- Latest available (Revised)

- Original (As adopted by EU)

Commission Implementing Regulation (EU) 2020/761Show full title

Commission Implementing Regulation (EU) 2020/761 of 17 December 2019 laying down rules for the application of Regulations (EU) No 1306/2013, (EU) No 1308/2013 and (EU) No 510/2014 of the European Parliament and of the Council as regards the management system of tariff quotas with licences

You are here:

- Regulations originating from the EU

- 2020 No. 761

- Annexes only

More Resources

When the UK left the EU, legislation.gov.uk published EU legislation that had been published by the EU up to IP completion day (31 December 2020 11.00 p.m.). On legislation.gov.uk, these items of legislation are kept up-to-date with any amendments made by the UK since then.

This item of legislation originated from the EU

Legislation.gov.uk publishes the UK version. EUR-Lex publishes the EU version. The EU Exit Web Archive holds a snapshot of EUR-Lex’s version from IP completion day (31 December 2020 11.00 p.m.).

Status:

This is the original version as it was originally adopted in the EU.

This legislation may since have been updated - see the latest available (revised) version

ANNEX I

| List of tariff quotas open and requirements to be fulfilled | |||||||

|---|---|---|---|---|---|---|---|

| Tariff rate quota number/description | Sector | Type of quota | Management method | Requirement of reference quantity laid down in Article 9 of Delegated Regulation (EU) 2020/760 | Requirement of proof of trade laid down in Article 8 of Delegated Regulation (EU) 2020/760 | Licence expiration date | Prior compulsory registration of operators in the electronic system referred to in Article 13 of Delegated Regulation (EU) 2020/760 |

| 09.4123 | Cereals | Import | EU: simultaneous examination | No | No | No | |

| 09.4124 | Cereals | Import | EU: simultaneous examination | No | No | No | |

| 09.4125 | Cereals | Import | EU: simultaneous examination | No | No | No | |

| 09.4131 | Cereals | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4133 | Cereals | Import | EU: simultaneous examination | No | No | No | |

| 09.4306 | Cereals | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4307 | Cereals | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4308 | Cereals | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4120 | Cereals | Import | EU: simultaneous examination | No | Yes | In accordance with Article 26 of this Regulation | No |

| 09.4121 | Cereals | Import | EU: simultaneous examination | No | Yes | In accordance with Article 26 of this Regulation | No |

| 09.4122 | Cereals | Import | EU: simultaneous examination | No | Yes | In accordance with Article 26 of this Regulation | No |

| 09.4112 | Rice | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4116 | Rice | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4117 | Rice | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4118 | Rice | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4119 | Rice | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4127 | Rice | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4128 | Rice | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4129 | Rice | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4130 | Rice | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4138 | Rice | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4148 | Rice | Import | EU: simultaneous examination | No | No | No | |

| 09.4149 | Rice | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4150 | Rice | Import | EU: simultaneous examination | No | No | No | |

| 09.4153 | Rice | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4154 | Rice | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4166 | Rice | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4168 | Rice | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4317 | Sugar | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4318 | Sugar | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4319 | Sugar | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4320 | Sugar | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4321 | Sugar | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4324 | Sugar | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4325 | Sugar | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4326 | Sugar | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4327 | Sugar | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4329 | Sugar | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4330 | Sugar | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4032 | Olive oil | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4099 | Fruits and vegetables | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4104 | Fruits and vegetables | Import | EU: simultaneous examination | Yes | Only when Article 9(9) of Delegated Regulation (EU) 2020/760 applies | No | |

| 09.4285 | Fruits and vegetables | Import | EU: simultaneous examination | Yes | Only when Article 9(9) of Delegated Regulation (EU) 2020/760 applies | Till end of TRQ period | Yes |

| 09.4287 | Fruits and vegetables | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4284 | Fruits and vegetables | Import | EU: simultaneous examination | Yes | Only when Article 9(9) of Delegated Regulation (EU) 2020/760 applies | Till end of TRQ period | No |

| 09.4286 | Fruits and vegetables | Import | EU: simultaneous examination | Yes | Only when Article 9(9) of Delegated Regulation (EU) 2020/760 applies | Till end of TRQ period | No |

| 09.4001 | Beef and veal | Import | EU: documents issued by the exporting country | No | No | No | |

| 09.4202 | Beef and veal | Import | EU: documents issued by the exporting country | No | No | No | |

| 09.4003 | Beef and veal | Import | EU: simultaneous examination | Yes | Only when Article 9(9) of Delegated Regulation (EU) 2020/760 applies | Till end of TRQ period | No |

| 09.4004 | Beef and veal | Import | EU: documents issued by the exporting country | No | No | No | |

| 09.4181 | Beef and veal | Import | EU: documents issued by the exporting country | No | No | No | |

| 09.4198 | Beef and veal | Import | EU: documents issued by the exporting country | No | No | No | |

| 09.4199 | Beef and veal | Import | EU: documents issued by the exporting country | No | No | No | |

| 09.4200 | Beef and veal | Import | EU: documents issued by the exporting country | No | No | No | |

| 09.4002 | Beef and veal | Import | EU: simultaneous examination | No | No | No | |

| 09.4270 | Beef and veal | Import | EU: simultaneous examination | Yes | Only when Article 9(9) of Delegated Regulation (EU) 2020/760 applies | Till end of TRQ period | No |

| 09.4280 | Beef and veal | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4281 | Beef and veal | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4450 | Beef and veal | Import | EU: documents issued by the exporting country | No | No | No | |

| 09.4451 | Beef and veal | Import | EU: documents issued by the exporting country | No | No | No | |

| 09.4452 | Beef and veal | Import | EU: documents issued by the exporting country | No | No | No | |

| 09.4453 | Beef and veal | Import | EU: documents issued by the exporting country | No | No | No | |

| 09.4454 | Beef and veal | Import | EU: documents issued by the exporting country | No | No | No | |

| 09.4455 | Beef and veal | Import | EU: documents issued by the exporting country | No | No | No | |

| 09.4504 | Beef and veal | Import | EU: documents issued by the exporting country | No | No | No | |

| 09.4505 | Beef and veal | Import | EU: documents issued by the exporting country | No | No | No | |

| 09.4155 | Milk and milk products | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4179 | Milk and milk products | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4182 | Milk and milk products | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4195 | Milk and milk products | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4225 | Milk and milk products | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4226 | Milk and milk products | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4227 | Milk and milk products | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4228 | Milk and milk products | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4229 | Milk and milk products | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4514 | Milk and milk products | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4515 | Milk and milk products | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4521 | Milk and milk products | Import | EU: documents issued by the exporting country | No | No | No | |

| 09.4522 | Milk and milk products | Import | EU: documents issued by the exporting country | No | No | No | |

| 09.4595 | Milk and milk products | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4600 | Milk and milk products | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4601 | Milk and milk products | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4602 | Milk and milk products | Import | EU: simultaneous examination | No | Yes | No | |

| Cheese quota opened by the United States of America | Milk and milk products | Export | EU: simultaneous examination | No | Yes | No | |

| Milk powder quota opened by the Dominican Republic | Milk and milk products | Export | EU: simultaneous examination | No | Yes | No | |

| Cheese quota opened by Canada | Milk and milk products | Export | Third country | No | No | 31 December | No |

| 09.4038 | Pigmeat | Import | EU: simultaneous examination | No | No | No | |

| 09.4170 | Pigmeat | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4271 | Pigmeat | Import | EU: simultaneous examination | Yes | Only when Article 9(9) of Delegated Regulation (EU) 2020/760 applies | Till end of TRQ period | No |

| 09.4272 | Pigmeat | Import | EU: simultaneous examination | Yes | Only when Article 9(9) of Delegated Regulation (EU) 2020/760 applies | Till end of TRQ period | No |

| 09.4282 | Pigmeat | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4275 | Eggs | Import | EU: simultaneous examination | No | No | No | |

| 09.4276 | Eggs | Import | EU: simultaneous examination | No | No | No | |

| 09.4401 | Eggs | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4402 | Eggs | Import | EU: simultaneous examination | No | No | No | |

| 09.4067 | Poultry meat | Import | EU: simultaneous examination | Yes | Only when Article 9(9) of Delegated Regulation (EU) 2020/760 applies | Till end of TRQ period | Yes |

| 09.4068 | Poultry meat | Import | EU: simultaneous examination | Yes | Only when Article 9(9) of Delegated Regulation (EU) 2020/760 applies | Till end of TRQ period | Yes |

| 09.4069 | Poultry meat | Import | EU: simultaneous examination | Yes | Only when Article 9(9) of Delegated Regulation (EU) 2020/760 applies | Till end of TRQ period | Yes |

| 09.4070 | Poultry meat | Import | EU: simultaneous examination | No | No | No | |

| 09.4092 | Poultry meat | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4169 | Poultry meat | Import | EU: simultaneous examination | No | No | No | |

| 09.4211 | Poultry meat | Import | EU: simultaneous examination | Yes | Only when Article 9(9) of Delegated Regulation (EU) 2020/760 applies | Till end of TRQ period | Yes |

| 09.4212 | Poultry meat | Import | EU: simultaneous examination | Yes | Only when Article 9(9) of Delegated Regulation (EU) 2020/760 applies | Till end of TRQ period | Yes |

| 09.4213 | Poultry meat | Import | EU: simultaneous examination | Yes | Only when Article 9(9) of Delegated Regulation (EU) 2020/760 applies | Till end of TRQ period | Yes |

| 09.4214 | Poultry meat | Import | EU: simultaneous examination | Yes | Only when Article 9(9) of Delegated Regulation (EU) 2020/760 applies | Till end of TRQ period | Yes |

| 09.4215 | Poultry meat | Import | EU: simultaneous examination | Yes | Only when Article 9(9) of Delegated Regulation (EU) 2020/760 applies | Till end of TRQ period | Yes |

| 09.4216 | Poultry meat | Import | EU: simultaneous examination | Yes | Only when Article 9(9) of Delegated Regulation (EU) 2020/760 applies | Till end of TRQ period | Yes |

| 09.4217 | Poultry meat | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4218 | Poultry meat | Import | EU: simultaneous examination | No | No | No | |

| 09.4251 | Poultry meat | Import | EU: simultaneous examination | Yes | Only when Article 9(9) of Delegated Regulation (EU) 2020/760 applies | Till end of TRQ period | Yes |

| 09.4252 | Poultry meat | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4253 | Poultry meat | Import | EU: simultaneous examination | No | No | No | |

| 09.4254 | Poultry meat | Import | EU: simultaneous examination | Yes | Only when Article 9(9) of Delegated Regulation (EU) 2020/760 applies | Till end of TRQ period | Yes |

| 09.4255 | Poultry meat | Import | EU: simultaneous examination | Yes | Only when Article 9(9) of Delegated Regulation (EU) 2020/760 applies | Till end of TRQ period | Yes |

| 09.4256 | Poultry meat | Import | EU: simultaneous examination | Yes | Only when Article 9(9) of Delegated Regulation (EU) 2020/760 applies | Till end of TRQ period | No |

| 09.4257 | Poultry meat | Import | EU: simultaneous examination | Yes | Only when Article 9(9) of Delegated Regulation (EU) 2020/760 applies | Till end of TRQ period | No |

| 09.4258 | Poultry meat | Import | EU: simultaneous examination | Yes | Only when Article 9(9) of Delegated Regulation (EU) 2020/760 applies | Till end of TRQ period | No |

| 09.4259 | Poultry meat | Import | EU: simultaneous examination | Yes | Only when Article 9(9) of Delegated Regulation (EU) 2020/760 applies | Till end of TRQ period | No |

| 09.4260 | Poultry meat | Import | EU: simultaneous examination | Yes | Only when Article 9(9) of Delegated Regulation (EU) 2020/760 applies | Till end of TRQ period | Yes |

| 09.4263 | Poultry meat | Import | EU: simultaneous examination | Yes | Only when Article 9(9) of Delegated Regulation (EU) 2020/760 applies | Till end of TRQ period | Yes |

| 09.4264 | Poultry meat | Import | EU: simultaneous examination | No | No | No | |

| 09.4265 | Poultry meat | Import | EU: simultaneous examination | No | No | No | |

| 09.4266 | Poultry meat | Import | EU: simultaneous examination | No | No | No | |

| 09.4267 | Poultry meat | Import | EU: simultaneous examination | No | No | No | |

| 09.4268 | Poultry meat | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4269 | Poultry meat | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4273 | Poultry meat | Import | EU: simultaneous examination | Yes | Only when Article 9(9) of Delegated Regulation (EU) 2020/760 applies | Till end of TRQ period | Yes |

| 09.4274 | Poultry meat | Import | EU: simultaneous examination | Yes | Only when Article 9(9) of Delegated Regulation (EU) 2020/760 applies | Till end of TRQ period | No |

| 09.4283 | Poultry meat | Import | EU: simultaneous examination | No | Yes | No | |

| 09.4410 | Poultry meat | Import | EU: simultaneous examination | Yes | Only when Article 9(9) of Delegated Regulation (EU) 2020/760 applies | Till end of TRQ period | Yes |

| 09.4411 | Poultry meat | Import | EU: simultaneous examination | Yes | Only when Article 9(9) of Delegated Regulation (EU) 2020/760 applies | Till end of TRQ period | Yes |

| 09.4412 | Poultry meat | Import | EU: simultaneous examination | Yes | Only when Article 9(9) of Delegated Regulation (EU) 2020/760 applies | Till end of TRQ period | Yes |

| 09.4420 | Poultry meat | Import | EU: simultaneous examination | Yes | Only when Article 9(9) of Delegated Regulation (EU) 2020/760 applies | Till end of TRQ period | Yes |

| 09.4422 | Poultry meat | Import | EU: simultaneous examination | Yes | Only when Article 9(9) of Delegated Regulation (EU) 2020/760 applies | Till end of TRQ period | Yes |

| Dog and cat food to Switzerland | Dog and cat food | Export | Third country | No | No | 31 December | No |

ANNEX II Tariff quotas in the sector of cereals

| Order number | 09.4123 |

| International agreement or other act | Agreement in the form of an Exchange of Letters between the European Community and the United States of America pursuant to Article XXIV:6 and Article XXVIII of the General Agreement on Tariffs and Trade (GATT) 1994 relating to the modification of concessions in the schedules of the Czech Republic, the Republic of Estonia, the Republic of Cyprus, the Republic of Latvia, the Republic of Lithuania, the Republic of Hungary, the Republic of Malta, the Republic of Poland, the Republic of Slovenia and the Slovak Republic in the course of their accession to the European Union, concluded by Council Decision 2006/333/EC |

| Tariff quota period | 1 January to 31 December |

| Tariff quota sub-periods | No |

| Licence application | In accordance with Articles 6, 7 and 8 of this Regulation |

| Product description | Common wheat of a quality other than high quality as defined in Annex II to Regulation (EU) No 642/2010 |

| Origin | United States of America |

| Proof of origin at licence application. If yes, body authorised to issue it | No |

| Proof of origin for release into free circulation | Yes. In accordance with Article 61 of Regulation (EU) No 952/2013 |

| Quantity in kilograms | 572 000 000 kg |

| CN codes | Ex10019900 |

| In-quota customs duty | EUR 12 per 1 000 kg |

| Proof of trade | No |

| Security for import licence | EUR 30 per 1 000 kg |

| Specific entries to be made on the licence application and on the licence | Section 8 of the import licence application and of the import licence shall indicate the country of origin; box ‘yes’ in that section shall be crossed |

| Period of validity of a licence | In accordance with Article 13 of this Regulation |

| Transferability of licence | Yes |

| Reference quantity | No |

| Operator registered in LORI database | No |

| Specific conditions | No |

| Order number | 09.4124 |

| International agreement or other act | Comprehensive Economic and Trade Agreement (CETA) between Canada, of the one part, and the European Union and its Member States, of the other part, provisionally applied in the EU on the basis of Council Decision (EU) 2017/38 |

| Tariff quota period | 1 January to 31 December Tariff quota opened from 2017 to 2023 |

| Tariff quota sub-periods | No |

| Licence application | In accordance with Articles 6, 7 and 8 of this Regulation |

| Product description | Common wheat of a quality other than high quality as defined in Annex II to Regulation (EU) No 642/2010 |

| Origin | Canada |

| Proof of origin at licence application. If yes, body authorised to issue it | No |

| Proof of origin for release into free circulation | Yes. In accordance with Article 20 of this Regulation |

| Quantity in kilograms | From 2017 to 2023: 100 000 000 kg |

| CN codes | Ex10019900 |

| In-quota customs duty | EUR 0 |

| Proof of trade | No |

| Security for import licence | EUR 30 per 1 000 kg |

| Specific entries to be made on the licence application and on the licence | Section 8 of the import licence application and of the import licence shall indicate the country of origin; box ‘yes’ in that section shall be crossed |

| Period of validity of a licence | In accordance with Article 13 of this Regulation |

| Transferability of licence | Yes |

| Reference quantity | No |

| Operator registered in LORI database | No |

| Specific conditions | No |

| Order number | 09.4125 |

| International agreement or other act | Agreement in the form of an Exchange of Letters between the European Community and the United States of America pursuant to Article XXIV:6 and Article XXVIII of the General Agreement on Tariffs and Trade (GATT) 1994 relating to the modification of concessions in the schedules of the Czech Republic, the Republic of Estonia, the Republic of Cyprus, the Republic of Latvia, the Republic of Lithuania, the Republic of Hungary, the Republic of Malta, the Republic of Poland, the Republic of Slovenia and the Slovak Republic in the course of their accession to the European Union, concluded by Council Decision 2006/333/EC |

| Tariff quota period | 1 January to 31 December |

| Tariff quota sub-periods | 1 January to 30 June 1 July to 31 December |

| Licence application | In accordance with Articles 6, 7 and 8 of this Regulation |

| Product description | Common wheat of a quality other than high quality as defined in Annex II to Regulation (EU) No 642/2010 |

| Origin | Third countries other than the United States of America and Canada |

| Proof of origin at licence application. If yes, body authorised to issue it | No |

| Proof of origin for release into free circulation | Yes. In accordance with Article 61 of Regulation (EU) No 952/2013 |

| Quantity in kilograms | 2 371 600 000 kg, divided as follows:

|

| CN codes | Ex10019900 |

| In-quota customs duty | EUR 12 per 1 000 kg |

| Proof of trade | No |

| Security for import licence | EUR 30 per 1 000 kg |

| Specific entries to be made on the licence application and on the licence | Section 8 of the import licence application and of the import licence shall indicate the country of origin; box ‘yes’ in that section shall be crossed |

| Period of validity of a licence | In accordance with Article 13 of this Regulation |

| Transferability of licence | Yes |

| Reference quantity | No |

| Operator registered in LORI database | No |

| Specific conditions | No |

| Order number | 09.4131 |

| International agreement or other act | Agreement in the form of an Exchange of Letters between the European Community and the United States of America pursuant to Article XXIV:6 and Article XXVIII of the General Agreement on Tariffs and Trade (GATT) 1994 relating to the modification of concessions in the schedules of the Czech Republic, the Republic of Estonia, the Republic of Cyprus, the Republic of Latvia, the Republic of Lithuania, the Republic of Hungary, the Republic of Malta, the Republic of Poland, the Republic of Slovenia and the Slovak Republic in the course of their accession to the European Union, concluded by Council Decision 2006/333/EC |

| Tariff quota period | 1 January to 31 December |

| Tariff quota sub-periods | 1 January to 30 June 1 July to 31 December |

| Licence application | In accordance with Articles 6, 7 and 8 of this Regulation |

| Product description | Maize |

| Origin | Erga omnes |

| Proof of origin at licence application. If yes, body authorised to issue it | No |

| Proof of origin for release into free circulation | No |

| Quantity in kilograms | 277 988 000 kg, divided as follows:

|

| CN codes | 1005 10 90 and 1005 90 00 |

| In-quota customs duty | EUR 0 |

| Proof of trade | Yes. 25 tonnes |

| Security for import licence | EUR 30 per 1 000 kg |

| Specific entries to be made on the licence application and on the licence | No |

| Period of validity of a licence | In accordance with Article 13 of this Regulation |

| Transferability of licence | Yes |

| Reference quantity | No |

| Operator registered in LORI database | No |

| Specific conditions | No |

| Order number | 09.4133 |

| International agreement or other act | Agreement in the form of an Exchange of Letters between the European Community and the United States of America pursuant to Article XXIV:6 and Article XXVIII of the General Agreement on Tariffs and Trade (GATT) 1994 relating to the modification of concessions in the schedules of the Czech Republic, the Republic of Estonia, the Republic of Cyprus, the Republic of Latvia, the Republic of Lithuania, the Republic of Hungary, the Republic of Malta, the Republic of Poland, the Republic of Slovenia and the Slovak Republic in the course of their accession to the European Union, concluded by Council Decision 2006/333/EC |

| Tariff quota period | 1 January to 31 December |

| Tariff quota sub-periods | No |

| Licence application | In accordance with Articles 6, 7 and 8 of this Regulation |

| Product description | Common wheat of a quality other than high quality as defined in Annex II to Regulation (EU) No 642/2010 |

| Origin | Erga omnes |

| Proof of origin at licence application. If yes, body authorised to issue it | No |

| Proof of origin for release into free circulation | No |

| Quantity in kilograms | 129 577 000 kg |

| CN codes | Ex10019900 |

| In-quota customs duty | EUR 12 per 1 000 kg |

| Proof of trade | No |

| Security for import licence | EUR 30 per 1 000 kg |

| Specific entries to be made on the licence application and on the licence | No |

| Period of validity of a licence | In accordance with Article 13 of this Regulation |

| Transferability of licence | Yes |

| Reference quantity | No |

| Operator registered in LORI database | No |

| Specific conditions | No |

| Order number | 09.4306 |

| International agreement or other act | Association Agreement between the European Union and the European Atomic Energy Community and their Member States, of the one part, and Ukraine, of the other part; signed and provisionally applied on the basis of Council Decision 2014/668/EU |

| Tariff quota period | 1 January to 31 December |

| Tariff quota sub-periods | No |

| Licence application | In accordance with Articles 6, 7 and 8 of this Regulation |

| Product description | Spelt, common wheat and meslin, other than seed Common wheat flour and spelt flour, meslin flour Cereal flour other than wheat, meslin, rye, maize, barley, oat, rice Groats and meal of common wheat and spelt Wheat pellets |

| Origin | Ukraine |

| Proof of origin at licence application. If yes, body authorised to issue it | No |

| Proof of origin for release into free circulation | Yes. EUR.1 certificate |

| Quantity in kilograms | TRQ period (calendar year) 2019: 980 000 000 kg TRQ period (calendar year) 2020: 990 000 000 kg TRQ period (calendar year) as from 2021: 1 000 000 000 kg |

| CN codes | 1001 99 (00), 1101 00 (15-90), 1102 90 (90), 1103 11 (90), 1103 20 (60) |

| In-quota customs duty | EUR 0 |

| Proof of trade | Yes. 25 tonnes |

| Security for import licence | EUR 30 per 1 000 kg |

| Specific entries to be made on the licence application and on the licence | Section 8 of the import licence application and of the import licence shall indicate the country of origin; box ‘yes’ in that section shall be crossed |

| Period of validity of a licence | In accordance with Article 13 of this Regulation |

| Transferability of licence | Yes |

| Reference quantity | No |

| Operator registered in LORI database | No |

| Special conditions | No |

| Order number | 09.4307 |

| International agreement or other act | Association Agreement between the European Union and the European Atomic Energy Community and their Member States, of the one part, and Ukraine, of the other part; signed and provisionally applied on the basis of Council Decision 2014/668/EU |

| Tariff quota period | 1 January to 31 December |

| Tariff quota sub-periods | No |

| Licence application | In accordance with Articles 6, 7 and 8 of this Regulation |

| Product description | Barley, other than seed Barley flour Barley pellets |

| Origin | Ukraine |

| Proof of origin at licence application. If yes, body authorised to issue it | No |

| Proof of origin for release into free circulation | Yes. EUR.1 certificate |

| Quantity in kilograms | TRQ period (calendar year) 2019: 310 000 000 kg TRQ period (calendar year) 2020: 330 000 000 kg TRQ period (calendar year) as from 2021: 350 000 000 kg |

| CN codes | 1003 90 (00), 1102 90 (10), ex 1103 20 (25) |

| In-quota customs duty | EUR 0 |

| Proof of trade | Yes. 25 tonnes |

| Security for import licence | EUR 30 per 1 000 kg |

| Specific entries to be made on the licence application and on the licence | Section 8 of the import licence application and of the import licence shall indicate the country of origin; box ‘yes’ in that section shall be crossed |

| Period of validity of a licence | In accordance with Article 13 of this Regulation |

| Transferability of licence | Yes |

| Reference quantity | No |

| Operator registered in LORI database | No |

| Specific conditions | No |

| Order number | 09.4308 |

| International agreement or other act | Association Agreement between the European Union and the European Atomic Energy Community and their Member States, of the one part, and Ukraine, of the other part; signed and provisionally applied on the basis of Council Decision 2014/668/EU |

| Tariff quota period | 1 January to 31 December |

| Tariff quota sub-periods | No |

| Licence application | In accordance with Articles 6, 7 and 8 of this Regulation |

| Product description | Maize other than seed Maize flour Groats and meal of maize Maize pellets Worked grains of maize |

| Origin | Ukraine |

| Proof of origin at licence application. If yes, body authorised to issue it | No |

| Proof of origin for release into free circulation | Yes. EUR.1 certificate |

| Quantity in kilograms | TRQ period (calendar year) 2019: 550 000 000 kg TRQ period (calendar year) 2020: 600 000 000 kg TRQ period (calendar year) as from 2021: 650 000 000 kg |

| CN codes | 1005 90 (00), 1102 20 (10-90), 1103 13 (10-90), 1103 20 (40), 1104 23 (40-98) |

| In-quota customs duty | EUR 0 |

| Proof of trade | Yes. 25 tonnes |

| Security for import licence | EUR 30 per 1 000 kg |

| Specific entries to be made on the licence application and on the licence | Section 8 of the import licence application and of the import licence shall indicate the country of origin; box ‘yes’ in that section shall be crossed |

| Period of validity of a licence | In accordance with Article 13 of this Regulation |

| Transferability of licence | Yes |

| Reference quantity | No |

| Operator registered in LORI database | No |

| Specific conditions | No |

| Order number | 09.4120 |

| International agreement or other act | Council Decision 94/800/EC of 22 December 1994 concerning the conclusion on behalf of the European Community, as regards matters within its competence, of the agreements reached in the Uruguay Round of multilateral negotiations (1986-1994) |

| Tariff quota period | 1 January to 31 December |

| Tariff quota sub-periods | No |

| Licence application | In accordance with Articles 21 and 22 of this Regulation |

| Product description | Maize into Spain |

| Origin | Erga omnes |

| Proof of origin at licence application. If yes, body authorised to issue it | No |

| Proof of origin for release into free circulation | No |

| Quantity in kilograms | 2 000 000 000 kg |

| CN codes | 1005 90 00 |

| In-quota customs duty | Most Favoured Nation duty from 1 January until 31 March and EUR 0 from 1 April until 31 December |

| Proof of trade | Yes. 25 tonnes |

| Security for import licence | EUR 20 per 1 000 kg |

| Performance security for import licence | Import duty fixed in accordance with Regulation (EU) No 642/2010 at the day of the licence application |

| Specific entries to be made on the licence application and on the licence | Section 8 of the import licence application and of the import licence shall indicate the country of origin; box ‘yes’ in that section shall be crossed; Section 24 of the licence application shall indicate one of the entries listed in Annex XIV.1 to this Regulation |

| Period of validity of a licence | In accordance with Article 26 of this Regulation |

| Transferability of licence | No |

| Reference quantity | No |

| Operator registered in LORI database | No |

| Specific conditions | No |

| Order number | 09.4121 |

| International agreement or other act | Council Decision 94/800/EC of 22 December 1994 concerning the conclusion on behalf of the European Community, as regards matters within its competence, of the agreements reached in the Uruguay Round of multilateral negotiations (1986-1994) |

| Tariff quota period | 1 January to 31 December |

| Tariff quota sub-periods | No |

| Licence application | In accordance with Articles 21 and 22 of this Regulation |

| Product description | Maize into Portugal |

| Origin | Erga omnes |

| Proof of origin at licence application. If yes, body authorised to issue it | No |

| Proof of origin for release into free circulation | No |

| Quantity in kilograms | 500 000 000 kg |

| CN codes | 1005 90 00 |

| In-quota customs duty | Most Favoured Nation duty from 1 January until 31 March and EUR 0 from 1 April until 31 December |

| Proof of trade | Yes. 25 tonnes |

| Security for import licence | EUR 20 per 1 000 kg |

| Performance security for import licence | Import duty fixed in accordance with Regulation (EU) No 642/2010 at the day of the licence application |

| Specific entries to be made on the licence application and on the licence | Section 8 of the import licence application and of the import licence shall indicate the country of origin; box ‘yes’ in that section shall be crossed Section 24 of the licence application shall indicate one of the entries listed in Annex XIV.1 to this Regulation |

| Period of validity of a licence | In accordance with Article 26 of this Regulation |

| Transferability of licence | No |

| Reference quantity | No |

| Operator registered in LORI database | No |

| Specific conditions | No |

| Order number | 09.4122 |

| International agreement or other act | Council Decision 94/800/EC of 22 December 1994 concerning the conclusion on behalf of the European Community, as regards matters within its competence, of the agreements reached in the Uruguay Round of multilateral negotiations (1986-1994) |

| Tariff quota period | 1 January to 31 December |

| Tariff quota sub-periods | No |

| Licence application | In accordance with Articles 21 and 22 of this Regulation |

| Product description | Sorghum into Spain |

| Origin | Erga omnes |

| Proof of origin at licence application. If yes, body authorised to issue it | No |

| Proof of origin for release into free circulation | No |

| Quantity in kilograms | 300 000 000 kg |

| CN codes | 1007 90 00 |

| In-quota customs duty | MFN duty from 1 January until 31 March and EUR 0 from 1 April until 31 December |

| Proof of trade | Yes. 25 tonnes |

| Security for import licence | EUR 20 per 1 000 kg |

| Performance security for import licence | Import duty fixed in accordance with Regulation (EU) No 642/2010 at the day of the licence application |

| Specific entries to be made on the licence application and on the licence | Section 8 of the import licence application and of the import licence shall indicate the country of origin; box ‘yes’ in that section shall be crossed Section 24 of the licence application shall indicate one of the entries listed in Annex XIV.1 to this Regulation |

| Period of validity of a licence | In accordance with Article 26 of this Regulation |

| Transferability of licence | No |

| Reference quantity | No |

| Operator registered in LORI database | No |

| Specific conditions | No |

ANNEX III Tariff quotas in the sector of rice

| Order number | 09.4112 |

| International agreement or other act | Council Decision 2005/953/EC of 20 December 2005 on the conclusion of an agreement in the form of an Exchange of Letters between the European Community and Thailand pursuant to Article XXVIII of GATT 1994 relating to the modification of concessions with respect to rice provided for in EC Schedule CXL annexed to GATT 1994 (for Thailand) |

| Tariff quota period | 1 January to 31 December |

| Tariff quota sub-periods | 1 January to 30 June 1 July to 31 August 1 September to 31 December |

| Licence application | In accordance with Articles 6, 7 and 8 of this Regulation |

| Product description | Wholly milled or semi-milled rice |

| Origin | Thailand |

| Proof of origin at licence application. If yes, body authorised to issue it | No |

| Proof of origin for release into free circulation | Yes. In accordance with Article 61 of Regulation (EU) No 952/2013 |

| Quantity in kilograms | 5 513 000 kg, divided as follows:

|

| CN codes | 1006 30 |

| In-quota customs duty | EUR 0 |

| Proof of trade | Yes. 25 tonnes |

| Security for import licence | EUR 46 per 1 000 kg |

| Specific entries to be made on the licence application and on the licence | Section 8 of the import licence application and of the import licence shall indicate the country of origin; box ‘yes’ in that section shall be crossed |

| Period of validity of a licence | In accordance with Article 13 of this Regulation |

| Tansferability of licence | Yes |

| Reference quantity | No |

| Operator registered in LORI database | No |

| Specific conditions | No |

| Order number | 09.4116 |

| International agreement or other act | Council Decision 94/800/EC of 22 December 1994 concerning the conclusion on behalf of the European Community, as regards matters within its competence, of the agreements reached in the Uruguay Round multilateral negotiations (1986-1994) |

| Tariff quota period | 1 January to 31 December |

| Tariff quota sub-periods | 1 January to 30 June 1 July to 31 August 1 September to 31 December |

| Licence application | In accordance with Articles 6, 7 and 8 of this Regulation |

| Product description | Wholly milled or semi-milled rice |

| Origin | United States of America |

| Proof of origin at licence application. If yes, body authorised to issue it | No |

| Proof of origin for release into free circulation | Yes. In accordance with Article 61 of Regulation (EU) No 952/2013 |

| Quantity in kilograms | 2 388 000 kg, divided as follows:

|

| CN codes | 1006 30 |

| In-quota customs duty | EUR 0 |

| Proof of trade | Yes. 25 tonnes |

| Security for import licence | EUR 46 per 1 000 kg |

| Specific entries to be made on the licence application and on the licence | Section 8 of the import licence application and of the import licence shall indicate the country of origin; box ‘yes’ in that section shall be crossed |

| Period of validity of the licence | In accordance with Article 13 of this Regulation |

| Transferability of licence | Yes |

| Reference quantity | No |

| Operator registered in LORI database | No |

| Specific conditions | No |

| Order number | 09.4117 |

| International agreement or other act | Council Decision 94/800/EC of 22 December 1994 concerning the conclusion on behalf of the European Community, as regards matters within its competence, of the agreements reached in the Uruguay Round multilateral negotiations (1986-1994) |

| Tariff quota period | 1 January to 31 December |

| Tariff quota sub-periods | 1 January to 30 June 1 July to 31 August 1 September to 31 December |

| Licence application | In accordance with Articles 6, 7 and 8 of this Regulation |

| Product description | Wholly milled or semi-milled rice |

| Origin | India |

| Proof of origin at licence application. If yes, body authorised to issue it | No |

| Proof of origin for release into free circulation | Yes. In accordance with Article 61 of Regulation (EU) No 952/2013 |

| Quantity in kilograms | 1 769 000 kg, divided as follows:

|

| CN codes | 1006 30 |

| In-quota customs duty | EUR 0 |

| Proof of trade | Yes. 25 tonnes |

| Security for import licence | EUR 46 per 1 000 kg |

| Specific entries to be made on the licence application and on the licence | Section 8 of the import licence application and of the import licence shall indicate the country of origin; box ‘yes’ in that section shall be crossed |

| Period of validity of a licence | In accordance with Article 13 of this Regulation |

| Transferability of licence | Yes |

| Reference quantity | No |

| Operator registered in LORI database | No |

| Specific conditions | No |

| Order number | 09.4118 |

| International agreement or other act | Council Decision 94/800/EC of 22 December 1994 concerning the conclusion on behalf of the European Community, as regards matters within its competence, of the agreements reached in the Uruguay Round multilateral negotiations (1986-1994) |

| Tariff quota period | 1 January to 31 December |

| Tariff quota sub-periods | 1 January to 30 June 1 July to 31 August 1 September to 31 December |

| Licence application | In accordance with Articles 6, 7 and 8 of this Regulation |

| Product description | Wholly milled or semi-milled rice |

| Origin | Pakistan |

| Proof of origin at licence application. If yes, body authorised to issue it | No |

| Proof of origin for release into free circulation | Yes. In accordance with Article 61 of Regulation (EU) No 952/2013 |

| Quantity in kilograms | 1 595 000 kg, divided as follows:

|

| CN codes | 1006 30 |

| In-quota customs duty | EUR 0 |

| Proof of trade | Yes. 25 tonnes |

| Security for import licence | EUR 46 per 1 000 kg |

| Specific entries to be made on the licence application and on the licence | Section 8 of the import licence application and of the import licence shall indicate the country of origin; box ‘yes’ in that section shall be crossed |

| Period of validity of a licence | In accordance with Article 13 of this Regulation |

| Transferability of licence | Yes |

| Reference quantity | No |

| Operator registered in LORI database | No |

| Specific conditions | No |

| Order number | 09.4119 |

| International agreement or other act | Council Decision 94/800/EC of 22 December 1994 concerning the conclusion on behalf of the European Community, as regards matters within its competence, of the agreements reached in the Uruguay Round multilateral negotiations (1986-1994) |

| Tariff quota period | 1 January to 31 December |

| Tariff quota sub-periods | 1 January to 30 June 1 July to 31 August 1 September to 31 December |

| Licence application | In accordance with Articles 6, 7 and 8 of this Regulation |

| Product description | Wholly milled or semi-milled rice |

| Origin | Other origins (except India, Pakistan, Thailand, United States of America |

| Proof of origin at licence application. If yes, body authorised to issue it | No |

| Proof of origin for release into free circulation | Yes. In accordance with Article 61 of Regulation (EU) No 952/2013 |

| Quantity in kilograms | 3 435 000 kg, divided as follows:

|

| CN codes | 1006 30 |

| In-quota customs duty | EUR 0 |

| Proof of trade | Yes. 25 tonnes |

| Security for import licence | EUR 46 per 1 000 kg |

| Specific entries to be made on the licence application and on the licence | Section 8 of the import licence application and of the import licence shall indicate the country of origin; box ‘yes’ in that section shall be crossed |

| Period of validity of a licence | In accordance with Article 13 of this Regulation |

| Transferability of licence | Yes |

| Reference quantity | No |

| Operator registered in LORI database | No |

| Specific conditions | No |

| Order number | 09.4127 |

| International agreement or other act | Council Decision 94/800/EC of 22 December 1994 concerning the conclusion on behalf of the European Community, as regards matters within its competence, of the agreements reached in the Uruguay Round multilateral negotiations (1986-1994) |

| Tariff quota period | 1 January to 31 December |

| Tariff quota sub-periods | 1 January to 31 March 1 April to 30 June 1 July to 31 August 1 September to 30 September |

| Licence application | In accordance with Articles 6, 7 and 8 of this Regulation |

| Product description | Wholly milled or semi-milled rice |

| Origin | United States of America |

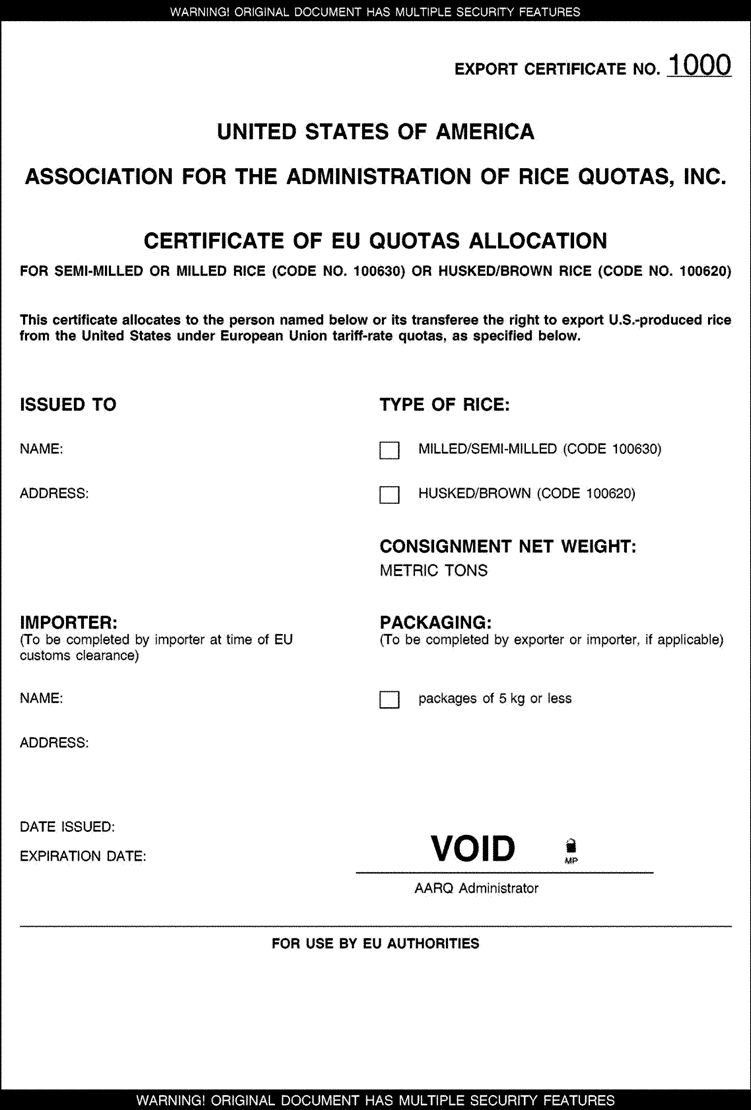

| Proof of origin at licence application. If yes, body authorised to issue it | Export certificate in accordance with the model set out in Annex XIV.2 to this Regulation |

| Proof of origin for release into free circulation | No |

| Quantity in kilograms | 38 721 000 kg, divided as follows:

|

| CN codes | 1006 30 |

| In-quota customs duty | EUR 0 |

| Proof of trade | Yes. 25 tonnes |

| Security for import licence | EUR 46 per 1 000 kg |

| Specific entries to be made on the licence application and on the licence | Section 8 of the import licence application and of the import licence shall indicate the country of origin; box ‘yes’ in that section shall be crossed |

| Period of validity of a licence | In accordance with Articles 13 and 27 of this Regulation |

| Transferability of licence | Yes |

| Reference quantity | No |

| Operator registered in LORI database | No |

| Specific conditions | No |

| Order number | 09.4128 |

| International agreement or other act | Council Decision 2005/953/EC of 20 December 2005 on the conclusion of an agreement in the form of an Exchange of Letters between the European Community and Thailand pursuant to Article XXVIII of GATT 1994 relating to the modification of concessions with respect to rice provided for in EC Schedule CXL annexed to GATT 1994 (for Thailand) |

| Tariff quota period | 1 January to 31 December |

| Tariff quota sub-periods | 1 January to 31 March 1 April to 30 June 1 July to 31 August 1 September to 30 September |

| Licence application | In accordance with Articles 6, 7 and 8 of this Regulation |

| Product description | Wholly milled or semi-milled rice |

| Origin | Thailand |

| Proof of origin at licence application. If yes, body authorised to issue it | Export certificate in accordance with the model set out in Annex XIV.2 to this Regulation |

| Proof of origin for release into free circulation | No |

| Quantity in kilograms | 21 455 000 kg, divided as follows:

|

| CN codes | 1006 30 |

| In-quota customs duty | EUR 0 |

| Proof of trade | Yes. 25 tonnes |

| Security for import licence | EUR 46 per 1 000 kg |

| Specific entries to be made on the licence application and on the licence | Section 8 of the import licence application and of the import licence shall indicate the country of origin; box ‘yes’ in that section shall be crossed |

| Period of validity of a licence | In accordance with Articles 13 and 27 of this Regulation |

| Transferability of licence | Yes |

| Reference quantity | No |

| Operator registered in LORI database | No |

| Specific conditions | No |

| Order number | 09.4129 |

| International agreement or other act | Council Decision 94/800/EC of 22 December 1994 concerning the conclusion on behalf of the European Community, as regards matters within its competence, of the agreements reached in the Uruguay Round multilateral negotiations (1986-1994) |

| Tariff quota period | 1 January to 31 December |

| Tariff quota sub-periods | 1 January to 31 March 1 April to 30 June 1 July to 31 August 1 September to 30 September |

| Licence application | In accordance with Articles 6, 7 and 8 of this Regulation |

| Product description | Wholly milled or semi-milled rice |

| Origin | Australia |

| Proof of origin at licence application. If yes, body authorised to issue it | Export licence in accordance with the model set out in Annex XIV.2 to this Regulation |

| Proof of origin for release into free circulation | No |

| Quantity in kilograms | 1 019 000 kg, divided as follows:

|

| CN codes | 1006 30 |

| In-quota customs duty | EUR 0 |

| Proof of trade | Yes. 25 tonnes |

| Security for import licence | EUR 46 per 1 000 kg |

| Specific entries to be made on the licence application and on the licence | Section 8 of the import licence application and of the import licence shall indicate the country of origin; box ‘yes’ in that section shall be crossed |

| Period of validity of a licence | In accordance with Articles 13 and 27 of this Regulation |

| Transferability of a licence | Yes |

| Reference quantity | No |

| Operator registered in LORI database | No |

| Specific conditions | No |

| Order number | 09.4130 |

| International agreement or other act | Council Decision 94/800/EC of 22 December 1994 concerning the conclusion on behalf of the European Community, as regards matters within its competence, of the agreements reached in the Uruguay Round multilateral negotiations (1986-1994) |

| Tariff quota period | 1 January to 31 December |

| Tariff quota sub-periods | 1 January to 31 March 1 April to 30 June 1 July to 31 August 1 September to 30 September |

| Licence application | In accordance with Articles 6, 7 and 8 of this Regulation |

| Product description | Wholly milled or semi-milled rice |

| Origin | Other origins (except Australia, Thailand, United States of America) |

| Proof of origin at licence application. If yes, body authorised to issue it | No |

| Proof of origin for release into free circulation | Yes. In accordance with Article 61 of Regulation (EU) No 952/2013 |

| Quantity in kilograms | 1 805 000 kg, divided as follows:

|

| CN codes | 1006 30 |

| In-quota customs duty | EUR 0 |

| Proof of trade | Yes. 25 tonnes |

| Security for import licence | EUR 46 per 1 000 kg |

| Specific entries to be made on the licence application and on the licence | Section 8 of the import licence application and of the import licence shall indicate the country of origin; box ‘yes’ in that section shall be crossed |

| Period of validity of a licence | In accordance with Articles 13 and 27 of this Regulation |

| Transferability of licence | Yes |

| Reference quantity | No |

| Operator registered in LORI database | No |

| Specific conditions | No |

| Order number | 09.4138 |

| International agreement or other act | Council Decision 94/800/EC of 22 December 1994 concerning the conclusion on behalf of the European Community, as regards matters within its competence, of the agreements reached in the Uruguay Round multilateral negotiations (1986-1994) |

| Tariff quota period | 1 January to 31 December |

| Tariff quota sub-periods | 1 October to 31 December |

| Licence application | In accordance with Articles 6, 7 and 8 of this Regulation |

| Product description | Wholly milled or semi-milled rice |

| Origin | Erga omnes |

| Proof of origin at licence application. If yes, body authorised to issue it | No |

| Proof of origin for release into free circulation | No |

| Quantity in kilograms | Remaining quantity from order numbers 09.4127, 09.4128, 09.4129, 09.4130, not allocated in previous sub-periods |

| CN codes | 1006 30 |

| In-quota customs duty | EUR 0 |

| Proof of trade | Yes. 25 tonnes |

| Security for import licence | EUR 46 per 1 000 kg |

| Specific entries to be made on the licence application and on the licence | No |

| Period of validity of a licence | In accordance with Article 13 of this Regulation |

| Transferability of licence | Yes |

| Reference quantity | No |

| Operator registered in LORI database | No |

| Specific conditions | No |

| Order number | 09.4148 |

| International agreement or other act | Council Decision 94/800/EC of 22 December 1994 concerning the conclusion on behalf of the European Community, as regards matters within its competence, of the agreements reached in the Uruguay Round multilateral negotiations (1986-1994) |

| Tariff quota period | 1 January to 31 December |

| Tariff quota sub-periods | 1 January to 30 June 1 July to 30 September 1 October to 31 December |

| Licence application | In accordance with Articles 6, 7 and 8 of this Regulation |

| Product description | Husked rice |

| Origin | Erga omnes |

| Proof of origin at licence application. If yes, body authorised to issue it | No |

| Proof of origin for release into free circulation | No |

| Quantity in kilograms | 1 634 000 kg, divided as follows:

|

| CN codes | 1006 20 |

| In-quota customs duty | Ad valorem duty of 15 % |

| Proof of trade | No |

| Security for import licence | EUR 30 per 1 000 kg |

| Specific entries to be made on the licence application and on the licence | No |

| Period of validity of a licence | In accordance with Article 13 of this Regulation |

| Transferability of licence | Yes |

| Reference quantity | No |

| Operator registered in LORI database | No |

| Specific conditions | No |

| Order number | 09.4149 |

| International agreement or other act | Council Decision 2005/953/EC of 20 December 2005 on the conclusion of an agreement in the form of an Exchange of Letters between the European Community and Thailand pursuant to Article XXVIII of GATT 1994 relating to the modification of concessions with respect to rice provided for in EC Schedule CXL annexed to GATT 1994 (for Thailand) |

| Tariff quota period | 1 January to 31 December |

| Tariff quota sub-periods | 1 January to 30 June 1 July to 31 December |

| Licence application | In accordance with Articles 6, 7 and 8 of this Regulation |

| Product description | Broken rice |

| Origin | Thailand |

| Proof of origin at licence application. If yes, body authorised to issue it | Export certificate in accordance with the model set out in Annex XIV.2 to this Regulation |

| Proof of origin for release into free circulation | No |

| Quantity in kilograms | 52 000 000 kg, divided as follows:

|

| CN codes | 1006 40 00 |

| In-quota customs duty | 30,77 % duty reduction |

| Proof of trade | Yes. 25 tonnes |

| Security for import licence | EUR 5 per 1 000 kg |

| Specific entries to be made on the licence application and on the licence | Section 8 of the import licence application and of the import licence shall indicate the country of origin; box ‘yes’ in that section shall be crossed |

| Period of validity of a licence | In accordance with Article 13 of this Regulation |

| Transferability of licence | Yes |

| Reference quantity | No |

| Operator registered in LORI database | No |

| Specific conditions | No |

| Order number | 09.4150 |

| International agreement or other act | Council Decision 94/800/EC of 22 December 1994 concerning the conclusion on behalf of the European Community, as regards matters within its competence, of the agreements reached in the Uruguay Round multilateral negotiations (1986-1994) |

| Tariff quota period | 1 January to 31 December |

| Tariff quota sub-periods | 1 January to 30 June |

| 1 July to 31 December | |

| Licence application | In accordance with Articles 6, 7 and 8 of this Regulation |

| Product description | Broken rice |

| Origin | Australia |

| Proof of origin at licence application. If yes, body authorised to issue it | No |

| Proof of origin for release into free circulation | No |

| Quantity in kilograms | 16 000 000 kg, divided as follows:

|

| CN codes | 1006 40 00 |

| In-quota customs duty | 30,77 % duty reduction |

| Proof of trade | No |

| Security for import licence | EUR 5 per 1 000 kg |

| Specific entries to be made on the licence application and on the licence | Section 8 of the import licence application and of the import licence shall indicate the country of origin; box ‘yes’ in that section shall be crossed |

| Period of validity of a licence | In accordance with Article 13 of this Regulation |

| Transferability of licence | Yes |

| Reference quantity | No |

| Operator registered in LORI database | No |

| Specific conditions | No |

| Order number | 09.4153 |

| International agreement or other act | Council Decision 94/800/EC of 22 December 1994 concerning the conclusion on behalf of the European Community, as regards matters within its competence, of the agreements reached in the Uruguay Round multilateral negotiations (1986-1994) |

| Tariff quota period | 1 January to 31 December |

| Tariff quota sub-periods | 1 January to 30 June 1 July to 31 December |

| Licence application | In accordance with Articles 6, 7 and 8 of this Regulation |

| Product description | Broken rice |

| Origin | United States of America |

| Proof of origin at licence application. If yes, body authorised to issue it | No |

| Proof of origin for release into free circulation | No |

| Quantity in kilograms | 9 000 000 kg, divided as follows:

|

| CN codes | 1006 40 00 |

| In-quota customs duty | 30,77 % duty reduction |

| Proof of trade | Yes. 25 tonnes |

| Security for import licence | EUR 5 per 1 000 kg |

| Specific entries to be made on the licence application and on the licence | Section 8 of the import licence application and of the import licence shall indicate the country of origin; box ‘yes’ in that section shall be crossed |

| Period of validity of a licence | In accordance with Article 13 of this Regulation |

| Transferability of licence | Yes |

| Reference quantity | No |

| Operator registered in LORI database | No |

| Specific conditions | No |

| Order number | 09.4154 |

| International agreement or other act | Council Decision 94/800/EC of 22 December 1994 concerning the conclusion on behalf of the European Community, as regards matters within its competence, of the agreements reached in the Uruguay Round multilateral negotiations (1986-1994) |

| Tariff quota period | 1 January to 31 December |

| Tariff quota sub-periods | 1 January to 30 June 1 July to 31 December |

| Licence application | In accordance with Articles 6, 7 and 8 of this Regulation |

| Product description | Broken rice |

| Origin | Other origins (except Australia, Guyana, Thailand, United States of America) |

| Proof of origin at licence application. If yes, body authorised to issue it | No |

| Proof of origin for release into free circulation | Yes. In accordance with Article 61 of Regulation (EU) No 952/2013 |

| Quantity in kilograms | 12 000 000 kg, divided as follows:

|

| CN codes | 1006 40 00 |

| In-quota customs duty | 30,77 % duty reduction |

| Proof of trade | Yes. 25 tonnes |

| Security for import licence | EUR 5 per 1 000 kg |

| Specific entries to be made on the licence application and on the licence | Section 8 of the import licence application and of the import licence shall indicate the country of origin; box ‘yes’ in that section shall be crossed |

| Period of validity of a licence | In accordance with Article 13 of this Regulation |

| Transferability of licence | Yes |

| Reference quantity | No |

| Operator registered in LORI database | No |

| Specific conditions | No |

| Order number | 09.4166 |

| International agreement or other act | Council Decision 94/800/EC of 22 December 1994 concerning the conclusion on behalf of the European Community, as regards matters within its competence, of the agreements reached in the Uruguay Round multilateral negotiations (1986-1994) |

| Tariff quota period | 1 January to 31 December |

| Tariff quota sub-periods | 1 January to 30 June 1 July to 31 August 1 September to 31 December |

| Licence application | In accordance with Articles 6, 7 and 8 of this Regulation |

| Product description | Wholly milled or semi-milled rice |

| Origin | Erga omnes |

| Proof of origin at licence application. If yes, body authorised to issue it | No |

| Proof of origin for release into free circulation | No |

| Quantity in kilograms | 25 516 000 kg, divided as follows:

|

| CN codes | 1006 30 |

| In-quota customs duty | EUR 0 |

| Proof of trade | Yes. 25 tonnes |

| Security for import licence | EUR 46 per 1 000 kg |

| Specific entries to be made on the licence application and on the licence | No |

| Period of validity of a licence | In accordance with Article 13 of this Regulation |

| Transferability of licence | Yes |

| Reference quantity | No |

| Operator registered in LORI database | No |

| Specific conditions | No |

| Order number | 09.4168 |

| International agreement or other act | Council Decision 94/800/EC of 22 December 1994 concerning the conclusion on behalf of the European Community, as regards matters within its competence, of the agreements reached in the Uruguay Round multilateral negotiations (1986-1994) |

| Tariff quota period | 1 January to 31 December |

| Tariff quota sub-periods | 1 September to 30 September 1 October to 31 December |

| Licence application | In accordance with Articles 6, 7 and 8 of this Regulation |

| Product description | Broken rice |

| Origin | Erga omnes |

| Proof of origin at licence application. If yes, body authorised to issue it | No |

| Proof of origin for release into free circulation | No |

| Quantity in kilograms | 31 788 000 kg, divided as follows:

|

| CN codes | 1006 40 00 |

| In-quota customs duty | EUR 0 |

| Proof of trade | Yes. 25 tonnes |

| Security for import licence | EUR 5 per 1 000 kg |

| Specific entries to be made on the licence application and on the licence | No |

| Period of validity of a licence | In accordance with Article 13 of this Regulation |

| Transferability of licence | Yes |

| Reference quantity | No |

| Operator registered in LORI database | No |

| Specific conditions | No |

ANNEX IV Tariff quotas in the sector of sugar

| Order number | 09.4317 – WTO SUGAR QUOTAS |

| International agreement or other act | Council Regulation (EC) No 1095/96 of 18 June 1996 on the implementation of the concessions set out in Schedule CXL drawn up in the wake of the conclusion of the GATT XXIV.6 negotiations Council Decision 2006/106/EC of 30 January 2006 on the conclusion of an Agreement in the form of an Exchange of Letters between the European Community and Australia pursuant to Article XXIV:6 and Article XXVIII of the General Agreement on Tariffs and Trade (GATT) 1994 relating to the modification of concessions in the schedules of the Czech Republic, the Republic of Estonia, the Republic of Cyprus, the Republic of Latvia, the Republic of Lithuania, the Republic of Hungary, the Republic of Malta, the Republic of Poland, the Republic of Slovenia and the Slovak Republic in the course of their accession to the European Union |

| Tariff quota period | 1 October to 30 September |

| Tariff quota sub-periods | No |

| Licence application | In accordance with Articles 6, 7 and 8 of this Regulation |

| Product description | Raw cane sugar for refining |

| Origin | Australia |

| Proof of origin at licence application. If yes, body authorised to issue it | No |

| Proof of origin for release into free circulation | Yes. In accordance with Articles 57, 58 and 59 of Implementing Regulation (EU) 2015/2447 |

| Quantity in kilograms | 9 925 000 kg |

| CN codes | 1701 13 10 and 1701 14 10 |

| In-quota customs duty | EUR 98 per 1 000 kg Where the polarimetric reading of the imported raw sugar departs from 96 degrees, the rate of EUR 98 per 1 000 kg shall be increased or reduced, as appropriate, by 0,14 % per tenth of a degree difference established (in accordance with Article 34(1)(d) of this Regulation) |

| Proof of trade | Yes. 25 tonnes |

| Security for import licence | EUR 20 per 1 000 kg |

| Specific entries to be made on the licence application and on the licence | Section 8 of the import licence application and of the import licence shall indicate the country of origin; box ‘yes’ in that section shall be crossed Section 20 shall indicate ‘Sugar intended for refining’ and the text as set out in Annex XIV.3 Part A to this Regulation |

| Period of validity of a licence | Until the end of the third month following that in which they were issued but no longer than 30 September (in accordance with Article 32 of this Regulation) |

| Transferability of licence | Yes |

| Reference quantity | No |

| Operator registered in LORI database | No |

| Specific conditions | Refining obligation in accordance with Article 34 of this Regulation |

| Order number | 09.4318 – WTO SUGAR QUOTAS |

| International agreement or other act | Council Regulation (EC) No 1095/96 of 18 June 1996 on the implementation of the concessions set out in Schedule CXL drawn up in the wake of the conclusion of the GATT XXIV.6 negotiations Council Regulation (EC) No 1894/2006 of 18 December 2006 concerning the implementation of the Agreement in the form of an Exchange of Letters between the European Community and Brazil relating to the modification of concessions in the schedules of the Czech Republic, the Republic of Estonia, the Republic of Cyprus, the Republic of Latvia, the Republic of Lithuania, the Republic of Hungary, the Republic of Malta, the Republic of Poland, the Republic of Slovenia and the Slovak Republic in the course of accession to the European Community, amending and supplementing Annex I to Regulation (EEC) No 2658/87 on the tariff and statistical nomenclature and on the Common Customs Tariff Council Regulation (EC) No 880/2009 of 7 September 2009 concerning the implementation of the Agreement in the form of an Exchange of Letters between the European Community and Brazil pursuant to Article XXIV:6 and Article XXVIII of the General Agreement on Tariffs and Trade (GATT) 1994 relating to the modification of concessions in the schedules of the Republic of Bulgaria and Romania in the course of their accession to the European Union, amending and supplementing Annex I to Regulation (EEC) No 2658/87 on the tariff and statistical nomenclature and on the Common Customs Tariff Council Decision (EU) 2017/730 of 25 April 2017 on the conclusion of the Agreement in the form of an Exchange of Letters between the European Union and the Federative Republic of Brazil pursuant to Article XXIV:6 and Article XXVIII of the General Agreement on Tariffs and Trade (GATT) 1994 relating to the modification of concessions in the schedule of the Republic of Croatia in the course of its accession to the European Union |

| Tariff quota period | 1 October to 30 September |

| Tariff quota sub-periods | No |

| Licence application | In accordance with Articles 6, 7 and 8 of this Regulation |

| Product description | Raw cane sugar for refining |

| Origin | Brazil |

| Proof of origin at licence application. If yes, body authorised to issue it | No |

| Proof of origin for release into free circulation | Yes. In accordance with Articles 57, 58 and 59 of Implementing Regulation (EU) 2015/2447 |

| Quantity in kilograms | TRQ periods until 2023/2024: 334 054 000 kg TRQ periods from 2024/2025: 412 054 000 kg |

| CN codes | 1701 13 10 and 1701 14 10 |

| In-quota customs duty | EUR 98 per 1 000 kg Where the polarimetric reading of the imported raw sugar departs from 96 degrees, the rate of EUR 98 per 1 000 kg shall be increased or reduced, as appropriate, by 0,14 % per tenth of a degree difference established (in accordance with Article 34(1)(d) of this Regulation) |

| Proof of trade | Yes. 25 tonnes |

| Security for import licence | EUR 20 per 1 000 kg |

| Specific entries to be made on the licence application and on the licence | Section 8 of the import licence application and of the import licence shall indicate the country of origin; box ‘yes’ in that section shall be crossed Section 20 shall indicate ‘Sugar intended for refining’ and the text as set out in Annex XIV.3 Part A to this Regulation |

| Period of validity of a licence | Until the end of the third month following that in which they were issued but no longer than 30 September (in accordance with Article 32 of this Regulation) |

| Transferability of licence | Yes |

| Reference quantity | No |

| Operator registered in LORI database | No |

| Specific conditions | Refining obligation in accordance with Article 34 of this Regulation |

| Order number | 09.4319 – WTO SUGAR QUOTAS |

| International agreement or other act | Council Regulation (EC) No 1095/96 of 18 June 1996 on the implementation of the concessions set out in Schedule CXL drawn up in the wake of the conclusion of the GATT XXIV.6 negotiations Council Decision 2008/870/EC of 13 October 2008 on the conclusion of an Agreement in the form of an Exchange of Letters between the European Community and the republic of Cuba pursuant to Article XXIV:6 and Article XXVIII of the General Agreement on Tariffs and Trade (GATT) 1994 relating to the modification of concessions in the schedules of the Republic of Bulgaria and Romania in the course of their accession to the European Union |

| Tariff quota period | 1 October to 30 September |

| Tariff quota sub-periods | No |

| Licence application | In accordance with Articles 6, 7 and 8 of this Regulation |

| Product description | Raw cane sugar for refining |

| Origin | Cuba |

| Proof of origin at licence application. If yes, body authorised to issue it | No |

| Proof of origin for release into free circulation | Yes. In accordance with Articles 57, 58 and 59 of Implementing Regulation (EU) 2015/2447 |

| Quantity in kilograms | 68 969 000 kg |

| CN codes | 1701 13 10 and 1701 14 10 |

| In-quota customs duty | EUR 98 per 1 000 kg Where the polarimetric reading of the imported raw sugar departs from 96 degrees, the rate of EUR 98 per 1 000 kg shall be increased or reduced, as appropriate, by 0,14 % per tenth of a degree difference established (in accordance with Article 34(1)(d) of this Regulation) |

| Proof of trade | Yes. 25 tonnes |

| Security for import licence | EUR 20 per 1 000 kg |

| Specific entries to be made on the licence application and on the licence | Section 8 of the import licence application and of the import licence shall indicate the country of origin; box ‘yes’ in that section shall be crossed Section 20 shall indicate ‘Sugar intended for refining’ and the text as set out in Annex XIV.3 Part A to this Regulation |

| Period of validity of a licence | Until the end of the third month following that in which they were issued but no longer than 30 September (in accordance with Article 32 of this Regulation) |

| Transferability of licence | Yes |

| Reference quantity | No |

| Operator registered in LORI database | No |

| Specific conditions | Refining obligation in accordance with Article 34 of this Regulation |

| Order number | 09.4320 – WTO SUGAR QUOTAS |

| International agreement or other act | Council Regulation (EC) No 1095/96 of 18 June 1996 on the implementation of the concessions set out in Schedule CXL drawn up in the wake of the conclusion of the GATT XXIV.6 negotiations Council Decision 2009/718/EC of 7 September 2009 on the conclusion of an Agreement in the form of an Exchange of Letters between the European Community and Brazil pursuant to Article XXIV:6 and Article XXVIII of the General Agreement on Tariffs and Trade (GATT) 1994 relating to the modification of concessions in the schedules of the Republic of Bulgaria and Romania in the course of their accession to the European Union |

| Tariff quota period | 1 October to 30 September |

| Tariff quota sub-periods | No |

| Licence application | In accordance with Articles 6, 7 and 8 of this Regulation |

| Product description | Raw cane sugar for refining |

| Origin | Any third country |

| Proof of origin at licence application. If yes, body authorised to issue it | No |

| Proof of origin for release into free circulation | No |

| Quantity in kilograms | 289 977 000 kg |

| CN codes | 1701 13 10 and 1701 14 10 |

| In-quota customs duty | EUR 98 per 1 000 kg Where the polarimetric reading of the imported raw sugar departs from 96 degrees, the rate of EUR 98 per 1 000 kg shall be increased or reduced, as appropriate, by 0,14 % per tenth of a degree difference established (in accordance with Article 34(1)(d) of this Regulation) |

| Proof of trade | Yes. 25 tonnes |

| Security for import licence | EUR 20 per 1 000 kg |

| Specific entries to be made on the licence application and on the licence | Section 20 shall indicate ‘Sugar intended for refining’ and the text as set out in Annex XIV.3 Part A to this Regulation |

| Period of validity of the licence | Until the end of the third month following that in which they were issued but no longer than 30 September (in accordance with Article 32 of this Regulation) |

| Transferability of licence | Yes |

| Reference quantity | No |

| Operator registered in LORI database | No |

| Specific conditions | Refining obligation in accordance with Article 34 of this Regulation |

| Order number | 09.4321 – WTO SUGAR QUOTAS |

| International agreement or other act | Council Regulation (EC) No 1095/96 of 18 June 1996 on the implementation of the concessions set out in Schedule CXL drawn up in the wake of the conclusion of the GATT XXIV.6 negotiations Council Decision 75/456/EEC of 15 July 1975 on the conclusion of the Agreement between the European Economic Community and the Republic of India on cane sugar |

| Tariff quota period | 1 October to 30 September |

| Tariff quota sub-periods | No |

| Licence application | In accordance with Articles 6, 7 and 8 of this Regulation |

| Product description | Cane or beet sugar and chemically pure sucrose, in solid form |

| Origin | India |

| Proof of origin at licence application. If yes, body authorised to issue it | No |

| Proof of origin for release into free circulation | Yes. In accordance with Articles 57, 58 and 59 of Implementing Regulation (EU) 2015/2447 |

| Quantity in kilograms | 10 000 000 kg |

| CN codes | 1701 |

| In-quota customs duty | EUR 0 |

| Proof of trade | Yes. 25 tonnes |

| Security for import licence | EUR 20 per 1 000 kg |

| Specific entries to be made on the licence application and on the licence | Section 8 of the import licence application and of the import licence shall indicate the country of origin; box ‘yes’ in that section shall be crossed Section 20 shall indicate the text as set out in Annex XIV.3 Part A to this Regulation |

| Period of validity of a licence | Until the end of the third month following that in which they were issued but no longer than 30 September (in accordance with Article 32 of this Regulation) |

| Transferability of licence | Yes |

| Reference quantity | No |

| Operator registered in LORI database | No |

| Specific conditions | No |

| Order number | 09.4324 – BALKANS SUGAR |

| International agreement or other act | Council Decision 2009/330/EC of 15 September 2008 on the signing of a Protocol to the Stabilisation and Association Agreement between the European Communities and their Member States, of the one part, and the Republic of Albania, of the other part, to take account of the accession of the Republic of Bulgaria and Romania to the European Union Article 27(2) of the Stabilisation and Association Agreement between the European Communities and their Member States, of the one part, and the Republic of Albania, of the other part |

| Tariff quota period | 1 October to 30 September |

| Tariff quota sub-periods | No |

| Licence application | In accordance with Articles 6, 7 and 8 of this Regulation |

| Product description | Cane or beet sugar and chemically pure sucrose, in solid form and other sugars, including chemically pure lactose, maltose, glucose and fructose, in solid form; sugar syrups not containing added flavouring or colouring matter; artificial honey, whether or not mixed with natural honey; caramel |

| Origin | Albania |

| Proof of origin at licence application. If yes, body authorised to issue it | Export licence issued by the competent authority of the third country in accordance with Article 35 of this Regulation |

| Proof of origin for release into free circulation | No |

| Quantity in kilograms | 1 000 000 kg |

| CN codes | 1701 and 1702 |

| In-quota customs duty | EUR 0 |

| Proof of trade | Yes. 25 tonnes |

| Security for import licence | EUR 20 per 1 000 kg |