- Latest available (Revised)

- Point in Time (20/05/2004)

- Original (As adopted by EU)

Commission Regulation (EC) No 794/2004Show full title

Commission Regulation (EC) No 794/2004 of 21 april 2004 implementing Council Regulation (EC) No 659/1999 laying down detailed rules for the application of Article 93 of the EC Treaty

You are here:

- Regulations originating from the EU

- 2004 No. 794

- Annexes only

- Show Geographical Extent(e.g. England, Wales, Scotland and Northern Ireland)

- Show Timeline of Changes

More Resources

Revised version PDFs

- Revised 22/12/20166.08 MB

- Revised 17/03/20165.42 MB

- Revised 30/12/20152.27 MB

- Revised 02/05/20148.51 MB

- Revised 24/11/20097.91 MB

- Revised 16/04/20097.21 MB

- Revised 22/11/20087.20 MB

- Revised 14/04/20087.39 MB

- Revised 19/01/20073.46 MB

- Revised 21/11/20065.12 MB

- Revised 20/05/20045.06 MB

When the UK left the EU, legislation.gov.uk published EU legislation that had been published by the EU up to IP completion day (31 December 2020 11.00 p.m.). On legislation.gov.uk, these items of legislation are kept up-to-date with any amendments made by the UK since then.

This item of legislation originated from the EU

Legislation.gov.uk publishes the UK version. EUR-Lex publishes the EU version. The EU Exit Web Archive holds a snapshot of EUR-Lex’s version from IP completion day (31 December 2020 11.00 p.m.).

Changes over time for: Commission Regulation (EC) No 794/2004 (Annexes only)

Version Superseded: 19/01/2007

Alternative versions:

- 21/04/2004- Amendment

- 20/05/2004- Amendment

- 20/05/2004

Point in time - 19/01/2007- Amendment

- 14/04/2008- Amendment

- 22/11/2008- Amendment

- 16/04/2009- Amendment

- 24/11/2009- Amendment

- 02/05/2014- Amendment

- 30/12/2015- Amendment

- 17/03/2016- Amendment

- 22/12/2016- Amendment

- Exit day: start of implementation period31/01/2020 11pm- Amendment

- End of implementation period31/12/2020- Amendment

Status:

Point in time view as at 20/05/2004.

Changes to legislation:

There are currently no known outstanding effects for the Commission Regulation (EC) No 794/2004.![]()

Changes to Legislation

Revised legislation carried on this site may not be fully up to date. At the current time any known changes or effects made by subsequent legislation have been applied to the text of the legislation you are viewing by the editorial team. Please see ‘Frequently Asked Questions’ for details regarding the timescales for which new effects are identified and recorded on this site.

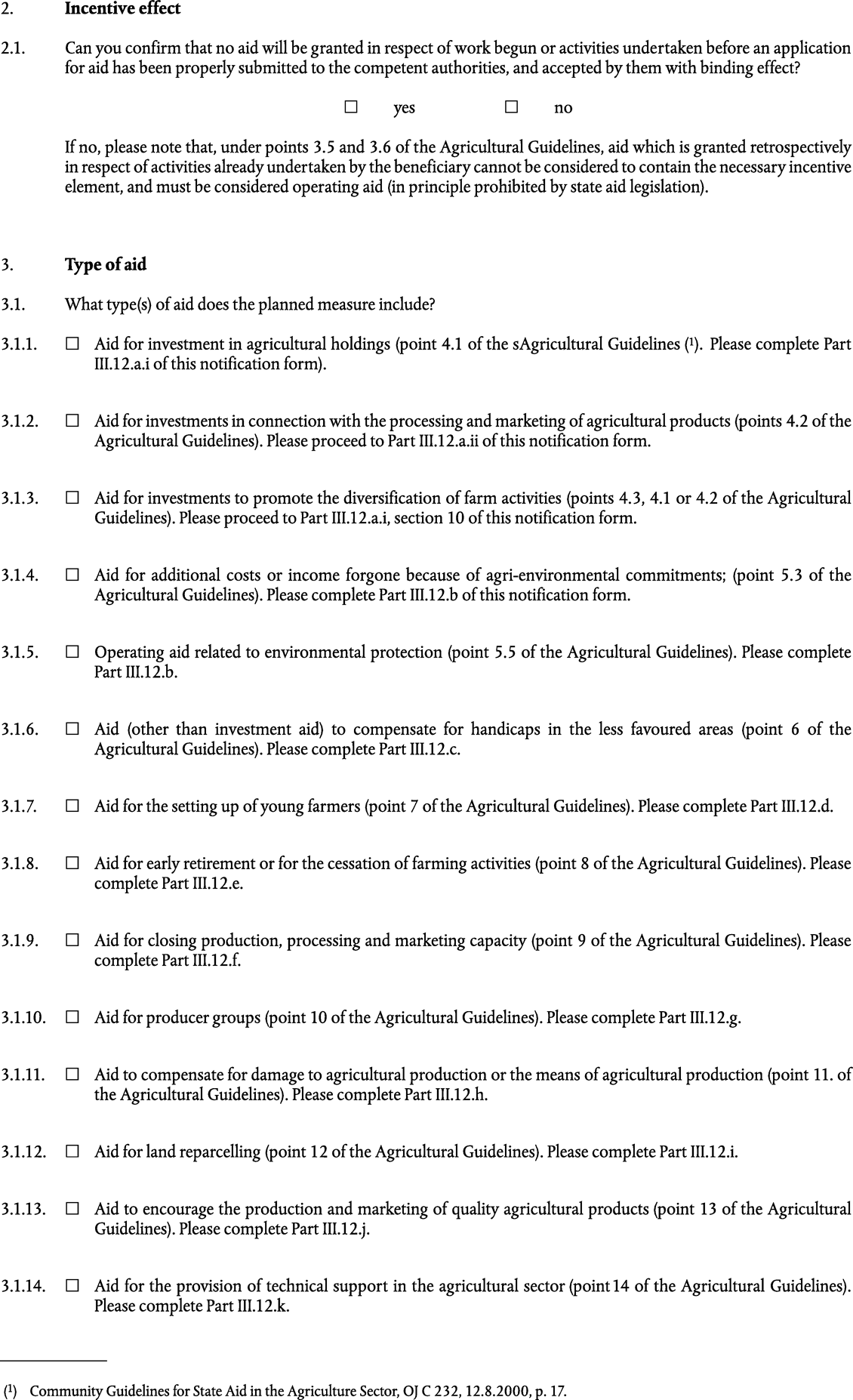

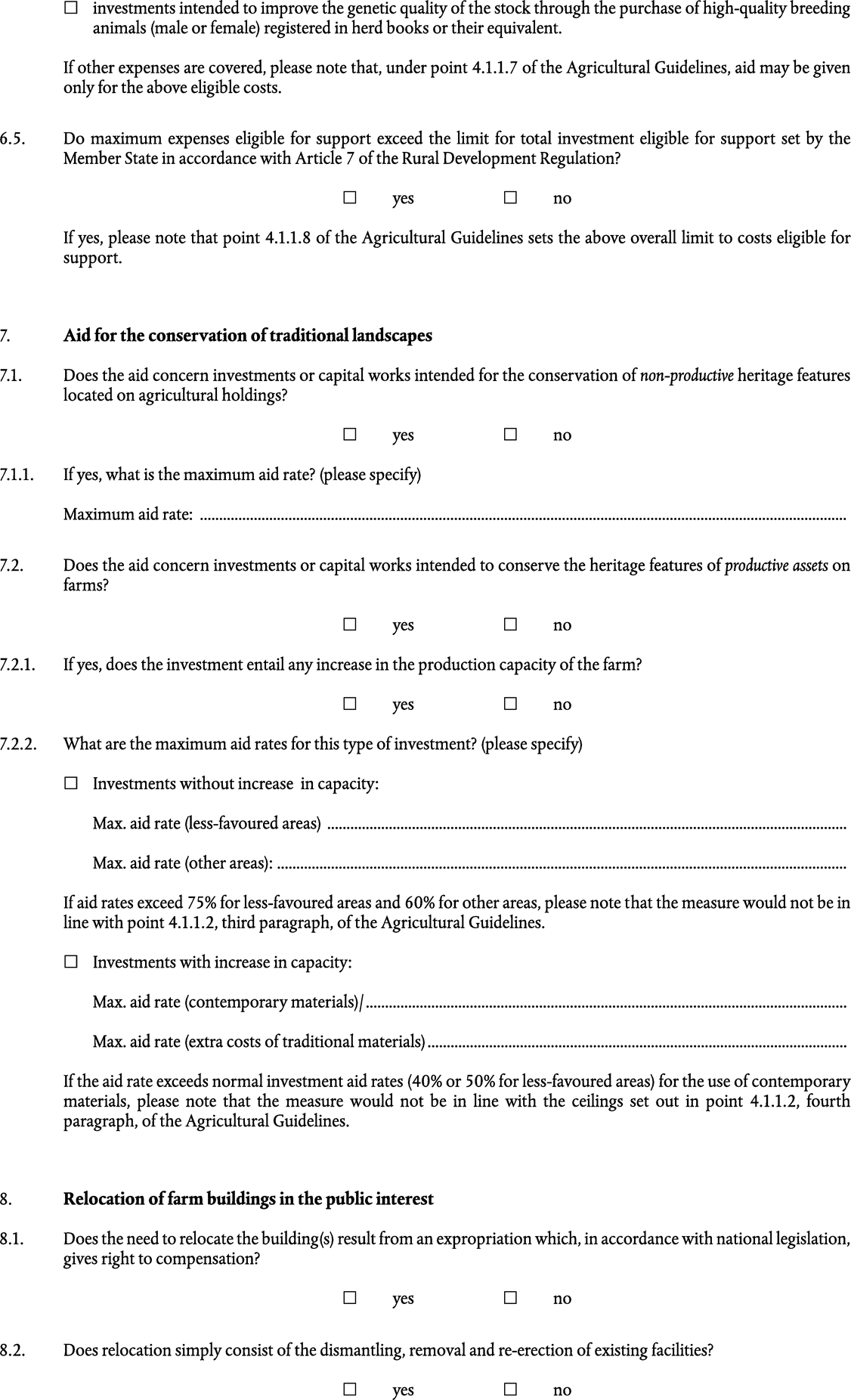

ANNEX IU.K.

[X1 [X2PART III.14 U.K. SUPPLEMENTARY INFORMATION SHEET FOR AID TO FISHERIES

1. Objectives of the scheme (tick as appropriate): U.K.

aid for the permanent withdrawal of fishing vessels through their transfer to third countries (aid to export, aid for the setting up of joint ventures) (point 4.2 of the guidelines);

aid for investment in the fleet (aid for renewal, aid for modernisation and equipment, aid for the purchase of used vessels) (point 4.4 of the guidelines);

aid to make good damage caused by natural disaster or exceptional occurrences (point 4.6 of the guidelines);

others (in particular, indicate if the aid concerned falls within the categories of aid covered by the Commission Regulation on State aid to SMEs in the fisheries sector).

2. Where aid scheme concerns permanent transfer of fishing vessels to developing countries, indicate how will it be ensured that international law will be not infringed in particular with respect to conservation and management of marine resources. U.K.

3. A fully reasoned justification as to why and on the basis of which provision of the guidelines the scheme may be considered as compatible with the common market shall be provided. This text should include a detailed demonstration that all conditions of the guidelines and, where they refer to Regulation (EC) No 2792/1999, the conditions of the relevant provisions of, and annexes to that Regulation are fulfilled. It should also summarise the content of the necessary supporting documents submitted with the notification (e.g. socioeconomic data on the recipient regions, scientific and economic justification). U.K.

4. Each notification should contain the following undertakings from the Member State: U.K.

commitment that the measures financed and their effects comply with Community law,

commitment that, during the grant period, the beneficiaries of the aid comply with the rules of the Common Fisheries Policy.] ]

Editorial Information

X1 Inserted by Corrigendum to Commission Regulation (EC) No 794/2004 of 21 April 2004 implementing Council Regulation (EC) No 659/1999 laying down detailed rules for the application of Article 93 of the EC Treaty (Official Journal of the European Union L 140 of 30 April 2004).

X2 Substituted by Corrigendum of the Corrigendum to Commission Regulation (EC) No 794/2004 of 21 April 2004 implementing Council Regulation (EC) No 659/1999 laying down detailed rules for the application of Article 93 of the EC Treaty (Official Journal of the European Union L 25 of 28 January 2005).

ANNEX IIU.K.

ANNEX III AU.K.STANDARDISED REPORTING FORMAT FOR EXISTING STATE AID

(This format covers all sectors except agriculture)U.K.

With a view to simplifying, streamlining and improving the overall reporting system for State aid, the existing Standardised Reporting Procedure shall be replaced by an annual updating exercise. The Commission shall send a pre-formatted spreadsheet, containing detailed information on all existing aid schemes and individual aid, to the Member States by 1 March each year. Member States shall return the spreadsheet in an electronic format to the Commission by 30 June of the year in question. This will enable the Commission to publish State aid data in year t for the reporting period t-1(1).

The bulk of the information in the pre-formatted spreadsheet shall be pre-completed by the Commission on the basis of data provided at the time of approval of the aid. Member States shall be required to check and, where necessary, modify the details for each scheme or individual aid, and to add the annual expenditure for the latest year (t-1). In addition, Member States shall indicate which schemes have expired or for which all payments have stopped and whether or not a scheme is co-financed by Community Funds.

Information such as the objective of the aid, the sector to which the aid is directed, etc shall refer to the time at which the aid is approved and not to the final beneficiaries of the aid. For example, the primary objective of a scheme which, at the time the aid is approved, is exclusively earmarked for small and medium-sized enterprises shall be aid for small and medium-sized enterprises. However, another scheme for which all aid is ultimately awarded to small and medium-sized enterprises shall not be regarded as such if, at the time the aid is approved, the scheme is open to all enterprises.

The following parameters shall be included in the spreadsheet. Parameters 1-3 and 6-12 shall be pre-completed by the Commission and checked by the Member States. Parameters 4, 5 and 13 shall be completed by the Member States.

Title

Aid number

All previous aid numbers (e.g., following the renewal of a scheme)

Expiry

Member States should indicate those schemes which have expired or for which all payments have stopped.

Co-financing

Although Community funding itself is excluded, total State aid for each Member State shall include aid measures that are co-financed by Community funding. In order to identify which schemes are co-financed and estimate how much such aid represents in relation to overall State aid, Member States are required to indicate whether or not the scheme is co-financed and if so the percentage of aid that is co-financed. If this is not possible, an estimate of the total amount of aid that is co-financed shall be provided.

Primary objective

Secondary objective

A secondary objective is one for which, in addition to the primary objective, the aid (or a distinct part of it) was exclusively earmarked at the time the aid was approved. For example, a scheme for which the primary objective is research and development may have as a secondary objective small and medium-sized enterprises (SMEs) if the aid is earmarked exclusively for SMEs. Another scheme for which the primary objective is SMEs may have as secondary objectives training and employment if, at the time the aid was approved, the aid is earmarked for x% training and y% employment.

Region(s)

Aid may, at the time of approval, be exclusively earmarked for a specific region or group of regions. Where appropriate, a distinction should be made between the Article 87(3)a regions and the Article 87(3)c regions. If the aid is earmarked for one particular region, this should be specified at NUTS(3) level II.

Category of aid instrument(s)

A distinction shall be made between six categories (Grant, Tax reduction/exemption, Equity participation, Soft loan, Tax deferral, Guarantee).

Description of aid instrument in national language

Type of aid

A distinction shall be made between three categories: Scheme, Individual application of a scheme, Individual aid awarded outside of a scheme (ad hoc aid).

Expenditure

As a general rule, figures should be expressed in terms of actual expenditure (or actual revenue foregone in the case of tax expenditure). Where payments are not available, commitments or budget appropriations shall be provided and flagged accordingly. Separate figures shall be provided for each aid instrument within a scheme or individual aid (e.g. grant, soft loans, etc.) Figures shall be expressed in the national currency in application at the time of the reporting period. Expenditure shall be provided for t-1, t-2, t-3, t-4, t-5.

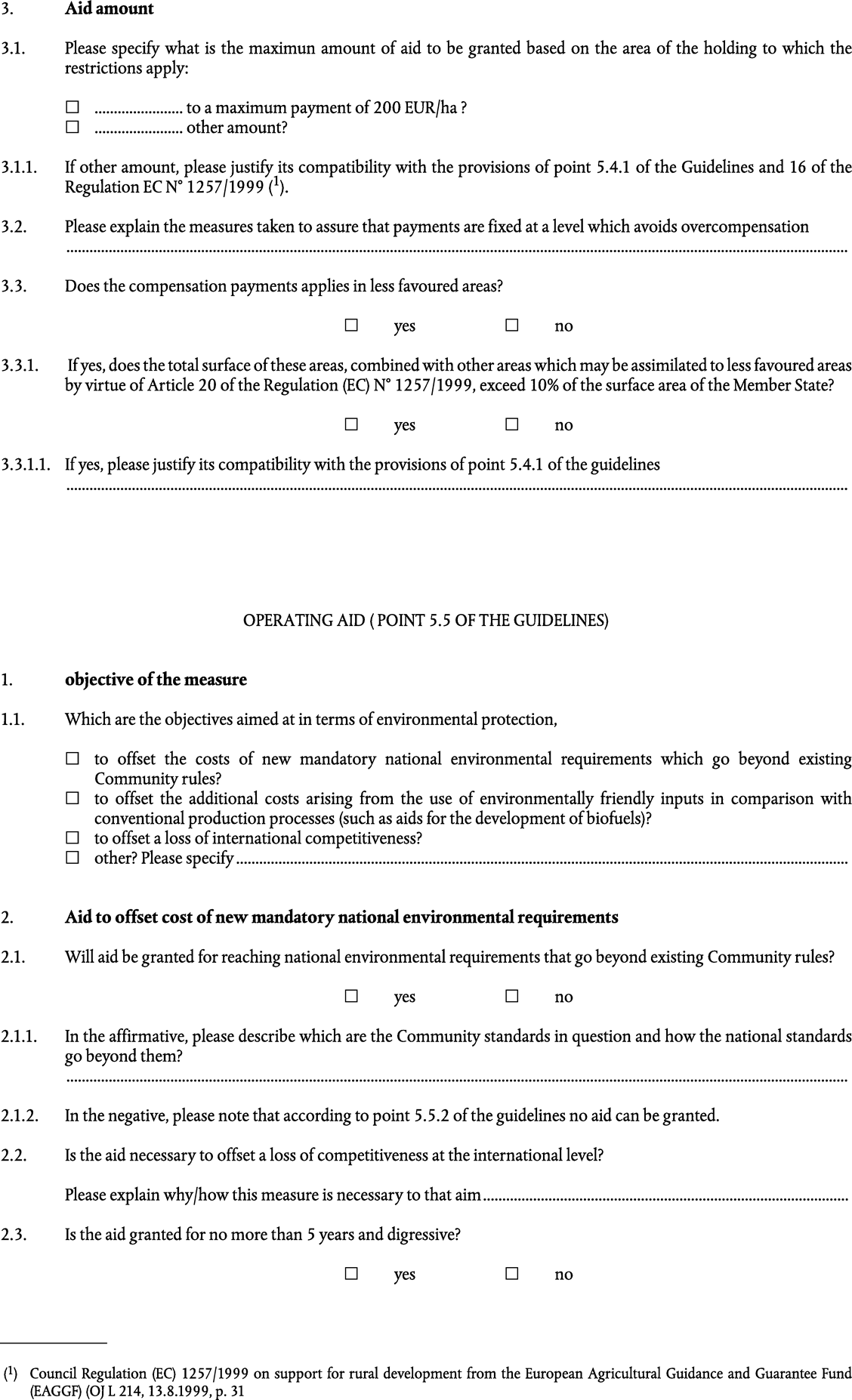

ANNEX III BU.K.STANDARDISED REPORTING FORMAT FOR EXISTING STATE AID

(This format covers the agricultural sector)U.K.

With a view to simplifying, streamlining and improving the overall reporting system for State aid, the existing Standardised Reporting Procedure shall be replaced by an annual updating exercise. The Commission shall send a pre-formatted spreadsheet, containing detailed information on all existing aid schemes and individual aid, to the Member States by 1 March each year. Member States shall return the spreadsheet in an electronic format to the Commission by 30 June of the year in question. This will enable the Commission to publish State aid data in year t for the reporting period t-1(4).

The bulk of the information in the pre-formatted spreadsheet shall be pre-completed by the Commission on the basis of data provided at the time of approval of the aid. Member States shall be required to check and, where necessary, modify the details for each scheme or individual aid, and to add the annual expenditure for the latest year (t-1). In addition, Member States shall indicate which schemes have expired or for which all payments have stopped and whether or not a scheme is co-financed by Community Funds.

Information such as the objective of the aid, the sector to which the aid is directed, etc shall refer to the time at which the aid is approved and not to the final beneficiaries of the aid. For example, the primary objective of a scheme which, at the time the aid is approved, is exclusively earmarked for small and medium-sized enterprises shall be aid for small and medium-sized enterprises. However, another scheme for which all aid is ultimately awarded to small and medium-sized enterprises shall not be regarded as such if, at the time the aid is approved, the scheme is open to all enterprises.

The following parameters shall be included in the spreadsheet. Parameters 1-3 and 6-12 shall be pre-completed by the Commission and checked by the Member States. Parameters 4, 5, 13 and 14 shall be completed by the Member States.

Title

Aid number

All previous aid numbers (e.g., following the renewal of a scheme)

Expiry

Member States should indicate those schemes which have expired or for which all payments have stopped.

Co-financing

Although Community funding itself is excluded, total State aid for each Member State shall include aid measures that are co-financed by Community funding. In order to identify which schemes are co-financed and estimate how much such aid represents in relation to overall State aid, Member States are required to indicate whether or not the scheme is co-financed and if so the percentage of aid that is co-financed. If this is not possible, an estimate of the total amount of aid that is co-financed shall be provided.

Primary objective

Secondary objective

A secondary objective is one for which, in addition to the primary objective, the aid (or a distinct part of it) was exclusively earmarked at the time the aid was approved. For example, a scheme for which the primary objective is research and development may have as a secondary objective small and medium-sized enterprises (SMEs) if the aid is earmarked exclusively for SMEs. Another scheme for which the primary objective is SMEs may have as secondary objectives training and employment aid if, at the time the aid was approved the aid is earmarked for x% training and y% employment.

Region(s)

Aid may, at the time of approval, be exclusively earmarked for a specific region or group of regions. Where appropriate, a distinction should be made between Objective 1 regions and less-favoured areas.

Category of aid instrument(s)

A distinction shall be made between six categories (Grant, Tax reduction/exemption, Equity participation, Soft loan, Tax deferral, Guarantee).

Description of aid instrument in national language

Type of aid

A distinction shall be made between three categories: Scheme, Individual application of a scheme, Individual aid awarded outside of a scheme (ad hoc aid).

Expenditure

As a general rule, figures should be expressed in terms of actual expenditure (or actual revenue foregone in the case of tax expenditure). Where payments are not available, commitments or budget appropriations shall be provided and flagged accordingly. Separate figures shall be provided for each aid instrument within a scheme or individual aid (e.g. grant, soft loans, etc.) Figures shall be expressed in the national currency in application at the time of the reporting period. Expenditure shall be provided for t-1, t-2, t-3, t-4, t-5.

Aid intensity and beneficiaries

Member States should indicate:

the effective aid intensity of the support actually granted per type of aid and of region

the number of beneficiaries

the average amount of aid per beneficiary.

ANNEX III CU.K.INFORMATION TO BE CONTAINED IN THE ANNUAL REPORT TO BE PROVIDED TO THE COMMISSION

The reports shall be provided in computerised form. They shall contain the following information:U.K.

1.Title of aid scheme, Commission aid number and reference of the Commission decisionU.K.

2.Expenditure. The figures have to be expressed in euros or, if applicable, national currency. In the case of tax expenditure, annual tax losses have to be reported. If precise figures are not available, such losses may be estimated. For the year under review indicate separately for each aid instrument within the scheme (e.g. grant, soft loan, guarantee, etc.):U.K.

2.1.amounts committed, (estimated) tax losses or other revenue forgone, data on guarantees, etc. for new assisted projects. In the case of guarantee schemes, the total amount of new guarantees handed out should be provided;U.K.

2.2.actual payments, (estimated) tax losses or other revenue forgone, data on guarantees, etc. for new and current projects. In the case of guarantee schemes, the following should be provided: total amount of outstanding guarantees, premium income, recoveries, indemnities paid out, operating result of the scheme under the year under review;U.K.

2.3.number of assisted projects and/or enterprises;U.K.

2.4.estimated overall amount of:U.K.

aid granted for the permanent withdrawal of fishing vessels through their transfer to third countries;

aid granted for the temporary cessation of fishing activities;

aid granted for the renewal of fishing vessels;

aid granted for modernisation of fishing vessels;

aid granted for the purchase of used vessels;

aid granted for socio-economic measures;

aid granted to make good damage caused by natural disasters or exceptional occurences;

aid granted to outermost regions;

aid granted through parafiscal charges;

2.5.regional breakdown of amounts under point 2.1. by regions defined as Objective 1 regions and other areas;U.K.

3.Other information and remarks.U.K.

t is the year in which the data are requested.

NACE Rev.1.1 is the Statistical classification of economic activities in the European Community.

NUTS is the nomenclature of territorial units for statistical purposes in the Community.

t is the year in which the data are requested

NACE Rev.1.1 is the Statistical classification of economic activities in the European Community.

Options/Help

Print Options

PrintThe Whole Regulation

PrintThe Annexes only

Legislation is available in different versions:

Latest Available (revised):The latest available updated version of the legislation incorporating changes made by subsequent legislation and applied by our editorial team. Changes we have not yet applied to the text, can be found in the ‘Changes to Legislation’ area.

Original (As adopted by EU): The original version of the legislation as it stood when it was first adopted in the EU. No changes have been applied to the text.

Point in Time: This becomes available after navigating to view revised legislation as it stood at a certain point in time via Advanced Features > Show Timeline of Changes or via a point in time advanced search.

See additional information alongside the content

Geographical Extent: Indicates the geographical area that this provision applies to. For further information see ‘Frequently Asked Questions’.

Show Timeline of Changes: See how this legislation has or could change over time. Turning this feature on will show extra navigation options to go to these specific points in time. Return to the latest available version by using the controls above in the What Version box.

More Resources

Access essential accompanying documents and information for this legislation item from this tab. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as adopted version that was used for the EU Official Journal

- lists of changes made by and/or affecting this legislation item

- all formats of all associated documents

- correction slips

- links to related legislation and further information resources

Timeline of Changes

This timeline shows the different versions taken from EUR-Lex before exit day and during the implementation period as well as any subsequent versions created after the implementation period as a result of changes made by UK legislation.

The dates for the EU versions are taken from the document dates on EUR-Lex and may not always coincide with when the changes came into force for the document.

For any versions created after the implementation period as a result of changes made by UK legislation the date will coincide with the earliest date on which the change (e.g an insertion, a repeal or a substitution) that was applied came into force. For further information see our guide to revised legislation on Understanding Legislation.

More Resources

Use this menu to access essential accompanying documents and information for this legislation item. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as adopted version that was used for the print copy

- correction slips

Click 'View More' or select 'More Resources' tab for additional information including:

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- links to related legislation and further information resources