- Latest available (Revised)

- Point in Time (19/01/2007)

- Original (As adopted by EU)

Commission Regulation (EC) No 794/2004Show full title

Commission Regulation (EC) No 794/2004 of 21 april 2004 implementing Council Regulation (EC) No 659/1999 laying down detailed rules for the application of Article 93 of the EC Treaty

You are here:

- Regulations originating from the EU

- 2004 No. 794

- Whole Regulation

- Previous

- Next

- Show Geographical Extent(e.g. England, Wales, Scotland and Northern Ireland)

- Show Timeline of Changes

More Resources

Revised version PDFs

- Revised 22/12/20166.08 MB

- Revised 17/03/20165.42 MB

- Revised 30/12/20152.27 MB

- Revised 02/05/20148.51 MB

- Revised 24/11/20097.91 MB

- Revised 16/04/20097.21 MB

- Revised 22/11/20087.20 MB

- Revised 14/04/20087.39 MB

- Revised 19/01/20073.46 MB

- Revised 21/11/20065.12 MB

- Revised 20/05/20045.06 MB

When the UK left the EU, legislation.gov.uk published EU legislation that had been published by the EU up to IP completion day (31 December 2020 11.00 p.m.). On legislation.gov.uk, these items of legislation are kept up-to-date with any amendments made by the UK since then.

This item of legislation originated from the EU

Legislation.gov.uk publishes the UK version. EUR-Lex publishes the EU version. The EU Exit Web Archive holds a snapshot of EUR-Lex’s version from IP completion day (31 December 2020 11.00 p.m.).

Changes over time for: Commission Regulation (EC) No 794/2004

Version Superseded: 14/04/2008

Alternative versions:

- 21/04/2004- Amendment

- 20/05/2004- Amendment

- 21/11/2006- Amendment

- 19/01/2007- Amendment

- 19/01/2007

Point in time - 14/04/2008- Amendment

- 22/11/2008- Amendment

- 16/04/2009- Amendment

- 24/11/2009- Amendment

- 02/05/2014- Amendment

- 30/12/2015- Amendment

- 17/03/2016- Amendment

- 22/12/2016- Amendment

- Exit day: start of implementation period31/01/2020 11pm- Amendment

- End of implementation period31/12/2020- Amendment

Status:

Point in time view as at 19/01/2007.

Changes to legislation:

There are currently no known outstanding effects for the Commission Regulation (EC) No 794/2004.![]()

Changes to Legislation

Revised legislation carried on this site may not be fully up to date. At the current time any known changes or effects made by subsequent legislation have been applied to the text of the legislation you are viewing by the editorial team. Please see ‘Frequently Asked Questions’ for details regarding the timescales for which new effects are identified and recorded on this site.

Commission Regulation (EC) No 794/2004

of 21 april 2004

implementing Council Regulation (EC) No 659/1999 laying down detailed rules for the application of Article 93 of the EC Treaty

THE COMMISSION OF THE EUROPEAN COMMUNITIES,

Having regard to the Treaty establishing the European Community,

Having regard to Council Regulation (EC) No 659/1999 of 22 March 1999 laying down detailed rules for the application of Article 93 of the EC Treaty(1), and in particular Article 27 thereof,

After consulting the Advisory Committee on State Aid,

Whereas:

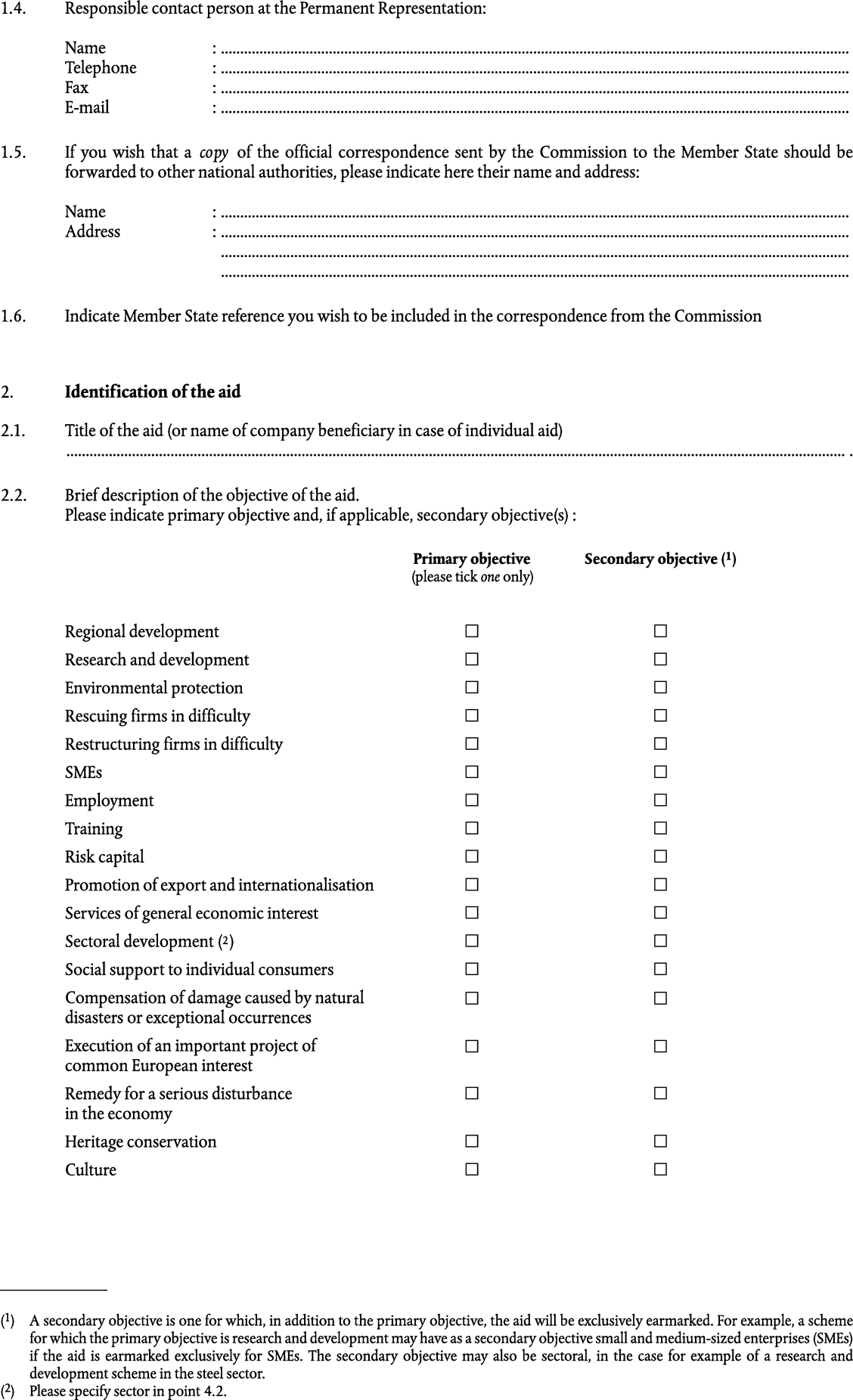

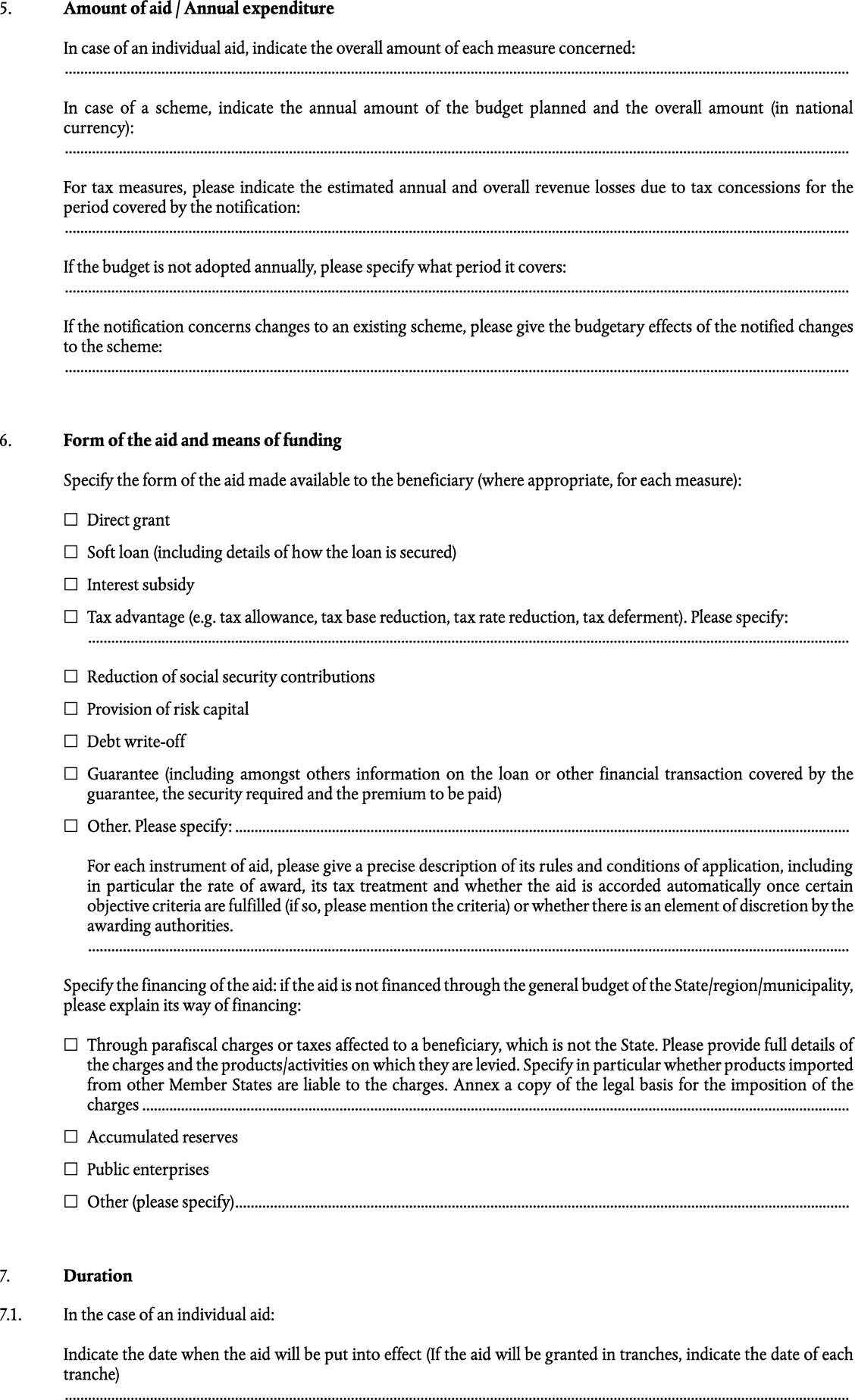

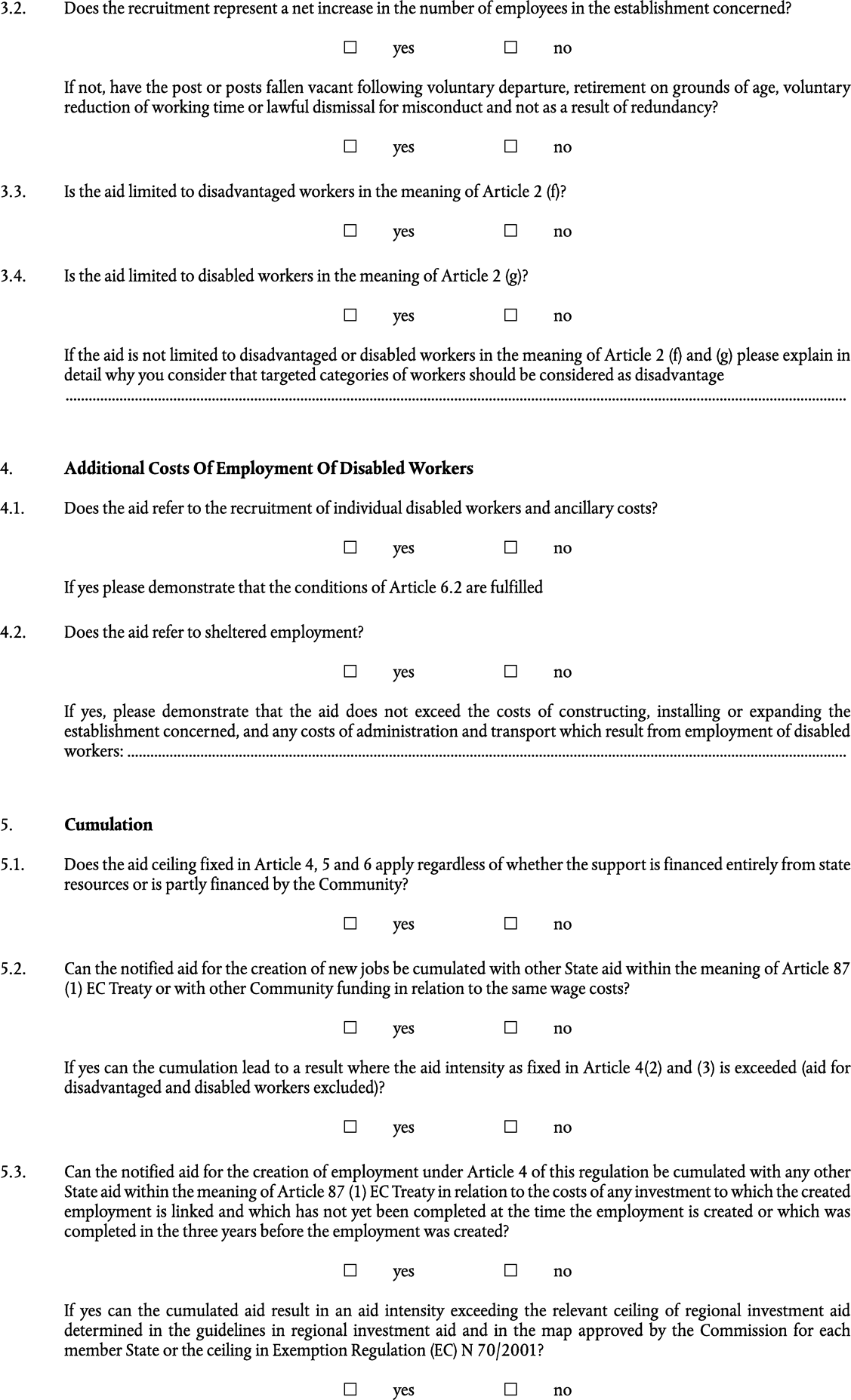

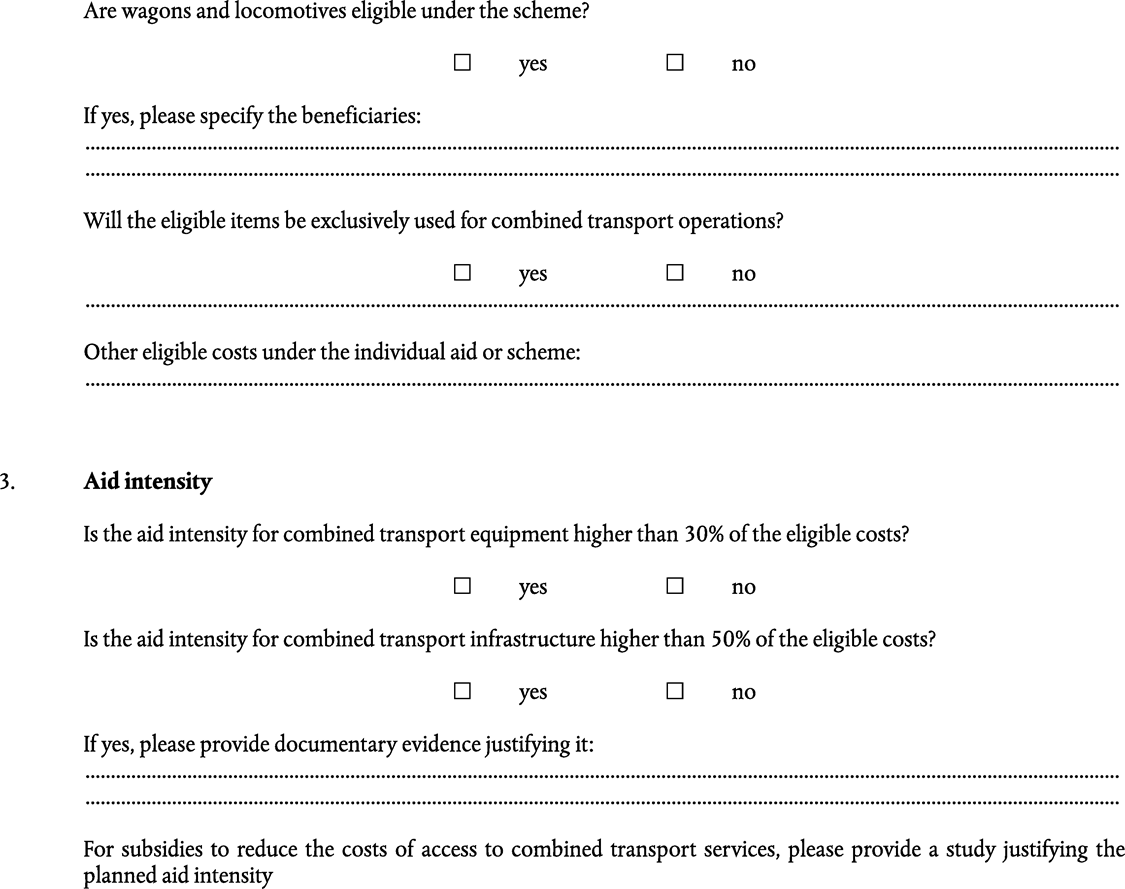

(1) In order to facilitate the preparation of State aid notifications by Member States, and their assessment by the Commission, it is desirable to establish a compulsory notification form. That form should be as comprehensive as possible.

(2) The standard notification form as well as the summary information sheet and the supplementary information sheets should cover all existing guidelines and frameworks in the state aid field. They should be subject to modification or replacement in accordance with the further development of those texts.

(3) Provision should be made for a simplified system of notification for certain alterations to existing aid. Such simplified arrangements should only be accepted if the Commission has been regularly informed on the implementation of the existing aid concerned.

(4) In the interests of legal certainty it is appropriate to make it clear that small increases of up to 20 % of the original budget of an aid scheme, in particular to take account of the effects of inflation, should not need to be notified to the Commission as they are unlikely to affect the Commission’s original assessment of the compatibility of the scheme, provided that the other conditions of the aid scheme remain unchanged.

(5) Article 21 of Regulation (EC) No 659/1999 requires Member States to submit annual reports to the Commission on all existing aid schemes or individual aid granted outside an approved aid scheme in respect of which no specific reporting obligations have been imposed in a conditional decision.

(6) For the Commission to be able to discharge its responsibilities for the monitoring of aid, it needs to receive accurate information from Member States about the types and amounts of aid being granted by them under existing aid schemes. It is possible to simplify and improve the arrangements for the reporting of State aid to the Commission which are currently described in the joint procedure for reporting and notification under the EC Treaty and under the World Trade Organisation (WTO) Agreement set out in the Commission’s letter to Member States of 2 August 1995. The part of that joint procedure relating to Member States reporting obligations for subsidy notifications under Article 25 of the WTO Agreement on Subsidies and Countervailing measures and under Article XVI of GATT 1994, adopted on 21 July 1995 is not covered by this Regulation.

(7) The information required in the annual reports is intended to enable the Commission to monitor overall aid levels and to form a general view of the effects of different types of aid on competition. To this end, the Commission may also request Member States to provide, on an ad hoc basis, additional data for selected topics. The choice of subject matter should be discussed in advance with Member States.

(8) The annual reporting exercise does not cover the information, which may be necessary in order to verify that particular aid measures respect Community law. The Commission should therefore retain the right to seek undertakings from Member States, or to attach to decisions conditions requiring the provision of additional information.

(9) It should be specified that time-limits for the purposes of Regulation (EC) No 659/1999 should be calculated in accordance with Regulation (EEC, Euratom) No 1182/71 of the Council of 3 June 1971 determining the rules applicable to periods, dates and time limits(2), as supplemented by the specific rules set out in this Regulation. In particular, it is necessary to identify the events, which determine the starting point for time-limits applicable in State aid procedures. The rules set out in this Regulation should apply to pre-existing time-limits which will continue to run after the entry into force of this Regulation.

(10) The purpose of recovery is to re-establish the situation existing before aid was unlawfully granted. To ensure equal treatment, the advantage should be measured objectively from the moment when the aid is available to the beneficiary undertaking, independently of the outcome of any commercial decisions subsequently made by that undertaking.

(11) In accordance with general financial practice it is appropriate to fix the recovery interest rate as an annual percentage rate.

(12) The volume and frequency of transactions between banks results in an interest rate that is consistently measurable and statistically significant, and should therefore form the basis of the recovery interest rate. The inter-bank swap rate should, however, be adjusted in order to reflect general levels of increased commercial risk outside the banking sector. On the basis of the information on inter-bank swap rates the Commission should establish a single recovery interest rate for each Member State. In the interest of legal certainty and equal treatment, it is appropriate to fix the precise method by which the interest rate should be calculated, and to provide for the publication of the recovery interest rate applicable at any given moment, as well as relevant previously applicable rates.

(13) A State aid grant may be deemed to reduce a beneficiary undertaking’s medium-term financing requirements. For these purposes, and in line with general financial practice, the medium-term may be defined as five years. The recovery interest rate should therefore correspond to an annual percentage rate fixed for five years.

(14) Given the objective of restoring the situation existing before the aid was unlawfully granted, and in accordance with general financial practice, the recovery interest rate to be fixed by the Commission should be annually compounded. For the same reasons, the recovery interest rate applicable in the first year of the recovery period should be applied for the first five years of the recovery period, and the recovery interest rate applicable in the sixth year of the recovery period for the following five years.

(15) This Regulation should apply to recovery decisions notified after the date of entry into force of this Regulation,

HAS ADOPTED THIS REGULATION:

CHAPTER IU.K.SUBJECT MATTER AND SCOPE

Article 1U.K.Subject matter and scope

1.This Regulation sets out detailed provisions concerning the form, content and other details of notifications and annual reports referred to in Regulation (EC) No 659/1999. It also sets out provisions for the calculation of time limits in all procedures concerning State aid and of the interest rate for the recovery of unlawful aid.

2.This Regulation shall apply to aid in all sectors.

CHAPTER IIU.K.NOTIFICATIONS

Article 2U.K.Notification forms

Without prejudice to Member States’ obligations to notify state aids in the coal sector under Commission Decision 2002/871/CE(3), notifications of new aid pursuant to Article 2(1) of Regulation (EC) No 659/1999, other than those referred to in Article 4(2), shall be made on the notification form set out in Part I of Annex I to this Regulation.

Supplementary information needed for the assessment of the measure in accordance with regulations, guidelines, frameworks and other texts applicable to State aid shall be provided on the supplementary information sheets set out in Part III of Annex I.

Whenever the relevant guidelines or frameworks are modified or replaced, the Commission shall adapt the corresponding forms and information sheets.

Article 3U.K.Transmission of notifications

1.The notification shall be transmitted to the Commission by the Permanent Representative of the Member State concerned. It shall be addressed to the Secretary — General of the Commission.

If the Member State intends to avail itself of a specific procedure laid down in any regulations, guidelines, frameworks and other texts applicable to State aid, a copy of the notification shall be addressed to the Director-General responsible. The Secretary — General and the Directors — General may designate contact points for the receipt of notifications.

2.All subsequent correspondence shall be addressed to the Director — General responsible or to the contact point designated by the Director — General.

3.The Commission shall address its correspondence to the Permanent Representative of the Member State concerned, or to any other address designated by that Member State.

4.Until 31 December 2005 notifications shall be transmitted by the Member State on paper. Whenever possible an electronic copy of the notification shall also be transmitted.

With effect from 1 January 2006 notifications shall be transmitted electronically, unless otherwise agreed by the Commission and the notifying Member State.

All correspondence in connection with a notification which has been submitted after 1 January 2006 shall be transmitted electronically.

5.The date of transmission by fax to the number designated by the receiving party shall be considered to be the date of transmission on paper, if the signed original is received no later than ten days thereafter.

6.By 30 September 2005 at the latest, after consulting Member States, the Commission shall publish in the Official Journal of the European Union details of the arrangements for the electronic transmission of notifications, including addresses together with any necessary arrangements for the protection of confidential information.

Article 4U.K.Simplified notification procedure for certain alterations to existing aid

1.For the purposes of Article 1(c) of Regulation (EC) No 659/1999, an alteration to existing aid shall mean any change, other than modifications of a purely formal or administrative nature which cannot affect the evaluation of the compatibility of the aid measure with the common market. However an increase in the original budget of an existing aid scheme by up to 20 % shall not be considered an alteration to existing aid.

2.The following alterations to existing aid shall be notified on the simplified notification form set out in Annex II:

(a)increases in the budget of an authorised aid scheme exceeding 20 %;

(b)prolongation of an existing authorised aid scheme by up to six years, with or without an increase in the budget;

(c)tightening of the criteria for the application of an authorised aid scheme, a reduction of aid intensity or a reduction of eligible expenses;

The Commission shall use its best endeavours to take a decision on any aid notified on the simplified notification form within a period of one month.

3.The simplified notification procedure shall not be used to notify alterations to aid schemes in respect of which Member States have not submitted annual reports in accordance with Article 5, 6, and 7, unless the annual reports for the years in which the aid has been granted are submitted at the same time as the notification.

CHAPTER IIIU.K.ANNUAL REPORTS

Article 5U.K.Form and content of annual reports

1.Without prejudice to the second and third subparagraphs of this Article and to any additional specific reporting requirements laid down in a conditional decision adopted pursuant to Article 7(4) of Regulation (EC) No 659/1999, or to the observance of any undertakings provided by the Member State concerned in connection with a decision to approve aid, Member States shall compile the annual reports on existing aid schemes referred to in Article 21(1) of Regulation (EC) No 659/1999 in respect of each whole or part calendar year during which the scheme applies in accordance with the standardised reporting format set out in Annex IIIA.

Annex IIIB sets out the format for annual reports on existing aid schemes relating to the production, processing and marketing of agricultural products listed in Annex I of the Treaty.

Annex IIIC sets out the format for annual reports on existing aid schemes for state aid relating to the production, processing or marketing of fisheries products listed in Annex I of the Treaty.

2.The Commission may ask Member States to provide additional data for selected topics, to be discussed in advance with Member States.

Article 6U.K.Transmission and publication of annual reports

1.Each Member State shall transmit its annual reports to the Commission in electronic form no later than 30 June of the year following the year to which the report relates.

In justified cases Member States may submit estimates, provided that the actual figures are transmitted at the very latest with the following year’s data.

2.Each year the Commission shall publish a State aid synopsis containing a synthesis of the information contained in the annual reports submitted during the previous year.

Article 7U.K.Status of annual reports

The transmission of annual reports shall not be considered to constitute compliance with the obligation to notify aid measures before they are put into effect pursuant to Article 88(3) of the Treaty, nor shall such transmission in any way prejudice the outcome of an investigation into allegedly unlawful aid in accordance with the procedure laid down in Chapter III of Regulation (EC) No 659/1999.

CHAPTER IVU.K.TIME-LIMITS

Article 8U.K.Calculation of time-limits

1.Time-limits provided for in Regulation (EC) No 659/1999 and in this Regulation or fixed by the Commission pursuant to Article 88 of the Treaty shall be calculated in accordance with Regulation (EEC, Euratom) No 1182/71, and the specific rules set out in paragraphs 2 to 5 of this Article. In case of conflict, the provisions of this regulation shall prevail.

2.Time limits shall be specified in months or in working days.

3.With regard to time-limits for action by the Commission, the receipt of the notification or subsequent correspondence in accordance with Article 3(1) and Article 3(2) of this Regulation shall be the relevant event for the purpose of Article 3(1) of Regulation (EEC, Euratom) No 1182/71.

As far as notifications transmitted after 31 December 2005, and correspondence relating to them are concerned, the receipt of the electronic notification or communication at the relevant address published in the Official Journal of the European Union shall be the relevant event.

4.With regard to time-limits for action by Member States, the receipt of the relevant notification or correspondence from the Commission in accordance with Art. 3(3) of this Regulation shall be the relevant event for the purposes of Article 3(1) of Regulation (EEC, Euratom) No 1182/71.

5.With regard to the time-limit for the submission of comments following initiation of the formal investigation procedure referred to in Art. 6(1) of Regulation (EC) No 659/1999 by third parties and those Member States which are not directly concerned by the procedure, the publication of the notice of initiation in the Official Journal of the European Union shall be the relevant event for the purposes of Article 3(1) of Regulation (EEC, Euratom) No 1182/71.

6.Any request for the extension of a time-limit shall be duly substantiated, and shall be submitted in writing to the address designated by the party fixing the time-limit at least two working days before expiry.

CHAPTER VU.K.INTEREST RATE FOR THE RECOVERY OF UNLAWFUL AID

Article 9U.K.Method for fixing the interest rate

1.Unless otherwise provided for in a specific decision the interest rate to be used for recovering State aid granted in breach of Article 88(3) of the Treaty shall be an annual percentage rate fixed for each calendar year.

It shall be calculated on the basis of the average of the five-year inter-bank swap rates for September, October and November of the previous year, plus 75 basis points. In duly justified cases, the Commission may increase the rate by more than 75 basis points in respect of one or more Member States.

2.If the latest three-month average of the five-year inter-bank swap rates available, plus 75 basis points, differs by more than 15 % from the State aid recovery interest rate in force, the Commission shall recalculate the latter.

The new rate shall apply from the first day of the month following the recalculation by the Commission. The Commission shall inform Member States by letter of the recalculation and the date from which it applies.

3.The interest rate shall be fixed for each Member State individually, or for two or more Member States together.

4.In the absence of reliable or equivalent data or in exceptional circumstances the Commission may, in close co-operation with the Member State(s) concerned, fix a State aid recovery interest rate, for one or more Member States, on the basis of a different method and on the basis of the information available to it.

Article 10U.K.Publication

The Commission shall publish current and relevant historical State aid recovery interest rates in the Official Journal of the European Union and for information on the Internet.

Article 11U.K.Method for applying interest

1.The interest rate to be applied shall be the rate applicable on the date on which unlawful aid was first put at the disposal of the beneficiary.

2.The interest rate shall be applied on a compound basis until the date of the recovery of the aid. The interest accruing in the previous year shall be subject to interest in each subsequent year.

3.The interest rate referred to in paragraph 1 shall be applied throughout the whole period until the date of recovery. However, if more than five years have elapsed between the date on which the unlawful aid was first put at the disposal of the beneficiary and the date of the recovery of the aid, the interest rate shall be recalculated at five yearly intervals, taking as a basis the rate in force at the time of recalculation.

CHAPTER VIU.K.FINAL PROVISIONS

Article 12U.K.Review

The Commission shall in consultation with the Member States, review the application of this Regulation within four years after its entry into force.

Article 13U.K.Entry into force

This Regulation shall enter into force on the twentieth day following that of its publication in the Official Journal of the European Union.

Chapter II shall apply only to those notifications transmitted to the Commission more than five months after the entry into force of this Regulation.

Chapter III shall apply to annual reports covering aid granted from 1 January 2003 onwards.

Chapter IV shall apply to any time limit, which has been fixed but which has not yet expired on the date of entry into force of this Regulation.

Articles 9 and 11 shall apply in relation to any recovery decision notified after the date of entry into force of this Regulation.

This Regulation shall be binding in its entirety and be directly applicable in all Member States.

ANNEX IU.K.

[F1 [X1PART III.12 U.K. INFORMATION SHEET FOR AGRICULTURE

Please note that this State aid notification form only applies to activities related to the production, processing and marketing of agricultural products as defined in point 6 of the Community Guidelines for State aid in the agriculture and forestry sector 2007 to 2013 (4) . Please note that the specific State aid rules for agriculture do not apply to measures related to the processing of Annex I products into non-Annex I products. For such measures you should complete the relevant notification form.

1. Products covered U.K.

1.1. Does the measure apply to any of the following products which are not yet subject to a common market organisation: U.K.

potatoes other than starch potatoes;

horsemeat;

coffee;

cork;

vinegars derived from alcohol;

the measure does not apply to any of these products.

2. Incentive effect U.K.

A. Aid schemes U.K.

2.1. Will aid under an aid scheme only be granted in respect of activities undertaken or services received after the aid scheme has been set up and declared compatible with the EC Treaty by the Commission? U.K.

| | yes | | no |

If no, please refer to point 16 of the Guidelines.

2.2. If the aid scheme creates an automatic right to receive the aid, requiring no further administrative action at administrative level, may the aid itself only be granted for activities undertaken or services received after the aid scheme has been set up and declared compatible with the EC Treaty by the Commission? U.K.

| | yes | | no |

If no, please refer to point 16 of the Guidelines.

2.3. If the aid scheme requires an application to be submitted to the competent authority concerned, may the aid itself only be granted for activities undertaken or services received after the following conditions have been fulfilled: U.K.

the aid scheme must have been set up and declared compatible with the EC Treaty by the Commission;

an application for the aid must have been properly submitted to the competent authority concerned;

the application must have been accepted by the competent authority concerned in a manner which obliges that authority to grant the aid, clearly indicating the amount of aid to be granted or how this amount will be calculated; such acceptance by the competent authority may only be made if the budget available for the aid or aid scheme is not exhausted?

| | yes | | no |

If no, please refer to point 16 of the Guidelines.

B. Individual aids: U.K.

2.4. Will individual aid outside any scheme only be granted in respect to activities undertaken or services received after the criteria in point 2.3 (b) and (c) above have been satisfied? U.K.

| | yes | | no |

If no, please refer to point 16 of the Guidelines.

C. Compensatory aids: U.K.

2.5. Is the aid scheme compensatory in nature? U.K.

| | yes | | no |

If yes, points A and B above do not apply.

3. Type of aid U.K.

What type(s) of aid does the planned measure include:

RURAL DEVELOPMENT MEASURES U.K.

Aids for investments in agricultural holdings

Aids for investments in connection with the processing and marketing of agricultural products

Agri-environmental and animal welfare aid

Nature 2000 payments and payments linked to Directive 2000/60/EC (5)

Aid to compensate for handicaps in certain areas

Aid for meeting standards

Aid for the setting up of young farmers

Aid for early retirement or for the cessation of farming activities

Aid for producer groups

Aid for land re-parcelling

Aid to encourage the production and marketing of quality agricultural products

Provision of technical support in the agricultural sector

Aid for the livestock sector

Aid for the outermost regions and the Aegean Islands

RISK AND CRISIS MANAGEMENT U.K.

Aid to compensate for damage to agricultural production or the means of agricultural production

Aid for combating animal and plant diseases

Aid towards the payment of insurance premiums

Aid for closing production, processing and marketing capacity

OTHER AIDS U.K.

Aid for advertising of agricultural products

Aid linked to tax exemptions under directive 2003/96/EC (6) ,

Aids for the forestry sector

Editorial Information

X1 Substituted by Corrigendum to Commission Regulation (EC) No 1935/2006 of 20 December 2006 amending Regulation (EC) No 794/2004 implementing Council Regulation (EC) No 659/1999 laying down detailed rules for the application of Article 93 of the EC Treaty (Official Journal of the European Union L 407 of 30 December 2006).

Textual Amendments

PART III.12.A U.K. SUPPLEMENTARY INFORMATION SHEET ON SUPPORT FOR INVESTMENTS IN AGRICULTURAL HOLDINGS

This information sheet relates to investments in agricultural holdings discussed in point IV.A of the Community Guidelines for State aid in the agriculture and forestry sector 2007 to 2013 (7) .

1. Objective of the aid U.K.

1.1. Which of the following objectives does the investment pursue? U.K.

Reduce production costs;

Improve and redeploy production;

Increase quality;

Preserve and improve the natural environment, comply with animal hygiene and standards;

Promote the diversification of farm activities;

Other (please specify):

If the investment pursues other aims, please note that only investments pursuing one or more of the objectives listed above are eligible for support for investments in agricultural holdings.

1.2. Does the aid concern simple replacement investments? U.K.

| | yes | | no |

If yes, please note that simple replacement investments are not eligible for support for investments in agricultural holdings.

1.3. Is the aid linked to investments in products which are subject to restrictions on production or limitations of Community support at the level of individual farmers, holdings or processing plants under a common organisation of the market (including direct support schemes) financed by the EAGF, which would increase production capacity beyond these restrictions or limitations? U.K.

| | yes | | no |

If yes, please note that, under point 37 of the Guidelines, no aid may be granted for such investments.

2. Beneficiaries U.K.

Who are the beneficiaries of the aid?

farmers;

producer groups;

other (please specify):

…………

3. Aid intensity U.K.

3.1. Please state the maximum rate of public support, expressed as a percentage of eligible investment: U.K.

………… in less-favoured areas or the areas referred to in Article 36(a)(i), (ii) or (iii) of Regulation (EC) No 1698/2005 (8) (max. 50 %);

………… in other regions (max. 40 %);

………… for young farmers in less-favoured areas or the areas referred to in Article 36(a)(i), (ii) or (iii) of Regulation (EC) No 1698/2005, carrying out the investment within five years of setting up (max. 60 %);

………… for young farmers in other areas, carrying out the investment within five years of setting up (max. 50 %);

…………. in the outermost regions and on the smaller Aegean islands within the meaning of Regulation (EEC) No 2019/93 (9) (max. 75 %);

…………. for investments entailing extra costs linked to the preservation and improvement of the natural environment or improvements in the hygiene of livestock farms or the well-being of livestock carried out within the time-limits for transposition of the newly introduced minimum standards (max. 75 % in less-favoured areas or the areas referred to in Article 36(a)(i), (ii) or (iii) of Regulation (EC) No 1698/2005, and max. 60 % in other areas);

………… for investments entailing extra costs linked to the preservation and improvement of the natural environment or improvements in the hygiene of livestock farms or the well-being of livestock carried out within three years following the date on which the investment must be authorised under Community legislation (max. 50 % in less-favoured areas or the areas referred to in Article 36(a)(i), (ii) or (iii) of Regulation (EC) No 1698/2005, and max. 40 % in other areas);

………… for investments entailing extra costs linked to the preservation and improvement of the natural environment or improvements in the hygiene of livestock farms or the well-being of livestock carried out in the fourth year following the date on which the investment must be authorised under Community legislation (max. 25 % in less-favoured areas or the areas referred to in Article 36(a)(i), (ii) or (iii) of Regulation (EC) No 1698/2005, and max. 20 % in other areas);

………… for investments entailing extra costs linked to the preservation and improvement of the natural environment or improvements in the hygiene of livestock farms or the well-being of livestock carried out in the fifth year following the date on which the investment must be authorised under Community legislation (max. 12,5 % in less-favoured areas or the areas referred to in Article 36(a)(i), (ii) or (iii) of Regulation (EC) No 1698/2005, and max. 10 % in other areas, ( no aid can be granted for expenses incurred beyond the fifth year );

………… for additional investment expenditure made by those Member States who joined the Union on 1 May 2004 and 1 January 2007 respectively, for the purposes of implementing Directive 91/676/EEC (10) (max. 75 %);

………… for additional investment expenditure made for the purposes of implementing Directive 91/676/EEC and which is the subject of support under Regulation (EC) No 1698/2005 (max. 50 % in less-favoured areas or the areas referred to in Article 36(a)(i), (ii) or (iii) of Regulation (EC) No 1698/2005, and max. 40 % in other areas);

…………. for investments made by young farmers in order to comply with Community or national standards in force (max. 60 % in less favoured areas or the areas referred to in Article 36(a)(i), (ii) or (iii) of Regulation (EC) No 1698/2005, and max. 50 % in other areas).

3.2. In the case of investments entailing extra costs linked to the preservation and improvement of the natural environment, improvements in the hygiene of livestock farms or the well-being of livestock, are the extra costs limited to investments either exceeding the minimum requirements currently prescribed by the Community or complying with newly introduced minimum standards? Are they strictly limited to eligible extra costs in connection with these objectives without resulting in an increased production capacity? U.K.

| | yes | | no |

3.3. In the case of investments made for the purposes of implementing Directive 91/676/EEC, is the envisaged aid intensity limited to necessary and eligible extra costs, and does it exclude investments leading to increased production capacity? U.K.

| | yes | | no |

3.4. In the case of investments made by young farmers in order to comply with Community or national standards in force, is the aid limited to extra costs as a result of implementing these standards and have these costs been incurred within 36 months after installation? U.K.

| | yes | | no |

4. Eligibility criteria U.K.

4.1. Is the aid limited to agricultural holdings not in difficulty? U.K.

| | yes | | no |

4.2. Is the aid intended for the manufacture and marketing of products which imitate or substitute for milk and milk products? U.K.

| | yes | | no |

5. Eligible expenditure U.K.

5.1. Do eligible expenses include: U.K.

construction, acquisition or improvement of immovable property;

the purchase or lease purchase of machinery and equipment, including computer software up to the market value of the asset, exclusive of costs connected with a leasing contract (tax, lessor's margin, interest refinancing costs, overheads, insurance charges etc);

overheads connected with the two previous types of expenses (for instance architect's fees, engineer's fees, expert's fees, feasibility studies, acquisition of patents and licences)?

5.2. Does the aid cover the purchase of second-hand machinery? U.K.

| | yes | | no |

5.3. If yes, is eligibility limited to small and medium enterprises with a low technical level and limited capital? U.K.

| | yes | | no |

5.4. Are any of the following excluded from the aid scheme: the purchase of production rights, animals and annual plants, or the planting of annual plants? U.K.

| | yes | | no |

If no, please note that according to point 29 of the Guidelines no aid may be granted for such types of expenditure.

5.5. Is the share of purchases of land other than land for construction purposes in the eligible expenses for the planned investment limited to 10 %? U.K.

| | yes | | no |

If no, please note that this 10 % ceiling is one of the eligibility criteria to be met under point 29 of the Guidelines.

6. Aid for the conservation of traditional landscapes and buildings U.K.

6.1. Does the aid concern investments or capital works intended for the conservation of non-productive heritage features located on agricultural holdings? U.K.

| | yes | | no |

6.1.1. If yes, what is the envisaged rate of aid (max. 100 %): U.K.

…………

6.1.2. Do the eligible expenses include remuneration for the work of the farmer or his workers? U.K.

| | yes | | no |

6.1.3. If yes, will this remuneration be limited to a maximum of EUR 10 000 per year? U.K.

| | yes | | no |

6.1.4. If no, please give reasons for exceeding the above limit. U.K.

…

6.2. Does the aid concern investments or capital works intended to conserve the heritage features of productive assets on farms? U.K.

| | yes | | no |

6.2.1. If yes, does the investment entail any increase in the production capacity of the farm? U.K.

| | yes | | no |

6.2.2. What are the envisaged maximum aid rates for this type of investment? U.K.

Investments without increase in capacity:

Maximum rate envisaged for less-favoured areas or the areas referred to in Article 36(a)(i), (ii) or (iii) of Regulation (EC) No 1698/2005 (max. 75 %): …………

Maximum rate envisaged for other areas (max. 60 %): …………

Investments with increase in capacity:

Maximum rate envisaged in cases where contemporary materials are used (max.: see point 3.1): …………

Maximum rate envisaged in cases where traditional materials are used, expressed as a percentage of the extra cost (max. 100 %): …………

7. Relocation of farm buildings in the public interest U.K.

7.1. Does the relocation result from expropriation? U.K.

| | yes | | no |

7.2. Is the relocation justified on grounds of public interest specified in the legal basis? U.K.

| | yes | | no |

Please note that the legal basis must explain the public interest served by the relocation.

7.3. Does relocation simply consist of the dismantling, removal and re-erection of existing facilities? U.K.

| | yes | | no |

7.3.1. If yes, what it the intensity of the aid? (max. 100 %) U.K.

…………

7.4. Does relocation result in the farmer benefiting from more modern equipment and facilities? U.K.

| | yes | | no |

7.4.1. If yes, what is the farmer's own contribution, as a percentage of the added value of the facilities after relocation? U.K.

In less-favoured areas or the areas referred to in Article 36(a)(i), (ii) or (iii) of Regulation (EC) No 1698/2005 (min. 50 %)

…………

In other areas (min. 60 %)

…………

Young farmers in less-favoured areas or the areas referred to in Article 36(a)(i), (ii) or (iii) of Regulation (EC) No 1698/2005 (min. 45 %)

…………

Young farmers in other areas (min. 55 %)

7.5. Does relocation result in an increase in production capacity? U.K.

| | yes | | no |

7.5.1. If yes, what is the farmer's own contribution, as a percentage of the expenditure linked to the increase? U.K.

In less-favoured areas or the areas referred to in Article 36(a)(i), (ii) or (iii) of Regulation (EC) No 1698/2005 (min. 50 %)

…………

In other areas (min 60 %)

…………

Young farmers in less-favoured areas or the areas referred to in Article 36(a)(i), (ii) or (iii) of Regulation (EC) No 1698/2005 (min. 45 %)

…………

Young farmers in other areas (min 55 %)

8. Other information U.K.

8.1. Is the notification accompanied by documentation demonstrating how the State aid measure is consistent with the relevant rural development programme(s) concerned? U.K.

| | yes | | no |

If yes, please provide this documentation below or in an annex to this supplementary information sheet

…………

If no, please note that this documentation must be provided under point 26 of the Guidelines

8.2. Is the notification accompanied by documentation showing that support is targeted on clearly defined objectives reflecting identified structural and territorial needs and structural disadvantages? U.K.

| | yes | | no |

If yes, please provide this documentation below or in an annex to this supplementary information sheet

…………

If no, please note that this documentation must be provided under point 36 of the Guidelines

PART III.12.B. U.K. SUPPLEMENTARY INFORMATION SHEET FOR AID FOR INVESTMENTS IN CONNECTION WITH THE PROCESSING AND MARKETING OF AGRICULTURAL PRODUCTS

This notification form applies to aid investments in the processing (11) and marketing (12) of agricultural products, as dealt with in point IV.B. of the Community Guidelines for State aid in the agriculture and forestry sector 2007 to 2013 (13) .

1. Scope & beneficiaries of the aid U.K.

1.1. Please specify under which provision of the Agricultural Guidelines this notification is meant to fall: U.K.

1.1.1.

point IV.B.2. (a) [Commission Regulation (EC) No 70/2001 (14) or any provision replacing it]

1.1.2.

point IV.B.2. (b) [Commission Regulation (EC) No 1628/2006 (15) ]

1.1.3.

point IV.B.2. (c) [Commission guidelines on national regional aid for 2007 to 2013 (16) ]

1.1.4.

point IV.B.2. (d) [aid for intermediate companies in regions not eligible for regional aid]

1.2. Commission Regulation (EC) No 70/2001 (State aid to small and medium-sized enterprises) U.K.

Is the beneficiary a SME in the processing or marketing of agricultural products?

| | yes | | no |

If no, the aid does not fulfil the necessary conditions under this Regulation and cannot be declared compatible with the Common Market under point IV.B.2.(a) of the Guidelines.

If yes, the aid is exempted from the obligation to notify. Please state the reasons why your authorities still would like to submit a notification. In this case, please refer to the relevant part of the general notification form (Annex I part I and III.1 of Regulation (EC) No 794/2004 (17) or any provision replacing it).

1.3. Commission Regulation for regional investment aid U.K.

Does the aid fulfil the conditions set out in this Regulation?

| | yes | | no |

If no, the aid does not fulfil the necessary conditions under this Regulation and cannot be declared compatible with the Common Market under point IV.B.2.(b) of the Guidelines.

If yes, the aid is exempted from the obligation to notify. Please state the reasons why your authorities would still like to submit a notification. In this case, please refer to the specific notification form.

1.4. Commission guidelines on national regional aid for 2007 to 2013 (16) U.K.

Does the aid fulfil the conditions set out in these Guidelines?

| | yes | | no |

If no, the aid does not fulfil the necessary conditions under these Guidelines and cannot be declared compatible with the Common Market under point IV.B.2.(c) of the Agricultural Guidelines.

If yes, note that the assessment of such aid is to be carried out on the basis of the Guidelines on National Regional aid. Please refer to the relevant part of the general notification form (Annex of Commission Regulation (EC) No 1627/2006 (18) ).

1.5. Aid in regions NOT eligible for regional aid U.K.

1.5.1. Are there beneficiaries, which are SMEs? U.K.

| | yes | | no |

If yes, please refer to point 1.2. above [point IV.B.2 (a) of the Agricultural guidelines].

1.5.2. Are there beneficiaries, which are large companies (i.e. 750 employees or more and EUR 200 million turnover or more)? U.K.

| | yes | | no |

If yes, please note that the aid cannot be declared compatible with the Common Market under point IV.B.2(d) of the Agricultural guidelines.

1.5.3. Are there beneficiaries, which are intermediate companies (i.e. less than 750 employees and/or less than EUR 200 million turnover)? U.K.

| | yes | | no |

If yes, please refer to the relevant part of the general notification form (Annex of Commission Regulation (EC) No1627/2006) regarding the eligible expenses.

2. Aid intensity U.K.

2.1. If the beneficiaries are SMEs (Commission Regulation (EC) No 70/2001 or any provision replacing it): U.K.

Please state the maximum aid intensity for eligible investments in:

2.1.1. outermost regions: ………… (max. 75 %) U.K.

2.1.2. smaller Aegean Islands (19) : ………… (max. 65 %) U.K.

2.1.3. regions eligible under Art. 87(3)(a): …………(max. 50 %) U.K.

2.1.4. other regions: ………… (max. 40 %) U.K.

If the rate is higher than the above ceiling, please note that the measure would not be in line with Art. 4 of Commission Regulation (EC) No 70/2001.

2.2. For aid falling under the Commission Regulation for regional investment aid or the Commission guidelines on national regional aid for 2007 to 2013 please specifiy the maximum aid intensity for: U.K.

2.2.1. SMEs : U.K.

2.2.1.1. regarding eligible investments in regions under Article 87(3)(a) of the Treaty: ………… (max. 50 % or maximum amount determined in the regional map approved for the Member State concerned for the period 2007-2013) U.K.

2.2.1.2. regarding eligible investments in other regions eligible for regional aid: ………… (max. 40 % or maximum amount determined in the regional map approved for the Member State concerned for the period 2007 to 2013) U.K.

2.2.2. intermediate enterprises in the meaning of Article 28 (3) of Council Regulation No 1698/2005 (20) (not SME but with less than 750 employees or less than EUR 200 million turnover ): U.K.

2.2.2.1. regarding eligible investments in regions eligible under Article 87(3)(a) of the Treaty: ………… (max. 25 % or maximum amount determined in the regional map approved for the Member State concerned for the period 2007-2013) U.K.

2.2.2.2. regarding eligible investments in other regions eligible for regional aid: ………… (max. 20 % or maximum amount determined in the regional map approved for the Member State concerned for the period 2007 to 2013) U.K.

If aid rates are higher than the above ceilings, please note that the measure would not be in line with point IV.B.2.(c)(ii) of the Agricultural Guidelines.

2.2.2.3. Do the beneficiaries fulfil all other conditions of Commission Recommendation 2003/361/EC (21) ? U.K.

| | yes | | no |

If no, the measure would not be in line with point IV.B.2.(c)(ii) of the Agricultural Guidelines.

2.2.3. Are there beneficiaries that are larger than the intermediate enterprises mentioned under point 2.2.2. (i.e. large enterprises)? U.K.

| | yes | | no |

If yes, is the maximum aid intensity equal to or below the maximum amount determined in the regional aid map approved for the Member State concerned for the period 2007 to 2013?

| | yes | | no |

If no, the aid cannot be declared compatible under point IV.B.2.(c) of the Agricultural Guidelines. If yes, please mention the maximum aid intensity in the aforementioned regional aid map. The relevant maximum aid intensity in the corresponding regional aid map is ………… %.

2.3. For investment aid in favour of intermediate companies in regions not eligible for regional aid: U.K.

2.3.1. please specify the maximum aid intensity: ………… (max. 20 %) U.K.

If aid rates are higher than the above ceilings, please note that the measure would not be in line with point IV.B.2.(d) of the Agricultural Guidelines.

2.3.2. Do the beneficiaries fulfil all other conditions of Commission Recommendation 2003/361/EC? U.K.

| | yes | | no |

If no, the measure would not be in line with point IV.B.2.(d) of the Agricultural Guidelines.

3. Eligibility criteria & expenses U.K.

3.1. Does the aid concern the manufacture and marketing of products which imitate or substitute milk and milk products? U.K.

| | yes | ' | no |

If you have answered yes, please note that the measure would not be in line with point IV.B. of the Agricultural Guidelines.

3.2. Regarding intermediate or large companies, does the aid concern the purchase of second-hand equipment? U.K.

| | yes | | no |

If you have answered yes, please note that the measure would not be in line with point IV.B. of the Agricultural Guidelines.

3.3. For aid for investments in regions not eligible for regional aid: U.K.

Can you confirm that the eligibles expenses for investments correspond fully to the eligible expenses listed in the Commission guidelines on national regional aid for 2007 to 2013?

| | yes | | no |

If no:

if the beneficiaries are not SME the measure would not be in line with point IV.B.2.(d) of the Agricultural Guidelines.

if the beneficiaries are SME, are the eligible expenses in conformity with Articles 2 and 4 of Commission Regulation (EC) No 70/2001?

| | yes | | no |

If not, the measure would not be in line with point IV.B.2.(d) of the Agricultural Guidelines

3.4. Could the aid support investments for which a common market organisation, including direct support schemes, financed by the EAGF places restrictions on production or limitations on Community support at the level of individual farmers, holdings or processing plants which would increase production beyond those restrictions or limitations? U.K.

| | yes | | no |

If yes, please note that point 47 of the agricultural guidelines does not allow aid for these investments.

4. Other information U.K.

4.1. Is the notification accompanied by documentation showing that that support is targeted on clearly defined objectives reflecting identified structural and territorial needs and structural disadvantages? U.K.

| | yes | | no |

If yes, please provide that documentation hereunder or in an annex to this supplementary information sheet

…………

If not, please note that this documentation is requested in conformity with point 46 of the agricultural guidelines.

4.2. Is the notification accompanied by documentation demonstrating that the State aid measure fits into and is coherent with the relevant rural development programme(s) concerned? U.K.

| | yes | | no |

If yes, please provide that documentation hereunder or in an annex to this supplementary information sheet

…………

If no, please note that this documentation must be provided under point 26 of the Guidelines.

5. Individual notifications U.K.

Could the eligible investments exceed EUR 25 million or the aid amount to EUR 12 million?

| | yes | | no |

If yes, will an individual notification be done?

| | yes | | no |

If you have answered no, please note that the measure would not be in line with point IV.B of the Agricultural Guidelines.

PART III.12.C U.K. SUPPLEMENTARY INFORMATION SHEET ON AGRI-ENVIRONMENTAL AND ANIMAL WELFARE AID

This form must be used for the notification of any State aid measure to support agricultural production methods designed to protect the environment and to maintain the countryside (agri-environment) or to improve animal welfare covered by point IV.C. of the Community Guidelines for State aid in the agriculture and forestry sector 2007 to 2013 (22) (hereinafter called ‘ the guidelines ’ ) and articles 39 and 40 of Council Regulation (EC) No 1698/2005 (23) .

Does the measure concern compensation to farmers who voluntarily give agri-environmental commitments (Article 39(2) of Council Regulation (EC) No 1698/2005?

yes no If yes, please refer to the part of this Supplementary Information Sheet (SIS) relating to ‘ aid for agri-environmental commitments ’ .

Does the measure concern compensation to farmers who voluntarily enter into animal welfare commitments (Article 40(1) of Council Regulation (EC) No 1698/2005?

yes no If yes, please refer to the part of this SIS relating to ‘ aid for animal welfare commitments ’

Does the aid only concern environmental investments (point 62 of the guidelines)?

yes no If yes, please refer to SIS relating to ‘ Investment aids in the agricultural sector ’

Does the environmental aid pursue other objectives such as training and advisory services to help agricultural producers (point IV.K of the guidelines)?

yes no If yes, please refer to SIS relating to point IV.K of the guidelines.

Others?

Please provide a complete description of the measure(s) …………

Is documentation demonstrating that the State aid fits into and is coherent with the relevant Rural Development plan attached to the notification?

yes no If yes, please provide that documentation hereunder or in an annex to this supplementary information sheet

…………

If no, please note that this documentation is requested in conformity with point 26 of the agricultural guidelines.

Aid for agri-environmental commitments (point IV.C.2 of the guidelines) U.K.

1. Objective of the measure U.K.

Which one of the following specific objectives does the support measure promote?

ways of using agricultural land which are compatible with the protection and improvement of the environment, the landscape and its features, natural resources, the soil and genetic diversity and reducing production costs;

an environmentally-favourable extensification of farming and management of low-intensity pasture systems, improve and redeployment of production ;

the conservation of high nature-value farmed environments, which are under threat, and increase quality;

the upkeep of the landscape and historical features on agricultural land;

the use of environmental planning in farming practice. If the measure does not pursue any of the above objectives, please indicate which are the objectives aimed at in terms of environmental protection? (Please submit a detailed description)

…………

…………

If the measure in question has already been applied in the past, what have been the results in terms of environmental protection?

…………

…………

2. Eligibility criteria U.K.

2.1. Will the aid be granted to farmers and/or other land managers (Article 39(2) of Regulation (EC) No 1698/2005) who give agri-environmental commitments for a period of between five and seven years? U.K.

| | yes | | no |

2.2. Will a shorter or a longer period be necessary for all or particular types of commitments? U.K.

| | yes | | no |

In the affirmative please provide the reasons justifying that period

…………

…………

2.3. Please confirm that no aid will be granted to compensate for agri-environmental commitments that do not go beyond the relevant mandatory standards established pursuant to Articles 4 and 5 of, and Annexes III and IV to Regulation (EC) No 1782/2003 (24) as well as minimum requirements for fertiliser and plant protection product use and other relevant mandatory requirements established by national legislation and identified in the rural development programme. U.K.

| | yes | | no |

If no, please note that Article 39(3) of Regulation (EC) No 1698/2005 does not allow for aid for agri-environmental commitments that do not involve more than the application of these standards and requirements.

2.4. Please describe what the abovementioned standards and requirements are and explain how the agri-environmental commitments involve more than their application. U.K.

…………

…………

3. Aid amount U.K.

3.1. Please specify the maximum amount of aid to be granted based on the area of the holding to which agri-environmental commitments apply: U.K.

for specialised perennial crops ………… (maximum payment of 900 EUR/ha)

for annual crops ………… (maximum payment of 600 EUR/ha)

for other land uses ………… (maximum payment of 450 EUR/ha)

local breeds in danger of being lost to farming ………… (maximum payment of 200 EUR/live stock unit)

other …………………………………………..….

If the maximum amounts mentioned are exceeded please justify the compatibility of the aid with the provisions of Article 39(4) of Regulation (EC) No 1698/2005.

3.2. Is the support measure granted annually? U.K.

| | yes | | no |

If no, please provide the reasons justifying other period

…………

…………

3.3. Is the amount of annual support calculated on the basis of: U.K.

income foregone,

additional costs resulting from the commitment given, and

the need to provide compensation for transaction costs

| | yes | | no |

Explain the calculation method used in fixing the amount of support and specify the income foregone, additional costs and possible transaction costs: ……………………

3.4. Is the reference level for calculating income foregone and additional cost resulting from the commitments given, the standards and requirements as mentioned above under point 2.3? U.K.

| | yes | | no |

If no please explain the reference level taken into consideration

…………

…………

3.5. Are the payments made per unit of production? U.K.

| | yes | | no |

If yes please explain the reasons justifying that method and the initiatives undertaken to ensure that the maximum amounts per year eligible for Community support as set out in the Annex to Regulation (EC) No 1698/2005 are complied with.

…………

…………

3.6. Do you intend to give aid for transaction costs for the continuation of agri-environmental commitments already undertaken in the past? U.K.

| | yes | | no |

3.7. If yes, please demonstrate that such costs still continue to be incurred U.K.

…………

3.8. Do you intend to give aid for the costs of non-productive investments linked to the achievements of agri-environmental commitments (non-productive investments being investments which should not lead to a net increase in farm value or profitability)? U.K.

| | yes | | no |

3.9. If yes, which aid rate will be applied (max. 100 %)? U.K.

…

AID FOR ANIMAL WELFARE COMMITMENTS (POINT IV.C.2 OF THE GUIDELINES) U.K.

1. Objective of the measure U.K.

For which of the following areas do the animal welfare commitments provide upgraded standards?

water and feed closer to their natural needs;

housing conditions such as space allowances, bedding, natural lights;

outdoor access;

absence of systematic mutilations, isolation or permanent tethering,

prevention of pathologies mainly determined by farming practices and/or keeping conditions.

(Please submit a detailed description)

…………

…………

If the measure in question has already been applied in the past, what have been the results in terms of animal welfare?

…………

2. Eligibility criteria U.K.

2.1. Will the aid be exclusively granted to farmers who give animal welfare commitments for a period of between five and seven years? U.K.

| | yes | | no |

2.2. Will a shorter or a longer period be necessary for all or particular types of commitments? U.K.

| | yes | | no |

In the affirmative please provide the reasons justifying that period

…………

…………

2.3. Please confirm that no aid will be granted to compensate for animal welfare commitments that do not go beyond the relevant mandatory standards established pursuant to Articles 4 and 5 of, and Annexes III and IV to, Regulation (EC) No 1782/2003 (25) and other relevant mandatory requirements established by national legislation and identified in the rural development programme. U.K.

| | yes | | no |

If no, please note that Article 40(2) of Regulation 1698/2005 does not allow for aid for animal welfare commitments that do not involve more than the application of these standards and requirements

2.4. Please describe what the abovementioned standards and requirements are and explain how the animal welfare commitments involve more than their application. U.K.

…………

…………

3. Aid amount U.K.

3.1. Please specify the maximum amount of animal welfare aid to be granted: U.K.

………… (maximum payment of EUR 500/live stock unit)

If the amount exceeds EUR 500/live stock unit, please justify its compatibility with the provisions of Article 40(3) of Regulation (EC) No 1698/2005

3.2. Is the support measure granted annually? U.K.

| | yes | | no |

If no, please provide the reasons justifying other period

…………

…………

3.3. Is the amount of annual support calculated on the basis of: U.K.

income foregone,

additional costs resulting from the commitment given, and

the need to provide compensation for transaction costs ?

| | yes | | no |

Explain the calculation method used in fixing the amount of support and specify the income foregone, additional costs, possible transaction costs and possible costs of any non remunerative capital works:

…………

…………

3.4. Is the reference level for calculating income foregone and additional cost resulting from the commitments given, the standards and requirements as mentioned above under point 2.3? U.K.

| | yes | | no |

If no please explain the reference level taken into consideration

…………

…………

3.5. Are the payments made per livestock unit? U.K.

| ' | yes | | no |

If no, please explain the reasons justifying the method chosen as well as the initiatives undertaken to ensure that the maximum amounts per year eligible for Community support as set out in the Annex to Regulation (EC) No 1698/2005 are complied with.

3.6. Do you intend to give aid for transaction costs for the continuation of animal welfare commitments already undertaken in the past? U.K.

| | yes | | no |

3.7. If yes, please demonstrate that such costs still continue to be incurred U.K.

…………

3.8. Do you intend to give aid for the costs of non-productive investments linked to the achievements of agri-environmental commitments (non-productive investments being investments which should not lead to a net increase in farm value or profitability)? U.K.

| | yes | | no |

3.9. If yes, which aid rate will be applied (max. 100 %)? U.K.

…

PART III 12 Cbis U.K. SUPPLEMENTARY INFORMATION SHEET ON AID CONCERNING NATURA 2000 PAYMENTS AND PAYMENTS LINKED TO DIRECTIVE 2000/60/EC

This form must be used by Member State to notify aids under Natura 2000 payments and payments linked to Directive 2000/60/EC (26) , as dealt with in Part IV.C.3 of the Community Guidelines for State aid in the agriculture and forestry sector 2007 to 2013 (27) .

1. objective of the measure U.K.

1.1. Is the measure aimed to compensate farmers for costs incurred and income foregone resulting from disadvantages in the areas concerned related to the implementation of Directives 79/409/EEC (28) , 92/43/EEC (29) and 2000/60/EC? U.K.

| | Yes | | No |

1.1.1. If no, please note that Part IV.C.3 of the Agricultural Guidelines does not allow for aid to compensate for costs other than those related to the disadvantages related to the implementation of Directives 79/409/EEC, 92/43/EEC and 2000/60/EC. U.K.

2. Eligibility criteria U.K.

2.1. Are costs incurred and income foregone resulting from disadvantages in the areas concerned related to the implementation of Directives 79/409/EEC, 92/43/EEC and 2000/60/EC? U.K.

| | Yes | | No |

2.1.1. If yes please provide all the details concerning the relevant provisions of the Directive(s) in question U.K.

…………

…………

2.1.2. If no, please note that Part IV.C.3 of the Agricultural Guidelines does not allow for aid to compensate for other costs than those resulting from disadvantages related to the implementation of Directives 79/409/EEC, 92/43/EEC and 2000/60/EC. U.K.

2.2. Are the planned compensation payments necessary to solve specific problems arising from the Directive(s)? U.K.

| | Yes | | No |

2.2.1. If yes please explain why this measure is necessary U.K.

…………

…………

2.2.2. If no, please note that according to Part IV.C.3 of the Agricultural Guidelines only payments that are necessary to solve specific problems arising from these Directives can be authorised U.K.

2.3. Is the support granted only for obligations going beyond cross compliance obligations? U.K.

| | Yes | | No |

2.3.1. If no, please justify its compatibility with the provisions of Part IV.C.3 of the Agricultural Guidelines U.K.

…………

…………

2.4. Is the support granted for obligations going beyond conditions set out by Article 5 of Council Regulation (EC) No 1782/2003 (30) ? U.K.

| | Yes | | No |

2.4.1. If no, please justify its compatibility with the provisions of Part IV.C.3 of the Agricultural Guidelines U.K.

…………

…………

2.5. Is the aid granted in breach of the polluter pays principle? U.K.

| | Yes | | No |

2.5.1. If yes, please provide all elements justifying its compatibility with the provisions of Part IV.C.3 of the Agricultural Guidelines and that it is exceptional, temporary and degressive U.K.

…………

…………

3. Aid amount U.K.

3.1. Please specify the maximum amount of aid, based on the utilised agricultural area (UAA): U.K.

………… (initial maximum Natura 2000 payment for a period not exceeding five years of 500 EUR/hectare of UAA)

………… (normal maximum Natura 2000 payment of 200 EUR/hectare of UAA)

………… (maximum amount of support linked to Directive 2000/60/EC is fixed in accordance with the procedure referred to in Article 90(2) of Regulation (EC) No 1698/2005)

3.1.1 With regard to payments linked to Directive 2000/60/EC please provide additional information. U.K.

…………

…………

3.1.2. If you intend to grant a higher amount of aid, please justify its compatibility with the provisions of Part IV.C.3 of the Agricultural Guidelines and Article 38 of Regulation (EC) No 1698/2005 (31) . U.K.

…………

…………

3.2. Please explain the measures taken to ensure that payments are fixed at a level which avoids overcompensation U.K.

…………

…………

4. Other Information U.K.

Is documentation demonstrating that the State aid fits into and is coherent with the relevant Rural Development plan attached to the notification?

| | yes | | no |

If yes, please provide that documentation hereunder or in an annex to this supplementary information sheet

…………

If no, please note that this documentation is requested in conformity with point 26 of the agricultural guidelines.

PART III.12.D U.K. SUPPLEMENTARY INFORMATION SHEET ON AID TO COMPENSATE FOR HANDICAPS IN CERTAIN AREAS

This form must be used for the notification of aid aiming to compensate for natural handicaps in certain areas, which is dealt with in point IV.D. of the Community Guidelines for State aid in the agriculture and forestry sector 2007 to 2013 (32) .

1. Questions relevant for all notifications of aid to compensate for handicaps in certain areas U.K.

1. Describe the handicap in question: U.K.

…………

…………

…………

…………

…………

…………

…………

…………

2. Provide proof that the amount of compensation to be paid avoids any overcompensation to farmers of the effect of the handicaps: U.K.

…………

…………

…………

…………

…………

…………

…………

…………

3. If there are areas of handicaps where the average impact of handicaps per hectare of comparable farms differs, demonstrate that the level of compensatory payments is proportionate to the economic impact of the handicaps in the different areas: U.K.

…………

…………

…………

…………

…………

…………

…………

…………

4. Is it within human control to reverse the economic impact of the permanent handicap? U.K.

| | yes | | no |

If yes, please note that only the economic impact of permanent handicaps that lie outside of human control may be taken into account for calculating the amount of compensatory payments. Structural disadvantages open to improvement through modernisation of farms or factors like taxes, subsidies or the implementation of the CAP reform may not be taken into account.

If no, explain why it is outside human control to reverse the economic impact of the permanent handicap:

…………

…………

…………

Could you specify the size of the farms that will benefit from these payments?

…………

5. Is the amount of compensation established by comparing the average income per hectare of farms in areas with handicaps with the income of same-sized farms producing the same products in areas without handicaps situated in the same Member State, or when a whole Member State is considered as consisting of areas with handicaps, with the income of same-sized farms in similar areas in other Member States in which the production conditions can be meaningfully compared to those in the first Member State? The income to be taken into account in this respect shall be direct income from farming and notably leave aside taxes paid or subsidies received. U.K.

| | yes | | no |

Describe how the comparison was made:

…………

…………

…………

…………

…………

…………

…………

6. Is the aid measure combined with support under Articles 13, 14 and 15 of the Council Regulation (EC) No 1257/1999 (33) ? U.K.

| | yes | | no |

7. Can you confirm that the total support granted to the farmer will not exceed the amount determined in accordance with Article 15 of Regulation (EC) No 1257/1999? U.K.

| | yes | | no |

Specify the amount ……………………………………………………..

If no, please note that, according to point 72 of the Agricultural Guidelines, the maximum aid that can be granted in the form of compensatory allowance cannot exceed the above amount.

8. Does the measure provide that the following eligibility criteria must be fulfilled? U.K.

Farmers are required to farm a minimum area of land (please specify the minimum area)

…………

Farmers must undertake to pursue their farming activity in a less-favoured area for at least five years from the first payment of a compensatory allowance;

Farmers must apply the relevant mandatory standards established pursuant to Articles 4 and 5 of, and Annexes III and IV to, Regulation (EC) No 1782/2003 (34) as well as minimum requirements for fertiliser and plant protection product use and other mandatory requirements established by national legislation and identified in the rural development programme

| ' | yes | | no |

9. Does the measure provide that, in the event of obstruction on the part of the owner or holder of the animals when inspections are being carried out and the necessary samples are being taken in application of national residue-monitoring plans, or when the investigations and checks provided for under Directive 96/23/EC are being carried out, the penalties provided for under question 4 shall apply? U.K.

| | yes | | no |

10. In case of aid schemes still in force at the date of the entry into force of Articles 37 and 88(3) of Council Regulation (EC) No 1698/2005 (35) , will the aid scheme be amended to comply with the provisions of those articles as from that date? U.K.

| | yes | | no |

If no, please note that from the entry into force of Articles 37 and 88 (3) of the abovementioned regulation new rules will be applied to measures aiming to compensate for natural handicaps in certain areas and that aid measures that do not fulfil all the criteria of these Articles and any implementing rules adopted by the Council or the Commission will have to be put to an end.

2. Other Information U.K.

Is documentation demonstrating that the State aid fits into and is coherent with the relevant Rural Development plan attached to the notification?

| | yes | | no |

If yes, please provide that documentation hereunder or in an annex to this supplementary information sheet

…………

If no, please note that this documentation is requested in conformity with point 26 of the agricultural guidelines

PART III.12.E U.K. SUPPLEMENTARY INFORMATION SHEET ON AID FOR MEETING STANDARDS

This information sheet relates to investments in agricultural holdings discussed in point IV.E of the Community Guidelines for State aid in the agriculture and forestry sector 2007 to 2013 (36) .

1. Does the planned aid apply only to primary producers (farmers)? U.K.

| | yes | | no |

2. Are the new standards based on Community standards? U.K.

| | yes | | no |

3. If no, will the aid be limited to expenses resulting from standards likely to create a genuine competition handicap for the farmers involved? U.K.

| | yes | | no |

4. Please demonstrate this handicap on the basis of mean net profit margins for average agricultural holdings in the (sub-)sector involved: U.K.

…………

5. Is the aid farmers are entitled to over a period of five years for costs or loss of income incurred as a result of applying one or more standards to be provided on a diminishing scale and limited to a total of EUR 10 000 ? U.K.

| | yes | | no |

6. Please describe the diminishing scale of the aid: U.K.

…

7. If the total of EUR 10 000 is exceeded: is the aid limited to 80 % of costs and loss of income incurred by farmers, and to EUR 12 000 per agricultural holding, and is account taken of any Community aid provided? U.K.

| | yes | | no |

8. Does the aid pertain to standards which can be shown to be the direct cause of: U.K.

an increase in the operating costs of at least 5 % for the product or products affected by the standard?

yes no a loss of income equal to at least 10 % of net profits derived from the product or products affected by the standard?

yes no

9. Please demonstrate the abovementioned parameters ( please note that they must be calculated for an average agricultural holding in the sector and in the Member State affected by the standard ): U.K.

…………

10. Does the aid apply only to standards resulting in an increase in operating costs or loss of income equal to at least 25 % of all agricultural holdings of the (sub-) sector in the Member State concerned? U.K.

| | yes | | no |

11. Is the notification accompanied by documentation demonstrating how the State aid measure is consistent with the relevant rural development programme(s) concerned? U.K.

| | yes | | no |

If yes, please provide this documentation below or in an annex to this supplementary information sheet

…………

If no, please note that this documentation must be provided under point 26 of the Guidelines

PART III.12.F U.K. SUPPLEMENTARY INFORMATION SHEET ON AID FOR THE SETTING UP OF YOUNG FARMERS

This notification form applies to aid granted for the setting up of young farmers, as dealt with in chapter IV.F of the Community Guidelines for State aid in the agriculture and forestry sector 2007 to 2013 (37) .

1. Eligibility Criteria U.K.

Please note that State aid for the setting up of young farmers may only be granted if it fulfils the same conditions set out in the Rural Development Regulation (38) for co-financed aid, and in particular the eligibility criteria of Article 22 thereof.

1.1. Is the support measure granted only to primary production ? U.K.

| | yes | | no |

If no, please note that according to point 82 of the Guidelines, the support may not be granted for activities other than primary production.

1.2. Are the following conditions fulfilled? U.K.

the farmer is under 40 years of age ;

the farmer possesses adequate occupational skills and competence ;

the farmer is setting up on an agricultural holding as head of the holding for the first time ;

the farmer submitted a business plan for the development of his/her farming activity;

| | yes | | no |

If you answered no to any of these questions, please note that the measure would not be in line with the requirements of Article 22 of the Rural Development Regulation and could not be authorised under the Guidelines.

1.3. Does the measure provide that the above eligibility requirements must be met at the time the individual decision to grant support is taken? U.K.

| | yes | | no |

1.4. Does the measure comply with existing Community or national standards? U.K.

| | yes | | no |

1.4.1. If not, is the aim to comply with existing Community or national standards identified in the submitted business plan? U.K.

| | yes | | no |

1.4.2. Does the period of grace within which the standard needs to be met exceed 36 months from the date of setting up? U.K.

| | yes | | no |

2. Maximum allowable aid U.K.

2.1. Is the setting up support granted in the form of U.K.

a single premium? (max. EUR 40 000 )

(please specify the amount)

…………

and/or

an interest rate subsidy? (max. capitalised value of EUR 40 000 )

If yes, please describe the conditions of the loan — interest rate, duration, period of grace, etc.)

…………

2.2. Can you confirm that the aid combined with the support granted under the Rural Development Regulation will not exceed EUR 55 000 and the maximum amounts laid down for either form of aid (EUR 40 000 for single premium; EUR 40 000 for subsidised loan) will be respected? U.K.

| | yes | | no |

3. Other Information U.K.

Is documentation demonstrating that the State aid fits into and is coherent with the relevant Rural Development plan attached to the notification?

| | yes | | no |

If yes, please provide that documentation hereunder or in an annex to this supplementary information sheet

…………

If no, please note that this documentation is requested in conformity with point 26 of the agricultural guidelines.

PART III.12.G U.K. SUPPLEMENTARY INFORMATION SHEET FOR AID FOR EARLY RETIREMENT OR FOR THE CESSATION OF FARMING ACTIVITIES

This form must be used for the notification of any State aid schemes which are designed to encourage older farmers to take early retirement as described by chapter IV.G of the Community Guidelines for State aid in the agricultural and forestry sector 2007 to 2013 (39) .

1. Types of aid U.K.

1.1. Is the support measure granted only to primary production? U.K.

| | yes | | no |

If no, please note that according to point 85 of the Guidelines, the support may not be granted for other activities than primary production.

1.2. Is the early retirement support granted: U.K.

to farmers who decide to stop their agricultural activity for the purpose of transferring the holdings to other farmers?

to farm workers who decide to stop all farming work definitively upon the transfer of the holding?

Please describe the envisaged measures:

…………

2. Eligibility criteria U.K.

2.1. Will the aid be exclusively granted when the transferor of the farm, U.K.

stops all commercial farming activity definitively,

is not less than 55 years old but not yet of normal retirement age at the time of transfer or not more than 10 years younger than the normal retirement age in the Member State concerned at the time of transfer and

has practised farming for the 10 years preceding transfer?

| | yes | | no |

If no please note that according to point 87 of the Guidelines combined with article 23 of Council Regulation No 1698/2005 (40) , no aid can be authorised if the transferor does not fulfil all those conditions.

2.2. Will the aid be exclusively granted when the transferee of the farm: U.K.