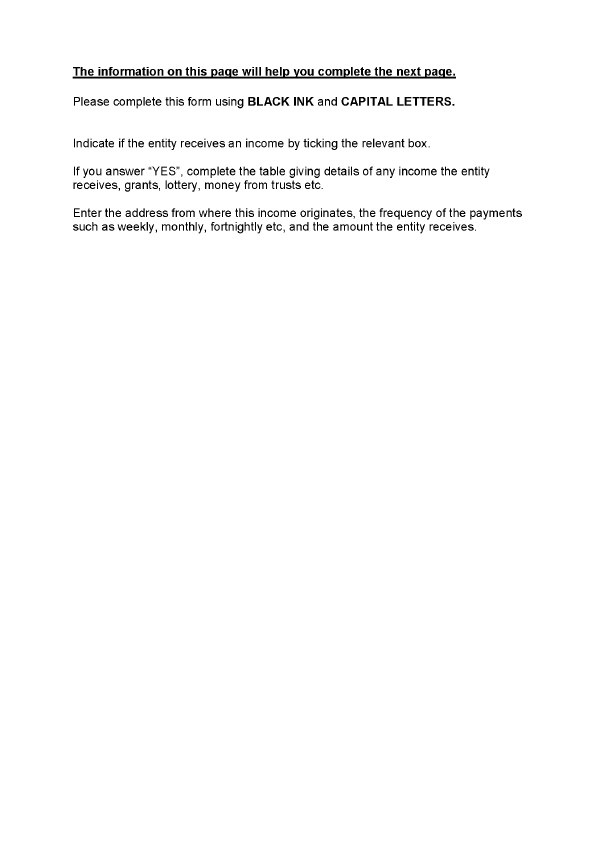

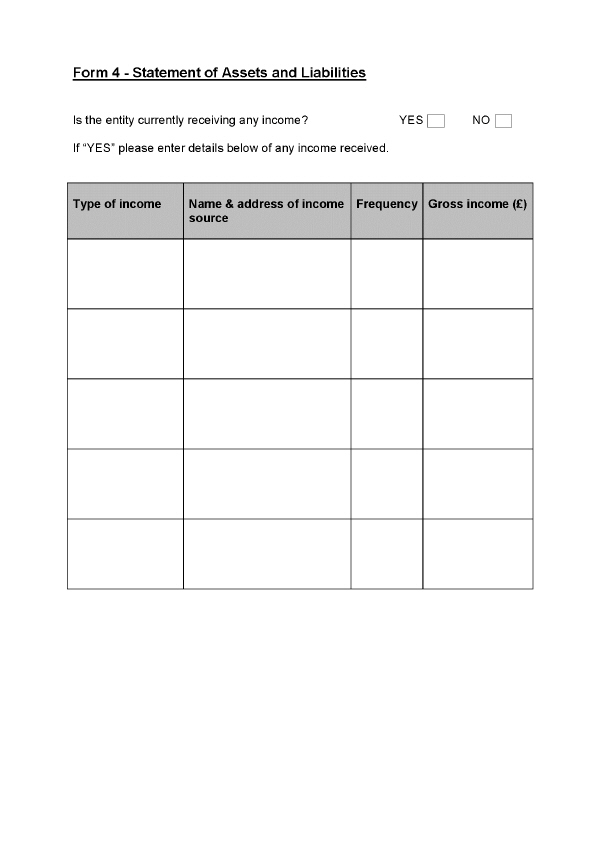

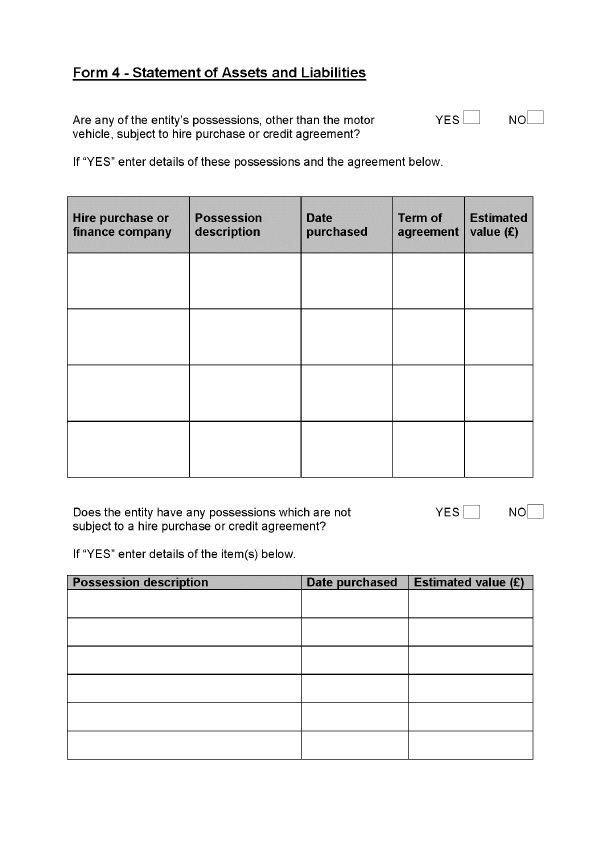

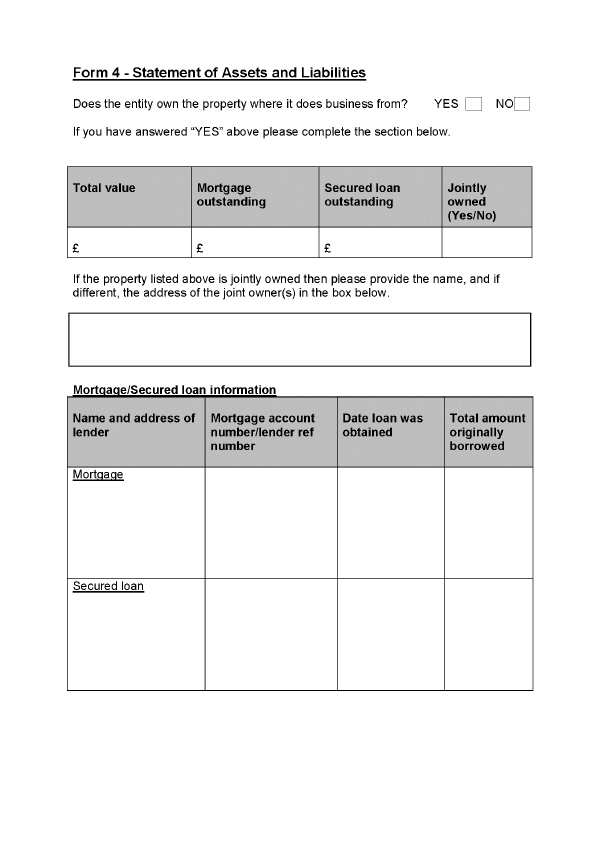

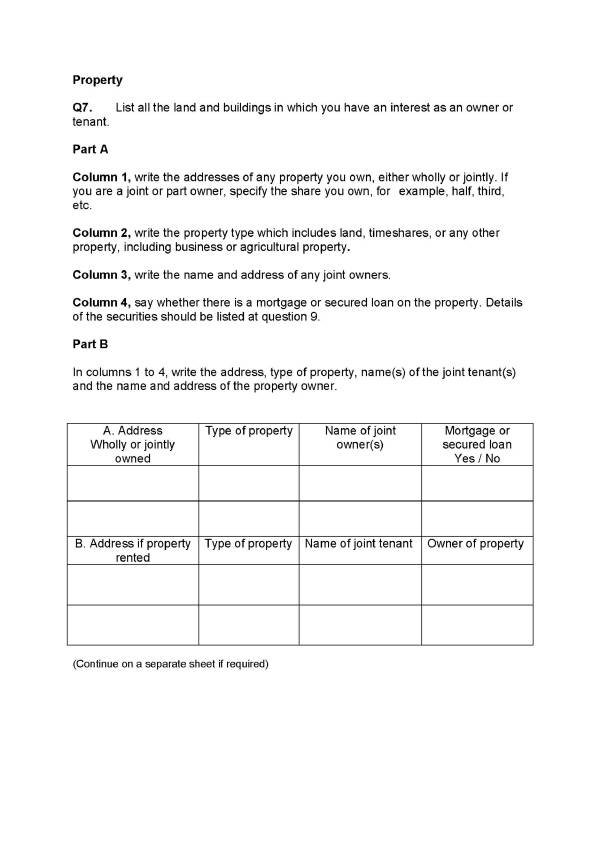

(b)in the case of an application by an entity referred to in section 6(1) of the Act, must be in Form 3 accompanied by a statement of assets and liabilities in Form 4.

(2) Where in a debtor application the debtor nominates an insolvency practitioner to act as the trustee in the sequestration and the insolvency practitioner agrees to act, the application must be accompanied by the insolvency practitioner's written undertaking to act as the trustee in Form 12.

(3) The Accountant in Bankruptcy or Depute Accountant in Bankruptcy must daily sign a Schedule in Form 7 listing those debtors whose estates have been sequestrated that day, and must enter the Schedule into the register of insolvencies.

(4) AiB must notify in writing debtors in respect of whom an award of sequestration has been made without delay after the award of sequestration.

(5) Where AiB refuses to award sequestration, the Accountant in Bankruptcy or Depute Accountant in Bankruptcy must complete and sign a Form 8 in respect of the debtor and without delay send a copy to the applicant, or applicants, in the debtor application.

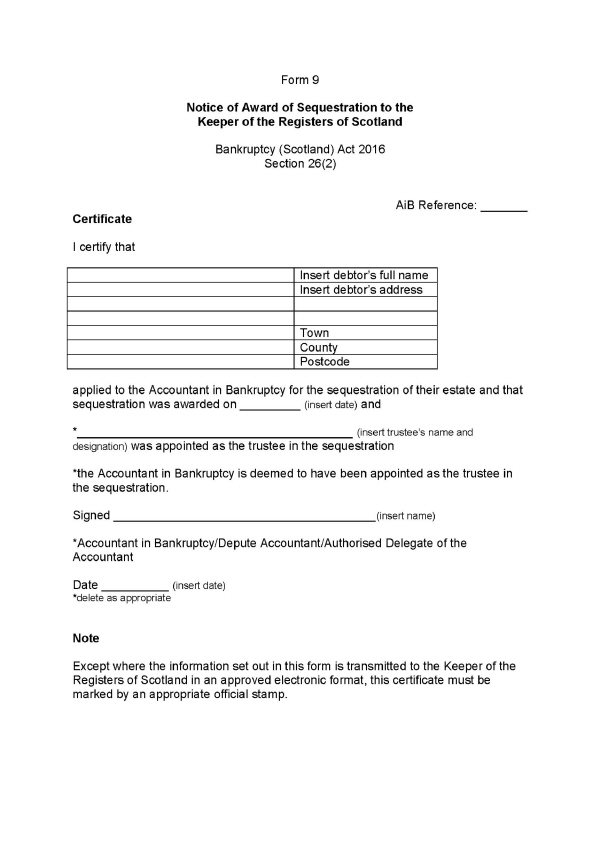

(6) Where AiB awards sequestration the certified notice of the determination to be sent by AiB to the Keeper for recording in terms of section 26(2) of the Act must be in Form 9 and the certification is to be by the Accountant in Bankruptcy, Depute Accountant in Bankruptcy or any other person authorised by the Accountant in Bankruptcy to certify the notice of the determination on behalf of the Accountant in Bankruptcy.

(7) A certified notice containing an electronic signature, in a form to be agreed between AiB and the Keeper, of a determination referred to in paragraph (6) may be sent by AiB to the Keeper electronically M18.

Marginal Citations

M18This regulation re-enacts, with modifications, regulation 5 of the 2014 Regulations.

“Minimal Asset Process” debtors to whom section 2(2) of Act applies: prescribed paymentsS

13.—(1) The payments specified in paragraph (2) are prescribed for the purposes of section 2(2)(a)(ii) of the Act (criteria for sequestration where debtor has minimal assets).

(2) Where the debtor has no other income (than from any of these payments) at the date of making his or her debtor application—

(a)universal credit under Part 1 of the Welfare Reform Act 2012 M19;

(b)another income-related benefit (as defined in section 191 of the Social Security Administration Act 1992 M20);

(c)an income-based jobseeker's allowance, as defined by section 1(4) of the Jobseekers Act 1995 M21;

(d)state pension credit under the State Pension Credit Act 2002 M22;

(e)child tax credit under the Tax Credits Act 2002 M23; or

(f)an income-related allowance under Part 1 of the Welfare Reform Act 2007 M24 (employment and support).

Marginal Citations

M201992 c.5. This definition, and the relevant provisions are repealed by Part 1 of Schedule 14 to the Welfare Reform Act 2012 (c.5) subject to saving and transitional provisions.

M211995 c.18, repealed by Part 1 of Schedule 14 to the Welfare Reform Act 2012 (c.5), subject to saving and transitional provisions.

“Minimal Asset Process” debtors to whom section 2(2) of Act applies: total assetsS

14. The amount of £2,000 is prescribed for the purposes of paragraph 2(5)(a) of schedule 1 of the Act (total value of debtor's assets after date of debtor application for AiB duty to consider whether paragraph 1 of that schedule should cease to have effect).

PART 3SDebtor's contribution

116Common financial toolS

15.—(1) The specified method to be used to assess the debtor's contribution in accordance with paragraphs (2) to (11) and regulations 16 and 17 (“the common financial tool”) is the Common Financial Statement.

(2) Subject to paragraphs (3) and (7), the debtor's contribution is to be the debtor's whole surplus income (assessed for instance weekly, fortnightly or monthly in accordance with the Common Financial Statement) in excess of the lower of—

(a)the trigger figures for a reasonable amount of the debtor's expenditure published from time to time as part of the Common Financial Statement; or

(b)the debtor's expenditure over that period (for each relevant Common Financial Statement category of expenditure).

(3) AiB, the trustee on variation or removal under section 95 of the Act, the court, or the trustee acting under a protected trust deed—

(a)may allow an amount of expenditure to the debtor which exceeds those trigger figures if satisfied that the expenditure is reasonable; and

(b)must allow the debtor to decide to retain an additional amount of income in accordance with regulation 16 towards contingencies which may arise.

(4) In determining what is reasonable under paragraph (3)(a), evidence of why the expenditure is reasonable must be provided, or supplied by the debtor on request, to satisfy AiB, the trustee or court with regard to that evidence and any explanation provided.

(5) Insofar as the income and expenditure of any other person may be taken into account in the Common Financial Statement, if either income or expenditure is so taken into account, both the income and the expenditure of that person must be taken into account.

(6) In calculating the debtor's income where she or he is paid regularly by a period other than a week, fortnight or month, the debtor's income shall be the income for that period times such multiplier as converts the period into a year divided by 52, 26 or 12 as the case may be.

(7) If the debtor has income solely from social security benefits and tax credits, no contribution is due.

(8) If the expenditure amount so determined is less than the total amount of any income received by the debtor by way of guaranteed minimum pension (within the meaning of the Pension Schemes Act 1993 M25) that income amount shall be allowed instead.

(9) The expenditure amount determined under paragraph (3)(a) must be sufficient to allow for—

(a)aliment for the debtor;

(b)any obligation of aliment owed by the debtor (“obligation of aliment” having the same meaning as in the Family Law (Scotland) Act 1985 M26);

(c)any obligation of the debtor to make a periodical allowance to a former spouse or former civil partner; and

(d)any obligation of the debtor to pay child support maintenance under the Child Support Act 1991 M27.

(10) The amount referred to in paragraph (9)(b) and (c) need not be sufficient for compliance with a subsisting order or agreement as regards the aliment or periodical allowance.

(11) Any person applying the common financial tool must have regard to guidance issued by AiB on—

(a)the treatment of types of income and expenditure under paragraph (3);

(b)how income and expenditure are to be verified by the money adviser and the trustee; and

(c)the conduct of money advisers in carrying out their functions under the Act in relation to the common financial tool.

Common financial tool: contingency allowanceS

16.—(1) The amount of income which the debtor may decide to retain towards contingencies under regulation 15(3)(b) is—

(a)up to 10% of the weekly, fortnightly or monthly (or the equivalent amount for another period) debtor's contribution assessed under regulation 15, before any calculation is made under this regulation for the purposes of regulation 15(3)(b);

(b)subject to a maximum amount of £4.62 per week, £9.23 per fortnight, £20 per month or the equivalent maximum for such other period, as the case may be.

(2) The amount to be retained under paragraph (1) must be treated as an item of expenditure for the purposes of the relevant form setting out the debtor's expenditure in applying the common financial tool M28.

Marginal Citations

M28Form 1 in schedule 1; Form 2A in the Protected Trust Deeds (Forms) (Scotland) Regulations 2016 (S.S.I. 2016/398); and Form 1 of the Debt Arrangement Scheme (Scotland) Regulations 2011 (S.S.I. 2011/141), as amended by S.S.I. 2014/294.

Common financial tool: supporting statements and evidenceS

17.—(1) Any debtor application, initial proposals under section 90(2) of the Act, or application for review or appeal of the debtor's contribution under section 92 or 97 of the Act must contain or be accompanied by a statement—

(a)that the money adviser or trustee, as the case may be, assessed the debtor's expenditure against the Common Financial Statement; and

(b)explaining any instance in which those trigger figures are exceeded.

(2) Any such statement setting out expenditure in excess of the trigger figures must be accompanied by evidence of why any expenditure allowed that exceeds the trigger figures is reasonable.

(3) Paragraphs (1) and (2) do not apply to an application for review or appeal mentioned in paragraph (1) by an interested person other than the debtor or the trustee.

(4) Any statement for the purposes of assessment by the common financial tool that there has been a change in the debtor's financial circumstances must be accompanied by evidence that the debtor's circumstances were not as they were when last assessed for those purposes.

Money Advice Trust licence requirements: reportS

18. Where it appears to AiB that in using the Common Financial Statement to advise on completion of a debtor application a money adviser has contravened a licence requirement imposed by the Money Advice Trust, AiB may notify the Trust of that matter.

Debtor contribution ordersS

19.—(1) A debtor contribution order under section 90(1)(a) of the Act must be in Form 17.

(2) A debtor contribution order under section 90(1)(b) of the Act must be in Form 18.

Deduction from debtor's earnings and other incomeS

20.—(1) This regulation applies where an instruction to make deductions of specified amounts from the debtor's earnings or other income and payments to the trustee of the amounts so deducted is given by a debtor or trustee under section 94(2) or (4) of the Act.

(2) Except in the case of a subsequent variation under paragraph (7)—

(a)an instruction given by the debtor under section 94(2) must be in Form 19; and

(b)an instruction given by the trustee under section 94(4) must be in Form 20.

(3) On delivery of the instruction and while the instruction is in effect, the—

(a)person by whom the debtor is employed; or

(b)third person required to pay to the trustee money otherwise due to the debtor by way of income (“third person”),

must deduct the sum specified in the instruction on every pay day or day on which a payment is to be made to the debtor, as the case may be, and pay the sum deducted to the trustee as soon as it is reasonably practicable to do so.

(4) Where an employer or third person fails without good cause to make a payment due under an instruction, the employer or third person is—

(a)liable to pay on demand by a trustee the amount that should have been paid; and

(b)not entitled to recover from a debtor the amount paid to the debtor in breach of the instruction.

(5) An employer or third person may on making a payment due under an instruction charge a fee equivalent to the fee chargeable for the time being under section 71 of the Debtors (Scotland) Act 1987 M29 (employer's fee for operating diligence against earnings) and deduct that fee from the balance due to the debtor.

(6) The trustee must, without delay after the end of the payment period for the debtor under section 91 of the Act, notify in writing any person who has received an instruction in accordance with paragraph (2) (or varied in accordance with paragraph (7)) that the instruction has been recalled.

(7) Following any change to the debtor's contribution, the debtor or trustee may give a variation instruction under section 94(2) or (4) of the Act in accordance with that change to the instruction mentioned in paragraph (2) in Form 21 to the employer or third person.

Marginal Citations

M291987 c.18. A sum was specified in S.S.I. 2006/116.

PART 4SAdministration of sequestration

Claims in foreign currencyS

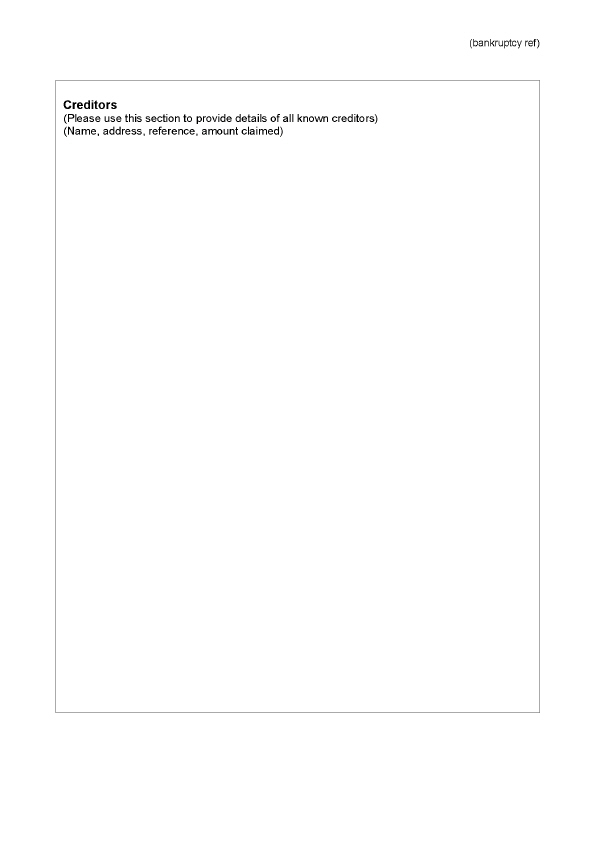

21. A creditor may state the amount of that creditor's claim in a foreign currency for the purposes of section 46(6) or 125(1) of the Act—

(a)where the claim is constituted by decree or other order made by a court ordering the debtor to pay to the creditor a sum expressed in a foreign currency; or

(b)where the claim is not so constituted, it arises from a contract or bill of exchange in terms of which payment is or may be required to be made by the debtor to the creditor in a foreign currency M30.

Marginal Citations

M30This regulation re-enacts, with modifications, regulation 10 of the 2014 Regulations.

Conversion of foreign currency claimsS

[F422. For the purposes of sections 48(1)(a) and 126(5) of the Act, the manner of conversion into sterling of the amount of a claim stated in foreign currency is to be at a single exchange rate for that currency determined by the trustee with reference to the exchange rates prevailing at the close of business on the date of sequestration.]

Textual Amendments

F4Reg. 22 substituted (1.5.2017) by The Bankruptcy and Protected Trust Deeds (Miscellaneous Amendments) (Scotland) Regulations 2017 (S.S.I. 2017/136), regs. 1, 2(2)

Trustee resignation applicationS

23. An application under section 69(1) of the Act by a trustee for authority to resign must be in Form 14 M31.

Marginal Citations

M31This regulation re-enacts regulation 12 of the 2014 Regulations.

Abandonment of heritable property by trusteeS

24.—(1) Where a trustee in sequestration has abandoned to the debtor any heritable property, notice of abandonment for the purposes of section 87(8) of the Act must be—

(a)where the trustee is not AiB, in Form 15; or

(b)where AiB is the trustee, in Form 16.

(2) Where AiB records a certified copy notice of abandonment under section 87(9) of the Act, it may be sent electronically to the Keeper containing an electronic signature in a form to be agreed between AiB and the Keeper.

(3) The Accountant in Bankruptcy, Depute Accountant in Bankruptcy or any other person authorised by the Accountant in Bankruptcy must certify such a copy on behalf of AiB M32.

Marginal Citations

M32This regulation re-enacts regulation 13 of the 2014 Regulations.

Financial educationS

25. The course of financial education prescribed for the purposes of section 117(1) of the Act is—

(a)the Scottish Financial Education Module learning materials divided into sections and published under that title by Money Advice Scotland M33; or

(b)all of the sections of that Module except for any section where the debtor's circumstances indicate the debtor does not require financial education on the topic of that section, in relation to any of the following topics—

(i)budgeting and financial planning;

(ii)saving;

(iii)borrowing;

(iv)insurance;

(v)tax;

(vi)financial life stages (financial considerations in relation to renting or buying a home, having a baby and loss of employment);

(vii)welfare benefits.

Marginal Citations

M33Money Advice Scotland is a company registered in Scotland with registered number SC137717, registered charity in Scotland registration number SC005663. The Scottish Financial Education Module is available at http://www.moneyadvicescotland.org.uk/.

Interest on claims in sequestrationS

26.— [F5(1)] The prescribed rate of interest for the purposes of section 129(10)(a) of the Act (interest on preferred debts and ordinary debts between the date of sequestration and the date of payment of the debt) is [F6an annual rate of 2 percentage points above the Bank of England base rate that applies on the date of sequestration].

[F7(2) In paragraph (1), “Bank of England base rate” means—

(a)except where sub-paragraph (b) applies, the percentage rate announced from time to time by the Monetary Policy Committee of the Bank of England as the official dealing rate, being the rate at which the Bank is willing to enter into transactions for providing short-term liquidity in the money markets, or

(b)where an order under section 19 of the Bank of England Act 1998 (reserve powers) is in force, any equivalent percentage rate determined by the Treasury under that section.]

Textual Amendments

F5Reg. 26 renumbered as reg. 26(1) (6.4.2024) by The Bankruptcy (Scotland) Amendment Regulations 2024 (S.S.I. 2024/48), regs. 1, 2(2)

F6Words in reg. 26(1) substituted (6.4.2024) by The Bankruptcy (Scotland) Amendment Regulations 2024 (S.S.I. 2024/48), regs. 1, 2(3)

F7Reg. 26(2) inserted (6.4.2024) by The Bankruptcy (Scotland) Amendment Regulations 2024 (S.S.I. 2024/48), regs. 1, 2(4)

Certificate of deferral of debtor's dischargeS

27. A certificate deferring indefinitely the discharge of the debtor under section 141(4)(b) or (6)(b) of the Act (where the debtor cannot be traced) must be in Form 30 M34.

Marginal Citations

M34This regulation re-enacts regulation 19 of the 2014 Regulations.

Premium of bond of cautionS

28. Any premium (or a proportionate part of any premium) of any bond of caution or other security required to be given by an insolvency practitioner in respect of the practitioner's actings as interim trustee or trustee in any sequestration in which the practitioner is elected or appointed may be taken into account as part of that practitioner's outlays in that sequestration M35.

Marginal Citations

M35This regulation re-enacts regulation 20 of the 2014 Regulations.

PART 5SMoratorium on diligence

Moratorium on diligence: notice of intention to applyS

29.—(1) A notice given by a person for the purposes of section 195(1) of the Act (notice of intention to make debtor application, protect trust deed or apply to the Debt Arrangement Scheme) must be in Form 33.

(2) A notice given by a person for the purposes of section 196(1) of the Act (notice of intention to apply: sequestration of estate under section 6) must be in Form 34.

PART 6SRegister of Insolvencies

Register of InsolvenciesS

30.—(1) The register of insolvencies maintained by AiB under section 200(1)(c) of the Act is to be in the form specified in schedule 2.

(2) Information need not be included in the register of insolvencies where AiB is of the opinion that inclusion of the information would be likely to put any person at risk of violence or otherwise jeopardise the safety or welfare of any person.

PART 7SLimited partnerships

Application of Bankruptcy (Scotland) Act 2016 to limited partnershipsS

31.—(1) The application of the Act to the sequestration of the estate of a limited partnership is subject to the modifications specified in this regulation.

(2) Any reference in the Act or in legislation made under it (unless the context suggests otherwise) to a partnership (other than in section 6(1)) or to a firm shall be construed as including a reference to a limited partnership.

(3) In the application of section 15 of the Act (jurisdiction) to limited partnerships—

(a)AiB has jurisdiction if a limited partnership is registered in Scotland and has a place of business in Scotland; and

(b)the sheriff has jurisdiction if a limited partnership is registered in Scotland and has a place of business within the sheriff's sheriffdom.

(4) Without prejudice to the provisions of sections 26(1), 27(11) and 30(9) of the Act, the sheriff clerk must send a copy of every court order mentioned in those sections to the Registrar of Limited Partnerships in Scotland.

(5) In the case of a debtor application by a limited partnership, AiB must send a copy of the determination to the Registrar of Limited Partnerships in Scotland M36.

Marginal Citations

M36This regulation re-enacts regulation 8 of the 2014 Regulations.

PART 8SRevocations and sequestrations and trust deeds before 30th November 2016

RevocationsS

32. The Regulations specified in schedule 3 are revoked to the extent mentioned in the second column of that schedule, subject to regulation 33.

Sequestrations and trust deeds before 30th November 2016S

33. These Regulations have no effect in relation to—

(a)sequestrations as regards which the petition was presented or the debtor application was made before, or

(b)trust deeds executed before,

30th November 2016.

Moratorium on diligence: notice of intention to apply under Bankruptcy (Scotland) Act 2016S

34. For the avoidance of doubt, notice given under section 4A or 4B of the Bankruptcy (Scotland) Act 1985 before 30th November 2016 is treated as validly given after that date notwithstanding that it refers to an application for sequestration under the Bankruptcy (Scotland) Act 2016 rather than under that Act of 1985.

PAUL WHEELHOUSE

Authorised to sign by the Scottish Ministers

St Andrew's House,

Edinburgh

Regulation 3

SCHEDULE 1SFORMS

LIST OF FORMS TO BE USEDS

| Form | Purpose | Relevant provisions of the Act | Relevant provision of the Regulations | Form consolidated |

|---|---|---|---|---|

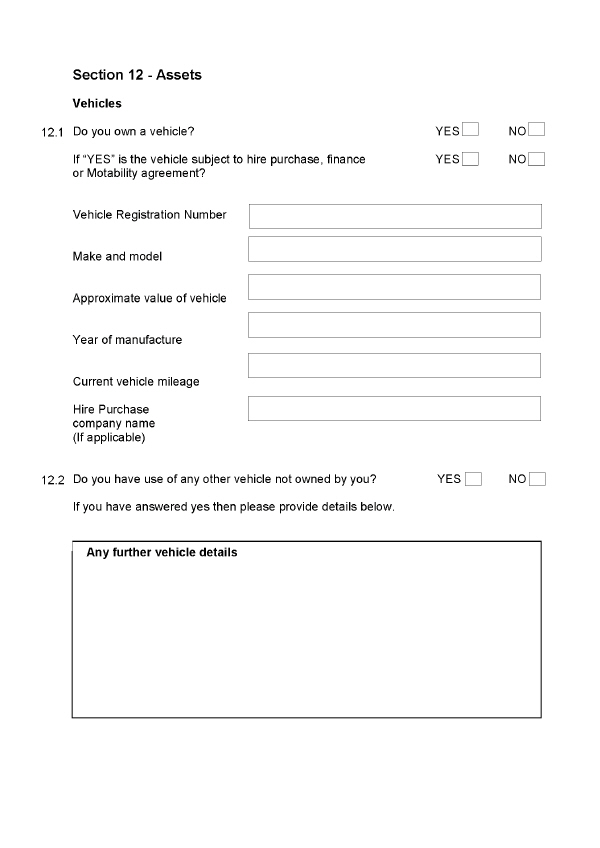

| F8F9F101 | Debtor Application | Sections 2(1)(a), 5(a), 8(3)(a), 224(3)(c) and 228(1) | Regulation 12(1)(a) | Form 14 |

| 2 | Certificate for sequestration | Section 9 | Regulation 8(1) | S.S.I. 2010/397, amended by S.S.I. 2014/296. |

| 3 | Debtor Application (Trust, Partnership etc.) | Sections 6(3)(a), (4)(b) and (7)(a) and 8(3)(a) and 228(1) | Regulation 12(1)(b) | Form 15 |

| 4 | Statement of Assets and Liabilities (Trusts, Partnerships etc.) | Sections 6(9), 8(3)(a) and 228(1) | Regulation 12(1)(b) | Form 16 |

| 5 | Statutory Demand for Payment of Debt | Section 16(1)(i) | Regulation 3 | Form 2 |

| 6 | Oath By Creditor | Section 19(1) | Regulation 3 | Form 3 |

| 7 | Form of Schedule of Award of Sequestration on Application by Debtor or Executor | Section 22(1) and (2) | Regulation 12(3) | Form 18 |

| F118 | Form of Refusal of Award of Sequestration | Section 22 | Regulation 12(5) | Form 19 |

| 9 | Notice of Award of Sequestration to the Keeper | Section 26(2) | Regulation 12(6) | Form 20 |

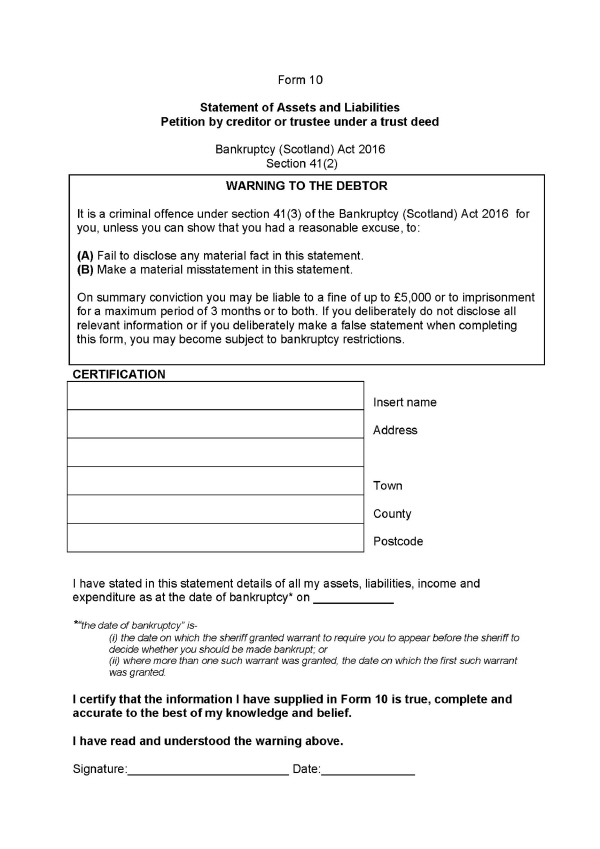

| 10 | Statement of Assets and Liabilities Petition by creditor or trustee under a trust deed | Section 41(2) and 228(1) | Regulation 3 | Form 4 |

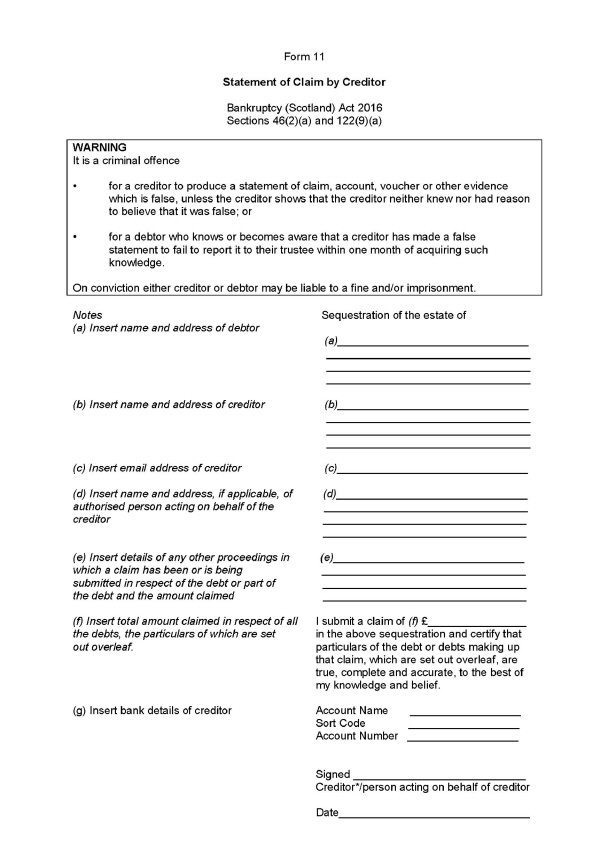

| F12F1311 | Statement of Claim by Creditor | Sections 46(2)(a) and 122(9)(a) | Regulation 3 | Form 5 |

| 12 | Form of Undertaking to act as Trustee in Sequestration on the Application of a Debtor | Section 51(8) and (9) | Regulation 12(2) | Form 17 |

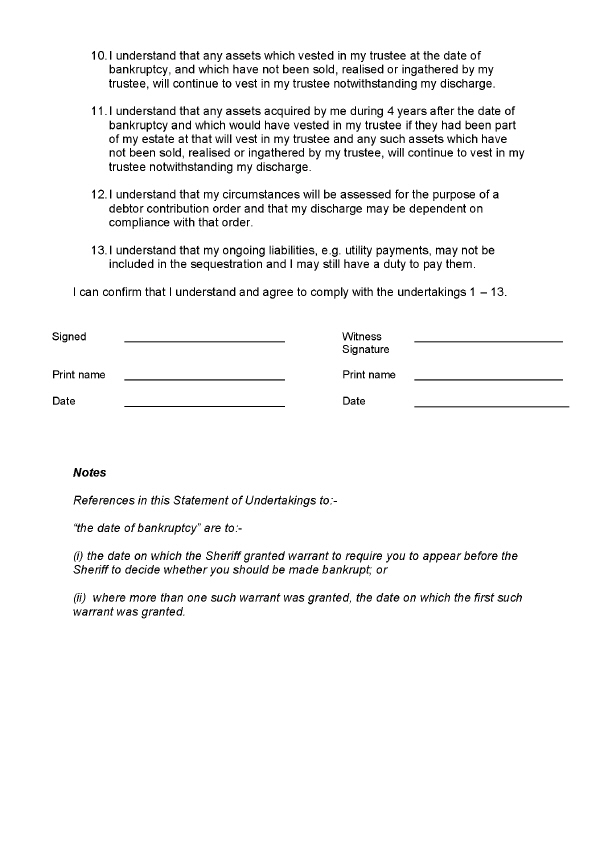

| F1413 | Statement of Undertakings | Sections 8(3)(b), 51(14), 54(4) and 228(1) | Regulation 3 | Form 1 |

| 14 | Trustee Application for Authority to Resign Office as Trustee in Sequestration | Section 69(1) | Regulation 23 | Form 21 |

| 15 | Notice of Abandonment of Heritable Property by Trustee in Sequestration where Accountant in Bankruptcy not the Trustee | Section 87(8) | Regulation 24 | Form 22 |

| 16 | Notice of Abandonment of Heritable Property where the Accountant in Bankruptcy is the Trustee | Section 87(8) | Regulation 24 | Form 23 |

| 17 | Debtor Contribution Order (Debtor Application) | Section 90(1)(a) | Regulation 19 | Form 24 |

| 18 | Debtor Contribution Order (Petition for Sequestration) | Section 90(1)(b) | Regulation 19 | Form 25 |

| 19 | Deduction from Income – Debtor's payment instruction to employer or third person | Section 94(2) and (7)(a) | Regulation 20(2)(a) | S.S.I. 2014/296, Form 1 |

| 20 | Deduction from Income – Trustee's payment instruction to employer or third person | Section 94(4) and (7)(a) | Regulation 20(2)(b) | S.S.I. 2014/296, Form 2 |

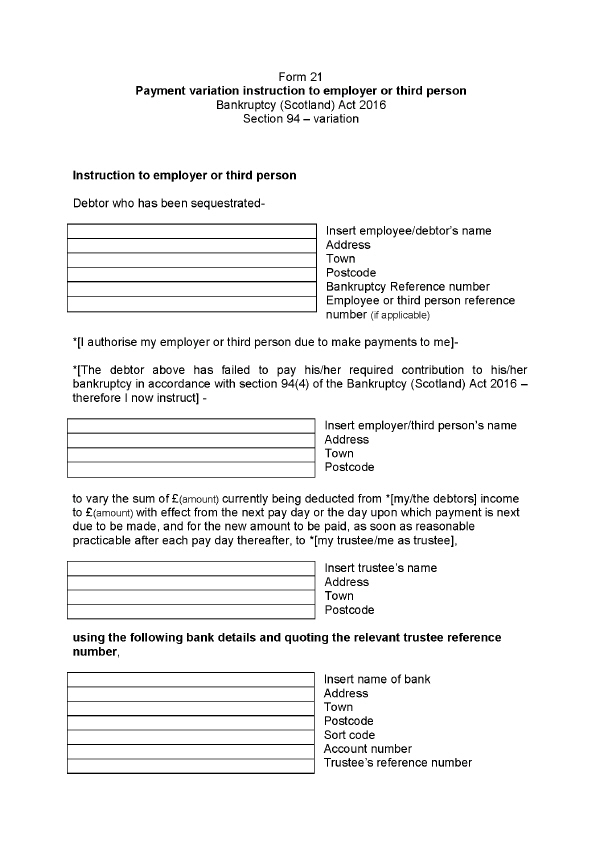

| 21 | Deduction from Income – Payment variation instruction to employer or third person | Section 94(2), (4) and (7)(a) | Regulation 20(7) | S.S.I. 2014/296, Form 3 |

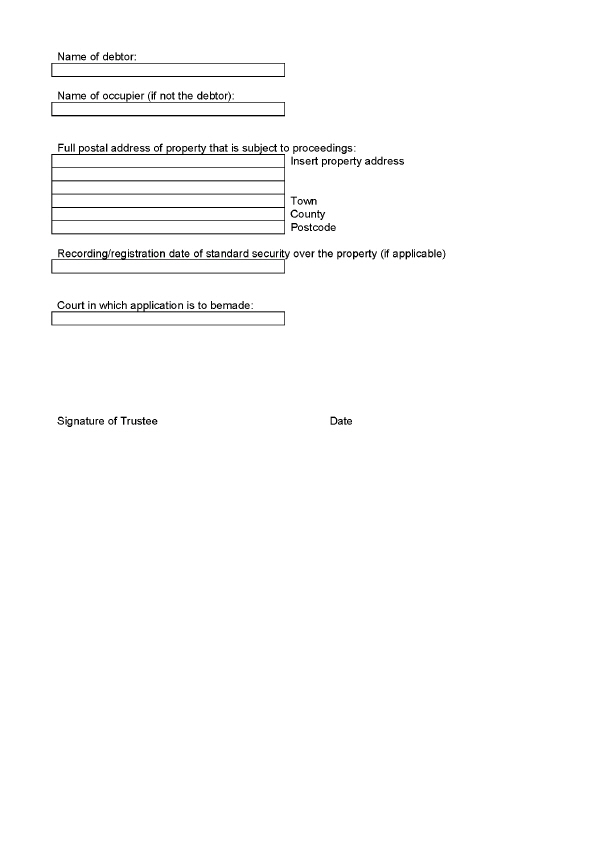

| 22 | Notice of Proceedings by Trustee to Obtain Authority in Relation to Debtor's Family Home | Section 113(4) and (5) | Regulation 3 | Form 26 |

| 23 | Debtor's Account of Current State of Affairs | Section 116(2) | Regulation 3 | Form 27 |

| 24 | Notice by Trustee: Public Examination of the Debtor or a Relevant Person | Section 119(6)(a) | Regulation 3 | Form 6 |

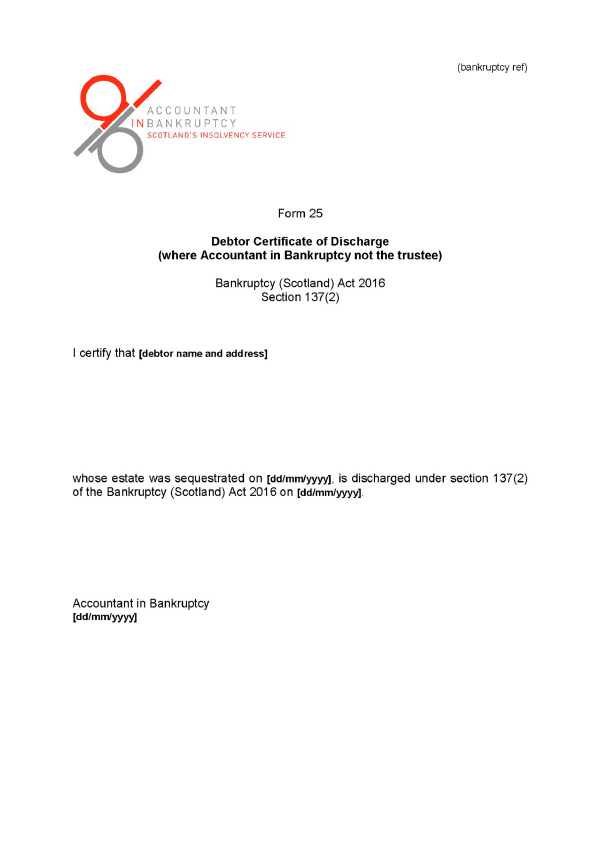

| 25 | Debtor Certificate of Discharge (where Accountant in Bankruptcy not the trustee) | Section 137(2) | Regulation 3 | Form 7 |

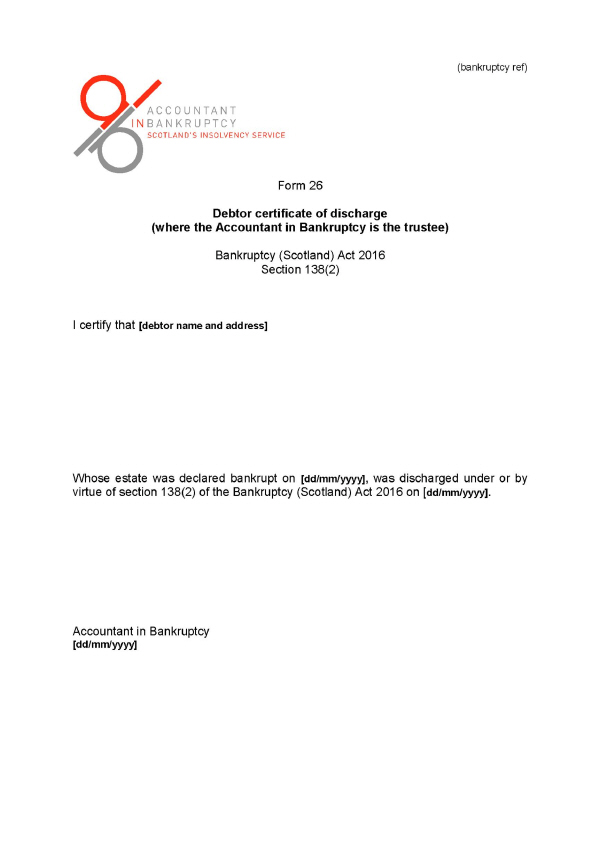

| F15F1626 | Debtor Certificate of Discharge (where Accountant in Bankruptcy is the trustee) | Section 138(2) | Regulation 3 | Form 8 |

| F1727 | Debtor Certificate of Discharge (debtor to whom section 2(2) applies) | Section 140(2) | Regulation 3 | Form 9 |

| 28 | Deferral Notice | Section 141(2)(a) | Regulation 3 | Form 10 |

| 29 | Application for Deferral | Section 141(2)(c) | Regulation 3 | Form 11 |

| 30 | Certificate of Deferral of Discharge | Section 141(4)(b) or (6)(b) | Regulation 27 | Form 28 |

| 31 | Trustee Application for Authority to Resign Office: debtor not traced | Section 142(2) | Regulation 3 | Form 12 |

| 32 | Notice granting Trustee Authority to Resign Office | Section 142(5) | Regulation 3 | Form 13 |

| 33 | Moratorium – Notice of Intention to Apply | Section 195(1) | Regulation 29 | Form 29 |

| 34 | Moratorium – Notice of Intention to Apply (Trust, Partnership, etc.) | Section 196(1) | Regulation 29 | Form 30 |

Textual Amendments

F8Sch. 1 Form 1: in the Statement of Undertakings, in undertaking 2, the word “application” is substituted for “award” (1.5.2017) by The Bankruptcy and Protected Trust Deeds (Miscellaneous Amendments) (Scotland) Regulations 2017 (S.S.I. 2017/136), regs. 1, 2(3)(a)

F9sch. 1 Form 1, section 3.1a: "£25,000" substituted for "£17,000" (29.3.2021) by The Bankruptcy (Miscellaneous Amendments) (Scotland) Regulations 2021 (S.S.I. 2021/148), regs. 1, 7(2)

F10sch. 1 Form 1, undertaking 13: "the total Full Administration bankruptcy application fee" substituted for “a further £110” (29.3.2021) by The Bankruptcy (Miscellaneous Amendments) (Scotland) Regulations 2021 (S.S.I. 2021/148), regs. 1, 7(3)

F11sch. 1 Form 8: "£25,000" substituted for "£17,000" (29.3.2021) by The Bankruptcy (Miscellaneous Amendments) (Scotland) Regulations 2021 (S.S.I. 2021/148), regs. 1, 8

F12Sch. 1 Form 11: in note 4, the words “insolvency practitioner” are substituted for “liquidator” each time it occurs (26.6.2017) by The Insolvency (Regulation (EU) 2015/848) (Miscellaneous Amendments) (Scotland) Regulations 2017 (S.S.I. 2017/210), regs. 1, 7(2) (with reg. 9)

F13Sch. 1 Form 11 Note 4 omitted (31.12.2020) by virtue of The Insolvency (EU Exit) (Scotland) (Amendment) Regulations 2019 (S.S.I. 2019/94), regs. 1, 7(2) (with reg. 9) (as amended by S.S.I. 2020/337, regs. 1, 2); 2020 c. 1, Sch. 5 para. 1(1)

F14Sch. 1 Form 13: after “that” in the third line of undertaking 11, the word “date” is inserted (1.5.2017) by The Bankruptcy and Protected Trust Deeds (Miscellaneous Amendments) (Scotland) Regulations 2017 (S.S.I. 2017/136), regs. 1, 2(3)(b)

F15Sch. 1 Form 26: for the title to the notes, the words “Debtor certificate of discharge (where the Accountant in Bankruptcy is the trustee)” are substituted for “Debtor certificate of discharge” (1.5.2017) by The Bankruptcy and Protected Trust Deeds (Miscellaneous Amendments) (Scotland) Regulations 2017 (S.S.I. 2017/136), regs. 1, 2(3)(c)(i)

F16Sch. 1 Form 26: in the notes, at the third bullet point of (1), the words “justice of the peace court (or a district court)” are substituted for “district court” (1.5.2017) by The Bankruptcy and Protected Trust Deeds (Miscellaneous Amendments) (Scotland) Regulations 2017 (S.S.I. 2017/136), regs. 1, 2(3)(c)(ii)

F17Sch. 1 Form 27: the word “2016” is substituted for “1985 (as amended)” (1.5.2017) by The Bankruptcy and Protected Trust Deeds (Miscellaneous Amendments) (Scotland) Regulations 2017 (S.S.I. 2017/136), regs. 1, 2(3)(d)

Regulation 30

SCHEDULE 2SREGISTER OF INSOLVENCIES

A. Sequestrations

Name of debtor

Debtor's date of birth (where known)

Debtor's residence and any former residence within the past 5 years and principal place of business (if any) at date of sequestration or date of death

Date of death in case of deceased debtor

Occupation of debtor

Whether sequestration awarded by sheriff or by AiB

Date of any order converting protected trust deed to sequestration

Whether sequestration under paragraph 1 of schedule 1 of the Act (the Minimal Asset Process (“MAP”))

Name and address of petitioner for sequestration (where applicable)

Court by which sequestration awarded (where applicable)

Date of presentation of petition (where applicable)

Date of first order (where applicable)

Date of award of sequestration

Particulars of petition for recall of sequestration M37 (where applicable)

Date of recall of sequestration (where applicable)

Name and address of trustee and date of appointment

Level of debt when trustee's statement of debtor's affairs is produced

Level of assets when trustee's statement of debtor's affairs is produced

Name and address of trustee (or replacement trustee) and date of confirmation of appointment

Particulars of notice of public examination of debtor or relevant person M38 (where applicable)

If the MAP ceases to apply

Issue of certificate deferring debtor's discharge indefinitely M39 (where applicable)

Particulars of any application for removal of trustee M40 and any order removing trustee or declaring office vacant

Date of debtor's discharge and whether on composition or by operation of law

Date of trustee's discharge M41 and of any decision to grant or refuse certificate of discharge

Period of any MAP bankruptcy credit restriction following discharge M42

Marginal Citations

M37As provided for in section 29(5) of the Act.

M38As provided for in section 119(7) of the Act.

M39As provided for in section 141(7) of the Act.

M40As provided for in section 70(4)(b) of the Act.

M41As required by section 149(8)(a) of the Act.

M42Under section 146 or 147 of the Act.

B. Protected trust deeds for creditors

Name and address of granter of trust deed

Granter's date of birth (where known)

Address of the centre of main interests and all establishments, within the meaning of the [F18Regulation (EU) 2015/848] [F19(as it forms part of domestic law on and after exit day)], of the granter of the trust deed,F20...

Whether the protected trust deed is considered to be main or territorial proceedings within the meaning of the said [F21EU] Regulation

The location and nature of any other insolvency proceedings

Name and address of trustee under deed

Date (or dates) of execution of deed

Date on which copy deed and certificate of accession was registered

Date of registration of statement indicating how the estate was realised and distributed and certificate to the effect that the distribution was in accordance with the trust deed

Date of trustee's discharge

Date of registration of copy of order of court that non-acceding creditor is not bound by trustee's discharge

Textual Amendments

F18Words in sch. 2 substituted (26.6.2017) by The Insolvency (Regulation (EU) 2015/848) (Miscellaneous Amendments) (Scotland) Regulations 2017 (S.S.I. 2017/210), regs. 1, 7(3)(a) (with reg. 9)

F19Words in sch. 2 inserted (31.12.2020) by The Insolvency (EU Exit) (Scotland) (Amendment) Regulations 2019 (S.S.I. 2019/94), regs. 1, 7(3)(a) (with reg. 9) (as amended by S.S.I. 2020/337, regs. 1, 2); 2020 c. 1, Sch. 5 para. 1(1)

F20Words in sch. 2 omitted (31.12.2020) by virtue of The Insolvency (EU Exit) (Scotland) (Amendment) Regulations 2019 (S.S.I. 2019/94), regs. 1, 7(3)(b) (with reg. 9) (as amended by S.S.I. 2020/337, regs. 1, 2); 2020 c. 1, Sch. 5 para. 1(1)

F21Word in sch. 2 substituted (26.6.2017) by The Insolvency (Regulation (EU) 2015/848) (Miscellaneous Amendments) (Scotland) Regulations 2017 (S.S.I. 2017/210), regs. 1, 7(3)(b) (with reg. 9)

C. Bankruptcy Restrictions Orders, Interim Bankruptcy Restrictions Orders and Bankruptcy Restrictions Undertakings

Name of debtor

Debtor's date of birth (where known)

Date of sequestration

Date of making of bankruptcy restrictions order or interim bankruptcy restrictions order

Date of acceptance of bankruptcy restrictions undertaking

Date of order varying bankruptcy restrictions order or bankruptcy restrictions undertaking (where applicable)

Date of annulment or revocation of bankruptcy restrictions order or bankruptcy restrictions undertaking (where applicable)

Date of discharge of bankruptcy restrictions undertaking (where applicable)

Date bankruptcy restrictions order, interim bankruptcy restrictions order or bankruptcy restrictions undertaking ceased to have effect

D. Moratorium

Notice of intention to apply – moratorium on diligence M43 (where applicable)

Marginal Citations

M43As provided for in section 195(1) or 196(1) of the Act.

E. Winding up and receivership of business associations

Company number

Company name

Type of proceedings

Name of office holder(s)

Date of appointment of office holder(s)

Date of termination of appointment of office holder(s)

Date of winding-up order (for compulsory liquidations)

Court by which company wound up

Regulation 32

SCHEDULE 3SREVOCATIONS

| Regulations revoked | Extent of revocation | References |

|---|---|---|

| The Bankruptcy (Certificate for Sequestration) (Scotland) Regulations 2010 | The whole instrument. | S.S.I. 2010/397, amended by S.S.I. 2014/296. |

| The Bankruptcy (Scotland) Regulations 2014 | Regulations 2(2) to 20, 22 to 24 and the schedules. | S.S.I. 2014/225, amended by S.S.I. 2015/80. |

| The Bankruptcy (Miscellaneous Amendments) (Scotland) Regulations 2015 | Regulation 2. | S.S.I. 2015/80 |

| The Common Financial Tool etc. (Scotland) Regulations 2014 | Regulations 1 to 5 and 11. | S.S.I. 2014/290 amended by S.S.I. 2015/149. |

| The Common Financial Tool etc. (Scotland) Amendment Regulations 2015 | The whole instrument. | S.S.I. 2015/149 |

| The Bankruptcy (Money Advice and Deduction from Income etc.) (Scotland) Regulations 2014 | The whole instrument. | S.S.I. 2014/296. |

Explanatory Note

(This note is not part of the Regulations)

These Regulations prescribe matters which fall to be prescribed by the Scottish Ministers under the Bankruptcy (Scotland) Act 2016 which consolidates Scottish bankruptcy legislation (“the Act”).

They apply from 30th November 2016 to sequestrations where the creditor petition for sequestration is presented, or the debtor application for sequestration is received by the Accountant in Bankruptcy (“AiB”), on or after that date (see section 236 of the Act).

They re-enact, with modifications, provisions of the Bankruptcy (Certificate for Sequestration) (Scotland) Regulations 2010, the Bankruptcy (Scotland) Regulations 2014, the Common Financial Tool etc. (Scotland) Regulations 2014, and the Bankruptcy (Money Advice and Deduction from Income etc.) (Scotland) Regulations 2014.

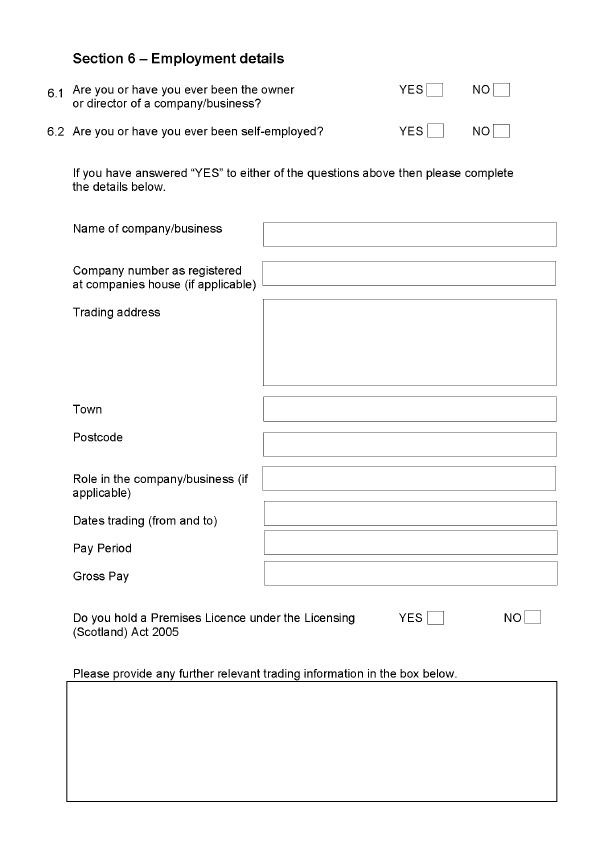

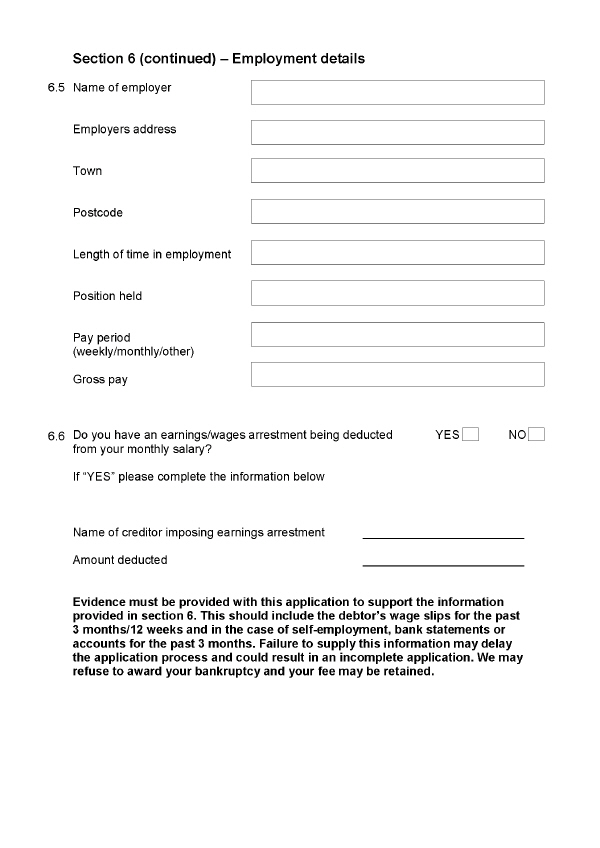

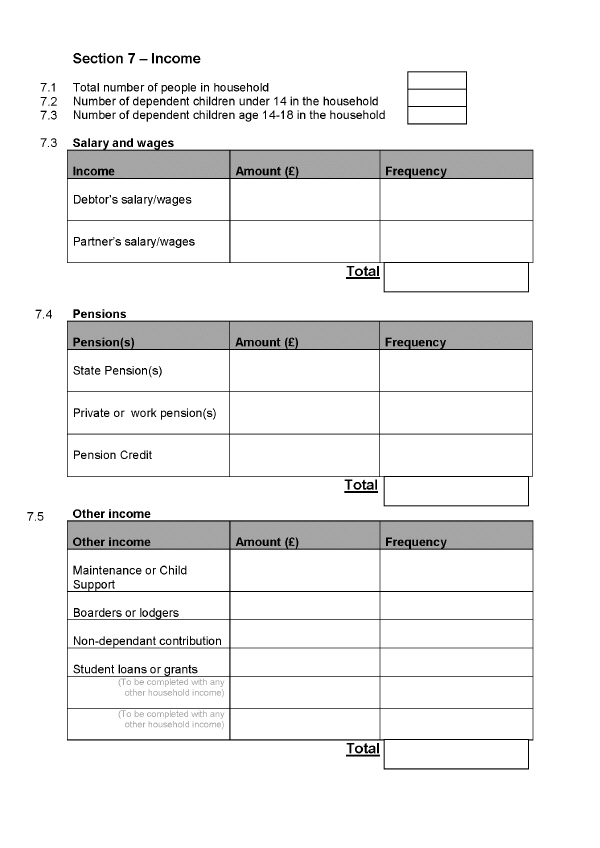

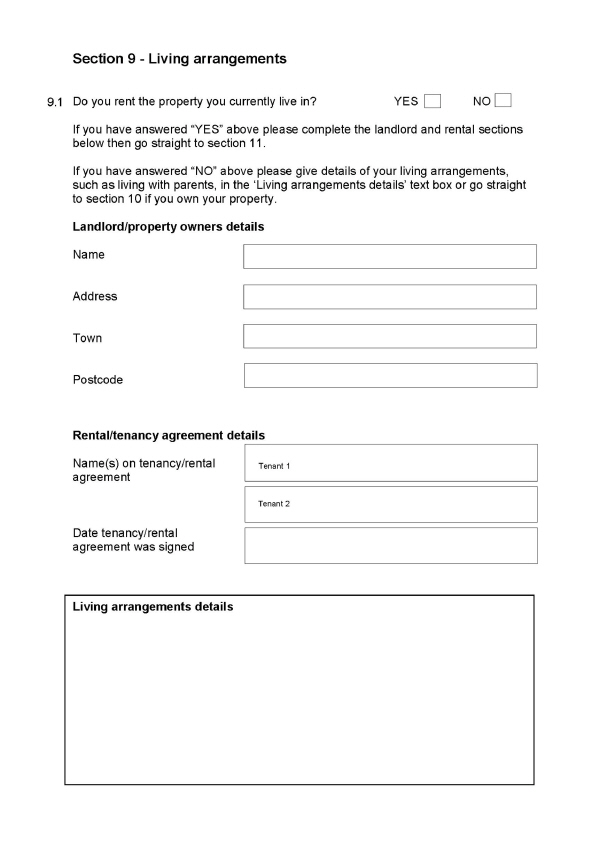

Regulation 3 and schedule 1 provide for the main forms to be used in relation to sequestration.

Regulation 4 prescribes persons who can act as money advisers in relation to sequestration, including the classes of—

insolvency practitioners and persons who work for them who have been given authority by the insolvency practitioner to act on behalf of that insolvency practitioner

persons approved for the purposes of the Debt Arrangement Scheme

persons working as money advisers for organisations awarded Type 2 against Scottish National Standards for Information and Advice Provision, full bureau members of the Scottish Association of Citizens Advice Bureaux – Citizens Advice Scotland; or councils.

Regulation 5 provides for who may not be a money adviser, including those whose approval is revoked by AiB in specific cases.

Regulation 6 prescribes additional matters on which debtors must obtain money advice in making a debtor application (an application made by a debtor to the Accountant in Bankruptcy for an award of sequestration under the Act). Regulation 7 sets out procedural requirements for obtaining money advice in connection with such a debtor application.

Regulations 8 to 10 provide for a Certificate for Sequestration of a debtor's estate by money advisers who certify the debtor has demonstrated he or she is unable to pay his or her debts as they become due. A money adviser is entitled to rely on statements and paperwork provided by the debtor, in particular information provided as to financial circumstances declared in the form, which can be included in the debtor application. The prescribed period for granting a certificate is the 30 days before the date on which a debtor may apply (see section 2(10) of the Act). This is intended to allow flexibility to sign the certificate and debtor application on the same day.

Regulation 11 provides for when a debtor must be provided with a debt advice and information package prior to presentation of a creditor petition for sequestration.

Regulation 12 makes procedural provision for debtor applications.

Regulation 13 provides for “prescribed payments” of social security benefits as part for the criteria for eligibility for the Minimal Asset Process (“MAP”) where the debtor has few assets under section 2(2) of the Act. Regulation 14 lowers the total amount of assets a debtor may have before AiB is to consider whether the MAP ceases to apply to a debtor.

Part 3 of the Regulations makes provision for about the method for determining an appropriate amount of a living debtor's income to be paid to a trustee after sequestration of the debtor's estate, known as the “common financial tool” – see section 89 of the Act. It is used in making debtor contribution orders under Part 6 of the Act which fix the contribution a debtor must pay from income received after sequestration for the benefit of creditors.

Regulations 15 to 16 provide for the common financial tool, how income and expenditure of the debt is established by reference principally to the Common Financial Statement (the “CFS”) published by the Money Advice Trust. The debtor's surplus income in excess of the lower of the debtor's expenditure, or the “trigger figures” which are part of the CFS for a reasonable amount of expenditure is the basis of the contribution, and an amount of reasonable expenditure may be allowed to the debtor which exceeds those trigger figures. The debtor can retain up to an amount subject to certain limits from regular payments towards an allowance to meet contingencies which may arise for the debtor. Guidance is also to be set out by AiB on types of income and expenditure, verifying income and expenditure and money advisers' functions. Supporting statements, explanation and evidence are required (regulation 17). AiB can in some cases related to debtor applications notify the Money Advice Trust where it appears money advisers have breached licence restrictions (regulation 18).

Regulation 20 provides for instructions by the debtor or trustee under section 94 of the Act to an employer or third party due to make payment to the debtor for deductions from earnings or other income. It also provides for how the instruction affects the recipient and what happens if the employer or third person refuse to pay the deduction.

Regulation 21 prescribes the circumstances in which a creditor may state the amount of the creditor's claim in foreign currency for voting purposes at a statutory meeting and submission of claims to a trustee under sections 46 and 125 of the Act respectively.

Regulation 22 prescribes the manner in which the trustee is required to convert a creditor's claim made in foreign currency for the purposes of proceedings at a statutory meeting and the adjudication of creditors' claims under sections 48 and 126 of the Act respectively.

Regulation 24 provides for how notice is given to the debtor under section 87(8) of the Act where the trustee abandons to the debtor heritable property included in the debtor's sequestrated estate.

Regulation 25 provides for the courses of financial education which a debtor may be required to undertake by the trustee under section 117 of the Act.

Regulation 26 prescribes 8% per annum as the rate of interest to be paid on the preferred debts and the ordinary debts between the date of sequestration and the date of payment of the debt for the purposes of section 129 of the Act (order of priority in distribution of the debtor's estate).

Regulation 28 provides that the premium of any bond of caution or other security given by an insolvency practitioner in relation to acting as interim trustee or trustee may be taken into account as part of the insolvency practitioner's outlays in the sequestration.

Regulation 29 provides for forms of notice to be given by a person to trigger the moratorium on debt enforcement by diligence having effect under Part 15 of the Act.

Regulation 30 and schedule 2 re-enact provision for the register of insolvencies which AiB maintains (section 200(1)(c) of the Act refers).

Part 7 of the Regulations makes modifications of the Act in its application to limited partnerships.

Regulation 32 revokes the instruments re-enacted, subject to regulation 33 which saves provision for sequestrations where the creditor petition for sequestration is presented, or the debtor application for sequestration is received by AiB, before 30th November 2016, and for trust deeds executed before that date. For the avoidance of doubt, moratorium notices before that date of intention to apply under the Act will also be given effect to (regulation 34).

Regulation 21 of the Bankruptcy (Scotland) Regulations 2014 which restated the law on reserved matters prescribing £800 as the maximum amount which may be claimed as a preferred debt by an employee by way of remuneration or by a person under the Reserve Forces (Safeguard of Employment) Act 1985 remains in force (paragraphs 2 and 3 of schedule 3 of the Act consolidating paragraphs 5 and 6 of schedule 3 of the Bankruptcy (Scotland) Act 1985 refer).

A Business and Regulatory Impact Assessment has been prepared for these Regulations. Copies can be obtained from the Accountant in Bankruptcy's website: http://www.aib.gov.uk.

Options/Help

Print Options

PrintThe Whole Instrument

Mae deddfwriaeth ar gael mewn fersiynau gwahanol:

Y Diweddaraf sydd Ar Gael (diwygiedig):Y fersiwn ddiweddaraf sydd ar gael o’r ddeddfwriaeth yn cynnwys newidiadau a wnaed gan ddeddfwriaeth ddilynol ac wedi eu gweithredu gan ein tîm golygyddol. Gellir gweld y newidiadau nad ydym wedi eu gweithredu i’r testun eto yn yr ardal ‘Newidiadau i Ddeddfwriaeth’.

Gwreiddiol (Fel y’i Deddfwyd neu y’i Gwnaed): Mae'r wreiddiol fersiwn y ddeddfwriaeth fel ag yr oedd pan gafodd ei deddfu neu eu gwneud. Ni wnaed unrhyw newidiadau i’r testun.

Gweler y wybodaeth ychwanegol ochr yn ochr â’r cynnwys

Rhychwant ddaearyddol: Indicates the geographical area that this provision applies to. For further information see ‘Frequently Asked Questions’.

Dangos Llinell Amser Newidiadau: See how this legislation has or could change over time. Turning this feature on will show extra navigation options to go to these specific points in time. Return to the latest available version by using the controls above in the What Version box.

Policy Note

Policy Note sets out a brief statement of the purpose of a Scottish Statutory Instrument and provides information about its policy objective and policy implications. They aim to make the Scottish Statutory Instrument accessible to readers who are not legally qualified and accompany any Scottish Statutory Instrument or Draft Scottish Statutory Instrument laid before the Scottish Parliament from July 2012 onwards. Prior to this date these type of notes existed as ‘Executive Notes’ and accompanied Scottish Statutory Instruments from July 2005 until July 2012.

Rhagor o Adnoddau

Gallwch wneud defnydd o ddogfennau atodol hanfodol a gwybodaeth ar gyfer yr eitem ddeddfwriaeth o’r tab hwn. Yn ddibynnol ar yr eitem ddeddfwriaeth sydd i’w gweld, gallai hyn gynnwys:

- y PDF print gwreiddiol y fel deddfwyd fersiwn a ddefnyddiwyd am y copi print

- rhestr o newidiadau a wnaed gan a/neu yn effeithio ar yr eitem hon o ddeddfwriaeth

- manylion rhoi grym a newid cyffredinol

- pob fformat o’r holl ddogfennau cysylltiedig

- slipiau cywiro

- dolenni i ddeddfwriaeth gysylltiedig ac adnoddau gwybodaeth eraill

Llinell Amser Newidiadau

This timeline shows the different points in time where a change occurred. The dates will coincide with the earliest date on which the change (e.g an insertion, a repeal or a substitution) that was applied came into force. The first date in the timeline will usually be the earliest date when the provision came into force. In some cases the first date is 01/02/1991 (or for Northern Ireland legislation 01/01/2006). This date is our basedate. No versions before this date are available. For further information see the Editorial Practice Guide and Glossary under Help.

Rhagor o Adnoddau

Defnyddiwch y ddewislen hon i agor dogfennau hanfodol sy’n cyd-fynd â’r ddeddfwriaeth a gwybodaeth am yr eitem hon o ddeddfwriaeth. Gan ddibynnu ar yr eitem o ddeddfwriaeth sy’n cael ei gweld gall hyn gynnwys:

- y PDF print gwreiddiol y fel gwnaed fersiwn a ddefnyddiwyd am y copi print

- slipiau cywiro

liciwch ‘Gweld Mwy’ neu ddewis ‘Rhagor o Adnoddau’ am wybodaeth ychwanegol gan gynnwys

- rhestr o newidiadau a wnaed gan a/neu yn effeithio ar yr eitem hon o ddeddfwriaeth

- manylion rhoi grym a newid cyffredinol

- pob fformat o’r holl ddogfennau cysylltiedig

- dolenni i ddeddfwriaeth gysylltiedig ac adnoddau gwybodaeth eraill

The data on this page is available in the alternative data formats listed: