- Latest available (Revised)

- Point in Time (20/12/2010)

- Original (As adopted by EU)

Commission Regulation (EC) No 1794/2006 (repealed)Show full title

Commission Regulation (EC) No 1794/2006 of 6 December 2006 laying down a common charging scheme for air navigation services (Text with EEA relevance) (repealed)

You are here:

- Regulations originating from the EU

- 2006 No. 1794

- Annexes only

- Show Geographical Extent(e.g. England, Wales, Scotland and Northern Ireland)

- Show Timeline of Changes

More Resources

Revised version PDFs

- Revised 01/01/20150.44 MB

- Revised 04/12/20120.33 MB

- Revised 20/12/20100.33 MB

When the UK left the EU, legislation.gov.uk published EU legislation that had been published by the EU up to IP completion day (31 December 2020 11.00 p.m.). On legislation.gov.uk, these items of legislation are kept up-to-date with any amendments made by the UK since then.

This item of legislation originated from the EU

Legislation.gov.uk publishes the UK version. EUR-Lex publishes the EU version. The EU Exit Web Archive holds a snapshot of EUR-Lex’s version from IP completion day (31 December 2020 11.00 p.m.).

Changes over time for: Commission Regulation (EC) No 1794/2006 (repealed) (Annexes only)

Version Superseded: 01/01/2015

Status:

Point in time view as at 20/12/2010.

Changes to legislation:

There are currently no known outstanding effects by UK legislation for Commission Regulation (EC) No 1794/2006 (repealed).![]()

Changes to Legislation

Revised legislation carried on this site may not be fully up to date. At the current time any known changes or effects made by subsequent legislation have been applied to the text of the legislation you are viewing by the editorial team. Please see ‘Frequently Asked Questions’ for details regarding the timescales for which new effects are identified and recorded on this site.

ANNEX IU.K.ASSESSMENT OF THE CONDITIONS FOR THE PROVISION OF AIR NAVIGATION SERVICES AT AIRPORTS FALLING WITHIN ARTICLE 1(6)

The conditions to be assessed under Article 1(6) are the following:

The extent to which air navigation service providers can freely offer to provide or withdraw from the provision of air navigation services at airports:

the existence or otherwise of any significant economic barriers that would prevent an air navigation service provider from offering to provide or withdrawing from the provision of air navigation services,

the existence or otherwise of any significant legal barriers that would prevent an air navigation service provider from offering to provide or withdrawing from the provision of air navigation services,

the length of contract duration,

the existence of a procedure allowing assets and staff to be transferred from one air navigation service provider to another.

The extent to which airports can freely determine who will provide their air navigation services, including the option to self-supply:

the ability or otherwise of airports to move towards self-supply of air navigation services,

the existence or otherwise of legal, contractual or practical barriers to an airport’s ability to change air navigation service provider,

the role of airspace users’ representatives in the selection process of the air navigation service provider.

The extent to which there is a range of air navigation service providers from which airports can choose:

the existence or otherwise of structural rigidity which restricts the effective choice of the air navigation services for airports,

evidence of alternative air navigation service providers, including the option of self-supply that provides choice in the selection of air navigation services by airports.

The extent to which airports are subject to commercial cost pressures or incentive-based regulation:

whether airports actively compete for airline business,

the extent to which airports bear the air navigation service charge,

whether airports operate in a competitive environment or under economic incentives designed to cap prices or otherwise incentivise cost reductions.

[F1Where there are more than 150 000 commercial movements per year, the assessment referred to in points 1 to 4 shall be carried out at each individual airport.]

Textual Amendments

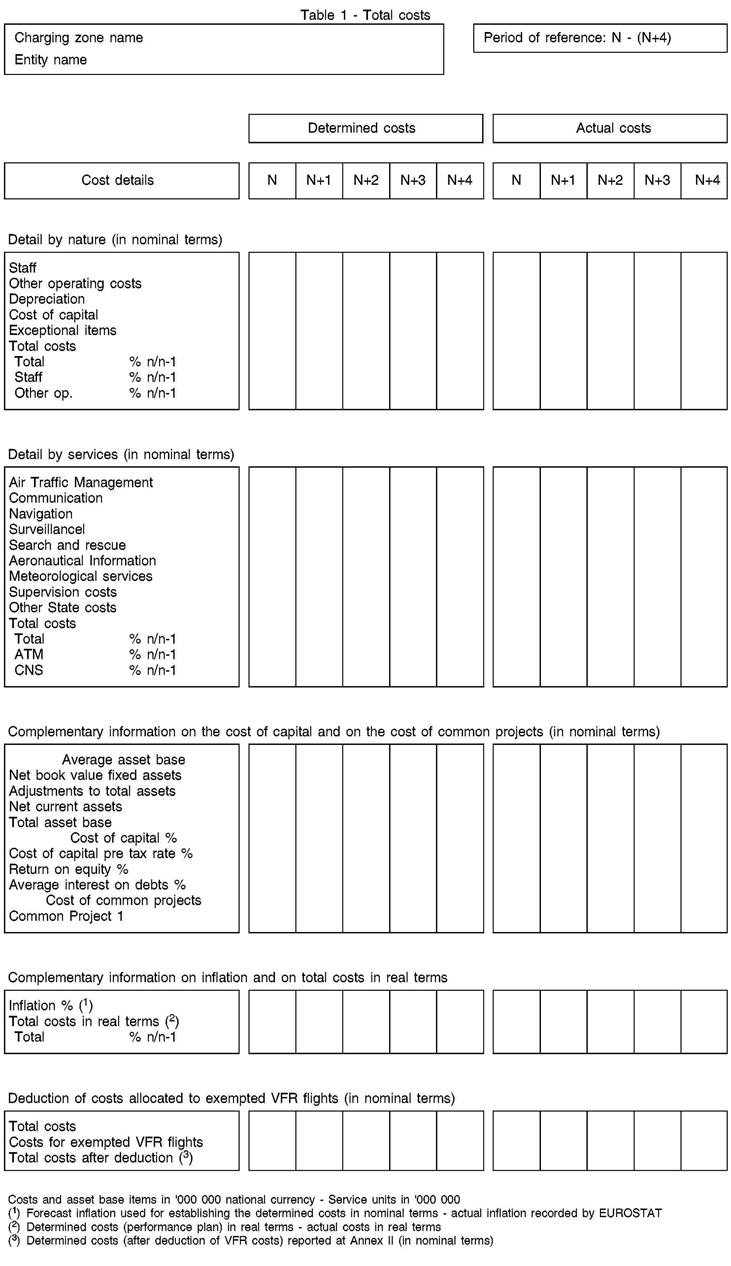

[F2ANNEX II U.K. Transparency of costs

Textual Amendments

1. REPORTING TABLE U.K.

Member States as well as air navigation service providers shall fill in the following reporting table for each charging zone under their responsibility and for each reference period. Member States shall also provide a consolidated reporting table for each charging zone under their responsibility.

A consolidated table shall be filled in for all airports subject to the provisions of this Regulation.

When a charging zone extends across the airspace of more than one Member State, they shall fill in the table jointly in accordance with the arrangements referred to in Article 4(4).

Actual costs shall be established on the basis of the certified accounts. The costs shall be established in accordance with the business plan required by the certificate and reported in the currency in which they are established in accordance with Article 6(1), fourth subparagraph.

In order to facilitate the establishment by the Commission of Union-wide performance targets and without prejudice to the performance plans to be adopted at national or functional airspace block level, Member States as well as air navigation service providers shall fill such reporting table with initial forecast figures eighteen months before the start of a reference period.

2. ADDITIONAL INFORMATION U.K.

In addition, Member States as well as air navigation service providers shall provide at least the following information:

Description of the methodology used for allocating costs of facilities or services between different air navigation services based on the list of facilities and services listed in ICAO Regional Air Navigation Plan, European Region (Doc 7754) and a description of the methodology used for allocating those costs between different charging zones;

Description and explanation of the method adopted for the calculation of depreciation costs: historic costs or current costs. When current cost accounting is adopted, provision of comparable historic cost data;

Justification for the cost of capital, including the components of the asset base, the possible adjustments to total assets and the return on equity;

Description of the total determined costs for each airport submitted to the provision of this Regulation for each terminal charging zone; for airports with less than 20 000 commercial air transport movements per year being calculated as the average over the previous three years, costs may be presented in an aggregated way;

Definition of the criteria used to allocate costs between terminal and en route services for each regulated airport;

Breakdown of the meteorological costs between direct costs and ‘ MET core costs ’ defined as the costs of supporting meteorological facilities and services that also serve meteorological requirements in general. These include general analysis and forecasting, surface and upper-air observation networks, meteorological communication systems, data processing centres and supporting core research, training and administration;

Description of the methodology used for allocating total MET costs and MET core costs to civil aviation and between charging zones;

As requested in point 1, eighteen months before the start of a reference period, description of the reported forecast costs and traffic;

Every year of the reference period, description of the reported actual costs and their difference against the determined costs.]

ANNEX IIIU.K.SPECIFIC TRANSPARENCY REQUIREMENTS FOR THE PROVISION OF AIR NAVIGATION SERVICES AT AIRPORTS FALLING WITHIN ARTICLE 1(6)

1.THE COSTS OF AIR NAVIGATION SERVICESU.K.

1.1.Reporting tableU.K.

Air navigation service providers shall fill the following reporting table for each terminal charging zone under their responsibility.

The figures shall be actual figures for year (n – 3) until year (n – 1) and planned figures for year (n) onwards. Actual costs shall be established on the basis of the certified accounts. Planned costs shall be established in accordance with the business plan required by the certificate.

Costs shall be established in National currency.

Table 1

Total costs

| |||||||||

| (n – 3)A | (n – 2)A | (n – 1)A | (n)F | (n + 1)F | (n + 2)P | (n + 3)P | (n + 4)P | (n + 5)P | |

|---|---|---|---|---|---|---|---|---|---|

| Detail by nature | |||||||||

| Staff | |||||||||

| Other operating costs | |||||||||

| Depreciation | |||||||||

| Cost of capital | |||||||||

| Exceptional items | |||||||||

| Total costs | |||||||||

[F21.2. Additional information U.K.

In addition, air navigation service providers shall provide at least the following information:

Description of the criteria used for allocating costs of facilities or services between different air navigation services based on the list of facilities and services listed in ICAO Regional Air Navigation Plan, European Region (Doc 7754);

Description and explanation of differences between planned and actual non-confidential figures for year (n-1);

Description and explanation of non-confidential five year planned costs and investments in relation to expected traffic;

Description and explanation of the method adopted for the calculation of depreciation costs: historic costs or current costs;

Justification for the cost of capital, including the components of the asset base, the possible adjustments to total assets and the return on equity.]

2.THE FINANCING OF AIR NAVIGATION SERVICESU.K.

Air navigation service providers shall provide the following information for each terminal charging zone:

description of the way(s) by which the costs of air navigation services are financed.

[F2ANNEX IV U.K. Calculation of the en route service units and unit rates

1. Calculation of en route service units U.K.

1.1. The en route service unit shall be calculated as the multiplication of the distance factor and the weight factor for the aircraft concerned. U.K.

1.2. The distance factor shall be obtained by dividing by one hundred the number of kilometres flown in the great circle distance between the entry and the exit point of the charging zones, according to the latest known flight plan filed by the aircraft concerned for air traffic flow purposes. U.K.

1.3. If the exit and entry point of one flight are identical in a charging zone, the distance factor shall be equal to the distance in the great circle distance between these points and the most distant point of the flight plan multiplied by two. U.K.

1.4. The distance to be taken into account shall be reduced by 20 kilometres for each take-off from and for each landing on the territory of a Member State. U.K.

1.5. The weight factor, expressed as a figure taken to two decimal places, shall be the square root of the quotient obtained by dividing by fifty the number of metric tons in the maximum certificated take-off weight of the aircraft as shown in the certificate of airworthiness or any equivalent official document provided by the aircraft operator. Where this weight is unknown, the weight of the heaviest aircraft of the same type known to exist shall be used. Where an aircraft has multiple certificated maximum take-off weights, the maximum one shall be used. Where an aircraft operator operates two or more aircraft which are different versions of the same type, the average of the maximum take-off weights of all his aircraft of that type shall be used for each aircraft of that type. The calculation of the weight factor per aircraft type and per operator shall be effected at least once a year. U.K.

2. Calculation of en route unit rates U.K.

2.1. The en route unit rate shall be calculated before the beginning of each year of the reference period. U.K.

2.2. It shall be calculated by dividing the forecast number of total en route service units for the relevant year into the algebraic sum of the following elements: U.K.

the determined costs of the relevant year,

the application of the difference between forecasted and actual inflation as referred to in Article 6(1),

the carry-overs resulting from the implementation of the traffic risk-sharing referred to in Article 11a(2) to (7),

the carry-overs from the previous reference period resulting from the implementation of the cost risk-sharing referred to in Article 11a(8),

bonuses and penalties resulting from the financial incentives referred to in Article 12(2),

for the first two reference periods, the over or under recoveries incurred by Member States up to the year 2011 included,

a deduction of the costs of VFR flights as identified in Article 7(4).]

[F2ANNEX V U.K. Calculation of the terminal service units and unit rates

1. Calculation of terminal service units U.K.

1.1. The terminal service unit shall be equal to the weight factor for the aircraft concerned. U.K.

1.2. The weight factor, expressed as a figure taken to two decimal places, shall be the quotient, obtained by dividing by fifty the number of metric tons in the highest maximum certified take-off weight of the aircraft, referred to in Annex IV point 1.5, to the power of 0.7. However, in a transitional period of five years following the calculation of the first terminal unit rate under this Regulation, this exponent shall be comprised between 0.5 and 0.9. U.K.

2. Calculation of terminal unit rates U.K.

2.1. The terminal unit rate shall be calculated before the beginning of each year of the reference period. U.K.

2.2. It shall be calculated by dividing the forecast number of total terminal service units for the relevant year into the algebraic sum of the following elements: U.K.

the determined costs of the relevant year,

the application of the difference between forecasted and actual inflation as referred to in Article 6(1),

the carry-overs resulting from the implementation of the traffic risk-sharing referred to in Article 11a(2) to (7),

the carry-overs from the previous reference period resulting from the implementation of the cost risk-sharing referred to in Article 11a(8),

bonuses and penalties resulting from the financial incentives referred to in Article 12(2),

for the first two reference periods, the over or under recoveries incurred by Member States up to the year preceding the application of this Regulation to terminal charges,

a deduction of the costs of VFR flights as identified in Article 7(4).]

[F2ANNEX VI U.K. Charging mechanism

1. REPORTING TABLE U.K.

Member States as well as air navigation service providers shall fill the following reporting table for each charging zone under their responsibility and for each reference period. Member States shall also provide a consolidated table for each charging zone under their responsibility.

When a charging zone extends across the airspace of more than one Member State, they shall fill the table jointly in accordance with the arrangements referred to in Article 4(4).

2. ADDITIONAL INFORMATION U.K.

In addition, the Member States concerned shall collect and provide at least the following information:

Description and rationale for the establishment of the different charging zones, in particular with regard to terminal charging zones and potential cross-subsidies between airports;

Description and explanation on the calculation of the forecast chargeable service units;

Description of the policy on exemptions and description of the financing means to cover the related costs;

Description of the carry-overs of over or under recoveries incurred by Member States up to the year 2011 for en route charges and up to the year preceding the application of this Regulation for terminal charges;

Description of the under recoveries carried over in accordance with Article 11a (4) second subparagraph;

Description by factors of the amounts carried over from the previous reference period in accordance with Article 11a (8) (c);

Description of the other revenues when they exist;

Description of the formula used for calculating terminal charges;

Description and explanation of incentives applied on users of air navigation services.]

Options/Help

Print Options

PrintThe Whole Regulation

PrintThe Annexes only

Legislation is available in different versions:

Latest Available (revised):The latest available updated version of the legislation incorporating changes made by subsequent legislation and applied by our editorial team. Changes we have not yet applied to the text, can be found in the ‘Changes to Legislation’ area.

Original (As adopted by EU): The original version of the legislation as it stood when it was first adopted in the EU. No changes have been applied to the text.

Point in Time: This becomes available after navigating to view revised legislation as it stood at a certain point in time via Advanced Features > Show Timeline of Changes or via a point in time advanced search.

See additional information alongside the content

Geographical Extent: Indicates the geographical area that this provision applies to. For further information see ‘Frequently Asked Questions’.

Show Timeline of Changes: See how this legislation has or could change over time. Turning this feature on will show extra navigation options to go to these specific points in time. Return to the latest available version by using the controls above in the What Version box.

More Resources

Access essential accompanying documents and information for this legislation item from this tab. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as adopted version that was used for the EU Official Journal

- lists of changes made by and/or affecting this legislation item

- all formats of all associated documents

- correction slips

- links to related legislation and further information resources

Timeline of Changes

This timeline shows the different versions taken from EUR-Lex before exit day and during the implementation period as well as any subsequent versions created after the implementation period as a result of changes made by UK legislation.

The dates for the EU versions are taken from the document dates on EUR-Lex and may not always coincide with when the changes came into force for the document.

For any versions created after the implementation period as a result of changes made by UK legislation the date will coincide with the earliest date on which the change (e.g an insertion, a repeal or a substitution) that was applied came into force. For further information see our guide to revised legislation on Understanding Legislation.

More Resources

Use this menu to access essential accompanying documents and information for this legislation item. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as adopted version that was used for the print copy

- correction slips

Click 'View More' or select 'More Resources' tab for additional information including:

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- links to related legislation and further information resources