- Y Diweddaraf sydd Ar Gael (Diwygiedig)

- Pwynt Penodol mewn Amser (01/02/1991)

- Gwreiddiol (Fel y'i Deddfwyd)

Finance Act 1968

You are here:

- Deddfau Cyhoeddus Cyffredinol y Deyrnas Unedig

- 1968 c. 44

- Schedules only

- Dangos Graddfa Ddaearyddol(e.e. Lloegr, Cymru, Yr Alban aca Gogledd Iwerddon)

- Dangos Llinell Amser Newidiadau

Rhagor o Adnoddau

Changes over time for: Finance Act 1968 (Schedules only)

Version Superseded: 30/09/2004

Alternative versions:

- 01/02/1991- Amendment

- 01/02/1991

Point in time - 30/09/2004- Amendment

- 21/07/2008- Amendment

- 02/11/2010- Amendment

Status:

Point in time view as at 01/02/1991.

Changes to legislation:

There are currently no known outstanding effects for the Finance Act 1968.![]()

Changes to Legislation

Revised legislation carried on this site may not be fully up to date. At the current time any known changes or effects made by subsequent legislation have been applied to the text of the legislation you are viewing by the editorial team. Please see ‘Frequently Asked Questions’ for details regarding the timescales for which new effects are identified and recorded on this site.

Schedules

Schedules 1—4.U.K. . . . F1

Textual Amendments

F1Schs. 1–4 repealed by Finance Act 1969 (c. 32), s. 61(6), Sch. 21 Pt. I

Schedule 5.U.K. . . . F2

Textual Amendments

F2Sch. 5 repealed by Betting and Gaming Duties Act 1972 (c. 25), s. 29(2), Sch. 7

Schedule 6.U.K. . . . F3

Textual Amendments

F3Sch. 6 repealed by Finance Act 1972 (c. 41), ss. 54(8), 134(7), Sch. 28 Pt. II

Schedule 7.U.K. . . . F4

Textual Amendments

F4Sch. 7 repealed by Vehicles (Excise) Act 1971 (c. 10), s. 39(5), Sch. 8 Pt. I

Schedules 8—10.U.K. . . . F5

Textual Amendments

Schedules 11, 12.U.K. . . . F6

Textual Amendments

F6Schs. 11, 12 repealed (with savings) by Capital Gains Tax Act 1979 (c. 14), ss. 157(1), 158, Sch. 6 para. s. 10(2)(b), Sch. 8

Schedule 13.U.K. . . . F7

Textual Amendments

Schedule 14.U.K. . . . F8

Textual Amendments

F8Sch. 14 repealed (with savings) by Finance Act 1975 (c. 7), ss. 50, 52(2)(3), 59, Sch. 13 Pt. I

Section 41.

Schedule 15.U.K. Special Charge: Trusts

Modifications etc. (not altering text)

C1The text of ss, 40–50, 53, 60, 61(2)(7) and Schs. 15 and 16 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and, except as otherwise indicated, does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

Income out of capital, etc.U.K.

1(1)The investment income of an individual arising under a trust shall be ascertained without regard to any part of it shown to the satisfaction of the Board to be attributable to payments duly made otherwise than out of the income of the trust.U.K.

(2)For the purposes of this paragraph the income of a trust shall be ascertained without regard to—

(a)income or deductions of any description which, under section 42 of this Act, are to be left out of account in ascertaining aggregate investment income, or

(b)income from another trust which is shown to the satisfaction of the Board to be attributable to payments duly made otherwise than out of the income of that trust,

and no deduction shall be made in respect of any payment made to a beneficiary under the trust or to any person claiming under such a beneficiary.

Recovery of charge from trusteesU.K.

2(1)If the person originally chargeable has not paid the special] charge or any part of it, and so elects as respects any trust—U.K.

(a)his liability to the special charge shall be reduced by the amount, if any, attributable to the trust, and

(b)the amount so attributable shall be chargeable on the person answerable for the trust.

(2)If the person originally chargeable has paid part only of the special charge he may nevertheless make an election in accordance with sub-paragraph (1) above, but the reduction under sub-paragraph (1)(a) above in respect of the trust, or, if more than one, of all the trusts together, shall not exceed the amount remaining unpaid.

(3)An election under this paragraph shall be made by notice in writing to the Board within thirty days from the date of the notice of assessment to the special charge or such longer time as the Board may allow, and shall not be effective unless the notice contains, to the satisfaction of the Board, sufficient particulars of the trust, the names and addresses of the persons answerable for the trust, and the amount of investment income arising under the trust to the person making the election.

(4)In this and the four next following paragraphs “trust" does not include a foreign trust.

3,(1)If the person originally chargeable has paid the whole of the special charge he may recover from the person answerable for a trust the amount, if any. attributable to that trust.U.K.

(2)If the person originally chargeable has paid the part of the special charge which is not attributable to any trust, and any additional amount, he may recover from the person answerable for a trust the amount, if any, attributable to that trust, but so that the total amount recoverable, and the amount recoverable from any one trust, shall not exceed that additional amount.

4U.K.If at any time after the expiration of thirty days from the date when the special charge became due, all or any part of the special charge remains due from the person originally chargeable, then, without prejudice to the powers of recovery from that person, the amount attributable to any trust may be charged on the person answerable for the trust, but not so as to charge more than is unpaid.

5U.K.The amount with which a person answerable for a trust is chargeable under paragraph 2 or paragraph 4 above shall be due and payable by him on the issue to him of a notice of charge by the Board, and an appeal shall lie against the notice of charge in the same way as an appeal lies against an assessment to the special charge.

Income derived from another trustU.K.

6(1)This paragraph has effect where all or part of an individual’s investment income arising under a trust (in this paragraph called “the first trust”) derives from another trust (in this paragraph called “the second trust”).U.K.

(2)If—

(a)the person originally chargeable has made an election under paragraph 2 above as respects the first trust, or

(b)any amount has become chargeable on the person answerable for the first trust in accordance with paragraph 4 above,

the person answerable for the first trust may elect that for all the purposes of this Schedule the individual’s investment income deriving from the second trust shall be treated as arising under that trust, and not under the first trust, and then any election under paragraph 2 above as respects the first trust shall take effect also as an election as respects the second trust.

An election under this sub-paragraph shall be made by notice in writing to the Board within thirty days from the date of the notice of charge on the person answerable for the first trust, or such longer time as the Board may allow, and shall not be effective unless the notice contains, to the satisfaction of the Board, sufficient particulars of the second trust, the names and addresses of the persons answerable for that trust, and the amount of the individual’s investment income deriving from that trust.

(3)If the person originally chargeable has made a claim for recovery of any amount under paragraph 3 above from the person answerable for the first trust, the person answerable for the first trust may by notice in writing to the person originally chargeable require that, as respects his rights of recovery, the individual’s investment income deriving from the second trust shall be treated as arising under that trust, and not under the first trust.

A notice under this sub-paragraph shall give particulars of the names and addresses of the persons answerable for the second trust, and of the amount of the individual’s investment income deriving from the second trust.

(4)Where income arising under the second trust derives from a third trust, the person answerable for the second trust shall have the rights conferred by this paragraph as respects that income, and so on for any further trust, and in such a case references in this paragraph to the first and second trust shall be construed accordingly.

(5)For the purposes of this paragraph the amount of the individual’s income which derives from the second trust shall be that fraction of his income arising under the first trust of which—

(a)the numerator is the income arising under the second trust to the trustees of the first trust, ascertained in accordance with paragraph 1(1) above,

(b)the denominator is the total income of the first trust, ascertained in accordance with paragraph 1(2) above.

Notice to persons answerable for a trustU.K.

7(1)The person originally chargeable shall not be entitled to exercise his right under paragraph 3 above unless, not later than six months after his payment of, or of the part of, the special charge or after the making of the assessment, whichever is the later, he gave notice in writing to the person answerable for the trust of his intention to exercise any right available to him under paragraph 3 above.U.K.

(2)If notice is so given, the person answerable for the trust shall not be entitled to give a notice under paragraph 6(3) above unless, not later than one month after the receipt of the notice under this paragraph, he has given notice in writing of its receipt to the person answerable for the second trust.

(3)If an application is made to the Board in accordance with the following provisions of this paragraph, showing to their satisfaction the amount of an individual’s investment income which arises under a trust, the Board shall give to the person originally chargeable, and to the person answerable for the trust, a certificate stating the amount of the special charge attributable to the trust, and, if less, the amount recoverable from the person answerable for the trust.

(4)An application under sub-paragraph (3) above—

(a)may be made by the person originally chargeable, if he has paid the whole of the special charge, or the part of the special charge which is not attributable to any trust together with an additional amount. but shall be made not later than six months after the payment, or after the making of the assessment, whichever is the later,

(b)may be made by the person answerable for the trust not later than one month after receipt of a notice under sub-paragraph (1) above, or as the case may be, of a notice under sub-paragraph (2) above.

Application of trust property in payment of chargeU.K.

8(1)The powers of a trustee or tenant for life (whether arising under the M1Settled Land Act 1925 or that Act as applied by section 28 of the M2Law of Property Act 1925, or otherwise) shall include a power to apply or direct the application of capital money, and to raise money by mortgage, for the purpose of paying the special charge, or interest on the special charge, of making payments in advance of assessment in or towards the special charge, and of discharging any liability arising under the preceding provisions of this Schedule.U.K.

(2)As between the persons interested (whether in income or capital) under a trust, the law relating to the ultimate incidence of estate duty shall apply to any amount falling to be paid under the preceding provisions of this Schedule in respect of income derived from property subject to the trust as if—

(a)that amount were estate duty charged on that property,

(b)estate duty was so charged on the cesser of a life interest in the property, occurring at the end of the year 1967–68, being an interest not subject to any interest in the property in fact existing under the trust, and

(c)that amount were charged as on property not passing to the executor as such :

Provided that as between any annuity, other than one by reason of which the said amount or any part thereof fell to be paid, and other interests, the amount shall be borne by the other interests to the exoneration of the annuity.

(3)Where the income derived from property referred to in sub-paragraph (2) above was a share only of income from the property, whether or not subject to other interests, that sub-paragraph shall apply as if the income so derived had been derived from a corresponding share of the property.

(4)This paragraph shall, in its application to Scotland, have effect as if for sub-paragraph (1) there were substituted the following sub-paragraph:—

“(1)For the purpose of paying the special charge, of making payments in advance of assessment in or towards the special charge, and of discharging any liability arising under the preceding provisions of this Schedule, a trustee, a liferenter or an heir of entail in possession shall have power to expend capital money and to sell, or to borrow money on the security of, the estate or any part thereof, heritable as well as moveable.”

(5)In the application of sub-paragraph (1) above to Northem Ireland, for the first reference to the M3Settled Land Act 1925 there shall be substituted a reference to the Settled Land Acts 1882 to 1890, and the reference to the said Act of 1925 as applied by the Law of Property Act 1925 shall be omitted.

Foreign trustsU.K.

9(1)If it is shown to the satisfaction of the Board—U.K.

(a)that any part of the special charge in respect of an individual’s aggregate investment income is directly or indirectly attributable to a foreign trust, and

(b)that neither the individual or his wife nor, if different, the person chargeable, nor the trustee of any intermediate trust which is not a foreign trust, was absolutely entitled, as against the trustees, to the capital of the trust, or to a part of the capital of the trust of an amount or value not less than the amount of the special charge so attributable, and

(c)that the income in question does not arise under a settlement in relation to which the individual or his wife is a settlor under any of the provisions of Part XVIII of the M4Income Tax Act 1952,

the Board shall relieve all persons of liability to that part of the special charge, by discharge or by repayment, and, as between the person originally chargeable and any person answerable for a trust any amount recovered in respect of that part of the special charge sball be repaid.

(2)For the purposes of this paragraph part of the special charge is directly or indirectly attributable to a foreign trust—

(a)if, in accordance with this Schedule, it is attributable to that trust, or

(b)if income of a trust which is not a foreign trust derives from the foreign trust, and part of the special charge would be attributable to the foreign trust if it were not a foreign trust and if an election were made under paragraph 6 of this Schedule.

(3)For the purposes of this paragraph—

(a)a trust is, in relation to a foreign trust, an intermediate trust if any part of the investment income arising under the trust derives, directly or indirectly, from the foreign trust,

(b)where a person has any rights or powers which could be exercised so as to make him absolutely entitled, as against the trustees, to the capital of the trust or any part of it, he shall be treated as absolutely entitled, as against the trustees, to the capital or that part of it.

Marginal Citations

Limitation of liability of trusteesU.K.

10(1)Where on a claim against a trustee or tenant for life made in pursuance of this Schedule by the Board or some other person it is shown to the satisfaction of the Board that the rights of indemnification of the trustee or tenant for life out of the trust estate are, otherwise than by negligence or default on his part, insufficient to provide for his reimbursement, the Board shall give such directions for the limitation or release of his liability as appear just and equitable.U.K.

(2)Sub-paragraph (1) above shall not apply to a claim against a trustee for any amount in respect of which the trustee could have made an election or given a notice under paragraph 6 of this Schedule.

(3)Where a person who has paid any part of the special charge proves to the satisfaction of the Board that by reason of directions under sub-paragraph (1) above he is deprived of the right to recover any amount in respect thereof, the Board shall repay that amount to him.

InterpretationU.K.

ll(1)The following provisions have effect for the interpretation of this Schedule in a case where the special charge falls to be made in respect of an individual’s aggregate investment income and that income includes any amount arising under a trust.U.K.

(2)For the purposes of this Schedule the amount of the special charge attributable to the trust shall be the fraction of the special charge of which—

(a)the numerator is the individual’s investment income arising under the trust, and

(b)the denominator is the individual’s aggregate investment income, ascertained before making any deduction under section 42(7) of this Act.

(3)Where credit for foreign tax falls to be allowed against the special charge, the amount of the special charge attributable to the trust shall be ascertained—

(a)by applying the fraction in sub-paragraph (2) above to the special charge without allowing the credit against the amount of the special charge, and

(b)by deducting from the resulting amount so much of the credit, if any, as is allowable in respect of income arising from the trust.

(4)For the said purposes “the person originally chargeable” means the individual or other person liable to pay the special charge apart from the provisions of this Schedule.

12(1)For the said purposes “the person answerable” for a trust is—U.K.

(a)in the case of a subsisting settlement within the meaning of the M5Settled Land Act 1925, or in Northern Ireland the Settled Land Acts 1882 to 1890, the tenant for fife,

(b)in the case of any other subsisting trust, the trustees.

(2)Where the trust has come to an end, “the person answerable” for the trust is the person who immediately after the trust came to an end was entitled in law to the trust property, either beneficially or as the trustee of property settled under another trust, and if more than one person was then so entitled, those persons shall be severally liable as persons answerable for the trust in proportion to the value of their interests therein.

(3)In applying sub-paragraph (2) above a person becoming entitled by virtue of a mortgage or charge, or in Scotland by virtue of the exercise of a power of sale contained in a bond and disposition in security, shall be disregarded, and sub-paragraph (2) above shall apply to the person or persons who would have been entitled in law to the trust property but for the mortgage or charge. or the exercise of the power of sale.

(4)For the purposes of this paragraph a trust shall be deemed to have come to an end when any person has become entitled thereunder to capital and the trust property has in consequence thereof become vested in that person or an assignee of his interest, and where part of the trust property has become so vested a proportionate part of the amount recoverable from the person answerable for the trust shall be recoverable from the person described in sub-paragraphs (2) and (3) above, and the remainder from the person described in sub-paragraph (1) above, and “subsisting” in relation to a settlement or trust shall be construed accordingly.

Marginal Citations

13(1)In this Schedule, unless the context otherwise requires—U.K.

a trust is a “foreign trust” if and only if the general administration of the trust is ordinarily carried on outside the United Kingdom and the trustees or a majority of them for the time being are not resident or not ordinarily resident in the United Kingdom,

“tenant for life” means, in relation to any settlement, any person who has the powers of a tenant for life under the M6Settled Land Act 1925 or in Northern Ireland under the Settled Land Acts 1882 to 1890,

“trustee” includes a personal representative and “trust” shall be construed accordingly,

and references to a trust do not include references to a trust constituted in pursuance of a unit trust scheme as defined in section 26(1) of the M7Prevention of Fraud (Investments) Act 1958 or section 22 of the M8Prevention of Fraud (Investments) Act (Northern Ireland) 1940.

(2)In this Schedule references to income of an individual arising under a trust include references to income from property subject to the trust which is treated as the income of that individual for income tax purposes generally, or for surtax.

(3)Where any property or fund is held as to different parts thereof on different trusts, this Schedule shall apply separately to each part.

Section 45.

Schedule 16.U.K. Special Charge: Close Companies

Modifications etc. (not altering text)

C2The text of ss, 40–50, 53, 60, 61(2)(7) and Schs. 15 and 16 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and, except as otherwise indicated, does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

Special ApportionmentsU.K.

1U.K.Subject to paragraph 2 below—

(a)any apportionment under Part IV of this Act of the income of a close company shall be made according to the respective interests of the participators in that company,

(b)any sub-apportionment under Part IV of this Act of income of one close company apportioned to another close company shall be made according to the respective interests of the participators in that other company.

2(1)In the case of any company—U.K.

(a)the provisos to section 258(3) of the M9Income Tax Act 1952 (beneficial interests in loans),

(b)section 259(1) of that Act (interests which would arise in a winding up), and

(c)section 260 of that Act, without subsection (5) (further provision as to underlying interests),

shall apply as they applied, in the case of an investment company, to apportionments for surtax under Chapter 111 of Part IX of that Act (a reference to a participator being substituted for any reference to a member or loan creditor).

(2)For the purposes of sub-paragraph (1) above, a loan creditor shall be deemed to have an interest in any company which is an investment company to the extent that the income to be apportioned or assets representing it is or have been expended or applied, or is or are available to be expended or applied. in redemption or repayment or discharge of the loan capital or debt (including any premium thereon) in respect of which he is a loan creditor.

In this sub-paragraph “investment company” means a company whose income consists wholly or mainly of investment income, construing “investment income” in accordance with paragraph 8(1) of Schedule 18 to the M10Finance Act 1965.

3(1)Notice of any apportionment (including any sub-apportionment) of the income of a close company under Part IV of this Act shall be given by serving on the company a statement showing the amount of the income of the company up to the required standard for the purposes of the apportionment, and either the amount apportioned to each participator or the amount apportioned to each class of shares, as the Board think fit.U.K.

(2)A company which is aggrieved by any such notice of apportionment shall be entitled to appeal to the Special Commissioners on giving notice to an officer of the Board within thirty days after the date of the notice.

Recovery of special charge from companyU.K.

4(1)This paragraph has effect where the special charge falls to be made in respect of an individual’s investment income and that income includes any amount–U.K.

(a)treated as part of his total income for surtax in consequence of an apportionment (with any sub-apportionment) of the income of a company under section 78 of the Finance Act 1965, or

(b)treated as part of his investment income in consequence of an apportionment (with any sub-apportionment) of the income of a close company under Part IV of this Act,

and in this paragraph “the apportioned income” means any amount falling within paragraph (a) or (b) above.

(2)If at the expiration of thirty days from the time when the special charge became due, any part of it remains unpaid, the Board may by notice in writing addressed to the company require the company to pay what then remained unpaid up to the following limit.

(3)The said limit is the fraction of the special charge falling to be made in respect of the individual’s aggregate investment income of which—

(a)the numerator is the apportioned income, and

(b)the denominator is the individual’s aggregate investment income, ascertained before making any deduction under section 42(7) of this Act.

(4)Where credit for foreign tax falls to be allowed against the special charge, the said limit shall be ascertained by applying the fraction in sub-paragraph (3) above to the special charge without allowing the credit against the amount of the special charge.

(5)Any sum required to be paid by a company in pursuance of the notice shall be payable on the day next following the giving of the notice, and the provisions of Part IV of this Act shall apply as if that amount had been assessed on the company.

Schedule 17.U.K. . . . F9

Textual Amendments

F9Sch. 17 repealed by Finance Act 1972 (c. 41), ss. 122(5), 134(7), Sch. 28 Pt. IX

SCHEDULE 18U.K. Premium Savings Bonds: New Terms

1U.K.Premium Savings Bonds are a Government Security and are eligible for inclusion in draws for cash prizes. These prizes are free from United Kingdom Income Tax, Surtax and Capital Gains Tax.

2U.K.Premium Saving Bonds, (Series B) (hereinafter called Bonds) will be issued in units of £1 by the Treasury and will be subject to regulations made from time to time by the Treasury under section 12 of the M11National Debt Act 1958, or having effect by virtue of that Act. The principal of the Bonds and the prizes allotted will be a charge on the National Loans Fund with recourse to the Consolidated Fund.

3U.K.The purchaser will be required to fill in an application form giving his full name and address, the amount of Bonds which he wishes to purchase and his usual signature.

4U.K.Bonds are not transferable either during the lifetime or on the death of the registered holder. No responsibility can be accepted in respect of their use as security for a loan.

5U.K.There will be a monthly prize fund which will be determined by calculating one month’s interest on each bond eligible for the draws in that month. The rate of interest will be 45/8% per annum or such other rate as may be prescribed under the provisions of paragraph 15 below.

6U.K.A draw will be held each week to allot from the prize fund one prize of £25,000, and a draw will be held each month to allot the amount remaining after the amounts for the prizes for the weekly draws in that month have been set aside.

7U.K.A Bond will be eligible for inclusion in the first draw held after the expiration of the three clear calendar months following the month in which it is purchased, provided that it has not been repaid before the expiration of those three months. After a Bond has qualified for its first draw it will be included in each succeeding draw, unless it has been repaid before the first day of the month in which the draw is held or (subject to the provisions of paragraph 15 below) the registered holder has died before the first day of a period of twelve consecutive calendar months preceding the month in which the draw is held.

8U.K.Each £1 unit Bond will have one chance in each draw for which it is eligible. Each £1 unit Bond may win not more than one prize in each draw for which it is eligible and in draws producing more that one prize will be allotted the highest prize for which it is drawn.

9U.K.Notwithstanding the provisions of paragraph 7 above any Bond purchased in contravention of any regulation limiting the number of unit Bonds which may held by any person shall not be eligible for inclusion in any draw until the holding has been reduced to not more than the maximum number permitted by such regulation.

10U.K.The monthly prize fund will be allocated in prizes of the following numbers and amounts (or such other numbers and amounts as may be prescribed under the provisions of paragraph 15 below):

(a)For the weekly draws there will be set aside an amount to be allocated as single prizes of £25,000 each week, the number of such prizes to be equal to the number of Saturdays in the month.

(b)For the monthly draw the remaining prize fund will then be allocated as follows:—

(i)each complete £100,000 will be divided into:

1 prize of £5,000

10 prizes of £1,000

10 prizes of £500

20 prizes of £250

30 prizes of £100

150 prizes of £50

2,580 prizes of £25

(ii)of the remainder, each complete £10,000 will be divided into:

1 prize of £1,000

1 prize of £500

2 prizes of £250

3 prizes of £100

20 prizes of £50

268 prizes of £25

(iii)any amount of less than £10,000 will be allocated in prizes of £25, any residual sum of less than £25 being added to the prize fund in the following month.

11U.K.The serial numbers of Bonds which are allotted prizes will be published in the London Gazette, and the registered holders will be notified by post at their last address as recorded at the Bonds and Stock Office.

12U.K.All matters relating to the method and conduct of the draw and allotment of prizes shall be at the sole discretion of the Postmaster General, whose decision as to which Bonds have drawn prizes shall be final.

13U.K.The purchase price of a Bond is repayable in full on application to the Bonds and Stock Office.

14U.K.For the purposes of this Prospectus a Bond shall be deemed to be repaid on the day on which a warrant for the amount repayable is posted to the person entitled to it.

15U.K.The Treasury reserve the right by giving not less than three months notice in the London, Edinburgh and Belfast Gazettes:—

(a)to vary the rate of interest specified in paragraph 5 above for determining the amount of the prize fund;

(b)to vary the scale of prizes set out in paragraphs 6 and 10 above;

(c)to vary the provisions of paragraph 7 above insofar as they relate to the eligibility of a Bond for inclusion in a draw after the death of the registered holder;

(d)to declare any Bonds purchased on or before a date specified in the Notice to be ineligible for further draws.

16U.K.If the Treasury give notice under paragraph 15 above to vary the terms of this Prospectus for any Bonds sold on those terms, its terms shall be deemed to be varied accordingly, as from the date of publication of the Notice, for any application to buy a Bond or Bonds on or after that date.

Schedule 19U.K. . . . F10

Textual Amendments

F10Sch. 19 repealed by Finance Act 1971 (c. 68), s. 69(7), Sch. 14 Pt. VII

Section 61

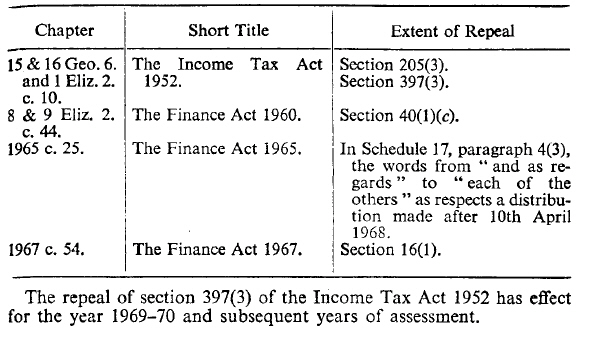

schedule 20U.K. REPEALS

Modifications etc. (not altering text)

C3The text of Schedule 20 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and, does not reflect any amendments or repeals which may have been prior to 1.2.1991.

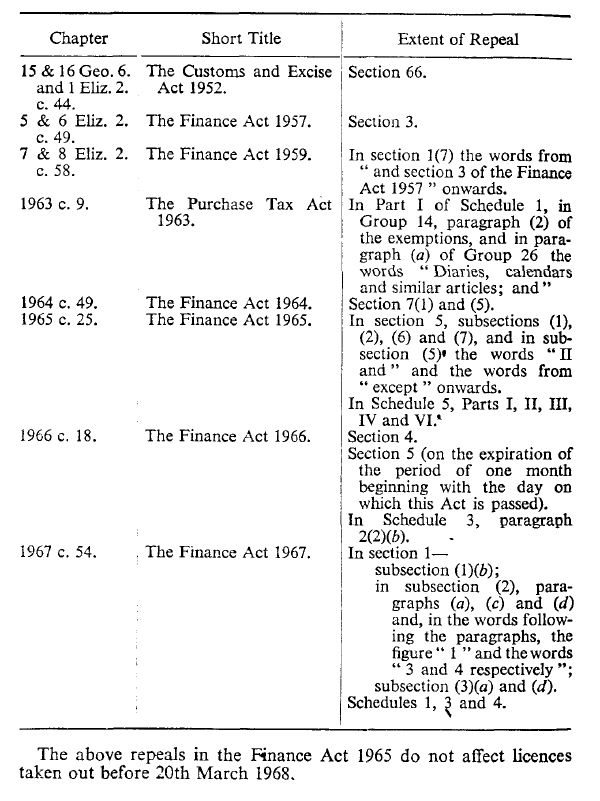

PART IU.K. CUSTOMS AND EXCISE REPEALS

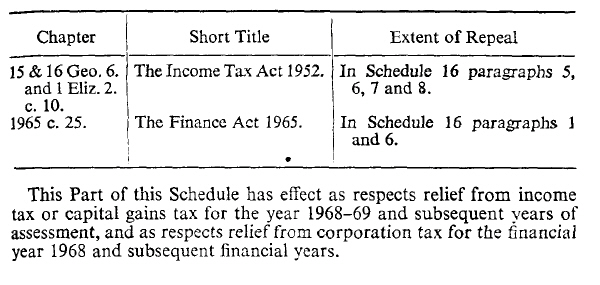

PART IIU.K. DOUBLE TAXATION RELIEF REPEALS

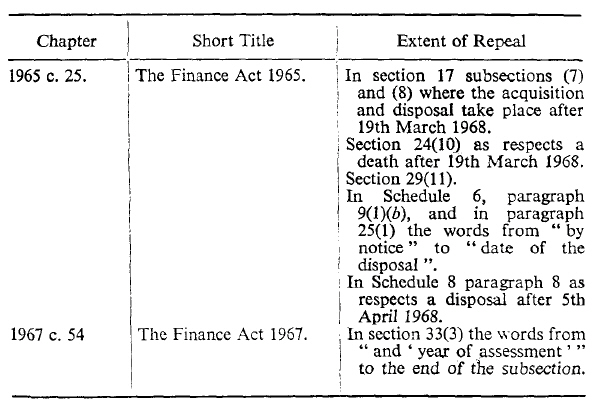

PART IIIU.K. CAPITAL GAINS REPEALS

PART IVU.K. ESTATE DUTY REPEALS

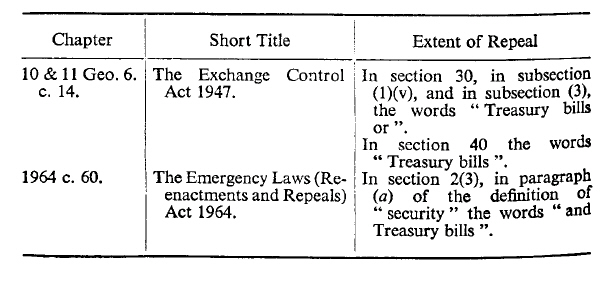

PART VU.K. EXCHANGE CONTROL REPEALS

PART VIU.K. MISCELLANEOUS REPEALS

Options/Help

Print Options

PrintThe Whole Act

PrintThe Schedules only

Mae deddfwriaeth ar gael mewn fersiynau gwahanol:

Y Diweddaraf sydd Ar Gael (diwygiedig):Y fersiwn ddiweddaraf sydd ar gael o’r ddeddfwriaeth yn cynnwys newidiadau a wnaed gan ddeddfwriaeth ddilynol ac wedi eu gweithredu gan ein tîm golygyddol. Gellir gweld y newidiadau nad ydym wedi eu gweithredu i’r testun eto yn yr ardal ‘Newidiadau i Ddeddfwriaeth’.

Gwreiddiol (Fel y’i Deddfwyd neu y’i Gwnaed): Mae'r wreiddiol fersiwn y ddeddfwriaeth fel ag yr oedd pan gafodd ei deddfu neu eu gwneud. Ni wnaed unrhyw newidiadau i’r testun.

Pwynt Penodol mewn Amser: This becomes available after navigating to view revised legislation as it stood at a certain point in time via Advanced Features > Show Timeline of Changes or via a point in time advanced search.

Gweler y wybodaeth ychwanegol ochr yn ochr â’r cynnwys

Rhychwant ddaearyddol: Indicates the geographical area that this provision applies to. For further information see ‘Frequently Asked Questions’.

Dangos Llinell Amser Newidiadau: See how this legislation has or could change over time. Turning this feature on will show extra navigation options to go to these specific points in time. Return to the latest available version by using the controls above in the What Version box.

Rhagor o Adnoddau

Gallwch wneud defnydd o ddogfennau atodol hanfodol a gwybodaeth ar gyfer yr eitem ddeddfwriaeth o’r tab hwn. Yn ddibynnol ar yr eitem ddeddfwriaeth sydd i’w gweld, gallai hyn gynnwys:

- y PDF print gwreiddiol y fel deddfwyd fersiwn a ddefnyddiwyd am y copi print

- rhestr o newidiadau a wnaed gan a/neu yn effeithio ar yr eitem hon o ddeddfwriaeth

- manylion rhoi grym a newid cyffredinol

- pob fformat o’r holl ddogfennau cysylltiedig

- slipiau cywiro

- dolenni i ddeddfwriaeth gysylltiedig ac adnoddau gwybodaeth eraill

Llinell Amser Newidiadau

This timeline shows the different points in time where a change occurred. The dates will coincide with the earliest date on which the change (e.g an insertion, a repeal or a substitution) that was applied came into force. The first date in the timeline will usually be the earliest date when the provision came into force. In some cases the first date is 01/02/1991 (or for Northern Ireland legislation 01/01/2006). This date is our basedate. No versions before this date are available. For further information see the Editorial Practice Guide and Glossary under Help.

Rhagor o Adnoddau

Defnyddiwch y ddewislen hon i agor dogfennau hanfodol sy’n cyd-fynd â’r ddeddfwriaeth a gwybodaeth am yr eitem hon o ddeddfwriaeth. Gan ddibynnu ar yr eitem o ddeddfwriaeth sy’n cael ei gweld gall hyn gynnwys:

- y PDF print gwreiddiol y fel deddfwyd fersiwn a ddefnyddiwyd am y copi print

- slipiau cywiro

liciwch ‘Gweld Mwy’ neu ddewis ‘Rhagor o Adnoddau’ am wybodaeth ychwanegol gan gynnwys

- rhestr o newidiadau a wnaed gan a/neu yn effeithio ar yr eitem hon o ddeddfwriaeth

- manylion rhoi grym a newid cyffredinol

- pob fformat o’r holl ddogfennau cysylltiedig

- dolenni i ddeddfwriaeth gysylltiedig ac adnoddau gwybodaeth eraill