- Latest available (Revised)

- Point in Time (01/03/2000)

- Original (As enacted)

Consumer Credit Act 1974

You are here:

- UK Public General Acts

- 1974 c. 39

- Schedules only

- Show Geographical Extent(e.g. England, Wales, Scotland and Northern Ireland)

- Show Timeline of Changes

Changes over time for: Consumer Credit Act 1974 (Schedules only)

Version Superseded: 01/04/2003

Alternative versions:

- 01/02/1991- Amendment

- 01/10/1991- Amendment

- 27/08/1993- Amendment

- 05/11/1993- Amendment

- 01/09/1994- Amendment

- 06/01/1997- Amendment

- 01/03/2000

Point in time - 01/04/2003- Amendment

- 20/06/2003- Amendment

- 29/12/2003- Amendment

- 06/04/2005- Amendment

- 15/11/2005- Amendment

- 01/12/2007- Amendment

- 06/04/2008- Amendment

- 26/05/2008- Amendment

- 21/07/2008- Amendment

- 03/11/2008- Amendment

- 01/09/2009- Amendment

- 01/02/2011- Amendment

- 26/07/2013- Amendment

- 14/02/2014- Amendment

- 28/02/2014- Amendment

- 01/04/2014- Amendment

- 01/10/2015- Amendment

Status:

Point in time view as at 01/03/2000.

Changes to legislation:

Consumer Credit Act 1974 is up to date with all changes known to be in force on or before 09 November 2024. There are changes that may be brought into force at a future date. Changes that have been made appear in the content and are referenced with annotations.![]()

Changes to Legislation

Changes and effects yet to be applied by the editorial team are only applicable when viewing the latest version or prospective version of legislation. They are therefore not accessible when viewing legislation as at a specific point in time. To view the ‘Changes to Legislation’ information for this provision return to the latest version view using the options provided in the ‘What Version’ box above.

SCHEDULES

Valid from 01/12/2007

SCHEDULE A1U.K.The Consumer Credit Appeals Tribunal

Valid from 06/04/2008

Part 1 U.K.Interpretation

1In this Schedule—

“the Deputy President” means the Deputy President of the Consumer Credit Appeals Tribunal;

“lay panel” means the panel established under paragraph 3(3);

“panel of chairmen” means the panel established under paragraph 3(1);

“party” means, in relation to an appeal, the appellant or the OFT;

“the President” means the President of the Consumer Credit Appeals Tribunal;

“rules” means rules under section 40A(3) of this Act;

“specified” means specified by rules.

Valid from 06/04/2008

Part 2 U.K.The Tribunal

The President and the Deputy PresidentU.K.

2(1)The Lord Chancellor shall appoint one of the members of the panel of chairmen to preside over the discharge of the Tribunal's functions.

(2)The person so appointed shall be known as the President of the Consumer Credit Appeals Tribunal.

(3)The Lord Chancellor may appoint one of the members of the panel of chairmen to be the Deputy President of the Consumer Credit Appeals Tribunal.

(4)The Deputy President shall have such functions in relation to the Tribunal as the President may assign to him.

(5)If the President or the Deputy President ceases to be a member of the panel of chairmen, he shall also cease to be the President or (as the case may be) the Deputy President.

(6)The functions of the President may, if he is absent or is otherwise unable to act, be discharged—

(a)by the Deputy President; or

(b)if there is no Deputy President or he too is absent or otherwise unable to act, by a person appointed for that purpose from the panel of chairmen by the Lord Chancellor.

PanelsU.K.

3(1)The Lord Chancellor shall appoint a panel of persons for the purpose of serving as chairmen of the Tribunal.

(2)A person shall not be appointed to the panel of chairmen unless he—

(a)has a seven year general qualification within the meaning of section 71 of the Courts and Legal Services Act 1990;

(b)is an advocate or solicitor in Scotland of at least seven years' standing; or

(c)is a member of the Bar of Northern Ireland, or a solicitor of the Supreme Court of Northern Ireland, of at least seven years' standing.

(3)The Lord Chancellor shall also appoint a panel of persons who appear to him to be qualified by experience or otherwise to deal with appeals of the kind that may be made to the Tribunal.

Terms of office etc.U.K.

4(1)Each member of the panel of chairmen or the lay panel shall hold and vacate office in accordance with the terms of his appointment.

(2)The Lord Chancellor may remove a member of either panel from office on the ground of incapacity or misbehaviour.

(3)A member of either panel—

(a)may at any time resign office by notice in writing to the Lord Chancellor;

(b)is eligible for re-appointment if he ceases to hold office.

Remuneration and allowancesU.K.

5The Lord Chancellor may pay to a person in respect of his service—

(a)as the President or the Deputy President,

(b)as a member of the Tribunal, or

(c)as a person appointed under paragraph 7(4),

such remuneration and allowances as the Lord Chancellor may determine.

Staff and costsU.K.

6(1)The Lord Chancellor may appoint such staff for the Tribunal as he may determine.

(2)The Lord Chancellor shall defray—

(a)the remuneration of the Tribunal's staff; and

(b)such other costs of the Tribunal as he may determine.

Valid from 06/04/2008

Part 3 U.K.Constitution of the Tribunal

7(1)On an appeal to the Tribunal, the persons to act as members of the Tribunal for the purposes of the appeal shall be selected from the panel of chairmen or the lay panel.

(2)The selection shall be in accordance with arrangements made by the President for the purposes of this paragraph.

(3)Those arrangements shall provide for at least one member to be a person selected from the panel of chairmen.

(4)If it appears to the Tribunal that a matter before it involves a question of fact of special difficulty, it may appoint one or more experts to provide assistance.

Part 4 U.K.Tribunal powers and procedure

Valid from 06/04/2008

SittingsU.K.

8The Tribunal shall sit at such times and in such places as the Lord Chancellor may direct.

EvidenceU.K.

9(1)Subject to sub-paragraph (2), the Tribunal may, on an appeal, consider any evidence that it thinks relevant, whether or not it was available to the OFT at the time it made the determination appealed against.

(2)Rules may make provision restricting the evidence that the Tribunal may consider on an appeal in specified circumstances.

Rules on procedureU.K.

10Rules may include, amongst other things, provision—

(a)about the withdrawal of appeals;

(b)about persons who may appear on behalf of a party to an appeal;

(c)about how an appeal is to be dealt with if a person acting as member of the Tribunal in respect of the appeal becomes unable to act;

(d)setting time limits in relation to anything that is to be done for the purposes of an appeal or for such limits to be set by the Tribunal or a member of the panel of chairmen;

(e)for time limits (including the period specified for the purposes of section 41(1) of this Act) to be extended by the Tribunal or a member of the panel of chairmen;

(f)conferring powers on the Tribunal or a member of the panel of chairmen to give such directions to the parties to an appeal as it or he thinks fit for purposes connected with the conduct and disposal of the appeal;

(g)about the holding of hearings by the Tribunal or a member of the panel of chairmen (including for such hearings to be held in private);

(h)placing restrictions on the disclosure of information and documents or for such restrictions to be imposed by the Tribunal or a member of the panel of chairmen;

(i)about the consequences of a failure to comply with a requirement imposed by or under any rule (including for the immediate dismissal or allowing of an appeal if the Tribunal or a member of the panel of chairmen thinks fit);

(j)for proceedings on different appeals (including appeals with different appellants) to take place concurrently;

(k)for the suspension of determinations of the OFT;

(l)for the suspension of decisions of the Tribunal;

(m)for the Tribunal to reconsider its decision disposing of an appeal where it has reason to believe that the decision was wrongly made because of an administrative error made by a member of its staff.

Prospective

Council on TribunalsU.K.

11A member of the Council on Tribunals or of its Scottish Committee shall be entitled —

(a)to attend any hearing held by the Tribunal or a member of the panel of chairmen whether or not it is held in public; and

(b)to attend any deliberations of the Tribunal in relation to an appeal.

Valid from 06/04/2008

Disposal of appealsU.K.

12(1)The Tribunal shall decide an appeal by reference to the grounds of appeal set out in the notice of appeal.

(2)In disposing of an appeal the Tribunal may do one or more of the following—

(a)confirm the determination appealed against;

(b)quash that determination;

(c)vary that determination;

(d)remit the matter to the OFT for reconsideration and determination in accordance with the directions (if any) given to it by the Tribunal;

(e)give the OFT directions for the purpose of giving effect to its decision.

(3)In the case of an appeal against a determination to impose a penalty, the Tribunal—

(a)has no power by virtue of sub-paragraph (2)(c) to increase the penalty;

(b)may extend the period within which the penalty is to be paid (including in cases where that period has already ended).

(4)Sub-paragraph (3) does not affect—

(a)the Tribunal's power to give directions to the OFT under sub-paragraph (2)(d); or

(b)what the OFT can do where a matter is remitted to it under sub-paragraph (2)(d).

(5)Where the Tribunal remits a matter to the OFT, it may direct that the requirements of section 34 of this Act are not to apply, or are only to apply to a specified extent, in relation to the OFT's reconsideration of the matter.

(6)Subject to sub-paragraphs (7) and (8), where the Tribunal remits an application to the OFT, section 6(1) and (3) to (9) of this Act shall apply as if the application had not been previously determined by the OFT.

(7)In the case of a general notice which came into effect after the determination appealed against was made but before the application was remitted, the applicant shall provide any information or document which he is required to provide under section 6(6) within—

(a)the period of 28 days beginning with the day on which the application was remitted; or

(b)such longer period as the OFT may allow.

(8)In the case of—

(a)any information or document which was superseded,

(b)any change in circumstances which occurred, or

(c)any error or omission of which the applicant became aware,

after the determination appealed against was made but before the application was remitted, any notification that is required to be given by the applicant under section 6(7) shall be given within the period of 28 days beginning with the day on which the application was remitted.

Valid from 06/04/2008

Decisions of the TribunalU.K.

13(1)A decision of the Tribunal may be taken by majority.

(2)A decision of the Tribunal disposing of an appeal shall—

(a)state whether it was unanimous or taken by majority; and

(b)be recorded in a document which—

(i)contains a statement of the reasons for the decision and any other specified information; and

(ii)is signed and dated by a member of the panel of chairmen.

(3)Where the Tribunal disposes of an appeal it shall—

(a)send to each party to the appeal a copy of the document mentioned in sub-paragraph (2)(b); and

(b)publish that document in such manner as it thinks fit.

(4)The Tribunal may exclude from what it publishes under sub-paragraph (3)(b) information of a specified description.

Valid from 06/04/2008

CostsU.K.

14(1)Where the Tribunal disposes of an appeal and—

(a)it decides that the OFT was wrong to make the determination appealed against, or

(b)during the course of the appeal the OFT accepted that it was wrong to make that determination,

it may order the OFT to pay to the appellant the whole or a part of the costs incurred by the appellant in relation to the appeal.

(2)In determining whether to make such an order, and the terms of such an order, the Tribunal shall have regard to whether it was unreasonable for the OFT to make the determination appealed against.

15Where—

(a)the Tribunal disposes of an appeal or an appeal is withdrawn before the Tribunal disposes of it, and

(b)the Tribunal thinks that a party to the appeal acted vexatiously, frivolously or unreasonably in bringing the appeal or otherwise in relation to the appeal,

it may order that party to pay to the other party the whole or a part of the costs incurred by the other party in relation to the appeal.

16An order of the Tribunal under paragraph 14 or 15 may be enforced—

(a)as if it were an order of the county court; or

(b)in Scotland, as if it were an interlocutor of the Court of Session.

Section 167.

SCHEDULE 1U.K. Prosecution and Punishment of Offences

| 1 | 2 | 3 | 4 |

|---|---|---|---|

| Section | Offence | Mode of prosecution | Imprisonment or fine |

| 7 | Knowingly or recklessly giving false information to Director. | (a) Summarily. | £400. |

| (b) On indictment. | 2 years or a fine or both. | ||

| 39(1) | Engaging in activities requiring a licence when not a licensee. | (a) Summarily. | £400. |

| (b) On indictment. | 2 years or a fine or both. | ||

| 39(2) | Carrying on a business under a name not specified in licence. | (a) Summarily. | £400. |

| (b) On indictment. | 2 years or a fine or both. | ||

| 39(3) | Failure to notify changes in registered particulars. | (a) Summarily. | £400. |

| (b) On indictment. | 2 years or a fine or both. | ||

| 45 | Advertising credit where goods etc. not available for cash. | (a) Summarily. | £400. |

| (b) On indictment. | 2 years or a fine or both. | ||

| 46(1) | False or misleading advertisements. | (a) Summarily. | £400. |

| (b) On indictment. | 2 years or a fine or both. | ||

| 47(1) | Advertising infringements. | (a) Summarily. | £400. |

| (b) On indictment. | 2 years or a fine or both. | ||

| 49(1) | Canvassing debtor-creditor agreements off trade premises. | (a) Summarily. | £400. |

| (b) On indictment. | 1 year or a fine or both. | ||

| 49(2) | Soliciting debtor-creditor agreements during visits made in response to previous oral requests. | (a) Summarily. | £400. |

| (b) On indictment. | 1 year or a fine or both. | ||

| 50(1) | Sending circulars to minors. | (a) Summarily. | £400. |

| (b) On indictment. | 1 year or a fine or both. | ||

| 51(1) | Supplying unsolicited credit-tokens. | (a) Summarily. | £400. |

| (b) On indictment. | 2 years or a fine or both. | ||

| 77(4) | Failure of creditor under fixed-sum credit agreement to supply copies of documents etc. | Summarily. | [F1level 4 on the standard scale]. |

| 78(6) | Failure of creditor under running-account credit agreement to supply copies of documents etc. | Summarily. | [F1level 4 on the standard scale]. |

| 79(3) | Failure of owner under consumer hire agreement to supply copies of documents etc. | Summarily. | [F1level 4 on the standard scale]. |

| 80(2) | Failure to tell creditor or owner whereabouts of goods. | Summarily. | [F1level 3 on the standard scale]. |

| 85(2) | Failure of creditor to supply copy of credit-token agreement. | Summarily. | [F1level 4 on the standard scale]. |

| 97(3) | Failure to supply debtor with statement of amount required to discharge agreement. | Summarily. | [F1level 3 on the standard scale]. |

| 103(5) | Failure to deliver notice relating to discharge of agreements. | Summarily. | [F1level 3 on the standard scale]. |

| 107(4) | Failure of creditor to give information to surety under fixed-sum credit agreement. | Summarily. | [F1level 4 on the standard scale]. |

| 108(4) | Failure of creditor to give information to surety under running-account credit agreement. | Summarily. | [F1level 4 on the standard scale]. |

| 109(3) | Failure of owner to give information to surety under consumer hire agreement. | Summarily. | [F1level 4 on the standard scale]. |

| 110(3) | Failure of creditor or owner to supply a copy of any security instrument to debtor or hirer. | Summarily. | [F1level 4 on the standard scale]. |

| 114(2) | Taking pledges from minors. | (a) Summarily. | £400. |

| (b) On indictment. | 1 year or a fine or both. | ||

| 115 | Failure to supply copies of a pledge agreement or pawn-receipt. | Summarily. | [F1level 4 on the standard scale]. |

| 119(1) | Unreasonable refusal to allow pawn to be redeemed. | Summarily. | [F1level 4 on the standard scale]. |

| 154 | Canvassing ancillary credit services off trade premises. | (a) Summarily. | £200. |

| (b) On indictment. | 1 year or a fine or both. | ||

| 157(3) | Refusal to give name etc. of credit reference agency. | Summarily. | [F1level 4 on the standard scale]. |

| 158(4) | Failure of credit reference agency to disclose filed information. | Summarily. | [F1level 4 on the standard scale]. |

| 159(6) | Failure of credit reference agency to correct information. | Summarily. | [F1level 4 on the standard scale]. |

| 160(6) | Failure of credit reference agency to comply with section 160(3) or (4). | Summarily. | [F1level 4 on the standard scale]. |

| 162(6) | Impersonation of enforcement authority officers. | (a) Summarily. | £400. |

| (b) On indictment. | 2 years or a fine or both. | ||

| 165(1) | Obstruction of enforcement authority officers. | Summarily. | [F1level 4 on the standard scale]. |

| 165(2) | Giving false information to enforcement authority officers. | (a) Summarily. | £400. |

| (b) On indictment. | 2 years or a fine or both. | ||

| 167(2) | Contravention of regulations under section 44, 52, 53, 54, or 112. | (a) Summarily. | £400. |

| (b) On indictment. | 2 years or a fine or both. | ||

| 174(5) | Wrongful disclosure of information. | (a) Summarily. | £400. |

| (b) On indictment. | 2 years or a fine or both. |

Textual Amendments

F1Words substituted by virtue of (E.W.) Criminal Justice Act 1982 (c. 48, SIF 39:1), ss. 38, 46, (S.) by Criminal Procedure (Scotland) Act 1975 (c. 21, SIF 39:1), s. 289F, 289G and (N.I.) by S.I. 1984/703 (N.I. 3), arts. 5, 6

Section 188(1).

SCHEDULE 2U.K. Examples of Use of New Terminology

Part I U.K. Lists of Terms

| Term | Defined in section | Illustrated by example(s) |

|---|---|---|

| Advertisement | 189(1) | 2 |

| Advertiser | 189(1) | 2 |

| Antecedent negotiations | 56 | 1, 2, 3, 4 |

| Cancellable agreement | 67 | 4 |

| Consumer credit agreement | 8 | 5, 6, 7, 15, 19, 21 |

| Consumer hire agreement | 15 | 20, 24 |

| Credit | 9 | 16, 19, 21 |

| Credit-broker | 189(1) | 2 |

| Credit limit | 10(2) | 6, 7, 19, 22, 23 |

| Creditor | 189(1) | 1, 2, 3, 4 |

| Credit-sale agreement | 189(1) | 5 |

| Credit-token | 14 | 3, 14, 16 |

| Credit-token agreement | 14 | 3, 14, 16, 22 |

| Debtor-creditor agreement | 13 | 8, 16, 17, 18 |

| Debtor-creditor-supplier agreement | 12 | 8, 16 |

| Fixed-sum credit | 10 | 9, 10, 17, 23 |

| Hire-purchase agreement | 189(1) | 10 |

| Individual | 189(1) | 19, 24 |

| Linked transaction | 19 | 11 |

| Modifying agreement | 82(2) | 24 |

| Multiple agreement | 18 | 16, 18 |

| Negotiator | 56(1) | 1, 2, 3, 4 |

| Personal credit agreement | 8(1) | 19 |

| Pre-existing arrangements | 187 | 8, 21 |

| Restricted-use credit | 11 | 10, 12, 13, 14, 16 |

| Running-account credit | 10 | 15, 16, 18, 23 |

| Small agreement | 17 | 16, 17, 22 |

| Supplier | 189(1) | 3, 14 |

| Total charge for credit | 20 | 5, 10 |

| Total price | 189(1) | 10 |

| Unrestricted-use credit | 11 | 8, 12, 16, 17, 18. |

Part II U.K.

EXAMPLES

Example 1

Facts.Correspondence passes between an employee of a moneylending company (writing on behalf of the company) and an individual about the terms on which the company would grant him a loan under a regulated agreement.

Analysis.The correspondence constitutes antecedent negotiations falling within section 56(1)(a), the moneylending company being both creditor and negotiator.

Example 2

Facts.Representations are made about goods in a poster displayed by a shopkeeper near the goods, the goods being selected by a customer who has read the poster and then sold by the shopkeeper to a finance company introduced by him (with whom he has a business relationship). The goods are disposed of by the finance company to the customer under a regulated hire-purchase agreement.

Analysis.The representations in the poster constitute antecedent negotiations falling within section 56(1)(b), the shopkeeper being the credit-broker and negotiator and the finance company being the creditor. The poster is an advertisement and the shopkeeper is the advertiser.

Example 3

Facts.Discussions take place between a shopkeeper and a customer about goods the customer wishes to buy using a credit-card issued by the D Bank under a regulated agreement.

Analysis.The discussions constitute antecedent negotiations falling within section 56(1)(c), the shopkeeper being the supplier and negotiator and the D Bank the creditor. The credit-card is a credit-token as defined in section 14(1), and the regulated agreement under which it was issued is a credit-token agreement as defined in section 14(2).

Example 4

Facts.Discussions take place and correspondence passes between a secondhand car dealer and a customer about a car, which is then sold by the dealer to the customer under a regulated conditional sale agreement. Subsequently, on a revocation of that agreement by consent, the car is resold by the dealer to a finance company introduced by him (with whom he has a business relationship), who in turn dispose of it to the same customer under a regulated hire-purchase agreement.

Analysis.The discussions and correspondence constitute antecedent negotiations in relation both to the conditional sale agreement and the hire-purchase agreement. They fall under section 56(1)(a) in relation to the conditional sale agreement, the dealer being the creditor and the negotiator. In relation to the hire-purchase agreement they fall within section 56(1)(b), the dealer continuing to be treated as the negotiator but the finance company now being the creditor. Both agreements are cancellable if the discussions took place when the individual conducting the negotiations (whether the “negotiator ” or his employee or agent) was in the presence of the debtor, unless the unexecuted agreement was signed by the debtor at trade premises (as defined in section 67(b)). If the discussions all took place by telephone however, or the unexecuted agreeement was signed by the debtor on trade premises (as so defined) the agreements are not cancellable.

Example 5

Facts.E agrees to sell to F (an individual) an item of furniture in return for 24 monthly instalments of £10 payable in arrear. The property in the goods passes to F immediately.

Analysis.This is a credit-sale agreement (see definition of “credit-sale agreement ” in section 189(1)). The credit provided amounts to £240 less the amount which, according to regulations made under section 20(1), constitutes the total charge for credit. (This amount is required to be deducted by section 9(4)). Accordingly the agreement falls within section 8(2) and is a consumer credit agreement.

Example 6

Facts.The G Bank grants H (an individual) an unlimited overdraft, with an increased rate of interest on so much of any debit balance as exceeds £2,000.

Analysis.Although the overdraft purports to be unlimited, the stipulation for increased interest above £2,000 brings the agreement within section 10(3)(b)(ii) and it is a consumer credit agreement.

Example 7

Facts.J is an individual who owns a small shop which usually carries a stock worth about £1,000. K makes a stocking agreement under which he undertakes to provide on short-term credit the stock needed from time to time by J without any specified limit.

Analysis.Although the agreement appears to provide unlimited credit, it is probable, having regard to the stock usually carried by J, that his indebtedness to K will not at any time rise above £5,000. Accordingly the agreement falls within section 10(3)(b)(iii) and is a consumer credit agreement.

Example 8

Facts.U, a moneylender, lends £500 to V (an individual) knowing he intends to use it to buy office equipment from W. W introduced V to U, it being his practice to introduce customers needing finance to him. Sometimes U gives W a commission for this and sometimes not. U pays the £500 direct to V.

Analysis.Although this appears to fall under section 11(1)(b), it is excluded by section 11(3) and is therefore (by section 11(2)) an unrestricted-use credit agreement. Whether it is a debtor-creditor agreement (by section 13(c)) or a debtor-creditor-supplier agreement (by section 12(c)) depends on whether the previous dealings between U and W amount to “pre-existing arrangements ”, that is whether the agreement can be taken to have been entered into “in accordance with, or in furtherance of ” arrangements previously made between U and W, as laid down in section 187(1).

Example 9

Facts.A agrees to lend B (an individual) £4,500 in nine monthly instalments of £500.

Analysis.This is a cash loan and is a form of credit (see section 9 and definition of “cash ” in section 189(1)). Accordingly it falls within section 10(1)(b) and is fixed-sum credit amounting to £4,500.

Example 10

Facts.C (in England) agrees to bail goods to D (an individual) in return for periodical payments. The agreement provides for the property in the goods to pass to D on payment of a total of £7,500 and the exercise by D of an option to purchase. The sum of £7,500 includes a down-payment of £1,000. It also includes an amount which, according to regulations made under section 20(1), constitutes a total charge for credit of £1,500.

Analysis.This is a hire-purchase agreement with a deposit of £1,000 and a total price of £7,500 (see definitions of “hire-purchase agreement ”, “deposit ” and “total price ” in section 189(1)). By section 9(3), it is taken to provide credit amounting to £7,500—(£1,500 + £1,000), which equals £5,000. Under section 8(2), the agreement is therefore a consumer credit agreement, and under sections 9(3) and 11(1) it is a restricted-use credit agreement for fixed-sum credit. A similar result would follow if the agreement by C had been a hiring agreement in Scotland.

Example 11

Facts.X (an individual) borrows £500 from Y (Finance). As a condition of the granting of the loan X is required—

(a) to execute a second mortgage on his house in favour of Y (Finance), and

(b) to take out a policy of insurance on his life with Y (Insurances).

In accordance with the loan agreement, the policy is charged to Y (Finance) as collateral security for the loan. The two companies are associates within the meaning of section 184(3).

Analysis.The second mortgage is a transaction for the provision of security and accordingly does not fall within section 19(1), but the taking out of the insurance policy is a linked transaction falling within section 19(1)(a). The charging of the policy is a separate transaction (made between different parties) for the provision of security and again is excluded from section 19(1). The only linked transaction is therefore the taking out of the insurance policy. If X had not been required by the loan agreement to take out the policy, but it had been done at the suggestion of Y (Finance) to induce them to enter into the loan agreement, it would have been a linked transaction under section 19(1)(c)(i) by virtue of section 19(2)(a).

Example 12

Facts.The N Bank agrees to lend O (an individual) £2,000 to buy a car from P. To make sure the loan is used as intended, the N Bank stipulates that the money must be paid by it direct to P.

Analysis.The agreement is a consumer credit agreement by virtue of section 8(2). Since it falls within section 11(1)(b), it is a restricted-use credit agreement, P being the supplier. If the N Bank had not stipulated for direct payment to the supplier, section 11(3) would have operated and made the agreement into one for unrestricted-use credit.

Example 13

Facts.Q, a debt-adjuster, agrees to pay off debts owed by R (an individual) to various moneylenders. For this purpose the agreement provides for the making of a loan by Q to R in return for R’s agreeing to repay the loan by instalments with interest. The loan money is not paid over to R but retained by Q and used to pay off the moneylenders.

Analysis.This is an agreement to refinance existing indebtedness of the debtor’s, and if the loan by Q does not exceed £5,000 is a restricted-use credit agreement falling within section 11(1)(c).

Example 14

Facts.On payment of £1, S issues to T (an individual) a trading check under which T can spend up to £20 at any shop which has agreed, or in future agrees, to accept S’s trading checks.

AnalysisThe trading check is a credit-token falling within section 14(1)(b). The credit-token agreement is a restricted-use credit agreement within section 11(1)(b), any shop in which the credit-token is used being the “supplier ”. The fact that further shops may be added after the issue of the credit-token is irrelevant in view of section 11(4).

Example 15

Facts.A retailer L agrees with M (an individual) to open an account in M’s name and, in return for M’s promise to pay a specified minimum sum into the account each month and to pay a monthly charge for credit, agrees to allow to be debited to the account, in respect of purchases made by M from L, such sums as will not increase the debit balance at any time beyond the credit limit, defined in the agreement as a given multiple of the specified minimum sum.

Analysis.This agreement provides credit falling within the definition of running-account credit in section 10(1)(a). Provided the credit limit is not over £5,000, the agreement falls within section 8(2) and is a consumer credit agreement for running-account credit.

Example 16

Facts.Under an unsecured agreement, A (Credit), an associate of the A Bank, issues to B (an individual) a credit-card for use in obtaining cash on credit from A (Credit), to be paid by branches of the A Bank (acting as agent of A (Credit)), or goods or cash from suppliers or banks who have agreed to honour credit-cards issued by A (Credit). The credit limit is £30.

Analysis.This is a credit-token agreement falling within section 14(1)(a) and (b). It is a regulated consumer credit agreement for running-account credit. Since the credit limit does not exceed £30, the agreement is a small agreement. So far as the agreement relates to goods it is a debtor-creditor-supplier agreement within section 12(b), since it provides restricted-use credit under section 11(1)(b). So far as it relates to cash it is a debtor-creditor agreement within section 13(c) and the credit it provides is unrestricted-use credit. This is therefore a multiple agreement. In that the whole agreement falls within several of the categories of agreement mentioned in this Act, it is, by section 18(3), to be treated as an agreement in each of those categories. So far as it is a debtor-creditor-supplier agreement providing restricted-use credit it is, by section 18(2), to be treated as a separate agreement; and similarly so far as it is a debtor-creditor agreement providing unrestricted-use credit. (See also Example 22.)

Example 17

Facts.The manager of the C Bank agrees orally with D (an individual) to open a current account in D’s name. Nothing is said about overdraft facilities. After maintaining the account in credit for some weeks, D draws a cheque in favour of E for an amount exceeding D’s credit balance by £20. E presents the cheque and the Bank pay it.

Analysis.In drawing the cheque D, by implication, requests the Bank to grant him an overdraft of £20 on its usual terms as to interest and other charges. In deciding to honour the cheque, the Bank by implication accept the offer. This constitutes a regulated small consumer credit agreement for unrestricted-use, fixed-sum credit. It is a debtor-creditor agreement, and falls within section 74(1)(b) if covered by a determination under section 74(3). (Compare Example 18.)

Example 18

Facts.F (an individual) has had a current account with the G Bank for many years. Although usually in credit, the account has been allowed by the Bank to become overdrawn from time to time. The maximum such overdraft has been is about £1,000. No explicit agreement has ever been made about overdraft facilities. Now, with a credit balance of £500, F draws a cheque for £1,300.

Analysis.It might well be held that the agreement with F (express or implied) under which the Bank operate his account includes an implied term giving him the right to overdraft facilities up to say £1,000. If so, the agreement is a regulated consumer credit agreement for unrestricted-use, running-account credit. It is a debtor-creditor agreement, and falls within section 74(1)(b) if covered by a direction under section 74(3). It is also a multiple agreement, part of which (i.e. the part not dealing with the overdraft), as referred to in section 18(1)(a), falls within a category of agreement not mentioned in this Act. (Compare Example 17.)

Example 19

Facts.H (a finance house) agrees with J (a partnership of individuals) to open an unsecured loan account in J’s name on which the debit balance is not to exceed £7,000 (having regard to payments into the account made from time to time by J). Interest is to be payable in advance on this sum, with provision for yearly adjustments. H is entitled to debit the account with interest, a “setting-up ” charge, and other charges. Before J has an opportunity to draw on the account it is initially debited with £2,250 for advance interest and other charges.

Analysis.This is a personal running-account credit agreement (see sections 8(1) and 10(1)(a), and definition of “individual ” in section 189(1)). By section 10(2) the credit limit is £7,000. By section 9(4) however the initial debit of £2,250, and any other charges later debited to the account by H, are not to be treated as credit even though time is allowed for their payment. Effect is given to this by section 10(3). Although the credit limit of £7,000 exceeds the amount (£5,000) specified in section 8(2) as the maximum for a consumer credit agreement, so that the agreement is not within section 10(3)(a), it is caught by section 10(3)(b)(i). At the beginning J can effectively draw (as credit) no more than £4,750, so the agreement is a consumer credit agreement.

Example 20

Facts.K (in England) agrees with L (an individual) to bail goods to L for a period of three years certain at £2,000 a year, payable quarterly. The agreement contains no provision for the passing of the property in the goods to L.

Analysis.This is not a hire-purchase agreement (see paragraph (b) of the definition of that term in section 189(1)), and is capable of subsisting for more than three months. Paragraphs (a) and (b) of section 15(1) are therefore satisfied, but paragraph (c) is not. The payments by L must exceed £5,000 if he conforms to the agreement. It is true that under section 101 L has a right to terminate the agreement on giving K three months’ notice expiring not earlier than eighteen months after the making of the agreement, but that section applies only where the agreement is a regulated consumer hire agreement apart from the section (see subsection (1)). So the agreement is not a consumer hire agreement, though it would be if the hire charge were say £1,500 a year, or there were a “break ” clause in it operable by either party before the hire charges exceeded £5,000. A similar result would follow if the agreement by K had been a hiring agreement in Scotland.

Example 21

Facts.The P Bank decides to issue cheque cards to its customers under a scheme whereby the bank undertakes to honour cheques of up to £30 in every case where the payee has taken the cheque in reliance on the cheque card, whether the customer has funds in his account or not. The P Bank writes to the major retailers advising them of this scheme and also publicises it by advertising. The Bank issues a cheque card to Q (an individual), who uses it to pay by cheque for goods costing £20 bought by Q from R, a major retailer. At the time, Q has £500 in his account at the P Bank.

Analysis.The agreement under which the cheque card is issued to Q is a consumer credit agreement even though at all relevant times Q has more than £30 in his account. This is because Q is free to draw out his whole balance and then use the cheque card, in which case the Bank has bound itself to honour the cheque. In other words the cheque card agreement provides Q with credit, whether he avails himself of it or not. Since the amount of the credit is not subject to any express limit, the cheque card can be used any number of times. It may be presumed however that section 10(3)(b)(iii) will apply. The agreement is an unrestricted-use debtor-creditor agreement (by section 13(c)). Although the P Bank wrote to R informing R of the P Bank’s willingness to honour any cheque taken by R in reliance on a cheque card, this does not constitute pre-existing arrangements as mentioned in section 13(c) because section 187(3) operates to prevent it. The agreement is not a credit-token agreement within section 14(1)(b) because payment by the P Bank to R, would be a payment of the cheque and not a payment for the goods.

Example 22

Facts.The facts are as in Example 16. On one occasion B uses the credit-card in a way which increases his debit balance with A (Credit) to £40. A (Credit) writes to B agreeing to allow the excess on that occasion only, but stating that it must be paid off within one month.

Analysis.In exceeding his credit limit B, by implication, requests A (Credit) to allow him a temporary excess (compare Example 17). A (Credit) is thus faced by B’s action with the choice of treating it as a breach of contract or granting his implied request. He does the latter. If he had done the former, B would be treated as taking credit to which he was not entitled (see section 14(3)) and, subject to the terms of his contract with A (Credit), would be liable to damages for breach of contract. As it is, the agreement to allow the excess varies the original credit-token agreement by adding a new term. Under section 10(2), the new term is to be disregarded in arriving at the credit limit, so that the credit-token agreement at no time ceases to be a small agreement. By section 82(2) the later agreement is deemed to revoke the original agreement and contain provisions reproducing the combined effect of the two agreements. By section 82(4), this later agreement is exempted from Part V (except section 56).

Example 23

Facts.Under an oral agreement made on 10th January, X (an individual) has an overdraft on his current account at the Y bank with a credit limit of £100. On 15th February, when his overdraft stands at £90, X draws a cheque for £25. It is the first time that X has exceeded his credit limit, and on 16th February the bank honours the cheque.

Analysis.The agreement of 10th January is a consumer credit agreement for running-account credit. The agreement of 15th-16th February varies the earlier agreement by adding a term allowing the credit limit to be exceeded merely temporarily. By section 82(2) the later agreement is deemed to revoke the earlier agreement and reproduce the combined effect of the two agreements. By section 82(4), Part V of this Act (except section 56) does not apply to the later agreement. By section 18(5), a term allowing a merely temporary excess over the credit limit is not to be treated as a separate agreement, or as providing fixed-sum credit. The whole of the £115 owed to the bank by X on 16th February is therefore running-account credit.

Example 24

Facts.On 1st March 1975 Z (in England) enters into an agreement with A (an unincorporated body of persons) to bail to A equipment consisting of two components (component P and component Q). The agreement is not a hire-purchase agreement and is for a fixed term of 3 years, so paragraphs (a) and (b) of section 15(1) are both satisfied. The rental is payable monthly at a rate of £2,400 a year, but the agreement provides that this is to be reduced to £1,200 a year for the remainder of the agreement if at any time during its currency A returns component Q to the owner Z. On 5th May 1976 A is incorporated as A Ltd., taking over A’s assets and liabilities. On 1st March 1977, A Ltd. returns component Q. On 1st January 1978, Z and A Ltd. agree to extend the earlier agreement by one year, increasing the rental for the final year by £250 to £1,450.

Analysis.When entered into on 1st March 1975, the agreement is a consumer hire agreement. A falls within the definition of “individual ” in section 189(1) and if A returns component Q before 1st May 1976 the total rental will not exceed £5,000 (see section 15(1)(c)). When this date is passed without component Q having been returned it is obvious that the total rental must now exceed £5,000. Does this mean that the agreement then ceases to be a consumer hire agreement? The answer is no, because there has been no change in the terms of the agreement, and without such a change the agreement cannot move from one category to the other. Similarly, the fact that A’s rights and duties under the agreement pass to a body corporate on 5th May 1976 does not cause the agreement to cease to be a consumer hire agreement (see the definition of “hirer ” in section 189(1)).

The effect of the modifying agreement of 1st January 1978 is governed by section 82(2), which requires it to be treated as containing provisions reproducing the combined effect of the two actual agreements, that is to say as providing that—

(a) obligations outstanding on 1st January 1978 are to be treated as outstanding under the modifying agreement;

(b) the modifying agreement applies at the old rate of hire for the months of January and February 1978, and

(c) for the year beginning 1st March 1978 A Ltd. will be the bailee of component P at a rental of £1,450.

The total rental under the modifying agreement is £1,850. Accordingly the modifying agreement is a regulated agreement. Even if the total rental under the modifying agreement exceeded £5,000 it would still be regulated because of the provisions of section 82(3).

Section 192(1).

SCHEDULE 3U.K. Transitional and Commencement Provisions

Note.Except as otherwise mentioned in this Schedule, the provisions of this Act come into operation on its passing, that is on 31st July 1974.

Part II of Act U.K. Credit Agreements, Hire Agreements and Linked Transactions

Regulated agreementsU.K.

1(1)An agreement made before [F21st April 1977]is not a regulated agreement within the meaning of this Act.U.K.

(2)In this Act “prospective regulated agreement ” does not include a prospective agreement which, if made as expected, would be made before [F21st April 1977].

Textual Amendments

F2Words substituted by S.I. 1977/325, art. 2 Sch. 1 para. 1

Linked transactionsU.K.

2U.K.A transaction may be a linked transaction in relation to a regulated agreement or prospective regulated agreement even though the transaction was entered into before the day appointed for the purposes of paragraph 1.

3U.K.Section 19(3) applies only to transactions entered into on or after [F319th May 1985].

Textual Amendments

F3Words substituted by S.I. 1983/1551, arts. 2(1), 3(a)(i)

Total charge for creditU.K.

4U.K.Section 20 applies to consumer credit agreements whenever made.

Part III of Act U.K. Licensing of Credit and Hire Businesses

[F4 Businesses needing a licence]U.K.

Textual Amendments

F4Sch. 3 para. 5 substituted by virtue of S.I. 1989/1128, art. 3, Sch.

[F55(1)Section 21 does not apply to the carrying on of any description of consumer credit business or consumer hire business—U.K.

(a)before 31st July 1989 in the case of a consumer credit business which is carried on by an individual and in the course of which only the following regulated consumer credit agreements (excluding agreements made before that date) are made, namely—

(i)agreements for fixed-sum credit not exceeding £30, and

(ii)agreements for running-account credit where the credit limit does not exceed that amount;

(b)before 1st October 1977 in the case of any other description of consumer credit business; and

(c)before 1st October 1977 in the case of any consumer hire business.

(2)Where the person carrying on a consumer credit business or a consumer hire business applies for a licence—

(a)before 31st July 1989 in the case of a consumer credit business to which sub-paragraph (1)(a) above applies, or

(b)before 1st October 1977 in the case of any other description of consumer credit business or in the case of any consumer hire business,

he shall be deemed to have been granted on 31st July 1989 or 1st October 1977, as the case may be, a licence covering that business and continuing in force until the licence applied for is granted or, if the application is refused, until the end of the appeal period.]

Textual Amendments

F5Sch. 3 para. 5 substituted by virtue of S.I. 1989/1128, art. 3, Sch.

The registerU.K.

6U.K.Sections 35 and 36 come into operation on [F62nd February 1976].

Textual Amendments

F6Words substituted by S.I. 1975/2123, art. 3 (a)

Enforcement of agreements made by unlicensed traderU.K.

[F77U.K.Section 40 does not apply to a regulated agreement made in the course of any business before the day specified or referred to in paragraph 5(1) in relation to the description of business in question.]

Textual Amendments

F7Sch. 3 para. 7 substituted by S.I. 1977/325, Sch. 1 para. 3

Part IV of Act U.K. Seeking Business

AdvertisementsU.K.

8U.K.Part IV does not apply to any advertisement published before [F86th October 1980].

Textual Amendments

F8Words substituted by S.I. 1980/50, art. 3

CanvassingU.K.

9U.K.Section 49 comes into operation on [F91st October 1977].

Textual Amendments

F9Words substituted by S.I. 1977/802, para. 3

Circulars to minorsU.K.

10U.K.Section 50 comes into operation on [F101st July 1977].

Textual Amendments

F10Words substituted by S.I. 1977/802, para. 3

Unsolicited credit-tokensU.K.

11(1)Section 51(1) does not apply to the giving of a credit-token before [F111st July 1977].U.K.

(2)In section 51(3), “agreement ” means an agreement whenever made.

Textual Amendments

F11Words substituted by S.I. 1977/802, para. 3

Part V of Act U.K. Entry into Credit or Hire Agreements

Antecedent negotiationsU.K.

12(1)Section 56 applies to negotiations in relation to an actual or prospective regulated agreement where the negotiations begin after [F1216th May 1977].U.K.

(2)In section 56(3), “agreement ”, where it first occurs, means an agreement whenever made.

Textual Amendments

F12Words substituted by S.I. 1977/325, art. 2 Sch. 1 para. 1

GeneralU.K.

13U.K.Sections 57 to 59, 61 to 65 and 67 to 73 come into operation on [F1319th May 1985].

Textual Amendments

F13Words substituted by S.I. 1983/1551, arts. 2(1), 3(a)(i)

14U.K.Section 66 comes into operation on [F1419th May 1985].

Textual Amendments

F14Words substituted by S.I. 1983/1551, arts. 2(1), 3(a)(i)

Part VI of Act U.K. Matters Arising During Currency of Credit or Hire Agreements

Liability of creditor for breaches by supplierU.K.

15U.K.Section 75 comes into operation on [F151st July 1977 but only in relation to regulated agreements made on or after that day].

Textual Amendments

F15Words substituted by S.I. 1977/802, para. 3

Duty to give noticeU.K.

16(1)Section 76 comes into operation on [F1619th May 1985].U.K.

(2)Section 76 applies to an agreement made before [F1619th May 1985]where the agreement would have been a regulated agreement if made on that day.

Textual Amendments

F16Words substituted by S.I. 1983/1551, arts. 2(1), 3(a)(i)

Duty to give informationU.K.

17(1)Sections 77 to 80 come into operation on [F1719th May 1985].U.K.

(2)Sections 77 to 79 apply to an agreement made before [F1719th May 1985]where the agreement would have been a regulated agreement if made on that day.

Textual Amendments

F17Words substituted by S.I. 1983/1551, arts. 2(1), 3(a)(i)

Appropriation of paymentsU.K.

18U.K.Section 81 comes into operation on [F1819th May 1985].

Textual Amendments

F18Words substituted by S.I. 1983/1551, arts. 2(1), 3(a)(i)

Variation of agreementsU.K.

19U.K.Section 82 comes into operation on [F191st April 1977].

Textual Amendments

F19Words substituted by S.I. 1977/325, art. 2 Sch. 1 para. 1

Misuse of credit facilitiesU.K.

20(1)Sections 83 and 84 come into operation on [F2019th May 1985].U.K.

(2)Subject to sub-paragraph (4), section 83 applies to an agreement made before [F2019th May 1985] where the agreement would have been a regulated consumer credit agreement if made on that day.

(3)Subject to sub-paragraph (4), section 84 applies to an agreement made before [F2019th May 1985] where the agreement would have been a credit-token agreement if made on that day.

(4)Sections 83 and 84 do not apply to losses arising before [F2019th May 1985].

(5)Section 84(4) shall be taken to be satisfied in relation to an agreement made before [F2019th May 1985] if, within 28 days after that day, the creditor gives notice to the debtor of the name, address and telephone number of a person stated in that notice to be the person to whom notice is to be given under section 84(3).

Textual Amendments

F20Words substituted by S.I. 1983/1551, arts. 2(1), 3(a)(i)

Duty on issue of new credit-tokensU.K.

21(1)Section 85 comes into operation on [F2119th May 1985].U.K.

(2)Section 85 applies to an agreement made before [F2119th May 1985] where the agreement would have been a regulated agreement if made on that day.

Textual Amendments

F21Words substituted by S.I. 1983/1551, arts. 2(1), 3(a)(i)

Death of debtor or hirerU.K.

22(1)Section 86 comes into operation on [F2219th May 1985].U.K.

(2)Section 86 applies to an agreement made before [F2219th May 1985] where the agreement would have been a regulated agreement if made on that day.

Textual Amendments

F22Words substituted by S.I. 1983/1551, arts. 2(1), 3(a)(i)

Part VII of Act U.K. Default and Termination

Default noticesU.K.

23U.K.Sections 87 to 89 come into operation on [F2319th May 1985].

Textual Amendments

F23Words substituted by S.I. 1983/1551, arts. 2(1), 3(a)(i)

Retaking of goods and landU.K.

24U.K.Sections 90 and 91 come into operation on [F2419th May 1985].

Textual Amendments

F24Words substituted by S.I. 1983/1551, arts. 2(1), 3(a)(i)

25U.K.Section 92 comes into operation on [F2519th May 1985].

Textual Amendments

F25Words substituted by S.I. 1983/1551, arts. 2(1), 3(a)(i)

Interest on defaultU.K.

26U.K.Section 93 comes into operation on [F2619th May 1985].

Textual Amendments

F26Words substituted by S.I. 1983/1551, arts. 2(1), 3(a)(i)

Early payment by debtorU.K.

27U.K.Sections 94 to 97 come into operation on [F2719th May 1985].

Textual Amendments

F27Words substituted by S.I. 1983/1551, arts. 2(1), 3(a)(i)

Termination of agreementsU.K.

28U.K.Section 98 comes into operation on [F2819th May 1985].

Textual Amendments

F28Words substituted by S.I. 1983/1551, arts. 2(1), 3(a)(i)

29U.K.Section 99 comes into operation on [F2919th May 1985].

Textual Amendments

F29Words substituted by S.I. 1983/1551, arts. 2(1), 3(a)(i)

30U.K.Section 100 comes into operation on [F3019th May 1985].

Textual Amendments

F30Words substituted by S.I. 1983/1551, arts. 2(1), 3(a)(i)

31U.K.Section 101 comes into operation on [F3119th May 1985].

Textual Amendments

F31Words substituted by S.I. 1983/1551, arts. 2(1), 3(a)(i)

32U.K.Section 102 comes into operation on [F3219th May 1985].

Textual Amendments

F32Words substituted by S.I. 1983/1551, arts. 2(1), 3(a)(i)

33U.K.Section 103 comes into operation on [F3319th May 1985].

Textual Amendments

F33Words substituted by S.I. 1983/1551, arts. 2(1), 3(a)(i)

34U.K.Section 104 comes into operation on [F3419th May 1985].

Textual Amendments

F34Words substituted by S.I. 1983/1551, arts. 2(1), 3(a)(i)

Old agreementsU.K.

35U.K.Part VII (except sections 90, 91, 93 and 99 to 102 and 104) applies to an agreement made before [F3519th May 1985] where the agreement would have been a regulated agreement if made on that day.

Textual Amendments

F35Words substituted by S.I. 1983/1551, arts. 2(1), 3(a)(i)

Part VIII of Act U.K. Security

GeneralU.K.

36U.K.Section 105 comes into operation on [F3619th May 1985].

Textual Amendments

F36Words substituted by S.I. 1983/1551, arts. 2(1), 3(a)(i)

37(1)Sections 107 to 110 come into operation on [F3719th May 1985].U.K.

(2)Sections 107 to 110 apply to an agreement made before [F3719th May 1985] where the agreement would have been a regulated agreement if made on that day.

Textual Amendments

F37Words substituted by S.I. 1983/1551, arts. 2(1), 3(a)(i)

38(1)Section 111 comes into operation on [F3819th May 1985].U.K.

(2)Section 111 applies to an agreement made before [F3819th May 1985] where the agreement would have been a regulated agreement if made on that day.

Textual Amendments

F38Words substituted by S.I. 1983/1551, arts. 2(1), 3(a)(i)

PledgesU.K.

39U.K.Sections 114 to 122 come into operation on [F3919th May 1985 but only in respect of articles taken in pawn under a regulated consumer credit agreement].

Textual Amendments

F39Words substituted by S.I. 1983/1551, arts. 2(2), 3(a)(ii)

Negotiable instrumentsU.K.

40U.K.Sections 123 to 125 come into operation on [F4019th May 1985].

Textual Amendments

F40Words substituted by S.I. 1984/436, art. 3

Land mortgagesU.K.

41U.K.Section 126 comes into operation on [F4119th May 1985].

Textual Amendments

F41Words substituted by S.I. 1983/1551, arts. 2(1), 3(a)(i)

Part IX of Act U.K. Judicial Control

42U.K.Sections 137 to 140 (extortionate credit bargains) come into operation on [F4216th May 1977], and apply to agreements and transactions whenever made.

Textual Amendments

F42Words substituted by S.I. 1977/325, art. 2 Sch. 1 para. 1

43U.K.Subject to paragraph 42, Part IX comes into operation on [F4319th May 1985].

Textual Amendments

F43Words substituted by S.I. 1983/1551, arts. 2(1), 3(a)(i)

Part X of Act U.K. Ancillary Credit Businesses

LicensingU.K.

[F4444(1)Section 21(1) does not apply (by virtue of section 147(1)) to the carrying on of any ancillary credit business before 3rd August 1976 in the case of any business so far as it comprises or relates to—U.K.

(a)debt-adjusting,

(b)debt-counselling,

(c)debt-collecting, or

(d)the operation of a credit reference agency.

(1A)Section 21(1) does not apply (by virtue of section 147(1)) to the carrying on of any ancillary credit business before 1st July 1978 so far as it comprises or relates to credit brokerage, not being a business which is carried on by an individual and in the course of which introductions are effected only of individuals desiring to obtain credit—

(a)under debtor-creditor-supplier agreements which fall within section 12(a) and where, in the case of any such agreement—

(i)the person carrying on the business would be willing to sell the goods which are the subject of the agreement to the debtor under a transaction not financed by credit, and

(ii)The amount of credit does not exceed £30; and

(b)under debtor-creditor-supplier agreements which fall within section 12(b) or (c) and where, in the case of any such agreement—

(i)the person carrying on the business is the supplier,

(ii)the creditor is a person referred to in section 145(2)(a)(i), and

(iii)the amount of credit or, in the case of an agreement for running-account credit, the credit limit does not exceed £30.

(1B)Section 21(1) does not apply (by virtue of section 147(1)) to the carrying on of any ancillary credit business before the day appointed for the purposes of this paragraph in the case of any description of ancillary credit business in relation to which no day is appointed under the foregoing provisions of this paragraph.

(2)Where the person carrying on an ancillary credit business applies for a licence before—

(a)3rd August 1976 in the case of an ancillary credit business of a description to which sub-paragraph (1) above applies;

(b)1st July 1978 in the case of an ancillary credit business of a description to which sub-paragraph (1A) above applies; or

(c)the day appointed for the purposes of this paragraph in the case of an ancillary credit business to which sub-paragraph (1B) above applies,

he shall be deemed to have been granted on 3rd August 1976, 1st July 1978 or the day so appointed, as the case may be, a licence covering the description of ancillary credit business in question and continuing in force until the licence applied for is granted or, if the application is refused, until the end of the appeal period.]

Textual Amendments

F44Sch. 3 para. 44 substituted by S.I. 1977/2163, art. 2, Sch.

Enforcement of agreements made by unlicensed traderU.K.

[F4545U.K.Section 148(1) does not apply to an agreement made in the course of any business before 3rd August 1976 in the case of any business so far as it comprises or relates to—

(a)debt-adjusting,

(b)debt-counselling,

(c)debt-collecting, or

(d)the operation of a credit reference agency,

or before 1st July 1978 in the case of an ancillary credit business of a description to which sub-paragraph (1A) of paragraph 44 applies or before the day appointed for the purposes of that paragraph in the case of an ancillary credit business to which sub-paragraph (1B) of that paragraph applies.]

Textual Amendments

F45Sch. 3 para. 45 substituted by S.I. 1977/2163, art. 2, Sch.

Introductions by unlicensed credit-brokerU.K.

[F4646U.K.Section 149 does not apply to a regulated agreement made on an introduction effected in the course of any business if the introduction was effected before 1st July 1978 in the case of an ancillary credit business to which sub-paragraph (1A) of paragraph 44 applies or before the day appointed for the purposes of that paragraph in the case of an ancillary credit business to which sub-paragraph (1B) of that paragraph applies.]

Textual Amendments

F46Sch. 3 para. 46 substituted by S.I. 1977/2163, art. 2, Sch.

AdvertisementsU.K.

47U.K.Subsections (1) and (2) of section 151 do not apply to any advertisement published before [F476th October 1980].

Textual Amendments

F47Words substituted by S.I. 1980/50, art. 3

Credit reference agenciesU.K.

48U.K.Sections 157 and 158 do not apply to a request received before [F4816th May 1977].

Textual Amendments

F48Words substituted by S.I. 1977/325, art. 2 Sch. 1 para. 1

Part XII of Act U.K. Supplemental

InterpretationU.K.

49(1)In the case of an agreement—U.K.

(a)which was made before [F4919th May 1985], and

(b)to which (by virtue of paragraph 17(2)) section 78(4) applies,

section 185(2) shall have effect as respects a notice given before that day in relation to the agreement (whether given before or after the passing of this Act) as it would have effect if section 78(4) had been in operation when the notice was given.

(2)Paragraph (1) applies to an agreement made on or after [F4919th May 1985] to provide credit on a current account opened before that day as it applies to an agreement made before that day.

Textual Amendments

F49Words substituted by S.I. 1983/1551, art. 3(b)

50U.K.In section 189, the definition of “local authority ” shall have effect in relation to matters arising before 16th May 1975 as if for the words “regional, islands or district council ” there were substituted “a county council or town council ”.

Section 192.

SCHEDULE 4.U.K. MINOR AND CONSEQUENTIAL AMENDMENTS

PART I U.K. UNITED KINGDOM

M1 Bills of Sale Act (1878) Amendment Act 1882U.K.

X11U.K.The following section shall be inserted after section 7

“7A Default under consumer credit agreements.

(1)Paragraph (1) of section 7 of this Act does not apply to a default relating to a bill of sale given by way of security for the payment of money under a regulated agreement to which section 87(1) of the Consumer Credit Act 1974 applies —

(a)unless the restriction imposed by section 88(2) of that Act has ceased to apply to the bill of sale ; or

(b)if, by virtue of section 89 of that Act, the default is to be treated as not having occurred.

(2)Where paragraph (1) of section 7 of this Act does apply in relation to a bill of sale such as is mentioned in subsection (1) of this section, the proviso to that section shall have effect with the substitution of “county court ” for “High Court ”.”

Editorial Information

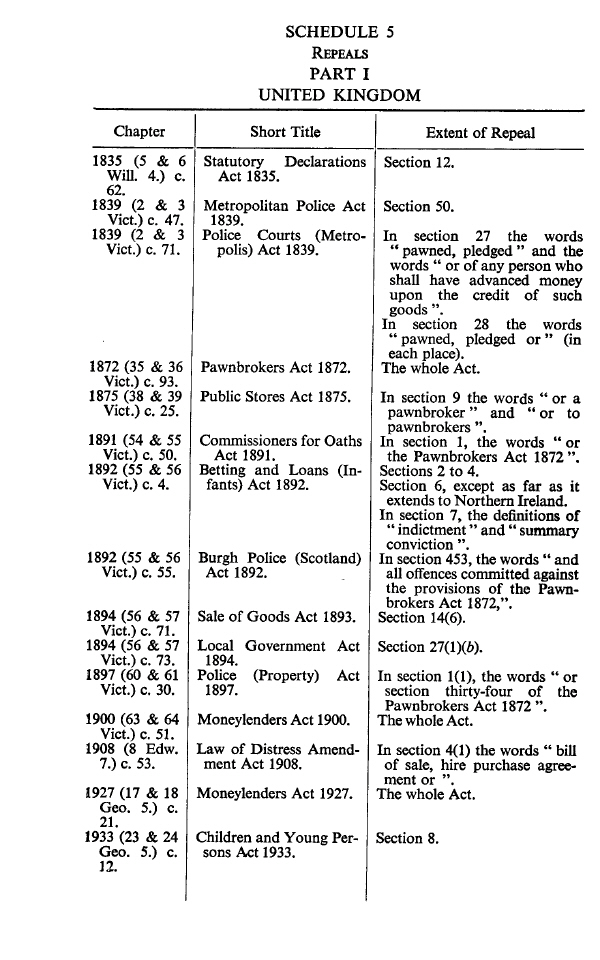

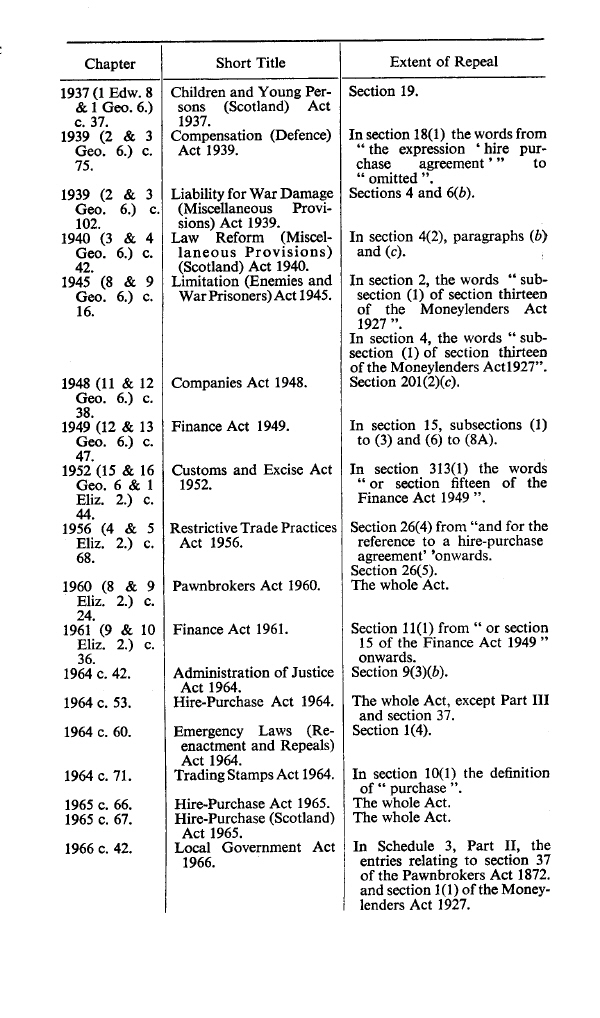

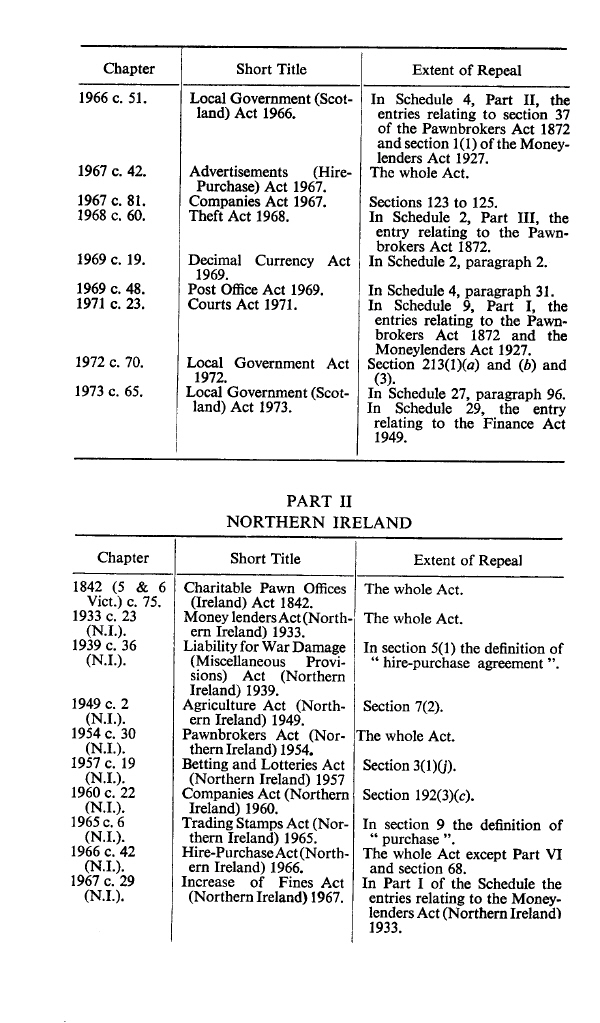

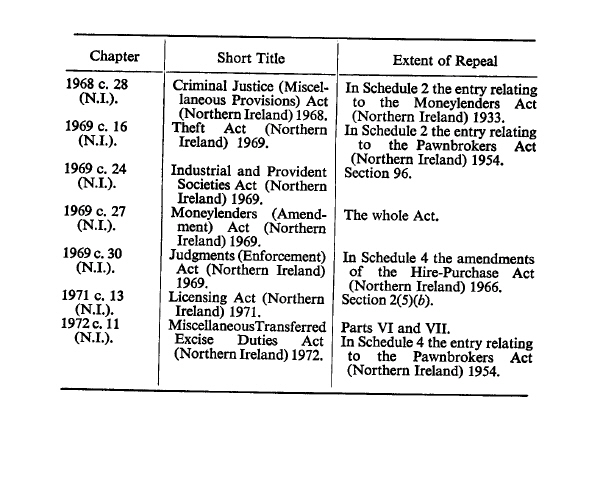

X1The text of ss. 3(a)(b)(c), 5, 42(1)(2)(3), 192(3)(a)(b), Sch. 4 Pt. I paras. 1, 2, 5, 7 - 9, 11 - 17, 19, 22 - 28, 30 - 32, 34 - 37, Sch. 4 Pt. II paras. 39, 40, 43 -45, 49 - 51 and Sch. 5 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

M2 Factors Act 1889U.K.

Marginal Citations

M21889 c 45.

X22U.K.At the end of section 9 insert “For the purposes of this section—

(i)the buyer under a conditional sale agreement shall be deemed not to be a person who has bought or agreed to buy goods, and

(ii) “conditional sale agreement ” means an agreement for the sale of goods which is a consumer credit agreement within the meaning of the Consumer Credit Act 1974 under which the purchase price or part of it is payable by instalments, and the property in the goods is to remain in the seller (notwithstanding that the buyer is to be in possession of the goods) until such conditions as to the payment of instalments or otherwise as may be specified in the agreement are fulfilled.”

Editorial Information

X2The text of ss. 3(a)(b)(c), 5, 42(1)(2)(3), 192(3)(a)(b), Sch. 4 Pt. I paras. 1, 2, 5, 7 - 9, 11 - 17, 19, 22 - 28, 30 - 32, 34 - 37, Sch. 4 Pt. II paras. 39, 40, 43 -45, 49 - 51 and Sch. 5 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

3, 4.U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F50

Textual Amendments

M3Law of Distress Amendment Act 1908U.K.

Marginal Citations

X35U.K.The following section shall be inserted after section 4—

“4A Hire purchase etc. agreements.

(1)Goods—

(a)bailed under a hire-purchase agreement or a consumer hire agreement, or

(b)agreed to be sold under a conditional sale agreement,

are, where the relevant agreement has not been terminated, excluded from the application of this Act except during the period between the service of a default notice under the Consumer Credit Act 1974 in respect of the goods and the date on which the notice expires or is earlier complied with.

(2)Goods comprised in a bill of sale are excluded from the application of this Act except, during the period between service of a default notice under the Consumer Credit Act 1914 in respect of goods subject to a regulated agreement under which a bill of sale is given by way of security and the date on which the notice expires or is earlier complied with.

(3)In this section—

“conditional sale agreement ” means an agreement for the sale of goods under which the purchase price or part of it is payable by instalments, and the property in the goods is to remain in the seller (notwithstanding that the buyer is to be in possession of the goods) until such conditions as to the payment of instalments or otherwise as may be specified in the agreement are fulfilled ;

“consumer hire agreement ” has the meaning given by section 15 of the Consumer Credit Act 1974.

“hire-purchase agreement ” means an agreement, other than a conditional sale agreement, under which—

(a)goods are bailed in return for periodical payments by the person to whom they are bailed, and

(b)the property in the goods will pass to that person if the terms of the agreement are complied with and one or more of the following occurs—

(i)the exercise of an option to purchase by that person,

(ii)the doing of any other specified act by any party to the agreement,

(iii)the happening of any other specified event; and

“regulated agreement ” has the meaning given by section 189(1) of the Consumer Credit Act 1974.”

Editorial Information

X3The text of ss. 3(a)(b)(c), 5, 42(1)(2)(3), 192(3)(a)(b), Sch. 4 Pt. I paras. 1, 2, 5, 7 - 9, 11 - 17, 19, 22 - 28, 30 - 32, 34 - 37, Sch. 4 Pt. II paras. 39, 40, 43 -45, 49 - 51 and Sch. 5 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

M4Bankruptcy Act 1914U.K.

Marginal Citations

[F51X46U.K.The following section shall be inserted after section 38—

38A“ Hire purchase etc. agreement.

(1)Goods—

(a)bailed under a hire-purchase agreement or a consumer hire agreement, or

(b)agreed to be sold under a conditional sale agreement, or

(c)subject to a regulated agreement under which a bill of sale is given by way of security.

shall not be treated as the property of the bankrupt during the period between the service of a default notice under the Consumer Credit Act 1974 in respect of the goods and the date on which the notice expires or is earlier complied with.

(2)In this section—

“conditional sale agreement ” means an agreement for the sale of goods under which the purchase price or part of it is payable by instalments, and the property in the goods is to remain in the seller (notwithstanding that the buyer is to be in possession of the goods) until such conditions as to the payment of instalments or otherwise as may be specified in the agreement are fulfilled;

“consumer hire agreement ” has the meaning given by section 15 of the Consumer Credit Act 1974;

“hire-purchase agreement ” means an agreement, other than a conditional sale agreement, under which—

(a)goods are bailed in return for periodical payments by the person to whom they are bailed, and

(b)the property in the goods will pass to that person if the terms of the agreement are complied with and one or more of the following occurs—

(i)the exercise of an option to purchase by that person,

(ii)the doing of any other specified act by any party to the agreement,

(iii)the happening of any other specified event; and “regulated agreement ” has the meaning given by section 189(1) of the Consumer Credit Act 1974.”]

Editorial Information

X4The text of Sch. 4 Pt. I paras. 6, 18 and Sch. 4 Pt. II para. 38 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and, except as specified, does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

Textual Amendments

F51Sch. 4 Pt. I para. 6 repealed (E.W.) by Insolvency Act 1985 (c. 65, SIF 66), s. 235, Sch. 9 para. 11, Sch. 10 Pt. III

M5Compensation (Defence) Act 1939U.K.

Marginal Citations

X57U.K.In section 13 after “hire-purchase agreement ” insert “or a conditional sale agreement ”.

Editorial Information

X5The text of ss. 3(a)(b)(c), 5, 42(1)(2)(3), 192(3)(a)(b), Sch. 4 Pt. I paras. 1, 2, 5, 7 - 9, 11 - 17, 19, 22 - 28, 30 - 32, 34 - 37, Sch. 4 Pt. II paras. 39, 40, 43 -45, 49 - 51 and Sch. 5 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

X68U.K.In section 17(1)—

(1)After the definition of “aircraft ” insert—

“ “conditional sale agreement ” means an agreement for the sale of goods which is a consumer credit agreement within the meaning of the Consumer Credit Act 1974 under which the purchase price or part of it is payable by instalments, and the property in the goods is to remain in the seller (notwithstanding that the buyer is to be in possession of the goods) until such conditions as to the payment of instalments or otherwise as may be specified in the agreement are fulfilled ;” , and

(2)for the definition of “hire-purchase agreement ” substitute—

“ “hire-purchase agreement ” means an agreement which is a consumer credit agreement within the meaning of the Consumer Credit Act 1974, other than a conditional sale agreement, under which—

(a)goods are bailed or (in Scotland) hired in return for periodical payments by the person to whom they are bailed or hired, and

(b)the property in the goods will pass to that person if the terms of the agreement are complied with and one or more of the following occurs—

(i)the exercise of an option to purchase by that person,

(ii)the doing of any other specified act by any party to the agreement,

(iii)the happening of any other specified event ;”

Editorial Information

X6The text of ss. 3(a)(b)(c), 5, 42(1)(2)(3), 192(3)(a)(b), Sch. 4 Pt. I paras. 1, 2, 5, 7 - 9, 11 - 17, 19, 22 - 28, 30 - 32, 34 - 37, Sch. 4 Pt. II paras. 39, 40, 43 -45, 49 - 51 and Sch. 5 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

M6Liability for War Damage (Miscellaneous Provisions) Act 1939U.K.

Marginal Citations

X79U.K.In section 1(3), for paragraphs (a) and (b) substitute—

“(a)a hire-purchase agreement or a conditional sale agreement within the meaning of the Consumer Credit Act 1974 being (in either case) a consumer credit agreement as defined by that Act ; or

(b)a consumer hire agreement as defined by that Act.”

Editorial Information

X7The text of ss. 3(a)(b)(c), 5, 42(1)(2)(3), 192(3)(a)(b), Sch. 4 Pt. I paras. 1, 2, 5, 7 - 9, 11 - 17, 19, 22 - 28, 30 - 32, 34 - 37, Sch. 4 Pt. II paras. 39, 40, 43 -45, 49 - 51 and Sch. 5 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

10U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F52

Textual Amendments

M7Rag Flock and Other Filing Materials Act 1951U.K.

Marginal Citations

F5311U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F53Sch. 4 para. 11 repealed (6.1.1997) by S.I. 1996/ 3097, arts. 1, 3(1)(b)

M8Reserve and Auxiliary Forces (Protection of Civil Interest) Act 1951U.K.

Marginal Citations

X812U.K.In section 4 for subsections (4), (5) and (6), substitute—

“(4)Where the appropriate court refuses leave under section 4(2) of this Act to take possession of goods subject to a hire-purchase agreement or a conditional sale agreement or to execute a judgment or order for delivery of such goods, or gives leave subject to restrictions and conditions, and the person to whom the goods are bailed, or, as the case may be, the buyer, before possession is taken or execution on the judgment or order completed, pays the total price, the creditor’s title to the goods shall, notwithstanding any failure to pay the total price at the time required by the agreement, vest in that person.

(5)Where the creditor under a hire-purchase agreement or a conditional sale agreement has taken possession of the goods bailed or agreed to be sold under it, the appropriate court on an application under section 3(1)(c) of this Act, may, if it thinks fit, deal with the case as if the creditor were proceeding to take possession of the goods and, if it makes an order under that paragraph, may direct accordingly that the goods be restored to the person to whom they were bailed or, as the case may be, the buyer ; and if, after the creditor has taken possession of the goods, notice is given under that paragraph with respect to them, he shall not, so long as the notice is in force or any application in pursuance of the notice is undisposed of, deal with the goods in such a way as to prejudice the powers of the appropriate court under this subsection.”

Editorial Information

X8The text of ss. 3(a)(b)(c), 5, 42(1)(2)(3), 192(3)(a)(b), Sch. 4 Pt. I paras. 1, 2, 5, 7 - 9, 11 - 17, 19, 22 - 28, 30 - 32, 34 - 37, Sch. 4 Pt. II paras. 39, 40, 43 -45, 49 - 51 and Sch. 5 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

X913U.K.For section 10 substitute—

“10 Property in goods subject to hire-purchase agreement.

(1)Where the appropriate court refuses leave under section 8(3) of this Act to take or resume possession of goods subject to a hire-purchase agreement or a conditional sale agreement or to do diligence on any decree for the delivery of such goods, or gives leave subject to restrictions and conditions, and the person to whom they are hired, or, as the case may be, the buyer before possession is taken or resumed or diligence is done, pays the total price, the creditor’s title to the goods shall, notwithstanding any failure to pay the total price at the time required by the agreement, vest in that person.

(2)Where the creditor under a hire-purchase agreement or a conditional sale agreement has taken possession of the goods hired or agreed to be sold under it, the appropriate court on an application under section 9(1)(C) of this Act may, if it thinks fit, deal with the case as if the creditor were proceeding to take possession of the goods and, if it makes an order under that paragraph, may direct accordingly that the goods be restored to the person to whom they were hired or, as the case may be, the buyer ; and if, after the creditor has taken possession of the goods, notice is given under that paragraph with respect to them, he shall not, so long as the notice is in force or any application in pursuance of the notice is undisposed of, deal with the goods in such a way as to prejudice the powers of the appropriate court under this subsection”.

Editorial Information

X9The text of ss. 3(a)(b)(c), 5, 42(1)(2)(3), 192(3)(a)(b), Sch. 4 Pt. I paras. 1, 2, 5, 7 - 9, 11 - 17, 19, 22 - 28, 30 - 32, 34 - 37, Sch. 4 Pt. II paras. 39, 40, 43 -45, 49 - 51 and Sch. 5 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

X1014U.K.In section 64(I)—

(1)after the definition of “compulsory national service ” insert—

“ “conditional sale agreement ” means an agreement for the sale of goods under which the purchase price or part of it is payable by instalments, and the property in the goods is to remain in the seller (notwithstanding that the buyer is to be in possession of the goods) until such conditions as to the payment of instalments or otherwise as may be specified in the agreement are fulfilled ;

“creditor ” means the person by whom goods are bailed or (in Scotland) hired under a hire-purchase agreement or, as the case may be, the seller under a conditional sale agreement, or the person to whom his rights and duties have passed by assignment or operation of the law ;

“hire-purchase agreement ” means an agreement, other than a conditional sale agreement, under which—

(a)goods are bailed or (in Scotland) hired in return for periodical payments by the person to whom they are bailed or hired, and

(b)the property in the goods will pass to that person if the terms of the agreement are complied with and one or more of the following occurs—

(i)the exercise of an option to purchase by that person,

(ii)the doing of any other specified act by any party to the agreement,

(iii)the happening of any other specified event ;”.

(2)After the definition of “short period of training ” insert—

“ “total price ” means the total sum payable by the person to whom goods are bailed or hired under a hire-purchase agreement or, as the case may be, the buyer under a conditional sale agreement including any sum payable on the exercise of an option to purchase but excluding any sum payable as a penalty or as compensation or damages for a breach of the agreement”.

Editorial Information