- Latest available (Revised)

- Original (As adopted by EU)

Commission Implementing Regulation (EU) No 498/2012Show full title

Commission Implementing Regulation (EU) No 498/2012 of 12 June 2012 on the allocation of tariff-rate quotas applying to exports of wood from the Russian Federation to the European Union

You are here:

- Regulations originating from the EU

- 2012 No. 498

- Whole Regulation

- Previous

- Next

- Show Geographical Extent(e.g. England, Wales, Scotland and Northern Ireland)

- Show Timeline of Changes

More Resources

Revised version PDFs

- Revised 22/04/20160.24 MB

- Revised 24/04/20150.22 MB

When the UK left the EU, legislation.gov.uk published EU legislation that had been published by the EU up to IP completion day (31 December 2020 11.00 p.m.). On legislation.gov.uk, these items of legislation are kept up-to-date with any amendments made by the UK since then.

This item of legislation originated from the EU

Legislation.gov.uk publishes the UK version. EUR-Lex publishes the EU version. The EU Exit Web Archive holds a snapshot of EUR-Lex’s version from IP completion day (31 December 2020 11.00 p.m.).

Changes to legislation:

There are currently no known outstanding effects for the Commission Implementing Regulation (EU) No 498/2012.![]()

Changes to Legislation

Revised legislation carried on this site may not be fully up to date. At the current time any known changes or effects made by subsequent legislation have been applied to the text of the legislation you are viewing by the editorial team. Please see ‘Frequently Asked Questions’ for details regarding the timescales for which new effects are identified and recorded on this site.

Commission Implementing Regulation (EU) No 498/2012

of 12 June 2012

on the allocation of tariff-rate quotas applying to exports of wood from the Russian Federation to the European Union

THE EUROPEAN COMMISSION,

Having regard to the Treaty on the Functioning of the European Union,

Having regard to Council Decision 2012/105/EU of 14 December 2011 on the signing, on behalf of the European Union, and provisional application of the Agreement in the form of an Exchange of Letters between the European Union and the Russian Federation relating to the administration of tariff-rate quotas applying to exports of wood from the Russian Federation to the European Union and the Protocol between the European Union and the Government of the Russian Federation on technical modalities pursuant to that Agreement(1), and in particular Article 4 thereof,

Whereas:

(1) Considering the economic importance for the European Union of imports of raw wood and the importance that the Russian Federation has for the Union as a supplier of raw wood, the Commission has negotiated with the Russian Federation commitments by the Russian Federation to reduce or eliminate its currently applied export duties, including on raw wood.

(2) These commitments, which will become part of the World Trade Organization (WTO) Schedule of Concessions of the Russian Federation upon its accession to the WTO, include tariff-rate quotas for the export of specified types of coniferous wood, a share of which has been allocated for exports to the Union.

(3) In the context of the negotiations regarding the accession of the Russian Federation to the WTO, the Commission has negotiated, on behalf of the Union, with the Russian Federation, an agreement in the form of an Exchange of Letters relating to the administration of those tariff-rate quotas applying to exports of certain coniferous wood from the Russian Federation to the Union (hereinafter referred to as ‘the Agreement’).

(4) As provided for in the Agreement, the Union and the Russian Federation have negotiated detailed technical modalities on the management of the tariff-rate quotas, which are contained in an agreement in the form of a Protocol negotiated between the Union and the Government of the Russian Federation (hereinafter referred to as ‘the Protocol’).

(5) In implementation of the Agreement and the Protocol, methods for allocating tariff quotas depending on the date of submission of applications by importers should be established and rules and methods for establishing rights of traditional importers for each quota period and for each product group should be laid down.

(6) Rules on business continuity for the determination of whether an importer claiming status of traditional importer is the same natural or juridical person that imported the covered products during the reference periods specified in this Regulation should be laid down.

(7) Rules and procedures related to unused quota authorisations should be laid down.

(8) Transitional rules applicable during the first three quota periods of application of this Regulation should be established in connection with the choice of reference periods for the calculation of ceilings of quota authorisations for traditional importers.

(9) The measures provided for in this Regulation are in accordance with the opinion of the Wood Committee established by Decision 2012/105/EU,

HAS ADOPTED THIS REGULATION:

CHAPTER 1U.K. SCOPE AND DEFINITIONS

Article 1U.K.

This Regulation lays down detailed rules on the allocation of quota authorisations in accordance with Article 5(2) of the Protocol, and establishes other provisions necessary for the management by the Union of the quantities of the tariff-rate quotas allocated to exports to the Union in implementation of the Agreement and the Protocol.

Article 2U.K.

For the purposes of this Regulation the definitions set out in Article 1(3), Article 2 and Article 5(3) and (4) of the Protocol shall apply.

In addition, the following definition shall apply: ‘product group’ means each of the two categories of covered products according to the classification of such products under the tariff and statistical nomenclature applied in the Russian Federation, namely spruce (tariff lines 4403 20 110 and 4403 20 190) and pine (tariff lines 4403 20 310 and 4403 20 390). The relevant tariff codes applied in the Russian Federation and corresponding Combined Nomenclature(2) (‘CN’) and TARIC codes are attached as Annex I.

CHAPTER 2U.K. ALLOCATION PRINCIPLES

[F1Article 3 U.K.

The method for allocating the tariff quota shall depend on the date of submission of the application by the importer, as follows:

for any application submitted by 31 May of each year (hereinafter referred to as ‘ first part of the quota period ’ ), the Commission shall allocate tariff quotas in accordance with the ‘ traditional ’ or ‘ new ’ categories of importers, pursuant to Article 5(2)(b) of the Protocol; and

for any application submitted from 1 June (hereinafter referred to as ‘ second part of the quota period ’ ), the Commission shall allocate the remaining quantities of the tariff quotas in accordance with the chronological order of receipt by the Commission of notifications from the competent authorities of Member States (hereinafter referred to as ‘ Licence Office(s) ’ ) of applications submitted by individual importers, pursuant to Article 5(2)(a) of the Protocol.]

Textual Amendments

Article 4U.K.

1.During the first part of the quota period:

(a)70 % of each tariff quota per product group shall be allocated to traditional importers (hereinafter referred to as ‘quota for traditional importers’); and

(b)30 % of each tariff quota per product group shall be allocated to new importers (hereinafter referred to as ‘quota for new importers’).

2.The quota for new importers shall be allocated in accordance with the chronological order of receipt by the Commission of notifications from the Licence Offices of applications for a quota authorisation from such importers.

3.Each new importer shall be granted a maximum of 1,5 % of the tariff quota for each product group in accordance with the allocation procedure referred to in paragraph 2.

Article 5U.K.

During the second part of the quota period, each importer shall be granted a maximum of 5 % of the remaining tariff quota for each product group.

Article 6U.K.

1.During the first part of the quota period, each traditional importer shall only be entitled to request quota authorisations for a specific share of the quota for traditional importers for each product group (hereinafter referred to as ‘ceiling’), calculated in accordance with paragraph 2. All the quota authorisations granted to a traditional importer during the first part of the quota period shall be counted against such importer’s ceilings.

[F12. The ceiling for each product group of a traditional importer applicable in the following quota period ( ‘ quota period n+1 ’ ) shall be calculated in accordance with the average of such importer's actual imports of the product group concerned during the two quota periods preceding the year of calculation of such ceiling, on the basis of the following formula:

C i = T * (Ī i /ΣĪ i )

where:

‘ Ci ’ represents the ceiling for the product group concerned (spruce or pine) for importer i during quota period n+1;

‘ T ’ represents the quota for traditional importers available for the product group concerned during the year of calculation of the ceiling ( ‘ quota period n ’ );

‘ Īi ’ represents the average of the actual imports by the traditional importer i of the product group concerned, in the two quota periods preceding the calculation ( ‘ quota period n-2 ’ and ‘ quota period n-1 ’ , respectively), as follows:

[(actual imports of importer i in quota period n-2) + (actual imports of importer i in quota period n-1)]/2

‘ΣĪ i ’ represents the sum of all traditional importers' average imports Ī i for the product group concerned.]

Textual Amendments

[F1Article 7 U.K.

1. Every year, the Commission shall calculate ceilings applicable to each traditional importer for the following quota period in accordance with the method established in Article 6(2). If the calculated ceiling of a traditional importer for a given product group is higher than 0 %, but lower than the maximum of 1,5 % of the tariff quota granted to new importers in accordance with Article 4(3), the ceiling of the traditional importer concerned shall be established at a level of 1,5 % of the tariff quota for the respective product group.

2. Licence Offices shall provide the Commission, by 31 March of quota period n at the latest, with information on actual imports of covered products in quota period n-1 notified to them in accordance with Article 11(1). Such summary shall be submitted in an electronic format, in conformity with the information technology system established by the Commission.

3. The Commission shall inform the Licence Offices of ceilings resulting from the calculations made in accordance with Articles 6(2) and 7(1) by 30 April of quota period n at the latest.]

Textual Amendments

CHAPTER 3U.K. BUSINESS CONTINUITY

Article 8U.K.

1.Where an importer claiming status of traditional importer under Article 5(4) of the Protocol (hereinafter referred to as ‘the applicant’) does not provide satisfactory evidence that it is the same natural or legal person that imported the covered products during the reference period retained pursuant to Article 17(2) (hereinafter referred to as ‘the predecessor’), it shall provide the Licence Office with the necessary evidence to prove that it has business continuity with the activities of the predecessor.

2.Business continuity as referred to in paragraph 1 shall be deemed to exist where:

(a)the applicant and the predecessor are under the control of the same legal entity within the meaning of Council Regulation (EC) No 139/2004(3); or

(b)the economic activity of the predecessor, as regards the covered products, has been legally transferred to the applicant, for instance as a result of a merger or acquisition within the meaning of Regulation (EC) No 139/2004.

3.Importers that do not provide evidence of business continuity shall be considered as new importers.

Article 9U.K.

The provisions of Article 8 shall apply mutatis mutandis where an importer claims status of traditional importer under Article 5(3) of the Protocol.

CHAPTER 4U.K. APPLICATIONS FOR QUOTA AUTHORISATIONS

Article 10U.K.

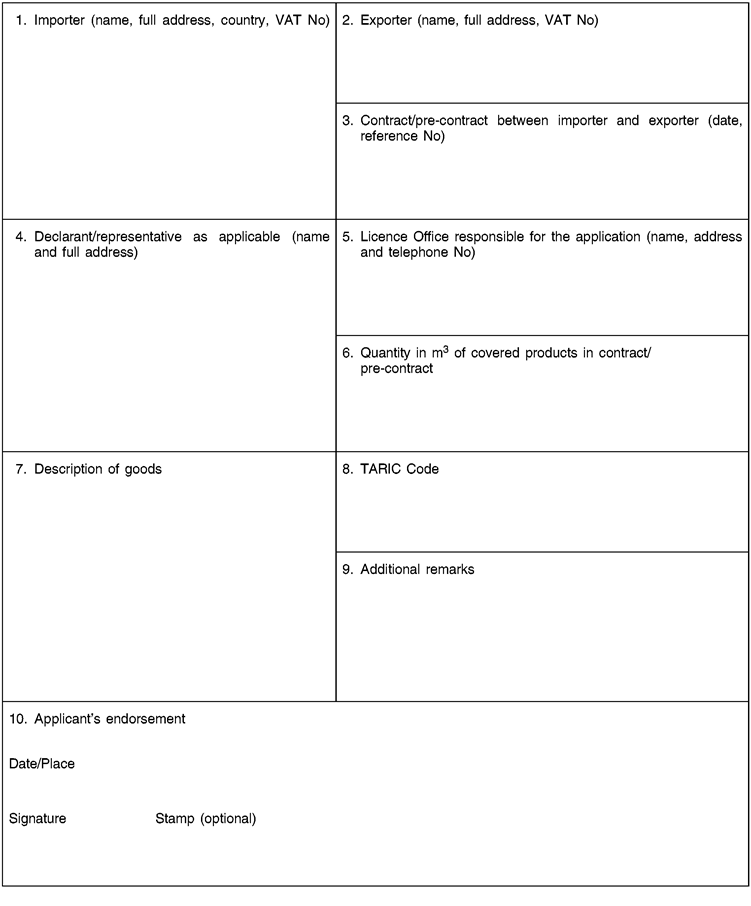

1.Applications for quota authorisations shall be submitted in the form established in Annex II. If information provided in the application is considered inadequate, the Licence Office may require additional details from the applicant.

2.The granting of a quota authorisation shall be subject to the requirement that the corresponding products undergo processing, within the customs territory of the Union, conferring Union origin in accordance with Article 24 of Council Regulation (EEC) No 2913/92(4).

3.Applications for quota authorisations shall be accompanied by an affidavit by the applicant containing a commitment to:

(a)assign the products concerned to the prescribed processing within one year from the date on which the customs declaration for release for free circulation, containing the exact description of the goods and the TARIC codes, was accepted by the competent customs authorities;

(b)keep adequate records in the Member State where the authorisation was granted enabling the Licence Office to carry out any checks which they consider necessary to ensure that the products are actually assigned to the prescribed processing, and to retain such records; for the purpose of this subparagraph, ‘records’ means the data containing all the necessary information and technical details on whatever medium, enabling the Licence Offices to supervise and control operations;

(c)enable the Licence Office to trace the products concerned to their satisfaction in the premises of the undertaking concerned throughout their processing;

(d)notify the Licence Office of all factors which may affect the authorisation.

4.Where the products concerned are transferred, the applicant shall provide sufficient evidence of their assignment to the prescribed processing in accordance with paragraph 3(a).

5.Article 308d of Commission Regulation (EEC) No 2454/93(5) shall apply.

6.Non-compliance with the commitment referred to in paragraph 3 of this Article, by the importer or by any natural or legal person to whom the importer subsequently transfers such products, shall be considered as equivalent to an unused quota authorisation, in accordance with Article 13, for the relevant amount of products.

7.The Commission shall publish a list of the Licence Offices in the Official Journal of the European Union and update it as necessary.

CHAPTER 5U.K. PROOF OF ACTUAL IMPORTS

Article 11U.K.

[F11. Not later than 15 calendar days after the end of each third month, the importers shall inform the Licence Office of the Member State from which they received a quota authorisation of their actual imports of covered products into the European Union during the last 3 months. For that purpose, the importer shall provide the Licence Office with a copy of the customs declarations of the imports concerned. The Licence Offices shall provide the Commission, not later than 30 calendar days after the end of each third month, with a summary of actual imports of covered products into the European Union during the last 3 months notified by importers.]

2.Where the quantity recorded in the customs declaration is measured free of bark and the quantity mentioned in entry 9 of the quota authorisation form includes bark, the importer shall provide the Licence Office, in addition to the information provided in paragraph 1, and within the same time limit, with correct import quantities for each customs declaration, that take account of the bark. The correct quantities shall be established by application of the correction coefficients set out in Annex III.

Textual Amendments

CHAPTER 6U.K. UNUSED QUOTA AUTHORISATIONS

[F1Article 12 U.K.

1. Where a quota authorisation remains unused after 6 months of its issuing, the importer shall either notify the Licence Office of its intention to use it within the remainder of the quota period or return the quota authorisation to the relevant Licence Office. Should the importer be unable to retrieve the unused quota authorisation from the authorities of the Russian Federation, it can present instead a corresponding sworn declaration to the Licence Office in the form set out in Annex IV stating its inability to reclaim the unused quota authorisation despite its best efforts. In any case, by the end of quota period n at the latest, the importer shall return any unused quota authorisation or present, if applicable, the corresponding sworn declaration(s) using the form set out in Annex IV. Where a quota authorisation has been issued before the beginning of the quota period in accordance with Article 4 of the Protocol, the 6-month time limit shall be counted as from 1 January of the year corresponding to the quota period.

2. The Licence Offices shall immediately notify the Commission of any quota authorisation or any sworn declaration returned by importers in accordance with paragraph 1. The balance of traditional importers' ceilings available for the product group concerned shall be modified for the corresponding amount.

Textual Amendments

Article 13 U.K.

1. Where the actual imports by a traditional importer during quota period n-1 are less than 75 % of the quantities covered by all quota authorisations for a product group granted to such importer during the same quota period, the importer's import ceilings for the product group concerned during quota period n+1 shall be reduced by an amount proportional to the size of missing actual imports.

2. The reduction referred to in paragraph 1 shall be calculated as follows:

r i = (0,75*ΣΑ i – I i )/ΣΑ i

where:

‘ ri ’ represents the reduction applicable to the import ceiling of importer i, for the product group concerned, during the quota period n+1;

‘ ΣΑi ’ represents the sum of the quantities covered by quota authorisations for the product group concerned granted to the traditional importer i during the quota period n-1;

‘ Ii ’ represents the actual imports of the product group concerned of importer i during the quota period n-1.

Textual Amendments

Article 14 U.K.

1. Where a quota authorisation that has not been returned or covered by a corresponding sworn declaration pursuant to Article 12 remains unused at the end of quota period n-1, the importer's import ceilings for the product group concerned during quota period n+1 shall be reduced by the amount proportional to the size of the unused quota authorisation.

2. The reduction referred to in paragraph 1 shall be calculated as follows:

R i = ΣU i /ΣΑ i

where:

‘R i ’ represents the reduction applicable to the import ceiling of importer i, for the product group concerned, during quota period n+1;

‘ΣU i ’ represents the sum of unused quantities covered by quota authorisations for the product group concerned granted to importer i during the quota period n-1;

‘ΣΑ i ’ represents the sum of the quantities covered by quota authorisations granted to importer i, for the product group concerned, during the quota period n-1.]

Textual Amendments

[F2Article 15 U.K.

1. Should the conditions for reduction of import ceilings provided for in Articles 13 and 14 be both met simultaneously, only the higher reduction (R i or r i ) shall be applied.

[F12. The provisions of Article 13 and 14 shall not apply during the first three quota periods following the transitional period.] ]

Textual Amendments

CHAPTER 7U.K. TRANSITIONAL MEASURES APPLYING TO THE FIRST THREE QUOTA PERIODS

Article 16U.K.

1.The allocation method set out in Article 4 of this Regulation shall apply to the entire first quota period of application of this Regulation. During this quota period, the provisions of Chapter 6 shall not apply.

2.Articles 17 to 19 shall apply during the first three quota periods of application of this Regulation.

Article 17U.K.

1.The reference period provided for in Article 5(4) of the Protocol shall be, at the choice of the importer, year 2004, year 2007, or the combination of both years.

2.Importers claiming status of traditional importer shall specify which of the three options provided for in paragraph 1 is retained for the calculation of their ceilings, in accordance with Article 6, not later than 20 calendar days after the entry into force of this Regulation.

3.The reference period retained by each importer in accordance with paragraph 2 shall apply to all the first three quota periods of application of this Regulation.

Article 18U.K.

1.Importers claiming status of traditional importer shall inform the Licence Office(s) of the Member State(s) from which they intend to request quota authorisations, not later than 20 calendar days after the entry into force of this Regulation, of their actual imports of covered products into that Member State(s) during the reference period retained in accordance with Article 17(2). In order to substantiate such actual import claims, the importer shall provide the Licence Office with a copy of the customs declarations of the imports concerned.

2.The Licence Offices shall provide the Commission, not later than 35 calendar days after the entry into force of this Regulation, with a summary of actual imports of covered products notified to them in accordance with paragraph 1 of this Article. Such summary shall be submitted in an electronic spreadsheet format, in conformity with the template set out in Annex V.

Article 19U.K.

1.Where a single year is retained pursuant to Article 17(2), the variable Īi referred to in Article 6(2) shall represent the importer’s actual imports of the product group concerned during such year.

2.Where the combination of both 2004 and 2007 is retained pursuant to Article 17(2), the variable Īi referred to in Article 6(2) shall represent the average of the importer’s actual imports of the product group concerned in years 2004 and 2007, calculated as follows:

[(Actual imports in 2004) + (Actual imports in 2007)]/2.

3.The Commission shall inform the Licence Offices of the ceilings resulting from the calculations made according to Article 6(2) not later than 65 calendar days after the entry into force of this Regulation.

4.In case the ceilings referred to in Article 6 have not been calculated by the time the Agreement and the Protocol are applied on a provisional basis, the tariff quotas per product group shall be allocated to all importers in accordance with the allocation procedure referred to in Article 3(b) until the Commission has notified the Licence Offices that the ceilings have been established and that the allocation procedure referred to in Article 3(b) has ended. For the purposes of this paragraph, each importer shall be granted a maximum of 2,5 % of the tariff quota for each product group.

CHAPTER 8U.K.

Article 20U.K.

This Regulation shall enter into force on the day of its publication in the Official Journal of the European Union.

It shall cease to apply on the date on which the Protocol ceases to be applied provisionally.

This Regulation shall be binding in its entirety and directly applicable in all Member States.

ANNEX IU.K.

Relevant tariff codes applied in the Russian Federation and corresponding CN and TARIC codes (cf. Article 2 of this Regulation)

| CN code | TARIC code | Russian Tariff code | Full description | |

|---|---|---|---|---|

| 1. | ex 4403 20 11 | 10 | 4403 20 110 1 | Timber of spruce of the kind Picea abies Karst. or silver fir (Abies alba Mill.), of a diameter of no less than 15 cm but no more than 24 cm, of a length of no less than 1,0 m |

| ex 4403 20 19 | 10 | |||

| 2. | ex 4403 20 11 | 10 | 4403 20 110 2 | Timber of spruce of the kind Picea abies Karst. or silver fir (Abies alba Mill.), of a diameter of more than 24 cm, of a length of no less than 1,0 m |

| ex 4403 20 19 | 10 | |||

| 3. | ex 4403 20 19 | 10 | 4403 20 190 1 | Wood of spruce of the kind Picea abies Karst. or silver fir (Abies alba Mill.) in the rough, whether or not stripped of bark or sapwood, or roughly squared, of a diameter of less than 15 cm |

| 4. | ex 4403 20 19 | 10 | 4403 20 190 9 | Other wood of spruce of the kind Picea abies Karst. or silver fir (Abies alba Mill.) |

| 5. | ex 4403 20 31 | 10 | 4403 20 310 1 | Timber of pine of the kind Pinus sylvestris L., of a diameter of no less than 15 cm but no more than 24 cm, of a length of no less than 1,0 m |

| ex 4403 20 39 | 10 | |||

| 6. | ex 4403 20 31 | 10 | 4403 20 310 2 | Timber of pine of the kind Pinus sylvestris L., of a diameter of more than 24 cm, of a length of no less than 1,0 m |

| ex 4403 20 39 | 10 | |||

| 7. | ex 4403 20 39 | 10 | 4403 20 390 1 | Wood of pine of the kind Pinus sylvestris L. (in the rough, whether or not stripped of bark or sapwood, or roughly squared) of a diameter of less than 15 cm |

| 8. | ex 4403 20 39 | 10 | 4403 20 390 9 | Other wood of pine of the kind Pinus sylvestris L. |

ANNEX IIU.K. Model application for quota authorisation (cf. Article 10(1) of this Regulation)

Annex to the model application for quota authorisation: Affidavit according to Article 10(3) of this Regulation

Affidavit U.K.

Affidavit of … (Name of declarant)

I, the undersigned, do hereby make the following declarations:

As regards my application for a quota authorisation of (DD/MM/YY), I commit to:

assign the products concerned to the prescribed processing within one year from the date on which the customs declaration for release for free circulation, containing the exact description of the goods and the TARIC codes, was accepted by the competent customs authorities;

keep adequate records in the Member State where the authorisation was granted enabling the Licence Office to carry out any checks which they consider necessary to ensure that the products are actually assigned to the prescribed processing, and to retain such records;

enable the Licence Office to trace the products concerned to their satisfaction in the premises of the undertaking concerned throughout their processing;

notify the Licence Office of all factors which may affect the authorisation.

I, the undersigned, do hereby solemnly verify contents of my above affidavit are true and correct to my knowledge and no part of it is false.

| Place/Date | Signature |

ANNEX IIIU.K. Correction coefficients according to Article 11(2) of this Regulation

The correction coefficients according to Article 11(2) of this Regulation are hereby established as follows:

| CN code | Correction coefficient |

|---|---|

| 4403 20 11 | 0,9 |

| 4403 20 19 | 0,88 |

| 4403 20 31 | 0,88 |

| 4403 20 39 | 0,87 |

[F1ANNEX IV U.K. Sworn declaration

Importer:

EU Member State:

VAT Number:

Contact person:

Telephone:

E-mail:

I, the undersigned, do hereby confirm that, despite my best efforts, it has not been possible to reclaim the unused quota authorisations listed below from the authorities of the Russian Federation.

Quota authorisation 1:

Quota authorisation No:

Date of issuance of quota authorisation:

Importer (name, country, VAT No):

Exporter (name, VAT No):

Quota authorisation 2 etc.:

I, the undersigned, do hereby solemnly declare that the contents of my above declaration are true and correct to my best knowledge and no part of it is false.

| Place/Date | Signature] |

ANNEX VU.K.

Summary of actual imports according to Article 18(2) in conjunction with Article 18(1) of this Regulation

| Name of the importing company | VAT No of the importing company | Actual imports of spruce (Σ of CN 4403 20 11 and 4403 20 19) in m3 in reference year … | Actual imports of pine (Σ of CN 4403 20 31 and 4403 20 39) in m3 in reference year … |

|---|---|---|---|

Currently falling within Commission Regulation (EU) No 1006/2011 (OJ L 282, 28.10.2011, p. 1).

Options/Help

Print Options

PrintThe Whole Regulation

Legislation is available in different versions:

Latest Available (revised):The latest available updated version of the legislation incorporating changes made by subsequent legislation and applied by our editorial team. Changes we have not yet applied to the text, can be found in the ‘Changes to Legislation’ area.

Original (As adopted by EU): The original version of the legislation as it stood when it was first adopted in the EU. No changes have been applied to the text.

See additional information alongside the content

Geographical Extent: Indicates the geographical area that this provision applies to. For further information see ‘Frequently Asked Questions’.

Show Timeline of Changes: See how this legislation has or could change over time. Turning this feature on will show extra navigation options to go to these specific points in time. Return to the latest available version by using the controls above in the What Version box.

More Resources

Access essential accompanying documents and information for this legislation item from this tab. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as adopted version that was used for the EU Official Journal

- lists of changes made by and/or affecting this legislation item

- all formats of all associated documents

- correction slips

- links to related legislation and further information resources

Timeline of Changes

This timeline shows the different versions taken from EUR-Lex before exit day and during the implementation period as well as any subsequent versions created after the implementation period as a result of changes made by UK legislation.

The dates for the EU versions are taken from the document dates on EUR-Lex and may not always coincide with when the changes came into force for the document.

For any versions created after the implementation period as a result of changes made by UK legislation the date will coincide with the earliest date on which the change (e.g an insertion, a repeal or a substitution) that was applied came into force. For further information see our guide to revised legislation on Understanding Legislation.

More Resources

Use this menu to access essential accompanying documents and information for this legislation item. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as adopted version that was used for the print copy

- correction slips

Click 'View More' or select 'More Resources' tab for additional information including:

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- links to related legislation and further information resources