- Latest available (Revised)

- Point in Time (15/07/1996)

- Original (As enacted)

Stock Transfer Act 1963

You are here:

- UK Public General Acts

- 1963 c. 18

- Whole Act

- Previous

- Next

- Show Geographical Extent(e.g. England, Wales, Scotland and Northern Ireland)

- Show Timeline of Changes

More Resources

Changes over time for: Stock Transfer Act 1963

Version Superseded: 06/01/1997

Alternative versions:

- 01/02/1991- Amendment

- 02/11/1992- Amendment

- 01/04/1995- Amendment

- 01/08/1995- Amendment

- 15/07/1996- Amendment

- 15/07/1996

Point in time - 06/01/1997- Amendment

- 01/12/2001- Amendment

- 01/10/2004- Amendment

- 10/11/2004- Amendment

- 21/06/2006- Amendment

- 06/04/2008- Amendment

- 01/10/2009- Amendment

- 06/06/2013- Amendment

- 01/08/2014- Amendment

- 08/12/2017- Amendment

Status:

Point in time view as at 15/07/1996.

Changes to legislation:

There are currently no known outstanding effects for the Stock Transfer Act 1963.![]()

Changes to Legislation

Revised legislation carried on this site may not be fully up to date. At the current time any known changes or effects made by subsequent legislation have been applied to the text of the legislation you are viewing by the editorial team. Please see ‘Frequently Asked Questions’ for details regarding the timescales for which new effects are identified and recorded on this site.

Stock Transfer Act 1963

1963 CHAPTER 18

An Act to amend the law with respect to the transfer of securities.

[10th July 1963]

Modifications etc. (not altering text)

C1Act modified (10.2.2000) by 2000 c. iii, s. 13(3) (with s. 16)

Act modified (22.3.2001) by 2001 c. i, s. 10(3) (with s. 13)

Act modified (4.12.2001) by 2001 c. v, s. 11(2)

Act modified (with effect as mentioned in s. 4 of the amending Act) by 2002 c. iii, s. 10(2)

Act modified (with effect as mentioned in s. 4(1)(d) of the amending Act) by 2002 c. iv, s. 13(3)

Commencement Information

I1Act partly in force at Royal Assent see s. 6(2); Act wholly in force at 26.10.1963

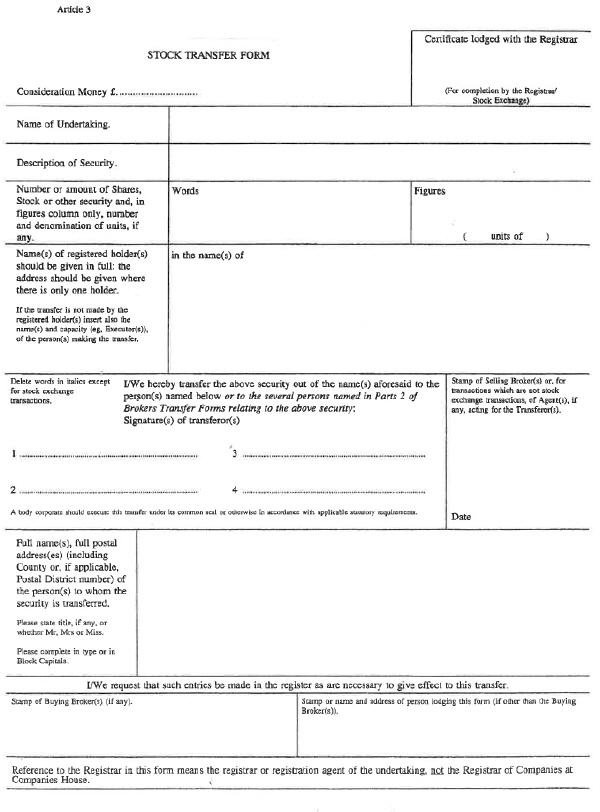

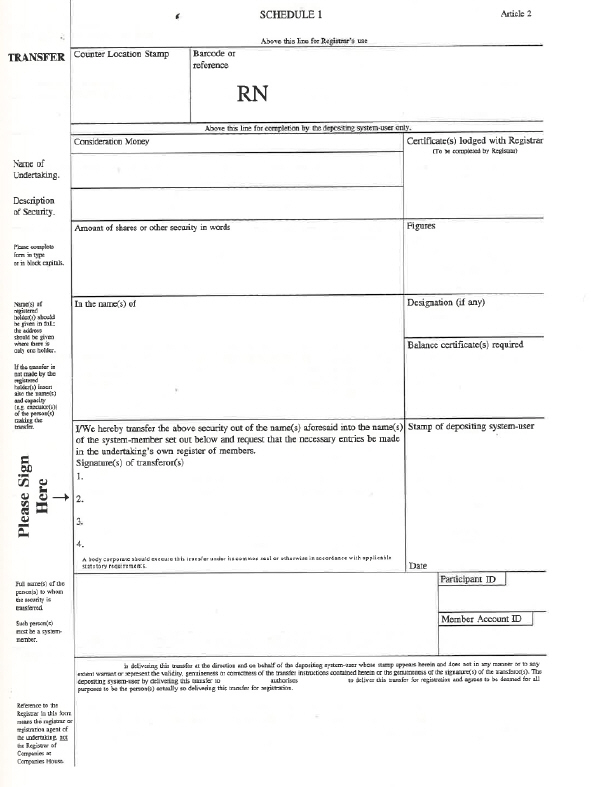

1 Simplified transfer of securities. U.K.

(1)Registered securities to which this section applies may be transferred by means of an instrument under hand in the form set out in Schedule 1 to this Act (in this Act referred to as a stock transfer), executed by the transferor only and specifying (in addition to the particulars of the consideration, of the description and number or amount of the securities, and of the person by whom the transfer is made) the full name and address of the transferee.

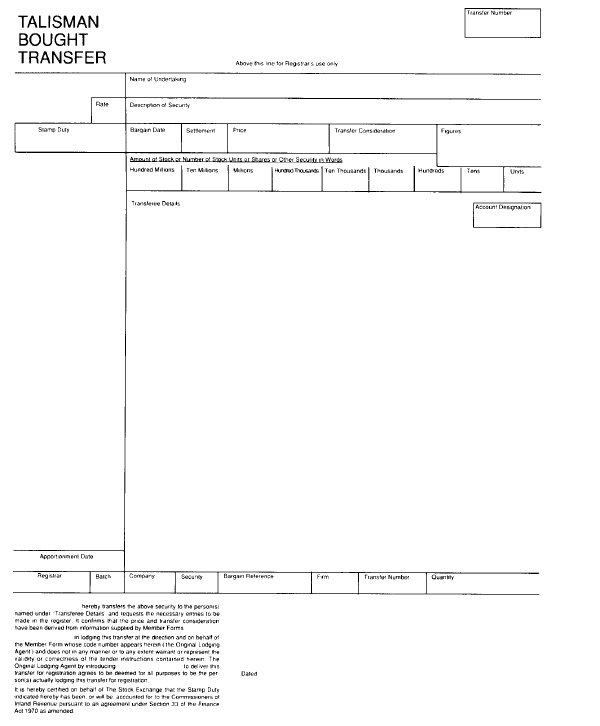

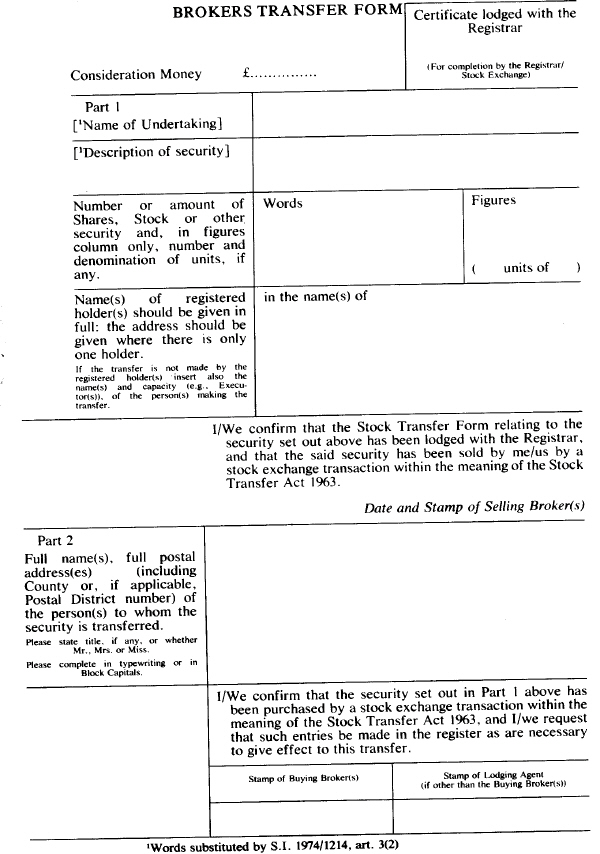

(2)The execution of a stock transfer need not be attested; and where such a transfer has been executed for the purpose of a stock exchange transaction, the particulars of the consideration and of the transferee may either be inserted in that transfer or, as the case may require, supplied by means of separate instruments in the form set out in Schedule 2 to this Act (in this Act referred to as brokers transfers), identifying the stock transfer and specifying the securities to which each such instrument relates and the consideration paid for those securities.

(3)Nothing in this section shall be construed as affecting the validity of any instrument which would be effective to transfer securities apart from this section; and any instrument purporting to be made in any form which was common or usual before the commencement of this Act, or in any other form authorised or required for that purpose apart from this section, shall be sufficient, whether or not it is completed in accordance with the form, if it complies with the requirements as to execution and contents which apply to a stock transfer.

(4)This section applies to fully paid up registered securities of any description, being—

(a)securities issued by any company within the meaning of the [F1Companies Act 1985] except a company limited by guarantee or an unlimited company;

(b)securities issued by any body (other than a company within the meaning of the said Act) incorporated in Great Britain by or under any enactment or by Royal Charter except a building society within the meaning of the M1Building Societies Act [F21986] or a society registered under [F3the M2Industrial and Provident Societies Act 1965;]

(c)securities issued by the Government of the United Kingdom, except stock or bonds in the [F4the National Savings Stock Register] . . . F5, and except national savings certificates;

(d)securities issued by any local authority;

[F6(e)units of an authorised unit trust scheme or a recognised scheme within the meaning of the Financial Services Act 1986].

Textual Amendments

F1Words substituted by Companies Consolidation (Consequential Provisions) Act 1985 (c. 9, SIF 27), ss. 21, 23, 30, 31(8), Sch. 2

F2 “1986” substituted by Building Societies Act 1986 (c. 53, SIF 16), ss. 54(3)(a)(5), 120, Sch. 18 Pt. I para. 5

F3Words substituted by virtue of Interpretation Act 1889 (c. 63), s. 38(1)

F4Words substituted by Post Office Act 1969 (c. 48), s. 108(1)(f)

F5Words repealed by Finance Act 1964 (c. 49), Sch. 9

F6S. 1(4)(e) substituted by Financial Services Act 1986 (c. 60, SIF 69), s. 212(2), Sch. 16 para. 4(a)

Modifications etc. (not altering text)

C2S. 1 amended by S.I. 1979/277, art. 3

C3S. 1 modified by S.I. 1990/18, art. 4

C4S. 1(3) modified by S.I. 1990/18, art. 3

Marginal Citations

2 Supplementary provisions as to simplified transfer.U.K.

(1)Section 1 of this Act shall have effect in relation to the transfer of any securities to which that section applies notwithstanding anything to the contrary in any enactment or instrument relating to the transfer of those securities; but nothing in that section affects—

(a)any right to refuse to register a person as the holder of any securities on any ground other than the form in which those securities purport to be transferred to him: or

(b)any enactment or rule of law regulating the execution of documents by companies or other bodies corporate, or any articles of association or other instrument regulating the execution of documents by any particular company or body corporate.

(2)Subject to the provisions of this section, any enactment or instrument relating to the transfer of securities to which section 1 of this Act applies shall, with any necessary modifications, apply in relation to an instrument of transfer authorised by that section as it applies in relation to an instrument of transfer to which it applies apart from this subsection; and without prejudice to the generality of the foregoing provision, the reference in [F7section 184 of the Companies Act 1985] (certification of transfers) to any instrument of transfer shall be construed as including a reference to a brokers transfer.

(3)In relation to the transfer of securities by means of a stock transfer and a brokers transfer—

(a)any reference in any enactment or instrument (including in particular [F7section 183(1) and (2) of the Companies Act 1985] . . . F8) to the delivery or lodging of an instrument (or proper instrument) of transfer shall be construed as a reference to the delivery or lodging of the stock transfer and the brokers transfer;

(b)any such reference to the date on which an instrument of transfer is delivered or lodged shall be construed as a reference to the date by which the later of those transfers to be delivered or lodged has been delivered or lodged; and

(c)subject to the foregoing provisions of this subsection, the brokers transfer (and not the stock transfer ) shall be deemed to be the conveyance or transfer for the purposes of the enactments related to stamp duty.

[F9(4)Without prejudice to subsection (1) of this section, section 1 of this Act shall have effect, in its application to Scotland, notwithstanding anything to the contrary in any enactment relating to the execution of instruments or the validity of instruments delivered with particulars left blank; but so much of subsection (2) of that section as provides that the execution of a stock transfer need not be attested shall not apply to a transfer executed in accordance with section 18 of the M3Conveyancing (Scotland) Act 1924 on behalf of a person who is blind or unable to write.]

Textual Amendments

F7Words substituted by Companies Consolidation (Consequential Provisions) Act 1985 (c. 9, SIF 27), ss. 21, 23, 30, 31(8), Sch. 2

F8Words repealed by Finance Act 1990 (c. 29, SIF 114), s. 132, Sch. 19 Pt. VI (subject to the provisions at the end of that Part) and expressed to be repealed (27.7.1999 with effect as mentioned in Sch. 20 Pt. V(5) of 1999 c. 16) by 1999 c. 16, s. 139, Sch. 20 Pt. V(5), Notes 1, 2

F9S. 2(4) repealed (S.) (1.8.1995) by 1995 c. 7, ss. 14(2), 15(2), Sch. 5 (with ss. 9(3)(5)(7), 13, 14(3))

Marginal Citations

3 Additional provisions as to transfer forms.U.K.

(1)References in this Act to the forms set out in Schedule 1 and Schedule 2 include references to forms substantially corresponding to those forms respectively.

(2)The Treasury may by order amend the said Schedules either by altering the forms set out therein or by substituting different forms for those forms or by the addition of forms for use as alternatives to those forms; and references in this Act to the forms set out in those Schedules (including references in this section) shall be construed accordingly.

(3)Any order under subsection (2) of this section which substitutes a different form for a form set out in Schedule 1 to this Act may direct that subsection (3) of section 1 of this Act shall apply, with any necessary modifications, in relation to the form for which that form is substituted as it applies to any form which was common or usual before the commencement of this Act.

(4)Any order of the Treasury under this section shall be made by statutory instrument, and may be varied or revoked by a subsequent order; and any statutory instrument made by virtue of this section shall be subject to annulment in pursuance of a resolution of either House of Parliament.

[F10(5)An order under subsection (2) of this section may—

(a)provide for forms on which some of the particulars mentioned in subsection (1) of section 1 of this Act are not required to be specified;

(b)provide for that section to have effect, in relation to such forms as are mentioned in the preceding paragraph or other forms specified in the order, subject to such amendments as are so specified (which may include an amendment of the reference in subsection (1) of that section to an instrument under hand);

(c)provide for all or any of the provisions of the order to have effect in such cases only as are specified in the order.]

Textual Amendments

4 Interpretation.U.K.

(1)In this Act the following expressions have the meanings hereby respectively assigned to them, that is to say—

“local authority” means, in relation to England and Wales, any authority being, within the meaning of the Local Loans Act 1875, an authority having power to levy a rate

[F11[F12(a)a billing authority or a precepting authority, as defined in section 69 of the Local Government Finance Act 1992;

(aa)[F13a combined police authority or] a combined fire authority, as defined in section 144 of the M4Local Government Finance Act 1988;]

(b)a levying body within the meaning of section 74 of that Act; and

F11(c)a body as regards which section 75 of that Act applies.] and, in relation to Scotland, a county council, a town council and any statutory authority, commissioners or trustees to whom section 270 of the M5Local Government (Scotland) Act 1947 applies;

“registered securities” means transferable securities the holders of which are entered in a register (whether maintained in Great Britain or not);

“securities” means shares, stock, debentures, debenture stock, loan stock, bonds, units of a [F14collective investment scheme within the meaning of the Financial Services Act 1986], and other securities of any description;

“stock exchange transaction” means a sale and purchase of securities in which each of the parties is a member of a stock exchange acting in the ordinary course of his business as such or is acting through the agency of such a member;

“stock exchange” means the Stock Exchange, London, and any other stock exchange (whether in Great Britain or not) which is declared by order of the Treasury to be a recognised stock exchange for the purposes of this Act.

(2)Any order of the Treasury under this section shall be made by statutory instrument, and may be varied or revoked by a subsequent order.

Textual Amendments

F11S. 4(1): in definition of "local authority" paras. (a)(b)(c) substituted (E.W.) (1.4.1990) for words by S.I. 1990/776, art. 8, Sch. 3 para. 8

F12S. 4(1): in definition of "local authority" paras. (a)(aa) substituted (2.11.1992) for para. (a) by Local Government Finance Act 1992 (c. 14), s. 117(1), Sch. 13 para. 12; S.I. 1992/2454, art. 2.

F13Words in s. 4(1) repealed ((E.W.) 1.4.1995 and otherwiseprosp.) by 1994 c. 29, ss. 93, 94(1), Sch. 9 Pt.I; S.I. 1994/3262, art. 4,Sch.

F14Words substituted by Financial Services Act 1986 (c. 60, SIF 69), s. 212(2), Sch. 16 para. 4(b)

Marginal Citations

5 Application to Northern Ireland.U.K.

(1)This Act, so far as it applies to things done outside Great Britain, extends to Northern Ireland.

(2)Without prejudice to subsection (1) of this section, the provisions of this Act affecting securities issued by the Government of the United Kingdom shall apply to any such securities entered in a register maintained in Northern Ireland.

(3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F15

(4)Except as provided by this section, this Act shall not extend to Northern Ireland.

Textual Amendments

Modifications etc. (not altering text)

C5S. 5(1)(2) applied to s. 3(5) of this Act by Stock Exchange (Completion of Bargains) Act 1976 (c. 47), ss. 6(2), 7(4)

6 Short title and commencement.U.K.

(1)This Act may be cited as the Stock Transfer Act 1963.

(2)Subsection (3) of section 5 of this Act shall come into force on the passing of this Act, and the remaining provisions of this Act shall come into force on such date as the Treasury may by order made by statutory instrument direct.

Modifications etc. (not altering text)

C626.10.1963 appointed under s. 6(2) by S.I. 1963/1592

SCHEDULES

Schedule IU.K.

Textual Amendments

F16Form substituted (15.7.1996) by S.I. 1996/1571, art. 3 Sch. 2

F17Form added (15.7.1996) to Sch. 1 by S.I. 1996/1571, art. 2 Sch. 1.

Section 1

Schedule 2U.K.

Options/Help

Print Options

PrintThe Whole Act

Legislation is available in different versions:

Latest Available (revised):The latest available updated version of the legislation incorporating changes made by subsequent legislation and applied by our editorial team. Changes we have not yet applied to the text, can be found in the ‘Changes to Legislation’ area.

Original (As Enacted or Made): The original version of the legislation as it stood when it was enacted or made. No changes have been applied to the text.

Point in Time: This becomes available after navigating to view revised legislation as it stood at a certain point in time via Advanced Features > Show Timeline of Changes or via a point in time advanced search.

See additional information alongside the content

Geographical Extent: Indicates the geographical area that this provision applies to. For further information see ‘Frequently Asked Questions’.

Show Timeline of Changes: See how this legislation has or could change over time. Turning this feature on will show extra navigation options to go to these specific points in time. Return to the latest available version by using the controls above in the What Version box.

More Resources

Access essential accompanying documents and information for this legislation item from this tab. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as enacted version that was used for the print copy

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- correction slips

- links to related legislation and further information resources

Timeline of Changes

This timeline shows the different points in time where a change occurred. The dates will coincide with the earliest date on which the change (e.g an insertion, a repeal or a substitution) that was applied came into force. The first date in the timeline will usually be the earliest date when the provision came into force. In some cases the first date is 01/02/1991 (or for Northern Ireland legislation 01/01/2006). This date is our basedate. No versions before this date are available. For further information see the Editorial Practice Guide and Glossary under Help.

More Resources

Use this menu to access essential accompanying documents and information for this legislation item. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as enacted version that was used for the print copy

- correction slips

Click 'View More' or select 'More Resources' tab for additional information including:

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- links to related legislation and further information resources

The data on this page is available in the alternative data formats listed: