- Y Diweddaraf sydd Ar Gael (Diwygiedig)

- Pwynt Penodol mewn Amser (17/03/2004)

- Gwreiddiol (Fel y'i Deddfwyd)

Finance Act 2004

You are here:

- Deddfau Cyhoeddus Cyffredinol y Deyrnas Unedig

- 2004 c. 12

- Schedules only

- Dangos Graddfa Ddaearyddol(e.e. Lloegr, Cymru, Yr Alban aca Gogledd Iwerddon)

- Dangos Llinell Amser Newidiadau

Status:

Point in time view as at 17/03/2004.

Changes to legislation:

Finance Act 2004 is up to date with all changes known to be in force on or before 16 November 2024. There are changes that may be brought into force at a future date. Changes that have been made appear in the content and are referenced with annotations.![]()

Changes to Legislation

Changes and effects yet to be applied by the editorial team are only applicable when viewing the latest version or prospective version of legislation. They are therefore not accessible when viewing legislation as at a specific point in time. To view the ‘Changes to Legislation’ information for this provision return to the latest version view using the options provided in the ‘What Version’ box above.

SCHEDULES

Yn ddilys o 22/07/2004

Section 4

SCHEDULE 1U.K.New Schedule 2A to the Alcoholic Liquor Duties Act 1979

The Schedule inserted before Schedule 3 to the Alcoholic Liquor Duties Act 1979 (c. 4) is as follows—

Section 64A

“SCHEDULE 2AU.K.Duty stamps

Retail containers to be stampedU.K.

1(1)Retail containers of alcoholic liquors to which this Schedule applies shall be stamped—

(a)in such cases and circumstances, and with a duty stamp of such a type, as may be prescribed; but

(b)subject to such exceptions as may be prescribed.

(2)In this Schedule “retail container”, in relation to an alcoholic liquor, means a container—

(a)of a capacity of 35 centilitres or more, and

(b)in which, or from which, the liquor is intended to be sold by retail.

(3)This Schedule applies to the following alcoholic liquors—

(a)spirits;

(b)wine or made-wine of a strength exceeding 22 per cent.

(4)For the purposes of this Schedule a retail container is “stamped” if—

(a)it carries a duty stamp of a type mentioned in sub-paragraph (5)(a) below which has been affixed to the container in a way that complies with the requirements of regulations under this Schedule, or

(b)it carries a label which has been so affixed to the container and the label incorporates a duty stamp of a type mentioned in sub-paragraph (5)(b) below.

(5)In this Schedule “duty stamp” means any of the following—

(a)a document (a “type A stamp”) issued by or on behalf of the Commissioners which—

(i)is designed to be affixed to a retail container of alcoholic liquor, and

(ii)indicates that the appropriate duty, or an amount representing some or all of the appropriate duty, has been (or is to be) paid;

(b)a part of a label for a retail container of alcoholic liquor (a “type B stamp”) which—

(i)is incorporated in the label under the authority of the Commissioners, and

(ii)indicates that the appropriate duty, or an amount representing some or all of the appropriate duty, has been (or is to be) paid.

(6)In sub-paragraph (5) above “the appropriate duty” means the duty chargeable on the quantity and description of alcoholic liquor contained, or to be contained, in the retail container to which the stamp, or the label incorporating the stamp, is, or is to be, affixed.

Power to alter liquors, and capacity of container, to which this Schedule appliesU.K.

2(1)The Treasury may by order made by statutory instrument amend paragraph (a) of paragraph 1(2) above for the purpose of varying the capacity from time to time specified in that paragraph.

(2)The Treasury may by order made by statutory instrument amend paragraph 1(3) above for the purpose of causing this Schedule—

(a)to apply to any description of alcoholic liquor to which it does not apply, or

(b)to cease to apply to any description of alcoholic liquor to which it does apply.

(3)A statutory instrument containing an order under this paragraph shall not be made unless a draft of the instrument has been laid before, and approved by a resolution of, the House of Commons.

Acquisition of and payment for duty stampsU.K.

3(1)The Commissioners may by regulations make provision as to the terms and conditions on which a person may obtain—

(a)a type A stamp,

(b)authority to incorporate in a label a type B stamp,

(c)authority to obtain a label incorporating a type B stamp,

(d)authority to affix such a label to a retail container of alcoholic liquor.

(2)Regulations under sub-paragraph (1) above may in particular make provision for or in connection with—

(a)requiring a person in prescribed cases or circumstances to pay, or agree to pay, the prescribed amount to the Commissioners or to a person authorised by the Commissioners for this purpose;

(b)requiring a person in prescribed cases or circumstances to provide to the Commissioners such security as they may require in respect of payment of the appropriate duty.

(3)An amount prescribed for the purposes of sub-paragraph (2)(a) above must not exceed the aggregate of—

(a)an amount representing the appropriate duty, and

(b)in the case of a type A stamp, the cost of issuing the stamp.

(4)Regulations under sub-paragraph (1) above may also in particular make provision for or in connection with requiring or enabling the Commissioners to bear, in prescribed circumstances, in the case of a type B stamp, all or part of so much of the cost of producing the label as is attributable to the incorporation in it of the stamp.

(5)The whole of an amount payable for a duty stamp shall be treated for the purposes of the Customs and Excise Acts 1979 as an amount due by way of excise duty.

(6)In this paragraph “the appropriate duty” means the duty chargeable on the quantity and description of alcoholic liquor contained, or to be contained, in the retail container to which the stamp, or the label incorporating the stamp, is to be affixed.

RegulationsU.K.

4(1)The Commissioners may by regulations make provision as to such matters relating to duty stamps as appear to them to be necessary or expedient.

(2)Regulations under this Schedule may in particular make provision about—

(a)the times at which a retail container must bear a duty stamp;

(b)the type of duty stamp (see paragraph 1(5)) with which a retail container is to be stamped in any particular case or circumstances;

(c)the design and appearance of a duty stamp (including the production of a label incorporating a type B stamp);

(d)the information that is to appear on a duty stamp;

(e)the cost of issuing a type A stamp for the purposes of paragraph 3(3)(b) above;

(f)the procedure for obtaining—

(i)a type A stamp,

(ii)authority to incorporate in a label a type B stamp,

(iii)authority to obtain a label incorporating a type B stamp,

(iv)authority to affix such a label to a retail container of alcoholic liquor,

(including provision setting periods of notice);

(g)where on the container a type A stamp, or a label incorporating a type B stamp, is to be affixed;

(h)repayment of, or credit for, in prescribed circumstances and subject to such conditions as may be prescribed, all or part of a payment made under or by virtue of this Schedule to the Commissioners or to a person authorised by the Commissioners;

(i)liability to forfeiture in prescribed circumstances of some or all of a payment made, or security provided, under or by virtue of this Schedule to the Commissioners or to a person authorised by the Commissioners.

(3)Regulations under this Schedule may also, in particular, make provision for or in connection with preventing a type A stamp, or a label incorporating a type B stamp, from being used by a person other than—

(a)in the case of a type A stamp, the person to or for whom the stamp was issued or a person authorised by that person to affix the stamp to a retail container of alcoholic liquor,

(b)in the case of a type B stamp, the person to or for whom authority to obtain the label incorporating the stamp, or to affix that label to a retail container of alcoholic liquor, was given by the Commissioners.

(4)Regulations under this Schedule may also, in particular, make provision—

(a)for or in connection with requiring a person who is not established, and does not have any fixed establishment, in the United Kingdom, in prescribed circumstances, to appoint another person (a “duty stamps representative”) to act on his behalf in relation to duty stamps, and

(b)as to the rights, obligations or liabilities of duty stamps representatives.

(5)The Commissioners may, with a view to the protection of the revenue, make regulations for securing and collecting duty payable in accordance with this Schedule.

(6)Regulations under this Schedule may make different provision for different cases.

Offences of possession, sale etc of unstamped containersU.K.

5(1)Except in such cases as may be prescribed, a person commits an offence if he—

(a)is in possession of, transports or displays, or

(b)sells, offers for sale or otherwise deals in,

unstamped retail containers containing alcoholic liquor to which this Schedule applies.

(2)It is a defence for a person charged with an offence under this paragraph to prove that the retail containers in question were not required to be stamped.

(3)A person who commits an offence under this paragraph is liable on summary conviction to a fine not exceeding level 5 on the standard scale.

(4)A retail container in relation to which an offence under this paragraph is committed is liable to forfeiture (together with its contents).

Offence of using premises for sale of liquor in or from unstamped containersU.K.

6(1)A manager of premises commits an offence if—

(a)he suffers the premises to be used for the sale of liquor in an unstamped retail container, or for the sale of liquor that is from an unstamped retail container; and

(b)the liquor is alcoholic liquor to which this Schedule applies.

(2)It is a defence for a person charged with an offence under this paragraph to prove that the retail container in question was not required to be stamped.

(3)A person who commits an offence under this paragraph is liable on summary conviction to a fine not exceeding level 5 on the standard scale.

(4)Where an offence is committed under this paragraph, all unstamped retail containers of alcoholic liquor to which this Schedule applies that are on the premises at the time of the offence are liable to forfeiture (together with their contents).

(5)For the purposes of this Schedule a person is a “manager” of premises if he—

(a)is entitled to control their use,

(b)is entrusted with their management, or

(c)is in charge of them.

Alcohol sales ban following conviction for offence under paragraph 6U.K.

7(1)A court by or before which a person is convicted of an offence under paragraph 6 above may make an order prohibiting the use of the premises in question for the sale of alcoholic liquors during a period specified in the order.

(2)The period specified in an order under this paragraph shall not exceed six months; and the first day of the period shall be the day specified as such in the order.

(3)If a manager of premises suffers the premises to be used in breach of an order under this paragraph, he commits an offence and is liable on summary conviction to a fine not exceeding level 5 on the standard scale.

Penalty for altering duty stampsU.K.

8(1)This paragraph applies where a person—

(a)alters a type A stamp, otherwise than in accordance with regulations under this Schedule, after it has been issued, or

(b)so alters a type B stamp after the label in which it is incorporated has been produced.

(2)His conduct attracts a penalty under section 9 of the Finance Act 1994 (civil penalties).

(3)The stamp, or the label in which it is incorporated, is liable to forfeiture.

Penalty for affixing wrong, altered or forged stamps, or over-labellingU.K.

9(1)This paragraph applies where a person affixes to a retail container that is required to be stamped any of the items mentioned in sub-paragraphs (2) to (5) below.

(2)The first is—

(a)a type A stamp, or

(b)a label incorporating a type B stamp,

if the stamp is not a correct stamp for that container in accordance with regulations under this Schedule.

(3)The second is—

(a)a type A stamp that has been altered, otherwise than in accordance with regulations under this Schedule, after it has been issued, or

(b)a label incorporating a type B stamp if the stamp has been so altered after the label has been produced.

(4)The third is an item that purports to be, but is not,—

(a)a type A stamp, or

(b)a label incorporating a type B stamp.

(5)The fourth is any label or other item affixed in such a way as to cover up all or part of—

(a)a type A stamp affixed to the container, or

(b)a type B stamp incorporated in a label affixed to the container,

except where the label or other item is so affixed in accordance with regulations under this Schedule.

(6)The person’s conduct attracts a penalty under section 9 of the Finance Act 1994 (civil penalties).

(7)The container is liable to forfeiture (together with its contents).

Penalty for failing to comply with regulationsU.K.

10(1)If a person fails to comply with a requirement imposed by or under regulations under this Schedule—

(a)his conduct attracts a penalty under section 9 of the Finance Act 1994 (civil penalties);

(b)any article in respect of which he fails to comply with the requirement is liable to forfeiture (including, in the case of a container, its contents).

(2)Regulations under this Schedule may make provision as to the amount by reference to which the penalty under sub-paragraph (1)(a) above is to be calculated.

Forfeiture of forged, altered or stolen duty stampsU.K.

11(1)The following items are liable to forfeiture.

(2)The first is an item that purports to be, but is not,—

(a)a type A stamp, or

(b)a label incorporating a type B stamp.

(3)The second is—

(a)a type A stamp that has been altered, otherwise than in accordance with regulations under this Schedule, after it has been issued, or

(b)a label incorporating a type B stamp if the stamp has been so altered after the label has been produced.

(4)The third is—

(a)a type A stamp, or

(b)a label incorporating a type B stamp,

that is in a person’s possession unlawfully.

InterpretationU.K.

12In this Schedule—

“duty stamp” has the meaning given by paragraph 1(5) above;

“prescribed” means prescribed in regulations made by the Commissioners;

“retail container” has the meaning given by paragraph 1(2) above;

“stamped” and “unstamped” are to be read in accordance with paragraph 1(4) above;

“type A stamp” has the meaning given by paragraph 1(5)(a) above;

“type B stamp” has the meaning given by paragraph 1(5)(b) above.”.

Yn ddilys o 22/07/2004

Section 19

SCHEDULE 2U.K.Disclosure of value added tax avoidance schemes

Part 1 U.K.Principal amendments of Value Added Tax Act 1994

1U.K.After section 58 of the Value Added Tax Act 1994 (c. 23) insert—

“Disclosure of avoidance schemesU.K.

58ADisclosure of avoidance schemes

Schedule 11A (which imposes disclosure requirements relating to the use of schemes for avoiding VAT) shall have effect.”.

Commencement Information

I1Sch. 2 para. 1 wholly in force at 1.8.2004; Sch. 2 para. 1 in force for specified purposes at Royal Assent, see s. 19(2); Sch. 2 para. 1 in force otherwise at 1.8.2004 by S.I. 2004/1934, art. 2

2U.K.After Schedule 11 to that Act insert—

Section 58A

“SCHEDULE 11AU.K.Disclosure of avoidance Schemes

InterpretationU.K.

1In this Schedule—

“designated scheme” has the meaning given by paragraph 3(4);

“notifiable scheme” has the meaning given by paragraph 5(1);

“scheme” includes any arrangements, transaction or series of transactions;

“tax advantage” is to be read in accordance with paragraph 2.

Obtaining a tax advantageU.K.

2(1)For the purposes of this Schedule, a person obtains a tax advantage if—

(a)in any prescribed accounting period, the amount by which the output tax accounted for by him exceeds the input tax deducted by him is less than it otherwise would be, or

(b)he obtains a VAT credit when he would not otherwise do so, or obtains a larger VAT credit or obtains a VAT credit earlier than would otherwise be the case.

(2)A person also obtains a tax advantage for the purposes of this Schedule if, in a case where he recovers input tax as a recipient of a supply before the supplier accounts for the output tax, the period between the time when the input tax is recovered and the time when the output tax is accounted for is greater than would otherwise be the case.

Designation by order of avoidance schemesU.K.

3(1)If it appears to the Treasury—

(a)that a scheme of a particular description has been, or might be, entered into for the purpose of enabling any person to obtain a tax advantage, and

(b)that it is unlikely that persons would enter into a scheme of that description unless the main purpose, or one of the main purposes, of doing so was the obtaining by any person of a tax advantage,

the Treasury may by order designate that scheme for the purposes of this paragraph.

(2)A scheme may be designated for the purposes of this paragraph even though the Treasury are of the opinion that no scheme of that description could as a matter of law result in the obtaining by any person of a tax advantage.

(3)The order must allocate a reference number to each scheme.

(4)In this Schedule “designated scheme” means a scheme of a description designated for the purposes of this paragraph.

Designation by order of provisions included in or associated with avoidance schemesU.K.

4(1)If it appears to the Treasury that a provision of a particular description is, or is likely to be, included in or associated with schemes that are entered into for the purpose of enabling any person to obtain a tax advantage, the Treasury may by order designate that provision for the purposes of this paragraph.

(2)A provision may be designated under this paragraph even though it also appears to the Treasury that the provision is, or is likely to be, included in or associated with schemes that are not entered into for the purpose of obtaining a tax advantage.

(3)In this paragraph “provision” includes any agreement, transaction, act or course of conduct.

Meaning of “notifiable scheme”U.K.

5(1)For the purposes of this Schedule, a scheme is a “notifiable scheme”if—

(a)it is a designated scheme, or

(b)although it is not a designated scheme, conditions A and B below are met in relation to it.

(2)Condition A is that the scheme includes, or is associated with, a provision of a description designated under paragraph 4.

(3)Condition B is that the scheme has as its main purpose, or one of its main purposes, the obtaining of a tax advantage by any person.

Duty to notify CommissionersU.K.

6(1)This paragraph applies in relation to a taxable person where—

(a)the amount of VAT shown in a return in respect of a prescribed accounting period as payable by or to him is less than or greater than it would be but for any notifiable scheme to which he is party, or

(b)he makes a claim for the repayment of output tax or an increase in credit for input tax in respect of any prescribed accounting period in respect of which he has previously delivered a return and the amount claimed is greater than it would be but for such a scheme.

(2)Where the scheme is a designated scheme, the taxable person must notify the Commissioners within the prescribed time, and in such form and manner as may be required by or under regulations, of the reference number allocated to the scheme under paragraph 3(3).

(3)Where the scheme is not a designated scheme, the taxable person must, subject to sub-paragraph (4), provide the Commissioners within the prescribed time, and in such form and manner as may be required by or under regulations, with prescribed information relating to the scheme.

(4)Sub-paragraph (3) does not apply where the scheme is one in respect of which any person has previously—

(a)provided the Commissioners with prescribed information under paragraph 9, and

(b)provided the taxable person with a reference number notified to him by the Commissioners under paragraph 9(2)(b).

(5)The taxable person is not obliged to comply with sub-paragraph (2) or (3) in relation to any scheme if he has on a previous occasion complied with that sub-paragraph in relation to that scheme.

(6)This paragraph has effect subject to paragraph 7.

Exemptions from duty to notify under paragraph 6U.K.

7(1)Paragraph 6 does not apply to a taxable person in relation to a scheme—

(a)where the taxable person is not a group undertaking in relation to any other undertaking and conditions A and B below, as they have effect in relation to the scheme, are met in relation to the taxable person, or

(b)where the taxable person is a group undertaking in relation to any other undertaking and conditions A and B below, as they have effect in relation to the scheme, are met in relation to the taxable person and every other group undertaking.

(2)Condition A is that the total value of the person’s taxable supplies and exempt supplies in the period of twelve months ending immediately before the beginning of the relevant period is less than the minimum turnover.

(3)Condition B is that the total value of the person’s taxable supplies and exempt supplies in the prescribed accounting period immediately preceding the relevant period is less than the appropriate proportion of the minimum turnover.

(4)In sub-paragraphs (2) and (3) “the minimum turnover” means—

(a)in relation to a designated scheme, £600,000, and

(b)in relation to any other notifiable scheme, £10,000,000.

(5)In sub-paragraph (3) “the appropriate proportion” means the proportion which the length of the prescribed accounting period bears to twelve months.

(6)The value of a supply of goods or services shall be determined for the purposes of this paragraph on the basis that no VAT is chargeable on the supply.

(7)The Treasury may by order substitute for the sum for the time being specified in sub-paragraph (4)(a) or (b) such other sum as they think fit.

(8)This paragraph has effect subject to paragraph 8.

(9)In this paragraph—

“relevant period” means the prescribed accounting period referred to in paragraph 6(1)(a) or (b);

“undertaking” and “group undertaking” have the same meanings as in Part 7 of the Companies Act 1985.

Power to exclude exemptionU.K.

8(1)The purpose of this paragraph is to prevent the maintenance or creation of any artificial separation of business activities carried on by two or more persons from resulting in an avoidance of the obligations imposed by paragraph 6.

(2)In determining for the purposes of sub-paragraph (1) whether any separation of business activities is artificial, regard shall be had to the extent to which the different persons carrying on those activities are closely bound to one another by financial, economic and organisational links.

(3)If the Commissioners make a direction under this section—

(a)the persons named in the direction shall be treated for the purposes of paragraph 7 as a single taxable person carrying on the activities of a business described in the direction with effect from the date of the direction or, if the direction so provides, from such later date as may be specified in the direction, and

(b)if paragraph 7 would not exclude the application of paragraph 6, in respect of any notifiable scheme, to that single taxable person, it shall not exclude the application of paragraph 6, in respect of that scheme, to the persons named in the direction.

(4)The Commissioners shall not make a direction under this section naming any person unless they are satisfied—

(a)that he is making or has made taxable or exempt supplies,

(b)that the activities in the course of which he makes those supplies form only part of certain activities, the other activities being carried on concurrently or previously (or both) by one or more other persons, and

(c)that, if all the taxable and exempt supplies of the business described in the direction were taken into account, conditions A and B in paragraph 7(2) and (3), as those conditions have effect in relation to designated schemes, would not be met in relation to that business.

(5)A direction under this paragraph shall be served on each of the persons named in it.

(6)A direction under this paragraph remains in force until it is revoked or replaced by a further direction.

Voluntary notification of avoidance scheme that is not designated schemeU.K.

9(1)Any person may, at any time, provide the Commissioners with prescribed information relating to a scheme or proposed scheme of a particular description which is (or, if implemented, would be) a notifiable scheme by virtue of paragraph 5(1)(b).

(2)On receiving the prescribed information, the Commissioners may—

(a)allocate a reference number to the scheme (if they have not previously done so under this paragraph), and

(b)notify the person who provided the information of the number allocated.

Penalty for failure to notify use of notifiable schemeU.K.

10(1)A person who fails to comply with paragraph 6 shall be liable, subject to sub-paragraphs (2) and (3), to a penalty of an amount determined under paragraph 11.

(2)Conduct falling within sub-paragraph (1) shall not give rise to liability to a penalty under this paragraph if the person concerned satisfies the Commissioners or, on appeal, a tribunal that there is a reasonable excuse for the failure.

(3)Where, by reason of conduct falling within sub-paragraph (1)—

(a)a person is convicted of an offence (whether under this Act or otherwise), or

(b)a person is assessed to a penalty under section 60,

that conduct shall not give rise to a penalty under this paragraph.

Amount of penaltyU.K.

11(1)Where the failure mentioned in paragraph 10(1) relates to a notifiable scheme that is not a designated scheme, the amount of the penalty is £5,000.

(2)Where the failure mentioned in paragraph 10(1) relates to a designated scheme, the amount of the penalty is 15 per cent. of the VAT saving (as determined under sub-paragraph (3)).

(3)For this purpose the VAT saving is—

(a)to the extent that the case falls within paragraph 6(1)(a), the aggregate of—

(i)the amount by which the amount of VAT that would, but for the scheme, have been shown in returns in respect of the relevant periods as payable by the taxable person exceeds the amount of VAT that was shown in those returns as payable by him, and

(ii)the amount by which the amount of VAT that was shown in such returns as payable to the taxable person exceeds the amount of VAT that would, but for the scheme, have been shown in those returns as payable to him, and

(b)to the extent that the case falls within paragraph 6(1)(b), the amount by which the amount claimed exceeds the amount which the taxable person would, but for the scheme, have claimed.

(4)In sub-paragraph (3)(a) “the relevant periods” means the prescribed accounting periods beginning with that in respect of which the duty to comply with paragraph 6 first arose and ending with the earlier of the following—

(a)the prescribed accounting period in which the taxable person complied with that paragraph, and

(b)the prescribed accounting period immediately preceding the notification by the Commissioners of the penalty assessment.

Penalty assessmentsU.K.

12(1)Where any person is liable under paragraph 10 to a penalty of an amount determined under paragraph 11, the Commissioners may, subject to sub-paragraph (3), assess the amount due by way of penalty and notify it to him accordingly.

(2)The fact that any conduct giving rise to a penalty under paragraph 10 may have ceased before an assessment is made under this paragraph shall not affect the power of the Commissioners to make such an assessment.

(3)In a case where the penalty falls to be calculated by reference to the VAT saving as determined under paragraph 11(3) and the VAT that would, but for the scheme, have been shown in returns as payable by or to the taxable person cannot be readily attributed to any one or more prescribed accounting periods, it shall be treated for the purposes of this Schedule as VAT that would, but for the scheme, have been shown as payable by or to the taxable person in returns for such period or periods as the Commissioners may determine to the best of their judgment and notify to the person liable for the penalty.

(4)No assessment to a penalty under this paragraph shall be made more than two years from the time when facts sufficient, in the opinion of the Commissioners, to indicate that there has been a failure to comply with paragraph 6 in relation to a notifiable scheme came to the Commissioners' knowledge.

(5)Where the Commissioners notify a person of a penalty in accordance with sub-paragraph (1), the notice of assessment shall specify—

(a)the amount of the penalty,

(b)the reasons for the imposition of the penalty,

(c)how the penalty has been calculated, and

(d)any reduction of the penalty in accordance with section 70.

(6)Where a person is assessed under this paragraph to an amount due by way of penalty and is also assessed under section 73(1), (2), (7), (7A) or (7B) for any of the prescribed accounting periods to which the assessment under this paragraph relates, the assessments may be combined and notified to him as one assessment, but the amount of the penalty shall be separately identified in the notice.

(7)If an amount is assessed and notified to any person under this paragraph, then unless, or except to the extent that, the assessment is withdrawn or reduced, that amount shall be recoverable as if it were VAT due from him.

(8)Subsection (10) of section 76 (notification to certain persons acting for others) applies for the purposes of this paragraph as it applies for the purposes of that section.

Penalty assessmentsU.K.

13Regulations under this Schedule—

(a)may make different provision for different circumstances, and

(b)may include transitional provisions or savings.”.

Commencement Information

I2Sch. 2 para. 2 wholly in force at 1.8.2004; Sch. 2 para. 2 in force for specified purposes at Royal Assent, see s. 19(2); Sch. 2 para. 2 in force otherwise at 1.8.2004 by S.I. 2004/1934, art. 2

Part 2 U.K.Consequential amendments

3U.K.In section 70 of the Value Added Tax Act 1994 (c. 23) (mitigation of penalties), in subsection (1) after “69A” insert “ or under paragraph 10 of Schedule 11A ”.

Commencement Information

I3Sch. 2 para. 3 wholly in force at 1.8.2004; Sch. 2 para. 3 in force for specified purposes at Royal Assent, see s. 19(2); Sch. 2 para. 3 in force otherwise at 1.8.2004 by S.I. 2004/1934, art. 2

4U.K.In section 83 of that Act (appeals) after paragraph (z) insert—

“(za)a direction under paragraph 8 of Schedule 11A,

(zb)any liability to a penalty under paragraph 10(1) of Schedule 11A, any assessment under paragraph 12(1) of that Schedule or the amount of such an assessment;”.

Commencement Information

I4Sch. 2 para. 4 wholly in force at 1.8.2004; Sch. 2 para. 4 in force for specified purposes at Royal Assent, see s. 19(2); Sch. 2 para. 4 in force otherwise at 1.8.2004 by S.I. 2004/1934, art. 2

5(1)Section 84 of that Act (further provisions relating to appeals) is amended as follows.U.K.

(2)In subsection (3), for “or (ra)” substitute “ , (ra) or (zb) ”.

(3)After subsection (6) insert—

“(6A)Without prejudice to section 70, nothing in section 83(zb) shall be taken to confer on a tribunal any power to vary an amount assessed by way of penalty except in so far as it is necessary to reduce it to the amount which is appropriate under paragraph 11 of Schedule 11A.”.

Commencement Information

I5Sch. 2 para. 5 wholly in force at 1.8.2004; Sch. 2 para. 5 in force for specified purposes at Royal Assent, see s. 19(2); Sch. 2 para. 5 in force otherwise at 1.8.2004 by S.I. 2004/1934, art. 2

6U.K.In section 97 of that Act (orders, rules and regulations) in subsection (4) (which lists powers exercisable subject to affirmative procedure in the House of Commons) after paragraph (f) insert—

“(g)an order under paragraph 3 or 4 of Schedule 11A.”.

Commencement Information

I6Sch. 2 para. 6 wholly in force at 1.8.2004; Sch. 2 para. 6 in force for specified purposes at Royal Assent, see s. 19(2); Sch. 2 para. 6 in force otherwise at 1.8.2004 by S.I. 2004/1934, art. 2

Yn ddilys o 22/07/2004

Section 28

SCHEDULE 3U.K.Corporation tax: the non-corporate distribution rate: supplementary provisions

Part 1 U.K.General provisions

IntroductionU.K.

1U.K.The provisions of this Schedule supplement section 13AB (corporation tax: the non-corporate distribution rate).

Meaning of “non-corporate distribution”U.K.

2(1)A “non-corporate distribution” means a distribution made by a company to a recipient who is not a company.U.K.

“Recipient” here means the person beneficially entitled to the distribution.

(2)A distribution made to a partnership is treated as made to the partners notwithstanding that the partnership is regarded as a legal person, or as a body corporate, under the law of the country or territory under which it is formed.

Calculation of company’s “underlying rate of corporation tax”U.K.

3(1)A company’s underlying rate of corporation tax for an accounting period is determined as follows:U.K.

Step One

Take the company’s basic profits for the accounting period (“BP”).

Step Two

Find the amount of corporation tax chargeable on those profits apart from section 13AB (“CT”).

Step Three

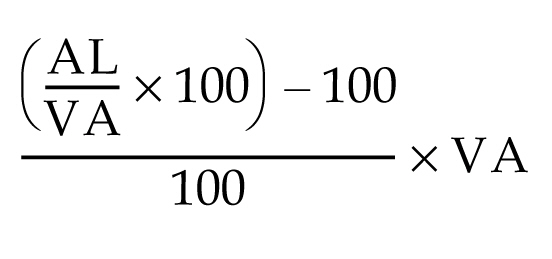

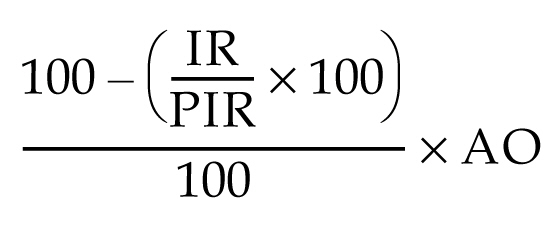

The company’s underlying rate of corporation tax is the percentage determined as follows—

(2)In determining CT—

(a)apply the rate of corporation tax fixed for companies generally, and

(b)if the company is entitled to and claims relief under section 13 (small companies' relief) or section 13AA (corporation tax starting rate), apply the provisions of those sections.

But take no account of any other relief that is given by reducing the amount or rate of tax payable (as opposed to the amount of the profits chargeable to tax).

Matching: distributions not exceeding basic profitsU.K.

4U.K.Where in an accounting period the total amount of the distributions made (or treated as made) by a company does not exceed the amount of its basic profits, the amount of the company’s basic profits matched with non-corporate distributions is equal to the total amount of the non-corporate distributions made (or treated as made) by the company in that period.

Matching: distributions exceeding basic profitsU.K.

5U.K.Where in an accounting period the total amount of the distributions made (or treated as made) by a company exceeds its basic profits, the amount of the company’s basic profits for that period matched with non-corporate distributions is—

where—

NCD is the total amount of the non-corporate distributions made (or treated as made) by the company in that period;

D is the total amount of all the distributions made (or treated as made) by the company in that period; and

BP is the amount of the company’s basic profits for that period.

Part 2 U.K.Allocation of excess NCDs to other companies

Allocation of excess NCDs to other companiesU.K.

6(1)This Part of this Schedule provides for the allocation to other companies of any amount by which the total amount of the non-corporate distributions made (or treated as made) by a company (the “distributing company”) in an accounting period (the “distribution period”) exceeds the amount of the company’s basic profits for that period that are matched under paragraph 5.U.K.

(2)That amount is referred to in this Schedule as “excess NCDs”.

(3)A company to which an amount of excess NCDs is allocated (a “recipient company”) is treated as if it had made a non-corporate distribution of that amount in the period to which it is allocated.

Allocation of excess NCDs to other group companiesU.K.

7(1)If at the end of the distribution period the distributing company is a member of a group, excess NCDs must be allocated, so far as possible, to the other group companies.U.K.

The allocation must be made in accordance with the following rules.

(2)Excess NCDs may not be allocated to a recipient company unless it has available profits for the accounting period to which they are to be allocated.

(3)The amount of a recipient company’s available profits for an accounting period is given by:

where—

BP is the amount of that company’s basic profits for that accounting period, and

NCD is the total amount of non-corporate distributions made (or treated as made) by that company in that period.

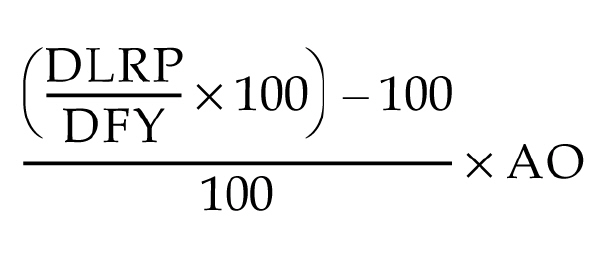

(4)The maximum amount of excess NCDs that may be allocated to an accounting period of a recipient company is:

where—

NCD is the total amount of the non-corporate distributions made (or treated as made) by the distributing company in the distribution period;

D is the total amount of all the distributions made (or treated as made) by that company in that period; and

AP is the amount of the recipient company’s available profits for that period.

(5)In determining the amount of a company’s available profits at any time account shall only be taken of excess NCDs allocated to it by virtue of an allocation made before that time that remains (or so far as it remains) effective.

Allocation of excess NCDs: period or periods to which amount to be allocatedU.K.

8(1)Excess NCDs falling to be allocated to another company under paragraph 7 (allocation to other group companies) may be allocated to any accounting period identified by this paragraph as a corresponding accounting period.U.K.

If there is more than one such period, excess NCDs must be allocated to the first to the full extent possible before any allocation is made to the second, and so on.

(2)The accounting period of a recipient company that includes the last day of the distribution period is its first corresponding accounting period.

Unless that accounting period is shorter than the distribution period, it is the recipient company’s only corresponding accounting period.

(3)If the first corresponding accounting period is shorter than the distribution period, any subsequent accounting period of the recipient company beginning before the end of the period specified in sub-paragraph (4) is a corresponding accounting period.

(4)The period referred to in sub-paragraph (3) is a period—

(a)of the same length as the distribution period, and

(b)beginning on the same day as the recipient company’s first corresponding accounting period.

Allocation of excess NCDs: degroupingU.K.

9(1)This paragraph applies where a company (“company A”) ceases to be a member of the same group as another company (“company B”) but the companies remain under the control of the same person or persons.U.K.

This is referred to below as “degrouping”.

(2)If at the end of any accounting period of company A ending on or after the degrouping but no more than two years after the degrouping—

(a)company A has excess NCDs that (apart from this paragraph) cannot be allocated to other companies,

(b)the business activities of company A and any other companies in the same group as that company are negligible, and

(c)the business activities of company B and any other companies in the same group as that company are not negligible,

the provisions of sub-paragraphs (3) to (5) below apply.

The end of the accounting period when the above conditions are met is referred to in those provisions as “the relevant time”.

(3)Company B and any other companies in the same group as that company at the relevant time (the “B group”) shall be treated for the purposes of allocating the excess NCDs as if they were members of the same group as company A.

(4)Any excess NCDs remaining after any allocation made by virtue of sub-paragraph (3) must be allocated—

(a)to company B or, if different, the company in the B group that at the relevant time has the greatest number of members who are not companies, and

(b)to the accounting period of that company that includes the relevant time.

This allocation is not subject to the restrictions in paragraph 7 on the amount that may be allocated to another company.

(5)If there is more than one company answering the description in sub-paragraph (4)(a), the excess NCDs shall be apportioned between them according to the amount of their basic profits for the accounting period to which the amount falls to be allocated.

(6)In this paragraph “control” shall be construed in accordance with section 416(2) to (6).

Allocation of excess NCDs: procedureU.K.

10(1)The basic rule is that the allocation of excess NCDs to another company must be made by the distributing company with the agreement of the recipient company.U.K.

(2)If excess NCDs are not so allocated within nine months after—

(a)in a case within paragraph 7, the end of the distribution period, or

(b)in a case within paragraph 9, the relevant time within the meaning of that paragraph,

they may be allocated at any time thereafter by an officer of the Board.

(3)An allocation under sub-paragraph (1) or (2) may be varied—

(a)by agreement between the relevant companies, or

(b)if further excess NCDs are required to be allocated and no variation is agreed within one year after its becoming apparent that a variation is required, by an officer of the Board.

Any such variation may in turn be varied as mentioned in paragraph (a) or (b).

(4)No allocation or variation of an allocation of excess NCDs may be made after the end of the period of one year after whichever of the following last occurs—

(a)the final determination of the tax affairs of the distributing company in relation to the distribution period,

(b)in a case within paragraph 7, the final determination of the tax affairs of all recipient or potential recipient companies in relation to accounting periods that are or could be corresponding accounting periods, or

(c)in a case within paragraph 9, the final determination of the tax affairs of all recipient or potential recipient companies in relation to accounting periods to which an allocation may be made under that paragraph.

(5)If circumstances arise as a result of which the tax affairs of any such company for any such period are reopened, an allocation or variation of an allocation may (and shall if necessary) be made at any time before the end of the period of one year after the tax affairs of the company are again finally determined.

(6)For the purposes of sub-paragraphs (4) and (5) the tax affairs of a company for a period are finally determined when the amounts are conclusively determined within the meaning of paragraph 88 of Schedule 18 to the Finance Act 1998 (c. 36) (company tax returns: conclusiveness of amounts stated in return).

(7)References in this paragraph to variation of an allocation include reducing the amount allocated to nil.

Allocation of excess NCDs: amounts proving to be excessiveU.K.

11(1)This paragraph applies where an amount of excess NCDs allocated to another company in accordance with this Part of this Schedule later proves to be excessive.U.K.

(2)The excess shall revert to the distributing company.

(3)If allocations to two or more companies are involved, the amounts shall revert in the opposite order to that in which the allocations were made.

(4)In the case of allocations made at the same time, the amounts reverting to the distributing company shall be in proportion to the original allocations.

Allocation of excess NCDs to companies not resident in the United KingdomU.K.

12(1)The provisions of this Part of this Schedule as to the allocation of excess NCDs to other companies apply, with any necessary modifications, to companies that are not resident in the United Kingdom as they apply to companies that are so resident.U.K.

(2)In particular, references to the company’s basic profits and accounting periods shall be read in relation to a company that is not resident in the United Kingdom as references to what would have been the case if the company had been resident in the United Kingdom at all material times.

Part 3 U.K.Other supplementary provisions

Carry forward of excess NCDsU.K.

13(1)Any excess NCDs not allocated to another company under Part 2 shall be carried forward by the distributing company.U.K.

(2)That company shall be treated as if it had made a non-corporate distribution of the amount carried forward (in addition to any distributions actually made by it) in its next accounting period.

(3)Where an allocation is made under paragraph 9(4) references in this paragraph to the distributing company shall be read as references to the company to which that allocation is made (which is treated by virtue of paragraph 6(3) as having made a distribution in the accounting period to which the allocation is made).

Definition of a groupU.K.

14(1)For the purposes of section 13AB and this Schedule a company and all its 51% subsidiaries form a group, and if any of those subsidiaries have 51% subsidiaries the group includes them and their 51% subsidiaries, and so on.U.K.

(2)The question whether a company is a 51% subsidiary shall be determined in accordance with section 838, subject to the following provisions.

(3)A company (“company A”) shall be treated for the purposes of this Schedule as if it were a 51% subsidiary of another company (“company B”) if company B has rights to, or in fact receives, more than 50% of the distributions made by company A.

(4)For the purposes of this paragraph a company shall be treated as not being the owner—

(a)of any share capital that it owns directly if a profit on the sale of the shares would be treated as a trading receipt of its trade, or

(b)of any share capital that it owns indirectly and that is owned directly by a body corporate for which a profit on the sale of the shares would be treated as a trading receipt of its trade.

Accounting period treated as ending if company ceases to be a member of a groupU.K.

15(1)Section 13AB and this Schedule apply in relation to an accounting period of a company in which it ceases to be a member of the group as if there were two accounting periods, one ending immediately before the company ceases to be a member of the group and the other consisting of the remainder of the period.U.K.

(2)For this purpose a company ceases to be in a group if it and another company cease to be in the same group, whether as a result it is no longer in a group, becomes a member of another group or continues to be in the same group as one or more other companies.

Treatment of distributions made otherwise than in an accounting periodU.K.

16U.K.For the purposes of section 13AB and this Schedule, a non-corporate distribution made by a company otherwise than in an accounting period of the company shall be treated as made in the next accounting period of the company.

Holding companies treated as carrying on a businessU.K.

17(1)For the purposes of section 13AB and this Schedule a holding company that is not otherwise carrying on a business shall be deemed to be carrying on a business and to be within the charge to corporation tax.U.K.

(2)For this purpose “a holding company” means a company that has one or more 51% subsidiaries from which it receives or has received one or more distributions.

InterpretationU.K.

18U.K.In section 13AB and this Schedule—

“basic profits” means the amount of a company’s profits for an accounting period on which corporation tax finally falls to be borne;

“corresponding accounting period”, in relation to a recipient company, has the meaning given by paragraph 8;

“distributing company” has the meaning given by paragraph 6(1);

“distribution” does not include an amount treated as a dividend under paragraph 2(2) of Schedule 23A (manufactured dividends and interest);

“distribution period” has the meaning given by paragraph 6(1); and

“excess NCDs” has the meaning given by paragraph 6(2);

“group” has the meaning given by paragraph 14 (and references to a group company and membership of a group have a corresponding meaning);

“non-corporate distribution” has the meaning given by paragraph 2;

“recipient company” has the meaning given by paragraph 6(3);

“underlying rate of corporation tax” has the meaning given by paragraph 3.

Yn ddilys o 22/07/2004

Section 29

SCHEDULE 4U.K.Amendments relating to the rate applicable to trusts

Sums paid to settlor otherwise than as incomeU.K.

1(1)Section 677 of the Taxes Act 1988 (sums paid to settlor otherwise than as income) is amended as follows.U.K.

(2)In subsection (2) (the amount of income available up to the end of a year) in paragraph (h) (deduction of amount equal to tax at the rate applicable to trusts on the undistributed income less the income etc referred to in certain paragraphs) for “paragraphs (c), (d), (e), (f) and (g) above” substitute “ each of paragraphs (c) to (g) above” ”.

(3)In subsection (7) (tax to be charged under Case VI of Schedule D, but with a set-off for the amount described in paragraph (a) or (b), whichever is the less) for the words from “charged,” in paragraph (b) to the end of the subsection substitute “charged; or

(c)the amount of tax paid by the trustees on the grossed-up amount of so much of the amount of income available up to the end of the year, in relation to the capital sum, as is taken into account under subsection (1) above in relation to that sum in that year (see subsections (7A) to (7C) below),

whichever is the least. ”.

(4)After subsection (7) insert—

“(7A)For the purposes of subsection (7)(c) above—

(a)any reduction falling to be made under subsection (2)(h) above shall be treated as made against income arising under the settlement in an earlier year of assessment before income arising under the settlement in a later year of assessment; and

(b)income arising under the settlement in an earlier year of assessment shall be regarded as being taken into account under subsection (1) above before income arising under the settlement in a later year of assessment.

(7B)For the purposes of subsection (7)(c) above—

(a)the grossed-up amount of any sum is such amount as, after the deduction of tax at the appropriate rate for each part of that sum, would be equal to that sum; and

(b)the amount of tax paid by the trustees on that grossed-up amount is the amount of tax falling to be deducted under paragraph (a) above.

(7C)For the purposes of subsection (7B) above—

(a)the appropriate rate for any part of a sum is 0% if—

(i)the income that falls to be regarded in accordance with subsection (7A) above as representing that part of the sum is income from a source outside the United Kingdom, and

(ii)the trustees were not resident in the United Kingdom for the relevant year of assessment;

(b)the appropriate rate for any part of a sum in relation to which paragraph (a) above does not apply is—

(i)34%, if the relevant year of assessment is the year 2003-04 or any earlier year of assessment,

(ii)40%, if the relevant year of assessment is the year 2004-05 or any subsequent year of assessment.

For the purposes of this subsection the relevant year of assessment in relation to any part of a sum is the year of assessment in which the income to be regarded in accordance with subsection (7A) above as representing that part of the sum arose under the settlement.”.

Trustees chargeable to income tax at 30 per cent in certain casesU.K.

2U.K.The side-note to section 694 of the Taxes Act 1988 becomes “Trustees chargeable to income tax in certain cases at higher rate reduced by rate applicable to trusts”.

CommencementU.K.

3U.K.The amendments made by paragraph 1 have effect for the purpose of determining the amount to be set off under section 677(7) of the Taxes Act 1988 in the year 2004-05 or any subsequent year of assessment (whenever the undistributed income arose).

Yn ddilys o 22/07/2004

Section 30

SCHEDULE 5U.K.Provision not at arm’s length: related amendments

Taxes Management Act 1970U.K.

Notice of enquiryU.K.

1(1)Section 9A of the Taxes Management Act 1970 (c. 9) is amended as follows.U.K.

(2)For subsection (4) (scope of inquiry) substitute—

“(4)An enquiry extends to—

(a)anything contained in the return, or required to be contained in the return, including any claim or election included in the return,

(b)consideration of whether to give the taxpayer a transfer pricing notice under paragraph 5C of Schedule 28AA to the principal Act (provision not at arm’s length: medium-sized enterprise),

but this is subject to the following limitation.”.

Income and Corporation Taxes Act 1988U.K.

Valuation of trading stock at discontinuance of tradeU.K.

2(1)Section 100 of the Taxes Act 1988 is amended as follows.U.K.

(2)After subsection (1) insert—

“((1ZA))This section does not apply in relation to any trading stock if paragraph 1(2) of Schedule 28AA (provision not at arm’s length) has effect in relation to any provision made or imposed in relation to that stock and having effect in connection with the discontinuance of the trade.”.

Petroleum extraction activities: ring fence trade: charges on incomeU.K.

3(1)Section 494 of the Taxes Act 1988 (charges on income) is amended as follows.U.K.

(2)In subsection (2) (which restricts the loan relationship debits that may be brought into account in a manner resulting in reduction of ring fence profits)—

(a)at the end of paragraph (b) insert “ and ”;

(b)omit paragraph (d) (which imposes a restriction by reference to a reasonable commercial rate of return and is superseded by the application of paragraphs 1A and 1B of Schedule 28AA to the Taxes Act 1988 by virtue of paragraph 11 of that Schedule);

(c)omit the third sentence (which defines “net debit” for the purposes of paragraph (d)).

(3)Omit subsection (2B) (which relates to the net debit within the meaning of subsection (2)(d)).

Assumptions for calculating chargeable profits etc: transfer pricingU.K.

4U.K.In Schedule 24 to the Taxes Act 1988, paragraph 20 shall cease to have effect.

Finance Act 1996U.K.

Loan relationships: introductoryU.K.

5U.K.Schedule 9 to the Finance Act 1996 (c. 8) (loan relationships: special computational provisions) is amended as follows.

Transactions not at arm’s lengthU.K.

6(1)Paragraph 11 is amended as follows.U.K.

(2)In sub-paragraph (1) (which is expressed to be subject to sub-paragraphs (2) to (3A)) for “(2)” substitute “ (1A) ”.

(3)After sub-paragraph (1) insert—

“(1A)Notwithstanding section 80(5) of this Act, sub-paragraph (1) above shall not apply to debits or credits in respect of amounts which—

(a)fall to be adjusted for tax purposes under Schedule 28AA to the Taxes Act 1988 (provision not at arm’s length), or

(b)fall within that Schedule without falling to be so adjusted.

(1B)For the purposes of sub-paragraph (1A) above, an amount falls within Schedule 28AA to the Taxes Act 1988 without falling to be adjusted under that Schedule in a case where—

(a)the conditions in paragraph 1(1) of that Schedule are met, and

(b)the actual provision does not differ from the arm’s length provision.”.

Continuity of treatment: groups etc.U.K.

7(1)Paragraph 12 is amended as follows.U.K.

(2)After sub-paragraph (2) insert—

“((2ZA))Where the debits or credits to be brought into account for the purposes of this Chapter in respect of any amounts fall to be determined in accordance with sub-paragraph (2) above, Schedule 28AA to the Taxes Act 1988 (provision not at arm’s length) does not apply in relation to those amounts.”.

Amounts imputed under Schedule 28AA to the Taxes Act 1988U.K.

8U.K.For paragraph 16 (imputed interest) substitute—

“Amounts imputed under Schedule 28AA to the Taxes Act 1988U.K.

16(1)This paragraph applies where, in pursuance of Schedule 28AA to the Taxes Act 1988 (provision not at arm’s length), an amount falls to be treated as any of the following—

(a)an amount of profits, gains or losses (whether or not of a capital nature) arising to a company from any of its loan relationships or related transactions;

(b)interest payable under any of a company’s loan relationships;

(c)charges or expenses incurred by a company under or for the purposes of any of its loan relationships or related transactions.

(2)That Schedule shall have effect, notwithstanding the provisions of any authorised accounting method, so as to require credits or debits relating to the amount so treated to be brought into account for the purposes of this Chapter to the same extent as they would be in the case of an actual amount of—

(a)profits, gains or losses (whether or not of a capital nature) arising to the company from the loan relationship or related transaction,

(b)interest accruing or becoming due and payable under the loan relationship, or

(c)charges or expenses incurred under or for the purposes of the loan relationship or related transaction,

as the case may be.”.

Finance Act 1998U.K.

IntroductoryU.K.

9U.K.The Finance Act 1998 (c. 36) is amended as follows.

Scope of enquiryU.K.

10(1)In Schedule 18 (company tax returns, assessments and related matters) paragraph 25 is amended as follows.U.K.

(2)In sub-paragraph (1), for the words following paragraph (b) substitute— “ and also extends to consideration of whether to give the company a transfer pricing notice under paragraph 5C of Schedule 28AA to the Taxes Act 1988 (provision not at arm’s length: medium-sized enterprise). But this is subject to the following limitation. ”.

Finance Act 2000U.K.

Introductory: tonnage tax: transactions not at arm’s lengthU.K.

11U.K.Schedule 22 to the Finance Act 2000 (c. 17) (tonnage tax) is amended as follows.

Transactions between tonnage tax company and another personU.K.

12(1)Paragraph 58 is amended as follows.U.K.

(2)In sub-paragraph (1) (Schedule 28AA to the Taxes Act 1988 to apply with certain omissions) for the words following paragraph (b) substitute— “ Schedule 28AA to the Taxes Act 1988 (transactions not at arm’s length) has effect with the omission of paragraphs 6 to 7A (elimination of double counting etc). ”.

Transactions between tonnage tax trade and other activities of same companyU.K.

13(1)Paragraph 59 is amended as follows.U.K.

(2)For sub-paragraph (2) (Schedule 28AA to the Taxes Act 1988 to apply with certain omissions) substitute—

“(2)As applied by sub-paragraph (1), Schedule 28AA has effect with the omission of paragraphs 6 to 7A (elimination of double counting etc).”.

Finance Act 2002U.K.

IntroductoryU.K.

14U.K.The Finance Act 2002 (c. 23) is amended as follows.

Derivative contractsU.K.

15(1)Schedule 26 (derivative contracts) is amended as follows.U.K.

(2)In Part 6 (special computational provisions) in paragraph 28 (transactions within groups) after sub-paragraph (3) insert—

“(3A)Where the debits or credits to be brought into account for the purposes of this Schedule in respect of any amounts fall to be determined in accordance with sub-paragraph (3), Schedule 28AA to the Taxes Act 1988 (provision not at arm’s length) does not apply in relation to those amounts.”.

(3)After paragraph 31 insert—

“Amounts imputed under Schedule 28AA to the Taxes Act 1988U.K.

31A(1)This paragraph applies where, in pursuance of Schedule 28AA to the Taxes Act 1988 (provision not at arm’s length), an amount falls to be treated as any of the following—

(a)an amount of profits or losses (disregarding any charges or expenses) arising to a company from any of its derivative contracts or related transactions;

(b)charges or expenses incurred by a company under or for the purposes of any of its derivative contracts or related transactions.

(2)That Schedule shall have effect, notwithstanding the provisions of any authorised accounting method, so as to require credits or debits relating to the amount so treated to be brought into account for the purposes of this Chapter to the same extent as they would be in the case of an actual amount of—

(a)profits or losses (disregarding any charges or expenses) arising to the company from the derivative contract or related transaction, or

(b)charges or expenses incurred under or for the purposes of the derivative contract or related transaction,

as the case may be.”.

Intangible fixed assetsU.K.

16(1)Schedule 29 (gains and losses of a company from intangible fixed assets) is amended as follows.U.K.

(2)In paragraph 55 (transfers within a group), after sub-paragraph (1) insert—

“(1A)Where this paragraph applies in relation to the transfer of an asset, Schedule 28AA to the Taxes Act 1988 (provision not at arm’s length) does not apply in relation to the transfer.”.

(3)In paragraph 92 (transfer between company and related party treated as being at market value) in sub-paragraph (3) (cases where consideration for transfer falls within Schedule 28AA without falling to be adjusted)—

(a)at the end of paragraph (a) insert “ , but ”,

(b)at the end of paragraph (b) omit “, and”,

(c)omit paragraph (c) (which refers to paragraph 5(2) of Schedule 28AA to the Taxes Act 1988).

Yn ddilys o 22/07/2004

Section 41

SCHEDULE 6U.K.Expenses of companies with investment business and insurance companies

Income and Corporation Taxes Act 1988U.K.

Levies and repayments under Financial Services and Markets Act 2000: investment companiesU.K.

1(1)Section 76B of the Taxes Act 1988 is amended as follows.U.K.

(2)In subsection (1) (certain sums paid by an investment company to be treated as expenses of management) for “an investment company” substitute “ a company with investment business ”.

(3)In subsection (2) (repayment to investment company to be charged under Case VI of Schedule D)—

(a)at the beginning, insert “ For the purposes of corporation tax, ”, and

(b)for “an investment company” substitute “ a company with investment business ”.

Incidental costs of obtaining loan financeU.K.

2(1)Section 77 of the Taxes Act 1988 is amended as follows.U.K.

(2)In subsection (1) (which does not apply for the purposes of corporation tax but which includes provision for the costs in question to be treated as expenses of management) omit the words from “and the incidental costs” to the end of the subsection.

Change in ownership of investment company: deductions generally.U.K.

3(1)Section 768B of the Taxes Act 1988 is amended as follows.U.K.

(2)In subsection (1) (case where section applies) for “an investment company” substitute “ a company with investment business ”.

(3)In subsection (6) (treatment of expenses of management disbursed in the accounting period)—

(a)for “are disbursed or treated as disbursed as expenses of management in the accounting period” substitute “ are, or are treated as, expenses of management referable to the accounting period ”;

(b)in the words following paragraph (b), for “as disbursed in that part” substitute “ expenses of management referable to that part ”.

(4)In subsection (8) (treatment of capital allowances apportioned to either part of the accounting period) for “75(4)” substitute “ 75(7) ”.

(5)In subsection (9) (which prevents certain sums being deducted under section 75 of the Taxes Act 1988) in paragraph (a) for “sums disbursed” substitute “ expenses of management deductible ”.

(6)In subsection (14) (meaning of “investment company”) for “ “investment company”” substitute “ “company with investment business” ”.

(7)The sidenote to the section accordingly becomes “Change in ownership of company with investment business: deductions generally”.

Deductions: assets transferred within groupU.K.

4(1)Section 768C of the Taxes Act 1988 is amended as follows.U.K.

(2)In subsection (1) (case where section applies) in paragraph (a) for “an investment company” substitute “ a company with investment business ”.

(3)In subsection (7) (no deduction under section 75 from an amount of total profits equal to the amount of the relevant gain) in paragraph (a) for “sums disbursed” substitute “ expenses of management deductible ”.

(4)In subsection (12), for the definition of “investment company”substitute—

““company with investment business” has the same meaning as in Part 4.”.

Change in ownership of company carrying on property businessU.K.

5(1)Section 768D of the Taxes Act 1988 is amended as follows.U.K.

(2)In subsection (1) (case where section applies)—

(a)in paragraph (a) (investment company) for “an investment company” substitute “ a company with investment business ”, and

(b)in paragraph (b) (company other than investment company) for “an investment company” substitute “ a company with investment business ”.

(3)In subsection (4) (apportionment of profits and losses to two periods)—

(a)in paragraph (a) (investment company) for “an investment company” substitute “ a company with investment business ”, and

(b)in paragraph (b) (company other than investment company) for “an investment company” substitute “ a company with investment business ”.

(4)In subsection (6) (restriction of profits from which certain losses may be deducted) for “an investment company”, wherever occurring, substitute “ a company with investment business ”.

(5)In subsection (8) (definitions) for paragraph (b) (investment company) substitute—

“(b)“company with investment business” has the same meaning as in Part 4.”.

Change in ownership of company with unused non-trading loss on intangible fixed assetsU.K.

6(1)Section 768E of the Taxes Act 1988 is amended as follows.U.K.

(2)In subsection (1) (change in ownership of investment company) for “an investment company” substitute “ a company with investment business ”.

(3)In subsection (7) (definition of “investment company”) for “ “investment company”” substitute “ “company with investment business” ”.

Finance Act 1989U.K.

Charge of certain receipts of basic life assurance businessU.K.

7(1)Section 85 of the Finance Act 1989 (c. 26) is amended as follows.U.K.

(2)In subsection (2) (receipts excluded from subsection (1) omit paragraphs (c) to (d).

(3)After subsection (2) insert—

“(2A)Receipts falling within subsection (1) above are to be taken into account for the purposes of corporation tax when they are brought into account.

Subsection (6) of section 89 (meaning of “brought into account”) shall also apply for the purposes of this section.

(2B)Expenses fall to be deducted from receipts falling within subsection (1) above in accordance with the provisions of the Corporation Tax Acts applicable to Case VI of Schedule D.

(2C)For the purposes of subsection (1) above, a receipt is referable to basic life assurance and general annuity business if—

(a)in the case of a repayment or refund of acquisition expenses, the acquisition expenses fell within section 86 below,

(b)in the case of a reinsurance commission, the policy or contract reinsured under the arrangement in respect of which the commission is paid constitutes basic life assurance and general annuity business, and

(c)in any other case, it is income which, if it were income from an asset, would by virtue of section 432A of the Taxes Act 1988 (apportionment of insurance companies' income) be referable to basic life assurance and general annuity business.”.

Spreading of relief for acquisition expensesU.K.

8(1)Section 86 of the Finance Act 1989 (c. 26) is amended as follows.U.K.

(2)For subsections (1) to (1B) (meaning of “acquisition expenses”) substitute—

“(1)For the purposes of this section, the acquisition expenses for any period of an insurance company carrying on life assurance business are such of the following as for that period fall to be included at Step 1 in section 76(7) of the Taxes Act 1988 (expenses of insurance companies)—

(a)commissions (however described), other than commissions for persons who collect premiums from house to house,

(b)any other expenses payable solely for the purpose of the acquisition of business,

(c)so much of any other expenses payable partly for the purpose of the acquisition of business and partly for other purposes as are properly attributable to the acquisition of business,

reduced by the appropriate portion of the adjusted loss deduction (if any) for the purposes of Step 5 for the period.

The appropriate portion of the adjusted loss deduction is the amount which bears to the whole of that deduction the proportion which UAE bears to S1, where—

UAE is the amount of the acquisition expenses, before making the reduction required by this subsection; and

S1 is the sum of the amounts described in paragraphs (a) and (b) in Step 4.”.

(3)In subsection (2) (which relates to commissions for persons who collect premiums from house to house) for “expenses of management” substitute “ expenses payable ”.

(4)Omit—

(a)subsection (5) (expenses of management attributable to basic life assurance and general annuity business), and

(b)subsection (5A) (exclusion of additional expenses of management under section 256(2)(a) of the Capital Allowances Act).

(5)For subsection (6) (only one-seventh of acquisition expenses to be treated as deductible under sections 75 and 76 of the Taxes Act 1988) substitute—

“(6)Only a portion of the acquisition expenses for any accounting period (in this section referred to as “the base period”) is to be relieved under section 76 of the Taxes Act 1988 for that period.

That portion is one-seventh of the adjusted amount of the acquisition expenses for the period.

For the purposes of this section the adjusted amount of the acquisition expenses for the period is so much of those expenses as remains after—

(a)including the whole of those expenses at Step 1,

(b)making any reduction in those expenses which is required at Step 2, and

(c)deducting any amount of reinsurance commission or any repayment or refund (in whole or in part) that falls for the period to be charged to tax under section 85 above,

Effect is given to this subsection at Step 6 (which requires the deduction of six-sevenths of the adjusted amount of the acquisition expenses for the period).”.

(6)Omit subsection (7) (which relates to accounting periods falling wholly or partly within the years 1990 to 1993).

(7)For subsections (8) and (9) (deduction of further one-sevenths of full amount for succeeding accounting periods) substitute—

“(8)This subsection applies in any case where, in accordance with subsection (6) above, only a fraction of the adjusted amount of the acquisition expenses for the base period is to be relieved under section 76 of the Taxes Act 1988 for that period.

In any such case—

(a)a further fraction of the adjusted amount of those expenses is to be relieved under that section for each succeeding accounting period after the base period, until the whole of the adjusted amount has been relieved,

(b)the fraction is one-seventh, except that for any accounting period of less than a year the fraction is to be proportionately reduced, and

(c)the relief is given by including that fraction of the adjusted amount at paragraph (b) of Step 8,

but this is subject to subsection (9) below.

(9)For any accounting period for which—

(a)the fraction of the adjusted amount of the acquisition expenses for the base period which would otherwise fall to be relieved in accordance with subsection (8) above, exceeds

(b)the balance of that adjusted amount which has not been so relieved for earlier accounting periods,

only that balance shall be so relieved.”.

(8)After subsection (9) insert—

“(9A)In this section “expenses payable” has the same meaning as in Step 1.

(9B)Any reference in this section to a numbered Step is a reference to the Step so numbered in section 76(7) of the Taxes Act 1988.”.

Finance Act 1996U.K.

Loan relationships: special provisions for insurers: treatment of deficitU.K.

9(1)In Schedule 11 to the Finance Act 1996 (c. 8) paragraph 4 is amended as follows.U.K.

(2)In sub-paragraph (2), in the words following paragraph (b) (which require a reduction under that sub-paragraph to be made before any deduction by virtue of section 76 of the Taxes Act 1988 for expenses of management) for “any deduction by virtue of section 76 of the Taxes Act 1988 of any expenses of management” substitute “ any expenses deduction under section 76 of the Taxes Act 1988 ”.

(3)In sub-paragraph (3) (claim to carry back whole or part of excess of deficit over net income and gains) in the opening words, omit “net”.

(4)In sub-paragraph (4) (deficit, so far as not set off, to be carried forward and included in expenses of management for following period) for “an amount to be included in the company’s expenses of management for the period following the deficit period” substitute “ expenses payable which are referable to the period following the deficit period and are to be brought into account at Step 3 in section 76(7) of the Taxes Act 1988 ”.

(5)In sub-paragraph (11) (meaning of references in sub-paragraph (10) to deductions by virtue of section 76 of the Taxes Act 1988) for “the deductions by way of management expenses” substitute “ the expenses deduction ”.

(6)In sub-paragraph (12) (treatment of section 76(5) amount attributable to a claim under sub-paragraph (3) etc)—

(a)for “section 76(5) amount”, in both places, substitute “ section 76(13) amount ”;

(b)for “section 75(3)” substitute “ section 76(13) ”.

(7)In sub-paragraph (13) (treatment of section 76(5) amount to which the sub-paragraph applies) for “section 76(5) amount” substitute “ section 76(13) amount ”.

(8)In sub-paragraph (14) (the section 76(5) amount attributable to a claim under sub-paragraph (3))—

(a)in the opening words, for “section 76(5) amount” substitute “ section 76(13) amount ”; and

(b)in paragraphs (a) and (b) for “section 75(3)” substitute “ section 76(13) ”.

(9)The amendment made by sub-paragraph (4) also has effect where the deficit period is the last accounting period of the company to begin before 1st April 2004.

Yn ddilys o 22/07/2004

Section 47

SCHEDULE 7U.K.Insurance companies etc

Transfers of businessU.K.

1U.K.In section 444A(3ZA) of the Taxes Act 1988 (losses), for “343(2), (4),” substitute “ 343(4), ”.

2(1)Section 444AB of the Taxes Act 1988 (charge on transferor retaining assets) is amended as follows.U.K.

(2)In subsection (5) (which defines, as “the previously untaxed amount”, the amount which, or a fraction of which, is chargeable to tax), for paragraph (a) substitute—

“(a)if there are no retained liabilities, the fair value of the retained assets or, if there are, so much of the fair value of the retained assets as exceeds the amount of the retained liabilities, and”.

(3)After subsection (6) insert—

“(6A)In subsection (5) above—

(a)“the retained assets” means such of the assets held by the transferor immediately after the transfer as were assets of its long-term insurance fund immediately before the transfer; and

(b)“the retained liabilities” means such of the liabilities of the transferor immediately after the transfer as were included in column 1 of line 14, 17, 22, 31 or 38 of Form 14 in the periodical return of the transferor covering the period of account ending immediately before the transfer.”.

(4)Sub-paragraphs (1) to (3) have effect in relation to insurance business transfer schemes (within the meaning of section 444AB of the Taxes Act 1988) taking place on or after 17th March 2004.

3(1)In the Taxes Act 1988, after section 444AB insert—U.K.

“444ABASubsequent charge in certain cases within s.444AB

(1)This section applies where—

(a)section 444AB applies in relation to a transfer in the case of which there are retained liabilities, and

(b)in any accounting period of the transferor beginning after the day of the transfer there is a reduction in the amount of the retained liabilities occasioned otherwise than by the making of a payment in or towards their discharge.

(2)The transferor shall be charged to tax under Case VI of Schedule D in respect of the taxable amount as if it had been received by the transferor in the accounting period in which the reduction occurs.

(3)If the transferor was charged to tax on the profits of its life assurance business under Case I of Schedule D for the accounting period ending with the day of the transfer, the taxable amount is the whole amount of the reduction.

(4)Otherwise the taxable amount is the non-BLAGAB fraction of the amount of the reduction.

(5)The non-BLAGAB fraction of the amount of the reduction is the fraction of which—

(a)the numerator is the amount of the liabilities transferred, apart from those which are liabilities of basic life assurance and general annuity business, and