- Latest available (Revised)

- Point in Time (16/12/2014)

- Original (As adopted by EU)

Commission Regulation (EU) No 1388/2014Show full title

Commission Regulation (EU) No 1388/2014 of 16 December 2014 declaring certain categories of aid to undertakings active in the production, processing and marketing of fishery and aquaculture products compatible with the internal market in application of Articles 107 and 108 of the Treaty on the Functioning of the European Union

You are here:

- Regulations originating from the EU

- 2014 No. 1388

- Annexes only

- Show Geographical Extent(e.g. England, Wales, Scotland and Northern Ireland)

- Show Timeline of Changes

More Resources

Revised version PDFs

- Revised 10/12/20200.49 MB

When the UK left the EU, legislation.gov.uk published EU legislation that had been published by the EU up to IP completion day (31 December 2020 11.00 p.m.). On legislation.gov.uk, these items of legislation are kept up-to-date with any amendments made by the UK since then.

This item of legislation originated from the EU

Legislation.gov.uk publishes the UK version. EUR-Lex publishes the EU version. The EU Exit Web Archive holds a snapshot of EUR-Lex’s version from IP completion day (31 December 2020 11.00 p.m.).

Changes over time for: Commission Regulation (EU) No 1388/2014 (Annexes only)

Version Superseded: 31/12/2020

Alternative versions:

Status:

Point in time view as at 16/12/2014.

Changes to legislation:

There are currently no known outstanding effects for the Commission Regulation (EU) No 1388/2014.![]()

Changes to Legislation

Revised legislation carried on this site may not be fully up to date. At the current time any known changes or effects made by subsequent legislation have been applied to the text of the legislation you are viewing by the editorial team. Please see ‘Frequently Asked Questions’ for details regarding the timescales for which new effects are identified and recorded on this site.

ANNEX IU.K.SME DEFINITION

Article 1U.K.Enterprise

An enterprise is considered to be any entity engaged in an economic activity, irrespective of its legal form. This includes, in particular, self-employed persons and family businesses engaged in craft or other activities, and partnerships or associations regularly engaged in an economic activity.

Article 2U.K.Staff headcount and financial thresholds determining enterprise categories

1.The category of micro, small and medium-sized enterprises (‘SMEs’) is made up of enterprises which employ fewer than 250 persons and which have an annual turnover not exceeding EUR 50 million, and/or an annual balance sheet total not exceeding EUR 43 million.

2.Within the SME category, a small enterprise is defined as an enterprise which employs fewer than 50 persons and whose annual turnover and/or annual balance sheet total does not exceed EUR 10 million.

3.Within the SME category, a micro-enterprise is defined as an enterprise which employs fewer than 10 persons and whose annual turnover and/or annual balance sheet total does not exceed EUR 2 million.

Article 3U.K.Types of enterprise taken into consideration in calculating staff numbers and financial amounts

1.An ‘autonomous enterprise’ is any enterprise which is not classified as a partner enterprise within the meaning of paragraph 2 or as a linked enterprise within the meaning of paragraph 3.

2.‘Partner enterprises’ are all enterprises which are not classified as linked enterprises within the meaning of paragraph 3 and between which there is the following relationship: an enterprise (upstream enterprise) holds, either solely or jointly with one or more linked enterprises within the meaning of paragraph 3, 25 % or more of the capital or voting rights of another enterprise (downstream enterprise).

However, an enterprise may be ranked as autonomous, and thus as not having any partner enterprises, even if this 25 % threshold is reached or exceeded by the following investors, provided that those investors are not linked, within the meaning of paragraph 3, either individually or jointly to the enterprise in question:

(a)public investment corporations, venture capital companies, individuals or groups of individuals with a regular venture capital investment activity who invest equity capital in unquoted businesses (business angels), provided the total investment of those business angels in the same enterprise is less than EUR 1 250 000;

(b)universities or non-profit research centres;

(c)institutional investors, including regional development funds;

(d)autonomous local authorities with an annual budget of less than EUR 10 million and less than 5 000 inhabitants.

3.‘Linked enterprises’ are enterprises which have any of the following relationships with each other:

(a)an enterprise has a majority of the shareholders' or members' voting rights in another enterprise;

(b)an enterprise has the right to appoint or remove a majority of the members of the administrative, management or supervisory body of another enterprise;

(c)an enterprise has the right to exercise a dominant influence over another enterprise pursuant to a contract entered into with that enterprise or to a provision in its memorandum or articles of association;

(d)an enterprise, which is a shareholder in or member of another enterprise, controls alone, pursuant to an agreement with other shareholders in or members of that enterprise, a majority of shareholders' or members' voting rights in that enterprise.

There is a presumption that no dominant influence exists if the investors listed in the second subparagraph of paragraph 2 are not involving themselves directly or indirectly in the management of the enterprise in question, without prejudice to their rights as shareholders.

Enterprises having any of the relationships described in the first subparagraph through one or more other enterprises, or any one of the investors mentioned in paragraph 2, are also considered to be linked.

Enterprises which have one or other of such relationships through a natural person or group of natural persons acting jointly are also considered linked enterprises if they engage in their activity or in part of their activity in the same relevant market or in adjacent markets.

An ‘adjacent market’ is considered to be the market for a product or service situated directly upstream or downstream of the relevant market.

4.Except in the cases set out in paragraph 2, second subparagraph, an enterprise cannot be considered an SME if 5 % or more of the capital or voting rights are directly or indirectly controlled, jointly or individually, by one or more public bodies.

5.Enterprises may make a declaration of status as an autonomous enterprise, partner enterprise or linked enterprise, including the data regarding the thresholds set out in Article 2. The declaration may be made even if the capital is spread in such a way that it is not possible to determine exactly by whom it is held, in which case the enterprise may declare in good faith that it can legitimately presume that it is not owned as to 25 % or more by one enterprise or jointly by enterprises linked to one another. Such declarations are made without prejudice to the checks and investigations provided for by national or Union rules.

Article 4U.K.Data used for the staff headcount and the financial amounts and reference period

1.The data to apply to the headcount of staff and the financial amounts are those relating to the latest approved accounting period and calculated on an annual basis. They are taken into account from the date of closure of the accounts. The amount selected for the turnover is calculated excluding value added tax (VAT) and other indirect taxes.

2.Where, at the date of closure of the accounts, an enterprise finds that, on an annual basis, it has exceeded or fallen below the headcount or financial thresholds stated in Article 2, this will not result in the loss or acquisition of the status of medium-sized, small or micro-enterprise unless those thresholds are exceeded over two consecutive accounting periods.

3.In the case of newly-established enterprises whose accounts have not yet been approved, the data to apply is to be derived from a bona fide estimate made in the course of the financial year.

Article 5U.K.Staff headcount

The headcount corresponds to the number of annual work units (AWU), i.e. the number of persons who worked full-time within the enterprise in question or on its behalf during the entire reference year under consideration. The work of persons who have not worked the full year, the work of those who have worked part-time, regardless of duration, and the work of seasonal workers are counted as fractions of AWU. The staff consists of:

employees;

persons working for the enterprise being subordinated to it and deemed to be employees under national law;

owner-managers;

partners engaging in a regular activity in the enterprise and benefiting from financial advantages from the enterprise.

Apprentices or students engaged in vocational training with an apprenticeship or vocational training contract are not included as staff. The duration of maternity or parental leaves is not counted.

Article 6U.K.Establishing the data of an enterprise

1.In the case of an autonomous enterprise, the data, including the number of staff, are determined exclusively on the basis of the accounts of that enterprise.

2.The data, including the headcount, of an enterprise having partner enterprises or linked enterprises are determined on the basis of the accounts and other data of the enterprise or, where they exist, the consolidated accounts of the enterprise, or the consolidated accounts in which the enterprise is included through consolidation.

To the data referred to in the first subparagraph are added the data of any partner enterprise of the enterprise in question situated immediately upstream or downstream from it. Aggregation is proportional to the percentage interest in the capital or voting rights (whichever is greater). In the case of cross-holdings, the greater percentage applies.

To the data referred to in the first and second subparagraph are added 100 % of the data of any enterprise, which is linked directly or indirectly to the enterprise in question, where the data were not already included through consolidation in the accounts.

3.For the application of paragraph 2, the data of the partner enterprises of the enterprise in question are derived from their accounts and their other data, consolidated if they exist. To these are added 100 % of the data of enterprises which are linked to these partner enterprises, unless their accounts data are already included through consolidation.

For the application of the same paragraph 2, the data of the enterprises which are linked to the enterprise in question are to be derived from their accounts and their other data, consolidated if they exist. To these are added, pro rata, the data of any possible partner enterprise of that linked enterprise, situated immediately upstream or downstream from it, unless it has already been included in the consolidated accounts with a percentage at least proportional to the percentage identified under the second subparagraph of paragraph 2.

4.Where in the consolidated accounts no staff data appear for a given enterprise, staff figures are calculated by aggregating proportionally the data from its partner enterprises and by adding the data from the enterprises to which the enterprise in question is linked.

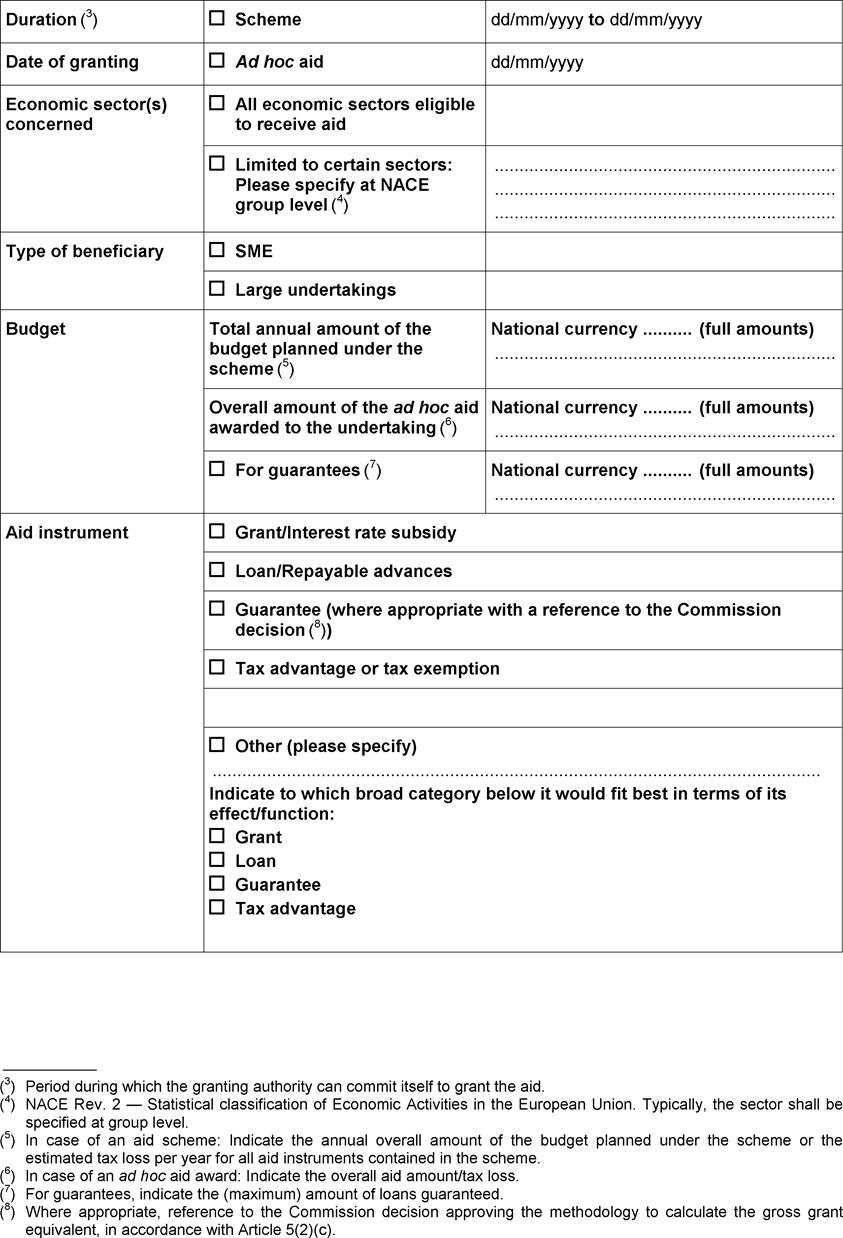

ANNEX IIU.K.Information regarding State aid exempt under the conditions of this Regulation to be provided through the established Commission IT application as laid down in Article 11

ANNEX IIIU.K.Provisions for the publication of information referred to in Article 9(1)

Member States shall organise their comprehensive State aid websites, on which the information referred to in Article 9(1) is to be published, in a way to allow easy access to the information.

Information shall be published in a spreadsheet data format, which allows data to be searched, extracted and easily published on the Internet, for instance in CSV or XML format. Access to the website shall be allowed to any interested party without restrictions. No prior user registration shall be required to access the website.

The following information on individual awards as laid down in Article 9(1)(c) shall be published:

Name of the beneficiary

Beneficiary's identifier

Type of enterprise (SME/large) at the date of granting

Region in which the beneficiary is located, at NUTS level II(1)

Sector of activity at NACE group level(2)

Aid element, expressed as full amount in national currency(3)

Aid instrument(4) (grant/interest rate subsidy, loan/repayable advances/reimbursable grant, guarantee, tax advantage or tax exemption, other (please specify))

Date of granting

Objective of the aid

Granting authority

NUTS — Nomenclature of Territorial Units for Statistics. Typically, the region is specified at level 2.

Council Regulation (EEC) No 3037/90 of 9 October 1990 on the statistical classification of economic activities in the European Community (OJ L 293, 24.10.1990, p. 1).

Gross grant equivalent. For fiscal schemes, this amount can be provided by the ranges set out in Article 9(2).

If the aid is granted through multiple aid instruments, the aid amount shall be provided by instrument.

Options/Help

Print Options

PrintThe Whole Regulation

PrintThe Annexes only

Legislation is available in different versions:

Latest Available (revised):The latest available updated version of the legislation incorporating changes made by subsequent legislation and applied by our editorial team. Changes we have not yet applied to the text, can be found in the ‘Changes to Legislation’ area.

Original (As adopted by EU): The original version of the legislation as it stood when it was first adopted in the EU. No changes have been applied to the text.

Point in Time: This becomes available after navigating to view revised legislation as it stood at a certain point in time via Advanced Features > Show Timeline of Changes or via a point in time advanced search.

See additional information alongside the content

Geographical Extent: Indicates the geographical area that this provision applies to. For further information see ‘Frequently Asked Questions’.

Show Timeline of Changes: See how this legislation has or could change over time. Turning this feature on will show extra navigation options to go to these specific points in time. Return to the latest available version by using the controls above in the What Version box.

More Resources

Access essential accompanying documents and information for this legislation item from this tab. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as adopted version that was used for the EU Official Journal

- lists of changes made by and/or affecting this legislation item

- all formats of all associated documents

- correction slips

- links to related legislation and further information resources

Timeline of Changes

This timeline shows the different versions taken from EUR-Lex before exit day and during the implementation period as well as any subsequent versions created after the implementation period as a result of changes made by UK legislation.

The dates for the EU versions are taken from the document dates on EUR-Lex and may not always coincide with when the changes came into force for the document.

For any versions created after the implementation period as a result of changes made by UK legislation the date will coincide with the earliest date on which the change (e.g an insertion, a repeal or a substitution) that was applied came into force. For further information see our guide to revised legislation on Understanding Legislation.

More Resources

Use this menu to access essential accompanying documents and information for this legislation item. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as adopted version that was used for the print copy

- correction slips

Click 'View More' or select 'More Resources' tab for additional information including:

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- links to related legislation and further information resources