- Latest available (Revised)

- Original (As enacted)

Finance Act 1969

You are here:

- UK Public General Acts

- 1969 c. 32

- Schedules only

- Show Geographical Extent(e.g. England, Wales, Scotland and Northern Ireland)

- Show Timeline of Changes

More Resources

Changes to legislation:

Finance Act 1969 is up to date with all changes known to be in force on or before 22 January 2025. There are changes that may be brought into force at a future date. Changes that have been made appear in the content and are referenced with annotations.![]()

Changes to Legislation

Revised legislation carried on this site may not be fully up to date. Changes and effects are recorded by our editorial team in lists which can be found in the ‘Changes to Legislation’ area. Where those effects have yet to be applied to the text of the legislation by the editorial team they are also listed alongside the legislation in the affected provisions. Use the ‘more’ link to open the changes and effects relevant to the provision you are viewing.

Changes and effects yet to be applied to :

- s. 59 ceases to have effect by 2004 c. 25 Sch. 4 para. 6

SCHEDULE 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F1U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F1Sch. 1 repealed by Finance Act 1972 (c. 41), s. 134(7), Sch. 28 Pt. III

SCHEDULES 2—5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F2U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F2Schs. 2–5 repealed by Finance Act 1973 (c. 51), s. 59(7), Sch. 22 Pt. I

SCHEDULE 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F3U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F3Sch. 6 repealed by Finance Act 1972 (c. 41), ss. 54(8), 134(7), Sch. 28 Pt. II

Section 1(5).

SCHEDULE 7U.K. Miscellaneous Provisions as to Customs and Excise

[F4 Definition of whiskyU.K.

Textual Amendments

F4Sch. 7 repealed (prosp.) by Finance Act 1983 (c. 28, SIF 40:1), s. 9(2)(3), Sch. 10 Pt. I

1U.K.In relation to spirits distilled on or after 1st August 1969, section 243(1)(b) of the M1Customs and Excise Act 1952 (which defines Scotch whisky) shall cease to have effect, and for all purposes of customs and excise—

(a)the expression “whisky” shall mean spirits which have been distilled from a mash of cereals which has been—

(i)saccharified by the diastase of malt contained therein with or without other natural diastases approved for the purpose by the Commissioners; and

(ii)fermented by the action of yeast; and

(iii)distilled at [F5an alcoholic strength (computed in accordance with section 2 of the M2Alcoholic Liquor Duties Act 1979) less than 94.8 per cent.] in such a way that the distillate has an aroma and flavour derived from the materials used,

and which have been matured in wooden casks in warehouse for a period of at least three years;

[F6(b)the expression “Scotch whisky" shall have the same meaning as it has in section 3(1) of the Scotch Whisky Act 1988;]

[F7(b)the expression “Scotch whisky" shall have the same meaning as it has in Article 2(2) of the Scotch Whisky (Northern Ireland) Order 1988;]

(c)the expression “blended whisky" or “blended Scotch whisky” shall mean a blend of a number of distillates each of which separately is entitled to the description whisky or Scotch whisky as the case may be;

(d)the period for which any blended whisky or blended Scotch whisky shall be treated as having been matured as mentioned in sub-paragraph (a) of this paragraph shall be taken to be that applicable in the case of the most recently distilled of the spirits contained in the blend.

Textual Amendments

F5Words substituted (1.1.1980) by S.I. 1979/241, art. 3

F6Sch. 7 para. 1(b) substituted (E.W.S.) by Scotch Whisky Act 1988 (c. 22, SIF 109:1), s. 3(5)

F7Sch. 7 para. 1(b) substituted (N.I.) by S.I. 1988/1852(N.I. 19), art. 2(5)

Marginal Citations

2U.K. . . . F8

Textual Amendments

3U.K. . . . F9

Textual Amendments

F9Sch. 7 para. 3 repealed by Finance Act 1973 (c. 51), s. 59(7), Sch. 22 Pt. I

4,5.U.K. . . . F10]

Textual Amendments

F11F11SCHEDULE 8U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F11Sch. 8 repealed by Finance Act 1970 (c. 24), s. 36(8), Sch. 8 Pt. II

Section 3.

SCHEDULE 9U.K. Provisions Relating to Bingo Duty

Part IU.K. Exemptions from Duty

1—6.U.K. . . . F12

Textual Amendments

Part IIU.K. Administration and Enforcement

7—21.U.K. . . . F13

Textual Amendments

22(1)In paragraph 20(1) of Schedule 2 to the M3Gaming Act 1968 (grounds on which the grant or renewal of a licence under that Act may be refused by the licensing authority), the following shall be added after sub-paragraph (e):—U.K.

“(f)that any bingo duty payable in respect of bingo played on the premises remains unpaid”

and at the end of the said paragraph 20 there shall be added the following:—

“(3)Where the licensing authority entertain an application for the grant or renewal of a licence under this Act in respect of any premises, and are satisfied that any bingo duty payable as mentioned in sub-paragraph (1)(f) of this paragraph remains unpaid, they shall refuse the application.”

(2)In paragraph 60 of the said Schedule 2 (grounds for refusal of transfer of licence), in sub-paragraph (c) (ground that the transferee has not paid duty under section 13 of the M4Finance Act 1966), after the word “1966" there shall be inserted the words “ or any bingo duty payable by him ”.

Modifications etc. (not altering text)

C1The text of ss. 1(4), 43–49, Sch. 9 paras. 22–24 and Sch. 20 para. 11 and Sch. 21 is in the form in which it was originally enacted: it was not reproduced in the Statutes in Force and does not reflect any amendments or repeals which may have been made prior to 1.2.1991

Marginal Citations

23U.K.In paragraph 9 of Schedule 3 to the M5Gaming Act 1968 (grounds on which, in England and Wales, the licensing authority may refuse renewal of registration of club or institute under Part II of that Act), the following shall be added after sub-paragraph (e):—

“(f)that any bingo duty payable in respect of bingo played on the premisesd remains unpaid;

and where the authority entertain an application for the renewal of registration and are satisfied that any bingo duty remains unpaid, they shall refuse the application.”

Modifications etc. (not altering text)

C2The text of ss. 1(4), 43–49, Sch. 9 paras. 22–24 and Sch. 20 para. 11 and Sch. 21 is in the form in which it was originally enacted: it was not reproduced in the Statutes in Force and does not reflect any amendments or repeals which may have been made prior to 1.2.1991

Marginal Citations

24U.K.In paragraph 11 of Schedule 4 to the Gaming Act 1968 (grounds on which, in Scotland, the sheriff may refuse renewal of registration of a club or institute under Part II of that Act) the following shall be added after sub-paragraph (e):—

“(f)that any bingo duty payable in respect of bingo played on the premises remains unpaid;

and where the sheriff entertains an application for the renewal of registration and is satisfied that any bingo duty payanle as mentioned in sub-paragraph (f) above remains unpaid, he shall refuse the application.”

Modifications etc. (not altering text)

C3The text of ss. 1(4), 43–49, Sch. 9 paras. 22–24 and Sch. 20 para. 11 and Sch. 21 is in the form in which it was originally enacted: it was not reproduced in the Statutes in Force and does not reflect any amendments or repeals which may have been made prior to 1.2.1991

SCHEDULE 10. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F14U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F14Sch. 10 repealed except as respects any gaming before 1.10.1970, by Finance Act 1970 (c. 24), Sch. 8 Pt. I

SCHEDULE 11. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F15U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F15Sch. 11 repealed by Betting and Gaming Duties Act 1972 (c. 25), Sch. 7

SCHEDULE 12. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F16U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F16Sch. 12 repealed by Vehicles (Excise) Act 1971 (c. 10), s.39(5), Sch. 8 Pt. I

SCHEDULES 13—16. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F17U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

SCHEDULE 17. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F18U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F18Sch. 17 repealed with saving by Finance Act 1975 (c. 7), ss. 50, 52(2)(3), 59, Sch. 13 Pt. I

SCHEDULES 18, 19. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F19U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F19Schs. 18, 19 repealed with saving by Capital Gains Tax Act 1979 (c. 14), ss. 157(1),158, Sch. 6 para. 10(2)(b), Sch. 8

Section 60

SCHEDULE 20U.K. Consolidation Amendments

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Modifications etc. (not altering text)

C4The text of ss. 1(4), 43–49, Sch. 9 paras. 22–24 and Sch. 20 para. 11 and Sch. 21 is in the form in which it was originally enacted: it was not reproduced in the Statutes in Force and does not reflect any amendments or repeals which may have been made prior to 1.2.1991

Section 61.

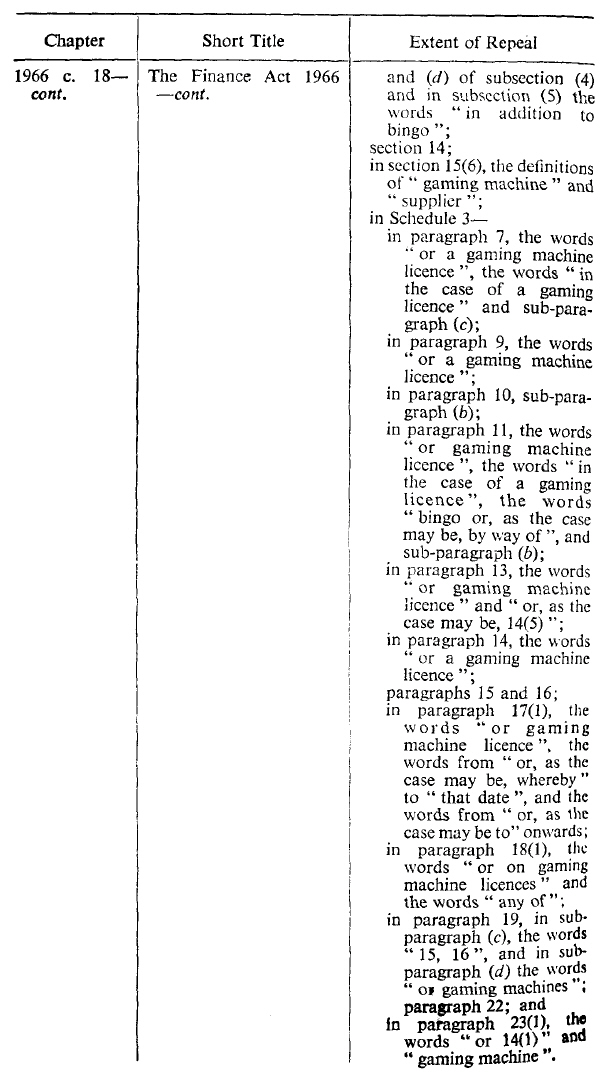

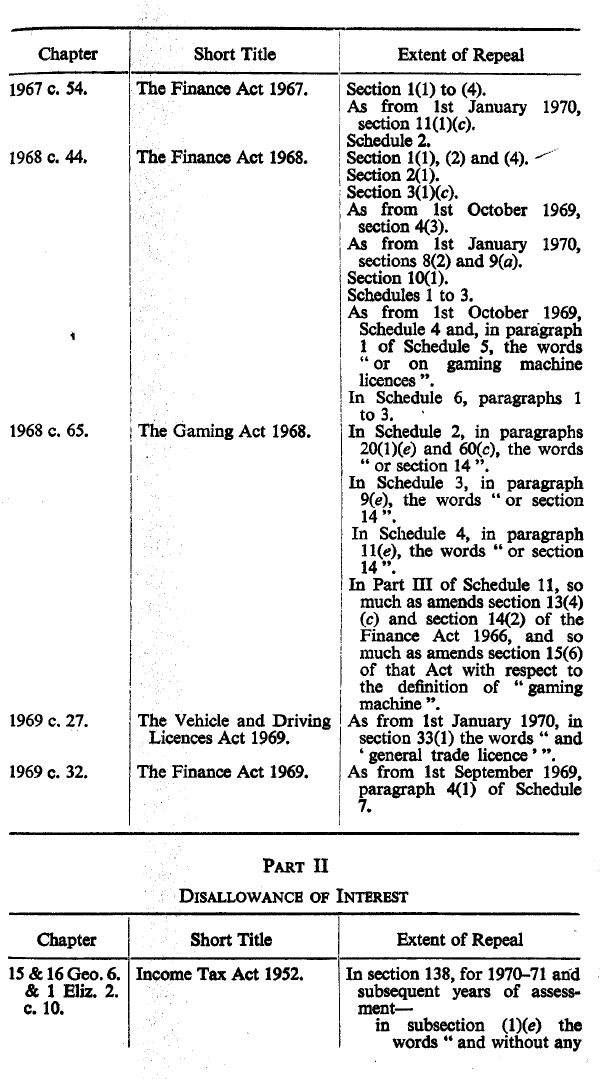

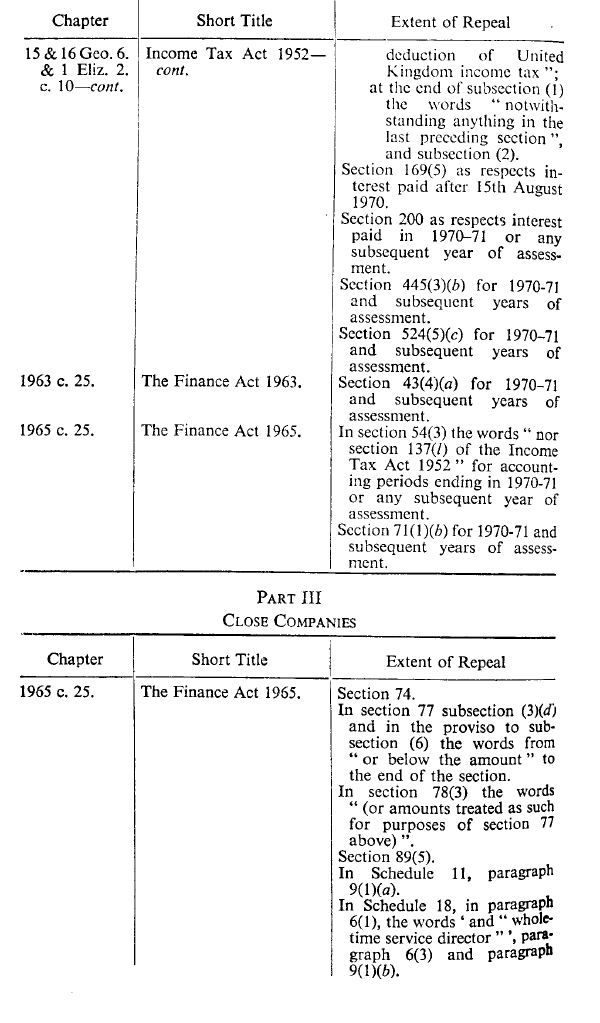

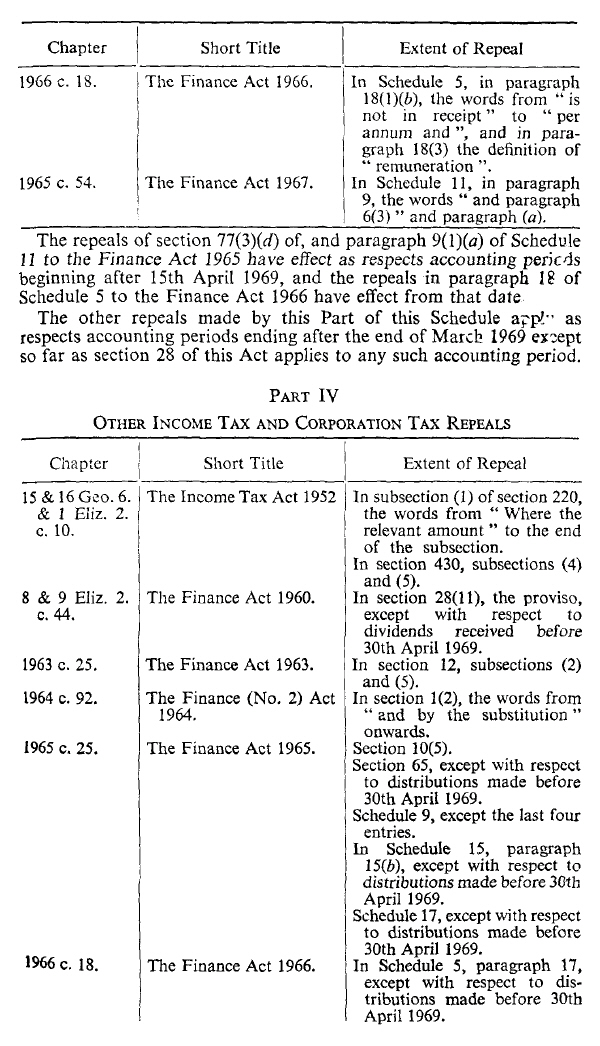

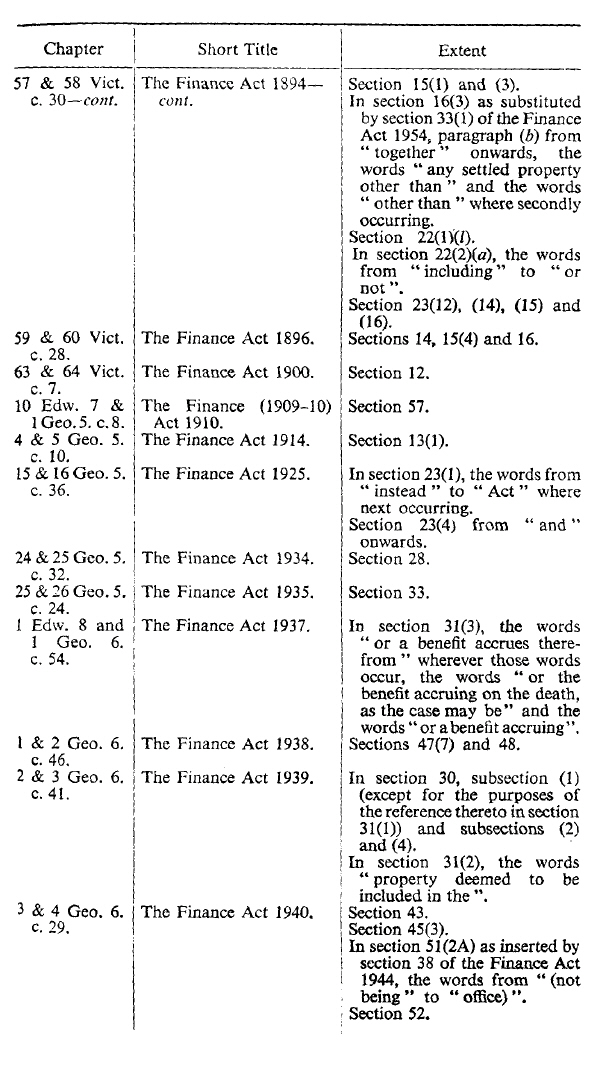

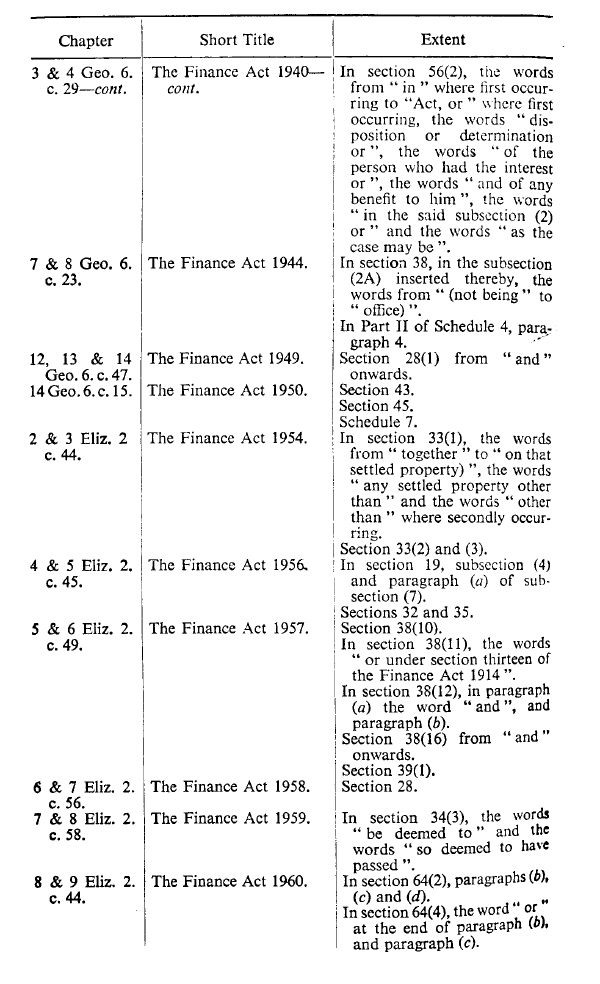

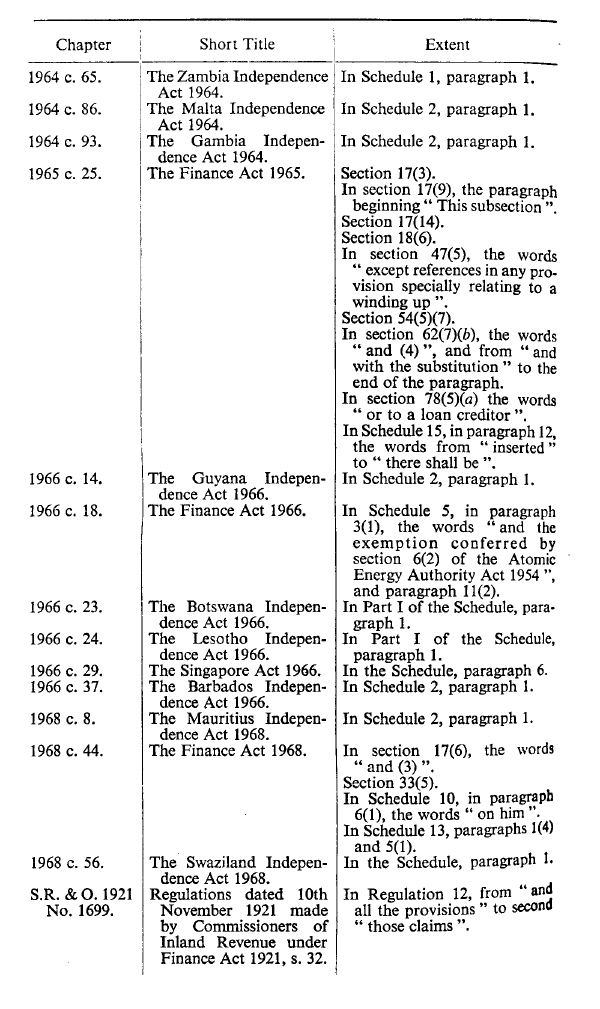

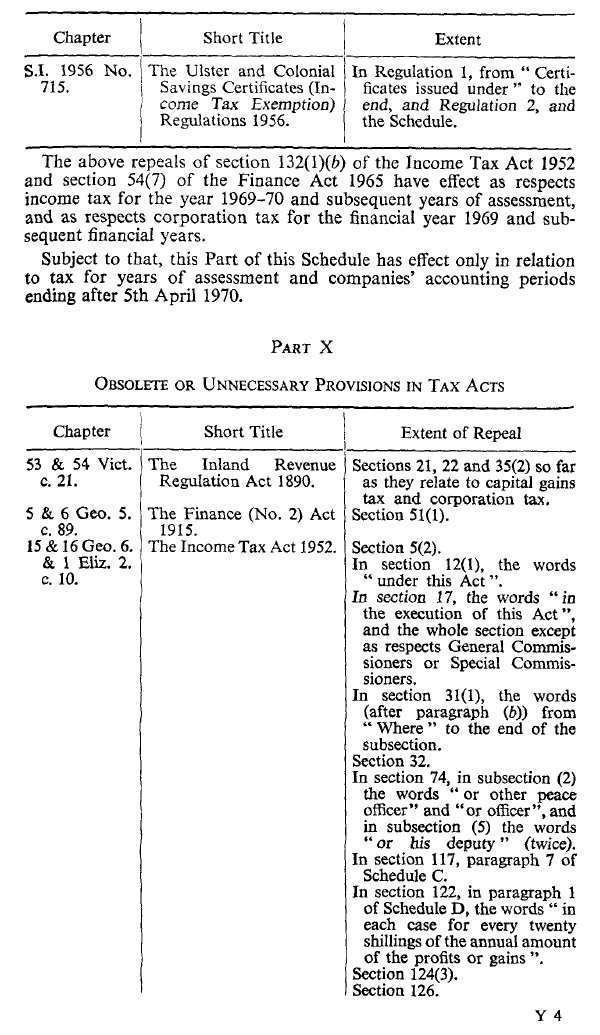

SCHEDULE 21U.K. Repeals

Modifications etc. (not altering text)

C5The text of ss. 1(4), 43–49, Sch. 9 paras. 22–24 and Sch. 20 para. 11 and Sch. 21 is in the form in which it was originally enacted: it was not reproduced in the Statutes in Force and does not reflect any amendments or repeals which may have been made prior to 1.2.1991

Options/Help

Print Options

PrintThe Whole Act

PrintThe Schedules only

Legislation is available in different versions:

Latest Available (revised):The latest available updated version of the legislation incorporating changes made by subsequent legislation and applied by our editorial team. Changes we have not yet applied to the text, can be found in the ‘Changes to Legislation’ area.

Original (As Enacted or Made): The original version of the legislation as it stood when it was enacted or made. No changes have been applied to the text.

See additional information alongside the content

Geographical Extent: Indicates the geographical area that this provision applies to. For further information see ‘Frequently Asked Questions’.

Show Timeline of Changes: See how this legislation has or could change over time. Turning this feature on will show extra navigation options to go to these specific points in time. Return to the latest available version by using the controls above in the What Version box.

More Resources

Access essential accompanying documents and information for this legislation item from this tab. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as enacted version that was used for the print copy

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- correction slips

- links to related legislation and further information resources

Timeline of Changes

This timeline shows the different points in time where a change occurred. The dates will coincide with the earliest date on which the change (e.g an insertion, a repeal or a substitution) that was applied came into force. The first date in the timeline will usually be the earliest date when the provision came into force. In some cases the first date is 01/02/1991 (or for Northern Ireland legislation 01/01/2006). This date is our basedate. No versions before this date are available. For further information see the Editorial Practice Guide and Glossary under Help.

More Resources

Use this menu to access essential accompanying documents and information for this legislation item. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as enacted version that was used for the print copy

- correction slips

Click 'View More' or select 'More Resources' tab for additional information including:

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- links to related legislation and further information resources