- Latest available (Revised)

- Point in Time (01/02/1991)

- Original (As enacted)

Finance Act 1968

You are here:

- UK Public General Acts

- 1968 c. 44

- Whole Act

- Previous

- Next

- Show Geographical Extent(e.g. England, Wales, Scotland and Northern Ireland)

- Show Timeline of Changes

More Resources

Changes over time for: Finance Act 1968

Version Superseded: 02/02/1991

Alternative versions:

Status:

Point in time view as at 01/02/1991.

Changes to legislation:

There are currently no known outstanding effects for the Finance Act 1968.![]()

Changes to Legislation

Revised legislation carried on this site may not be fully up to date. At the current time any known changes or effects made by subsequent legislation have been applied to the text of the legislation you are viewing by the editorial team. Please see ‘Frequently Asked Questions’ for details regarding the timescales for which new effects are identified and recorded on this site.

Finance Act 1968

1968 CHAPTER 44

An Act to grant certain duties, to alter other duties, and to amend the law relating to the National Debt and the Public Revenue, and to make further provision in connection with Finance.

[26th July 1968]

Commencement Information

I1Act partly in force at Royal Assent, partly retrospective, see individual sections; all provisions so far as unrepealed wholly in force at 1.2.1991. Some provisions came in to force at specific times of the day.

I2For the extent of this Act as regards Northern Ireland, see s. 61(9)

Finance Act 1968

1968 CHAPTER 44

An Act to grant certain duties, to alter other duties, and to amend the law relating to the National Debt and the Public Revenue, and to make further provision in connection with Finance.

[26th July 1968]

Part IU.K.

1

(1)(2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F1

(3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F2

(4). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F1

Textual Amendments

F1S. 1(1)(2)(4) repealed by Finance Act 1969 (c. 32), s. 61(6), Sch. 21 Pt. I

F2S. 1(3) repealed by Alcoholic Liquor Duties Act 1979 (c. 4), s. 92(2), Sch. 4 Pt. I

2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F3U.K.

Textual Amendments

F3S. 2 repealed by Hydrocarbon Oil (Customs & Excise) Act 1971 (c. 12), s. 24(2), Sch. 7

3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F4U.K.

Textual Amendments

F4S. 3 repealed by Finance Act 1973 (c. 51), s. 59(7), Sch. 22 Pt. I

4

(1). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F5

(2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F6

(3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F7

(4). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F6

Textual Amendments

F5S. 4(1) repealed by Finance Act 1970 (c. 24), s. 36(8), Sch. 8 Pt. II

F6S. 4(2)(4) repealed by Betting and Gaming Duties Act 1972 (c. 25), s. 29(2), Sch. 7

F7S. 4(3) repealed by Finance Act 1969 (c. 32), s. 61(6), Sch. 21 Pt. I

5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F8U.K.

Textual Amendments

F8S. 5 repealed by Finance Act 1972 (c. 41), ss. 54(8), 134(7), Sch. 28 Pt. II

6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F9U.K.

Textual Amendments

F9S. 6 repealed by Customs and Excise Management Act 1979 (c. 2), s. 177(3), Sch. 6 Pt. I

7. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F10U.K.

Textual Amendments

F10S. 7 repealed by Customs and Excise Duties (General Reliefs) Act 1979 (c. 3), s. 19(2), Sch. 3 Pt. I

8, 9.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F11U.K.

Textual Amendments

F11Ss. 8, 9 repealed by Vehicles (Excise) Act 1971 (c. 10), s. 39(5), Sch. 8 Pt. I

10

(1). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F12

(2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F13

Textual Amendments

F12S. 10(1) repealed by Finance Act 1969 (c. 32), s. 61(6), Sch. 21 Pt. I

F13S. 10(2) repealed by Excise Duties (Surcharges or Rebates) Act 1979 (c. 8), s. 4(3), Sch. 2

Part IIU.K.

11—22.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F14U.K.

Textual Amendments

F14Ss. 11–22 repealed by Income and Corporation Taxes Act 1970 (c. 10), ss. 538(1), 539(1), Sch. 16

23

(1)(2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F15

(3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F16

(4)(5). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F15

Textual Amendments

F15S. 23(1)(2)(4)(5) repealed by Income and Corporation Taxes Act 1970 (c. 10), ss. 538(1), 539(1), Sch. 16

F16S. 23(3) repealed by Finance Act 1974 (c. 30), s. 57, Sch. 14 Pt. VII

24—30.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F17U.K.

Textual Amendments

F17Ss. 24–30 repealed by Income and Corporation Taxes Act 1970 (c. 10), ss. 538(1), 539(1), Sch. 16

Part IIIU.K.

31. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F18U.K.

Textual Amendments

F18S. 31 repealed by Finance Act 1971 (c. 68), ss. 57(5), 69(7), Sch. 14 Pt. VII

32. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F19U.K.

Textual Amendments

F19S. 32 repealed (with savings) by Capital Gains Tax Act 1979 (c. 14), ss. 157(1), 158, Sch. 6 para. 10(2)(b), Sch. 8

33. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F20U.K.

Textual Amendments

F20S. 33 repealed by Income and Corporation Taxes Act 1970 (c. 10), ss. 538(1), 539(1), Sch. 16

34. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F21U.K.

Textual Amendments

F21S. 34 repealed (with savings) by Capital Gains Tax Act 1979 (c. 14), ss. 157(1), 158, Sch. 6 para. 10(2)(b), Sch. 8

35—37.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F22U.K.

Textual Amendments

F22S. 35–37 repealed (with savings) by Finance Act 1975 (c. 7), ss. 50, 52(2)(3), 59, Sch. 13 Pt. I

38, 39.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F23U.K.

Textual Amendments

F23Ss. 38, 39 repealed by Finance Act 1969 (c. 32), s. 61(6), Sch. 21 Pt. V

Betterment levyU.K.

40 Minerals: betterment levy, income tax and corporation tax. U.K.

(1)This section has effect as respects the power of making regulations under section 74 of the M1 Land Commission Act 1967 (power to adapt betterment levy for minerals by regulations requiring affirmative resolution of House of Commons) and has effect without prejudice to the generality of that section.

(2)The amount, rate and incidence of betterment levy in respect of mining leases (as defined by the regulations) may be altered by the regulations so that—

(a)betterment levy is charged from time to time by reference to the actual amount of the rents, royalties and other payments (including premiums) which are received or become receivable under the lease,

(b)the rate may be less than that prescribed under section 28 of the Land Commission Act 1967.

(c)the person chargeable in respect of any payment is, or is ascertained by reference to, the person entitled to the payment,

and the regulations may contain such transitional or other consequential provisions, including provisions making exceptions or modifications in Part III of the said Act of 1967. as may appear to the Minister making the regulations to be necessary or expedient.

(3)The regulations shall, as respects every mining lease, confer a right of election as respects the application to the mining lease of all provisions made in accordance with subsection (2) above so that—

(a)in the case of a mining lease granted on or after 6th April 1968, an election may be made in accordance with the regulations excluding the application of those provisions;

(b)in the case of a mining lease granted before that date, no such provisions shall apply unless an election is made in accordance with the regulations.

(4)—(7). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F24

(8)This section—

(a)so far as it relates to betterment levy, applies as respects any payment made before or after the passing of this Act, and shall be construed as one with Part III of the M2 Land Commission Act 1967.

(b),(c). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F24

(9). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F24

Textual Amendments

F24S. 40(4)–(7), (8)(b)(c), (9) repealed by Income and Corporation Taxes Act 1970 (c. 10), ss. 538(1), 539(1), Sch. 16

Modifications etc. (not altering text)

C1The text of ss, 40–50, 53, 60, 61(2)(7) and Schs. 15 and 16 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and, except as otherwise indicated, does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

Marginal Citations

Part IVU.K. The Special Charge

41 The special charge. U.K.

(1)In the case of an individual whose aggregate investment income for the year 1967–68 exceeded £3,000 plus the amount of his surtax personal allowances, there shall be made in accordance with the provisions of this Part of this Act a special charge in accordance with the following Table—

TABLE

For every pound of

| the first thousand pounds of the excess | 2 shillings |

| the next thousand pounds of the excess | 3 shillings |

| the next three thousand pounds of the excess | 6 shillings |

| the remainder of the excess | 9 shillings. |

(2)For the purposes of subsection (1) above the amount of an individual’s surtax personal allowances is the amount deductible from his total income for the year 1967–68 under section 14(1) of the M3 Finance Act 1957, without regard to subsection (2) of that section (apportionment between husband and wife).

(3)Subsection (1) above applies—

(a)to any individual domiciled in the United Kingdom in the year 1967–68, and

(b)to any individual not so domiciled, if he was resident and ordinarily resident in the United Kingdom in the year 1967–68, and had been ordinarily resident in the United Kingdom throughout the nine preceding years.

(4)The special charge shall not be made in the case of an individual who died before the end of the year 1967–68, but if a husband or wife died during the year 1967–68, this Part of this Act shall apply to the survivor as if during that year they had not been married.

(5)Schedule 15 to this Act shall have effect as respects trustees, including personal representatives, and income arising under a trust.

(6)Except as otherwise expressly provided expressions used in this Part of this Act have the same meanings as in the Income Tax Acts.

(7)This Part of this Act shall extend to Northern Ireland . . . F25.

Textual Amendments

F25Words repealed by Northern Ireland Constitution Act 1973 (c. 36), s. 41(1), Sch. 6 Pt. II

Modifications etc. (not altering text)

C2The text of ss, 40–50, 53, 60, 61(2)(7) and Schs. 15 and 16 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and, except as otherwise indicated, does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

Marginal Citations

42 Investment income. U.K.

(1)This section shall apply in ascertaining investment income and aggregate investment income for the purposes of this Part of this Act.

(2)Subject to the provisions of this Part of this Act, “investment income” means income from any source other than a source of earned income and other than income chargeable under Case VII of Schedule D (short-term capital gains), and the “aggregate investment income” of an individual shall be taken to be the aggregate of his investment income from all sources.

(3)Subject to the provisions of this Part of this Act, income from any source shall be ascertained as it is ascertained for the purposes of surtax, and income shall be treated as income of an individual if it would be so treated for the purposes of surtax.

(4)Investment income shall not include—

(a)income from investments (including land) which falls to be taken into account as a receipt in computing, in accordance with the provisions of the Income Tax Acts, the profits or gains of a trade, profession or vocation, or which would fall so to be taken into account but for the fact that it has been subjected to tax under other provisions of those Acts,

(b)any other income arising from a trade, profession or vocation carried on by an individual otherwise than in partnership, not being income specified in subsection (5) below.

(5)Investment income shall include income from investments (including land) held by or on behalf of the persons carrying on or exercising a trade, profession or vocation, not being income falling within subsection (4)(a) above.

(6)Investment income shall not include—

(a)any annuity purchased for an individual in pursuance of any direction in a will, or to provide for an annuity payable by virtue of a will or settlement out of income of property disposed of by the will or settlement. or

(b)royalties or other sums paid for or in respect of—

(i)the copyright in a literary, dramatic, musical or artistic work, or

(ii)the use of a patent,

where the copyright or patent or the right to receive such sums has devolved by will or on intestacy on the death of the author or inventor, and the recipient took on that death or after one or more further devolutions on death, or

(c)any amount as being a sum charged to surtax under section 242 of the M4 Income Tax Act 1952 (consideration for certain restrictive covenants, etc.).

(7)Subject to the following provisions of this section. in ascertaining aggregate investment income any deduction in respect of interest, annuities or other annual payments allowable in computing the individual’s total income for the year 1967–68 for surtax shall be allowed as a deduction.

(8)In ascertaining aggregate investment income no deduction shall be allowed in respect of—

(a)payments of any of the descriptions in subsections (1), (2), (3) and (4) of section 23 of the M5 Finance Act 1966 (whether or not the disposition was made after 6th April 1965),

(b)periodical payments allowable as deductions in ascertaining total income for surtax, being payments—

(i)in pursuance of an order of any court for the payment of maintenance or aliment or in pursuance of an affiliation order or a decree of affiliation and aliment, or

(ii)in pursuance of a disposition not made for full consideration in money or money’s worth,

or any other payments constituting income of the description in subsection (5) of section 23 of the Finance Act 1966 (whether or not the disposition was made after 6th April 1965),

(c)payments allowable as deductions in computing profits or gains of any description,

(d)any loss incurred in carrying on a trade, profession, employment or vocation, or in the occupation of woodlands in respect of which the person in question has elected to be charged to tax under Schedule D.

(9)Payments within paragraphs (a) and (b) of subsection (8) above shall not be treated as the income of any person other than the person making the payment.

(10)In ascertaining aggregate investment income the amount of any allowance under Part X of the M6 Income Tax Act 1952 (capital allowances) available or primarily available against a specified class of income for the year 1967–68 shall be allowed as a deduction, in so far only as the amount of the allowance does not exceed the individual’s investment income for that year of that class.

(11)In ascertaining aggregate investment income no deduction shall be allowed in respect of payments which are deemed under paragraph 9(1) of Schedule 21 to the Income Tax Act 1952 (underwriters’ payments into special reserve fund) to be annual payments, and the following (also relating to underwriters) shall not be treated as the income of any person, namely—

(a)payments deemed to be annual payments under sub-paragraph (2) or sub-paragraph (3) of the said paragraph 9,

(b)annual payments deemed to have been received under section 3(2) of the M7Finance (No. 2) Act 1955.

Modifications etc. (not altering text)

C3The text of ss, 40–50, 53, 60, 61(2)(7) and Schs. 15 and 16 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and, except as otherwise indicated, does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

Marginal Citations

43 Due date, interest and administration. U.K.

(1)Subject to the provisions of this Part of this Act, the special charge in respect of an individual’s aggregate investment income shall be made by assessment on that individual, and shall be payable by that individual.

(2)Subject to the provisions of this Part of this Act, the special charge shall be payable on or before 1st January 1969, or on the day next following the making of the assessment, whichever is the later.

(3)If all or any part of the special charge, whether already assessed or not, is not paid by 1st January 1969, it shall carry interest at the rate of four per cent. per annum from that date to the, date of payment:

Provided that interest shall not be payable on the special charge made by any assessment unless the total amount of the interest exceeds five pounds.

(4)The interest payable under subsection (3) above shall be paid without any deduction of income tax and shall be recoverable from the like persons as if it were part of the special charge in respect of which it is payable.

(5)So far as all or any part of the special charge carries interest from 1st January 1969 to the date when the special charge, or that part of it, becomes due, the grossed-up amount of that interest shall be allowable as a deduction in computing income for surtax for the year of assessment in which the interest is paid, but, subject to that, interest payable under subsection (3) above for any period shall not be allowable as a deduction for surtax or for any other purpose.

In this subsection the “grossed-up” amount of any interest is such amount as would, after deduction of tax at the standard rate for the year in which it is paid, equal the amount of interest paid.

(6)The special charge shall be under the care and management of the Board.

(7)Subject to the provisions of this Part of this Act, the special charge shall be assessed and recoverable as if it were an amount of surtax, and all enactments applying to the management and administration of income tax, including those relating to incapacitated persons and personal representatives, those relating to assessing, collecting and receiving of income tax and those conferring or regulating a right of appeal, shall apply accordingly.

(8)The Board shall have power by regulations contained in a statutory instrument subject to annulment in pursuance of a resolution of the Commons House of Parliament—

(a)to direct that any of the provisions applied by subsection (7) above shall have effect as may be prescribed by the regulations, and subject to such exceptions or modifications as may be so prescribed, and

(b)to make further provision for the management, administration and collection of the special charge and interest thereon, including provision for enabling any question which may affect the liability of two or more persons to pay the special charge in respect of any particular investment income to be determined for all those persons in the same proceedings.

(9)Where an assessment, or a decision on a claim, which under the provisions of this Part of this Act may affect the amount of an individual’s aggregate investment income has become final and conclusive for the purposes of the Income Tax Acts, it shall be final and conclusive for the purposes of this Part of this Act as to the amount of the income or relief in question.

(10)An assessment to the special charge in respect of an individual’s aggregate investment income may be made at any time if an assessment to surtax in respect of that individual’s total income for the year 1967–68 could be then made within the time limited by the Income Tax Acts for the making of assessments to surtax.

(11)The Board may, whether an assessment to the special charge has been made or not, by notice in writing require any person in whose case it appears to the Board that the special charge may be payable by, or recoverable from, him, and that he has in his possession any information relevant to the assessment or recovery of the special charge, to furnish to the Board within such time as may be specified in the notice, not being less than thirty days, such particulars as they consider necessary for the purposes of the assessment or recovery of the special charge.

[F26Part X of the Taxes Management Act 1970] (penalties) sha11 have effect as if this subsection were referred to in [F26column 1 of the Table in section 98 of that Act] and, subject to any modifications necessary for applying the said [F26Part X]to the special charge as it applies to income tax.

(12)Special Commissioners or other persons who have made declarations in the form in Part I of Schedule I to the M8Income Tax Management Act 1964, or in the amended form provided for in paragraph 16 of Schedule 10 to the M9Finance Act 1965, shall be subject to the same obligations as to secrecy with respect to the special charge as they are subject to with respect to income tax.

Textual Amendments

F26Words substituted by Income and Corporation Taxes Act 1970 (c. 10), s. 537(2), Sch. 15 para. 11 Pt. I

Modifications etc. (not altering text)

C4The text of ss, 40–50, 53, 60, 61(2)(7) and Schs. 15 and 16 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and, except as otherwise indicated, does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

Marginal Citations

44 Husband and wife. U.K.

(1)In ascertaining aggregate investment income, subsections (1), (2) and (4) of section 354 (wife’s income to be treated as that of her husband) and section 361 (separation, etc.) of the M10Income Tax Act 1952 shall apply as they apply for the purposes of income tax, but subject to the followin provisions of this section.

(2)Subsection (3) below shall apply in the case of a husband and wife—

(a)where application in that behalf is made either by the husband or the wife in such manner and form as may be prescribed by the Board, or

(b)where an application by the husband or wife under section 356 of the Income Tax Act 1952 for separate assessment to surtax has effect as respects the year 1967–68. unless notice in writing requiring that subsection (3) below shall not apply is given both by the husband and by the wife in such manner and form as may be prescribed by the Board:

Provided that no application or notice under this subsection shall be made or given after 5th October 1968 or such later date, not falling after the expiration of thirty days from the giving to the husband of a notice of the assessment to the special charge, as the Board may allow.

(3)Where the provisions of this subsection apply—

(a)the husband and wife shall be assessed under this Part of this Act, and the special charge shall be recoverable, as if they were not married, and this Part of this Act shall apply to each of them accordingly, but

(b)in ascertaining aggregate investment income for the purposes of this Part of this Act the income of the husband and wife shall be treated as the income of one individual, and

(c)the amount of the special charge payable by reference to the aggregate investment income so ascertained shall be divided between the husband and wife in proportion to the amounts of their respective aggregate investment incomes, after deducting the surtax personal allowances (that is to say the amount deductible under section 14(1) of the M11Finance Act 1957) apportioned in accordance with paragraph (d) below, and

(d)that apportionment shall be made—

(i)in the case of the allowances within subsection (2)(b)(i) of the said section 14 (allowances for certain children and dependants), according to the apportionment in the said sub-paragraph (i),

(ii)in the case of any other allowances, according to the respective amounts of the aggregate investment incomes of the husband and wife,

but so that, if the amount by which the aggregate investment income of either falls to be reduced under sub-paragraph (i) or (ii) of this paragraph exceeds the amount of that aggregate investment income, the aggregate investment income of the other shall be treated as reduced by the amount of the excess.

(4)Section 359 (collection from wife of tax assessed on husband attributable to her income) and section 360 (disclaimer by husband of liability for tax on deceased wife’s income) of the M12Income Tax Act 1952 shall apply with any necessary modifications for the purposes of the special charge as they apply for the purposes of income tax.

Modifications etc. (not altering text)

C5The text of ss, 40–50, 53, 60, 61(2)(7) and Schs. 15 and 16 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and, except as otherwise indicated, does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

Marginal Citations

M121952 e. 10.

45 Close companies. U.K.

–

(1)It is hereby declared that, subject to subsection (3) below, investment income includes any amount apportioned for purposes of surtax (whether originally or by one or more sub-apportionments) to an individual under section 78 of the M13Finance Act 1965.

(2)Subsection (5) of section 249 of the Income Tax Act 1952 as applied by the said section 78 (which, for surtax, prevents undistributed income which has been assessed and charged to surtax in pursuance of the said section 78 from being again assessed when distributed) shall apply for the purposes of computing investment income, but the other provisions of the said section 249 shall not apply for the purposes of this Part of this Act.

(3)The Board may, if they see reason for it, apportion the whole of the income of a close company for the accounting period ending in the year 1967–68, up to the amount of the required standard, among the participators, and any amount apportioned to another close company, whether originally or by one or more sub-apportionments under this subsection, shall be further apportioned among the participators in that company.

Any income apportioned to an individual under this subsection shall be included in his aggregate investment income.

(4)Where the Board have made an apportionment under subsection (3) above, any distribution made by the company and any apportionment of the company’s income for surtax shall be left out of account in ascertaining aggregate investment income for the purposes of the special charge.

(5)Subsection (3) above shall not apply in the case of a trading company or of a member of a trading group.

(6)Schedule 16 to this Act shall have effect for supplementing and giving effect to this section.

(7)For the purposes of this section and the said Schedule—

(a)“distribution” shall have the meaning assigned by Schedule 11 to the M14Finance Act 1965,

(b)“the required standard” has the meaning given by section 77(2) of the Finance Act 1965,

(c)other expressions shall be construed in accordance with the provisions of the Corporation Tax Acts relating to close companies.

(8)For the said purposes “the accounting period ending in the year 1967–68”, in relation to a close company—

(a)if there is one, and only one, accounting period of the company ending in the year 1967–68, and it is an accounting period of twelve months, means that accounting period,

(b)if not, means the parts of accounting periods, and any whole accounting periods, falling within the year 1967–68, apportioning income of any accounting period to the respective parts in accordance with section 89(6) of the Finance Act 1965.

Modifications etc. (not altering text)

C6The text of ss, 40–50, 53, 60, 61(2)(7) and Schs. 15 and 16 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and, except as otherwise indicated, does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

Marginal Citations

46 Relief where income attributable to period of years was received in 1967–68. U.K.

(1)Where, on a claim being made, the Board are satisfied as respects any assets that the income from the assets represents more than the income which would be attributable to a period of one full year if the income were deemed to have accrued from day to day, the Board shall in ascertaining aggregate investment income for the purposes of this Part of this Act make such reduction, if any, as may be appropriate to secure that there shall be taken as representing the income from the assets an amount equivalent to a full year’s income therefrom.

Section 240(1) of the M15Income Tax Act 1952 shall apply for the purposes of this subsection as it applies for the purposes of section 238 of that Act (corresponding provision for surtax).

(2)If an individual’s investment income includes an amount in respect of which a claim could be made for relief under section 472 of the Income Tax Act 1952 (spreading of patent royalties over several years) a claim may be made under this section requiring that amount to be reduced, in ascertaining the individual’s aggregate investment income, by multiplying by the fraction of which—

(a)the numerator is one, and

(b)the denominator is the six or less number of instalments into which that amount would be divided by a claim under the said section 472.

(3)If an individual’s investment income includes an amount in respect of which a claim could be made for relief under Schedule 6 to the M16Finance Act 1963 (premium, etc. treated as rent) a claim may be made under this section requiring that amount to be reduced, in ascertaining the individual’s aggregate investment income, to the yearly equivalent of that amount, as defined in paragraph 1 of the said Schedule 6, less any sums deductible under paragraph 3(1)(a) of the said Schedule 6.

(4)A claim for relief under this or either of the two next following sections—

(a)may be made by any person who has borne or is liable to bear the special charge in respect of the income in question, either by assessment or by a payment under Schedule 15 to this Act,

(b)shall be made to the Board,

(c)shall be made not later than the end of the year 1973–74, except that a claim which could not have been allowed but for the making of an assessment to the special charge in the year 1973–74 or a later year may be made at any time before the end of the year of assessment following that in which the assessment was made,

and [F27section 42 of the Taxes Management Act 1970] shall apply to the claim as it applies for the purposes of income tax.

(5)Where in pursuance of a claim for relief under this or either of the two next following sections any amount of the special charge is repaid, there shall also be repaid any interest paid in respect of that amount of the special charge.

Textual Amendments

F27Words substituted by Income and Corporation Taxes Act 1970 (c. 10), s. 537(2), Sch. 15 para. 11 Pt. I

Modifications etc. (not altering text)

C7The text of ss, 40–50, 53, 60, 61(2)(7) and Schs. 15 and 16 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and, except as otherwise indicated, does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

Marginal Citations

47 Relief where capital is subject to estate duty or capital gains tax. U.K.

(1)If on a claim being made it is shown to the satisfaction of the Board that—

(a)in consequence of a death occurring before the end of the year 1967–68 estate duty or capital gains tax became payable in respect of any assets, and

(b)investment income affecting, whether directly or indirectly, the amount of the special charge arose from the assets, and

(c)the amount of that income exceeded what it would have been if all estate duty and capital gains tax payable in consequence of the death had been paid immediately on the occurrence of the death or other event whereby the estate duty or capital gains tax became payable,

the amount of the said investment income shall in ascertaining aggregate investment income for the purposes of this Part of this Act be treated as reduced by such amount as the Board may determine to be appropriate to offset the excess.

(2)In this section “estate duty” includes estate duty payable under the law of Northern Ireland, and references to capital gains tax payable in consequence of a death shall be construed in accordance with subsection (8) and subsection (9)(a) of section 26 of the M17Finance Act 1965.

Modifications etc. (not altering text)

C8The text of ss, 40–50, 53, 60, 61(2)(7) and Schs. 15 and 16 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and, except as otherwise indicated, does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

Marginal Citations

48 Relief in respect of error or mistake, U.K.

If on a claim being made it is shown to the satisfaction of the Board that—

(a)by reason of an error or mistake in a return or statement made for the purpose of the special charge. or for the purpose of income tax (including surtax), an assessment to the special charge was excessive, or

(b)that after an assessment to the special charge became final, any adjustment was made under the provisions of the Income Tax Acts of any income which affected the ascertainment of aggregate investment income,

the Board shall make any appropriate adjustment.

Modifications etc. (not altering text)

C9The text of ss, 40–50, 53, 60, 61(2)(7) and Schs. 15 and 16 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and, except as otherwise indicated, does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

49 Double taxation relief. U.K.

(1)Part XIII of the M18Income Tax Act 1952 together with any other enactment relating or referring to double taxation relief, and any arrangements made under section 347 of that Act in relation to income tax, shall have effect in relation to the special charge and investment income as they are expressed to have effect in relation to income tax and income subject to income tax.

(2)In paragraph 5(1)(b) of Schedule 16 to the said Act (limit on total credit). as it applies to the total income for the year 1967–68 of an individual whose investment income is subject to the special charge, the sum of the rates there specified (effective income tax rate plus effective surtax rate) shall be increased for the purpose of allowing credit for foreign tax in respect of investment income by adding the rate ascertained by dividing the special charge by the amount of his aggregate investment income.

Modifications etc. (not altering text)

C10The text of ss, 40–50, 53, 60, 61(2)(7) and Schs. 15 and 16 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and, except as otherwise indicated, does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

Marginal Citations

50 Transactions designed to avoid liability. U.K.

(1)Where, as a result of any action or decision taken by any person on or after 19th March 1968, an individual’s aggregate investment income is, apart from this section, less by any amount than it would have been but for that action or decision, his aggregate investment income shall for the purposes of this Part of this Act be increased by that amount unless it is shown to the satisfaction of the Board that avoidance of, or reduction of liability to, the special charge was not the main object or one of the main objects of the action or decision.

(2)Without prejudice to the generality of subsection (1) above, the following shall be treated for the purposes of that subsection as actions or decisions as a result of which an individual’s aggregate investment income is less than it would have been but for the action or decision—

(a)the forgoing of any investment income to which the individual or his wife would otherwise have been entitled as income of the year 1967–68,

(b)the postponement of any entitlement to or receipt of investment income so as to prevent it from being income of the year 1967–68,

(c)the making of a settlement of which the individual or his wife is the settlor in consequence of which investment income becomes payable to any person or persons other than the individual or his wife,

(d)the incurring of any expenditure (including any liability to pay interest) which, but for this section, would affect the amount of the individual’s aggregate investment income.

(3)If it appears that the main benefit which might have been expected to accrue from the action or decision was the avoidance or reduction of liability either to the special charge, or to the special charge and surtax together, the avoidance or reduction of liability to special charge shall be deemed for the purposes of this section to have been the main object, or one of the main objects, of the action or decision.

(4)If it appears to the Board that any person has taken or may have taken any action or decision as a result of which an individual’s aggregate investment income is less than it would have been but for the action or decision, and that that person has in his possession any information relevant for the purpose of giving effect to this section, the Board may, whether an assessment to the special charge has been made or not, by notice in writing require that person to furnish to the Board within such time as may be specified in the notice, not being less than thirty days, such particulars as they consider necessary for that purpose.

[F28Part X of the Taxes Management Act 1970] shall have efect as if this subsection were referred to in [F28column 1 of the Table in section 99 of that Act] and, subject to any modifications necessary for applying the said [F28Part X] to the special charge as it applies to income tax.

(5)In this section “settlement” and “settlor” have the meanings given by section 403 of the Income Tax Act 1952.

Textual Amendments

F28Words substituted by Income and Corporation Taxes Act 1970 (c. 10), s. 537(2), Sch. 15 para. 11 Pt. I

Modifications etc. (not altering text)

C11The text of ss, 40–50, 53, 60, 61(2)(7) and Schs. 15 and 16 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and, except as otherwise indicated, does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

Part VU.K.

51

(1). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F29

(2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F30

(3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F29

(4). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F30

Textual Amendments

F29S. 51(1)(3) repealed by Finance Act 1969 (c. 32), s. 61(6), Sch. 21 Pt. VII

F30S. 51 (so far as unrepealed) repealed by Finance Act 1972 (c. 41), ss. 122(5), 134(7), Sch. 28 Pt. VIII

52. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F31U.K.

Textual Amendments

F31S. 52 repealed by Finance Act 1972 (c. 41), ss. 122(5), 134(7), Sch. 28 Pt. IX

Part VIU.K. Miscellaneous

53 Interest on overdue tax. U.K.

(1). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F32 in section 8(2) of the Finance (No. 2) Act 1947 (remission of interest for tax paid not later than three months from the date on which it becomes due and payable) for the words “three months" there shall be substituted the words “two months".

(2)Without prejudice to the general interpretative provisions of this Act, this section applies to the enactmemtns mentioned in subsection (1) above as extended by any other enactments, . . . F32

(3)This section has effect as respects tax becoming due and payable on or after 1st July 1968.

Textual Amendments

F32Words repealed by Income and Corporation Taxes Act 1970 (c. 10), ss. 538(1), 539(1), Sch. 16

Modifications etc. (not altering text)

C12The text of ss, 40–50, 53, 60, 61(2)(7) and Schs. 15 and 16 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and, except as otherwise indicated, does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

54 Premium savings bonds: increase of prize money.U.K.

(1)The terms of issue of premium savings bonds shall be altered by substituting for the prospectus relating to the issue of bonds of series B the provisions of Schedule 18 to this Act, being provisions which—

(a)increase the rate of interest at which the prize fund is calculated from 4½ per cent. to 45/8percent. (but subject, as in the existing prospectus, to a power of varying the rate of interest by giving not less than three months notice), and

(b)give effect to that increase in the rate of interest by providing for—

(i)a weekly draw of one £25,000 prize, and

(ii)an adjustment of the prizes on the monthly draw.

(2)Subsection (1) above shall come into force on 1st September 1968 and have effect as respects all bonds issued before that date, whether before or after the passing of this Act.

(3)If after the coming into force of subsection (1) above the Treasury issue premium savings bonds on the terms set out in the said Schedule to this Act, they may use any stock of forms of bonds which were prepared before the passing of this Act, notwithstanding that the forms refer to the prospectus superseded by subsection (1) above, and bonds issued in that form shall be valid and effectual as if they stated that the bond was issued under the terms in the said Schedule to this Act.

This subsection applies whether or not the bonds are issued after notice has been given, in pursuance of paragraph 15 in the said Schedule, of a variation of its terms.

(4)In this section “bonds of series B” means the second issue of premium savings bonds, and “” means both those issued under the M19National Loans Act 1939 and those issued under the M20National Loans Act 1968.

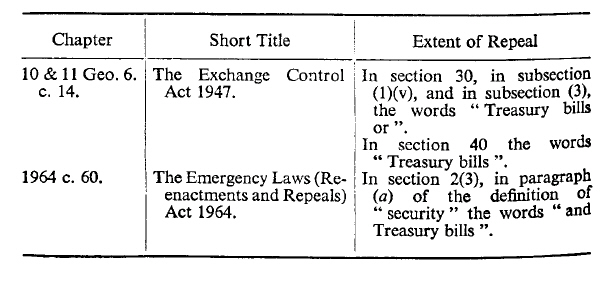

55 Exchange control. U.K.

(1)The definitions of . . . F33“security" . . . F33 in section 2(3) of the M21Emergency Laws (Re-enactments and Repeals) Act 1964 (power of Treasury to prohibit action on certain orders as to securities) shall include—

(a)certificates of deposit,

(b)Government bills, and

(c)any description of promissory notes which is for the time being prescribed under this paragraph for the purposes . . . F33 of the said section 2, . . . F33

(2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F34

(3)In this section—

“certificate of deposit” means a document relating to money, in any currency, which has been deposited with the issuer or some other person, being a document which recognises an obligation to pay a stated amount to bearer or to order, with or without interest, and being a document by the delivery of which, with or without endorsement, the right to receive that stated amount, with or without interest, is transferable,

“Government bill” means any bill, note or other obligation of a Government in any part of the world, being a document by the delivery of which, with or without endorsement, title is transferable, and not being an obligation which is or has been legal tender in any part of the world, and “Government bill” includes in particular a Treasury bill,

“prescribed”—

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F33 means prescribed by the Treasury by order in a statutory instrument subject to annulment in pursuance of a resolution of either House of Parliament,

and any such order may be varied or revoked by a subsequent order so made.

(4)This section has effect notwithstanding that the said definitions of . . . F33“security" exclude promissory notes.

(5)This section—

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F33 shall be construed as one with section 2 of that Act,

(6). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F33 this section shall apply outside the United Kingdom in the same way as. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F33, section 2 of the said Act of 1964, so applies.

Textual Amendments

F33Words repealed by Finance Act 1977 (c. 36), s. 59(5), Sch. 9 Pt. VI

F34S. 55(2) repealed by Finance Act 1977 (c. 36), Sch. 9 Pt. VI

Modifications etc. (not altering text)

C13S. 55 applied by Finance Act 1984 (c. 43), s. 27(3)(4), Sch. 8 paras. 3(8), 6(2), Finance Act 1985 (c. 54), s. 77, Sch. 23 Pt. I para. 1(2)(d) and Finance Act 1986 (c. 41), s. 31, Sch. 7 Pt. II para. 9

Marginal Citations

56. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F35U.K.

Textual Amendments

F35S. 56 repealed by Finance Act 1973 (c. 51), s. 59(7), Sch. 22 Pt. V

57. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F36U.K.

Textual Amendments

F36S. 57 repealed by Finance Act 1970 (c. 24), s. 36(8), Sch. 8 Pt. V

58. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F37U.K.

Textual Amendments

F37S. 58 repealed by European Communities Act 1972 (c. 68), s. 4, Sch. 3 Pt. II

59. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F38U.K.

Textual Amendments

F38S. 59 repealed by Finance Act 1971 (c. 68), s. 69(7), Sch. 14 Pt. VII

60 Provisional collection of taxes. U.K.

In section 1(4) of the Provisional Collection of Taxes Act 1968 M22 (circumstances in which a resolution ceases to have statutory effect) paragraph (b) (under which a resolution continues in force if a Bill is amended by the house so as to implement the resolution within twenty-five sitting days from the passing of the resolution) shall have effect as if after the words “is amended by the House" there were added the words “in Committee or on Report, or by any Standing Committee of the House".

Modifications etc. (not altering text)

C14The text of ss, 40–50, 53, 60, 61(2)(7) and Schs. 15 and 16 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and, except as otherwise indicated, does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

Marginal Citations

61 Citation, interpretation, construction, extent and repeals.U.K.

(1)This Act may be cited as the Finance Act 1968.

(2)In this Act, except where the context otherwise requires, “the Board” means the Commissioners of Inland Revenue.

(3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F39

(4). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F40

(5). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F41

(6). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F42

(7)This Act, so far as it relates to the M23Sugar Act 1956, shall extend to the Isle of Man.

(8)Any reference in this Act to any other enactment shall, except so far as the context otherwise requires, be construed as a reference to that enactment as amended or applied by or under any other enactment, including this Act.

(9)Except as otherwise expressly provided, such of the provisions of this Act as relate to matters in respect of which the Parliament of Northern Ireland has power to make laws shall not extend to Northern Ireland.

Textual Amendments

F39S. 61(3) repealed by Customs and Excise Management Act 1979 (c. 2), s. 177(3), Sch. 6 Pt. I

F40S. 61(4) repealed by Income and Corporation Taxes Act 1970 (c. 10), ss. 538(1), 539(1), Sch. 16

F41S. 61(5) repealed (with savings) by Capital Gains Tax Act 1979 (c. 14), ss. 157(1), 158, Sch. 6 para. 10(2)(b), Sch. 8

F42S. 61(6) repealed (with savings) by Finance Act 1975 (c. 7), ss. 50, 52(2)(3), 59, Sch. 13 Pt. I

Modifications etc. (not altering text)

C15The text of ss, 40–50, 53, 60, 61(2)(7) and Schs. 15 and 16 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and, except as otherwise indicated, does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

Marginal Citations

Schedules

Schedules 1—4.U.K. . . . F43

Textual Amendments

F43Schs. 1–4 repealed by Finance Act 1969 (c. 32), s. 61(6), Sch. 21 Pt. I

Schedule 5.U.K. . . . F44

Textual Amendments

F44Sch. 5 repealed by Betting and Gaming Duties Act 1972 (c. 25), s. 29(2), Sch. 7

Schedule 6.U.K. . . . F45

Textual Amendments

F45Sch. 6 repealed by Finance Act 1972 (c. 41), ss. 54(8), 134(7), Sch. 28 Pt. II

Schedule 7.U.K. . . . F46

Textual Amendments

F46Sch. 7 repealed by Vehicles (Excise) Act 1971 (c. 10), s. 39(5), Sch. 8 Pt. I

Schedules 8—10.U.K. . . . F47

Textual Amendments

Schedules 11, 12.U.K. . . . F48

Textual Amendments

F48Schs. 11, 12 repealed (with savings) by Capital Gains Tax Act 1979 (c. 14), ss. 157(1), 158, Sch. 6 para. s. 10(2)(b), Sch. 8

Schedule 13.U.K. . . . F49

Textual Amendments

Schedule 14.U.K. . . . F50

Textual Amendments

F50Sch. 14 repealed (with savings) by Finance Act 1975 (c. 7), ss. 50, 52(2)(3), 59, Sch. 13 Pt. I

Section 41.

Schedule 15.U.K. Special Charge: Trusts

Modifications etc. (not altering text)

C16The text of ss, 40–50, 53, 60, 61(2)(7) and Schs. 15 and 16 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and, except as otherwise indicated, does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

Income out of capital, etc.U.K.

1(1)The investment income of an individual arising under a trust shall be ascertained without regard to any part of it shown to the satisfaction of the Board to be attributable to payments duly made otherwise than out of the income of the trust.U.K.

(2)For the purposes of this paragraph the income of a trust shall be ascertained without regard to—

(a)income or deductions of any description which, under section 42 of this Act, are to be left out of account in ascertaining aggregate investment income, or

(b)income from another trust which is shown to the satisfaction of the Board to be attributable to payments duly made otherwise than out of the income of that trust,

and no deduction shall be made in respect of any payment made to a beneficiary under the trust or to any person claiming under such a beneficiary.

Recovery of charge from trusteesU.K.

2(1)If the person originally chargeable has not paid the special] charge or any part of it, and so elects as respects any trust—U.K.

(a)his liability to the special charge shall be reduced by the amount, if any, attributable to the trust, and

(b)the amount so attributable shall be chargeable on the person answerable for the trust.

(2)If the person originally chargeable has paid part only of the special charge he may nevertheless make an election in accordance with sub-paragraph (1) above, but the reduction under sub-paragraph (1)(a) above in respect of the trust, or, if more than one, of all the trusts together, shall not exceed the amount remaining unpaid.

(3)An election under this paragraph shall be made by notice in writing to the Board within thirty days from the date of the notice of assessment to the special charge or such longer time as the Board may allow, and shall not be effective unless the notice contains, to the satisfaction of the Board, sufficient particulars of the trust, the names and addresses of the persons answerable for the trust, and the amount of investment income arising under the trust to the person making the election.

(4)In this and the four next following paragraphs “trust" does not include a foreign trust.

3,(1)If the person originally chargeable has paid the whole of the special charge he may recover from the person answerable for a trust the amount, if any. attributable to that trust.U.K.

(2)If the person originally chargeable has paid the part of the special charge which is not attributable to any trust, and any additional amount, he may recover from the person answerable for a trust the amount, if any, attributable to that trust, but so that the total amount recoverable, and the amount recoverable from any one trust, shall not exceed that additional amount.

4U.K.If at any time after the expiration of thirty days from the date when the special charge became due, all or any part of the special charge remains due from the person originally chargeable, then, without prejudice to the powers of recovery from that person, the amount attributable to any trust may be charged on the person answerable for the trust, but not so as to charge more than is unpaid.

5U.K.The amount with which a person answerable for a trust is chargeable under paragraph 2 or paragraph 4 above shall be due and payable by him on the issue to him of a notice of charge by the Board, and an appeal shall lie against the notice of charge in the same way as an appeal lies against an assessment to the special charge.

Income derived from another trustU.K.

6(1)This paragraph has effect where all or part of an individual’s investment income arising under a trust (in this paragraph called “the first trust”) derives from another trust (in this paragraph called “the second trust”).U.K.

(2)If—

(a)the person originally chargeable has made an election under paragraph 2 above as respects the first trust, or

(b)any amount has become chargeable on the person answerable for the first trust in accordance with paragraph 4 above,

the person answerable for the first trust may elect that for all the purposes of this Schedule the individual’s investment income deriving from the second trust shall be treated as arising under that trust, and not under the first trust, and then any election under paragraph 2 above as respects the first trust shall take effect also as an election as respects the second trust.

An election under this sub-paragraph shall be made by notice in writing to the Board within thirty days from the date of the notice of charge on the person answerable for the first trust, or such longer time as the Board may allow, and shall not be effective unless the notice contains, to the satisfaction of the Board, sufficient particulars of the second trust, the names and addresses of the persons answerable for that trust, and the amount of the individual’s investment income deriving from that trust.

(3)If the person originally chargeable has made a claim for recovery of any amount under paragraph 3 above from the person answerable for the first trust, the person answerable for the first trust may by notice in writing to the person originally chargeable require that, as respects his rights of recovery, the individual’s investment income deriving from the second trust shall be treated as arising under that trust, and not under the first trust.

A notice under this sub-paragraph shall give particulars of the names and addresses of the persons answerable for the second trust, and of the amount of the individual’s investment income deriving from the second trust.

(4)Where income arising under the second trust derives from a third trust, the person answerable for the second trust shall have the rights conferred by this paragraph as respects that income, and so on for any further trust, and in such a case references in this paragraph to the first and second trust shall be construed accordingly.

(5)For the purposes of this paragraph the amount of the individual’s income which derives from the second trust shall be that fraction of his income arising under the first trust of which—

(a)the numerator is the income arising under the second trust to the trustees of the first trust, ascertained in accordance with paragraph 1(1) above,

(b)the denominator is the total income of the first trust, ascertained in accordance with paragraph 1(2) above.

Notice to persons answerable for a trustU.K.

7(1)The person originally chargeable shall not be entitled to exercise his right under paragraph 3 above unless, not later than six months after his payment of, or of the part of, the special charge or after the making of the assessment, whichever is the later, he gave notice in writing to the person answerable for the trust of his intention to exercise any right available to him under paragraph 3 above.U.K.

(2)If notice is so given, the person answerable for the trust shall not be entitled to give a notice under paragraph 6(3) above unless, not later than one month after the receipt of the notice under this paragraph, he has given notice in writing of its receipt to the person answerable for the second trust.

(3)If an application is made to the Board in accordance with the following provisions of this paragraph, showing to their satisfaction the amount of an individual’s investment income which arises under a trust, the Board shall give to the person originally chargeable, and to the person answerable for the trust, a certificate stating the amount of the special charge attributable to the trust, and, if less, the amount recoverable from the person answerable for the trust.

(4)An application under sub-paragraph (3) above—

(a)may be made by the person originally chargeable, if he has paid the whole of the special charge, or the part of the special charge which is not attributable to any trust together with an additional amount. but shall be made not later than six months after the payment, or after the making of the assessment, whichever is the later,

(b)may be made by the person answerable for the trust not later than one month after receipt of a notice under sub-paragraph (1) above, or as the case may be, of a notice under sub-paragraph (2) above.

Application of trust property in payment of chargeU.K.

8(1)The powers of a trustee or tenant for life (whether arising under the M24Settled Land Act 1925 or that Act as applied by section 28 of the M25Law of Property Act 1925, or otherwise) shall include a power to apply or direct the application of capital money, and to raise money by mortgage, for the purpose of paying the special charge, or interest on the special charge, of making payments in advance of assessment in or towards the special charge, and of discharging any liability arising under the preceding provisions of this Schedule.U.K.

(2)As between the persons interested (whether in income or capital) under a trust, the law relating to the ultimate incidence of estate duty shall apply to any amount falling to be paid under the preceding provisions of this Schedule in respect of income derived from property subject to the trust as if—

(a)that amount were estate duty charged on that property,

(b)estate duty was so charged on the cesser of a life interest in the property, occurring at the end of the year 1967–68, being an interest not subject to any interest in the property in fact existing under the trust, and

(c)that amount were charged as on property not passing to the executor as such :

Provided that as between any annuity, other than one by reason of which the said amount or any part thereof fell to be paid, and other interests, the amount shall be borne by the other interests to the exoneration of the annuity.

(3)Where the income derived from property referred to in sub-paragraph (2) above was a share only of income from the property, whether or not subject to other interests, that sub-paragraph shall apply as if the income so derived had been derived from a corresponding share of the property.

(4)This paragraph shall, in its application to Scotland, have effect as if for sub-paragraph (1) there were substituted the following sub-paragraph:—

“(1)For the purpose of paying the special charge, of making payments in advance of assessment in or towards the special charge, and of discharging any liability arising under the preceding provisions of this Schedule, a trustee, a liferenter or an heir of entail in possession shall have power to expend capital money and to sell, or to borrow money on the security of, the estate or any part thereof, heritable as well as moveable.”

(5)In the application of sub-paragraph (1) above to Northem Ireland, for the first reference to the M26Settled Land Act 1925 there shall be substituted a reference to the Settled Land Acts 1882 to 1890, and the reference to the said Act of 1925 as applied by the Law of Property Act 1925 shall be omitted.

Foreign trustsU.K.

9(1)If it is shown to the satisfaction of the Board—U.K.

(a)that any part of the special charge in respect of an individual’s aggregate investment income is directly or indirectly attributable to a foreign trust, and

(b)that neither the individual or his wife nor, if different, the person chargeable, nor the trustee of any intermediate trust which is not a foreign trust, was absolutely entitled, as against the trustees, to the capital of the trust, or to a part of the capital of the trust of an amount or value not less than the amount of the special charge so attributable, and

(c)that the income in question does not arise under a settlement in relation to which the individual or his wife is a settlor under any of the provisions of Part XVIII of the M27Income Tax Act 1952,

the Board shall relieve all persons of liability to that part of the special charge, by discharge or by repayment, and, as between the person originally chargeable and any person answerable for a trust any amount recovered in respect of that part of the special charge sball be repaid.

(2)For the purposes of this paragraph part of the special charge is directly or indirectly attributable to a foreign trust—

(a)if, in accordance with this Schedule, it is attributable to that trust, or

(b)if income of a trust which is not a foreign trust derives from the foreign trust, and part of the special charge would be attributable to the foreign trust if it were not a foreign trust and if an election were made under paragraph 6 of this Schedule.

(3)For the purposes of this paragraph—

(a)a trust is, in relation to a foreign trust, an intermediate trust if any part of the investment income arising under the trust derives, directly or indirectly, from the foreign trust,

(b)where a person has any rights or powers which could be exercised so as to make him absolutely entitled, as against the trustees, to the capital of the trust or any part of it, he shall be treated as absolutely entitled, as against the trustees, to the capital or that part of it.

Marginal Citations

Limitation of liability of trusteesU.K.

10(1)Where on a claim against a trustee or tenant for life made in pursuance of this Schedule by the Board or some other person it is shown to the satisfaction of the Board that the rights of indemnification of the trustee or tenant for life out of the trust estate are, otherwise than by negligence or default on his part, insufficient to provide for his reimbursement, the Board shall give such directions for the limitation or release of his liability as appear just and equitable.U.K.

(2)Sub-paragraph (1) above shall not apply to a claim against a trustee for any amount in respect of which the trustee could have made an election or given a notice under paragraph 6 of this Schedule.

(3)Where a person who has paid any part of the special charge proves to the satisfaction of the Board that by reason of directions under sub-paragraph (1) above he is deprived of the right to recover any amount in respect thereof, the Board shall repay that amount to him.

InterpretationU.K.

ll(1)The following provisions have effect for the interpretation of this Schedule in a case where the special charge falls to be made in respect of an individual’s aggregate investment income and that income includes any amount arising under a trust.U.K.

(2)For the purposes of this Schedule the amount of the special charge attributable to the trust shall be the fraction of the special charge of which—

(a)the numerator is the individual’s investment income arising under the trust, and

(b)the denominator is the individual’s aggregate investment income, ascertained before making any deduction under section 42(7) of this Act.

(3)Where credit for foreign tax falls to be allowed against the special charge, the amount of the special charge attributable to the trust shall be ascertained—

(a)by applying the fraction in sub-paragraph (2) above to the special charge without allowing the credit against the amount of the special charge, and

(b)by deducting from the resulting amount so much of the credit, if any, as is allowable in respect of income arising from the trust.

(4)For the said purposes “the person originally chargeable” means the individual or other person liable to pay the special charge apart from the provisions of this Schedule.

12(1)For the said purposes “the person answerable” for a trust is—U.K.

(a)in the case of a subsisting settlement within the meaning of the M28Settled Land Act 1925, or in Northern Ireland the Settled Land Acts 1882 to 1890, the tenant for fife,

(b)in the case of any other subsisting trust, the trustees.

(2)Where the trust has come to an end, “the person answerable” for the trust is the person who immediately after the trust came to an end was entitled in law to the trust property, either beneficially or as the trustee of property settled under another trust, and if more than one person was then so entitled, those persons shall be severally liable as persons answerable for the trust in proportion to the value of their interests therein.

(3)In applying sub-paragraph (2) above a person becoming entitled by virtue of a mortgage or charge, or in Scotland by virtue of the exercise of a power of sale contained in a bond and disposition in security, shall be disregarded, and sub-paragraph (2) above shall apply to the person or persons who would have been entitled in law to the trust property but for the mortgage or charge. or the exercise of the power of sale.

(4)For the purposes of this paragraph a trust shall be deemed to have come to an end when any person has become entitled thereunder to capital and the trust property has in consequence thereof become vested in that person or an assignee of his interest, and where part of the trust property has become so vested a proportionate part of the amount recoverable from the person answerable for the trust shall be recoverable from the person described in sub-paragraphs (2) and (3) above, and the remainder from the person described in sub-paragraph (1) above, and “subsisting” in relation to a settlement or trust shall be construed accordingly.

Marginal Citations

13(1)In this Schedule, unless the context otherwise requires—U.K.

a trust is a “foreign trust” if and only if the general administration of the trust is ordinarily carried on outside the United Kingdom and the trustees or a majority of them for the time being are not resident or not ordinarily resident in the United Kingdom,

“tenant for life” means, in relation to any settlement, any person who has the powers of a tenant for life under the M29Settled Land Act 1925 or in Northern Ireland under the Settled Land Acts 1882 to 1890,

“trustee” includes a personal representative and “trust” shall be construed accordingly,

and references to a trust do not include references to a trust constituted in pursuance of a unit trust scheme as defined in section 26(1) of the M30Prevention of Fraud (Investments) Act 1958 or section 22 of the M31Prevention of Fraud (Investments) Act (Northern Ireland) 1940.

(2)In this Schedule references to income of an individual arising under a trust include references to income from property subject to the trust which is treated as the income of that individual for income tax purposes generally, or for surtax.

(3)Where any property or fund is held as to different parts thereof on different trusts, this Schedule shall apply separately to each part.

Section 45.

Schedule 16.U.K. Special Charge: Close Companies

Modifications etc. (not altering text)

C17The text of ss, 40–50, 53, 60, 61(2)(7) and Schs. 15 and 16 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and, except as otherwise indicated, does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

Special ApportionmentsU.K.

1U.K.Subject to paragraph 2 below—

(a)any apportionment under Part IV of this Act of the income of a close company shall be made according to the respective interests of the participators in that company,

(b)any sub-apportionment under Part IV of this Act of income of one close company apportioned to another close company shall be made according to the respective interests of the participators in that other company.

2(1)In the case of any company—U.K.

(a)the provisos to section 258(3) of the M32Income Tax Act 1952 (beneficial interests in loans),

(b)section 259(1) of that Act (interests which would arise in a winding up), and

(c)section 260 of that Act, without subsection (5) (further provision as to underlying interests),

shall apply as they applied, in the case of an investment company, to apportionments for surtax under Chapter 111 of Part IX of that Act (a reference to a participator being substituted for any reference to a member or loan creditor).

(2)For the purposes of sub-paragraph (1) above, a loan creditor shall be deemed to have an interest in any company which is an investment company to the extent that the income to be apportioned or assets representing it is or have been expended or applied, or is or are available to be expended or applied. in redemption or repayment or discharge of the loan capital or debt (including any premium thereon) in respect of which he is a loan creditor.

In this sub-paragraph “investment company” means a company whose income consists wholly or mainly of investment income, construing “investment income” in accordance with paragraph 8(1) of Schedule 18 to the M33Finance Act 1965.

3(1)Notice of any apportionment (including any sub-apportionment) of the income of a close company under Part IV of this Act shall be given by serving on the company a statement showing the amount of the income of the company up to the required standard for the purposes of the apportionment, and either the amount apportioned to each participator or the amount apportioned to each class of shares, as the Board think fit.U.K.

(2)A company which is aggrieved by any such notice of apportionment shall be entitled to appeal to the Special Commissioners on giving notice to an officer of the Board within thirty days after the date of the notice.

Recovery of special charge from companyU.K.

4(1)This paragraph has effect where the special charge falls to be made in respect of an individual’s investment income and that income includes any amount–U.K.

(a)treated as part of his total income for surtax in consequence of an apportionment (with any sub-apportionment) of the income of a company under section 78 of the Finance Act 1965, or

(b)treated as part of his investment income in consequence of an apportionment (with any sub-apportionment) of the income of a close company under Part IV of this Act,

and in this paragraph “the apportioned income” means any amount falling within paragraph (a) or (b) above.

(2)If at the expiration of thirty days from the time when the special charge became due, any part of it remains unpaid, the Board may by notice in writing addressed to the company require the company to pay what then remained unpaid up to the following limit.

(3)The said limit is the fraction of the special charge falling to be made in respect of the individual’s aggregate investment income of which—

(a)the numerator is the apportioned income, and

(b)the denominator is the individual’s aggregate investment income, ascertained before making any deduction under section 42(7) of this Act.

(4)Where credit for foreign tax falls to be allowed against the special charge, the said limit shall be ascertained by applying the fraction in sub-paragraph (3) above to the special charge without allowing the credit against the amount of the special charge.

(5)Any sum required to be paid by a company in pursuance of the notice shall be payable on the day next following the giving of the notice, and the provisions of Part IV of this Act shall apply as if that amount had been assessed on the company.

Schedule 17.U.K. . . . F51

Textual Amendments

F51Sch. 17 repealed by Finance Act 1972 (c. 41), ss. 122(5), 134(7), Sch. 28 Pt. IX

SCHEDULE 18U.K. Premium Savings Bonds: New Terms

1U.K.Premium Savings Bonds are a Government Security and are eligible for inclusion in draws for cash prizes. These prizes are free from United Kingdom Income Tax, Surtax and Capital Gains Tax.

2U.K.Premium Saving Bonds, (Series B) (hereinafter called Bonds) will be issued in units of £1 by the Treasury and will be subject to regulations made from time to time by the Treasury under section 12 of the M34National Debt Act 1958, or having effect by virtue of that Act. The principal of the Bonds and the prizes allotted will be a charge on the National Loans Fund with recourse to the Consolidated Fund.

3U.K.The purchaser will be required to fill in an application form giving his full name and address, the amount of Bonds which he wishes to purchase and his usual signature.

4U.K.Bonds are not transferable either during the lifetime or on the death of the registered holder. No responsibility can be accepted in respect of their use as security for a loan.

5U.K.There will be a monthly prize fund which will be determined by calculating one month’s interest on each bond eligible for the draws in that month. The rate of interest will be 45/8% per annum or such other rate as may be prescribed under the provisions of paragraph 15 below.

6U.K.A draw will be held each week to allot from the prize fund one prize of £25,000, and a draw will be held each month to allot the amount remaining after the amounts for the prizes for the weekly draws in that month have been set aside.

7U.K.A Bond will be eligible for inclusion in the first draw held after the expiration of the three clear calendar months following the month in which it is purchased, provided that it has not been repaid before the expiration of those three months. After a Bond has qualified for its first draw it will be included in each succeeding draw, unless it has been repaid before the first day of the month in which the draw is held or (subject to the provisions of paragraph 15 below) the registered holder has died before the first day of a period of twelve consecutive calendar months preceding the month in which the draw is held.

8U.K.Each £1 unit Bond will have one chance in each draw for which it is eligible. Each £1 unit Bond may win not more than one prize in each draw for which it is eligible and in draws producing more that one prize will be allotted the highest prize for which it is drawn.

9U.K.Notwithstanding the provisions of paragraph 7 above any Bond purchased in contravention of any regulation limiting the number of unit Bonds which may held by any person shall not be eligible for inclusion in any draw until the holding has been reduced to not more than the maximum number permitted by such regulation.

10U.K.The monthly prize fund will be allocated in prizes of the following numbers and amounts (or such other numbers and amounts as may be prescribed under the provisions of paragraph 15 below):

(a)For the weekly draws there will be set aside an amount to be allocated as single prizes of £25,000 each week, the number of such prizes to be equal to the number of Saturdays in the month.

(b)For the monthly draw the remaining prize fund will then be allocated as follows:—

(i)each complete £100,000 will be divided into:

1 prize of £5,000

10 prizes of £1,000

10 prizes of £500

20 prizes of £250

30 prizes of £100

150 prizes of £50

2,580 prizes of £25

(ii)of the remainder, each complete £10,000 will be divided into:

1 prize of £1,000

1 prize of £500

2 prizes of £250

3 prizes of £100

20 prizes of £50

268 prizes of £25

(iii)any amount of less than £10,000 will be allocated in prizes of £25, any residual sum of less than £25 being added to the prize fund in the following month.

11U.K.The serial numbers of Bonds which are allotted prizes will be published in the London Gazette, and the registered holders will be notified by post at their last address as recorded at the Bonds and Stock Office.

12U.K.All matters relating to the method and conduct of the draw and allotment of prizes shall be at the sole discretion of the Postmaster General, whose decision as to which Bonds have drawn prizes shall be final.

13U.K.The purchase price of a Bond is repayable in full on application to the Bonds and Stock Office.

14U.K.For the purposes of this Prospectus a Bond shall be deemed to be repaid on the day on which a warrant for the amount repayable is posted to the person entitled to it.