- Y Diweddaraf sydd Ar Gael (Diwygiedig)

- Pwynt Penodol mewn Amser (19/11/1998)

- Gwreiddiol (Fel y'i Deddfwyd)

Finance Act 1969

You are here:

- Blaenorol

- Nesaf

- Dangos Graddfa Ddaearyddol(e.e. Lloegr, Cymru, Yr Alban aca Gogledd Iwerddon)

- Dangos Llinell Amser Newidiadau

Rhagor o Adnoddau

Changes over time for: Finance Act 1969

Version Superseded: 06/04/2003

Alternative versions:

- 01/02/1991- Amendment

- 01/04/1994- Amendment

- 01/04/1995- Amendment

- 01/01/1996- Amendment

- 01/04/1996- Amendment

- 27/05/1997- Amendment

- 01/10/1998- Amendment

- 19/11/1998- Amendment

- 19/11/1998

Point in time - 06/04/2003- Amendment

- 28/09/2004- Amendment

- 15/10/2005- Amendment

- 01/04/2006- Amendment

- 01/04/2008- Amendment

- 31/01/2013- Amendment

- 15/09/2016- Amendment

Status:

Point in time view as at 19/11/1998.

Changes to legislation:

Finance Act 1969 is up to date with all changes known to be in force on or before 02 February 2025. There are changes that may be brought into force at a future date. Changes that have been made appear in the content and are referenced with annotations.![]()

Changes to Legislation

Changes and effects yet to be applied by the editorial team are only applicable when viewing the latest version or prospective version of legislation. They are therefore not accessible when viewing legislation as at a specific point in time. To view the ‘Changes to Legislation’ information for this provision return to the latest version view using the options provided in the ‘What Version’ box above.

Finance Act 1969

1969 CHAPTER 32

An Act to grant certain duties, to alter other duties, and to amend the law relating to the National Debt and the Public Revenue, and to make further provision in connection with Finance.

[25th July 1969]X1

Editorial Information

X1The text of ss. 1(5), 58, 60, 61(1)(2)(4)–(6), Sch. 20 para.11 and Sch. 21 was taken from S.I.F. group 63:1 (Income, Corporation and Capital Gains Taxes: Income and Corporation Taxes) ss. 1(4)(5), 61(3)(a), Sch.7 was taken from S.I.F.Group 40:1 (Customs and Excise: Customs and Excise Duties) and ss. 3(9), 59, Sch.9 paras. 22-24 was taken from S.I.F. Group 12:1 (Betting, Gaming and Lotteries: General) ; Provisions omitted from S.I.F. have been dealt with as referred to in other commentary.

Extent Information

E1For the extent of this Act, in so far as it relates in Northern Ireland, see s. 61(5)

Modifications etc. (not altering text)

C1Words of enactment omitted under authority of Statute Law Revision Act 1948 (c. 62), s. 3

C2General amendments etc. to Tax Acts (or Income Tax Acts or Corporation Taxes Acts as the case may be) made by Taxes Management Act 1970 (c. 9, SIF 63:1), s. 41A(7) (as added by Finance Act 1990 (c. 29, SIF 63:1), s. 95(1)(2), British Telecommunications Act 1981 (c. 38, SIF 96), s. 82(2)(7); Telecommunications Act 1984 (c. 12, SIF 96), s. 72(3); Finance Act 1984 (c. 43, SIF 63:1), ss. 82(6), 85(2), 89(1)(7), 96(1)(7), 98(7), Sch. 9 para. 3(2)(9), Sch. 16 paras. 6, 12 and Finance Act 1985 (c. 54, SIF 63:1), ss. 72(1), 74(5), Sch. 23 para. 15(4), S.I. 1987/530, regs. 11(2), 13(1), 14, Income and Corporation Taxes Act 1988 (c. 1, SIF 63:1), ss. 4, 6, 7, 9, 32, 34, 78, 134, 135, 141, 142, 185, 191, 193, 194, 195, 200, 203, 209, 212, 213, 219, 247, 253, 272, 287, 314, 315, 317, 318, 325, 326, 327, 345, 350, 351, 368, 375, 381, 397, 414, 432, 440, 442, 446, 458, 460, 461, 463, 463(2)(3) (as added by Finance Act 1990 (c. 29, SIF 63:1), s. 50(2) ), 468, 474, 475, 486, 490, 491, 503, 511, 518, 524, 532, 544, 550, 556, 558, 569, 572, 582, 595, 601, 613, 617, 619, 621, 639, 656, 660, 663, 676, 689, 691, 694, 700, 701, 714, 716, 739, 743, 754, 763, 776, 780, 781, 782, 787, 789, 811, 828, 829, 832, 833, 834, 835, 837, 838, 839, 840, 841, 842, Sch. 2 para. 5, Sch. 4 para. 5, Sch. 13 para. 10, Sch. 16 para. 10, Sch. 21 para. 6, Sch. 26 para. 1, Sch. 27 para. 20, Finance Act 1988 (c. 39, SIF 63:1), ss. 66, 127(1)(6), Sch. 12 para. 6, Capital Allowances Act 1990 (c. 1, SIF 63:1), ss. 28(1), 68(8), 74, 82, 83(5), 148(5), 163(4), 164(2), S.I. 1990/627 and Finance Act 1990 (c. 29, SIF 63:1), s. 25(10)

Part IU.K.

1 Termination of surcharge under Finance Act 1961 s. 9 and related increases in duties.U.K.

(1) . . . F1

(2) . . . F2

(3) . . . F3

(4)Subject to any new order of the Treasury under section 2 of the M1Purchase Tax Act 1963, Part I of Schedule 1 to that Act (chargeable and exempt goods and rates of tax) as amended by section 5 of the M2Finance Act 1968 shall have effect—

(a)as from 16th April 1969, with the substitution for any reference to 12½ per cent., 20 per cent., 331/3 per cent. or 50 per cent. of a reference respectively to 13¾ per cent., 22 per cent., 362/3; per cent. or 55 per cent. ; and

(b)as from 27th May 1969, with the further amendments specified in Schedule 6 to this Act (being amendments adding further goods to those chargeable with purchase tax or amending the provisions as to exemptions).

[F4(5)The provisions of Schedule 7 to this Act shall have effect for the purpose of—

(a)defining whisky for all purposes of customs and excise;

(b) . . . F5

(c) . . . F6

(d) . . . F7]

Textual Amendments

F1S. 1(1) repealed by Finance Act 1970 (c. 24), Sch. 8 Pt. II and Finance Act 1973 (c. 51), Sch. 22 Pt. I

F2S. 1(2) repealed by Finance Act 1972 (c. 41), Sch. 28 Pt. III and Finance Act 1973 (c. 51), Sch. 22 Pt I

F4S. 1(5) repealed (prosp.) by Finance Act 1983 (c. 28, SIF 40:1), s. 9(3), Sch. 10 Pt. I

F6S. 1(5)(c) repealed by Finance Act 1973 (c. 51), Sch. 22 Pt. I

Modifications etc. (not altering text)

C3The text of ss. 1(4), 43–49, Sch. 9 paras. 22–24 and Sch. 20 para. 11 and Sch. 21 is in the form in which it was originally enacted: it was not reproduced in the Statutes in Force and does not reflect any amendments or repeals which may have been made prior to 1.2.1991

Marginal Citations

2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F8U.K.

Textual Amendments

F8S. 2 repealed except as respects any period before 27.4.1970, by Finance Act 1970 (c. 24), Sch. 8 Pt. II

3 Bingo duty.U.K.

(1)—(7) . . . F9

(8) . . . F10

(9)The provisions of Part II of Schedule 9 to this Act (being provisions as to administration and enforcement) shall have effect with respect to bingo duty.

(10)—(12) . . . F11

Textual Amendments

F10S. 3(8) repealed by Statute Law (Repeals) Act 1974 (c. 22), Sch. Pt. II

Modifications etc. (not altering text)

C4The text of s. 3(9) is in the form in which it was originally enacted: it was not reproduced in the Statutes in Force and does not reflect any amendments or repeals which may have been made prior to 1.2.1991

4. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F12U.K.

Textual Amendments

F12S. 4 repealed, except as regards any gaming before 1.10.1970, by Finance Act 1970 (c. 24), Sch. 8 Pt. I

5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F13U.K.

Textual Amendments

F13S. 5 repealed by Statute Law (Repeals) Act 1974 (c. 22), Sch. Pt. II

6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F14U.K.

Textual Amendments

F14S. 6 repealed by Vehicles (Excise) Act 1971 (c. 10), s.39(5), Sch. 8 Pt. I

Part IIU.K. Income Tax and Corporation Tax

7—10.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F15U.K.

Textual Amendments

11 Child relief, accumulation settlements and family allowances.U.K.

(1)—(4) . . . F16

(5)For the purposes of section 228 of the M3Income Tax Act 1952 (relief in respect of income accumulated under trusts) no account shall be taken of any tax paid in respect of income for a year of assessment beginning after the year 1968-69 or of any relief to which a person would have been entitled for such a year of assessment in the circumstances mentioned in that section.

(6) . . . F16

Textual Amendments

F16Ss. 7–11(4), 11(6), 12–15 repealed by Income and Corporation Taxes Act 1970 (c. 10), ss. 537(1), 538(1), 539(1), Sch. 14 para. 1, Sch. 16

Marginal Citations

12—15.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F17U.K.

Textual Amendments

16. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F18U.K.

Textual Amendments

F18S. 16 repealed by Statute Law (Repeals) Act 1975 (c. 10), s. 1(1), Sch. Pt. VI

17—34.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F19U.K.

Textual Amendments

Parts III—VU.K.

35—40.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F20U.K.

Textual Amendments

F20Ss. 35–40 repealed with savings by Finance Act 1975 (c. 7), ss. 50, 52(2)(3), 59, Sch. 13 Pt. I; 2016 c. 24, s. 97(3)

41, 42.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F21U.K.

Textual Amendments

F21Ss. 41, 42 repealed with savings by Capital Gains Tax Act 1979 (c. 14), ss. 157(1), 158, Sch. 6 para. 10(2)(b), Sch. 8

Betterment LevyU.K.

F2243. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F22Ss. 43-49 repealed (19.11.1998) by 1998 c. 43, s. 1(1), Sch. 1 Pt. IV Group 2

F2344. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F23Ss. 43-49 repealed (19.11.1998) by 1998 c. 43, s. 1(1), Sch. 1 Pt. IV Group 2

F2445. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F24Ss. 43-49 repealed (19.11.1998) by 1998 c. 43, s. 1(1), Sch. 1 Pt. IV Group 2

F2546. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F25Ss. 43-49 repealed (19.11.1998) by 1998 c. 43, s. 1(1), Sch. 1 Pt. IV Group 2

F2647. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F26Ss. 43-49 repealed (19.11.1998) by 1998 c. 43, s. 1(1), Sch. 1 Pt. IV Group 2

F2748. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F27Ss. 43-49 repealed (19.11.1998) by 1998 c. 43, s. 1(1), Sch. 1 Pt. IV Group 2

F2849. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .U.K.

Textual Amendments

F28Ss. 43-49 repealed (19.11.1998) by 1998 c. 43, s. 1(1), Sch. 1 Pt. IV Group 2

50. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F29U.K.

Textual Amendments

F29S. 50 repealed by Finance Act 1971 (c. 68), s. 69(7), Sch. 14 Pt. VII

51. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F30U.K.

Textual Amendments

F30S. 51 repealed by Finance Act 1972 (c. 41), ss. 122(5), 134(7), Sch. 28 Pt. IX

Part VIU.K. Miscellaneous

52. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F31U.K.

Textual Amendments

F31S. 52 repealed by Finance Act 1990 (c. 29), s. 132, Sch. 19 Pt. IV

53. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F32U.K.

Textual Amendments

54. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F33U.K.

Textual Amendments

55. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F34U.K.

Textual Amendments

F34S. 55 repealed by Finance Act 1972 (c. 41), ss. 54(8), 134(7), Sch. 28 Pt. II

56. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F35U.K.

Textual Amendments

F35S. 56 repealed by Finance Act 1973 (c. 51), s. 59(7), Sch. 22 Pt. V

57. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F36U.K.

Textual Amendments

F36S. 57 repealed by Finance Act 1970 (c. 24), ss. 35(5), 36(8), Sch. 8 Pt. VI

58 Disclosure of information for statistical purposes by Board of Inland Revenue.U.K.

(1)For the purpose of any statistical survey conducted or to be conducted by the Department of Employment and Productivity [F37the Department of Trade and Industry or the [F38Office for National Statistics]], the Board of Inland Revenue may disclose to an authorised officer of that Department or Office—

(a)the names and addresses of persons (in this section referred to as “employers”) required under [F39section [F40203 of the M4Income and Corporation Taxes Act 1988]] (pay as you earn) to make deductions of tax from payments of, or on account of, emoluments to which that section applies; and

(b)information concerning the number of persons (in this section referred to as “employees”) in receipt of emoluments paid by an employer.

(2)For the purpose of any statistical survey relating to earnings conducted or to be conducted by the [F38Office for National Statistics] and Productivity, the Board of Inland Revenue may disclose to an authorised officer of [F41that Office] the name and address of the employer of any person who is one of a number of employees selected (as a statistical sample) for the purpose of that survey.

(3)Subsections (1) and (2) above shall have effect notwithstanding any obligation as to secrecy imposed on the Board or any officer of the Board under the M5Income Tax Management Act 1964 or otherwise.

(4)Subject to subsection (5) below, no information obtained by virtue of this section by an officer of the Department of Employment and Productivity [F42or of the Department of Trade and Industry or of the [F38Office for National Statistics]] may be disclosed except—

(a)to another officer of that Department or Office for the purpose of the statistical survey concerned, or

(b)to another department (including a department of the Government of Northern Ireland) for the purpose of a statistical survey conducted or to be conducted by that department. [F43or

(c)to an authorised officer of any body specified in the first column of the following Table for the purposes of functions of that body under any enactment specified in relation to it in the second column of the Table.]

[F43Table

| Body | Enactment |

|---|---|

| F44. . . | F44. . . |

| F44. . . | F44. . . |

| The Northern Ireland Training Authority. | The M6 Industrial Training (Northern Ireland) Order 1984. |

| A local planning authority within the meaning of [F45the Town and Country Planning Act 1990] and any board which exercises for any area the functions of such an authority. | [F46Part II of the M7 Town and Country Planning Act 1990] |

| A planning authority as defined in [F47section 1 of the Town and Country Planning (Scotland) Act 1997]. | Part II of the M8 Town and Country Planning (Scotland) Act [F481997]. |

| The Welsh Development Agency. | The M9 Welsh Development Agency Act 1975. |

| [F49The Scottish Development Agency][F49Scottish Enterprise.] | [F49The M10Scottish Development Agency Act 1975.][F49Part I of the M11 Enterprise and New Towns (Scotland) Act 1990.] |

| F50. . . | F50. . . |

| [F51The Highlands and Islands Development Board][F51Highlands and Islands Enterprise.] | [F51The M12M13Highlands and Islands Development (Scotland) Acts 1965 and 1968.][F51Part I of the M14 Enterprise and New Towns (Scotland) Act 1990.] |

| A development corporation within the meaning of the M15 New Towns Act 1981. | Section 4 of the M16 New Towns Act 1981. |

| A development corporation within the meaning of the M17 New Towns (Scotland) Act 1968. | Section 3 of the M18 New Towns (Scotland) Act 1968. |

| A new town commission within the meaning of the M19 New Towns Act (Northern Ireland) 1965. | Section 7 of the M20 New Towns Act (Northern Ireland) 1965.] |

(5)Subsection (4) above does not apply to the disclosure of any such information as is mentioned in subsection (1) or subsection (2) above—

(a)in the form of a summary so framed as not to enable particulars relating to an employer or employee to be ascertained from it, or

(b)in the case of such information as is mentioned in subsection (1) above, with the consent of the employer concerned and, in the case of such information as is mentioned in subsection (2) above, with the consent of the employee concerned.

(6)If any person who has obtained any information by virtue of any provision of this section discloses that information otherwise than in accordance with paragraph (a) [F52paragraph (b) or paragraph (c) of subsection (4) above] or subsection (5) above, he shall be liable on summary conviction to a fine not exceeding £400, or on conviction on indictment to imprisonment for a term not exceeding two years or to a fine or to both.

(7)References in this section to the Department of Employment and Productivity [F53the Department of Trade and Industry or the [F38Office for National Statistics]] include references to any department of the Government of Northern Ireland carrying out similar functions.

Textual Amendments

F37 Words substituted by S.I. 1989/992 , art. 6(4) , Sch. 2 para. 1(1)(a)

F38 Words in s. 58(1)(2)(4)(7) substituted (1.4.1996) by S.I. 1996/273 , art. 5(1) , Sch. 2 para. 17

F39Words substituted by Income and Corporation Taxes Act 1970 (c. 10), s. 537(2), Sch. 15 para. 11 Table Pt. 11

F40Words substituted by Income and Corporation Taxes Act 1988 (c. 1, SIF 63:1), s. 844(1)(2), Sch. 29 para. 32

F41 Words in s. 58(2) substituted (1.1.1996) by S.I. 1995/2986 , art. 11 , Sch. para. 6(b)

F42 Words substituted by S.I. 1989/992 , art. 6(4) , Sch. 2 para. 1(1)(b)

F43 Words added by Finance (No. 2) Act 1987 (c. 51, SIF 63:1) , s. 69(1)(2)

F44 Entries in s. 58(4) repealed (1.4.1994 in relation to England and Scotland and 1.4.1995 for all other purposes) by 1993 c. 19 , s. 51 , Sch. 10 ; S.I. 1993/2503 , art. 2(3) , Sch. 3 .

F45Words substituted by Planning (Consequential Provisions) Act 1990 (c. 11, SIF 123:1, 2), s. 4, Sch. 2 para 23(a)

F46Words substituted by Planning (Consequential Provisions) Act 1990 (c. 11, SIF 123:1, 2), s. 4, Sch. 2 para. 23(b)

F47 Words in s. 58(4)(c) substituted (27.5.1997) by 1997 c. 11 , ss. 4 , 6(2) , Sch. 2 para. 18(a)

F48 Words in s. 58(4)(c) substituted (27.5.1997) by 1997 c. 11 , ss. 4 , 6(2) , Sch. 2 para. 18(b)

F49 Words “Scottish Enterprise." and “Part I of the Enterprise and New Towns (Scotland) Act 1990." substituted respectively (1.4.1991) (E.W.S.) for the words “The Scottish Development Agency." and “The Scottish Development Agency Act 1975." by Enterprise and New Towns (Scotland) Act 1990 (c. 35, SIF 64) , s. 38(1) , Sch. 4 para. 2(a)

F50 Entry in s. 58(4)(c) repealed (1.10.1998) by 1998 c. 38 , s. 152 , Sch. 18 Pt. IV (with ss. 137(1) , 139(2) , 143(2) ); S.I. 1998/2244 , art. 4

F51 Words “Highlands and Islands Enterprise." and “Part I of the Enterprise and New Towns (Scotland) Act 1990." substituted respectively (1.4.1991) (E.W.S.) for the words “The Highlands and Islands Development Board," and “The Highlands and Islands Development (Scotland) Acts 1965 and 1968." by Enterprise and New Towns (Scotland) Act 1990 (c. 35, SIF 64) , s. 38(1) , Sch. 4 para. 2(b)

F52 Words substituted by Finance (No. 2) Act 1987 (c. 51, SIF 63:1, 2) , s. 69(1)(3)

F53 Words substituted by S.I. 1989/992 , art. 6(4) , Sch. 2 para. 1(1)(c)

Marginal Citations

M5 1964 c. 37 .

M8 1972 c. 52 ( 123:2

M101975 c. 69(64)

M111990 c. 35(64)

M121965 c. 46(64).

M131968 c. 51(64).

M141990 c. 35(64)

M151981 c. 64(123:3).

M161981 c. 64(123:3).

M171968 c. 16(123:4).

M181968 c. 16(123:4).

59 Disclosure of information by Commissioners of Customs and Excise.U.K.

If the Horserace Betting Levy Board so request at any time with respect to a specified person and a specified period, and the Commissioners of Customs and Excise are satisfied that the Board require the information for the purpose of determining whether or not that person falls to be assessed by the Board to pay in respect of that period such a contribution as is mentioned in section 24(1) of the M21Betting, Gaming and Lotteries Act 1963 and that the Board will not use the information for any other purpose, the Commissioners may inform the Board whether that person has or has not made a payment to the Commissioners during or in respect of that period on account of the general betting duty.

60 Amendments for purposes of tax consolidation.U.K.

The enactments specified in Schedule 20 to this Act shall have effect subject to the amendments specified in that Schedule, being amendments designed to facilitate, or otherwise desirable in connection with, the consolidation of the Income Tax Acts, the Corporation Tax Acts and certain enactments relating to capital gains tax.

61 Citation, interpretation, construction, extent and repeals.U.K.

(1)This Act may be cited as the Finance Act 1969.

(2)In this Act, except where the context otherwise requires, “the Board” means the Commissioners of Inland Revenue.

(3)In this Act–

(a)Part I (except sections 1(1) and (4) and (6)) shall be construed as one with [F54the Customs and Excise Acts 1979];

(b) . . . F55

(c) . . . F56

(d) . . . F57

(e) . . . F58

(4)Any reference in this Act to any other enactment shall, except so far as the context otherwise requires, be construed as a reference to that enactment as amended or applied by or under any other enactment, including this Act.

(5)Except as otherwise expressly provided, such of the provisions of this Act as relate to matters in respect of which the Parliament of Northern Ireland has power to make laws shall not extend to Northern Ireland.

(6)The enactments mentioned in Schedule 21 to this Act (which include enactments which are spent or otherwise unnecessary) are hereby repealed to the extent mentioned in the third column of that Schedule, but subject to any provision in relation thereto made at the end of any Part of that Schedule.

Textual Amendments

F54S. 61(3)(a): Words substituted by Customs and Excise Management Act 1979 (c. 2), Sch. 4 para. 12 Table Pt. I

F55S. 61(3)(b) repealed by Finance Act 1972 (c. 41), s. 54(8), Sch. 28 Pt. II

F56S. 61(3)(c) repealed by Income and Corporation Taxes Act 1970 (c. 10), s. 539(1), Sch. 16

F57S. 61(3)(d) repealed by Finance Act 1975 (c. 7), ss. 50, 52(2)(3), 59, Sch. 13 Pt. I

F58S. 61(3)(e) repealed by Capital Gains Tax Act 1979 (c. 14), ss. 157(1),158, Sch. 6 para. 10(2)(b), Sch. 8

Modifications etc. (not altering text)

C5S. 61(5) amended by Northern Ireland Constitution Act 1973 (c. 36), s. 40

C6S. 61(5) amended by Northern Ireland Constitution Act 1973 (c. 36), s. 40

SCHEDULE 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F59U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F59Sch. 1 repealed by Finance Act 1972 (c. 41), s. 134(7), Sch. 28 Pt. III

SCHEDULES 2—5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F60U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F60Schs. 2–5 repealed by Finance Act 1973 (c. 51), s. 59(7), Sch. 22 Pt. I

SCHEDULE 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F61U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F61Sch. 6 repealed by Finance Act 1972 (c. 41), ss. 54(8), 134(7), Sch. 28 Pt. II

Section 1(5).

SCHEDULE 7U.K. Miscellaneous Provisions as to Customs and Excise

[F62 Definition of whiskyU.K.

Textual Amendments

F62Sch. 7 repealed (prosp.) by Finance Act 1983 (c. 28, SIF 40:1), s. 9(2)(3), Sch. 10 Pt. I

1U.K.In relation to spirits distilled on or after 1st August 1969, section 243(1)(b) of the M22Customs and Excise Act 1952 (which defines Scotch whisky) shall cease to have effect, and for all purposes of customs and excise—

(a)the expression “whisky” shall mean spirits which have been distilled from a mash of cereals which has been—

(i)saccharified by the diastase of malt contained therein with or without other natural diastases approved for the purpose by the Commissioners; and

(ii)fermented by the action of yeast; and

(iii)distilled at [F63an alcoholic strength (computed in accordance with section 2 of the M23Alcoholic Liquor Duties Act 1979) less than 94.8 per cent.] in such a way that the distillate has an aroma and flavour derived from the materials used,

and which have been matured in wooden casks in warehouse for a period of at least three years;

[F64(b)the expression “Scotch whisky" shall have the same meaning as it has in section 3(1) of the Scotch Whisky Act 1988;]

[F65(b)the expression “Scotch whisky" shall have the same meaning as it has in Article 2(2) of the Scotch Whisky (Northern Ireland) Order 1988;]

(c)the expression “blended whisky" or “blended Scotch whisky” shall mean a blend of a number of distillates each of which separately is entitled to the description whisky or Scotch whisky as the case may be;

(d)the period for which any blended whisky or blended Scotch whisky shall be treated as having been matured as mentioned in sub-paragraph (a) of this paragraph shall be taken to be that applicable in the case of the most recently distilled of the spirits contained in the blend.

Textual Amendments

F63Words substituted (1.1.1980) by S.I. 1979/241, art. 3

F64Sch. 7 para. 1(b) substituted (E.W.S.) by Scotch Whisky Act 1988 (c. 22, SIF 109:1), s. 3(5)

F65Sch. 7 para. 1(b) substituted (N.I.) by S.I. 1988/1852(N.I. 19), art. 2(5)

Marginal Citations

2U.K. . . . F66

Textual Amendments

3U.K. . . . F67

Textual Amendments

F67Sch. 7 para. 3 repealed by Finance Act 1973 (c. 51), s. 59(7), Sch. 22 Pt. I

4,5.U.K. . . . F68]

Textual Amendments

F69F69SCHEDULE 8U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F69Sch. 8 repealed by Finance Act 1970 (c. 24), s. 36(8), Sch. 8 Pt. II

Section 3.

SCHEDULE 9U.K. Provisions Relating to Bingo Duty

Part IU.K. Exemptions from Duty

1—6.U.K. . . . F70

Textual Amendments

Part IIU.K. Administration and Enforcement

7—21.U.K. . . . F71

Textual Amendments

22(1)In paragraph 20(1) of Schedule 2 to the M24Gaming Act 1968 (grounds on which the grant or renewal of a licence under that Act may be refused by the licensing authority), the following shall be added after sub-paragraph (e):—U.K.

“(f)that any bingo duty payable in respect of bingo played on the premises remains unpaid”

and at the end of the said paragraph 20 there shall be added the following:—

“(3)Where the licensing authority entertain an application for the grant or renewal of a licence under this Act in respect of any premises, and are satisfied that any bingo duty payable as mentioned in sub-paragraph (1)(f) of this paragraph remains unpaid, they shall refuse the application.”

(2)In paragraph 60 of the said Schedule 2 (grounds for refusal of transfer of licence), in sub-paragraph (c) (ground that the transferee has not paid duty under section 13 of the M25Finance Act 1966), after the word “1966" there shall be inserted the words “ or any bingo duty payable by him ”.

Modifications etc. (not altering text)

C7The text of ss. 1(4), 43–49, Sch. 9 paras. 22–24 and Sch. 20 para. 11 and Sch. 21 is in the form in which it was originally enacted: it was not reproduced in the Statutes in Force and does not reflect any amendments or repeals which may have been made prior to 1.2.1991

Marginal Citations

23U.K.In paragraph 9 of Schedule 3 to the M26Gaming Act 1968 (grounds on which, in England and Wales, the licensing authority may refuse renewal of registration of club or institute under Part II of that Act), the following shall be added after sub-paragraph (e):—

“(f)that any bingo duty payable in respect of bingo played on the premisesd remains unpaid;

and where the authority entertain an application for the renewal of registration and are satisfied that any bingo duty remains unpaid, they shall refuse the application.”

Modifications etc. (not altering text)

C8The text of ss. 1(4), 43–49, Sch. 9 paras. 22–24 and Sch. 20 para. 11 and Sch. 21 is in the form in which it was originally enacted: it was not reproduced in the Statutes in Force and does not reflect any amendments or repeals which may have been made prior to 1.2.1991

Marginal Citations

24U.K.In paragraph 11 of Schedule 4 to the Gaming Act 1968 (grounds on which, in Scotland, the sheriff may refuse renewal of registration of a club or institute under Part II of that Act) the following shall be added after sub-paragraph (e):—

“(f)that any bingo duty payable in respect of bingo played on the premises remains unpaid;

and where the sheriff entertains an application for the renewal of registration and is satisfied that any bingo duty payanle as mentioned in sub-paragraph (f) above remains unpaid, he shall refuse the application.”

Modifications etc. (not altering text)

C9The text of ss. 1(4), 43–49, Sch. 9 paras. 22–24 and Sch. 20 para. 11 and Sch. 21 is in the form in which it was originally enacted: it was not reproduced in the Statutes in Force and does not reflect any amendments or repeals which may have been made prior to 1.2.1991

SCHEDULE 10. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F72U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F72Sch. 10 repealed except as respects any gaming before 1.10.1970, by Finance Act 1970 (c. 24), Sch. 8 Pt. I

SCHEDULE 11. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F73U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F73Sch. 11 repealed by Betting and Gaming Duties Act 1972 (c. 25), Sch. 7

SCHEDULE 12. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F74U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F74Sch. 12 repealed by Vehicles (Excise) Act 1971 (c. 10), s.39(5), Sch. 8 Pt. I

SCHEDULES 13—16. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F75U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

SCHEDULE 17. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F76U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F76Sch. 17 repealed with saving by Finance Act 1975 (c. 7), ss. 50, 52(2)(3), 59, Sch. 13 Pt. I

SCHEDULES 18, 19. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F77U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F77Schs. 18, 19 repealed with saving by Capital Gains Tax Act 1979 (c. 14), ss. 157(1),158, Sch. 6 para. 10(2)(b), Sch. 8

Section 60

SCHEDULE 20U.K. Consolidation Amendments

Modifications etc. (not altering text)

C10The text of ss. 1(4), 43–49, Sch. 9 paras. 22–24 and Sch. 20 para. 11 and Sch. 21 is in the form in which it was originally enacted: it was not reproduced in the Statutes in Force and does not reflect any amendments or repeals which may have been made prior to 1.2.1991

1—10U.K. . . . F78

Textual Amendments

Discharge of functions of Commissioners of Inland RevenueU.K.

11(1)The M27Inland Revenue Act 1890 (in which “the Commissioners” means the Commissioners of Inland Revenue) shall be amended as follows.U.K.

(2)After section 4 insert—

“4A Exercise of functions of Commissioners.

Any functions conferred by or under any enactment, including any future enactment, on the Commissioners may be exercises by any officer of the Commissioners acting under their authority:

Provided that this section shall not apply to the making of any statutory instrument.”

(3)At the end of section 24 add—

“(4)Any notice or other document purporting to be issued in exercise of any function conferred on the Commissioners shall, until the contrary is proved, be deemed to be so issued.”

12—25.U.K. . . . F79

Textual Amendments

26U.K. . . . F80

Textual Amendments

F80Sch. 20 para. 26 repealed by Gas Act 1972 (c. 60), Sch. 8

27U.K. . . . F81

Textual Amendments

Electricity Act 1957U.K.

28(1) . . . F82U.K.

(2) . . . F83

Textual Amendments

29U.K. . . . F84

Textual Amendments

Commencement of amendmentsU.K.

30(1)—(3) . . . F85U.K.

(4) . . . F86

Textual Amendments

F85Sch. 20 paras. 27, 28(1), 29, 30(1)(2)(3) repealed by Income and Corporation Taxes Act 1970 (c. 10), s. 539(1), Sch. 16

F86Sch. 20 para. 30(4) repealed with savings by Income and Corporation Taxes Act 1970 (c. 10), s. 539(1), Sch. 16

Section 61.

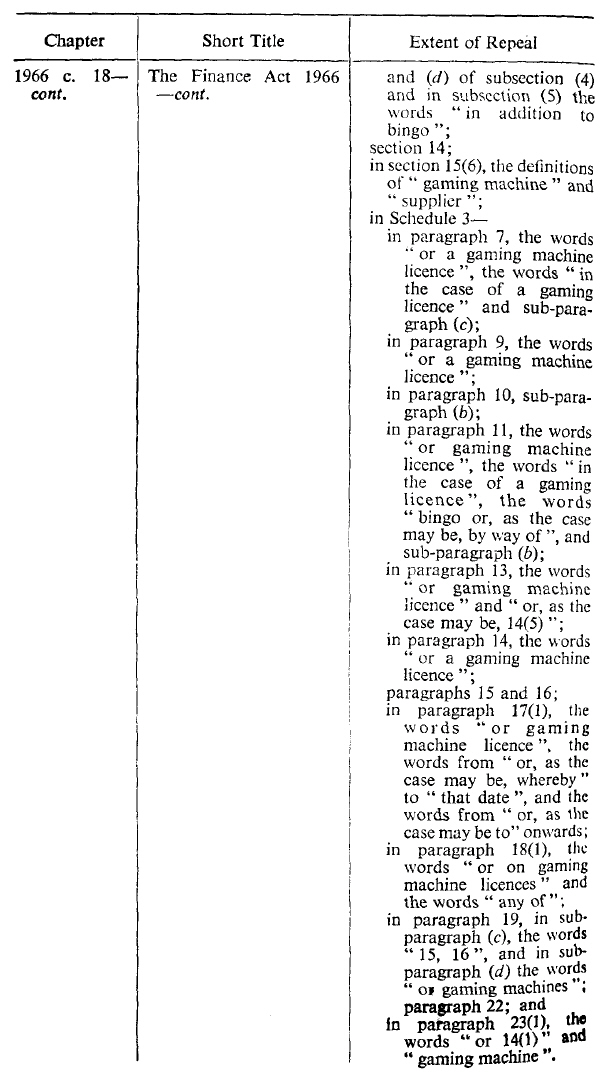

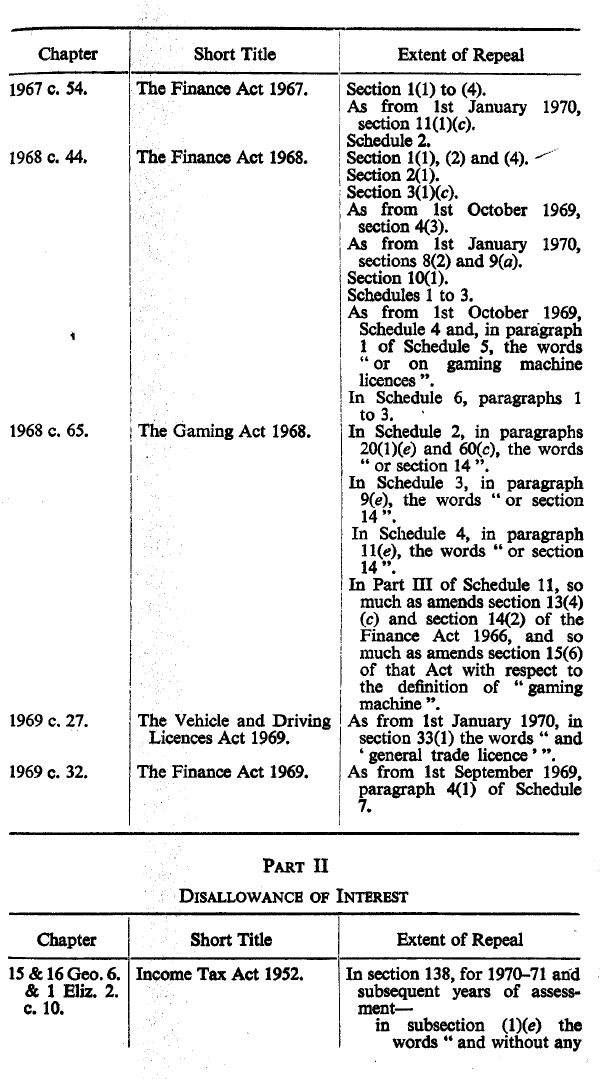

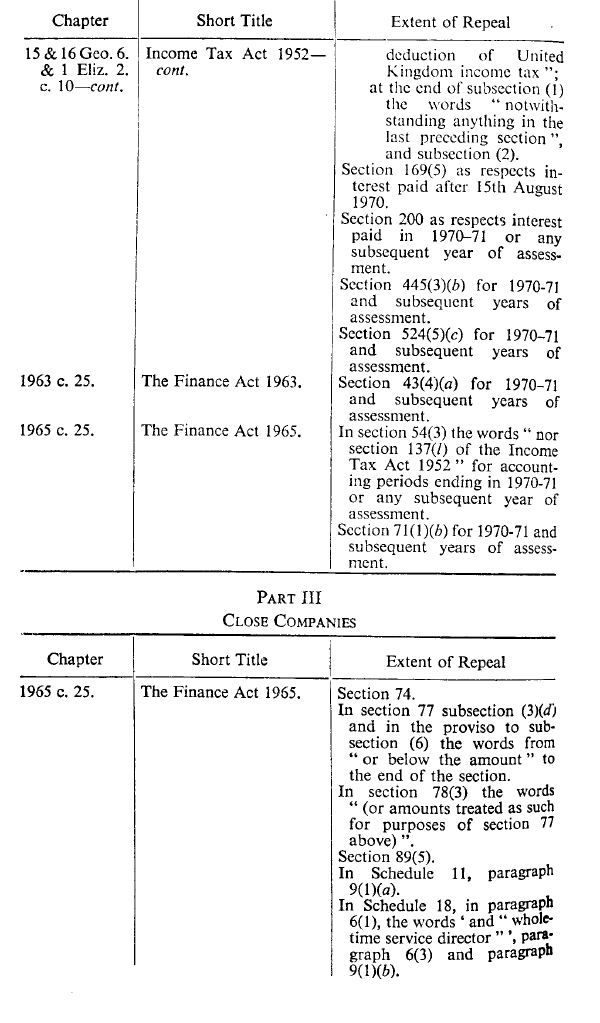

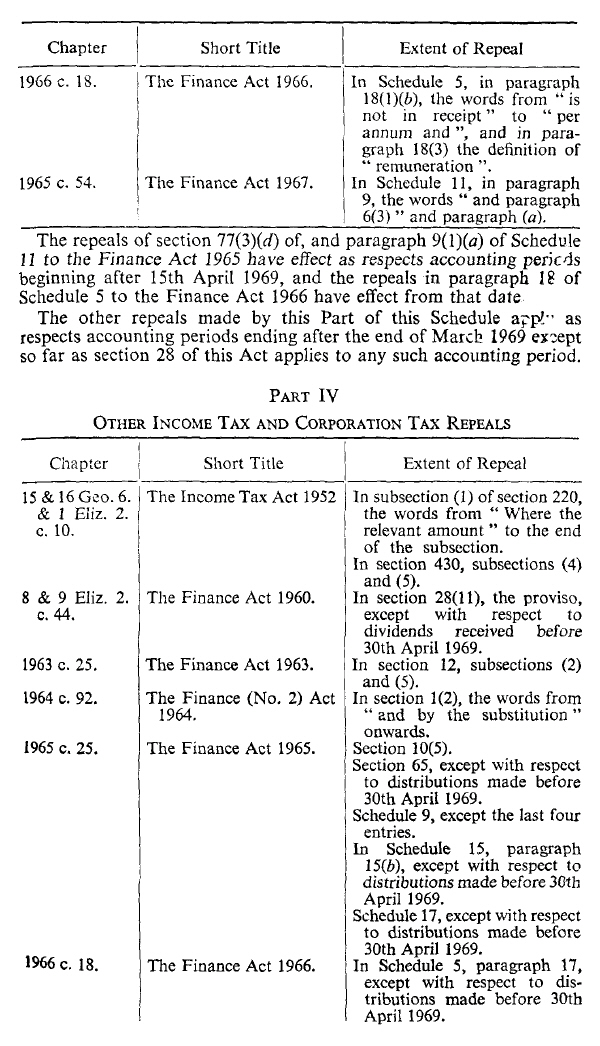

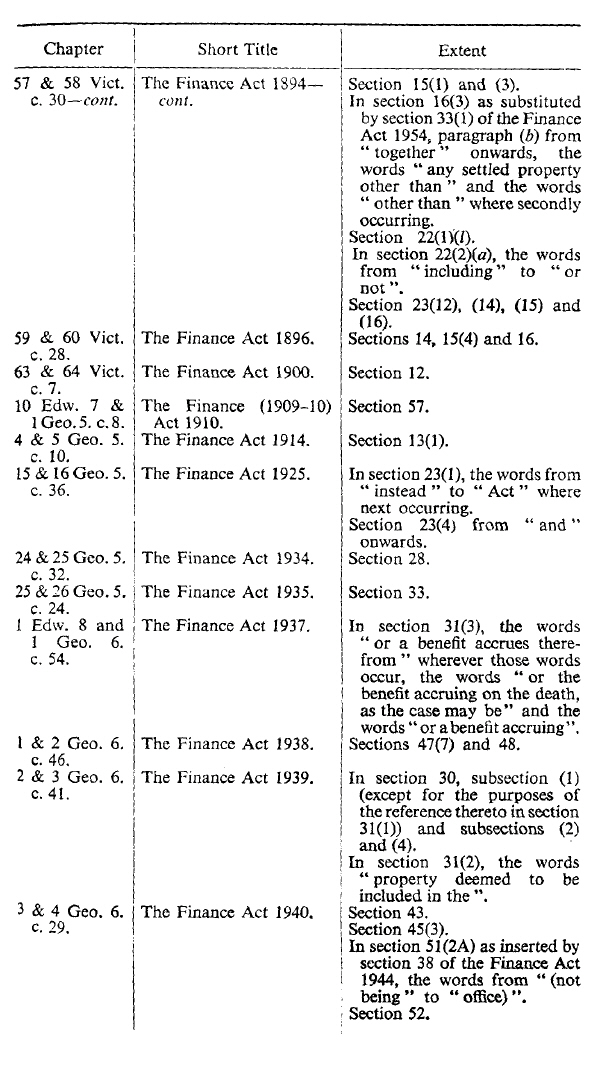

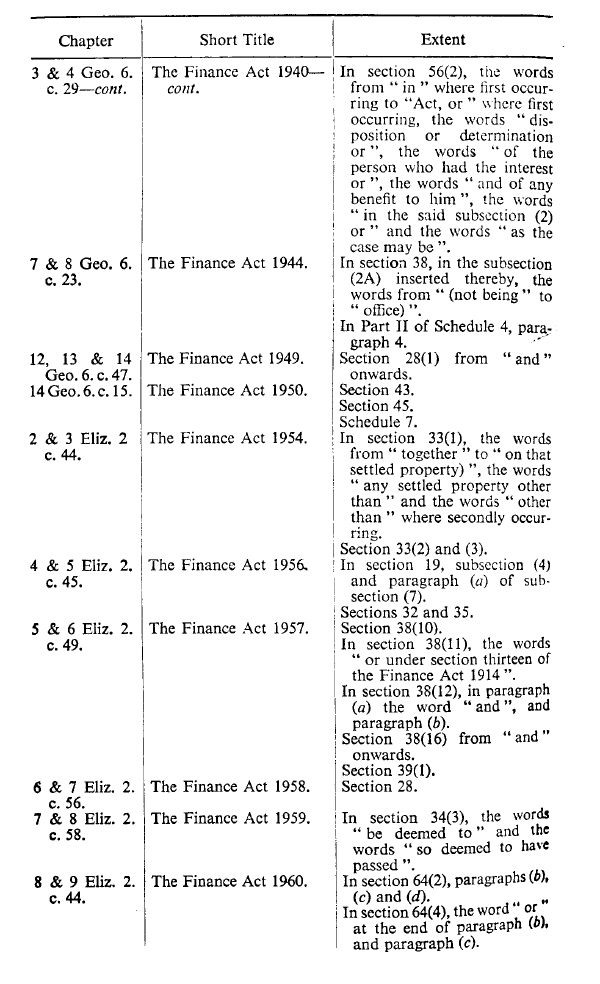

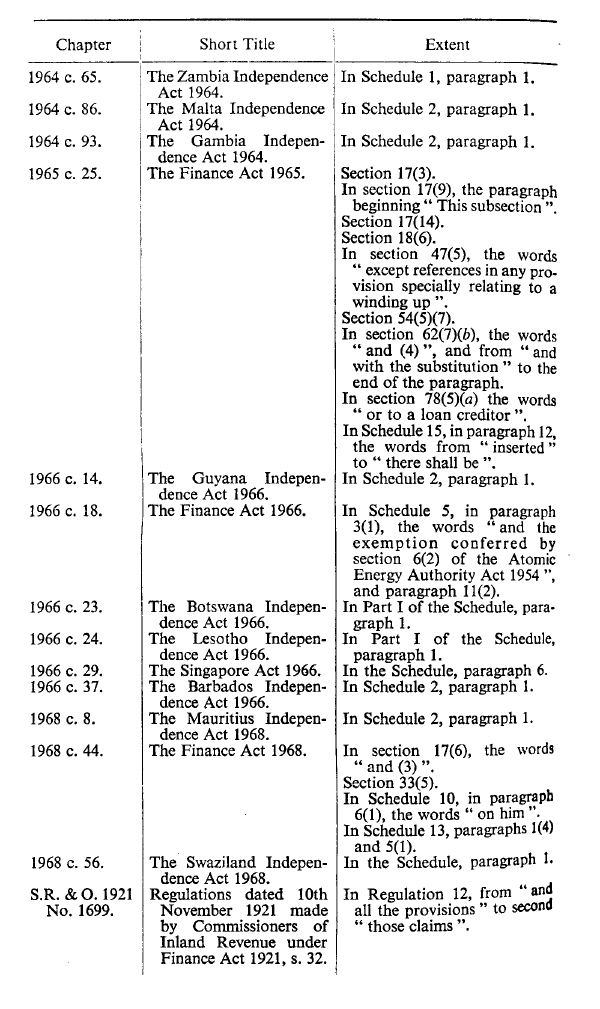

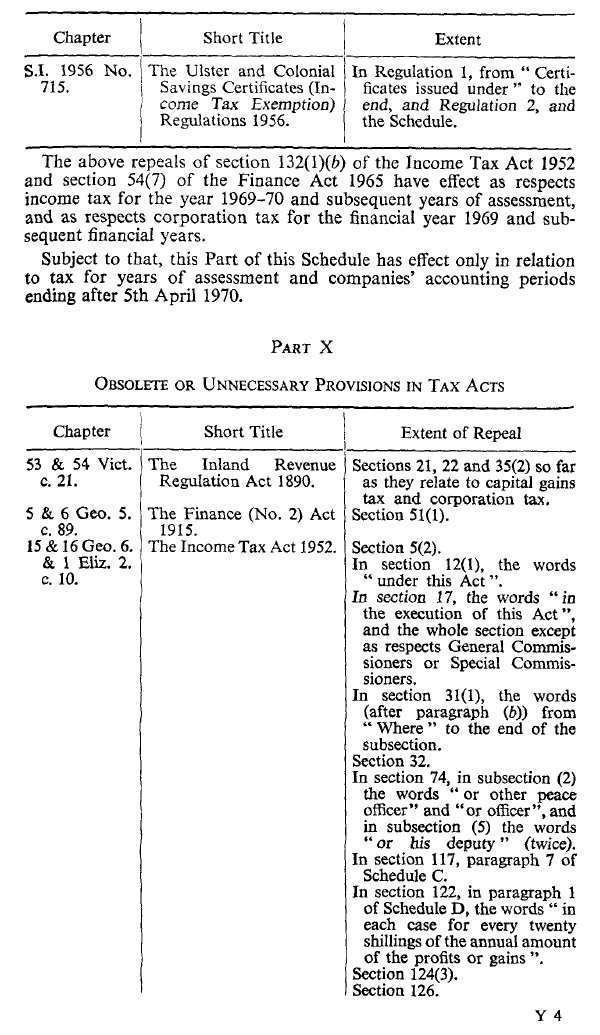

SCHEDULE 21U.K. Repeals

Modifications etc. (not altering text)

C11The text of ss. 1(4), 43–49, Sch. 9 paras. 22–24 and Sch. 20 para. 11 and Sch. 21 is in the form in which it was originally enacted: it was not reproduced in the Statutes in Force and does not reflect any amendments or repeals which may have been made prior to 1.2.1991

Options/Cymorth

Print Options

PrintThe Whole Act

Mae deddfwriaeth ar gael mewn fersiynau gwahanol:

Y Diweddaraf sydd Ar Gael (diwygiedig):Y fersiwn ddiweddaraf sydd ar gael o’r ddeddfwriaeth yn cynnwys newidiadau a wnaed gan ddeddfwriaeth ddilynol ac wedi eu gweithredu gan ein tîm golygyddol. Gellir gweld y newidiadau nad ydym wedi eu gweithredu i’r testun eto yn yr ardal ‘Newidiadau i Ddeddfwriaeth’.

Gwreiddiol (Fel y’i Deddfwyd neu y’i Gwnaed): Mae'r wreiddiol fersiwn y ddeddfwriaeth fel ag yr oedd pan gafodd ei deddfu neu eu gwneud. Ni wnaed unrhyw newidiadau i’r testun.

Pwynt Penodol mewn Amser: This becomes available after navigating to view revised legislation as it stood at a certain point in time via Advanced Features > Show Timeline of Changes or via a point in time advanced search.

Gweler y wybodaeth ychwanegol ochr yn ochr â’r cynnwys

Rhychwant ddaearyddol: Indicates the geographical area that this provision applies to. For further information see ‘Frequently Asked Questions’.

Dangos Llinell Amser Newidiadau: See how this legislation has or could change over time. Turning this feature on will show extra navigation options to go to these specific points in time. Return to the latest available version by using the controls above in the What Version box.

Rhagor o Adnoddau

Gallwch wneud defnydd o ddogfennau atodol hanfodol a gwybodaeth ar gyfer yr eitem ddeddfwriaeth o’r tab hwn. Yn ddibynnol ar yr eitem ddeddfwriaeth sydd i’w gweld, gallai hyn gynnwys:

- y PDF print gwreiddiol y fel deddfwyd fersiwn a ddefnyddiwyd am y copi print

- rhestr o newidiadau a wnaed gan a/neu yn effeithio ar yr eitem hon o ddeddfwriaeth

- manylion rhoi grym a newid cyffredinol

- pob fformat o’r holl ddogfennau cysylltiedig

- slipiau cywiro

- dolenni i ddeddfwriaeth gysylltiedig ac adnoddau gwybodaeth eraill

Llinell Amser Newidiadau

This timeline shows the different points in time where a change occurred. The dates will coincide with the earliest date on which the change (e.g an insertion, a repeal or a substitution) that was applied came into force. The first date in the timeline will usually be the earliest date when the provision came into force. In some cases the first date is 01/02/1991 (or for Northern Ireland legislation 01/01/2006). This date is our basedate. No versions before this date are available. For further information see the Editorial Practice Guide and Glossary under Help.

Rhagor o Adnoddau

Defnyddiwch y ddewislen hon i agor dogfennau hanfodol sy’n cyd-fynd â’r ddeddfwriaeth a gwybodaeth am yr eitem hon o ddeddfwriaeth. Gan ddibynnu ar yr eitem o ddeddfwriaeth sy’n cael ei gweld gall hyn gynnwys:

- y PDF print gwreiddiol y fel deddfwyd fersiwn a ddefnyddiwyd am y copi print

- slipiau cywiro

liciwch ‘Gweld Mwy’ neu ddewis ‘Rhagor o Adnoddau’ am wybodaeth ychwanegol gan gynnwys

- rhestr o newidiadau a wnaed gan a/neu yn effeithio ar yr eitem hon o ddeddfwriaeth

- manylion rhoi grym a newid cyffredinol

- pob fformat o’r holl ddogfennau cysylltiedig

- dolenni i ddeddfwriaeth gysylltiedig ac adnoddau gwybodaeth eraill