- Latest available (Revised)

- Original (As adopted by EU)

Commission Regulation (EC) No 794/2004Show full title

Commission Regulation (EC) No 794/2004 of 21 april 2004 implementing Council Regulation (EC) No 659/1999 laying down detailed rules for the application of Article 93 of the EC Treaty

You are here:

- Regulations originating from the EU

- 2004 No. 794

- Annexes only

More Resources

Revised version PDFs

- Revised 22/12/20166.08 MB

- Revised 17/03/20165.42 MB

- Revised 30/12/20152.27 MB

- Revised 02/05/20148.51 MB

- Revised 24/11/20097.91 MB

- Revised 16/04/20097.21 MB

- Revised 22/11/20087.20 MB

- Revised 14/04/20087.39 MB

- Revised 19/01/20073.46 MB

- Revised 21/11/20065.12 MB

- Revised 20/05/20045.06 MB

When the UK left the EU, legislation.gov.uk published EU legislation that had been published by the EU up to IP completion day (31 December 2020 11.00 p.m.). On legislation.gov.uk, these items of legislation are kept up-to-date with any amendments made by the UK since then.

This item of legislation originated from the EU

Legislation.gov.uk publishes the UK version. EUR-Lex publishes the EU version. The EU Exit Web Archive holds a snapshot of EUR-Lex’s version from IP completion day (31 December 2020 11.00 p.m.).

Status:

This is the original version as it was originally adopted in the EU.

This legislation may since have been updated - see the latest available (revised) version

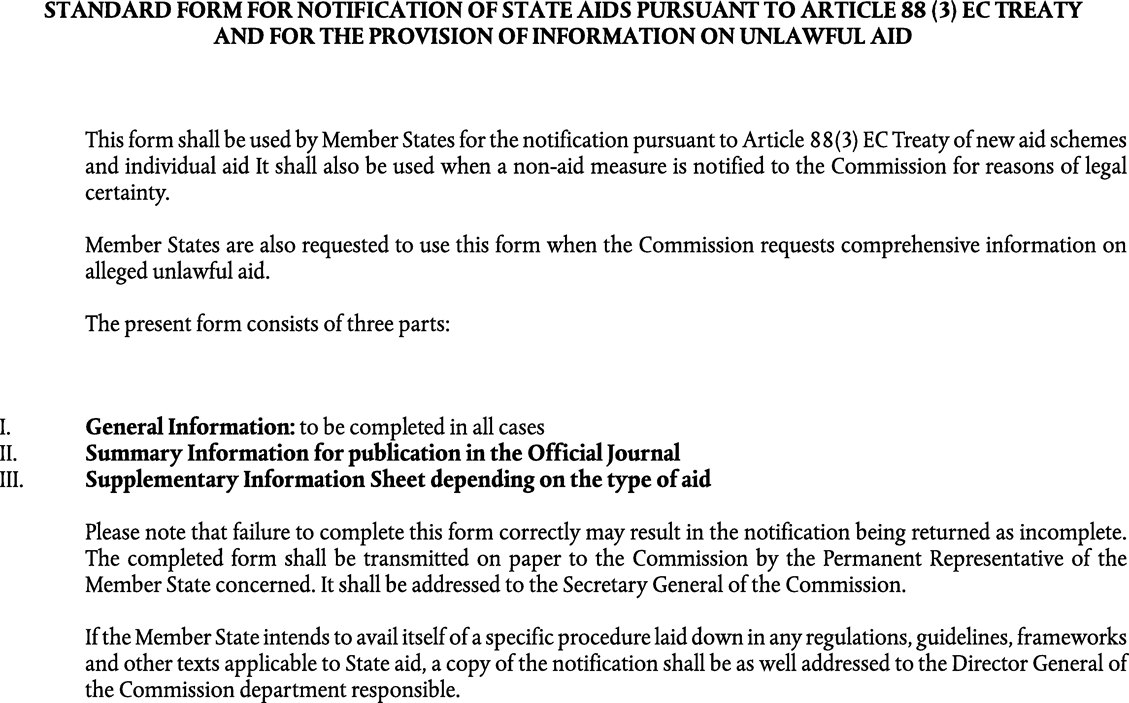

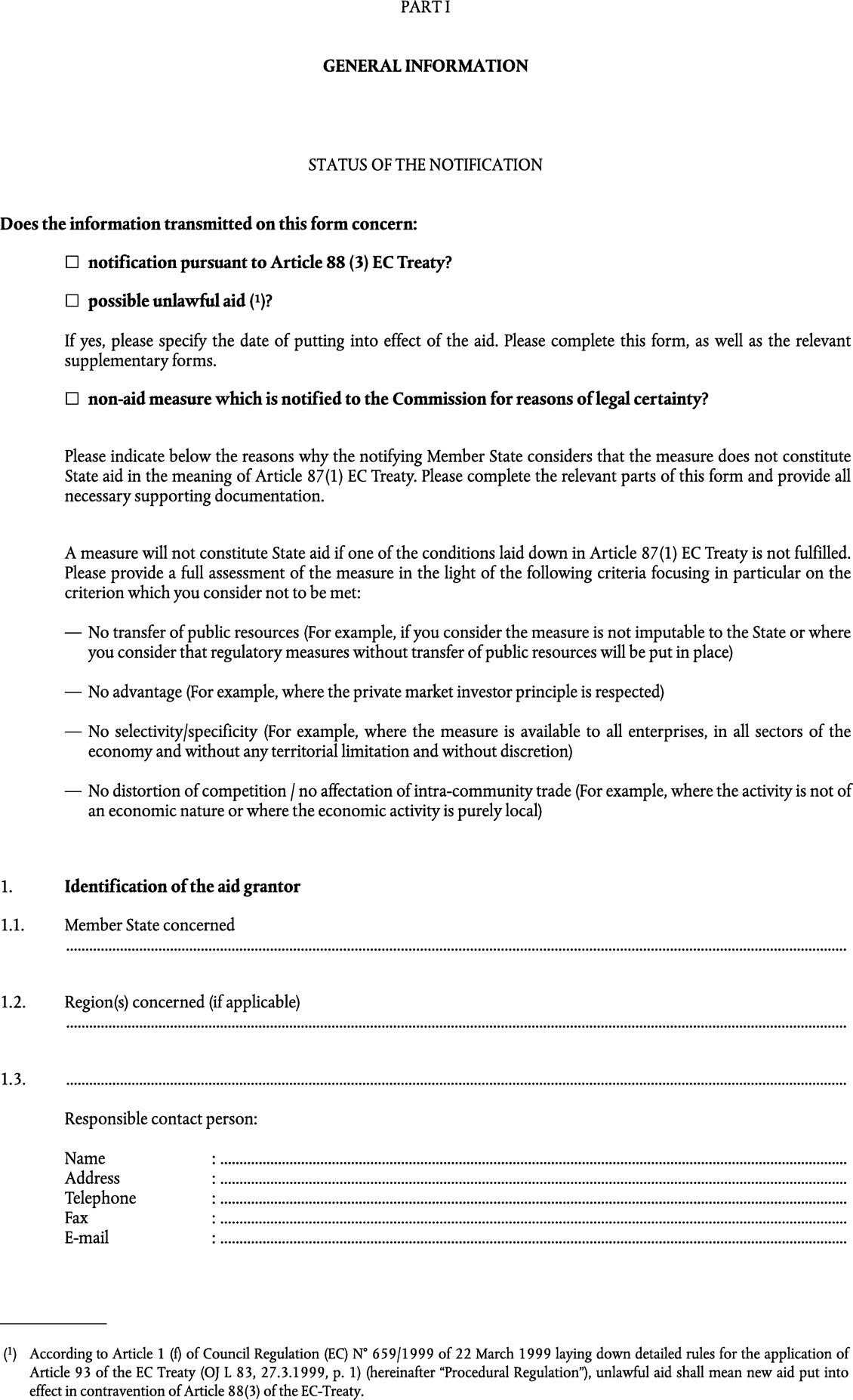

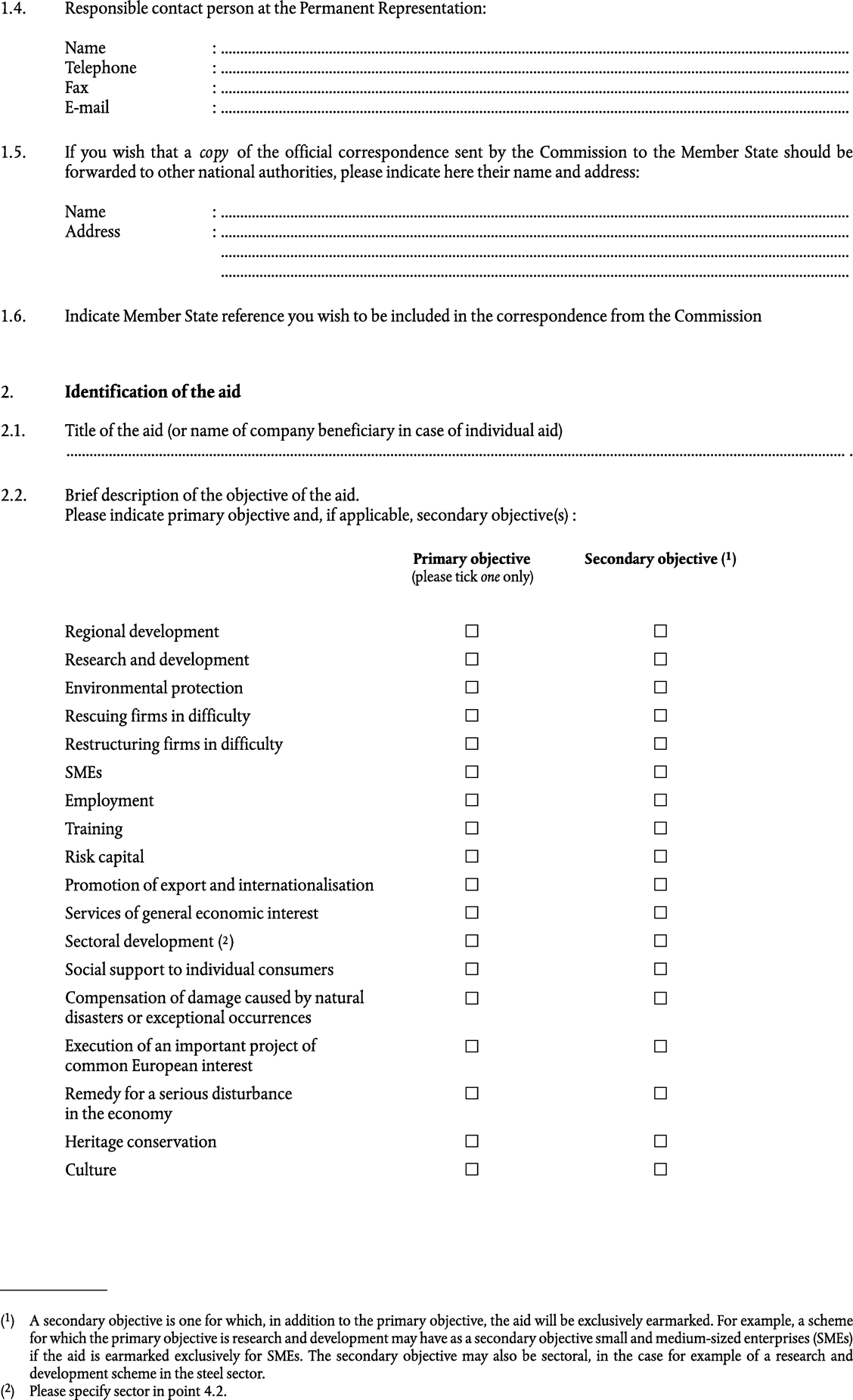

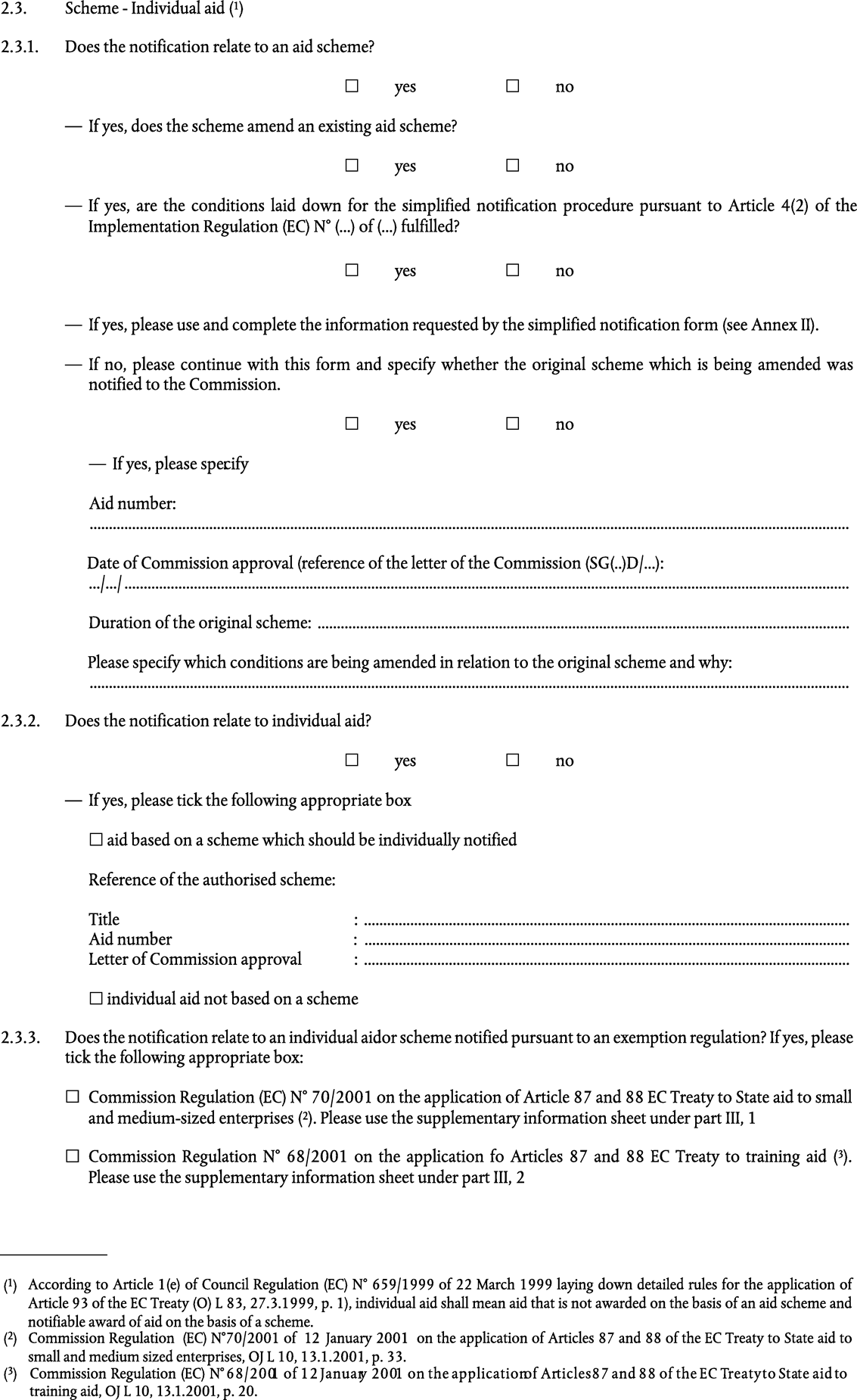

ANNEX I

ANNEX II

ANNEX III ASTANDARDISED REPORTING FORMAT FOR EXISTING STATE AID

(This format covers all sectors except agriculture)

With a view to simplifying, streamlining and improving the overall reporting system for State aid, the existing Standardised Reporting Procedure shall be replaced by an annual updating exercise. The Commission shall send a pre-formatted spreadsheet, containing detailed information on all existing aid schemes and individual aid, to the Member States by 1 March each year. Member States shall return the spreadsheet in an electronic format to the Commission by 30 June of the year in question. This will enable the Commission to publish State aid data in year t for the reporting period t-1(1).

The bulk of the information in the pre-formatted spreadsheet shall be pre-completed by the Commission on the basis of data provided at the time of approval of the aid. Member States shall be required to check and, where necessary, modify the details for each scheme or individual aid, and to add the annual expenditure for the latest year (t-1). In addition, Member States shall indicate which schemes have expired or for which all payments have stopped and whether or not a scheme is co-financed by Community Funds.

Information such as the objective of the aid, the sector to which the aid is directed, etc shall refer to the time at which the aid is approved and not to the final beneficiaries of the aid. For example, the primary objective of a scheme which, at the time the aid is approved, is exclusively earmarked for small and medium-sized enterprises shall be aid for small and medium-sized enterprises. However, another scheme for which all aid is ultimately awarded to small and medium-sized enterprises shall not be regarded as such if, at the time the aid is approved, the scheme is open to all enterprises.

The following parameters shall be included in the spreadsheet. Parameters 1-3 and 6-12 shall be pre-completed by the Commission and checked by the Member States. Parameters 4, 5 and 13 shall be completed by the Member States.

Title

Aid number

All previous aid numbers (e.g., following the renewal of a scheme)

Expiry

Member States should indicate those schemes which have expired or for which all payments have stopped.

Co-financing

Although Community funding itself is excluded, total State aid for each Member State shall include aid measures that are co-financed by Community funding. In order to identify which schemes are co-financed and estimate how much such aid represents in relation to overall State aid, Member States are required to indicate whether or not the scheme is co-financed and if so the percentage of aid that is co-financed. If this is not possible, an estimate of the total amount of aid that is co-financed shall be provided.

Primary objective

Secondary objective

A secondary objective is one for which, in addition to the primary objective, the aid (or a distinct part of it) was exclusively earmarked at the time the aid was approved. For example, a scheme for which the primary objective is research and development may have as a secondary objective small and medium-sized enterprises (SMEs) if the aid is earmarked exclusively for SMEs. Another scheme for which the primary objective is SMEs may have as secondary objectives training and employment if, at the time the aid was approved, the aid is earmarked for x% training and y% employment.

Region(s)

Aid may, at the time of approval, be exclusively earmarked for a specific region or group of regions. Where appropriate, a distinction should be made between the Article 87(3)a regions and the Article 87(3)c regions. If the aid is earmarked for one particular region, this should be specified at NUTS(3) level II.

Category of aid instrument(s)

A distinction shall be made between six categories (Grant, Tax reduction/exemption, Equity participation, Soft loan, Tax deferral, Guarantee).

Description of aid instrument in national language

Type of aid

A distinction shall be made between three categories: Scheme, Individual application of a scheme, Individual aid awarded outside of a scheme (ad hoc aid).

Expenditure

As a general rule, figures should be expressed in terms of actual expenditure (or actual revenue foregone in the case of tax expenditure). Where payments are not available, commitments or budget appropriations shall be provided and flagged accordingly. Separate figures shall be provided for each aid instrument within a scheme or individual aid (e.g. grant, soft loans, etc.) Figures shall be expressed in the national currency in application at the time of the reporting period. Expenditure shall be provided for t-1, t-2, t-3, t-4, t-5.

ANNEX III BSTANDARDISED REPORTING FORMAT FOR EXISTING STATE AID

(This format covers the agricultural sector)

With a view to simplifying, streamlining and improving the overall reporting system for State aid, the existing Standardised Reporting Procedure shall be replaced by an annual updating exercise. The Commission shall send a pre-formatted spreadsheet, containing detailed information on all existing aid schemes and individual aid, to the Member States by 1 March each year. Member States shall return the spreadsheet in an electronic format to the Commission by 30 June of the year in question. This will enable the Commission to publish State aid data in year t for the reporting period t-1(4).

The bulk of the information in the pre-formatted spreadsheet shall be pre-completed by the Commission on the basis of data provided at the time of approval of the aid. Member States shall be required to check and, where necessary, modify the details for each scheme or individual aid, and to add the annual expenditure for the latest year (t-1). In addition, Member States shall indicate which schemes have expired or for which all payments have stopped and whether or not a scheme is co-financed by Community Funds.

Information such as the objective of the aid, the sector to which the aid is directed, etc shall refer to the time at which the aid is approved and not to the final beneficiaries of the aid. For example, the primary objective of a scheme which, at the time the aid is approved, is exclusively earmarked for small and medium-sized enterprises shall be aid for small and medium-sized enterprises. However, another scheme for which all aid is ultimately awarded to small and medium-sized enterprises shall not be regarded as such if, at the time the aid is approved, the scheme is open to all enterprises.

The following parameters shall be included in the spreadsheet. Parameters 1-3 and 6-12 shall be pre-completed by the Commission and checked by the Member States. Parameters 4, 5, 13 and 14 shall be completed by the Member States.

Title

Aid number

All previous aid numbers (e.g., following the renewal of a scheme)

Expiry

Member States should indicate those schemes which have expired or for which all payments have stopped.

Co-financing

Although Community funding itself is excluded, total State aid for each Member State shall include aid measures that are co-financed by Community funding. In order to identify which schemes are co-financed and estimate how much such aid represents in relation to overall State aid, Member States are required to indicate whether or not the scheme is co-financed and if so the percentage of aid that is co-financed. If this is not possible, an estimate of the total amount of aid that is co-financed shall be provided.

Primary objective

Secondary objective

A secondary objective is one for which, in addition to the primary objective, the aid (or a distinct part of it) was exclusively earmarked at the time the aid was approved. For example, a scheme for which the primary objective is research and development may have as a secondary objective small and medium-sized enterprises (SMEs) if the aid is earmarked exclusively for SMEs. Another scheme for which the primary objective is SMEs may have as secondary objectives training and employment aid if, at the time the aid was approved the aid is earmarked for x% training and y% employment.

Region(s)

Aid may, at the time of approval, be exclusively earmarked for a specific region or group of regions. Where appropriate, a distinction should be made between Objective 1 regions and less-favoured areas.

Category of aid instrument(s)

A distinction shall be made between six categories (Grant, Tax reduction/exemption, Equity participation, Soft loan, Tax deferral, Guarantee).

Description of aid instrument in national language

Type of aid

A distinction shall be made between three categories: Scheme, Individual application of a scheme, Individual aid awarded outside of a scheme (ad hoc aid).

Expenditure

As a general rule, figures should be expressed in terms of actual expenditure (or actual revenue foregone in the case of tax expenditure). Where payments are not available, commitments or budget appropriations shall be provided and flagged accordingly. Separate figures shall be provided for each aid instrument within a scheme or individual aid (e.g. grant, soft loans, etc.) Figures shall be expressed in the national currency in application at the time of the reporting period. Expenditure shall be provided for t-1, t-2, t-3, t-4, t-5.

Aid intensity and beneficiaries

Member States should indicate:

the effective aid intensity of the support actually granted per type of aid and of region

the number of beneficiaries

the average amount of aid per beneficiary.

ANNEX III CINFORMATION TO BE CONTAINED IN THE ANNUAL REPORT TO BE PROVIDED TO THE COMMISSION

The reports shall be provided in computerised form. They shall contain the following information:

1.Title of aid scheme, Commission aid number and reference of the Commission decision

2.Expenditure. The figures have to be expressed in euros or, if applicable, national currency. In the case of tax expenditure, annual tax losses have to be reported. If precise figures are not available, such losses may be estimated. For the year under review indicate separately for each aid instrument within the scheme (e.g. grant, soft loan, guarantee, etc.):

2.1.amounts committed, (estimated) tax losses or other revenue forgone, data on guarantees, etc. for new assisted projects. In the case of guarantee schemes, the total amount of new guarantees handed out should be provided;

2.2.actual payments, (estimated) tax losses or other revenue forgone, data on guarantees, etc. for new and current projects. In the case of guarantee schemes, the following should be provided: total amount of outstanding guarantees, premium income, recoveries, indemnities paid out, operating result of the scheme under the year under review;

2.3.number of assisted projects and/or enterprises;

2.4.estimated overall amount of:

aid granted for the permanent withdrawal of fishing vessels through their transfer to third countries;

aid granted for the temporary cessation of fishing activities;

aid granted for the renewal of fishing vessels;

aid granted for modernisation of fishing vessels;

aid granted for the purchase of used vessels;

aid granted for socio-economic measures;

aid granted to make good damage caused by natural disasters or exceptional occurences;

aid granted to outermost regions;

aid granted through parafiscal charges;

2.5.regional breakdown of amounts under point 2.1. by regions defined as Objective 1 regions and other areas;

3.Other information and remarks.

t is the year in which the data are requested.

NACE Rev.1.1 is the Statistical classification of economic activities in the European Community.

NUTS is the nomenclature of territorial units for statistical purposes in the Community.

t is the year in which the data are requested

NACE Rev.1.1 is the Statistical classification of economic activities in the European Community.

Options/Help

Print Options

PrintThe Whole Regulation

PrintThe Annexes only

Legislation is available in different versions:

Latest Available (revised):The latest available updated version of the legislation incorporating changes made by subsequent legislation and applied by our editorial team. Changes we have not yet applied to the text, can be found in the ‘Changes to Legislation’ area.

Original (As adopted by EU): The original version of the legislation as it stood when it was first adopted in the EU. No changes have been applied to the text.

More Resources

Access essential accompanying documents and information for this legislation item from this tab. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as adopted version that was used for the EU Official Journal

- lists of changes made by and/or affecting this legislation item

- all formats of all associated documents

- correction slips

- links to related legislation and further information resources

More Resources

Use this menu to access essential accompanying documents and information for this legislation item. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as adopted version that was used for the print copy

- correction slips

Click 'View More' or select 'More Resources' tab for additional information including:

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- links to related legislation and further information resources