- Latest available (Revised)

- Point in Time (13/04/2005)

- Original (As adopted by EU)

Directive 2000/12/EC of the European Parliament and of the CouncilShow full title

Directive 2000/12/EC of the European Parliament and of the Council of 20 March 2000 relating to the taking up and pursuit of the business of credit institutions

You are here:

- Show Geographical Extent(e.g. England, Wales, Scotland and Northern Ireland)

- Show Timeline of Changes

More Resources

Revised version PDFs

- Revised 20/07/20060.44 MB

- Revised 29/03/20060.36 MB

- Revised 13/04/20050.30 MB

- Revised 18/05/20040.30 MB

- Revised 01/05/20040.31 MB

- Revised 11/02/20030.29 MB

- Revised 27/10/20000.39 MB

When the UK left the EU, legislation.gov.uk published EU legislation that had been published by the EU up to IP completion day (31 December 2020 11.00 p.m.). On legislation.gov.uk, these items of legislation are kept up-to-date with any amendments made by the UK since then.

This item of legislation originated from the EU

Legislation.gov.uk publishes the UK version. EUR-Lex publishes the EU version. The EU Exit Web Archive holds a snapshot of EUR-Lex’s version from IP completion day (31 December 2020 11.00 p.m.).

Status:

EU Directives are published on this site to aid cross referencing from UK legislation. Since IP completion day (31 December 2020 11.00 p.m.) no amendments have been applied to this version.

ANNEX I

LIST OF ACTIVITIES SUBJECT TO MUTUAL RECOGNITION

1.Acceptance of deposits and other repayable fundsU.K.

2.Lending(1) U.K.

3.Financial leasingU.K.

4.Money transmission servicesU.K.

5.Issuing and administering means of payment (e.g. credit cards, travellers' cheques and bankers' drafts)U.K.

6.Guarantees and commitmentsU.K.

7.Trading for own account or for account of customers in:U.K.

money market instruments (cheques, bills, certificates of deposit, etc.)

foreign exchange;

financial futures and options;

exchange and interest-rate instruments;

transferable securities

8.Participation in securities issues and the provision of services related to such issuesU.K.

9.Advice to undertakings on capital structure, industrial strategy and related questions and advice as well as services relating to mergers and the purchase of undertakingsU.K.

10.Money brokingU.K.

11.Portfolio management and adviceU.K.

12.Safekeeping and administration of securitiesU.K.

13.Credit reference servicesU.K.

14.Safe custody servicesU.K.

[F1The services and activities provided for in Section A and B of Annex I of [X1Directive 2004/ 39/EC of the European Parliament and of the Council of 21 April 2004 on markets in financial instruments] (2) when referring to the financial instruments provided for in Section C of Annex I of that Directive are subject to mutual recognition according to this Directive.]

Editorial Information

X1 Substituted by Corrigendum to Directive 2004/39/EC of the European Parliament and of the Council of 21 April 2004 on markets in financial instruments amending Council Directives 85/611/EEC and 93/6/EEC and Directive 2000/12/EC of the European Parliament and of the Council and repealing Council Directive 93/22/EEC (Official Journal of the European Union L 145 of 30 April 2004).

Textual Amendments

F1 Inserted by Directive 2004/39/EC of the European Parliament and of the Council of 21 April 2004 on markets in financial instruments amending Council Directives 85/611/EEC and 93/6/EEC and Directive 2000/12/EC of the European Parliament and of the Council and repealing Council Directive 93/22/EEC.

Editorial Information

X1 Substituted by Corrigendum to Directive 2004/39/EC of the European Parliament and of the Council of 21 April 2004 on markets in financial instruments amending Council Directives 85/611/EEC and 93/6/EEC and Directive 2000/12/EC of the European Parliament and of the Council and repealing Council Directive 93/22/EEC (Official Journal of the European Union L 145 of 30 April 2004).

Textual Amendments

F1 Inserted by Directive 2004/39/EC of the European Parliament and of the Council of 21 April 2004 on markets in financial instruments amending Council Directives 85/611/EEC and 93/6/EEC and Directive 2000/12/EC of the European Parliament and of the Council and repealing Council Directive 93/22/EEC.

ANNEX II

CLASSIFICATION OF OFF-BALANCE-SHEET ITEMS

Full risk

Guarantees having the character of credit substitutes,

Acceptances,

Endorsements on bills not bearing the name of another credit institution,

Transactions with recourse,

Irrevocable standby letters of credit having the character of credit substitutes,

Assets purchased under outright forward purchase agreements,

Forward forward deposits,

The unpaid portion of partly-paid shares and securities,

Other items also carrying full risk.

Medium risk

Documentary credits issued and confirmed (see also medium/low risk),

Warranties and indemnities (including tender, performance, customs and tax bonds) and guarantees not having the character of credit substitutes,

Asset sale and repurchase agreements as defined in Article 12(3) and (5) of Directive 86/635/EEC,

Irrevocable standby letters of credit not having the character of credit substitutes,

Undrawn credit facilities (agreements to lend, purchase securities, provide guarantees or acceptance facilities) with an original maturity of more than one year,

Note issuance facilities (NIFs) and revolving underwriting facilities (RUFs),

Other items also carrying medium risk.

Medium/low risk

Documentary credits in which underlying shipment acts as collateral and other self-liquidating transactions,

Other items also carrying medium/low risk.

Low risk

Undrawn credit facilities (agreements to lend, purchase securities, provide guarantees or acceptance facilities) with an original maturity of up to and including one year or which may be cancelled unconditionally at any time without notice,

Other items also carrying low risk.

The Member States undertake to inform the Commission as soon as they have agreed to include a new off-balance-sheet item in any of the last indents under each category of risk. Such items will be definitively classified at Community level once the procedure laid down in Article 60 has been completed.

ANNEX III

THE TREATMENT OF OFF-BALANCE-SHEET ITEMS

1.CHOICE OF THE METHODU.K.

To measure the credit risks associated with the contracts listed in points 1 and 2 of Annex IV, credit institutions may choose, subject to the consent of the competent authorities, one of the methods set out below. Credit institutions which have to comply with Article 6(1) of Directive 93/6/EEC(3) must use method 1 set out below. To measure the credit risks associated with the contracts listed in point 3 of Annex IV all credit institutions must use method 1 set out below.

2.METHODSU.K.

Method 1:the ‘mark to market’ approachU.K.

by attaching current market values to contracts (mark to market), the current replacement cost of all contracts with positive values is obtained.

to obtain a figure for potential future credit exposure(4), the notional principal amounts or underlying values are multiplied by the following percentages:

TABLE 1a b

aContracts which do not fall within one of the five categories indicated in this table shall be treated as contracts concerning commodities other than precious metals.

bFor contracts with multiple exchanges of principal, the percentages have to be multiplied by the number of remaining payments still to be made according to the contract.

cFor contracts that are structured to settle outstanding exposure following specified payment dates and where the terms are reset such that the market value of the contract is zero on these specified dates, the residual maturity would be equal to the time until the next reset date. In the case of interest-rate contracts that meet these criteria and have a remaining maturity of over one year, the percentage shall be no lower than 0,5 %.

Residual maturityc Interest-rate contracts Contracts concerning foreign-exchange rates and gold Contracts concerning equities Contracts concerning precious metals except gold Contracts concerning commodities other than precious metals One year or less 0 % 1 % 6 % 7 % 10 % Over one year, less than five years 0,5 % 5 % 8 % 7 % 12 % Over five years 1,5 % 7,5 % 10 % 8 % 15 % For the purpose of calculating the potential future exposure in accordance with step (b) the competent authorities may allow credit institutions until 31 December 2006 to apply the following percentages instead of those prescribed in Table 1 provided that the institutions make use of the option set out in Article 11a of Directive 93/6/EEC for contracts within the meaning of paragraph 3(b) and (c) of Annex IV:

TABLE 1a

Residual maturity Precious metals (except gold) Base metals Agricultural products (softs) Other, including energy products One year or less 2 % 2,5 % 3 % 4 % Over one year, less than five years 5 % 4 % 5 % 6 % Over five years 7,5 % 8 % 9 % 10 % the sum of current replacement cost and potential future credit exposure is multiplied by the risk weightings allocated to the relevant counterparties in Article 43.

Method 2:the ‘original exposure’ approachU.K.

the notional principal amount of each instrument is multipliedby the percentages given below:

TABLE 2

aIn the case of interest-rate contracts, credit institutions may, subject to the consent of their competent authorities, choose either original or residual maturity.

Original maturitya Interest-rate contracts Contracts concerning foreign-exchange rates and gold One year or less 0,5 % 2 % More than one year but not exceeding two years 1 % 5 % Additional allowance for each additional year 1 % 3 % the original exposure thus obtained is multiplied by the risk weightings allocated to the relevant counterparties in Article 43.

For methods 1 and 2 the competent authorities must ensure that the notional amount to be taken into account is an appropriate yardstick for the risk inherent in the contract. Where, for instance, the contract provides for a multiplication of cash flows, the notional amount must be adjusted in order to take into account the effects of the multiplication on the risk structure of that contract.

3.CONTRACTUAL NETTING (CONTRACTS FOR NOVATION AND OTHER NETTING AGREEMENTS)U.K.

(a)Types of netting that competent authorities may recogniseU.K.

For the purpose of this point 3 ‘counterparty’ means any entity (including natural persons) that has the power to conclude a contractual netting agreement.

The competent authorities may recognise as risk-reducing the following types of contractual netting:

bilateral contracts for novation between a credit institution and its counterparty under which mutual claims and obligations are automatically amalgamated in such a way that this novation fixes one single net amount each time novation applies and thus creates a legally binding, single new contract extinguishing former contracts;

other bilateral agreements between a credit institution and its counterparty.

(b)Conditions for recognitionU.K.

The competent authorities may recognise contractual netting as risk-reducing only under the following conditions:

a credit institution must have a contractual netting agreement with its counterparty which creates a single legal obligation, covering all included transactions, such that, in the event of a counterparty's failure to perform owing to default, bankruptcy, liquidation or any other similar circumstance, the credit institution would have a claim to receive or an obligation to pay only the net sum of the positive and negative mark-to-market values of included individual transactions;

a credit institution must have made available to the competent authorities written and reasoned legal opinions to the effect that, in the event of a legal challenge, the relevant courts and administrative authorities would, in the cases described under (i), find that the credit institution's claims and obligations would be limited to the net sum, as described in (i), under:

the law of the jurisdiction in which the counterparty is incorporated and, if a foreign branch of an undertaking is involved, also under the law of the jurisdiction in which the branch is located,

the law that governs the individual transactions included, and

the law that governs any contract or agreement necessary to effect the contractual netting;

a credit institution must have procedures in place to ensure that the legal validity of its contractual netting is kept under review in the light of possible changes in the relevant laws.

The competent authorities must be satisfied, if necessary after consulting the other competent authorities concerned, that the contractual netting is legally valid under the law of each of the relevant jurisdictions. If any of the competent authorities are not satisfied in that respect, the contractual netting agreement will not be recognised as risk-reducing for either of the counterparties.

The competent authorities may accept reasoned legal opinions drawn up by types of contractual netting.

No contract containing a provision which permits a non-defaulting counterparty to make limited payments only, or no payments at all, to the estate of the defaulter, even if the defaulter is a net creditor (a ‘walkaway’ clause), may be recognised as risk-reducing.

The competent authorities may recognise as risk-reducing contractual-netting agreements covering foreign-exchange contracts with an original maturity of 14 calendar days or less written options or similar off-balance-sheet items to which this Annex does not apply because they bear only a negligible or no credit risk. If, depending on the positive or negative market value of these contracts, their inclusion in another netting agreement can result in an increase or decrease of the capital requirements, competent authorities must oblige their credit institution to use a consistent treatment.

(c)Effects of recognitionU.K.

(i)Contracts for novationU.K.

The single net amounts fixed by contracts for novation, rather than the gross amounts involved, may be weighted. Thus, in the application of method 1, in

step (a): the current replacement cost, and in

step (b): the notional principal amounts or underlying values

may be obtained taking account of the contract for novation. In the application of method 2, in step (a) the notional principal amount may be calculated taking account of the contract for novation; the percentages of Table 2 must apply.

(ii)Other netting agreementsU.K.

In application of method 1:

in step (a) the current replacement cost for the contracts included in a netting agreement may be obtained by taking account of the actual hypothetical net replacement cost which results from the agreement; in the case where netting leads to a net obligation for the credit institution calculating the net replacement cost, the current replacement cost is calculated as ‘0’,

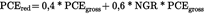

in step (b) the figure for potential future credit exposure for all contracts included in a netting agreement may be reduced according to the following equation:

where:

— PCEred=

the reduced figure for potential future credit exposure for all contracts with a given counterparty included in a legally valid bilateral netting agreement,

— PCEgross=

the sum of the figures for potential future credit exposure for all contracts with a given counterparty which are included in a legally valid bilateral netting agreement and are calculated by multiplying their notional principal amounts by the percentages set out in Table 1,

— NGR=

‘net-to-gross ratio’: at the discretion of the competent authorities either:

(i)separate calculation: the quotient of the net replacement cost for all contracts included in a legally valid bilateral netting agreement with a given counterparty (numerator) and the gross replacement cost for all contracts included in a legally valid bilateral netting agreement with that counterparty (denominator), or

(ii)aggregate calculation: the quotient of the sum of the net replacement cost calculated on a bilateral basis for all counterparties taking into account the contracts included in legally valid netting agreements (numerator) and the gross replacement cost for all contracts included in legally valid netting agreements (denominator).

If Member States permit credit institutions a choice of methods, the method chosen is to be used consistently.

For the calculation of the potential future credit exposure according to the above formula perfectly matching contracts included in the netting agreement may be taken into account as a single contract with a notional principal equivalent to the net receipts. Perfectly matching contracts are forward foreign-exchange contracts or similar contracts in which a notional principal is equivalent to cash flows if the cash flows fall due on the same value date and fully or partly in the same currency.

In the application of method 2, in step (a)

perfectly matching contracts included in the netting agreement may be taken into account as a single contract with a notional principal equivalent to the net receipts, the notional principal amounts are multiplied by the percentages given in Table 2,

for all other contracts included in a netting agreement, the percentages applicable may be reduced as indicated in Table 3:

TABLE 3

| a In the case of interest-rate contracts, credit institutions may, subject to the consent of their competent authorities, choose either original or residual maturity. | ||

| Original maturitya | Interest-rate contracts | Foreign-exchange contracts |

|---|---|---|

| One year or less | 0,35 % | 1,5 % |

| More than one year but not more than two years | 0,75 % | 3,75 % |

| Additional allowance for each additional year | 0,75 % | 2,25 % |

ANNEX IV

TYPES OF OFF-BALANCE-SHEET ITEMS

1. Interest-rate contracts: U.K.

single-currency interest rate swaps;

basis-swaps;

forward rate agreements;

interest-rate futures;

interest-rate options purchased;

other contracts of similar nature.

2. Foreign-exchange contracts and contracts concerning gold: U.K.

cross-currency interest-rate swaps;

forward foreign-exchange contracts;

currency futures;

currency options purchased;

other contracts of a similar nature;

contracts concerning gold of a nature similar to (a) to (e).

3. Contracts of a nature similar to those in points 1(a) to (e) and 2(a) to (d) concerning other reference items or indices concerning: U.K.

equities;

precious metals except gold;

commodities other than precious metals;

other contracts of a similar nature.

ANNEX V

PART AU.K.REPEALED DIRECTIVES TOGETHER WITH THEIR SUCCESSIVE AMENDMENTS(referred to in Article 67)

Council Directive 73/183/EEC

Council Directive 77/780/EEC

Council Directive 85/345/EEC

Council Directive 86/137/EEC

Council Directive 86/524/EEC

Council Directive 89/646/EEC

Directive 95/26/EC of the European Parliament and of the Council,

only Article 1, first indent, Article 2(1), first indent and (2), first indent, Article 3(2), Article 4(2), (3) and (4), as regards references to Directive 77/780/EEC, and (6), and Article 5, first indent

Council Directive 96/13/EC

Directive 98/33/EC of the European Parliament and of the Council

Council Directive 89/299/EEC

Council Directive 91/633/EEC

Council Directive 92/16/EEC

Council Directive 92/30/EEC

Council Directive 89/646/EEC

Council Directive 92/30/EEC

Directive 95/26/EC of the European Parliament and of the Council

only Article 1, first indent

Council Directive 89/647/EEC

Commission Directive 91/31/EEC

Council Directive 92/30/EEC

Commission Directive 94/7/EC

Commission Directive 95/15/EC

Commission Directive 95/67/EC

Directive 96/10/EC of the European Parliament and of the Council

Directive 98/32/EC of the European Parliament and of the Council

Directive 98/33/EC of the European Parliament and of the Council (Article 2)

Council Directive 92/30/EEC

Council Directive 92/121/EEC

PART BU.K.DEADLINES FOR IMPLEMENTATION(referred to in Article 67)

| a However, as regards the abolition of the restriction referred to in Article 3(2)(g), the Netherlands was allowed to defer implementation until 2 July 1977. (See: Article 8, second subparagraph of Directive 73/183/EEC). | ||

| Directive | Deadline for implementation | |

|---|---|---|

| 73/183/EEC (OJ L 194, 16.7.1973, p. 1) | 2.1.1975a | |

| 77/780/EEC (OJ L 322, 17.12.1977, p. 30) | 15.12.1979 | |

| 85/345/EEC (OJ L 183, 16.7.1985, p. 19) | 15.7.1985 | |

| 86/137/EEC (OJ L 106, 23.4.1986, p. 35) | — | |

| 86/524/EEC (OJ L 309, 4.11.1986, p. 15) | 31.12.1986 | |

| 89/299/EEC (OJ L 124, 5.5.1989, p. 16) | 1.1.1993 | |

| 89/646/EEC (OJ L 386, 30.12.1989, p. 1) | Article 6(2), | 1.1.1990 |

| other provisions | 1.1.1993 | |

| 89/647/EEC (OJ L 386, 30.12.1989, p. 14) | 1.1.1991 | |

| 91/31/EEC (OJ L 17, 23.1.1991, p. 20) | 31.3.1991 | |

| 91/633/EEC (OJ L 339, 11.12.1991, p. 16) | 31.12.1992 | |

| 92/16/EEC (OJ L 75, 31.3.1992, p. 48) | 31.12.1992 | |

| 92/30/EEC (OJ L 110, 28.4.1992, p. 52) | 31.12.1992 | |

| 92/121/EEC (OJ L 29, 5.2.1993, p. 1) | 31.12.1993 | |

| 94/7/EC (OJ L 89, 6.4.1994, p. 17) | 25.11.1994 | |

| 95/15/EC (OJ L 125, 8.6.1995, p. 23) | 30.9.1995 | |

| 95/26/EC (OJ L 168, 18.7.1995, p. 7) | 18.7.1996 | |

| 95/67/EC (OJ L 314, 28.12.1995, p. 72) | 1.7.1996 | |

| 96/10/EC (OJ L 85, 3.4.1996, p. 17) | 30.6.1996 | |

| 96/13/EC (OJ L 66, 16.3.1996, p. 15) | 15.4.1996 | |

| 98/32/EC (OJ L 204, 21.7.1998, p. 26) | 21.7.2000 | |

| 98/33/EC (OJ L 204, 21.7.1998, p. 29) | 21.7.2000 | |

ANΝΕΧ VI

CORRELATION TABLE

| This Directive | Directive 77/780/EEC | Directive 89/299/EEC | Directive 89/646/EEC | Directive 89/647/EEC | Directive 92/30/EEC | Directive 92/121/EEC | Directive 96/10/EC |

|---|---|---|---|---|---|---|---|

| Article 1(1) | Article 1, first indent | Article 1, first indent | Article 1(a) | ||||

| Article 1(2) | Article 1, second indent | ||||||

| Article 1(3) | Article 1(3) | ||||||

| Article 1(4) to (8) | Article 1(5) to (9) | ||||||

| Article 1(9) | Article 1, sixth indent | ||||||

| Article 1(10) and (11) | Article 1(10) and (11) | ||||||

| Article 1(12) | Article 1(12) | Article 1, seventh indent | Article 1(c) | ||||

| Article 1(13) | Article 1(13) | Article 1, eighth indent | Article 1(d) | ||||

| Article 1(14) to (17) | Article 2(1), second to fifth indents | ||||||

| Article 1(18) to (20) | Article 2(1), sixth to eighth indents | ||||||

| Article 1(21) to (23) | Article 1, third to fifth indents | ||||||

| Article 1(24) | Article 1(h) | ||||||

| Article 1(25) | Article 1(m) | ||||||

| Article 1(26) | Article 1, fifth indent | ||||||

| Article 1(27) | Article 2(1), ninth indent | ||||||

| Article 2(1) | Article 2(1) | Article 2(1) | Article 1(1) | ||||

| Article 2(2) | Article 2 | ||||||

| Article 2(3) | Article 2(2) | ||||||

| Article 2(4) | Article 2(3) | ||||||

| Article 2(5), first, second and third subparagraph | Article 2(4)(a), (b) and (c) | ||||||

| Article 2(6) | Article 2(3) | Article 1(3) | Article 2(2)(b) | ||||

| Article 3 | Article 3 | ||||||

| Article 4 | Article 3(1) | ||||||

| Article 5(1), first subparagraph | Article 3(2), first subparagraph | Article 4(1) | |||||

| Article 5(1), second subparagraph | Article 10(1), third subparagraph | ||||||

| Article 5(2) | Article 4(2), introductory sentence, (a), (b) and (c) | ||||||

| Article 5(3) to (7) | Article 10(1) to (5) | ||||||

| Article 6(1) | Article 3(2), first subparagraph, third indent and second subparagraph | ||||||

| Article 6(2) | Article 3(2)a | ||||||

| Article 7(1) and (2) | Article 1(10), second subparagraph and Article 5(1) and (2) | ||||||

| Article 7(3) | Article 3(2) third, fourth and fifth subparagraphs | ||||||

| Article 8 | Article 3(4) | ||||||

| Article 9 | Article 3(3)(a) | ||||||

| Article 10 | Article 3(6) | ||||||

| Article 11 | Article 3(7) | ||||||

| Article 12 | Article 7 | ||||||

| Article 13 | Article 6(1) | ||||||

| Article 14(1) | Article 8(1) | ||||||

| Article 14(2) | Article 8(5) | ||||||

| Article 15 | Article 5 | ||||||

| Article 16(1) to (5) | Article 11(1) to (5) | ||||||

| Article 16(6) | Article 1(10), second subparagraph | ||||||

| Article 17 | Article 13(2) | ||||||

| Article 18 | Article 18(1) | ||||||

| Article 19 | Article 18(2) | ||||||

| Article 20(1) to (6) | Article 19 | ||||||

| Article 20(7) | Article 23(1) | ||||||

| Article 21(1) and (2) | Article 20 | ||||||

| Article 21(3) | Article 23(2) | ||||||

| Article 22 | Article 21 | ||||||

| Article 23(1) | Article 8 | ||||||

| Article 23(2) to (7) | Article 9 | ||||||

| Article 24 | Article 9 | ||||||

| Article 25 | Article 8 | ||||||

| Article 26 | Article 13(1) and (3) | ||||||

| Article 27 | Article 14(2) | ||||||

| Article 28 | Article 7(1) | ||||||

| Article 29 | Article 15 | ||||||

| Article 30(1) to (5) | Article 12(1) to (5) | ||||||

| Article 30(6) | Article 12(5a) | ||||||

| Article 30(7) | Article 12(5b) | ||||||

| Article 30(8) | Article 12(6) | ||||||

| Article 30(9) | Article 12(7) | ||||||

| Article 30(10) | Article 12(8) | ||||||

| Article 31 | Article 12a | ||||||

| Article 32 | Article 17 | ||||||

| Article 33 | Article 13 | ||||||

| Article 34(1) | Article 1(1) | ||||||

| Article 34(2) to (4) | Article 2(1) to (3) | ||||||

| Article 35 | Article 3 | ||||||

| Article 36 | Article 4 | ||||||

| Article 37 | Article 5 | ||||||

| Article 38 | Article 6(1) and (4) | ||||||

| Article 39 | Article 7 | ||||||

| Article 40 | Article 3(1) to (4), (7) and (8) | ||||||

| Article 41 | Article 4 | ||||||

| Article 42 | Article 5 | ||||||

| Article 43 | Article 6 | ||||||

| Article 44 | Article 7 | ||||||

| Article 45 | Article 8 | ||||||

| Article 46 | Article 2(2) | ||||||

| Article 47 | Article 10 | ||||||

| Article 48 | Article 3 | ||||||

| Article 49 | Article 4(1) to (7)(r), second subparagraph, first sentence, and (7)(s) to (12) | ||||||

| Article 50 | Article 5(1) to (3) | ||||||

| Article 51(1) to (5) | Article 12(1) to (5) | ||||||

| Article 51(6) | Article 12(8) | ||||||

| Article 52(1) to (7) | Article 3(1) to (7) | ||||||

| Article 52(8) and (9) | Article 3(5) and (6) | Article 3(8) and (9) | Article 5(4) and (5) | ||||

| Article 52(10) | Article 3(10) | ||||||

| Article 53 | Article 4 | ||||||

| Article 54 | Article 5 | ||||||

| Article 55 | Article 6 | ||||||

| Article 56 | Article 7 | ||||||

| Article 57 | Article 11 | ||||||

| Article 58 | Article 3(5) | ||||||

| Article 59 | Article 6 | ||||||

| Article 60 | Article 8 | Article 22 | Article 9 | Article 7 | |||

| Article 61 | Article 4a | ||||||

| Article 62(1) and (2) | Article 11(4) and (5) | ||||||

| Article 62(3) | Article 2 | ||||||

| Article 63 | Article 11(1) to (3) | ||||||

| Article 64 | Article 6(1) to (9) | ||||||

| Article 65 | Article 12(7) | ||||||

| Article 66 | Article 14(2) | Article 9(2) | Article 24(3) | Article 12(2) | |||

| Article 67 | — | — | — | — | — | — | — |

| Article 68 | — | — | — | — | — | — | — |

| Article 69 | — | — | — | — | — | — | — |

| Annex I | Annex | ||||||

| Annex II | Annex I | ||||||

| Annex III | Annex II | ||||||

| Annex IV | Annex III | ||||||

| Annex V | — | — | — | — | — | — | — |

| Annex VI | — | — | — | — | — | — | — |

[Including, inter alia :]

consumer credit,

mortgage credit,

factoring, with or without recourse,

[financing of commercial transactions (including forfaiting).]

[F1 [X1 OJ L 145, 30.4.2004, p. 1 .] ]

Council Directive 93/6/EEC of 15 March 1993 on the capital adequacy of investment firms and credit institutions (OJ L 141, 11.6.1993, p. 1). Directive amended by Directive 98/33/EC (OJ L 204, 21.7.1998, p. 29).

Except in the case of single-currency ‘floating/floating’ interest rate swaps in which only the current replacement cost will be calculated.

Editorial Information

X1 Substituted by Corrigendum to Directive 2004/39/EC of the European Parliament and of the Council of 21 April 2004 on markets in financial instruments amending Council Directives 85/611/EEC and 93/6/EEC and Directive 2000/12/EC of the European Parliament and of the Council and repealing Council Directive 93/22/EEC (Official Journal of the European Union L 145 of 30 April 2004).

Textual Amendments

F1 Inserted by Directive 2004/39/EC of the European Parliament and of the Council of 21 April 2004 on markets in financial instruments amending Council Directives 85/611/EEC and 93/6/EEC and Directive 2000/12/EC of the European Parliament and of the Council and repealing Council Directive 93/22/EEC.

Options/Help

Print Options

PrintThe Whole Directive

PrintThe Whole Attachments

Legislation is available in different versions:

Latest Available (revised):The latest available updated version of the legislation incorporating changes made by subsequent legislation and applied by our editorial team. Changes we have not yet applied to the text, can be found in the ‘Changes to Legislation’ area.

Original (As adopted by EU): The original version of the legislation as it stood when it was first adopted in the EU. No changes have been applied to the text.

Point in Time: This becomes available after navigating to view revised legislation as it stood at a certain point in time via Advanced Features > Show Timeline of Changes or via a point in time advanced search.

See additional information alongside the content

Geographical Extent: Indicates the geographical area that this provision applies to. For further information see ‘Frequently Asked Questions’.

Show Timeline of Changes: See how this legislation has or could change over time. Turning this feature on will show extra navigation options to go to these specific points in time. Return to the latest available version by using the controls above in the What Version box.

More Resources

Access essential accompanying documents and information for this legislation item from this tab. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as adopted version that was used for the EU Official Journal

- lists of changes made by and/or affecting this legislation item

- all formats of all associated documents

- correction slips

- links to related legislation and further information resources

Timeline of Changes

This timeline shows the different versions taken from EUR-Lex before exit day and during the implementation period as well as any subsequent versions created after the implementation period as a result of changes made by UK legislation.

The dates for the EU versions are taken from the document dates on EUR-Lex and may not always coincide with when the changes came into force for the document.

For any versions created after the implementation period as a result of changes made by UK legislation the date will coincide with the earliest date on which the change (e.g an insertion, a repeal or a substitution) that was applied came into force. For further information see our guide to revised legislation on Understanding Legislation.

More Resources

Use this menu to access essential accompanying documents and information for this legislation item. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as adopted version that was used for the print copy

- correction slips

Click 'View More' or select 'More Resources' tab for additional information including:

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- links to related legislation and further information resources